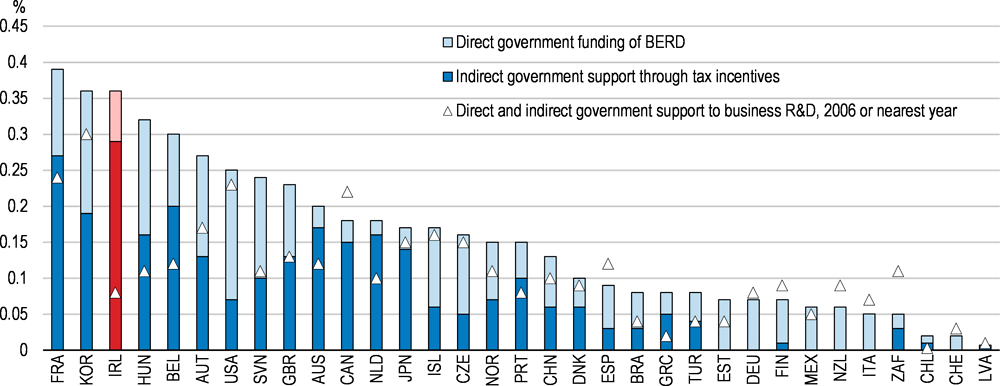

The Irish economy has experienced a decline in productivity growth over the past decade. This has mostly reflected the poor performance of local firms, with the large productivity gap between foreign-owned and local enterprises having widened. Given the mobility of foreign-owned firms, achieving sustainable productivity growth requires addressing productivity stagnation in the local business sector. Government policy should ensure high-potential businesses can enter markets and expand unimpeded, and that the most productive firms thrive in the market. To achieve this, some aspects of the regulatory environment for businesses need to be reformed and the quality of Irish infrastructure improved. Access to finance for high-performing firms must be broadened as well, through restoring credit supply in the banking sector, developing equity finance and improving public financial support. It needs to be assured that government policy is also calibrated to encourage productivity-enhancing knowledge spillovers from frontier firms. Trade linkages and research collaboration between foreign-owned and local firms can be better promoted. However, the ability for local firms to absorb new knowledge relies on their investment in knowledge based capital and managerial skills. These can be promoted by greater direct government funding of business R&D, supporting labour mobility across firms, and worker participation in lifelong learning activities.

OECD Economic Surveys: Ireland 2018

Chapter 1. Reforms for sustainable productivity growth

Abstract

The Irish economy has been among the most successful across the OECD, with living standards rapidly catching up to those of the highest income countries. The cornerstone of its growth model has been to attract highly-productive multinational enterprises. The growth model, however, faces a challenge, as productivity has stagnated among Irish local firms and there has been a widening divergence in productivity performance between multinational enterprises and local firms since the mid-2000s. The presence of multinational enterprises presents an opportunity but also a challenge. Currently, the diffusion of knowledge and technology to local firms is weak and in some instances local firms are crowded-out by multinational enterprises. International competition to attract multinational enterprises is also strong, suggesting that the long-term sustainability of the economy could be dependent on the performance of local businesses.

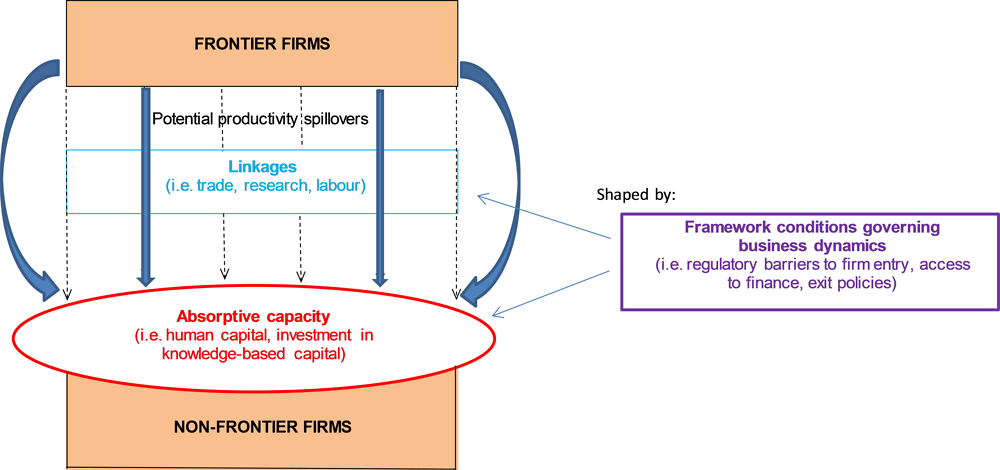

For more rapid and sustainable productivity growth, government policy should aim to enhance knowledge spillovers from frontier firms to the rest of the economy (Figure 1.1). Such spillovers are the single most important driver of productivity growth in the long run (Johansson et al., 2013). First and foremost, spillovers are conditional on a country’s policy settings (Johansson et al., 2013) and shaped by business dynamism and the efficiency of resource allocation (OECD, 2015a). More directly, spillovers are maximised by tighter linkages in terms of trade, research (with both frontier firms and universities) and labour between frontier and laggard – which are usually local – firms. Nevertheless, the productivity gains of such linkages can only be realised if the latter have the capacity to absorb the new ideas and technologies utilised by frontier enterprises. To build such capacity, investment in knowledge-based capital and human capital by local firms is key (OECD, 2015a). Reforming policy settings in these areas would give the Irish economy a better opportunity of leveraging the performance of multinational enterprises, thereby raising living standards further.

Figure 1.1. A stylised depiction of the factors impacting the magnitude of productivity spillovers

Productivity among local firms has stagnated

Productivity trends in Ireland

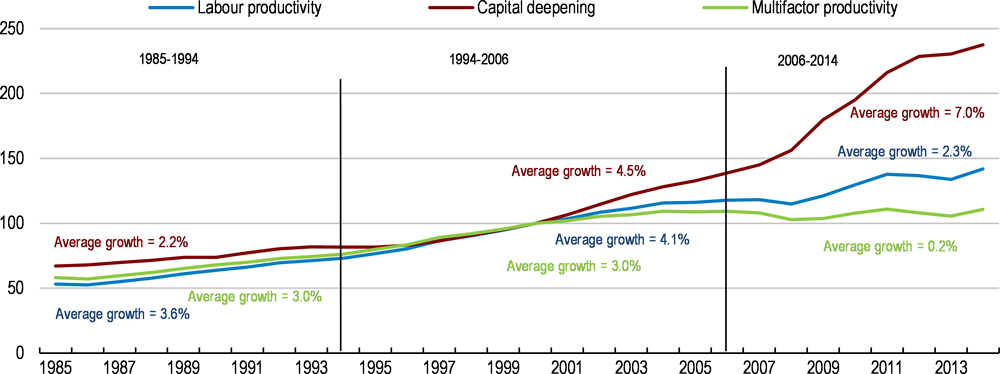

Aggregate productivity in Ireland has slowed over the past 15 years. Labour productivity rose by above 4% in annual average terms between 1994 and 2006, which slowed to below 2½ per cent between 2006 and 2014 (Figure 1.2). This is due to the marked decline in multifactor productivity (MFP) growth, which more than offset the contribution from the substantial rise in capital deepening over the post-2006 period. Although MFP has been continuing to rise, the decline in its growth rate highlights slower efficiency improvements in production processes.

Figure 1.2. Trend productivity growth has slowed

Index, 2000=100

Note: Labour productivity is calculated as GDP per hour worked. Labour productivity growth can be broken down into the contribution from multifactor productivity growth and capital deepening, with the latter weighted by its income share. Growth in capital deepening is measured as the growth in the aggregate flow of capital services minus the growth in aggregate hours worked. Multifactor productivity growth is measured as the difference between the change in GDP and the change in measured inputs (capital and labour), where the inputs are weighted by their respective cost shares.

Source: OECD Productivity Database.

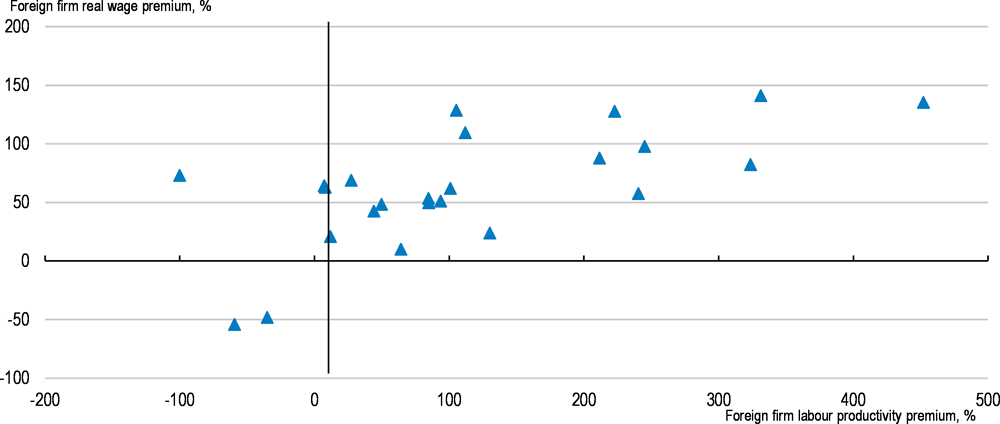

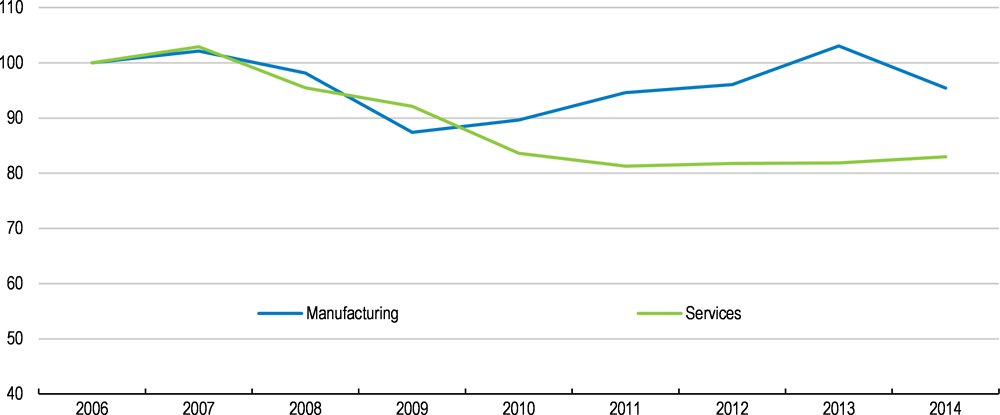

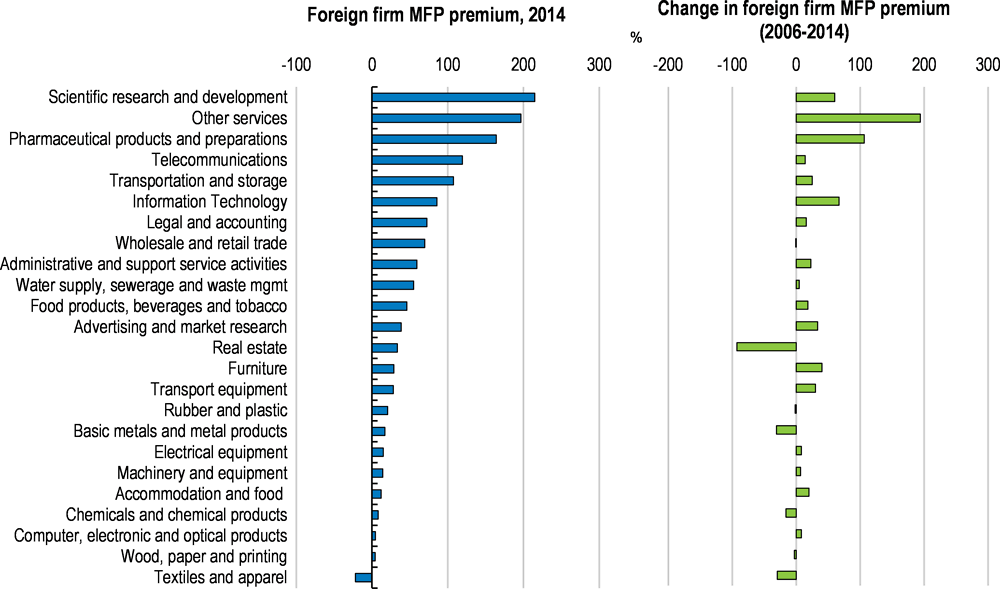

Looking beneath the aggregate trends, new firm-level analysis highlights that the majority of businesses have actually experienced falling productivity in the period since 2006 (Figure 1.3; Department of Finance, 2018). This has been especially apparent in the services sector. The rise in aggregate productivity (highlighted in Figure 1.2) has relied on the performance of a group of very large successful firms and is consistent with rising dispersion in productivity between Ireland’s foreign-owned and local firms in most industries (Figure 1.4). The disparity in productivity levels between these two types of firms has tended to translate into gaps in wages (Figure 1.5), stoking Ireland’s very high level of market income inequality.

Figure 1.3. Most businesses have experienced a decline in productivity

Median firm productivity (Index 2006 = 100)

Note: The figure above shows multifactor productivity (using the Solow method) of the median firm in the productivity distribution at each point in time. These results are consistent with labour productivity estimates based on both micro and macro data.

Source: Department of Finance (2018).

Figure 1.4. Foreign-owned firms tend to be more productive

Note: The “Foreign firm MFP premium” is the percentage point difference between the multifactor productivity level (using the Solow method) of foreign firms and that of local firms in the given industry. Reflecting data availability, the change in foreign firm MFP premium is calculated between 2008 and 2014 for the telecommunications industry and 2010 and 2014 for the water supply, sewerage and waste management industry.

Source: OECD MultiProd.

