Croatia’s labour market has made important progress over the past decade. Employment rates are rising, reducing the gap with OECD countries, and poverty has fallen. While important weaknesses remain, many dimensions of equity and working conditions are similar to OECD countries. Continuing this progress is essential for Croatia’s incomes and well-being to converge with OECD countries, to counter accelerating population ageing and to make the most of emerging opportunities, including from digitalisation and the green economy transition. For employers, filling increasingly advanced skill needs is a growing obstacle. Relatively few of the young and older adults are in work – contributing to weakening skills, lower incomes and higher poverty risks. Addressing these challenges will require dramatically expanding participation in re-skilling and adult education programmes, and raising the workforce’s flexibility, for example by strengthening active labour market policies, improving the housing market’s dynamism and making the most of immigrants and returned emigrants’ skills.

OECD Economic Surveys: Croatia 2023

4. A better performing labour market for inclusive convergence

Abstract

Introduction

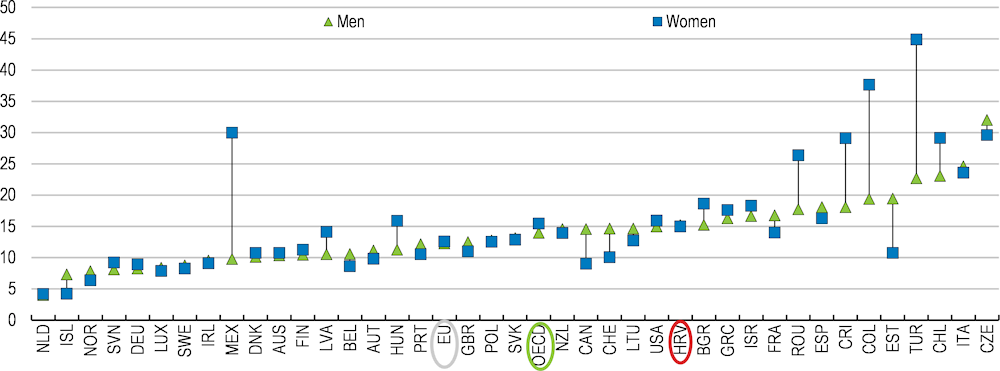

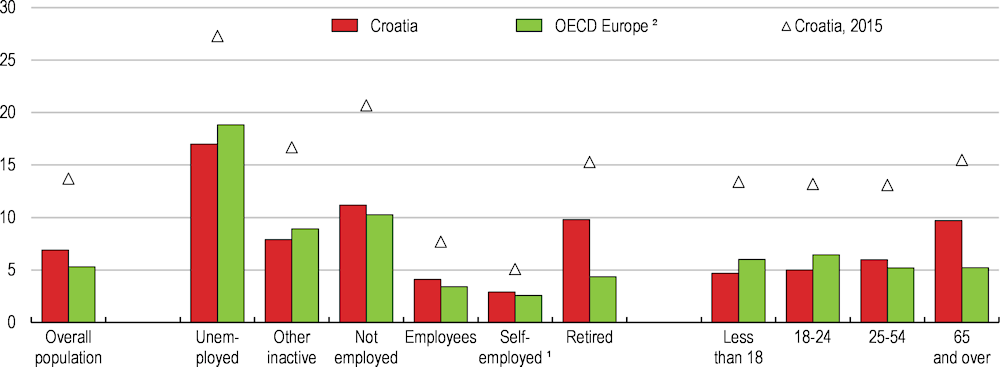

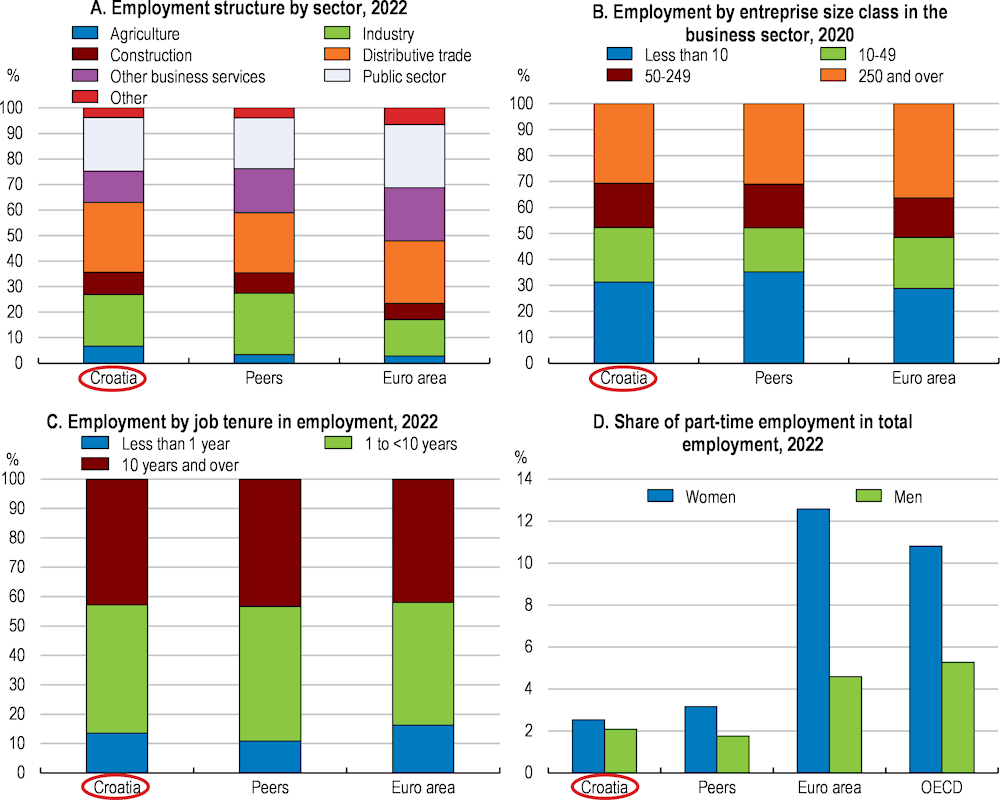

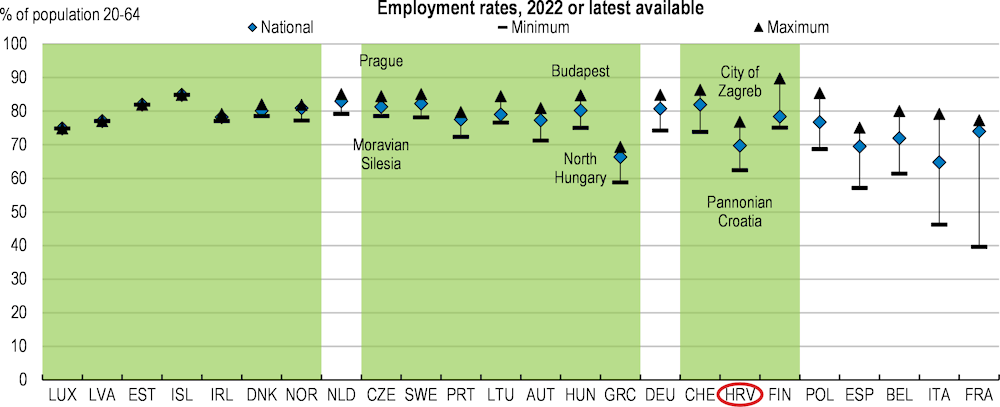

Croatia’s social and labour market conditions have improved over recent decades and now compare well with OECD countries in many important dimensions. Unemployment has fallen to approach historic lows and the share of adults in work is reaching historic highs. Poverty has declined considerably (Figure 4.1). Income inequality overall is relatively low and the social safety net is being strengthened and targeting improved. Employment and wage gaps between men and women are smaller than in many countries (Figure 4.2). Personal income tax and social security contribution rates are less of a burden than in many OECD countries (discussed in Chapter 2).

Figure 4.1. Poverty has declined significantly

Percent of population living in households reporting severe material deprivation, 2020 or latest

Note: The severe material deprivation rate is the proportion of the population group living in households unable to afford at least four of the following items: unexpected expenses, a one-week annual holiday away from home, a meal involving meat, chicken, or fish every second day, the adequate heating of a dwelling, durable goods like a washing machine, colour television, telephone, or car, or are confronted with payment arrears. This indicator of well-being and poverty is not affected by income underreporting.

1. ’Self-employed’ is the category ‘employed other than employees’.

2. EU countries that are OECD members plus Iceland, Norway, Switzerland, Türkiye and United Kingdom.

Source: Eurostat.

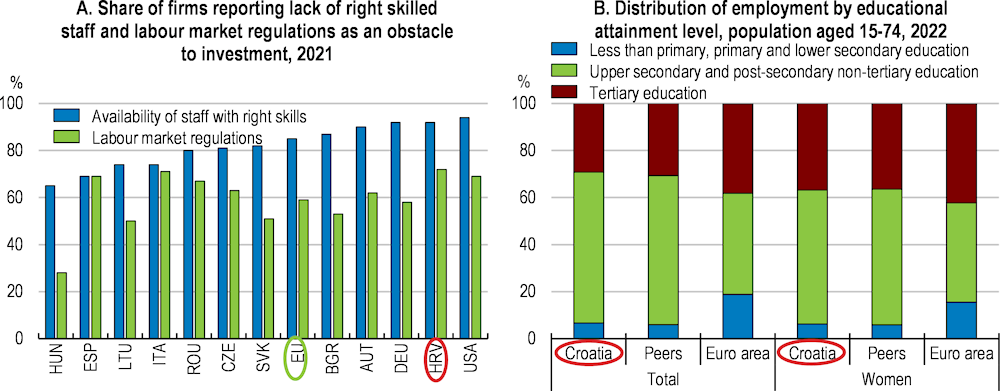

With this progress, Croatia’s labour market now faces two core challenge. The first is strengthening skills. A growing share of employers report that recruitment has become a major constraint, especially for skills that are critical to advancing Croatia’s digitalisation and the green economy transition (Chapter 2 and Figure 4.3). Fewer school students aim to continue into advanced education and fewer adults have completed it than in most OECD countries. Weaknesses in the vocational education system hamper students’ transition from education to work. It is rare for adults to return to training or education later in life. For many, weak skills from schooling make retraining later in life more challenging.

