Catherine MacLeod

Paula Adamczyk

Catherine MacLeod

Paula Adamczyk

Luxembourg announced ambitious climate targets to accelerate progress towards carbon neutrality in 2050. These objectives require significant mitigation efforts, as progress in the green transition has stalled in the past few years. The emissions reductions required in the next 30 years are greater than the declines of the 1990s, which were driven by reforms to the steel industry and the closure of coal power plants. At the same time, the targets can allow Luxembourg to benefit from the green transition. Owing to the specificities of Luxembourg’s economy, most of the efforts will need to be focused on the transport and housing sectors. The transition will require deep changes in the behaviour of households, whose high carbon footprint is due to car usage and home heating. Sustainably reducing emissions also requires tackling cross-border fuel sales for both freight and commuters. Furthermore, reforms in agriculture are needed to reduce pressures on biodiversity. A wide range of policy tools need to be used to increase public acceptability. A higher carbon price over the medium and long term would lead to lower fuel sales and greater energy efficiency. Better spatial planning policy could reduce urban sprawl and car dependency. Stricter regulations and enhanced incentives would facilitate more environmentally-friendly agricultural practices.

This chapter discusses how to make Luxembourg’s economy greener through a more effective and inclusive strategy. The current environmental challenges are assessed (first section) and the key risks posed by the transition (second section). The policy framework necessary to manage these risks, and policy recommendations to achieve climate ambitions and maintain public support are then proposed (third section).

Climate change is currently one of the most pressing long-term challenges and many governments have put it at the forefront of their political agendas. Climate action is needed since increased droughts, flooding and extreme weather events will become more common if sufficient mitigation efforts are not put in place urgently (IPCC, 2022[1]). Recognising these challenges, the Luxembourgish authorities have adopted ambitious climate targets for 2030, with the long-term goal of reaching carbon neutrality by 2050.

This strategy will require enhanced decarbonisation efforts of all stakeholders as well as efficient policy implementation and coordination. Early action can prevent exacerbating the risks but also help benefit from the economic opportunities generated by the green transition. While Luxembourg is not particularly vulnerable to natural catastrophes, evidence shows that it still faces significant potential costs associated with climate-related weather events (Figure 2.1).

Economic losses from extreme-weather events, euros per capita, in 2020 prices

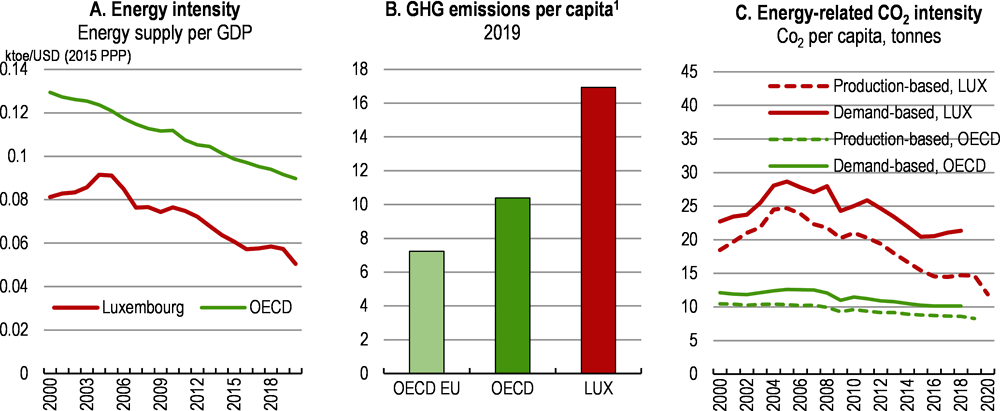

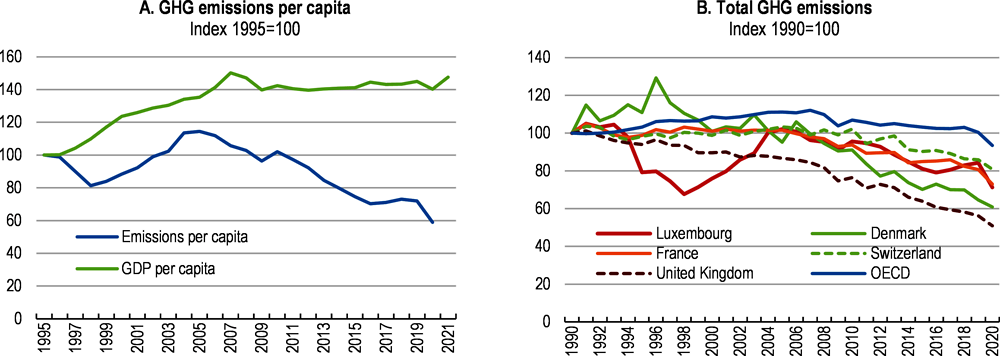

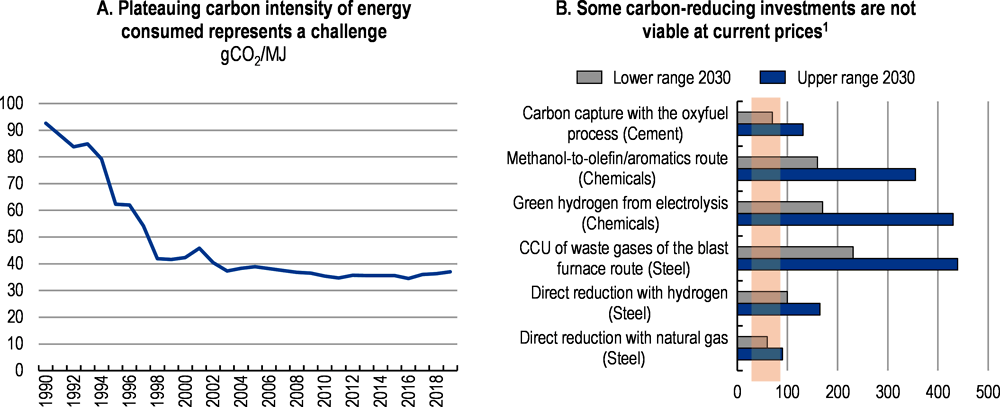

Luxembourg has made considerable progress towards the green transition. In spite of high economic growth, greenhouse gas emissions have decoupled from GDP and energy intensity remains significantly lower than the OECD average (Figure 2.2, panel A), thanks to the relatively low-carbon intensity of the financial and business services sectors. Substantial investments in renewable energy sources have resulted in the share of renewables in energy supply doubling over the past decade. The government has entered into a Climate Pact with municipalities that provides certification and funding to those implementing environmental and climate measures. The Naturpakt with municipalities aims to encourage nature protection and biodiversity conservation. The government has also implemented ambitious climate targets to accelerate the green transition.

At the same time, there is scope for further improvements to ensure reductions in emissions since 2020 are long-lasting. The consumption and production patterns of Luxembourgish citizens as well as an increasing population have contributed to pressures on the natural environment. The gains in greenhouse gas emissions reductions from early 1990s reforms of the steel sector to arc-furnaces and the phase-out of coal were offset by steady growth in transport sector (including freight) emissions from the mid-1990s (IEA, 2020[2]).

Luxembourg’s residents are the largest per capita consumers of carbon in the OECD, even when excluding fuels sales to non-residents, as shown by the production and demand-based measures of CO2 emissions (Figure 2.2, Panel B). The carbon intensity of demand is much higher than that of production as Luxembourg imports most of its energy needs (Figure 2.2, panel C). Around 95% of energy demand is imported, mainly oil and natural gas, and is not accounted for in the production-based measure. Demand-based CO2 intensity measures the intensity of CO2 emissions based on final demand consumption, excluding the impact of fuel sales, reflecting the actual emissions in the economy (OECD, 2017[3]). It is an indicator of how much carbon has to be imported in order to satisfy the final demand of the citizens (Box 2.1).

1. Including Land Use, Land-Use Change and Forestry (LULUCF). Because of the principle of territoriality, it includes fuel sales to non-residents.

Source: OECD Green Growth Indicators.

In addition, Luxembourg’s consumption patterns generate important amounts of waste per capita. The material footprint, which takes into account resources required to satisfy the final demand in a country, is one of the highest among OECD countries (Figure 2.3, panel A). As a result, the amount of waste produced per capita is also significantly above the OECD average (Figure 2.3, panel B). In part, the high levels of consumption and waste are due to the large numbers of cross-border workers that commute to Luxembourg on a daily basis and essentially inflate the numbers that are measured in per capita of the population (OECD, 2020[4]). Encouragingly, the amount of municipal waste going to landfills has significantly declined and currently represents only 4% of total waste generated, against 47% incinerated and 49% recycled (Figure 2.3, panel B). This is a major improvement from the 21% landfilled in 2000, following the First (2000) and Second (2010) Waste Management Plans. The government has also recently introduced the Circular Economy Strategy aimed at reducing waste and promoting reuse and recycling.

Over the past two decades, emissions of small particulate matter into the atmosphere decreased, resulting in air quality improvements in Luxembourg (Figure 2.3, panel C). However, the country’s high reliance on car-based transport and the large number of daily foreign commuters have led to high levels of exposure to other pollutants, in particular nitrogen oxides and carbon monoxide that are the result of burning fuels in car engines. Nitrogen oxide emission levels are much higher than in neighbouring countries (Figure 2.4, panel A).

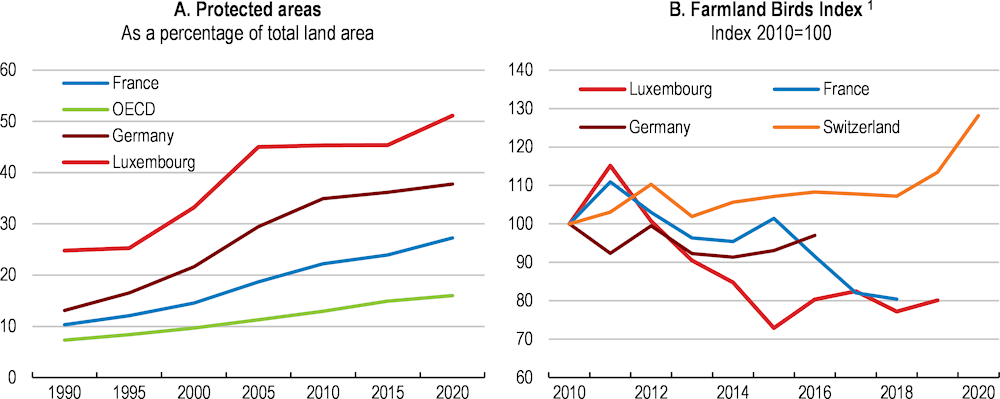

More attention should be paid to the health of Luxembourg’s ecosystem whose quality has worsened over the years. Biodiversity, soil sealing, the quality of water and deforestation and the associated loss of species will need to be addressed (Figure 2.4, panel B). The sharp expansion of the built environment, including the extensive and expanding road infrastructure network, exacerbates soil sealing, and increases pressure on land. Intensive farming practices, such as livestock grazing and excessive use of fertilisers and pesticides, have a negative impact on water and soil quality and contribute significantly to biodiversity losses.

