Caroline Klein

OECD

Sahra Sakha

OECD

Yosuke Jin

OECD

Paula Adamczyk

OECD

Caroline Klein

OECD

Sahra Sakha

OECD

Yosuke Jin

OECD

Paula Adamczyk

OECD

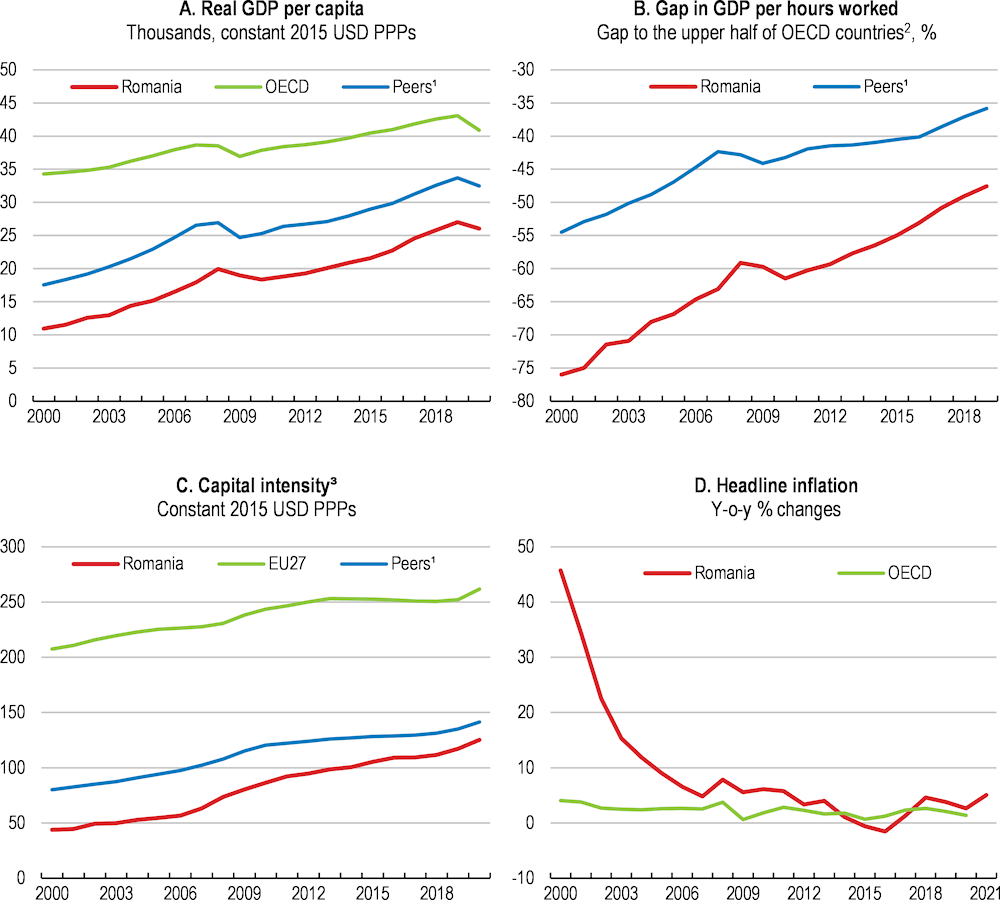

Romania’s economic performance in recent years has been impressive. GDP per capita has reached 63% of the OECD average in 2019, from around 30% in the early 2000s (Figure 1.1, Panel A & B). After being hit hard by the global financial crisis and before the outset of the coronavirus pandemic, Romania’s convergence in living standards progressed rapidly, with GDP and productivity growth rates persistently exceeding the OECD average supported by strong capital accumulation and efficiency gains (Figure 1.1, Panel C). Labour market conditions improved, with the unemployment rate reaching a historically low level in 2019 and wages converging to EU average standards. Inflation, which was very high in the early 2000’s, has slowed down since 2000 (Figure 1.1, Panel D).

Since the transition from a planned to a market economy initiated in 1990, and especially after joining the European Union in 2007, the Romanian economy has become increasingly sophisticated and open, on the back of high levels of foreign direct investment. Structural reforms related to the EU accession, including in state-owned enterprises and in judiciary, and a prudent monetary policy contributed to its strong economic performance. The economy is still characterised by relatively large agriculture and manufacturing sectors, but services account for a fast increasing share of output. The information and communications sector, in particular, amounted to 6.3% of GDP in 2019, above the EU average. Romania remains a dual economy, though, where high-performing foreign-owned companies coexist with low-productivity domestic firms. Local firms are relatively small, under-capitalised and not well integrated in global value chains (Chapter 2).

The pandemic has slowed down the convergence process, but the recovery from the initial hit has been fast. After declining by 3.7% in 2020, GDP reached its pre-crisis level at the beginning of 2021. At the same time, the COVID-19 crisis poses large risks to future economic developments. The recovery hinges on the capacity to contain the pandemic, which is complicated by the spread of more contagious COVID variants and the slow vaccine rollout.

Note: 1. Peers is the unweighted average of Czech Republic, Estonia, Hungary, Latvia, Lithuania, Slovakia, Slovenia, and Poland. 2. Percentage gap with respect to the weighted average using population weights of the highest 17 OECD countries in terms of GDP per capita and GDP per hour worked (in constant 2015 PPPs). 3. Capital intensity is defined as net capital stock per person employed.

Source: OECD National Accounts Database; OECD Calculations based on OECD (2021), Economic Policy Reforms 2021: Going for Growth; and the Secretariat’s calculation based on the European Commission AMECO database.

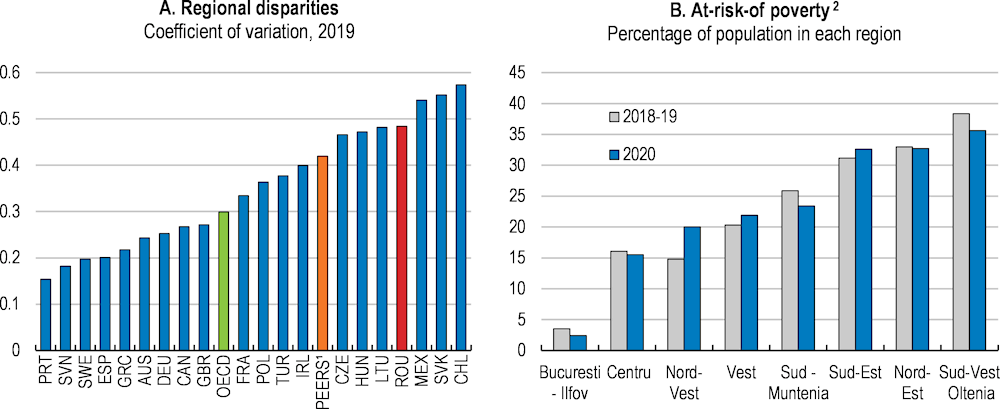

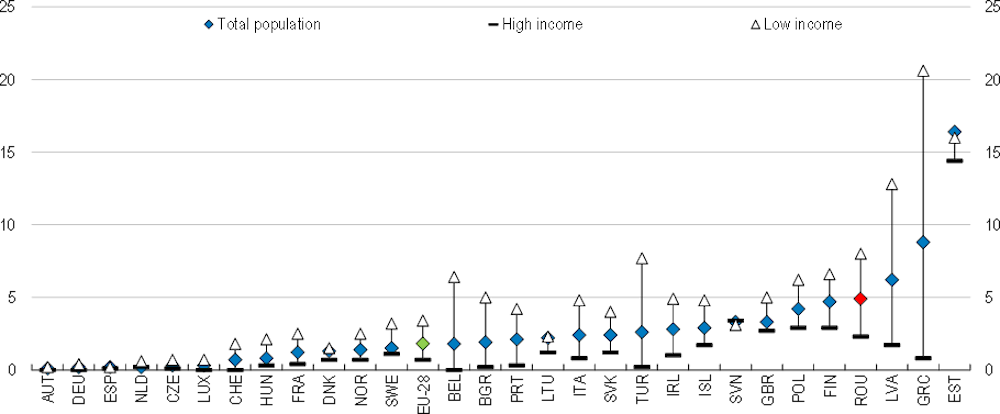

Poverty has declined significantly over the past decades. Around half of the Romanian population was at risk of poverty or social exclusion before the global financial crisis, down to 30% in 2020. Nevertheless, poverty remains relatively high compared to OECD countries (Figure 1.2, Panel A). The share of the population living with less than 50% of the median income has stabilised since 2017 at around 18%. Poverty risks are particularly high for people living in rural areas and Roma. Income inequality, measured by the Gini coefficient, remains above levels seen in many OECD countries (Figure 1.2, Panel B).

The pandemic has deepened inequalities, by hitting more vulnerable population groups hard, including marginalised communities. Women have been more affected by the COVID-19 crisis as they are over-represented in heavily impacted sectors and less secure forms of employment (World Bank, 2021a). While the gender pay gap is among the lowest in the EU, indicators point to relatively high gender inequality, in particular in terms of access to quality employment (European Institute for the Gender Equality, 2019).

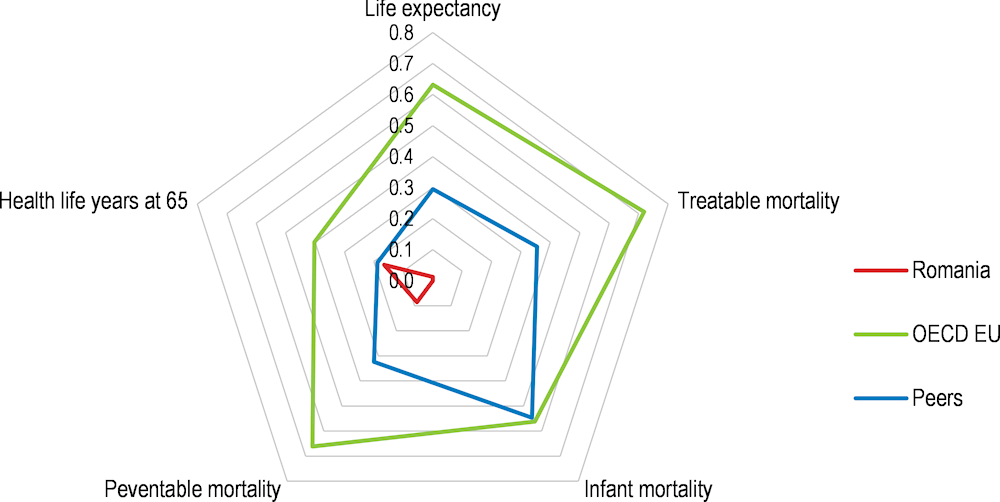

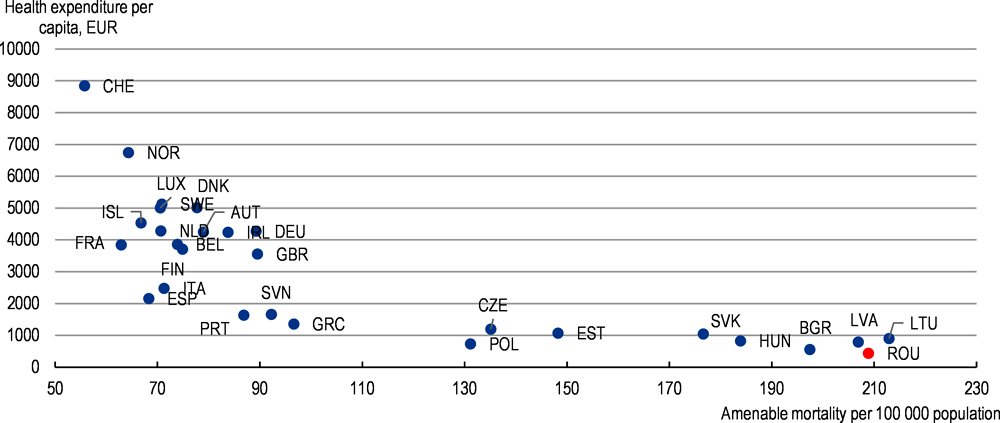

Despite substantial improvements, Romania still lags behind most OECD countries in terms of access to high-quality education, healthcare, housing, transport infrastructure, and a clean environment. In the absence of effective and timely policy action, the COVID-19 crisis risks aggravating pre-existing vulnerabilities in these areas. Early school leaving is a challenge, and around 15% of the youth were neither in employment nor in education or training in 2019. Lockdowns and school closures have widened learning gaps, especially in disadvantaged groups. Health outcomes improved before the pandemic, but amenable mortality – mortality that could have been avoided through appropriate healthcare interventions – was the highest in the EU in 2019 (OECD/EOHSP, 2019). The pandemic put huge pressure on the health system, highlighting the urgent need to invest in this sector and to address structural shortages, especially of health professionals. Housing conditions are still poor in particular for low-income families with children. Overcrowding and the lack of access to basic sanitation affect health outcomes and have likely contributed to greater spread of COVID-19 within disadvantaged communities (OECD, 2021a; Ahmad et al, 2020). Romania managed to decouple greenhouse gas emissions from economic growth. However, air pollution is high and associated with a relatively high number of premature deaths by international norms (OECD, 2021e).