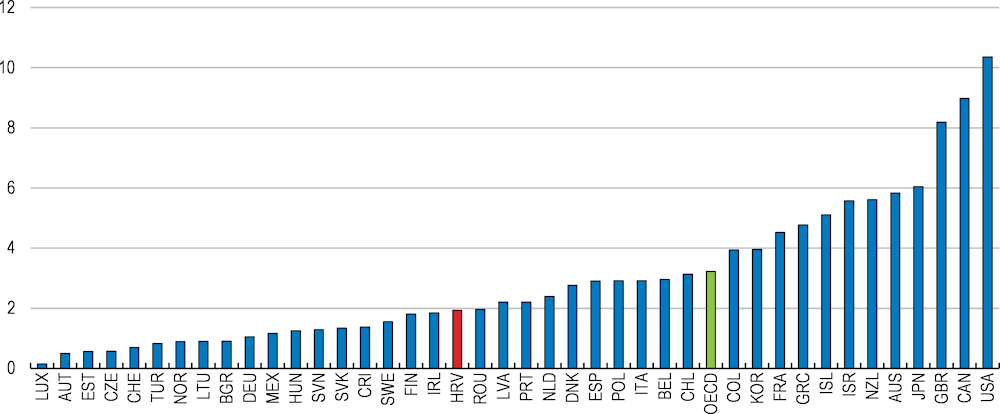

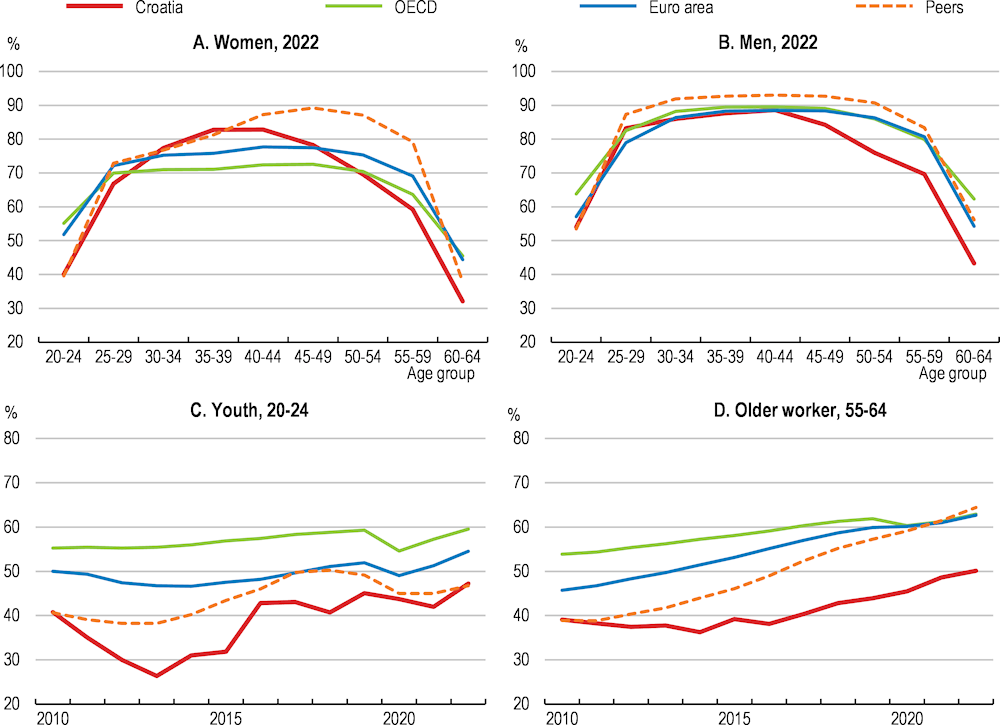

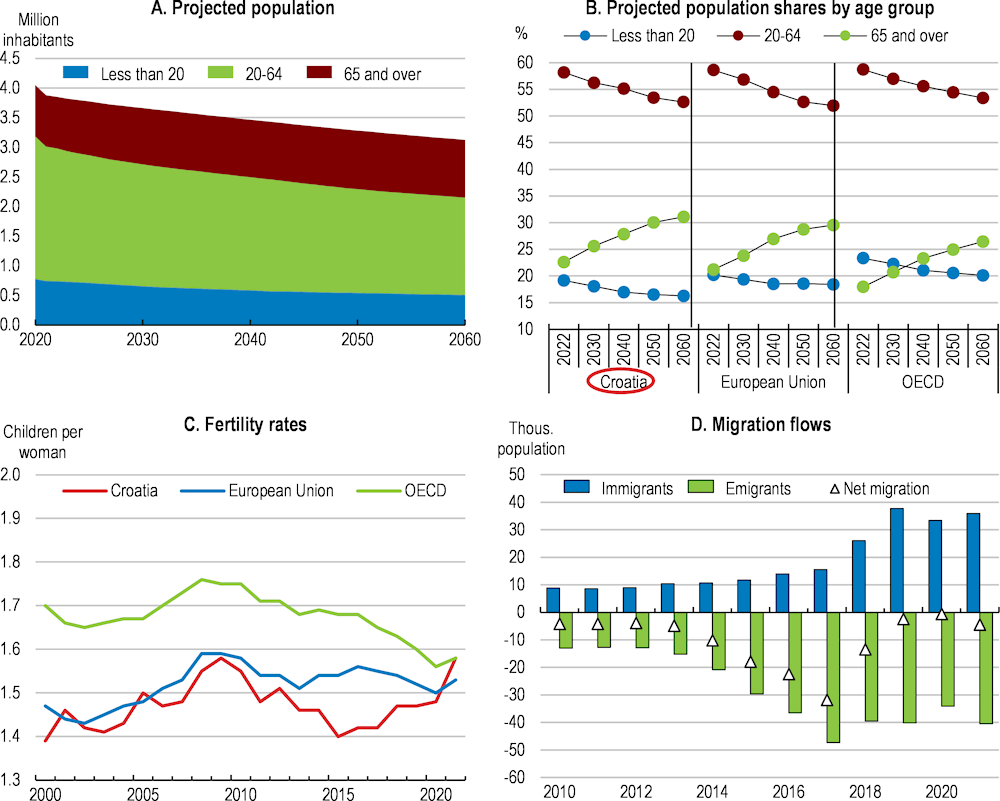

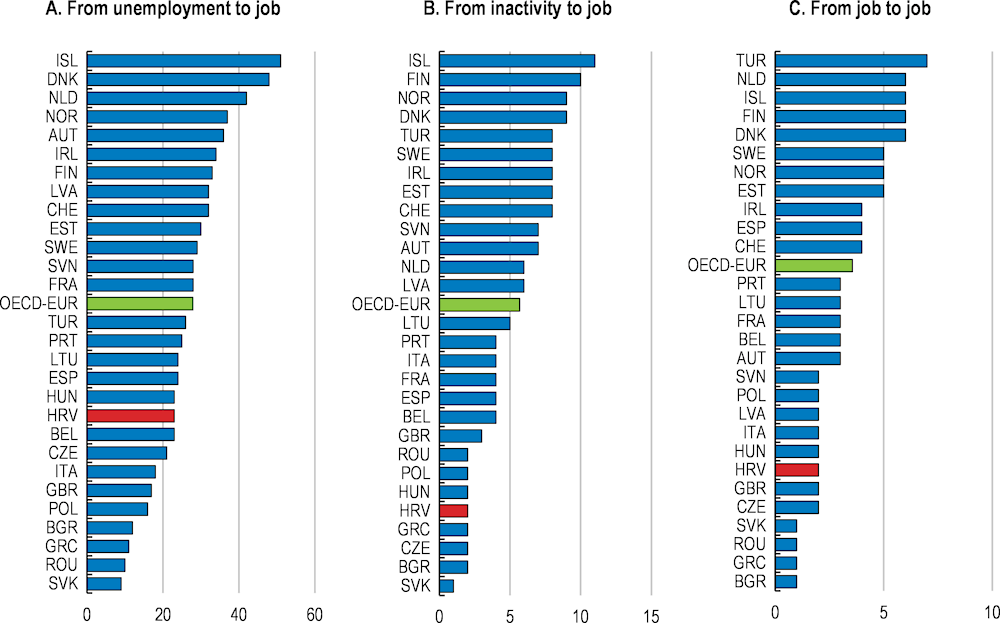

A second, related core challenge is to raise the share of adults in formal work. Working lives in Croatia are relatively short, especially among adults with low skills living in lagging regions, and informal or undeclared activity remains significant (discussed in Box 2.9). Across groups, labour market participation lags peers and OECD countries among the young and older adults, while the share of prime-age women in employment is comparatively high (Figure 4.4) Active labour market measures provided through the public employment service have lacked the capacity to help individuals improve their employment situation and fall short of needs particularly in Croatia’s lagging regions. These shortfalls in employment rates add to the challenge of a declining working-age population following decades of low fertility and significant emigration in the wake of the deep recession of the early 2010s. The number of adults aged between 25 and 64 is expected to decline by almost one-quarter between 2020 and 2050, faster than the overall population (Figure 4.5). Data suggest compromised labour mobility may be one constraint to higher labour force participation and career progression. Workers change jobs less often and those out of work are less likely to move into jobs than in many OECD countries (Figure 4.6).

Figure 4.2. The structure of Croatia’s workforce in international comparison

Note: Peers is the unweighted average of Czech Republic, Hungary, Slovak Republic and Slovenia.; Panel A: Agriculture includes forestry and fishing; Industry includes energy; Distributive trade includes repairs, transports, accommodation and food service activities, Other business services include: information and communication, financial and insurance activities, real estate activities, professional, scientific, technical activities, administrative and, support service activities; Public sector includes public administration, compulsory social security, education and human health.

Source: OECD National accounts (database); OECD Structural Business Statistics (database); and OECD Labour Force Statistics (database).

Figure 4.3. Raising the share of workers with advanced skills would address a key challenge

Source: EIB (2022), Investment Survey; Eurostat.

Figure 4.4. Croatia can further raise employment rates of younger and older adults

Employment rates, % of population

Note: Peers is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia.

Source: OECD Labour Force Statistics (database).

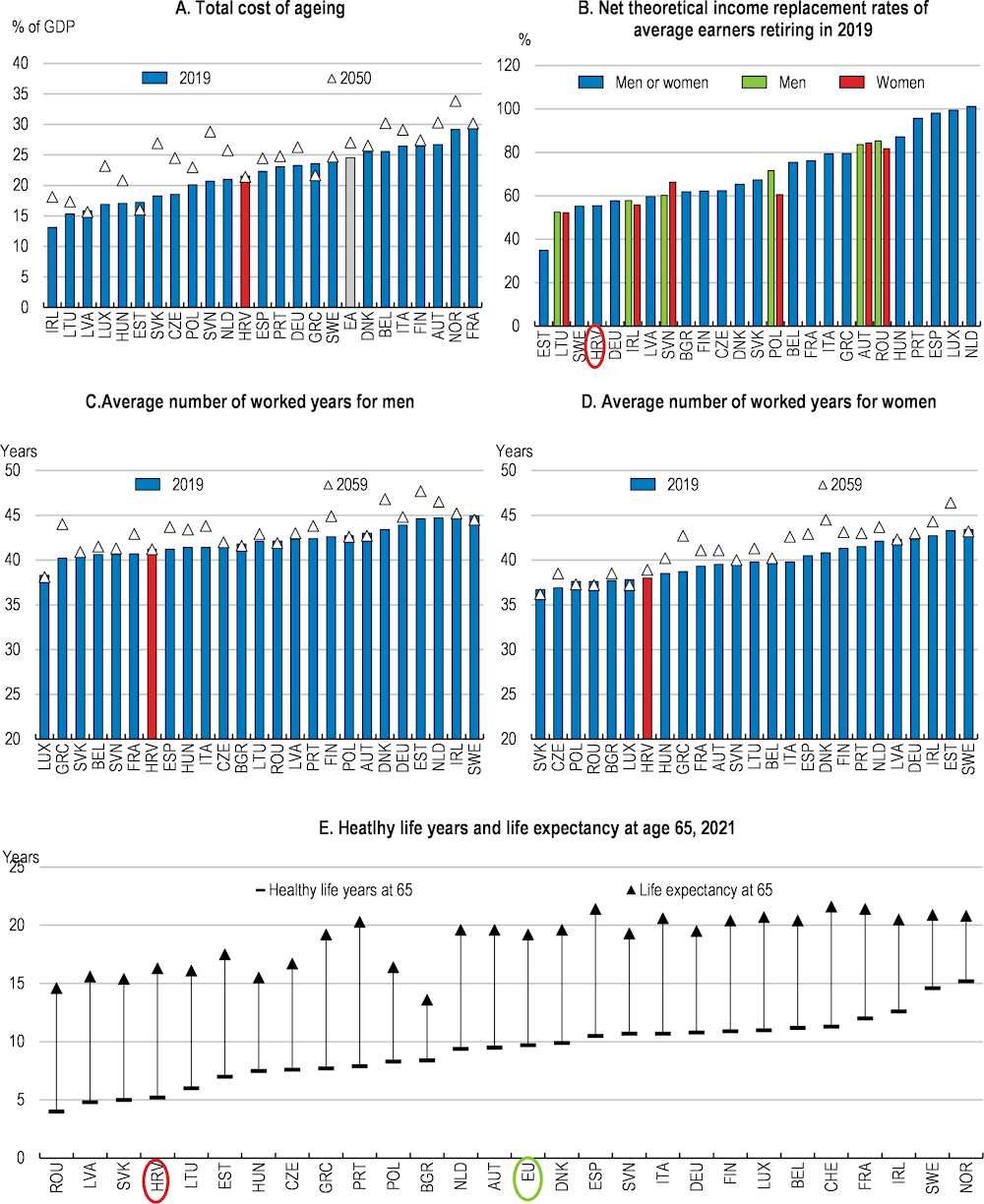

Housing and pensions policies have a role to play in addressing these two core challenges, and in raising the share of adults in work and improving well-being. Many adults who want to relocate to areas with greater opportunities face the practical impediment of a thin rental market and high and rising house purchase prices. Also, there is some evidence of overcrowding in housing. Ensuring there are no undue disincentives to continuing work among older cohorts is a key consideration for pension policies and reducing retirees’ risk of poverty.

Figure 4.5. Low fertility and net out-migration contribute to an ageing and declining population

Source: OECD Population Statistics (database); OECD Family Statistics (database); and Eurostat.

The government is accelerating reforms and investments to improve the labour market’s performance, led by measures in its Recovery and Resilience Plan. It aims to raise the employment rate from 63.4% in 2021 to 70% by the end of 2024, which would be 2 percentage points above the OECD average and would represent remarkable progress. This Chapter presents priorities that align with and extend this agenda, towards strengthening how Croatia’s labour market supports incomes, productivity and well-being. Primordial is a stronger push to raise skills, and other measures can support participation and movement to higher-productivity jobs:

Investing in active labour market policies, skill development and helping adults transition into and between jobs can help those with little experience of formal work transition into sustained career.

Greater support to caregivers, by improving access to early childhood education and care and by making workplace arrangements more flexible, can reduce the obstacles for adults having careers, families and engaging in education.

Gradually strengthening the social safety net, as fiscal conditions and measures to reduce informality allow, can improve inclusiveness while giving workers more confidence to shift jobs.

Reforming housing taxation and construction approval processes can mobilise more of the existing stock for rental and purchases, and encourage new dwelling construction, making it easier for workers to relocate to Croatia’s most economically dynamic areas.

Creating incentives and support for older workers to continue working and to further build their pensions can extend their contribution to the economy and improve their quality of life in retirement.

