Costa Rica recovered well from the pandemic-induced recession. Sustained and resilient export performance continues to support growth, while consumption is hindered by high inflation and unemployment. The fiscal situation improved but remains challenging, requiring sustained efforts to contain spending and boost public sector efficiency for several years. Maintaining and reinforcing the commitment to foreign direct investment and trade, which has been key to diversify the export basket, and improving the conditions for domestic companies to thrive are key challenges to boost living standards and formal job creation. This would require reducing the regulatory burden, improving the tax mix, fostering more competition in key markets and continuing decarbonisation and environment protection efforts. Supporting higher female labour participation and upgrading social protection will help to adapt to ongoing demographic changes and improve the equality of opportunities.

OECD Economic Surveys: Costa Rica 2023

1. Key Policy Insights

Abstract

Costa Rica recovered well but faces substantial challenges

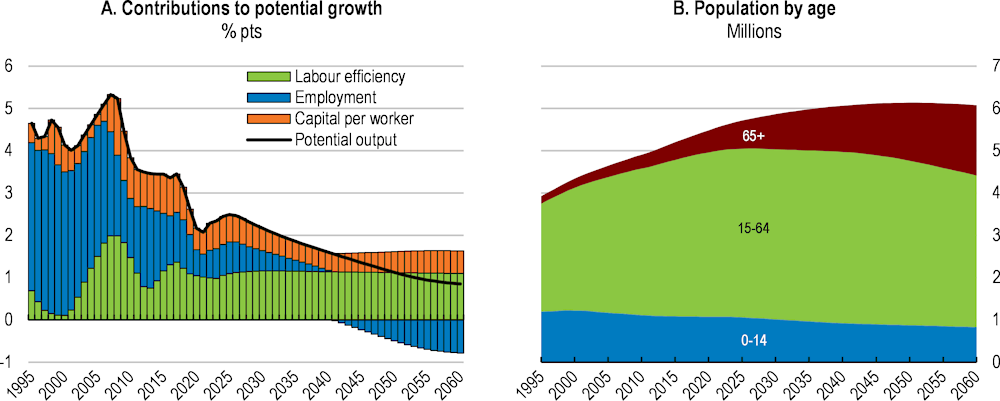

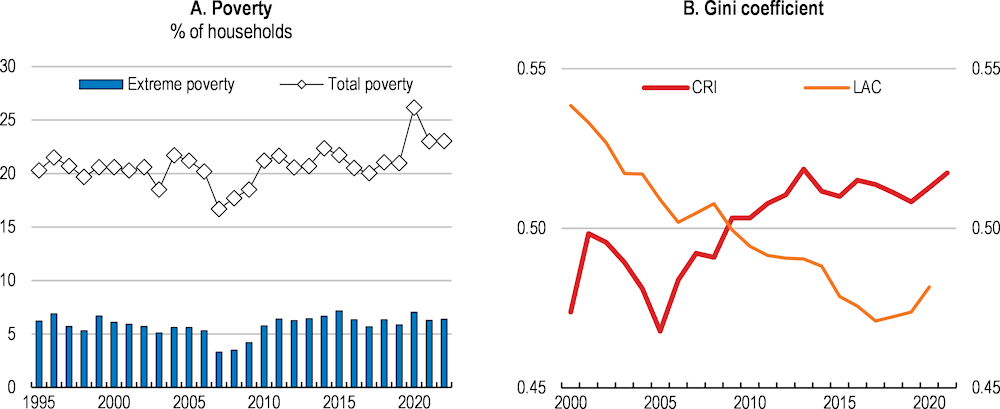

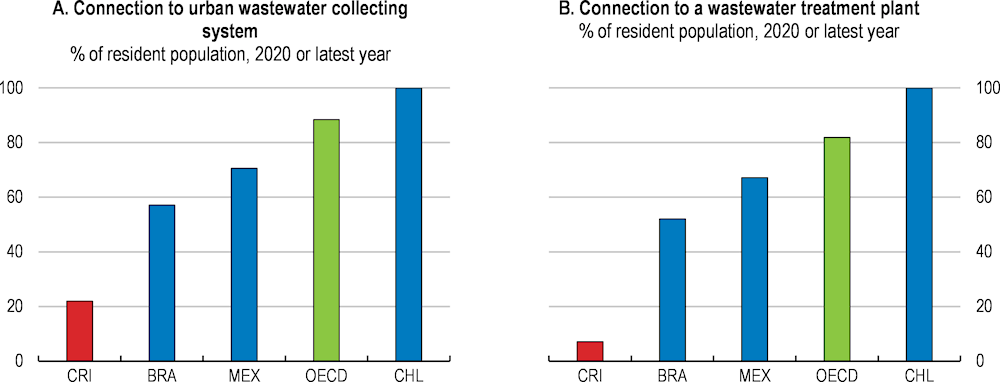

Costa Rica’s economy recovered well from the pandemic-induced recession. A targeted fiscal response, ample monetary support, a successful vaccination campaign and sustained export performance supported the recovery. Costa Rica, the oldest democracy in Latin America, has displayed significant political stability over the years, thanks to its solid institutions, and a strong commitment to environment protection. However, it faces critical challenges to safeguard achieved successes and to continue converging towards higher living standards. A strong social pact has delivered some remarkable results. Most notably, life expectancy is now at par with the OECD average and the highest in Latin America. At the same time, despite increases in social spending, progress in other areas, such as education or poverty reduction, has stalled. Unemployment, at a two-digit rate since 2018, and informality, affecting nearly half of the labour force, are high. Spreading the benefits of integration in international trade across the country is a key pending challenge. Growth prospects were deteriorating before the pandemic and, in the absence of further reforms, will further erode in the medium-term, as population ageing accelerates (Figure 1.1). The fiscal situation improved in 2021, thanks to the 2018 fiscal reform, but with public debt at around 70% of GDP, public finances remain a critical vulnerability requiring sustained efforts to contain spending and boost public sector efficiency for several years. The surge in global energy prices triggered by Russia’s aggression against Ukraine adds pressures on Costa Ricans real incomes.

Figure 1.1. The economy's growth potential will fall as the demographic bonus fades

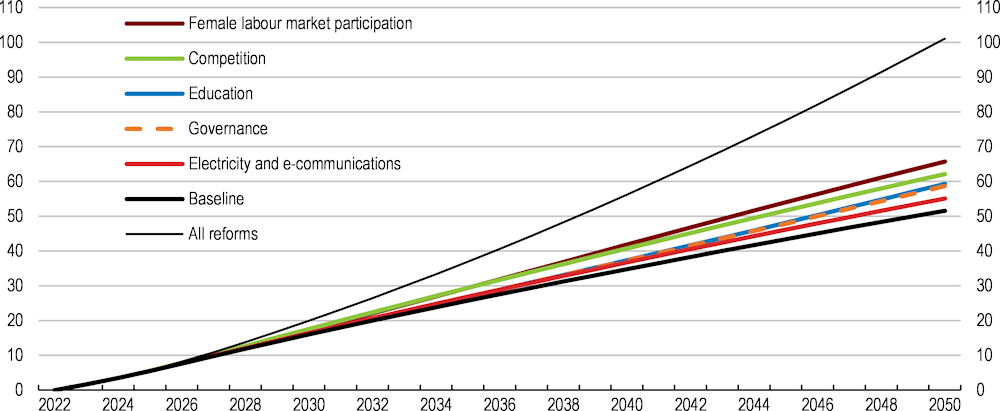

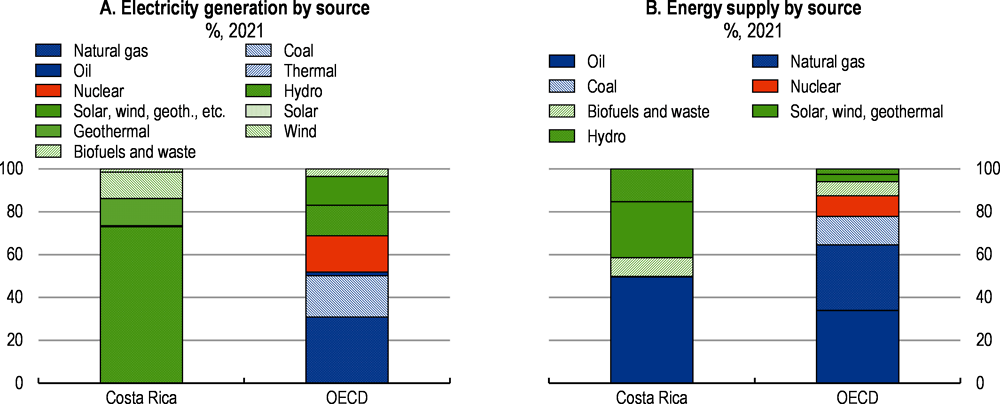

Stepping up structural reform efforts would be the best way to respond to these challenges. Reforms would spur productivity, key to help more Costa Ricans achieve higher living standards at a time when demographics are shifting. Reforms would also help to seize the new opportunities that are arising. Costa Rica’s strong commitment towards trade openness has been key to attract foreign direct investment, move Costa Rica up the global value chain and diversify its exports basket. Nearshoring trends, by which companies seek reducing supply chain disruptions risks by locating closer to their final markets, are providing new opportunities. Costa Rica is a front runner in environmental protection and renewables generation, and the global transition to net zero greenhouse gas emissions can increase the country’s competitiveness further. Seizing these opportunities will help to create more formal jobs, a key priority for the government that took office in May 2022 (Box 1.1). Enhancing education outcomes, boosting competition, facilitating greater female labour market participation and reducing the scope for corruption are key elements of a reform agenda that could raise growth prospects and incomes substantially (Figure 1.2). Simulations based on the OECD long-term growth model (Guillemette and Turner, 2018[1]) suggest that the right type of reforms could raise GDP per capita by an additional 26% over 20 years, equivalent to 1.3 percentage points of additional growth each year.

Box 1.1. Key features of Costa Rica’s government programme and recent reform efforts

The government took office in May 2022. Among its priorities are the following:

Reactivating the economy by creating more jobs, simplifying procedures and digitalizing the State.

Fighting corruption by incentivizing “whistle-blowers” and increasing sanctions for corruption.

Reducing living costs by reducing the costs of the basket of essential goods and services.

Improving education by strengthening education in STEM areas and dual learning systems.

Eliminating extreme poverty by improving targeting of social expenditure.

Further integration into the global economy by pursuing further trade agreements and contributing to strengthen the multilateral trade system.

Strengthening the pension system by eliminating exorbitant pensions received by some workers from public agencies outside central government, equalizing the contributions of the State across the different pension modalities, and strengthening compulsory and voluntary pensions.

Improving the quality of the health system by implementing transparency in the health system, modernising digital medical files and reducing waiting lines.

Protecting the ecosystem by developing an interconnected public transport system and improving recycling.

Promoting and effective democracy by simplifying the procedures for calling referendums and proposing new laws to congress.

Recent reforms efforts include:

Eliminating minimum prices for rice and reducing the rice import tariff.

Phasing out the monopoly to import medicines.

Eliminating minimum compulsory fees in professional services.

The 2022 laws to improve the institutional structure and policy execution in the Public Works and Transport Ministry and in the Environment and Energy Ministry.

The 2022 law to create the Public Investment National System, aiming at strengthening and harmonising public investment processes and improving project selection across the public sector.

The 2022 law to eliminate 15 decentralised public agencies and devolve responsibilities to the respective ministries.

Figure 1.2. Structural reforms would lift growth and incomes substantially

Simulations for the GDP per capita using the OECD long term growth model, % of 2022 GDP

Note: The “Baseline” projection depicts the increase of potential per-capita GDP in Costa Rica according to current estimations of potential growth, without any reform. The “Competition” and “Electricity and e-communications” scenarios assume adoption of OECD best practices and their impact is estimated based on OECD’s Product Market Regulations index. The “Governance” scenario assumes that the rule of law reaches the OECD average by 2060. The “Female labour market participation" scenario assumes the gap with the OECD average is closed by 2060. Finally, the “Education” scenario assumes that an average of 12.5 years of education is reached by 2060 together with improvements in quality. The results suggest that without any reform GDP per capita would grow by 50% by 2050. If all reforms are implemented, GDP per capita will grow by 100% instead.

Source: OECD calculations based on OECD Long-term growth model.

Against this background, the main messages of the Survey are:

Maintaining fiscal prudence, including by ensuring full implementation of the fiscal rule, is critical to maintain macroeconomic stability. Improving spending efficiency and enlarging the tax base would allow for a stronger contribution of fiscal policy to growth and equity.

Strengthening productivity and creating formal jobs are fundamental priorities. This will require reducing the regulatory burden, improving the tax mix, fostering more competition in key markets, pursuing ongoing efforts to strengthen trade integration and continuing decarbonisation efforts.

Enhancing education and training outcomes, upgrading and better targeting social protection, facilitating female labour market participation and adapting the pension system to demographic changes would be key to maintain and expand social achievements and reduce inequalities.

