Brazil is less integrated into the world economy than other emerging markets as trade barriers shield enterprises from global opportunities and foreign competition. Stronger integration would improve the ability of Brazilian firms to compete in foreign markets by greater access to intermediate inputs and technology at internationally competitive conditions. This would boost productivity and allow them to pay higher wages. Lowering barriers to trade would also reduce the cost of capital goods, spurring investment and growth and creating new jobs across the economy. Consumers would see their purchasing power increase, with particularly strong effects among low-income households. Ensuring that everyone can benefit from trade will require accompanying policies to help workers cope with the likely reallocation of jobs across firms and sectors. Such policies should focus on protecting workers, rather than jobs, by creating training and education opportunities that allow low-skill individuals to acquire new skills and get ready for new jobs, while protecting their incomes in the transition.

OECD Economic Surveys: Brazil 2018

Chapter 2. Fostering Brazil’s integration into the world economy

Abstract

International trade has been a powerful engine of growth and improvement in living standards across countries. In emerging economies it has contributed to economic convergence and poverty decline. Both consumers and producers can broadly benefit from trade and the efficiencies it creates. Brazil has so far not fully reaped the benefits that integrating into the world economy can offer. High tariff and non-tariff barriers have shielded large parts of the economy from international competition, with detrimental effects for their competitiveness, but also for consumers in higher prices. For example cars tend to cost three times more than in more open economies. Increasing integration into the global economy would create new opportunities and propel growth, which is the basis for further improvements in living standards.

Brazil is missing out on the opportunities arising from international trade

The economy is relatively closed and poorly integrated into the global economy

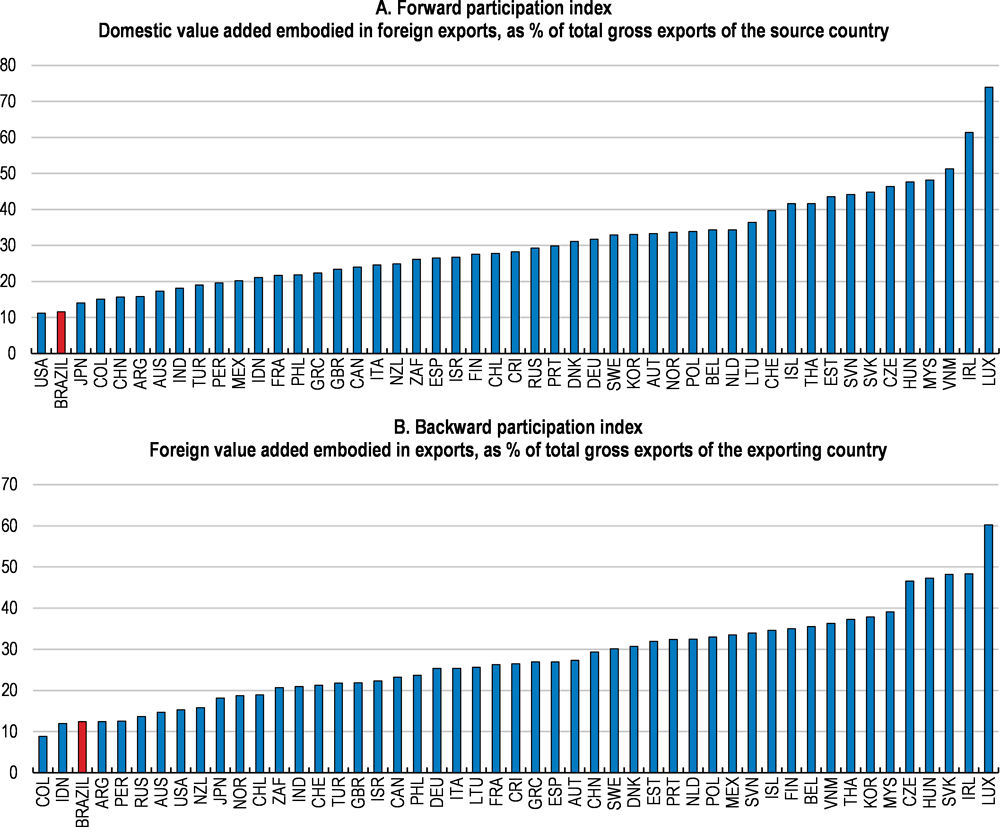

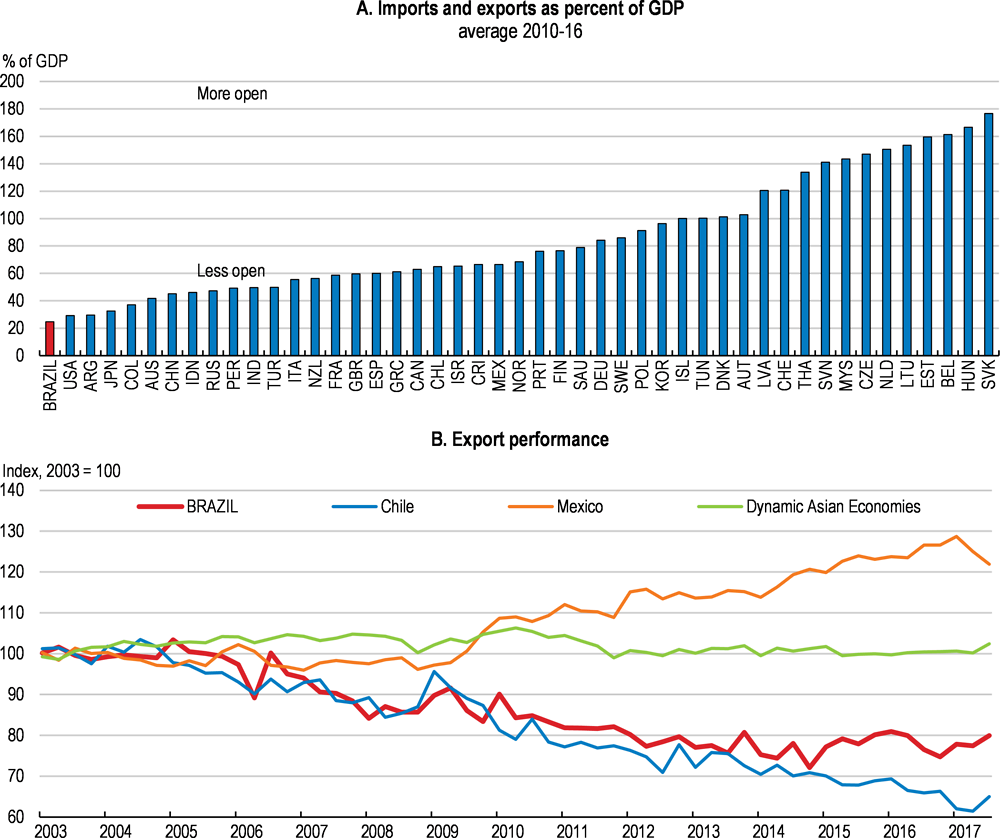

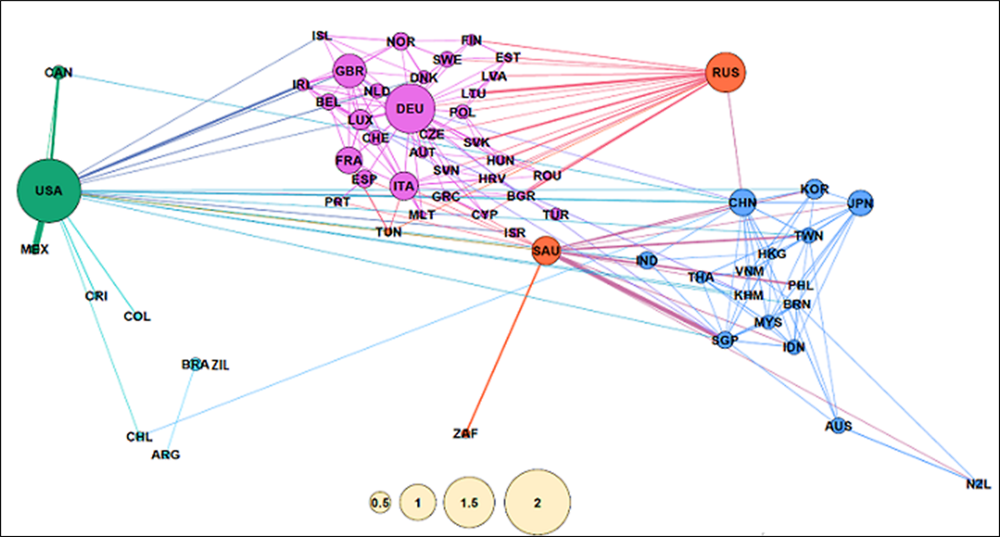

Brazil has remained on the side lines of an increasingly integrated world economy. This reflects several decades of inward oriented policies including a strategy of industrialisation through import substitution. Trade has been persistently falling, with imports plus exports amounting to less than 30% of GDP, even lower than in much larger economies (Figure 2.1, Panel A). Export performance, which measures how exports have grown relative to the growth of export markets, has been worsening persistently since 2007 (Figure 2.1, Panel B). Brazil’s participation in global value chains is low (Figure 2.2), both forward and backward, meaning that Brazil adds little value to foreign exports and, at the same time, Brazilian firms make little use of foreign intermediate goods and services. Brazil’s only discernible GVC link is with neighbouring Argentina, while many Asian and European economies are tightly intertwined through their trade relationships, both among themselves and with advanced economies (Figure 2.3).

Figure 2.1. Exposure to trade is low and export performance has declined

Note: Export performance is measured as actual growth in exports relative to the growth of the country’s export market, which represents the potential export growth for a country assuming that its market shares remain unchanged.

Source: IMF, International Financial Statistics; OECD Economic Outlook database.

Figure 2.2. Brazil integration in global value chains is minimal

Figure 2.3. Brazil has remained on the side lines of global value chains

A map of global value chains

Note: A larger circle reflects an economy that is more connected within global production networks. A line reflects input flows exceeding 2% of total inputs used in the importing or exporting economy.

Source: Criscuolo and Timmins (2017).

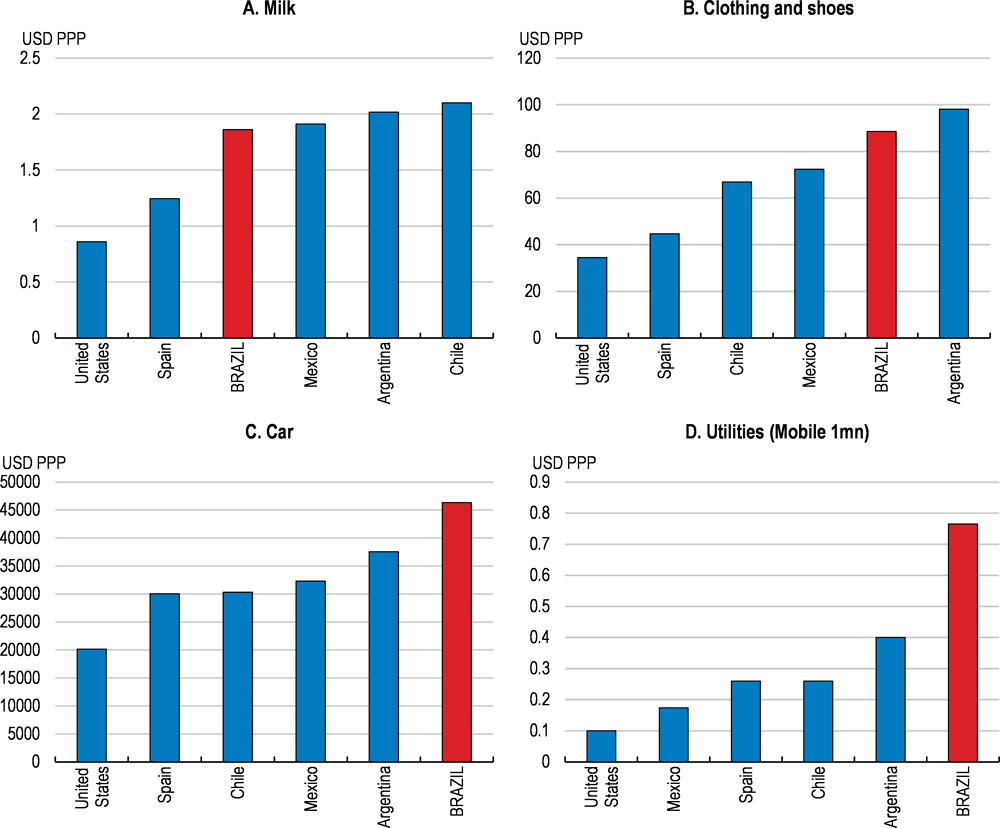

Prices are high

Brazil has not shared in many of the benefits that an increasingly integrated global economy is offering, such as access to a wider variety of quality goods and services at more competitive prices for both firms and consumers. At present, prices for tradable goods are substantially higher than in other countries (Figure 2.4). For example, a 2017 Toyota Corolla passenger car costs 40% more in Brazil than in Mexico, which like Brazil is a producer of this model. Relatively high prices also affect services, including in key sectors such as telecommunications, but also business services, as Brazil restricts trade in services more than other countries, reducing competition in key sectors that provide inputs to other sectors across the economy.

Figure 2.4. Prices are relatively high

Note: Clothing and shoes prices are proxied by the price of a dress in a chain store. Car prices are proxied by the price of a Toyota Corolla or equivalent new car. Mobile prices are those of 1 min. of prepaid mobile tariff local. Prices are converted to PPP dollars by using conversion rates published in IMF’s World Economic Outlook.

Source: Numbeo database.

