Rebuilding fiscal buffers should be a priority. The high level of public debt and pressures from population ageing create vulnerabilities.

The public debt-to-GDP ratio has declined, but remains high at 100%. Recent adjustments have been partly driven by supportive macroeconomic conditions and the temporary effect of the advance payment of corporate taxes, and partly by structural efforts.

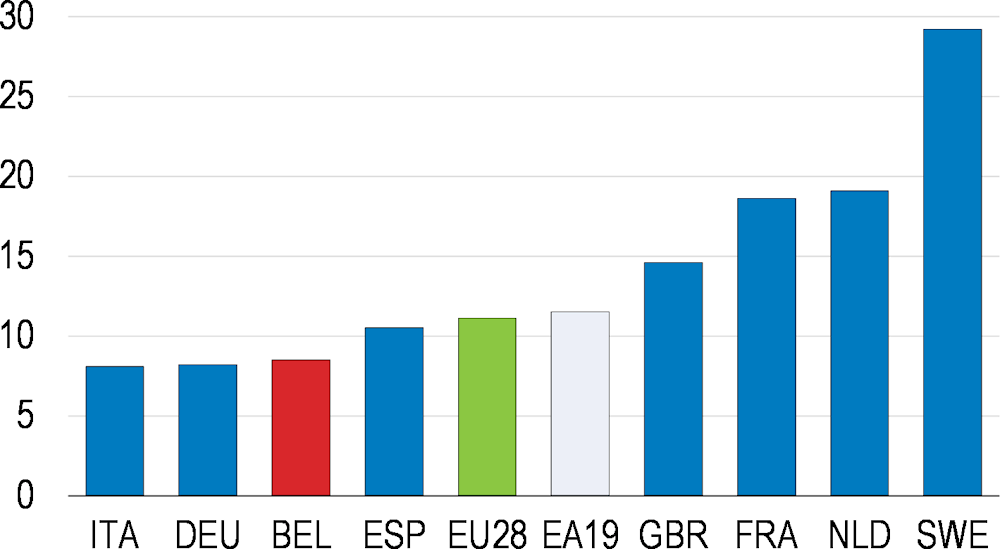

The composition and efficiency of public spending can be improved to create space for higher public investment. There is room to improve the efficiency of public spending in areas such as health and education. Despite the need to reprioritise expenditures, the use of spending reviews is limited. Using spending reviews and policy evaluation at each level of government would allow a shift in expenditures to more productive uses.

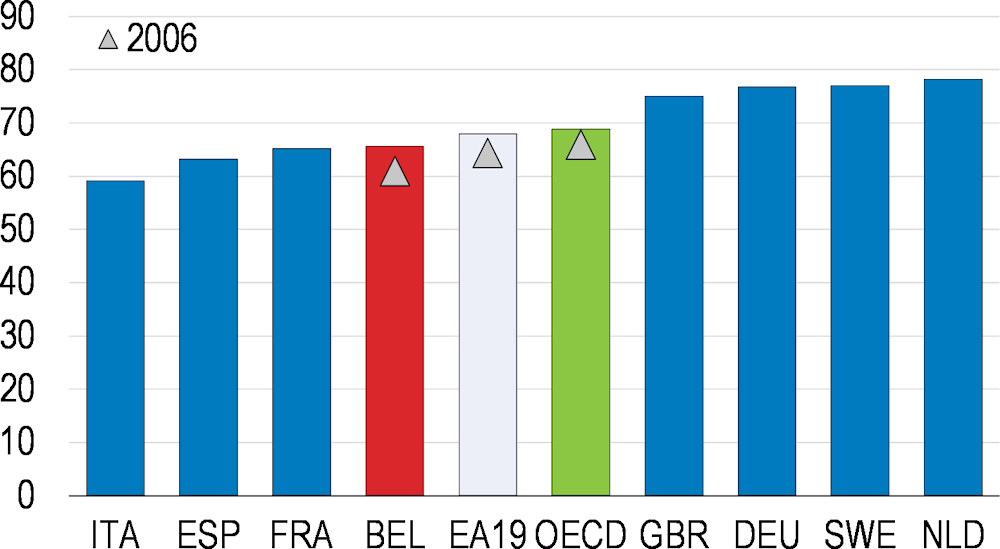

Shifting the tax mix towards more growth friendly sources would boost employment. Taxation remains tilted towards labour income, which penalises growth and employment. Tax bases of value-added taxes are narrow with exemptions and reduced rates, lowering the efficiency of tax collection. In sectors other than transport, taxation of fossil fuel use is low, which can lower environmental outcomes.

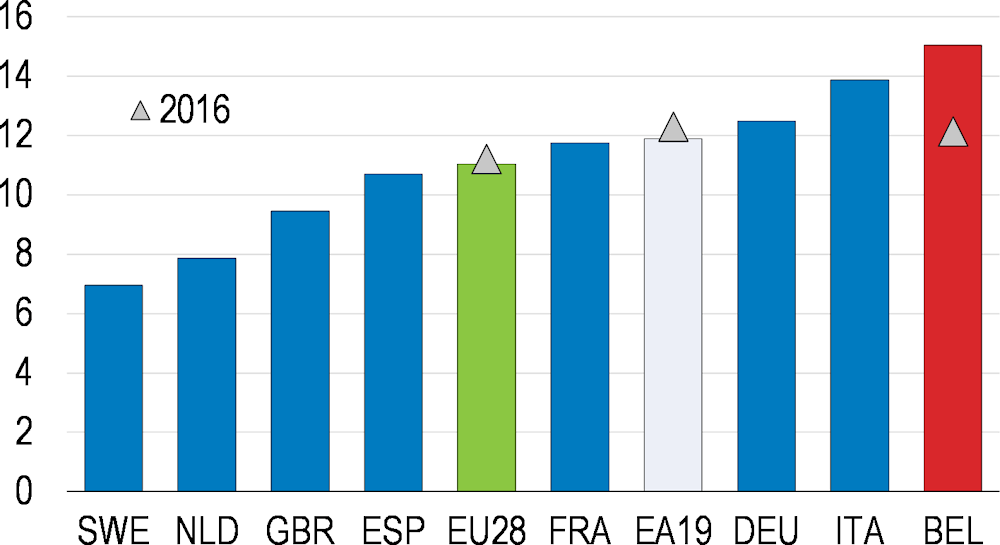

The pressures on fiscal sustainability will rise due to population ageing. Public spending on pensions is projected to rise to 15% in 2070 (Figure B). Recent reforms have improved the financial sustainability of the pension system. While the statutory retirement age will increase to 67 by 2030, the effective retirement age remains low. Linking the retirement age to life expectancy could further lower the growth of pension spending, and should be accompanied by measures to re-skill older workers since boosting employment rates will also be key.