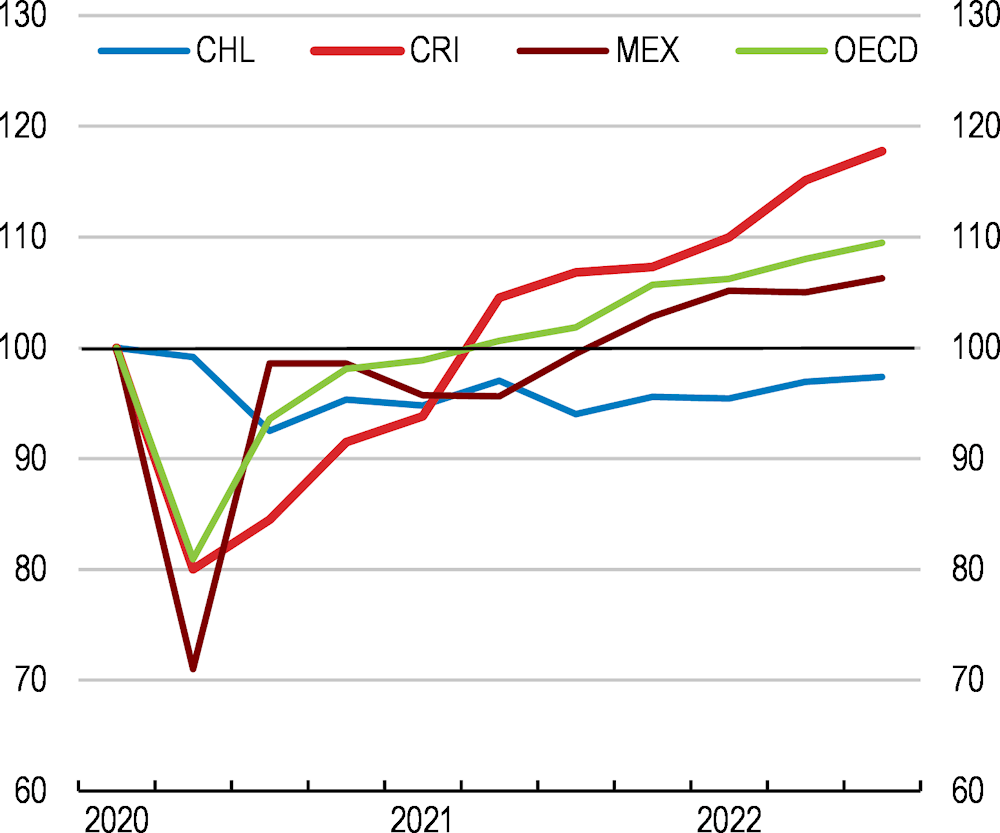

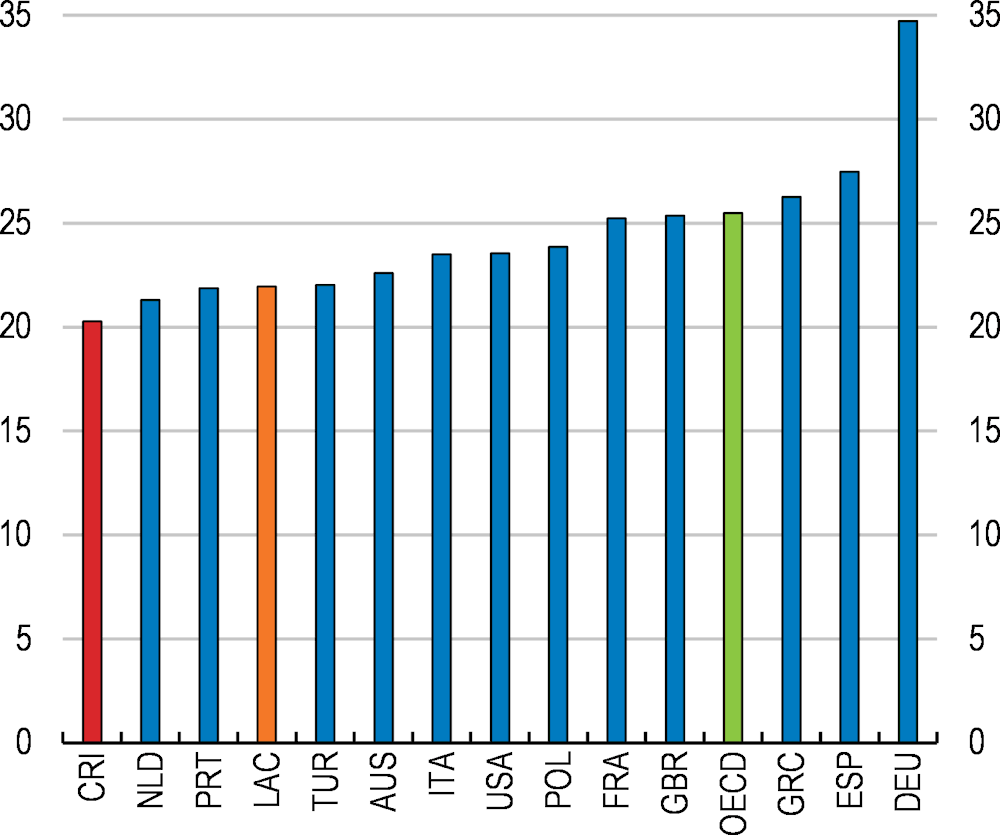

Costa Rica has made remarkable economic progress, but faces substantial challenges to safeguard its achievements and further improve living standards. Life expectancy is at par with the OECD average and political stability has been sustained thanks to solid institutions. Unemployment (Figure 1) and informality, affecting nearly half of the labour force, are high. Growth prospects were deteriorating before the pandemic and going forward population ageing will take an additional toll.

OECD Economic Surveys: Costa Rica 2023

Executive summary

Costa Rica recovered well but growth prospects are worsening

Figure 1. Unemployment is high