Figure 1.5. Wages are substantially higher in foreign firms

Foreign firm premium over local firms for wages and labour productivity, by industry, 2014

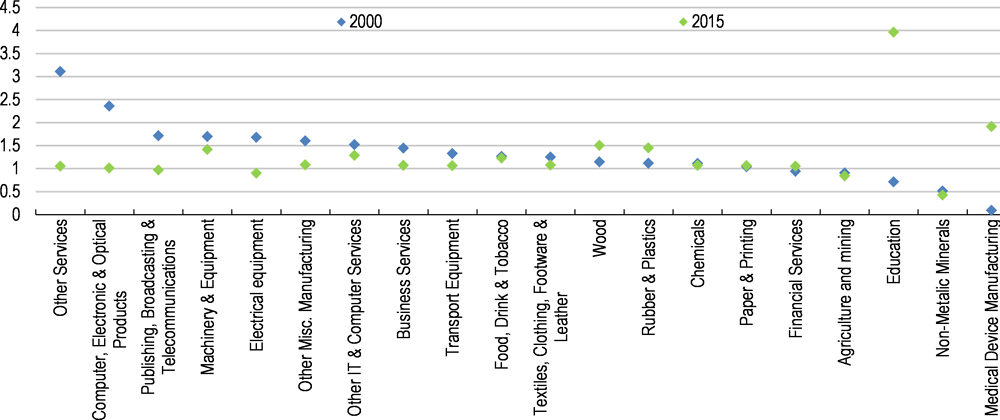

Forces at the firm level

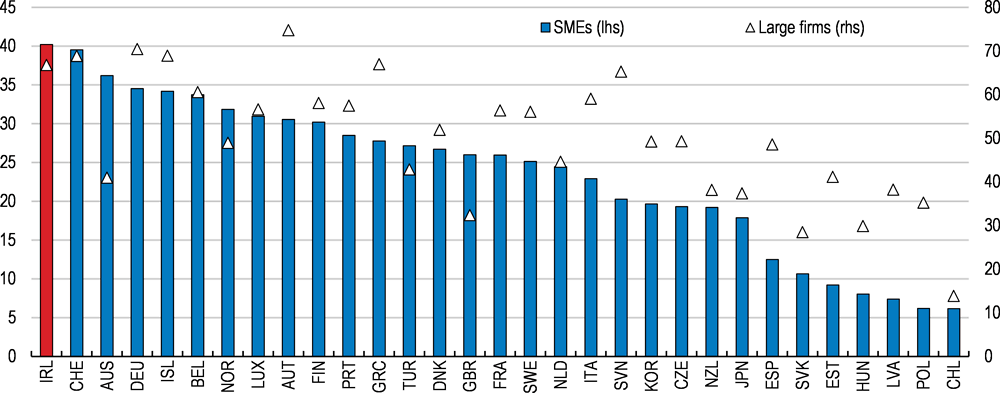

The Irish economy has strong productivity potential, as some parts already exhibit high levels of innovation and entrepreneurial activity. For example, against the backdrop of high-performing multinational enterprises in the ICT sector, Ireland has the highest share of ICT-related domestic value added in the OECD (accounting for 14% of GDP; OECD, 2017a). The country also has a relatively high share of patents in high-tech industries, namely communication and medical devices (OECD, 2015b). The share of firms adopting innovation strategies is also elevated, including among small businesses (Figure 1.6). However, as evidenced by the productivity trends just highlighted, these strengths have not translated into ongoing improvements in macroeconomic performance.

Figure 1.6. The share of SMEs adopting innovation strategies is high

Firms undertaking an innovation strategy as a % of all firms in each size category

Note: The chart is based on national innovation surveys on “product or process” and “marketing or organisational” innovation strategies. The chart shows the share of firms adopting both types of innovation strategy.

Source: OECD STI Scoreboard 2017 (database).

An aggregate productivity slowdown among OECD economies over the past decade has been linked to declining business dynamism and rising misallocation of resources (OECD, 2016a). Business dynamism, typically proxied by firm start-up and exit rates, enhances market discipline and promotes better allocation of resources. In turn, the efficiency of resource allocation boosts business dynamism, allowing high potential businesses to enter markets and grow easily (OECD, 2015a). Both the extent of business dynamism and the efficiency of resource allocation condition knowledge spillovers from frontier firms (Figure 1.1).

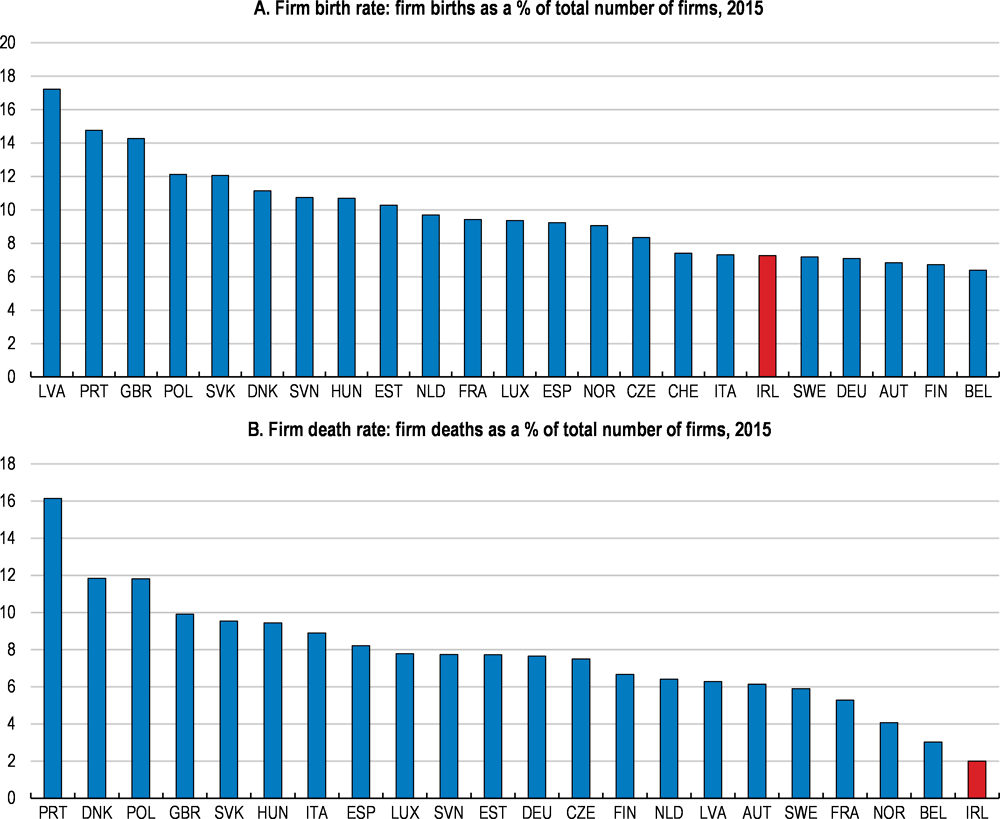

In Ireland, the firm entry rate is low but the firm exit rate is even lower (Figure 1.7). Firm entry is important since young firms have a comparative advantage in radical innovations and they encourage incumbents to innovate through competitive pressures, which raises aggregate productivity. Despite low rates of firm entry, the survival rate is high in Ireland, thus firms are old on average. A high survival rate could be an indication that the selection of firms at entry is efficient. However, if a high survival rate is due to inefficiencies at the exit margin, it suggests that the market selection mechanism is weak (OECD, 2015a).

Figure 1.7. Both the firm entry rate and exit rate are low in Ireland

Note: In Panel A: 2014 for Denmark, Portugal, Switzerland and the United Kingdom. In Panel B: 2014 for Denmark and Poland; 2013 for Portugal and the United Kingdom.

Source: Eurostat (2017), Business Demography (database).

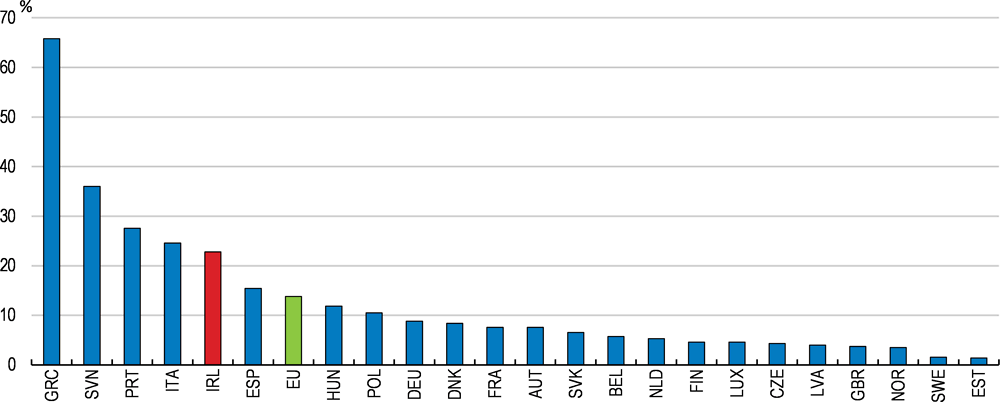

Weak market selection can lead to unproductive firms lingering in the market, weighing on the performance of the economy. Non-viable firms ‒ those kept alive by forbearance loans but otherwise insolvent ‒ trap scarce resources and hinder the growth prospects of young and innovative firms (Caballero et al., 2008). Such non-viable firms have reduced the investment and employment growth of healthy firms in many OECD countries over the past decade (Adalet McGowan et al., 2017a). In Ireland, default rates among Irish SMEs have been higher than their counterparts in many other EU countries over the past years (Figure 1.8). Most defaulted loans have experienced a breach of loan terms and forbearance has frequently been granted (Bank of Ireland, 2017). The prevalence of non-viable firms weakens the efficiency of resource allocation. This is because such firms trap resources that could otherwise be allocated to enable highly-productive businesses to expand.

Figure 1.8. Default rates are high for Irish SMEs

SME default rate by country, 2017Q2

Source: European Banking Authority (EBA), “Risk Assessment Report of the European Banking System, November 2017”.

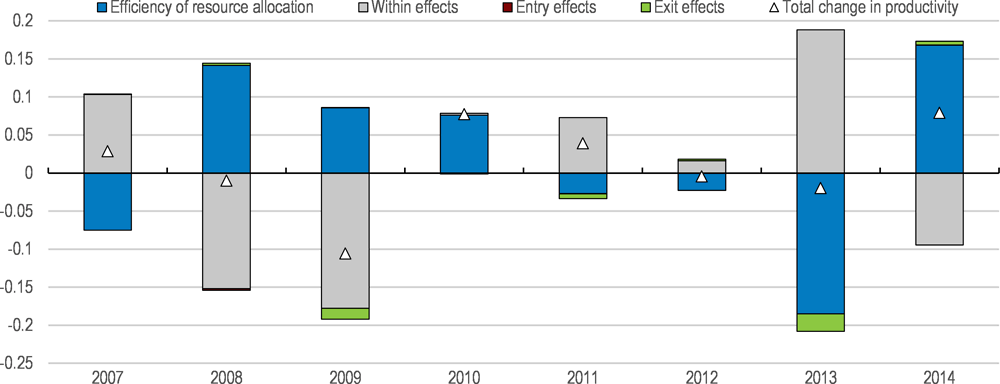

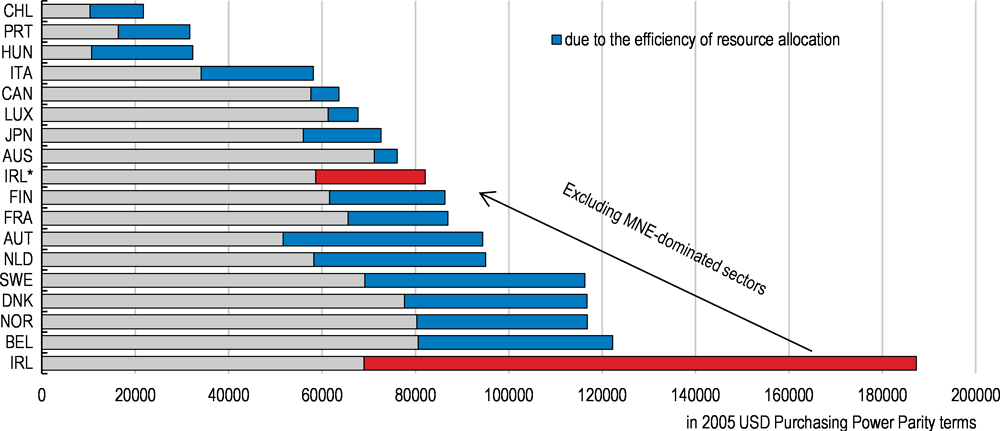

At first glance, the efficiency of resource allocation in Ireland appears to be very high (Box 1.1). However, this result owes largely to highly productive multinational enterprises (MNEs) that can raise a huge amount of resources from different channels, including from abroad. Once the MNE dominated sectors have been excluded, the efficiency of resource allocation in the Irish economy is greatly reduced and lags that of other OECD countries (Figure 1.9). Distinguishing between the results including or excluding MNEs is particularly important for Ireland since the MNE dominated sectors account for around 40% of total production in the economy, much higher than in most other countries. The contribution of resource reallocation to productivity growth has also weakened, while that of firm entry and exit has been negligible (reflecting the very limited firm entry and exit rates) over the past decade (Figure 1.10).

Box 1.1. Productivity analysis using OECD MultiProd

The OECD MultiProd project provides a comprehensive picture of productivity patterns across countries over the last two decades. The MultiProd project is part of a larger effort within the OECD Directorate for Science, Technology and Innovation to exploit existing official firm-level data (official surveys and administrative sources) in a harmonised framework to provide micro-aggregated statistics and analysis that are comparable across countries (see Berlingieri et al., 2017 for more details).

The MultiProd project collects statistics of 18 countries which have been successfully incorporated in the MultiProd database for the 1994-2012 period. A joint project between the OECD and the Department of Finance of Ireland was undertaken in parallel with this Economic Survey to include Ireland in the dataset.

The project provides a series of productivity metrics (Department of Finance, 2018). It focuses on, in particular, measures relating to industry concentration, productivity dispersion across firms, and the efficiency of resource allocation.

Efficiency of resource allocation

The Olley-Pakes decomposition used in MultiProd decomposes aggregate productivity into the contribution of two terms, an unweighted productivity term representing average firm level productivity, and a covariance term that links productivity to firm size (defined by employment shares). The latter term (known as the OP gap) is a measure of allocative efficiency, since it increases if more productive firms capture a larger share of resources in the sector:

is sectoral level productivity at time t, N represents the number of firms in a sector, is the share of firm i at time t, is the productivity of firm i at time t, and and are sectoral averages.

Figure 1.9 shows, in the Irish manufacturing sector, more than half of aggregate labour productivity is accounted for by the allocative efficiency term (OP gap) over the whole 2006-2014 period. The remaining part of aggregate productivity in manufacturing is accounted for by within-firm productivity. On the whole, Ireland’s OP gap indicates a high degree of allocative efficiency.

Figure 1.9. The efficiency of resource allocation is weaker for local firms

Labour productivity of firms in the manufacturing sector

Note: “IRL” covers all firms including multinational enterprises (MNEs); “IRL*” excludes those in the MNEs dominated sectors.

Source: Department of Finance (2018) based on the MultiProd dataset.

Figure 1.9 also shows the OP gap for manufacturing when foreign-owned multinational enterprise (MNE) dominated sectors are excluded (“IRL*”). Relative to the full manufacturing sample, the exclusion of foreign-owned MNE dominated sectors results in a much lower OP gap. These results suggest that a substantial part of aggregate labour productivity in the manufacturing sector is due to the presence of large multinational firms that have high productivity.