Growth is mitigated by high inflationary pressures and the global outlook

The recovery has further progressed

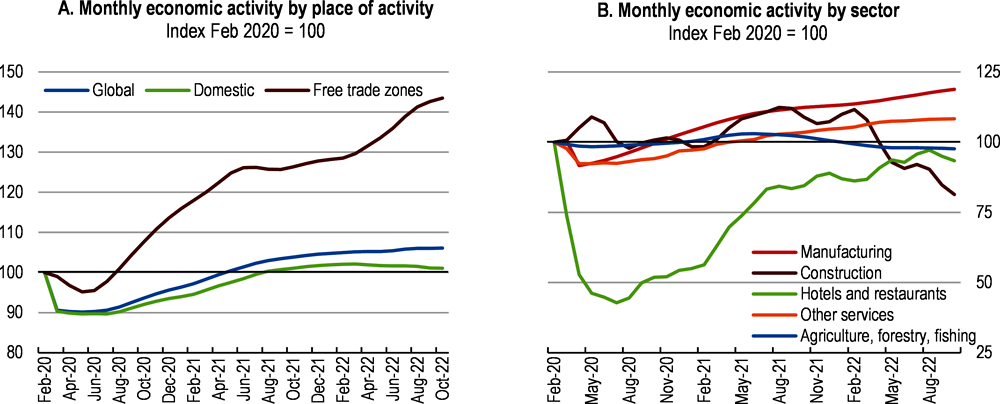

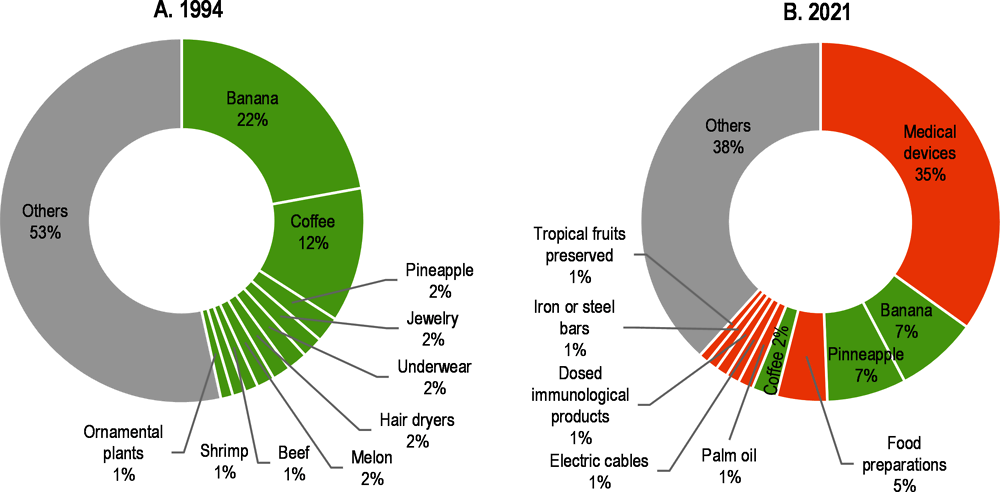

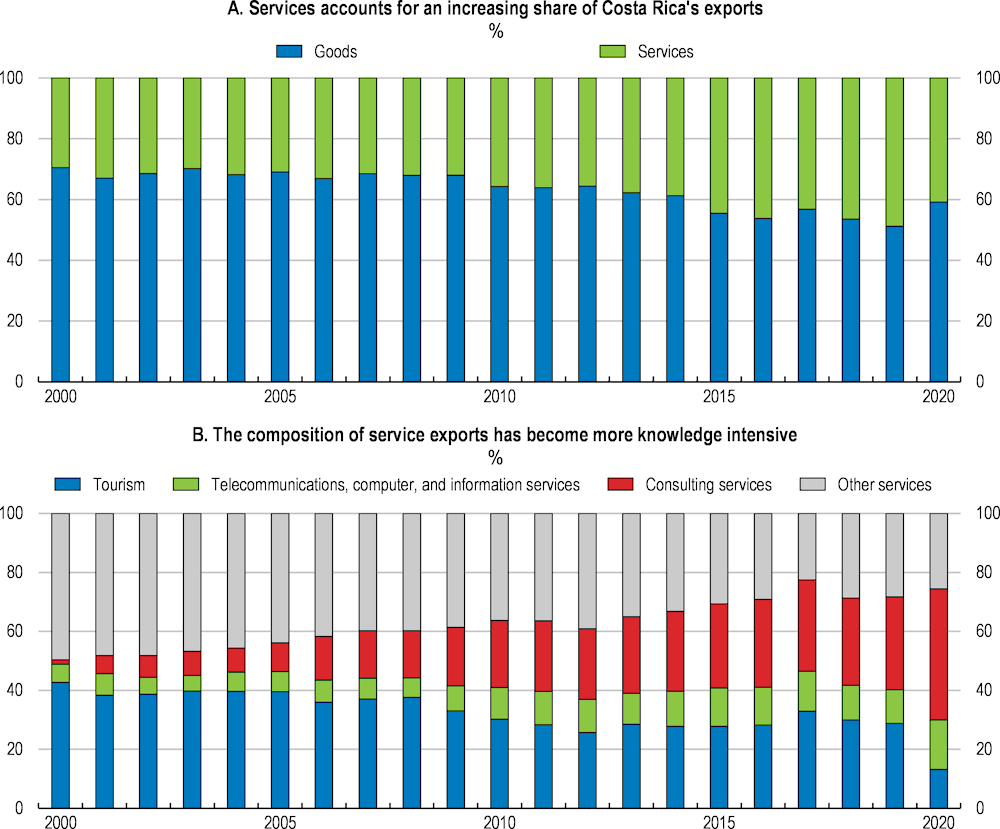

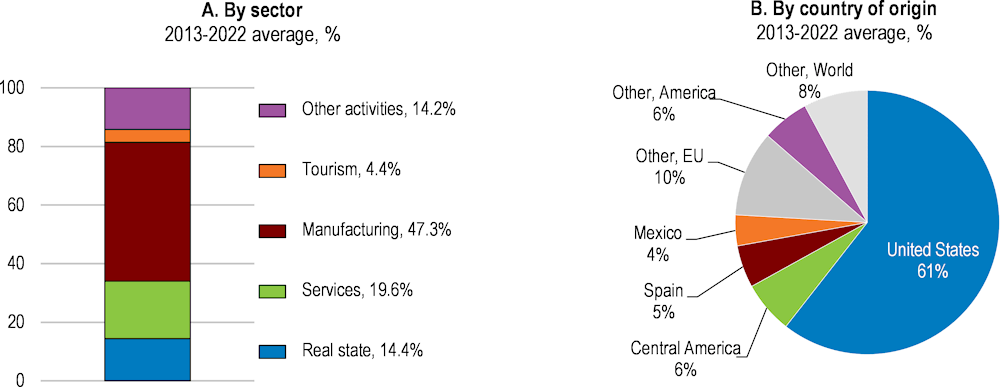

The economy continues to grow, but at a slower pace than in 2021. Activity in free trade zones, strongly linked to exports, improved very quickly after the pandemic recession, while the recovery of tourism related services was more protracted (Figure 1.3). An increasingly diversified export basket (Figure 1.4) has supported the recovery, which has also benefited from strong growth in the United States, Costa Rica’s main trading partner (Figure 1.5). Trade linkages with China are relatively small, and its zero-Covid policy impacts Costa Rica indirectly, through the associated deceleration in global growth and trade. Direct trade linkages with Russia and Ukraine are negligible, but the imports of metals and fertilisers are relevant, and finding alternative sources of supply will take some time and imply higher costs. However, as a very open economy, the Costa Rican economy is hampered by the deceleration in global growth, notably in the United States, triggered by Russia’s invasion of Ukraine.

Figure 1.3. Export sectors led the recovery

Figure 1.4. The export basket has become increasingly diversified

Main exported products, % of all exports

Note: The ten main exported products in 1994 are displayed in green in both panels.

Source: COMEX based on data from PROCOMER.

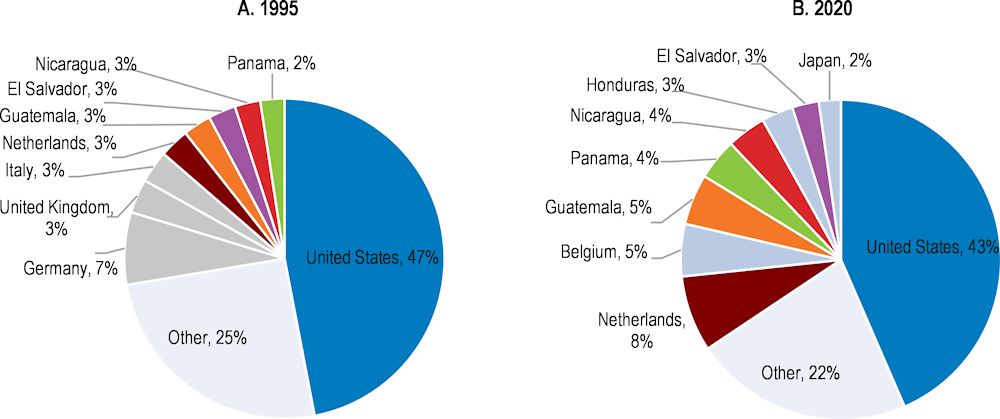

Figure 1.5. The United States and the European Union are the main trading partner

Top ten export markets in 1995 and 2020

Note: 1995 export markets no longer in the top ten in 2020 are in grey; 2020 export markets not in the top ten in 1995 are in blue.

Source: UNCTAD.

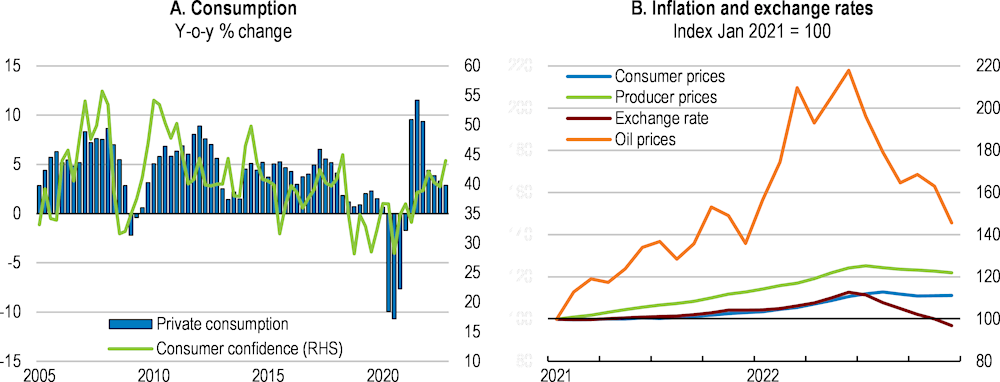

The roll-out of the vaccination campaign was very successful, and, as of December 2022, 83% of the total population had received at least a second dose. This has supported consumption, which, at the same time, is being mitigated by rising inflationary pressures (Figure 1.6). Inflationary pressures stem from high energy prices, exchange rate depreciations and cost pressures triggered by disruptions in global value chains. The war in Ukraine has exacerbated inflationary pressures contributing to further worsen Costa Rica’s terms of trade (Figure 1.7). Headline and core inflation after reaching, respectively, 12.1% and 7% in August, the highest value in the last 13 years, decreased to 7.9% and 5.4% in December. Inflationary pressures affect particularly food and energy, with services remaining less impacted. The Central Bank started a hiking cycle in December 2021 and has been gradually increasing the monetary policy rate since then, delivering a cumulative increase of 825 basis points, to 9.0%.

The authorities have put in place some measures to contain increases in energy prices. The main one is a change in the formula regulating fuel prices, which will now be using actual import prices instead of some reference prices that were higher than import prices. This change should in theory result in a notable reduction of gasoline prices. However, the authorities have decided to temporarily set up a cross-subsidy and maintain gasoline prices stable and reduce instead diesel prices, as diesel is more predominantly used by transport, agriculture and fishing sectors. To mitigate the impact of the rise in energy prices, the authorities have also established in November a temporary (3-months) subsidy targeted at low-income households (Beneficio temporal por inflación). It will be targeted using Costa Rica’s registry of beneficiaries of social programmes. This is a preferable way to provide support, as the subsidy is channelled to poorer households, whose purchasing power is being eroded more severely, and does not disincentive energy savings.

Figure 1.6. Consumption is held back by rising inflation

Note: Panel B: Exchange rate between the Costa Rican colon and the United States dollar. An increase implies a depreciation of the colon.

Source: Banco Central de Costa Rica; World Bank Commodity Price Data.

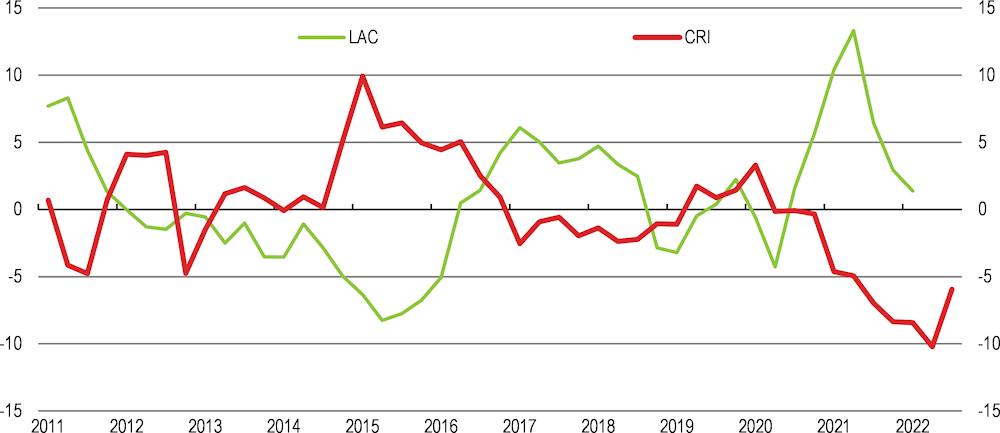

Figure 1.7. Terms of trade are deteriorating

Y-o-y % changes

Note: LAC refers to Chile, Colombia, Mexico, Argentina, and Brazil.

Source: OECD Economic Outlook Database.

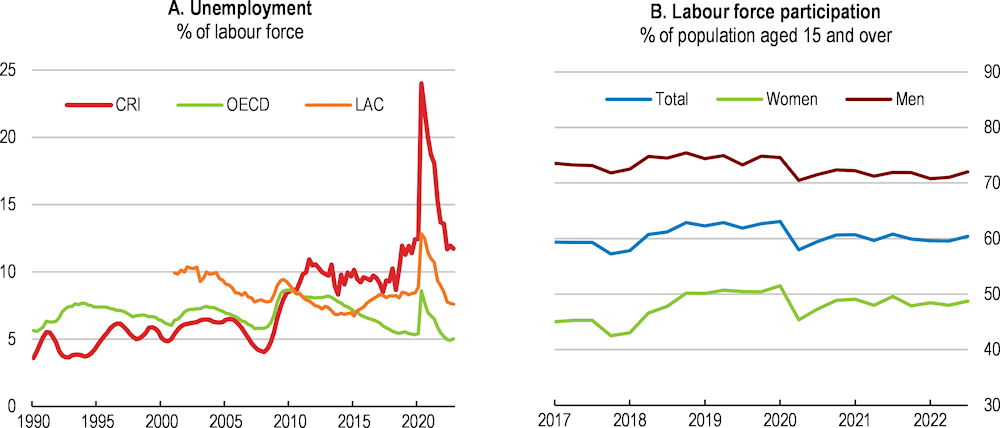

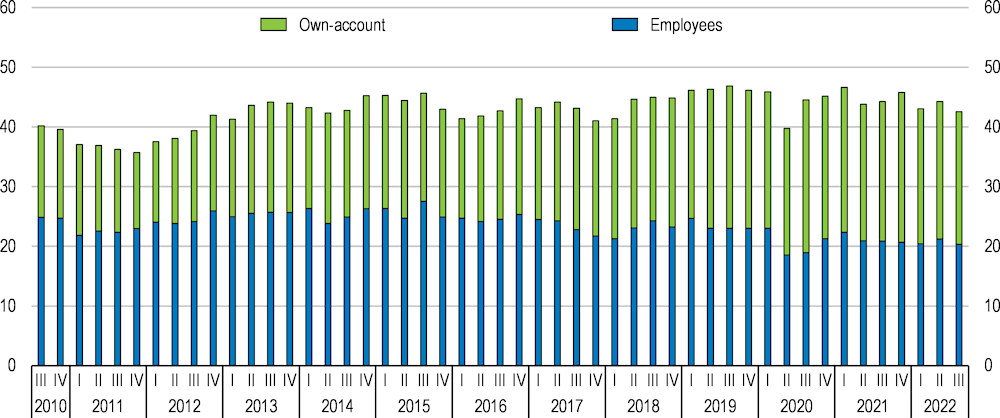

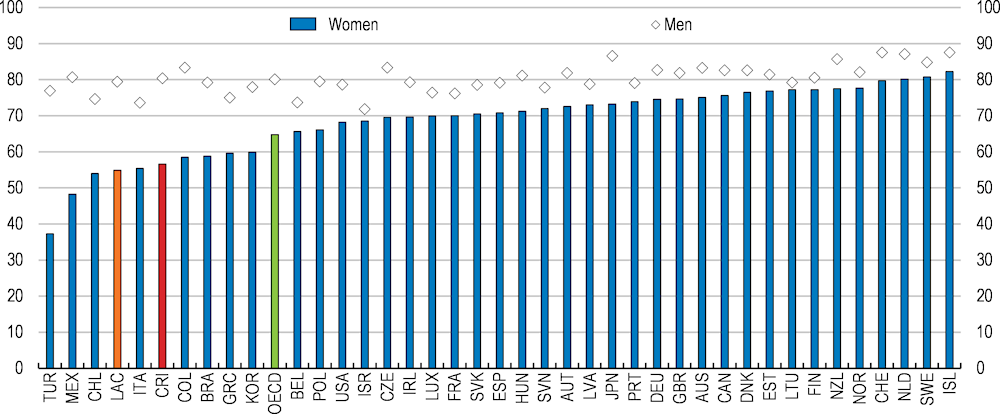

Labour market conditions are gradually improving. Employment has rebounded more slowly than activity, as the recovery in the employment-intensive tourism sector has been more protracted. The unemployment rate has recently decreased to its pre-pandemic level, but this was a historically high rate (Figure 1.8). Labour participation has not recovered its pre-pandemic level (60.3% at end-2022 versus 64% pre-pandemic). The recovery in employment shows significant heterogeneity. Employment of high-qualified workers is well above pre-pandemic levels, while employment of low skilled and medium-skilled workers has recovered more slowly. Formal employment grew back to its pre-pandemic level while informal employment is still lower than in February 2020. Informality remains high by historical standards, hovering around 45% of total employment.