% of labour force

Note: LAC refers to Chile, Colombia, Mexico and Brazil.

Source: OECD Economic Outlook database.

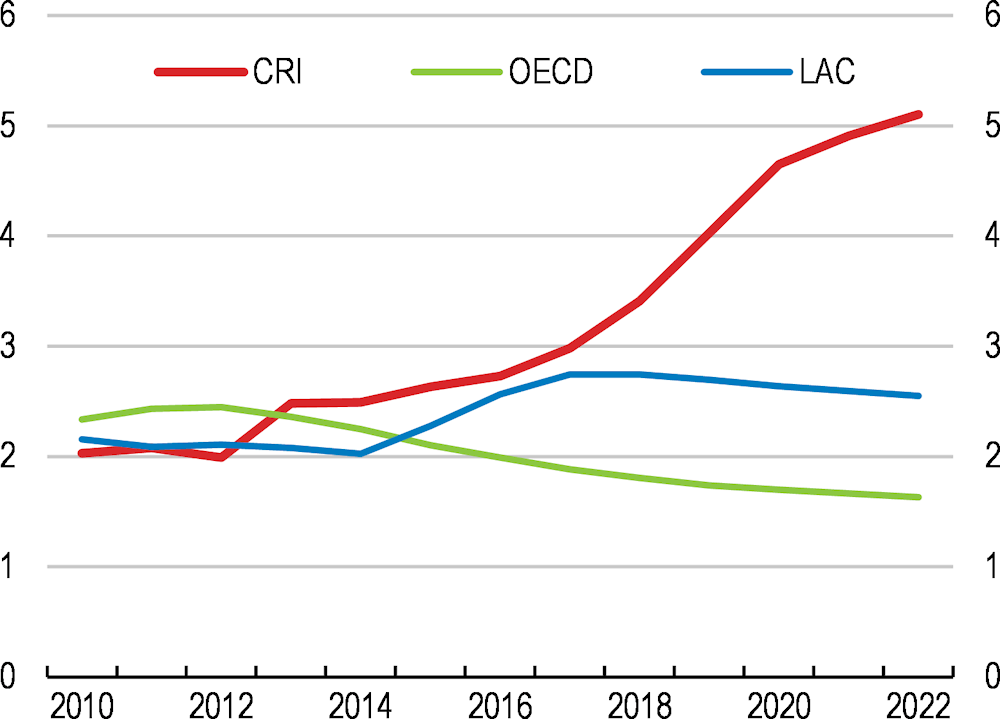

A targeted fiscal response, a successful vaccination campaign and strong export performance have supported a rapid recovery from the pandemic (Figure 2). Growth will slow, as consumption is damped by rising inflation (Table 1). Exports will benefit from specialisation in high value-added resilient sectors, but their dynamism will be mitigated by the global economy’s loss of momentum. The gradual resumption of tourism will improve employment. Inflation will remain high, as external inflationary pressures are expected to continue.

