This chapter outlines investment trends in Bulgaria. It provides information on the evolution of inward and outward FDI flows and stocks and compares Bulgaria’s performance to other similar countries. It also provides information on the relative importance of greenfield FDI and mergers and acquisitions. Bulgaria has performed relatively strongly in attracting foreign investment, but there is need to diversify FDI by destination sector, source country and mode of entry as well as support further internationalisation of domestic firms.

OECD Investment Policy Review: Bulgaria

2. Economic trends and the role of investment

Abstract

Introduction

Bulgaria has undergone a significant transformation over the past three decades. A broad range of reforms has been designed to accomplish macroeconomic stabilisation and the transition from a planned economy to an open, market-based, upper-middle‑income economy anchored in the European Union (EU).1 The increased co‑operation with the World Trade Organisation (WTO) – that Bulgaria joined in 1996 – and the EU in the context of the accession process acted as an external anchor for reforms. Bulgaria applied to become an EU Member State in December 1995 and has been an EU member country since 1 January 2007.

Through the process, Bulgaria has engaged in many structural reforms including privatisation of State‑Owned Enterprises (SOEs), adoption of a favourable investment regime, and liberalisation of trade, and the strengthening of the tax system. As a result, the 2000s were a decade of economic growth and improvements in living standards except the year 2009 when the global financial and economic crisis affected Bulgaria’s economy. Since it joined the EU in 2007, Bulgaria has made additional progress, with living standards raising from 41% of the EU average in 2007 to 53% in 2019, measured in terms of purchasing power parity according to figures released by EU statistics agency Eurostat. These achievements have also been reflected in the pre‑crisis sustained increase of foreign direct investment (FDI) inflows, which in turn played an important role in Bulgaria’s development. As the global financial crisis started to spill over Bulgaria, investment activity contracted substantially and, despite the recently witnessed recovery of business investment, remained below pre‑crisis levels in 2019.

The COVID‑19 pandemic sent shockwaves through the Bulgarian economy, resulting in a revision of the 2020 GDP from expected growth of about 3% to a 4.2% contraction.2 Notwithstanding the decline of FDI in the first half of 2020 due to the COVID‑19 crisis, by the end of 2020 Bulgaria recorded more FDI inflows than in 2019. According to estimates from the Bulgarian National Bank at the time of this Review, FDI inflows reached approximately EUR 2.1 billion in 2020, an increase of about EUR 590 million compared to 2019 when FDI inflows amounted to approximately EUR 1.5 billion. Given the role that investment has played in Bulgaria’s development during the past two decades, attracting more and better investment, including FDI, has taken central stage in the National Development Programme: Bulgaria 2020 (NDP BG 2020) and the National Development Programme BULGARIA 2030 (NDP BULGARIA 2030). FDI has been seen as potentially mitigating the impact of the COVID‑19 crisis and reinforcing the economic recovery of countries by financing the public debt, creating more and better-paid jobs, decreasing poverty, and boosting productivity, among others (WB, 2020a).

This chapter presents Bulgaria’s situation in terms of its overall economic performance and FDI trends over the past three decades to provide key insights into the role and evolution of foreign investment in the Bulgarian economy.

Bulgaria’s economic performance

Bulgaria has experienced a significant transformation over the past decades. The transition from a planned economy to an open, market-based economy begun in 1991. It was initially hampered by slow institutional restructuring, opaque privatisation, high indebtedness, a deep economic and banking crisis, and a loss of savings. GDP growth was correspondingly low and the promises of convergence failed to materialise. This period was characterised by a low level of foreign investments due to macroeconomic and political instability in the country.

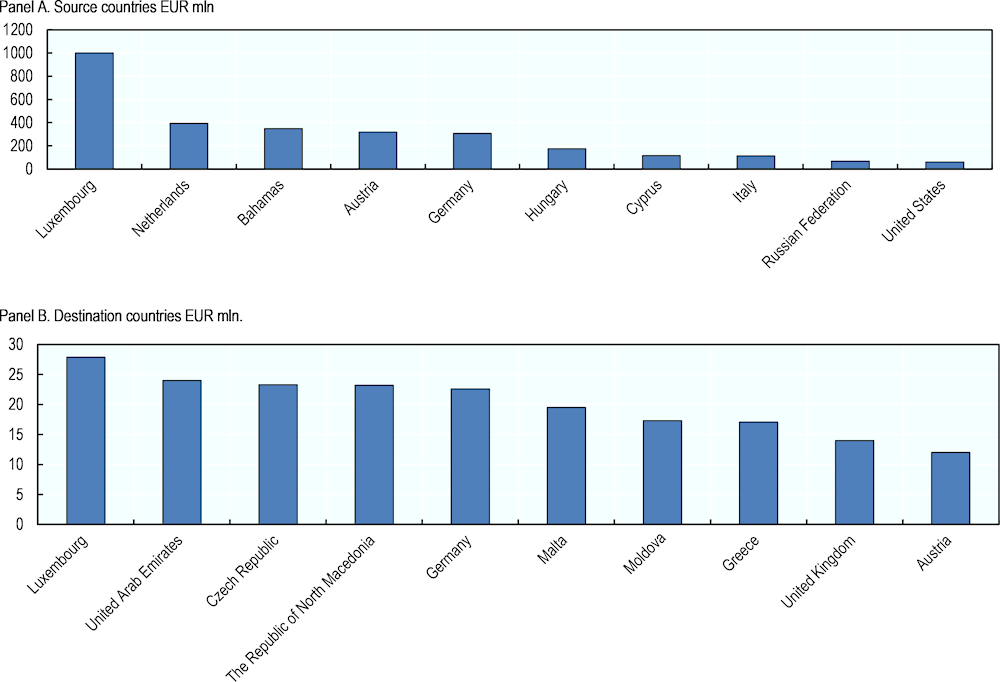

In 1996, Bulgaria faced a severe economic and banking crisis, which culminated in February 1997 with a short period of very high inflation and important shortages of basic items. The situation started to improve in the late 1990s thanks to the introduction of the currency board in 1997 as the key component of a broad macroeconomic stabilisation programme, the deepening of structural reforms, and the legislative and institutional harmonisation with the EU ahead of the 2007 accession. With the rule of law more firmly established, the 2000s were a decade of economic growth and improvements in living standards (e.g. lower incidence of unemployment and poverty and longer life expectancy at birth). Substantial improvements in several dimensions of material and human well-being marked this period. Bulgaria’s GDP annual growth marked its highest peak in 2005 with the rate of 7.2% and then decreased to 0.6% in 2010 because of the global financial crisis.