Raising skills for a more productive and dynamic workforce

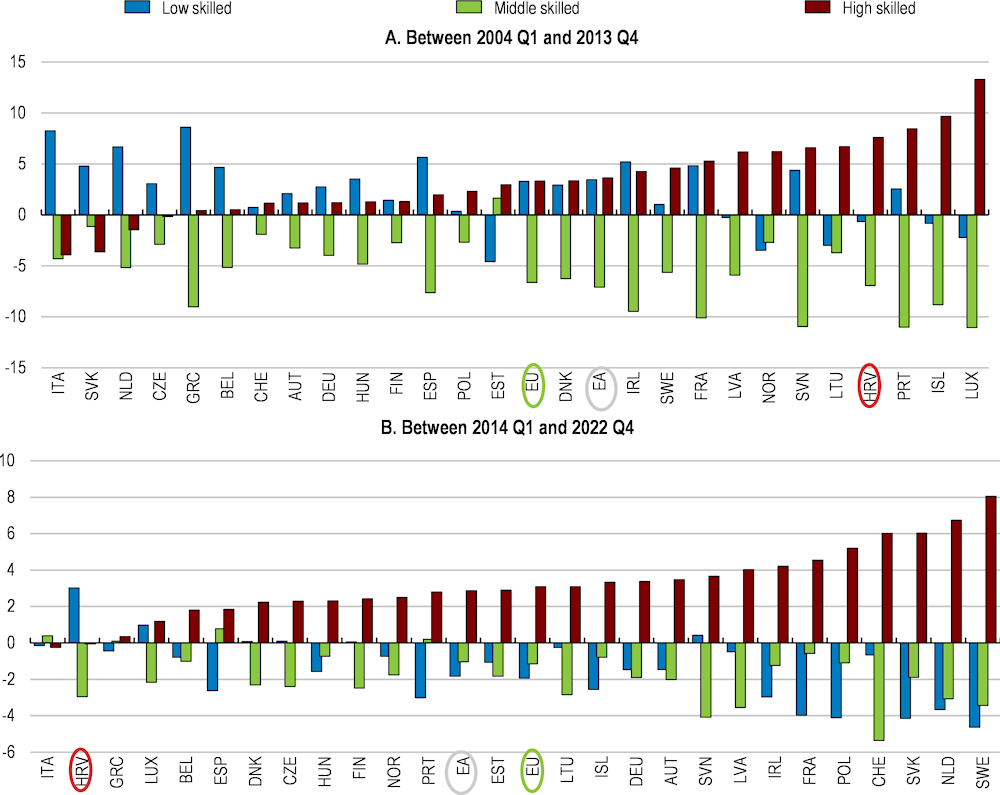

Levels of education are increasing but remain well below those of many OECD countries. High shares of Croatia’s working age population have not gone beyond intermediate levels of education (Figure 4.3). The share who has completed tertiary education is rising fast among the younger population but is still only one in five across the population, well below OECD and EU averages. A relatively modest share of mostly older adults has only completed very low levels of education. Relatively low shares of the workforce are over- or under-skilled for their current jobs (ILO, 2021[1]). In the workforce, the growth in employment over the past decade has been led by low-skilled jobs relative to moderate- and high-skilled jobs (Figure 4.7). Digital skills exemplify Croatia’s broader skill patterns. A larger share of Croatia’s population has above-basic digital skills than the European averages, especially among cohorts who are younger or more educated. However, a large shortfall remains in ICT specialists, who make up a lower share of the workforce than the EU average, and this shortage impedes businesses’ integration of digital technology and ability to achieve the digital transformation (European Commission, 2022[2]).

Figure 4.6. The labour market could be more dynamic

Annual averages of quarterly labour market transitions, 2022, %

Note: Annual averages of quarterly transition probabilities estimated by Eurostat. Transitions from unemployment to job are expressed as share of previously unemployed people, while job-to-job transitions are expressed as share of previously employed persons and transitions from inactivity are expressed as share of previously inactive people.

Source: Eurostat.

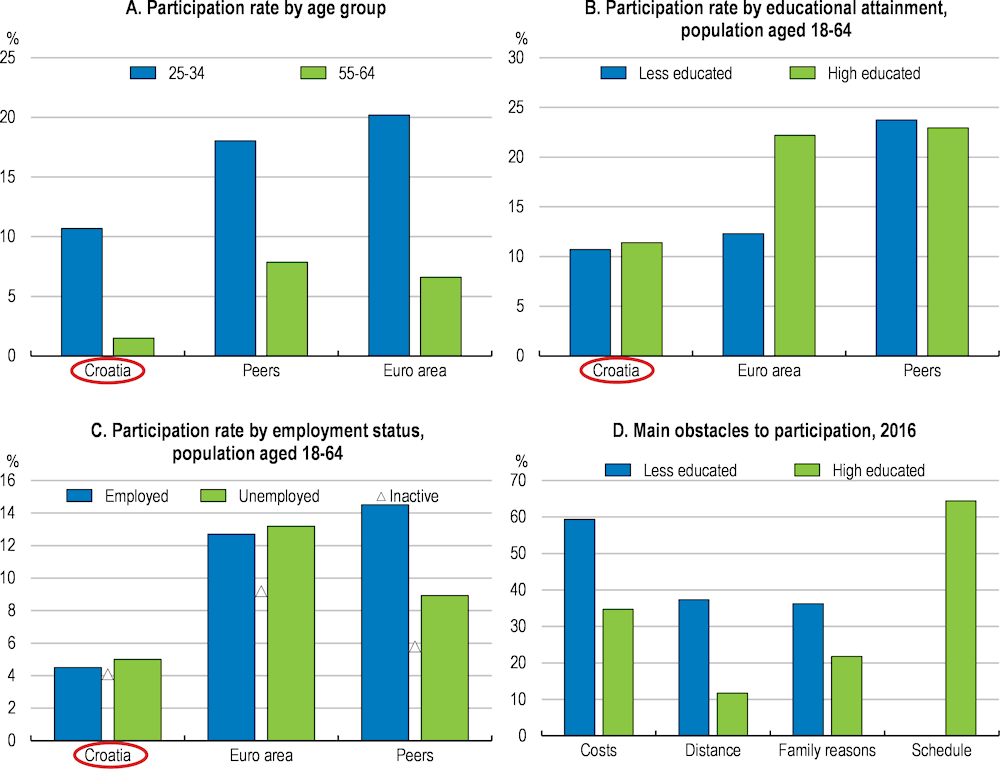

Upgrading adults’ skills

Croatia’s adults can build on their high completion rates of intermediate education by participating more in formal and informal skill upgrading programmes. More adult skill training can also help the minority with low levels of education reduce their risk of economic and social exclusion. Very few adults in Croatia, lower shares than in most OECD countries, participate in ongoing education, regardless of their previous education or engagement in the labour market (Figure 4.8). Survey data show four-fifths of respondents who did not participate in adult learning did not want to. This is despite more qualified workers receiving significant wage premiums, higher than in many OECD EU countries (Pipień and Roszkowska, 2018[3]), (Botrić, 2016[4]). Key reasons for not participating included the cost of training, and inflexible scheduling (Figure 4.8, Panel D). Raising adults’ participation in skill development will require addressing both training supply and demand.

Expanding access to quality skill-upgrading programmes

Croatia is raising the number of adults engaging in adult education with a voucher programme that targets groups in greatest need of skill upgrading. Introduced in 2022, the scheme is funded by the Recovery and Resilience Plan, which limits the programme to digital and green skills. Vouchers are awarded based on an assessment of skills conducted by the Croatia Employment Service’s officers. The programme’s initial capacity is modest. The government plans to cover 26 400 people in the programme, including 13 000 who are inactive, long-term unemployed, or young people not in education or employment by 2025. In late 2022, the labour force survey reported 91 000 people aged 15 to 29 years to be out of employment or education, and 107 000 aged 25 or older were long-term unemployed, while the Croatian Employment Service had 118 000 registered unemployed.

Demand in its first year has exceeded providers’ capacity for digital skills programmes but has lagged for green skills. Participants have been predominately higher-skilled adults, who often are already in work and want to deepen their skills, rather than lower-skilled adults out of the workforce. In response, the government is expanding the programme, while ensuring that more places provide the broader training needed by lower-skilled adults out of employment. The strong initial demand and the government’s planned expansion, in a context where motivating adults to participate in education programmes has been challenging, are welcome and merit being further pursued.

Figure 4.7. The share of low-skilled jobs has grown over the past decade

Percentage point change in share of total employment

Note: Total employment refers to civilian employment excluding agricultural workers. High-skilled occupations include jobs classified under the ISCO-88 major groups: legislators, senior officials, and managers (group 1), professionals (group 2), and technicians and associate professionals (group 3). Middle-skilled occupations include clerks (group 4), craft and related trades workers (group 7), and plant and machine operators and assemblers (group 8). Low-skilled occupations include service workers and shop and market sales workers (group 5), and elementary occupations (group 9).

Source: Calculations based on Eurostat data.

Further measures to increase the availability of adult education courses would help make the voucher system a success and more broadly strengthen adult education. These could include:

Figure 4.8. Few adults participate in training, partly due to programmes’ cost and inflexibility

Participation rate and obstacles to participation in education and training, % of the population, 2022

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. Includes formal as well as non-formal education and training. The reference period for participation is the four weeks prior to the interview. Low educational attainment refers to below upper secondary education (ISCED 0-2) and high refers to tertiary education (ISCED 5-8).

Source: Eurostat.

Expanding the number of educational programmes that meet the voucher programme’s standards. Croatia already has over 350 institutions providing adult education which could be brought into the programme. Implementing the 2021 Law on Adult Education’s new framework for quality assurance in adult education would provide greater transparency to participants.

Developing distance learning opportunities could expand access to education for adults, notably those in lagging regions, and for those with busy schedules. Adult education providers in many OECD countries have shifted to hybrid formats, for example with part of course work provided online. Legal reforms in 2021 allow all educational programmes to be taught at distance, subject to the approval of the Agency for Vocational Education and Training and Adult Education. Introducing territorial targets for the number of training voucher users could motivate providers to reach under-served populations.

Building greater flexibility into the design of adult education programmes can help adults tailor learning programmes to their capacity and schedules. A system of learning credits, aligned with the European Credit Systems and the Bologna process, can support this. Croatia adopted a renewed classification of complete and partial qualifications and associated them with the national qualifications framework in 2018. The system has been only partly implemented and does not yet allow programmes to be tailored (European Commission/EACEA/Eurydice, 2021[5]). Implementing the 2021 Law on Adult Education’s recognition of micro-credentials and obliging providers to harmonise educational programs with the occupation and qualification standards registered in the Register of the Croatian Qualification Framework would be positive steps.

Providing more opportunities for those who have not completed lower secondary education, with a special focus on vulnerable groups (e.g., Roma). To access higher level adult education programmes, participants must have completed lower secondary education. The government finances this training. Still, it adds a barrier for the mostly older adults who have completed only basic schooling. A number of OECD countries allow these adults to access shorter, practical VET programmes. In countries without a minimum education-level requirement, such as Ireland, Finland or Sweden, the education provider has the discretion to determine if a candidate has the necessary knowledge or skills to complete a learning programme.

Encouraging greater demand for adult education and training

Croatia provides income support and subsidises programme costs for those undertaking educational programmes, prioritising those with the fewest qualifications. However, this support may be insufficient for many potential participants. Further, the process for providing financial support is relatively bureaucratic, which may impede access or scaling-up programmes. For example, for subsidies for primary education for adults (osnovna škola za odrasle), the Ministry of Science and Education covers programme costs and provides the Croatian Employment Service (CES) the names of those enrolled. Registered unemployed can receive reimbursements of their transport costs and income support of 50% of the gross minimum daily wage less compulsory social security contributions of 20%. This support may be insufficient to motivate adults to forgo employment income. At the same time, income support needs to be designed to ensure that it does not discourage participants from completing their studies and starting work.

Measures that improve the transparency and comparability of skills can raise demand for skill training programmes. In 2018, Croatia adopted a renewed classification of complete and partial qualifications and associated them with the national qualification framework. Recruiters report that this is helping to set national standards for courses. Greater progress can be made to applying the Quality Framework for Traineeships standards to open-market traineeships (non-mandatory, bilateral, and private agreements agreed between a trainee and a traineeship provider) (European Commission, 2023[6]).

Croatia’s introduction of a credit system for adult learning courses is welcome, but implementation is lagging. The system does not allow study programmes to be customised to an individual’s needs and capacities. Currently skills are validated primarily through labour market participants. Croatia has committed to recognise prior learning. Adopting a system, similar to many OECD countries, of an independent or neutral institution that validates education courses, would improve the transparency and attractiveness of adult learning, and reduce barriers for adults with few qualifications. Being able to obtain generally recognised post-secondary qualifications through adult education courses, especially in an environment where such qualifications are rare, could further motivate participation.

Skill audits can help encourage more adults to upgrade their skills. Croatia is one of a minority of European countries that provides skills audits (or skills assessments) of those registering as unemployed or at risk of unemployment (European Commission/EACEA/Eurydice, 2021[5]). Modest, although higher than the EU average, shares of working-age adults report receiving free information or advice. This maps out skills acquired through work experience, and supports job matching and training. Greater use of skill audits can help adults whether in employment or out of the workforce to analyse their career background, position in the labour force, and plan training needs or validate non-formal training.