Figure 1.8. Unemployment has started to fall but participation has not fully recovered

Note: LAC refers to Chile, Colombia, Mexico and Brazil.

Source: OECD Economic Outlook database; OECD Labour Force Statistics.

The economy is projected to expand by by 2.3% in 2023 and by 3.7 % in 2024 (Table 1.1). The gradual reactivation of tourism will reinforce labour intensive sectors and improve employment. Consumption will be supported by the successful vaccination campaign and the gradual improvement in the labour market but will also be damped by high inflation and worsening terms of trade. Exports will keep benefiting from the specialisation in high value-added resilient sectors, such as medical devices, although their dynamism will be mitigated by the United States slowdown and higher import prices. Inflation will remain elevated, with oil prices expected to remain high in 2023.

Table 1.1. Macroeconomic indicators and projections

|

2017 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

|---|---|---|---|---|---|---|---|

|

Current prices CRC billion |

Percentage changes, volume (2013 prices) |

||||||

|

GDP at market prices |

34,343.6 |

2.4 |

-4.3 |

7.8 |

4.3 |

2.3 |

3.7 |

|

Private consumption |

22,365.8 |

1.7 |

-6.9 |

7.0 |

3.6 |

2.3 |

2.7 |

|

Government consumption |

5,618.0 |

5.9 |

0.8 |

1.7 |

2.1 |

0.1 |

0.8 |

|

Gross fixed capital formation |

6,242.9 |

-8.2 |

-3.4 |

11.0 |

1.6 |

-0.5 |

5.5 |

|

Final domestic demand |

34,226.7 |

0.6 |

-5.0 |

6.6 |

3.0 |

1.4 |

2.9 |

|

Stockbuilding1 |

-38.8 |

-0.3 |

0.2 |

1.1 |

-0.8 |

0.6 |

0.0 |

|

Total domestic demand |

34,187.9 |

0.2 |

-4.8 |

7.8 |

1.8 |

1.7 |

2.8 |

|

Exports of goods and services |

11,251.9 |

4.3 |

-10.6 |

15.9 |

12.2 |

8.8 |

9.1 |

|

Imports of goods and services |

11,096.2 |

-2.3 |

-12.9 |

16.9 |

5.5 |

8.5 |

7.5 |

|

Net exports1 |

155.7 |

2.2 |

0.4 |

0.3 |

2.5 |

0.6 |

1.1 |

|

Memorandum items |

|||||||

|

GDP deflator |

- |

2.6 |

0.8 |

2.0 |

7.8 |

6.4 |

4.2 |

|

Consumer price index |

- |

2.1 |

0.7 |

1.7 |

8.8 |

6.9 |

4.2 |

|

Core inflation index2 |

- |

2.7 |

1.3 |

0.9 |

4.5 |

5.8 |

4.2 |

|

Potential growth |

- |

2.9 |

2.6 |

2.6 |

2.8 |

2.6 |

2.7 |

|

Output gap (% of GDP) |

- |

-1.3 |

-7.9 |

-3.2 |

-1.8 |

-2.2 |

-1.2 |

|

Unemployment rate3 (% of labour force) |

- |

11.8 |

19.5 |

16.4 |

12.2 |

11.4 |

11.1 |

|

Current account balance (% of GDP) |

- |

-1.2 |

-1.1 |

-3.3 |

-4.0 |

-3.8 |

-2.7 |

|

Central government balance (% of GDP) |

- |

-6.4 |

-8.5 |

-5.0 |

-4.1 |

-2.6 |

-2.2 |

|

Central government debt (% of GDP) |

- |

56.4 |

67.2 |

68.2 |

67.5 |

66.8 |

66.0 |

1. Contributions to changes in real GDP, actual amount in the first column. 2. Consumer price index excluding volatile items: agricultural, energy and tariffs approved by various levels of government. 3. Based on national employment survey.

Source: OECD Economic Outlook database.

The economic and inflation outlook remains very uncertain. Inflation may be higher for longer, eroding purchasing power, particularly of vulnerable households, and requiring greater tightening of monetary policy. Risks of a price-wage spiral, contained so far by ample spare capacity in the labour market, could materialise. Such second-round effects would require additional increases in monetary policy rates. Costa Rica is a small, open economy dependent on foreign markets for investment and trade, which makes it vulnerable to external shocks, such as a sharp deceleration in global growth and additional increases in oil prices. Episodes of financial volatility may trigger greater risk aversion, reduce net financial inflows and increase financing costs. On the upside, near-shoring opportunities could imply stronger exports. The recovery in tourism could be quicker than anticipated. The economy may also face unpredictable shocks, with effects that are difficult to factor into the projections (Table 1.2).

Table 1.2. Events that could entail major changes to the outlook

|

Vulnerability |

Possible outcome |

Possible policy action |

|---|---|---|

|

Contagion from acute financial volatility in other emerging markets. |

Large exchange rate depreciation and higher costs of financing the fiscal deficit and servicing debt. |

Tighten monetary policy and active debt management to re-profile debt maturity. |

|

Deepening crisis in Nicaragua. |

Large inflows of migrants with high humanitarian assistance needs. |

Provide border assistance to immigrants and flexible residence permits. |

|

Sustained hacking and ransomware of government agencies. |

Disclosure of highly sensitive information and unavailability of critical infrastructure. |

Put in place stricter cybersecurity protocols. |

|

Extreme weather events. |

Seasonal and unpredictable extreme weather events, such as El Niño or La Niña, hampering the agriculture sector. Earthquakes or volcanic eruptions damaging the infrastructure. |

Continue to strengthen disaster risk management and to foster climate change adaptation strategies. |

Financial stability risks appear contained

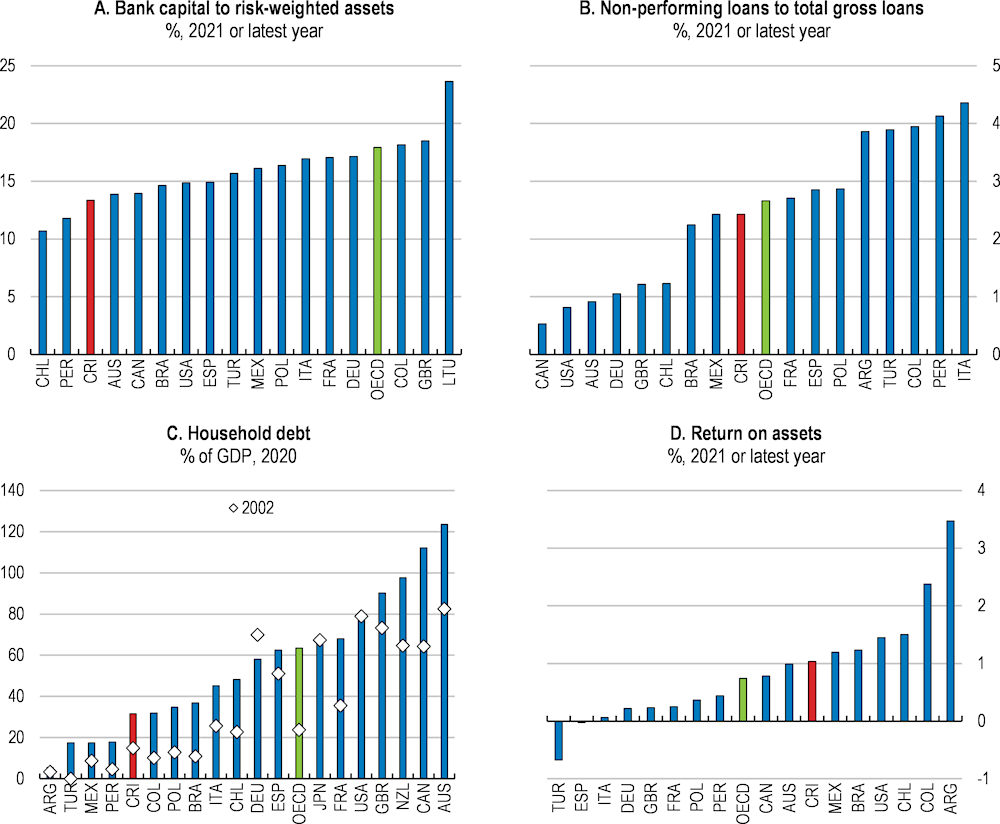

The financial system has been stable and resilient so far, maintaining capitalisation and liquidity levels above regulatory requirements (Figure 1.9, Panel A). A supportive monetary policy, macro prudential measures and emergency funding for firms supported the functioning of financial markets during the pandemic recession. Almost half of the loan portfolio took advantage of temporary measures to support loan restructurings. Non-performing loans increased but remain contained (Figure 1.9, Panel B), although part of the impact of the pandemic recession on assets quality could still materialise. The latest stress tests conducted by the Central Bank suggest that the banking system, including public banks, has sufficient capital buffers and liquidity to weather extreme economic events (BCCR, 2022[2]).

Households’ and firms’ indebtedness remain low in international perspective (Figure 1.9, Panel C). However, households’ indebtedness has recently increased, more than doubling in the past two decades. Actual indebtedness is likely to be larger than reflected in data, as loans by non-supervised creditors are not included in official statistics and pockets of households with excessive indebtedness have increased, more notably through credit card debt, which currently represents 3.4% of GDP. Strengthening the credit registry office would be key to contain excessive borrowing and avoid increasing financial stability risks. The credit registry in Costa Rica covers around 35% of the adult population, against 50% in Chile or 80% in Brazil. Boosting the scope of the registry, to incorporate information also from non-supervised entities that are performing lending activities, is a priority. Reducing information asymmetries through a more comprehensive credit registry can also help boost financial inclusion (OECD, 2020[3]). In fact, it can be more effective in facilitating access to credit than the cap on interest rates introduced in June 2020, which can constrain access to credit for the most vulnerable individuals and incentivise informal credit channels. Establishing a financial consumer protection framework, a pending OECD recommendation (OECD, 2020[4]), would also facilitate access to financial services and formal credit by a larger share of the population. In the medium-term reinforced macroprudential tools can also play a role in mitigating financial stability risks stemming from excessive households’ indebtedness.

Figure 1.9. The financial sector appears resilient

Note: Panel A refers to regulatory tier 1 capital to risk-weighted assets. Panel D refers to deposit takers’ efficiency in using their assets; it is an indicator of bank profitability.

Source: IMF Financial Soundness Indicators; and IMF Global Debt Database.

Costa Rica is vulnerable to risks from climate change and has started assessing the potential financial impact from climate change and other environmental vulnerabilities on its financial sector. Phasing in a mandatory disclosure of climate-related risks by large financial institutions would facilitate more transparent management of these risks and provide incentives for allocating resources to cleaner activities. Costa Rica could also consider integrating climate-related risks into the Central Bank risk management framework and running climate change stress tests, which have started to be conducted in several OECD economies, such as France, the Netherlands or the United Kingdom.

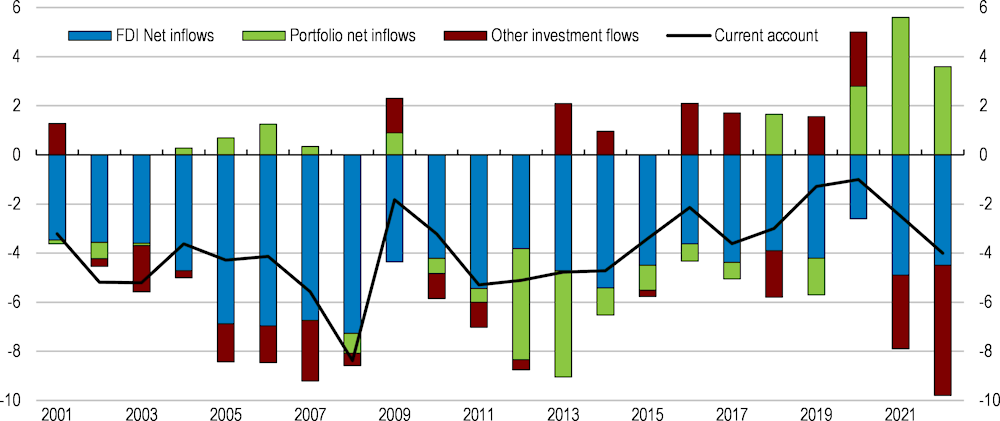

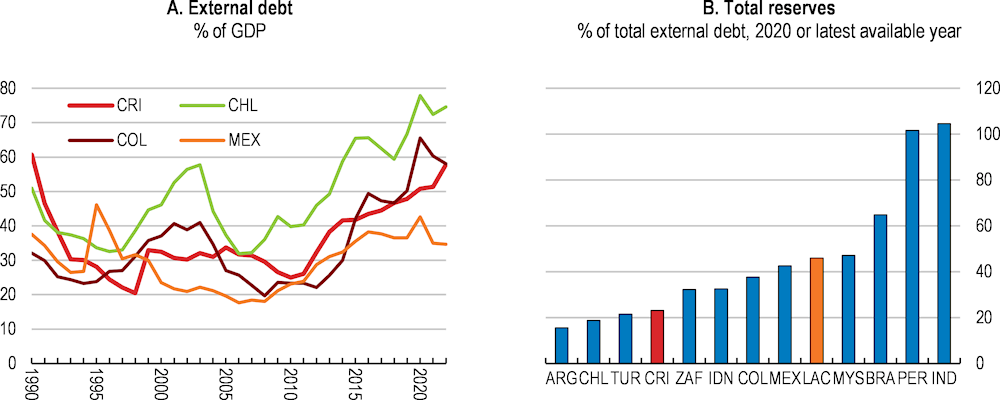

On the external side, the current account reached a deficit of 4% of GDP in 2022 (Figure 1.10), largely financed by a stable pipeline of foreign direct investment. However, external debt has significantly risen in the past decade (Figure 1.11), increasing vulnerability to global financial conditions. Currency reserves, of around 25% of external debt or 13.5% of 2021 GDP, are comparatively low and have recently decreased, covering around 5.3 months of imports. The Central Bank has recently announced a set of welcome measures to increase the availability of currency reserves, such as setting up a credit facility with the Latin American Reserve Fund. Accessing financing from multilateral financial institutions, such as through the IMF’s Extended Arrangement in place since 2020, would also increase the availability of foreign reserves.