For the 2010‑19 period, Bulgaria’s GDP growth fluctuated between 0.5% and 4% per year (Figure 2.1). In PPP terms (current international USD), GDP per capita considerably increased from USD 17.5 000 (approximately EUR 14 700) in 2010 to USD 23 300 (approximately EUR 19 600) in 2019. Poverty declined from 8.5% in 2015 to 7.1% in 2018 (at the USD 5.5 per day line, approximately EUR 5.0).

Figure 2.1. GDP growth and GDP per capita in Bulgaria, 1990‑2019

Note: Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 USD. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

Source: World Bank (2021), World Bank national accounts (database), https://data.worldbank.org/country/bulgaria.

The most recent period, prior to the pandemic, witnessed growing optimism, with annual GDP growth averaging 3.6% in the years 2015‑19. For example, real GDP expanded by 3.7% in 2019. Exports, underpinned by growing links with EU value chains (notably with Germany and Italy), as well as strong household consumption have been the main driver of economic growth. Private consumption expanded robustly thanks to low inflation and favourable labour market conditions. The employment rate for the 20‑64 age group3 reached 72.4% in 2018, while the unemployment rate4 decreased to 5.2% in 2018 (EC, 2020). In 2019, Bulgaria recorded even better results, with a 4.2% unemployment rate.5

While some of the progress before the pandemic has been wiped out by the global economic crisis, even in the most difficult time inflation was kept low. The fiscal deficit was brought down to less than 1% of GDP in 2012‑13 from 4.2% in 2009; and in 2011 Bulgaria exited the excessive fiscal deficit procedure. Bulgaria’s general government debt decreased to 20.2% of GDP at the end of the fourth quarter of 2019, remaining the second lowest in the EU at that time.6

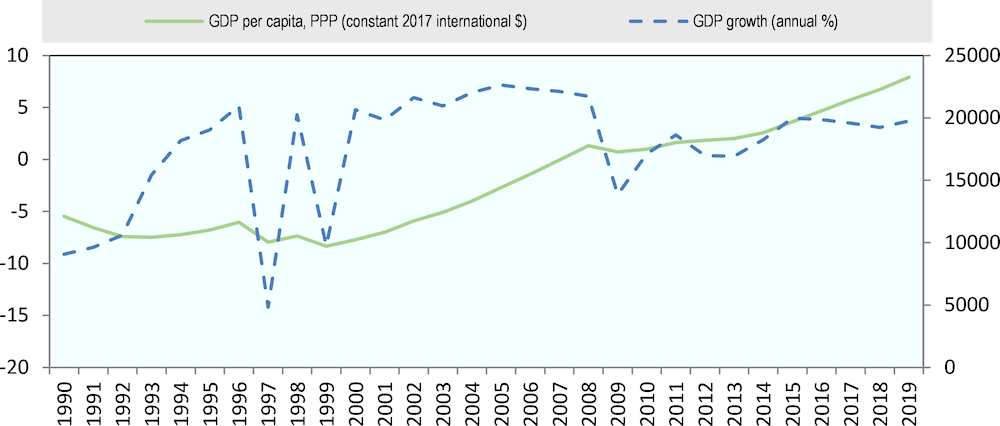

The past years also led to profound changes in the economic structure, especially in exports, which have proved particularly important given the small size of the economy and thus the importance of trade for Bulgaria’s overall economic performance. Export of goods and services was equivalent to 65% of GDP in 2015‑17 (compared to 42% in Romania and 30% in Greece), while trade per capita – at around EUR 5 400 in 2018 – was significantly higher than in Romania (EUR 4 612) and Republic of Türkiye (hereafter ‘Türkiye’) (EUR 3 011) (WTO, 2018). Foreign trade has followed broad trends consistent with Bulgaria’s accession to the WTO in 1996 and then with improving trade and tax-related legislation to make it consistent with EU trade policy and internal market rules in the scope of Bulgaria’s accession to the EU in 2007. Bulgaria’s economic performance largely reflects the growing integration into the world economy that the country has gone through (Figure 2.2).

Once a country that was in many ways closed off to the global economy, Bulgaria’s involvement in global value chains (GVCs) grew robustly. As a small open economy, prior to the COVD‑19 pandemic, Bulgaria sourced more foreign inputs than large economies such as the EU countries and hence had predominantly backward GVC participation (Ivanova and Ivanov, 2017). Bulgaria’s relatively high openness level was reflected in its TiVA (trade in value added) and GVC (global value chain) statistics. For example, foreign value‑added share in Bulgaria’s gross exports amounted to 36% in 2015, the latest available year (while the OECD average was 9%). Meanwhile, Bulgaria has lower levels of forward GVC participation7 as the share of domestic value added embodied in foreign exports was 16% in 2015 (compared to 18% at the OECD). In other words, the comparison with OECD GVC reveals that the foreign value added share of exports is higher in Bulgaria, whereas the domestic value added sent to consumer economy is lower than in OECD economies. In addition, between 2012 and the COVID‑19 pandemic, the number of automotive parts manufacturers doubled to almost 100 with a workforce of more than 33 000 in the sector.8

In the past decades, there has also been strong trade growth in Bulgaria. Bulgaria has had traditionally a trade deficit, but the balances are broadly comparable to other peer countries. For instance, in 2018, Bulgaria’s merchandise trade ratio amounted to 109% and was higher than in Greece (48%) Croatia (74.5%) but lower than in Slovenia (160%), and the Slovak Republic (178%).9 FDI has played a significant role in supporting these economic transformations. Over the last two decades, actual FDI inflows as a percentage of GDP have grown, notably during the years 2004‑07, reaching 28% of Bulgaria’s GDP. They then sharply declined in 2008‑10 (3.1% of GDP in 2010) and then again in 2014 (0.8% as a percentage of GDP) and 2016 (1.9%), primarily as the result of the global financial crisis and the steady decline of FDI flows globally. From 2016 to 2019, FDI stocks in Bulgaria followed an upward trend, which continued during the first quarter of 2020 before the COVID‑19 crisis spread across Europe.

Figure 2.2. GDP, trade and FDI in the Bulgarian economy, 1990‑2019

Source: World Bank (2021), World Bank national accounts (database), https://data.worldbank.org/country/bulgaria.

