Growth has held up better in Egypt until recently than in neighbouring countries in the face of a series of major exogenous shocks, and reform efforts have been stepped up in several areas. However, growth slowed in 2022, as inflation surged and massive capital outflows occurred, which led to foreign currency shortages and devaluations of the Egyptian pound.

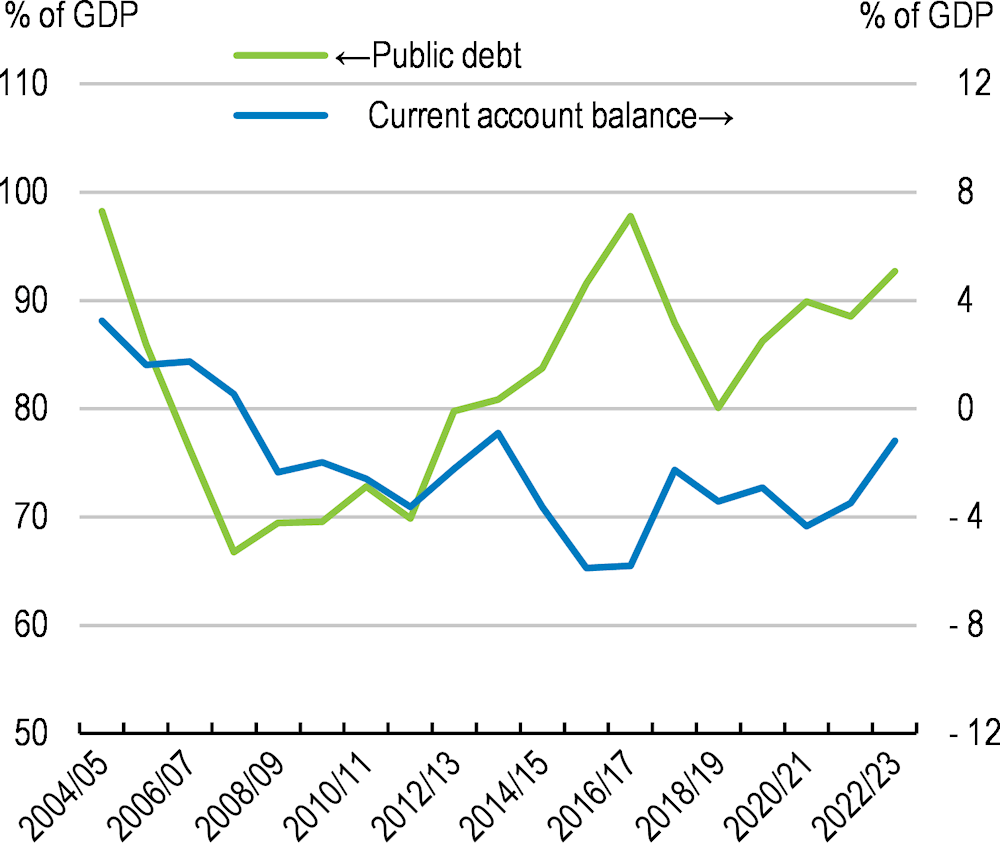

Egypt was hit hard by the surge in global food prices. Inflation took off, even though energy prices were kept in check via price controls. It has become broad-based and, coupled with currency depreciation, reached very high levels in 2023. Fiscal support, including the expansion of targeted cash-transfer programmes, has sustained private consumption. Business activity has weakened due to tightened financing conditions, limited access to foreign currency, and increased uncertainty, following large-scale capital outflows of around USD 20 billion (4.7% of GDP). Egypt was particularly vulnerable to such outflows, due to its large current account deficit and high public debt (Figure 1), which had been increasingly financed from abroad. IMF financial assistance was put in place in late 2022, the fourth package in six years. Under this IMF programme, Egypt has expanded the scope of policy reforms to reduce public debt and macroeconomic imbalances.