Raising productivity growth is central to closing the gap with the incomes and well-being enjoyed in many OECD countries. Croatia has internationally competitive firms, and a dynamic economy with many young and potentially productive firms. However, overall performance has been limited by the presence of many less productive firms and more productive firms that often fail to grow. This likely reflects a business environment that weakens competitive pressures and makes investments more costly and risky. Reducing the burdens of lengthy and unpredictable regulatory procedures, resolving legal disputes faster with a more efficient judicial system, and improving public sector integrity, will be key for boosting productivity growth. Developing public equity markets and expanding R&D support would improve access to finance for young and innovative firms. State-owned enterprises play a comparatively large role in Croatia’s economy but tend to underperform financially and in delivering goods and services. Improving their governance, by strengthening the state’s oversight and governance arrangements, can improve outcomes.

OECD Economic Surveys: Croatia 2023

3. Improving the business environment to accelerate convergence

Abstract

Improving Croatia’s business environment is key to boosting productivity growth. The country’s productivity gap to OECD countries narrowed little in recent years. A very wide range of policy areas influence the environment for business. Prominent are education and skills policy (discussed in Chapter 4), and policies supporting research and development. This Chapter focuses on another important issue; the role of allocative efficiency in productivity. The share of low-productivity firms is high, while productive firms often struggle to grow. Obstacles to greater productivity include lengthy licensing procedures with uncertain outcomes, long and frequent legal disputes and weak competitive pressures (Section 3.2). Croatia’s reliance on banking for access to finance means that young and more innovative firms may find it more difficult to get financing (Section 3.3). Meanwhile, state-owned enterprises continue to play a sizeable role for Croatia’s economy. Indicators suggest, however, that they often underperform and that they remain vulnerable to political influence (Section 3.4). Addressing each these issues can bring direct benefits of higher investment and stronger and broader productivity growth. Together, these efforts can also contribute to addressing perceptions of corruption and the quality of the rule of law, essential for fostering stronger and more inclusive growth.

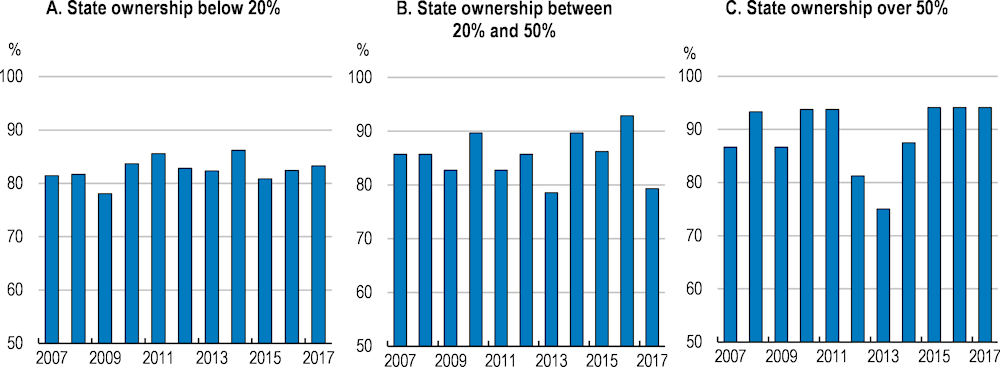

Widespread productivity gaps call for improving the business environment

Productivity gaps between Croatia and OECD countries remain large. On average, workers in Croatia are about two thirds as productive as those in the OECD area (Figure 3.1, Panel A). The pace of catch- up in productivity was brisk in the in the early 2000s but has slowed in recent years. At the aggregate level, this partly reflects low investments in physical capital (Figure 3.1, Panel B). The slow catch-up in total factor productivity also suggests scope for improving innovation, technology adoption, and managerial practices (Figure 3.1, Panel C).

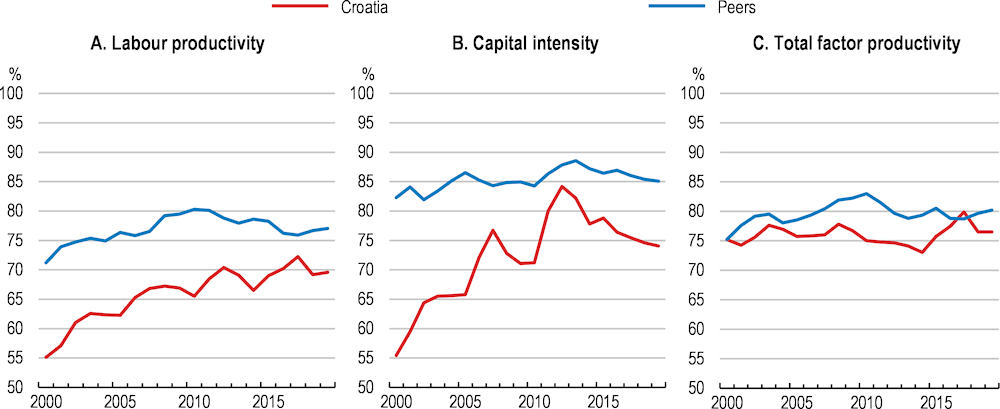

Closing productivity gaps will require raising performance across all sectors of the economy. Croatia’s composition of economic activities explains only a small part of its relatively weaker productivity performance. The large size of the tourism sector is often seen as key barrier to faster productivity growth, yet it is among Croatia’s most productive sectors. All sectors exhibit lower labour productivity compared to the EU average (Figure 3.2). A World Bank study finds that even if Croatia had the same sector composition as Germany, it would still be 57% less productive (World Bank, 2023[1]). Rather than focusing on the challenges in individual sectors or groups of firms, fostering a business environment that supports higher investment and dynamism across all of the economy will be essential to continue Croatia’s convergence.

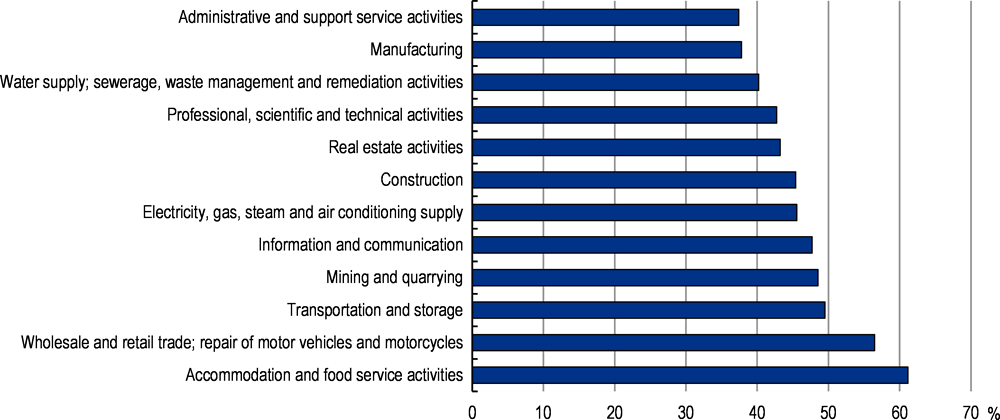

Firm level data suggest that Croatia’s low productivity within sectors derives from a comparatively large share of poor-performing firms and relatively few high performers (Figure 3.3, Panel A) (OECD, Forthcoming[2]). The “long tail” of low-productivity firms can reflect a number of issues. Technological adoption appears to be one factor. A relatively large share of firms (around 40%) are recorded as operating with very low digital intensity (Figure 3.3, Panel B) and the share of firms participating in global value chains through importing or exporting is smaller than elsewhere (Figure 3.3, Panel C). Studies also suggest managerial skills may be a limiting factor (Criscuolo et al., 2021[3]). Improving allocative efficiency would better leverage managerial talent, for example by assuring that better managed firms grow. Boosting access and participation in adult education and training, as discussed in Chapter 4, alongside the support included in the Recovery and Resilience Plan to mentor individual businesses, could help to deepen managerial skills.

Figure 3.1. Productivity catch-up with the average of OECD countries has slowed

Labour productivity and its components from 2000 to 2019 as a percentage of the OECD average

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. Labour productivity is measured as real GDP at current USD at purchasing power parity, divided by the number of persons employed. Capital intensity is computed as the capital stock at current USD at purchasing power parity per person employed. The computation of total factor productivity is described in (Feenstra, Inklaar and Timmer, 2015[4]).

Source: OECD calculations based on Penn World Table Version 10.0.

Figure 3.2. Closing productivity gaps requires improving performance across all sectors

Labour productivity as a percentage of the EU27 average, in 2020

Note: Labour productivity is defined as the value added expressed in EUR (using average exchange rates) divided by the number of persons employed.

Source: Eurostat.

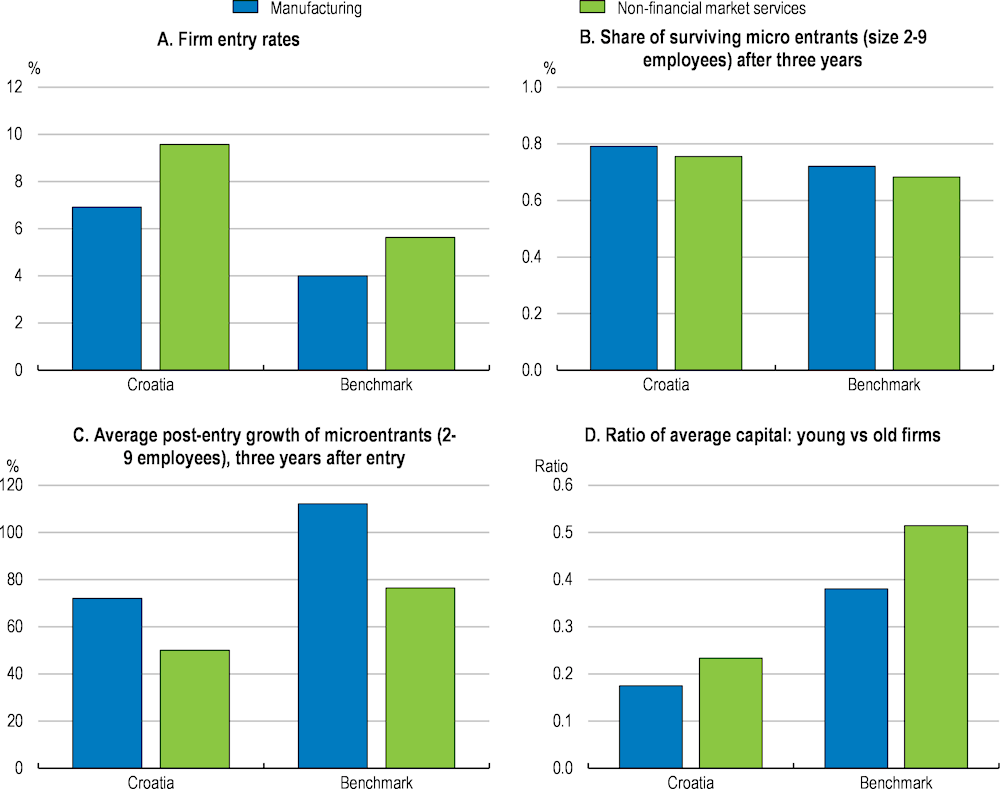

Firm entry can introduce new technologies into the market and challenge incumbents. Croatia has high firm entry rates compared to OECD countries (Figure 3.4, Panel A). Firm survival rates are on a par with OECD countries (Figure 3.4, Panel B). However, young firms on average grow less rapidly than entrants in OECD countries, both in terms of employment (Figure 3.4, Panel C) and capital (Figure 3.4, Panel D), suggesting that they make a weaker contribution to raising overall productivity than elsewhere.

Figure 3.3. Overall productivity is weighed down by many unproductive firms

Note: Panel A: The figure shows the dispersion of productivity within SNA A38 industry, according to the SNA A38 classification, and year by country, averaged across macro sectors and country groups. Within macro sectors, observations at the level of the country-SNA A38 industry-year are aggregated weighted averaged to the country-year level using the share of the SNA A38 industry in total value added of the country-year as weight, and country-years over the period 2014-2018 are aggregated to the country-level using unweighted averages. The “benchmark” group of countries is a simple average of Belgium, Finland, France, Hungary, Italy, Latvia, Netherlands, Portugal, Slovenia and Sweden. Panel B: Digital intensity index version 4 for all enterprises of 10 persons employed or more in all activities except financial services.

Source: Calculations based on the OECD MultiProd v2 project; Eurostat; and OECD, Main Science and Technology Indicators (database).

