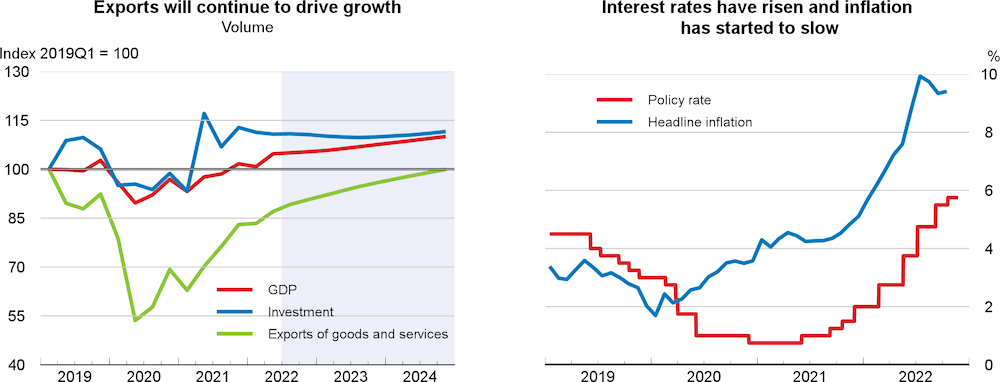

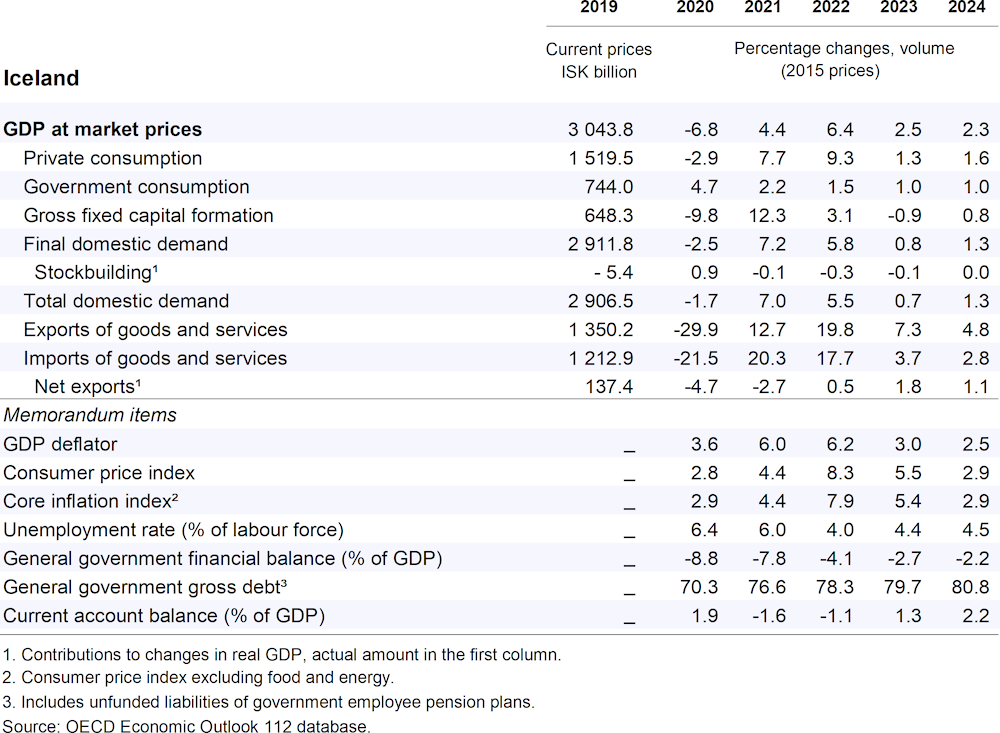

Economic growth will slow to 2.5% in 2023 and 2.3% in 2024. Private consumption will weaken as wage growth moderates and dissaving comes to an end. Business and housing investment are likely to decrease as financial conditions continue to tighten, and public investment will also decline in 2023-24. Export growth will remain strong thanks to robust growth of foreign tourism. The unemployment rate will rise gradually to around 4.5%. Headline inflation peaked at around 10% in late summer and is expected to subside over the projection period.

In early October, the central bank lifted the policy rate to 5.75%, the ninth increase since tightening started in May 2021. The bank is projected to tighten further to bring inflation back to target in due course. The fiscal consolidation planned for 2023-24 is appropriate to reduce inflationary pressures and maintain fiscal space. Investing in energy diversification and research and development could help improve energy security and achieve the government’s climate targets.