Changes in the efficiency of resource allocation

A dynamic version of the OP gap, as developed by Melitz and Polanec (2015), is presented below, for the manufacturing sector. This approach decomposes the contributions to the growth in labour productivity into four elements:

where is sectoral level productivity, and , , are the weighted productivity averages of, respectively, entrants, incumbents and exitors computed in the relevant time period. The first term is the change in the unweighted productivity average of incumbents, representing within firm growth in productivity; the second term is the change in the efficiency of resource allocation (i.e. the change in the OP covariance term) computed for incumbents; the third term is the contribution of the productivity of new firms relative to average productivity and; the fourth term is the contribution of the productivity of exiting firms relative to average productivity of the previous period.

Overall the annual changes in labour productivity growth in manufacturing were driven by within-firm productivity changes by incumbents and reallocation over the period 2006-2014. The contribution of firm entry and exit (on an annual basis) to labour productivity growth has been negligible and sometimes negative.

Figure 1.10. A decline in the efficiency of resource allocation has pulled down aggregate productivity

Annual growth rate of productivity and the contribution of its components, Manufacturing sector, change in log points

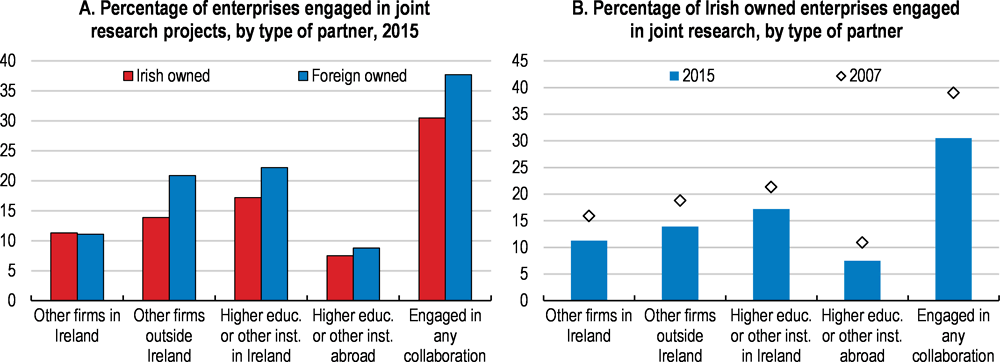

Linkages between foreign- and locally-owned firms

Impediments to firm growth may lower the incentive or ability for local firms to create linkages with highly productive foreign-owned enterprises. In turn, weak linkages lower the potential for productivity spillovers. Trade linkages, expressed as the intensity of supply chains between foreign- and locally-owned firms, are weak. Local firms can be incorporated into the supply chains of foreign-owned firms by either providing intermediate inputs in their production processes (i.e. a “backward linkage”) or using the inputs of foreign-owned firms as inputs to their operations (i.e. a “forward linkage”).

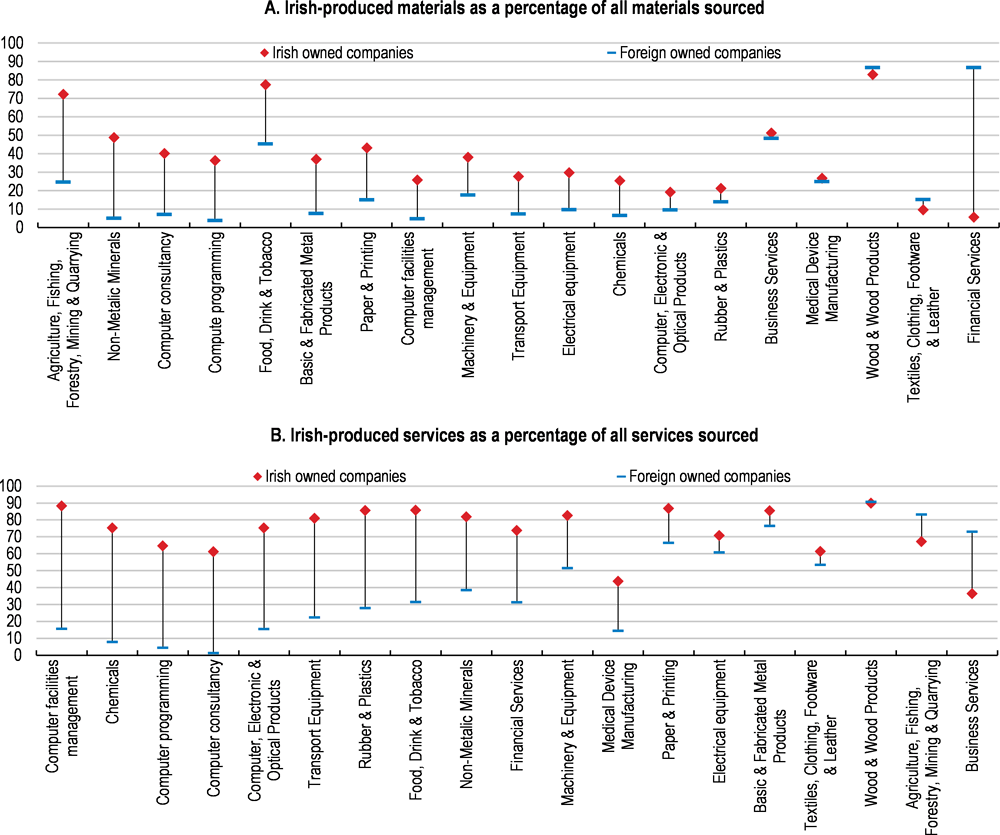

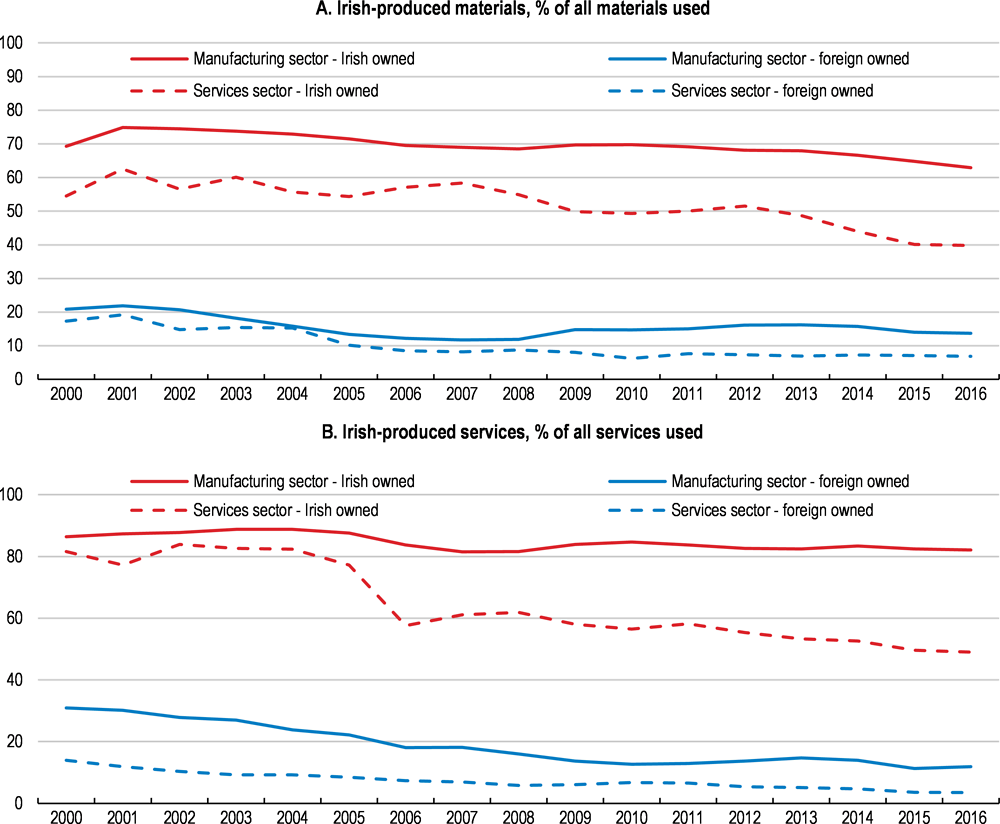

Foreign-owned firms are far less likely than Irish-owned firms to source production inputs locally (Figure 1.11). In some cases this may reflect foreign-owned subsidiaries not having full autonomy over procurement decisions, but the differences in sourcing behaviour are vast: around 65% of the material inputs of surveyed Irish-owned manufacturers were locally sourced in 2015 compared with 14% for foreign-owned manufacturers. Focusing on services inputs, over 80% of those used by surveyed Irish-owned manufacturers were sourced from Irish companies in 2015 compared to 12% by foreign-owned manufacturers.

Figure 1.11. Foreign-owned firms are much less likely to source production inputs from Ireland

Note: Data are based on a survey of around 4200 companies that are clients of either Enterprise Ireland, IDA Ireland or Údarás na Gaeltachta that have at least ten employees.

Source: Department of Business, Enterprise and Innovation.

There are disparities across more narrowly-defined industries in the extent to which differences exist in the sourcing behaviour of Irish-owned and foreign firms. There is a large gap in the degree of local sourcing in large manufacturing industries such as food, drink and tobacco (Figure 1.12). Similarly, in many key industries in the services sector, the extent of inputs sourced domestically is much lower for foreign-owned firms. This is particularly the case in some high-tech industries such as computer consultancy and computer programming.

Figure 1.12. Disparities in the sourcing behaviour of foreign and local firms differ by sector

Not only are trade linkages weak, but productivity spillovers from foreign-owned to local firms are modest. New analysis using Irish firm level data finds some evidence of positive productivity spillovers from the presence of foreign-owned firms in the services sector, but minimal (and sometimes negative) spillovers in the manufacturing sector (Box 1.2; Di Ubaldo, Lawless and Siedschlag, 2018). Furthermore, on average, trade linkages between foreign and locally-owned firms appear to have negligible positive productivity effects on the latter. Nonetheless, such linkages do appear to produce productivity spillovers for services firms with high absorptive capacity (captured by R&D investment).

Box 1.2. Estimating productivity spillovers from firm-level data

Ireland has been highly successful at attracting foreign direct investment, with foreign-owned firms accounting for close to half the country’s gross value added over recent years. One of the rationales for attracting such investment is the positive spillovers that foreign-owned firms may confer to local businesses. Abstracting from the impact of heightened competition from the entry of foreign firms (the productivity effect of which is theoretically unclear), a key channel through which such spillovers proliferate is the diffusion of new knowledge. As foreign firms are at a disadvantage to local businesses due to distance from their parent and limited knowledge of the local market, their ability to compete must be due to possessing firm-specific assets such as superior production technology, know-how or management strategy (Görg, 2007). Such assets often have public good characteristics as they can be used in the production processes of other entities at no additional cost.

To explore the extent to which productivity spillovers are apparent in Ireland, Di Ubaldo, Lawless and Siedschlag (2018) incorporate the firm-level multifactor productivity estimates from the OECD MultiProd project (detailed in Department of Finance, 2018) into an econometric model.

The analysis confirms that foreign-owned firms are more productive than Irish-owned firms on average, meaning that there is potential for positive productivity spillovers. To highlight this, a regression model is estimated which explains multifactor productivity at the firm level by ownership status (i.e. foreign vs local-owned) while controlling for firm size, industry and region-specific time invariant factors as well as common factors that vary over time across all firms. The results suggest that a foreign ownership firm premium in Ireland exists (Table 1.1). This is the case across both the manufacturing and services sectors and for foreign affiliates owned by firms based in both the European Union and non-European Union countries. The estimates indicate that the foreign ownership premium is around 26% on average for firms from EU countries and 39% for those from outside the EU.

Table 1.1. Estimating the foreign ownership productivity premium

|

|

Log(Multifactor productivity) |

||

|---|---|---|---|

|

Variable name |

All |

Manufacturing |

Services |

|

Foreign-owned firm (EU origin) |

0.23*** |

0.09*** |

0.26*** |

|

Foreign-owned firm (non-EU origin) |

0.33*** |

0.17*** |

0.39*** |

|

Small size |

0.00 |

-0.03*** |

0.03*** |

|

Medium size |

0.02*** |

-0.02* |

0.06*** |

|

Large size |

0.01 |

0.03* |

0.03** |

|

Constant |

2.17*** |

2.22*** |

3.46*** |

|

Observations |

70663 |

13668 |

51843 |

Note: *** represents statistical significance at the 1% level, ** at the 5% level and * at the 10% level. All regressions include industry, region and time fixed effects. The reference category for firm size is micro firms (firms having less than 10 employees).

The extent of productivity spillovers is then investigated by estimating if the MFP of local firms is impacted by the presence of and interactions with foreign-owned businesses. Such spillovers may come about through competition and learning effects from a strong presence of foreign-owned firms in the same sector of activity or vertical supply chain relationships (for further discussion, see Di Ubaldo, Lawless and Siedschlag, 2018). Each of these potential channels is specified in the empirical framework and tested through firm-level regressions on an unbalanced panel across the 2008-2014 period.

The estimation results highlight positive productivity spillovers in the services sector, but minimal (and sometimes negative) spillovers to locally-owned manufacturing firms (Table 2). The differential impact between sectors may be because productivity-improving processes or technologies are more observable to other industry participants in the services sector without direct technology transfer needing to occur (Di Ubaldo, Lawless and Siedschlag, 2018).

The estimation results also highlight the importance of absorptive capacity of local firms in maximizing productivity spillovers from foreign-owned businesses. On average, the productivity impact of having forward (foreign-owned firms supplying local firms) or backward (local firms supplying foreign-owned firms) trade linkages with industries that have a high share of foreign-owned firms is not discernable. However, there is evidence that indigenous services firms that invest in R&D are better able to internalise productivity spillovers. Column (6) of Table 1.2 highlights that this is the case when indigenous firms in upstream sectors supply to foreign-owned businesses in downstream sectors.