Depopulation, due to ageing and emigration, undermines economic development, notably by exacerbating labour shortages. Romania lost around 3.7 million inhabitants since 1991 and had one of the strongest declines in the working age population over the past decade (Figure 1.3). Around 17% of the Romanians were estimated to live in OECD countries in 2015-16, making the Romanian diaspora the fifth largest in the OECD (OECD, 2019a). Adverse impacts of emigration go beyond labour market issues. In December 2020, around 75 000 children in Romania were missing at least one parent because they were working abroad, with negative consequences on children’s wellbeing and development (Salvati Copiii, 2021; UNICEF, 2008).

The impact of the COVID-19 crisis on migration flows remains unclear and will mainly depend on economic prospects in Romania compared with emigration countries. Substantial differences in wages and job prospects have been the main reasons to emigrate in the past, while shortcomings of public services and the perceived lack of meritocracy also played an important role (European Commission, 2019a). Policy measures that strengthen the business environment, foster jobs opportunities, and improve the rule of law can contribute to retaining potential emigrants.

Romania needs to find new growth drivers, while ensuring all citizens benefit from future economic developments. Increasing labour market participation from current low levels and the quality of jobs can help to compensate for the fast decline in working age population and to tackle poverty issues (Chapter 3). Furthermore, the reform process should resume to help Romania pursue the convergence process, notably by supporting the transition to a knowledge-based economy and the expansion of high-value-added goods and services production.

The government’s priorities, outlined in the national Recovery and Resilience Plan, aim at addressing these challenges. However, in the past, the lack of policy continuity has delayed the implementation of policies. Romania should seize the opportunity of the Next Generation EU Plan to support the recovery, improve the resilience of the economy to future shocks, including new waves of COVID-19 infections, and implement long-awaited structural reforms. In this context, the main messages of the Survey are:

The low vaccination rate and the new pandemic wave pose important growth risks. In this context, fiscal policy should timely adapt to the pandemic and target the most affected sectors. At the same time, structural reforms of public spending and the taxation system are needed to maintain the sustainability of public finances.

Reducing inequalities, offering quality jobs, addressing skills shortages and adapting to population ageing require reinforcing active labour market policies and improving access to quality vocational and adult education.

Reviving productivity growth involves reducing competition barriers, raising human capital, enhancing the regulatory framework, and improving transport infrastructure.

Finally, improving the rule of law and fighting corruption are crucial to pursue economic convergence to the highest OECD standards.

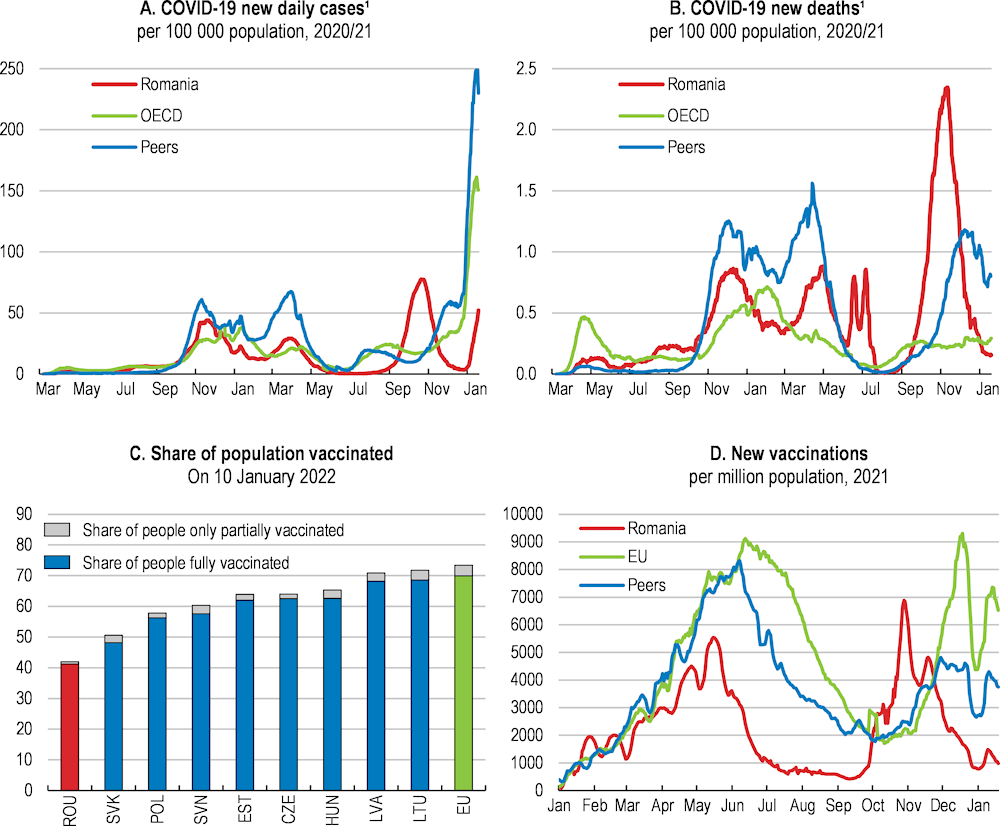

Like in Central and Eastern European (CEE) OECD countries, the second and third waves of the pandemic hit Romania hard (Figure 1.4, Panel A and B). The pandemic put the healthcare system under huge pressure, due to past under-investment, shortages of health professionals, and lack of adequate protective and medical equipment (Dascalu, 2020). In response to the virus surge, strict containment measures were put in place, including a national lockdown in spring 2020 and substantial resources were allocated to hospitals for the purchase of equipment and the expansion of capacity. In the first half of 2021, restrictions have been more targeted and were gradually relaxed as the health situation improved. The number of infections and hospitalisations surged from September 2021 due to the fast progression of the Delta variant in Europe, which has been declining toward the end of the year. However, due to the progression of the more infectious Omicron variant, the number of infections has risen again since the beginning of 2022, posing additional risks going forward. Targeted containment measures have been put in place at the local level, including curfews and reduced opening hours.

After a good start, the vaccine rollout has slowed down dramatically between May and September 2021, with the number of daily doses administered standing well below the EU average (Figure 1.4, Panel C and D). Despite initiatives to encourage vaccine uptake, the government’s objective of vaccinating half the population by end-September was not reached. Accelerating vaccination is crucial to avoiding new waves of infections and requires more information campaigns and targeted incentives.

Difficulty in reaching the rural population (44% of the total) partly explains the low vaccination rate and calls for strengthening mechanisms of outreach to isolated people and marginalised communities, notably by multiplying mobile vaccination centres and involving trusted community voices, as in Israel, for instance (OECD, 2021b). At the same time, in major cities where access to vaccines is easy, only around half of the population is vaccinated. This reflects low vaccine confidence among the Romanian population. Evidence-based and transparent educational campaigns aimed at improving public trust in vaccines and tackling disinformation should be reinforced. Vaccination or recent negative test was required to access some activities at the local level when the infection rate exceeded 3/1000. In response to the fast rise in infections and hospitalisations, this measure has been imposed at the national level on a more general basis as in France or Germany. Mandating vaccines for some professions as in Italy should also be envisaged, if uptake does not improve rapidly.

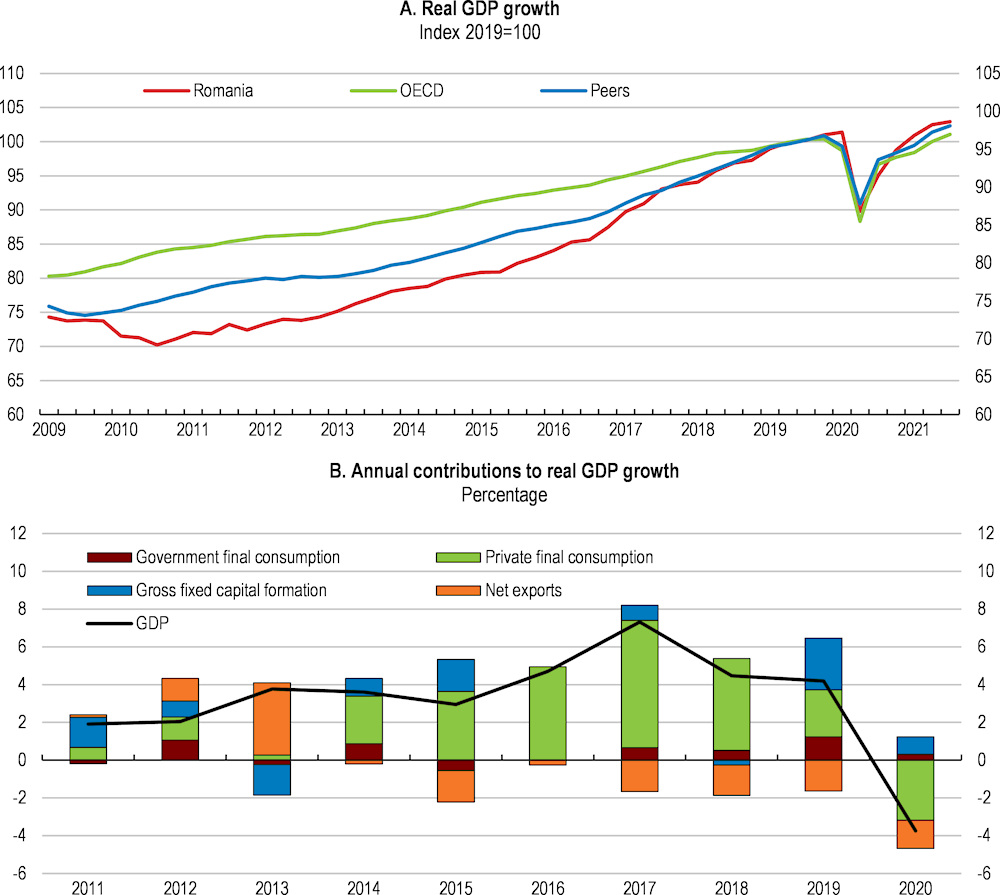

The pandemic triggered a deep economic contraction in 2020, albeit milder than in the OECD and the EU on average (Figure 1.5, Panel A). After peaking at around 7% in 2017 and exceeding 4% in 2018 and 2019, GDP growth declined by 3.7% in 2020, close to levels seen in the OECD and OECD CEE countries. Consumption, which was the main driver of growth before the pandemic, dropped due to containment measures and low consumer confidence (Figure 1.5, Panel B). Exports fell on the back of factory closures and supply chains disruptions. Still, investment was resilient, sustained by strong activity in the construction sector. Fiscal stimulus rightly helped weather the shock. Measures to support households and firms included a short time work scheme, non-refundable grants, credit guarantees and tax deferrals for a total amount of around 5% of GDP (Box 1.1).

Note: 1. 7-day moving average. Peers refers to the weighted average of Czech Republic, Estonia, Hungary, Latvia, Lithuania, Slovak Republic, Slovenia and Poland. 2. The stringency index score is an index averaged across eight closure and containment policy components and scaled from 0 (no restriction) to 100 (highest category of restrictions).

Source: Our World in Data; OECD calculations based on the Oxford Covid-19 Government Response Tracker https://covidtracker.bsg.ox.ac.uk/.