The share of imported inputs is low

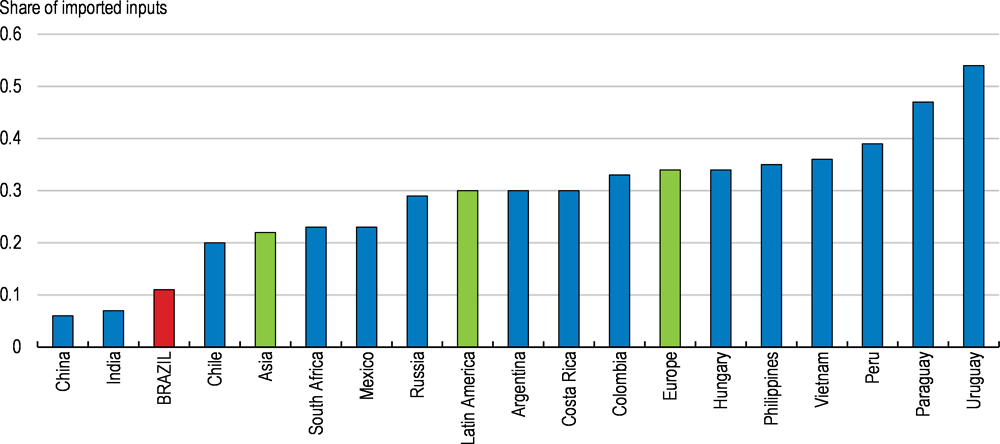

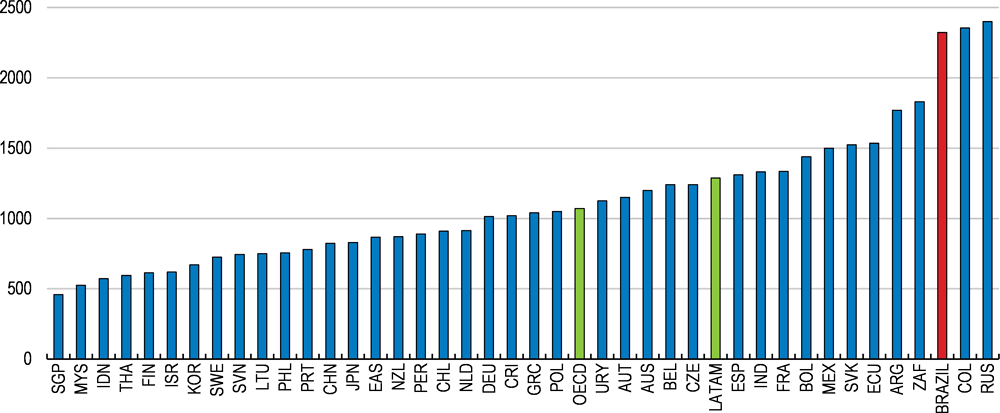

Brazilian firms use significantly less imported inputs than their peers in Latin American and other emerging economies (Figure 2.5). Imported inputs can be an important conduit for the spread of new technologies and a wider choice of available inputs can reduce costs and improve competitiveness. Firm-level evidence shows a sizeable link between the use of imported inputs and productivity (Brambrilla et al., 2016), which is the basis for sustainable improvements in wages and living conditions.

Figure 2.5. The share of imported inputs is low

Competition is weak and policies have protected existing industry structures

Shielding domestic producers from foreign competition has curbed competition in many sectors, which has in turn reduced the incentives and discipline for undertaking constant improvements and innovation (OECD, 2015a; World Bank, 2018). Moreover, international trade is an important vehicle for cross-border knowledge diffusion (Andrews and Cingano, 2014).

Trade protection tends to cement existing industry structures and hampers the natural reallocation of resources towards their most productive uses, both across sectors and across firms.. Even more recently, trade policies have been excessively focused on protecting specific economic sectors. This includes both high tariffs but also an extensive use of non-tariff barriers such as local content rules and antidumping measures. Such sector-specific support policies create an uneven playing field that can favour ailing sectors and hamper the reallocation of resources towards the most competitive sectors.

Weak competition within sectors, resulting from trade policies but also from domestic policies, have furthermore protected incumbent firms at the expense of entrants and deterred firm creation. Given the importance of entry and exit for aggregate productivity growth and job creation (Brandt et al., 2012; Criscuolo et al., 2014), this is likely to be one factor behind Brazil’s weak productivity growth.

In contrast, other Latin American countries like Chile, Colombia, Mexico and Peru, but also emerging market economies in Asia, have put a greater emphasis on horizontal policies and in actively promoting integration with large markets such as Japan, China and the United States, which has contributed to better productivity performance (Chapter 1).

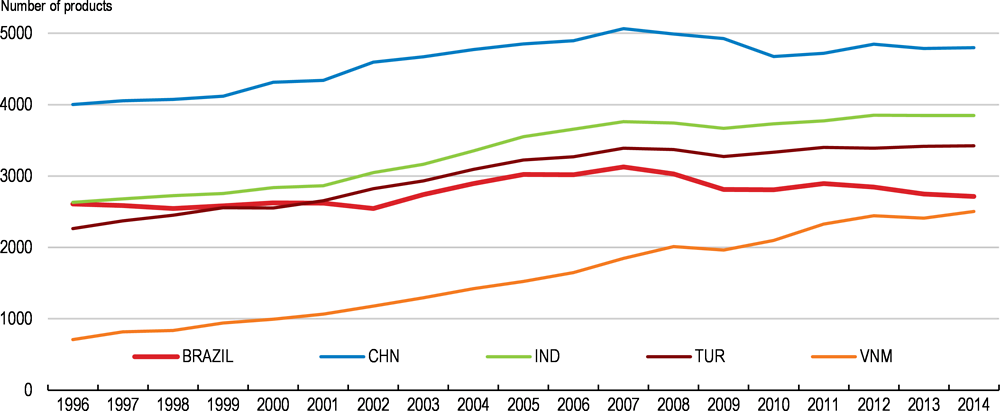

Trade is dominated by commodities

Brazil is a large exporter of natural resources. Soybeans, iron ore, crude petroleum and raw sugar account for 30% of all exports (Table 2.1). Refined and crude petroleum are the largest import items, followed by vehicle parts and cars. Export diversification has fallen overtime (Figure 2.6), and remains below the one observed in other emerging economies, including large economies such as India. At the same time, the level of sophistication of its export base has not improved overtime, with an increasing share of primary agricultural exports). This contrasts with other countries in the region such as Mexico or Costa Rica, which managed to enhance the sophistication of their export basket.

Table 2.1. The structure of exports and imports

10 main exported/imported goods (% on total exports/imports)

|

|

Exports |

|

Imports |

|

|---|---|---|---|---|

|

|

Soy beans and oleaginous fruits |

10.4 |

Refined petroleum |

5.3 |

|

|

Iron ore |

7.2 |

Vehicles and parts |

3.5 |

|

|

Raw sugar |

5.6 |

Electronics |

3.6 |

|

|

Crude Petroleum |

5.4 |

Pharmaceutical |

2.4 |

|

|

Meat |

3.3 |

Crude petroleum |

2.1 |

|

|

Wood |

2.8 |

Vehicles and parts |

2.1 |

|

|

Soybean oil |

2.8 |

Electrical machinery |

2.0 |

|

|

Coffee |

2.6 |

Mechanical appliances |

2.0 |

|

|

Vehicle and parts |

2,5 |

Mineral fuels and oils |

2.0 |

|

|

Aircrafts |

2.4 |

Pharmaceutical products |

1.9 |

Source: OECD computations based on UNCTAD data.

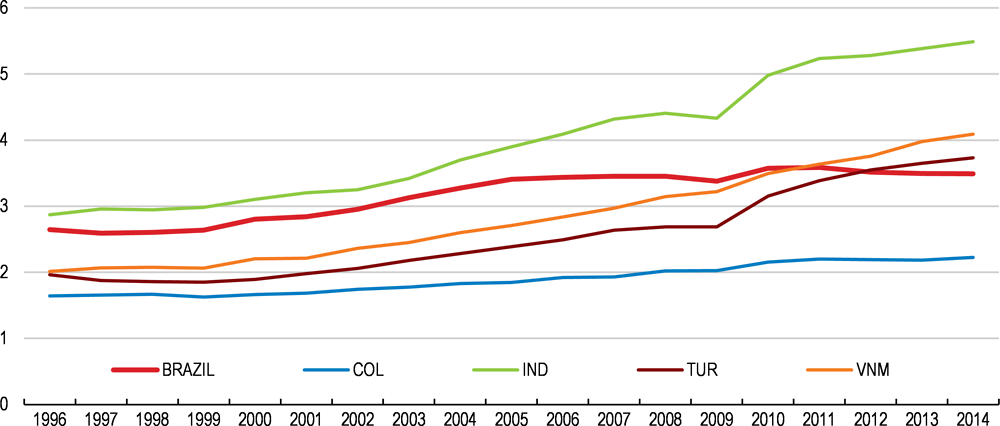

Figure 2.6. Export diversification has fallen

Box 2.1. Building on Brazil’s success in agriculture and food

Brazil is the world’s largest supplier of sugar, orange juice and coffee and among the top three in soybeans, beef, maize and poultry. The strong performance of these sectors today illustrates the benefits of opening up to trade and competition.

In the late 1980s, Brazil started to adopt market-oriented policies in these sectors, which allowed the transformation from being a net food importer to a net food exporter. New technologies and economic reforms, which created a more competitive environment and enabled the reallocation of resources, boosted incentives to increase productivity (OECD, 2015b).

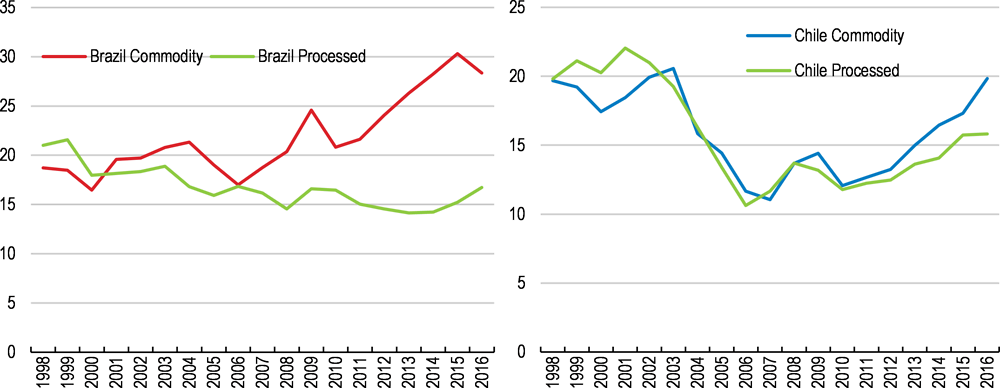

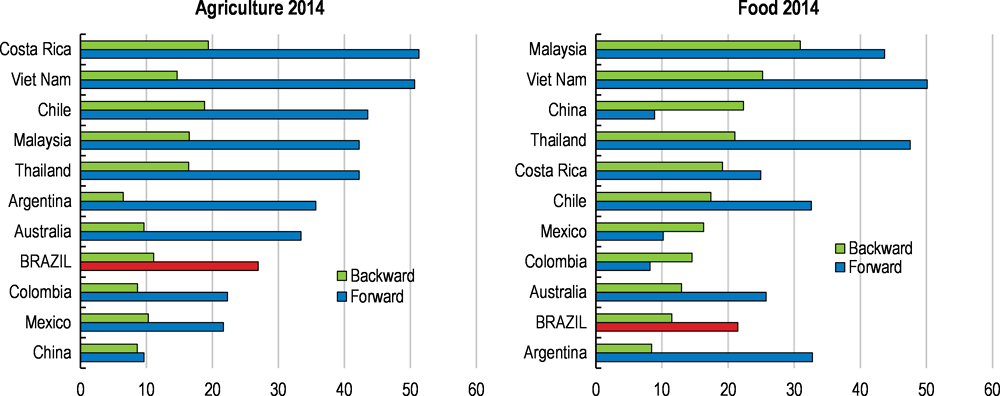

To build on this progress, Brazil will need to respond to global changes in agro-food trade. The share of processed products in global trade has been increasing, to the detriment of primary agriculture products. In general, the demand for goods of higher knowledge content is expected to increase more in the future, also in the agro-food sectors. However, Brazil has been increasing its relative specialisation in raw agriculture products compared to processed foods, in contrast to Chile (Figure 2.7; OECD, 2013).

Figure 2.7. The share of processed agriculture and good exports has diminished

Share of raw and processed agriculture and food exports over total exports

Global value chains (GVCs) are also changing the nature of production and specialisation in agriculture and food around the world (Greenville et al, 2017). Among agro-food traders, Brazil is in the middle range in terms of participation in global value chains in agriculture, and in the bottom in food (Figure 2.8).

Globally, services are an important part of value added in exports in agro-food, greater than in the manufacturing sector. The functioning of services markets is therefore critically important for agro-food sectors. In Brazil, the services value added share of food exports is relatively low (OECD, 2015c), particularly with respect to foreign services.

Figure 2.8. Brazil’s participation in food GVCs is small

Note: Forward participation index: Domestic value added embodied in foreign exports, as % of total gross exports of the source country. Backward participation index: Foreign value added embodied in exports, as % of total gross exports of the exporting country.

Source: OECD (2017a).

Given these trends, Brazil will need to continue improving productivity and competitiveness in primary products to sustain its strong position in this segment. Indeed, it has significant opportunities to diversify its agro-food export base by adding value to primary products and differentiating them. Seizing these would allow Brazil to tap into the increasing demand for processed and differentiated agro-food products. Filling infrastructure gaps, improving access to credit and reducing tariffs on inputs, as recommended across this survey, would help to achieve these goals. Beyond that, services that add value through differentiation, customisation and innovation, such as R&D, design, engineering, branding or IT services are fundamental. Lowering trade barriers in these areas would support a stronger performance in the agro-food sector. Argentina’s wine sector is a good example of how differentiating products, based on innovation and by adding value through marketing and branding services, can allow tapping into new markets and boost exports, incomes and jobs (Artopoulos et al., 2013).