Yet, the COVID‑19 pandemic has affected Bulgaria’s economy. In the course of 2020, the export and import sectors decreased by 11.3% and 6.6%, respectively.10 Employment fell, eroding recent gains. Bulgaria’s unemployment rate of 5.9% recorded in December 2019 increased to 8.9% in April 202011. A recovery was nevertheless underway in 2021 : according to the statistics of the Ministry of Labour and Social Policy, the unemployment rate was approximately 6.7% in December 202012 and further decreased to 4.60 % in April 2022. Economic growth rebounded by 4.2% in 2021 after real GDP contracted by 4.1% in 2020 as a result of the coronavirus pandemic, thus bringing the economy to pre-pandemic levels of output. According to the OECD Economic Survey of Bulgaria, a growth of 3.7% was expected in 2022 (OECD, 2021), whereas the European Commission expected a 4.7% GDP growth in 2022 (Table 2.1).

Since then, the outlook for 2022 and 2023 has nevertheless worsened owing to the war in Ukraine, the OECD expecting growth to weaken to 2.5 % in 2022 and 2.25 % in 2023 and be accompanied by a surge in inflation (OECD, 2022). Investment will be essential to overcome the impacts of the COVID‑19 crisis and the war in Ukraine. Boosting the economy will require ambitious reforms. The economy is still in the process of convergence. Bulgaria’s GDP per capita, in purchasing power standards, was the lowest in the EU in 2019, at half of the EU average. Bulgaria ranked last in the EU in terms of actual individual consumption (AIC) – 57% of the EU average.13 According to the National Statistical Institute of Bulgaria, in 2018, four of the seven European regions with the lowest standard of living were in Bulgaria. North-West Bulgaria was the region with the lowest standard of living, at 34% of the EU average, followed by North-Central Bulgaria (35%) (NSI, 2019a).

Since 2012, income inequality in Bulgaria has been increasing and is the highest in the EU, with the Gini coefficient reaching 39.6 in 2018 (World Bank 2019).14 Along these lines, Bulgaria still faces an important income gap vis-à-vis the EU average, and additionally faces unfavourable demographic prospects. In 2018, more than a quarter of Bulgaria’s population (32.8%) was at risk of poverty or social exclusion followed by Romania (32.5%), Greece (31.8%), Latvia (28.4%), Lithuania (28.3%), Italy (27.3%) and Spain (26.1%) (Eurostat, 2019).15

Table 2.1. Economic forecast for Bulgaria, 2020‑22

|

Indicators |

2020 |

2021 |

2022 |

|---|---|---|---|

|

GDP growth (%, yoy) |

‑4.2 |

3.5 |

4.7 |

|

Inflation (%, yoy) |

1.2 |

1.6 |

2 |

|

Unemployment (%) |

5.1 |

4.8 |

3.9 |

|

General governement balance (% of GDP) |

‑3.4 |

‑3.2 |

‑1.9 |

|

Gross public debt (% of GDP) |

25 |

24.5 |

24 |

|

Current account balance (% of GDP) |

4.1 |

6 |

7.5 |

Source: The European commission, Directorate‑General for Economic and Financial Affairs (DG ECFIN), May 2021, https://ec.europa.eu/info/business-economy-euro/economic-performance-and-forecasts/economic-performance-country/bulgaria/economic-forecast-bulgaria_en, https://ec.europa.eu/economy_finance/forecasts/2021/spring/ecfin_forecast_spring_2021_bg_en.pdf.

