South Africa has an incomplete social protection system without a mandatory pension savings scheme. Designing a universal insurance pension system would allow to reduce the important government funded pension grant system and ensure that the old-age population has decent income. Only 40% of employees are contributing to a form of saving-retirement scheme, with often a low pension. Moreover, South Africa has a dual, public and private, health care system. Half of the country’s health-care spending goes to the private sector, which covers only 16% of the population. Moreover, the health care system fails to deliver affordable quality services. The COVID-19 pandemic has highlighted the unequal distribution of health care services between public and private health providers. Around 70% of critical care beds available were in the private health care sector. Finally, the sizeable unconditional cash transfer system though reaching a large share of the population fail to lift many children in the poorest families above the poverty line.

OECD Economic Surveys: South Africa 2020

2. Building an inclusive social protection system

Abstract

The social protection system is incomplete

South Africa has made important progress in broadening social assistance since 1994. The social grants programmes are reaching over 17 million beneficiaries and around half of all South African households. Social grants are the main government instrument to reduce poverty, and inequality and remedy the long-lasting effects of the apartheid era. However, South Africa still lacks a comprehensive social protection system. There are various inadequacies between the provisions of the current system and the situation and risks faced by different population groups. Social assistance targets a mix of age-related needs (child and old age grants) and disease-related needs (disability and care dependency). However, there are important gaps in the coverage and provision of social protection (Box 2.1).

Firstly, there is no mandatory pension coverage (Table 2.1). The absence of mandatory pension coverage has led to the development of many private and occupational pension schemes that are only partially fulfilling the need for longevity risk coverage. Secondly, unemployed adults aged 18–59 are not covered by the social assistance or insurance schemes. Moreover, the duration of the unemployment benefits is short and unemployed individuals financial position deteriorates quickly thereafter, when they are not covered anymore. Thirdly, health care access is almost universal and provided by the government but due to poor delivery, many people revert to private health insurance and facilities leading to significant inequalities in health care access and outcomes.

Table 2.1. The current structure of social protection

|

Social assistance (Non-contributory) |

Social insurance (Contributory) |

Occupational and voluntary schemes (Contributory) |

|---|---|---|

|

Old age grants |

Unemployment insurance |

Pension and Provident Funds |

|

Child care grants |

Compensation Funds for occupational injuries and diseases |

Retirement annuities |

|

Disability |

Road accident fund |

Medical schemes |

|

Foster care |

||

|

Care dependency |

||

|

Social relief of distress |

||

|

War veterans |

Source: OECD, 2019.

Fragmentation of the management of the social protection system between different government departments and of the delivery between different agencies and bodies is undermining efficient delivery. At least seven government departments are involved in the policy development of social protection and different agencies are responsible for the delivery of the different grants and funds.

The main challenge of the social protection system has been the growing number of beneficiaries and the incapacity of the system to lift them all above the poverty line. Priority has been given to raise the number of beneficiaries of the different grants, in particular of the old age grant.

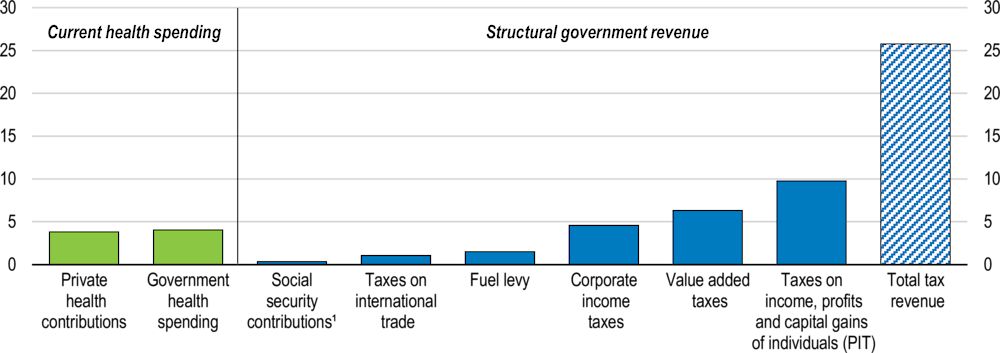

The current financing of the overall social protection systems also presents some gaps and may pose sustainability risks in the future. The government funds social grants and public health care entirely through tax revenue. Combined, they represent around 24% of government spending. The prospects of further expansion of social assistance coverage and spending are limited though in the current fiscal juncture and any improvement in life expectancy will push up social assistance spending.

According to official projections, future social and health spending does not threaten the sustainability of public finances (Department of Social Development, 2016b). However, in a tight fiscal situation due to low growth, it crowds out other spending, such as on education and infrastructure, which would undermine growth prospects further. It is thus necessary to rethink the financing of social protection, in particular, with respect to the agenda of introducing mandatory pension schemes and national health insurance.

In the following sections, the four main components of social protection are reviewed: social assistance, pension insurance, health care and unemployment benefits. Health care, longevity and unemployment are the main financial risks workers and individuals face. However, these risks are not well covered in the South African social protection system. Moreover, low coverage pushes up spending on social assistance (old age grant) and on private insurance (private health schemes and private provident pension funds). Against this background, the government has published a discussion paper to reform social protection (Box 2.1).

Box 2.1. Government discussion paper on social security reform

Comprehensive social security in South Africa (released in November 2016)

Background

There is no mandatory pension. About 2.7 million formal sector workers – primarily low-income earners – are excluded from occupational pension schemes.

Members of private retirement funds rarely receive a sufficient income in retirement, in part because they do not preserve their savings throughout their career and in part, because their savings are eroded by high administrative costs.

Social assistance does not reach all target groups and its cash payment system is expensive.

There is insufficient policy coordination between social insurance funds such as the Unemployment Insurance Fund, workers’ Compensation Fund and the Road Accident Fund. The funds also have separate systems and administration, resulting in high costs and increasing the scope for fraudulent claims.

Main proposals

Establishment of a social security fund: introduce a public fund to provide pensions, death and disability benefits and unemployment benefits.

Extending social assistance: a universal child, disabled and old age grant is proposed, replacing tax rebates for high-income families.

Enhancing social insurance funds: institutional consolidation is proposed by merging the departments or entities managing social assistance and social security programmes in the different ministries.

Regulatory reforms of the pensions and life insurance industry are also proposed (prudential, governance, fiduciary responsibility, transparency and control of costs).

Better policy co-ordination between the proposed department of social security and the department of labour including sharing facilities at the territorial level.

Alignment of social security with National Health Insurance (NHI) issues include:

The role of earnings-related contributions as a financing mechanism;

The tax treatment of medical expenses and associated risk-pooling arrangements;

The alignment of medical benefits provided by compensation funds and the RAF with the NHI system.

Source: Comprehensive social security in South Africa, released in November 2016, South Africa Government. https://www.gov.za/sites/default/files/gcis_document/201611/comprehensivesocialsecurityinsouthafricaa.pdf

Assessing social transfers and the unemployment insurance

Develop active labour market policies to complete the unemployment insurance scheme

The public Unemployment Insurance Fund (UIF) is the largest of the three social insurance programmes (Compensation Fund and Road Accident Fund). It provides short-term benefits to workers when they become unemployed or are unable to work due to illness, maternity leave or adoption leave. It also provides a death benefit to the dependents of a deceased contributor. The UIF is funded entirely through contributions from employers and employees and the returns generated on investments. The contribution rate is 2% of wages equally paid by the employee and the employer. Contributions to the UIF are subject to a maximum earnings ceiling (SARS, 2017). The UIF has accumulated a substantial surplus, which is managed by the Public Investment Corporation (National Treasury, 2019a).

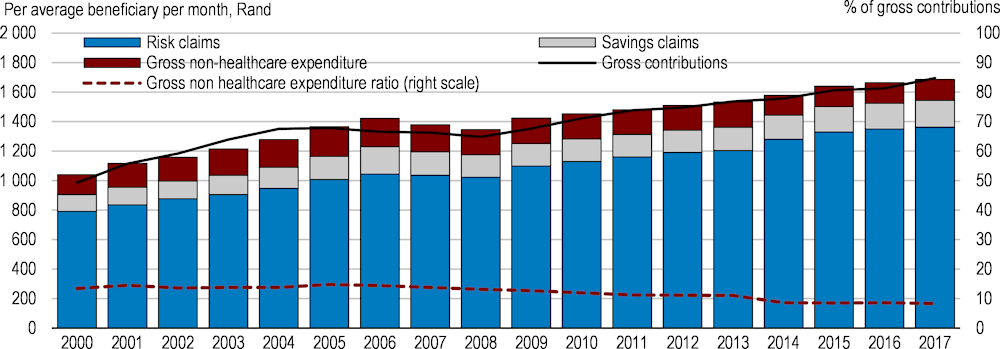

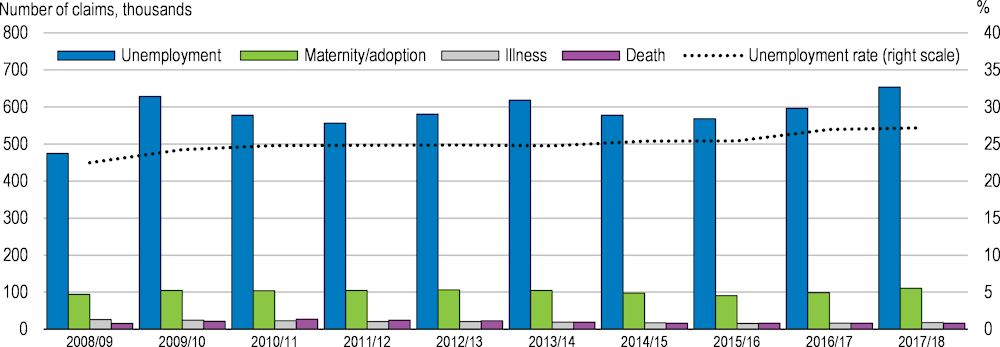

The total number of claims has been increasing since 2015/16, driven by rising unemployment (Figure 2.1). In 2018/19, around 770 000 claims were received (Department of Labour and UIF, 2019). The UIF is effective in terms of service delivery and has improved the processing times for claims (Department of Labour and UIF, 2018), but many of the unemployed do not receive unemployment benefits.

Figure 2.1. Unemployment insurance claims by type of benefit

Unemployment insurance claims by type of benefit

Note: Claims data taken from the Unemployment Insurance Fund Annual Report 2018. Official unemployment rate is an average over four quarters corresponding to the reporting periods of the UIF.

Source: (Department of Labour and UIF, 2018; Statistics South Africa, 2018c).

The Unemployment Insurance Amendment Act of 2016, which came into effect in 2019, expanded the level and reach of benefits. In particular, after becoming unemployed, workers have one year instead of currently 6 months to claim their benefits. The benefit duration is increased from eight months to a year. Civil servants and students completing apprenticeships or vocational education and training programmes are covered. Finally a better coverage of maternity leave is provided (66% replacement rate up to a maximum benefit of ZAR 17 712 per month). Income from contributions and investments should be sufficient to cover the expanded benefit pay-outs.

In response to the global financial crisis, the Labour Activation Programmes (LAP) Unit was established within the UIF. This unit provides training and reskilling opportunities for unemployed UIF beneficiaries to enable them to either start their own business or re-enter the labour market. In 2017, 11 744 unemployed UIF beneficiaries participated in various skill training programmes conducted in partnership with TVET colleges and Sector Education and Training Authorities (SETAs) (Department of Labour and UIF, 2018). The Labour Activation Programmes should be scaled up by considerably increasing the number of individuals participating in skills development and training programmes. There is a need to develop specific training and employment programmes such as the public employment programme for long-term unemployed.

To respond to the impacts of the COVID-19 pandemics and the ensuing lockdown, the government established a Temporary Employee/Employer Relief Scheme (TEERS) within the UIF. It covers people who test positive for COVID-19 or need to be quarantined as a result of exposure, reduced work time and unemployment benefits. This benefit is applicable to contributing employers to the UIF. The minimum benefit payable is equal to the national minimum wage of ZAR 3 500 per employee, or the sectoral minimum wage and a maximum benefit of ZAR 6 370. It was payable for the duration of the national lockdown or up to three months, whichever period is the shortest. As of end June 2020, the UIF had paid a total of ZAR 28 billion to over 4 million employees under this benefit.