Croatia is developing a system to validate non-formal and informal learning outcomes, aligning standards with the learning outcomes laid out in the Croatian Qualification Framework Registry. Measures introduced with the new training voucher (discussed above) are strengthening this accreditation. Such validation adds value to participating in adult learning and helps employers identify candidates with needed skills, and merits being implemented and its effectiveness monitored.

Engaging children in education from an earlier age

Children’s participation in early childhood education and care, at near 80%, lags most OECD countries and is exceptionally low among children younger than three. This is due in part to compulsory school attendance starting late, even after recent reforms lowered it to the age of six years. The availability of places falls well short of demand for children below the age of compulsory schooling. Costs are not a primary barrier to enrolling children. In Croatia, parents contribute to the cost of early childhood education and care for the years prior to compulsory pre-school. Still, the net fees for children of all ages are low relative to incomes, even if they vary between localities, reflecting in part the high share of places provided publicly. Even though parents from vulnerable groups receive targeted support for childcare costs and preferential access to places, children from more advantaged backgrounds are better able to secure places, contributing to a larger enrolment gap between the two groups than in most OECD countries.

The government is using Recovery and Resilience Plan resources to expand the number of places available, with the commendable goal of raising enrolment rates among children aged from 3 years to school age from 76.3% in 2018 to 90% in 2026, and to 96% by 2030. Expanding access to childcare can make inroads into several of Croatia’s long-term challenges. It is associated with stronger educational progress at school, particularly benefiting children from disadvantaged households. It can improve the inclusiveness of the labour market and reduce gender inequalities (OECD, 2017[7]) (Matković, Dobrotić and Baran, 2019[8]). When affordable facilities are not accessible or not trusted, families often turn to their extended family to care for children. While this may reduce costs, there is often less attention to learning, and relying on this care makes relocating more difficult.

The long gap between when parental leave expires and when guaranteed places in kindergartens becoming available can be a barrier for women who are considering having children. Even if a place can be found, the preschool year is short. In practice, hours are also short in the compulsory early childhood education and care system and the government aims to increase the number of hours during the compulsory year of preschool from 250 to 700. Extending them to at least standard school hours, and ideally standard work hours, would help parents manage the demands of care and work, especially if they have children in different levels of the education system. For example, in the Czech Republic facilities are available for up to 60 hours per week, while in Slovenia, 98% of children attend full-time kindergarten programmes offering six to nine hours per day (30-45 weekly hours) (European Commission/EACEA/Eurydice, 2019[9]).

Ensuring schools provide solid educational foundations

Strengthening Croatia’s school system has been, rightly, a high public priority for many years. Croatia’s schooling compares favourably with many OECD countries on several dimensions including completion rates, equality of opportunity and outcomes, student well-being, classroom discipline and bullying. Also, resources for education in Croatia appear relatively ample. Overall spending on education, at above 5% of GDP, is higher than many OECD countries. Pay rates for teachers are comparable to other countries relative to GDP per capita, teacher-to-student ratios are comparatively low, especially for tertiary education, and relatively few principals report staff shortages.

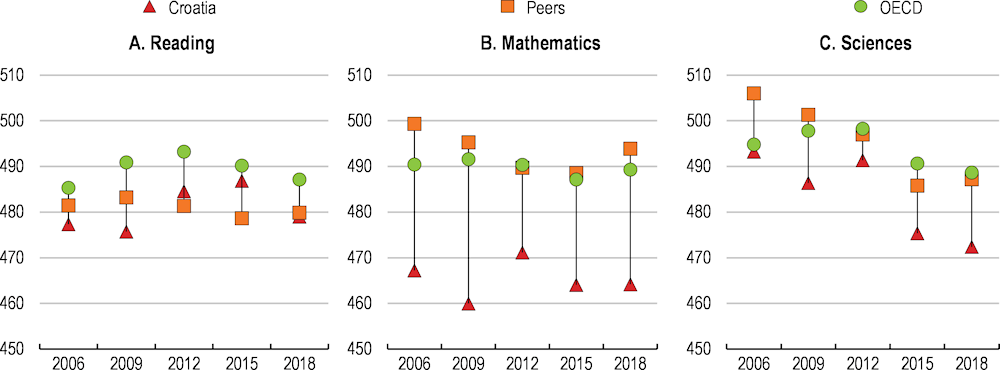

However, there remain shortfalls in learning performance, particularly in mathematics and science. The OECD’s Programme for International Student Assessment (PISA) tests suggest that Croatia’s 15-year-old students lag significantly behind their regional peers or the OECD average, especially for mathematics, and their performance has declined for sciences notably among the lowest-achieving students (Figure 4.9). Comparatively high shares of parents use after-school tutoring, which also suggests teaching in schools may be underperforming, adding to the pressures to achieve well on the state exam. There remain important gender differences, such as in study interests, for example: 11% of high-performing boys but 1% of high-performing girls want to study ICT (Avvisati et al., 2019[10]).

Croatia is using its Recovery and Resilience Plan to improve education. For older students, strengthening vocational education is appropriately a high priority. To encourage greater participation in education in STEM and in ICT, the government’s Recovery and Resilience Plan provides grants to develop scholarships in related subjects and to promote these fields from the earliest levels of education. The government is improving curricula, and developing new teaching materials, training opportunities for teachers and regional skill centres. More than half of 15-year-olds in Croatia were enrolled in vocational programmes, compared with 14% on average in OECD countries, highlighting vocational schools’ central role in providing education. Analysis of the PISA data suggests that Croatia could improve schools’ performance and students’ foundation and job skills by extending schools’ teaching time, developing educators’ autonomy and accountability, and by providing students with greater guidance about their subject and career choices (OECD, 2020[11]).

Limited classroom space has impeded raising school hours to lengths typical of most European countries. Hours in class are comparatively short in Croatia and shorter hours are statistically associated with poorer results on standardised tests, especially among students from disadvantaged backgrounds. Many schools run multiple shifts of classes over the day to make full of use of their classrooms, which creates challenges in scheduling for schools, students and parents. The scheduling problems mean 80% of students and over 90% in disadvantaged schools report taking additional classes outside of normal school hours (OECD, 2020[11]). To an extent, declining student population is freeing up classroom space to achieve this but new school facilities are also needed.

Figure 4.9. Croatia’s education needs to improve, especially in mathematics and sciences

Mean PISA score in reading, mathematics, and sciences

Note: The unweighted OECD average covers all OECD countries depending on data availability. Unweighted average of Peers covers Czech Republic, Hungary, Slovenia, and Slovak Republic.

Source: OECD, PISA 2006, 2009, 2012, 2015 and 2018 databases.

Developing greater autonomy for educators and schools, accompanied by ensuring accountability, can improve educational outcomes. Schools in Croatia have had limited autonomy, notably in curriculum and assessment, and in allocating resources. Developing autonomy requires investing in teachers’ and school administrators’ capacities. This autonomy better supports schools’ performance when accompanied by transparent accountability around educational performance. Relatively few schools post achievement results publicly in Croatia, and the share doing so declined between 2006 and 2018 (OECD, 2020[11]).

The government’s ‘whole day’ schooling reform is its flagship programme to address many of the school system’s challenges. It focuses on primary school, and its first pilot will commence with the 2023/24 school year, with full implementation expected by 2027/28. It will bring harmonised hours and support for students after class. It will provide teachers with greater resources and flexibility to adapt learning to students’ needs, and will expand access to extracurricular and extra-academic education for all students, with the goals of improving students’ achievements, reducing inequalities and improving teachers’ working conditions. Implementing these reforms effectively will require good dissemination strategies, for instance to inform and train teachers in curriculum changes. Implementation will also need strong coordination across levels of government and across agencies, for example by ensuring that local governments, which are responsible for maintaining school buildings, have the resources and capacity to do so.

Guidance about how students can best structure their studies to achieve their career ambitions and be ready for labour market needs improves job-readiness and students’ satisfaction and ambition. However nearly 30% of students in Croatia do not have access to such guidance, a share that is much higher than most OECD countries and has risen over the past decade, although, encouragingly, such guidance is more readily available in disadvantaged schools. Career guidance helps students (as well as adults out of school) make informed choices about their education and occupation. Students who receive career counselling focus more on their studies (Rupani, Haughey and Cooper, 2012[12]). Low-achieving and low-income students tend to benefit the most, as they are less likely to have other sources of information and assistance. To achieve this, Croatia can pursue plans to develop its career guidance system, and ensure that students have access to guidance prior to key decision points in their studies such as when selecting subjects for the final years of secondary schooling (OECD, 2004[13]; OECD, 2019[14]).

Helping youth graduate into work

While Croatia’s youth unemployment rate has fallen dramatically over the past half decade, many youth struggle with the transition from study to work. The share neither working nor in education is higher than in many OECD countries (Figure 4.10). This joblessness weighs heavily on those individuals’ life-time employment, income and well-being prospects (Schmillen and Umkehrer, 2017[15]). Efforts are underway to improve the vocational education system, and the preparation for work from schooling, and realising these can help improve the job-readiness of Croatia’s youth.

Greater access to effective career guidance in schools would help students choose studies that better suit both their interests and the labour market’s needs. It can strengthen social mobility by informing young people of career paths that their family and social networks may not suggest. However, career guidance services were not available to over one-quarter of students in Croatia’s schools in 2018, and to nearly 15% of disadvantaged students, well above the OECD average (OECD, 2020[11]).

Improvements to vocational education and training at the high school level can help reduce the numbers of young people neither in work nor in education. A relatively high share of upper-secondary school students is enrolled in vocational education and training schools. Modernising these schools’ curricula to better align with employers’ current and future needs and students’ interests, and incorporating greater work-based learning can improve students prospects of successfully transitioning from school to work. The government is expanding the place of in-work experience in educational programmes, which is welcome. Pursuing planned reforms in these directions would be an appropriate complement to the whole-day school reforms (discussed above).

Ensuring that more vulnerable youth enter and complete apprenticeship programmes is a challenge in Croatia, as it is in many OECD countries. At-risk youth may lack the motivation and skills to find a position for an apprenticeship or to complete it, with high non-completion rates in many countries (OECD, 2014[10]). Croatia is currently reforming its programmes dedicated to higher-risk youth. These focus on developing essential practical skills for performing less demanding work so students are job ready. It may consider developing pre-apprenticeship programmes targeting disadvantaged youth. In OECD countries including Austria and Germany, such programmes prepare young people by improving their skills, building motivation, familiarising them with work routines and giving them short spells of work experience (OECD, 2018[16]).

Improved apprenticeship renumeration should also be considered. A study found the low levels of income provided to trainee participants younger than 30 in Croatia (50% of the minimum wage, less the 20% social contribution) discouraged youth from participating in the programme. Very low wage rates for trainees risks leading employers to cycle through trainees rather than recruiting and developing staff, and can make participation difficult for those coming from disadvantaged backgrounds. Currently in Croatia employers of young people undertaking workplace training are not obliged to contribute to trainees’ social security, which excludes some trainees from certain benefits. A public consultation found that ensuring participants receive social security benefits while participating in traineeships would improve traineeships’ attractiveness (European Commission, 2023[6]).

Figure 4.10. A significant share of young people is neither employed or in education

Percentage of 18–24-year-old NEETs (neither employed nor in education or training), 2022 or latest available

Making the most of immigrants’ and returning emigrants’ skills

Increasing numbers of young and skilled immigrants are helping Croatia address skills shortages. Immigration can also help to counter the ageing workforce. Croatia received significant inflows of migrants over the 1990s and early 2000s especially, largely related to movements during the 1990s’ wars. About 10% of the population aged between 15 and 64. was born outside of Croatia, but largely speak Croatian and have Croatian nationality. The composition of immigrants is changing and is likely to change further over coming years and numbers are set to rise, following Croatia’s integration into the Schengen area and the introduction of skilled immigrant visas (Figure 4.5).

The skilled immigration strategy could be improved. The recently introduced approach provides immigrant working visas following requests from employers, where the employer reports a skill gaps. A more proactive approach would be to anticipate the labour market’s needs and to seek immigrants with the needed skills. Croatia is planning to augment its policy with new measures to support immigrants’ education and training as part of its Recovery and Resilience Plan. However, more courses helping immigrants integrate into Croatian society should be considered, such as encouraging immigrants to participate in Croatian language classes. Currently the government only provides such classes to immigrants under protection visas, and some employers provide them too. Participation in language and cultural courses could be combined with a skills and job assessment. An evaluation of such a combined programme in Switzerland found that it improved immigrants’ training and integration (OECD, 2022[17]). Immigrants’ qualification and skills could be better recognised. Currently recognition processes can be long, bureaucratic and costly. For instance, they have contributed to highly qualified refugees from Ukraine taking low-skilled jobs.