Importance of FDI in Bulgarian economy

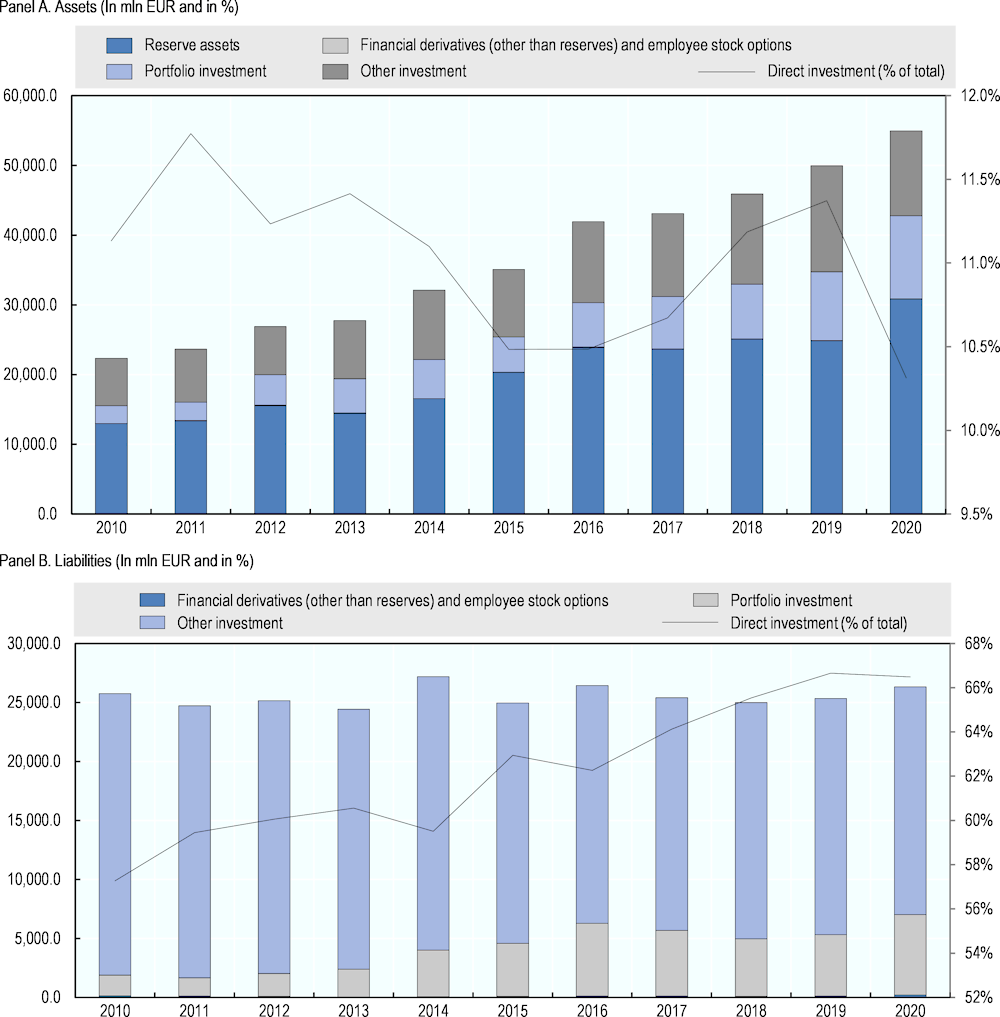

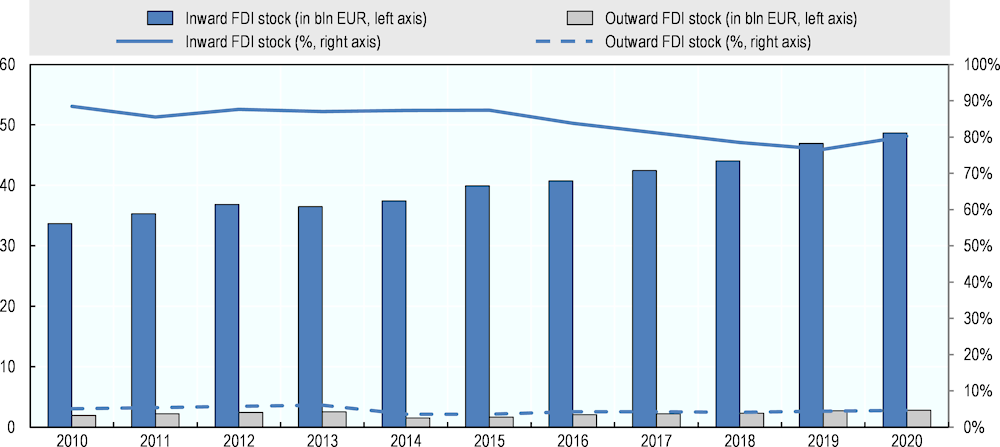

Foreign direct investment has established itself as an important driver of economic development in Bulgaria since the very start of the market transition, which determined the establishment of a liberal foreign investment regime. In December 2020, FDI accounted for 10% of all financial assets and 66% of all financial liabilities in Bulgaria, respectively (Figure 2.3).

Figure 2.3. Bulgaria’s International investment position by functional type of investment, 2010‑20

Source: Bulgarian National Bank (March 2021), International Investment Position.

Over the last two decades, inward foreign investment increased, reflecting the country’s openness towards foreign investors, the absence of screening from the government, and of limits on foreign ownership or control of firms as well as other reforms undertaken by the authorities as described throughout this Review. Following the global financial and economic crisis, FDI activity contracted: the share of inward FDI stock to GDP fell to 85.1% in 2008 (corresponding to an amount of approximately EUR 37 billion) but then quickly recovered. In particular, the share of inward FDI stock in GDP increased dramatically at the beginning of the past decade, representing 87.6% of Bulgaria’s GDP (approximately EUR 36.8 billion) in 2012. After a recovery in the period 2013 – 2015 (reaching 87.4% of Bulgaria’s GDP, approximately EUR 40 billion, in 2015), it followed a downward trend, reaching approximately 77% of GDP (EUR 46.9 billion) in 2019 (Figure 2.4). As of the end of 2020, the inward FDI stock in GDP stood at EUR 48.7 billion (80.3% of GDP). Like in many countries of the world, for the past decade direct investments by foreign-owned firms in Bulgaria have remained more important than investments by Bulgarian firms abroad as illustrated in Figure 2.4.

Figure 2.4. Inward and outward stock as a share of GDP, 2010‑20

Source: Bulgarian National Bank and Eurostat (2021).