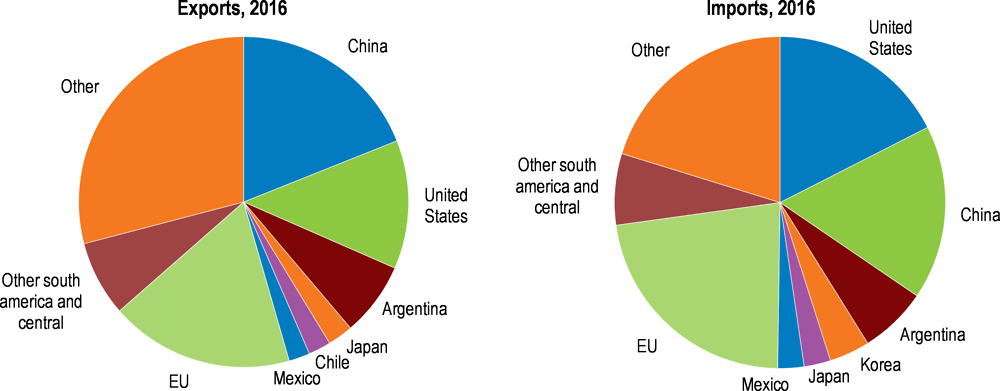

As a major commodity importer, China is Brazil’s main trading partner, accounting for 19% of all exports and 17 % of imports. The European Union and the United States are also important trading partners (Figure 2.9). By contrast, Brazil trades relatively little with other Latin American countries, beyond Argentina. Unlike other emerging market economies, Brazil has not been able to raise the diversification of its trading partners in recent years (Figure 2.10).

Figure 2.9. China is Brazil's main trading partner

Figure 2.10. Brazil has not gained new markets for its exports in recent years

Annual average number of trading partners per product category

Trade barriers have significant economic effects

Brazil’s low participation in international trade is the result of policies that restrict trade in one way or another, as trade policy has focused on safeguarding domestic markets rather than facilitating access to foreign markets.

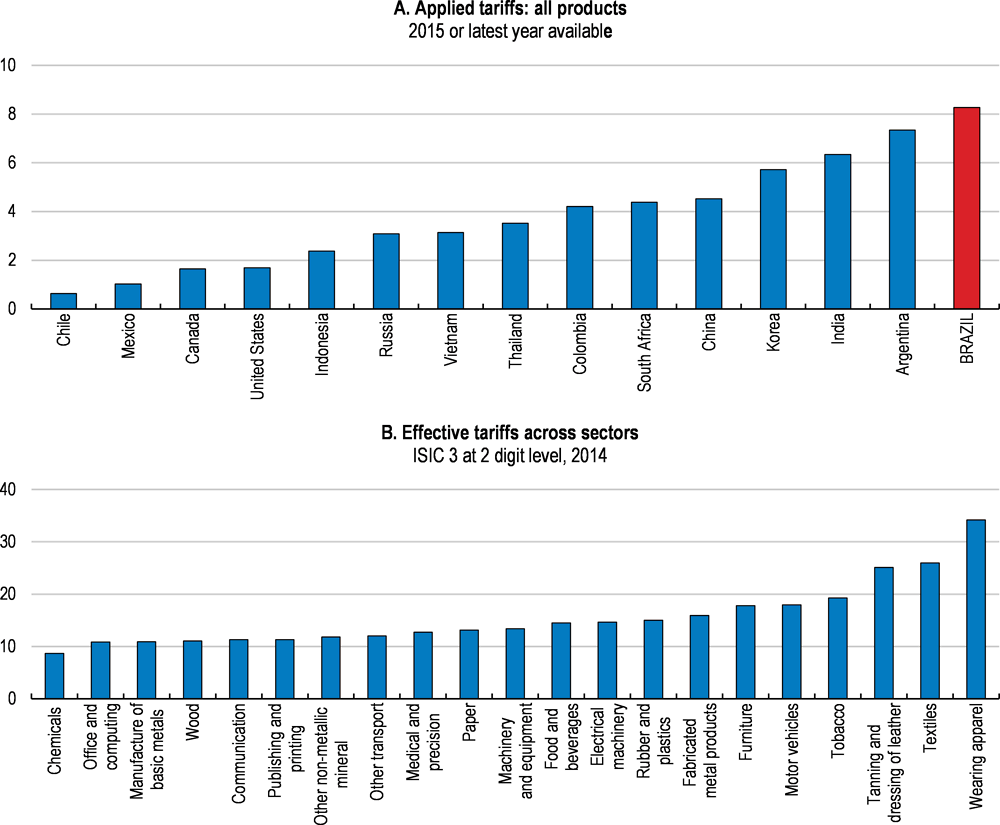

Trade tariffs are high

Tariff barriers are among the highest among advanced economies, but also emerging economies in Latin America and Asia (Figure 2.11, Panel A). For example, average tariffs are almost twice as high as in neighbouring Colombia and more than eight times higher as in Mexico or Chile. Average tariff levels vary across different industries (Figure 2.11, Panel B). Wearing apparel, textiles, motor vehicles and furniture are particularly protected. On the other side of the spectrum, the aerospace industry is much more open to trade (Box 2.2).

Brazil’s most frequently applied tariff rate is 14%, while around 450 tariff lines are at the maximum of 35%, including textiles, apparel and leather. Brazil has the highest number of tariff lines above 10% among emerging markets. High tariffs in labour-intensive and low-productivity activities, such as textiles, distorts relative prices and encourages resources to remain in – or even flow to – low-productivity, protected sectors.

Figure 2.11. Tariffs barriers are high

Box 2.2. A tale of two industries – automobiles and aerospace

Brazil is the world’s seventh largest automobile producer, and the industry is heavily protected from foreign competition. As a result, Brazil’s car manufacturers are excessively focused on the domestic market. Only 15% of the production is exported, much of which is sold to equally protected Argentina where Brazilian producers enjoy tariff preferences, and Brazil ranks only 21st in automotive exports. While many foreign producers have set up production plants in Brazil in light of the country’s rising middle class and the resulting domestic market prospects, most of them have not integrated their Brazilian plants into global value chains. Productivity has fallen sharply behind Mexican car manufacturers, who are fully integrated into global production chains and have achieved remarkable gains in global market share. For example, Mexican plants produce 53 cars per worker and year, as opposed to 27 in Brazil, although the cars produced in Mexico are on average smaller models.

A very different story can be told about Brazil’s aircraft industry. Imports tariffs on aircraft components were lifted, allowing firms in the sector to source from global suppliers. Given that production volumes of airplanes are much smaller than for automobiles, economies of scale mandate that firms in this industry naturally focus on the global market. Embraer, originally created in 1969 as a state-owned company, was privatized in 1994 and has become one of the top global players in the industry since. Its initial strategy was largely based on buying almost all components internationally for a final assembly in Brazil, although over time it has started to produce parts itself. As a result of its roots, Embraer has always been strongly integrated into global production chains, and imports still account for 70% of its value added.

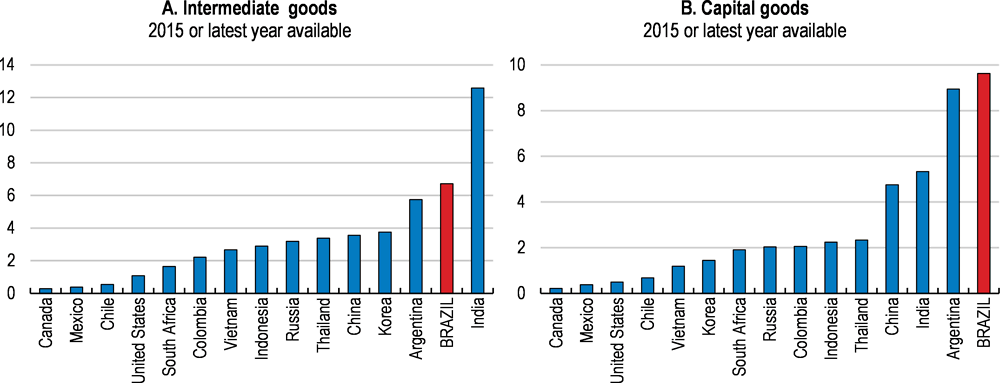

Tariffs are particular high on capital and intermediate goods (Figure 2.12). A special tax regime is in place to reduce import tariffs on capital goods, but it is applicable only if no equivalent domestic product exists, and Brazil has a sizeable capital goods industry. As a result, all sectors face high tariffs on their inputs, which hampers their competitiveness and efficiency. Effective protection levels, which account for total effect of the entire tariff structure across the production chain in each sector, are 26% on average, but range between 40% and 130% for textiles, apparel, and motor vehicles, in ascending order (Castilho and Miranda, 2017).

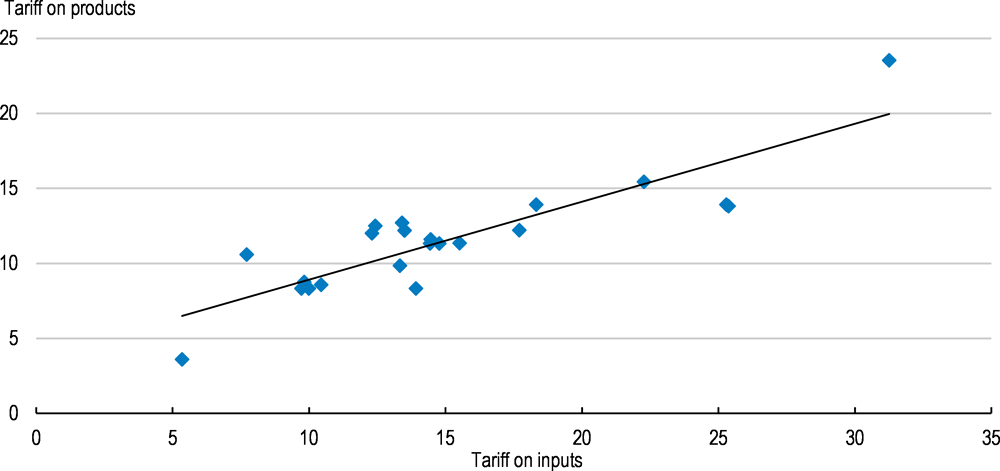

Figure 2.12. Tariff to intermediate and capital products are very high

The detrimental impact of tariff on inputs is larger in sectors whose final products are subject to high tariffs on their outputs, such as textiles, clothing and leather (Figure 2.13). This suggests that some of these sectors could in fact be more competitive in foreign markets if they had better access to competitively-priced inputs.

Figure 2.13. Sectors with high tariffs are also hampered by high tariffs on their inputs

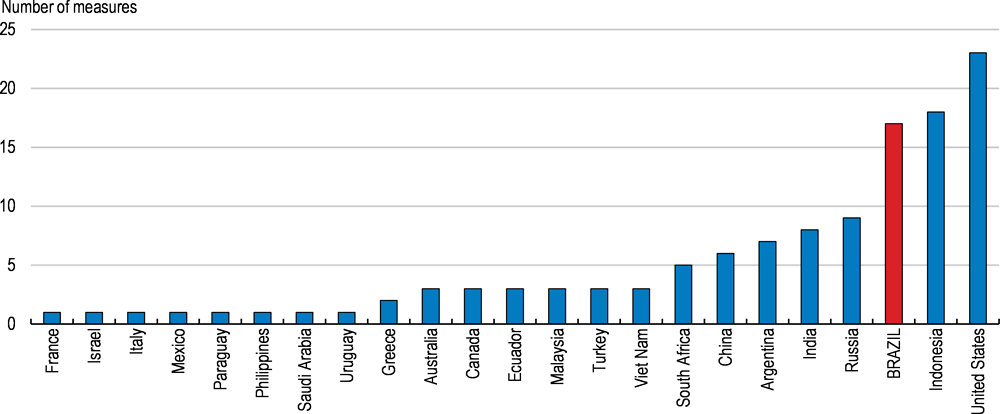

Non-tariff barriers are numerous

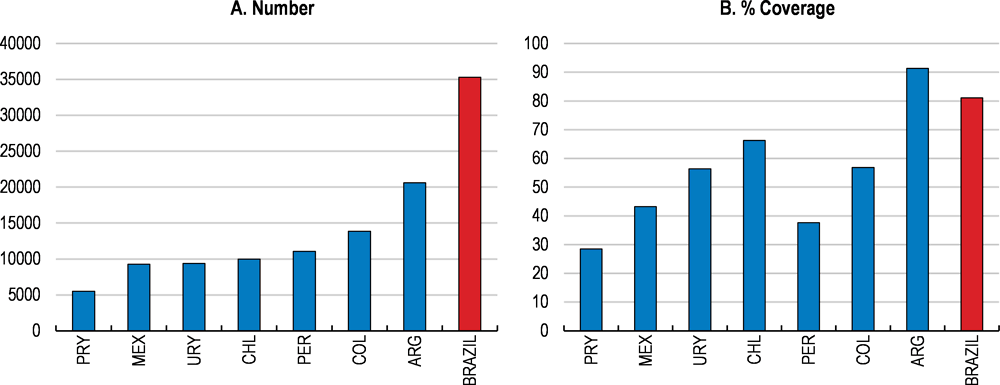

Besides tariffs, other policies also affect trade flows, but often in a much less transparent manner. In Brazil, local content rules and anti-dumping measures are examples of such measures. Some measures such as anti-dumping, countervailing duties and safeguard measures are easy to quantify as they are “tariff-like” measures, acting via a tariff rate or price surcharge. For measures that involve specific regulation, however, measuring the economic effects of so-called non-tariff measures can be fraught with difficulties, as a result of which existing indicators are limited to number counts or measures of the proportion of goods categories subject to a least one non-tariff measure. Compared to other countries in the region, Brazil makes more frequent use of these (Figure 2.14). The non-tariff measures have increased overtime for all sectors, but those more heavily affected are textiles, clothing and leather.