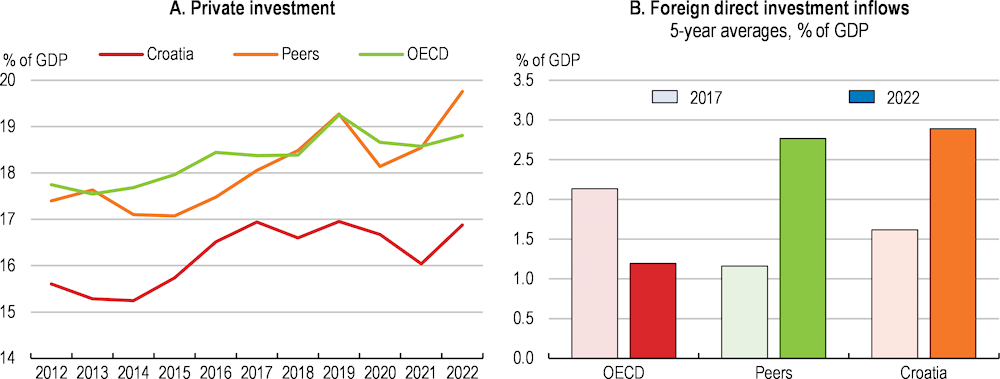

Croatia appears to have fewer linkages with global value chains (GVCs) and lower foreign direct investment than its neighbours, which may imply weaker transfer of productivity enhancing knowledge and know-how (Figure 3.5). The share of foreign value-added content in exports accounted for about 25% of the value of exports in 2018, well below the 38% on average in central and eastern European (CEE) economies. Some of this difference may reflect the country’s later accession to the EU than other CEE economies; sectors involving substantial cross-border production, for instance in car manufacturing, make up a smaller share of activity in Croatia than elsewhere in CEE. These limited linkages may also reflect lower private investment than Croatia’s peers in recent years (Figure 3.5).

Figure 3.4. Strong business dynamism translates less well into sustainable productivity gains

Note: The figures are based on weighted averages across SNA A38 industries in manufacturing and non-financial market services. Within these SNA A7 macro sectors, observations at the level of the country-SNA A38 industry-year are aggregated to the country-year-macro sector level using the share of the SNA A38 industry in the total number of firms in the country-year as weight, and country-years over the period 2014-2018 are aggregated to the country-level using unweighted averages. The comparison group of countries (“benchmark”) is composed of Belgium, Finland, Hungary, Italy, Latvia, Slovenia, and Sweden, and the blue bars reflect the unweighted average across these countries. Owing to methodological differences, figures may deviate from officially published national statistics. Panels B and C relate to the number of employees.

Source: Calculations based on the OECD DynEmp v3.2 project and OECD MultiProd v2 project.

Accelerating firms’ digitalisation, building on the progress spurred by the COVID-19 crisis, can enable faster productivity growth, notably among lagging firms (Gal et al., 2019[5]). Firms’ investments have accelerated in recent years in cloud computing, online sales platforms, communications platforms, and in workforces’ digital skills. Still, digitalisation lags the typical OECD EU country (European Commission, 2022[6]). For example, broadband coverage has fallen further behind the averages of OECD and EU countries, although investments in the Recovery and Resilience Plan and the roll-out of 5G technologies may bring gains. Despite strong levels of general digital skills, scarce high-level digital skills have also impeded firms’ digitalisation. Investments in the Recovery and Resilience Plan, the government’s new digital transformation strategy and the push to expand adults’ access to digital skill development (discussed in Chapter 4) are steps in the right direction to support firms’ digitalisation (Sorbe et al., 2019[7]).

Also reflecting low productivity, Croatia’s manufactured exports are traditionally concentrated at the low end of the technology scale, though the composition is changing. One study finds that about two-thirds of goods exports are in low-technology manufacturing products, for example in wood, paper and printing. These make up a higher share of exports than in other CEE countries. However, competitiveness and exports in several higher-technology intensive manufacturing goods, such as pharmaceuticals, machinery and equipment and chemicals improved in recent years (OECD, Forthcoming[8]). This is being supported by a growing share of greenfield foreign direct investment in higher technology sectors. Policy measures to improve Croatia’s attractiveness for foreign direct investment are discussed in (OECD, Forthcoming[8]).

Strengthening framework conditions for business

Reducing regulatory burdens

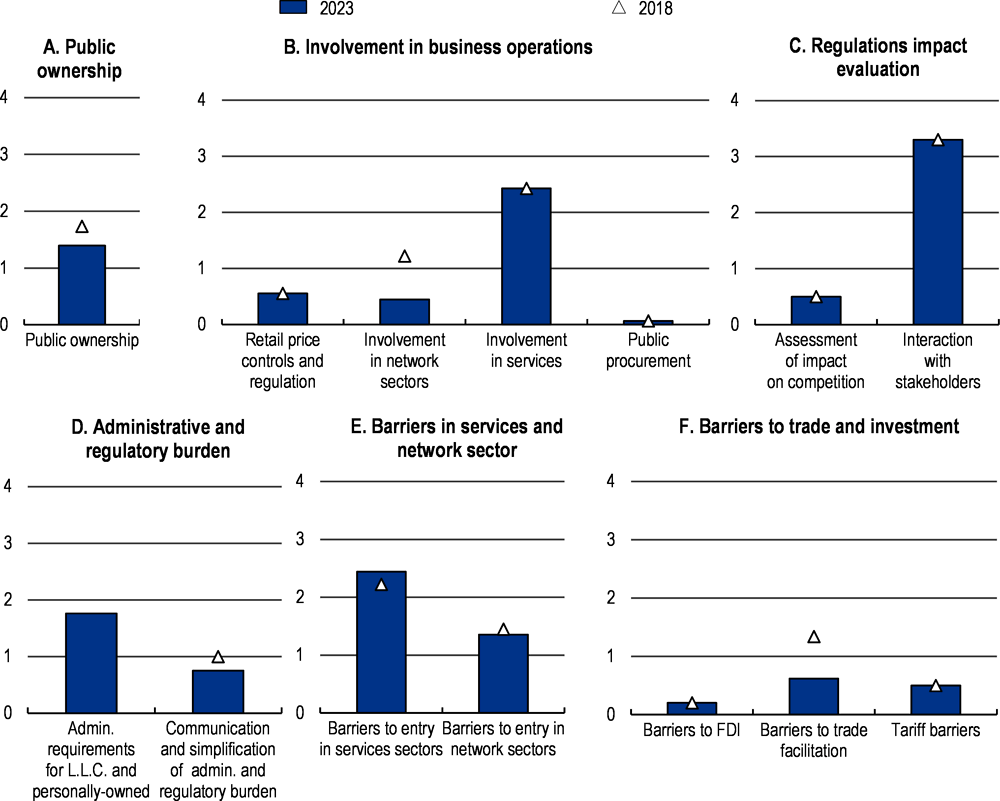

Croatia’s regulatory framework – in so far as it reflects de jure regulations at the national level – is generally conducive to competition. Its product market regulation index scored close to the OECD average in 2018 (at 1.43 versus 1.42 in the OECD on average), which suggests that regulatory burdens are not exceptionally burdensome for businesses but also that there is scope for improvement (OECD, 2018[9]). Box 3.2 outlines some of Croatia’s efforts over recent years to improve its regulatory framework. Complementing these are the ongoing reforms to improve revenue administration, including the consolidation and suppression of the many parafiscal fees charged by different public entities and simplification of their payment processes.

Areas where the formal regulatory framework can be improved appear to relate to firm entry and businesses operations in services – notably for pharmacies, lawyers and notaries (Figure 3.6, Panels B and E). For example, abolishing territorial restrictions for notaries, or allowing a wider variety of owners of pharmacies would improve competitiveness in those sectors. OECD countries have undertaken related reforms (Box 3.3). Croatia’s Recovery and Resilience Plan, which envisages further waves of regulatory simplification, including cutting at least 300 regulatory requirements for professional services by 2024, promises important improvement.

Figure 3.5. Private and foreign direct investment have lagged peers

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia.

Source: OECD International Direct Investment Statistics (database) and United Nations Conference on Trade and Development Statistics.

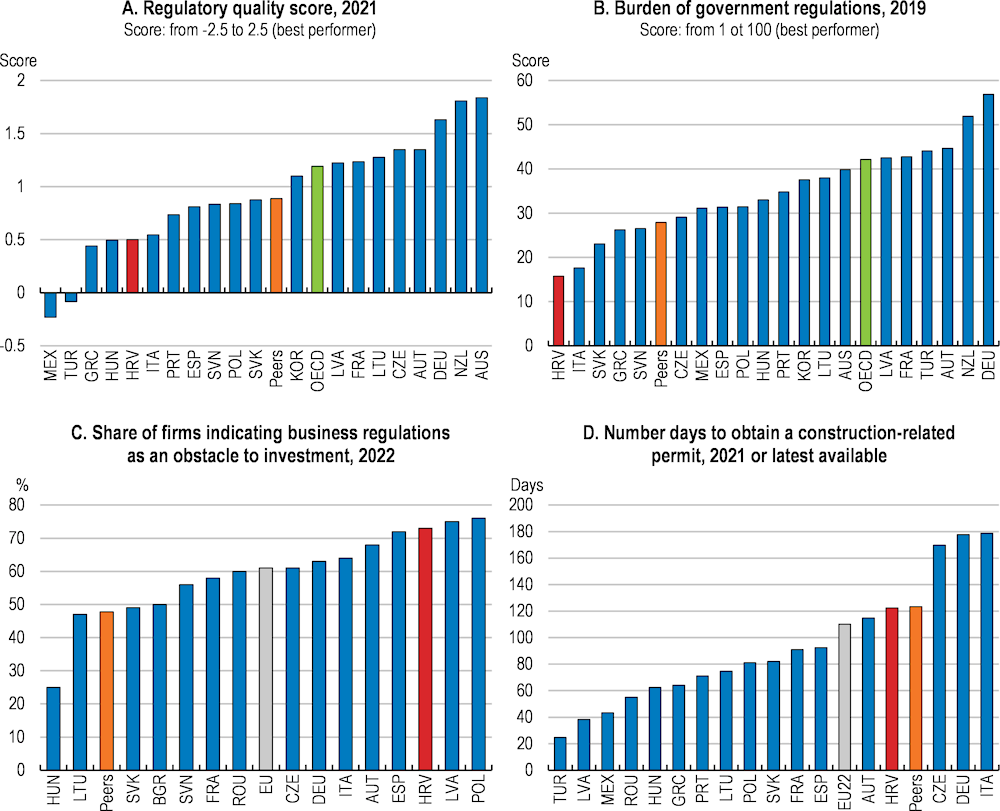

While Croatia’s de jure regulatory framework often appears competition-friendly, in practice regulatory burdens are often significant. Regulatory quality is perceived to be lower, and burdens of government regulations higher, than in most OECD countries (Figure 3.8, Panels A and B). Such burdens weigh on firms’ investment and productivity, and contribute to perceived corruption (discussed below). For example, a comparatively large share of potential investors in Croatia reports that business regulations are a major obstacle to investing (Figure 3.8, Panel C). Unpredictably or slow implementation often makes regulation burdensome in practice (OECD, 2019[10]). For example, it takes businesses on average 122 days to obtain a construction-related permit in Croatia, longer than in most OECD economies (Figure 3.8, Panel D). Estimates suggest about 50% of businesses in Croatia – more than in most EU countries – lack confidence in effective investment protection due to, among others, unpredictable and non-transparent administrative conduct and frequent changes in the related legal frameworks (European Commission, 2022[11]).

The digitalisation of public services has lagged typical OECD EU countries, contributing to more burdensome administrative and regulatory processes (European Commission, 2022[6]). Measures included in Croatia’s Recovery and Resilience Plan, worth EUR 283 million (0.4% of GDP in 2022), to digitalise its public administration and improve its effectiveness will contribute to reducing regulatory burdens. Nevertheless, even with comprehensive plans and financial support, on-the-ground achievement in paring back regulation and ensuring efficient application is challenging. Reviewing and simplifying the administrative and regulatory processes that are being digitalised, and monitoring progress can only be encouraged.

Expanding the role of regulatory impact assessments

Regulatory impact assessments (RIAs) – when considering new or reviewing existing regulations – help inform policymakers on how to design regulations that achieve policy goals with minimal collateral costs (OECD, 2012[12]). They inform policymakers whether less costly and more effective alternatives - ranging from the option to do nothing to steering or nudging behaviour with information campaigns or incentives - are available (OECD, 2020[13]). Comprehensive RIAs can also reduce burdens from how the regulation is enforced, for example whether inspections are needed, or by promoting proportionate and risk-based approaches (OECD, 2018[14]).