Moreover, climate change impacts, notably periods of heat and drought, have facilitated the spread of pests and resulted in Luxembourg losing more forest space than any other OECD country. The health of trees has significantly deteriorated over the past few years. Only 16% of all trees in Luxembourg are currently without damage while half of them are considered significantly damaged (Figure 2.4, panel C). Projected weather change patterns are likely to intensify problems, as warmer weather encourages the proliferation of pests, such as bark beetle, whilst also potentially having a negative impact on yields for crops. This would worsen the impact of the shift to emissions-intensive cattle production underway since 2010.

Luxembourg has managed to decouple greenhouse gas emissions from GDP growth since 2005 but progress has slowed over the past few years (Figure 2.5, panel A). After initial reductions in the early 1990s, the rise of transport emissions led to GHG emissions increasing again. Despite a gradual decrease since 2000, total emissions have remained at relatively higher levels compared to top-performing countries (Figure 2.5, panel B).

The territorial-based measure of greenhouse gas emissions is widely used for country emissions targets. It includes fuel sales to non-residents, which would increase Luxembourg’s emissions relative to those countries where fuel exports are proportionally smaller relative to resident fuel sales. The territorial-based measure includes power generated in the territory, rather than the power that is used in the territory. As Luxembourg is a net energy importer, this reduces Luxembourg’s emissions relative to those countries that generate power for their own consumption, especially those that export power. No distinction is made between residents and non-residents in territorial-based measures.

The OECD produces production-based and demand-based measures of CO2 emissions from residents alone, excluding the impact of cross-border workers, and fuel sales. The production-based measure includes all energy that is produced within the country, whether used domestically or exported. The demand-based measure also includes the emissions associated with imported energy, which is an important power source in Luxembourg. This indicator provides a clearer pattern of the emissions intensity of how Luxembourgish residents live and work, but is more complicated to measure. It is also only available for the economy as a whole and not disaggregated by sectors. Both the production-based and demand-based measures cover only CO2 emissions, not all greenhouse gas emissions.

To facilitate international comparisons, emissions are often scaled per capita or by unit of value added produced. In Luxembourg, scaling territorial-based measures by population could introduce an upward bias, since cross-border commuters expand the number of people in the territory by about 30%, but do not affect the total population size. Using the OECD’s demand- and production-based measures of emissions per capita avoids the issue of having different samples of population in the numerator and denominator, as both include just the resident population. Scaling territorial-based measures by unit of GDP may under-represent the carbon intensity of production given the importance of economic activities with a limited physical presence in Luxembourg. Using GNI instead of GDP might give a more relevant measure of emissions per value-added produced in the case of Luxembourg.

In light of these various caveats, it is critical to consider a range of measures to benchmark performance and policies.

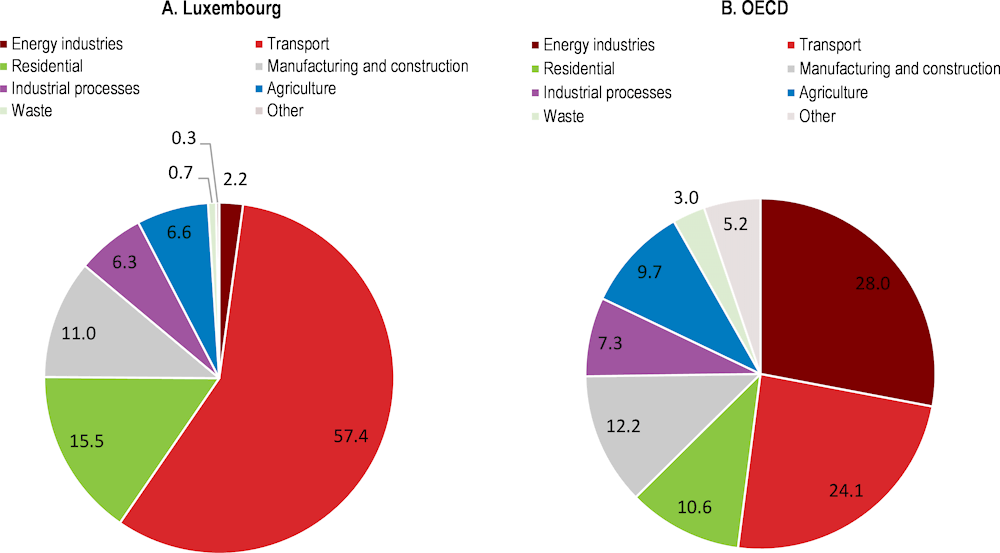

Meeting Luxembourg’s international commitments on greenhouse gas emissions will require significant progress in tackling territorial emissions from transport, including cross-border fuel sales, as well as the residential sector (Figure 2.6). The transport sector’s share of emissions (57.4%) is more than double its share in other OECD countries. The transport sector drives a heavy reliance on hydrocarbons in total energy needs: oil makes up 65% of total gross energy consumption in the country (IEA, 2020[2]). The importance of fuel sales to non-residents, including freight transport, has played an important role in the rise in greenhouse gas emissions since 2015 as well as the subsequent COVID-related decline in emissions in 2020. Luxembourg is an international transit hub owing to its geographic position and low fuel prices compared to neighbouring countries. Freight trucks, cross-border residents and other fuel tourists are responsible for around two-thirds of transport-related fuel consumption (IEA, 2020[2]).

Sustainably tackling emissions from the residential sector, which makes up 15.5% of total emissions, will require reducing heating-related consumption and increasing the energy efficiency of buildings, as well as switching out of carbon-intensive heating sources. Natural gas accounted for 53.2% of homes’ heating systems and heating oil accounted for a further 36% of home heating (Ministère de l’Énergie et de l’Aménagement du territoire, 2020[6]). Residential heating related emissions have risen steadily over time. Despite its relatively small industrial sector, the share of emissions from manufacturing are roughly equivalent to the OECD average. The manufacturing sector’s energy needs are dominated by the steel and glass industries.

Note: Emissions including Land Use, Land-Use Change and Forestry (LULUCF). GDP per capita is based on purchasing power parity.

Source: OECD Greenhouse gas emissions (database); and OECD National Accounts (database).

The carbon intensity of the economy stems from the reliance on fossil fuels for energy consumption. Oil makes up 65% of gross energy consumption, mainly in the transport sector, but is also used for heating in the residential and commercial sectors (IEA, 2020[2]). Natural gas accounts for 15% of gross energy consumption. It is an important source of energy for homes and firms, making up 46% and 41% of their energy needs in 2017.

Greenhouse gas emissions by source, percentage, 2019

Note: Emissions are calculated on a territorial basis. This includes the fuel sales to non-residents and excludes electricity consumed but not produced in the territory. Note that energy not produced within the territory is also excluded. Since Luxembourg imports 95% of its energy, this means energy sectors account for just 2.2% of emissions compared to an OECD average of 28%. Because of its computational ease, this has been the standard that has been agreed to for international greenhouse gas commitments.

Source: OECD, Greenhouse gas emissions by source (database).

Reducing fossil fuel reliance brings environmental benefits and would make Luxembourg’s energy system more resilient, especially in the current context of Russia’s war of aggression against Ukraine. An EU-wide embargo on coal has been in place since August 2022 and will be extended to seaborne oil by the end of 2022. Oil imports from Russia are negligible. About 25% of natural gas imports were from Russia in 2020, but they have fallen since given the reduction in supply to Europe (Ministère de l’Énergie et de l’Aménagement du territoire, 2022[7]). Most natural gas comes through LNG facilities in Belgium, primarily sourced from Norway and the United Kingdom, transported to Luxembourg via pipeline. Gas shortages are not expected in the near term, given the recent decline in domestic demand. Gas storage facilities are in Germany, and a multilateral agreement is in place with neighbouring countries. While Luxembourg imports relatively less energy directly from Russia than other EU countries, it is still indirectly affected by the conflict and bears the consequences of higher energy prices. Accelerating the shift to non-fossil fuel resources would thus both reduce the carbon intensity of the economy and improve domestic energy security.

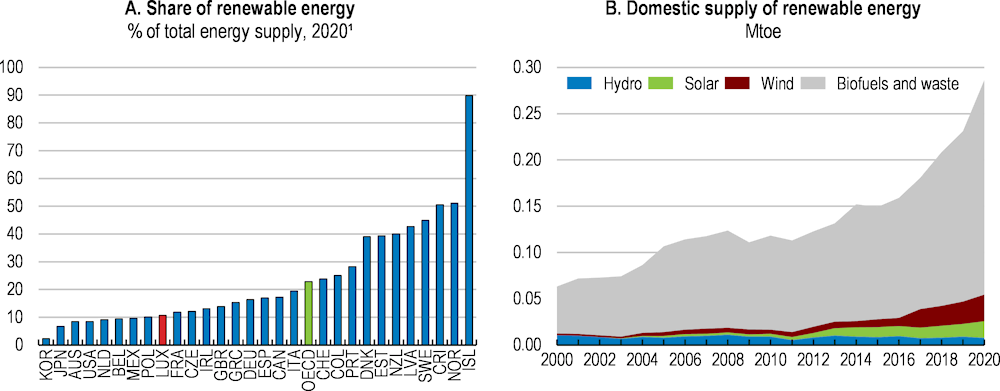

Domestically based renewable energy production has expanded, but remains relatively low, at around half the share of OECD peers (Figure 2.7, panel A). Most of the growth has been from biofuels rather than photovoltaics or wind-based power (Figure 2.7, panel B), even though solar capacity per capita is relatively high compared to other EU member states. The supply of renewable energy sources is supported by feed-in and premium tariffs for electricity produced by renewable sources, as well as investment subsidies for renewable energy deployment.

1. Data for Costa Rica refers to 2019.

Source: OECD Green Growth Indicators; and IEA, World Energy Balances.

In order to augment its low levels of domestic production of renewables in the context of EU requirements, Luxembourg has purchased statistical transfers of renewable energy, in line with EU regulations. This system allows countries with surplus renewable energy relative to targets (such as Estonia and Lithuania) to sell this renewable energy to countries who fall short of these targets, such as Luxembourg. These transfers are statistical, since they do not require the actual transmission of power between countries - but the money must be used for new measures to develop renewable energies or energy efficiency. In 2020, 1.6 percentage points were added to the renewable share from statistical transfers. This number is envisaged to reach 5.4 percentage points by 2030, as cooperation measures expand to include new instruments such as the European renewable energy financing mechanism.