Figure 1.10. The current account deficit is financed with foreign direct investment

% of GDP

Figure 1.11. External debt has increased and foreign exchange reserves are comparatively low

Macroeconomic policies can be further strengthened

Efforts made to improve Costa Rica’s macroeconomic framework paid off during the pandemic recession. Despite limited fiscal space, thanks to the higher flexibility to reallocate spending gained through the 2018 fiscal reform, Costa Rica put in place targeted measures towards vulnerable households and reoriented more public spending towards health and social programmes. Access to the IMF’s Extended Fund Facility helped to cover part of government financing needs at below-market interest rates. The Central Bank, whose independence was strengthened during the OECD accession process, supported the recovery by lowering the monetary policy rate and by providing significant liquidity, which was key to safeguarde financial stability and facilitate credit provision. More recently, it has increased the monetary policy rate to contain inflationary pressures. Looking ahead, the fiscal situation will remain challenging for some years. High inflation will have a positive impact on public debt dynamics in the short run, but at the same time, demands for higher budget allocations to support households will increase. Uncertainty in global financial and monetary markets will also remain high. Preserving macroeconomic stability in such a complex and challenging environment calls for further strengthening monetary and fiscal policy settings.

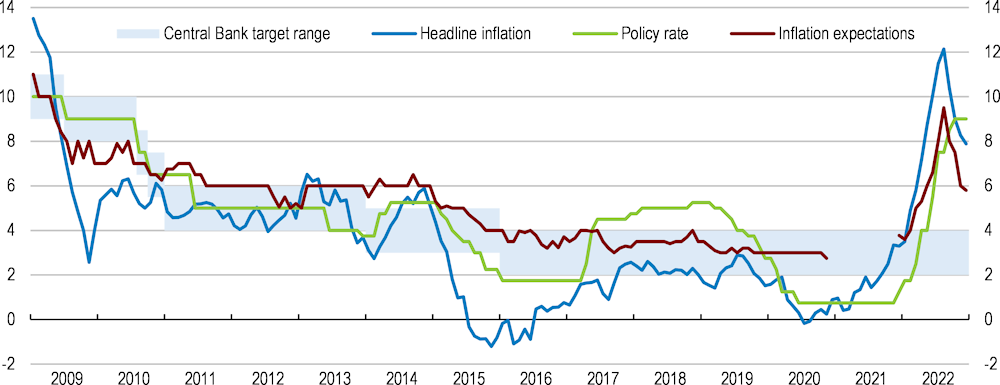

Adapting the monetary policy stance to contain inflation

As in most OECD countries, headline and core inflation have accelerated due to supply-side constraints as well as the increase in imported prices, especially energy and commodities, and the depreciation of the exchange rate. Inflationary pressures are notable in goods and more muted in services. Inflation expectations based on surveys conducted by the Central Bank suggest that expectations for the next 12 months are at 5.8% (Figure 1.12), around twice the inflation target. Expectations for the next 24 months, at 4%, are also elevated. Wages for high-skilled workers have trended up due to skill mismatches and shortages in some areas (see Chapter 2), but, for the time being, ample spare capacity in the labour market mitigates risks of a generalised wage-price spiral.

Figure 1.12. Inflation remains high

%

Note: Inflation expectations are the median one-year ahead expectations according to a survey run by the Central Bank. The survey was not conducted between December 2020 and November 2021.

Source: Banco Central de Costa Rica.

The Central Bank started a hiking cycle in December 2021 and has been gradually increasing the policy rate since then, delivering a total increase of 825 basis points, to 9.0%. The Bank also announced a gradual increase of reserves requirements for operations in national currency, aimed at reducing excess liquidity. Inflationary pressures are expected to persist, as producer prices have been increasing at two-digit rates (year-to-year) (Figure 1.6, Panel B above). Against the background of rising inflationary pressures, maintaining a restrictive monetary policy stance is appropriate to bring inflation back towards the target and anchor inflation expectations.

Maintaining exchange rate flexibility would also be key to absorb ongoing external shocks and will improve the effectiveness of monetary policy. Costa Rica has been gradually increasing exchange rate flexibility, in line with favourable experiences in other countries in the region, such as Colombia. At the current juncture, the central bank intervenes to manage foreign exchange requirements by the non-financial public sector and to avoid abrupt changes in the exchange rate. Most recent interventions aimed at satisfying foreign exchange requirements by the public sector, in the context of an increasing oil import bill, and by pension funds, as they pursue diversified financing strategies. Continuing to limit foreign exchange rate interventions to those strictly needed to avert abrupt changes and to manage foreign exchange requirements by the non-financial public sector, without seeking to alter market trends, would be the first line of defence against external shocks.

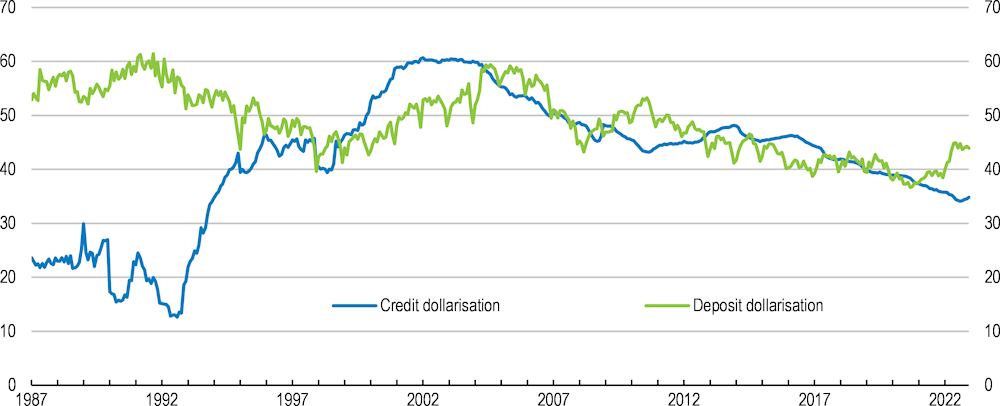

Exchange rate flexibility would also help to contain financial dollarization, which remains relatively high (Figure 1.13), with both credit and deposits in dollars representing around 40% of the total. This hampers the transmission of monetary policy and implies financial stability risks. Regulators indicate that two thirds of the dollarized debt is unhedged. Limiting interventions in the foreign exchange market would make it easier for economic agents to better internalise exchange rate fluctuations risks, reduce moral hazard and contribute to reduce large currency mismatches and unhedged positions. Eliminating the legal requirement on public institutions to deposit in state banks would reduce dollarization of deposits, as private banks currently face difficulties to collect local currency deposits and are forced to operate in foreign currency. Eliminating this requirement would also increase competition in the banking sector (see also competition section). The authorities could also consider additional prudential measures to discourage unhedged foreign exchange borrowing and lending, such as imposing an additional margin on loans to unhedged borrowers whose main source of income is in colones.

Figure 1.13. Financial dollarization remains large

%

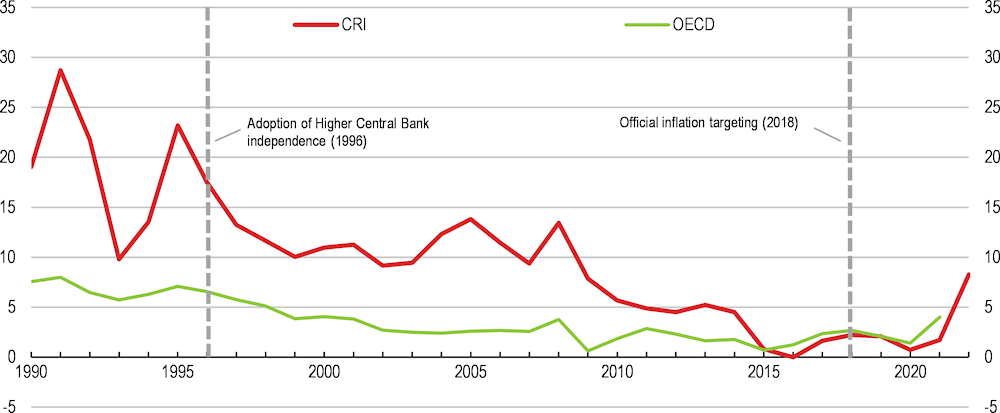

Central bank independence and a gradually stronger inflation-targeting framework have been key to reduce inflation over the past 30 years (Figure 1.14). This has brought macroeconomic stability, a key element for attracting and retaining foreign direct investment. Preserving central bank autonomy and credibility, by maintaining price stability as its principal mandate, is fundamental, particularly at the current juncture when episodes of financial volatility are likely to increase, as advanced economies withdraw monetary stimulus. A central bank focused on maintaining inflation low and stable can also play a key role in moderating economic cycles and running anticyclical policies when needed. This was illustrated by the strong anticyclical policies run by Costa Rica’s Central Bank in 2019, when the economy weakened and inflation was below target, and during the pandemic recession. Filling the current vacancy in the Central Bank board, which would put an end to the transitional possibility for the Minister of Finance to vote in board meetings while the vacancy is being filled, would buttress the autonomy of the Bank.

Figure 1.14. Inflation has fallen significantly since reinforcing Central Bank’s independence

Annual consumer price inflation, %

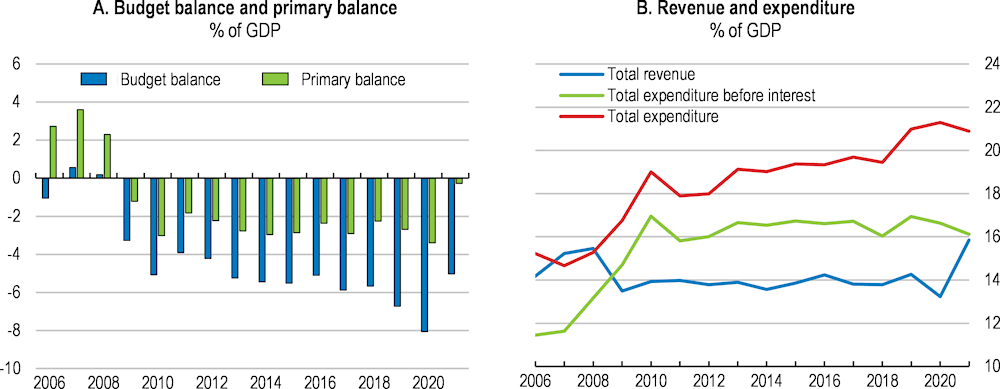

Improving debt sustainability and reinforcing the fiscal framework

After a decade of widening fiscal deficits, fiscal performance improved significantly in 2021 (Figure 1.15). The headline deficit stood at 5% of GDP, lower than foreseen in the authorities’ medium-term fiscal plan and in the memorandum of understanding that was agreed with the IMF to access the three-year Extended Fund Facility. The primary deficit stood at 0.3% of GDP, 3.1 percentage points lower than in 2020. This improvement reflects the combination of stronger than expected economic activity in 2021, and that all elements of the 2018 fiscal reform were for the first time in place. This included the implementation of the fiscal rule capping expenditure growth (Box 1.2), a fully-fledged value-added tax that replaced the sales tax and strengthened taxation of capital income at personal level. Tax revenues also increased thanks to several one-offs amounting to 0.7% of GDP, such as those caused by some tax payments deferments applied during 2020 that increased tax revenues in 2021.

Box 1.2. Costa Rica’s fiscal rule

The fiscal rule limits the growth of nominal spending depending on the level of public debt, as follows:

When debt at the end of the previous fiscal year is under 30% of GDP or the current expenditure-to-GDP ratio is below 17%, the annual growth of current expenditure should not exceed the average nominal GDP growth in the past four years.

When debt at the end of the previous fiscal year is between 30% and 45% of GDP, the annual growth of current expenditure should not exceed 85% of the average nominal GDP growth in the past four years.

When debt at the end of the previous fiscal year is between 45% and 60% of GDP, the annual growth of current expenditure should not exceed 75% of the average nominal GDP growth in the past four years.

When debt at the end of the previous fiscal year is above 60% of GDP, the annual growth of total expenditure should not exceed 65% of the average nominal GDP growth in the past four years.

The fiscal rule law, approved in December 2018, established that the spending of all non-financial entities of the public sector is subject to the rule. This includes the central government, all deconcentrated bodies, the legislature, the judiciary, local governments or non-financial public companies. Exceptions embedded in the law are the Social Security Fund (CCSS), the non-contributory pension regime, the Refinery of Oil (Recope), concerning the oil bill, and the Institute of Electricity (ICE), concerning the part of their activities in the telecommunication sector. In May 2020 a law was approved, exempting municipalities from the fiscal rule. In June 2022 a legal change established that fiscal rule calculations will start to be based on budgeted spending instead of on executed spending.

The fiscal rule law also established different conditions under which some institutions can apply for a derogation. For example, derogations are possible in the case of the declaration of a national emergency or when the country is going through an economic recession (or projections of growth below 1%). In either case, the law allows for up to two years of derogation after each of these events. As a result of the pandemic shock, several institutions such as Health Ministry, Education Ministry, the Vocational Training Centre (INA) or the Social Protection Ministry (IMAS), were granted derogations during 2020 or 2021, which enabled them to spend above the limits established by the fiscal rule.

Figure 1.15. The budget deficit has decreased

Central government, % of GDP

Note: Data refer to central government only. Total revenues do not include social security contributions.

Source: Finance Ministry.

Maintaining fiscal prudence is key for debt sustainability

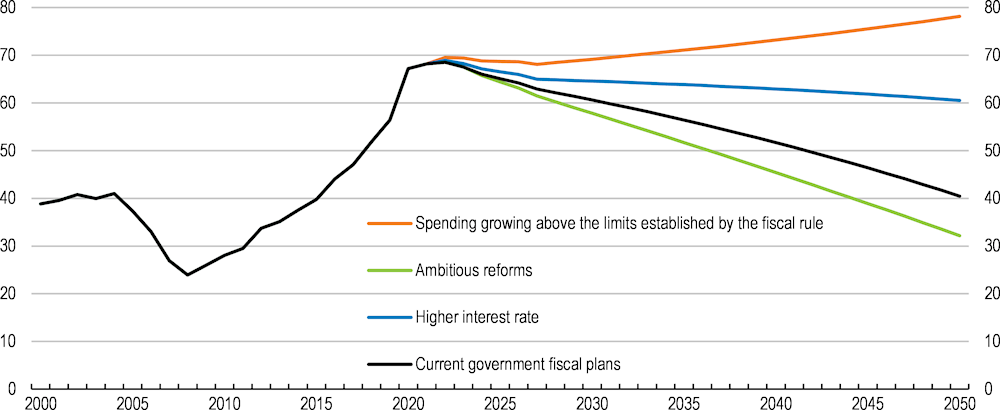

With public debt around 70% of GDP, public finances remain a critical vulnerability and the fiscal medium-term outlook remains challenging. According to the government medium-term fiscal plan, the deficit is expected to fall to 2.5% of GDP by 2025, while the primary balance would reach a surplus of 2.1% of GDP (Table 1.3). If these targets are met, the central government debt-to-GDP ratio would gradually decline from its 68% peak in 2021 (Figure 1.16, black line). Complying with this medium-term fiscal plan will require maintaining fiscal prudence, including by ensuring a strict implementation of the fiscal rule, which caps expenditure growth (Box 1.2). As of 2022, with central government debt above the threshold of 60% of GDP, the fiscal rule entered the most stringent scenario and annual growth of total expenditure should not exceed 65% of the average nominal GDP growth in the past four years. Meeting the targets established in the medium-term fiscal plan and full implementation of the fiscal rule are critical for containing spending and ensuring debt sustainability. In a scenario with spending growing above the limits established by the fiscal rule, the debt ratio will continue to rise (Figure 1.16, orange line). An ambitious reform scenario, boosting potential output as described in Figure 1.2, above, plus the planned fiscal consolidation plan, would put debt below 50% significantly earlier (Figure 1.16, green line).