Overview of cash transfers

South Africa has an extensive and well-functioning means-tested cash-transfer system, which the government has progressively scaled up since the end of Apartheid. Cash transfers form the backbone of South Africa’s overall social protection system. The social assistance programme (i.e. social grants) provides income support for the elderly, children, people with disabilities and social relief for individuals and households that experience sudden income distress (Table 2.2). Around 17.5 million out of 57 million South Africans now receive social grants – the majority of which are children and the elderly, with little support for the unemployed. Social assistance plays a critical role in reducing poverty, inequality and protecting vulnerable households from economic shocks. Social grants are funded from tax revenues, are non-contributory and unconditional. They comprise the largest segment of social protection expenditure at around 84%. However, poverty incidence remains relatively high at 26% for the entire population (measured as revenue below 50% of the median income).

The South African Social Security Agency (SASSA) was established in 2006 to administer and pay social grants on behalf of the Department of Social Development, which is responsible for policy and legislation. There have been significant improvements in SASSA’s administration of grants, which now works with the South African Post Office (SAPO) and commercial banks to provide social grant payments using biometric data. However, many remote areas lack adequate infrastructure so that cash payments lead to higher operating costs (Department of Social Development, 2016c). Leveraging the extensive infrastructure coverage of the postal service can improve the reach of the rural poor, who are often excluded from grants because of geographical barriers.

The economic restrictions due to the COVID-19 pandemic have led to severe distress for households that lack income and savings. Between three and five million informal-sector workers and their families are particularly vulnerable. As many of these workers live with grant recipients, government has used the existing grant system to support those most vulnerable. The government has augmented the social grants budgets by ZAR 25 billion to assist vulnerable groups (National treasury, 2020). Existing social grants are temporarily increased and a new social relief of distress grant for unemployed adults is being introduced (Table 2.2). Lengthy administrative procedures, such as registering new beneficiaries and checking their incomes, are required before the new grant can be paid.

Table 2.2. COVID-19 measures to increase social grant spending

In Rand

|

Baseline per month |

Number of beneficiaries |

Top-up |

Top-up % |

||

|---|---|---|---|---|---|

|

Child support (1) |

445 |

12 811 209 |

300 |

67.4% |

|

|

Old-age |

1 860 |

3 672 552 |

250 |

13.4% |

|

|

Disability |

1 860 |

1 045 388 |

250 |

13.4% |

|

|

Foster care |

1 040 |

339 959 |

250 |

24.0% |

|

|

Care dependency |

1 860 |

155 094 |

250 |

13.4% |

|

|

New social assistance grants |

Amount per month |

Number of beneficiaries |

|||

|

Social relief of distress |

350 |

700 000 – 8 MILLION |

|||

|

Caregiver |

500 |

7 167 022 |

|||

Note: After month on changed to caregiver grant.

Source: National Treasury, Supplementary Budget, June.

Steady increase in the number of grant beneficiaries

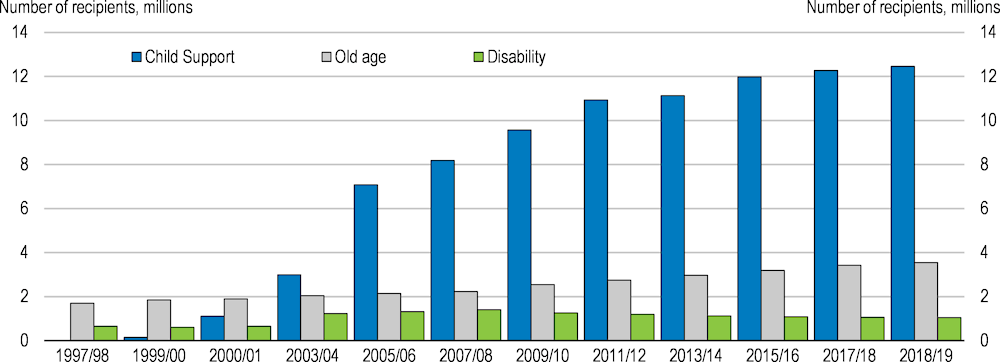

The number of beneficiaries has steadily increased from around 2.5 million people in 1998 to approximately 11 million in 2006 and reached 17.5 million in 2017/18 (SASSA, 2018). The increase in beneficiaries has mainly been driven by the expansion of the child support grant, reaching almost 12.3 million children in 2017/18 (Figure 1.2). The number of children receiving the child grant increased rapidly during the 2000s due to increased take- up and an increase in the upper age limit from 7 to 14 years (Samson et al., 2008). The age limit was further raised to include all children under 18 years in later years.

Table 2.3. Type of cash transfers

|

Name |

Administration requirements |

|---|---|

|

Old age grant |

Provides income support to people aged 60 and older who earn an annual income of less than ZAR 82 440 (single) / ZAR 164 880 (married), and whose assets do not exceed ZAR 1 174 800 (single) / ZAR 2 349 600 (married) |

|

War veterans grant |

Provides income support to those who fought in World War II or the Korean War, and who earn an annual income of less than ZAR 82 440 (single) / ZAR164 880 (married), and whose assets do not exceed ZAR1 174 800 (single) / ZAR2 349 600 (married) |

|

Disability grant |

Provides income support to people with permanent or temporary disabilities who earn an annual income of less than ZAR 82 440 (single) / ZAR164 880 (married), and whose assets do not exceed ZAR1 174 800 (single) / ZAR2 349 600 (married) |

|

Foster care grant |

Provides grants for children in foster care |

|

Care dependency grant |

Provides income support to parents and caregivers of children who have physical or mental disabilities, and require regular care and support. Parents or caregivers must earn an annual income of less than ZAR 213 600 (single) / ZAR 427 200 (married) |

|

Child support grant |

Provides income support to parents and caregivers of children younger than 18 who earn an annual income of less than ZAR 50 400 (single) / ZAR 100 800 (married) |

|

Grant-in-Aid |

Is an additional grant to recipients of the old age, disability or war veterans grants who require regular care from another person because of their physical or mental condition. |

|

Social Relief of Distress |

Provides temporary income support, food parcels and other forms of relief to people experiencing undue hardship. |

Source: National Treasury, 2019.

Figure 2.2. Distribution of social grants has been increasing

Social grants, number of recipients

Note: Recipients are only able to claim for one grant at any given time.

Source: South African Social Security Agency: Annual Report 2008/09; South African Social Security Agency: Annual Report 2018/19.

Coverage rates have improved

The coverage of social grants has improved thanks to a combination of policy changes, outreach campaigns to raise awareness and service delivery improvements. Coverage rates across the poorest 60% of the population is far above average coverage rates of other upper-middle income countries (World Bank, 2018a). According to the General Household Survey 2017, the percentage of individuals in the population that benefited from social grants increased from 12.8% in 2003 to 30.8% in 2017 (Statistics South Africa, 2018a). At the same time, the percentage of households that received at least one social grant increased from 30.8% in 2003 to 43.8% in 2017.

The composition of social assistance has shifted

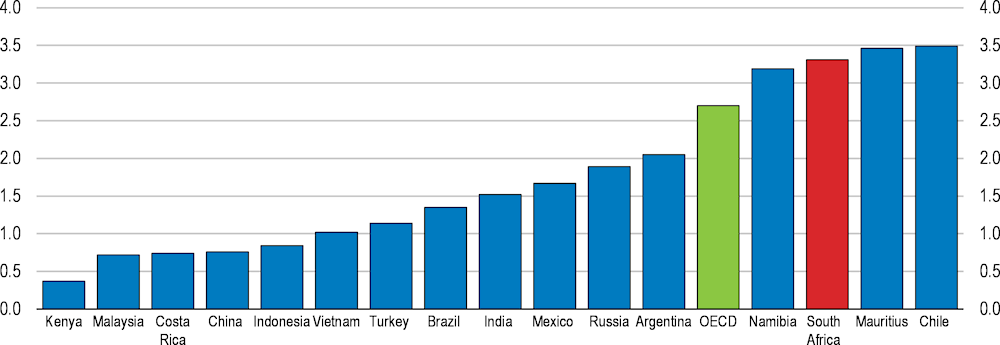

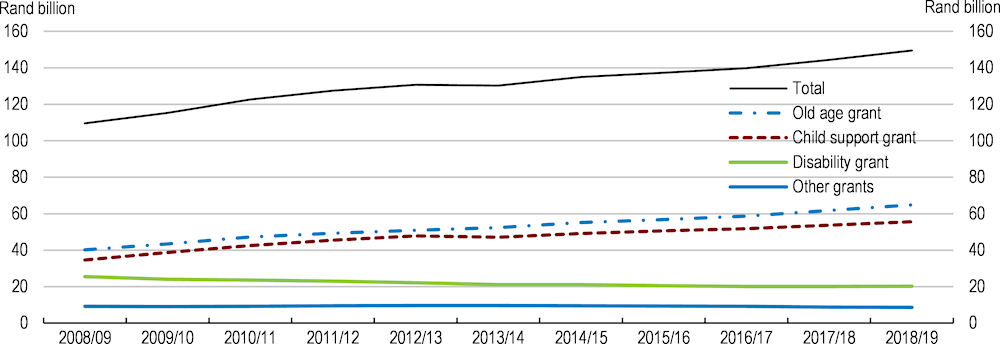

Public expenditure on social assistance programmes is relatively high in South Africa compared with other low to upper-middle-income countries (Figure 2.3). In 2015, government expenditure on social assistance programmes amounted to 3.3% of GDP. This compares with 1.4% in Brazil, 1.5% in India, 1.9% in Russia and 2.7% in the OECD (World Bank, 2018b). The composition of social assistance spending has shifted towards old age and child support grants (Figure 2.4). In 2019/20, the value of the child support grant will increase by 4.9% to ZAR 425 per month, from ZAR405 per month in 2018/19. The old age grant will increase by 5% from ZAR 1 695 per month to ZAR 1 780 per month for beneficiaries up to 75 years. Annual adjustments to the value of social grants are made to compensate for projected inflation.

Figure 2.3. Spending on social transfers is high

Spending on social assistance programmes in 2015 (% of GDP)

Note: Malaysia, Costa Rica, Turkey refer to 2013; China and Namibia refer to 2014; Kenya and India refer to 2016. Social assistance programmes are defined as non-contributory interventions designed to help individuals and households cope with chronic poverty, destitution, and vulnerability. Examples include unconditional and conditional cash transfers, non-contributory social pensions, food and in-kind transfers, school feeding programmes and public works (World Bank, 2018b).

Source: World Bank ASPIRE database, 2018.

Figure 2.4. Social grants spending has been increasing steadily in the last decade

Real expenditure on social grants

Note: Figures are expressed in 2016 prices (CPI December 2016=100).

Source: Author’s calculations, South African Social Security Agency: Annual Report 2018/19, Statistics South Africa.

The impact of social grants on the poor

Effective at reducing poverty and inequality

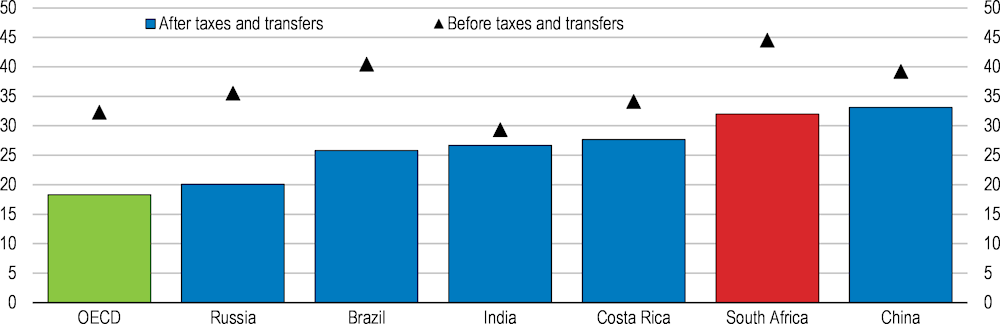

There is extensive evidence showing that social grants have been successful in reducing extreme poverty and improving health and education outcomes (Figure 2.5). Social grants dominate the income profile of many poor households, accounting for as much as 71% of total household income for the poorest 20% of the population and is particularly successful in reaching the poorest households (World Bank, 2018a; Woolard and Leibbrandt, 2010). The World Bank estimates that grants and old-age pensions contributed 24% to poverty reduction and 44% to narrowing the poverty gap (distance to poverty line) between 2006 and 2015 (World Bank, 2018a). Social grants are therefore a crucial source of income for poor families and provide a financial lifeline amid high levels of unemployment. However, 21% of people aged 60 and above remain poor.