Figure 2. Exports recovered quickly

Index of real exports, 2020Q1 = 100

Table 1. Growth will slow

Annual growth rates, %, unless specified

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|---|

|

Gross domestic product |

-4.3 |

7.8 |

4.3 |

2.3 |

3.7 |

|

Private consumption |

-6.9 |

7.0 |

3.6 |

2.3 |

2.7 |

|

Gross fixed capital formation |

-3.4 |

11.0 |

1.6 |

-0.5 |

5.5 |

|

Exports |

-10.6 |

15.9 |

12.2 |

8.8 |

9.1 |

|

Imports |

-12.9 |

16.9 |

5.5 |

8.5 |

7.5 |

|

Unemployment rate (%) |

19.5 |

16.4 |

12.2 |

11.4 |

11.1 |

|

Consumer price index |

0.7 |

1.7 |

8.8 |

6.9 |

4.2 |

|

Central gov. balance (% of GDP) |

-8.5 |

-5.0 |

-4.1 |

-2.6 |

-2.2 |

|

Central gov. debt (% of GDP) |

67.2 |

68.2 |

67.5 |

66.8 |

66.0 |

|

Current account (% of GDP) |

-1.1 |

-3.3 |

-4.0 |

-3.8 |

-2.7 |

Source: OECD Economic Outlook.

Inflation has risen, exacerbated by global supply constraints and Russia’s invasion of Ukraine, with food and energy prices up most. Inflation expectations have increased significantly, reaching more than twice the 3% inflation target. In response, the Central Bank raised its policy rate by 825 basis points, to 9%. Costa Rica has put in place targeted measures to support those most impacted by high energy prices.