The Romanian authorities have introduced a wide range of measures to tackle the health and economic crisis. These measures (excluding contingent liabilities) amount to RON 38 billion in 2020 and RON 14.4 billion in 2021 (3.6% and 1.4 % of GDP respectively).

Health expenditure increased by RON 6.7 billion in 2020 and RON 4.7 billion in 2021, notably to finance bonuses for health workers, emergency medical equipment, and the National vaccination programme.

Employment measures include, among others, a job retention scheme (with a compensation for employees at 75% of their gross salary), a 3-months wage subsidy for the resumption of activity, and an allowance for the self-employed. The government also provided subsidies for hiring jobseekers aged over 50 or below 30 or Romanian citizens returning to the country. These measures amounted to RON 8.0 billion in 2020 and RON 1.9 billion in 2021. Grants to microenterprises, SMEs and firms in the tourism, accommodation and food sectors were also introduced in 2021.

Tax measures amounted to RON 21.9 billion in 2020 and mainly consisted in deferrals of tax payments, the acceleration of VAT refunds and an exceptional rebate of the corporate income tax. The government also introduced the possibility to cancel interests and penalties on outstanding corporate tax liabilities (in place until January 2022) and to reschedule corporate tax liabilities for 12 months (in place until September 2021).

The government has introduced a new loan guarantee scheme “IMM-Invest” in which the State guarantees up to 80% of loans for SMEs and 90% of loans for microenterprises and subsidises interest payments as well as the management and risk fees. As of end of September 2021, the total amount of guarantees issued amounted to RON 19.09 billion, with two guarantees having been called so far.

A moratorium allowed to postponing debt repayments by up to 9 months for non-financial corporations and households (in place until March 2021).

Source: The Secretariat’s elaboration based on information provided by the Romanian authorities.

Note: Peers consists of Czech Republic, Estonia, Hungary, Latvia, Lithuania, Slovakia, Slovenia, and Poland.

Source: OECD Economic Outlook database.

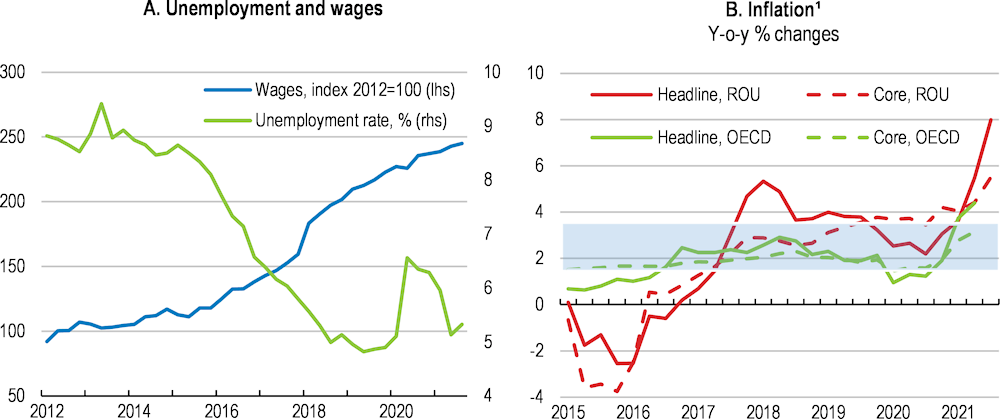

Job retention measures limited the rise in unemployment (Figure 1.6, Panel A). The unemployment rate, measured according to the ILO definition, reached 6.7% at its peak, from 5.0% at the beginning of 2020. After increasing by around 33% at its height, the number of registered unemployment has almost returned to its pre-crisis toward mid-2021. Contrasting with many OECD countries, labour market participation has not declined and working hours have dropped moderately. Intensifying recruitment difficulties amid strong emigration of skilled labour before the pandemic can partly explain job retention in some sectors. Labour market developments have been uneven though, with large downsizing in the sectors affected by the COVID-19 crisis (manufacturing, tourism, personal and cultural services).

Wage inflation decelerated significantly, due to some moderation in public and minimum wages growth since 2020, but remains strong (Figure 1.6, Panel A). At 8.2% in December 2021, headline inflation has largely exceeded the upper bound of the target band of the central bank (2.5 percent ±1 percentage point), mainly driven by electricity and fuel prices (National Bank of Romania, 2021a). Core inflation has accelerated (Figure 1.6, Panel B), mostly on the back of supply side shocks, including increases in commodity prices, persistent bottlenecks in production and supply chains, but also due to increasing demand. Against this background, the central bank increased its policy rate by 25 basis points three times from October 2021 to January 2022 to 2%.

1. The shaded area represents the target band of the National Bank of Romania.

Source: OECD Economic Outlook: Statistics and Projections.

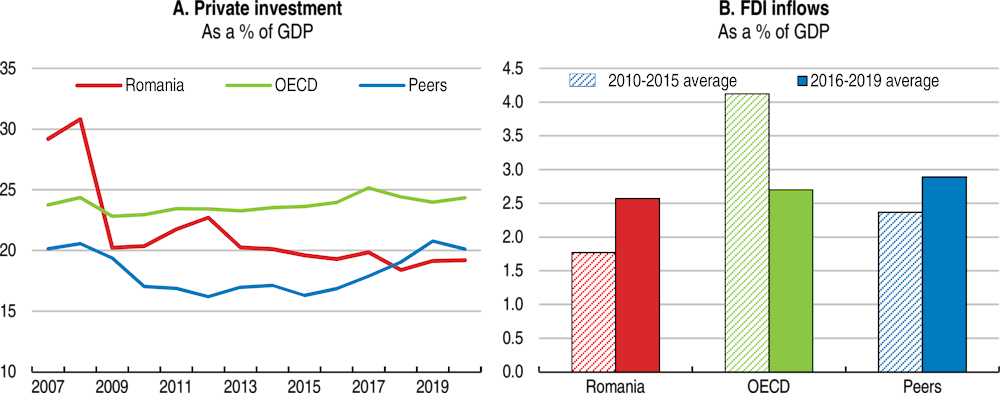

Supported by favourable financing conditions and despite a challenging economic environment, private investment has stalled in 2020 as a percentage of GDP (Figure 1.7). Nevertheless, the ratio of private investment to GDP remains below the OECD average and levels seen before the global financial crisis. Romania’s inward FDI position is still much weaker than that of OECD CEE peers and inflows have remained mainly skewed toward reinvested profits from existing investors (National Bank of Romania, 2020a). The underlying reasons are manifold, including the fragile balance sheets of domestic firms. Political instability and legal uncertainty that erode business confidence played a role (Chapter 2, IMF, 2019a). After a drop in 2020, FDI inflows bounced back in 2021, but a large share accounted for deferred tax payments.

Note: Peers consist of Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, and Slovenia.

Source: OECD Economic Outlook database, and OECD International Direct Investment Statistics.

Exports fell sharply in 2020, as international mobility restrictions triggered major supply chains disruptions and external demand collapsed, but they recovered their pre-crisis levels in early 2021. Imports fell less than exports leading to a deterioration of the trade balance. Before the COVID-19 crisis, trade openness increased significantly, with 85% of exports directed to EU countries in 2019 (Box 1.2). Exporters gained market shares at a fastest pace than CEE competitors, despite some losses in price competitiveness (Figure 1.8, Panel A). Increases in unit labour costs have only partly passed through export prices. The national currency has been slightly depreciating, moderating increases in the real effective exchange rate (Figure 1.8, Panel B).

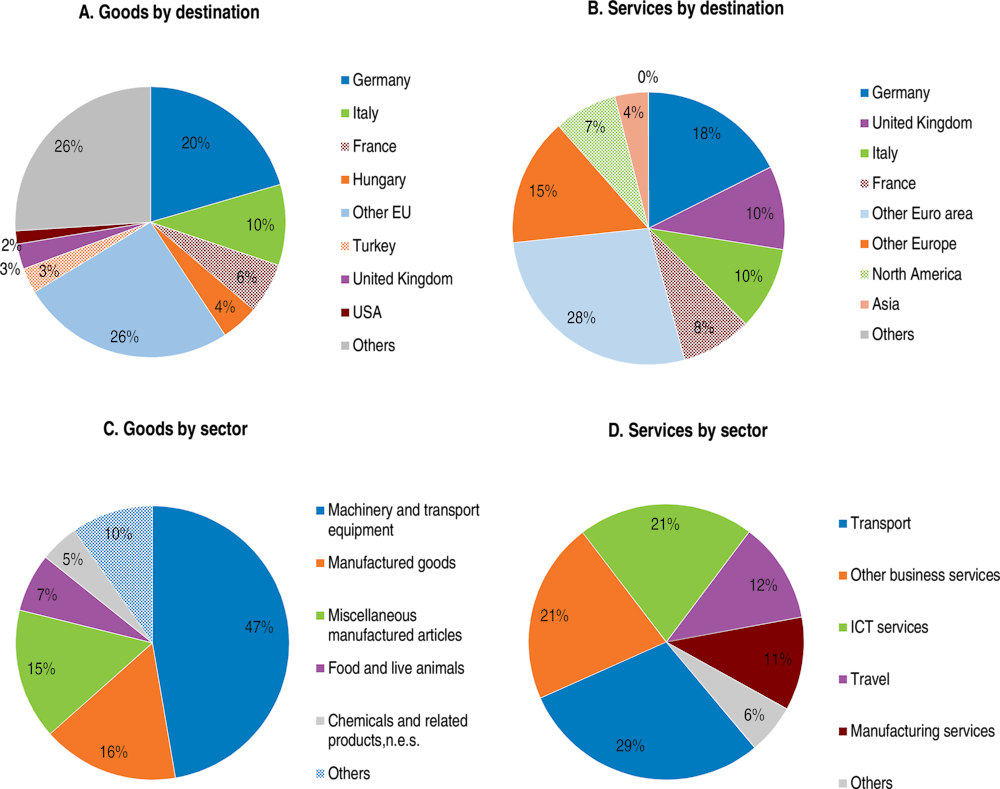

Supported by the EU membership, exports grew strongly over the past decades, with export of good and services accounting for 40% of GDP in 2019 from around 25% in early 2000’s. They remain lower than for many fast converging CEEC peers though. Around 85% of exports are directed to EU countries, Germany, Italy and France being the main destinations (Figure 1.9, Panel A and B).

Romania successfully diversified its export basket from labour-intensive, low-technology sectors (textile industry, raw material) toward medium-technology products and more advanced sectors (automotive, machinery, and electronic equipment, and information and communication services; World Bank, 2018a; Figure 1.9, Panel C and D). However, the shift to higher value-added activities has been slower than in OECD CEE countries, with agriculture still accounting for a large share of exports. Romania’s integration in global value chains lags behind its peers with relatively less use of foreign inputs in its exports. While the relative large size of the Romanian economy can partly explain higher reliance on domestic markets, performance of OECD economies of similar size suggests Romania has ample room to deepen integration in global value chains.

Share of exports by sector and destination, 2019

Note: Panel C: Others include beverages and tobacco, crude materials, mineral fuels, and animal and vegetable oils. Panel D: Others include construction services, maintenance and repair, financial services, cultural services, and insurance and pension services.

Miscellaneous category includes other services, construction and insurance and pension services.

Source: INSSE and Eurostat, International trade in services.

GDP growth is projected to reach 4.5% in 2022 and 2023 (Table 1.1). Assuming the pandemic is contained and restrictions are gradually lifted, private consumption are expected to accelerate on the back of pent-up demand and accumulated household savings. Exports should gain momentum as supply chains and trade in main trading partners recover. Labour market conditions will gradually improve and shortages in some sectors will accentuate, driving wages upwards. Despite policy measures to cap energy prices and subsidies for energy consumption, inflation is set to remain strong in 2022 and is subject to significant upside risks. In 2023, inflation is projected to remain close to the upper bound of the target band of the central bank at around 3½, even assuming increases in energy and food prices will recede. Monetary policy is expected to continue to normalise. The fiscal support will contract starting from 2022, but the disbursements of EU funds will stimulate investment.

