This chapter describes market developments and medium-term projections for world cereal markets for the period 2024-33. Projections cover consumption, production, trade and prices for wheat, rice, maize and other coarse grains. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world cereal markets over the next decade.

OECD-FAO Agricultural Outlook 2024-2033

3. Cereals

Copy link to 3. CerealsAbstract

3.1. Projection highlights

Copy link to 3.1. Projection highlightsDemand growth decelerates as production is sustained by growing yields

Over the forthcoming decade, the growth of cereal demand is anticipated to slow compared to the previous ten years, primarily due to weaker expansions in feed demand, biofuels, and other industrial applications. Additionally, in many high and middle-income countries, the direct per capita food consumption of most cereals is nearing saturation levels, posing a constraint on overall demand growth. Much of the rise in food demand is attributed to population growth, particularly in low- and lower-middle-income countries. Population-induced growth in wheat and rice consumption is foreseen in Asia, whereas in Africa, an increase in the consumption of millet, sorghum, and white maize is expected. Furthermore, the increasing significance of rice in African diets is projected to result in ongoing rises in its per capita food utilization in the region.

While cereals generally are less perishable compared to other food items, certain cereal-based food products such as bread or pastries can still be highly perishable. Consequently, and because cereals represent a significant portion of global consumption (about 45% of calories), their contribution to overall calorie loss and wastage exceeds 50%. If current trends persist, projections suggest that food loss and waste volumes within the cereal sector will increase by approximately 11% by 2033 relative to present levels, reflecting the anticipated increase in food utilization.

Over the next decade, the growth in global cereal production will stem from increasing productivity, in particular enhanced yields and the more intensive utilisation (multi-cropping) and to a lesser extent expansion of cultivated land. This anticipated increase is credited to broader accessibility and adoption of new and improved seed varieties, as well as the implementation of more rigorous and efficient input usage alongside improved agricultural techniques.

Global cereal production is projected to rise from its current level by approximately 350 Mt to 3.2 bln t by 2033, mainly due to increases in maize and wheat production. Asian countries are expected to contribute around 40% of this growth, similar to trends observed over the last decade with the People’s Republic of China (hereafter “China”) and India remaining as the leading producer of rice. Africa, with maize and other coarse grains as primary commodities, is anticipated to contribute larger shares to global cereal production growth compared to the previous decade. Latin America and the Caribbean will also play a significant role, particularly in maize production. However, Oceania is unlikely to sustain the record production levels seen in the base period, assuming average growing conditions (Figure 3.1).

In 2023, 17% of total global cereal production were traded internationally, with variations across different cereals, ranging from 10% for rice to 24% for wheat. This distribution as well as the share of production traded is expected to remain steady over the next decade. Asia is expected to retain its status as the world's largest rice-exporting region, while nations in Latin America and the Caribbean are anticipated to primarily import wheat and export maize. Moreover, many countries in Africa and Asia are projected to increasingly depend on cereal imports in the coming decade.

World cereal trade is anticipated to grow by 16% by 2033, reaching a total of 551 Mt. Wheat is expected to contribute 35% to this growth, with maize accounting for 52% and rice for 7%. The Russian Federation (hereafter “Russia”) is projected to maintain its position as the largest wheat exporter, providing 26% of global exports in 2033 as compared to 20% in the base period. The United States will surpass Brazil and become the primary maize exporter, while the European Union will continue as the main exporter of other coarse grains. Leading rice exporters will include India, Thailand, and Viet Nam, with Cambodia, Pakistan and Myanmar playing increasingly significant rice export roles. The expected export growth by the latter suppliers reflects a reaction to India’s implementation of rice export restrictions in July/August 2023. These restrictions are assumed to remain in place throughout the projection period, but their effects are assumed to be partly mitigated by exceptions approved by the Indian Government since instituting them on food security grounds. Chinese feed demand is expected to continue influencing cereal markets, with projections assuming imports of maize increasing by 16% to reach nearly 27 Mt by 2033.

As anticipated in previous Outlook editions, wheat and coarse grain prices have decreased from their recent highs, whereas international rice prices hit a 15-year peak in 2023. Under the assumptions of average yields and geopolitical stability, the long-term trajectory of declining prices in real terms may recommence and persist until 2033.