Figure 2.14. Brazil makes a large use of non-tariff trade barriers

Note: Based on product information at a six digit sub-heading in the Harmonized System Classification, as available in UNCTAD TRAINS database. Coverage refers to the percentage of imports subject to at least one non-tariff trade measure.

Source: OECD computations based on UNCTAD TRAINS database.

Local content rules are widely used in Brazil. They are defined as measures that favour domestic industry at the expense of foreign competitors and include aspects of government procurement and regulation (Stone et al, 2015). They are embedded in key government policies such as subsidised lending, transactions with state-owned companies or public procurement and applied more frequently than in other countries (Figure 2.15). For example in wind and power sectors, only those companies using local content of 50% in building their projects qualify for maximum financing from the national development bank BNDES. By excluding competition from imports just like tariffs, local content rules raise costs and reduce the choice of inputs or providers. This has restricted foreign participation and investment in key areas of the Brazilian economy, such as infrastructure projects.

Figure 2.15. Local content rules are relatively abundant in Brazil

Local content rules lack transparency and create the risk of political capture. Empirical evidence suggests that lobbies have had influence on Brazil’s trade policies (Baumann and Messa, 2017). This is not unique to Brazil, but research suggests that the weight is larger than observed in other countries. Moreover, this weight has increased at the same time as the use of non-tariff measures has expanded, suggesting that local content rules may be a preferred, possibly because they are less transparent, vehicle for attending political pressures from lobby groups. Clothing, ITC, electronics and optics are economic sectors benefiting from particularly high levels of trade protection that can be associated with lobby activities (Baumann and Messa, 2017).

Brazil has embarked on a process of reflection about local content rules recently, and some have been relaxed somewhat. This applies most notably to the oil and gas sector, but also to lending operations by BNDES, the largest public bank, which have also seen more flexibility regarding exceptions on a case-by-case basis. In some cases, local content rules could not even be met because of capacity constraints of domestic producers. In the oil and gas sector, for example, some have been systematically under fulfilled due to such constraints. This has led to the application of fines. Continuing the current reflection about the use of local content rules is welcome as their effect on trade is at least as restrictive as that of tariffs and their lack of transparency is a particular concern.

Besides local content rules, anti-dumping measures have been applied in an increasing manner over the last decade (Aráujo de Almeida and Messa, 2017). In fact, Brazil is one of the countries with the highest number of anti-dumping measures in effect (Figure 2.16). At end-2016, the number of measures was double that in the neighbouring Argentina. Empirical evidence for Brazil shows that antidumping measures increase profit margins in protected sectors and decreases their productivity (Remédio, 2017 and Kannebley et al., 2017). Antidumping measures appear to have very limited quantity effects, but they do increase import prices significantly (Aráujo de Almeida and Messa, 2017).

Figure 2.16. The number of antidumping measures in effect in Brazil is relatively large

In effect at end 2016

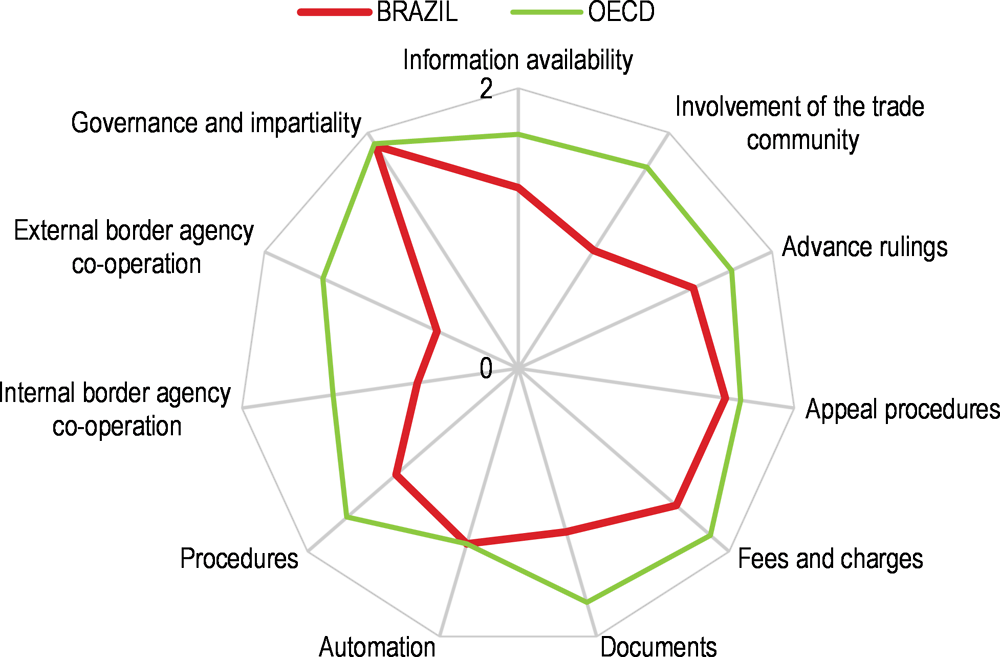

Trade facilitation measures can help

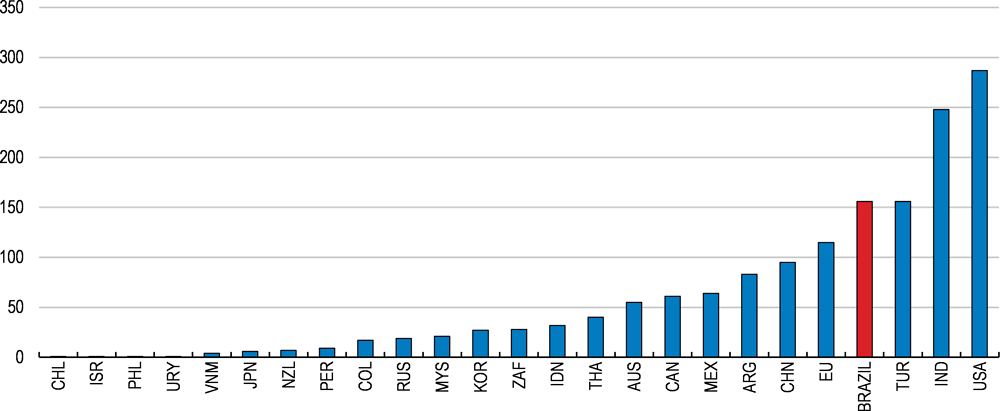

Trade facilitation measures can also play an important role in stimulating trade, for example by reducing costs to exporting, which are relatively high in Brazil (Figure 2.17). Infrastructure bottlenecks, such as those in ports or in roads (Chapter 1) contribute to these high costs to export but the complexity of trade procedures is also a key driver. There is room to improve trade procedures in Brazil (Figure 2.18). Administrative burdens on exports and imports have been high, and rank below regional partners such as Chile or Mexico in terms of efficiency of customs and border clearance, according to World Bank’s Logistics Performance Index. Harmonising procedures into a single electronic document and consolidating information and certifications from various authorities, such as customs or health and agriculture, can significantly increase efficiency in customs and reduce associated costs (Sarmiento et al., 2010).

There are ongoing efforts in the area of trade facilitation in Brazil, including the creation of a single trade window, called Portal Único de Comercio Exterior (Single Trade Window), to make export and import operations less costly. The programme will be gradually implemented until 2018 and foresees wider use of online tools and sharing of information across government agencies to reduce administrative burden. Ongoing efforts are concentrated in exports but it is expected to cover imports as well. These are significant steps in the right direction. Continuing to modernise and simplify customs procedures is fundamental, as cross-country evidence signals that it improves the capacity to export and import high-quality inputs (Moïse and Sorescu, 2012). It will also contribute to reduce the scope for corruption in the customs sector, especially if online procedures are introduced.

Figure 2.17. The cost to export is high

Fees levied on a 20-foot container in US dollars

Figure 2.18. Trade facilitation procedures could improve further

Index scale from 0 to 2 (best performance)

Beyond simplifying customs procedures, a cost-effective avenue for trade facilitation is through more cooperation, both among various agencies of the country and also with neighbouring and third countries. Brazil would benefit from a harmonisation of data requirements and documentary controls among domestic agencies involved in the management of cross border trade, as established in other countries in the region such as Peru and Mexico. A similar coordination and harmonisation effort with cross-border agencies in neighbouring countries will also help to reduce administrative burden. In the same vein, a systematic sharing of control results among neighbouring countries at border crossings would improve the risk analysis as well as the efficiency of border controls and would also facilitate intra-regional trade. Alignment of working days and hours with neighbouring countries at land borders would also contribute to decrease time and costs to trade across borders.

Engaging in mutual recognition agreements would be an additional measure that can facilitate trade. According to the OECD’s Product Market Regulation Indicators, there is room to pursue such agreements in areas such as construction, telecommunications, insurance, hotels and restaurant, and legal and engineering business services. Likewise, requiring regulators to use internationally harmonised standards and certification procedures would also facilitate trade. Business services, such as accountancy, legal, engineering and architecture, are areas where harmonisation is currently lacking.

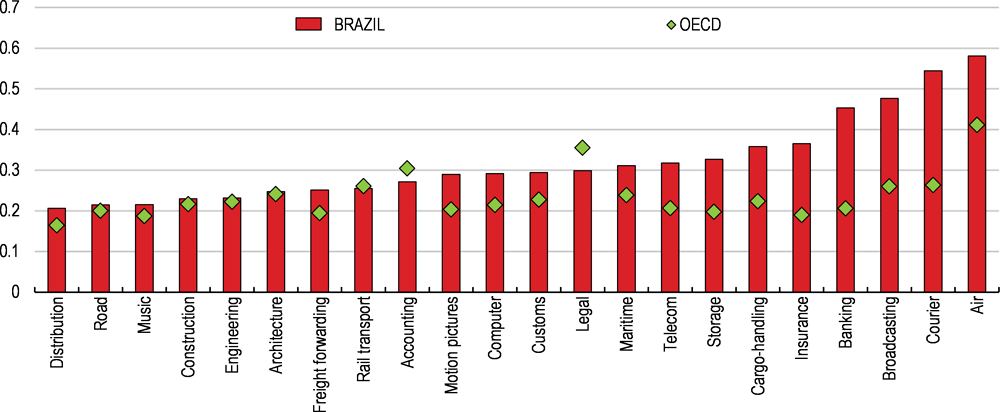

There is scope for more integration in services

The scope for stronger integration is not limited to goods trade. Producer services have also become an important intermediate input into manufacturing activities, representing 65% of manufacturing value added in industrial countries (CNI, 2014). Empirical research has demonstrated the significant role that services inputs can play for manufacturing productivity (Arnold et al., 2011; 2016). Brazil’s regulations are more restrictive than the OECD average (Figure 2.19), particularly so in the area of logistics, legal services, architecture and engineering services, telecoms, banking, insurance, air and rail transport and courier services. These barriers take the form of restrictions on foreign entry, such as in legal or accounting services, but also barriers to competition in telecommunication or lack of regulatory transparency in logistics services (OECD, 2016).

Across all sectors, the scope for using imported producer services is further limited by the taxation of many imported producer services under the CIDE tax. CIDE contributes to the very high taxation of imported services, for which effective tax rates range between 40% and 50% (Ernest and Young, 2013).

Figure 2.19. Brazil restricts trade in services more than other countries

Index, from 0 (least restrictive) to 1 (most restrictive)

Seizing the opportunities of the global economy

A stronger integration into the global economy would bring significant benefits in terms of growth and well-being. Estimates suggest long-run GDP gains of 8% (Table 1, Assessment and Recommendations). In fact, current trade barriers are preventing many Brazilians from seizing the opportunities of trade that have raised living standards in other emerging market economies. Instead, current barriers generate monopoly rents for a few and protect selected sectors at substantial costs for the rest of the economy.

The increase in trade that Brazil could experience from lowering its trade barriers is potentially large. Weak competitiveness has been a key concern for the manufacturing sector, for example, and part of this is related to a lack of competitively priced inputs and low levels of competition (OECD, 2015a). Lower trade restrictions, in addition to domestic structural reforms, would enable Brazil to become a strong producer for international markets in many sectors. The economy would also gain attractiveness as a production base for globally-oriented companies, who may see a large domestic market as an additional bonus rather than the only reason for coming.

More foreign trade and investment would generate economies of scale and trigger large productivity gains, which has been well-documented in the empirical literature for a wide range of countries (Amiti and Konings, 2007; Bloom et al. 2016; Taglioni, 2016; Haugh et al., 2016; Pavcnik, 2002, Tybout, 2002, Harrison, 1994; Ferreira and Rossi, 2003; Krishna and Mitra, 1998; Schor, 2004, Levinsohn, 1993). In addition, the flow of resources to more productive uses that result from stronger international integration would trigger substantial productivity gains and raise living standards.

It is important to acknowledge that opening up to trade, even gradually, will involve adjustment costs for some workers. Although the overall employment effects are likely positive, reallocation implies that jobs will be lost in some sectors, firms and regions and created in others. These movements enable capital and labour to move to more productive sectors where new firms will be created, or existing ones will expand, creating new jobs. But in the transition process policies can go a long way to reduce the burden of adjustment for poor and vulnerable households. Therefore, it is fundamental to analyse which sectors and regions would be affected by these adjustment costs so that appropriate policies, as discussed further below, can be deployed.