Annual percentage change, volume (2010 prices)

|

2018 Current prices (billion RON) |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|---|---|---|---|---|---|---|

|

Gross domestic product (GDP) |

951.7 |

4.2 |

-3.7 |

6.3 |

4.5 |

4.5 |

|

Private consumption |

607.3 |

3.9 |

-5.1 |

4.1 |

4.5 |

4.1 |

|

Government consumption |

160.1 |

7.3 |

1.8 |

1.6 |

2.6 |

2.1 |

|

Gross fixed capital formation |

200.4 |

12.9 |

4.1 |

7.5 |

8.3 |

9.8 |

|

Final domestic demand |

967.8 |

6.3 |

-1.9 |

4.6 |

5.1 |

5.2 |

|

Stockbuilding1 |

16.4 |

-0.6 |

-0.3 |

3.0 |

-0.5 |

0.0 |

|

Total domestic demand |

984.2 |

5.6 |

-2.2 |

7.6 |

4.4 |

5.0 |

|

Exports of goods and services |

398.4 |

5.4 |

-9.4 |

11.3 |

6.1 |

4.9 |

|

Imports of goods and services |

430.9 |

8.6 |

-5.2 |

14.6 |

5.6 |

5.9 |

|

Net exports1 |

-32.5 |

-1.6 |

-1.5 |

-1.9 |

-0.1 |

-0.7 |

|

Other indicators (growth rates, unless specified) |

||||||

|

Potential GDP |

3.7 |

3.6 |

3.4 |

3.3 |

3.3 |

|

|

Output gap2 |

3.0 |

-4.4 |

-1.7 |

-0.6 |

0.6 |

|

|

Employment |

0.6 |

-1.3 |

0.7 |

0.2 |

0.4 |

|

|

Unemployment rate |

4.9 |

6.1 |

5.4 |

5.2 |

4.8 |

|

|

Consumer price index |

3.8 |

2.6 |

5.0 |

6.6 |

3.6 |

|

|

Core consumer price index |

3.2 |

3.7 |

4.5 |

4.8 |

3.6 |

|

|

Current account balance4 |

-4.9 |

-5.0 |

-6.5 |

-6.1 |

-6.1 |

|

|

General government fiscal balance4 |

-4.4 |

-9.3 |

-8.0 |

-6.6 |

-5.3 |

|

|

Underlying general government fiscal balance2 |

-5.3 |

-7.6 |

-7.5 |

-6.8 |

-6.3 |

|

|

Underlying government primary fiscal balance2 |

-4.4 |

-6.5 |

-6.3 |

-5.4 |

-4.7 |

|

|

General government gross debt (Maastricht)4 |

35.3 |

47.2 |

50.3 |

54.1 |

57.1 |

|

|

General government net debt4 |

22.1 |

32.5 |

35.6 |

39.4 |

42.3 |

|

|

Three-month money market rate, average |

3.0 |

2.2 |

1.7 |

1.8 |

2.3 |

|

|

Ten-year government bond yield, average |

4.5 |

3.9 |

3.6 |

4.1 |

4.6 |

|

1. Contribution to changes in real GDP.

2. As a percentage of potential GDP.

3. As a percentage of household disposable income.

4. As a percentage of GDP.

Source: OECD (2021), OECD Economic Outlook: Statistics and Projections (database) with projections from "OECD Economic Outlook No. 110", December and updates.

Risks to the outlook mainly stem from the evolution of the COVID-19 pandemic and the vaccine rollout. Should the vaccination rate remain low and the number of infections increase fast, new restrictions will be needed to limit transmission and avoid overwhelming hospitals. New containment measures in Europe would weigh on Romanian exports and investment (Table 1.2). Persistent increases in commodity prices would dampen domestic and external demand, by eroding price competitiveness. In the same vein, further supply chain disruptions would undermine exports growth. By contrast, timely policy action to support the economy, including a fast and effective absorption of available EU funds would help to sustain the recovery while improving economic potential.

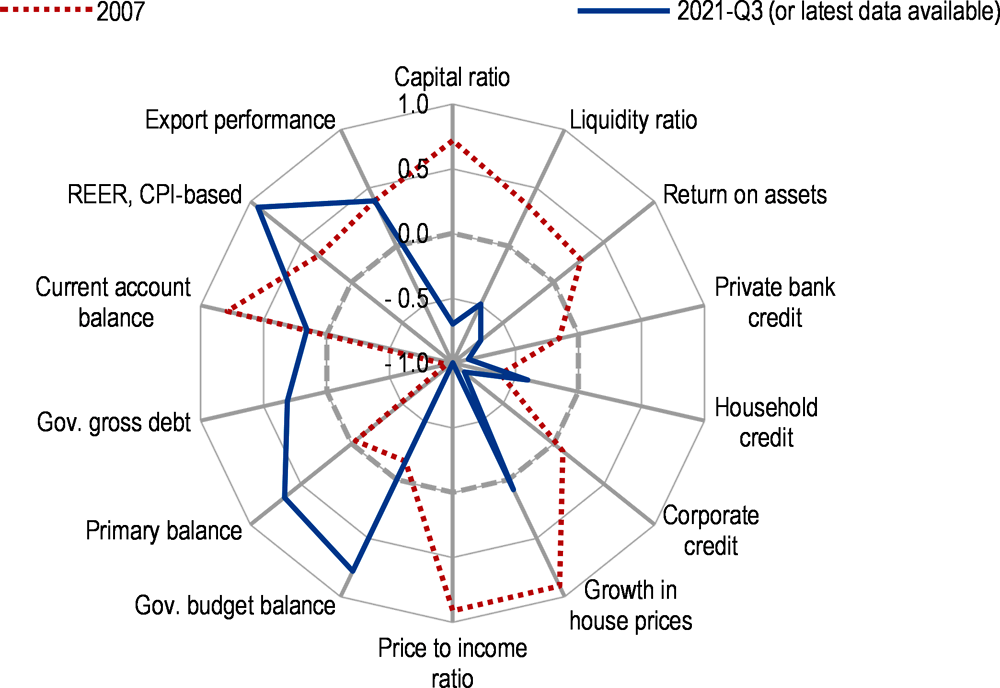

Many macroeconomic vulnerabilities have receded since 2007 (Figure 1.10). At the same time, before the pandemic, demand-driven growth led to the build-up of macroeconomic imbalances, with a marked widening of fiscal and external deficits (Figure 1.11). The COVID-19 crisis aggravated these imbalances, with a strong deterioration of the fiscal position and the current account. The current account deficit poses a risk since its funding has shifted from relatively stable sources to ones that are more volatile. External financing needs grew faster than FDI inflows, increasing the share of capital flows financed through debt.

Index scale of -1 to 1 from lowest to greatest potential vulnerability, where 0 refers to long-term average

Note: Indicators are normalised to range between -1 and 1, where -1 to 0 represents deviations from long-term average resulting in less vulnerability, 0 refers to long-term average and 0 to 1 refers to deviations from long-term average resulting in more vulnerability. Long-term averages are calculated since 1995 or the latest year available. Financial dimension includes: capital ratio (regulatory capital to risk-weighted assets) (inverted), return on assets (inverted), and domestic sovereign bonds (% of total assets). Non-financial dimension includes: total private credit (% of GDP), household credit (% of GDP), household foreign currency denominated liabilities (% of GDP) and corporate credit (% of GDP). Fiscal dimension includes: primary budget balance (% of GDP) (inverted), government gross debt (% of GDP), and government debt denominated in foreign currency (% of gross government debt). External dimension includes: current account balance (of % GDP) (inverted), real effective exchange rate (based on consumer price index), and export performance (exports of goods and services relative to export market for goods and services) (inverted).

Source: OECD Calculations based on: OECD Economic Outlook database; IMF Financial Soundness Indicators; World Bank, Quarterly Public Sector Debt; ECB; INSSE; and National Bank of Romania.

High external deficits increase Romania’s exposure to external shocks. Estimates from the Romanian central bank indicate that a one-percentage point deterioration of the current account balance as a share of GDP increases by five percentage points the probability of a foreign currency crisis (National Bank of Romania, 2019). Heightened global financial volatility and lower investors’ appetite for emerging economies could lead to capital outflows (Table 1.2; see below). Subsequent increases in borrowing costs would hamper business investment and induce negative wealth effects on households’ consumption. Steep rises in sovereign spreads could severely affect the banking sector due to large sovereign exposure. The influence of global financing conditions on real activity in Romania is significant, although less pronounced than in other CEE countries (Hajek and Horvath, 2018; Kubinschi and Barnea, 2016; Saman, 2016).

Percentage of GDP

|

Shock |

Possible impact |

|---|---|

|

Recurrent COVID-19 outbreaks due to ineffective vaccination rollout |

Strengthening of containment measures and repeated local and national lockdowns could trigger a surge in bankruptcies and job losses. |

|

Severe financial strains |

Sudden capital outflows could lead to sharp currency depreciation and a tightening of monetary policy to contain inflation risks. Increases in financing costs could negatively affect business investment and debt-servicing issues for indebted firms and households. |

|

Loss of fiscal credibility |

Strong deviation from fiscal rules could worsen market sentiment, increase financing costs and hit domestic banks highly exposed to sovereign risks. |

In this context, it is important to implement reforms that could sustain a strong and sustainable recovery. The OECD has estimated the potential benefit of some reforms that are recommended in this Survey. The table below shows that those reforms could help revive Romania’s economic performance in the medium and long term (Table 1.3). The next sections detail how such reforms could be implemented.

Difference in GDP per capita level, %

|

Measure |

Description |

1 year after the reform |

10 years after the reform |

|---|---|---|---|

|

Improvement in the rule of law |

Closing half of the gap to the OECD average |

0.5 |

2.4 |

|

Lower regulatory barriers (PMR) |

Closing half of the gap to the OECD average |

0.6 |

2 |

|

Increased public investment |

Closing half of the gap to the OECD CEECs average in pp of GDP (+1 pp) |

0.5 |

1.1 |

|

Increased spending on active labour market policies |

Closing half the gap to the OECD average for spending per unemployed in percentage points of GDP per capita (+12.4 pp) |

0.6 |

1.3 |

|

Increased women legal retirement age |

Harmonising legal retirement age of women to that of men |

0.3 |

0.8 |

Note: Model simulations based on the framework of Guillemette, De Mauro and Turner (2018), assuming a gradual convergence by 2030. Scenarios depict the effect on the level of GDP per capita 1 year and 10 years after the reform is complete (in 2031 and 2040 respectively) as compared to a baseline scenario with no policy changes.

Source: Calculations based on OECD (2019), OECD Economic Outlook: Statistics and Projections (database).

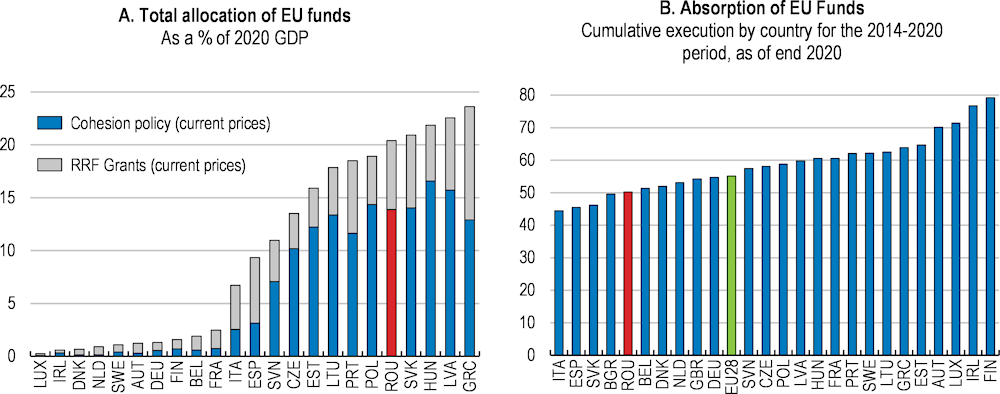

Romania should seize the opportunity offered by the Next Generation EU plan to support the recovery and implement long-awaited reforms. Under this plan, Romania could receive EUR 18 billion (around 8% of GDP) in grants by 2026, of which EUR 14.2 billion from the Recovery and Resilience Facility (Figure 1.12). The national Recovery and Resilience Plan rightly focuses on areas where policy action is urgently needed (Box 1.3). In line with EU guidelines, it dedicates 41% of the budget to measures addressing environmental challenges and 21% to the digitalisation of the economy and includes structural reforms based on country-specific recommendations by the European Commission. The Plan was submitted to the European Commission in May 2021 and was approved in September 2021.