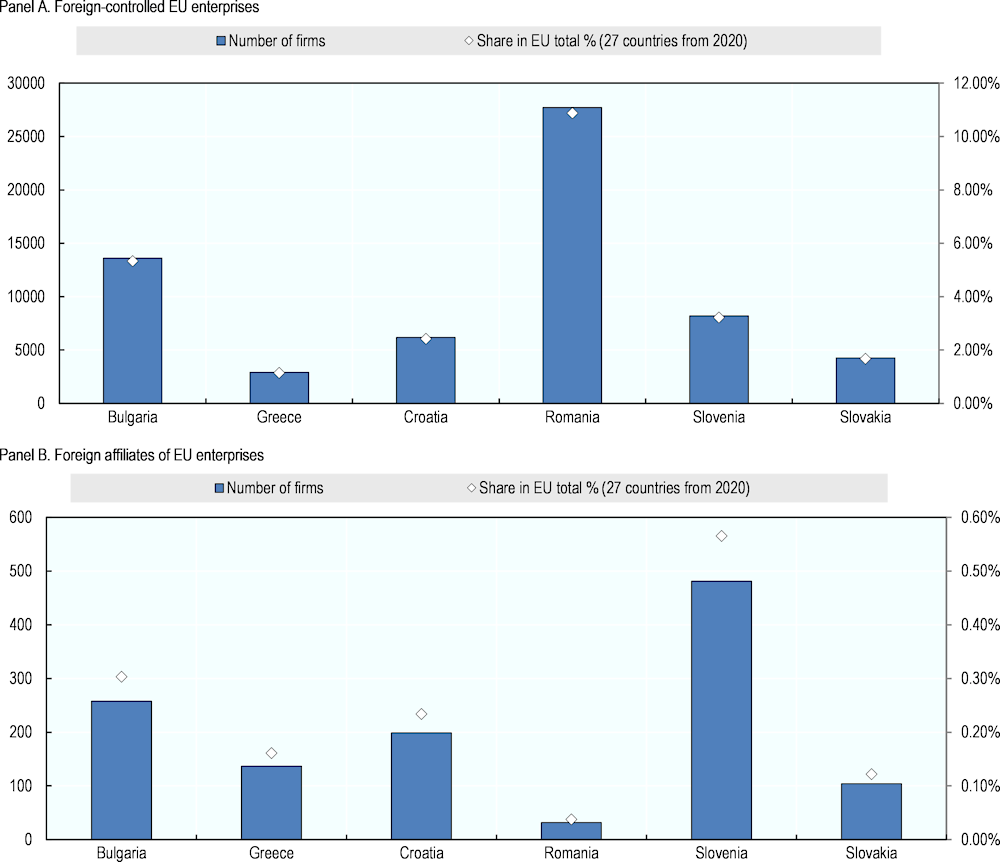

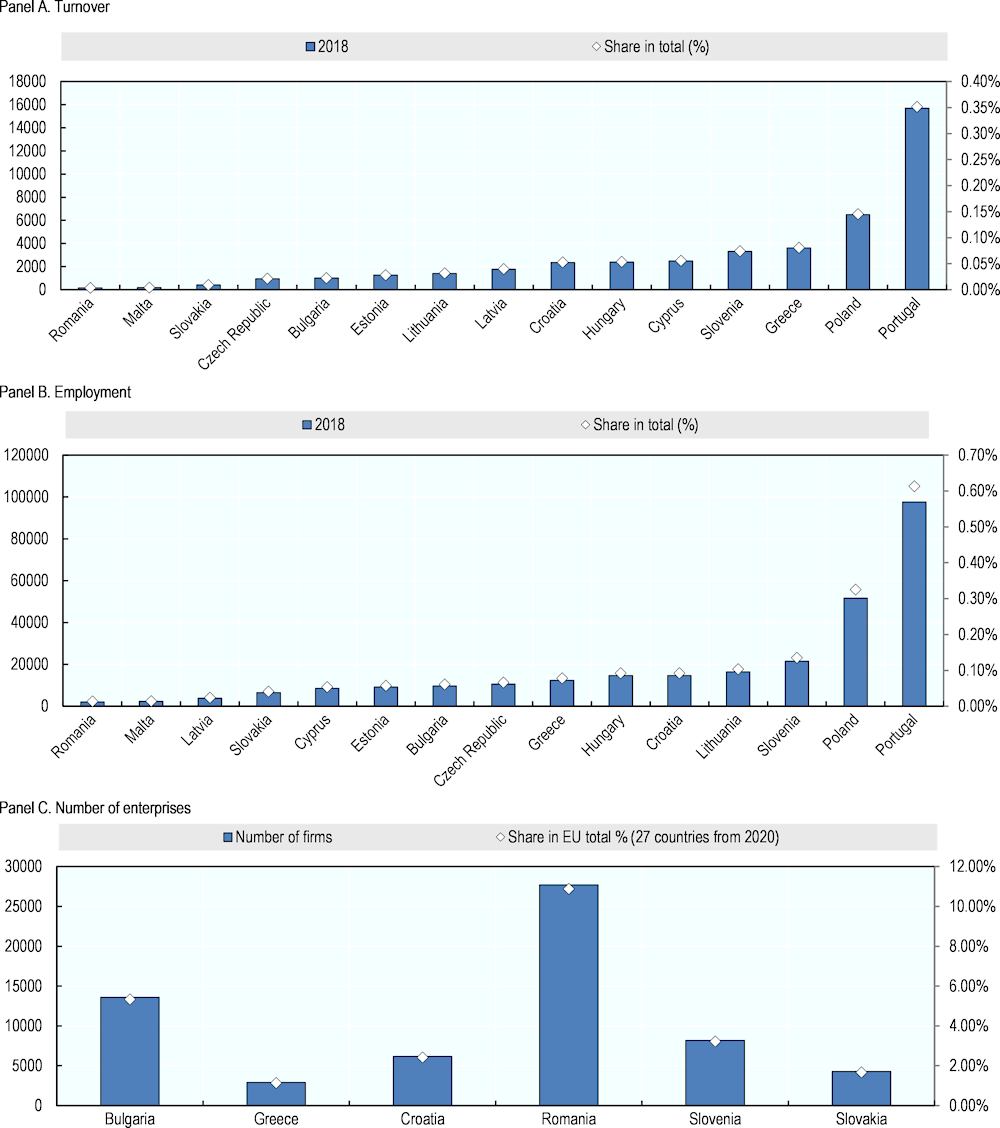

Considering data on the activities of affiliates by type of control and location, in 2018, foreign-controlled firms located in Bulgaria accounted for 5.3% of all foreign-controlled firms in the EU while the share of foreign affiliates of Bulgaria firms in the EU‑28 equalled to 0.3% (Figure 2.5).

Figure 2.5. Number of enterprises by type of control and location, 2018

Note: Foreign affiliates in the framework of inward FATS (Foreign Affiliates Statistics) mean an enterprise resident in the compiling country over which an institutional unit not resident in the compiling country has control. Number of enterprises refers to the number of 1) foreign controlled enterprises resident in the compiling economy for inward FATS (Panel A); and 2) foreign affiliates abroad that are controlled by an institutional unit resident in the compiling country for outward FATS (Panel B).

Source: Eurostat (2021).