As evidenced in the recent past, trade disruptions due to political instability and attempts to control domestic inflation and food availability can have a significant effect on future cereal markets. Some countries have expressed their intention to develop strategies to manage domestic prices, such as stock building, export restrictions, import barriers and increasing subsidies for producers and consumers, but the implementation of these measures is often unclear and financially difficult to sustain. Moreover, disruptions in transport and the importance of choke points as apparent from recent events become increasingly important. Conversely, production growth could face limitations due to the adverse effects of climate change on yields, limited access to new technologies in certain regions, and inadequate investments. Heightened environmental concerns and the implementation of new environmental policies could also temper yield growth.

3.2. Current market trends

Copy link to 3.2. Current market trendsCereal prices below recent peaks

During the 2023/2024 season, food commodity markets were under general downward pressure and exhibited less volatility, despite facing external challenges such as shipping disruptions. This trend mostly reflected significant year-on-year declines in grain prices, while rice prices increased.

Wheat and maize prices continued their downward trend from their near-record and record levels reached in 2022 following the outbreak of Russia’s war against Ukraine. By 2023, wheat and maize prices reached their lowest values since 2021. Ample supplies, especially in Russia (wheat) and Brazil (maize), and strong competition among exporters underpinned the downward trend in world wheat and maize prices. Reduced uncertainty as a result of continued shipments from Ukraine by alternative routes, along with lower energy and input prices also contributed to the overall softer market sentiment.

In contrast, 2023 proved more tumultuous for the global rice market. International rice prices soared to a 15-year peak, spurred initially by apprehensions regarding the adverse production effects of El Niño and by a step-up of export restrictions by India in July and August 2023. Since then, further prices increases have been averted by signs that the actual impact of El Niño on global rice production would be less severe than expected, combined with sizeable exceptions to export restrictions approved by India and a step-up of shipments by other exporters. Nevertheless, reflective of the lingering uncertainties surrounding trade policies and weather conditions, in March 2024, international rice prices remained high and about 14% above their year-earlier levels.

3.3. Market projections

Copy link to 3.3. Market projections3.3.1. Consumption

Asian countries will lead demand growth of cereals for food and feed

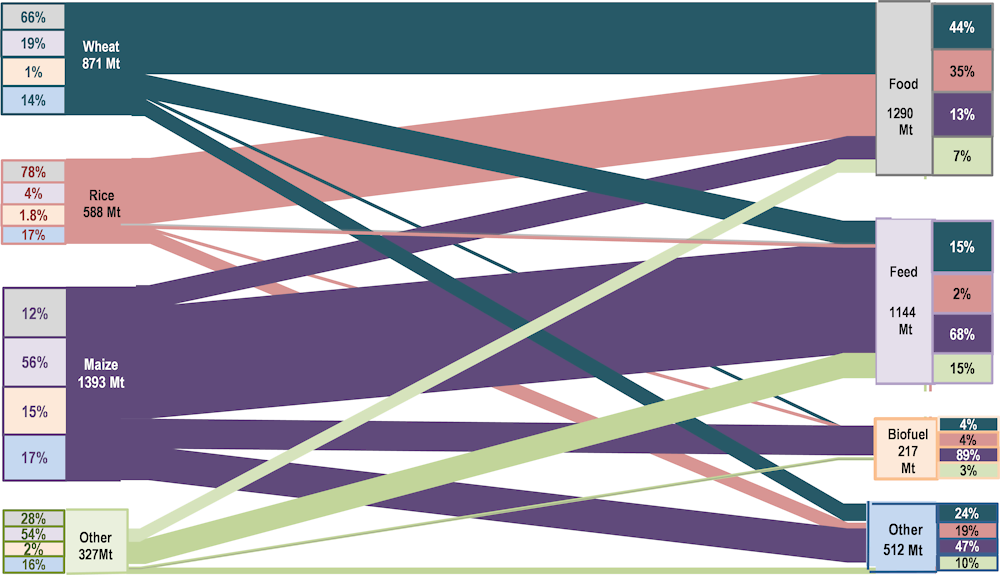

Cereal demand will continue to be dominated by food use closely followed by feed use. In 2033, 41% of all cereals will be directly consumed by humans, while 36% will be used for animal feeds. Biofuels and other uses are projected to account for the remaining 23%. However, these shares differ across the different cereal types. While wheat and rice are mainly used for food, feed use dominates maize and other coarse grains (Figure 3.2).