Emigration from Croatia rose considerably when Croatian citizens could move freely to other member countries of the European Union. Between 1 July 2013, when Croatia joined the European Union, and 2020, departures rose to average almost 33 000 per year and peaked at over 47 000 in 2017. Approximately 44% of these emigrants were aged between 20 and 39, the equivalent of 1.5% of residents in this age group. This compares with a little over 10 000 residents emigrating each year on average between 1999 and 2012. Flows fell over the COVID crisis period, but recent anecdotal reports suggest that emigration of younger, skilled workers remains a drag on the labour market.

Emigrants can benefit Croatia’s economy. Workers’ remittances reached EUR 5.1 billion (7.6% of GDP) in 2022, comprising employee compensation from residents of Croatia working elsewhere and from personal transfers from those residing outside Croatia. In the longer-term, the measures discussed throughout this Survey to expand opportunities for the young and for productive businesses, by improving Croatia’s business environment, government effectiveness and reducing corruption, are among the most effective means of ensuring skilled residents stay and encouraging emigrants to return (Carling and Talleraas, 2016[18]). Croatia is developing efforts to encourage emigrants and their descendants to return, such as the Scholarship for Croatian Language Learning programme, or the “I choose Croatia” scheme. Additional measures could be considered (Box 4.1).

Box 4.1. Policies to encourage emigrants to return

Several OECD countries have developed policies to maintain a global network of emigrants and to support and encourage those who wish to return, such as Ireland’s ‘Global Irish’. Some countries, such as Lithuania and Poland, have developed dedicated information services to communicate to emigrants who left for better economic opportunities elsewhere on the improved situation in their origin country. To support returnees, some countries integrate support with that for immigrants. This can include dedicated one-stop shops providing access to social support services, or dedicated employment services (Lithuania or Spain’s “Service Labour Mediation”). Programmes such as Ireland’s “Back for Business” mentoring programme provide returning emigrants with business mentoring and support for creating a business plan, on financial management skills, navigating bureaucratic processes, and accessing finance. To enhance financial incentives to return, several countries provide reduced tax rates or other financial incentives, including Greece, Portugal and Lithuania.

These policies have succeeded in supporting limited numbers of returning emigrants relative to the outflows. Some OECD members and partners, including Mexico, Colombia and South Africa, have struggled to achieve significant return migration flows. Constantly evaluating and adjusting policies supporting returning emigrants can contribute to more effective programmes. Overall, ensuring a supportive economic environment and growing opportunities and prospects, as discussed in Chapter 3, is likely to be the most effective means of limiting emigration and encouraging emigrants’ return.

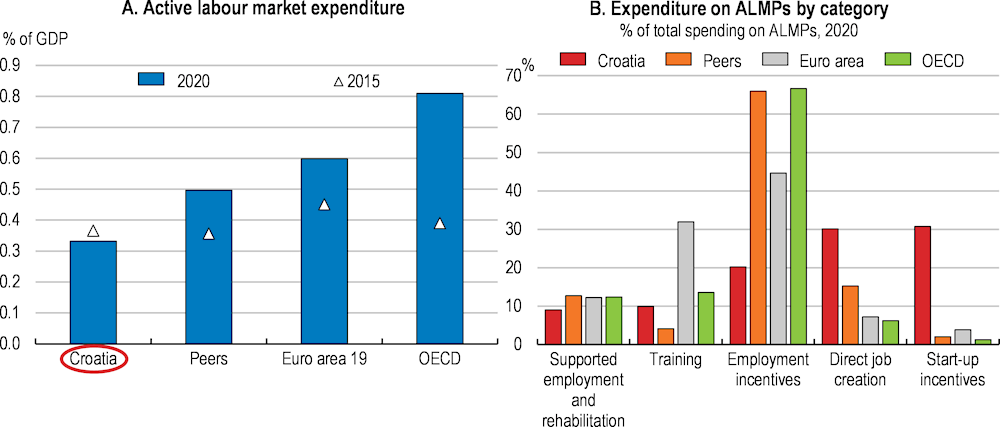

Improving active labour market policies

Over the past 15 years Croatia has been developing a system of modern active labour market policies, and spending is comparable to Croatia’s peers and many OECD countries (Figure 4.11). Initially these efforts focused on employment through direct job creation and start-up incentives or self-employment subsidies. Assessments suggest these policies have been effective at getting the recently unemployed with skills and experience back into work. Their effectiveness has been weaker among those with short or disrupted work histories and with lower skills (Srhoj and Zilic, 2020[22]). This is consistent with assessments of the effectiveness of active labour market policies internationally (Card, Kluve and Weber, 2017[23]).

Croatia’s development of active labour market policies has more recently focused on strengthening the Croatian Employment Service and expanding support for training and education. Such measures are often among the more effective for the groups that Croatia now needs to activate. Funding has grown significantly since the mid-2010s. The Recovery and Resilience Plan allocates EUR 277 million (0.4% of 2023 GDP) around four interventions that can further strengthen active labour market policies: i) the development of new activation policies; ii) a voucher system for adult education especially in green and digital skills (discussed above); iii) strengthening polices for inclusion and the monitoring of vulnerable groups in the labour market; and iv) digitalisation of the public employment services.

Figure 4.11. Croatia’s spending to help people into work is comparable with peers and focused on job creation

Note: Peers is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. 2019 data shown given the exceptional measures introduced by all countries in response to the COVID-19 crisis in 2020.

Source: European Commission - Directorate-General for Employment, Social Affairs, and Inclusion (DG EMPL); and OECD Labour Market Policies (database).

Croatia’s strengthening of the public employment services includes the development of profiling and case management. These tools can adapt support to those with low education or with little time spent in formal work. Experience across countries is that youth new to the workforce, older adults and the long-term out-of-work, whose activation needs are greatest, tend to require greater resources to move into work. Tailored programmes provided by dedicated support services tend to be most effective (Kluve et al., 2016[24]). Croatia is also expanding its Lifelong Career Guidance Centre (CISOK) by increasing its monitoring capabilities and making it accessible to all citizens, but the programmes’ scale is modest.

Better linking activation and other social policies

A tailored programme of support for an out-of-work individual, applying a mix of social, educational and other resources, is more likely to lift that individual into a lasting job than more standardised interventions. Enabling the Croatian Employment Service to follow individuals through different types of support, including social support, education, job placement and training, and comprehensive job search, would improve outcomes. This requires high levels of communication and cooperation between different institutions and the ability to ensure that resources can follow individual jobseekers’ needs, often for extended periods, rather than undertaking one-off needs assessments or short interventions. The development and planned expansion of a voucher system for vocational training (discussed above), in part administered by the Croatian Employment Service, are steps in the right direction, as is the introduction of social mentoring services for particularly socially disadvantaged individuals. However effective coordination and extended support has been a challenge in Croatia (European Commission, 2020[25]; Cipcic, 2019[26]). Developing these would constitute a useful next step in Croatia’s upgrading of its active labour market policies.

Croatia’s formal activation requirements for access to unemployment benefit are stricter than in most OECD countries. Activation support when combined with some sanction mechanisms linked to social support can raise employment rates. However, excessively punitive enforcement of activation requirements can be counterproductive. Studies in some OECD countries over periods when activation requirements and sanctions were particularly strong, such as the United Kingdom over the 2010s, have found that they can discourage the households with the greatest needs from engaging with services providing income support and other social services (Work and Pensions Committee, 2018[27]; Wright et al., 2016[28]). Excessively punitive sanctions may also discourage individuals from looking for work (Immervoll and Knotz, 2018[29]).

Croatia is making welcome investments in monitoring and evaluating the performance of the Croatian Employment Service. It is piloting customer and staff feedback surveys with plans to roll these out nationally once their design is completed. In 2025 it plans to review the effectiveness and outcomes of the programmes supported by its Recovery and Resilience Plan. Performance indicators can help shift the Croatian Employment Service and other providers from a managerial approach to one focused on achieving better outcomes.

Tailoring activation policies to regional needs

Differences in employment rates between regions are large considering Croatia’s relatively small size. Yet, the Recovery and Resilience Plan actions do not focus strongly on adapting support to varying regional needs (Figure 4.12). Currently services available in lagging areas such as Slavonia lack adequate capacity (Christiaensen et al., 2019[30]). The Plan proposes expanding the regional network of Lifelong Career Guidance Centres and greater tailoring of support measures to needs. However much of the policy builds on the existing management structure of active labour market policies. These are relatively centralised. For example, the central ministry defines objectives and leaves local operators with little autonomy in service provision (Corti and Ruiz La Ossa, 2023[31]).

Further developing local providers’ autonomy and access to additional resources, including more explicit focusing of active-labour-market spending in areas with lower share of adults in paid work, could help reduce these inter-regional inequalities. The ongoing investments in digitalising the public employment services can make inroads into the service’s process-heavy operations, which have limited staff’s time to work with jobseekers, and these efforts can benefit from further measures to transform the service’s internal operations to a greater service-delivery focus (European Commission, 2020[25]).

Figure 4.12. Employment rates vary considerably across Croatia

Note: Small countries having a population of less than 11 million are shaded. Regions are at the large (NUT2/TL2) levels, of which Croatia has four. Data refer to 2020 for Türkiye and 2019 for the United Kingdom.

Source: Eurostat.

Social protection to support employment, inclusiveness, and well-being

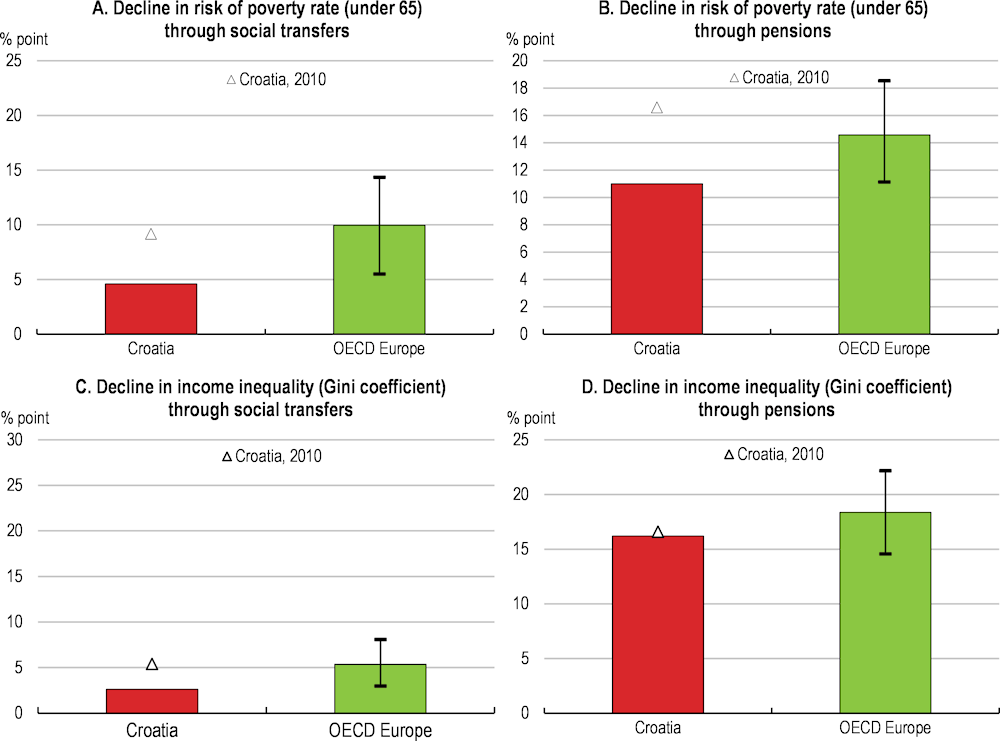

Croatia has made significant inroads into poverty in recent years to achieve rates comparable to many OECD countries (Figure 4.1). Rising employment and wages have contributed to much of this improvement. As in many countries, formal employment is the best protection from poverty. Poverty rates are highest among out-of-work younger households, and older households. The latter are often poor because short or disrupted employment has meant they have accumulated limited pension savings (discussed below). Disposable income is more equally distributed than in many OECD countries, largely as wages overall are relatively narrowly dispersed (discussed below) and through the income tax system.

Social protection spending can be better targeted. Overall social protection spending is higher than in many of Croatia’s peers, and near the average of OECD countries. However, a higher share than in most countries is not means tested. Significant shares of social benefits are provided to war veterans and the disabled without means testing. This squeezes the resources available to support other groups. Indeed, Croatia’s social transfers apart from pensions make smaller inroads into poverty and inequality than in most OECD countries (Figure 4.13). Boosting targeting can improve the effectiveness of social spending at reducing poverty and provide greater confidence to individuals suffering economic shocks or considering shifting jobs. Effective targeting systems can improve policy responses to shocks, such as the recent COVID-19 and energy price crises. Current approaches have led to much of the support being allocated to households who are not the most vulnerable. For example, about 14% of those who report great difficulty making ends meet received COVID-pandemic related government support, the lowest share across EU countries (Eurofound, 2023[32]). The planned digitalised household registers intended to identify individuals in need and eligible for support can greatly improve targeting. Such a system would bring Croatia’s social protection system ahead of many OECD countries. It will link together information sources including tax filings, demographic information and asset registers. Putting this to work this will require building public confidence in data integrity and confidentiality, especially if it is to encourage more informal activity to be declared.