Box 3.1. Croatia’s recent reforms to improve its regulatory environment

Several reforms in recent years have mad Croatia’s regulatory framework more competition friendly. The largest improvement was in reducing administrative burdens for starting a business (reflected in Figure 3.6, Panel D) with the establishment of the one-stop shop ‘START’ (https://start.gov.hr/). Procedures have been digitalised and streamlined.

Reforms improved competition in network sectors by giving the state a more active role in assuring transparency for prices and other information (Figure 3.6, Panel B), for example by introducing independent price comparison tools in gas retail markets to make it easier for customers to identify competitive suppliers, or setting up a platform providing 5G or fibre network operators with information about existing and planned infrastructure (European Commission, 2020[15]). International competition has been strengthened by simplifying procedures to appeal in disputes between contracting parties from different countries (Figure 3.6, Panel F).

Figure 3.6. Croatia’s formal regulatory framework has improved

Sub-indicators of the OECD Product market regulation index, 2018 and 2023, scale 0 to 6, with 0 indicating most competition-supportive regulation

Note: Preliminary results based on OECD PMR 2023 methodology. 2018 values based on 2023 methodology may deviate from 2018 values based on 2018 methodology.

Source: OECD PMR database.

Box 3.2. Reforms to reduce regulatory barriers in professional services

Expanding access to notarial services in France

Until 2015 in France, notaries could only access private practice by being appointed to an existing office. This mechanism had led to a stagnation in the number of notaries and a disconnect between the supply of notaries and the demand from individuals and companies. In addition, the profession was not able to absorb the flow of graduate notaries. This process led notarial density to become inversely proportional to population density, which betrayed a flagrant imbalance between supply and demand. Hence a new procedure for the creation of notary offices was introduced with the Macron Law in 2015, which requires the Autorité de la Concurrence (the French competition watchdog) to submit to the government, every two years, a proposed map of areas where the creation of offices appears useful, accompanied by recommendations on the rate of establishment compatible with a gradual increase in the number of professionals in the areas in question. The reform has resulted in the establishment of nearly 2,300 new private notaries since 2017, an increase of more than 30% in supply. This has resulted in greater availability of notaries, a reduction in the time taken to process files and increased use of digital tools.

Opening access to legal services in the UK

In March 2001 the UK competition watchdog produced a report on Competition in Professions that recommended the removal of unjustified restriction on competition in particular in the legal professions. This led to the passing of the Legal Services Act in 2007. Among other changes, the act introduced the concept of Alternative Business Structures that allow non-lawyers to own and manage law firms and that can deliver legal activities alongside other professional services.

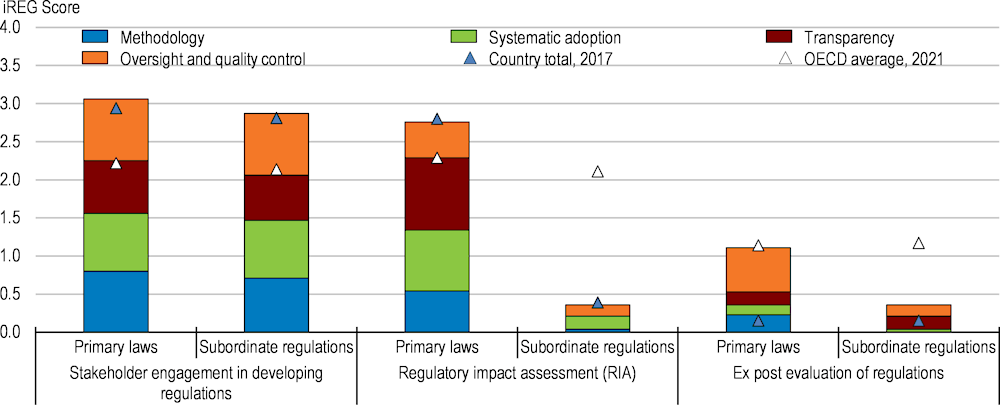

Croatia has put in place a solid framework for developing and assessing regulations (Figure 3.8). For example, new primary laws are legally required to be assessed for their necessity, benefits and administrative costs, using threshold criteria for potential impacts to decide whether an in-depth RIA may be needed. Croatia also systematically engages stakeholders when drafting new regulations, for example through the interactive consultation portal e-Savjetovanja. It can improve this framework further. RIAs are not required for subordinate regulations, – i.e., regulations that provide detail and enforcement arrangements for the primary laws (OECD, 2019[16]). A welcome expansion is underway of a special assessment of regulatory impact on SMEs (the “SME Test”) that covers areas missed by the RIA system.

Reviewing the existing stock of regulations can help make deeper inroads into regulatory burdens. Regulations that were issued when regulatory policies were less developed may have more unintended consequences and may simply have become redundant as circumstances changed (OECD, 2020[17]). Croatia has conducted several reviews of regulation over recent years and has established a special unit within the Ministry of Economy and Sustainable Development, the Business Environment Improving Service (BEIS). The latter conducts policy analysis and evaluates regulations in consultation with other state administration bodies. Regulatory assessment can be further improved by establishing a regular forum to discuss regulation that includes the presence of businesses and union representatives, as well as government, for example by building on the existing Economic and Social Council. For example, Denmark achieved substantial reductions in regulatory burdens by establishing a Business Forum for Better Regulation, as described in Box 3.3.

Concerted efforts to improve the quality of regulatory impact assessments (RIAs) would help ensure regulations are designed to be less burdensome in their implementation. Reports suggest that RIAs in Croatia are often conducted as a formality with limited influence on decision making (OECD, 2019[16]). Impact assessments often contain little quantitative analysis and consist in filling checkboxes on the scale of regulations’ impact. Alternatives to regulations are sometimes considered only after it has been decided to adopt the regulation. Consolidating oversight responsibilities at the centre of government could improve their analytical quality, as they are often prepared by different government bodies which often lack capacities to carry out cost-benefit analysis. Consolidating the responsibilities of the Government Legislation Office and the Ministry of Economy in reviewing proposed regulations would reduce coordination challenges and duplication. This could also help concentrate skilled staff, including those experienced in cost-benefit and other economic analyses, and reduce turnover rates. The national-level institution could improve the quality of sub-national regulations, which can be particularly burdensome for businesses. Improving transparency, for example by using online portals to disseminate information on consultations and regulatory practices across regions, and providing focused analytical support from the national to sub-national governments, can help reduce regions’ regulatory burdens.

Figure 3.7. Regulatory burdens, in practice, are a major obstacle to investments in Croatia

Note: Unweighted average for OECD. and ‘Peers’ is the unweighted average of which include Czech Republic, Hungary, Slovak Republic, and Slovenia. Panel D: EU22 covers OECD countries which are EU Members.

Source: World Bank, World Governance Indicators (database); World Economic Forum, Global Competitiveness Index; European Investment Bank (2022), EIB Investment Survey 2022: European Union overview; and World Bank, Enterprise Surveys data (database).

Figure 3.8. Croatia has improved its regulatory framework

Indicators of Regulatory Policy and Governance (iREG): Croatia, 2021

Note: The more regulatory practices as advocated in the OECD Recommendation on Regulatory Policy and Governance a country has implemented, the higher its iREG score. The indicators on stakeholder engagement and RIA for primary laws only cover those initiated by the executive (85% of all primary laws in Croatia).

Source: Indicators of Regulatory Policy and Governance Survey 2017 and 2021, http://oe.cd/ireg.

Box 3.3. Denmark’s Business Forum for Better Regulation

The Danish Business Regulation Forum was launched by the Danish Minister for Business and Growth in 2012. It aims to ensure the renewal of business regulation in close dialogue with the business community by identifying those areas that businesses perceive as the most burdensome and propose simplification measures. These could include changing rules, introducing new processes, or shortening processing times. Besides administrative burdens, the Forum’s definition of burdens also includes compliance costs in a broader sense as well as adaptation costs (“one-off” costs related to adapting to new and changed regulation).

The 19 members of the Business Forum include industry and labour organisations, businesses, as well as academic experts with expertise in simplification. Members are invited by the Ministry for Business and Growth either in their personal capacity or as a representative of an organisation. The Business Forum meets three times a year to decide which proposals to send to the government. So far, the proposals covered 13thirteen themes, ranging from “The employment of foreign workers” to “Barriers for growth”. In addition, interested parties can submit proposals for potential simplifications through the Business Forum’s website. Information on meetings and the resulting initiatives is published online.

Proposals from the Business Forum are subject to a “follow or explain” principle. This means that the government is committed to either implement the proposed initiatives or to justify why initiatives are not implemented. As of October 2016, 603 proposals were sent to Government, of which so far 191 were fully and 189 partially implemented. The cumulated annual burden reduction of some initiatives has been estimated at DKK 790 million (EUR 106 million). Information on the progress of the implementation of all proposals is available through a dedicated website. The results are updated three times a year on www.enklereregler.dk. The Business Forum publishes annual reports on its activities. The Danish Minister for Business and Growth also sends annual reports on the activities of the Business Forum to the Danish parliament.

Source: (OECD, 2019[16]).

Improving spatial planning to improve land use

Improving land administration and spatial planning would further reduce administrative burdens and reduce the risks of corrupt behaviour. Responsibilities for developing spatial plans in Croatia lie mostly with counties, municipalities and city administrations. However, weak coordination between these bodies, unclear rules about amending spatial plans, and overlapping mandates in the assignment of land can lead to difficulties (OECD, Forthcoming[8]). Cadastral and land registries often do not reflect the actual state of property rights, leading to delays in securing land rights and building projects. Inefficiencies in Croatia’s judicial system, discussed below, suggest additional delays in clarifying land ownership in case of land disputes.

Coordination between subnational authorities could be improved by clarifying responsibilities about assigning land and development rights. For example, counties could be given planning responsibilities for investments that involve land spanning several municipalities, such as for electricity grid connections. Formalising rules and procedures for amending county and municipal plans, including setting a maximum number of days for reviews, could help reduce delays in amending spatial plans.

Croatia is planning to make information about land administration and tenure more accessible, including welcome investments within its Recovery and Resilience Plan to develop digital platforms for spatial plans and the contents of cadastres. More will be needed. Croatia could develop a one-stop shop guiding investors through all stages of the process for securing land rights (OECD, Forthcoming[8]).

Improving legal certainty and trust with a more efficient judicial system

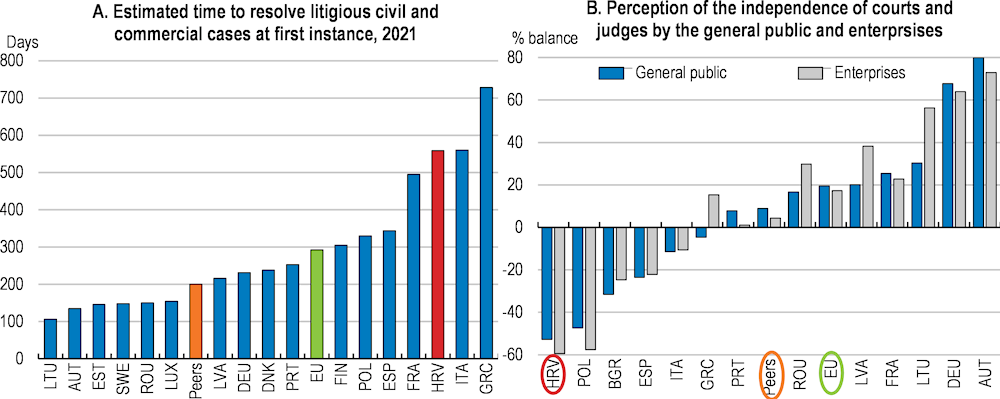

An effective legal system can provide firms with greater certainty when doing business and limit costs when disputes arise (OECD/WJP, 2019[18]; OECD, 2021[19]). It can also help to reduce corruption risks. Prolonged times to resolve cases and lack of trust in the judiciary are cited as important impediments to investment in Croatia (overall, Croatia ranked 63rd out of 140 countries in the latest assessment) (World Economic Forum, 2019[20]). They detract from the effectiveness of the anti-corruption system (discussed below) (European Commission, 2023[21]). Resolving commercial and civil cases took on average nearly 500 days in Croatia in 2019. This is almost double the average of EU countries (Figure 3.9, Panel A). In addition, trust in judges’ independence is the lowest among EU countries (Figure 3.9, Panel B).