Cash transfers, particularly the child support grant, are the most progressive of all spending programmes as the poorest 40% of individuals receive 69% of all transfers (Woolard et al., 2015; Inchauste et al., 2014). Furthermore, they augment the incomes of the poorest decile by more than tenfold, far larger than in other middle-income countries such as Argentina, Brazil and Mexico. The Gini coefficient, a measure of income inequality, is reduced from 0.715 for household market income to 0.623 after taxes and transfers (OECD Income Distribution and Poverty Dataset).

Figure 2.5. Poverty rate after taxes and transfers

% of population with 60% or less than the median disposable income, 2016 or latest year available

Note: Data for South Africa are for 2015 and provisional, Costa Rica for 2018, Brazil for 2013 and China and India are for 2011.

Source: OECD Income Distribution Database.

Child support grants improve child well-being and support human capital development

South Africa’s child support grant is one of the largest unconditional cash transfer programmes for children in the world. It is widely regarded as one of the government’s most successful interventions, particularly due to its high take-up and extensive coverage (Samson et al., 2008). Between 70 and 80% of children in the bottom six income deciles benefit from the grant (Grinspun, 2016). For poor families, the child grant is an important source of financial support, providing basic needs such as food, schooling and health care (Zembe-Mkabile et al., 2015).

The grant increases the nutritional well-being of recipient children as indicated by improved height-for-age scores (Coetzee, 2013). It reduces child hunger and the likelihood of illness and improves school attendance for pre-school, early grades and adolescents (Samson et al., 2008; DSD, SASSA and UNICEF, 2012). Children that receive the grant are also found to progress through the schooling system faster, with studies showing a lower likelihood of repetition and improved maths and reading scores (Coetzee, 2013; DSD, SASSA and UNICEF, 2012). Receipt of the grant has been shown to increase labour-seeking behaviour in recipient households, and generate a range of positive impacts for adolescents. Eyal and Woolard (2011) find that mothers who receive the child support grant in their 20s have significantly higher labour force participation and employment probabilities.

The old age pension grant affects labour force participation among adults and child outcomes positively

For nearly 75% of South Africans over the age of 60, the old age grant is the main source of income. While technically a cash transfer for older persons, extensive evidence points to the majority of recipients, especially women, sharing the pension within households (Ralston et al., 2015; Strijdom, Diop and Westphal, 2016). This is because household structures are often multigenerational, largely due to segregation policies of the apartheid era (lack of enough housing) and the high HIV/AIDS prevalence. Estimates indicate that one grant reaches up to six persons in a recipient’s household (Strijdom, Diop and Westphal, 2016). The grant can have a positive impact on the well-being of children through higher school attainment and primary school completion rates, decline in hours worked by children and improved health indicators (Budlender and Woolard, 2006; Van Biljon, 2017). Research has also shown that there is a positive correlation between households with an old age grant recipient and women living in that household participating in the labour force.

Issues of concern and proposals for broadening the social protection

Universalising the child support and old age grants

Many eligible children are excluded from receiving the child support grant. The two most common reasons given by caregivers for not applying for the grant were that they believed their income was too high and that they did not have the correct documentation. Problems around infrastructure, understaffed offices, complicated and lengthy application processes and a lack of awareness about eligibility impeded the rollout of the grant during the initial years (Eyal and Woolard, 2011). A recent study estimates that almost 18% of eligible children are not receiving the child grant (DSD, SASSA and UNICEF, 2016).

Universal or near-universal provision of child and family benefits is a reality in many high-income OECD countries, while in other parts of the world coverage tends to be targeted, usually towards poor families (International Labour Office: Social Protection Department, 2015). Some middle-income countries have made great progress towards achieving universal coverage, for instance Argentina in 2009 with Asignación universal por hijo. In South Africa, an upward adjustment in the means-test threshold at regular intervals since 2008 has opened up access to more poor households (Grinspun, 2016).

Universalising the child support grant would reduce the administrative burden and cost of means testing for both the state and caregivers and enable all children to access the benefit regardless of the caregivers’ income (Delany, Proudlock and Lake, 2016). The Inter-department Task Team on Social Security and Retirement Reform (IDTT) proposed that social grants be aligned with the personal income tax rebate structure to allow the means tests to be phased out and reach universal coverage (Department of Social Development, 2016c).

In general, universal pensions provide flat-rate benefits for all elderly people, while means-tested pension systems provide benefits to the poor who are usually not covered by other contributory elements of the pension system (World Bank, 2018b). Means-tested pensions are the most common in most regions (Pension Watch, 2019).

Universal and means tested old age pensions have clear trade-offs in terms of efficiency, cost, and effectiveness of implementation (World Bank, 2018b). Fiscal costs, sustainability and duplication of benefits present major challenges to the roll-out of a universal social pension (Guven and Leite, 2016). Universal social pensions are also argued to be less cost-effective at fighting poverty compared to poverty-targeted cash transfer programmes. Dorfman (2015) shows that social pension systems targeted at the elderly poor have been found to reduce national poverty at almost twice the rate of a universal approach.

Social pensions certainly have a role to play in closing the old-age security gap for those not covered by contributory schemes. Changes in the old-age grant should be linked to the planned introduction of a mandatory contributory pension scheme, depending on the complementary role it may play for individuals to reach the targeted income replacement rate (see Section 3).

The value of the child support grant is argued to be too low

There are concerns that the child support grant is too low. Evidence shows that the grant is not adequate on its own to meet even the most basic needs of its beneficiaries (i.e. food costs) and is insufficient for providing greater dietary diversity (Zembe-Mkabile et al., 2015). Food insecurity, stunting and child malnutrition remain significant challenges, and have deteriorated since 2012 despite more than 12 million children receiving the grant (World Bank, 2018a).

In 2018, the national food poverty line was ZAR 547 per person per month. People living below this line are considered to live in extreme poverty. The child grant (ZAR 445 per month in 2020/21) lies well below the food poverty line (for adults).

Proponents for increasing the child grant argue that a larger impact can be realised if the amount is increased. Budlender (2016) proposes that the grant should as a first step be set at the official food poverty line, which would not require any changes to the current administration of the grant. The government allocated ZAR 65 billion for the child support grant in 2019/20. If the grant were increased from ZAR 425 to ZAR 547, it would require an additional allocation of approximately ZAR 20 billion per year, which is hardly possible in the current budgetary situation.

However, instead of increasing the child support grant to the food poverty line, particularly in the case that it is universalised, the government could consider an additional means test for extremely poor households. For example, only households with a revenue such that the whole family lies below the food poverty line would receive extra-support. The value of such an extra-amount should be decided taking into account budget constraints.

Extending the cut-off age for the child support grant to 21 years

A criticism of South Africa’s social assistance programme is that it does not address poverty and unemployment among adults, particularly the vulnerable youth. Unemployment amongst the youth (15–24 years) was at 52.8% in 2018, compared to 27.5% for the full working age population (15–64 years) (Statistics South Africa, 2018c). Arguments to increase the cut-off age of the child grant are based on the lack of adequate social security coverage for young people who are either still completing secondary education, or are unable to find work or do not have the financial means to study further.

The child support grant terminates in the month that the child turns 18, with no consideration of the child’s education status. This often disrupts the financial stability of households, particularly where there are children who do not pass secondary education by the time they turn 18. In 2018, only 48.1% of students that were enrolled for Grade 10 in 2016 wrote the final secondary examination in 2018 (i.e. 512 735 of 1 067 075 students). Of this group, 78.2% passed. This means that from the Grade 10 class of 2016, around 660 000 children either dropped out of the system without finishing secondary education or are repeating certain years after they have turned 18, when they are no longer eligible to receive the child grant. Raising the age of the child grant does not address the underlying structural failures in the secondary education system. It may also create perverse incentives for beneficiaries to not complete secondary education by the age of 18 in order to continue receiving the grant up to the higher cut off age limit.

The government is gradually rolling out a fully subsidised fee-free higher education and training to all current and future undergraduate university and Technical and Vocational Education and Training (TVET) college students from poor and working-class families (National Treasury, 2018). The employment tax incentive aimed at addressing unemployment and the lack of skills amongst the youth, has been extended. Raising the age of the child grant may render these measures redundant, and limit the ability to serve other priorities.

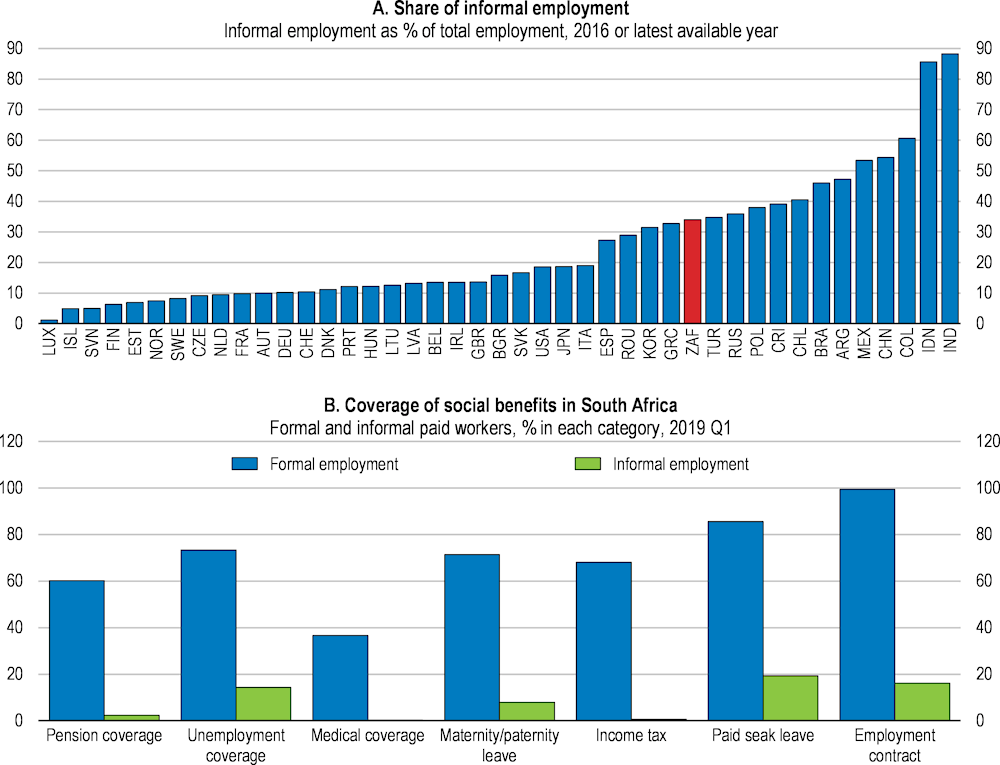

Broadening coverage of informal workers

At 32%, the informality rate in South Africa is considerably lower than the Latin American and Caribbean average (51%). Registration of firms is high in South Africa, almost 91% according to the World Bank. Employment status is less compliant, leaving space for informal employment. Informal employment represents a third of employment in South Africa (Figure 2.6). Informal employment recovers different types of situation including subsistence informality, voluntary informality and informality induced by regulations. The most prevalent type of informality in South Africa is subsistence informality mainly amongst those with low levels of education and those living in non-urban areas (Fernandez et al. 2017).

According to the National Statistics’ classification, about 74% of workers were working in the formal sector. Almost one million South African working in registered firms are informally employed, representing one fifth of the total informal workers. As a consequence, these workers are mostly not covered by pension provisions and unemployment benefits. As shown in Figure 2.6, medical coverage and pension coverage provided through employment packages are very low for informal workers. This is the case partly because pension insurance is not mandatory and provision of private health insurance by employers is not available in all firms, in particular in small size enterprises.