Timely and effective implementation of the Recovery and Resilience Plan can support the economy when it is most needed. According to estimates of the National Commission for Strategy and Prognosis, it could increase GDP by 5.4% cumulatively over the period 2021-26 should Romania obtain 100% of grants and loans allocated to the country. However, the Plan poses new challenges. Firstly, the government has to commit 70% of grants by the end of 2022. This calls for strengthening the administrative capacity to coordinate with various stakeholders including those who conduct investment projects on the ground and to monitor these projects throughout investment cycles. Secondly, the disbursement of the funds by the European Commission is conditioned to the progress of structural reforms. The governance structure for the Recovery and Resilience Plan will play a central role. The Romanian authorities rightly plan to set up a centralised unit under the remit of the Prime Minister’s Office to coordinate and monitor the implementation of the structural reforms. Sticking to the reform agenda defined in the plan will require strong political commitment and policy continuity.

1. “Cohesion Policy” stands for the European Social Fund, European Regional Development Fund, Cohesion Fund, and support for the European Territorial Co-operation. Total allocation over the period 2021-27 in current prices is expressed as a % of 2020 GDP. “RRF Grants” refer to the maximum grant allocations from the Recovery and Resilience Facilities over the period 2021-26, which is expressed as a % of 2020 GDP.

2. The cumulative execution of the EU funds is expressed as a % of total allocations.

Source: The Secretariat’s calculation based on the information from the European Commission’s website; European Commission (2021) “Analysis of the Budgetary Implementation of the European Structural and Investment Funds in 2020”.

In parallel to the Recovery and Resilience Plan, national measures to support the economy should keep adapting in an agile manner to the pandemic by remaining timely and targeted. To limit losses in productive capacities and avoid further rises in unemployment, it is crucial to maintain fiscal support directed at firms and individuals in most affected sectors until the recovery is firmly established. In particular, public employment services should be strengthened to support workers with the weakest employability, by developing counselling services, providing targeted hiring incentives and scaling up reskilling options (Chapter 3). Should the pandemic intensify again and require restrictions to economic activity, the short time work scheme should be reactivated and tax facilities provided.

Romania's National Recovery and Resilience Plan is designed to ensure a balance between the European Union's priorities and Romania's development needs, in the context of the recovery from the COVID-19 crisis. Under the Recovery and Resilience Facility, the maximum amounts allocated to Romania reach EUR 14.2 billion in grants (6.5% of GDP) and EUR 14.9 billion in loans (7% of GDP).

The NRRP is structured around 6 pillars:

Pillar I: Green transition (EUR 15.9 billion), promoting reforms and investments in green technologies and capacities, including biodiversity, energy efficiency, building renovation and the circular economy.

Pillar 2: Digital transformation (EUR 1.9 billion), promoting reforms and investments for the digitalisation of public services, the development of digital and data infrastructures, digital innovation centres, and open digital solutions.

Pillar 3: Smart, sustainable and inclusive growth (EUR 2.8 billion), aiming at strengthening growth potential, with diverse objectives including the promotion of entrepreneurship and the social economy.

Pillar 4: Social and territorial cohesion (EUR 2.3 billion), promoting reforms and investments for the creation of high-quality jobs, the inclusion of disadvantaged groups, and the strengthening of social dialogue, social infrastructure and services, as well as social protection.

Pillar 5: Health and economic, social and territorial resilience (EUR 2.8 billion): aiming at strengthening resilience in health and increasing crisis preparedness and response capabilities of the public institutions.

Pillar 6: Policies for the next generation (EUR 3.6 billion): enhancing policies for children and youth, including in the areas of education and skills.

The investment projects are associated with specific reforms identified by the Country Specific Recommendations over the period 2019-20 by the European Commission (Government of Romania, 2021), which cover 9 broad policy areas:

Public finances and taxation

Pension system and long-term fiscal sustainability

Health

Public administration, business environment and labour market

Poverty reduction and social inclusion

Education

R&D

Green transition

Digital Transition

Source: The Secretariat’s elaboration based on the information provided by the Romanian authorities; European Commission (2021d).

While most of financing options proposed to distressed firms during the crisis have been wound down, financial support should be reconfigured to support viable firms. Credit guarantees such as IMM Invest have helped to ease immediate financial constraints. They need to target those firms with high growth prospects but high risks (Chapter 2). The authorities should also develop equity-type financing further, which is particularly adapted to support firms involved in innovative activity and can include strengthening incentives for private sector participation in public support schemes (Chapter 2).

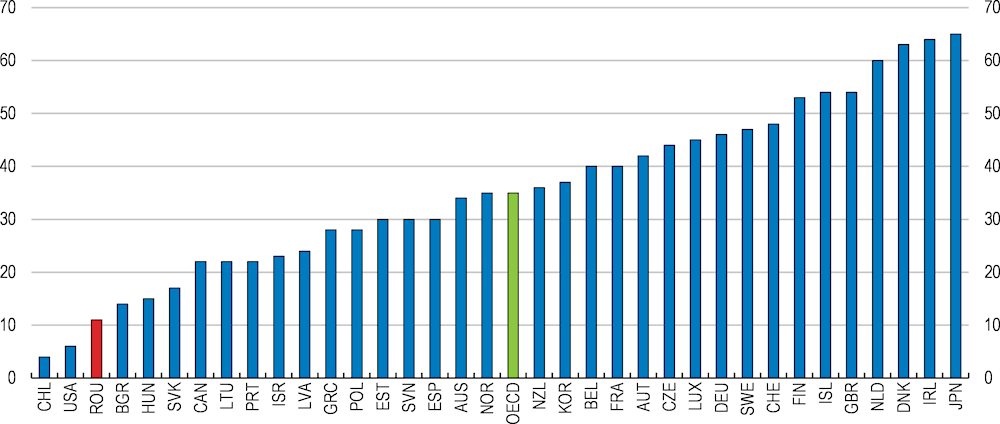

Public investment should be used to boost economic activity and is key to foster productivity, especially in catching-up countries like Romania where investment needs are large (Fournier, 2016). However, public investment in Romania has decreased significantly over the past decade, partly due to increases in other spending lines, especially public sector wages and pensions (Table 1.4). This downward trend stopped in 2019, but, at 4.6% of GDP in 2020, public investment still stands well below levels seen in OECD CEE countries (6.2%) or in some more advanced countries with a higher public capital stock. Investment in human capital has been shown to be a stronger predictor of regional long-term growth and innovation in Europe than other type of investment (Annoni and Catalina-Rubianes, 2016), but education, health and social assistance have been underfunded in Romania, posing multiple development issues as discussed in more detail below.

As Romania needs further public investment, it should improve the absorption of EU structural funds, in particular because the country will receive a large amount of EU funds over the 2021-27 programming period (Figure 1.12, Panel A). Their effective absorption will be challenging, as Romania’s absorption rate has been among the lowest in the EU so far (Figure 1.12, Panel B). Investment cycles have been very long in the past, due to the low quality of the project preparation and political interference. The administrative capacity should be improved further within line ministries or strategic beneficiaries to design projects, using the available expertise from external bodies, such as international financial institutes. Moreover, ensuring policy consistency and proper prioritisation of the projects will be key to accelerate absorption and raise value for money (Chapter 2).

A EUR 10 billion investment plan financed by the State budget and directed to local governments has been under discussion. An information system is being developed for the coordination with EU-funded projects and to avoid fraud. Nevertheless, transparent procedures and criteria for the allocation of the funds will be needed to ensure value for money.

|

% of GDP |

2007 |

2014 |

2016 |

2019 |

2020 |

OECD - 2019 |

|---|---|---|---|---|---|---|

|

Public spending |

37.5 |

35.3 |

34.6 |

36.2 |

42.4 |

40.6 |

|

Public investment |

6.2 |

4.3 |

3.7 |

3.5 |

4.6 |

4.7 |

|

Interest spending |

0.4 |

1.4 |

1.2 |

0.9 |

1.2 |

1.8 |

|

Public revenue |

34.7 |

34.1 |

32.0 |

31.8 |

33.1 |

37.5 |

|

Personal income tax |

3.4 |

3.9 |

4.0 |

2.6 |

- |

9.4 |

|

Corporate income tax |

3.1 |

2.3 |

2.4 |

2.3 |

- |

3.3 |

|

Tax on production and imports |

12.1 |

12.7 |

11.3 |

10.6 |

10.4 |

12.7 |

|

Environmental taxes |

2.0 |

2.3 |

2.3 |

2.2 |

- |

1.5 |

|

Property taxes |

1.0 |

0.9 |

0.8 |

0.6 |

- |

1.9 |

|

Headline deficit |

-2.7 |

-1.2 |

-2.6 |

-4.4 |

-9.2 |

-3.1 |

|

Underlying deficit1 |

-4.0 |

-0.6 |

-2.2 |

-3.8 |

-4.8 |

-3.1 |

|

Maastricht debt |

11.9 |

39.2 |

37.3 |

35.3 |

47.3 |

80.5 |

1. As a percentage of potential GDP.

Source: OECD Economic Outlook database; OECD Tax Revenue Statistics, and OECD Green Growth indicators.

The National Bank of Romania reacted in a timely and decisively manner to the COVID-19 crisis, starting in March 2020 when the activity began to contract substantially and financial markets faced turmoil. The central bank reduced the policy interest rate by 50 basis points, proceeded to repo transactions and purchased government bonds on the secondary market. The limited scale and duration of bond purchases by the central bank was consistent with the objective to mitigate financial market dysfunction, provide liquidity, and repair monetary policy transmission mechanisms (IMF, 2021). As the pandemic continued to drag real activity, the central bank cut the policy interest rate further by 25 basis points three times to 1.25% in January 2021. These policy measures supported the recovery of credit to the private sector (Figure 1.13).

While keeping monetary policy on an accommodative stance to support the recovery, which remains vulnerable to adverse epidemic shocks, the central bank should gradually normalise monetary policy, to be consistent with the policy objective of maintaining price stability, as defined by the 2.5% ±1 percentage point inflation target. At 8.2% in December 2021, headline inflation has risen above the inflation target band, essentially driven by increases in energy prices. This surge is expected to be only temporary and to diminish in the near term (National Bank of Romania, 2021a), but can affect inflation expectations. In the medium run, should the economic recovery gain momentum as expected, the underlying inflation pressures would intensify. Inflation expectations at the 2-years horizon currently stand inside the target band, but above 2.5%. Against this background, the central bank raised the policy interest rate three times from October 2021 to January 2022, and it should continue to do so if needed to ensure that inflation returns and remains in line with the inflation target. By contrast, the central bank should maintain monetary policy accommodative enough, should the economy be severely hit by a new wave of the pandemic.

Y-o-y % changes

Raising policy rates can help to stabilise the exchange rate. Romania’s exchange rate regime is a managed float. The exchange rate against the euro has remained relatively stable since the outbreak of the crisis, on the back of the relatively high policy interest rate, which had remained the highest among CEE countries, and policy measures to restore financial markets stability. In the medium run, a gradual rise in the policy interest rate would help guard against the depreciation of the Leu, as other CEE countries have begun to raise their policy interest rates firmly. The currency depreciation can induce strong inflation pressures due to the high foreign exchange pass-through. Moreover, given a high share of debt denominated in foreign currency, a depreciation could have contractionary wealth effects and undermine financial stability by increasing debt-servicing costs.