Figure 3.9. Resolving cases is slow and trust in courts and judges is low

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. Panel A: EU average excludes Belgium, Bulgaria, Cyprus, Ireland and Netherlands. Panel B shows the net percentage of respondents of the general public/enterprises answering having a good perception minus those having a bad perception vis-à-vis the independence of courts and judges. The negative/positive values show that the perception of the independence of courts and judges is predominantly negative/positive.

Source: European Commission (2023), The 2023 EU Justice Scoreboard.

Promoting out-of-court processes to solve disputes faster and at lower cost

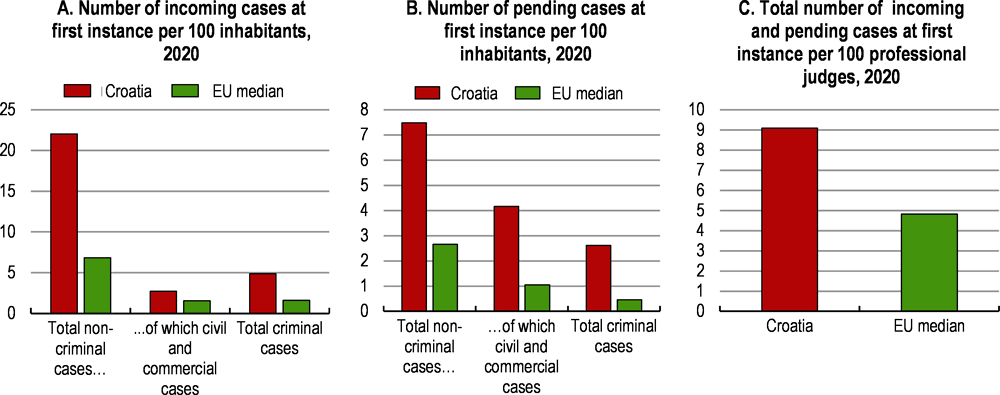

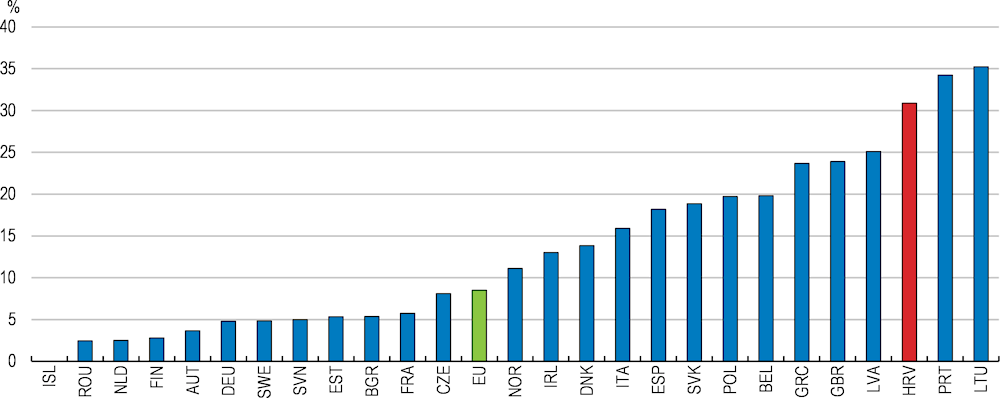

Croatia’s court system remains under pressure from a high case load even as recent efforts make inroads. Croatia employs more judges per inhabitant and spends a larger share of GDP on the judicial system than most EU countries (CEPEJ, 2022[22]), yet judges face a higher workload (Figure 3.10, Panel C), reflecting more cases per inhabitant being brought to courts (Figure 3.10, Panel A) and a larger backlog of older cases (Figure 3.10, Panel B) than in most EU countries. This contributes to delays and may compromise the quality of judgments. Investments and reforms included in Croatia’s Recovery and Resilience Plan, amounting to at least EUR 100 million (0.15% of GDP in 2022), will contribute to resolving cases faster, for example by upgrading the ICT system and developing digital platforms for case management, amending legal procedures, developing alternative dispute resolution, and improving the transparency of the court system notably through digital technologies.

Figure 3.10. Large numbers of incoming and pending cases pressure courts’ performance

Source: EC (2021), Study on the functioning of judicial systems in the EU Member States: Facts and figures from the CEPEJ questionnaires 2012 to 2020 – Part 2 Country fiches.

Resolving more cases through alternative dispute resolution mechanisms (ADRs) – such as mediation (described in Box 3.4) – would help reduce delays and resolve cases faster and at lower cost (European Parliament, 2016[23]). It would free court resources to address more complex cases, which could reduce procedural mistakes, make appeals less likely and improve trust. While Croatia is well equipped with accredited mediators (CEPEJ, 2022[24]) and is developing mediation services, mediation is used very rarely (World Bank, 2019[25]), as is the case in most EU countries (European Parliament, 2016[23]).

Requiring, or strongly encouraging, attending an initial mediation session or other ADRs can promote out-of-court solutions. On average across EU countries, using mediation before deciding whether to go to court has been shown to reduce the overall time to resolve disputes by up to 60%, and to cut average costs per case – comprising the use of courts, mediators and lawyers – by up to 33% (De Palo et al., 2014[26]). Mediation may nevertheless be used rarely for several reasons. People may not be aware of mediation as an option (Rozdeiczer and Alvarez de la Campa, 2006[27]), or – reflecting cognitive biases – they may overestimate their chances of winning in court (Nissito, 2022[28]), or because they lack trust that mediation can provide a fair and enforceable decision. Attending an initial mediation session – overseen by a neutral expert would help to overcome these obstacles. Several countries promote pre-court mediation or other forms of ADRs, for example by making an initial session mandatory (Box 3.5).

Measures are underway to strengthen mediation, and ensuring these change disputing parties’ practices will be key. The Act on the Peaceful Resolution of Disputes aims to address shortcomings in the use of mediation. It reforms court processes to increase their promptness and efficiency. It establishes a Center for Peaceful Dispute Resolution to, for instance, provide professional training and improvement of mediators, and publish information on the peaceful resolution of disputes. To ensure that mediation services are used, additional actions should be considered, including making mediation mandatory and recognising mediation agreements as enforceable.

Box 3.4. Alternative dispute resolution mechanisms to solve disputes outside of courts

Alternative dispute resolution mechanisms (ADRs) are procedures attempting to resolve disputes outside of courts, with the assistance of a neutral third party as opposed to a presiding judge, and with the aim to reduce costs and delays compared to litigation.

ADRs differ along several dimensions (Table 3.1). ADRs are usually voluntary, i.e., conflicting parties can decide whether to enter the process and to continue until they settle the case. If conflicting parties are mandated to attempt ADR, they can still decide to end the process after attempting in good faith. ADRs can be either binding or non-binding. In a binding ADR, for example arbitration, conflicting parties are bound to accept a third party’s decision about how to resolve the conflict. In a non-binding ADR, such as negotiation or mediation, conflicting parties have to jointly agree on an outcome. However, once they reached an agreement, they can be bound to the outcome through contractual obligations or through court decisions.

Mediation is the most common ADR and is a particularly broad procedure. In contrast to litigation, which is a rights-based process focusing on legal arguments, mediation expands the dispute beyond legal rights, including for example examining underlying interests, and emotions, and helping to improve communication. In addition, the mediator may also help clarify strengths and weaknesses of parties’ legal positions to explore potential outcomes from going to court.

Table 3.1. Examples of alternative dispute resolution mechanisms

|

Characteristics |

Negotiation |

Mediation |

Arbitration |

|---|---|---|---|

|

Voluntary/involuntary |

Voluntary |

Voluntary / mandatory attempt |

Voluntary (can be mandatory based on contract clause) |

|

Outcome binding/non-binding |

Mutually acceptable agreement sought, if agreement, enforceable as contract |

Mutually acceptable agreement sought, if agreement reached it is enforceable, as a contract or court decision. |

Binding principled decision or compromise, subject to review on limited grounds |

|

Nature of processing |

Usually informal and unbounded presentation of evidence, arguments and interests |

Usually informal and unbounded presentation of evidence, arguments and interests |

Less formal than litigation with procedural rules and substantive laws being set by parties; opportunity to present proofs and arguments |

Fostering trust in judges and courts

Surveys suggest widespread mistrust towards the judicial system. Over half of surveyed individuals and businesses report lacking trust in Croatia’s judicial system because they presume politicians or businesspeople have undue influence on the decisions of courts and judges, whom they also believe lack safeguards from such interference (European Commission, 2022[11]; CDCJ, 2022[29]). Low levels of trust may partly reflect historical rather than recent experience, and may be linked to relatively high perceived incidence of corruption (discussed below). For example, the period from the mid-1990s to 2000 saw particularly frequent instances of political interference with judicial independence, including in the selection and dismissal of judges (Venice Commission, 2022[30]).

The State Judicial Council plays a key role protecting the independence and impartiality of the judiciary. The Council’s responsibilities include appointing and dismissing judges and court presidents, conducting disciplinary proceedings, and verifying asset declarations of judges. It also provides training for judicial personnel. Croatia is among the first EU countries providing training for judges on negative stereotyping and non-discrimination (CDCJ, 2022[29]). The Council’s role has been strengthened in recent years. For example, powers of the Minister of Justice in the selection procedure of court presidents and attorneys have been abolished (CDCJ, 2022[29]). A previous change to the selection procedure of judges, which in effect made it more difficult for the State Judicial Council to choose candidates, has been amended to strengthen the role of the Council (European Commission, 2022[31]). Staffing and IT systems have been improved to facilitate verifying judges’ asset declarations (European Commission, 2022[31]).

Box 3.5. Country schemes encouraging alternative dispute resolution mechanisms

The United Kingdom’s small claims mediation service

Free of charge, the small claims mediation service by Civil Courts of England and Wales offers confidential and effective alternative dispute resolution for claims of up to GBP 10,000 via telephone. While the mediation process is a voluntary commitment, its agreements are binding. Only if mediation fails, is a formal court procedure is launched to resolve the dispute.

Australian Small Business and Family Enterprise Ombudsman

In 2016, the Australian Small Business and Family Enterprise Ombudsman was established. Striving to foster a viable business environment for small businesses and family enterprises, the Ombudsman provides information on dispute resolution options, access to mediation and facilitates alternative dispute resolution processes on a wide range of issues such as contract, franchise, lease, payment or product and service quality disputes.

France’s Court-Annexed Mediation

In France, the judge hearing a civil case may, after having obtained the agreement of the parties, refer the case to a mediator. Mediation can also be ordered during proceedings by the judge handling the case with the ultimate objective of enabling the parties to find a solution to the conflict between them.

Denmark’s Arbitration Act (2005)

In Denmark, the Arbitration Act, based on the UNCITRAL Model Law of 1985, centralizes party autonomy for dispute resolution. Arbitration proceedings are voluntary and most rulinge are non-binding as parties can largely decide together on how the arbitration is conducted. Several specialised arbitration institutions, which work often on a non-profit basis, can help resolve disputes

Source: United Kingdom small claims mediation; Australian Small Business Ombudsman; France Court-annex Mediation; Denmark Arbitration Act

There may be room to further strengthen the Judicial Council’s independence and capacities. Notably, the Council of Europe Action Plan on strengthening judicial independence and impartiality recommends that Council membership should not be allocated by virtue of holding an executive office or a position in the legislature (Council of Europe, 2016[32]). Two of the eleven seats on the State Judicial Council in Croatia are allocated to members of Parliament representing the ruling party and the opposition (European Commission, 2022[31]). Reports by the Consultative Council of European Judges of the Council of Europe and the European Committee on Legal Co-operation suggest that lack of resources and competencies limit the Council’s capacity to fulfil its mandate (CCJE, 2019[33]; CDCJ, 2022[29]). Disciplinary and criminal proceedings against judges can take several years (CDCJ, 2022[29]), which weakens the Council’s authority and contributed to public mistrust of the judiciary (CCJE, 2019[33]; CDCJ, 2022[29]). Ensuring the State Judicial Council has all the resources and authority it needs to pursue disciplinary proceedings and any other responsibilities in a timely manner would support its role in fostering judicial independence.