Therefore, working age informal workers do not directly benefit from social transfers (old-age and child grants, with exception of the disability grant) and are poorly covered for retirement income. However, they have access to health care provided by public health care service. In fact, as social protection benefits (health and pensions) are not systematically linked to employment it limits the incentives for the informally employed in registered firms to stand for their formalisation as they benefit from escaping income tax. The proposed reforms of introducing mandatory pension schemes and new health care system provides an opportunity to reduce informal employment. The financing and the conditions to be enrolled in these new schemes should include incentive mechanisms as subsidies and linking benefits to registration that reduce informal employment.

Figure 2.6. Coverage of informal workers is low

Source: ILO (2018), Women and men in the informal economy: a statistical picture (third edition); Statistics South Africa, Quarterly Labour Force Survey, Quarter 1: 2019.

Building a comprehensive pension system

South Africa is lacking a mandatory pension insurance. Rather than benefitting from potential savings during working life, retirees often fall back into the old-age grant system. Therefore, the social protection system, based only on old-age grant, does not protect financial risk associated with longevity and old-age revenue losses. This has led to an extensive old-age grant system and disincentives for long run savings, in particular for lower to middle-income people. Indeed, in many segments of the population, individuals are under-saving or dis-saving before retirement or using their savings in a sub-optimal way to access the old-age grant. South Africa is with New Zealand and Ireland among the few countries that do not have a mandatory pension insurance neither public nor private.

The current pension system is not adequate in reducing the risk of old-age poverty

Coverage is modest

Pension coverage is not satisfactory. It is difficult to gauge exactly the number of formal workers covered by any form of retirement saving provisions. Indeed, in the absence of mandatory pension insurance, businesses and trade unions have established retirement savings and insurance arrangements for their employees and members. According to the Quarterly Labour Force Survey (QLFS) about 6.5 million workers representing 40% of employees were contributing to a pension scheme in December 2018 (Statistics South Africa, 2018d).

The Government Employees Pension Fund (GEPF) is the largest occupational pension fund. It covers retirement, death and disability benefits of government employees. In 2018, the GEPF received contributions from 1.2 million active members and provided benefits to 450 322 pensioners or beneficiaries. Members with less than 10 years of contributions receive a lump sum at retirement while those with more than 10 years of contributions and above retirement age receive a lump sum and a monthly pension (annuity) (GEPF, 2018). In addition, workers resigning or leaving the public service can withdraw their accumulated contributions without any obligation to transfer it to another pension fund.

Private sector workers are covered by occupational pension plans. Coverage varies according to a worker’s income, the sector of employment and the degree of unionisation in that sector. Low-income workers are mostly not covered (Department of Social Development, 2016a). Self-employed and informal workers can contribute to private pension funds but coverage is low. Among the 40 private sector bargaining councils, 29 offer a savings and insurance arrangement covering around 2.5 million workers. Unions govern many savings-retirement funds, often called provident funds.

In 2018, there were 5 118 registered retirement funds of which 1 647 funds are active (a fund with members for whom it receives contributions and/or pays benefits). They cover around 11 million active contributors and 5.5 million pensioners, dependants and unclaimed benefit members. However, there is some double counting, as some individuals are members of more than one fund (FSCA, 2018).

Pension revenues are low, increasing the risk of old age poverty

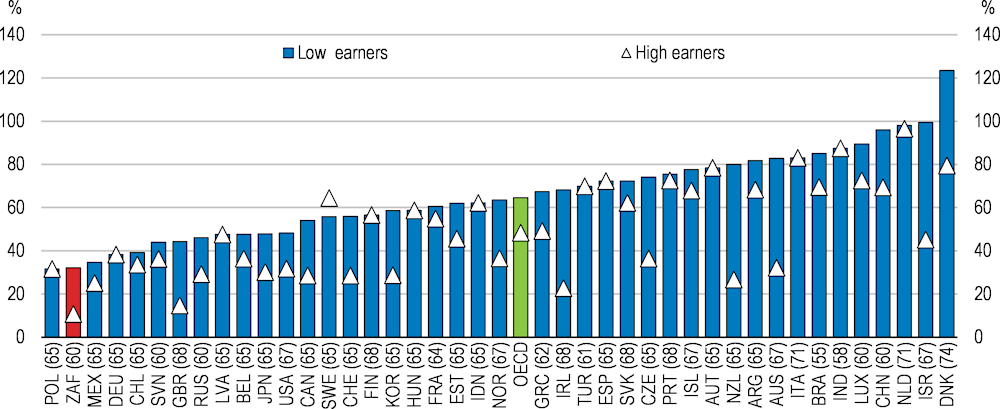

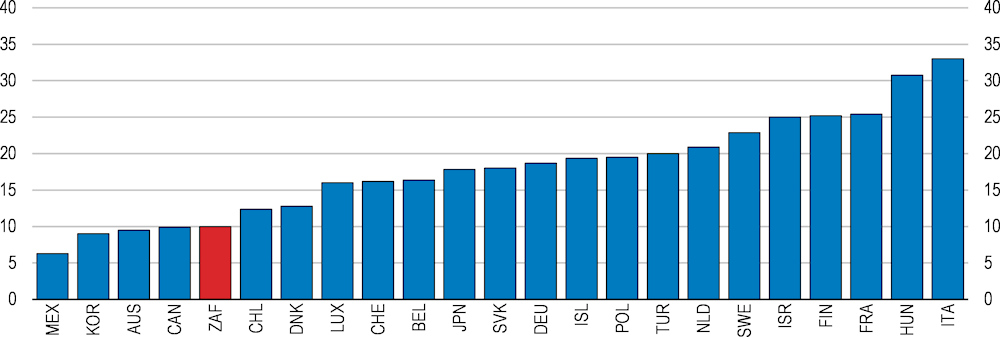

Pension revenues are not adequate, contributing to old-age poverty. South Africa’s poverty rate is relatively high when compared with OECD and emerging countries (Balestra et al., 2018). The old-age poverty rate is 21% compared with 26% for the entire population (measured as revenue below 50% of the median income) (OECD, Income distribution database, 2018). South Africa has the lowest gross replacement rate across OECD and partner countries based on mandatory schemes (Figure 2.7). The gross replacement rate is defined as future gross pension entitlement divided by gross pre-retirement earnings for someone currently entering the labour market at age 20. The gross replacement rate appears low because in the GEPF, as well as in most of the occupational and savings-retirement funds, workers can partially withdraw their funds at retirement in a one-off payment. The absence of medium-term saving vehicle explains partly these withdrawals on retirement funds. For example, civil servants affiliated with the GEPF have a theoretical 50% replacement rate, but due to the option of opting out and receiving a lump-sum payment, the effective replacement rate can differ substantially.

Figure 2.7. Pension levels are low

Gross pension replacement rate upon retirement

Note: Expected retirement age in year 2070 reported in parenthesis.

Source: OECD (2017), OECD Pensions at a Glance 2017.

Issues with the current retirement fund industry

There are some issues with the current retirement fund industry, which contribute to the low adequacy of the pension system. The large number of pensions and savings-retirement funds, more than 5 000, is not efficient. Around a third of the funds are dormant and not receiving pension contributions anymore (FSCA, 2018). The Financial Sector Conduct Authority (FSCA) is in charge of licencing, supervising and verifying that retirement funds fulfil their promises and preserve individual financial interests.

The government has already introduced measures to reform South Africa’s retirement industry and improve coverage. Substantial changes to the regulation of the financial sector were introduced recently to address some of the shortcomings of the retirement industry (see Box 2.2). However, there is room to improve the effectiveness of the pension industry further. For instance, retirement funds not receiving a contribution for three years in a row should see their portfolio transferred to another retirement fund. In addition, retirement funds not reaching a minimum size should be closed or required to merge with other existing funds.

Many savings-retirement beneficiaries do not claim their benefits partly due to financial illiteracy and lack of knowledge of their rights. In 2018, 3.6 million pension accounts were not claimed, representing around ZAR 34 billion. An individual may have many pension accounts, for instance, in the case they often switched their employer. The FSCA has initiated a campaign to inform people and has put in place a register where people can verify whether they have a pension account. Retirement funds should be required to do more to track their beneficiaries and to inform them about their entitlements when they are close to retirement age.

Many retirement funds charge high administration and asset management costs that erode the value of workers’ accumulations. Some also deliver a poor investment return. The FSCA has identified numerous supervisory issues related to boards’ roles and costs, high remuneration, failure to submit annual financial statements and valuation reports in some retirement funds. These observations call for giving more power to the FSCA to sanction or impose measures to address these issues.

Box 2.2. Recent pension reforms

In 2013 and 2015, the government introduced several reforms to the retirement fund industry to strengthen its governance, to harmonise tax deductions across retirement schemes, guarantee the preservation of retirement benefits and incentivise the annuitisation of pensions.

2013: Governance of retirement funds and taxation of pension contributions

The FSCA is given responsibility to monitor trustees’ appointments and ensure that boards and trustees meet and fit proper requirements; and to supervise that they are independent and free of conflicts of interest.

Whistle-blowing protection for Board members, valuators, principal/deputy officers, and employees who disclose material information to the Registrar (FSCA).

Fund board members/trustees to attain skills and training as prescribed by the Registrar, within 6 months.

Criminalisation and extending personal liability to employers in respect of non-payment of pension contributions to a pension fund.

Protection for board members/trustees from joint and several liability, if they act independently, honestly and exercise their fiduciary obligations.

Require pension funds to notify the Registrar of their intention to submit an application to register prior to commencing the business of a pension fund.

Same tax deductions for all contributions into retirement funds (retirement annuities, pension funds and provident funds).

Introduced partial annuitisation of benefits from provident funds, finally delayed to 2021.

Threshold to purchase an annuity increased from ZAR 75 000 to ZAR 150 000.

Tax-free lump sum at retirement increased from ZAR 315 000 to ZAR 500 000 in 2014.

Taking effect from March 2016, tax deduction on employer and employee contributions to a pension fund, provident fund or retirement annuity fund up to 27.5% of the higher between remuneration and taxable income. A ceiling of ZAR 350 000 per annum applies.

2015 Taxation laws amendment

A higher threshold to purchase an annuity of ZAR 247 500.

2017 Regulation of pension funds

A default in-fund preservation arrangement (conservation of savings until retirement) to members who leave the services of the participating employer before retirement.

A default investment portfolio to contributing members who do not exercise any choice regarding how their savings should be invested.

Incentivising for annuity payment within retirement funds.

However, the most important issue with private retirement funds is the early withdrawals from retirement funds during a worker’s career, which is the primary cause for low replacement rates. Many workers liquidate their funds each time they change their job. The government has already introduced different provisions to limit withdrawals of workers’ accumulated contributions and to incentivise workers to receive their pension in an annuity instead of a lump sum (see National Treasury 2017 and 2018b). For instance, if more than one third of the accumulated fund is withdrawn, tax applies, incentivising to transfer retirement savings to another retirement fund. Indeed, when workers transition to a new employer with a different retirement fund, contributions are often withdrawn. This is particularly true for provident funds. To transform these savings-retirement funds into a real retirement income, preservation of funds until retirement age and at least partial annuitisation should be mandatory as a counterpart to the tax deduction on contributions.

Reforming the pension system

Rationales for setting up a mandatory pension insurance scheme

The low level of retirement income and coverage call for reforming the pension system. The fragmentation of the pension system with important variations in pension coverage provisions across sectors argue for a consolidation of pension provision rules. The arguments for a mandatory pension scheme include protection against old age income poverty risk, better risk pooling and higher economic efficiency (Barr, 2012). The Taylor committee report has already recommended the establishment of a comprehensive pension system (Taylor Vivienne, 2002). Based on the interdepartmental task team report on social security, the government published in November 2016 a discussion paper recommending the establishment of a mandatory pension scheme. The aim is to establish a comprehensive social security system which comprises a three-tier system: universal old age grant, a mandatory pension scheme and voluntary pension funds.