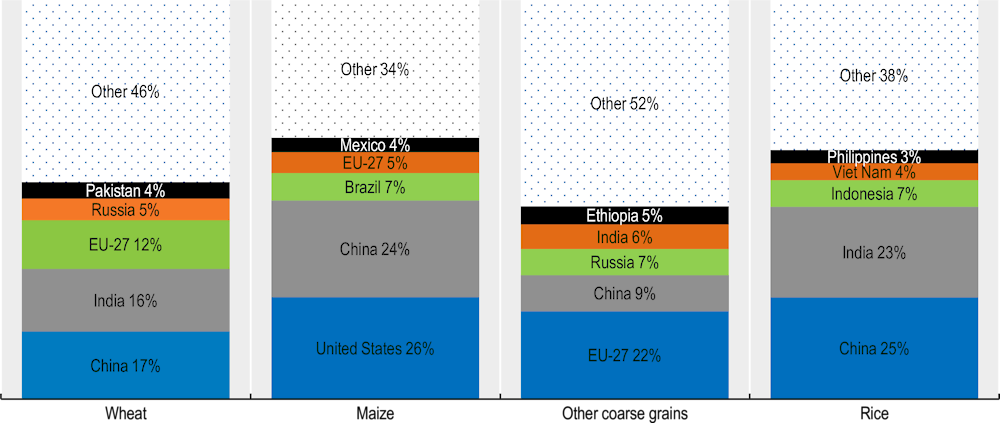

Between 48% and 66% of global cereal consumption occurs in the top five consuming countries for each commodity, which is rather less concentrated than production (Figure 3.3). Global use of cereals is projected to increase slightly from 2.8 bln t in the base period to 3.2 bln t by 2033, driven mainly by higher food use (+162 Mt), followed by feed use (+127 Mt). Asian countries will account for slightly more than half of the projected demand increase.

Increased global consumption of cereals for feed is expected to be dominated by maize followed by other coarse grains, wheat and rice over the next decade. Consumption of cereals for food is expected to increase at a higher rate than in the previous decade as per capita consumption is projected to increase in several lower- and middle-income countries.

Figure 3.2. Global use of cereals in 2033

Copy link to Figure 3.2. Global use of cereals in 2033

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 3.3. Global cereal demand concentration in 2033

Copy link to Figure 3.3. Global cereal demand concentration in 2033

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Wheat consumption is expected to be 11% higher in 2033 than in the base period. Four countries, India, Pakistan, the Arab Republic of Egypt (hereafter “Egypt”), and China account for more than half of this increase. Global use of wheat for food is projected to increase by 64 Mt but to remain stable at about 66% of total consumption; growth will be similar to the previous decade, in spite of the slowing rate of increase in world population.

Globally, the projected increase in consumption of wheat for food is more than three times larger than that for feed, especially in Asia, primarily in Western Asia and Central Asia where wheat is the mainstay in diets for a large share of the population. Moreover, there is increasing demand for processed products that call for higher quality, protein rich wheat, produced in the United States, Canada, Australia and, to a lesser extent, in the European Union and Russia. Countries in North Africa and Western Asia, notably Egypt and the Republic of Türkiye (hereafter “Türkiye”), and the Islamic Republic of Iran, will remain major consumers of wheat with high levels of per capita consumption. Global production of wheat-based ethanol is expected to recover mainly in India offsetting the reduction in other countries.

Rice is primarily consumed as food and is a major food staple in Asia, Latin America and the Caribbean, and increasingly in Africa. Total world rice consumption is expected to increase by 0.9% p.a., at a same pace as during the last decade, with Asian countries accounting for 66% of the projected increase, largely due to population rather than per capita consumption growth (Table 3.1). Across the various regions, Oceania and Africa are projected to see increases in per capita food intake of rice. At the global level, the average per capita food use of rice is projected to increase by 1.7 kg to around 52 kg per year.

Table 3.1. Rice per capita food consumption

Copy link to Table 3.1. Rice per capita food consumptionkg/person/year

|

2021-23 |

2033 |

Growth rate (% p.a.) |

|

|---|---|---|---|

|

Africa |

25.1 |

28.5 |

0.79 |

|

North America |

12.2 |

13.5 |

0.48 |

|

Europe |

7.1 |

7.2 |

0.27 |

|

Oceania |

19.0 |

21.5 |

1.11 |

|

Latin America and Caribbean |

24.9 |

24.9 |

0.17 |

|

Asia |

72.2 |

75.0 |

0.14 |

Source: OECD/FAO (2024), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global maize consumption is projected to increase by 1.2% p.a., a much slower pace compared to 2.1% p.a. in the previous decade. This increase is principally driven by higher incomes that translate into higher feed demand, which accounts for the largest share of total utilisation, maintaining 56% from the base period to 2033. Asian countries will account for 56% of the increase in feed consumption (nearly half of this in China) due to their rapidly expanding livestock sectors. Feed demand globally is expected to rise by 99 Mt to 777 Mt, mainly in China, the United States, Brazil, Argentina, Mexico, India, Viet Nam, Indonesia, and Egypt. Consumption in Southeast Asia will increase due to its fast-growing poultry industry.