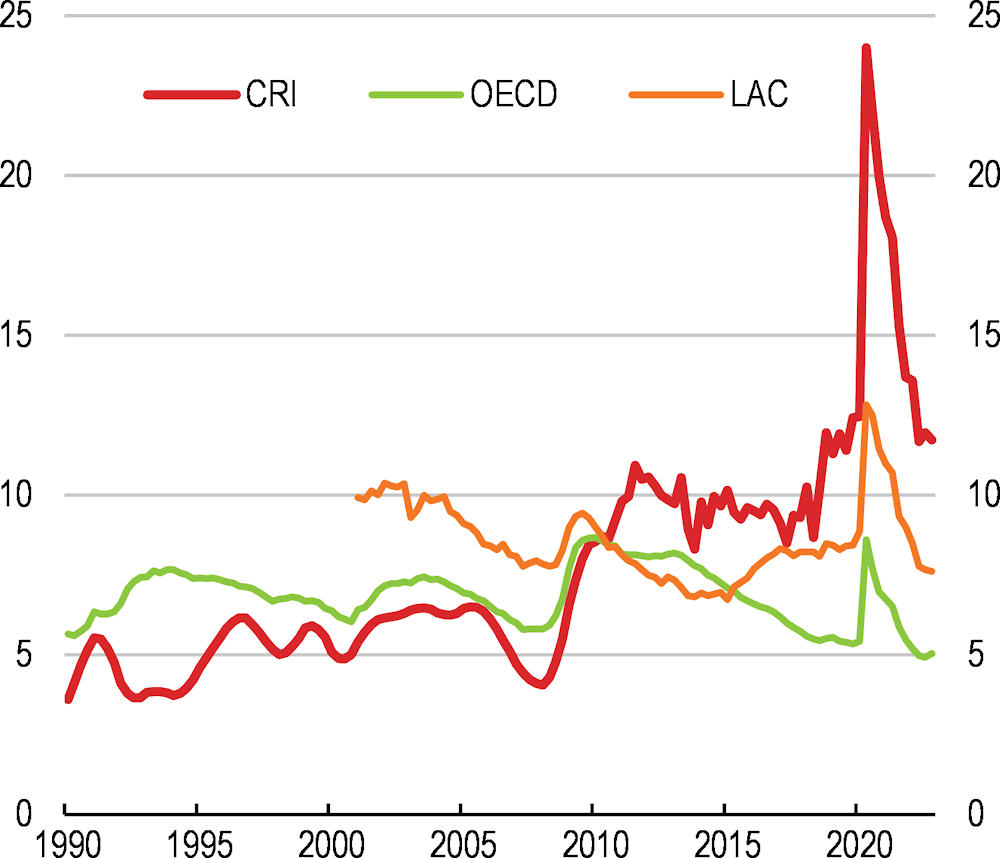

The fiscal outlook improved but remains challenging

After a decade of widening fiscal deficits, fiscal performance improved, thanks to stronger than expected economic activity in 2021 and the fact that all elements of the 2018 fiscal reform, such as the fiscal rule and the VAT, were in place for the first time. With public debt at 70% of GDP and a large interest rate bill (Figure 3), maintaining fiscal prudence, including by ensuring full implementation of the fiscal rule, is critical for debt sustainability. The interest rate bill could increase more than planned in light of on-going increases in global interest rates.

Figure 3. The interest rate bill is large

Central government debt interest expenditure, % of GDP

Containing public spending and improving its quality to better support growth and equity is a critical challenge. Continuing spending reallocation efforts, based on spending reviews, can facilitate deploying capital spending to address infrastructure gaps. The implementation of the public employment framework law, key to comply with the fiscal rule and improve public sector efficiency, is expected to bring annual savings of 0.8% of GDP.

The tax system is overly reliant on social security contributions. This favours informality, erodes the tax base and generates inequalities. Broadening tax bases holds the promise of increasing revenues without raising rates and making the tax system more progressive. Moving towards a more centralised and less fragmented tax payment and collection system could yield efficiency gains and facilitate tax compliance. Making social security charges more progressive, by reducing them for low-income workers, can facilitate formal job creation.