Evolution of FDI over time

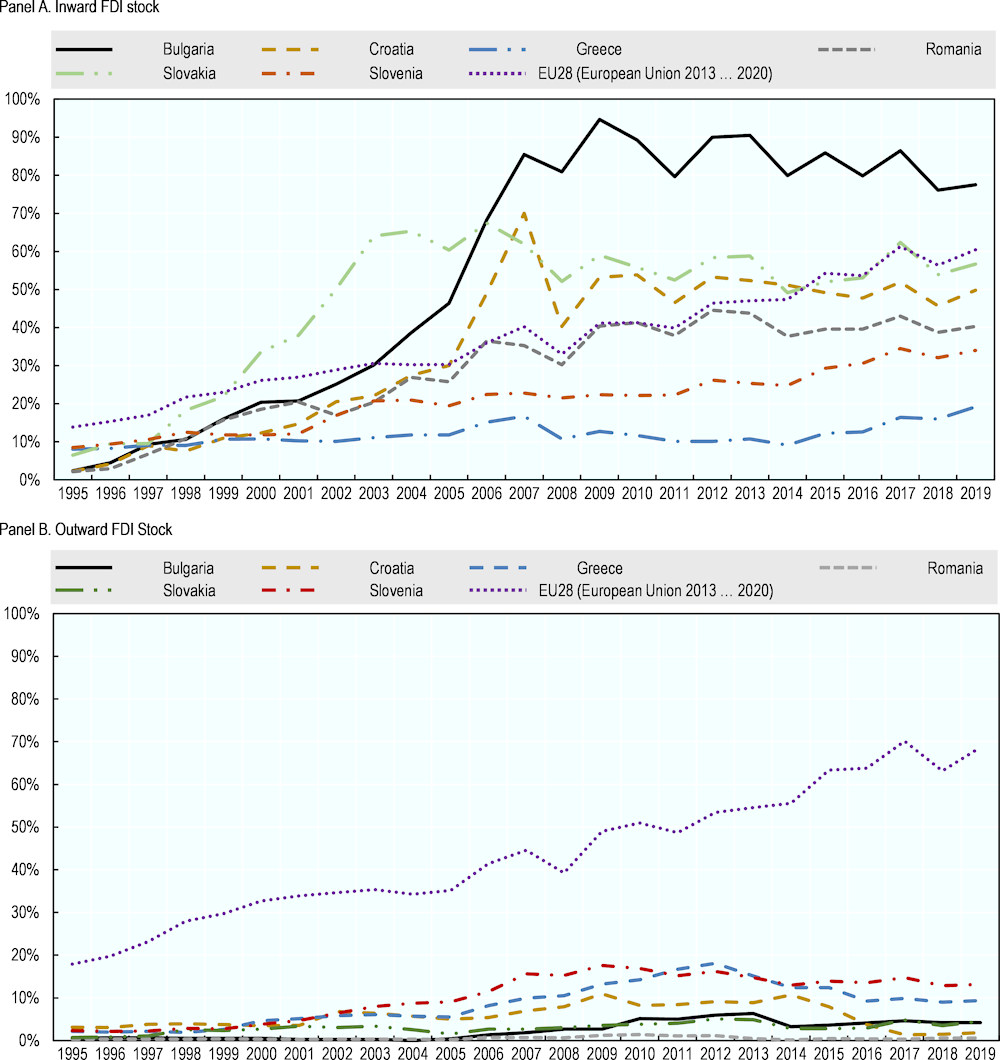

As noted in the introduction to this chapter, the importance of FDI inflows in the Bulgarian economy has been growing over time. The ratio of outward FDI stock to GDP has also generally increased, with a pace higher than in other economies in the region (Figure 2.6). In absolute terms, inward FDI has increased significantly since 2010 Bulgaria’s inward FDI increased from about EUR 33.7 billion in 2010 to EUR 48.7 billion in 2020. Meanwhile, during the same period (2010‑20), the amount of direct investment abroad increased significantly from approximately EUR 1.9 billion to EUR 2.8 billion.

Figure 2.6. Share of inward and outward FDI stock as a share of GDP in Bulgaria and selected EU countries, 1995‑2019

Note: EU membership and region are the criteria used in the selection of countries.

Source: UNCTADSTAT (2020), Data centre, https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740.

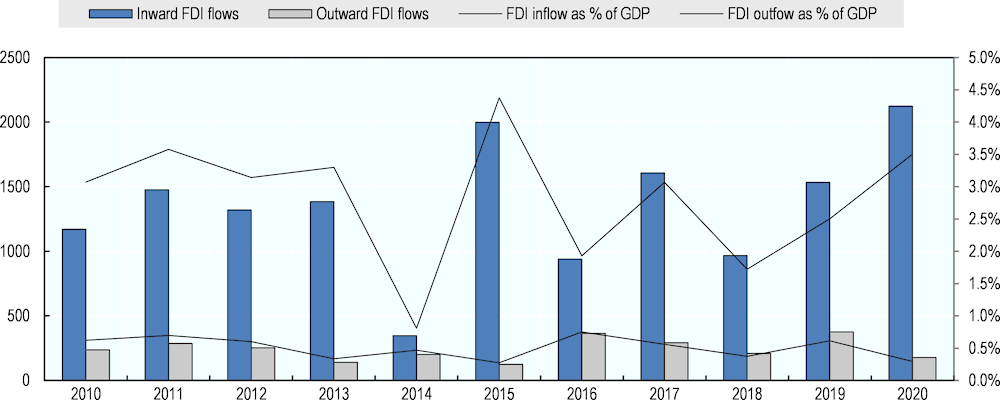

Concerning FDI flows, they declined for the first time in 2008 after six years of sustained growth, dropping to approximately EUR 6.7 billion. In 2009, FDI inflows dropped to approximately EUR 2.4 billion, about one‑third of the 2008 level. The same trend continued in 2010, with FDI inflows amounting to just over EUR 1.2 billion, the lowest figure since 2003. Thus, just between 2007 and 2010, FDI flows to Bulgaria dropped by almost 87% (Figure 2.7).

Figure 2.7. Bulgaria’s inward and outward FDI flows as a share of GDP, 2010‑20

Source: Bulgarian National Bank (2021).