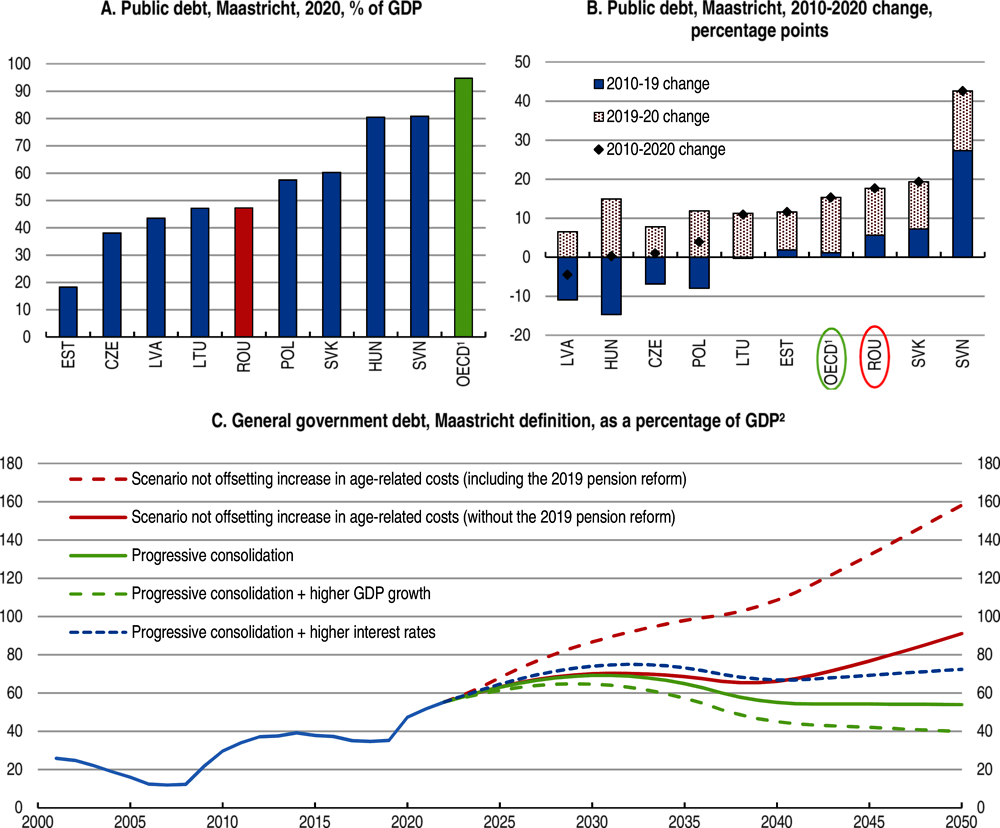

While still moderate, public debt has increased fast since the global financial crisis (Figure 1.14, Panel A and B). Fiscal support during the pandemic contributed to increase public indebtedness, but part of it was also due to past expansionary measures, including the 2019 pension reform (European Commission, 2021a). In the absence of fiscal consolidation, public debt is projected to increase to unsustainable levels over the next decades (Figure 1.14, Panel C). Under the national Recovery and Resilience Plan, the Romanian authorities have started a new reform of the pension system (Box 1.4). Without a reform, rising ageing costs could push public debt above 100% of GDP by 2040, should increases in these costs not be offset by consolidation measures.

1. In Panels A and B, OECD refers to EU countries that are members of the OECD.

2. The “not offsetting increase in age-related costs” scenario consists of the Economic Outlook N°109 projections and includes European Commission projections for net total ageing costs (net public pensions, long-term care, health, and education, adding 5.5% of GDP to annual public spending in 2050 compared to 2022). The "not offsetting increase in age-related costs (before the 2019 pension reform)" scenario includes 2018 European Commission projections for net total ageing costs and does not include the impact of the 2019 pension reform. In the "progressive consolidation" scenario, the primary balance is projected to gradually improve (by 0.5 percentage point of GDP per year) until public debt reaches 60% of GDP then gradually converge to balance. The "progressive consolidation + higher GDP growth" scenario combines the "progressive consolidation" scenario with an increase of GDP growth by 1 percentage point over the projection period, starting from 2023. The "progressive consolidation + higher interest rate" scenario combines the "progressive consolidation" scenario with an increase in interest rates by 1 percentage point, starting from 2023.

Source: OECD Economic Outlook database; Panel C adapted from OECD (2021), OECD Economic Outlook: Statistics and Projections (database), May; Guillemette, Y. and D. Turner (2018), "The Long View: Scenarios for the World Economy to 2060", OECD Economic Policy Paper No. 22., OECD Publishing, Paris; European Commission (2021), "The 2021 Ageing Report - Economic and budgetary projections for the 28 EU Member States (2019-2070)" Directorate-General for Economic and Financial Affairs, European Commission (2018), "The 2018 Ageing Report - Economic and budgetary projections for the 28 EU Member States (2016-2070)" Directorate-General for Economic and Financial Affairs.

Keeping debt at a prudent level is crucial for the resilience of small catching-up economies exposed to global financial risks. Around half of the public debt is denominated in foreign currencies and 40% is held by non-residents, exposing Romania to adverse shocks, in particular in a context of increasing instability of financial markets. Borrowing costs are by far the highest in the EU, due to an above‑average country risk premium (Figure 1.15). This reflects the perception of investors regarding Romania’s fiscal situation with respect to other European countries.

10 years government bond yields

Stabilising the debt-to-GDP ratio would require significant consolidation efforts (Figure 1.14, Panel C). The government rightly plans a progressive reduction in fiscal deficit to 2.9% by 2024, but offsetting measures have not been clearly identified yet. Consolidation should start in earnest from 2022, should the recovery be strong as expected. Measures that stimulate potential growth, such as those recommended in the Survey (Table 1.3) can mitigate fiscal pressures (Figure 1.14, Panel C). In particular, raising labour market participation and reducing informality can expand the tax base significantly (Chapter 3). In parallel, Romania has large room to improve revenue and spending efficiency (IMF, 2019a). This can be done by revising the pension system, as well as increasing tax compliance while making taxes less distortive. Fiscal reforms can help rebalance spending towards growth enhancing measures while reducing the deficit (Table 1.5).

Annual fiscal balance effect, % of GDP

|

Measure |

|

|---|---|

|

Deficit increasing measures |

5.1 |

|

Allocate more resources to disadvantaged schools and students |

1.2 |

|

Accelerate the vaccination campaign and spending on primary care, especially in rural areas |

1.8 |

|

Strengthen the social assistance services and integrate them with other public services |

0.8 |

|

Allocate more resources to active labour market policies, including training |

0.2 |

|

Increase public infrastructure investment |

1 |

|

Strengthened capacity of law enforcement agencies |

0.1 |

|

Offsetting measures |

Up to 6.5 |

|

More progressive increase in the value of the pension point |

Up to 3.4 |

|

Increase property tax |

0.6 |

|

Improve tax compliance |

2.5 |

Note: Estimations are accounting effect on fiscal balance of measures 1. halving the gap to the OECD average in spending on education, health, social protection and active labour market policies, and property taxation and 2. halving the gap to the OECD CEE countries average for public investment and tax compliance. Source: OECD calculations.

A thorough reform of the pension system is planned by the end of 2022 under the Recovery and Resilience Plan with the objective to improve its adequacy, equity and long-term financial sustainability. This reform is crucial to improve the sustainability of public finances. Without a reform, public pension spending is projected to grow by around 5% of GDP by 2030, due to measures voted in 2019, including a revision of the pension formula, increases in the value of the pension point and the planned recalculation of all pensions (European Commission, 2020a, Box 1.4).

The Romanian pension system consists of three main components: a defined benefit public pension system (Pillar 1), a fully funded mandatory private defined contribution system (Pillar 2) and a fully funded voluntary defined contribution system (Pillar 3).

The first pillar is financed on a pay-as-you-go basis and faces major imbalances, not least due to the fast population ageing. Despite relatively high contributions rates, the deficit of the first pillar amounts to around 2% of GDP (European Commission, 2020a). The ratio between the number of pensioners and employment reached around 60% in 2019 and is projected to rise to 95.5% by 2060.

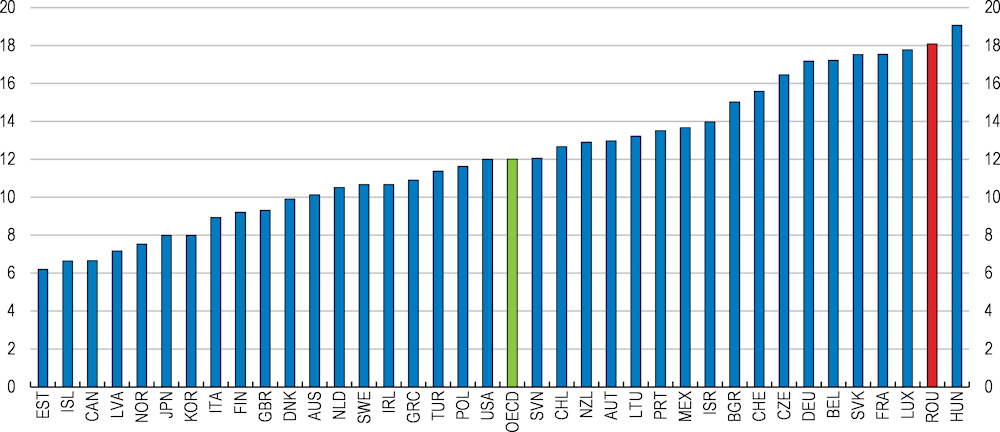

The latest pension reform, voted in 2019, aimed at addressing loopholes in the first pillar, but is excessively costly (Figure 1.16, Panel A). It was expected to bring the deficit of the public pension system above 6% of GDP, weighing on the government budget (see Figure 1.14). The authorities have partially delayed its implementation to 2023 and plan a broad revision of the public pension system, under the national Recovery and Resilience Plan, with the objective to improve adequacy, equity and long-term sustainability of the system.

Among others, the 2019 reform included significant ad-hoc annual increases of the value of the pension point between 2019 and 2022 (e.g. +40% in September 2020), changes to the indexation formula, and an upward recalculation of existing pensions from 2022 following the revision of the benefit formula. It also increased the level and the coverage of the minimum pension. Due to a lack of fiscal space, the government decided to increase the value of the pension point by 14% in September 2020 and to freeze it in 2021. Starting from 2022, the value of the pension point will be indexed to the average annual inflation rate and 50% of the real growth of average earnings.

In the first pillar, the calculation of the pension benefits is based on a point formula. Before the 2019 reform, the pension formula was complex, prone to ad-hoc adjustments and created inequities among pensioners. For instance, benefits varied significantly depending to the date of retirement and the gender of the pensioner. The 2019 reform aimed at addressing these issues, by ensuring all pensioners with the same entitlement receive the same pension level. The government plans to simplify the formula further. It envisages calculating the pension level by multiplying the number of points accumulated by the pensioners and the point value.

The 2019 and 2021 reforms also aim at improving pension adequacy. The former system entailed low replacement rates and pose old-age poverty issues. The net replacement rate of the pension system were low (around 40% in 2018), around 20 percentage points less than on average in the OECD (OECD, 2019h). The 2019 reform would have increased gross replacement rates temporarily (Figure 1.16, Panel B). The benefit ratio, measured by the ratio of the average net pension to the average net wage, would also have increased at around 42% by 2030, compared to around 27% in absence of reform (European Commission, 2020a).

While increasing the pension level is a valuable goal as the replacement rates are relatively low, future increases in pension benefits should be more in line with economic fundamentals. In addition, a clear benefit formula should be established, including a bonus-penalty system to encourage longer contribution periods and automatic adjustment mechanisms to avoid ad-hoc adjustments. Measures envisaged in the national Recovery and Resilience Plan go in that direction (Box 1.4). For instance, starting from 2022, the pension point value will be indexed to inflation and wages. Finally, special pensions that apply to several occupational categories in the public sector and cover around 3% of the total number of pensioners should be eliminated to ensure a more equitable and transparent treatment of pensioners.

Strengthening incentives to prolong working lives can be a sustainable and cost-effective way to improve pensioners’ living standards without increasing the tax burden. The pension system already includes financial incentives that have to be maintained. At the same time, women can retire earlier than men can (at around 61 vs. 65). Equalising statutory retirement ages at 65 and indexing them in line with life expectancy gains would be fairer and could help financing future pension costs. The minimum of 15 years of contributions to get a pension should be reduced as it entails inequity and strong disincentives to work for those with short working lives (for instance return migrants or workers with informal jobs). It could be fully eliminated like in the Netherlands or Switzerland, while ensuring that each additional year of contribution results in a higher minimum pension benefit. Early retirement options for certain groups of workers should also be reconsidered.