The use of maize as food is expected to increase primarily in Sub-Saharan Africa where population growth is strong. White maize will remain an important staple, accounting for about a quarter of total caloric intake. Growth in maize consumption as food in African countries is expected at about 2.5% p.a. on average.

Globally, maize use for biofuel production is expected to increase at a much slower rate than in the past two decades as national ethanol markets of key producers are constrained by biofuel policies. Brazil and the United States together account for more than 80% of the increase.

World utilisation of other coarse grains is projected to increase by nearly 29 Mt, or 0.8% p.a., over the next ten years, compared to 0.1% p.a. in the previous decade. This will be driven by greater use in African and Asian countries, while consumption is expected to remain stable in high-income countries. The food share of total consumption is projected to increase from about 26% in the base period to 28% by 2033. Sub-Saharan African countries, especially Ethiopia, rely heavily on millet as a food source owing to its resistance to droughts and the diverse climate conditions in the region.

Cereals account for more than 50% of calories lost and wasted globally. Most post-harvest losses of cereals occur during transport and processing, and are, currently estimated to be around 5% of global production. Additional waste occurs during distribution at the retail stage, reducing global food availability by another 5%, while household waste accounts for approximately 14%. If these proportions remain unchanged over the next decade, it is projected that food loss and waste volumes in the cereal sector will increase with global consumption by 11% by 2033 compared to current levels. This calls for further efforts to address food loss and waste in the cereal sector that may involve a combination of technological innovations, infrastructure development, policy interventions, consumer education, and behavioural changes throughout the supply chain. Initiatives such as improved storage facilities, better transportation networks, standardised labelling and donation programs have been implemented in some regions to mitigate these issues. Additionally, raising awareness about the environmental and social impacts of food waste is crucial in fostering a more sustainable food system.

3.3.2. Production

Improved technology and cultivation practices sustain yield and production growth