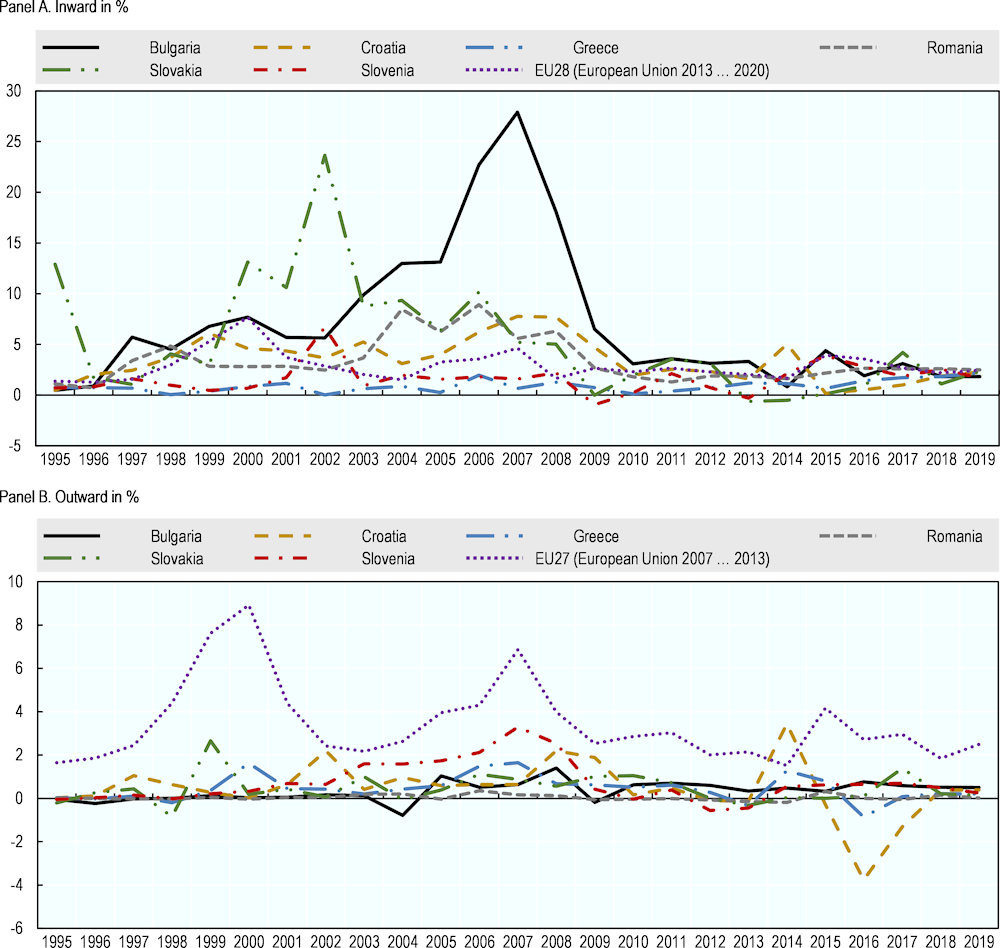

The importance of FDI for Bulgaria’s economy is similar to other peer economies. Figure 2.8 compares Bulgarian FDI inflows and outflows relative to other economies in the region in absolute and relative terms (as a share of GDP). Generally, the share of FDI flows to GDP in Bulgaria has been comparable to those found in other, similar countries in the region. For example, in the years 2015‑18, FDI inflows in Bulgaria accounted for 2.7% of GDP (slightly above the EU average of 2.3%). FDI outflows meanwhile accounted on average for 0.5% of Bulgaria’s GDP, below the EU average of 2.4% and more than the average of Bulgaria and the selected countries (0.3%).

Figure 2.8. Inward and outward FDI flows as a share of GDP in Bulgaria and selected EU countries, 1995‑2019

Note: EU membership and region are the criteria used in the selection of countries.

Source: UNCTADSTAT (2020), Data centre, https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740.

Greenfield FDI has picked up

Transition reforms such as the privatisation of SOEs have offered scope for the emergence of FDI projects, first through the creation of joint ventures (JVs) and subsequently, and increasingly, through cross-border mergers and acquisitions (M&A) of existing companies or the creation of new so-called greenfield investments (Sakali, 2013).

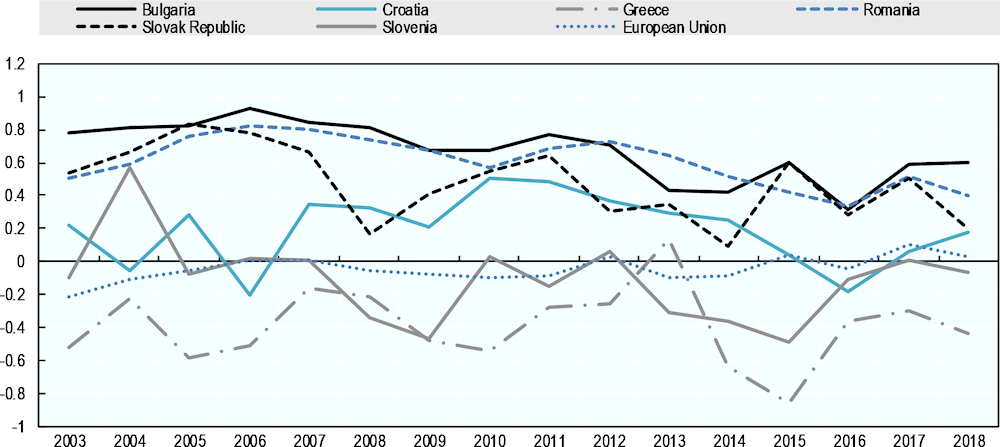

Similarly to other economies in the region that experienced big waves of privatisation in the 1990s, most of FDI in Bulgaria has taken place through so-called brownfield investments (i.e. via privatisations and mergers and acquisitions) rather than greenfield investments (i.e. foreign direct investment in which a parent company creates a subsidiary in Bulgaria, building its operations from the ground up). According to the FDI Greenfield Performance Index (which captures the country’s share in the world’s total of announced greenfield FDI projects to the country’s share in world GDP), Bulgaria attracted more greenfield FDI than suggested by the size of its economy between 2006 and 2018. It also performed better than countries such as Croatia, Greece and Slovenia for the same time period (Figure 2.9). Software & IT (Information and technology) services, automotive components, industrial equipment, transport and warehousing, business services have been among the top sectors for greenfield investment in Bulgaria. In 2019, greenfield investment into the Bulgarian technology sector recorded seven new projects amounting to USD 76.3 million (approximately EUR 69.4 million) of which more than 83.4% were from US companies.

Greenfield FDI has played an important role in job creation. Between 2015 and 2018 alone, the number of job-creating greenfield FDI projects into the technology sector in Bulgaria increased by 300% (fDi Markets, 2019). In 2019, leading international companies such as Facebook opened offices in the city of Sofia to provide ICT (Information, communication and technology) services (Financial times, 2019). For the past five or six years, the development of new sectors related to innovation and technology such as Machinery (SKF, Lufthansa, Technik, Montupet), IT & Telecoms (ICB, Cisco, Microsoft, HP, VMWare), shared services centres (Coca-Cola, HP, AIG), Electrical engineering (Siemens, ABB, Honeywell, Liebherr), Automotive (Witte Automotive, Sumitomo Electric, Yazaki Corporation), Lifesciences (Pharmaceutical Product Development, TEVA Pharmaceuticals) has increasingly attracted greenfield investment projects (CMS, 2018).

Figure 2.9. Greenfield FDI index, 2003‑18

Note: The Index is calculated as a share of the value of greenfield FDI projects announced in the country to the world’s total value of greenfield FDI projects divided by the share of country’s GDP in the world’s GDP (normalised around 0). A value > 0 means that a country attracts more FDI than suggested by the size of its GDP.

Source: Authors calculations based on UNCTAD, using on information from the Financial Times Ltd, fDi Markets (www.fDimarkets.com).

Table 2.2. Greenfield investment projects to Bulgaria, 2010‑19 Q3

In USD mln

|

Year |

Projects |

Capex (USD m) |

|---|---|---|

|

2010 |

63 |

2.186 |

|

2011 |

73 |

4.706 |

|

2012 |

49 |

2.296 |

|

2013 |

47 |

1.074 |

|

2014 |

41 |

1.040 |

|

2015 |

38 |

1.873 |

|

2016 |

46 |

1.033 |

|

2017 |

51 |

1.614 |

|

2018 |

54 |

2.285 |

|

2019 (Q1‑Q3) |

39 |

1.368 |

Note: Authors elaboration.