Table 1.2. Estimating productivity spillovers

|

|

Log(Multifactor productivity – local firms) |

|||||

|---|---|---|---|---|---|---|

|

Variable name |

Manufacturing |

Services |

||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Intra-industry |

-0.1* |

-0.03 |

0.01 |

0.3*** |

0.2** |

0.2** |

|

Intra-industry*R&D |

0.4 |

0.08** |

||||

|

Intra-region |

-0.1 |

-0.1 |

-0.1 |

0.03 |

0.03 |

0.03 |

|

Intra-region*R&D |

0.0 |

-0.06* |

||||

|

Forward linkage |

-2.2 |

-2.0 |

0.2 |

0.1 |

||

|

Forward linkage*R&D |

7.9 |

0.1 |

||||

|

Backward linkage |

-.3 |

0.3 |

-0.8 |

-0.8 |

||

|

Backward linkage*R&D |

-1.2 |

0.2*** |

||||

|

Constant |

2.0*** |

2.0*** |

2.0*** |

-0.5 |

-0.3 |

-0.4 |

|

Observations |

6719 |

6560 |

6560 |

14580 |

14530 |

14530 |

Note: *** represents statistical significance at the 1% level, ** at the 5% level and * at the 10% level. All regressions include industry, region and time fixed effects, as well as variables for industry growth, export and import status (introduced as a dummy variable that equals one if the firm exports/imports), industry concentration (proxied by the Herfindahl-Hirschman index), firm age, average wage at the firm (in log values), the R&D investment intensity of the firm (R&D investment per employee in log values) and dummy variables corresponding with firm size (i.e. “small”, “medium” and “large” as appearing in Table 1.1). The estimated coefficients on these variables can be found in Di Ubaldo, Lawless and Siedschlag (2018) or from those authors upon request. Forward linkages are measured using information from Ireland’s input-output tables while the measure of backward linkages uses information from the home country of the parent company of foreign affiliates to account for the specific input sourcing behaviour of multinationals.

To summarise the identified trends, Irish productivity growth has stagnated over the past decade, with the performance of local firms especially weak. This partly reflects a decline in the efficiency of resource allocation associated with weak business dynamism: while allocative efficiency is relatively high overall, it has had a declining impact on productivity growth over the period, with firm entry and exit having had very little impact on the productivity performance of the Irish economy. There is also evidence that the efficiency of resource allocation is notably weaker in those parts of the economy dominated by local firms. Given Ireland’s high share of multinational enterprises, there is potential for virtuous productivity spillovers from high-productivity foreign firms to local businesses. Nevertheless, supply chain linkages are limited and there is little evidence of knowledge spillovers between foreign and local firms in most instances. Against this backdrop, those aspects of government policy that impact upon firm entry and exit, the growth of high potential firms and the interactions between foreign businesses and local firms need to be examined.

Enhancing business dynamism

Reducing regulatory barriers for businesses

Well-functioning product markets ensure that high-potential businesses can enter markets and expand unimpeded. Reducing anti-competitive regulations facilitates more entry of young firms which tend to have a comparative advantage in commercialising and adopting new technologies (OECD, 2015a). It also strengthens market discipline, as new entrants create competitive pressures for incumbents to adopt innovations and reduce business costs. Reforms to reduce anti-competitive regulations enhance the market selection mechanism and the efficiency of resource allocation, boosting aggregate productivity (OECD, 2015a).

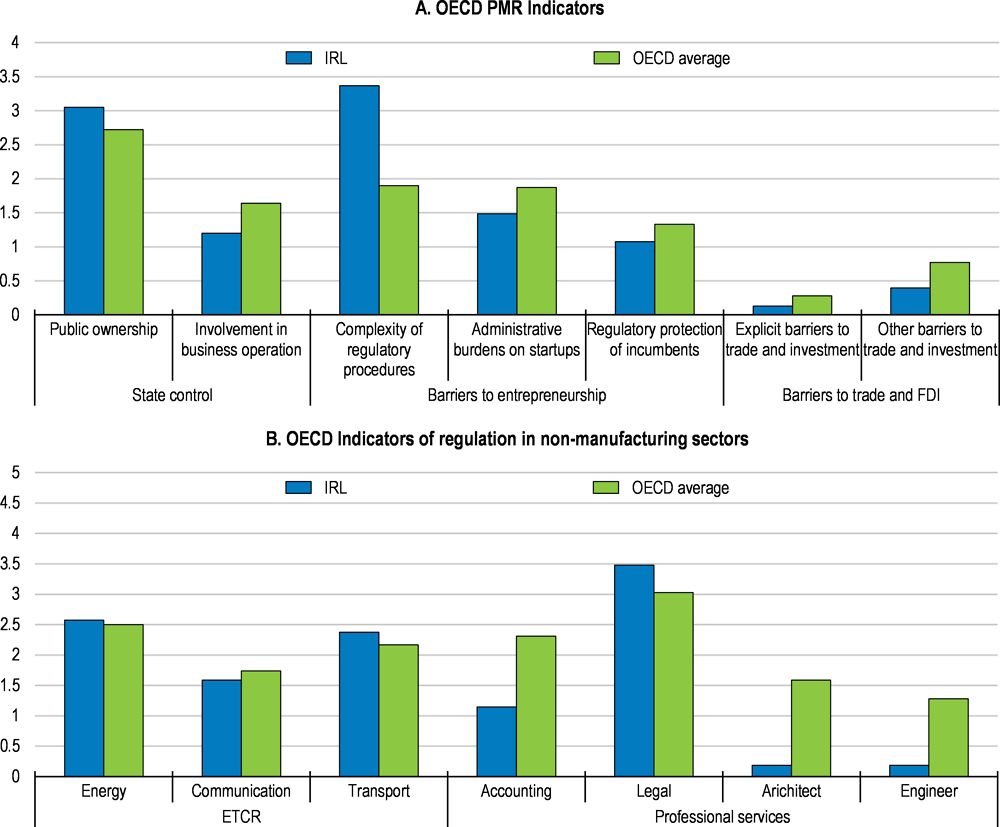

Ireland is a country where doing business is easy on average, ranking 17th in the world according to the World Bank’s Doing Business indicators. This owes largely to its low corporate tax rate and the fact that there are few barriers to entry for foreign firms, making the economy very open one for trade and foreign direct investment (FDI; Figure 1.13). However, regulatory obstacles inhibit the start-up and growth of small local businesses, reflected in the OECD Product Market Regulation (PMR) indicators for barriers to entrepreneurship (Figure 1.13). Such obstacles are particularly concentrated in the utility and legal services sectors.

Figure 1.13. Regulatory barriers are low overall but some barriers to entrepreneurship exist

Note: The OECD Indicators of Product Market Regulation are a comprehensive and internationally-comparable set of indicators that measure the degree to which policies promote or inhibit competition. The indicator ranges from zero (least stringent) to six (most stringent).

Source: OECD Product Market Regulations Statistics (database).

Entry regulations

Relatively high barriers to entrepreneurship come largely in the form of the complexity of Ireland’s licence and permits system (Figure 1.13). This is mainly because of the currently limited scope of points of single contact (“one-stop shops”) providing an interface between different spheres of competence. Although points of single contact for getting information on notifications and licences do exist, they were not available at the local level or via the Internet until recently. Furthermore, no point of single contact existed for issuing or accepting all licences required for opening a business.

Ireland introduced the Integrated Licence Application Service (ILAS) in early 2016. The service is on-line and expected to provide a single point of contact for all businesses to apply for, renew and pay for licences. Although it is not yet fully operational, 5 000 business users have already registered on the service, which connects seven licensing authorities across ten licence types. The government should fully roll out the ILAS, extending the system to include as many licensing authorities as possible, which will greatly reduce the administrative burden on small businesses.

Other administrative burdens, notably those related to commercial property, also weigh on entrepreneurship. It costs approximately 3.5 times the OECD average to obtain a planning permit from the local authorities (Figure 1.14). Stamp duty for the registration of property, which is paid to the national tax authority, is also costly, amounting to around 2% of the value of the property. These initial costs (planning charges and property registration) should be reduced, as they raise the barriers to entrepreneurship and distort investment decisions, as discussed in previous Economic Surveys.

Figure 1.14. The cost of construction permits is high in Ireland

Cost (% of structure value), 2016

Note: World Bank Doing Business records all procedures required for a business in the construction industry to build a warehouse of a given size. The procedures include, among others, obtaining and submitting all relevant project-specific documents (for example, building plans, site maps and certificates of urbanism) to the authorities. Cost is recorded as a percentage of the warehouse value (assumed to be 50 times income per capita).

Source: World Bank Doing Business (2017).

Not only initial costs, but also recurrent costs related to commercial property are high. Firms pay “commercial rates”, which are levied by local authorities and are based on the value of the property a firm – which is not necessarily the property owner – occupies. The valuation of properties is determined by the Commissioner of Valuation Rates. The “annual rate on valuation” is decided by local authorities. In the case of Dublin City Council, it amounted to 26% of the value of a property in early 2017. Such a system especially penalises innovative young firms as they are often in a loss-making position in their early years. Commercial rates should be abolished (as well as potentially the local property tax) and replaced by a broad-based land tax which covers at least commercial and residential property (see Key Policy Insights section). This would be less distortionary to production activity, especially for entrepreneurial firms, and could be designed in a way that preserves overall government tax receipts.

Conduct regulations

Regulations in the services sector often have “knock-on effects” to other sectors, through trade linkages in the economy (Conway and Nicoletti, 2006). Tackling inefficient regulations in the services sector can reduce the price of intermediate inputs and/or raise the quality of products. It also allows businesses to gain greater benefits from participating in global value chains (GVCs) to the extent that they rely on domestic services (OECD, 2015a). OECD indicators of regulation in non-manufacturing sectors identify excessively stringent regulations in energy and legal services (Figure 1.13, Panel B). The Irish authorities also identify high costs in these sectors (NCC, 2017).

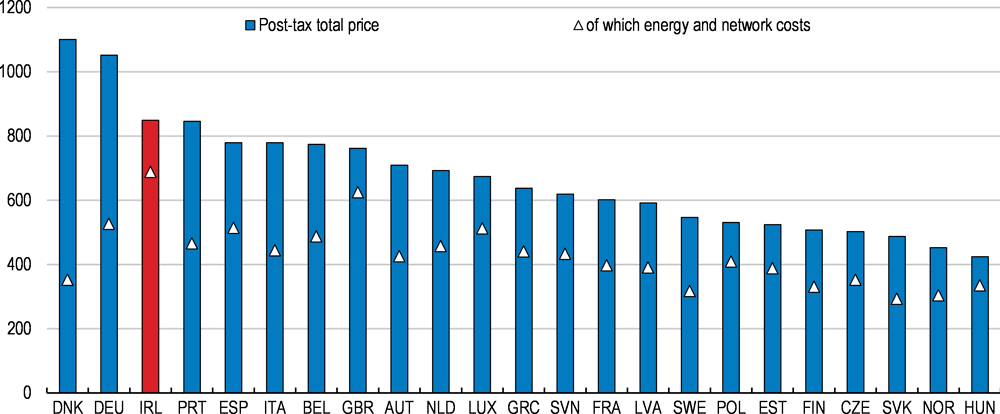

Electricity

Ireland’s electricity prices are high, with energy and network costs above many other EU countries (Figure 1.15). The energy component accounts for a large share of total electricity prices consisting of the expense of purchasing electricity on the wholesale market and the cost of electricity supply to consumers. The cost of purchasing electricity is largely determined by external conditions because of Ireland’s dependence on foreign energy sources. However, high energy costs can be explained by either price regulation or the lack of unbundling (ACER, 2016), and Ireland’s lack of unbundling can at least partly explain its overall high electricity prices.

Figure 1.15. Electricity costs are high in Ireland

Final price for the consumption of 3 500 kWh per household annually in the capital city

Note: The post-tax total price is broken down into: the energy component which consists of the cost of purchasing electricity on the wholesale market and the cost of retailers for supplying electricity to household consumers; the cost of network distribution; the cost of network transmission; energy taxes and charges; other taxes and charges; VAT; and the charges relating to support schemes for renewable energy sources.

Source: Agency for the Cooperation of Energy Regulators (2016).

The Irish energy sector is still characterised by relatively strong public ownership and vertical integration (Figure 1.13). In the electricity sector, the state owns virtually 100% of shares in the Electricity Supply Board (ESB), the only firm in the sector until the late 1990s. The ESB group owns the transmission and distribution networks (ESB Networks Limited, a legally separate body) and operates distribution (ESB). Eirgrid, which was established in 2006 and is also state-owned, operates transmission (the “independent system operator” model). ESB Networks Limited, which owns the transmission and distribution networks, does not have any significant assets or personnel, as these both lie within ESB Network, a ring-fenced business unit of the ESB group. The generation and supply segments are now open to competition, but ESB remains a major player in both segments, accounting for a market share of 47% and 51%, respectively.

In its decision to certify Eirgrid as the transmission operator, the European Commission made some proposals to make more effective and efficient transmission operations and governance arrangements (European Commission, 2013). The Commission found that the current arrangement, comprising ESB Networks (ESB’s business unit) and ESB Networks Limited (a separate legal entity), blurs the lines between transmission activities on the one hand and generation and supply activities on the other. The Commission made a number of proposals, including separating the ownership regime between Eirgrid and ESB, or ensuring that ESB’s transmission roles are in a single, separate entity. The authorities are currently assessing these proposals within the context of various other programmes.

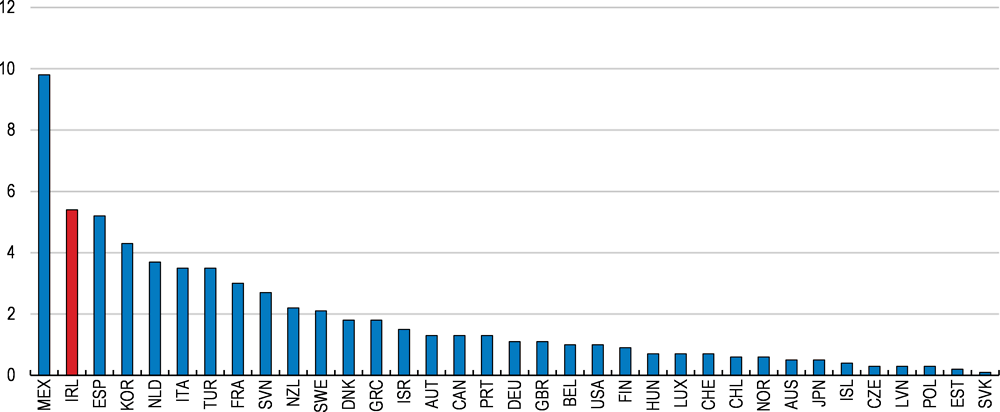

Legal Services

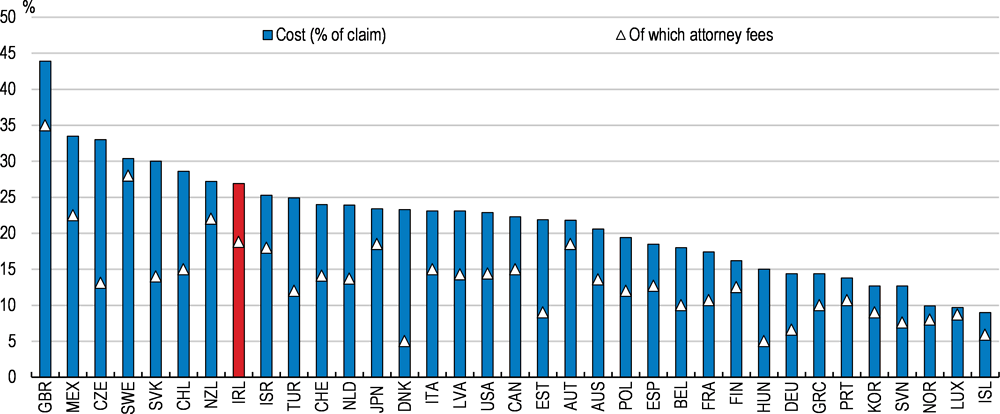

Among professional services, regulations on legal services are particularly high (Figure 1.13), leading to high costs in the sector (Figure 1.16). This stringency is due to regulations restricting the form of legal business to sole proprietorship and prohibiting inter-professional co-operation in most cases. The professional fees charged by lawyers vary largely for common services such as conveyancing transaction, and a lack of price transparency for legal services prevails (CCPC, 2012).