Spreading the benefits of integration in international trade

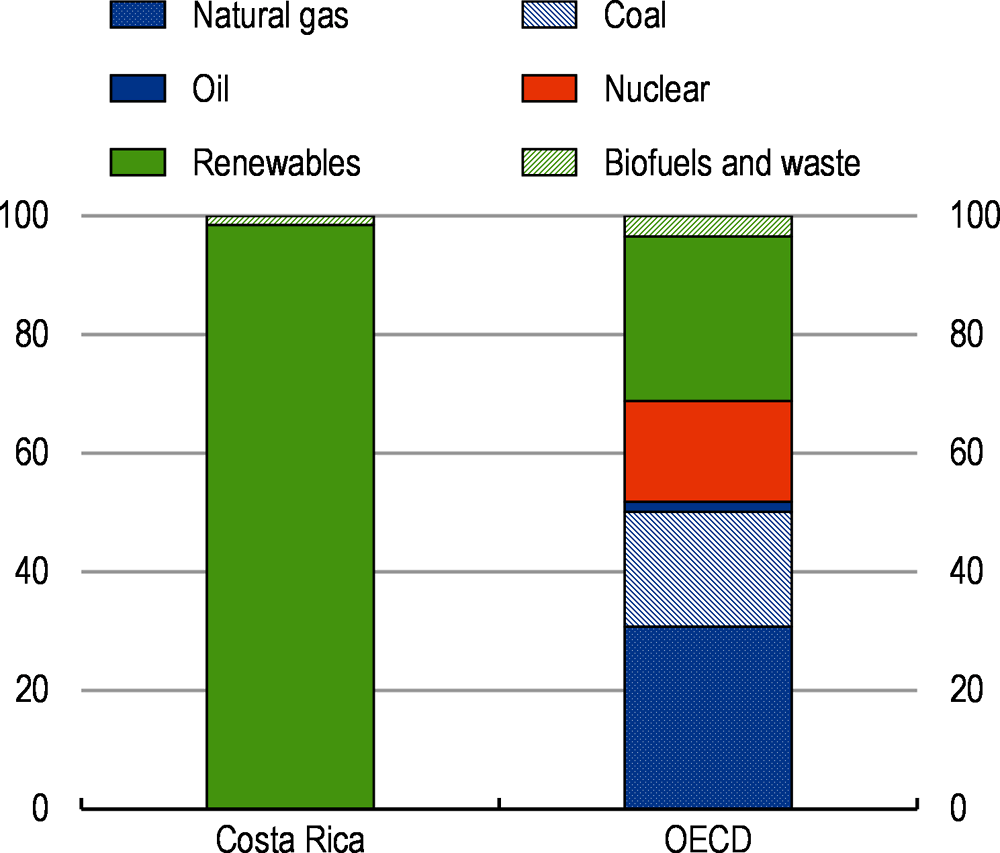

Costa Rica’s strong commitment to trade has been key to attract foreign direct investment, move up in global value chains and diversify exports. Nearshoring trends are providing new opportunities. Costa Rica’s clean electricity matrix (Figure 4) and its decarbonisation plan bring the opportunity to become a global leader in low-carbon exports. An ambitious and wide reform agenda would help to seize these new opportunities and to spread the benefits of trade integration throughout Costa Rica.

Figure 4. Electricity generation is green

Electricity generation by source, %, 2021

Note: The data for the OECD refer to the year 2020. In Costa Rica, about 0.2% of electricity is generated from a thermal source.

Source: Secretaría de Planificación Subsector Energía in Costa Rica and IEA.

Boosting competition should be a key element of the government’s reform agenda. The competition authority has received less than one third of the budget granted by law, which hampers its ability to perform its duties. Moreover, the stock of regulations is large and complex and there is no formal requirement to assess the impact of new regulations on competition. There is also a need to boost competition and efficiency in sectors where state companies play a dominant role, such as electricity, banking and e-communications.

Further fighting corruption is also crucial to spread the benefits of Costa Rica’s trade integration more widely. The country has been regularly shaken by corruption scandals and trust in government is relatively low. There is currently no dedicated law providing protection to public or private employees once they have disclosed wrongdoing.

Reducing the carbon footprint of the transport sector is a key challenge. The sector accounts for 42% of carbon emissions. The lack of an efficient public transport network has encouraged widespread and increasing use of private transport to meet mobility needs. Putting in place reliable, efficient and green public transportation is a key pillar of the decarbonisation plan.

Improving education and equality of opportunities

Enhancing education outcomes, reducing informality and facilitating female labour market participation are also crucial to fully realize Costa Rica’s growth potential and reduce inequality. Moreover, there is room to improve the targeting of some social programmes and to reduce fragmentation.

Female labour force participation lags other OECD countries. Women taking on family care responsibilities face difficulties to complete education or be in the labour force. More than 90% of women in poor households are out of the labour force. Expanding access to early education would facilitate women’s labour market participation and raise outcomes and equity in education. The coverage of early education for five-year-old children has recently increased, but access should also be expanded for children under the age of four.

Costa Rica’s commitment to education and training is strong, but educational outcomes are weak. The country has achieved almost full enrolment in primary education but lags behind in other key outcomes. Only half of the population aged 25-34 has completed upper secondary education, far from the OECD average (85%). Too many Costa Ricans leave the education system before completing secondary education. These challenges were exacerbated by one of the longest school closures in the OECD during the pandemic.

Firms struggle to fill vacancies, particularly in technical and scientific positions, endangering Costa Rica’s capacity to attract foreign direct investment. Only 16% of graduates follow scientific studies (Figure 5), a similar share as in 2005. Revisiting universities funding mechanisms can improve accountability and the responsiveness to labour market needs. Recent reforms in vocational education aim at increasing the supply and quality of technicians. This would reduce skills mismatches and help to access formal jobs.

Figure 5. The share of graduates in STEM is low

STEM graduates, % of total tertiary graduates

Note: STEM includes graduates in natural sciences, mathematics and statistics; information and communication technologies; and engineering, manufacturing and construction.

Source: OECD (2022) Education at a Glance.

Virtually universal health care and primary education and high pension coverage have led to remarkable social outcomes, but inequality keeps trending up. Costa Rica should streamline its social protection system, as 21 institutions currently deliver more than 35 schemes. This would facilitate increasing coverage and reinforcing social protection in some key areas, such as the social protection of children.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Further strengthening macroeconomic policies |

|

|

Inflation and inflation expectations have picked up strongly. Inflationary pressures are broad-based. |

Maintain a restrictive monetary policy stance to ensure the return of inflation to the 3% target. |

|

The fiscal situation improved in 2021, thanks to the 2018 fiscal reform, but remains challenging, requiring sustained efforts to contain public spending and boost efficiency. The implementation of the fiscal rule has met significant opposition from different segments of the public sector. |