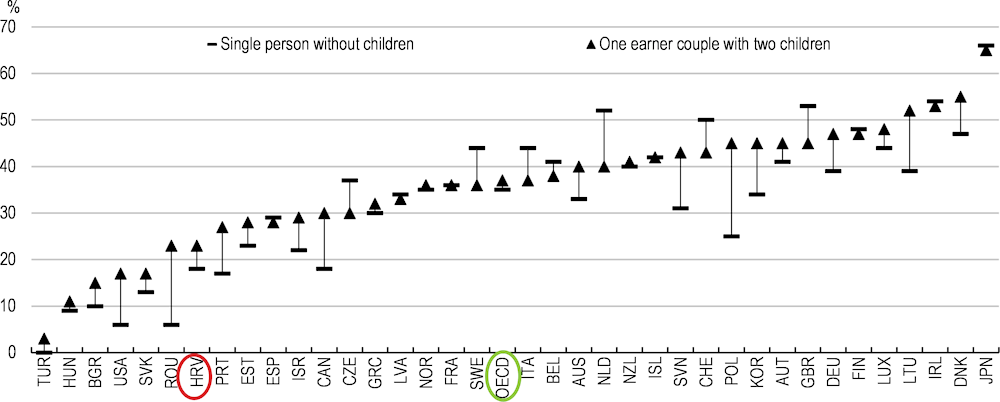

Developing the minimum social safety net

Croatia raised its main social benefits as part of its response to high energy prices (Chapter 2), following almost a decade of minimal nominal growth. For the lowest-income households, the ‘guaranteed minimum benefit’ is Croatia’s key social safety net. The benefit is lower than most OECD countries’ minimum benefit relative to the poverty line or median disposable income (Figure 4.14). Eligibility criteria are strict. If a recipient of the minimum income for at least six months enters employment, the benefit is withdrawn over three months, which is a positive design feature to encourage recipients to shift into work, rather than being withdrawn immediately. Measures in the Recovery and Resilience Plan, and recent and planned reforms of the Welfare Act are aiming to develop the link between the guaranteed minimum benefit system, other social transfers and access to employment and to social support and education services.

Croatia could also consider further developing an in-work benefit, for instance with reimbursable tax credits. It could follow other improvements to the social protection system, given the ongoing challenge of addressing un- and under-declared work. The design of further in-work support would need to avoid creating adverse financial incentives, for instance spikes in marginal effective tax rates with rising income, and to ensure that publicly funded social protection does not in practice subsidise employers' salary costs.

Figure 4.13. Pensions rather than social transfers reduce inequality and poverty in Croatia

Reduction in risk of income poverty and income inequality through social transfers and pensions, 2021 or latest available year

Note: “OECD Europe’ is an unweighted average of OECD countries that are EU members plus Norway, Türkiye, and United Kingdom. The whiskers show the range between the first and last decile of the OECD Europe. Panel A and B: Poverty rate is defined at 50% of median income.

Source: OECD calculations based on Eurostat data.

Figure 4.14. Guaranteed minimum income benefits are lower than in most OECD countries

Guaranteed minimum income amount, in % of median disposable income, 2022 or latest available year

Note: Adequacy of guaranteed minimum income is shown for a jobless person, for two sorts of family type: one single person without children and one earner couple with two children. The calculations include the impact of family benefits, housing benefits, taxes, and social contributions.

Source: OECD Benefits, Taxes and Wages (database).

Family policies to support higher quality employment and care

Effective family policies can support access to paid employment and reduce the obstacles in choosing to have children. In Croatia, women have fewer children than in most OECD countries. Fertility fell below the replacement rate of 2.1 in the late 1960s, and, since 2000, has fluctuated between 1.4 and 1.6. Of the relatively few households who do have children, nearly three-quarters have at least two.

In the labour market, the gaps in employment and wages between men and women are smaller than in many OECD countries. Nevertheless, challenges remain in addressing differences in treatment and outcomes both in and outside the workplace. ‘Glass ceilings’ appear to limit women’s pay rates accounting for their relatively higher education and skills (Figure 4.2, Panel E) (Nestić, 2010[33]). This is often attributed to time out from careers due to family and other care responsibilities, and may partly reflect many employers remaining inflexible on working hours or locations (Boll and Lagemann, 2018[34]). Part-time and flexible work arrangements are used less than in many OECD countries. Increase flexibility in work arrangements can help caregivers better juggle work and other tasks, and is increasingly shown to support more productive workplaces.

The tax-benefit system provides various cash payments for new parents, tax credits and cash transfers. Some distortive policies are being addressed. For example, Zagreb is discontinuing its subsidy for a stay-at-home parent in Zagreb (Novčana pomoć za roditelja odgojitelja), which provided a generous benefit to a non-employed parent who provided care for at least three children until the youngest child turned 15 years, and identifying and reforming similar policies elsewhere would be beneficial, and would complement measures to expand access to quality early childhood education and care discussed above.

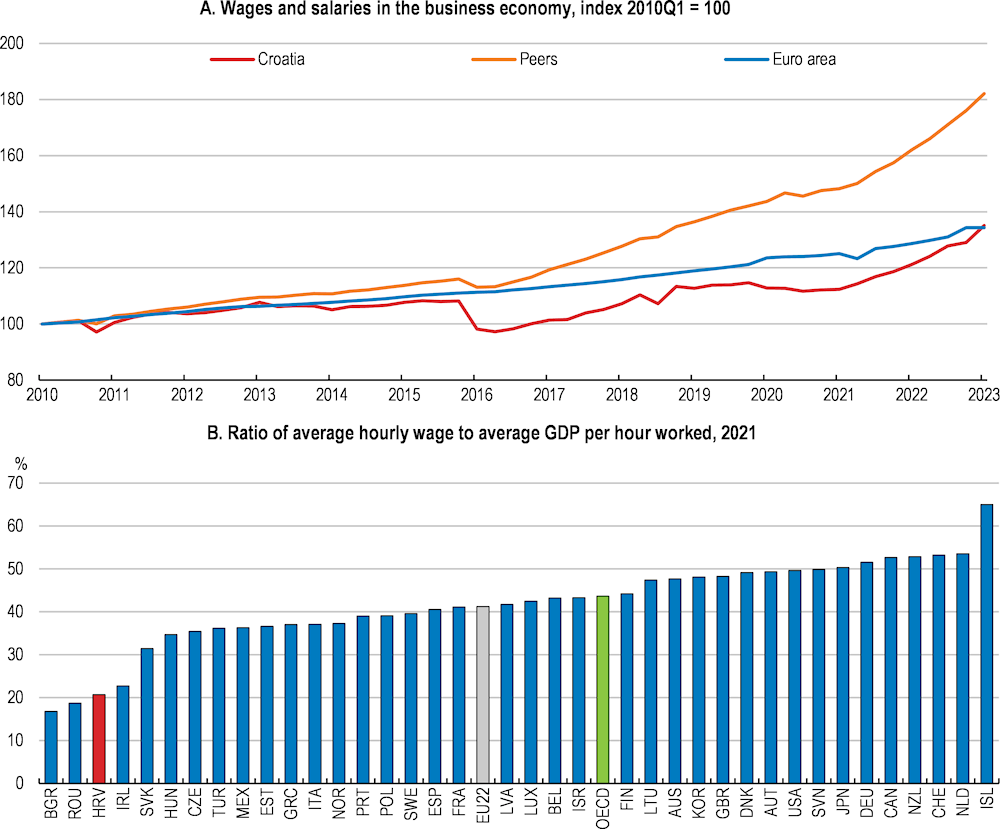

Wage setting to encourage higher productivity

Wages in Croatia have been growing firmly and faster than in many OECD countries recently, but remain moderate relative to other euro-area countries and to workers’ output (Figure 4.15). The range of wage rates is narrower than in many OECD countries, and the share of workers earning a low wage relative to the median is well above the average of OECD and EU countries. Non-wage labour costs, including bonuses and employment-related taxes, have grown less than wages, moderating the overall growth in labour costs for employers. This has contributed to slower growth in the overall cost of labour per unit of output in Croatia than in many other OECD countries. Wages across the workforce in Croatia are somewhat less widely distributed than in many OECD countries, and wage dispersion has narrowed slightly over the past decade.

Improving wage bargaining

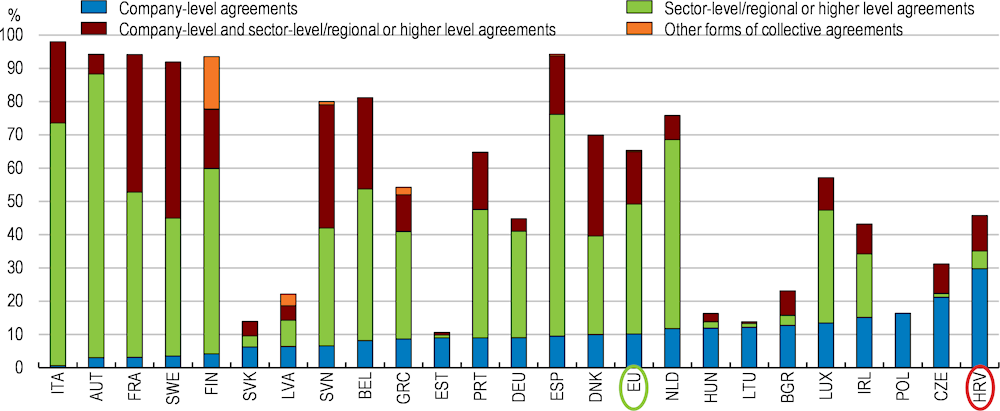

Wage setting in Croatia is fragmented, as shown by the limited coverage of collective agreements. The share of workers covered by collective agreements has declined to 47%, which is below the average of OECD countries but typical of Croatia’s OECD neighbours (Figure 4.16). Company-level collective agreements cover a much larger share of workers than sectoral or higher-level agreements. Union membership rates are moderate (about one-quarter of the workforce in 2018, similar to neighbouring OECD countries) but Croatia has a large number of unions and union umbrella groups relative to the workforce’s size.

Figure 4.15. Wages have been rising but are low relative to productivity

Note: Panel A: Nominal wages and salaries index. Panel B: Estimates for Bulgaria, Croatia, and Romania based on calculations using Eurostat data on labour costs index and structure of earnings statistics. OECD and EU22 averages are unweighted averages. The OECD average excludes Chile, Colombia, and Costa Rica.

Source: Eurostat and OED Analytical database.

Better supporting coordination in wage-setting through collective agreements can help Croatia maintain its tradables sectors’ competitiveness while ensuring that workers benefit from rising productivity. As a member of the euro, adjustment in relative prices via the exchange rate is no longer available, making adjustments to misaligned wages potentially costly in terms of lost employment or activity. In theory, collective bargaining may introduce distortions to the wage-setting process, for example, by strengthening the power of those covered by agreements relative to ‘outsiders’ who are not covered, but in practice empirical evidence supporting such costs is scarce (OECD, 2019[35]). In addition, effective, well-informed and constructive social dialogue accompanying coordinated wage-setting processes can bring broader benefits, such as improving the design and implementation of structural reforms or policies responding to macroeconomic shocks such as the recent surge in prices.

Coordinated wage-setting entails arrangements whereby wage increases account for prevailing macroeconomic and labour market conditions, as well as the economy’s structure and other labour market institutions such as employment protection or minimum wage adjustments. This approach can help to protect Croatia’s relatively low wage inequality, given that wage inequality tends to be higher in OECD countries with firm-level bargaining only or no collective bargaining compared with countries where workers are covered by sectoral bargaining. Croatia will be required to develop an action plan to promote collective bargaining to comply with a new EU directive. Across the spectrum of approaches to coordinating wage-setting (Box 4.2), one that supports greater coordination through pattern-based negotiations with workplace-level agreements may best build on Croatia’s recent approach to wage-setting. Croatia’s small and open economy, including the important international markets for services ranging from information technology to transport and storage to food and retail services, underlines the importance of information sharing and coordination across sectors. Croatia could strengthen an existing body such as the Economic and Social Council to make it more effective in supporting coordination across sectors and in sharing information about macroeconomic conditions, broader cost movements, wage agreements in other sectors, and developments among Croatia’s competitors. Developing its role as a strong mediator would further support effective coordination.

Figure 4.16. Croatia’s wage-setting is relatively decentralised

Estimated collective bargaining coverage, 2019

Source: Eurofound (2022), Moving with the times: Emerging practices and provisions in collective bargaining, Publications Office of the European Union, Luxembourg.

Box 4.2. Approaches to wage-setting coordination

Wage co-ordination takes different forms across OECD countries. Approaches can be categorised according to whether co-ordination is imposed by the state, follows agreements in leading sectors, and by the degree of co-ordination (OECD, 2019[35]).