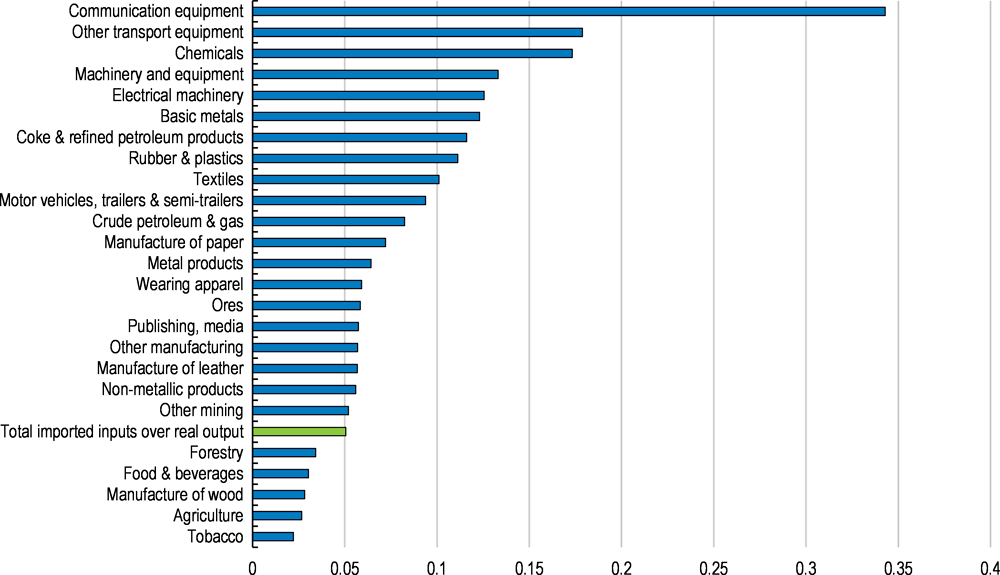

Productivity will improve through several channels

The economic literature has identified a positive link between decreasing tariffs barriers and productivity through various channels. One of these is the ability to source imported intermediate inputs and capital goods at a lower cost, thus raising competitiveness. Economic theory predicts that the competitive threat of imports will increase innovation and productivity among the more advanced firms in the intermediate sector that produce inputs for the final sector (Helpman and Krugman, 1989; Aghion et al., 2003). A tariff reduction in the input sector will then lead to higher productivity in the downstream sector as a result of this competitive effect. In addition to the price of inputs, their quality will also improve, for example by using more advanced technologies.

These effects do not necessarily imply a massive substitution of domestic inputs and capital goods by imports. Domestic producers of such goods would react to the stronger foreign competition by reducing their prices, reducing slack and improving their products. Many domestic producers would be able to withstand foreign competition through productivity-enhancing adjustment, and only the least productive ones would lose the battle and exit.

A substantial body of empirical work has confirmed the predictions from theory (Krishna and Mitra, 1998; Tybout, 2002; Pavcnik, 2002; Ferreira and Rossi, 2003; Schor, 2004; Amiti and Konings, 2007; Fernandes, 2007). In the case of Brazil, the reduction in tariffs undertaken in the first half of the 1990s made a substantial contribution to lowering input prices, particularly capital goods and led to a significant increase in productivity (Lisboa et al., 2010; World Bank, 2018). Such an effect was significantly stronger in the technology and capital-intensive sectors than in the natural resources and labour intensive ones. More broadly, recent studies have concluded that a 1% reduction in tariffs of inputs would increase productivity by around 2% (Gazzoli and Messa, 2017). Productivity would increase across all economic sectors, although the increase would be somewhat stronger for firms already making use of imported inputs.

Communication equipment, transport and chemicals products are the manufacturing sectors making larger use of imported inputs (Figure 2.20) and therefore would be those benefiting more from a cut in tariffs. Beyond manufacturing, extraction of crude petroleum and natural gas, and mining of metal ores would also potentially benefit largely from better access to foreign inputs.

Figure 2.20. Sectors using more imported inputs will benefit more from tariff cuts

Imported inputs over total outputs

Besides the input effect, the disciplining impact of foreign competition in the same sector would also force companies to reduce inefficiencies, apply more advanced technologies and reduce margins. Again, this would not imply a complete substitution towards imports, but rather lead to a revitalising effect by which the more productive firms manage to use the new incentives to become more efficient while some low-productivity firms would leave the market, freeing resources for more productive ones.

This would also create an environment in which it would be easier for new firms to enter and thrive. Among these, there are typically a number of so-called “rising stars”, i.e. new firms with a steep upward trajectory in productivity, which have been shown to contribute strongly to overall productivity growth in advanced economies (Bartelsman et al., 2013). New firms also tend to contribute disproportionately to job creation (Criscuolo et al. 2014).

Brazil, as other economies, shows a large firm heterogeneity with respect to size and productivity. For example, Brazilian exporting firms are 50% more productive than non-exporting ones (Araújo, 2017). This suggests that the scope for increasing productivity by reallocating resources would be large. The potential gains in terms of productivity of moving to a more efficient allocation of capital and labour have been estimated at 40% (Busso et al, 2013). This estimate is likely to be a lower bound as it is based on firms above 30 employees, and in Brazil, as elsewhere, the proportion of small firms is large and they display lower productivity. Potential gains would also vary across economic sectors and go beyond the manufacturing sector. For example they could reach 250% in the retail sector (De Vries, 2009). This large gain highlights that a good part of the low productivity in the services sector is not only due to the low productivity of firms, but also to the inefficient allocation of resources across them.

Reallocating resources imply that some firms, those less efficient, will exit. Studies based on data up to 2007 indicate that those firms that exited were 25% less productive than those that continue their activity (Gazzoli and Messa, 2017). Given that non-exporting and small firms are significantly less productive, it is expected that they would be the most affected by the resource reallocation.

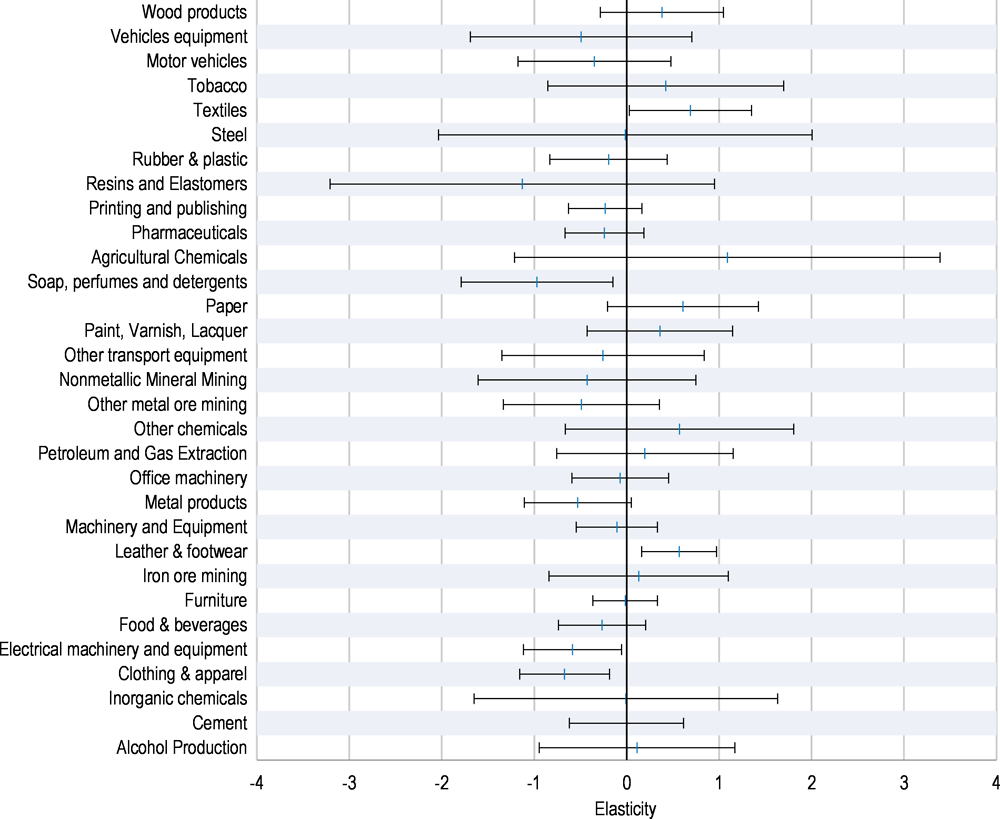

The impact would also diverge across economic sectors. Empirical analysis undertaken for this chapter has looked at how sectors have reacted to changes in effective trade protection over the past 20 years (Arnold et al., 2018). The difficulty with this exercise is that trade policy has hardly changed over this period, meaning that there is no variation to exploit empirically. However, exchange rate movements can have similar effects as trade protection, at least as far as competition with imports on the domestic market is concerned. Since exchange rate movements are affected in part by domestic developments and may hence be endogenous, the analysis has relied on instrumental variables techniques to identify exogenous variation in the BRL-USD exchange rate, based on developments that affected the global economy and that are not specific to Brazil. Relating these exogenous exchange rate movements (as a proxy for changes in trade protection) to the output of different sectors suggests that only a very limited number of sectors have seen their output reduced when foreign competitive pressures on the domestic market intensified (Box 2.3). The only two sectors for which the positive link between trade protection and value added is significant at the 95% level are textiles and shoes. These sectors may indeed reduce their activity in Brazil as trade barriers fall. By contrast, clothing, electrical equipment and para-pharmaceutical products have grown whenever simulated trade protection fell, which is consistent with benefits resulting from lower input prices.

Box 2.3. Quantifying the effects at sectoral level of a cut in trade tariffs

Trade protection in Brazil has not changed significantly since the beginning of the 1990s, which hampers any attempt to quantify the effects of a tariff reduction. However, an appreciation of the exchange rate is akin to a reduction in trade barriers, as far as domestic sales are concerned. Hence it is possible to proxy tariff cuts by long-lasting exchange rate changes (Arnold et al., 2018). By regressing the nominal exchange rate on market sentiment indexes and on global liquidity indicators, one is able to single out exogenous global drivers of exchange rate movements, such as global risk-appetite or levels of liquidity on international financial markets, allowing the construction of an exogenous proxy for changes in effective trade protection through long-lasting exchange rate trends. After constructing these measures, elasticities of sectoral value added with respect to changes in effective protection have been estimated (Figure 2.21).

Figure 2.21. Estimated responses of value added by sector to changes in trade protection

Note: How to read this chart: A blue centre bar above zero represents a positive estimated elasticity of sector value added in response to changes in trade protection, i.e. when protection rises, sector output will rise as well. The ends of the bars represent 95% confidence intervals.

Source: Arnold et al. (2018).

The estimated elasticities do not support the idea of widespread sectoral contractions in response to lower trade protection. For example, a 50% tariff cut would reduce output in textiles between approximately 5 and 70%, and output in leather & footwear by between 10 and 50%, but it would increase value added in clothing between 10 and 60%, and in electrical equipment between 5 and 55%.

Simulations based on a theoretical model have found quite similar results (Messa, 2015). These findings also hint at a positive effect for the clothing sector and find also a negative impact for textile and leather sectors. Other sectors either would not be affected by the cut or would be positively impacted, in particular in agriculture and extractive sectors, which would benefit from the cheaper access to capital goods.

Workers will benefit from new opportunities, despite short-term adjustment costs

The economic literature has concluded that the contribution of international trade to growing inequality has generally been modest (Goldberg and Pavcnik, 2007) compared to other forces such as technology. Improvements in export performance can even create substantial amounts of jobs. In the case of Brazil, the export acceleration during the early 2000s contributed to a fall in inequality and unemployment, suggesting that new export opportunities could foster inclusiveness (Cera and Woldemichael, 2017).

It is important to note that much of the existing wage inequality in Brazil occurs within sectors and occupations rather that between sectors and occupations and that wage inequality tend to occur between firms rather than within firms (Helpman et al., 2012). This reflects the large differences in productivity across firms and the fact that a significant share of labour is trapped in low-productivity firms that manage to survive on the back of preferential treatment including tax benefits specific to small and medium enterprises or specific sectors or regions, in addition to informality or subsidised access to credit (Castelar, 2017). A process of reallocation that would allow these jobs to move into higher-productivity activities would enhance the scope for better wages.

In addition to the competition effect, export status per se is a fundamental source of this type of wage inequality. Brazil shows one of the highest wage export premium among Latin American and emerging economies. Brazilian exporter firms pay 51% higher wages than non-exporters (Brambilla et al, 2016), which is in line with their higher productivity (Araújo, 2017).

Whenever some sectors or firms grow at the expense of others, this implies job losses in some areas and job creation in others. These effects are positive for the economy as a whole and, in the medium-run they raise the earnings potential of those workers who manage to find jobs in more productive activities. Still, such involuntary job changes can obviously imply temporary hardship for displaced workers who need to seek a new job. How large adjustment costs will be is determined by how swiftly workers can move across sectors. Currently, Brazil is already characterised by high voluntary job turnover rates in international comparison (see Chapter 1), suggesting that the burden on individuals is probably not too high. However, to the extent that job changes have to occur across sector boundaries, new skills may be required and this may involve risks for some workers. Policies should therefore be put in place to prevent long periods of inactivity or shifts into low-productivity informal activities, particularly for those with low skills and low incomes.