Recognising the climate challenges and risks, the authorities have put forward ambitious targets. The government has published two documents to guide its green strategy: the National Long-Term Strategy outlines a vision for the green transition and commits to Luxembourg becoming climate-neutral by 2050. The National Energy and Climate Plan 2021-2030 (NECP) defines Luxembourg’s targets for 2030 both at a national and sectoral level. Guided by the priority areas defined by the EU’s Fit for 55 strategy (see Box 2.2), the national plan commits Luxembourg to:

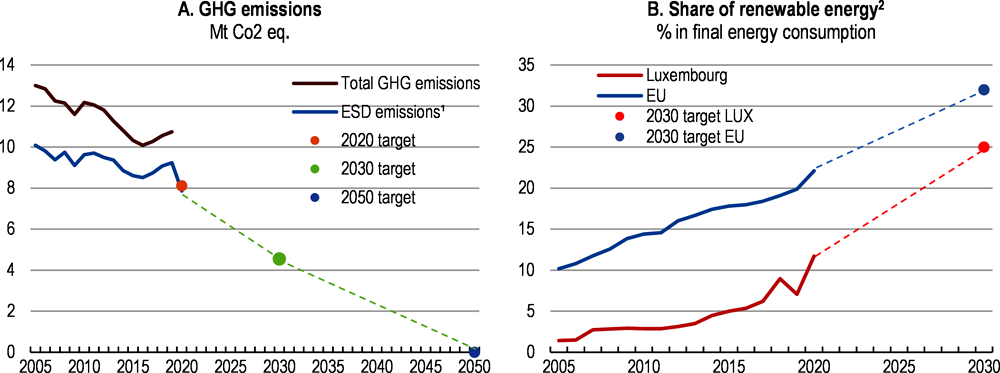

reduce greenhouse gas emissions by 55% in 2030 from 2005 levels (EU requirement: 40%) (Figure 2.8, panel A).

increase the share of renewable energy to 25% of gross final energy consumption by 2030 (Figure 2.8, panel B).

improve energy efficiency by 44% in 2030. This is with respect to the business-as-usual scenario (based on the benchmark EU PRIMES 2007 model).

1. ESD = Effort Sharing Directive. These emissions are covered by the EU Effort Sharing Directive and are not part of the EU Emissions Trading Scheme.

2. Luxembourg’s 2020 target for 11% share of renewable energy in final consumption was also supported by statistical transfers from Lithuania and Estonia, as well a large drop in fossil fuel consumption.

Source: Eurostat, Effort Sharing Directive emissions; Eurostat, Air emissions accounts; and Eurostat, Renewable energy statistics.

Fit for 55 package is a set of proposals to update the EU legislation in line with the 2030 objectives. The name comes from the EU-wide target of reducing net greenhouse gas emissions by at least 55% by 2030. The package covers targets in the EU’s emissions trading system, country-specific emissions reductions in sectors not covered by the Emissions Trading Scheme, as well as proposals to increase the EU renewable energy target to 40% and attain energy efficiency improvements of final and primary energy by 32.5-36% and 39% respectively.

Under the EU’s Effort Sharing Regulation, each Member State has a specific emissions reduction target for 2030 for sectors not covered by the Emissions Trading Scheme. For Luxembourg, the target is a 40% reduction compared with 2005 levels. In other policy areas, no specific targets are required: countries set out their objectives in their National Energy and Climate Plans, which are guided by the region-wide targets and assessed by the Commission.

Source: European Commission.

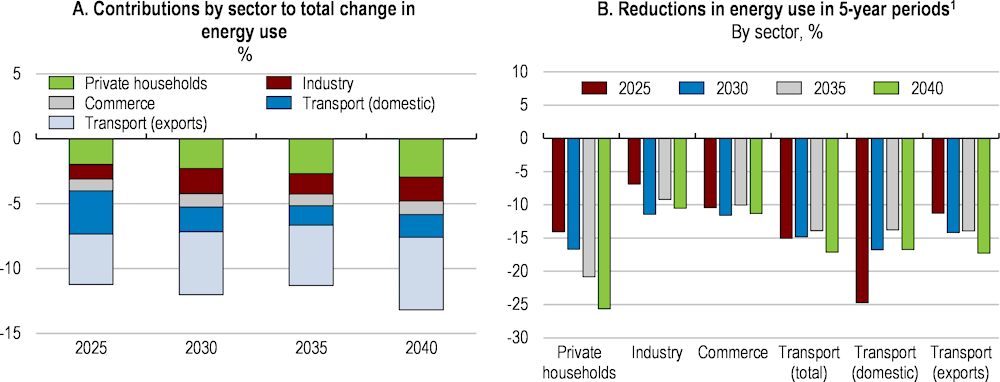

The government has outlined stretching sector-specific energy efficiency targets to reach the overall 44% reduction in final energy consumption. The biggest reductions are expected to be achieved in the residential building sector (-40%), followed by road transport (-38%) and services (-24%) (Figure 2.9, panel A). Over time, the pace of change for firms is expected to be relatively steady, with the adjustment for industry relatively slow compared to other sectors between now and 2030.

By contrast, the targets imply very sharp changes in households’ transport choices in the short term. Households contribute to around half of total domestic transport fuel consumption, which are expected to decline by a quarter between 2025 and 2030 (Figure 2.9, panel B). The government’s strategy seeks to raise the use of public transport and increase use of electric vehicles, with the ambitious target of reaching a 49% share of electro mobility in the vehicle fleet by 2030.

Electric and hybrid vehicles currently make up 4.5% of total vehicle stock. To meet the 2030 target, if the replacement rate remains at current levels, electric vehicles would need to make up 60% of all cars purchases by 2025 and 100% by 2030. In 2021, sales corresponded to almost 20.5% of new registrations. Generous subsidies are available for the purchase of electric vehicles. Citizens can receive EUR 8 000 for electric vehicles whose energy consumption does not surpass 180 Wh/km and EUR 3 000 for electric vehicles that do not meet this criterion. To further accelerate uptake, company car benefits will only apply to electric vehicles from 2025.

A national network of public charging points is being expanded with fast chargers installed along the main routes, whilst incentives are available for the installation of private charging points. The Recovery and Resilience Facility will finance a subsidy scheme for private stakeholders to install publicly-accessible and private charging stations from the second half of 2022. There are currently 14 electric vehicles per publicly-accessible charging point in Luxembourg, one of the lowest rates in the European Union, although as the number of cars expands, the number of charging units will need to increase dramatically. If targets for electric vehicle sales are met, reaching an average of 20 electric vehicles per public charging point would require installing over 10 000 charging points by 2030.

The residential sector’s energy efficiency gains are expected to accelerate substantially between 2025 and 2040 (Figure 2.9, panel B). The greater emphasis on future gains reflects in part the importance of renovations in reaching these goals. Luxembourg has in place net zero energy standards for new buildings, which will help to improve emissions from residential housing. In addition, a large stock of mainly single-family homes will have to be retrofitted, with home renovation rates needing to rise sharply from the current 1.1% to 3%, the NECP’s target to reach the 2030 goals.

Note: Each bar represents the annual average reduction in energy use over the five-year period for a given sector.

Source: Luxembourg PNEC; OECD calculations.

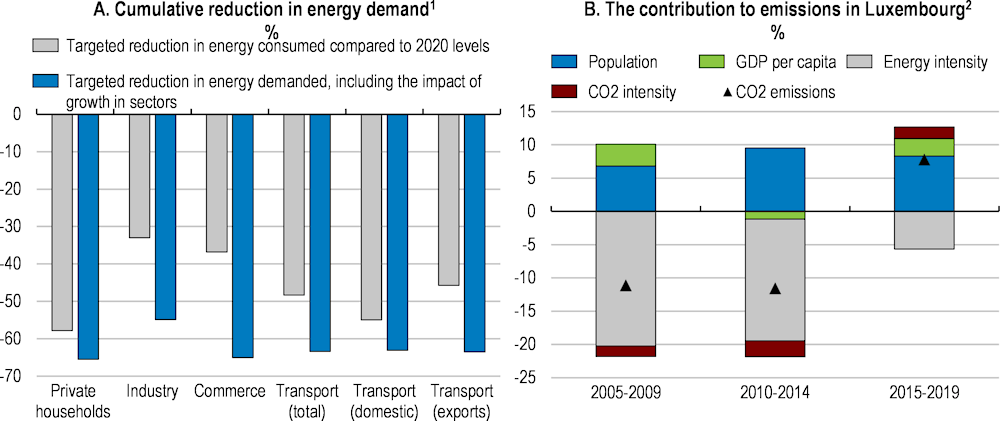

These stretching targets occur in the context of a growing population and economic growth, which implies that even greater savings are required from each sector (Figure 2.10, panel A). Luxembourg’s failure to sustain gains in energy efficiency against the backdrop of rising growth is the reason for the increase in emissions between 2015 and 2019 (Figure 2.10, Panel B).

1. Households’ consumption increases in line with population growth (1.0%, based on STATEC projections), industry at its long-term average of 2% and commercial business at 3%. This is broadly consistent with growth of 2.75%. The domestic transport sector is projected to grow in line with population, and fuel exports at 2% for freight in Western Europe, based on ITF assumptions (ITF, 2021[8]).

2. TES is total energy supplied. Emissions are disaggregated into the contribution of population growth, GDP per capita growth, energy intensity (energy per unit of GDP) and emission intensity of energy (emissions per unit of energy) or Total emissions = Population × (GDP / Population) × (Total energy consumption / GDP) × (Total emissions / Total energy consumption). GDP is in PPP. The sum of (positive and negative) components is approximately equal to the variation in CO2 emissions.

Source: OECD calculations based on Luxembourg PNEC, IEA, OECD.