Croatia belongs to a small number of EU countries allowing higher courts to take the initiative to amend lower court decisions (European Commission, 2022[11]). This can assure the consistent application of laws. At the same time, being subject to instructions from higher courts on how to decide an individual case can weaken judicial independence. For example, according to the Venice Commission, a hierarchical organisation of the judiciary, so that higher courts can impose their ruling on lower ranking judges, violates the principle of internal independence (European Commission, 2022[11]). Imposing limits for reviewing decisions through higher courts, for example requiring a third party to initiate a review or being allowed to give only non-binding decisions on its own initiative, can promote consistency while safeguarding the independence of individual judges. Most EU countries do not allow higher courts to issue decisions, especially binding ones, on specific cases on their own initiative. , while in Croatia, registration judges at several courts can alert a judge when a draft judgment diverges from previously delivered case law, and propose to discuss the divergence and to issue a decision binding on all judges in the court (European Commission, 2022[11]). Reviewing rules to adapt decisions may identify scope to further strengthen judicial independence.

Helping the public to better understand court decisions

Given the widespread mistrust of the judiciary, it is important that public debates about judges’ decisions reflect all relevant facts in an objective manner. The Council of Europe recommends taking steps to ensure that politicians and journalists are respectful of judicial decisions and judges (Council of Europe, 2016[32]). Misleading or impartial media reports and statements by politicians – including for example media reports of judges’ rulings which omit facts, generalising statements by politicians against judges as a whole, or politicians expressing wishes about rulings of ongoing cases – have been cited as reducing trust in the judiciary in Croatia (CCJE, 2019[33]). The government is establishing a communication service to make the vast majority of court decisions readily available electronically, and to communicate on specific issues, such that the judiciary can better clarify and respond to criticism (Council of Europe, 2016[32]). Box 3.6 provides examples from OECD countries for measures taken to improve trust in the judicial system through communication strategies and engaging with the public.

Reducing the complexity of the legal framework and the frequency of amendments would make the judicial system more efficient and transparent. Frequent changes to the legal framework can make it more difficult to understand judicial decisions, for example because seemingly similar cases at different times may be judged differently. Croatia’s institutional developments of the past decades – including, war, independence, the transition to a market economy, joining the EU, integrating into the euro and Schengen areas, and now ensuring laws align with OECD standards – have led to many changes in the legal framework (World Bank, 2019[25]). To allow for more time to simplify the legal framework, legislators could agree on a schedule for amending fundamental laws, abstaining from changes in between these dates except in exceptional cases (World Bank, 2019[25]).

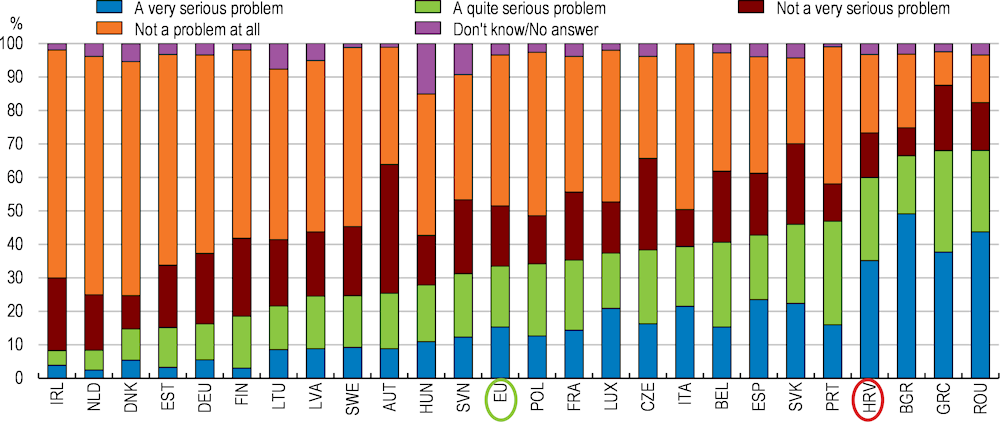

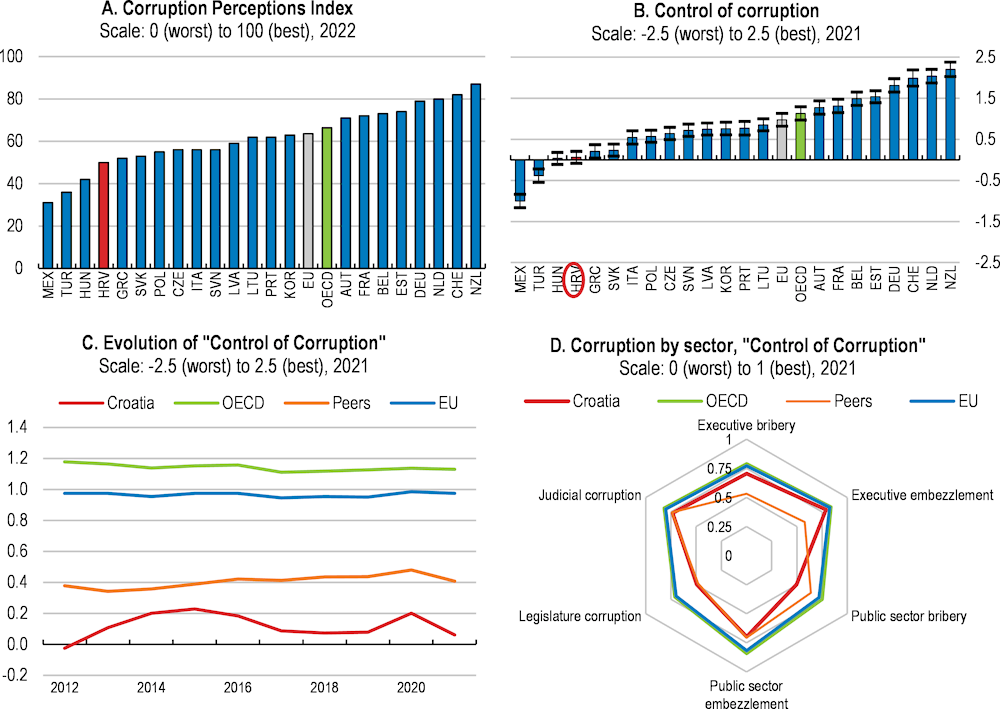

Levelling the playing field through tackling corruption and clientelism

Levels of perceived corruption in Croatia remain higher than in most OECD and EU countries, including peer countries (Figure 3.11). Corruption, such as paying or requesting bribes to get better access to public services or win contracts, undermines trust in public services and equitable access to them, reduces value-for-money of public spending and distorts decision making. Croatia’s Recovery and Resilience Plan aims to tackle corruption with several measures enhancing prevention and sanctioning, for example digitalising processes of local governments and speeding up court proceeding, which is welcome. In recent years, investigations of high-level corruption cases have continued, with more leading to inditements and judgements (European Commission, 2023[21]).

Box 3.6. Country examples on fostering trust in the judiciary through public engagement

Germany’s Federal Constitutional Court’s communication strategy

The German Federal Constitutional Court continuously invests in a comprehensive communication strategy. Not limited to communicating on recent decisions and litigated constitutional meaning, the Court’s Code of Conduct states that judges should impart knowledge on the Court’s functioning and the relevance of its case law. Pursuing a multimedia and interactive outreach agenda, the Court aims at strengthening legal and constitutional literacy among the people via nationwide campaigns.

Columbia’s Supreme Court’s communication strategy

In 2012, the Supreme Court of Justice of Columbia launched its own YouTube channel and further regularly updates several social media channels, such as Facebook and Instagram. Adopting a people-centred approach to translate its actions into audience-tailored formats, the Court disseminates videos and podcasts on its functioning and constitutional litigation.

United States’ courts’ public engagement strategy

In the United States, many courts established specific committees to engage with the population. In Washington, Public Engagement and Education Committees at courts strive to foster a relationship with the public based on accountability and understanding through collaboration with judicial, legal and community groups and organizations.

Sources: Colombia ; United States

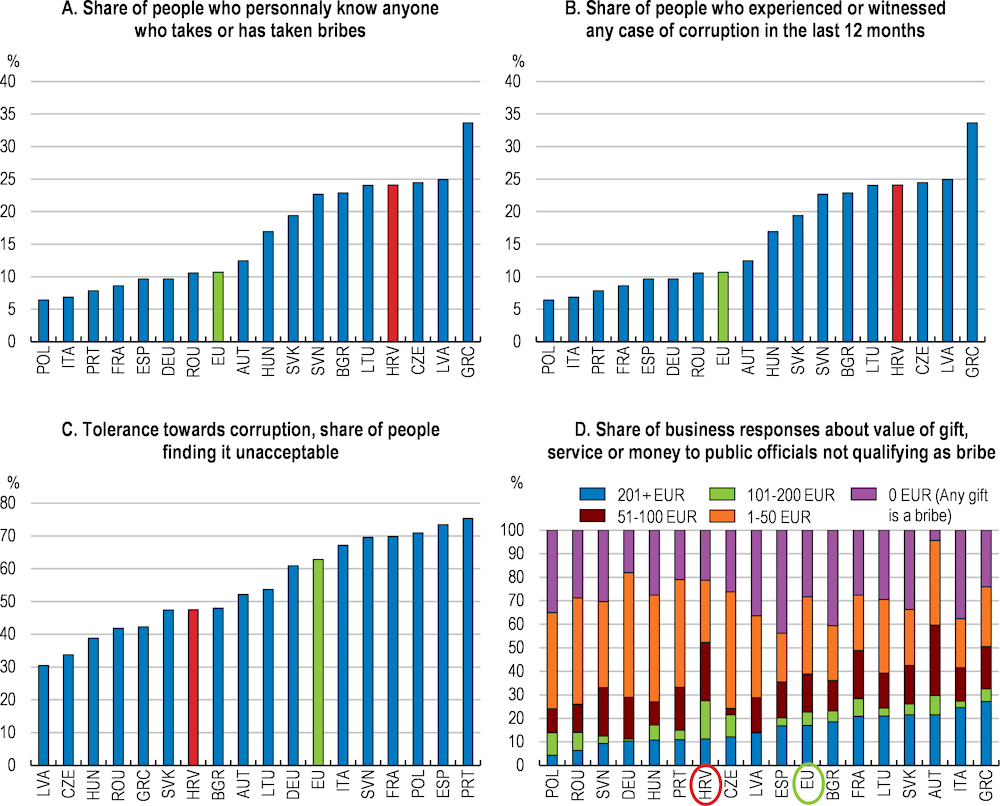

Tackling corruption in Croatia requires attention to both low- and high-level corruption. High profile cases have, for instance, involved high-level politicians (GRECO, 2019[34]). In addition, personal experiences with corruption are also relatively widespread. Around one-quarter of the population – a higher share than in most other EU countries – report to have experienced corruption within the last year or know someone who has (Figure 3.13, Panel A and B). Some of those experiences may also reflect activities similar but not identical to corruption, such as clientelism – for example awarding positions to personal connections or political allies with little regard to their merit. More businesses than in most other EU countries report patronage and nepotism as an important problem (Figure 3.12), and about one-quarter of businesses believe corruption prevented them from winning a public contract. Widespread personal experiences with corruption are accompanied by relatively lenient public attitudes. The share of people who find corruption unacceptable, or consider valuable gifts to public officials constitute a bribe, is lower than in most other EU countries (Figure 3.13, Panel C and D).

Better transparency can foster trust in policy makers and officials

Ensuring the Commission for the Resolution of Conflicts of Interests has adequate resources may support transparency. In Croatia, public officials are required to submit a self-declaration of their assets and other involvements to the Commission for assessment (GRECO, 2019[34]). Recent changes to the rules for asset declarations mean that more assessments are likely to need to be made, which are likely to require increased staff resources (European Commission, 2022[31]).

Oversight of lobbying activities is improving. Croatia recently extended the cooling-off period for people leaving top executive functions from 12 to 18 months (European Commission, 2022[31]), which is welcome. Also, a new Lobbying Act is in the pipeline that importantly includes provisions for a registry of lobbyists, a feature of policies in a number of countries (Figure 3.13). Ensuring this operates effectively and transparently can contribute to improving corruption perceptions and integrity.

Figure 3.11. Perceptions of corruption are high

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. Panel B shows the point estimate and the margin of error. Panel D shows sector-based subcomponents of the “Control of Corruption” indicator by the Varieties of Democracy Project.

Source: Panel A: Transparency International; Panels B & C: World Bank, Worldwide Governance Indicators; Panel D: Varieties of Democracy Project, V-Dem Dataset v12.