Table 1.3. Evolution of main fiscal aggregates

% of GDP

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

|---|---|---|---|---|---|---|---|---|---|---|

|

Total revenues |

14.2 |

14.8 |

13.9 |

15.8 |

14.8 |

15.0 |

14.9 |

14.9 |

15.0 |

15.1 |

|

Tax revenues |

13.1 |

13.5 |

12.1 |

13.9 |

13.3 |

13.4 |

13.4 |

13.5 |

13.5 |

13.7 |

|

Personal taxes |

1.4 |

1.5 |

2.1 |

2.1 |

2.0 |

2.1 |

2.1 |

2.1 |

2.1 |

2.2 |

|

Corporate taxes |

2.6 |

2.9 |

2.5 |

3.1 |

2.8 |

3.0 |

2.9 |

3.0 |

3.0 |

3.1 |

|

Value added taxes |

4.3 |

4.5 |

4.5 |

5.1 |

4.9 |

4.8 |

4.8 |

4.7 |

4.8 |

4.8 |

|

Other |

4.8 |

4.6 |

3.1 |

3.7 |

3.5 |

3.6 |

3.6 |

3.6 |

3.6 |

3.7 |

|

Other revenues |

1.1 |

1.3 |

1.7 |

1.9 |

1.6 |

1.6 |

1.5 |

1.5 |

1.5 |

1.5 |

|

Total expenditures |

19.7 |

21.2 |

22.4 |

20.8 |

19.2 |

18.5 |

18.0 |

17.5 |

17.2 |

16.9 |

|

Current expenditure |

18.3 |

19.2 |

20.6 |

19.3 |

17.5 |

16.8 |

16.2 |

15.7 |

15.4 |

15.0 |

|

Wages |

6.9 |

6.8 |

6.8 |

6.6 |

6.1 |

5.7 |

5.4 |

5.1 |

4.8 |

4.5 |

|

Goods and services |

0.6 |

0.6 |

0.9 |

0.9 |

0.8 |

0.8 |

0.8 |

0.8 |

0.9 |

0.9 |

|

Interest |

3.4 |

4.0 |

4.7 |

4.8 |

5.1 |

4.8 |

4.6 |

4.6 |

4.5 |

4.3 |

|

Transfers |

7.4 |

7.7 |

8.2 |

7.2 |

5.5 |

5.5 |

5.4 |

5.2 |

5.2 |

5.3 |

|

Capital expenditure |

1.4 |

2.0 |

1.8 |

1.5 |

1.7 |

1.7 |

1.8 |

1.8 |

1.9 |

1.9 |

|

Central government primary balance |

-2.1 |

-2.3 |

-3.9 |

-0.3 |

0.8 |

1.3 |

1.5 |

2.1 |

2.3 |

2.6 |

|

Central government overall balance |

-5.5 |

-6.4 |

-8.5 |

-5.0 |

-4.4 |

-3.6 |

-3.1 |

-2.5 |

-2.2 |

-1.7 |

|

Non-financial public sector overall balance |

-4.4 |

-5.2 |

-7.8 |

-4.2 |

-4.3 |

-3.3 |

-2.7 |

-2.3 |

-2.0 |

-1.2 |

|

Government financing needs |

12.2 |

12.1 |

13.2 |

11.1 |

9.8 |

10.1 |

9.6 |

9.0 |

8.5 |

6.8 |

|

Central government debt |

51.9 |

56.4 |

67.2 |

68.2 |

67.6 |

67.5 |

67.1 |

66.1 |

64.9 |

63.2 |

|

Non-financial public sector government debt |

|

51.0 |

60.5 |

60.6 |

60.4 |

60.4 |

58.9 |

56.9 |

54.8 |

51.9 |

Note: Central government unless otherwise specified. Data for 2022-2027 are projections. Other revenues include social security contributions; non-tax revenues; and transfers. Some rows may not add up due to rounding. Data for 2023-2027 are projections and based on Finance Ministry passive scenario.

Source: Medium-term fiscal and budgetary framework (Marco Fiscal Presupuestario de Mediano Plazo) 2022-2027.

Full implementation of the fiscal rule will require sustained policy efforts to contain public spending. The fiscal rule remains the only tool anchoring fiscal policies in Costa Rica. The implementation of the fiscal rule has met significant opposition and legal challenges and frequent requests for exceptions from different segments of the public sector. A recent legal change establishes that fiscal rule calculations will now be based on previous year’s budget instead of on the previous year’s execution. This change increases the room for spending, as budgeted spending tends to be higher than executed spending. It also avoids penalising those institutions achieving savings, as, at the moment, if they end spending less than budgeted, they automatically get their spending space reduced in the following budget. The government has recently published draft legislation proposing additional changes to the fiscal rule and to undertake public asset sales. Proposed changes include applying the fiscal rule to current spending instead of to total spending in the more binding scenario of the rule, and removing interest spending from calculations in all scenarios (i.e. the fiscal rule would be applied to current primary spending in all scenarios). Proposed public assets sales include a state-owned bank and 49% of the National Insurance Institute. The authorities foresee that revenues from the sale of the state-owned bank could be around 3% of GDP. Both pieces of legislation require approval by the Legislative Assembly and are subject to uncertainty about its final configuration and implementation schedule. The effects on public debt dynamics remain uncertain. While changes in the fiscal rule would imply a slower reduction of the headline deficit and public debt, the asset sales would reduce the level of public debt. In the medium-term, undertaking a careful review of the fiscal rule, taking stock of the experience gained during its implementation over the last years, could help to improve its design and to ensure that it continues to secure a prudent fiscal stance and sustainable debt dynamics.

Figure 1.16. Current fiscal policies will put public debt on a declining path

% of GDP

Note: The chart depicts central government public debt. The “Current government fiscal plans” scenario assumes GDP growth as in table 1.1 until 2023, with a gradual transition to OECD long-term model estimates of potential output thereafter. Inflation is projected as in table 1.1 until 2023 and a gradual convergence to 3% thereafter. Fiscal assumptions are those outlined in table 1.3 and remain constant until 2028 when ageing costs, in the form of higher pensions and health costs, will gradually start to kick. The “Ambitious reforms“ scenario assumes the implementation of reforms described in Figure 1.2. Both “Current government fiscal plans” and “Ambitious reforms” scenarios assume full implementation of the fiscal rule. The scenario “Spending growing above the limits established by the fiscal rule” assumes that primary spending is 1% of GDP higher than in current government fiscal plans and that revenues remain as in current government fiscal plans. In all scenarios the evolution of the interest rate paid on new debt issued is a function of the 10 years US sovereign yield and a risk spread that depends on the ratio of debt-to-GDP. In the “Higher interest rate scenario” the interest rate is 100 basis points higher over the projection period, which leds to interest spending being 1% of GDP higher than in the other scenarios, and that primary spending and revenues remain as in current government fiscal plans. All scenarios include ageing costs.

Source: OECD calculations.

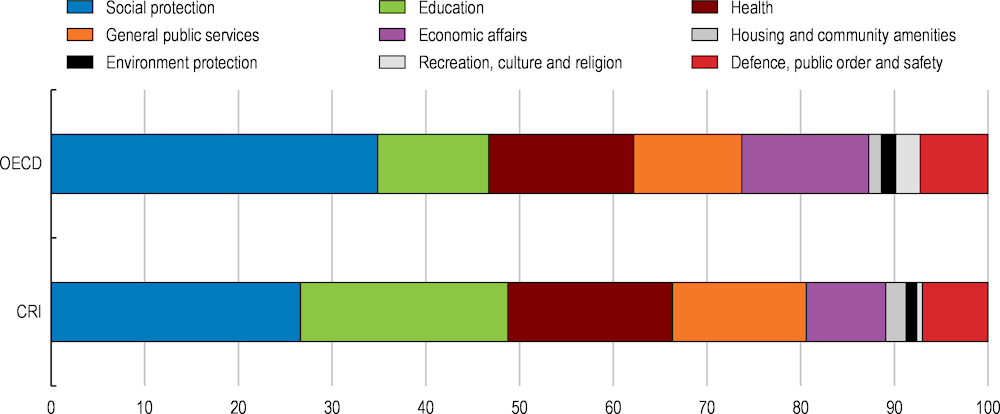

Improving the efficiency and quality of public spending

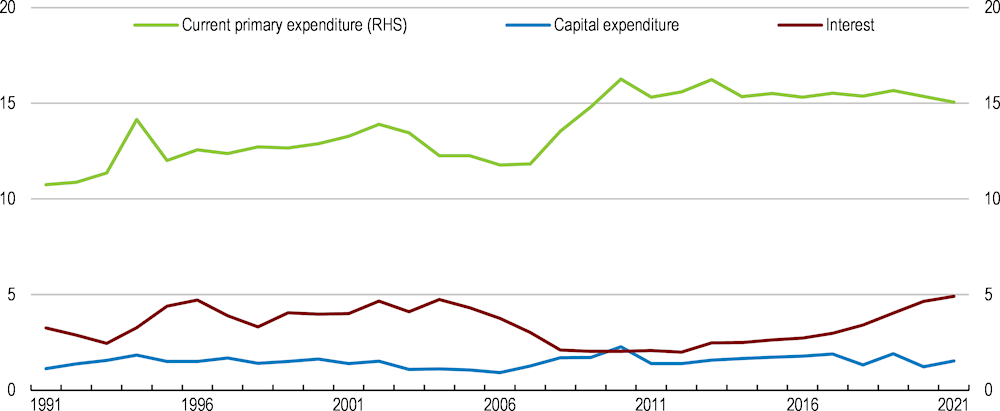

Containing spending and, at the same time, improving its efficiency and quality to better support growth and equity, is a critical challenge ahead. The surge in spending that led to Costa Rica’s critical fiscal situation in 2008-19 almost exclusively involved extra current primary spending (Figure 1.17), neglecting key investments in capital expenditure that typically underpin medium-term growth prospects. This spending increase saw no improvement in the quality of spending nor any stronger contribution to economic growth and equity (OECD, 2018[5]). A paradigmatic case is education spending. Despite the increase in education spending, which accounts for a larger share of total spending than in OECD countries (Figure 1.18), education outcomes have worsened (see Chapter 2). Overall, Costa Ricans have become increasingly dissatisfied with the quality of the delivery of public services (Estado de la Nación, 2017[6]). Looking ahead, as the need to contain spending will endure, Costa Rica should continue to switch from a focus on the volume of spending to a focus on how to improve its quality and efficiency. This would require stronger accountability mechanisms, transparency and impact evaluation. This is even more necessary given that population ageing will put further pressure on some categories of social spending. The 2018 fiscal reform removed part of the revenue-earmarking provisions introduced over the years. The Finance Ministry became able to reallocate spending away from legally mandated destinations when public debt exceeds 50% of GDP. Continuing to reduce earmarking and to increase the ability to reallocate spending will be key to boost public spending efficiency. Spending reviews can inform the process to decide on the necessary expenditures prioritisation and reallocation in a transparent way and would foster accountability across the public sector.

Figure 1.17. Capital expenditure has been largely neglected

Governement expenditure, % of GDP, 1991-2021

Source: Ministerio de Hacienda; IMF World Economic Outlook; OECD System of National Accounts database.

Figure 1.18. Education accounts for a larger share of public spending than in OECD countries

General government expenditure by function, % of total, 2020

Note: Data for Chile and Costa Rica are for the year 2019. OECD average excludes Mexico for which no data are available.

Source: IMF Government Finance Statistics database; and OECD Statistics on National Accounts.

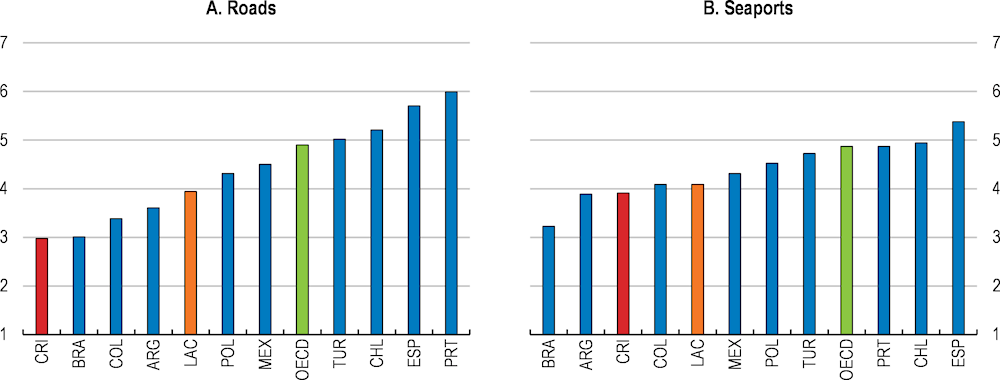

Fostering capital investment would boost the contribution of fiscal policy to growth. A first step would be to improve the ability to execute capital investment projects, as only 30% of the capital spending that is budgeted is executed. Ongoing reforms to foster the stewardship of the Ministry of Public Works and to reduce fragmentation in public investment processes can foster the ability to deliver capital investment projects in a more effective and efficient manner. Creating more space for capital spending is also needed (Figure 1.17). Focusing the needed fiscal containment efforts on current spending would facilitate deploying capital spending to close some of Costa Rica’s numerous infrastructure gaps (see infrastructure section below), boosting medium-term growth prospects. Despite being in the most stringent scenario of the fiscal rule, the design of the fiscal rule allows for such possibility. It remains at the discretion of authorities to focus the fiscal effort on current spending and allow capital spending to strengthen, as long as the sum of current and capital spending remains below the limit established by the rule for total spending. Basing the selection of capital investment projects on sound cost-benefit analysis would help to reduce infrastructure gaps in a cost-effective manner.