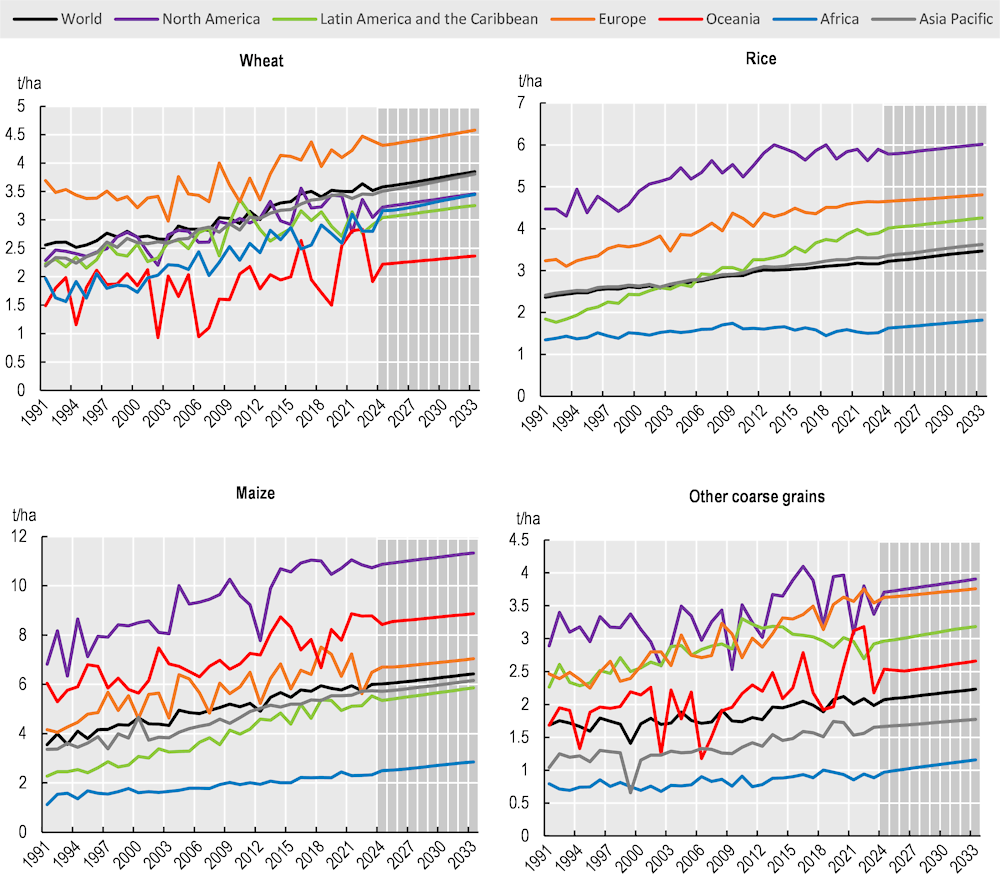

The global harvested area of cereals is expected to grow by 19.2 Mha (3%) by 2033. It will expand mainly in Latin American and the Caribbean by about 5.5 Mha, notably in Argentina and Brazil and more than half of this increase reflects increases in double-cropping production practices. Globally, wheat, maize and rice areas are projected to increase respectively by 2%, 6% and 2%, while the other coarse grains areas are expected to remain unchanged. Decreasing harvested areas of rice in China, Japan and Brazil will be offset by gains in some Asian and African countries. Compared to the previous decade, future land availability will be limited as many governments place constraints on converting forest or pasture into arable land, and land is taken by ongoing urbanisation. Increased global production is therefore expected to be largely driven by intensification. This growth in yields from improving technology and cultivation practices, in middle-income countries in particular, is expected to sustain future cereals production. Globally, yields are projected to grow by around 8% for wheat, 9% for maize, and 10% for rice and other coarse grains.

Nevertheless, regional disparities in cereal yields are expected to persist, with no convergence anticipated between higher and lower yield regions (Figure 3.4). Several factors contribute to these variations: natural conditions vary significantly, leading to heterogeneous regional yield potentials, diverse crop varieties exhibit differing yield performances, and optimal yields may not necessarily align with maximal yields, particularly when other factors like available land are not constraining. Despite these differences, countries in Africa, Latin America and Asia holds substantial untapped potential for further yield increases.

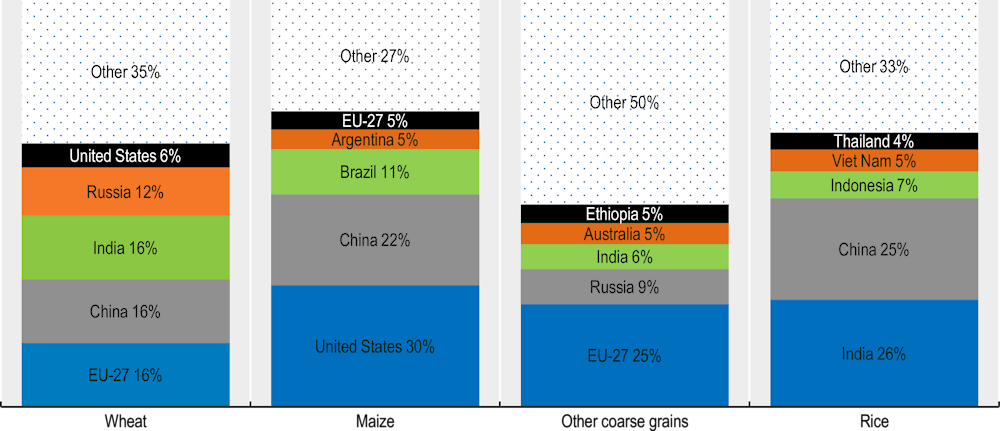

Global wheat production is expected to increase by 83 Mt to 872 Mt by 2033, of which 44 Mt will be in Asia (Figure 3.1), a higher growth rate than in the last decade. India, the world’s third largest wheat producer, is expected to provide the largest share of the additional wheat, accounting for more than 30% of the global production increase, driven by yield improvements and area expansion in response to national policies to improve self-sufficiency. There will also be significant production increases in Russia, Canada, Argentina, the United States, Türkiye, and Pakistan. The European Union is projected to become the largest producer of wheat by 2033 (Figure 3.5), overtaking China, where wheat production is adjusting to lower demand from negative population growth.