Figure 3.12. Many businesses report clientelism to be a problem

Share of people indicating patronage and nepotism to be a problem for their company when doing business

Figure 3.13. Experience with corruption is common and tolerance of it is relatively high

Complementing deterrence with promoting values of integrity and advocating positive examples will be crucial to tackle widespread low-level corruption. Experience among OECD countries suggests that approaches relying mostly on more rules and stronger deterrence have been of limited effectiveness (OECD, 2017[37]). Indeed, overly stringent rules or aggressive enforcement even contributed to reinforcing corruption and other unethical behaviour in some cases (Schulze and Frank, 2003[38]; Bandiera et al., 2021[39]), while adding costs to firms and weakening confidence (Bulman, 2021[40]). Corruption often results not from intentionally breaking the rules but from expectations about reciprocity and what constitutes common behaviour in certain situations (OECD, 2018[41]).

Codes of conduct for officials in executive bodies and parliamentarians have recently been expanded, addressing an important gap in measures to combat corruption. In May 2022, in line with recommendations from GRECO, the government adopted a code of conduct for state officials (GRECO, 2019[34]). Those covered by the code include members of the government and all the other officials in executive bodies, such as head of the Office of the Prime Minister and heads of state administrative bodies. Almost all regional and local administrations have adopted them too (European Commission, 2023[21]). A code of ethics for parliamentarians was adopted in November 2022. Completing the adoption of an updated code of ethics for police officers could help improve perceptions of an institution central to the robust rule of law.

Setting positive examples through information and awareness campaigns can help change behaviours. Research suggests information campaigns need to be careful to avoid further adding to perceptions that corruption is widespread, as this may inadvertently reinforce corruption by normalising it (Ajzenman, 2021[42]). By contrast, examples of appropriate behaviour can help to build trust that corruption is not the norm, and so change perceptions about how acceptable corruption is and how likely people are to engage in corruption. Such information campaigns may be most effective in building trust if executed by institutions that are not engaged in sanctioning violations (OECD, 2018[41]). As part of the Recovery and Resilience Plan, a national media campaign is planned from the end of 2023 to the end of 2024 to raise awareness of the harmfulness of corruption and inform the general public about existing anti-corruption mechanisms. Croatia can plan further campaigns and ensuring that they draw on the lessons on the effectiveness of this campaign.

Box 3.7. Australia’s implementation of codes of ethics

In the past, the Australian Public Service (APS) Commission used a statement of values expressed as a list of 15 rules. In 2010, the Advisory Group on Reform of the Australian Government Administration recommended that the APS values be revised, tightened, and made more memorable. APS values were revised to a set of core values that follow the acronym “I CARE”:

Impartial - The APS is apolitical and provides the government with advice that is frank, honest, timely, and based on the best available evidence.

Committed to service - The APS is professional, objective, innovative and efficient, and works collaboratively to achieve the best results for the Australian community and the government.

Accountable - The APS is open and accountable to the Australian community under the law and within the framework of ministerial responsibility.

Respectful - The APS respects all people, including their rights and heritage.

Ethical - The APS demonstrates leadership, is trustworthy, and acts with integrity, in all that it does.

The Australian Government also developed and implemented strategies to enhance ethics and accountability in the APS such as the Lobbyists Code of Conduct, and the register of ‘third parties’, the Ministerial Advisers’ Code and the work on whistleblowing and freedom of information. A model was developed to help public servants make decisions process when facing ethical dilemmas. The model follows the acronym REFLECT:

1. REcognise a potential issue or problem

2. Find relevant information

3. Linger at the ‘fork in the road’ (talking it through)

4. Evaluate the options

5. Come to a decision

6. Take time to reflect

Sources: Australian Public Service Commission (2011),“Values, performance and conduct”, https://resources.apsc.gov.au/2011/SOSr1011.pdf; Australian Public Service Commission , “APS Values”, https://apsc-site.govcms.gov.au/sites/g/files/net4441/f/APS-Values-and-code-ofconduct.pdf; Office of the Merit Protection Commissioner (2009), “Ethical Decision Making”, http://www.apsc.gov.au/publications-and-media/current-publications/ethicaldecision-making.

Continuing productivity-supporting reforms through a productivity board

Establishing a productivity board could support continuous evidence-based reforms to improve productivity in Croatia. Policies tackling widespread productivity gaps and weak allocative efficiency, discussed below, likely require sustained efforts over a prolonged period. Many OECD countries have established pro-productivity institutions to inform and monitor policymaking (Cavassini et al., 2021[43]; Pilat, 2023[44]). The European Commission recommends euro-area countries set up national productivity boards. In Croatia, such an institution could bring together academic experts and policy makers, and could use existing or collect micro-data to better design policies and to evaluate the impacts of existing policy. Australia has a long-established pro-productivity institution (Box 3.8), that has often served as a model for similar institutions in other OECD countries. More recently established institutions include Slovakia’s National Council for Productivity (established 2019). In some cases, productivity policy analysis is enhanced by expanding the role of an existing institution. For instance, in 2019 Germany’s Council of Economic Experts was appointed as the National Productivity Board.

Box 3.8. Pro-productivity institutions and the Australian example

A national productivity board can be a valuable tool for improving the policy environment to boost economic growth and ensuring the long-term prosperity of a country. A well-resourced, permanent body dedicated to developing policies can accelerate reforms. Although they are often called “Productivity Boards” or “Commissions”, governments often set a wider mandate that can include green growth and social issues, as well as the public sector’s role and effectiveness. These bodies evaluate government policies, with a goal of recommending reforms. They support a “whole-of-government” approach, helping to overcome the frequent fragmentation in policy making across different public agencies or layers of government. They can identify trends, produce robust evidence and in some cases collect data and make the case for reforms by presenting clearly the benefits of reforms. They can serve as a platform to share ideas and help forge a common view, thus deepening national ownership of reforms, including among the government bodies that will be responsible for implementation.

These bodies fall into three broad types:

1. Stand-alone inquiry bodies, such as the Australian and New Zealand Productivity Commissions. These are generally well resourced with strong analytical skills, independent and have inquiry and consultative mandates.

2. Advisory councils, such as the French Conseil National de Productivité, the US Council of Economic Advisers, and the Belgian Conseil National de la Productivité, These may tap into the existing knowledge of several well-established, high quality institutions without necessarily building their own capacity.

3. Ad hoc task forces, such as the Norwegian Productivity Commissions These may be formed with temporary mandates to assess particular issues.

Countries’ experience suggests that these bodies are generally most effective when they can work autonomously and have strong internal analytical, consultative and communication skills. Regular independent audits can protect these bodies’ independence and contribute to the quality of their work. Institutions located outside government can better promote reforms that challenge vested interests and work with longer-term policy goals.

Australia has one of the longest-standing pro-productivity institutions. The Productivity Commission was established in 1998 as an independent statutory body with the mandate to provide advice to the Australian government on policies and reforms that can enhance productivity and improve living standards for Australians. The Commission conducts research and analysis on a wide range of policy areas, including education, health, infrastructure, and industry, and provides recommendations to the government on ways to improve productivity and efficiency across these sectors. Its work has led to numerous policy changes and reforms in areas such as competition policy, trade, and regulation, which have helped to boost productivity and economic growth in Australia.

Source: Cavassini, F., et al. (2022), "Pro-Productivity institutions at work: Country practices and new insights on their set-up and functioning", OECD Productivity Working Papers, No. 32, OECD Publishing, Paris; https://www.pc.gov.au/

Expanding financing options to encourage innovative investment

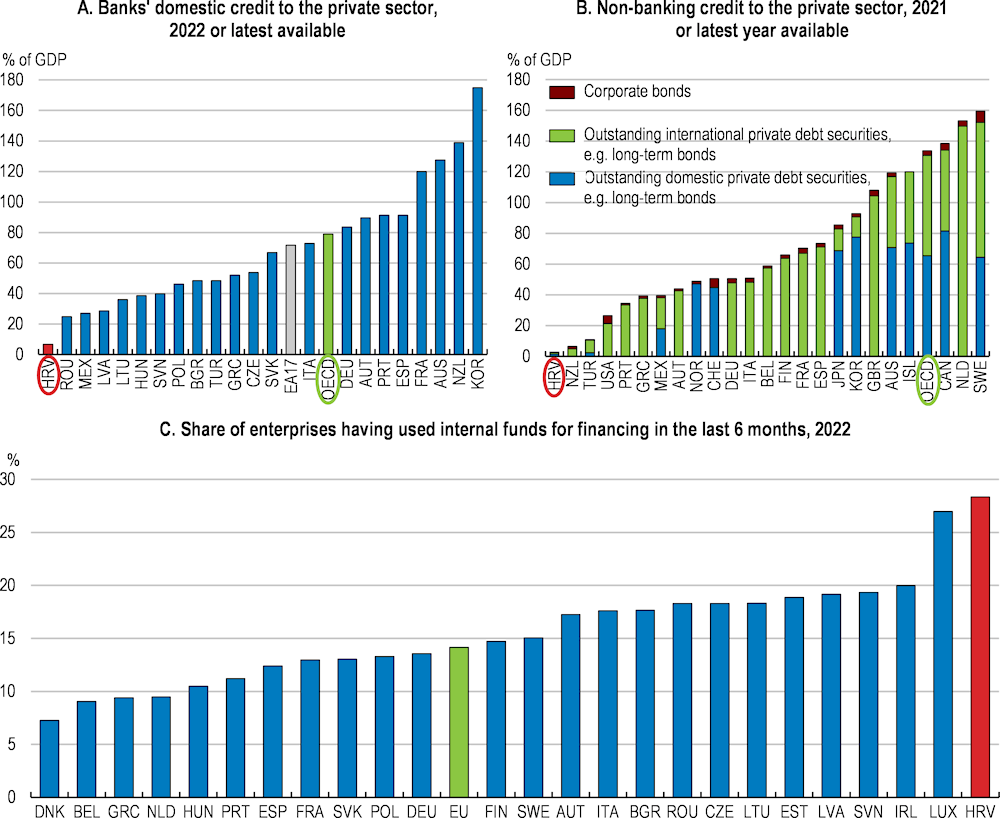

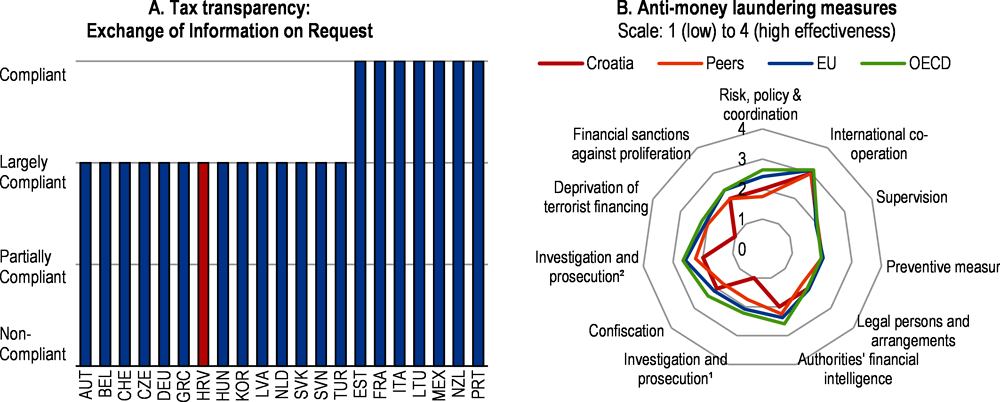

Businesses in Croatia use less external financing than their peers in OECD countries. Bank credit to the private sector as a share of GDP is low relative to most OECD countries (Figure 3.14, Panel A and B) and the share of non-bank credit ranks even lower. Meanwhile, the share of firms using internal funds for financing is comparatively high (Figure 3.14), Panel C). The heavy reliance on internal financing and dominance of banking in external financing suggests limits in the range of financing available to investors. Croatia’s integration into the euro area has the potential to contribute to greatly expanding firms’ access to finance, if the regulatory environment is supportive and vigilantly limiting risks (Chapter 2). In 2023 Croatia was ‘grey listed’ by the Financial Action Task Force (FATF), following a peer evaluation of progress implementing some specific controls to prevent terrorist financing and money laundering. This highlights the importance of continued efforts to improve the regulatory environment, so as to enable a deepening integration into the global financial system Figure 3.17).

Figure 3.14. Businesses’ use of external financing is low

Note: Panel B: Data on corporate bonds from 2021, from outstanding private debt securities from 2020.

Source: IMF, International Financial Statistics; World Bank, Global Financial Development Database 2022; and ECB, Survey on the Access to Finance of Enterprises (SAFE) 2022.