Co-ordination is strongest when it is imposed by the state. It can operate through indexation rules, binding minimum wages and/or rules for maximum adjustments. Belgium is currently the only OECD country that follows this approach. Wages are indexed to living costs but capped by a “wage norm” which accounts for (weighted) wage developments in its main trading partners (France, Germany and the Netherlands) on top of a statutory minimum wage negotiated between social partners.

Pattern bargaining, where a sector (usually manufacturing, which is most exposed to trade) sets the targets, and other sectors follow. Nordic countries, Austria, Germany and the Netherlands take this approach.

Inter- or intra-associational guidelines provide a third model of coordination. Peak-level organisations either set some norms or define an intra-associational objective that lower levels (e.g., individual workplaces) should follow. This approach is usually binding only in countries where peak-level trade unions or employer organisations are relatively strong and centralised (typically Nordic countries and to a significantly lower extent France and Italy).

Elements of coordination in Japan may be pertinent to Croatia. Coordinated wage negotiations emerged out of fragmented and politicised trade unions, and remains highly decentralised, taking place at the company level. Coordination takes place both within and across sectors. Annual negotiations typically start with large companies, with the national trade union confederation setting the intra-associational guidelines for wage adjustments, to be further specified by each sectoral-level trade union federation. This provides a minimum benchmark, and firm-level unions can negotiate over wages, bonuses and working conditions. Employers coordinate their bargaining through their organisations. While this approach has lost some of its effectiveness over recent decades, it has allowed wage setting in Japan to adjust and distribute the costs of major macroeconomic shocks while protecting employment.

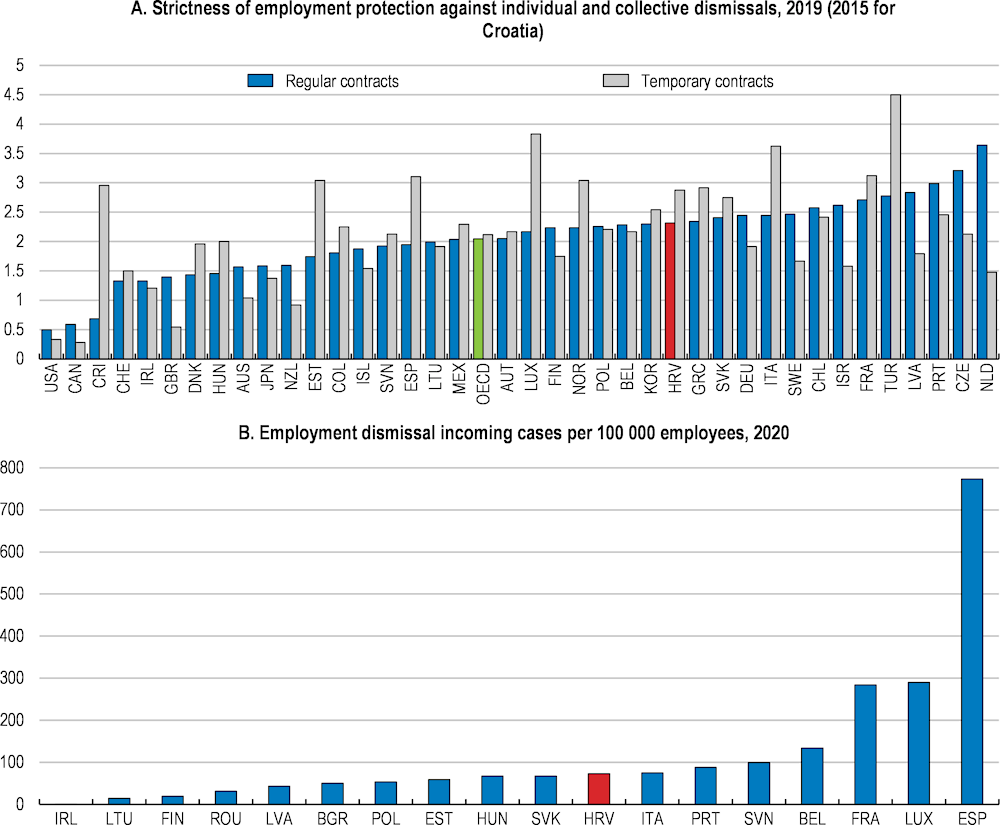

Balancing protecting employees, flexibility and workplace relations

Croatia’s employment protection has been liberalised to a similar level of strictness for permanent contracts as in many OECD countries, notably by the 2014 labour law (Figure 4.17, Panel A). Dismissal conditions are slightly stricter for temporary contracts, which reduces incentives for firms to use temporary rather than permanent contracts. Some relatively onerous rules remain in place, such as restrictions on which workers can be dismissed for redundancy depending on whether the worker has family dependents, for example, and limits to firms’ ability to re-hire workers following redundancies. Dismissal for misconduct can take three to five years, and severance pay is mandatory for employment contracts of over two years. Addressing high protection of formal employment can contribute to reducing Croatia’s still significant levels of undeclared and informal activity (discussed in Box 2.9).

Figure 4.17. Employment protection laws are somewhat stricter than the OECD average, and many dismissal cases end up in court

Source: OECD indicators of employment protection (database); and European Commission, Directorate-General for Justice and Consumers (2021), Study on the functioning of judicial systems in the EU Member States: facts and figures from the CEPEJ questionnaires 2012 to 2020. Part 1, Data tables per indicator for all EU Member States.

Employment relations appear to be more litigious than in many of Croatia’s peers, although less than in several OECD countries, for example regarding the number of dismissal cases that go to court (Figure 4.17, Panel B). Litigiousness adds to employment costs and uncertainty. Efforts should be made to reduce the number of employment disputes going to court. Part of the solution could lie in a review of compensation rules in dismissal cases. For example, large differences in compensation paid to dismissed workers depending on the reason for their dismissal can encourage conflicts. Complementing this, to hasten resolution and to minimise costs, especially for the court system, Croatia can build on the arbitration arrangements enabled by the legislation introduced over the 2010s. Most OECD countries use arbitration extensively to address labour disputes (Box 4.3 discusses the approaches used in Australia). Reducing recourse to courts would also be helped by continuing to develop the role of a dedicated service to support mediation. This could be based in Croatia’s Economic and Social Council. Measures discussed elsewhere in this Chapter, including continued strengthening of active labour market policies and social protection, can reduce the pressure for strong employment protection and litigation, as dismissed workers will have greater confidence in their ability to maintain their incomes and find new and potentially more rewarding opportunities following dismissal.

Box 4.3. Australia’s arbitration and mediation tools for managing employment disputes

Mediation plays an important role in resolving employment disputes in Australia. It is seen as a way of avoiding costly and time-consuming litigation. Its use reflects, among other factors, the role employment legislation gives to mediation, and to the clarity of the process. For example, in most circumstances a court or tribunal will be required to certify that mediation and conciliation is unlikely to resolve the matter before exercising its arbitrary powers.

Mediation generally consists of three stages:

1. Pre-session: The parties are prepared to mediate by setting realistic expectations about possible outcomes and encouraging them to identify desired behaviours and issues they wish to raise. The mediator discusses with human resources alternative outcomes if the mediation does not lead to an agreement. The mediator meets each party individually to understand the issues, provide information about the process and assess parties’ capacity to participate in the mediation. The mediator synthesises this information and plans the mediation session.

2. The session: These are typically two to four hours. The mediator leads the session through an opening statement, venting, identifying issues and setting an agenda, discussing the issues and building an agreement, then closure.

3. Post-session: The mediator finalises the agreement and sends it to the parties to sign and implement, and follows-up with human resources on the mediation’s success. Beaches of the agreement, or of confidentiality of the mediation process, can lead to penalties.

Critiques of alternative dispute resolution in Australia include that it does not develop precedent (i.e., an outcome decision does not inform future decisions), the difficulty of balancing stronger and weaker parties, and the risk that mediators favour the interests of employers, who tend to pay the mediators’ costs and who may employ the mediator for other services.

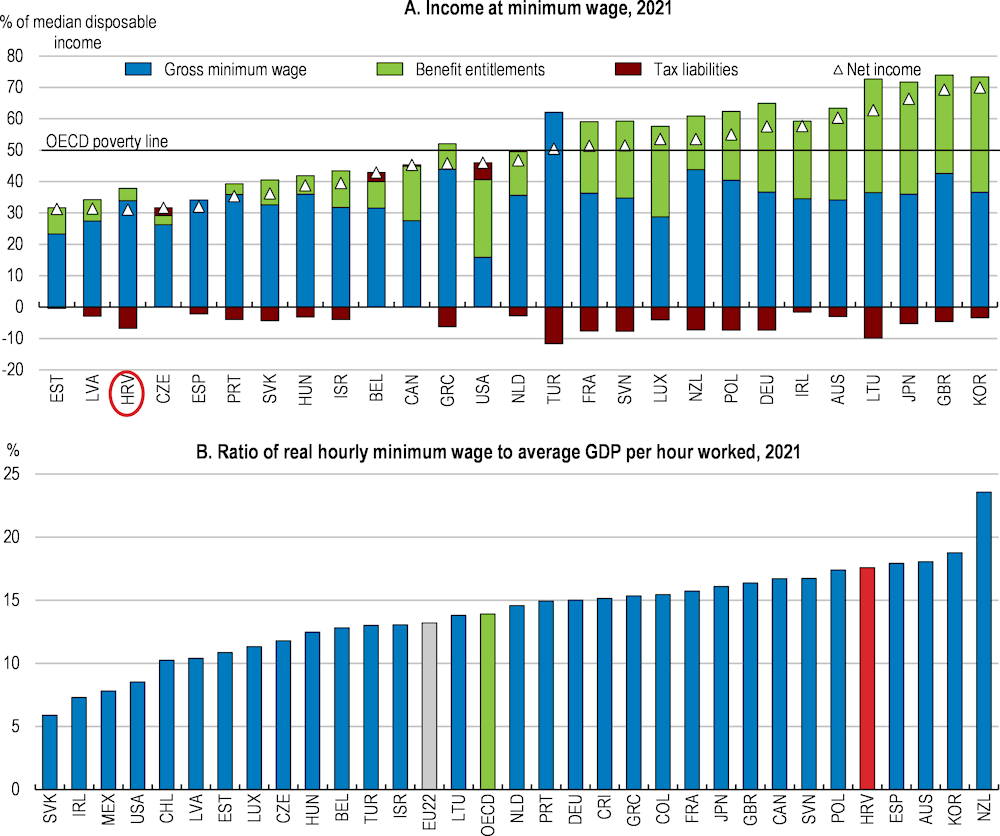

Minimum wage setting to support vulnerable workers’ incomes

Croatia’s minimum wage rose by 40% between 2019 and 2023, double the increase in consumer prices and ahead of the increase in the average wage over the same period. These increases have lifted the minimum wage to similar levels with other OECD countries relative to the median disposable income (Figure 4.18, Panel A). It is higher than in most OECD countries relative to output per hour worked (Figure 4.18, Panel B). Pressure to raise the minimum wage in part reflects minimum wage earners’ low incomes relative to the poverty line, in part as take-home pay is below the gross minimum wage, unlike most OECD countries where minimum wage earners’ incomes are supplemented by benefits (Figure 4.18, Panel A). In the longer-term, as fiscal space and improvements to the social protection system allow, developing direct, targeted benefits to support all households at risk of poverty (discussed above) rather than relying on the minimum wage can ensure adequate incomes without risking lower competitiveness or pricing lower skill or lower-productivity workers out of formal employment (OECD, 2018[16]).

Croatia’s minimum wage setting process contains many of the qualities of a system that balances protecting workers’ incomes with ensuring the minimum wage does not price those workers out of employment. The government mandates increases in the minimum wage following consultations with social partners and the advice of the Commission for Monitoring and Analysis of the Minimum Wage. The Commission, established in 2019, is composed of representatives of trade unions, employers, government and academia. It analyses recent relevant trends and proposes an adjustment, although the government is not required to adopt its proposal. The legislation governing the Council stipulates factors to consider, including raising the minimum wage relative to the median wage, unemployment and employment trends, demographic trends and the state of the economy in total, paying particular attention to low-wage and vulnerable groups of employees. As Croatia’s minimum wage is approaching a similar ratio to the median wage as in many OECD countries, it may be appropriate to remove the requirement that minimum wage adjustments further reduce the ratio to the median wage.