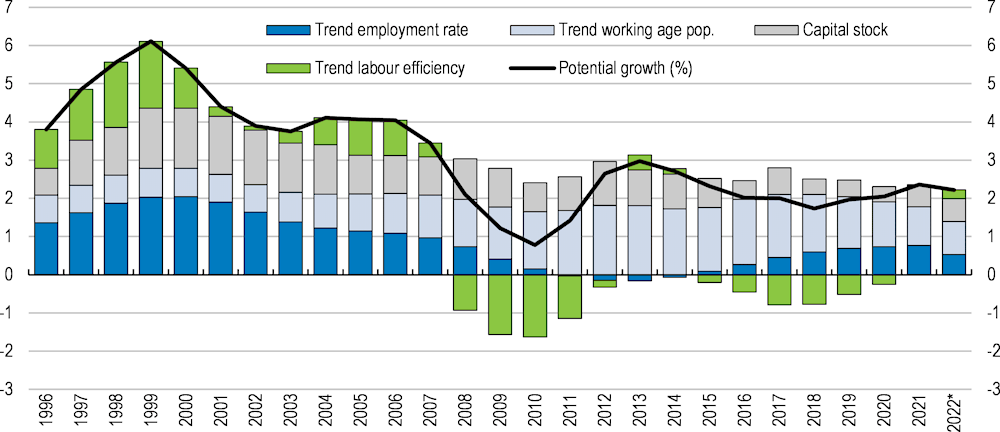

Changing the way in which Luxembourg grows can improve the likelihood of meeting these targets and reduce the trade-offs between growth and environmental targets. In the past, growth has heavily relied on contributions from an expanding workforce rather than investment growth (Figure 2.11), with a significant share of this workforce provided by neighbouring countries. Chapter 1 outlines reforms to increase the contribution of investment and productivity to growth, which have been relatively weak. Supporting higher productivity growth alongside the sustainable use of resources will minimise waste and the pressure on resources, and ensure Luxembourgish firms are well-positioned to take advantage of new markets. Tackling the structural factors that result in high car dependence and low housing density can further accelerate progress in reducing emissions.

% point contributions to potential growth

Note: The data for 2022 are projections.

Source: OECD Economic Outlook dataset EO111 and updates.

In addition, raising the share of older workers in employment has the potential to help mitigate resource pressures in the economy, whilst meeting the need for an expanding workforce. Luxembourg could add an additional 45 000 workers by 2060 if elderly workers’ participation rates rose to the average projected for the European Union. In turn, this could meet a substantial proportion of the projected expansions of the workforce under different scenarios (see Table 2.1).

|

Growth scenarios |

Assumed increase in workforce between 2030 and 20601 |

Share of projected employment increase that increased elderly workforce could meet2 |

|

|---|---|---|---|

|

Reaching projected EU participation rates for the elderly workforce3 |

Reaching improved EU participation rates for the elderly workforce 4 |

||

|

3% growth |

223 |

21% |

32% |

|

1.5% growth |

167 |

28% |

42% |

Note: 1. Based on projections from Table 4 in (Haas and Peltier, 2017[9]), assuming 50% cross border workers in 2030. 2. The elderly workforce is defined as those between 54- 74 years old. Increase in the elderly workforce calculated based on the Ageing Report’s (European Commission, 2021[10]) population growth estimates and participation rates for Luxembourg. The size of the workforce increase is calculated relative to the projected size of the elderly workforce. 3. The participation rate increase is based on the central scenario for the EU average over time. 4. The participation rate increase is based on the EU average plus 10 percentage points, consistent with the scenario put forward by the European Commission.

Source: OECD calculations, (Haas and Peltier, 2017[9]); (European Commission, 2021[10]).

The green transition can significantly improve the well-being of the population, but will also carry risks. Managing the recent sharp increases in carbon prices, alongside significantly accelerating the pace of decarbonisation from current levels could pose risks to economic growth, jobs and households’ cost of living.

These risks are assessed in the next section, alongside the possible physical risks that climate change poses. On this basis, the last section makes recommendations on how best to enhance the existing policy toolkit’s ability to meet these targets, notably in sectors where green challenges are the highest (transport, housing and agriculture).

Climate change has wide ranging impacts. The risk of continued lags in global policy commitments and implementation require policy makers to constantly evaluate a number of risks which could impact on livelihoods and the economy:

the physical risks from climate change, including the cost of more frequent catastrophic events that occur with increased, but still unpredictable, frequency.

the transition risks facing firms and households, who must absorb higher costs in the short term to reduce current carbon-intensive behaviours.

the resultant risks that climate change poses for the financial sector, which is exposed to its clients’ ability to both adapt to increased physical disasters as well as to undertake the costs of the transition (NGFS, 2020[11]), (NGFS, 2021[12]).

The manner in which these risks manifest themselves will have substantial implications for policy design and how much it is supported by the population. A resilient transition implies that households, communities and nations will be able to resist, absorb, recover from and adapt to hazards that emerge in the transition (IPCC, 2018[13]), (Dornelles et al., 2020[14]). Ongoing monitoring and evaluation of these risks and their interactions is critical to ensure continued support for and success of the green transition as the economy grapples with the current energy crisis as well as over the long term.

The physical risks from climate change in Luxembourg are expected to be relatively mild on average. Changes in weather conditions are forecast to be quite limited relative to other countries. In Luxembourg, temperatures are expected to become warmer, rising from an average of 8.1°C between 1961 and 1990, to 9.2°C between 2021 and 2050. This will primarily be driven by milder winters. Annual rainfall is likely to remain the same, but summers are expected to be drier and winters wetter.

Despite these relatively mild aggregate effects, periods of drought and low water levels will be more likely, as warmer winters result in reduced snowfall and lower buffer tanks, whilst flooding and more severe storms will exacerbate soil erosion challenges (Ministère de l'Environnement, du Climat et du Développement durable, 2018[15]). This could also increase the risks of severe drought for croplands (Maes et al., 2022[16]). Even these relatively mild climate change impacts could have an outsized impact on an already fragile ecosystem (Table 2.2). Between 2017 and 2021, Luxembourg has experienced an additional five days a year of at least strong heat stress exposure compared to 1981-2010 (Maes et al., 2022[16]).

|

Physical climate change impacts |

Key ecological impacts |

|---|---|

|

Higher temperatures |

Increased cooling needs in summer |

|

Increased heat in heat islands |

|

|

Increased pathogens and disease |

|

|

Increased pests and deforestation |

|

|

Increased health risks |

|

|

Increased incidence of flooding |

Increased sewerage stress |

|

Increased dry spells / severe low water |

Increased water shortages |

|

Combined impacts |

Increased surface pressure and soil erosion |

Source: OECD based on selection of measures highlighted by (Ministère de l'Environnement, du Climat et du Développement durable, 2018[15]).

The increased frequency of extreme events, notably flooding, could increase the associated losses. The probability of extreme flooding risks (a 100 year event) in Luxembourg is projected to increase almost 2.5 times between 2021 and 2050 compared to levels between 1970 and 2005 (Alfieri et al., 2015[17]), (Karagiannis et al., 2019[18]). This will bring Luxembourg’s extreme flood risk in line with the European average. Although the probability of these events may be low, economic losses can be outsized relative to losses from typical weather condition changes, as protection structures may be overwhelmed, and damages increased (Karagiannis et al., 2019[18]). To date, losses due to weather events have been quite limited – Munich Re assessed historic losses between 1980 and 2018 at USD 797 million, with the majority due to windstorms – about half the European average as a share of GDP (EIOPA, 2021[19]).

Most climate models assume a gradual or linear progression of risks and costs associated with climate change. However, there is growing evidence that breaching certain temperature thresholds could result in non-linear effects and tipping points beyond which the climate is not able to recover, if remedial action is not taken soon enough (Klose et al., 2020[20]); (Ritchie et al., 2021[21]); (Sims and Finnoff, 2016[22]); (Fan et al., 2021[23]). The likelihood of extreme events may thus increase even further if global coordination on climate policies fails, generating non-linear economic costs (IPCC, 2022[1]).

Decarbonising the economy and the speed with which this occurs will have economic, financial and political consequences. Higher levels of investments should help to improve energy efficiency and reduce operating costs. The transition will nonetheless entail costs – not only for funding upfront investments, but also in the early retirement of certain assets and the obsolescence of others, for example as companies switch to alternative fuels. As firms and sectors close and others open, the sources of employment growth will shift, alongside the skills needed of the workforce.

The distribution of the transition’s costs and benefits will vary across households and firms, depending on their capacity to absorb these shocks and the availability and cost of new technologies. The speed of the change will be a critical variable in influencing the sustainability and continued support for the green transition. The speed and size of recent increases in energy prices due to the war in Ukraine could potentially increase the risks of the transition, and need to be closely monitored.

Transition risks capture the extent to which the country faces large disruptions to become green, including how costly those disruptions might be. Changes in technology and shifts in consumer sentiment, alongside policy choices, as well as resilience and productivity of firms can impact the nature of these transition risks (BIS, 2021[24]); (IPCC, 2020[25]).

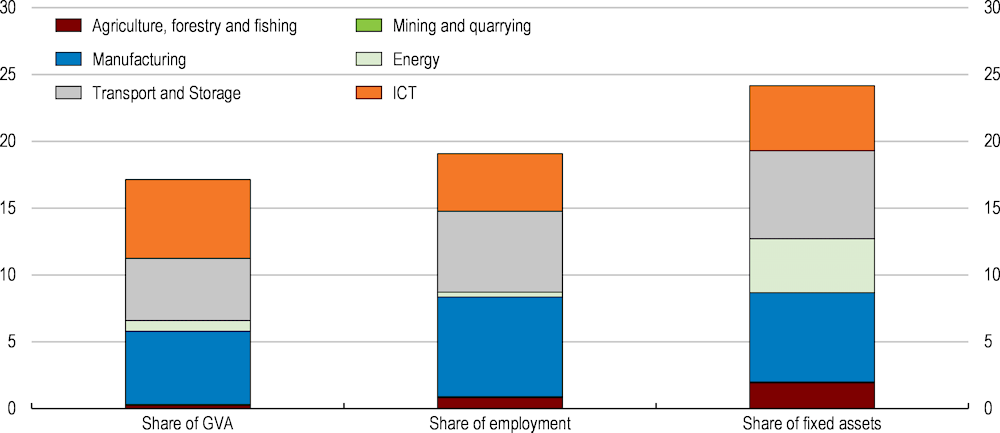

The total share of firms directly exposed to high transition risks from climate change is expected to be limited. The promotion of the services sector as a source of growth since the 1980s has insulated the economy by reducing the share of – and the potential shocks from – carbon intensive industries. The total weight of sectors assessed by the ECB’s climate stress test procedure (Alogoskoufis et al., 2021[26]) to have high transition risks in Luxembourg make up 17% of GDP. These same sectors account for 31% of GDP in the euro area. Nonetheless, these sectors account for just under 20% of total jobs and 25% of total fixed assets in Luxembourg (Figure 2.12).

Importance of industries with medium to high transition risks, % share

Source: OECD calculations based on OECD National Accounts (database) and (Alogoskoufis et al., 2021[26]).