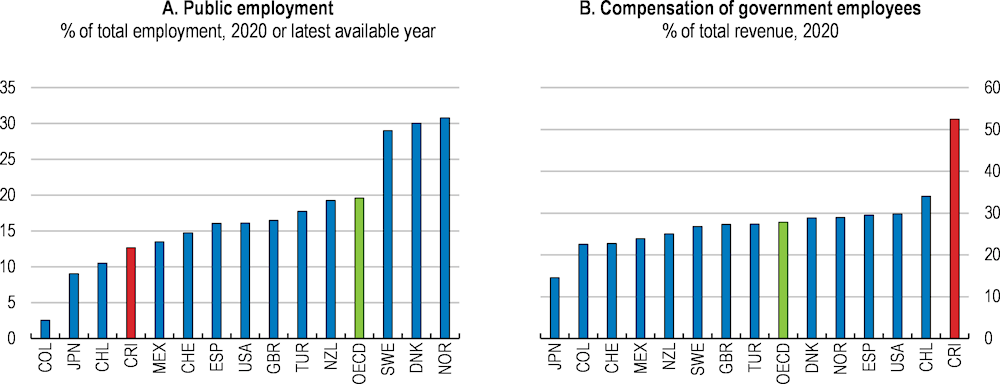

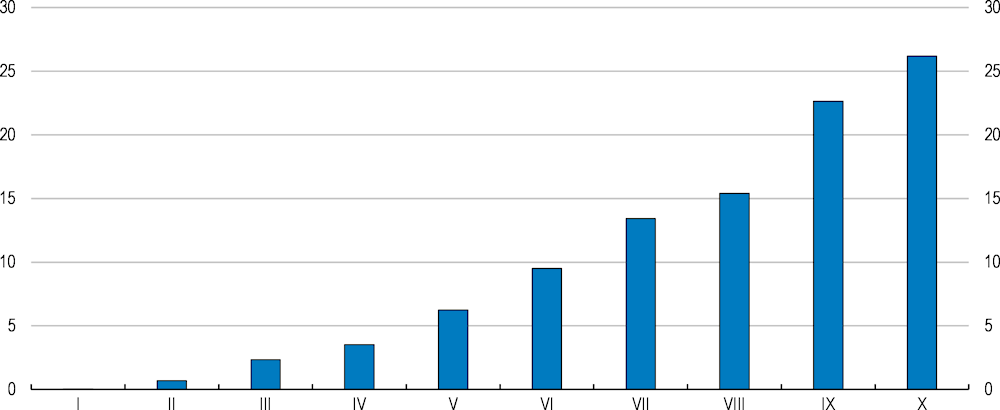

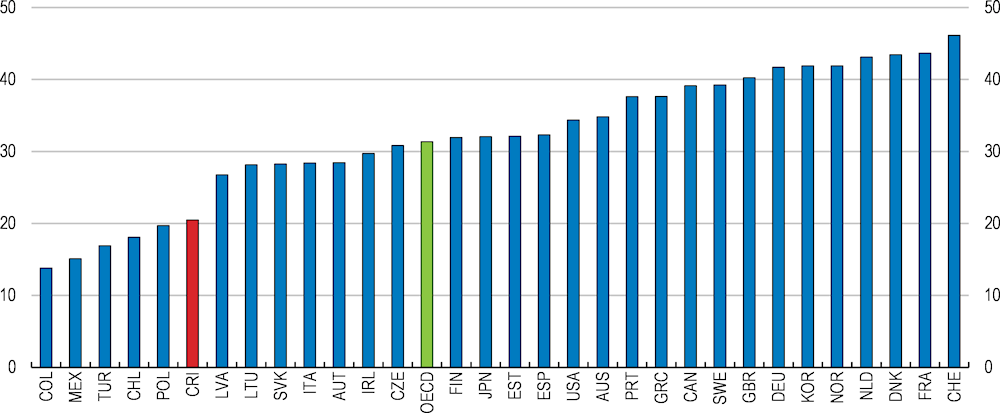

Containing the public employment wage bill will be key to comply with the fiscal rule and improve public sector efficiency. Compensation of government employees accounts for more than half of total government revenues (Figure 1.19), the largest share in OECD countries and more than double the OECD average. Public salaries are also almost 50% higher than in the private sector, after controlling for employees’ characteristics (World Bank, 2019[7]). Measures to contain the public wage bill affect more the higher-income households (Figure 1.20), with a lower propensity to consume, meaning that the impact on growth would be moderate. Limits to public wages included in the 2018 fiscal reform contributed to the reduction in the deficit in 2021. However, additional measures are necessary to make remuneration more transparent and performance based. The public employment framework law, introducing a new single and unified salary framework with equal pay scales for equivalent functions across the public sector and rationalized bonuses, a long-standing OECD recommendation, was finally approved in March 2022 (Table 1.4 and Box 1.3). Applying the law maintaining consistency between the job families and salary scales in the central government and other institutions, and ensuring a link between performance and remuneration are key challenges to reap the full benefits of the law and improve public sector efficiency.

Figure 1.19. The public employment bill accounts for a large share of government revenues

Figure 1.20. Public employment reforms in Costa Rica impact high-income households more

Percentage of Costa Rican households with at least one public worker by income decile

Table 1.4. Past OECD recommendations to improve macroeconomic policies

|

Past OECD recommendations |

Actions taken since the 2020 survey |

|---|---|

|

Any support to firms and households during the coronavirus crisis should be temporary and targeted to the most affected sectors. Prepare for increases in healthcare demand, including by boosting testing capabilities. Establish clear guidelines for the implementation of the fiscal rule. Allow that all spending categories can be adjusted when public debt exceeds 50% of GDP. Eliminate tax exemptions benefiting more affluent taxpayers. |

“Bono Proteger”, a temporary cash transfers targeted, was made available to individuals affected by the pandemic. Implemented a temporary hospital specialized in treating COVID patients. The fiscal rule underpinned the fiscal improvement in 2021. The latest two budgets contained significant spending reallocation and spending containment measures. Proposals for reducing some exemptions were submitted to Congress but were not approved. |

|

Be ready to ease monetary policy further to support the economy during the coronavirus outbreak. Continue to provide liquidity to the banking system to preserve its integrity and support confidence and continue to adjust prudential regulation as required during the coronavirus outbreak. |

The Central Bank lowered the interest rate, which reached a historical low level of 0.75%. The Central Bank provided banks with temporary medium-term credit, conditional on providing finance to medium-term solvent individuals. Prudential regulations were adjusted to facilitate debt re-profiling. |

|

Bring all purchases by all public entities to the central procurement system and limit the use of exceptions for direct contracting. |

A new law establishes that all the public sector must carry their purchases through the central procurement system. |

|

Adopt a single salary scale, streamline incentives schemes and make them performance based. |

The public employment framework law, introducing a new single and unified salary framework was approved in March 2022, with implementation starting in March 2023. |

|

Create a public debt management agency. Target attracting foreign investors to instruments issued in local currency. |

Measures to facilitate the purchasing of local debt in local currency by foreign investors have been put in place. |

|

Improve transparency of banks’ health, including by publishing individual stress tests. Gradually reduce existing regulatory distortions affecting public and private banks, including, in due time, phasing out the public guarantee of state-owned bank liabilities. |

Legal changes to start publishing stress tests results bank by bank have been finalized. No actions taken. |

|

Adopt a more diversified investment strategy, reducing the share of government securities. |

Pension funds have increased investment in external assets denominated in dollars. |

Box 1.3. The public employment framework law

The public employment framework law, approved in March 2022, introduces a new single and unified salary framework for the public sector (excluding non-state public entities, state companies in competition and the Meritorious Fire Brigade). The framework includes equal pay scales for equivalent functions, rationalizes bonuses and makes them more performance based. Public institutions with autonomy or independence will define the job families and salary scales for exclusive and exclusionary functions assigned to them by the Constitution. Exclusive and exclusionary functions refer to strategic roles within independent institutions, determined to avoid possible infringement of power independence among government branches. The Ministry of National Planning and Economic Policy (MIDEPLAN), with the General Directorate of Civil Service, will define them for the rest of the functions of the public sector. According to estimates by the Inter American Development Bank annual savings would range between 0.5% and 0.8% of GDP for the whole public sector, and between 0.4% and 0.6% for the central government, depending on the new reference salaries.

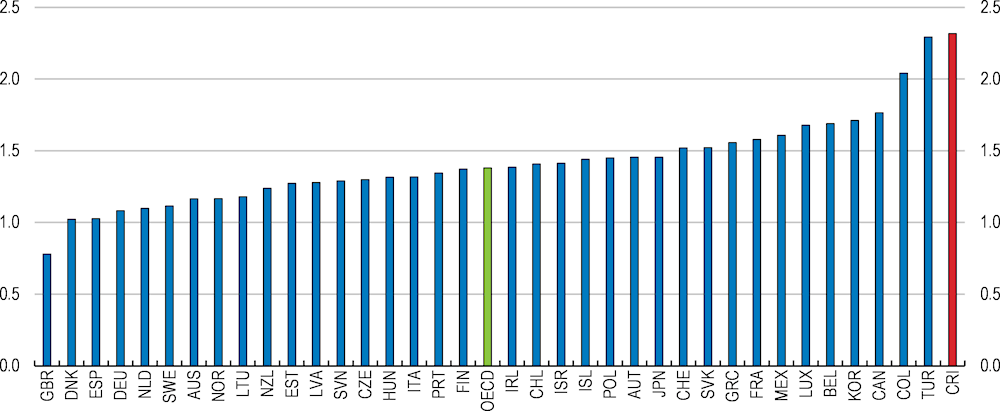

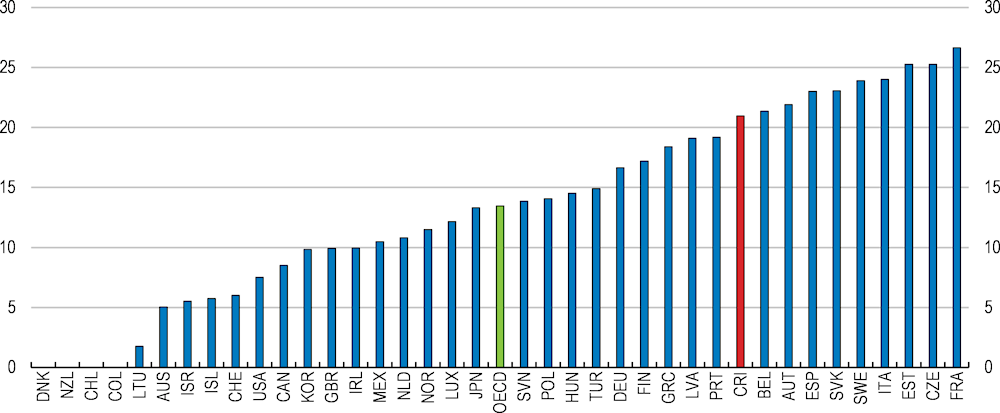

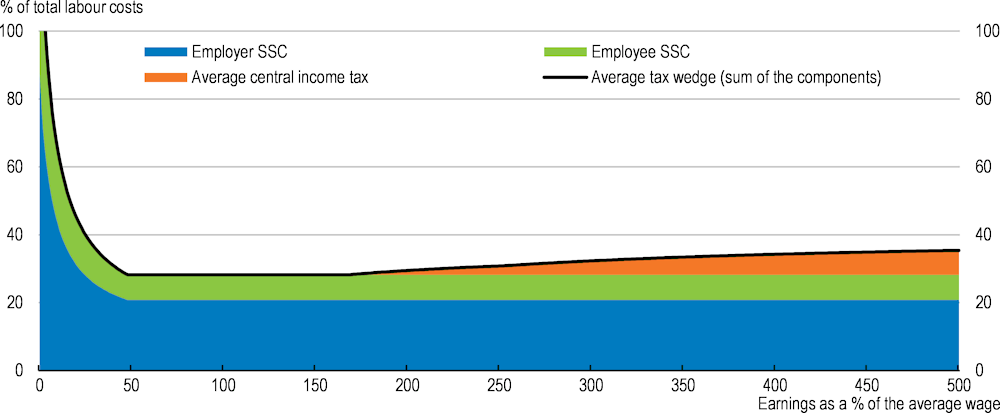

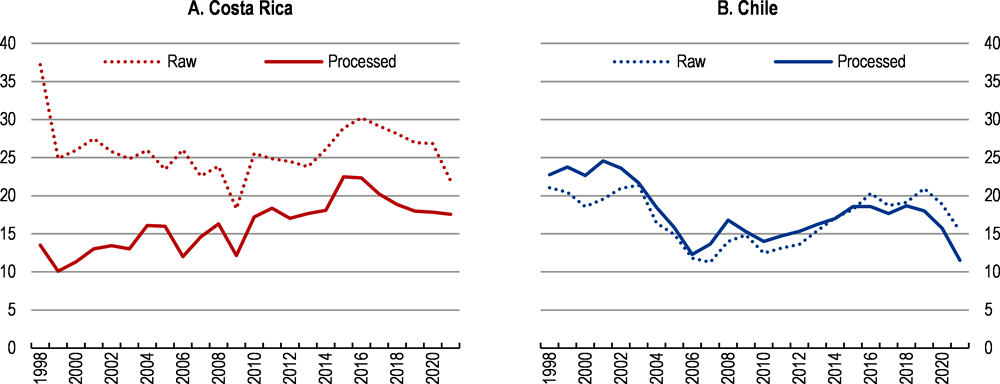

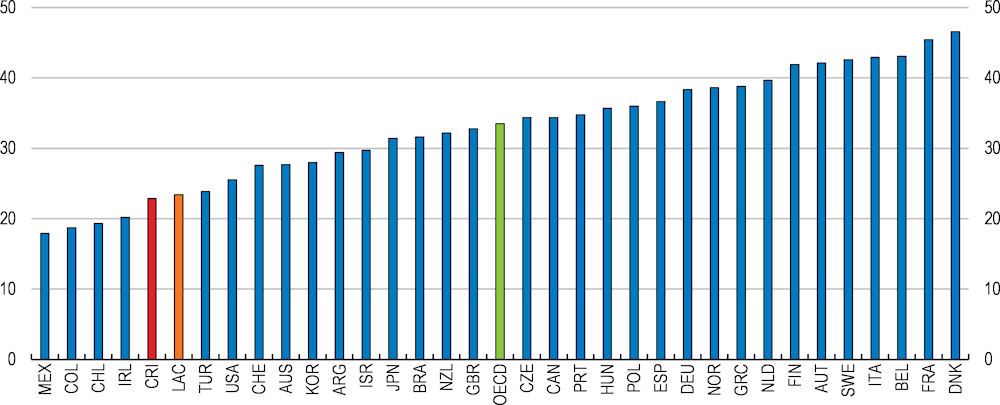

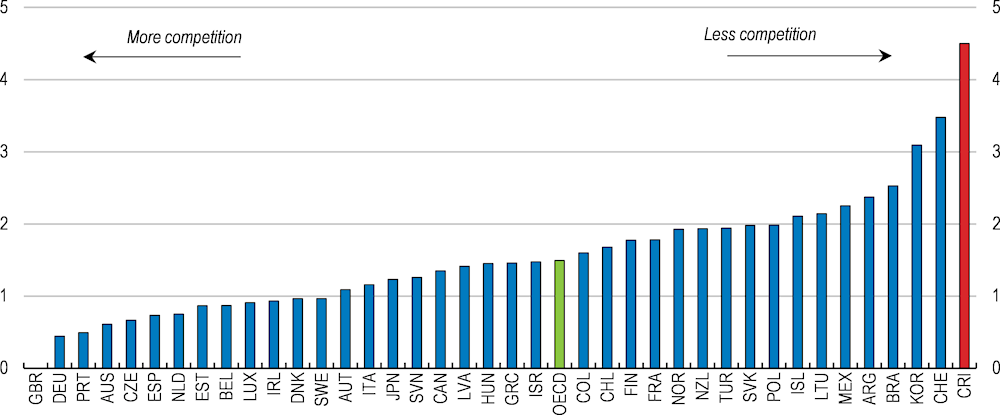

Raising more revenue and enhancing the redistributive power of tax policy

Tax revenues are in line with regional peers but lower than in most OECD countries (Figure 1.21). High tax evasion, narrow tax bases and various tax expenditures mean that there is room to increase revenues in a way that supports growth and reduces inequality. Costa Rica’s tax mix differs markedly from either the OECD or regional averages (Figure 1.22). The tax system is overly reliant on social security contributions, which account for more than one-third of total revenues, compared with the OECD average of 26% or less than 15% in peer Latin American countries. High social security contributions generate labour market distortions and favour informality (see also the informality section). This erodes the tax base and generates inequalities.