Maintain a prudent fiscal policy stance, including by ensuring a full and timely implementation of the fiscal rule. In the medium-term undertake a review of the fiscal rule to ensure that it continues to secure a prudent fiscal stance and sustainable debt dynamics. |

|

Containing spending and improving its efficiency and quality to better support growth and equity remains a critical challenge. Capital spending has historically been largely neglected. Infrastructure gaps remain significant. Medium-term growth prospects are falling. |

Based on spending reviews and sound cost-benefit analysis, continue to undertake the necessary expenditures prioritisation and reallocation and create space for capital spending to strengthen. |

|

Compensation of government employees accounts for more than half of total revenues. The salary structure contributes to income inequality. |

Fully implement the public employment framework law across the public sector. |

|

Tax revenues, at 23 % of GPD, are hampered by high tax evasion, narrow tax bases and a multiplicity of tax expenditures. The tax system hardly reduces income inequality. |

Broaden tax bases by phasing out regressive exemptions, such as the tax exemption on the 13th monthly salary and the one benefiting cooperatives. |

|

The law to establish an independent fiscal coun-cil was approved and three members nominated but no further action has been taken to allow the council to operate in a meaningful way. |

Provide the fiscal council with independent technical support and define its role more explicitly. |

|

Boosting productivity and formal job creation |

|

|

The national competition authority remains severely under resourced. An adequately resourced and operative competition authority is critical to ensure that on-going efforts to improve regulations and open up key markets translate into lower prices for households and lower costs for firms. |

Provide the national competition authority with the financing set in the law. |

|

The number of regulations is large. Same administrative requirements are replicated across different public agencies. Regulations do not take into account their impact on competition. |

Reduce the stock of regulations and conduct regulatory impact assessments. |

|

Informality, at around 45%, remains high. It is both a cause and a consequence of low productivity and widens inequalities. |

In the medium term, eliminate payroll charges not allocated to finance social security and finance social programmes and vocational training from the general budget. Reduce social security charges for low-income workers. |

|

There is room to deepen trade with Latin American countries and other regions, which would facilitate further integration in global and regional value chains. |

Pursue ongoing renewed efforts to increase trade integration further, including becoming a member of the Pacific Alliance. |

|

Improving equality of opportunities |

|

|

Only 30% of poor children receive a cash transfer. In some social programmes more than 40% of beneficiaries are middle or high-income households. Numerous institutions participate in the delivery of more than 35 social programmes. |

Set up a universal cash transfer for poor children. Improve targeting and reduce fragmentation of social programmes. |

|

Children from disadvantaged households have lower access to early education. Female labour market participation is hampered by care responsibilities, particularly in low-income families. |

Expand the coverage of early education for children below four years, giving priority to low-income families and using co-payment mechanisms. |

|

Educational exclusion and frequent grade repetition in secondary education, mostly affect students from vulnerable groups (poor, indigenous and migrants). |

Identify underperforming primary and secondary students and provide them with targeted and early tutoring support provided by well-trained teachers, prioritising those from vulnerable groups. |

|

The number of STEM graduates does not meet labour market demand. University funding mechanisms lack incentives for accountability and quality in education and research. |

Modify universities funding mechanisms by linking additional funding for public institutions to system-wide performance goals such as increasing STEM programmes and the number of graduates. |

|

Short-cycle vocational programmes are chosen by very few tertiary students while they can help to swiftly adapt to changes in skills needs and reduce inequalities. |

Strengthen the supply of high-quality short-cycle vocational programmes and promote a larger demand for them via an information campaign. |

|

Strengthening green growth |

|

|

The transport sector is the major source of emissions. Meeting the plan to be net carbon neutral will require reducing emissions in the transport sector and strengthening carbon sinks. Diesel is taxed at a rate that is 60% lower than gasoline. |

Align the tax rates on diesel and bunker fuel with the gasoline rate and gradually increase the carbon tax rate once high energy prices start falling, and channel part of the revenues towards low-income households. |

|

The increase in forest-covered areas has been underpinned by the Payment for Environmental Services scheme, offering compensation to land owners for providing eco-services. So far, the scheme has been financed only with fuel tax revenues, which will fall overtime. |

Broaden the sources of financing of the Payment for Environmental Services scheme. |