Firms will be able to absorb higher costs depending on the importance of carbon in their production cycle, demand for low-carbon products and their ability to pass on price increases to customers (Box 2.3). The balance of these risks depends not only on how the transition affects firms that are currently operating, but also on the ability of the economic system to support the emergence of new firms. A conducive regulatory environment will allow high-productivity, low-resource intensity firms to emerge and grow. These firms will employ the workers and resources that are released with the closure of resource-intensive and loss-making firms. Chapter 1 highlighted reforms to support this dynamism.

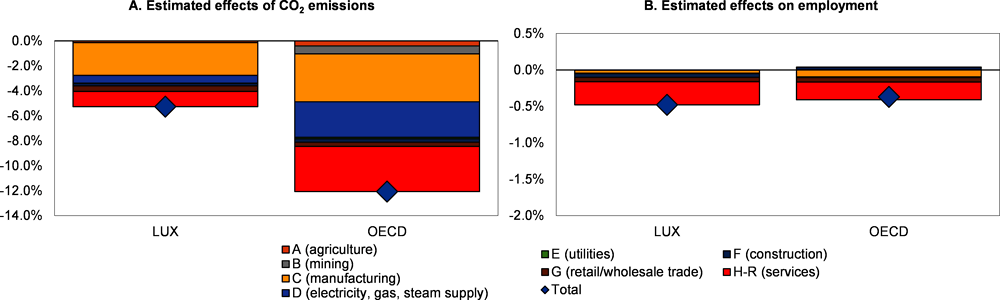

Estimates from the OECD suggest more stringent environmental policy is likely to have a modest impact on Luxembourg’s GDP and employment. The OECD Environmental Policy Stringency (EPS) indicator, developed by (Botta and Koźluk, 2014[27]), has recently been revised and updated until 2020. It covers 40 countries and 13 policy instruments, focussing predominantly on climate change and air pollution policies (Kruse et al., 2022[28]). (Frohm et al.[29]) uses this rich dataset and a panel of 30 OECD countries and 54 sectors of activity during 2000-14 to forecast the potential impact of increased environmental stringency. Preliminary results suggest an increase in environmental policy stringency is associated with a significant reduction in CO2 emissions after 10 years, with negligible aggregate effects on employment or activity (Frohm et al.[29]). Whilst the design of climate-related policies will influence sector and aggregate impacts, these results are largely in line with the international findings relating to the risks of carbon leakage (Box 2.3).

Aggregating the individual sector impacts for Luxembourg suggests a one index point increase in the overall Environmental Policy Stringency index is associated with a statistically significant 5% decrease in CO2 emissions after 10 years (Figure 2.13, Panel A). This is a smaller effect than for the OECD average, since the share of domestic power generated in Luxembourg is lower than in the aggregate group of OECD countries, lowering the share of fossil fuels in total energy use.

The estimates suggest most sectors would reduce CO2 emissions, with the manufacturing sector, particularly in non-metallic products such as glass, contributing significantly. The transportation and storage subsectors would experience some of the largest cumulative drops in CO2 emissions after 10 years, reaching as much as 20%. These sectors in turn drive most of the decline in employment, although on aggregate, employment would fall by just 0.5% in total over the 10-year period (Figure 2.13, Panel B). Whilst the aggregate impact might be small, policies must support these workers’ reskilling and their reabsorption into less emissions-intensive firms and sectors.

Note: The effects are calculated using point estimates from a fixed-effects panel regression of the (log of) CO2 emissions on current and up to 10 years lags of the EPS21 indicator, interactions of the EPS21 indicator with country-sector shares of fossil fuels in total energy use, and additional control variables. Control variables include the current and lagged sectoral (log of) real gross output and country (log of) real GDP, (log of) labour productivity per hour worked, (log of) capital stock, (log of) real labour compensation, a linear country and sector time-trends, as well as country-sector and year fixed effects. The decomposition of the aggregate country effect into sectoral effects is obtained using each sector’s weight in CO2 emissions/total employment in the respective country for the last year of data available (2014). The sector classification is based on ISIC Rev. 4. Fossil fuels include coal, coke and crude, fuel oil, gasoline, diesel, natural gas, other gases and other types of petrol.

Results are preliminary and might still change slightly until final publication as comments are incorporated. The results are indicative and based on past performance. The ultimate outcome of sector emissions, activity and employment impacts will depend heavily on the design of policies.

Source: (Frohm et al.[29]).

Carbon leakage arises when countries applying low-carbon policies impact emissions in other countries. If producers and consumers switch to cheaper, imported emissions, local emissions reductions will be offset by increases in global emissions. This will negatively affect domestic producers, lowering their market share. More positively, technology spillovers from economies that are applying low-carbon policies can reduce emissions in countries with no regulations. Finally, if a country is large enough to impact on global markets, it could impact on the demand for energy, reducing prices and encouraging greater consumption.

Evidence of imported emissions offsetting local emissions reductions is relatively limited, with few firms suffering a loss of market share as a result of carbon prices. Empirical studies of cross-country evidence have consistently found impacts around a tenth of the size estimated by forward-looking economic models. Part of the reason for the low impact could be due to past mitigation measures, which cushioned the impact – particularly given that many studies of carbon leakage focus on the European Emissions Trading System. In addition, model estimates rarely take into account frictions such as transport costs that can make it more difficult to substitute domestic for foreign production. Low estimates may reflect the fact that the easiest and lowest-cost reforms were undertaken first.

There is limited evidence of firms divesting from high carbon price areas, but there is evidence from multinationals that new investment is more likely to be located in lower-carbon cost areas. The final impact on global carbon emissions is mitigated by the fact that firms tend to transpose technologies from high carbon price areas when investing in low-carbon cost jurisdictions.

For Luxembourg specifically, (Misch and Wingender, 2021[30]) find a relatively high risk of carbon leakage from higher carbon prices, based on a cross-country estimate of carbon price sensitivity weighted by the share of exports and imports. Luxembourg, like most small economies, will mechanically show a higher risk of carbon leakage due to its high shares of exports and imports.

Source: (Albrizio, Kozluk and Zipperer, 2017[31]); (Dechezleprêtre et al., 2019[32]); (Delera, 2021[33]); (Dussaux, Vona and Dechezleprêtre, 2020[34]); (Misch and Wingender, 2021[30]).

For households, resilience will depend crucially on their ability to fund alternative consumption patterns, especially for transport, as well as to undertake energy efficiency investments in their homes. The ability of workers to reskill towards jobs that are in demand will have an important impact on household income vulnerability (OECD, 2021[35]). The reforms discussed in chapter 1 to improve active labour market policies will be an important tool in ensuring climate resilience.

The transition could have particularly negative effects on lower-income households (OECD, 2021[35]). Households are exposed to the risks of the transition through the impact on their incomes – particularly from employment (D’Arcangelo et al., 2022[36]). Displaced low-skilled workers may be more likely to suffer from long-term scarring effects, as they face higher barriers to reskilling, upskilling and geographical mobility (OECD, 2021[35]); (Phylipsen, Anger-Kraavi and Mukonza, 2020[37]); (Zachmann, Fredriksson and Claeys, 2018[38]). These workers are also most likely to face reduced demand for their jobs regardless of the green transition (see chapter 1).

A clear strategy for managing potential transition risks for employment should be developed, to manage both the displacement of lost jobs and the increase in hiring needs for certain sectors. Jobs that seem most at risk in the transition are concentrated in the transport and manufacturing sectors (see Figure 2.13 and Box 2.4). At the same time, the transition will raise employment in construction, and to a lesser extent the financial and business services sectors (see Box 2.4). This is in line with industry estimates that the number of workers will need to rise above 10 000 to meet demands for new construction as well as expanded renovations (Ministère de l’Énergie et de l’Aménagement du territoire, 2020[6]). Results from exercises such as these, as well as scenario analysis conducted by banks should feed into the skills strategy. Establishing a clear link between the green transition and the sectoral skills and occupation demand papers produced by ADEM could support workers most at risk of climate change and minimise the risks of inadequate labour supply on the transition (ADEM, 2021[39]); (ADEM, 2021[40]). Chapter 1 highlights measures to both increase residents’ labour force participation and the supply of skills through training and migration.

The transition to net zero emissions will imply a higher cost of living, as prices rise to reflect the externalities of carbon usage (D’Arcangelo et al., 2022[41]). The size of the impact will depend on the share of spending on high-carbon activities, the ease with which different consumer groups can change their consumption patterns and the design of policies (Reguant, 2019[42]); (Zachmann, Fredriksson and Claeys, 2018[38]). Although in Luxembourg, lower income households do not have a significantly different share of energy or transport costs in their consumption basket compared to higher income households, they may yet be disproportionately affected by higher living costs, as they are less able to switch to different types of consumption in response to higher prices. This means they must either pay higher prices or reduce their consumption altogether. The current system of wage indexation provides protection from increased costs of living – but it can benefit wealthier households more, and also have other implications for cost-push pressures in the economy (see Chapter 1). As such, targeted measures to help vulnerable groups may be required to manage the social impacts of the transition. The recent responses to the energy crisis could provide useful information both on the impact of the sharp price increases on household well-being as well as on energy-efficiency behaviour. In turn, this could inform the redesign of subsidies and support measures.

Many lower income households tend to live outside city centres for affordability reasons. Their access to public transport options can thus be lower, and their car usage higher. They may find it difficult to alter these consumption patterns despite higher petrol prices, if they face limited access to high-frequency public transport or constraints to financing an electric vehicle or moving into denser, more urban areas. Similarly, less wealthy households who rent will rarely be able to undertake energy efficiency investments to lower consumption and energy costs (OECD, 2021[35]). Landlords, who need to make the investments, face limited incentives to improve energy efficiency, whilst efforts to raise the costs for landlords could simply increase rent inflation.

These potential vulnerabilities suggest the need for a clearer analysis of the transition impact across households’ income brackets and possible policy design adjustments (OECD, 2021[35]). If there are significant divergences across income groups, the transition could increase the recent trend in growing inequality in Luxembourg. Whilst per capita income levels in Luxembourg are more than two and a half times those of the OECD, over the past three decades, social polarisation has risen faster than in most OECD countries. The population shares of the rich and poor income groups have risen in roughly equal proportion. Over the same period, the change in the income share of the rich outpaced its population share, worsening inequality (OECD, 2019[43]). The rise in the share of the lower income group is particularly worrying since they face a very high probability of remaining in this group. Some of this may be due to socioeconomic factors such as levels of schooling and past experience. Worryingly, the children of low-income parents are likely to remain low-income too, much more so than in other OECD countries (OECD, 2018[44]). Coupled with the increase in the number of children in low-income families, this could further lock in poverty and polarisation (OECD, 2019[43]).