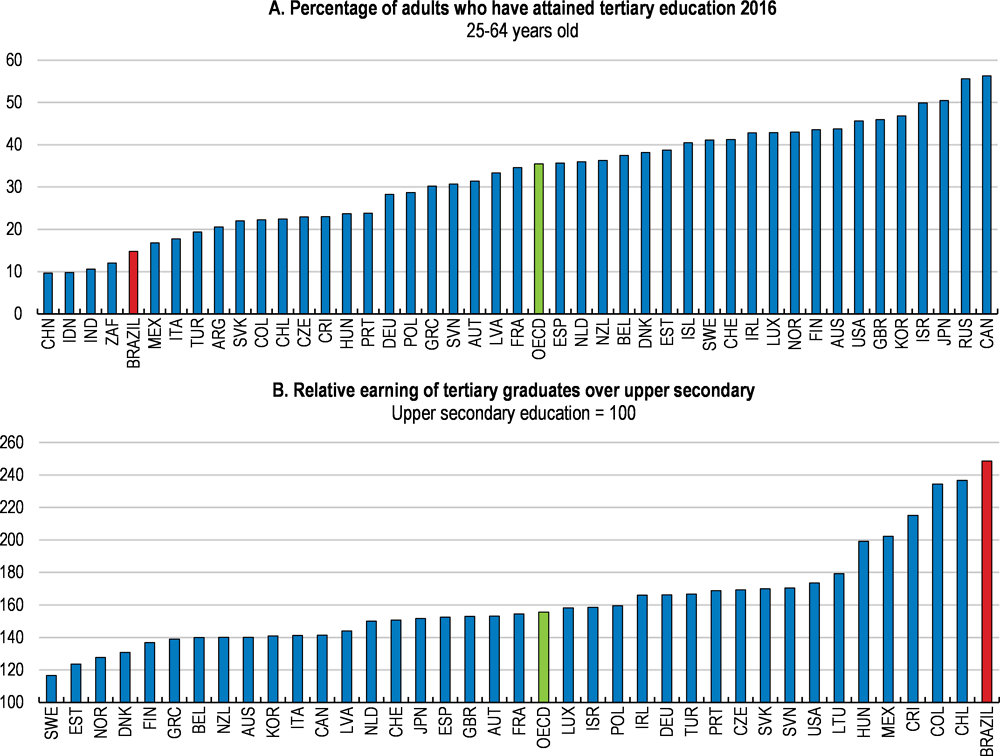

Increasing integration to the world economy would also raise the demand for skills. Not only do exporting firms pay a wage export premium in comparison with non-exporters but they also increase their demand for skills (Araújo and Paz, 2014). As Brazilian firms increase their imports of inputs of higher technology content, this will favour the adoption of new technologies, which in turn will increase the demand for skilled workers (Araújo and Paz, 2014 and Fajnzylber and Fernandes, 2009). This increasing demand for skilled workers will probably occur first in those sectors that make a greater use of foreign inputs (Acemoglu, 2003).

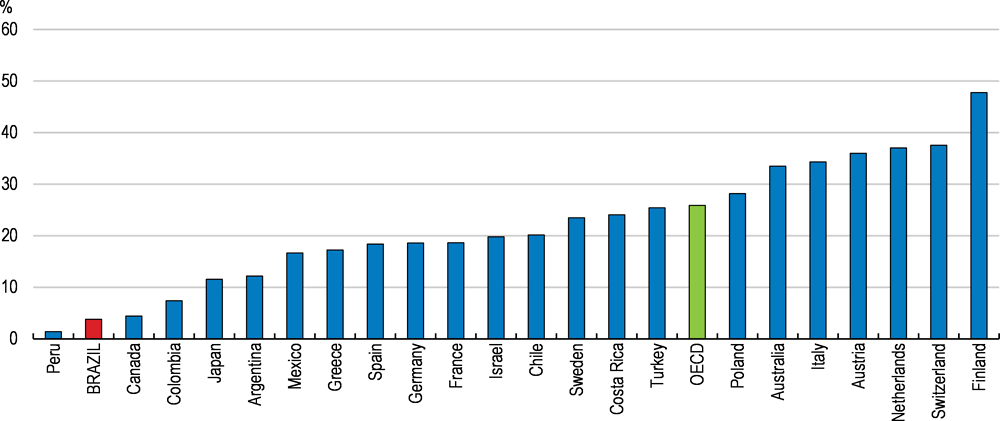

This expected increase in demand for skilled workers highlights the need to accompany changes in trade policies with stronger efforts to improve education outcomes. Only 15% of 25-64 year olds in Brazil have attained tertiary education, well below the OECD average and also below other Latin American countries such as Argentina, Chile, Colombia, Costa Rica or Mexico (Figure 2.22, Panel A). Employers are already struggling with difficulties to find skilled workers, especially in technical areas (ManPower, 2017). This is reflected in high skill premiums. Although it has declined over the past decade as more people gained access to education, Brazil still has one of the highest skill premiums among advanced and emerging economies (Figure 2.22, Panel B). A person with a bachelor degree earns 2.4 times more than those attaining upper secondary education.

Figure 2.22. The share of tertiary graduates is relatively low

Changes in trade protection can affect men and women differently as they are often employed in different sectors of the economy. Moreover, women are still more likely than men to be a secondary earner in the household. Empirical analysis for Brazil shows that the reduction in trade protection that occurred in the late 1980s and early 1990s was associated with an increase in female labour force participation and employment (Gaddis and Pieters, 2012). Female labour force participation and employment increased faster in those states that had greater exposure to the reduction in trade protection due to their sector specialisation. The increase in female employment occurred, on one hand, because new opportunities for women arose, particularly in trade and other services sectors. On the other hand as a result of lay-offs that affected men in some sectors, more women join the labour force.

Tariffs are taxes on imported goods and tariff rates are far from uniform. Since people with different levels of income consume these goods at different intensities, tariff reductions will also have a distributional impact.

Several studies have analysed the effect of trade from a consumption or expenditure perspective (e.g. Fajgelbaum and Khandelwal, 2016; Atkin et al., 2015). They focus on how international trade affects individuals through the expenditure channel and conclude that trade is pro-poor as the relative prices of goods consumed more intensively by the poor fall more. Analyses of the incidence of tariffs themselves across the income distribution are less frequent. But existing studies conclude that tariffs tend to have a regressive effect (Furman et al., 2017 and Porto, 2006).

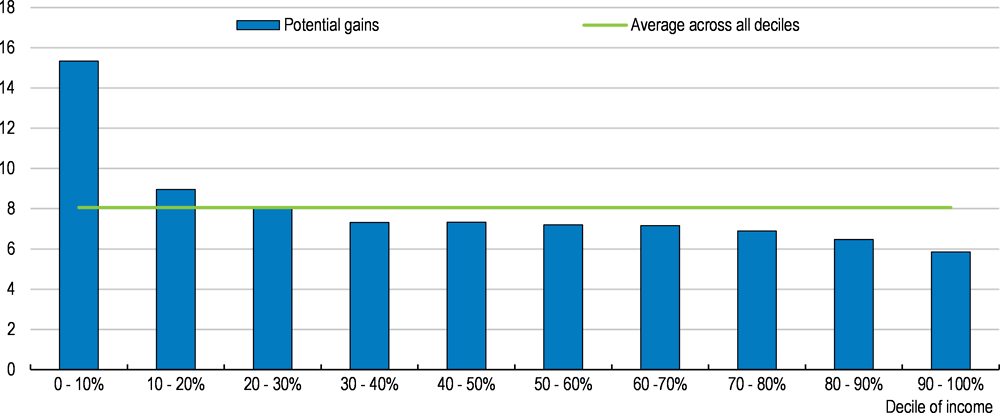

An analysis based on Brazilian household survey data conducted for this chapter reveals similar results. Reducing tariffs would result in income gains across the entire income distribution, but the largest benefits of the tariffs cut would accrue to lower income households (Arnold et al. 2018). In a scenario of tariffs being reduced to zero, the purchasing power of the poorest households, i.e. those in the lowest income decile, would increase by 15% (Figure 2.23). Overall, average household income would increase by 8%. The marked pro-poor feature of the tariff reduction is explained by the fact that lower income households spend more on traded goods as a share of their income. In addition, the higher tariffs are placed on key consumer goods, such as food, home appliances, furniture and clothing, which represent a relatively larger share in the consumption basket of lower income families. Thus, from a consumption perspective, the Brazilian tariff structure is clearly regressive and reducing tariffs would contribute to reduce income inequality. It will bring particular benefits to poor consumers, including women in their role as family providers (UN-IANWGE, 2011).

Figure 2.23. Reducing tariffs would benefit especially low-income households

Potential gains in purchasing power by deciles of income distribution

Policy options to strengthen integration

Defining a concrete policy agenda for integration requires a reflection on the right sequencing and about which policies should go in tandem with trade reform so as to maximise the benefits of trade. It will also require thinking about the role of international trade negotiations.

A gradual and pre-announced reduction of trade barriers would have many advantages

The case for Brazil to become more integrated into the global economy and fully reap its benefits in terms of economic growth and jobs is strong. Finding a right sequence for reducing numerous trade protection mechanisms would facilitate the quick materialisation of positive effects and would also help to mitigate adjustment costs.

A gradual, pre-announced and steady reduction of both tariff and non-tariff protection has many merits as it encourages firms to upgrade their technologies and become more competitive before protection is removed, helping to mitigate negative effects on some sectors. Thus, establishing and communicating a clear and credible time line for phasing out trade barriers could be a useful instrument. At the same time it is also important that in sectors providing key intermediate inputs to other parts of the economy, such as capital goods, trade protection is removed promptly to avoid harming the competitiveness of sectors that can benefit from better access to inputs. This would reduce effective trade protection across all the economy. This would in turn help to boost exports, as with expanded access to modern technology embodied in foreign inputs local companies can become more productive and competitive in global markets (Amiti and Konings, 2007). Tariffs on those goods with the highest tariffs are also good candidates for being reduced first, as it would help to eliminate the largest distortions (Rodrik, 2007). Lowering tariffs would not result in significant fiscal losses as they currently amount to around 0.5% of GDP and the productivity effects of better integration would likely lead to an expansion of activity and additional tax revenues.

Scaling back non-tariff mechanisms such as local content rules should also be frontloaded, as these measures are particularly non-transparent and their effects can be more binding than those of tariffs. First steps in the reduction of local content rules have been taken in some areas such as in the petrol industry. This should be pursued further and extended to other areas, as this will also help to boost investment. Eliminating local content rules from public procurement at all levels of government and from other government policies, such as directed subsided credit granted by public banks, would contribute to a more efficient allocation of resources and would have visible short-term benefits and even provide fiscal savings.

Reform packaging would help to maximise the benefits of trade, but should not be a pre-condition

To increase integration into the world economy and fully exploit the benefits of a gradual reduction of trade protection, accompanying trade reform with reforms in other key areas of the economy would ease the transition. The competitiveness of Brazilian firms could be improved by better infrastructure, lower administrative and tax compliance burdens or a more developed financial system. Reform packaging can also facilitate the implementation of reforms as it helps to maximise benefits and support those that may be initially negatively affected (OECD, 2017c). It also allows exploiting synergies and encouraging a faster translation of trade integration into more jobs and better living conditions. Improving education and active labour market policies is fundamental in this regard, and reforms in those areas should proceed in tandem with the trade reforms. Improvements in infrastructure would also bring benefits for workers from more remote and isolated areas and allow them to access newly created jobs. Ongoing efforts to improve the business environment would also help in the transition to a more open economy.

At the same time, some of these reform efforts have confronted challenges of their own in the past and building a political consensus may require further time. It may therefore not be a wise idea for trade policy reforms to be put on hold until all the other structural bottlenecks are removed. At the same time, it is important to acknowledge that more external competition would strengthen the voice of those advocating such domestic reforms and may in fact unlock progress in areas such as taxes, where discussion have been going on for many years.

Both unilateral and new trade agreements are needed

Trade policies can contribute to boost export performance by providing wider market access and facilitate integration into global value chains. Brazil, is a member of the Mercosul customs union, which has helped to strengthen trade linkages with other members of the trade bloc, in particular Argentina. At the same time, the exchange of goods and services with the rest of the region is weak (IMF, 2017). Regional integration could be supported by negotiations with other trade blocs and countries in the region such as the Pacific Alliance or Mexico. Besides lowering tariff barriers, which in the case of Brazil are on average significantly lower for vis-à-vis countries in the region than those outside, a convergence of trade rules and regulatory standards could also play a significant role. Finally, weak connectivity among countries due to geographic factors and low investment in infrastructure has been identified as key reasons behind Latin America’s relatively low intra-regional trade integration. This highlights the importance of progress on the quality of transport infrastructure (Chapter 1), the efficiency of customs management and the quality of logistic services (IMF, 2017).

Beyond South America, a tighter integration with large foreign markets would have strong potential to deliver a significant boost in competition and access to intermediate goods. Brazil has been significantly less active than other countries in the region in getting access to new export markets. It has bilateral trade agreements with economies representing only about 10% of world GDP. Countries like Colombia, Chile and Peru have more actively pursued free trade agreements and have concluded bilateral or multilateral negotiations with numerous developed and developing countries in other regions, especially Asia. As a result, their agreements cover economies representing about 70-80% of world GDP. Since Mercosul was created in the early 1990s, Brazil has only concluded three free trade agreements, while Mexico, since NAFTA, has put in place more than 40 agreements.

New opportunities for Mercosul to seek more trade agreements are coming up. Besides fostering stronger regional integration among Latin American economies, negotiations, such as those currently underway with the European Union/EFTA are important initiatives in which Brazil should play a leading role, taking advantage of the window of opportunity presented by recent policy efforts in Argentina to foster a greater integration into the global economy. This could combine the benefits of more openness with improvements in market access, particularly in the area of agriculture where Brazil has an obvious competitive edge. At the same time, the sometimes glacial pace of trade negotiations suggest making unilateral advances alongside bilateral negotiations according to a gradual, pre-announced schedule on both tariffs and local content rules, which should be phased out more swiftly. Many Asian countries pursued a strategy of liberalising unilaterally in addition to regional and bilateral agreements, with tariffs often reduced for the purpose of attracting investment (Baldwin, 2006).

Making trade work for all Brazilians

It is important to acknowledge that trade opening combines strong medium-term benefits, such as more and better jobs, with short-run adjustment costs as jobs will be lost in some firms, sectors and regions, and created in others. Policies can go a long way to reduce the burden of adjustment for poor and vulnerable households and facilitate that all Brazilians benefit from trade and that those that may be initially hurt by the transition get adequate support. This is particularly relevant to strengthen political support for stronger integration into the global economy.