Figure 3.4. Regional cereal yields

Copy link to Figure 3.4. Regional cereal yields

Note: Oceania has been dropped from the rice chart as the crop is not so relevant for that region.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global rice production is expected to grow by 60 Mt to reach 587 Mt by 2033. Yield improvements are expected to drive this growth. Production expansions in Asian countries, which account for the bulk of global rice output, are expected to be robust. The highest growth is expected in India, which will become the world’s largest rice producer by 2033 (Figure 3.5), followed by the LDC Asian region, Viet Nam, the Philippines and Thailand. India will remain a major producer of indica and basmati rice.

As with most other major rice producers, projected output gains are expected to rely on yield improvements, amid expectations in China that efforts to move least productive land out of cultivation will continue. Production in high-income countries, such as Korea and Japan is expected to continue a downward trend. Output in the European Union will remain close to base period levels, in the United States and Australia it will expand by about 0.5% and 2.2% p.a. respectively.

Global maize production is expected to grow by 187 Mt to 1.40 bln t by 2033, with the largest increases in the United States and China, followed by Brazil, Argentina and India. Increased production in Brazil will be largely driven by higher second-cropped maize following the soybean harvest. Production growth in the United States is expected to be below the global average of 1.2% p.a., at 0.6% p.a. over the next ten years. In Sub-Saharan Africa, total maize output is projected to increase by 28 Mt, of which white maize will account for the largest share.

Global production of other coarse grains – sorghum, barley, millets, rye, and oats ‒ is projected to reach 329 Mt by 2033, up 30 Mt from the base period. African countries will contribute more than 50% of this increase. Ethiopia, India, Russia, Brazil, and Türkiye will be contributing most to global production growth. Output in the European Union will continue its decreasing trend due to decreasing biofuel feedstock demand.

Figure 3.5. Global cereal production concentration in 2033

Copy link to Figure 3.5. Global cereal production concentration in 2033

Note: Presented numbers refer to shares in world totals of the respective variable.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

3.3.3. Trade

Trade in cereals will remain buoyant but with changing country shares

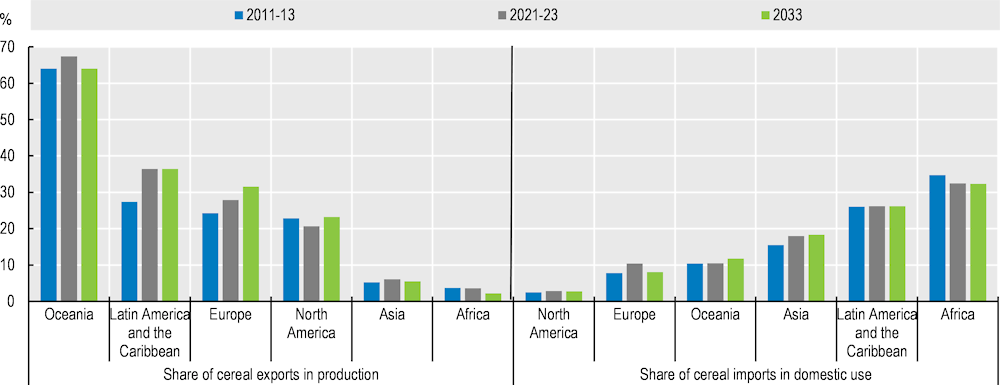

Trade in cereals currently accounts for about 17% of global consumption and is projected to slowly increase until 2033. Traditionally, the Americas and Europe supply cereals to Asia and Africa, where growing demand for food and feed from increasing populations and expanding livestock sectors is rising faster than domestic production. This buoyant trend is expected to continue over the next decade with exports of cereals increasing by 16% from the base period to 2033. Figure 3.6 illustrates the importance of cereal trade relative to production and consumption. Oceania and Latin America and the Caribbean are expected to have among the highest shares of cereal exports in national production, 64% and 37% respectively by 2033. Amongst all regions, it is Africa where imports of cereals contribute most to domestic consumption and by 2033 almost 32% of domestic cereal use in Africa will originate from non-African countries.