The open source ThreeME computable general equilibrium model was calibrated for Luxembourg in order to consider how the economy responds to carbon price changes. This model has been used by policy makers in France, the Netherlands and the United Kingdom. These results are intended to enrich the domestic policy debate, particularly in terms of the potential impact of a forward-looking carbon price. This is one modelling exercise that be considered alongside a range of models to understand the full impact of climate-related policies on income, well-being and inequality.

The model suggests a carbon price that rises steadily by EUR 10 per annum could support a reduction of emissions in 2050 by 50% compared to a scenario with no carbon price increases.

The economic impacts of the carbon tax are found to be mildly positive. Although the carbon tax increases costs for firms and households, recycling tax revenues from fuel exports to households and firms helps to fund the increases in investments required to respond to higher carbon prices. Employment rises with growth, as well as the fact that tax revenues are redistributed to the most employment intensive firms. Exports decline, primarily due to lower fuel exports, whilst imports fall because of the reduction of fossil fuel imports.

There are a number of reasons for the positive impact:

The assumption of redistributing carbon tax revenues. If positive, carbon tax revenues are redistributed: households and firms receive back what they pay in transfers. Fuel-export related revenues are divided between households (1/3), firms (1/3) and the government (1/3). The most employment-intensive firms receive the largest share of the revenue allocated to firms.

The carbon tax revenues from fuel exports. When positive and redistributed to households and firms, export-related carbon tax revenues help offset the impact of rising carbon prices for households and firms. Without these additional revenues from fuel exports, the model suggests a small negative impact from rising carbon taxes.

Luxembourg’s economic structure. The share of employment and activity in services sectors is high. The domestic power sector is small and does not require transformation.

The model set-up. The model is of a market-based economy that flexibly adjusts to shocks such as higher carbon prices. Whilst the model includes the costs firms and households must bear when increasing investment, there is no estimate of the income losses associated with stranded assets. The model also does not capture any potential well-being or health benefits.

The industrial sector is expected to reduce output as carbon prices increase, driven by the 2% decline in energy intensive industries relative to the baseline (Figure 2.14). The transport sector faces high transition risks, as increased use of public transport such as rail is not enough to compensate for the decrease in road and air sectors. By contrast, the construction industry expands at a faster rate, as the green transition prompts increased demand for new buildings and renovation. Services output increases in the medium term before stabilising, as it benefits from redistributed carbon tax revenues that allow it to maintain its competitiveness, alongside its role in supplying investment for the green transition.

Sectoral patterns in activity are mirrored in employment changes: overall, job growth is expected to be around 1% higher than the baseline. The construction sector’s fast pace of job creation accounts for the bulk of the increase in demand (Figure 2.15). Labour shortages in the construction and services sectors would reduce their cushioning impact in the green transition. Overall investment levels rise by 3.6% compared to baseline (Figure 2.16). Growth in construction is the fastest-rising investment category, contributing about half of the total increase in investment. Investment in machinery and equipment also increases quickly, but its relatively low share in total investment implies a relatively small contribution to total investment growth.

% change relative to the baseline

Total employment and sectoral contribution (difference compared to baseline)

Total investment and sectoral contribution (difference compared to baseline)

The model assumes that investment needs are not constrained by domestic savings, and that there are no credit constraints facing households and firms that wish to invest, consistent with Luxembourg’s strong and well-developed financial centre. Government spending is determined exogenously, but taxes are influenced by economic activity. Fuel sale tax revenues are not modelled separately, as the assumption is that these revenues will be offset by higher carbon tax revenues.

These results are sensitive to assumptions on how Luxembourgish fuel exports respond to carbon prices, which in part depend on the fuel and carbon tax policies in neighbouring countries. The model assumes that other countries raise their carbon prices by EUR 155 between 2030 and 2050. Higher carbon prices in neighbours raise fuel export sales and carbon revenues – but reduce emission reductions. Efforts to raise productivity and investment, such as outlined in Chapter 1, would help reduce this trade-off by raising growth and revenues. They would also improve the economy’s resilience to potential shocks in the carbon price in Luxembourg or its neighbours. Policies to reduce the carbon intensity of the transport sector in Luxembourg and across the region will also be critical.

Source: OECD calculations, ThreeME model (2020).

Globally, the financial sector faces financial stability risks from the economic shifts implied by the green transition. The green transition can impact the financial sector through a variety of transmission channels (see Table 2.3). The ability of clients to repay loans, the value of collateral and possible asset price valuations have been the main risk channels regulators have modelled to determine the risks to financial sector solvency.

|

Financial risk |

Transmission channel |

|---|---|

|

Credit risk |

Borrowers’ ability to repay is reduced due to transition risks (reduced market share, profitability). Value of collateral falls (stranded assets, damaged assets), reducing recovery rates of defaulted loans. |

|

Market risk |

Financial assets lose value as climate risks are increasingly priced into asset prices. The impact will be larger if the adjustment is sudden or if portfolio diversification is affected by the transition. “Brown” assets may be more correlated, compounding losses in the event of adverse outcomes. |

|

Liquidity risk |

Access to stable funding may be affected if counterparties draw down deposits or credit lines. |

|

Operational risk |

Legal liabilities relating to the accuracy of climate-related disclosures for investment and business could increase. Claims for liability insurance could increase as a result of class action and other disclosure related litigation. Regulatory compliance could increase operating costs and lower profitability. |

|

Reputational risk |

Difficulties in communicating the transition could lower credibility and brand value. Climate strategy could be misaligned with changing market or consumer sentiment. |

Source: Adapted from (BIS, 2021[24]); (ECB / ESRB, 2021[45]); (ESMA, 2021[46]).

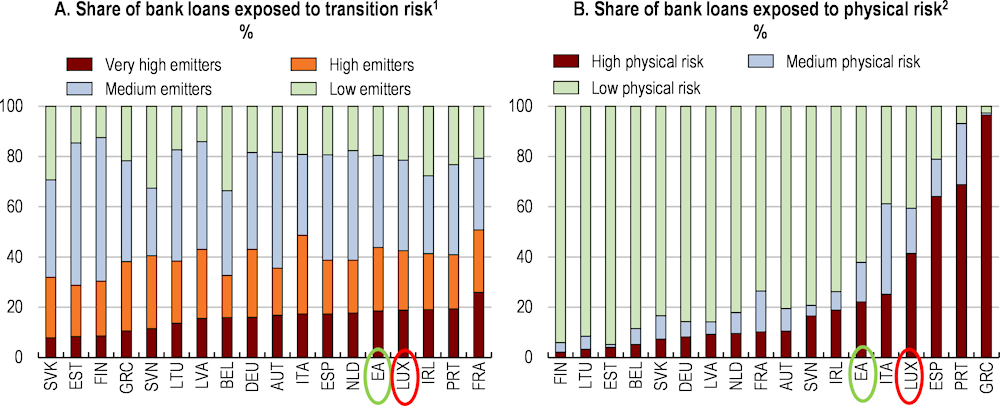

The Luxembourgish banking sector is exposed to effects of the climate transition on its loan portfolio. Just over 40% of loans from the Luxembourg banking sector to non-financial clients are provided to high or very high emitters (Alogoskoufis et al., 2021[26]) (Figure 2.17, Panel A). This is in line with the average exposure in the euro area. These estimates take into account the complex feedback loops between transition and physical risks – where early action can reduce physical risks but increase short-term costs and transition risks. Preliminary estimates of physical risks from (Alogoskoufis et al., 2021[26]) suggest relatively high exposures (Figure 2.17, Panel B), although these conclusions may change as the number of banks surveyed and the granularity of data increase.

1. Exposure are categorised as (very) high emitters if a firm's relative emissions are above the 70th (90th) percentile; exposures are categorised as low emitters if a firm's relative emissions are below the 30th percentile. Emission intensities include Scope 1, 2, and 3.

2. Exposures are categorized as high physical risk if a firm's probability of suffering from wildfire or a river or coastal flood in a given year over 1%, exposures are categorised as low physical risk if a firm's probability of suffering from a wildfire or a river or a coastal flood is less than 0.1%. Exposures are classified based on euro area creditor countries. This is based on a preliminary sample.

Note loans are non-financial corporation loans.

Source: (Alogoskoufis et al., 2021[26]).

The insurance sector losses associated with asset price valuations are not expected to be particularly large for Luxembourg. (EIOPA, 2020[47]) estimates that under its central scenario, total losses on the sovereign bond portfolio of Luxembourg-based insurers are estimated at around 0.2%. Losses in corporate bonds and equities are around 10%, as the weight of high-carbon assets is about five times that of low-carbon assets. Nonetheless, the combined effect of these losses is expected to be relatively small at 0.7%.

Increased transparency and ongoing data monitoring are critical to help the banking sector manage the operational challenges of responding to these climate risks. The BCL highlighted that currently, banks may be poorly positioned to cope with the required changes, as loans to high carbon-intensity industries actually increased in 2021 (BCL, 2021[48]). Authorities should continue to adapt financial sector regulation and supervision as climate-related risks and vulnerabilities are uncovered by stress-tests and related activities.

The tools to estimate firms’ climate-related risks are becoming more sophisticated, thanks to increased global regulatory scrutiny of climate disclosures. A range of emerging reporting standards aim to improve the granularity of information about individual companies (Table 2.4). The adoption of these reporting standards and disclosures has been increasing, as regulatory scrutiny and investor pressure has risen, even if the quality of reporting continues to lag coverage (EY, 2021[49]). Authorities should continue to promote a classification of green financing that is able to support clear and client-focused labelling, whilst allowing for a diversity of products to be delivered that could support a wide range of investor preferences. Greater diversification in climate investment strategies helps to limit systemic risks. Credible guidance for how loans to carbon-intensive industries can be classified as supporting the transition or not would help to mitigate the reputational and financial risks for the banking sector. The recent expansion of the remit of the banking and insurance regulators to cover green financial disclosures provides an opportunity for an independent channel to communicate with customers and investigators.

Even as more sophisticated techniques for estimating climate risks become widespread, the need for more granular information about companies’ transition strategies and how they impact risk will increase. With an improved understanding of baseline climate risks, risk management practice will likely begin to shift to estimate how well firms can respond to policy and technology changes. This could become a key differentiator of performance for financial institutions over the long term.