Figure 1.16. The costs in the legal services sector are high in Ireland

Note: In the case of MEX, JPN, USA, it refers to Mexico City, Tokyo, and New York City respectively.

Source: World Bank Doing Business (2017).

To reform the regulations in the sector, the Legal Services Regulations Act was adopted in late 2015. The Act established the Legal Services Regulatory Authority (LSRA), an independent but publicly accountable body. The LSRA will be responsible for overseeing both solicitors and barristers and processing complaints that have, so far, been dealt with by self-regulated professional bodies. The Act also sets up the Office of the Legal Costs Adjudicator to provide an independent and impartial assessment of legal costs, seeking to achieve a balance between the costs involved and the services rendered. Both institutions are expected to be fully operational in 2018. These changes will raise the transparency of legal costs and customers’ bargaining power.

The LSRA will also pursue, mostly subject to consultation, the competition-enhancing and cost-reducing provisions prescribed in the Act. The provisions envisage the introduction of legal partnerships (either solicitor-barrister or barrister-barrister partnerships) and of limited liability partnerships (LLP), the creation of multi-disciplinary practices (but limited to those between comparable professions), and the possibility of direct access to barristers for customers. These provisions will be possible only under the new regulations which the LSRA will issue. If introduced, these provisions should lower the costs of legal services through enhancing competition in the sector.

Creating a high-performing stock of physical infrastructure

High-quality transport infrastructure is also essential for the efficiency of supply chains, impacting the ability of local firms to embed themselves into global value chains and grow their business. Nevertheless, those business executives surveyed as part of the World Economic Forum Executive Opinion Survey in 2016 judged the quality of Ireland’s transport infrastructure to be poor compared with other OECD countries. This judgment was echoed by logistics professionals questioned for the World Bank Logistics Performance Indicator. The government has identified transport around urban centres as posing particular constraints, which are likely to become more pronounced given expected future demand trends (Department of Public Expenditure and Reform, 2017a). Dublin and Cork are already two of the most congested cities of their size class in the world, according to the Tom Tom Traffic Index, and both are expected to experience particularly strong population growth over the coming decade (CSO, 2013).

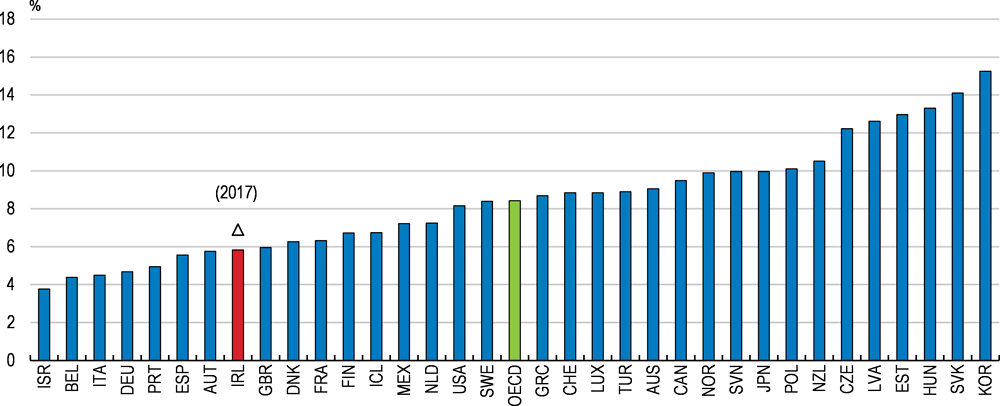

Cuts to public capital investment accounted for a disproportionate share of fiscal consolidation through the crisis, with transport infrastructure spending particularly hard hit (Kennedy, 2016). Between 2008 and 2015, government investment as a share of total government expenditures fell from 12.7% to 5.8%. By that time, the investment share of government spending was below the OECD average (Figure 1.17). The government plans to substantially increase public capital investment and the investment share of public spending has already begun to creep up. Between 2016 and 2021, capital expenditure is expected to rise by approximately 85% (Department of Public Expenditure and Reform, 2017b), with many new transport projects and upgrades planned. Furthermore, a new National Development Plan for the period 2018-2027 is being developed, that will closely align with the National Planning Framework that is also being drafted. The latter will outline a set of compatible development priorities for the country to 2040 and provide an overarching strategy for government activities across a range of policy areas including transport, housing, jobs, education, communications and the environment.

Figure 1.17. The investment share of government spending is low

Government investment as a share of total government expenditures, 2015

Note: 2015 is the latest data available for all countries.

Source: OECD (2017), Government at Glance (database).

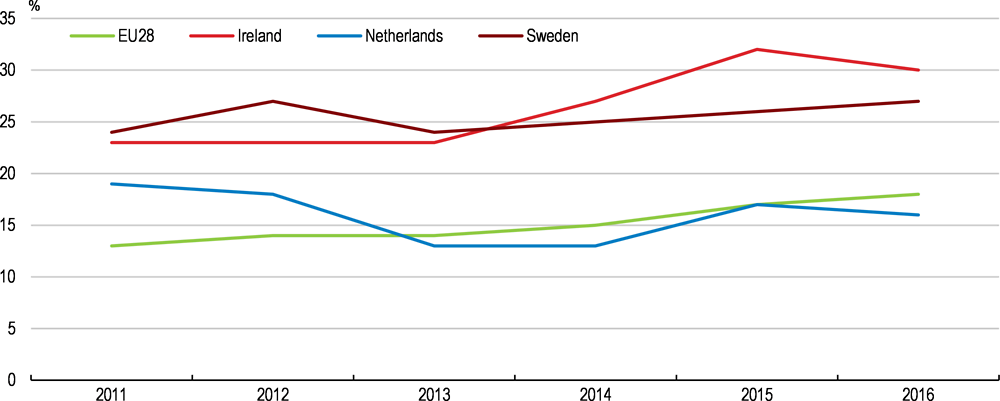

A business environment that enables firms to embrace digitalisation can also enhance their ability to reach new markets and implement new production processes. Recent work highlights that online sales have played an important role in the facilitation of export participation by Irish services firms (Lawless and Studnicka, 2017), with many Irish firms selling products online (Figure 1.18). While the proportion of enterprises with high speed broadband access (i.e. download speed above 30 mb/s) remains below that of some countries such as Sweden and the Netherlands, the increase in coverage between 2014 and 2016 was the second highest of any EU country. This partly reflects high speed broadband delivery being a strategic priority under the Programme for Government. The National Broadband Plan, published in 2012, envisaged that all premises in Ireland would have access to high speed broadband by 2020 (coverage was 65% as at September 2017). While full coverage is now not expected to be achieved until 2023, over 90% of premises should have access by 2020.

Figure 1.18. Many Irish firms sell online

Proportion of enterprises selling online (at least 1% of their turnover).

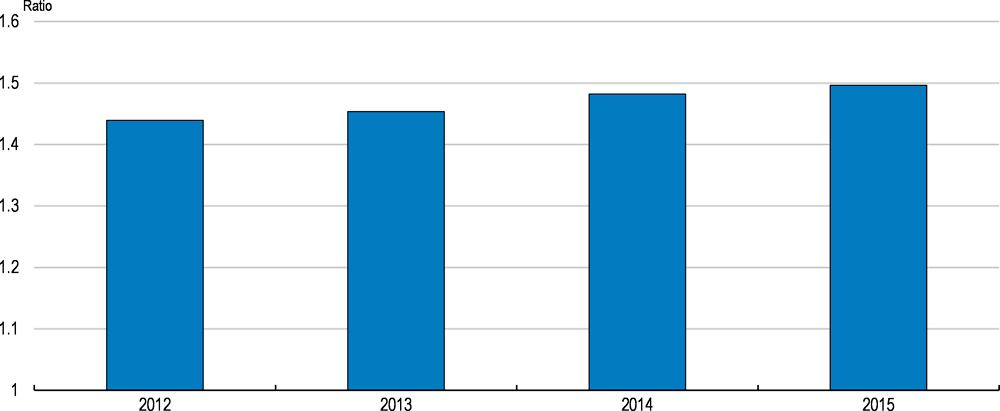

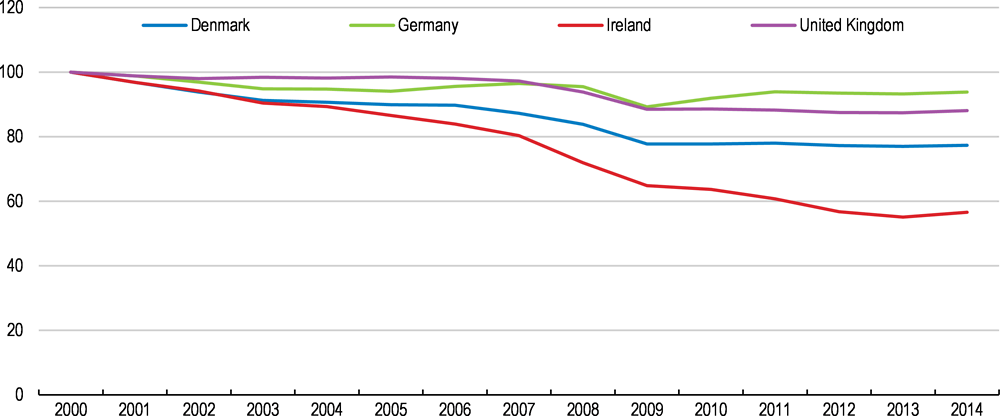

In the context of the large planned increase in public capital investment, choosing public infrastructure projects with the highest economic and social returns is critical. Since 2000, aggregate capital productivity has declined more sharply in Ireland than in any other OECD country for which comparable data exist (a subset of these are shown in Figure 1.19). This trend was observed prior to the financial crisis and has persisted since. Furthermore, recent work by the International Monetary Fund has estimated Ireland’s public infrastructure spending efficiency at below the EU average (IMF, 2017).

Figure 1.19. Capital productivity has declined sharply in Ireland

Index 2000=100

Note: Capital productivity is measured as the ratio between the volume of GDP and the volume of capital input, defined as the flow of productive services that capital delivers in production (i.e. capital services). The latest available data point for Ireland is for 2014.

Source: OECD (2017) Compendium of Productivity Indicators (database).

There are particular aspects of the selection, design and evaluation of public infrastructure projects in Ireland which may be limiting the performance of such capital. Prior to project development, there is no mandatory process of consulting with future users. Such provisions are in place in the UK and in most Scandinavian countries and provide an opportunity for user feedback that can be incorporated into infrastructure design (OECD, 2017b). The public consultation in Ireland for the mid-term review of the government’s Infrastructure and Capital Investment Plan 2016-21 was an example where such feedback has been encouraged, though it should be made compulsory in all future public investment projects.

There should also be better efforts to systematically collect information on the financial and non-financial performance of existing infrastructure. This can inform policymakers about the best delivery model for future projects and emerging capacity constraints. Furthermore, data can be used to create indicators for benchmarking infrastructure performance across time and sectors and, where possible, relative to other countries. New Zealand is one country that has invested in the evidence base for evaluating infrastructure assets. Following the 2011 National Infrastructure Plan, the government developed performance indicators for each sector on the stock, state and performance of central and local government infrastructure assets as well as those managed by the private sector. Once armed with better performance data, the establishment of an independent body that draws on that information to prioritise infrastructure projects should be considered. Nevertheless, the efficacy of such an institution relies on it being transparent and its findings not being influenced by vested interests.

In endeavouring to improve the quality of Irish infrastructure, the process for planning and delivering projects should also be reviewed. In recent years, the delay between the conception and completion of some public infrastructure projects has been inordinately long (IBEC, 2015a). This may reflect the fact that the responsibility for planning, delivering and maintaining infrastructure is highly fragmented across public sector entities (NCC, 2016). It should be ensured that there is a clear rationale for project responsibilities being divided across institutions and levels of government. In such a case, the Department of Housing, Planning and Local Government should undertake regular reviews to promote cooperation and ensure there are not contradictory approaches being undertaken by the entities involved.

Insolvency regimes are crucial in influencing business dynamics

Effective exit policies strengthen market selection by increasing the economy’s ability to wind down non-viable firms and by facilitating the restructuring of viable ones. They can also improve within-firm productivity growth among firms undergoing restructuring. Finally, such policies enhance the scope and speed at which resources sunk in failing firms are reallocated to more productive uses (Adalet McGowan and Andrews, 2016). Exit policy also matters for firm entry, since high exit costs disproportionately affect firms with riskier business strategies which entail a high probability of failure (Bartelsman et al., 2008). Recent OECD evidence shows that strengthening the insolvency regime is complementary to regulatory reforms for firm entry (Andrews et al., 2018).

While a number of policy domains are related to firm exit, insolvency regimes are crucial for the private market to facilitate the exit of non-viable firms in an orderly manner. According to Adalet McGowan and Andrews (2016), this is due to the existence of market imperfections including: information asymmetries, as debtor and creditors assign different values on the firm (Smith and Stroemberg, 2005); incomplete contracts, as it is difficult to write a complete contract ensuring an optimal outcome in advance (Hart, 2000); and coordination problems, as the interest of individual creditors can conflict with those of the creditors as a collective (Marinc and Vlahu, 2012).

In Ireland, corporate insolvency results in one of three main procedures: liquidation (winding up the business); receivership (enforcement of collateral against a loan); or examinership (restructuring). The number of insolvency cases is limited as there were 1 754 liquidations, accounting for only 12% of the total number of firms which were dissolved in 2016. The vast majority of liquidations are voluntary, while court-ordered liquidations accounted for just 61 cases. In 2016, 340 receiverships were initiated in 2016, while 20 companies went into examinership (CRO, 2017).