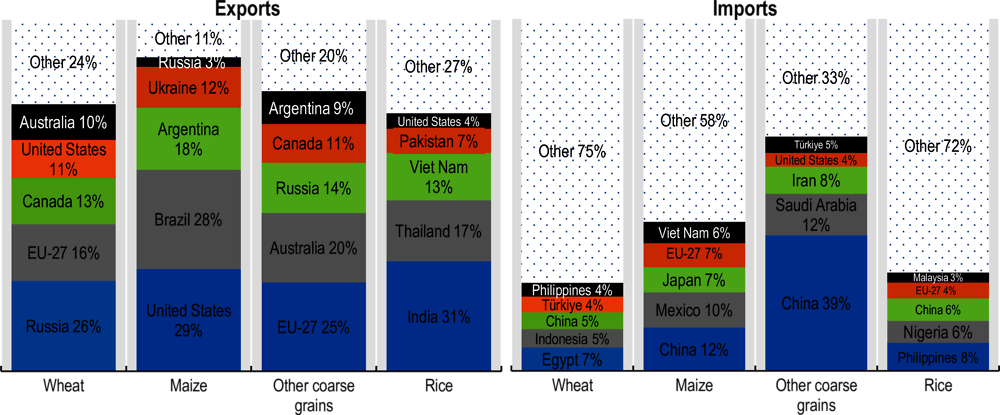

Wheat exports are expected to grow by 26 Mt to 220 Mt by 2033, with Russia expected to maintain its position as the main exporter, accounting for 26% of global exports by 2033 (Figure 3.7).

Figure 3.6. Trade as a percentage of production and consumption

Copy link to Figure 3.6. Trade as a percentage of production and consumption

Note: These estimates include intra-regional trade except for the European Union.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The European Union is the second largest wheat exporter and will continue to account for 16% of global trade in 2033, with exports projected to surpass the record volumes of 2019. Canada is expected to regain export market share after a very bad harvest in 2021 and reach 13% of global wheat exports by 2033. The United States, Canada, Australia and the European Union are expected to retain the higher quality protein wheat markets, particularly in Asia. While Russia plays a role in these markets, it is expected to remain more competitive in soft wheat markets, such as North Africa, Sub-Saharan Africa, Western Asia and Central Asia. The North African and Near East regions are set to slightly increase their share of wheat imports in total trade from 25.7% currently to 26.4% over the next decade.

During the past decade, rice trade grew at 2.2% p.a. This is expected to increase to about 2.3% p.a., with overall export volumes rising by 12 Mt to reach 66 Mt by 2033. In the case of India, the world’s largest rice exporter, projections assume that no change in its rice export policies will take place over the projection period, in particular that the bans on Indian exports of broken rice and on non-basmati white rice will remain in place. These are expected to keep overall Indian rice exports below the 22 Mt peak registered in 2022. At the same time, since instituting these export restrictions, the Indian Government has allowed exceptions to its rice exports bans on food security grounds. The projections assume that these exceptions will continue in the projection period, thereby sustaining a still sizeable volume of overall Indian rice exports through 2033. Amid prospects of sustained demand for these qualities, India’s more limited participation in international broken and non-basmati white rice trade are expected to bolster shipments by other competitive rice exporters of these qualities, including Pakistan and Myanmar. In the case of Viet Nam, ongoing changes in the varietal make up of production and increased focus on cultivating higher quality and non-indica strains could also help Viet Nam expand its market share in regions other than Asia. Meanwhile, Thailand is projected to remain the second largest rice exporter but is to continue facing strong competition for markets.

Less developed countries in Asia, particularly Cambodia and Myanmar, are projected to register strong export expansion, with their rice shipments collectively increasing by 146% from 4.3 Mt in the base period to 10.5 Mt by 2033, amid expectations that large exportable supplies will allow these countries to capture a greater share of Asian and African markets. Historically, Indica rice has accounted for the bulk of rice traded internationally. However, demand for other varieties is expected to continue to grow over the next decade.

Imports by China, the largest importer of rice during the base period, are expected to decrease from 5 Mt in the base period to about 4 Mt in 2033, well below the peak in 2015. Imports are projected to increase significantly in African countries, where growth in demand continues to outpace production growth. Especially in Nigeria the third largest importer of rice, imports increase by 2.3 Mt to 4.0 Mt by 2033. Africa’s share of world imports is projected to increase from 32% to 41%.

Maize exports are expected to grow by 35 Mt to 218 Mt by 2033. The export share of the top five exporters – the United States, Brazil, Argentina, Ukraine, and Russia will account for 89% of total trade by the end of the projection period. The United States is expected to regain the top maize exporter position, but the export share will stay below the average of the past decade. Brazil, which was the leading maize exporter in 2021 and 2022, benefitting from lower US exports, will be the second largest exporter. But exports of both countries are projected to be very close in 2033 at 63 and 61 Mt respectively. The LDC Sub-Saharan African region is expected to remain virtually self-sufficient in maize, with white maize continuing to play a key role for food security as a mainstay of local diets. South Africa will remain a regional supplier, but expansion will be limited as they produce genetically modified organisms (GMO) varieties that face import restrictions in neighbouring countries.