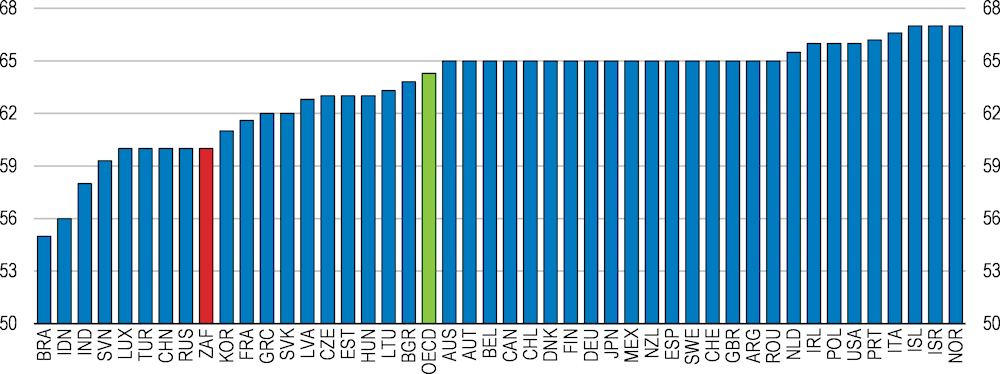

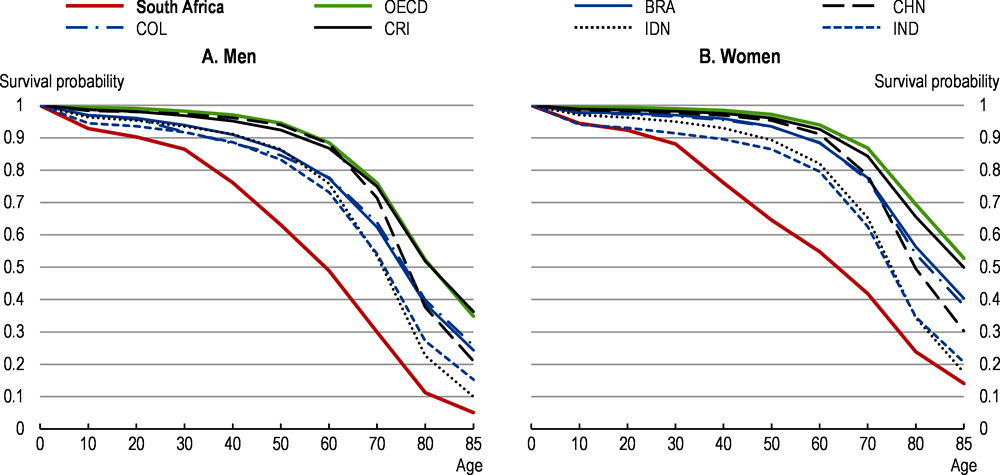

Moreover, the timing for introducing a mandatory pension scheme is favourable given the current demography. The current retirement age at 60 years in many pension schemes and 65 years for civil servants is adequate when compared to emerging and OECD countries (Figure 2.8). The current retirement age may seem high because of the low survival probability during old age (Figure 2.9) (Balestra et al., 2018). However, the survival rate will pick up progressively as cohorts highly affected by the HIV/AIDS disease fade out. Moreover, the average survival rate masks important dispersion in life expectancy linked to race, education and employment status. Therefore, in designing the mandatory pension scheme, the needs of low-income workers who tend to have a lower life expectancy should be taken into account through death/survivor benefit provisions.

Figure 2.8. The retirement age is adequate

Current retirement ages, years, men, 2016

Note: The current retirement age is calculated assuming labour market entry at age 20.

Source: OECD (2017), OECD Pensions at a Glance 2017.

Figure 2.9. Mortality is still high

Survival probability by age, 2010-14

Source: Balestra et al. (2018), “Inequalities in emerging economies: Informing the policy dialogue on inclusive growth”, OECD Statistics Working Papers, 2018/13.

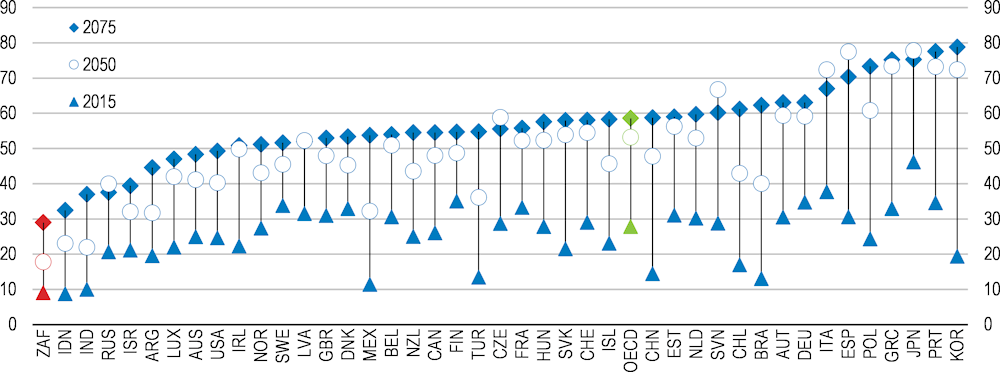

The evolution of the dependency ratio is favourable for setting up a mandatory pension scheme now as it will mature before the arrival of large cohorts in retirement age. As seen in Figure 2.10, South Africa has the lowest dependency ratio (percentage of individuals above retirement age per working age population) among OECD and emerging economies. In 2050, the dependency ratio will remain favourable while by 2075, the dependency ratio will have caught up with the 2015 OECD average. It takes 35–40 years for a pension scheme to mature as the first cohort of workers with full contribution duration reaches retirement age.

Figure 2.10. The evolution of the dependency ratio remains favourable

Note: The demographic old-age dependency ratio is defined as the number of individuals aged 65 and over per 100 people of working age defined as those aged between 20 and 64.

Source: OECD (2017), Pensions at a Glance 2017.

Policies to safeguard and build robust pension schemes

Automatic adjustment mechanisms

Automatic adjustment of pension system parameters allows pension financing to be closely aligned with demographic and economic trends. Like other pre-commitment mechanisms in economic policymaking – in monetary and fiscal policy, for example – it is designed to enhance credibility and provide assurance that public pension schemes will not place an unexpected burden on public finances in the future. Given the difficult process of pension reform, many countries have introduced automatic adjustment mechanisms to cope with trend changes or shocks that threaten the actuarial equilibrium (Fall and Bloch, 2014). For instance, pension benefits can be reduced through automatic sustainability factor, which take into account financial imbalances (Canada, Germany, Japan, and Sweden). Many countries have introduced adjustment mechanisms to take into account changes in life expectancy. The adjustment can link the pension level, the retirement age or the contribution period to life expectancy. In South Africa, introducing a regular analysis of the evolution of life expectancy (every five years for instance) to decide whether the parameters of the mandatory pension schemes need to be adjusted would reinforce the sustainability of the scheme.

Automatic enrolment in occupational pension plans

Occupational pensions will play an important role for middle and high-income earners to reach a decent replacement rate. In most of the existing occupational plans, enrolment is automatic and comes with the labour contract. However, as a mandatory pension scheme is introduced, enrolment in occupational plans may not be automatic any more.

Introducing automatic enrolment has increased coverage of private pension in many countries (Figure 2.12). The default rate at which contributions should be set in an automatic enrolment scheme depends on how the private pension system interacts with the public PAYG pension system. In the case of South Africa, in addition to the basic contribution rate, higher contribution rates could be considered for high income earners to ensure that the targeted replacement rate is met for different income levels.

Financial and non-financial incentives can be used to encourage automatically enrolled workers to stay enrolled and to not opt out. Historically, tax deductions and tax relief have been the main type of financial incentives provided by governments to promote private pensions (OECD, 2014a). However, the largest coverage gaps are concentrated among lower and middle-income households who may draw little benefit from these tax incentives. In order to encourage people in such households to stay enrolled, countries often provide other kinds of financial incentives: matching contributions (from the employer and/or the state), government flat subsidies and guarantees.

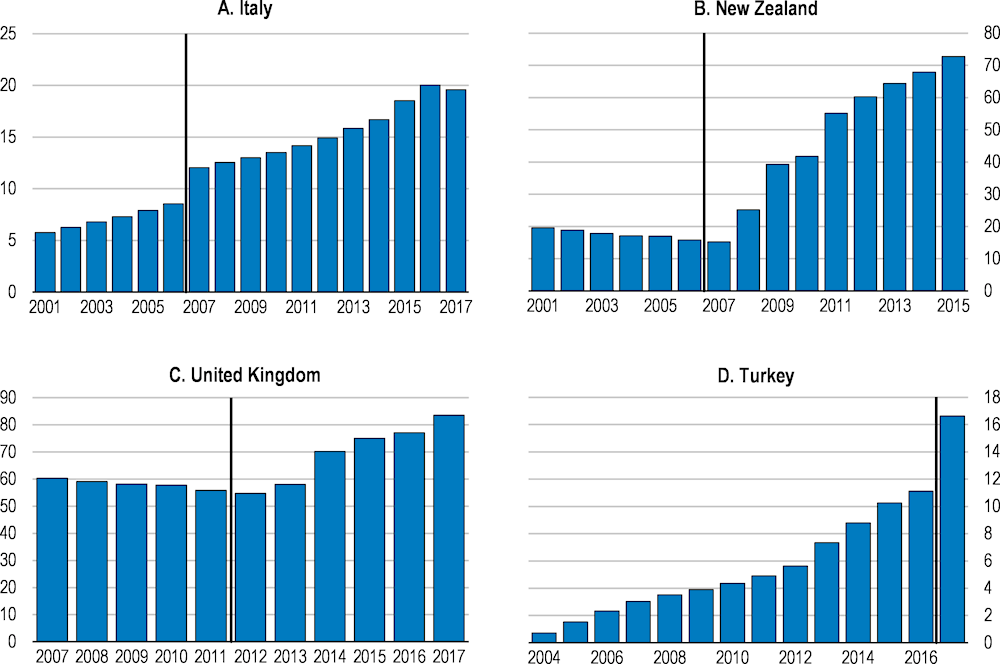

Figure 2.11. Pension coverage increases after introduction of automatic enrolment

Coverage of private pension plans before and after the introduction of automatic enrolment

Note: Participation is measured as the number of members enrolled in a pension plan (i.e. having assets or accrued benefits in a plan). It is expressed as a percentage of the working-age population (15-64) in the case of Italy and Turkey; as a percentage of people under age 65 in the case of New Zealand; as a percentage of eligible employees in the case of the United Kingdom. Vertical lines represent the dates when the automatic enrolment scheme was established.

Source: OECD (2019), Inclusiveness and Finance, www.oecd.org/daf/fin/financial-markets.

Building on the proposals of the government discussion paper

A three level pension system

The South African government proposes a three-level pension system in its discussion paper on social security. The old-age grant would be generalised to all individuals aged 60 years and above or 65 years and above (also envisaged as retirement age). The second pillar would be the new mandatory pension scheme managed through the National Social Security Fund (NSSF). Finally, occupational and voluntary retirement funds will serve as complementary retirement insurance (Box 2.3).

The objective of the new pension system is to target a minimum replacement rate of 40% through the combination of the old-age grant and the mandatory pension scheme for revenues up to an income ceiling (ZAR 178 464 applied in the unemployment insurance fund). For individuals earning more than the income ceiling (around 20–25% of workers), it is necessary to complement mandatory savings with an occupational pension plan and/or a private pension plan.

The government’s targeted replacement rate is based on simulation made in 2012 before the introduction of a minimum wage in January 2019 amounting to around ZAR 42 000 annually, which will be progressively expanded to all sectors. Therefore, all workers in the formal sector should qualify for the mandatory pension schemes, which will reinforce the coverage of the pension system. However, a specific enrolment system should be designed for self-employed and informal workers, in particular for their participation in the second tier of the mandatory system. In particular, the contribution subsidy considered in the proposal should specifically target informal workers and low earning self-employed but will need strong enrolment efforts.

The Government Employee Pension Fund (GEPF) covers civil servants. The contribution rate is 20.5% for employees and employers combined and 23.5% for members of the army and intelligence service while for the NSSF the proposed contribution rate is 10% plus 2% for the unemployment insurance fund (as now). The targeted replacement rate of the GEPF is 50%. For instance, for the inclusion of civil servants in the NSSF, their current contributions could be separated in two parts: 12% going to the NSSF with mandatory enrolment and the rest going to an occupational account managed by the GEPF. A transition period should be put in place. For example, only workers with less than 20 years of contribution would be enrolled in the NSSF and new civil servants, which leaves enough time to accumulate pension rights in the new system. Such a mechanism would preserve retirement plans of workers leaving the public service soon and ease the transition between private and public service.