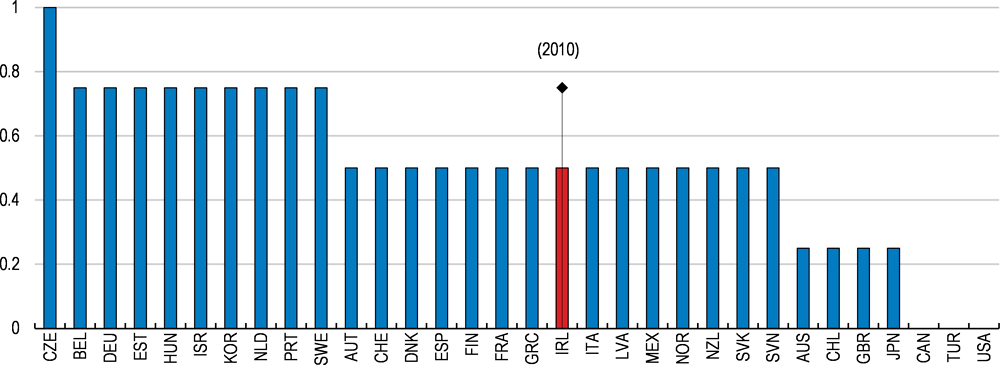

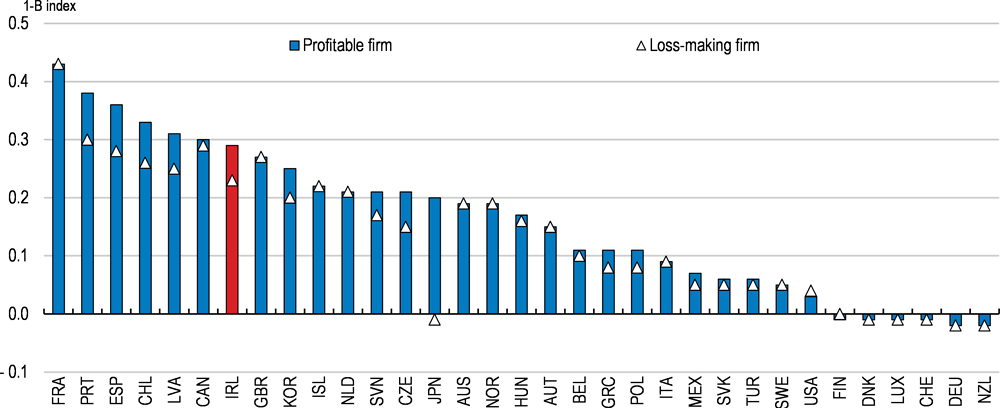

Corporate insolvency regime for restructuring

The Irish corporate insolvency regime is considered to be highly efficient (World Bank, 2017). The recovery rate (i.e. how much secured creditors recover from an insolvent firm at the end of insolvency proceedings) is very high, at 87.7% (versus the OECD average of 73.0%). The average duration of insolvency proceedings is short (0.4 years versus 1.7 years), though costs of insolvency proceedings are close to the OECD average (9% of the debtor’s assets versus 9.1%), mostly due to the cost of legal services. The framework of the Irish corporate insolvency regime is also considered to be strong (Adalet McGowan et al., 2017b; Figure 1.20), in particular with regard to corporate restructuring. The strength in the corporate insolvency framework (Figure 1.20) results from a number of positive practices in Ireland.

Insolvency proceedings start early, thus avoiding delays that reduce the possibility of successfully restructuring viable firms and lower the liquidation value of failing firms.

After the restructuring proceedings, the debtor is allowed to obtain new credit.

The debtor is allowed to continue operations during restructuring proceedings, thus increasing the chance of a successful outcome, particularly as incumbent managers are allowed to stay in charge for a limited period.

Restructuring plans need only a requisite majority of creditors for approval, instead of requiring a unanimous vote, thus facilitating the timely restructuring of firms.

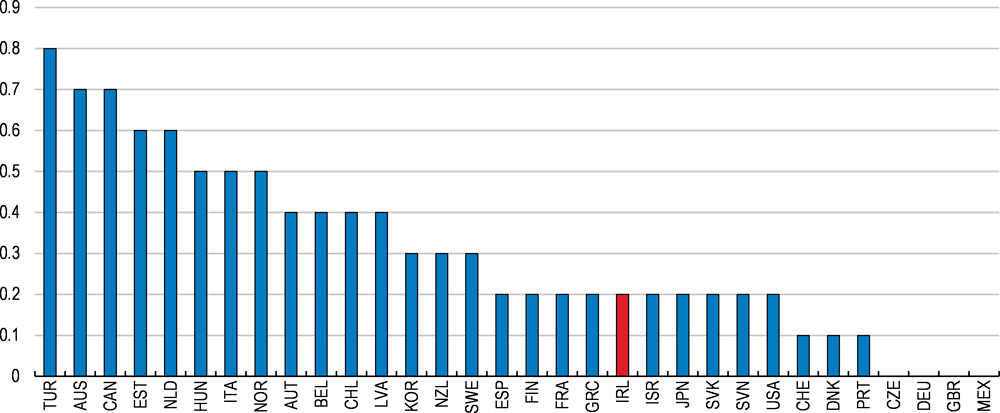

Figure 1.20. The insolvency regime for corporate restructuring is efficient

OECD insolvency indicator: Corporate restructuring, 2016

Note: The indicator is constructed based on the OECD questionnaire on insolvency regimes. It ranges from zero (least stringent) to one (most stringent). “Corporate restructuring” takes into the following aspects: creditors’ ability to initiate restructuring; availability and length of stay on assets in restructuring; treatment of management during restructuring; possibility and priority of new financing; and possibility to “cram-down” on dissenting creditors.

Source: Adapted by the Secretariat based on Adalet McGowan et al. (2017).

Bankruptcy law

Bankruptcy law often has greater importance than corporate insolvency regimes for influencing the exit (and hence entry) of entrepreneurs and small businesses (Armour and Cumming, 2008). Entrepreneurs often use personal finances prior to incorporating and obtaining limited liability protection (Berkowitz and White, 2004; Cumming, 2012) and lenders often require them to make personal guarantees. In Ireland, such guarantees are common practice, with some 40% of SMEs using them (CSO, 2014). This likely impedes firm exit, as an owner of a failing firm that has given personal guarantees becomes liable if the firm’s assets cannot fund all liabilities. In Ireland, if the owner cannot pay out the liabilities or avail of alternative debt resolution under personal insolvency law (discussed below), then they risk becoming bankrupt.

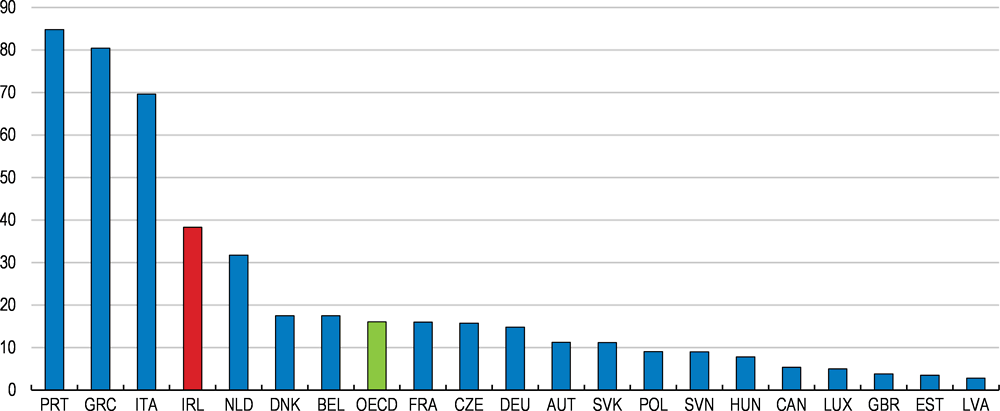

For many years, Ireland’s bankruptcy law was very stringent for debtors, and all parties avoided pursuing or declaring bankruptcy at any cost, to the extent that the number of personal bankruptcy cases was virtually zero in the 2000s. Two recent reforms, which reduced the penalties for the bankrupt (Figure 1.21), resulted in an increase in the number of bankruptcies adjudicated (from 58 in 2013 to 526 in 2016). This suggests that the reforms made bankruptcy a viable solution, although the number of bankruptcy cases remains unusually low with respect to the number of highly indebted persons.

Figure 1.21. Reforms to bankruptcy law have reduced penalties for failed entrepreneurs

OECD insolvency indicator: Treatment of failed entrepreneurs, 2016

Note: The indicator is constructed based on the OECD questionnaire on insolvency regimes. It ranges from zero (least stringent) to one (most stringent). “Treatment of failed entrepreneurs” takes into the following aspects: time to discharge; and bankruptcy exemptions.

Source: Adapted by the Secretariat based on Adalet McGowan et al. (2017).

The availability of discharge (exemption of future earnings from obligations to repay pre-bankruptcy debts) reduces the burden of the debtor and thus facilitates smoother firm exit. The recent reforms just discussed reduced the time to discharge (i.e. when the exemption from pre-bankruptcy debt repayment becomes available) from twelve years to three in 2012 and from three years to one in 2015 (although it can be extended for non-cooperative debtors up to a maximum eight years from the date of bankruptcy adjudication or up to a maximum of 15 years in very serious cases). If there is an Income Payment Agreement or an Income Payment Order in place, the bankrupt person will still have to comply with it until it expires, which can last up to 3 years. However, such orders are made only where the bankrupt’s income or assets so permit and subject to the courts having regard to the reasonable living expenses of the bankrupt and their dependents. In some other countries, discharge is not allowed or, even when it is allowed, the time to discharge is long.

The exemptions of assets of the bankrupt that are not directly linked to the business also affect firm exit. In Irish bankruptcy law, the exemptions of pre-bankrupt assets from the bankrupt estate (or the legally protected assets) are very strictly limited. All of the debtor’s assets, with the exception of necessities up to a value of EUR 6 000 (equivalent to a fifth of average annual earnings), are transferred to the Official Assignee who will sell them; the proceedings are distributed among the creditors. The assets include the debtor’s dwelling, under the prior permission of the court. This contrasts, for instance, with the exemptions available under US Federal Law, which sets up minimum standards across states, allowing the exemptions up to USD 22 975 for homestead, USD 11 525 for total household goods and USD 3 450 for motor vehicle, etc.

In practice, however, the bankrupt’s home is rarely sold by the Official Assignee, because the court must take into account the reasonable living expenses of the bankrupt and his or her dependents’ in making any bankruptcy payment order. Moreover, reforms to the bankruptcy law in 2015 specified that if neither the secured creditor nor the Official Assignee sought to repossess a dwelling within three years of the date of bankruptcy adjudication, the ownership of the dwelling by the debtor can be reinstated. Overall, the bankrupt is often granted more exemptions than what is defined in the bankruptcy law, but the courts define what are ‘reasonable’ living expenses (having regard to the Reasonable Living Expenses Guidelines issued annually by the Insolvency Service of Ireland) on a case by case basis, and in this sense uncertainty remains. In parallel, collateral enforcement by creditors rarely occurs in practice (even though a secured creditor’s contractual rights are not impaired by the debtor becoming bankrupt) due to the slow repossession proceedings (see Key Policy Insights section). Thus, in some cases at least, both the debtor and creditors can be better off by engaging actively in debt resolutions outside the bankruptcy procedure.

Alternative debt resolution mechanisms

The Personal Insolvency Act of 2012 introduced three new debt resolution mechanisms to help highly-indebted people reach agreements with their creditors. These mechanisms offer different solutions to people depending on their situations (Table 1.3). Among them, the Personal Insolvency Arrangement provides for the agreed settlement of both secured and unsecured debt on a voluntary basis (Table 1.3). The debtor must be able to make some repayments to their creditors in return for a discount of their debts. When the agreed period specified in each Personal Insolvency Arrangement ends, and if the debtor has fulfilled the agreement, they will be discharged from the unsecured debts. However, the secured debt will only be discharged to the extent specified in the Personal Insolvency Arrangement.

The three personal insolvency schemes have been increasingly used since their inception. Across the three schemes, 3 038 arrangements have been approved out of 6 800 applications since 2013 (ISI, 2017). The rejection of over half of applications by creditors reflects poor prospects of repayment by debtors, but is also related to the difficulties in co-ordination among creditors. Since late 2015, the debtor can appeal to the court for a review when creditors reject a PIA proposal which includes debt secured on the debtor’s main residence. The court may impose the rejected PIA proposal on creditors, subject to a number of criteria. Data on this new review process will be published in due course, and it may be useful in assessing how to further promote the alternative debt resolution mechanisms. Then, the authorities should consider making these debt resolution mechanisms more practical, for instance, requiring the approval of the simple majority of creditors, instead of 65% of them, and removing some other additional requirements (Table 1.3).

Facilitating the exit of non-viable firms may initially entail a rise in the number of displaced workers. Nevertheless, this should be considered in a broader context: In Ireland, around 1.1 million transitions occurred in the labour market in 2015 (SOLAS, 2016). A significant share of the transitions were accounted for by job churn, while the amount of inflow from employment to unemployment was 88 000. The number of those who were displaced and became unemployed due to business closure traditionally accounts for less than 10% of this inflow into unemployment. To cushion the impact on such workers, effective jobseeker assistance programmes are key. Regarding displaced workers due to firm exit, OECD evidence shows that active labour market programmes are found to be more effective among such displaced workers following firm exit, compared with other categories of jobseekers (Andrews and Saia, 2016).