Protecting workers with better active labour market policies

Policies should put the emphasis on supporting workers rather than on protecting economic sectors or firms (Flanagan and Khor, 2012). The focus should be on equipping them with the means to succeed in an open and changing world. This requires helping workers move from jobs in declining sectors to jobs in expanding sectors. This can be best achieved through activation measures, education and training, and by facilitating labour mobility across sectors but also regions.

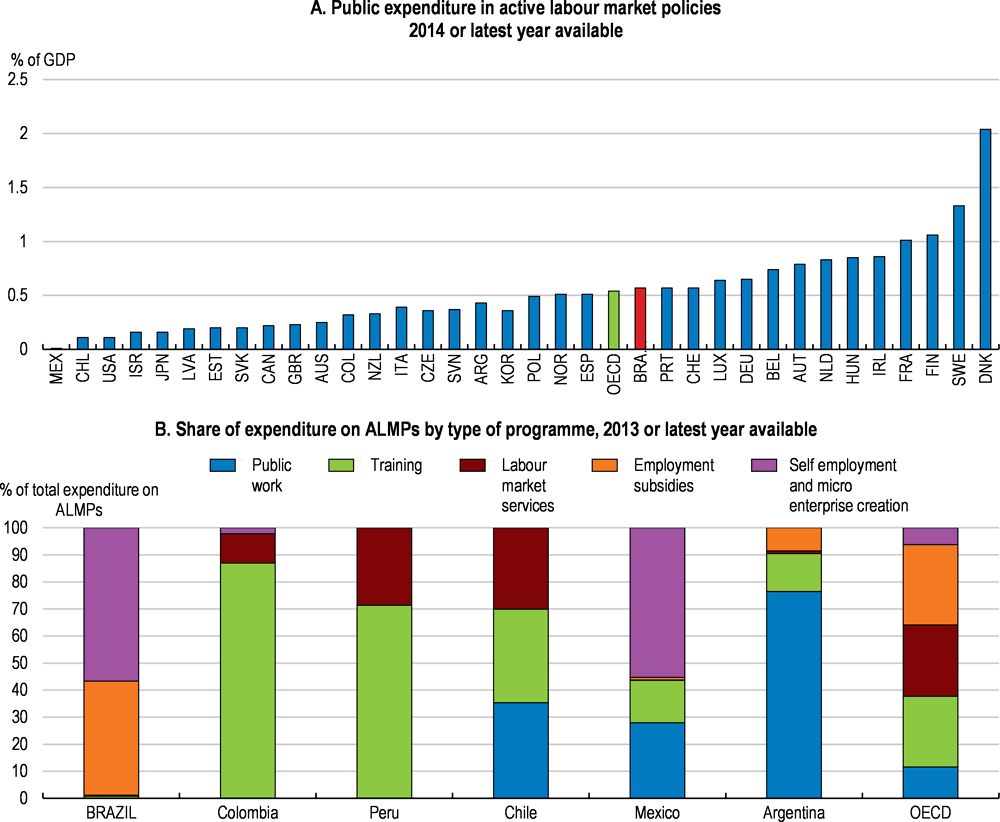

Scaling up active labour market policies and providing training opportunities is a key policy lever in this context. Training can help workers to get ready for new jobs in expanding sectors, and even enhance their chances of accessing better paying jobs. Unemployment benefits or other social safety nets can also protect incomes during temporary unemployment spells.

Spending on active labour market policies is on par with the OECD average (Figure 2.24, Panel A). But most of the spending goes to programmes to support self-employment and micro enterprise creation (56%) and employment subsidies (42%). Conversely the share of spending on training is very low, and below spending in Chile, Colombia or the average OECD country (Figure 2.24, Panel B). Labour market services take also a limited share of government budget, compared with Chile, Peru or OECD countries.

Programmes to support self-employment and micro enterprise creation are less effective in increasing the future employability of participants (Brown and Koettl, 2015). In the same vein, the effect of employment subsidies tends to be short-lived. Thus, shifting spending towards those schemes that support the acquisition of new skills, such as training, would better support that Brazilians get ready for the new jobs that will be created. Programs to retrain workers so that they get new skills and ready for new jobs in other sectors are only starting to be deployed and should become a priority. In addition, job search assistance programmes can help workers identify new job opportunities that they may not have been aware of, particularly in combination with new training opportunities.

Vocational education and training programmes have become a priority under the PRONATEC flagship programme, with a focus on reaching the poor and disadvantaged population. Still, Brazil has one of the least developed vocational tracks among advanced and Latin American economies (Figure 2.25). Given the needs, it is fundamental that resources devoted to technical education are allocated to programmes and courses that help participants to enter the labour market. To that end it is crucial that the impact of VET courses on participants labour market outcomes are tracked and that that information is used to adjust courses. So far such mechanisms for ensuring the labour market relevance of training courses offered are lacking.

Reinforcing unemployment insurance and the social safety net

Brazil has two parallel unemployment insurance schemes schemes, Seguro Desemprego and the individual unemployment accounts called FGTS (Fundo de Garantia por Tempo de Serviço). These two programmes essentially serve the same purpose.

Seguro Desemprego covers job losers in the formal private sector with monthly benefits over a period of three to five months, depending on their employment over the last three years. The duration of the benefit is short in comparison with OECD countries, where the average maximum period for receiving unemployment insurance is 16 months. A longer duration, conditioned on attending training and job-search efforts, would be advisable to provide affected workers with time to identify or get ready for a newly created job.

Such an extension of the benefit duration could be financed by merging the system with the individual account system FGTS, which is financed principally through an 8% employer contribution on salaries and government top-ups. Such individual account systems has performed well in several OECD countries, most notably Austria. In Brazil, however, the fund has been poorly managed and remunerated substantially below market rates in the past, leading to poor or even negative returns (OECD, 2014a). The individual accounts can only be accessed by workers upon unjustified dismissal and certain other life events, and a fine equivalent to 40% of the accumulated fund is paid by the employer directly to the worker. This has generated strong incentives for workers to induce their own dismissal. In addition, the value of severance pay for workers with four years of tenure is high by OECD standards and may create incentives for employers to dismiss workers earlier rather than later, further contributing to Brazil’s already high job turnover (OECD, 2014a).

Figure 2.24. Spending on active labour market is very concentrated in subsidies

Source: OECD Public expenditure and participant stocks on LMP database; ILO; and ILO (2016) "What works. Active labour market policies in Latin America and the Caribbean."

In its current configuration the FGTS is not providing income support in case of job losses as it creates perverse incentives for both among employers and employees to terminate voluntarily the employment relationship. Thus, the fund should be re-designed. One option would be to merge or sequence FGTS and Seguro Desemprego. FGTS could be used to provide income support beyond the three or five months during which Seguro Desemprego offers support. Such an option would provide better incentives and protect workers for longer time in case of a genuine job loss, facilitating that workers can follow a training to get ready for a new job.

Figure 2.25. Vocational education is not well developed

Percentage of secondary education enrolled in vocational programmes, 2015 or latest year

In the transition, FGTS account balances, whose remuneration has traditionally fallen short of inflation, should be remunerated at market rates to reduce the currently strong incentives for frequent job turnover, often involving self-induced layoffs by arrangement with the employer. Two overlapping employment subsidy programmes with a joint cost of 0.2% of GDP and no proven effects on formal job creation, Abono Salarial and Salário Família, could be reconsidered as they reach only workers with above-median incomes (see Figure 15, Assessment and Recommendations).

With almost half of employment currently informal, existing income protection schemes fail to reach the more vulnerable half of workers. This may strengthen the case for raising benefit levels in general minimum income schemes, most notably Bolsa Família, the well-targeted conditional cash transfer programme.

Several Latin American countries managed to make labour market policies more effective by adding an active labour market component, such as training and education, to existing conditional cash transfer programmes (Cecchini and Madariaga, 2011, González Pandiella, 2016 and López Mourelo and Escudero, 2017). Cash transfers provide income support in times of need but they can become more effective if supplemented by a training component that improves participants’ chances to find more autonomous and sustainable income generation opportunities. Hence, targeting additional training opportunities to recipients of Bolsa Família may also be an effective way to help those most in need of assistance to access employment. In this direction, the government has recently announced Progredir, a programme aiming at providing micro-credits, technical assistance, training and financial education to Bolsa Família recipients.

Facilitating workers mobility and regional adjustments

The effects of changes in the industry structure, such as those triggered by a stronger integration into the global economy, can affect regions asymmetrically if sectors affected by job reallocation are concentrated in specific regions In particular, manufacturing tends to be heavily affected by trade shocks and is more regionally concentrated than other sectors (Rusticelli et al., 2017). This has been the case in several OECD countries (OECD, 2017d). For Brazil, empirical evidence from the late 1980s and early 1990s shows that the reduction in trade barriers affected urban areas with more industrial employment more strongly than rural ones (Castilho et al, 2012).

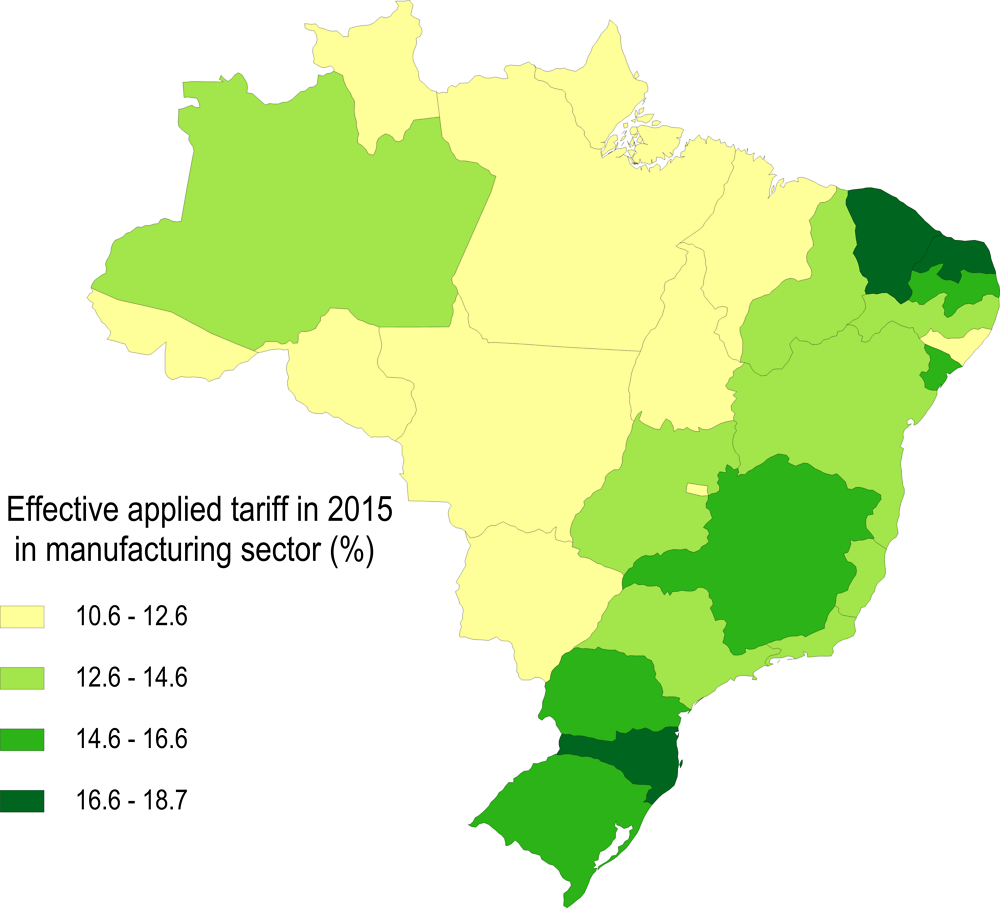

Regional measures of effective trade protection can be constructed using a weighted average of national industry-level tariffs, where the weights correspond to employment or value added shares by industry in each region. Such measures can give valuable insights into the regional impact of a reduction in trade barriers (Topalova, 2007; Kovak, 2013). For Brazil, an exercise conducted for this chapter reveals significant differences across states (González Pandiella and Hiroshi, 2017). For example, effective tariffs are 75% higher in Rio Grande do Norte than in Alagoas, despite being both states being situated relatively close to each other in the north-eastern part of Brazil (Figure 2.26). Rio Grande do Norte, Ceará, Santa Catarina and Paraíba, with a large proportions of employment in textiles, leather and food and beverages industries are the states that could be more initially exposed to job reallocations resulting from a reduction in tariffs. On the other side, states such as Alagoas, Roraima, Pará and Maranhão, where protected industries contribute less to employment, are likely to be less affected. Some of these states, such as Alagoas and Maranhão, are the nation’s poorest. These states would be less affected by job reallocations, but they would benefit from the positive effects on the prices of goods consumed by low-income consumers.

Figure 2.26. There are large differences in tariff protection across states

Even in cases where regions lose a key activity that has provided employment for a large part of the population, policies can help to ease the structural transformation of regional economies. Several OECD regions have seen their main industry decline or disappear, forcing them to move into entirely unrelated activities. This has particularly been the case for the coal, steel and textile industries, large parts of which found it impossible to compete with imports from countries with lower labour costs. Yet, there are examples where such a transformation has been managed successfully, supported by the right policies to facilitate the adjustment (Box 2.4). These examples suggest that working with regions to facilitate that firms can update their technology can speed up transformation and the creation of new opportunities. In this regard, Brasil Mais Produtivo, a recently launched horizontal programme to help firms adopt new technologies, is a promising initiative.

Where retaining all previous jobs turns out to be difficult, more mobility of workers and capital could in theory dampen the impact on specific regions. In practice, however, low geographical and inter-industry mobility of workers has hindered local economies’ ability to adjust to shocks across OECD countries (OECD, 2017d). This has also been observed in Brazil (Dix-Carnerio and Kovak, 2017a). Both imperfect interregional labour mobility and a slow response of labour demand, related to slow investment, contributed to prolonged declines in formal employment and earnings in some regions, which could have been mitigated by greater factor mobility (Dix-Carnerio and Kovak, 2017b). Instead, workers have tended to move primarily from the tradable to the non-tradable sector within the same region.