As such, supporting the development of the requisite skills to ensure banks measure and manage climate risk will be critical. Specific programmes targeted to increase the quantitative skills required to manage big data should be prioritised. The current CEDEFOP skills forecast for Luxembourg (CEDEFOP, 2020[50]) projects employment growth in the business services industry of 1.9% per year between 2018 and 2030, with an emphasis on continued demand for clerical skills rather than sophisticated data management. The ADEM projection for the financial sector projects that green analysts will be increasingly in demand (ADEM, 2021[39]). However, data management and skills are not highlighted as a particular focal area – even though demand for these skills rose to around 40% of the financial sector job offers in 2021, from 30% in 2015. Prioritising these skills’ prominence in training programmes and efforts to attract international talent could help to mitigate some of the risks of the transition for the financial sector.

|

Regulatory Standard |

Task Force on Climate-related Financial Disclosures |

International Sustainability Standards Board (ISSB)1 |

Corporate Sustainability Reporting Directive1 |

|---|---|---|---|

|

Disclosure topics |

Climate-related goals |

Environmental matters (detailed) |

Environmental matters |

|

Social and governance matters (general level, no detailed guidelines) |

Social matters Governance matters |

||

|

Areas of disclosure |

Present governance, strategy, risk management, metrics and targets |

In addition: Financial materiality (with a requirement to mention impact materiality if relevant) Disclose scope 3 emissions4 |

In addition: Double materiality2 Mandatory EU ESG reporting standards and guidelines3 Must be audited |

|

. |

Greater detail on areas of disclosure Greater detail on green disclosures to include energy consumption and mix, energy intensity, GHG removals and avoided GHG emissions from products and services |

||

|

Voluntary disclosure principles Mandatory for UK Will become mandatory for Canada, New Zealand |

Guidelines |

Mandatory in EU for all large public companies5 for all reports produced after 1 January 2025, with limited assurance. Reasonable assurance required after 2031. Mandatory for all large companies (including private) and most listed companies from 2027. |

Note: 1. Proposals are in draft format. 2. Double materiality defines a material matter from the impact perspective (of the reporting company on society or other stakeholders), the financial perspective (of the finances of the reporting company, regardless of time horizon), or both. This is much wider than the financial materiality concept defined in financial statements and used in ISSB standards. 3. The EU ESG reporting standards are expected to be finalised by the end 2022, with sector specific guidelines released October 2023. 4. Note that the combination of financial materiality and scope 3 emissions means that these risks only have to be disclosed if they have a material impact on firms. 5. This includes large public-interest companies with more than 500 employees (the same companies currently obliged to report under the Non-Financial Reporting Directive).

A broad mix of policy instruments that complement one another is the most cost-effective way of achieving decarbonisation goals, while also being inclusive and socially acceptable (D’Arcangelo et al., 2022[41]). A strong governance framework provides the legal basis for climate action. A steady, rising future path for emissions prices is required to guide long-term investment choices across all stakeholders in the economy. Subsidies and regulations can help to improve the impact of emissions pricing by encouraging broader behavioural change, since pricing alone cannot overcome typical innovation coordination failures (Bessen and Maskin, 2009[56]); (Stiglitz, 2019[57]). Key cross-cutting policies in spatial planning, housing and transport can support the transition by influencing how readily households and firms adapt. A transparent policy to consider how any revenues generated from the transition will be used is required.

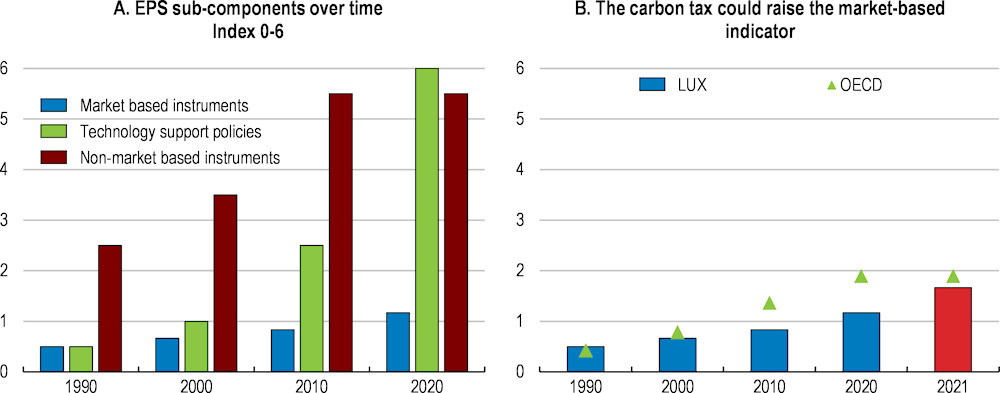

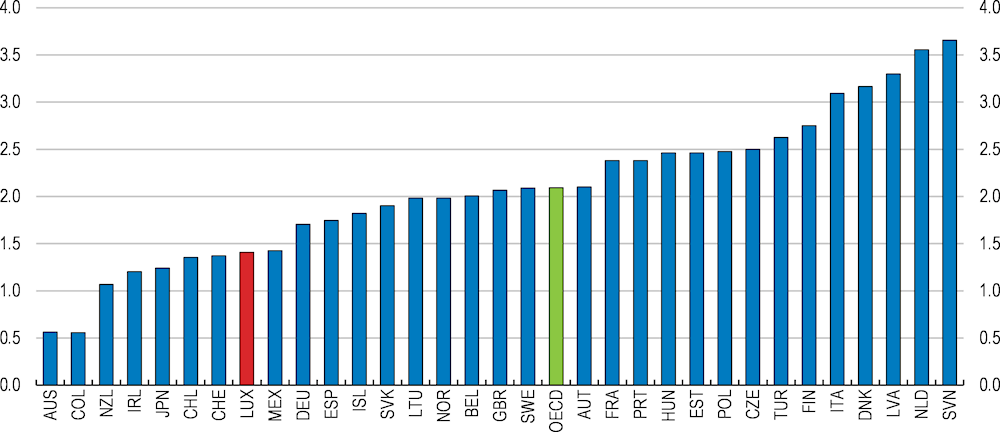

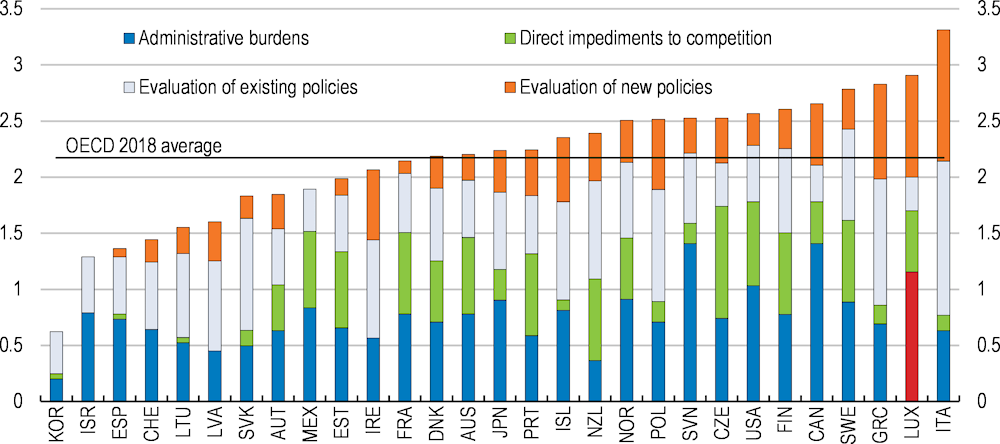

Environmental policy stringency in Luxembourg has risen sharply since 1990 (Figure 2.18). As a result, in 2020, Luxembourg was among the OECD countries with the most stringent environmental policies, together with France, Switzerland and Finland (Kruse et al., 2022[28]). Non-market-based instruments rose primarily due to more stringent regulations for sulphur and particulate matter between 2000 and 2010. Greater use of feed-in tariffs, market premiums and solar electricity tenders drove the increase in technology support policies, with green R&D support rising sharply between 2010 and 2020. This has been augmented by increases in the subsidies to support energy efficiency investments for both households and firms.

Note: Policies are scored on a scale from zero to six and aggregated. The market based instruments sub-index groups policies that put a price on pollution, such as CO2 trading schemes, renewable energy trading schemes, CO2, Nitrogen Oxides (NOX), Sulphurous Oxides (SOX) and fuel taxes. The non-market based instruments sub-index puts together policies that mandate emission limits and standards, such as emission limit values for NOX, SOX and particulate matter, and sulphur content limit for diesel. Technology support policies include public R&D expenditure on low-carbon energy technologies and renewable energy support for solar and wind from feed-in tariffs and auctions, relative to the global levelized cost of electricity. Panel B: Other OECD countries may also have introduced changes to their market-based instruments in 2021, which are not reflected in the represented OECD average for 2021, which is equal to the OECD average in 2020.

Source: (Frohm et al.[29]); (Kruse et al., 2022[28]); OECD calculations.

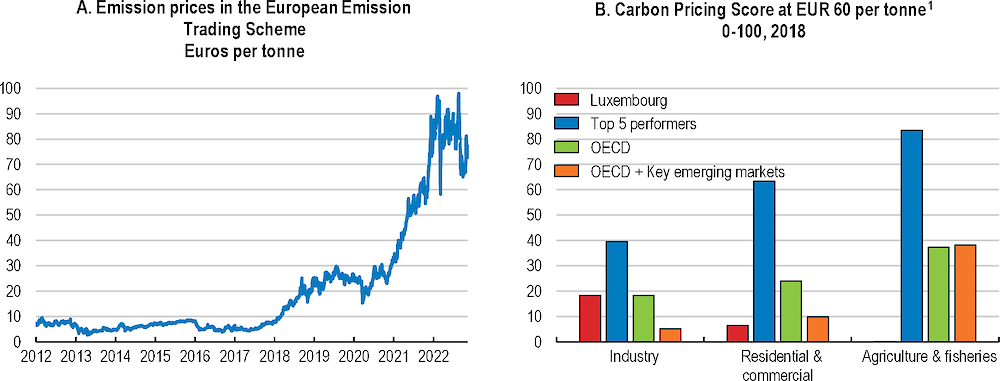

Nonetheless, there are gaps in the overall policy mix. The current policy mix relies heavily on subsidies and regulations (Table 2.5). Luxembourg’s score for market-based environmental policy instruments remains below the OECD average in 2020, reflecting low carbon prices. The recently introduced carbon tax, which is not reflected in the data, will reduce the gap with the OECD average. Increasing the carbon tax to the levels observed in the best performing OECD countries, which would imply a carbon tax rate of around EUR 80 per tonne, would raise the overall EPS indicator by 1.4 points.

|

Policy instruments |

Cost-effectiveness |

Public acceptability1 |

Current implementation in Luxembourg |

|---|---|---|---|

|

GHG Tax |

High minimisation of abatement costs Moderate to high monitoring costs |

Low to moderate |

- Carbon tax: introduced in 2021 at EUR 20 per tonne, currently at EUR 25, to be increased to EUR 30 in 2023 |

|

Emission Trading Schemes (ETS) |

High minimisation of abatement costs Relatively high monitoring costs |

Moderate |

- Luxembourg is part of the EU-ETS, which cover around 15% of LUX’s emissions |

|

Taxes on polluting goods and services |

Low (higher support when applied selectively) |

- Fuel excise tax (diesel and petrol) CO2-based vehicle taxation |

|

|

Environmental standards |

- NZEEB standards for new buildings |

||

|

Subsidies for climate change mitigation actions |

Potentially high Lower if they cover actions for carbon sequestration rather than outcomes |

High (reduces costs) |

- PRIMe House: subsidies for renovations improving energy-efficiency; installations of heat-pumps or photovoltaic panels |

|

Feebates |

- Passenger Vehicles: a CO2-based vehicle tax + subsidies for purchase of an electric car - Feed-in tariff for renewables |

||

|

Technology-support policies |

Low to moderate (but high incentives to invest in R&D) |

High |

- Financial aid to companies for investment in the fields of environmental technologies and innovation |

Note: 1. Based on international evidence of public acceptability.