Figure 3.7. Global cereal trade concentration in 2033

Copy link to Figure 3.7. Global cereal trade concentration in 2033

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The international trade volume of other coarse grains, dominated by barley and sorghum, is much smaller than for maize or wheat. Global exports are expected to increase by 3.7Mt to reach 49 Mt in 2033. The top five exporters – the European Union, Australia, Russia, Canada and Argentina are projected to account for 80% of global trade by 2033, four percentage points above the share in the base period and mainly driven by export increases in Russia and the European Union. The five major importers – China, Saudi Arabia, the Islamic Republic of Iran, Türkiye, and the United States – absorb almost 67% of global trade, with China expected to account for 39% by 2033.

3.3.4. Prices

Prices for cereals in real terms are expected to decline over the next decade

Nominal wheat prices are expected to decrease further from their 2023 level before returning to their medium-term trend. The price is then projected to increase to USD 287/t by 2033. Similarly, maize and other coarse grain prices are also expected to return to their medium-term path. The global maize price is expected to reach USD 218/t and the price for other coarse grains (measured by the feed barley price fob Rouen) is projected to reach USD 249/t (Figure 3.8).

The reference export price for milled rice (FAO All Rice Price Index normalised to India 5%) is also expected to decrease as exceptions to export restrictions allowed by India alongside a step-up of shipments from other competitively priced exporters of rice stabilize exportable supplies relative to 2023. Over the medium term, demand from countries in the Far East, Africa, and the Middle East is expected to grow, but rice supplies from exporters are expected to lead to concomitantly rise, thereby generating only a small increase in nominal prices to USD 467/t by 2033

Over the medium term, prices for wheat, maize, other coarse grains and rice are expected to decline to 2033 when adjusted for inflation (real terms).

3.4. Risks and uncertainties

Copy link to 3.4. Risks and uncertaintiesA much more volatile market and policy environment in the next decade?

More than most other commodities, grain markets have been markedly affected by the effects of Russia’s war against Ukraine given their major roles in international markets, especially for wheat and maize, as well as fertilisers and fossil fuels. While the tension on cereal markets has decreased and the reduced export expectations for cereals for Ukraine seem to be priced into current markets, this could change in the future.

Transport disruptions as experienced in recent events in the Panama and Suez Canals highlight the increasing importance of choke point. Such events together with increasing transport costs could form additional barriers to trade in the future.

Several other factors could impact on the cereals market that are not reflected in the current projections. While normal assumptions for weather lead to positive production prospects for the main grain-producing regions, extreme weather events accentuated by climate change may cause higher volatility in cereal yields, thereby affecting global supplies and prices. There are heightened risks in some regions of water scarcity constraining production. Increased regulations related to climate change or sanitary measures could increase costs.

The policy environment will be crucial. The reinforcement of food security and the focus on increased sustainability in anticipated reforms (e.g., the Farm to Fork Strategy in the European Union) as well as policies favouring biofuels will heighten competition in the demand for cereals. China’s domestic policies, which are an increasing influence on import demand as well as domestic production, are also crucial for future developments in cereal markets. Trade restrictions could provoke market reactions and changes in trade flows similar to those provoked by grains and rice export measures in the past and could have significant effects on availability and affordability of food staples, especially in low and medium income countries. Export regulations in Argentina are a major uncertainty for the coming years. While the Outlook assumes export taxes of wheat and maize at their current levels of 12%, discussions of an increase to 15% and their eventual elimination are ongoing. These changes will clearly impact Argentina’s export prospects.

For several years, China's grain imports have consistently exceeded official tariff rate quotas. The Outlook predicts that the country's feed net deficit will continue to grow in the medium term, leading to China maintaining significant shares of the grain trade. The projections in the Outlook are highly sensitive to this assumption.

The increasing reliance on grain imports for several countries, especially in the Near East and North Africa (NENA) region, as projected in this Outlook will increase their vulnerability to persistent trade disruptions that cannot be buffered by domestic stocks. A functioning and reliable trading system is therefore key for food security in these regions.

Crop pests and animal diseases pose ongoing threats that can disrupt markets, particularly in regions with limited resources to manage their impacts, and in regions where plant protection is increasingly restricted. Recent outbreaks of locusts and fall armyworms have severely affected food security in various Asian and African nations. Similarly, the African Swine Fever outbreak in Southeast Asia has led to decreased feed demand, illustrating the significant economic ramifications of such diseases.