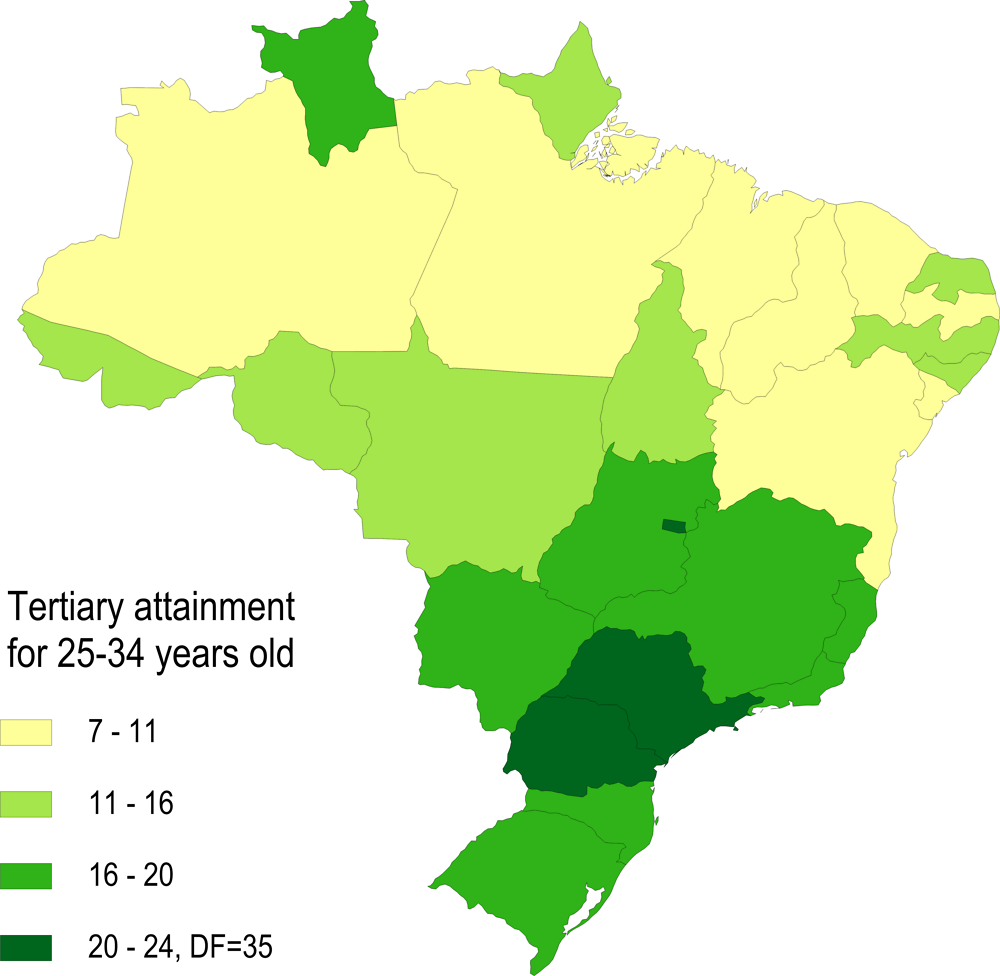

Policies could support more mobility of workers, both through public services and education. Good transport connections to high-density areas where more jobs are created would allow workers to seek new opportunities without having to move. For those that decide to move, access to childcare is an important factor, as such a move may limit the ability to rely on childcare services provided within the larger family (OECD, 2017d). Brazil has reached nearly universal enrolment of 5 and 6 years old but lags behind in the participation of children younger than 4. Boosting participation in early childhood education would also help to mitigate the impact of socio-economic background on education outcomes. Finally, education also matters. More educated workers are generally more mobile (OECD, 2005). In Brazil, some regions have particularly low educational attainments (Figure 2.27) and better education would allow some of their residents to seek better employment opportunities elsewhere.

Box 2.4. Successful examples of regional policies to foster structural transformation

Episodes of structural transformation across OECD regions can offer valuable insights about how policies can facilitate regional adjustments to changes in economic structure. The cases of the Ruhr area in Germany and Basque Country in Spain exemplify how a coherent and stable policy package can facilitate transformation and lead to jobs and opportunities in new areas.

The Ruhr region used to be one of the most important industrial regions of Europe, with strong coal mining and steel industries. With a shrinking global demand and a loss of international competiveness, the Ruhr area faced the challenge to restructure their economy. To respond to that challenge, regional policies changed the focus towards environmental technology. Enterprises shifted away from coal and steel and invested in plant engineering, control services and environmental technology. The move into the field of environmental technology has its root in the search for new ways to reduce pollution levels undertaken by traditional coal and steel industries (Galgóczi, 2014). As these industries required significant energy resources and produced a lot of waste, the region benefited from an existing comparative advantage in energy supplies and waste disposal. Building on that comparative advantage, the focus was on stimulating R&D in the fields of renewable resources, recycling and waste combustion. Nowadays, the Ruhr area is the centre of environmental technology research in Germany, underpinned by local universities, research centres and local firms. Labour market policies were also part of the strategy, as agencies specialized in job-counselling and training took care of facilitating labour market transitions of affected workers. The change in the employment structure of the area was large; manufacturing and services sector accounted respectively for 60% and 36% of employment at the beginning of the 1960s. By 2000, services employed 65% and manufacturing 33%.

In the 1970s and 1980s, the Basque County underwent a significant restructuring of its economy following the decline of traditional sectors such as steel, shipbuilding and machine tools, which led to high unemployment. Regional policies put the focus on technological upgrading as a way to restore the international competitiveness of the manufacturing sector. This included strengthening the existing but weak technology infrastructure, promoting R&D activities by firms, creating technology parks and developing training programmes for researchers (OECD, 2011). This strategy, pursued with stability and continuity over time, paid off in the end. The Basque Country now has a strong business-oriented innovation system and has technological strengths in machinery and equipment. Business R&D is double the national average and is also in the top 25% of OECD regions and countries (OECD, 2014b). The export performance of the region has improved markedly, driven by goods with a higher technological content (such as aeronautics or telecommunications) and also due to the innovation carried out in traditional industries such as automobile and tool‐machinery. Knowledge intensive sectors have also gained weight, particularly in areas linked to manufacturing (e.g. engineering and consultancy). The Basque County is now the region with the lowest unemployment rate in Spain and GDP per capita is 25% above the European Union average.

Oulu, the regional economic and administrative hub of Northern Finland, was also severely affected by the structural transformation that the ICT sector underwent in Finland. This implied significant closures and layoffs in the IT sector, especially Nokia and its suppliers. Building on its skilled workforce and talent pool, Oulu has seen the emergence of a successful high tech start-up ecosystem. This ecosystem has attracted significant interest from international investors and resulted in several acquisitions from top global IT and finance companies. Taking advantage of existing comparative advantage in mobile phone technology, many of the rising start-ups involved such technology. These successes in the technology start-up industry have been supported by programmes to boost equity financing and R&D support. Tech incubators in local universities and mentor programmes have also been established.

Figure 2.27. Educational differences across regions are large

Box 2.5. Recommendations to foster integration into the world economy

Key recommendations

Lower tariffs and scale back local content requirements.

Bolster training and job search assistance programmes for affected workers.

Other recommendations

Trade policies

Take an active role in seeking more trade agreements between Mercosul and large markets.

Take unilateral measures to reduce trade barriers, especially local content rules.

Undertake a thorough evaluation of anti-dumping measures.

Eliminate those not based on genuine injury to domestic producers, with a view towards reducing them altogether.

Expand mutual recognition agreements and require regulators to use internationally harmonised standards and certification procedures.

Develop coordination and harmonisation of documentation among agencies involved in the management of cross-border trade.

Further reduce administrative requirements for importing and exporting.

Support policies

Boost income support for job losers by extending the duration of unemployment insurance, for example by merging parallel unemployment insurance schemes.

Make available vocational training programmes to adult unemployed.

Evaluate the impact of vocational training on participants’ labour market outcomes and adjust courses, capacities and curricula accordingly.

Expand horizontal programmes to facilitate firms adopting new technologies.

Raise benefit levels in the minimum income scheme Bolsa Família.

Consider targeting additional training opportunities to Bolsa Família recipients.

Expand early childhood education.

Bibliography

Acemoglu, D. (2003), “Patterns of Skill Premia”, Review of Economic Studies, v. 70, n. 2, p. 199–230.

Aghion, P., R. Burgess., S. Redding and F. Zilibotti (2003), "The unequal effects of liberalization: theory and evidence from India", London School of Economics and Political Science.

Amiti, M. and J. Konings (2007), “Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia”, The American Economic Review, 97 (5), p. 1611–1638.

Andrews, D. and F. Cingano (2014), “Public Policy and Resource Allocation: Evidence from firms in OECD countries", Economic Policy, Issue 74, April.

Araújo, B. (2017), “De que maneira o comércio internacional afetou a desigualdade do trabalho na indústria brasileira”, in A Política Comercial Brasileira em Análise.

Araújo, B. and L.S. Paz (2014), “The effects of exporting on wages: An evaluation using the 1999 Brazilian exchange rate devaluation”, Journal of Development Economics, v. 111, p. 1–16.

Araújo, B., C. Bogliacino and M. Vivarelli (2011), “Technology, Trade and Skills in Brazil: Some Evidence from Microdata”, Cepal Review, v. 105, p. 157–171.

Araújo de Almeida, R. and A. Messa (2017), “Medidas antidumping e cadeia produtiva: evidências empíricas para o Brasil” , in A Política Comercial Brasileira em Análise.

Arnold, J., M. Bueno and A. González Pandiella (2018), “Much to gain and little pain: Evaluating economic effects of a stronger integration into the global economy in Brazil”, OECD Economics Department Working Paper, forthcoming.

Arnold, J., B. Javorcik and A. Mattoo (2011), “Does Services Liberalization Benefit Manufacturing Firms? Evidence from the Czech Republic”, Journal of International Economics 85(1), p. 136–146.

Arnold, J., B. Javorcik, M. Lipscomb and A. Mattoo (2016), “Services Reform and Manufacturing Performance: Evidence from India”, The Economic Journal, 126, Issue 590, p.1-39.

Artopoulos, A., D. Friel and J. C. Hallak (2013), “Export emergence of differentiated goods from developing countries: Export pioneers and business practices in Argentina”, Journal of Development Economics, 105, 19-35.

Atkin, D., B. Faber and M. Gonzalez-Navarro (2015), “Retail Globalisation and Household Welfare: Evidence from Mexico”, NBER Working Paper, 21176.

Bartelsman, E., J. Haltiwanger and S. Scarpetta (2013), "Cross-Country Differences in Productivity: The Role of Allocation and Selection", American Economic Review 2013, 103(1): 305–334.

Baumann, R. and A. Messa (2017), “A Economia Política da Política Comercial No Brasil”, in A Política Comercial Brasileira em Análise.

Baldwin, R. ( 2006), “Multilateralising Regionalism: Spaghetti Bowls as Building Blocs on the Path to Global Free Trade,” The World Economy 29(11), pp. 1451-1518.

Bloom, N, M. Draca and J. Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity”, Review of Economic Studies, 83, 1, 87-117.

Brambilla, I., N. Depetris Chauvin and G. Porto (2016), “Examining the Export Wage Premium in Developing Countries”, Review of International Economics.

Brandt, L., J. Van Biesebroeck, and Y. Zhang (2012), “Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing,” Journal of Development Economics, 97, 339–351.

Brown, A. JG and J. Koettl (2015), “Active labor market programs - employment gain or fiscal drain?”, IZA Journal of Labor Economics, 4:12.

Busso, M., L. Madrigal and C. Pagés (2013), "Productivity and resource misallocation in Latin America," The B.E. Journal of Macroeconomics, De Gruyter, vol. 13(1), pages 1-30, June.

Castelar, A. (2017)," Agenda de produtividade, Column in Valor Economico, October 6, 2017, http://www.valor.com.br/opiniao/5147428/agenda-de-produtividade.

Castilho, M. and P. Miranda (2017), "Tarifa aduaneira como instrumento de política industrial: A evolução da estrutura de proteção tarifária no Brasil no período 2004-2014", Messa A. and I. Machado (ed), Política Comercial Brasileira em Análise, IPEA, Brasilia.

Castilho M., M. Menéndez and A. Sztulman (2012), “Trade Liberalization, Inequality, and Poverty in Brazilian States”, World Development,Vol. 40, No. 4, pp. 821–835, 2012.

Cecchini, S. and A.Madariaga ( 2011), ”Conditional cash transfer programmes: The recent experience of Latin America and the Caribbean”. Cuadernos de la CEPAL No. 95, Santiago de Chile.

Cera, V. and T. Woldemichael (2017), “Launching Export Accelerations in Latin America and the World”, IMF Working Paper WP/17/43.

CNI (2014), "Custo tributário dos investimentos: as desvantagens do Brasil e as ações para mudar", Confederaçao Nacional da Indústria, Brasilia.

Criscuolo C., P. Gal and C. Menon, (2014), “The Dynamics of Employment Growth: New Evidence from 18 Countries”, OECD Science, Technology and Industry Policy Papers, No. 14, OECD Publishing, Paris.

Criscuolo, C. and J. Timmis (2017), "The changing structure of GVCs: Are central hubs key for productivity?", 2017 Conference of the Global Forum on Productivity, Budapest, https://www.oecd.org/global-forum-productivity/events/Changing_structure_of_gvcs.pdf.

De Vries, G. (2009), “Productivity in a Distorted Market: The Case of Brazil’s Retail Sector,” Memorandum GD-112, The Netherlands, University of Groningen, Groningen Growth and Development Centre.