Source: (D’Arcangelo et al., 2022[41]); (Dechezleprêtre et al., 2022[58]), national sources, and authors’ assessment.

The climate governance framework has grown significantly in line with Luxembourg’s climate ambitions. The governance and accountability of the government’s climate strategy is grounded in a climate law passed in December 2020, which provides a legally binding mechanism for action on sectoral targets that are set every ten years. According to the law, government plans must be guided by a national energy and climate plan every 10 years, which includes updated sector targets for energy reductions and the path for policy direction, as well as a 50-year strategy document issued every ten years, which sets the broad objectives for climate policy. The climate law is an important step: without it, those opposing climate policies can block action; the law provides a basis for policies to be advanced or to block policies that run counter to climate action.

Legally binding targets set into the future are an important commitment mechanism and can send important signals for certainty. The targets are reviewed every five years in line with the National Energy and Climate Plan. Regular reviews based on evidence are intended to allow for new information to be taken into account in setting targets, and will include extensive consultation with industry. Clear and regular entry points in the policy-making process for the civil society would help to enhance public acceptance of ambitious green policies (D’Arcangelo et al., 2022[41]). Luxembourg’s engagement with civil society and its ability to absorb inputs from those actors outside formal business and labour has been raised as a difficulty in general legislative processes (OECD, 2021[59]); (European Commission, 2022[60]). The 2020 climate law established the climate platform, a panel of experts appointed by government to test government policies. The Luxembourg in Transition project, which included a Citizens’ Committee that developed a report with concrete recommendations, forms a good basis for continued engagement. The Citizen’s Office for the Climate (KlimaBiergerRot) has been established to develop proposals to influence the 2024 National Energy and Climate Plan (Ministère d'État; Ministère de l'Environnement, du Climat et du Développement durable; Ministère de l'Énergie et de l'Aménagement du territoire - Département de l'aménagement du territoire, 2022[61]). These provide a platform for the public to engage on climate-related research, including that produced by the Climate Observatory.

To maintain good faith, engagement needs to also consistently show that recommendations are taken into account. In France, the President committed to taking forward the recommendations of the Convention Citoyenne pour le Climat with either a referendum, parliamentary votes or direct regulations (Ministère Ecologie, 2021[62]). The “Climate and Resilience Bill” (“Loi Climat et Résilience”), presented in early 2021, sought to implement many of the measures proposed by the citizens’ convention and to enhance existing environmental policies (OECD, 2021[63]).

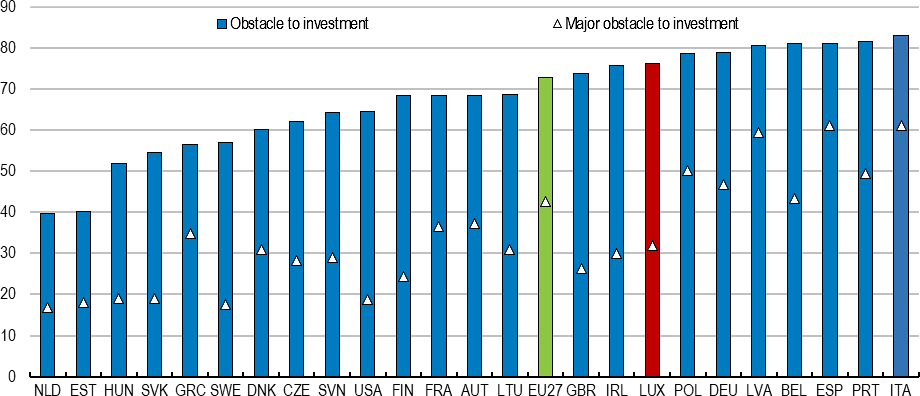

Support for the green transition amongst Luxembourg’s citizens is high. According to the latest Eurobarometer Survey on climate change attitudes, 78% of citizens consider climate change to be a very serious problem and 63% think the government is not doing enough to tackle the problem (Eurobarometer, 2022[64]). This support may, however, be contingent on the relatively low costs households have faced from the green transition so far. The war in Ukraine and sharp increase in energy prices will test public support.

Government targets imply large changes in household behaviour to reduce transport and residential buildings emissions. This increases the potential resistance to change in the future. Uncertainty about the benefits of the transition, risk aversion, high upfront costs for new investments and learning, and misperceptions of costs can reduce the willingness of firms and consumers to change (see Box 2.5), leaving them poorly prepared in the medium to long term. In the short term, this can increase the risks of a misalignment between policy objectives and the perceptions of firms and households, and itself pose risks for the transition. Experience from other countries, such as in France, suggests that the yellow vests movement, which opposed environmental taxes in 2018 and 2019, was driven by a poor understanding of the social benefits, the lack of compensation schemes and a lack of responsiveness to the combined impact of global prices and domestic policy choices (CEDD, 2019[65]).

The government has primarily responded to political risks to date by trying to keep the costs for households low, with a heavy reliance on generous subsidies and a very gradual increase in the carbon price. But lowering costs that households face is not necessarily the most effective strategy. Denmark, Sweden and Norway have managed the political risks of the transition in spite of sharp increases in the costs faced by households. Critical determinants of policy acceptance were clear communication campaigns, which stressed the objectives of the transition, and clearly defined programmes to support the vulnerable. Continued engagement will be required as policy choices are likely to become more difficult to ensure that society remains committed to the transition (Dechezleprêtre et al., 2022[58]).

Public debate would benefit from more precise quantification of the impact, costs and benefits of different policy tools – including a range of carbon pricing strategies – as well as the fiscal implications of long-term choices. A recent study has shown that across OECD countries, on average, people are more likely to support subsidies for developing clean technologies or bans rather than direct taxes on fossil fuels (Dechezleprêtre et al., 2022[58]). Politically popular policies are not, however, always economically efficient. Explicit revenue earmarking is generally discouraged, as it creates rigidities in spending priorities and reduces the efficiency of government allocations (D’Arcangelo et al., 2022[41]). Compliance costs for standards and rules can be high, particularly for lower-income households and smaller firms. For example, (Gillingham and Stock, 2018[66]) estimate implementing fuel standards could cost up to USD 2 900/tCO2. Others such as (Goulder and Parry, 2008[67]) suggest that regulations double the average costs per unit emission reduction compared to price interventions.

The eventual policy mix chosen by authorities needs to take into consideration the individual and combined impact of policies. Box 2.4 outlines the initial results of a modelling exercise conducted for this Survey, in order to estimate the potential impact of different carbon price trajectories. Given the complexity of the transition, no single model will be able to provide a complete picture of risks. A suite of models to consider the implications of various policy combinations should be used, and the results framed in the context of the risks of action and inaction. In the United Kingdom, Netherlands, Denmark and France, independent bodies play a key role in producing, disseminating and commenting on climate-related research and the potential impacts on the economy.

Luxembourg’s climate law established a climate policy observatory to lead on technical aspects related to climate policy. By establishing its neutrality and focusing on evidence-based policymaking, the Climate Observatory can play an important role in information sharing and acting as a trusted arbiter for social debates. It can commission and disseminate research, including for climate models that allow for a balanced and broad-based assessment of climate risks. The Climate Observatory should also evaluate potential policy tools’ impacts across different types of households, which will allow for a more informed set of public policy debates. Consideration should be given how to best coordinate the work of the Observatory and the considerable expertise in STATEC, which is another trusted body providing neutral assessments of policy choices.

The timing and costs relating to the realisation of climate risks are not always clear and there can be considerable uncertainty relating to the impact of climate policy. In addition, biases in measuring the risks of acting too soon or too slowly can hamper effective policy formation (Box 2.5). This can pose a considerable challenge in Luxembourg, where individual firms account for a larger share of total employment compared to their OECD counterparts, making it harder to generalise whether changes in firm circumstances are driven by unique events, or market forces. Changes in the fortunes of one firm could have an outsized impact on perceived costs and risks associated with the climate transition. This in turn could generate resistance to change or encourage overly generous subsidies and offsets. Overly generous support will not only represent an opportunity cost for funds, but could lock in lower carbon production techniques that expose the country to sharper transition costs in the long run. Supporting less productive firms could also lower overall aggregate productivity growth further.

Measurement bias. Uncertainty about the transition stems from uncertainty about the impact of policies on behaviours, as well as technological uncertainty on the timing and availability of alternatives (Table 2.6). Risk analysis tends to gravitate towards measuring what is known and over-emphasise the importance of maintaining the status quo - in this case, the costs of moving too fast, which are particularly salient since they are borne immediately, by a concentrated and identifiable set of stakeholders. By contrast, analysing the benefits of firms or households that do not yet exist seems less precise. The costs of acting too slowly (or the benefits of acting sooner) can seem less salient as they are estimated to take place in the future, and the benefits are often diffuse.

|

Too fast |

Too slow |

|

|---|---|---|

|

Firm operating risks |

Loss of competitiveness and market share in the short to medium term (carbon leakage). |

Lack of adaptation leaves firms vulnerable to competitive pressures in medium to long term. |

|

Lost benefits associated with first-mover advantage in the medium to long term (innovation path dependency). |

||

|

Firm investment risks |

Higher costs due to use of new technology and associated learning costs. |

Large capital outlays in “catch-up” investment required in the medium to long term. Build-up of investments with high scrapping risks in the long term. |

|

Sunk costs from investments in the “wrong” direction in the medium to long term. |

Lost medium to long-term benefits from long-life-cycle investments undertaken too early. |

|

|

Economy wide |

Disruptions to employment, exports due to loss of market share in the short to medium term. |

Lost benefits from reduced emissions in well-being. |

|

Forced switch into less productive, more costly investment crowds out domestic demand and other investments in the short to medium term. |

Lower productivity by supporting less productive firms. Lost benefits from economy-wide network and innovation effects. |