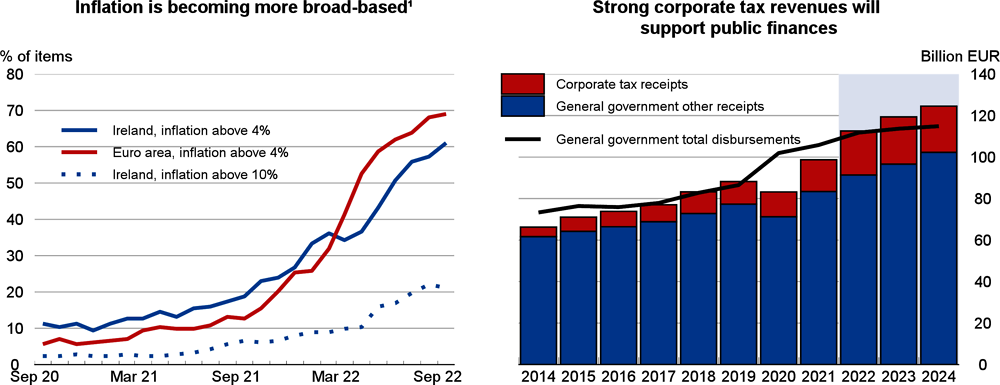

GDP growth is projected to exceed 10% in 2022, following the full relaxation of pandemic-related restrictions early in the year. Falling real incomes due to high inflation will hold back consumer spending up to mid-2023, despite significant wage growth. High costs and low confidence will reduce firms’ incentives to invest. Modified domestic demand will thus only grow by 0.9% next year, before rebounding by 3.1% in 2024. As exports in multinational-dominated sectors, though moderating, will remain supportive, GDP is projected to grow by 3.8% in 2023 and 3.3% in 2024.

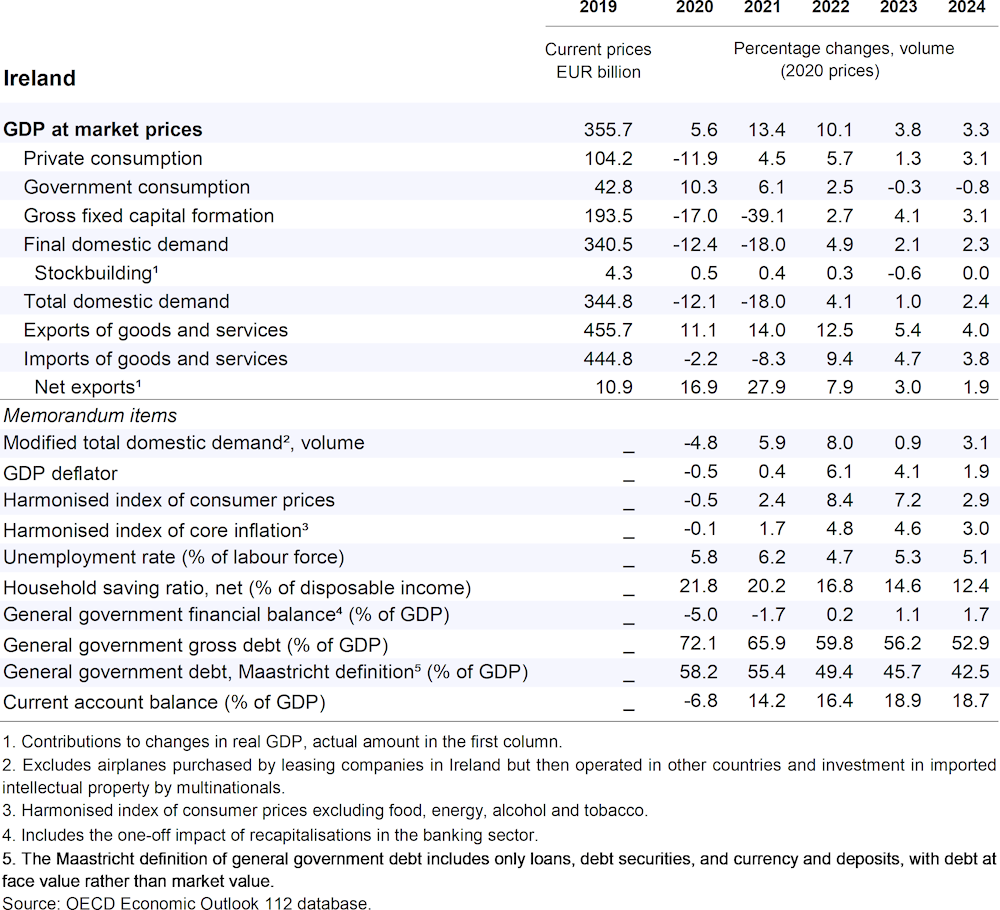

On the back of record-high tax receipts, boosted by multinationals’ large profits and labour market resilience, the government announced a wide set of measures to support households and SMEs against high inflation in 2022-23. If needed, further measures should be targeted and temporary. The welcome decision to allocate part of the windfall corporate tax revenues to the National Reserve Fund should be continued in the event of further windfall gains. Reverting to the new spending rule, after temporarily deviating from it in 2022 and 2023, would move fiscal policy onto a more stable spending path.