Figure 1.21. Tax revenues are low compared to OECD peers

% of GDP, 2020 or latest year

Note: LAC refers to Chile, Colombia, Mexico, Argentina and Brazil. All averages are unweighted.

Source: OECD Revenue Statistics database.

Figure 1.22. Costa Rica’s tax structure relies on social security contributions

% of total taxation

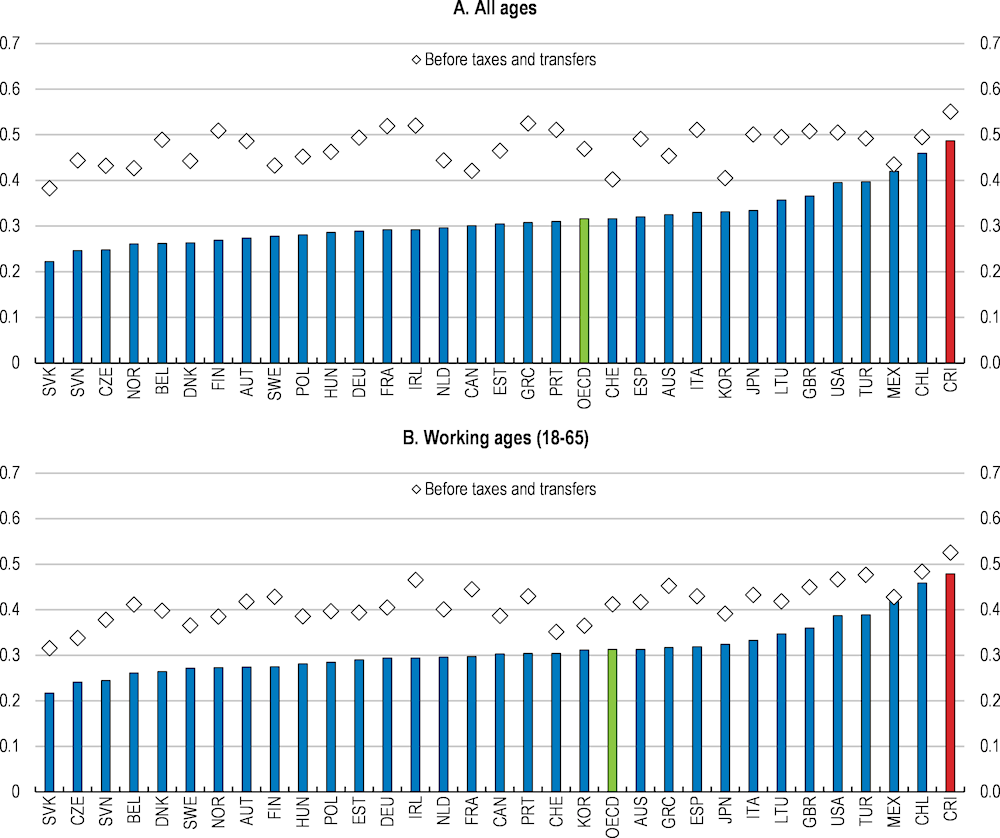

To raise additional revenue, the authorities are currently assessing new tax measures. With public debt still high and a tax system overly reliant on social security contributions and with a very weak redistributive power (Figure 1.23), Costa Rica should consider tax measures that improve the tax mix, make the tax system more progressive and raise additional revenue. In this regard, the authorities have announced plans to reform the personal income tax system and move to a system where all personal income sources are consolidated. At the moment, each personal income source is taxed separately. This change could increase revenues and the progressivity of the tax system.

Broadening tax bases also holds the promise of increasing revenues without increasing rates, and could also make the tax system more progressive. Tax expenditures are large, amounting to 4% of GDP in 2021. Tax exemptions granted to free trade zones, which amount to 1% of GDP, have brought economic advantages to the country, such as an increasingly diversified export basket. This suggests that the free trade zone tax scheme should be retained subject to regular and in-depth evaluations of its costs and benefits, focused on the additional investment, employment and productivity it generates. On the other hand, phasing out the exceptions that particularly benefit more affluent taxpayers should be prioritised, which includes the tax exemption on the additional monthly salary for most public employees (Salario escolar). Starting to tax the income of cooperatives, which remain exempt despite some of them being large corporations, enjoying trade protection and monopolistic conditions in key markets, should also be considered. There remains also room to optimise reduced VAT rates. Taxing the spending on private education and health at reduced VAT rates is particularly regressive, as it disproportionately benefits high-income households.

Additional revenue collection could also come from taxes on immovable property, which account for around 6% of total revenues in the OECD and peer regional countries but less than 2% in Costa Rica. The central government is responsible for building and maintaining the cadastre while the local governments are responsible for the valuation of property. Valuation rules across local governments are very heterogeneous. Providing support to local governments to ensure that the same valuation rules are applied across municipalities would prevent unfair competition and increase revenues (OECD, 2017[8]). Exempting low value properties and establishing different tax rates depending on the property value could be useful to ensure progressivity, as exemplified by some OECD countries, such as Ireland.

Figure 1.23. The tax and transfer system could be more efficient in reducing inequality

Gini coefficient before and after taxes and transfers, 2021 or latest year

Note: Data for Costa Rica refer to 2021. OECD refers to an unweighted average of all member countries with available data. The diamonds for Mexico, Hungary and Turkey show the Gini coefficient after taxes and before transfers.

Source: OECD Income Distribution Database.

Tax administration and collection reforms are critical. The authorities have already taken important steps, such as the roll out of electronic invoicing. Further reforms to strengthen tax administration and collection could include integrating the tax and social security contribution administrations or further modernising the tax administration through computerisation and risk-based compliance (OECD, 2017[8]). Measures to simplify the tax system could also help improve tax compliance. Numerous public agencies are involved in the collection of taxes. Beyond the Finance Ministry, municipalities, the Social Security Institute, the National Insurance Institute, the Central Bank, pensions and insurance operators, several SOEs and professional associations, all are involved in tax collection. More than 60% of the taxes are collected outside the Finance Ministry. Municipalities collect by themselves 21 taxes (CGR, 2021[9]). As a result, for the 99 taxes that remain active, there are 93 different IT platforms used in 143 public institutions. Moving towards a more centralised, digital and less fragmented tax payment and collection system could offer significant efficiency gains and savings that could reach 1% of GDP (CGR, 2021[9]) and facilitate tax compliance. Extending the use of prefilled tax returns can also help to facilitate compliance and reduce administration costs, as exemplified in several OECD countries (Box 1.4). Ongoing technical assistance to improve tax administration and public financial management, led by the IMF and with collaboration of the EU among other partners, have also a large potential to boost significantly tax efficiency and collection.

To ensure the medium-term stability and credibility of the tax system, it is also essential that Costa Rica remains proactive in the on-going international efforts to harmonise tax standards and avoid base erosion and profit shifting. Costa Rica’s free-trade-zone regime is one of the elements in its strategy to attract foreign direct investment. Continuing to update domestic tax rules in line with new international standards is the best way to remain attractive for foreign direct investment and preserve its reputation for international cooperation and transparency on tax issues. At the same time, progress towards establishing a minimum global corporate effective tax of 15% means that other elements in the strategy to attract foreign direct investment, such as the availability of highly skilled workers (see Chapter 2), will gain emphasis.

Box 1.4. Prefilling tax returns

Prefilled income tax returns represent a tax simplification initiative that can foster compliance and reduce burdens for taxpayers and tax administrations. Their use began in Denmark in the late 1980s and subsequently has spread across OECD countries. Pre-filling entails the use by tax administrations of information already held by them (e.g. taxpayer identity information, elements of taxpayer history, and third-party reports of income and expenses) to populate fields within tax returns that are made available to taxpayers for examination.

In a number of countries, for example Finland, Hungary and Norway, tax administrations generate at the end of the year a fully pre-filled personal income tax return for the majority of taxpayers required to file tax returns. Australia currently prefills around 88% of all income amounts reported by individual taxpayers. Ninety percent of these are accepted without amendment by the taxpayer. Substantial use of pre-filling to fully or partially complete tax returns for a significant share of taxpayers also takes place in many other OECD countries (OECD, 2022[10]). In recent years, the use of prefilled returns has extended beyond personal income tax. For example, the availability of electronic invoicing systems allows tax administrations to pre-fill value-added tax returns, as is the case in Portugal (OECD, 2022[10]).

Strengthening the fiscal framework

To support ongoing consolidation efforts and enhance medium-term fiscal sustainability, Costa Rica should continue modernising its fiscal framework by introducing a fully-fledged multi-year expenditure framework and an effective and independent fiscal council, as recommended in previous OECD Economic Surveys (OECD, 2020[3]) and done in many OECD countries, such as Chile recently (OECD, 2020[11]). Costa Rica’s high public debt implies that reducing the debt burden will be the medium-term focus of fiscal policy for several years to come. A multi-year expenditure framework would provide certainty and transparency about the medium-term plan, helping to plan and to align spending decisions with strategic objectives. The “Medium-term fiscal and budgetary framework” (Marco Fiscal Presupuestario de Mediano Plazo), published every year by the Ministry of Finance, detailing baseline expenditure forecasts for the year ahead, has been gradually enhanced and now covers both the central government and the non-financial public sector. Costa Rica could build on it to establish a fully-fledged multi-year expenditure framework, where multiyear targets are established. The medium-term framework publication now contains more descriptive and qualitative information about contingent liabilities but providing a quantitative assessment is a pending challenge.

Fiscal transparency and accountability would also be enhanced by establishing an independent and adequately resourced fiscal council. By providing non-partisan fiscal analysis, fiscal councils can enrich the fiscal policy debate and help to communicate fiscal risks and policy options. The law to establish an independent fiscal council was approved in March 2020 and its three members were nominated. However, no further action has been taken to enable the council to operate in a meaningful way. The council suffers from significant institutional weaknesses, such as a lack of clarity about the roles it has to perform or of a minimal technical support structure. Providing the three board members with independent technical support is critical. Defining explicitly at which moments in the process of preparation of the medium-term fiscal plan the council would be consulted and by when it should issue its assessment, providing sufficient time for preparing such an assessment, would allow the council to fulfil its role. Mechanisms to ensure that there is some follow-up of the council assessment and opinions are also lacking and should be established.

Improving public debt management

With interest payments at about 5% of GDP, and accounting for an increasing share of the central government budget, improving debt management remains increasingly important. Both domestic and global interest rates are expected to put additional pressure on the interest bill. In a scenario of increasing funding costs, the debt-to-GDP ratio would remain higher for longer (Figure 1.16, blue line). Planned access to additional international loans and issuance of instruments in foreign currency could reduce financing costs and provide some savings, relative to placing the debt in local markets to local investors. Costa Rica is expecting to access significant multilateral funding in 2023, including through the IMF Extended Arrangement under the Extended Fund Facility. In total multilaterals are expected to provide about 4% of GDP, out of the 10% of GDP of financing needs expected in 2023. Accessing some of these financing lines and issuing instruments in foreign currency requires approval by the parliament.

Issuing debt in foreign currency can provide savings relative to placing debt in local markets but also brings foreign currency risks, which should be carefully considered. Establishing a debt management agency, a long-standing OECD recommendation, would help to manage those risks. Debt management has suffered from institutional fragmentation, as different departments are in charge of local and external debt, which creates overlaps and inefficiencies (OECD, 2018[5]). Debt management practices have recently improved but improving the institutional set-up would further buttress debt management. With a debt management office in place, Costa Rica could consider relaxing the requirement of approval by the parliament to issue debt in foreign currency. This would allow for putting in place multi-year debt management plans based on sound guidelines and principles, helping to take better advantage of market opportunities. Costa Rica would also benefit from continuing efforts to attract foreign investors to local-currency denominated debt, as recommended in previous OECD Economic Surveys.

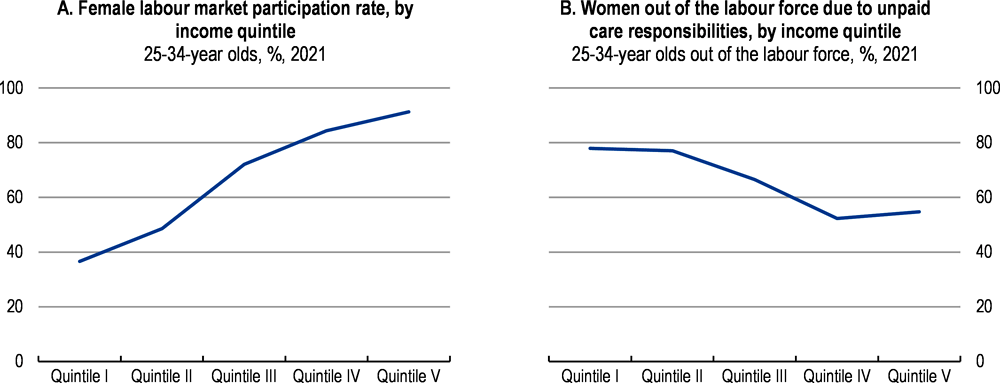

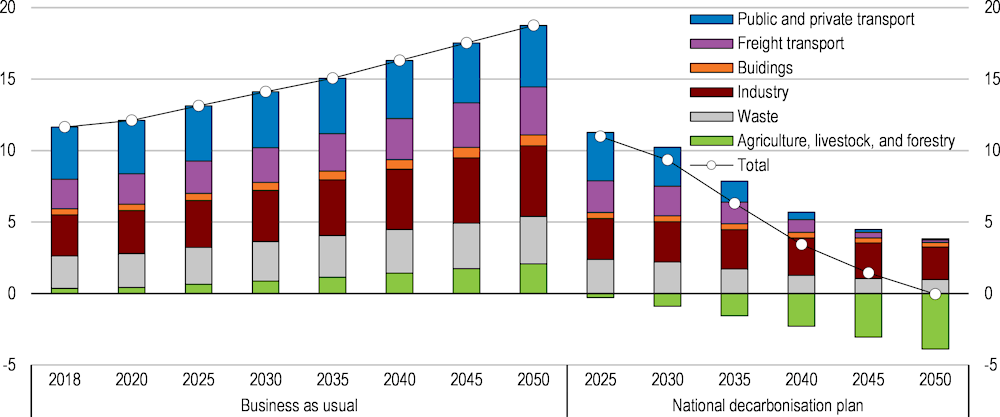

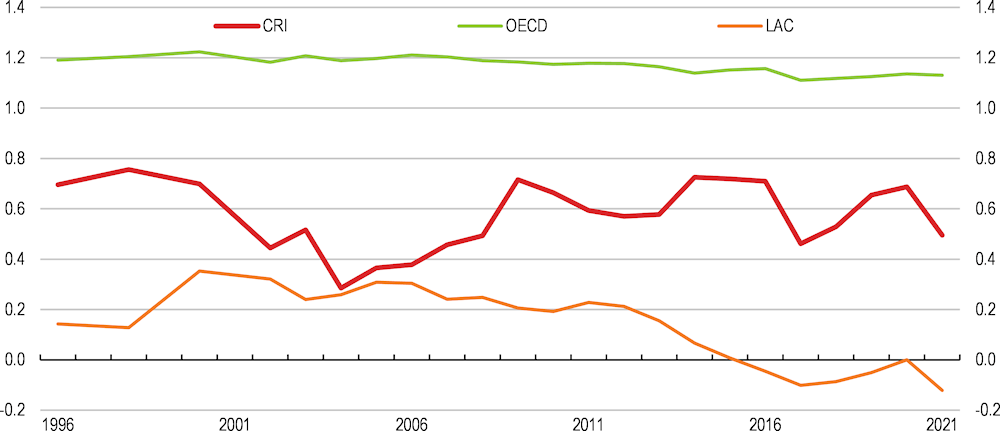

Strengthening productivity growth

Over the past 15 years, potential growth has declined markedly (Figure 1.1), from more than 5% per year in 2007, to around 2.3% now, according to OECD estimates. Falling employment rates and a shrinking working-age population have contributed to the decline. Boosting female labour market participation and further increasing employment rates hold the promise of improving growth prospects significantly. Still, population ageing will dampen aggregate growth substantially. Boosting productivity is therefore critical to uphold growth in GDP and living standards in Costa Rica.