The average effective retirement age is close to the EU average (63 years old in 2019), but the employment rate among old-age workers is low, with less than half of the people aged 55 and over in employment in 2019. Improving the employability of older workers by raising participation in adult education, adapting the working environment to an ageing work force, and improving access to healthcare services, as detailed below and in Chapter 3, will also be key for prolonging working lives.

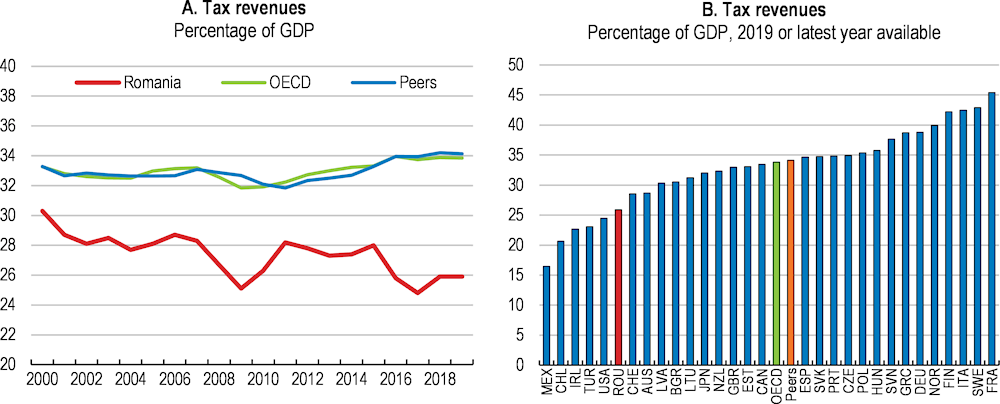

Tax revenue is low due to poor tax compliance and low taxation levels (Figure 1.17). Major fiscal reforms implemented since 2017, including cuts in the value added tax (VAT), the personal income tax (PIT) and social security contribution rates have significantly reduced the tax level. A recent VAT reform is estimated to have cut revenue by around 1 percentage point of GDP (IMF, 2018a).

Note: Peers consist of Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, and Slovenia. In panel B, data refer to 2016 for Australia and Japan.

Source: OECD Revenue Statistics; Eurostat; and OECD Productivity Indicators.

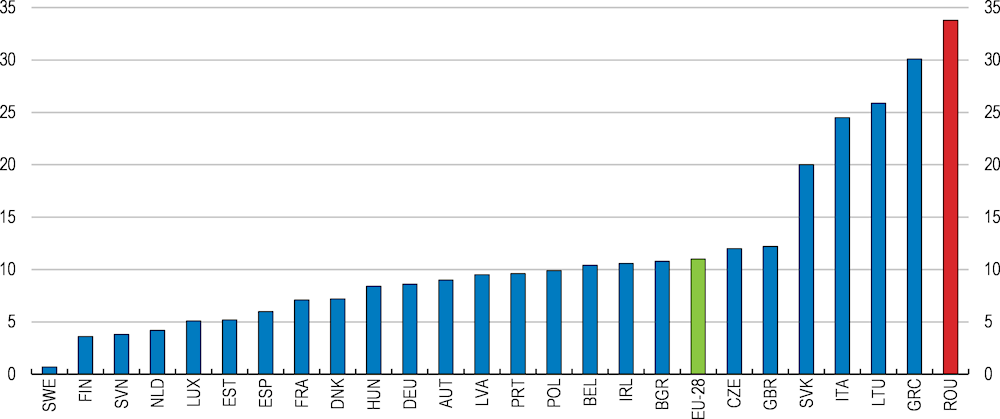

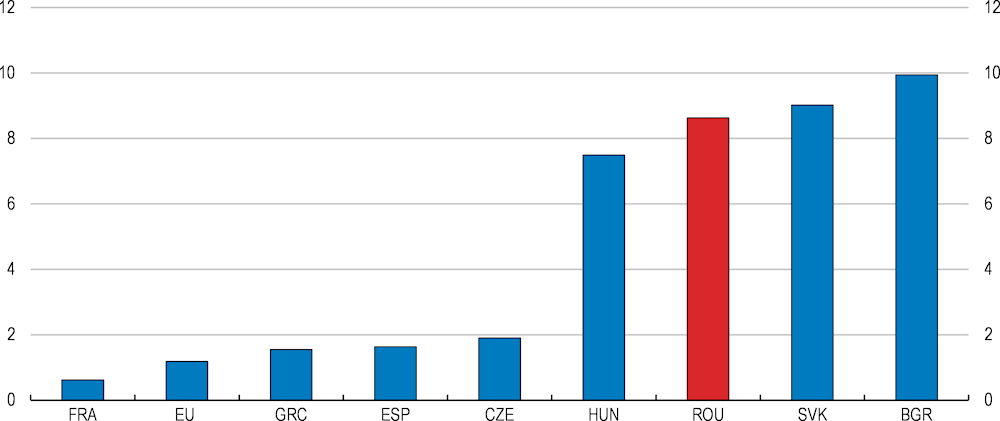

Despite some progress over the past few years, tax efficiency is much lower in Romania than in OECD countries. The VAT gap (i.e. the shortfall of VAT revenues compared with its potential) is the highest in the EU (Figure 1.18). This is mainly due to low compliance rather than to tax exemptions or reduced rates even if this component has increased over the past decades (IMF, 2018a). Improving tax collection would generate significant additional resources, estimated at 2.5% of GDP if efficiency is raised to the level of other CEE countries (IMF, 2018a).

VAT gap, as a % of VAT total tax liability, 2018

Note: The VAT gap measures the difference between the expected VAT revenue and the amount actually collected.

Source: European Commission (2020), "VAT Gap in the 28 EU Member States".

Improving tax collection requires modernising the tax administration. The government initiated a range of measures, including streamlining tax declarations and payments and restructuring the tax administration to allocate resources where they are most needed, with some positive effects (Romania Fiscal Council, 2019a). Progress continued during the pandemic, with the implementation of simplified procedures and information campaigns to encourage the use of digital services. A new comprehensive strategy for the modernisation of the tax administration is in place, and will be partly financed by the Recovery and Resilience Facility. Nevertheless, an extensive reform of the tax administration will require stronger political commitment than in the past. A World Bank Revenue Administration Modernization Project had been initiated in 2013, but was cancelled in 2019 due to the absence of progress in implementation.

Romania takes inspiration from other Central Eastern European countries, which recently implemented successful reforms. Developing inter-connectivity between the databases of public institutions can contribute to facilitate revenue collection. A modern compliance risk management approach can also facilitate and speed up the administration of tax recovery (IMF, 2018a) and the detection of frauds. Thus, the introduction of differentiated treatment of taxpayers and targeted tax audits based on data mining should continue as planned. Pilot projects and frameworks for desk audit have been recently put in place to develop risk management capacity, but it will be crucial to invest more and rapidly in digital equipment and training. Innovative analytical tools and collaboration with private experts, including from the IT sector, should be promoted, as they played a crucial role in Poland’s success (Sarnowski and Selera, 2019).

Low trust in institutions negatively affects tax compliance (Torgler and Schneider, 2007, Daude et al., 2012). In Romania, a number of complex factors, including low enforcement capability, widespread tax evasion, tax breaks for large firms, and low spending on public services results in a tax system seen as unfair, which is reducing the willingness to pay taxes in return (Todor, 2018). The use of emergency ordinances with minimal consultation has damaged public confidence in policymaking (European Commission, 2019a). Reducing the frequency of fiscal policy changes and avoiding the allocation of tax exemptions and tax amnesties without proper justification could help restore trust. Promoting mechanisms, such as credit history that differentiate and reward responsible behaviour can also encourage compliance.

Broadening the tax base is crucial for raising revenue, calling for a comprehensive reform of the taxation system. Eliminating inefficient and regressive tax expenditures can bring additional revenues. Special tax regimes or tax exemptions have been increasingly used, with the introduction of 26 exemptions, incentives, and special rates between 2013 and 2018 (IMF, 2018a). They include specific tax regimes, notably for microenterprises (see Chapter 2) and specific sectors (e.g. construction, ICT), and exemptions from energy-related taxes. Scaling back tax expenditures would broaden the tax base and simplify the tax system. A thorough evaluation of their distributional and efficiency effects needs to be carried out as they are not transparent and were subject to reduced scrutiny in the past. The Recovery and Resilience Plan rightly includes a series of measures to address these loopholes, including a revision of the micro-enterprise regime and of income taxation of construction workers.

Shifting the tax mix towards taxes that are less distortive to growth is another avenue to boost the recovery. Taxes on immovable property have been found to have the lowest negative impact on growth (Johansson et al., 2008). However, they account for a low and decreasing share of total taxation (2.4% in 2019, around 3 percentage points less than the EU average), partly due to the weak link between recurrent taxes on immovable property and housing values. It is thus welcome that the Recovery and Resilience Plan includes an in-depth revision of property taxes.

Environmental tax revenue increased significantly and accounted for 8.3% of total tax revenue in 2019, around 3 percentage points more than the OECD average. However, contrasting with revenues from energy taxes, revenues from the taxation of road transport, pollution and the use of resources are low by international norms. Options to better price environmental damages caused by economic activity include introducing a landfill tax and a pollutant-dependent car registration tax. In addition, adjusting environmental taxes to better reflect the environmental damage they generate (i.e. the cost of pollution and CO2 emissions) would help to incentivise investment in cleaner energy sources. Recent cuts in fuel excise rates are somewhat unwarranted, as they reduce incentives to opt for greener transportation means and further increase the gap in taxation between gasoline and diesel. Romania should gradually extend the coverage of the carbon tax to sectors not covered by the EU Emission Trading Scheme (EU-ETS) and harmonise its level. Additional revenues from environmental taxes should be used to foster the green transition, for instance by financing investment in low emission technologies and compensating those most affected by environmental policies.

Indicators suggest that the banking sector has remained sound during the crisis. Banks have maintained sufficient capital, liquidity and profitability (Figure 1.19; Panel A, B and C), which was supported by policy measures, such as the central bank’s recommendation to limit dividend payouts and share buybacks, thus raising capital retention. It helped to keep channelling funding to economic activity, along with policy measures such as IMM Invest, a public loan guarantee programme (see Box 1.1). The non-performing loans ratio, which had decreased significantly over the last decade (from 21.5% at its peak in 2013 to 4.0% in April 2020), has remained contained so far since the outbreak of the COVID-19 crisis. The moratorium on debt repayment played a role, covering 14.6% of total loans in non-financial corporations at its peak in 2020 (see Box 1.1). However, the share of non-performing loans is high compared with other countries (Figure 1.19; Panel D) and likely to increase, as debt repayments resume following the end of the moratorium and the exposure of banks to financially vulnerable firms is high.

While private indebtedness is low in Romania, some firms and households face a significant problem of solvency. Total private debts levels – the stock of loans issued to households and non-financial corporations – stood at 47.8% of GDP in 2020, well below the OECD average. Prudential measures adopted by the authorities, such as the introduction of the cap on the debt-service-to-income (DSTI) ratio in 2019, helped to contain debt in the private sector. Nonetheless, banks’ exposure to highly indebted clients is high. For instance, 55% of loans in the non-financial corporations sector are taken by highly indebted firms (with a debt-to-asset ratio of over 75%; National Bank of Romania, 2021b). Some firms are also vulnerable to currency and refinancing risks, which can add to difficulties in their debt repayments: external debt accounts for 54% of the total and debts with a maturity of up to one year account for 41% of the total in the non-financial corporations sector (National Bank of Romania, 2020b). This call for keeping monitoring financial stability risks and ensuring sufficient capital adequacy, liquidity and loss provisions. Moreover, debt restructuring should be facilitated by reforming insolvency regimes through, for instance, the introduction of out-of-court mechanisms (Chapter 2).