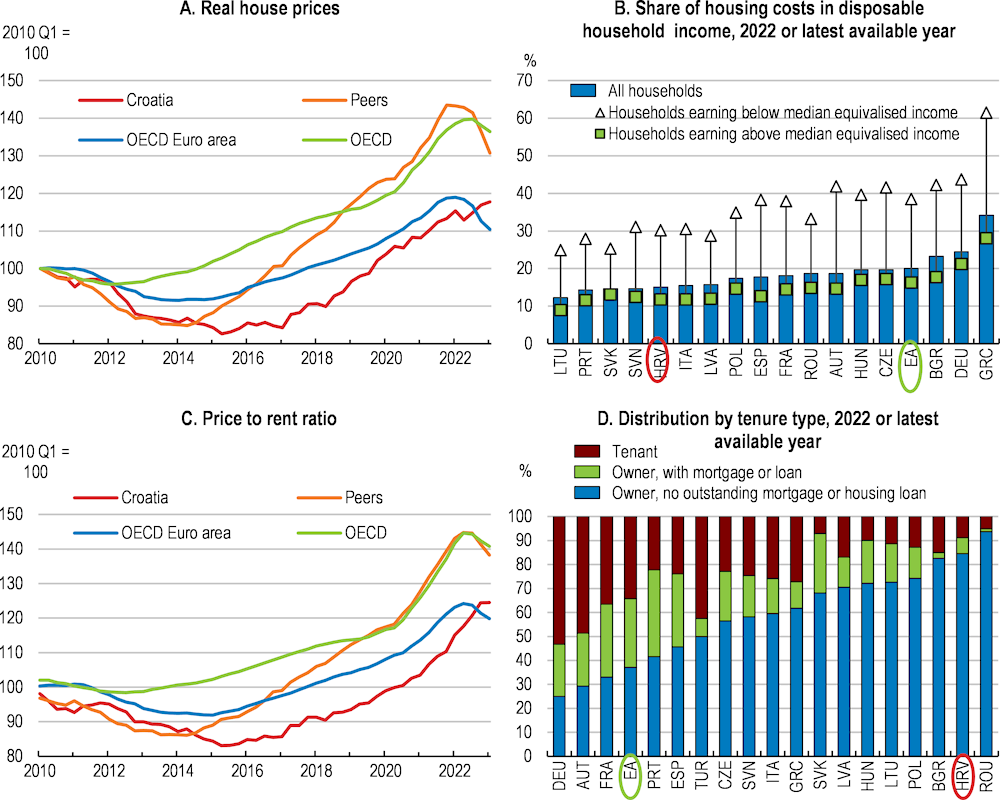

Improving access to housing to support mobility and well-being

The cost, quality and access to housing are growing concerns in Croatia, like in many OECD countries. After falling in the first half of the 2010s, prices and rents have grown rapidly in real terms since 2016 (Figure 4.19). Some of the housing stock has been damaged and destroyed over recent decades in some regions, first by the wars during the 1990s and, most recently, by the earthquakes of 2020. In the most economically dynamic regions, rapidly rising housing costs have become a barrier to growth in employment and activity.

Indicators suggest the quality of housing compares well with OECD countries across a number of dimensions. Nearly two-thirds of Croatia’s population, a far higher share than in most OECD EU countries, live in a detached house, while most urban dwellers live in apartments. The housing stock compares well for quality indicators such as having a leaking roof, sufficient light or the ability to heat the dwelling adequately. Their energy efficiency compares less well, contributing to relatively high rates of energy poverty. Housing energy efficiency and engineering robustness varies considerably with age. For example, seismic engineering standards were introduced in 1963 and progressively improved over the following decades, meaning only part of the building stock meets modern standards.

Also, high homeownership, much of it without outstanding mortgage debt, means many households are secure in terms of accommodation, have sizeable housing-asset wealth and face modest outlays related to housing costs. As for some other eastern European countries, the high rate of home ownership has origins in the transfer of ownership rights from the state to households in the 1990s. Eighty-five percent of the population live in their own house without a mortgage or loan, a far higher share than in most OECD countries. Around 6% live in their own home with a mortgage and the rental market, at least among the resident population, is small (Jakopic et al., 2015[39]). Furthermore, provisions for helping low-income households with accommodation costs seem in reasonable shape. For low-income households, small housing allowances, such as housing vouchers, benefits, or rent supplements, support rental and other housing costs, temporarily or on a long-term basis. Several municipalities provide the bulk of these. Croatia’s spending, at about 0.2% of GDP in 2018, was typical of many OECD EU countries.

Figure 4.18. Minimum wages are near other countries relative to incomes and high relative to productivity

Note: Panel A: Tax liabilities incudes direct taxes and social security contributions. Panel B: OECD and EU22 averages are unweighted averages. The EU22 average excludes Austria, Denmark, Finland, Italy, and Sweden. The OECD average also excludes Iceland, Norway, and Switzerland.

Source: Calculation based on data from OECD (2022), OECD Employment and Labour Market Statistics (database), OECD Productivity (database) and OECD Analytical (database).

However, the very high share of owner-occupiers and small rental market suggest geographical mobility and labour market dynamism may be compromised (Causa, Luu and Abendschein, 2021[40]). Renters on the housing market were four times more likely to have relocated over a five-year period in Croatia than those who owned their residence or rented below the market price, according to data collected for the 2012 EU-SILC wave, the latest available across countries. Overall, only 5% of the population relocated over this period, one of the lowest rates across the European Union and lower than in most OECD countries.

Figure 4.19. Housing prices have been rising in Croatia

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia. 'OECD Euro area/''EA17' refers to countries which are both members of the OECD and the Euro area.

Source: OECD Analytical house price (database); and Eurostat.

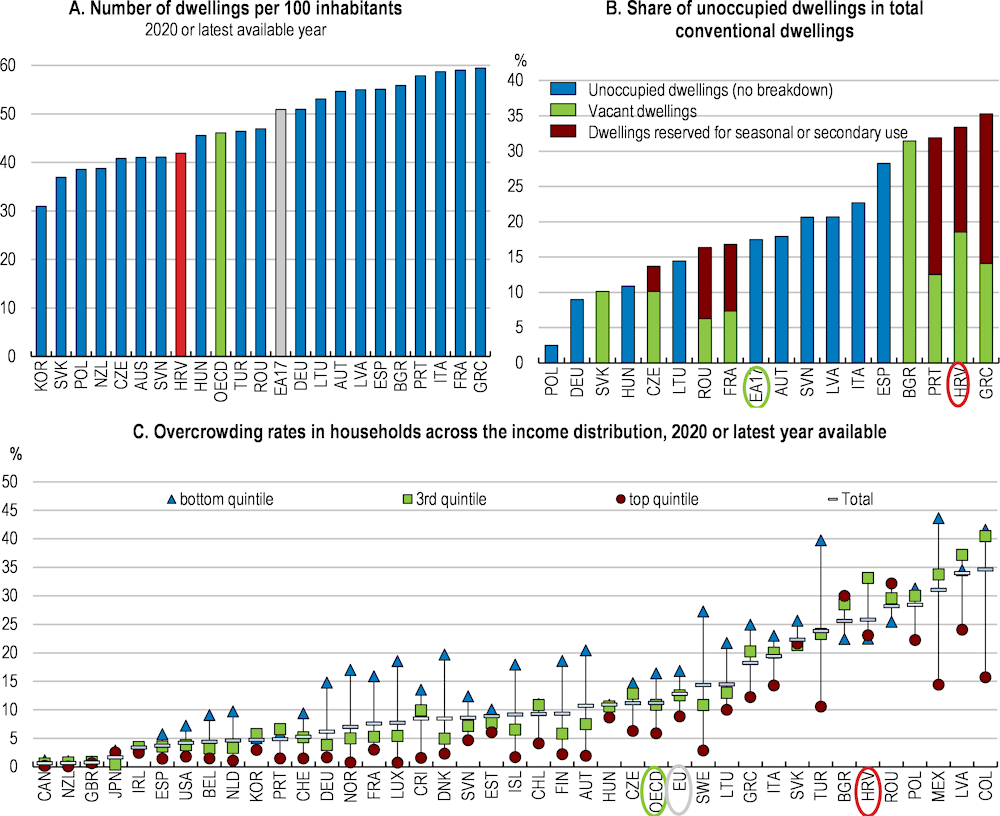

Evidence points to shortages in the supply of primary residences, and relatively high rates of overcrowding (Figure 4.20). Even accounting for the falling population in all regions apart from greater Zagreb, the total number of dwellings fell over the 2010s to 411 per 1000 inhabitants, well below the average of OECD countries (OECD, 2022[41]). The 2020 earthquakes damaged over 35 000 buildings, rendering over 10 000 dwellings at least temporarily unusable, equivalent to 0.6% of the national housing stock (Box 4.3). Demand for secondary residences, particularly by foreigners, has also increased the cost and limited the availability of primary residences, notably on the coast and in central Zagreb (Vizek, Barbić and Časni, 2023[42]; Mikulić et al., 2021[43]). Reforms in 2009 and 2012 made buying property easier for foreign owners, and online short-term rental platforms have further boosted demand. In 2021, foreign buyers accounted for more than 20% of the total value of purchases. Foreign demand is likely to have been further boosted by Croatia’s integration into the euro and Schengen areas.

Box 4.4. Two earthquakes in 2020 damaged housing and public buildings

Croatia is in a seismically active area. In March 2020 a magnitude 5.5 earthquake struck with an epicentre 7 kilometres from the centre of Zagreb followed by a series of aftershocks. In December 2020, a magnitude 6.4 earthquake struck central Croatia. Together these earthquakes caused seven deaths and scores of injuries.

The recovery and reconstruction needs from the 2020 earthquakes are estimated at EUR 26 billion (around 39% of 2022 GDP), with the largest share related to housing, much in central Zagreb. However, the estimated impact on output was minor, especially relative to the pause in activity due to the COVID-19 epidemic and response measures (Government of Croatia, 2020[44]; Government of Croatia, 2021[45]). Reconstruction work was delayed first by the difficulties created by the COVID-19 related restrictions, then by delays in mobilising the construction workers and materials to undertake the work. Work accelerated in 2022 and 2023.

Figure 4.20. A large share of dwellings is unoccupied yet many households are overcrowded

Note: Panel A: Unweighted OECD and EA17 averages. GBR refers to England only; Panel B: The figure on unoccupied dwellings for Sweden refers to dwellings without registered occupants. Panel C: Share of overcrowded households by quintiles of the income distribution.

Source: OECD Affordable Housing Database – http://oe.cd/ahd; European Statistical System, Census Hub website, https://ec.europa.eu/CensusHub2/query.do?step=selectHyperCube&qhc=false.

Some households have more complex ownership and occupation arrangements, due to the legacies of the communist period and the 1990s wars, and this contributes to low housing mobility and supply (Jakopic et al., 2015[39]). The government is undertaking a welcome consolidation of the cadastre, as multiple cadastres contribute to uncertain ownership rights, although the process is likely to take many years to complete. Ensuring that these legacies are resolved, for example at the time of inheritance, can minimise disruption to existing residents while improving the transparency and certainty of a well-documented modern property titling system.

Croatia is supporting the development of new dwellings in part through subsidising housing construction. The Housing Construction programme, Poticana stanogradnja, originated in 2001 offers state support for newly constructed dwellings, and, since 2019, loans for renovating existing dwellings. In addition, Croatia’s Recovery and Resilience Plan allocates EUR 764 million (1.0% of GDP) to renovate buildings including EUR 591 million for reconstruction, including EUR 96 million for residential buildings.

Support for purchases of existing dwelling should be phased out and reallocated. The Subsidised Loan Programme, Subvencioniranje stambenih kredita, provides citizens aged below 45 with a subsidised loan for the purchase of a house or an apartment, or the construction of house. It grants subsidies of up to EUR 1500 per square metre for loans up to EUR 100 000 with the annual interest rate capped at 3.8% per year. A new round of subsidised loans was introduced in March 2023. Experience in Croatia, and across OECD countries with similar schemes, is that such programmes contribute to faster price growth especially in areas with restricted supply or already strong demand, and have limited impact on resolving housing shortages (Kunovac and Žilić, 2020[46]) (OECD, 2021[47]).

Further addressing Croatia’s procedural barriers to constructing or renovating housing would encourage supply. Building larger integrated developments is particularly complicated due to heavy processes in consolidating urban land plots, that the rights of first refusal for the public sector in transactions. Incomplete, out-of-date and inconsistent cadastres and urban plans can impede redevelopment. Meanwhile, slow judicial processes mean delays to resolve contractual disputes. Addressing these constraints through the measures discussed in Chapter 1 to review and streamline regulatory and administrative processes and to improve the judicial system’s responsiveness, would contribute to reviving housing construction.

Figure 4.21. Croatia can increase revenue from recurrent taxes on immovable property

Recurrent taxes on immovable property, % of total taxation, 2021 or latest available year

There is scope to reform housing taxation. Croatia currently imposes a property transaction tax of 3%, which is around mid-range among OECD countries. Lowering this tax would add dynamism to the property market. Croatia taxes profits gained on the resale of a property as personal income, which is highly efficient and effective. Income from leasing a dwelling is taxed at a 15% personal income tax rate, after allowing for expenses. General recurrent taxes on property are very limited in scope. There is an annual tax on holiday homes based on the surface area, but unlike in most OECD countries, there is no general property tax linked to the value of a property. Introducing such a tax, and applying it to all properties, including secondary residences or properties that are rented would encourage owners to make full use of the housing stock and improve the availability of housing for primary dwellings. Ensuring that any reforms treat investments in private rental housing and owner-occupied housing equivalently would help develop a bigger rental market. Taxing owner-occupied housing in line with other saving vehicles, such as equity, can also help creating a neutral tax framework for investments.

Box 4.5. A recurrent property tax for equitable and effective use of property