The level of productivity is relatively low in international comparison (Figure 1.24). It remains at similar levels as in Latin American peers but below other emerging economies, such as those in Eastern Europe or Asia. One key factor helping to explain this is that Costa Rica remains a dual economy, combining a small number of large and relatively productive firms, largely focused on external markets, with another sector, mainly composed of local SMEs exclusively focused on domestic markets and unable to benefit from the opportunities provided by the integration into the global economy. Raising productivity by setting the right conditions for domestic companies to thrive and, at the same time, maintaining and reinforcing the commitment to foreign direct investment and trade, which has been key to increasingly diversify the export basket, remains a key challenge. Boosting the productivity of local firms would also facilitate their participation in global value chains.

Figure 1.24. Labour productivity is relatively low

1000s of PPP-adjusted USD per capita, 2021

Note: OECD average calculated as the simple average across OECD countries with available data.

Source: OECD Productivity database.

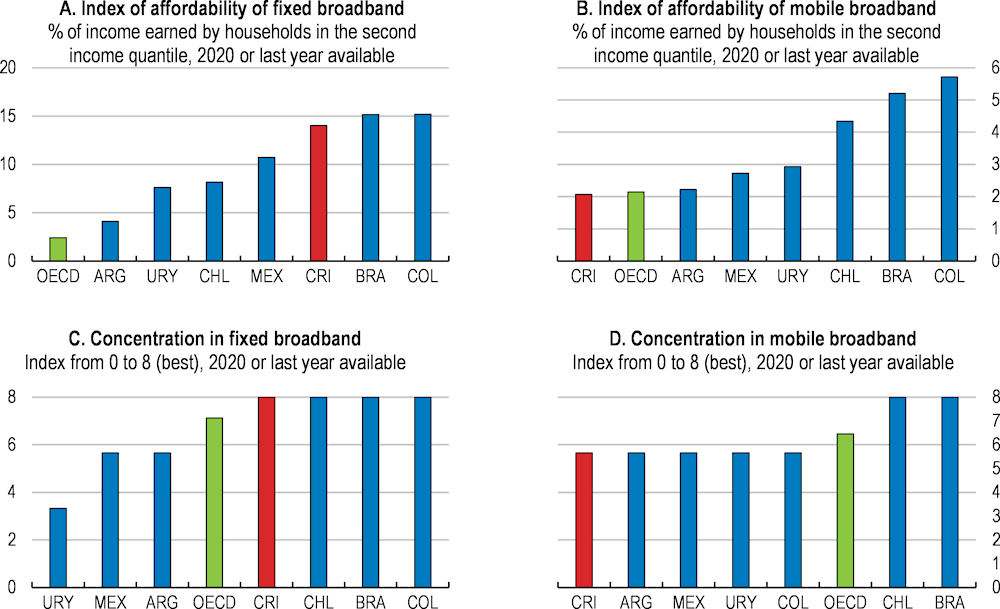

Boosting productivity through more competition

Weak competition tends to translate into relatively high prices of goods for consumers and of inputs for firms. Both features can be found in Costa Rica (OECD, 2020[3]), which has led to a general categorization of Costa Rica as an expensive country, where a basic basket of goods and services costs significantly more than in neighbouring countries (Angulo, 2014[12]). Private firms report that rising costs is the main barrier to their operations (UCCAEP, 2019[13]), particularly in agriculture and manufacturing. The elimination of the minimum price of rice is an important and welcome step to reduce the cost of the basic goods basket in Costa Rica. Likewise, the planned elimination of minimum prices in 11 professional services will foster competition in key sectors, such as healthcare and construction.

A fully independent and resourced competition authority is a key pillar of a solid competition framework. Many of the weaknesses in the competition framework, such as the lack of independence and resources of the national competition authority, were meant to be addressed by the new competition law approved in December 2019. However, in 2022, the national competition authority (COPROCOM) received less than one third of the budget granted by law. This severely hampers the authority’s ability to perform its duties, as it remains understaffed and unable to buy equipment. Despite these constraints, two competition studies have been completed (professional associations and liner shipping). Providing the national competition authority with adequate financial resources, as established by law, is a necessary condition for boosting competition, which would translate into lower prices for goods and services, enhancing households’ purchasing power and firms’ competitiveness. Effective competition authorities, by promoting stronger economic growth, can also support tax revenues and have a positive fiscal impact. A well-resourced and fully operational national competition authority would be particularly beneficial at the current juncture when authorities are taking bold and valuable measures to improve regulations, open up key sectors of the economy and remove obstacles to competition (e.g. in the rice sector). Introducing a filing fee for merger control notifications could make available some additional resources. However, granting the budget established in the law would still remain critical. Making sure that the national competition authority receives a direct budget allocation would help secure the necessary resources. For the time being, the national competition authority is a deconcentrated institution under the umbrella of the Ministry of Economy. This means that its budget is counted as part of the budget of the Ministry of Economy, which can create difficulties when establishing spending ceilings per Ministry to comply with the fiscal rule. Spending reviews can also support the necessary spending reallocation process that the Finance Ministry needs to undertake to grant the necessary resources to the national competition authority. It remains also important to continue granting adequate resources to the sectoral competition authority (SUTEL), which is in charge of protecting and promoting competition in the telecommunication sector.

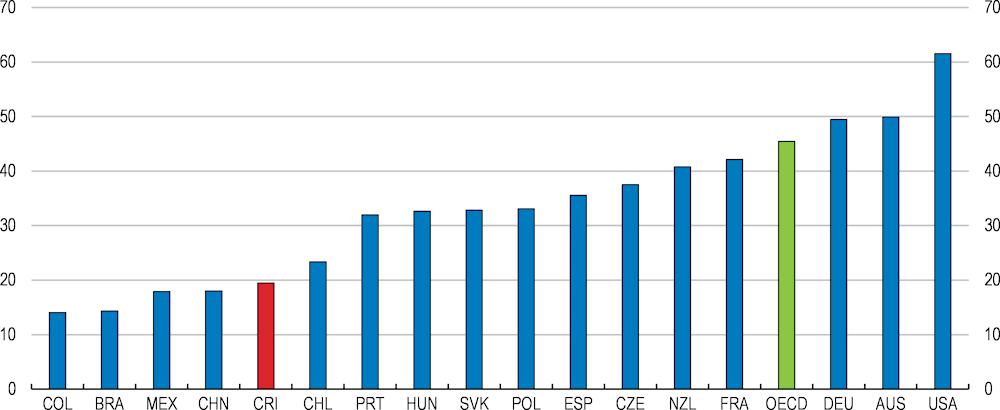

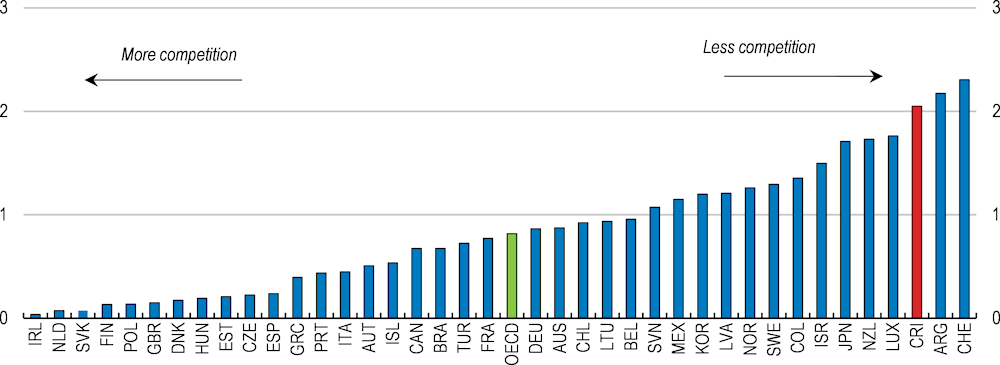

Keeping a competition-friendly regulatory framework is another key building block to foster competition. Regulations of product markets serve legitimate objectives but, when ill designed, can impose unnecessary restrictions on competition. The OECD’s Product Market Regulation indicator for Costa Rica shows that there is ample room to improve regulations (Figure 1.25), with high barriers to entry and state involvement. A key strategy to ensure pro-competition regulations, used by many OECD countries and lacking in Costa Rica, is to conduct regulatory impact assessments to inform the development of new laws or regulations. In many countries, there is also a requirement to include explicitly the assessment of the impact (i.e. costs and benefits) on competition in the laws or regulations. Adopting such a requirement can ensure that competition aspects are more systematically taken into consideration across the public sector.

Figure 1.25. Costa Rica has more stringent regulations than any other OECD country

Overall PMR score, index from 0 to 6 (most restrictive)

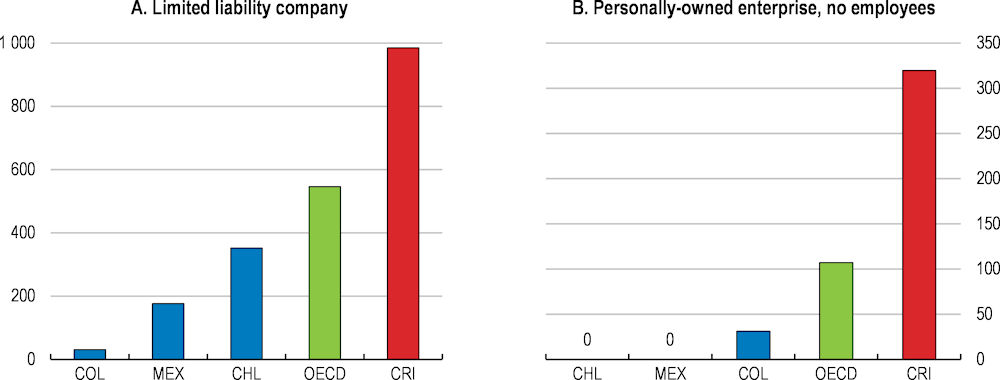

OECD countries have been boosting competition in their goods and services markets by facilitating entry. Costa Rica has ample room to follow suit. Among barriers hampering entry, administrative burdens and the license and permits system are the most problematic. Establishing a company is significantly more costly (Figure 1.26) and burdensome than in other OECD countries and in peer Latin American countries. Many OECD countries have reduced administrative burden by establishing virtual one-stop shops, where all administrative requirements can be met at once and online. Costa Rica is also moving in that direction, which should also help to facilitate the creation of formal firms. Pending challenges are that existing one-stop shops allow for solving all administrative requirements in one place and that they do so via online facilities.

Figure 1.26. Establishing a company is costly

PPP-adjusted USD

Note: The figures display the typical total monetary cost to complete all mandatory procedures to start a limited liability company and a personally owned enterprise with no employees.

Source: OECD Product Market Regulation database.

There is also a need to deal with the stock of regulations, many of which penalize firms and competitiveness, with a view to streamline, eliminate duplications and those no longer needed and harmonise regulations across different public agencies. International experiences show that dealing successfully with the legacy of measures requires intensified public-private dialogue, in which the private sector can flag problems and contribute to the solution, and a strong technical team (Cadot, Malouche and Sáez, 2012[14]). In this spirit, the Ministry of Economy is compiling in cooperation with the private sector a list of regulations and procedures that can be phased out, including also specific deadlines for their elimination.

Embracing e-government can be a powerful means to facilitate firms’ compliance with administrative procedures at a minimal cost. Costa Rica has been lagging in the use of digital tools to interact with citizens and firms. The pandemic triggered more digital interactions, which should be further pursued. A key obstacle for increasing the use of digital tools by government, citizens and firms is the digital signature mechanism, which is perceived to be too cumbersome. Those attempting to use it also face difficulties to get the same validity as with a handwritten signature by public institutions. The Central Bank is currently working towards a solution that would enable the use of the digital signature via mobile phones (Table 1.5). Some OECD countries (see Box 1.5) exemplify the cathartic effect that a widely accepted and user-friendly digital signature mechanism can have to reduce red tape and facilitate compliance with administrative requirements.

A significant number of economic sectors in Costa Rica remain state monopolies or are dominated by state-owned enterprises. This includes key sectors, such as electricity, transport, banking, insurance and petroleum products. SOEs governance has been gradually improved but important challenges lie ahead, such as the full implementation of international accounting standards, establishing and monitoring performance indicators for SOEs, strengthening the functioning of boards and reviewing boards remuneration and developing recommendations to support incentives that are aligned with good board practices (OECD, 2022[15]). To promote continuing progress in addressing these challenges, it will be important to maintain strong coordination and analytical capacity in the Presidency’s advisory unit for state-owned enterprises.

Box 1.5. The digital signature in Estonia

The Digital Signature Act in 2000 recognised digital signatures in Estonia as being equivalent to hand-written signatures, both in commercial transactions and in transactions with the public sector. The digital signature can be used directly through the national identification card, as the cards embed a chip that can be used as definitive proof of identification in an electronic environment. The signature can be used also through Mobile-IDs, or through Smart-IDs, which provide an identification solution for anyone that does not have a SIM card in their smart device but needs to securely prove their online identity. The dual use for commercial and public sector transactions, as well as the obligation for the public sector to recognise the digital signature, created an environment that stimulated the development of compatible public services as well as their take-up by the general population (OECD, 2015[16]). All digital public services can be accessed using the digital signature, including registration of businesses, electronic voting, electronic prescriptions, electronic health records, declaration of residence and social benefits claims. The use of digital signatures in Estonia is estimated to save 2% of GDP every year (OECD, 2019[17]).

As a whole, the SOE sector does not currently present a significant drain on the budget but some SOEs play a dominant role in critical sectors and their performance has critical economy-wide implications. A paradigmatic case is the electricity company, ICE, which dominates the electricity sector. It provides all transmission services in the country and is responsible for 44% of electricity distribution. One of its subsidiaries distributes around 32% of generated electricity. The share of allowed private-sector electricity generation is limited to 30%. Private-sector generators compete for the market rather than in the market, because to enter the market they must first win ICE tendering contracts. There are also barriers to foreign participation in the sector, as 35% of the capital of the firm generating the electricity should be Costa Rican. This regulatory framework implies high barriers to competition (Figure 1.27).

Figure 1.27. Regulatory barriers on electricity are high

Product-market regulation index for electricity

Note: This indicator is composed of information on how entry and conduct in the electricity sector is regulated, and on the level of public ownership.

Source: OECD, 2018 PMR database.