Fiscal policy is contractionary, but costs related to ageing pose a risk to long-term debt sustainability.

The general government fiscal balance recovered from around -9% in 2020 to around -4.5% in 2022, and the fiscal stance has become contractionary. Public debt as measured by the OECD rose from around 61% of GDP in 2019 to around 78% in 2022, while contingent liabilities continue to decline. The government projects the debt ratio to decline from 2023 and the budget to return to balance in 2027.

Government spending has been pro-cyclical most of the time since the turn of the millennium. However, the fiscal framework adopted in 2015 has improved the budget process. Adding a spending rule could help reduce procyclicality further.

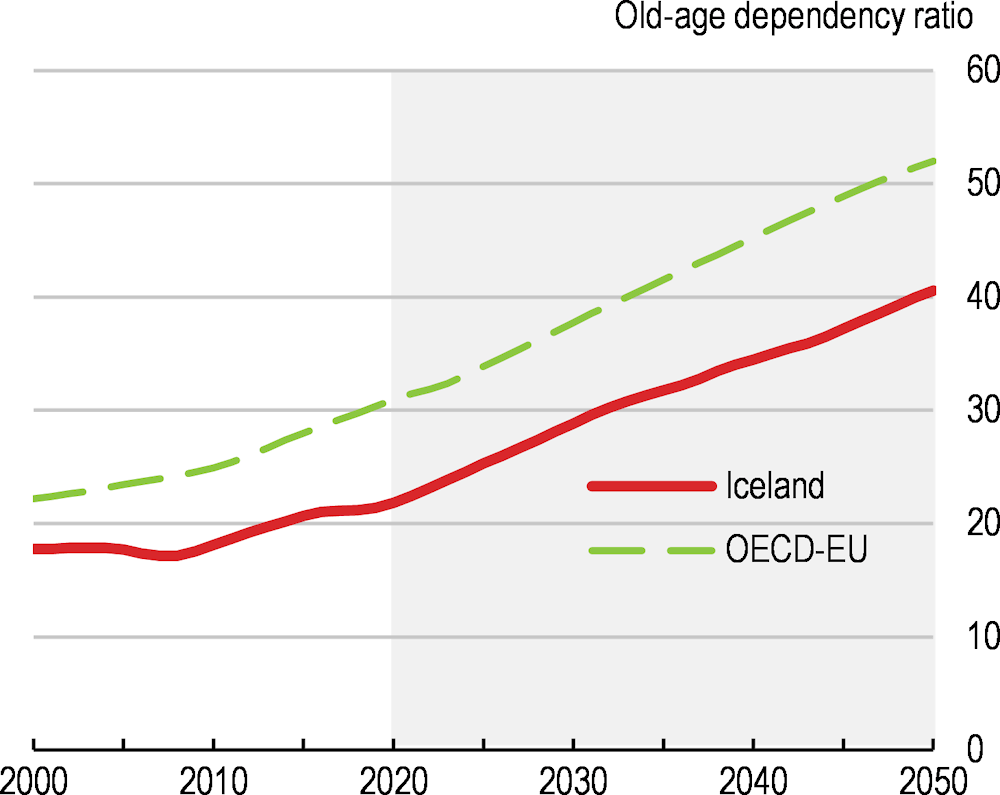

Ageing costs are rising. Iceland’s population is getting older and growing more slowly (Figure 2). The government projects health and long-term care spending to rise by more than 3% of GDP by 2050, although from a lower level than in almost any other OECD country. Reforms to the retirement age and others, such as reducing tax expenditures, would slow the build-up of debt.

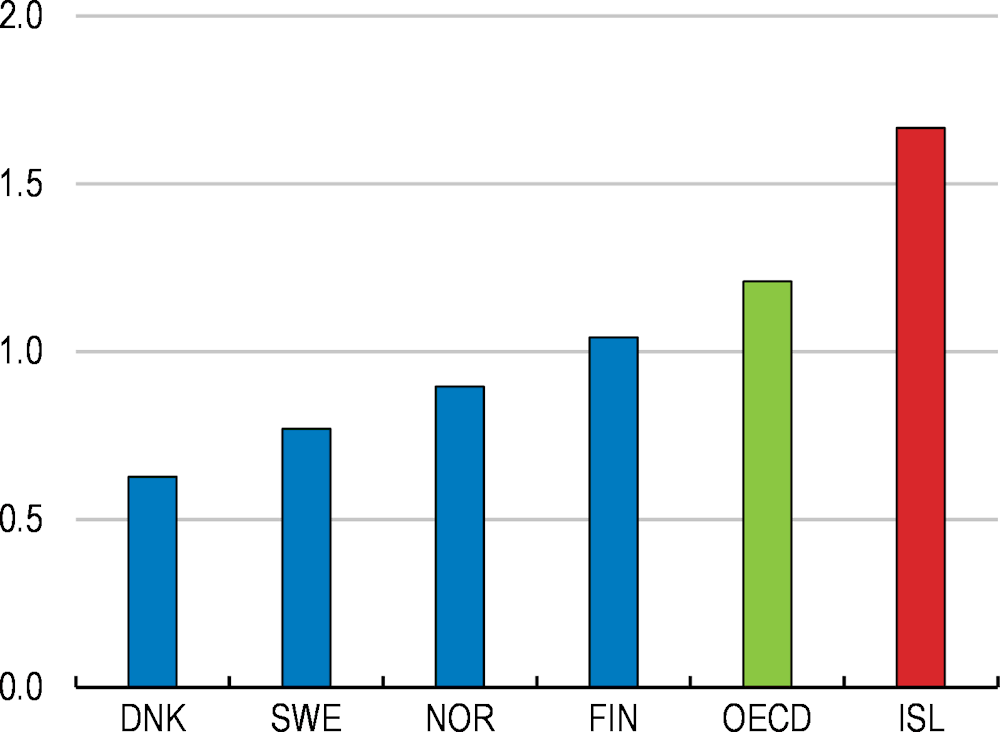

Marginal tax rates for low-and middle-income earners are high, reducing their incentives to work. High marginal tax rates could also discourage second earners, often women, from taking up work or working longer hours, partly driving the large gap in working hours between men and women.