Table 1.3. Four alternative resolution mechanisms for personal insolvency in Ireland

|

Arrangement |

Type of debt covered |

Value |

Duration |

Apply through |

Contents |

|---|---|---|---|---|---|

|

Bankruptcy |

Unsecured and secured |

Over EUR 20 000 |

1 year |

High Court (voluntary declaration or else creditors can petition) |

The bankrupt is automatically discharged from bankruptcy 1 year after the order of adjudication. The bankrupt's name will remain on the register, as a discharged bankrupt. If there is an Income Payment Agreement or an Income Payment Order in place, s/he will still have to comply with it until it expires. These arrangements can last up to 3 years. |

|

Debt Relief Notice (DRN) |

Unsecured (and secured in certain cases) |

Up to EUR 35 000 |

3 years |

Approved Intermediary (AI) |

DRN provides debt relief for people with no disposable income or assets and no prospect of being able to pay off the debt. DRN writes off debt up to EUR 35 000. During this 3-year period the creditors will not be able to pursue the debtor for payment, but if the debtor’s circumstances improve, s/he may have to pay part of debts. |

|

Debt Settlement Arrangement (DSA) |

Unsecured |

No limit |

5 years (+1) |

Personal Insolvency Practitioner (PIP) |

DSA provides for the agreed settlement of unsecured debt. The debtor must be able to make some repayments to the creditors in return for a discount of debts. It is a voluntary arrangement and it requires the support of creditors representing at least 65% of the total debt. If the DSA ends successfully, the debtor will be discharged from the unsecured debts. |

|

Personal Insolvency Arrangement (PIA) |

Unsecured and secured |

No limit on unsecured, Up to EUR 3m secured (though cap can increase if agreed) |

6 years (+1) |

Personal Insolvency Practitioner (PIP) |

PIA provides for the agreed settlement of secured or unsecured debt. The debtor must be able to make some repayments to the creditors in return for a discount of debts. It is a voluntary arrangement and it requires the support of creditors representing at least 65% of the total debt. In addition, over 50% of secured creditors and 50% of unsecured creditors must vote in favour. If the PIA ends successfully, the debtor will be discharged fully from the unsecured debt and s/he will be also discharged from the secured debt to the extent specified in the PIA. |

Source: based on citizensinformation.ie

Enhancing the allocation of finance

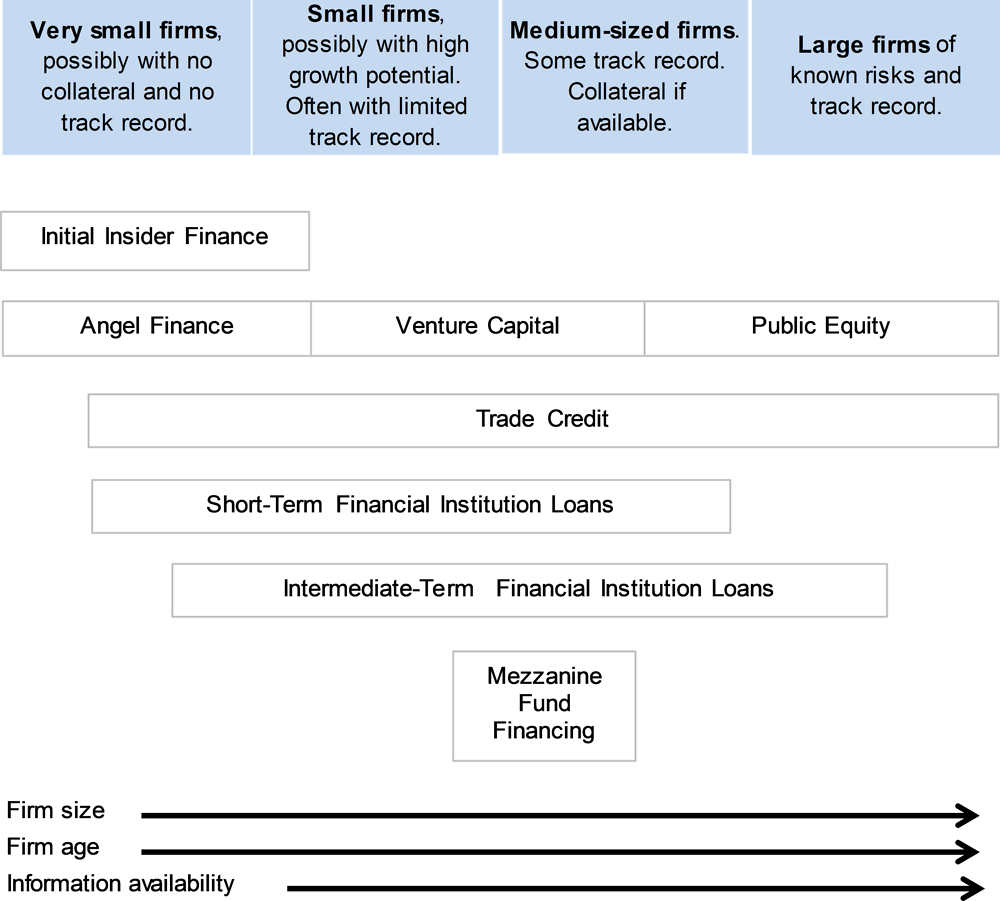

Well-functioning capital markets ensure the efficient allocation of capital. They facilitate the entry and expansion of high-potential businesses, boosting business dynamism. Access to finance for high-growth Irish firms also supports capital investments that better enable technology transfer or their ability to operate at a scale which makes supply relationships with MNEs feasible. On the credit demand side, the importance of different types of finance varies depending on firms’ risk/return profile and stage of business development (OECD, 2015c; Figure 1.22).

Figure 1.22. The importance of different types of finance varies across firms

Source: Berger and Udell (1998), adapted by the Secretariat.

Bank finance, traditionally the main source of external funding among Irish SMEs, has weakened since the crisis. The share of firms relying on bank finance declined by 50% between 2005 and 2012 and, within bank finance, the share of working capital facilities rose compared with bank loans (Lawless et al., 2013). Bank loans are overall less frequently used in Ireland than in other euro area countries (Table 1.4). The decline in bank finance has been substituted by other funding sources, such as internal funding and trade credit (Casey and O’Toole, 2014). Although other types of debt finance are overall more frequently used in Ireland than in other euro area countries (Table 1.4), funding through the stock exchange remains comparatively underdeveloped (see below).

Table 1.4. Financing sources used in Ireland more than in other euro area countries

|

|

Young firms |

Developing firms |

Mature firms |

|---|---|---|---|

|

|

(< 5 yrs) |

(5 - 10 yrs) |

(> 10 yrs) |

|

Micro enterprises |

|||

|

Retained earnings |

X |

X |

|

|

Bank working capital facilities |

X |

X |

X |

|

Bank loans |

X |

||

|

Issued debt |

X |

X |

|

|

Trade credit |

X |

X |

X |

|

Other loans |

X |

X |

|

|

L/F/HP |

|||

|

Mezzanine |

|||

|

Small-sized firms |

|||

|

Retained earnings |

X |

X |

X |

|

Bank working capital facilities |

X |

X |

X |

|

Bank loans |

X |

||

|

Issued debt |

X |

X |

X |

|

Trade credit |

X |

X |

X |

|

Other loans |

X |

X |

X |

|

L/F/HP |

X |

||

|

Mezzanine |

|||

|

Medium-sized firms |

|||

|

Retained earnings |

X |

X |

X |

|

Bank working capital facilities |

X |

X |

|

|

Bank loans |

|||

|

Issued debt |

X |

X |

|

|

Trade credit |

X |

X |

X |

|

Other loans |

X |

X |

X |

|

L/F/HP |

|||

|

Mezzanine |

X |

Note: X shows the financing is used more than in other euro area countries.

Source: Adapted by the OECD based on Lawless et al. (2014).

Restoring the normal functioning of the banking sector

Impairment in the banking system

The SME default rate has remained high compared with many other European countries over the past years (Figure 1.8). Some SMEs are highly indebted, which effectively raises solvency and default risks (McCann, 2014). At firm level, the financial position of SMEs varies significantly, as about one-third of SMEs do not hold debt, while 5% of them are heavily indebted as their debt-to-turnover ratio exceeds one (CBI, 2017). The share of such firms is particularly high in the hotels and restaurants sector, where property-related loans for business purposes were excessively extended. Around 75% of SMEs with property-related debt find it an obstacle to business performance (CSO, 2014).

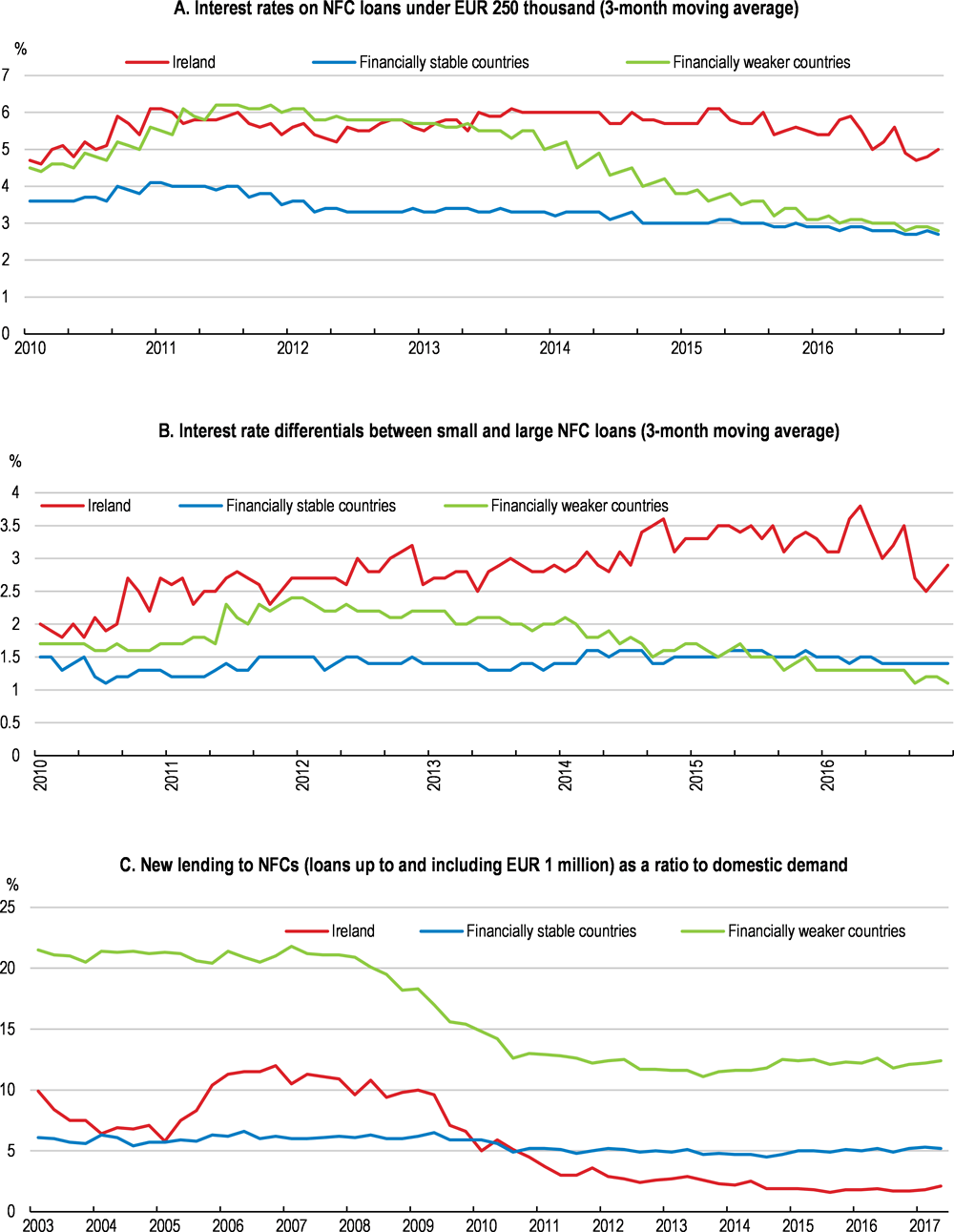

Reflecting the high SME default rate, borrowing conditions have remained very tight for small businesses since the onset of the crisis. Bank lending interest rates in the SME sector remain among the highest across euro-area countries (Figure 1.23, Panel A). Such market conditions tend to reflect high default rates, limited competition between lenders and high bank funding pressures (Carroll and McCann, 2016). Simultaneously, the interest rate differential between large firms and SMEs has also been significant (Figure 1.23, Panel B), a circumstance found where banks have greater market power and greater balance sheet weakness (Holton and McCann, 2016). As a result, total new lending remains very limited (Figure 1.23, Panel C), suggesting that potential lending to high-growth firms is likely to have been undermined.

Figure 1.23. Financing conditions for SMEs remain tight

Note: Financially stable countries group comprises Austria, Germany, Finland, the Netherlands and France (Belgium is also included in Panel C), and Financially weaker countries group comprises Portugal, Italy, and Spain.

Source: Central bank of Ireland.

Forbearance lending

While the SME default rate is high, forbearance measures (i.e. granting a temporary or permanent concession or agreed change to loan terms) to distressed firms have frequently been extended. Some forborne loans do return to performance, but the value of this is largely offset by that of new or extended forbearance lending (Bank of Ireland, 2017; AIB, 2017). Forbearance lending in the SME sector most often takes the form of term extension (Bank of Ireland, 2017; AIB, 2017); this is effective for viable firms facing short-term liquidity problems but is not a durable solution for non-viable firms. Such forbearance can reduce the access to finance for young high performing companies and slow the exit of poor performing ones, lowering the efficiency of resource allocation.

The extent of NPL write-offs has been limited, compared with the amount of non-recoverable loans. This may be because banks’ provisions against defaulted loans are not sufficient, at least by international standards (Figure 1.24). If they write them off, the enforcement of collateral would limit subsequent losses. However, repossession is very difficult when the collateralised assets include the business owner’s primary dwelling house, on which the business owner provided personal guarantees in the loan contract. As it stand, Ireland’s repossession process on primary dwelling house is lengthy with uncertain results. Thus, creditors’ claim on assets is very restricted in practical terms, which in turn adversely affects bank credit supply. In this respect, it is essential to improve judicial efficiency in repossession proceedings and the authorities should consider granting creditors a possession order for a future date to speed up repossession proceedings (see Key Policy Insights section).

Figure 1.24. The ratio of NPLs net of provisions to capital is high

Percentage, Q2 2017

Note: Q1 for the United Kingdom. The OECD aggregate is an unweighted average of the latest data available for 34 OECD countries.

Source: IMF (2017), Financial Soundness Indicators (database), International Monetary Fund, November.

Strengthening the insolvency regime would also speed up the resolution of NPLs. The health of the banking sector is closely associated with a reduction in the prevalence of non-viable firms, and this is facilitated by making the insolvency regime effective (Andrews and Petroulakis, 2017). As non-viable firms exit the market, which requires an effective insolvency regime, forbearance loans will decline and the banking sector will regain its health. This will strengthen the efficiency of the allocation of capital, enabling highly productive firms to attract more of it.

As for new loans, banks should reduce the use of personal guarantees of the business owner to cut off the link between business failure and personal bankruptcy. The most common conditions for new loans remain the commitment of business owners to their personal guarantees (CSO, 2014). Such collateral requirements help banks to screen out risky businesses, but once the firm defaults, banks get into trouble as repossession of collateral is not easy in practical terms. In this respect, the authorities should consider introducing guidelines for banks that specify circumstances under which personal guarantees from businesses should not be sought. Instead, banks should adopt a business model focusing on the assessment of the business plan and cash flow. Such a practice would also help differentiate the perceived risk of defaults across businesses.