2021Q3 or latest

The increasing reliance on external markets to finance public debt poses a major risk to financial stability. The government’s financing needs increased significantly in 2020 (to 14% of GDP) and will remain high in 2021 (around 11.5% of GDP). As a significant share of the debt is financed externally, the government’s external debt, mostly denominated in the euro and the US dollars, rose to 26% of GDP in 2020 (from 18% in 2019). Financing conditions (bond yields and maturity) through external financing can be volatile, as they are sensitive to policy changes elsewhere and investors’ sentiment. The financing of a growing stock of debt against the background of Romania’s relatively high and volatile borrowing costs raises concerns and warrants close monitoring (European Commission, 2021a). These calls for designing a medium-term fiscal consolidation plan and implementing it once the recovery is well established (see above).

The increasing exposure of banks to sovereign debt is another important risk to financial stability. The sovereign exposure of the banking sector (including State guarantees on loans) is 32.4% in Romania. This limits their capacity to absorb government bonds further and makes them vulnerable to a shock to government yields, which would affect the valuation of their assets adversely. Banks’ exposure to the government has increased notably due to the state guarantees provided in response to the pandemic (see Box 1.1). Maturity mismatch amplifies banks’ vulnerability to sovereign spreads and interest rate hikes (National Bank of Romania, 2021b). The vulnerability of banks could be aggravated by deepening macroeconomic imbalances resulting in further increases in spreads.

Non-banking loans to non-financial corporations have been rising fast albeit from low levels, which could be another risk to financial stability. The central bank draws particular attention on potential systemic effects that may arise from the non-bank financial sector, whose capital levels are thin and lending practices risky (National Bank of Romania, 2020b). This calls for closely monitoring risks from this sector, especially regarding foreign currency lending, and developing prudential tools including higher capital buffers.

Over the longer term, policy should support financial institutions to adopt business models generating higher value-added. Firstly, policy uncertainty needs to be eliminated. In December 2018, the government introduced a tax on financial assets of credit institutions. This tax was repealed in 2020, but such policy instability weighs on the activity of financial institutions. Secondly, financial intermediation remains very limited (around 40% of GDP). It should expand to finance firms with high growth prospects. To do so, policy can strengthen banks’ capacity to assess credit worthiness of businesses, for instance by extending the coverage of the Central Credit Registry to include information on debt collection, in particular, loans sold to debt recovery companies (World Bank, 2018c). In this vein, in 2020, a Cooperation Agreement between the National Bank of Romania, the National Authority for Consumer Protection and the Romanian Association of Banks was signed to improve the quality and expand the coverage of credit reporting activities. Moreover, the creditors’ rights should be ensured in effective terms by enhancing the insolvency regime. This will encourage financial institutions to take appropriate risks, which can result in a better allocation of capital across firms (Chapter 2).

Productivity growth is key to improve living standards. Productivity has increased at a fast pace over the past decades, but still remains low (Figure 1.20). This reflects the lack of business dynamism, as the entry of new and innovative start-ups is limited while many low-performing firms (including state-owned enterprises) subsist in the market. In order to boost business dynamism, the regulatory burden should be reduced, financing difficulties in some segments, such as SMEs in local areas and innovative firms, be addressed and transport infrastructure be improved. Moreover, unpredictability of policy-making, frequent regulatory changes, and law enforcement issues negatively affect the business climate. A set of structural policies can improve the business environment to support productivity growth in all sectors of the economy, including SMEs and entrepreneurs, as detailed in Chapter 2.

The role of national productivity boards has become more important to ensure sustainable productivity growth in the context of the recovery from the COVID-19 crisis. They can support the development of policy measures tailored to the individual needs of each country, including in the process of the implementation of the Recovery and Resilience Plans (European Commission, 2021b). As part of the reorganisation of the National Commission for Strategy and Forecast, Romania wound down the Economic Programming Council, which had a broader range of missions than what a national productivity board usually has. It intends to introduce a national productivity board following consultation and discussion to find its best remit.

Addressing tensions in the labour market is also crucial to sustain productivity, as they tend to affect investment capacity and knowledge diffusion. Labour shortages, together with rises in administered wages, had driven wage inflation above productivity growth prior to the pandemic (D’Adamo et al., 2019). Increases in unit labour costs reduce financial room for investment. Labour market shortages also threaten Romania’s attractiveness for foreign investors: international companies, especially those investing in knowledge intensive services, tend to move to markets, which offer skilled workforce (Carstensen and Toubal, 2003; Doh et al., 2009). Finally, shortages of skilled workers hamper technological adoption due to complementarity between the availability of highly skilled workers and investment in knowledge-based and technology-intensive capital (OECD, 2013). Raising labour market participation and offering reskilling options to the Romanian workforce to adapt to fast changing labour market needs and technologies is thus a policy priority, as identified in Romania’s new National Employment Strategy for 2021-2027 and discussed in Chapter 3.

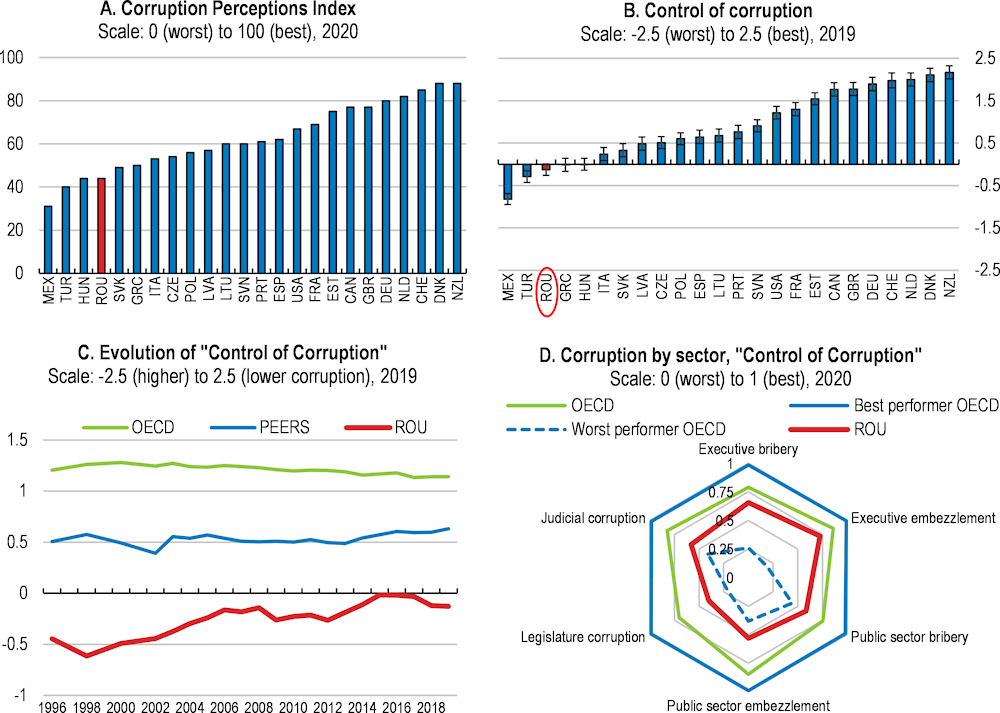

Romania has made significant progress with anti-corruption policies over the last two decades, but corruption is still perceived as a major issue, well above the average in OECD and peer countries (Figure 1.21). According to Eurobarometer (European Commission, 2019b), 88% of companies consider corruption is a problem when doing business in Romania and 83% consider corruption in public procurement is widespread, the highest rates in the EU. Corruption negatively affects economic activity by affecting the business climate, distorting markets, hindering the functioning of institutions, and imposing high social costs (Mauro, 1995, Rose-Ackerman and Soreide, 2012). It can also discourage labour market participation and incentivise emigration (Cooray and Dzhumashev, 2018; Cooray and Schneider, 2016; Ariu and Squicciarini, 2013).

Note: Panel A: the “Corruption Perceptions Index” by Transparency International is subsumes several sub-indicators. Panel B: the indicator is one of the subcomponents of the World Bank “Control of Corruption” indicator. The “Control of corruption” indicator in the World Bank Worldwide Governance Indicators (WGI) is also a composite indicator. For details, see Kaufmann et al., (2010). Public sector embezzlement stands for theft, or any kind of diversion of public resources for private gains in the public sector.

Source: World Bank; Transparency International; Varieties of Democracy Institute, University of Gothenburg, and University of Notre Dame.

The Romanian integrity system is still fragmented, and has large room for improvement, especially regarding incompatibility and conflicts of interest (European Commission, 2019c). The National Anti-Corruption Strategy 2016-20 aimed at enhancing public integrity and corruption prevention. This comprehensive programme adopted a multi-disciplinary approach and involved a wide range of public institutions, non-governmental organisations, business associations as well as state-owned and private companies. Progress has been uneven (European Commission, 2021c), and slow in some areas, such as the health sector. The OECD is carrying out an overall evaluation of the strategy and will provide recommendations for the new one, including to improving the technical capacities of the Romanian government to monitor its implementation (OECD, 2022, forthcoming). The Strategy 2021-25 will aim at improving performance in the area of law enforcement by strengthening criminal and administrative sanctions. The OECD is providing technical assistance in this area, by assessing Romania’s institutional framework against certain OECD anti-bribery standards.

Despite an impressive performance track record in fighting high-level corruption, especially in public procurement (DNA, 2017; DNA, 2018), control mechanisms need further strengthening. The National Anti-Corruption Directorate (DNA) has been subject to considerable political pressure in the last few years, notably by the amendments related to the Justice Laws adopted by a former government. These amendments were related to the introduction of dissuasive seniority thresholds for appointments of DNA prosecutors, limiting the recruitment capacity, and the introduction of a new section within the prosecution service for investigating criminal offences within the judiciary, which risks being prone to political pressures (European Commission, 2021c). These amendments created pressures on judges and prosecutors and could have changed the course of high-level corruption cases. The new section within the prosecution service should be abolished (GRECO, 2021; European Commission, 2021c). The justice system, including the DNA, should have adequate resources, powers and independence to conduct investigations in corruption cases effectively.

Romania ranks relatively poorly when it comes to corruption in the legislature (see Figure 1.21). Conflicts of interest, which are a breeding ground for corruption, need to be effectively controlled. The sanctions applicable to incompatibilities (public officials from holding other positions or exercising other function) are strict, but incompatibilities cover only a part of conflicts of interest in a general sense. There has been some progress, as a new code of conduct for members of Parliament was adopted in 2017. However, it lacks an effective enforcement mechanism and a framework for monitoring compliance (GRECO, 2019), in particular, as it does not clearly describe situations that constitute a conflict of interest and indications on how declaration is controlled or approved are missing. To address these shortcomings, Romania should provide guidance for the identification and management of conflicts of interest and set clear and proportionate procedures for the enforcement of public integrity standards through an effective disciplinary system.

The lack of transparency and predictability in the decision-making and legislative process renders this process more vulnerable to corruption. There are a number of difficulties in practice in having access to parliamentary sessions, including very short notices for registration (GRECO, 2015). The amendments to the criminal code and the special law on corruption were made by Parliament through urgency procedure in 2019, thus avoiding public scrutiny. These amendments risked undermining anti-corruption efforts by lowering penalties, shortening the statute of limitations for some offences, and decriminalising negligence in office. They were subsequently judged as unconstitutional by the Constitutional Court in July 2019 and rejected by Parliament in 2021. Government Emergency Ordinances, which enable the government to quickly pass legislation without consulting stakeholders or conducting ex-ante impact assessments, were frequently used in the past (Chapter 2; Council of Europe, 2019). The use of Government Emergency Ordinances has been limited over the past two years, which should be continued, as frequent changes in systems create uncertainty.

Transparency of the legislative process should be improved further by developing the rules to engage stakeholders, implement open government and access to information measures, as well as measures on lobbying to ensure transparency and integrity in public decision-making. Effective lobbying regulations would ensure equitable access to the policy-making processes and avert the risks of undue influence and policy capture. Romania has adopted the Single Transparency of Interests Register, a platform whereby citizens can obtain information on senior government officials meeting with interest groups. Going further, comprehensive lobbying rules should be adopted, setting clear definitions for “lobbyists” and “lobbying”, and regulating the engagement of members of Parliament with lobbyists and other third parties who seek to influence the legislative process. After being established, the effective enforcement of these rules should be monitored thoroughly.