A related issue is the management of the mandatory pension scheme. As the proposed mandatory pension scheme is a pay-as-you-go (PAYG) system and will need adjustments of the parameters because of the ageing of the population, a public entity with clear a governance structure is better suited to manage the system. A public entity or agency should manage the mandatory pension scheme. However, the governance of the public entity should be transparent and its management duly selected. First, the board composition should be broadened to include representatives of private sector employees and employers. Second, a specific body should be established and tasked to review the parameters of the system with regard to life expectancy evolution, labour market dynamics, etc. That body would make recommendations to the government for the evolution of the parameters of the scheme to guarantee its adequacy, funding and sustainability.

Introducing a mandatory pension scheme with a 10% contribution rate will affect the structure of the retirement fund industry. Indeed, a 10% contribution rate will crowd out part of actual contributions to occupational pension and provident plans. Provisions should be adopted guaranteeing that existing plans will not be dismantled for workers above 50 years (less than ten years to retirement age) that would not be covered by the new mandatory scheme. Moreover, there should be mandatory negotiations between workers’ representatives and employers in firms or sectors providing occupational plans to set up continuation conditions of occupational plans so that workers can complement the mandatory retirement benefit. Finally, as already mentioned, incentives to consolidate the retirement industry should be provided to raise efficiency.

The NSSF will also provide disability and survivor benefits. Part of the contributions to the NSSF will cover risk benefits. A clear distinction between disability and survivor benefits should be made and between events happening during working age and retirement. During the working-age period, disability provisions should be further consolidated with existing risk funds (the Compensation fund). Whereas the disability and survivor benefit provisions seem reasonable, their funding scheme with regard to pension financing is not clear. As pension liabilities will grow overtime, a clear separation of pension provisions including pension survivor benefits from disability benefits is important for monitoring pension liabilities and financing needs.

Choosing the main parameters of the mandatory pension scheme

The government proposal has opted for a defined benefit pay-as-you go scheme (PAYG). Some parameters are key for the financial sustainability and adequacy of defined benefit schemes (Fall and Bloch, 2014). In particular, the robustness of PAYG defined benefit schemes to macroeconomic trend changes (productivity, ageing or migration) will depend on the capacity to adjust key parameters such as contribution rates, retirement age or the accrual rate (Fall, 2014).

The contribution rate to the NSSF is proposed to be 12% decomposed as 2% for the unemployment insurance and 10% for the retirement and risk benefits (disability and survivor benefits). The 10% contribution rate is not particularly high when compared to the OECD average (Figure 1.11). Canada and Australia have a pension scheme that is close to that proposed in South Africa. The public pension in Canada targets a 25% replacement rate for a 9.9% contribution rate. However, in Canada and Australia, occupational pensions and capital income constitute an important share of old-age income. Moreover, many old-aged people have to rely on work income in these countries. Work income represents 26% and 24% of the income of old people in Australia and Canada respectively (OECD, 2017b).

Figure 2.12. The proposed contribution rate is not high

Mandatory pension contribution rates for an average worker in 2016, %

Note: In some cases, pension contribution revenues have been calculated assuming that the revenues are split between different social security programmes in the same proportion as the contribution rates. The total contribution includes payments from people who are not employed (principally the self-employed). In Denmark the ATP contribution is expressed as percentages of AW earnings of DNK 412 555.

Source: OECD (2017), OECD Pensions at a glance 2017 and OECD calculation.

The adequacy of the proposed pension scheme relies heavily on the old-age grant and the length of the contribution period. OECD simulations show that for a 0.6% accrual rate per year of contribution, a 24% replacement rate (out of average career wage) is reached only after 40 years of contributions (see Fall and Steenkamp, 2020, Table 1).

If the accrual rate is 1% per year then the replacement rate reaches 20% for 20 years of contributions and 40% for 40 years of contributions (see Fall and Steenkamp, 2020, Table 1, Scenario B and C). The overall replacement rate depends on the old age grant, which all workers will receive if universalised. Therefore, to reach the targeted average 40% replacement rate, there is a trade-off between 0.6% accrual rate plus a universal old-age grant and a 1% accrual rate without an old-age grant.

An important dimension to take into account when setting the parameters of the scheme is the evolution of life expectancy. South Africa’s demography is favourable for setting up a PAYG pension scheme, as overall life expectancy is low. However, life expectancy of participants in the pension scheme (workers and high-income earners) is higher than the average (Balestra et al., 2018). Old age longevity is expected to improve over time and could accelerate as well as survival probabilities at all age, as health delivery and living conditions improve.

Simulation of an ageing scenario where South Africa reaches the old age survival probabilities of Brazil shows that the individual actuarial balance of the scheme becomes highly favourable to individuals and may threaten its sustainability (see Fall and Steenkamp, 2020, Ageing scenario, Table 2 vs scenario D, Table 2.4). It means that a mechanism to adjust regularly the parameters of the scheme should be established from the beginning to guarantee the sustainability and adequacy of the pension scheme with regard to demographic evolutions.

Reforming the health care system for better quality, access and efficiency

Overview of health outcomes, healthy life styles and preventive policies

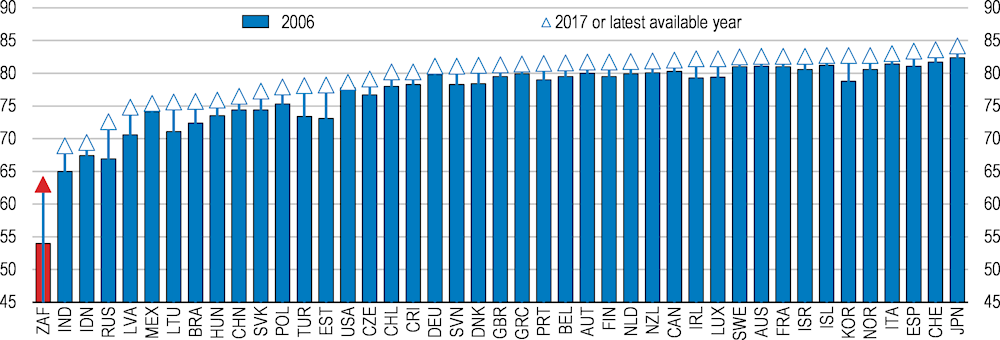

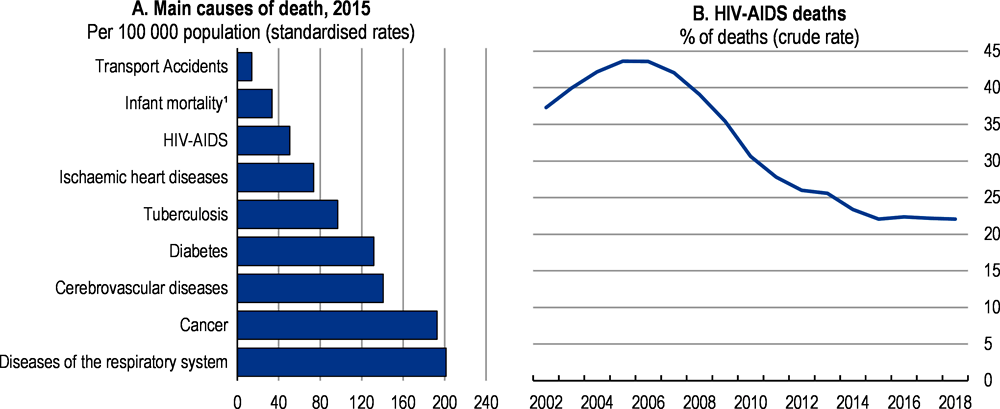

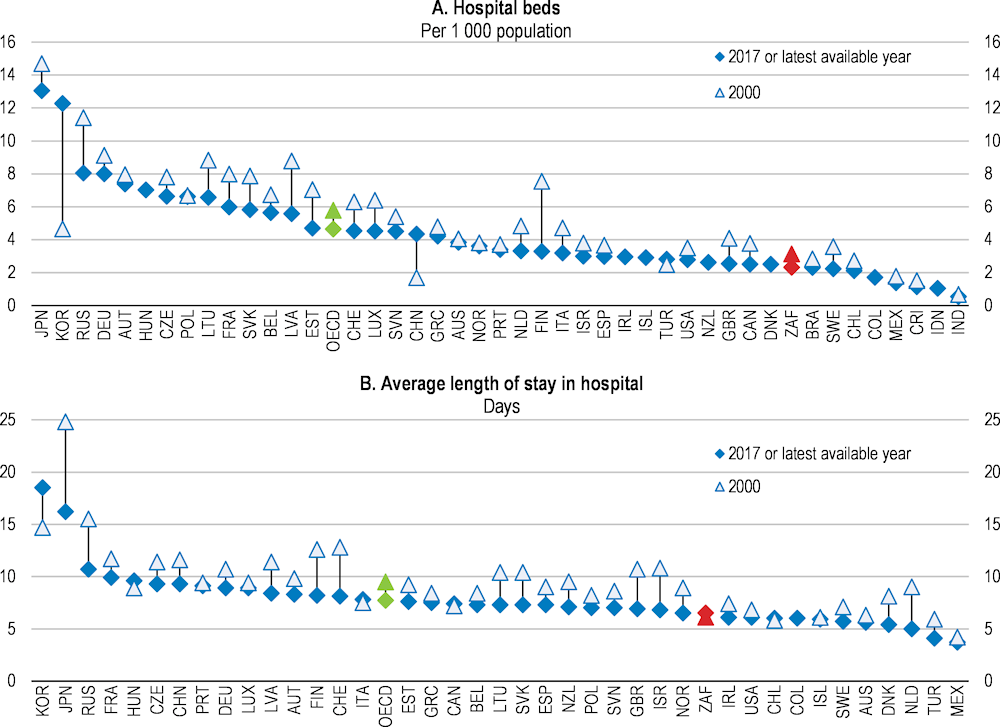

Although many health outcomes have improved significantly over the last decade, there is ample room for improvement. Life expectancy has increased in the last ten years from 54 to 63 years (Figure 2.13). The infant mortality rate has decreased from 39 to 23 infant deaths per 1 000 live births between 2009 and 2017; it is, however, still high by OECD standards. Prevention and treatment of tuberculosis and diseases of the respiratory system also show noticeable progress. However, tuberculosis remains a challenge, with a high number of new cases and multi-drug-resistant cases.

Figure 2.13. Life expectancy is improving

Life expectancy at birth, total population, years

The improvement in life expectancy is also a result of important government investment in the ARV programme that is now funding treatment for 4.6 million people. While deaths related to HIV/AIDS have more than halved since 2006, it is expected to contribute to further improvements of life expectancy (Figure 2.14). However, several diseases still cause high death rates, which are above OECD standards. In particular, diseases of the respiratory system, cancer and cerebrovascular disease's display high death rates (Figure 2.14). Diabetes treatment has seen no progress in the last ten years.

Figure 2.14. Despite progress, the main causes of death are still high

Box 2.3. Health Policy response to COVID-19

A strict national March 26 at the strictest level (5). The lockdown was alleviated on the June 1 and put in level 3, giving more freedom of movement. The Level 3 allows persons to leave their place of residence to travel to work, buy goods and services, to move children or attend a school or learning institutions for instance. The nationwide lockdown was accompanied by a public health management programme. The initial strategy has focused mainly on behaviour change (for example, social distancing, wearing masks and not going to work when sick), early detection of cases through community screening and testing, contact tracing, disease surveillance and public health campaigns to reduce transmission of the virus in communities. By end of June, 1.630 million tests were conducted, 151 thousands positive cases identified and 2 657 deaths.

The national institute for communicable diseases (NICD) reported 10 700 COVID-19 admissions from 269 facilities (71 public sector and 198 private sector) between March 5 and June 21, 2020. These were the key findings:

Among 8 245 (77%) patients with data on co-morbid conditions, 2 810 (34%) had one co-morbid condition and 3126 (37%) had two or more co-morbid conditions.

Of the 5 836 patients who had a co-morbid condition, the most commonly reported were hypertension 3419 (59%) and diabetes 2813 (48%); and there were 1 116 (19%) patients admitted with HIV, 240 (4%) with active tuberculosis (TB) and 579 (10%) patients with previous history of tuberculosis.

Obesity, while not consistently recorded for all reported COVID-19 admissions, was noted by clinicians as a risk factor in 297 (3%) patients.