Developing alternative financing channels

Equity finance is key for firms seeking long-term corporate investment for innovation, value creation and growth. The development of equity finance in Ireland is opportune, not only because it will take some time for the banking sector to regain its normal functioning, but more generally because equity financing is especially relevant for firms with a high risk-return profile, such as new, innovative and high-growth firms. It will also contribute to financial stability, containing an excessive rise in economy-wide leverage ratios (Cournède and Denk, 2015).

Private equity

Private equity finance can boost the creation and development of innovative firms. Business angels, mainly former entrepreneurs and wealthy individuals, operate in a seed/early-stage investment segment. They commonly target firms with a high potential to generate substantial revenues over the medium to long term. In contrast with business angels, venture capitalists are formally organised funds meeting retail investors’ requirements. They intervene at a later stage, after a business idea or product has been successfully test-marketed, to finance full-scale marketing and production. They target a small pool of high-growth-potential firms with the capacity to generate high returns in a relatively short timeframe.

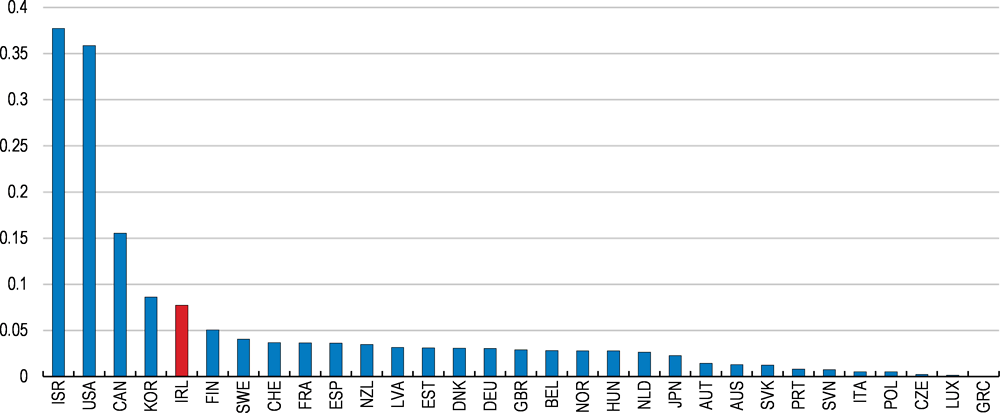

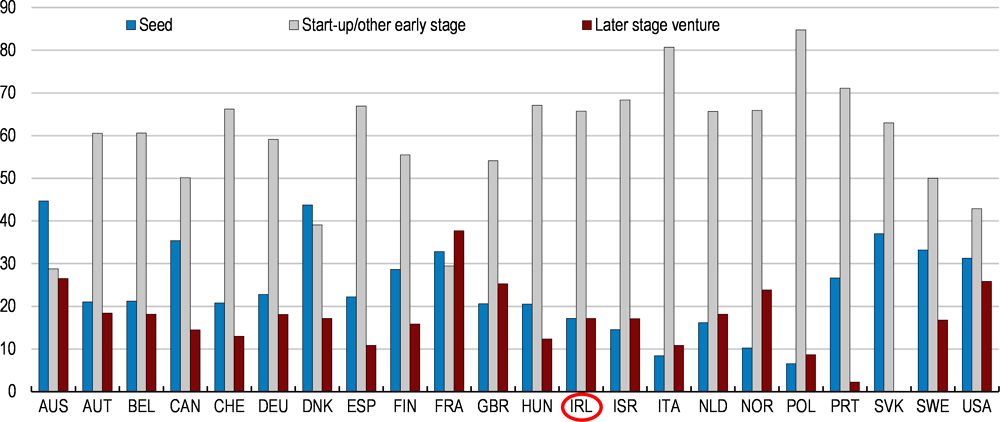

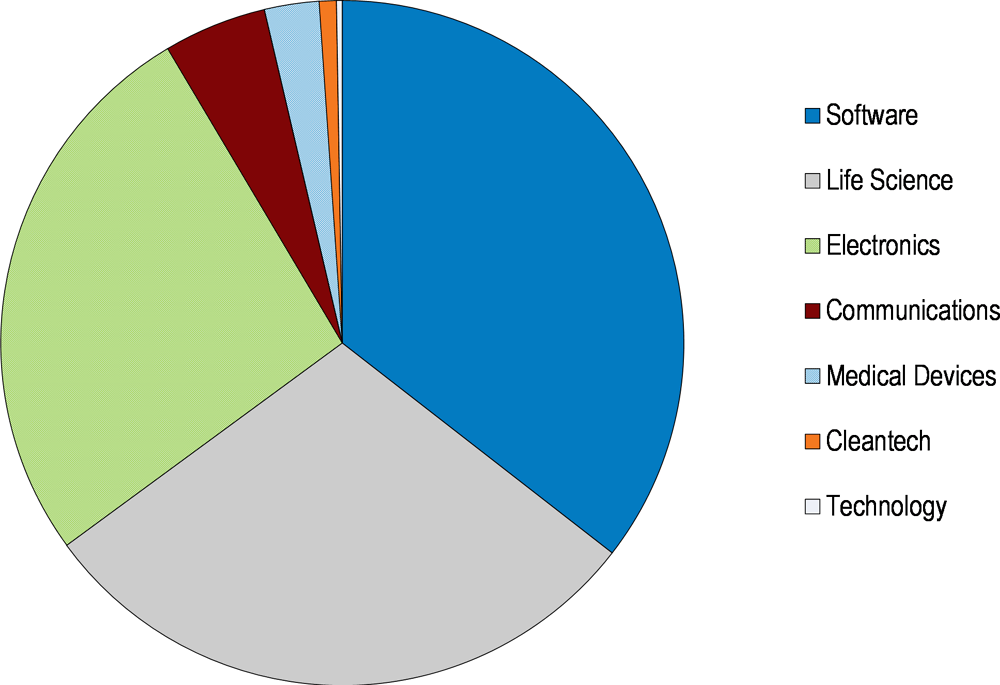

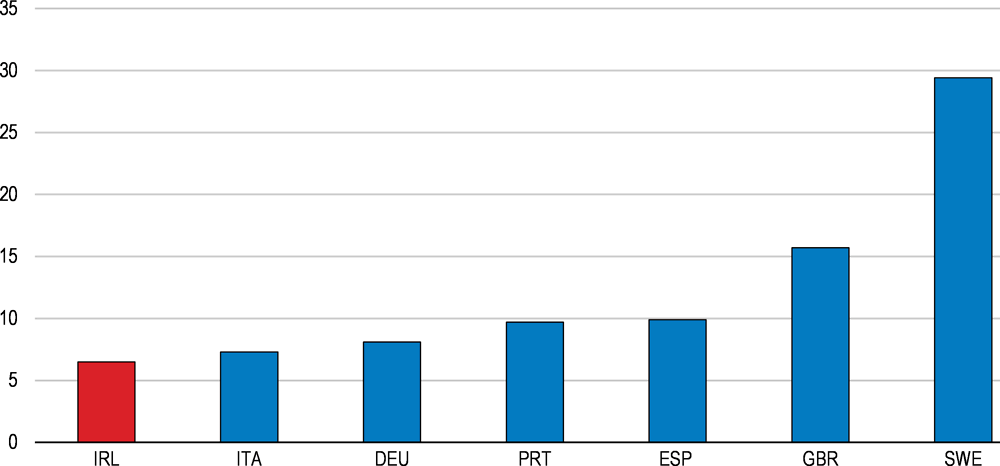

Financing by venture capitalists is more developed in Ireland than in other OECD countries (OECD, 2017c; Figure 1.25) but is limited to a small number of firms, with around 1% of Irish SMEs applying for it over each six-month period in recent years (Department of Finance, 2017). As in other countries, venture capital financing is concentrated in the ICT sector in particular (O’Toole, 2014). It is also disproportionately concentrated on firms in the middle stage of development (Figure 1.26). This leaves scope for public funds to target their support to a wide range of beneficiaries, in particular for those in earlier development stages (see below).

Figure 1.25. Venture capital investment is higher than in most other OECD countries

Venture capital investment as a percentage of GDP, 2016

Figure 1.26. Venture capital finance is concentrated in the middle-development stage in Ireland

Venture-capital-backed companies by development stage, % of total VC finance, 2016

Insolvency reforms that accelerate the initiation and resolution of insolvency proceedings is complementary to the core VC business model, which relies on the aggressive reallocation of resources across the investment portfolio from failing to high-performing ventures (Andrews et al., 2018).

Public equity

For growth-oriented and innovative enterprises, specialised platforms for a public listing can provide important financial resources (OECD, 2015c). For businesses in a late stage of development, the stock exchange serves as both a source of capital and an “exit vehicle” for venture capitalists, which can earn substantial revenues by selling their equity in successful businesses.

Listed firms have to comply with stock-exchange rules, which protect investors’ interests and market integrity. This usually involves disclosure by firms through an initial prospectus of basic information about their activities and financial situation, and later though regular reporting. It also requires firms to place a minimum share of their equity in public circulation. Trading takes place under the rules established by the exchange, which is usually regulated by a securities authority. All such requirements may be difficult and costly to meet for many small businesses.

The Enterprise Security Market (ESM), the specialised platform for small businesses in the Irish Stock Exchange, sets less strict listing and disclosure requirements. In contrast with the Main Securities Market (MSM), it does not set requirements for firms listed on it to place a minimum of 25% of shares in public circulation or to publish a prospectus. Similarly, price-sensitive information need only be provided twice yearly in the ESM, whereas its continuous provision is required in the MSM. In terms of preserving investors’ interests and market integrity, ESM advisors provide small firms with guidance on their responsibilities under the rules in the exchange.

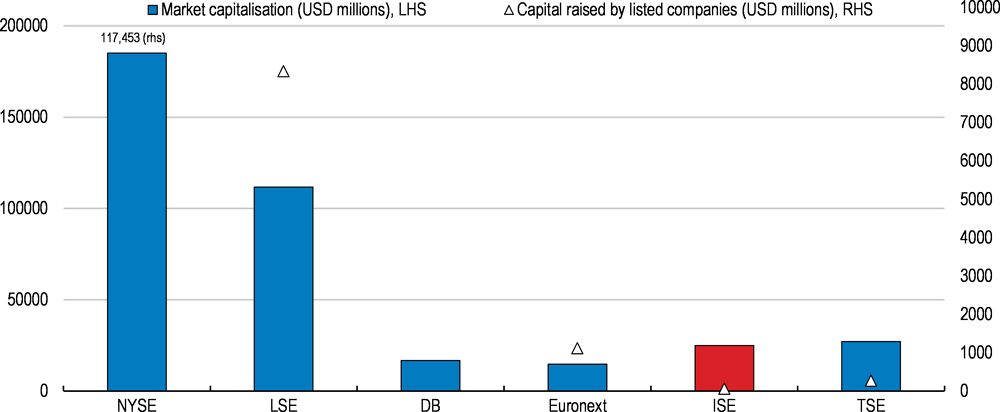

The ESM has made progress since its inception just over a decade ago. The market capitalisation value in the ESM is larger than the Alternext market, Euronext’s specialised platform for small businesses, though much lower than the Alternative Investment Market (AIM) in the London Stock Exchange (Figure 1.27). The number of the listed companies in the ESM is limited (25 in 2016) compared with Alternext and AIM (197 and 173, respectively). Compared with similar markets, the amount of new capital raised by ESM listed companies is also limited (Figure 1.27).

Figure 1.27. The alternative stock exchange platform can be developed further

Note: “NYSE”: NYSE MKT in New York Stock Exchange; “LSE”: the Alternative Investment Market in the London Stock Exchange; “DB”: the Entry Standard in the Deutsche Boerse; “Euronext”: ALTERNEXT in the Euronext group; “ISE”: the Enterprise Securities Market in the Irish Stock Exchange; “TSE”: MOTHERS in the Tokyo Stock Exchange. No data available for the capital raised by listed companies for “DB”.

Source: OECD calculation based on the World Federation of Exchanges’ database and the LSE’s annual report.

The limited number of firms may suggest that public equity finance is costly in Ireland. If this is the case, the authorities should consider alleviating debt bias of firms – interest payments are deductible in corporate taxation while the return on equity is not (de Mooij, 2011). To do so, firms could be allowed to deduct the notional return on equity from their corporate tax bill (Mirrlees et al., 2011), as was introduced in Belgium in the 2000s. However, given Ireland’s low rate of corporate taxation, the resulting reduction in the average effective tax levels would be very limited. This is even more so for small but high-growth-potential firms which do not yet pay corporate tax.

The limited amount of capital raised in the ESM may reflect the typical problem of a small stock exchange: that monitoring costs are very high for investors relative to the level of investment and low levels of liquidity. The marginal and average tax rate for interest on bonds and dividends is identical (OECD, 2015d) and a recent policy removed the obligation for investors in the ESM to pay stamp duty. As a further step, the authorities can consider reforming the Employment and Investment Incentive Scheme, a tax relief for investing in firms in early stages, to cover also those transitioning to public equity, following the example of the Enterprise Investment Scheme (EIS) in the United Kingdom.

The United Kingdom’s EIS offers tax relief to investors who purchase new shares in small and high-risk trading firms. The relief sets 30% of the cost of the shares up to a maximum investment of GBP 1 million against the individual’s income tax liability, which can be deferred over several years. The firms must be an unquoted company at the time the shares are issued. When the company transitions to the AIM, investors do not lose the tax relief if the company satisfies all the conditions such as the number of employees (250 or fewer). Such a tax relief would facilitate both the development of early stage private equity and the transition of successful businesses into the stock exchange.

Improving public financial support

Financing transactions are in general affected by market failures such as information asymmetry, particularly in the case of young innovative businesses (Calvino et al., 2016). Young firms tend to be liquidity constrained as they lack credit history and collateral to secure a loan. The problem becomes more acute if they are involved in innovation processes which have uncertain outcomes. This is particularly the case when they deal with assets whose nature may be intangible and difficult to evaluate, such as patents. All these problems call for public intervention to financially support young and innovative firms.

Ireland has set up a number of public funds to support small businesses since the early 2010s. These funds mainly take the form of fund-of-funds and co-investment funds, both of which seek to leverage private sector investment (Table 1.5).

Table 1.5. Funds that provide access to finance for small businesses in Ireland

|

Scheme |

Type |

Year launch |

Capacity |

Main targets |

Outline |

Achievements |

|---|---|---|---|---|---|---|

|

Ireland Strategic Investment Fund (ISIF) |

fund-of-funds |

2014 |

EUR 7.1 billion (taking over the portfolio of the National Pension Fund) |

Targeting investment in private sector entities that interface directly with SMEs. |

Large volumes of granular debt and equity investments to be made in SMEs. |