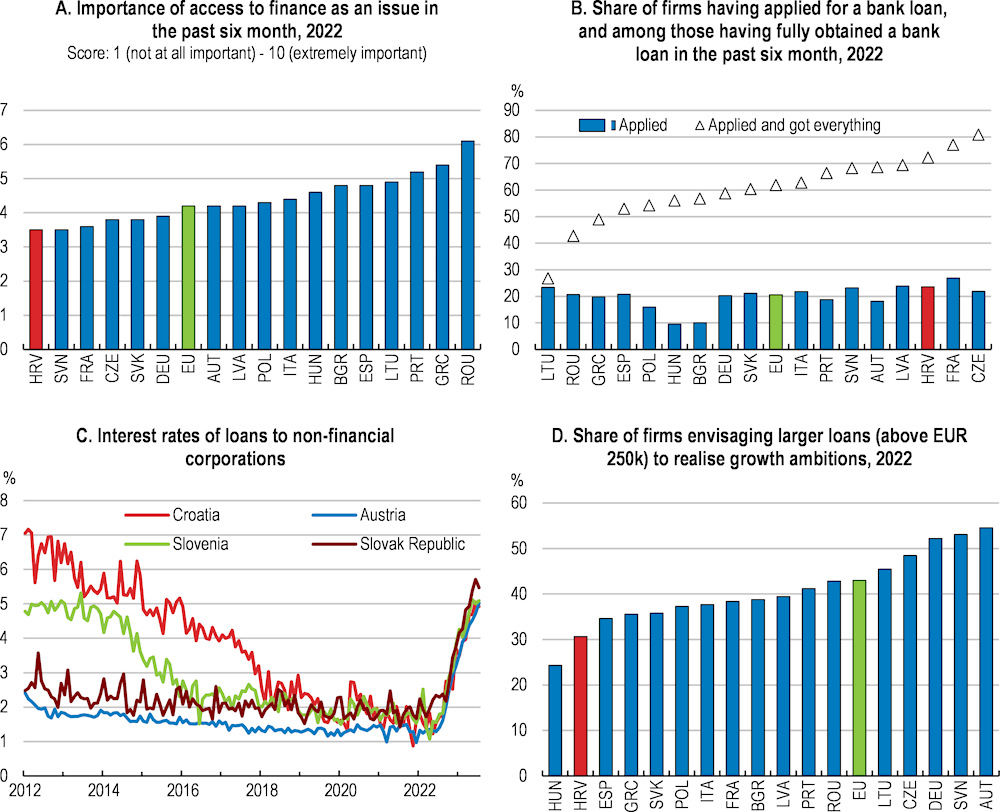

Businesses overall do not appear to be overly constrained in accessing finance, despite their relatively low use of external funds (Figure 3.15, Panel A). Most firms applying for bank loans – and a larger share than in most other EU countries – are successful (Figure 3.15, Panel B), and average loan costs are comparable to other EU countries (Figure 3.15, Panel C). Total volumes of bank financing may be low, even though the share of firms applying for loans is comparable to other countries, as firms tend to apply for smaller loans: the share of businesses reporting demand for loans of more than EUR 250 000 is lower than elsewhere in the European Union (Figure 3.15, Panel D).

Figure 3.15. Demand for finance is relatively low

Note: Panel C: New business loans of up to 1 year. For Greece new business loans with an initial rate fixation period of less than one year. Loans other than revolving loans and overdrafts, convenience and extended credit card debt; loans adjusted for credit and securitisation.

Source: ECB, Survey on the Access to Finance of Enterprises (SAFE) 2022; and ECB, MFI Interest Rates (MIR) Statistics.

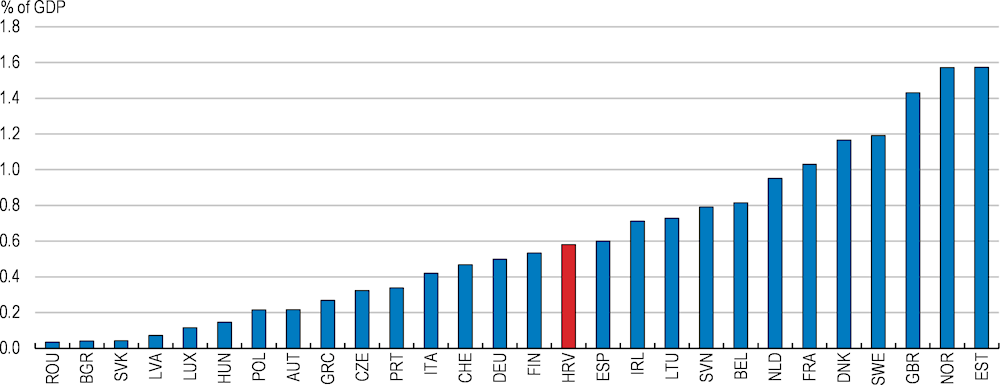

However, SMEs in Croatia are among the most likely of any EU country to report access to finance as a major obstacle (European Commission, 2022[45]). Developing financial markets to provide a broader range of financing options can boost investment especially among smaller and higher productivity and higher growth-potential firms. Croatia’s reliance on banking finance means that firms planning innovative projects, especially small and young firms with limited collateral or histories, find it difficult to obtain funds. Indeed, while the share undertaking these investments remains small at 9%, access to a range of financing sources is particularly important for investments in intangible assets – such as databases, designs, organisational capital or distribution networks –, which are crucial complements to adopting digital technologies. These investments are more difficult to finance through bank loans as they are less well suited to be pledged as collateral and their resale value in the event of a default is lower, while their returns tend to be more uncertain (Demmou and Franco, 2021[46]). Private equity markets in Croatia are relatively well developed and funded investments of almost 0.6% of GDP in 2021 (Figure 3.16). However, there is scope to improve access to finance for more innovative projects via banking, public equity markets, and R&D support.

Figure 3.16. Private equity markets are relatively well developed

Private equity inflows, % of GDP, 2021

Foreign direct investment (FDI) inflows are another potentially important source of financing. They are below the OECD average (discussed above), although this is likely to relate to the composition of economic activity, with a greater role for low-capital intensity activities rather, than policy restrictions. Over 2011-2022, average net FDI inflows to Croatia stood at 2.4% of GDP per year, compared to about 4% in OECD countries, with greenfield investments – i.e. new establishments of foreign-owned businesses in Croatia – being concentrated in construction and services, especially tourism and lower- technology services such as wholesale and retail trade or real estate activities (OECD, Forthcoming[8]). The relatively low capital intensity of these sectors, compared to, for example, vehicle manufacture possibly explains the relatively low average net FDI inflow. Croatia’s FDI rules are less restrictive than most OECD and EU countries across all of the sectors covered by the OECD’s FDI restrictiveness index, except for business services and financial services, in which they are assessed to be near but slightly more restrictive than the average of OECD countries (OECD, 2023[47]). Experience across OECD countries suggests that the types of broader improvements in the business environment discussed through this Survey can raise foreign direct investment alongside domestic investment.

Figure 3.17. Croatia’s financial regulations enable relative transparency but need to better address terrorist financing and money laundering risks

Note: Panel A summarises the overall assessment on the exchange of information in practice from peer reviews by the Global Forum on Transparency and Exchange of Information for Tax Purposes. Peer reviews assess member jurisdictions' ability to ensure the transparency of their legal entities and arrangements and to co-operate with other tax administrations in accordance with the internationally agreed standard. The figure shows first round results; a second round is ongoing. Panel B shows ratings from the FATF peer reviews of each member to assess levels of implementation of the FATF Recommendations. The ratings reflect the extent to which a country's measures are effective against 11 immediate outcomes. "Investigation and prosecution" refers to money laundering. "Investigation and prosecution" refers to terrorist financing.

Source: OECD Secretariat’s own calculation based on the materials from the Global Forum on Transparency and Exchange of Information for Tax Purposes; and OECD, Financial Action Task Force (FATF).

Improving business insolvency can facilitate bank financing especially for high-risk projects

Improving Croatia’s insolvency framework would reduce risks for banks and investors and stimulate financing for more innovative projects. Legislative reforms were approved in 2022 and improvements in insolvency management are underway. Improving the insolvency framework can reduce default risks, for example by detecting financial problems early to facilitate restructuring and helping to avert bankruptcies. It can also limit losses in the case of default, for example by providing rapid information about how much debt can be repaid, speeding-up procedures to recover the debt, and then allowing debtors a fresh start.

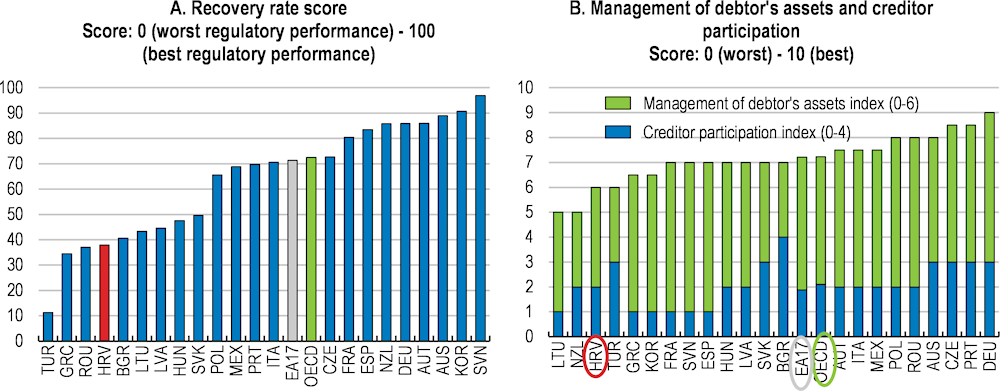

Croatia’s recovery rate – reflecting the costs and time to resolve insolvency cases and chances to avoid liquidation – lags most OECD economies (Figure 3.18, Panel A), while its insolvency framework could be further improved (Figure 3.18, Panel B). The OECD insolvency indicator highlights scope for improvement in the process for the initiation of restructuring, the involvement of court involvement, and the rights of employees (André and Demmou, 2022[48]). For example, allowing debtors to obtain new credits, which would be given priority over previous unsecured creditors, can facilitate restructuring and raise the final recovery value for all creditors (McGowan and D, 2016[49]). Reforms legislated in 2022 and currently being implemented are intended to improve these areas. To improve stakeholder involvement in insolvency proceedings, creditors could be granted the right to approve the sale of substantial assets and to request information from the insolvency representative (World Bank, 2020[50]; Coutinho, Kappeler and Turrini, 2023[51]).

Figure 3.18. Croatia’s insolvency framework leaves room for improvement

Note: Panel A: The recovery rate score was calculated based on the time, cost and outcome of insolvency proceedings in each economy. The higher the score the better is the framework assessed. Panel B: Management of debtor’s assets and creditor participation are two components of the strength of insolvency framework index. The strength of insolvency framework index measures the legal framework applicable to judicial liquidation and reorganization proceedings and the extent to which best insolvency practices have been implemented in each economy. The higher the score the better is the framework assessed.

Source: World Bank, Doing Business 2020 (database).

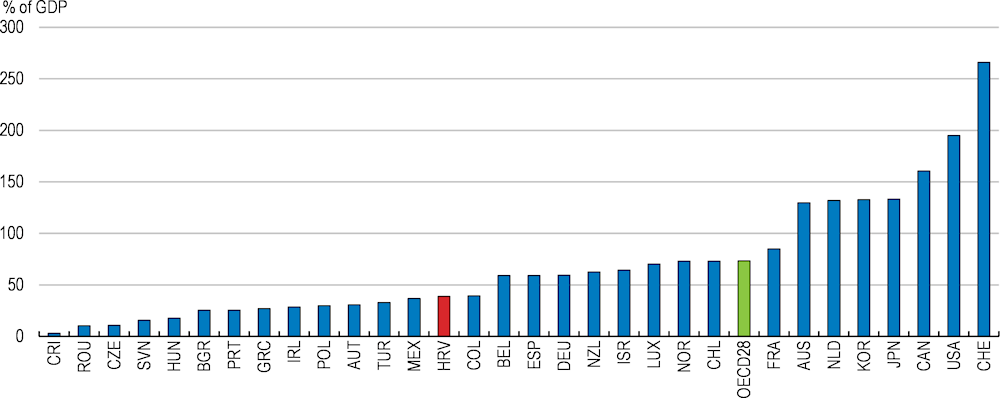

Mobilising public equity markets

Improving scale and liquidity would deepen Croatia’s public equity markets. Croatia’s domestic stock market, the Zagreb Stock Exchange (ZSE), was established in 1991 and is a for-profit corporation mostly owned by banks and insurance companies. Its capitalisation relative to GDP is comparatively small (Figure 3.19). The low number of listings and trading volumes makes it less attractive for people or firms to invest or raise funds, hindering it from reaching critical scale.