Some of the factors associated with in-hospital mortality were older age groups; male sex; and having co-morbid hypertension, diabetes, chronic cardiac disease, chronic renal disease, malignancy, HIV and obesity.

As the pandemic evolves, the strategy has shifted towards managing the increased volumes of patients that require hospital care. The objective is to rapidly scale up the capacity of hospitals to treat COVID-19 patients, including within intensive-care units. It is planned to set up field hospitals and other temporary facilities, procure equipment, recruit staff and buy medicines.

In response to the COVID‑19 crisis, closer co‑operation and pooling of available resources between the public and private sectors has been initiated. Most of the intensive/critical care beds are in the health private sector. Estimates vary widely. In April, the ministry of health estimated the total number of critical beds at around 3 300, with two-thirds of those in the private sector. However, healthcare provider Netcare estimates there are some 6 000 beds, with around 3 800 in private hospitals. Early June, the government and the health private sector representatives agreed on a daily fee of up to 16,000 rand ($950) for COVID-19 patients that get treated in critical care beds in private hospitals.

The government has increased financial support to the health sector to cope with the pandemic. In the June Supplementary Budget, ZAR 25 billion has been allocated to the health sector to cope with expenses related to the pandemic. In addition, ZAR 445 million has been allocated through the disaster funds mainly for personal protective equipment for health workers.

Source: National Treasury, Supplementary Budget, June 2020 and Ministry of Health, press release.

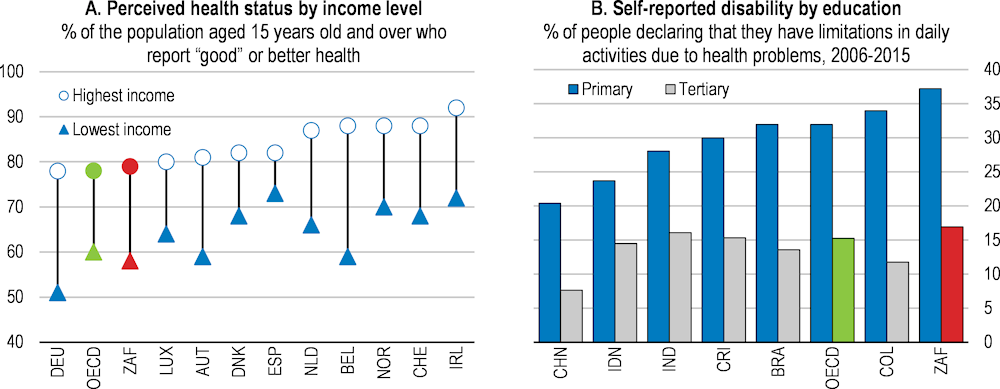

Despite formal equal access, health outcomes vary significantly by socio-economic status. There are still substantial differences in life expectancy and health status according to race, education and income (Statistics South Africa, 2018b). High-income individuals report having a better health status than low-income individuals, as in all countries. However, the difference between the two groups in South Africa is not as large as in many OECD countries (Figure 2.15, Panel A). The gap between the share of individuals reporting a disability amongst tertiary educated people and those with primary education is the highest among OECD and emerging countries (Figure 2.15, Panel B). These disparities may be explained by differences in the quality of health care accessed, financial access barriers, in living and working conditions, and in smoking and other risk factors.

Figure 2.15. Health inequalities are high

Note for panel B: Data are pooled across all available years 2006-2015.

Source: OECD (2017), OECD Better Life Index; Balestra, C., et al. (2018), "Inequalities in emerging economies: Informing the policy dialogue on inclusive growth", OECD Statistics Working Papers, No. 2018/13, OECD Publishing, Paris, https://doi.org/10.1787/6c0db7fb-en.

The government has devoted important efforts to stop the HIV/AIDS pandemics, treat millions of individuals, prevent the mother-to-child transmission of the disease and develop preventive policies. Efforts preventing non-communicable diseases and strengthening the promotion of a healthier lifestyle have to be strengthened.

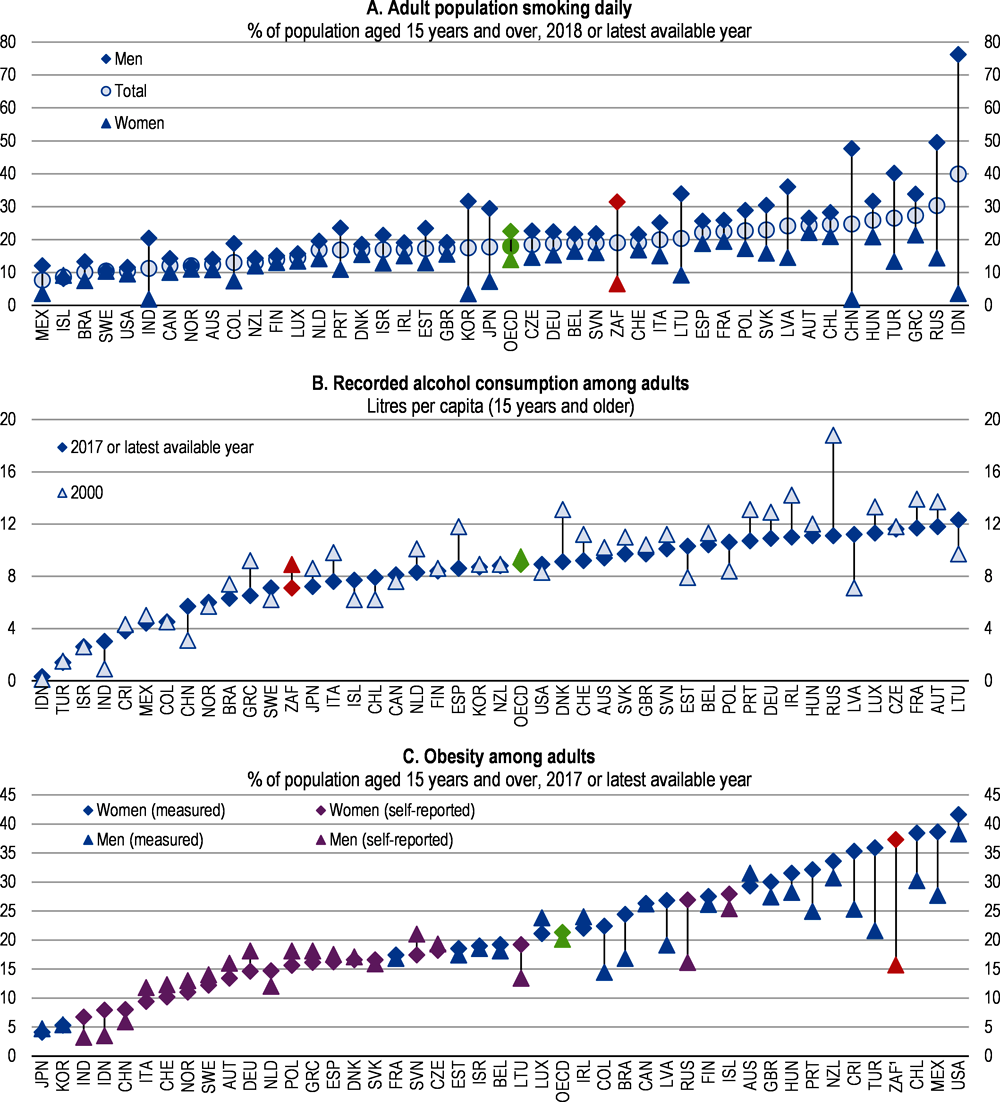

Obesity rates have reached alarming levels in South Africa. 37.3% of adult women are obese; this is the third highest rate among OECD and partner countries, just below Mexico and the United States (Figure 2.16, Panel C). As obesity is linked to the prevalence of diabetes and chronic diseases, it drives negative health outcomes and also increases in related health costs. Obesity is linked to co-morbid diseases like diabetes, hypertension, diseases of the respiratory system and cerebrovascular diseases that have a high mortality incidence in South Africa (Figure 2.14). In particular, type 2 diabetes is highly prevalent among obese black women in South Africa (Kruger et al., 2005).

The government has developed a national health promotion policy and a strategy for the prevention and control of obesity in South Africa (2015–2020). These programmes include actions targeting weight goals, healthy eating, physical activity and behavioural change (Department of Health, 2015a). The strategy identifies community services and primary health care services as the key actors for prevention and early detection. The implementation of these actions should be scaled up. South Africa has introduced a tax on sweetened beverages. The sale of sweetened beverages in school should be banned and preventive health messages linked to their advertisement.

Early school-based prevention programmes to promote a healthy lifestyle can reduce the prevalence of diabetes, whereas early control, counselling and quality management in the primary care sector can avoid high costs due to chronic complications that are common for diabetes when left untreated or poorly controlled (OECD, 2014b). South Africa has already a health programme targeting schools. It should be generalised to all schools and used to interact with parents to raise awareness of the risks linked to obesity, provide advice on diet and sports activity.

General practitioners and medical schemes should be incentivised to take on a greater role in prevention and chronic disease management as a fundamental part of their role as primary care provider. For example, they could act as main co-ordinator between primary and specialist care, while also supporting the patient through patient education and strengthening self-management practices (OECD, 2014b).

Tobacco consumption remains high, as 19% of the adult population are daily smokers. The rate of smokers is particularly high among men at 31% (Figure 2.16). Deaths related to tobacco consumption are high (Fuchs et al., 2018). Since 1994, the government has raised the tax on tobacco significantly. The combined excise tax and the value added tax was increased from 32% of the retail price to reach 50% by 1997. In 2006, the total tax target was increased to 52%. However, the tax burden of 52% (i.e. excise tax plus VAT) of the retail selling price of the most popular brand in each tobacco product category was changed in Budget 2015 to focus on excise tax component alone (i.e. removed the VAT component) to equate to 40%. Since 2017, tax on tobacco has further increased every year.

The authorities’ efforts to reduce tobacco consumption have shown effects as the proportion of regular smokers among adults in South Africa has declined markedly over the past two decades (31.0% in 1994 and 19% in 2016). The tobacco tax policy is credited for the decrease in tobacco consumption (Van Walbeek, 2002). (Stacey et al., 2018) argue that a more aggressive excise tax policy could lead to improvements in health and raise revenue. They estimate that an excise rate of 60% on tobacco would result in a gain of 858 923 life years (Stacey et al., 2018). Efforts to reduce tobacco consumption should be pursued both by further increasing taxes and specific information and education campaigns. The draft tobacco bill presented by the government in May 2018 to further regulate sale and advertising of tobacco products and packaging is a move in the right direction.

Figure 2.16. Health risk factors are high

Alcohol consumption is high. 33.1% of above 15 years olds reported drinking alcohol and 15.9% and 2.7% of men and women respectively are alcohol dependent (Health System Trust, 2018). Moreover, of all drinkers, 43% reported binge drinking representing 14.1% of the total population. The average quantity of alcohol drunk per adult, at 7.5 litres, is below the OECD average, but still high (Figure 2.16).

Since 2002, South Africa has been increasing the tax on alcoholic beverages. In 2012, the alcohol tax burden as a percentage of the weighted average retail selling prices for wine, beer and spirits were 23, 35 and 48% respectively (National Treasury of South Africa, 2014). However, the tax burden (i.e. excise tax plus VAT) was changed in Budget 2015 to focus on excise tax component alone (i.e. removed the VAT component) to equate to 11%, 23% and 36% for wine, beer and spirits respectively. In almost all the following years, the tax on alcoholic beverages was raised with a different treatment for local beer with low alcohol content and wine, to limit the impacts on low-income individuals and on wine producers.

Policy measures targeted to reduce alcohol consumption should follow an integrated approach that extends beyond price incentives, including educational and preventive programmes. These include measures targeting underage drinking, drinking during pregnancy, drunken driving, and alcohol abuse behaviour such as binge drinking. Additional measures to reduce alcohol consumption could therefore include the banning of advertisement, restricting places of sale as well as strengthening preventive programmes targeted at vulnerable population groups, which tend to consume more alcohol (National Treasury of South Africa, 2014).