Figure 3.19. The domestic stock market’s capitalisation is low

Stock market capitalisation, % of GDP, 2020 or latest available year

Note: OECD28 is the unweighted average and excludes Denmark, Estonia, Finland, Iceland, Italy, Latvia, Lithuania, Slovak Republic, Sweden, and United Kingdom.

Source: World Bank, Global Financial Development Database.

The ZSE’s market structure could be simplified. The ZSE hosts three markets, which are differentiated by increasingly stringent requirements for governance, transparency and capitalisation. The Prime Market with the strictest requirements only lists six stocks. Many European or other countries with larger market sizes have simpler stock market structures, including a single market or one more regulated and one alternative market (OECD, 2021[52]). Reducing the number of markets, for example by merging the two lower segments, would create a larger and thus more attractive domestic stock market. Providing financial incentives to firms listing or issuing new stocks, for example subsidies for issuance costs, could encourage more firms to move to the Prime Market and help reach critical scale.

A stronger corporate governance framework for listed companies would improve investor confidence and make listed companies more attractive. Croatia’s corporate governance framework ranks below most OECD and peer economies in the 2019 World Economic Forum Global Competitiveness Index (World Economic Forum, 2019[20]). Greater alignment with G20/OECD principles for corporate governance (OECD, 2015[53]; OECD, 2021[52]) would improve governance along several dimensions. Specifically:

Parts of Croatia’s corporate governance code for listed firms could be made legally binding. Only a small number of OECD countries rely on codes combining binding and voluntary elements. Croatia’s code currently has no legally binding elements. While voluntary codes allow for flexibility, their effectiveness ultimately rests on interested and relevant stakeholders monitoring compliance, which may be less effective in Croatia given the relatively small size of its stock market.

Strengthening independence criteria for audit committees could improve trust in company audits. Most OECD countries require listed companies to establish independent audit committees. While listed companies in Croatia are required to establish an audit committee, there are no independence requirements. For example, the audit committee can be organised as a committee of the board of directors of the audited company.

Croatia recently strengthened approval requirements for related party transitions, effectively requiring approval by the supervisory board or shareholders. However, minority stakeholder rights could be further strengthened by giving a greater role to independent supervisory board members for reviewing transactions.

Besides stock markets, corporate bonds can fund firms’ longer-term investments. While corporate bonds have become an increasingly important source for corporate financing globally (OECD, 2021[52]), very few firms in Croatia issue corporate bonds (Figure 3.14, Panel B). Most corporate bonds have been issued at foreign exchanges instead of the ZSE, likely reflecting the lack of intermediaries – from domestic credit rating agencies to investment banks – and high listing costs. For example, listing a EUR 500 million corporate bond is three- to two-times more expensive at the ZSE compared to Luxembourg or Prague (OECD, 2021[52]). Supporting the issuance of domestic corporate bonds would help expand the market and reduce costs. For example, to compensate for the lack of domestic rating agencies – which is an obstacle especially for SMEs to obtain ratings and issue bonds – alternative credit rating mechanisms could be provided by public institutions such as FINA. To tackle high listing costs, government support schemes could provide financial assistance when listing a bond to help kick-start the market.

Listing state-owned enterprises (SOEs) on the stock market can support investment in such enterprises, improve their governance and deepen the stock market. Out of Croatia’s approximately 1000 SOEs, only 14 are listed on the ZSE. Only one is listed on the Prime Market, although about half of listed SOEs would satisfy the Prime Market’s capitalisation criteria (OECD, 2021[52]). Issuing secondary public offerings would help meet liquidity criteria to move more SOEs to the Prime Market and improve SOE performance through the market’s more stringent governance criteria. In addition, more unlisted SOEs could be listed. For example, the large national power company Hrvatska Elektroprivreda or the Croatia’s toll road company Hrvatske Autoceste provide services that in many other countries are provided by listed companies (OECD, 2021[52]). SOEs could also help stimulate corporate bond markets. While Croatian SOEs have issued corporate bonds in the past, they mostly relied on foreign exchanges and their use remains limited (OECD, 2021[52]).

As a small country, Croatia stands to benefit from integrating its public equity markets with neighbouring countries. The ZSE has strengthened international links by acquiring full ownership of the Ljubljana Stock Exchange in 2015 and minority ownership of the Macedonian Stock Exchange in 2019. Together with the former it created the ADRIAprime index to jointly trade Croatian and Slovenian Prime Market stocks. The integration of Croatia’s public equity markets with neighbouring countries appears to be compromised by shortfalls in the technical infrastructure for selling and buying stocks. For instance market participants have encountered difficulties with settling cross-border transactions with Croatia’s Central Depository and Clearing Company (CDCC). Limited technical capacity is also hampering the full integrations of Croatia’s central depository framework into the pan-European TARGET2-Securities system (T2S), which facilitates the simultaneous exchanges between investors from 20 participating European markets. Promoting investments in CDCC’s technical capacity to enhance operations, connectivity, efficiency, and security would allow bring a better integration with international markets.

Improving the framework and expanding public support for research and development

Public support for business R&D is low. Croatia provided R&D support of 0.007% of GDP in 2021, compared to about 0.2% across OECD countries on average. It provides both tax incentives and R&D grants, which are mostly implemented via its Agency for Small Business, Innovation and Investment (HAMAG-BICRO). For example, depending on the type of research project, up to 200% with a maximum of EUR 300 000 of eligible R&D expenses can be deducted from the tax base. In 2021, however, 97% of R&D support was provided in the form of grants (OECD, Forthcoming[8]). An evaluation of the existing tax incentives is envisaged within the Recovery and Resilience Plan, to inform revisions to the support programme. The limited use of tax incentives seems to reflect low uptake, with most applications being approved, but only 100 applications being received, over the period 2019-2021. Low uptake may reflect their relatively modest advantages given low corporate tax rates (discussed in Chapter 2), lack of awareness of the schemes, or weak demand for innovative investments.

First improving the framework, then expanding the resources for R&D support programmes could stimulate more business R&D. Application costs for grants are high (OECD, Forthcoming[8]). For example, obtaining grants often requires several proposals with different objectives, timeframes, target groups and implementing authorities. Firms often employ consultants to assist with application and project management. In addition, many firms reported significant delays in procedures to obtain funds. Investments in the Recovery and Resilience Plan to digitalise the support programmes can make them more accessible. In addition, simplifying application procedures and design of R&D grants and tax incentives could help to make applications less burdensome and costly, allowing firms to focus on the research and development tasks.

Better coordinating and linking R&D support schemes could help to better match the financing needs of innovative firms. Support schemes often fail to provide firms with a longer-term perspective, for example because of lack of continuity between different schemes (OECD, Forthcoming[8]). Key players in managing Croatia’s R&D support currently include the Ministry of Economy and Sustainable Development, the Ministry of Science and Education and the National Innovation Council (NIC). Unclear division of responsibilities between these players hampered coordination in the past (European Commission, 2023[54]). More recently, Croatia’s Smart Specialisation Strategy has streamlined governance for R&D support and clarified the role of the NIC National Innovation Council, which is welcome. Pursuing the government’s plans to consolidate the large number of institutions involved in research could strengthen public-private collaboration on research, development and innovation.

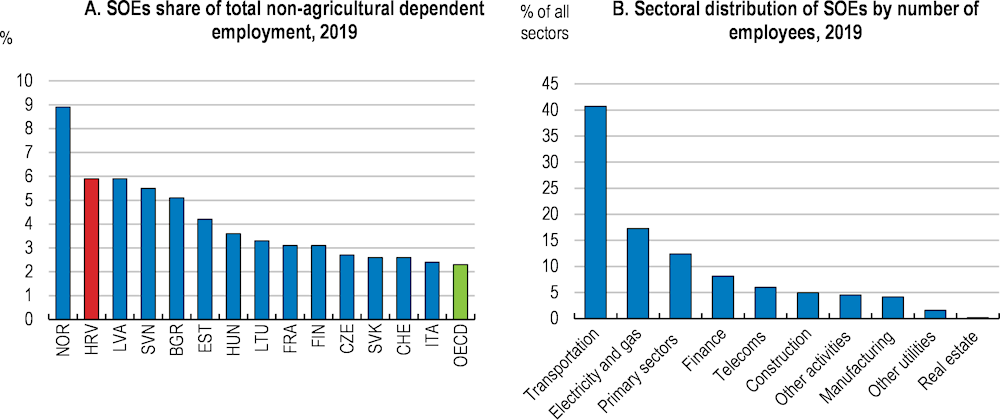

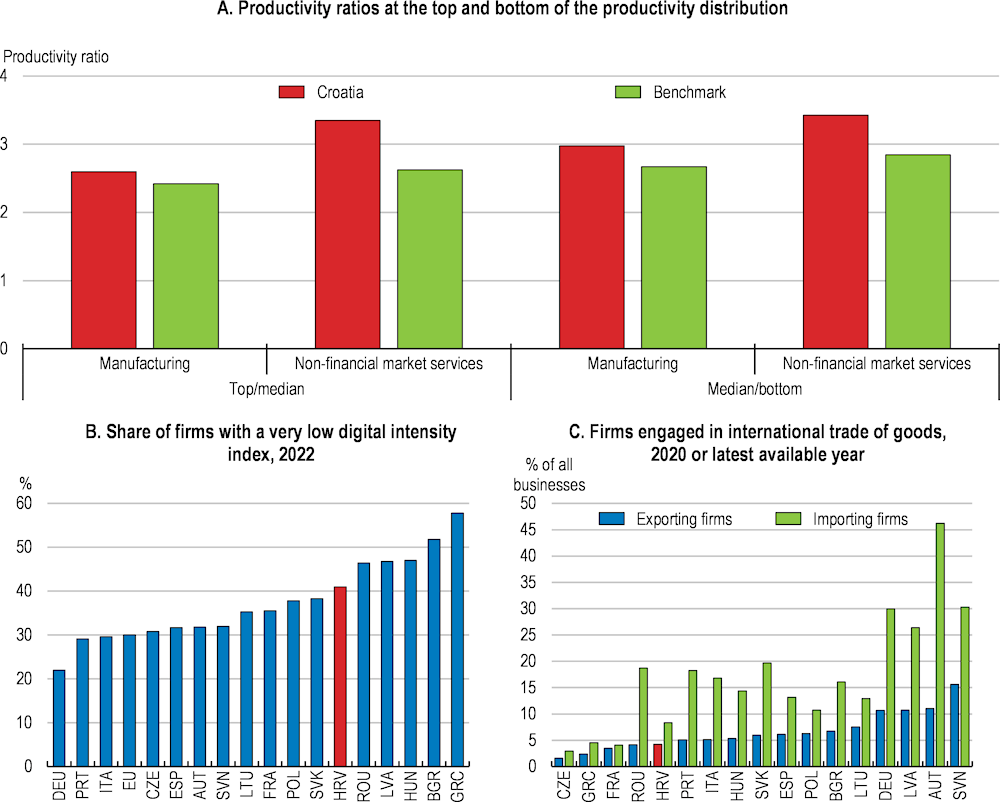

Strengthening the performance of state-owned enterprises

State-owned enterprises (SOEs) play a greater role in Croatia’s economy than in most OECD economies. A large number of previously socially-owned enterprises were privatised during Croatia’s transition to a market economy in the 1990s, but the SOE sector remains comparatively large. In 2019, a larger share of workers worked in SOEs in Croatia than most EU and peer countries (Figure 3.20, Panel A) (OECD, 2021[55]). SOEs’ assets are equivalent in value to about half of annual GDP (OECD, 2021[55]), among the highest ratios in central and eastern European countries (EBRD, 2018[56]).

Figure 3.20. State-owned enterprises play a significant role in some sectors

Companies owned by the state engage in a broad range of activities, often in competition with private businesses. Most of the SOE sector is under central government ownership. These firms account for about 90% of SOE employment and include among the largest individual businesses. They are mostly engaged in transportation, electricity and gas, finance, and construction (Figure 3.20, Panel B). A large number of generally smaller SOEs are owned by sub-national governments and mostly provide utilities. Box 3.9 provides examples of companies owned by the Croatian state.

Box 3.9. Examples of Croatia’s state-owned enterprises

Hrvatska Elektroprivreda (HEP)