Improving the coherence and organisation of the health care system

Inefficient health spending structure

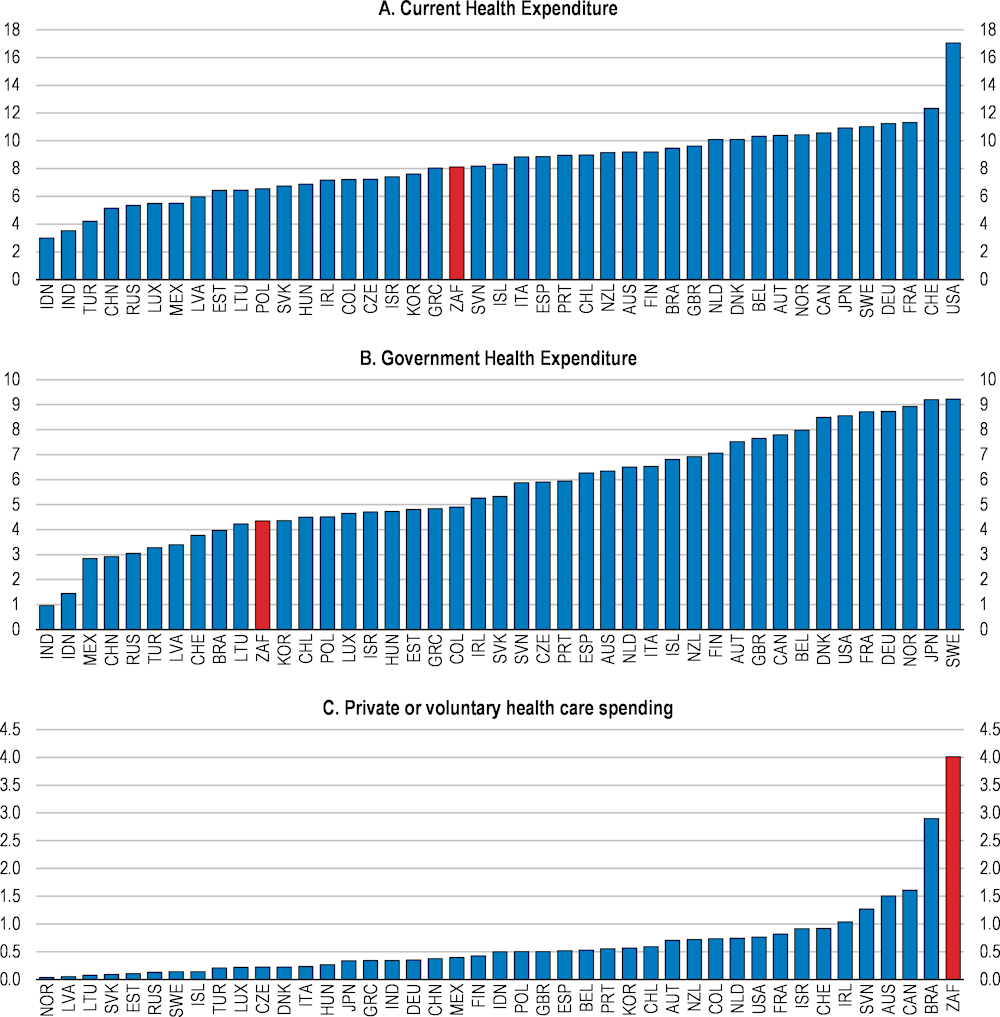

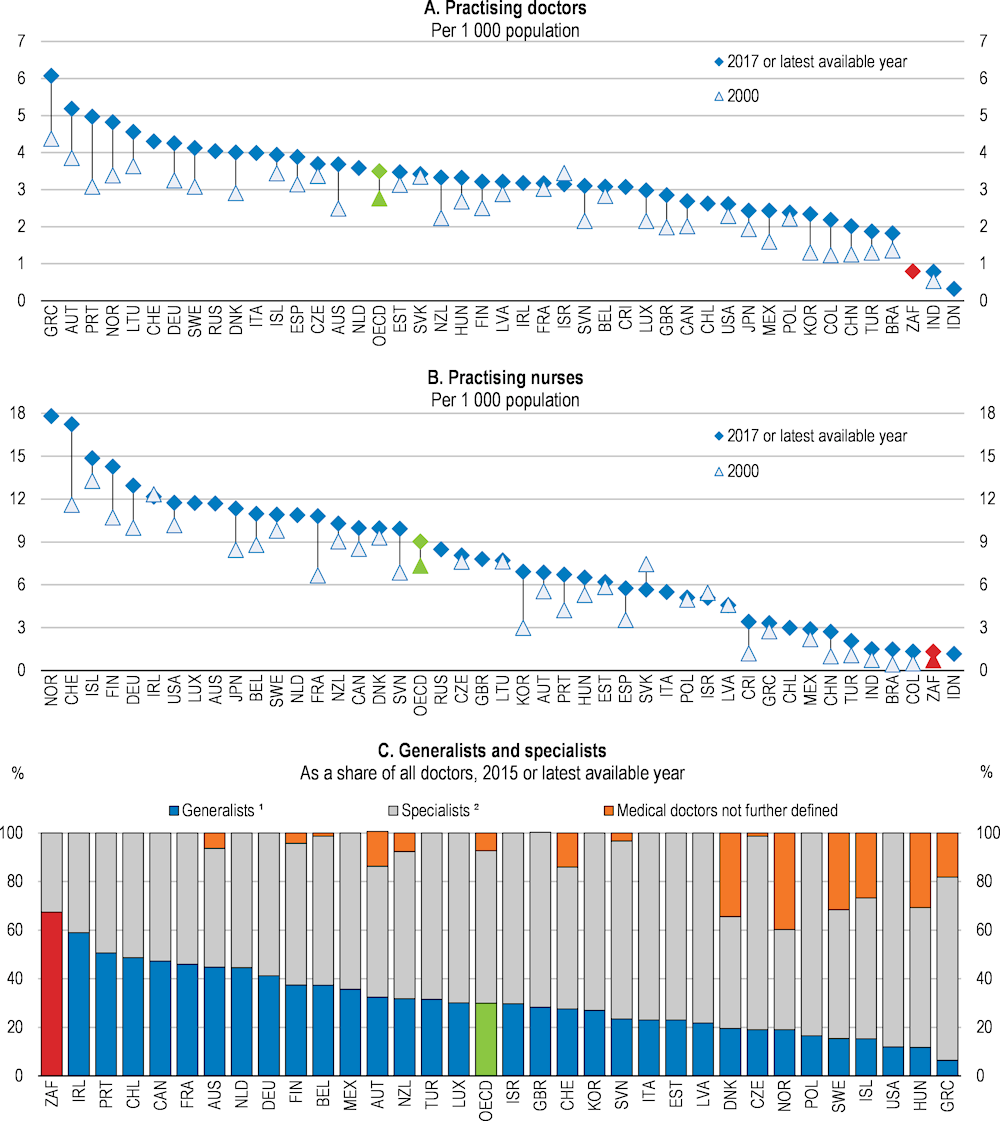

At 8.1 % of GDP in 2016, health spending seems high for an emerging economy and is comparable to the OECD average (Figure 2.17, Panel A). However, the total spending masks an unbalanced structure and important inefficiencies. In particular, government spending is low while private spending is the highest amongst OECD and emerging countries (Figure 2.17, Panel B and C). Government health spending has been increasing only slowly since 2010 by 0.1% of GDP per year and most of the increase has been due to wages and HIV/AIDS treatment.

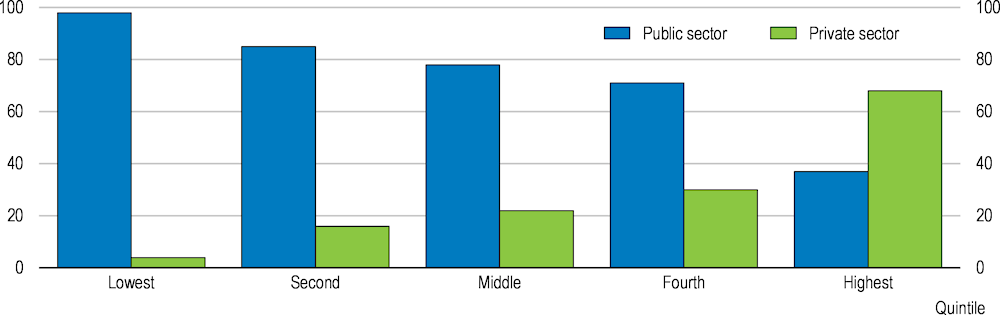

The unbalanced private and public structure of spending accentuates inequalities. Public health services cover all citizens but some people above a means-tested income threshold are subject to co-payments. However, private voluntary health insurance covers 16.9% of individuals, but amounts to half of the country’s health spending (Statistics South Africa, 2018b).

Many households not holding a private insurance use private facilities instead of free access to public facilities, because of perceptions of poor quality of health services and difficult access (waiting time and unsatisfactory conditions) of public health-care facilities. 27.4% of households indicated that they would go to private doctors, clinics or hospitals, even though they do not have a private insurance (Statistics South Africa, 2018b). This indicates that there is room to improve health spending. Inefficiencies are also high in the private health sector where unregulated price increases are not related to the quality of services (Competition Commission, 2018) (see section 2.4.3 below).

Figure 2.17. Health spending is mostly private

Spending as % of GDP, 2017

Within the public sector, there is room to improve the allocation and execution of health spending (James et al., 2018). South Africa has a three-level government structure (National, 9 provinces and 278 municipalities). Public providers owned by provinces and municipalities deliver most government health services. Provincial health budgets are transferred from national government, on average 80% from the allocation formula and the other 20% are conditional grants based on priority areas as HIV/AIDS interventions, infrastructure projects and are needs based (James et al., 2018). The allocation of conditional grants is the responsibility of the Department of Health and reflects differences in provincial needs.

Most of the inefficiencies in public health spending lie at the provincial level. The use of the budget allocated to the health sector at the provincial level is entirely a province-level decision. There are important disparities in the amount spent on health across provinces not necessarily related to health needs. More transparency is needed at the provincial level on the budget allocation to the different health care sectors to guarantee that the health sector is appropriately financed. Health facility budgets are not standardised across provinces (James et al., 2018). Regularly updating the budget allocation process at the provincial level will help to better match the needs of the different sectors. Developing diagnosis-related groups will help in assessing the needs of health care providers and give incentives to managers for better performance. Moreover, improving the capacity of district hospitals and managers of district health offices in budgeting would be an important first step to ensure their needs are better reflected in the budgets.

Finally, the wage bill and its strong increases are a binding constraint on public health providers’ activities. The growing number of personnel and substantial wage increases drive the rise in the wage bill, while the budget allocation by central and local government has not matched these increases in the recent years, crowding out maintenance of facilities and now freezing employment.

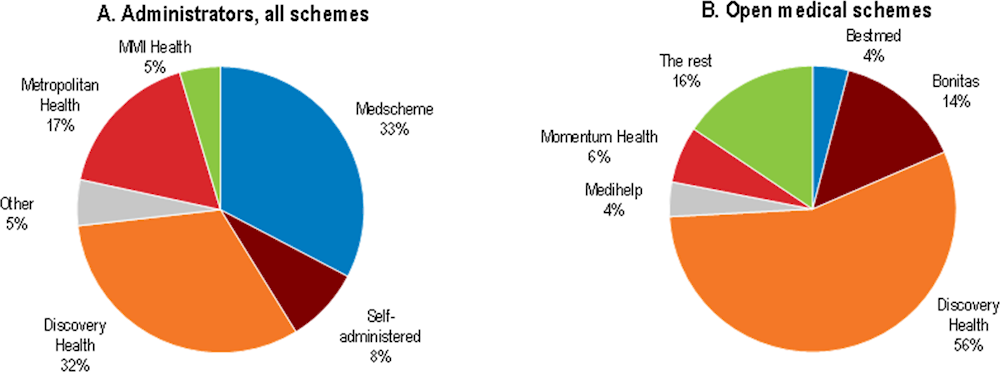

Challenges related to introducing a National Health Insurance scheme

The dual health system is not optimal in terms of funding arrangements and use of health facilities. While public health providers are for the benefit of all citizens, they receive those that are most exposed to diseases and the most fragile segments of the population. The lack of coordination between public and private health care facilities creates an overuse of public facilities while the prices of private facilities are high, due in part to lower volume.