Source: The Financial Times (2019), www.fDimarkets.com.

FDI patterns in Bulgaria

The relative concentration of FDI in trading and retail activities and real estate as well as in specific regions suggests that there could be scope for diversifying the portfolio of FDI projects in Bulgaria through improvements of the business climate and targeted investment promotion policies.

FDI remains regionally concentrated

A large amount of FDI has been located in Bulgaria’s relatively prosperous areas such as South Bulgaria and the large economic zones near Sofia, Plovdiv, and Haskovo. In 2018, the capital of Sofia benefited from half of the total FDI stock in non-financial enterprises; less than 2% of inward FDI was distributed to the North-West region.

Table 2.3. FDI regional distribution of non-financial sector in Bulgaria, 2018

|

Region |

Districts |

Total (EUR thousand) |

|---|---|---|

|

North West ( Severozapaden) |

Vidin, Vratsa, Lovech, Montana, Pleven |

469 721.3 |

|

North Central (Severen Tsentralen) |

Veliko Tarnovo, Gabrovo, Razgrad, Ruse, Silistra |

1 111 657.2 |

|

North East (Severoiztochen) |

Varna, Dobrich, Targovishte, Shumen. |

2 579 480.7 |

|

South East (Yugoiztochen) |

Burgas, Sliven, Stara Zagora, Yambol |

3 203 109.3 |

|

South West (Yugozapaden) |

Blagoevrgrad, Kiustendil, Pernik, Sofia, Sofia capital, |

14 562 477.3 |

|

South Central (Yuzhen tsentralen) |

Kardzhali, Pazardshik. Plovdiv, Smolyan, Haskovo |

2 993 143.5 |

Note: FDI in non-financial enterprises as of 31.12 2018 by statistical regions and districts. NSI statistics on the non-financial sector FDI represents stock at the end of the statistic period (2018) and not the annual FDI inflow for 2018. The data is from the annual statistical survey conducted by the NSI on foreign direct investment in enterprises in the non-financial sector.

Source: National Statistical Institute (2018).

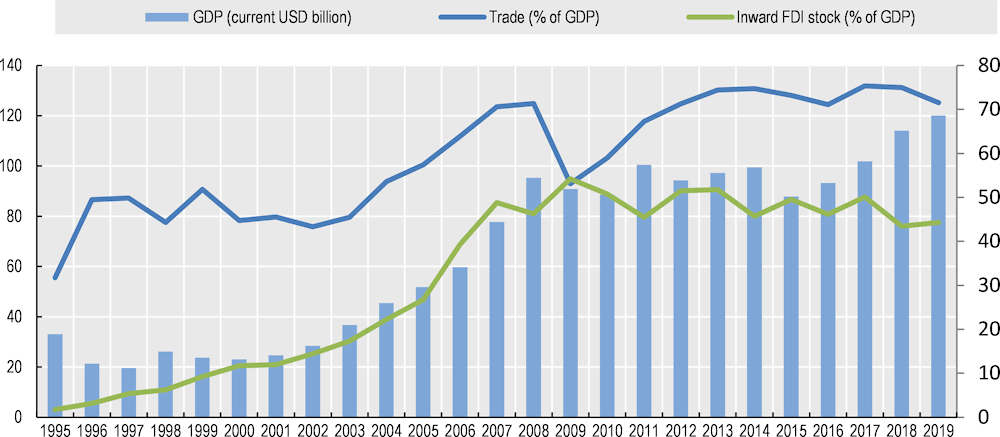

European countries dominate the FDI landscape

European countries dominate the FDI landscape in Bulgaria, topping the list of major destination and source countries (Figure 2.10). Among the largest investors, some countries have been traditionally associated with the presence of special-purpose entities (SPEs), which can serve as a conduit for pass-through capital motivated by tax purposes, e.g. Hungary, Luxembourg, and the Netherlands (see Box 2.1); other European countries, such as Austria, Italy, Germany, the United Kingdom as well as the Russian Federation have been the main sources of FDI inflows.

Meanwhile, in 2020, outward FDI flows of Bulgaria were targeted primarily at EU and neighbouring countries – in particular, Austria, the Czech Republic, Germany, Greece, Luxembourg, Malta, the Republic of North Macedonia, Moldova. This is congruent with Bulgaria’s geographic location, history, EU membership, and the country’s trade structure.

Figure 2.10. Top ten destination and source countries, 2020

Box 2.1. Special purpose entities: Why do they matter for FDI statistics?

Special purpose entities (SPEs), such as shell or shelf companies, are companies that do not have substantial economic activity in the country but that are used by companies to raise capital or to hold assets and liabilities. With the proliferation of international activities and increase in intra-firm trade, including in intangibles, it has become increasingly easy for companies to shift profits across jurisdictions according to the most favourable tax environment through corporate structures built for that purpose. Just as gross trade flows may obscure the destination and origin of value‑added produced in a given economy due to multiple shipments of goods across borders during the production process that spans several countries, so the passing of funds through SPEs can lead to the inflation of FDI statistics and the obscuring of the ultimate source and destination of FDI.

The OECD Revised Benchmark Definition of Foreign Direct Investment (BMD4) recommends that countries compile their FDI statistics excluding resident SPEs, and, then, separately for resident SPEs to provide a more meaningful measure of direct investment into and out of an economy (see OECD, 2008). For the country hosting the SPEs, this recommendation improves the measurement of FDI by excluding inward FDI that has little or no real impact on their economies and by excluding outward FDI that did not originate from their economies. Four countries-Austria, Hungary, Luxembourg, and the Netherlands-have reported FDI flows and positions excluding resident SPEs to the OECD for several years. With the implementation of the latest standards, 30 OECD countries currently report FDI data excluding resident SPEs. In some countries, such as Luxembourg, the Netherlands or Hungary, SPEs account for a sizable share of inward FDI stock (and, if not accounted for, could distort FDI statistics. Even in countries where SPEs do not play a significant role currently, it is useful to be able to identify resident SPEs in the FDI statistics so that their role can be monitored, especially as, by their nature, SPEs are easily established and can grow rapidly and can distort investment flows in particular years.

Source: OECD (2019)

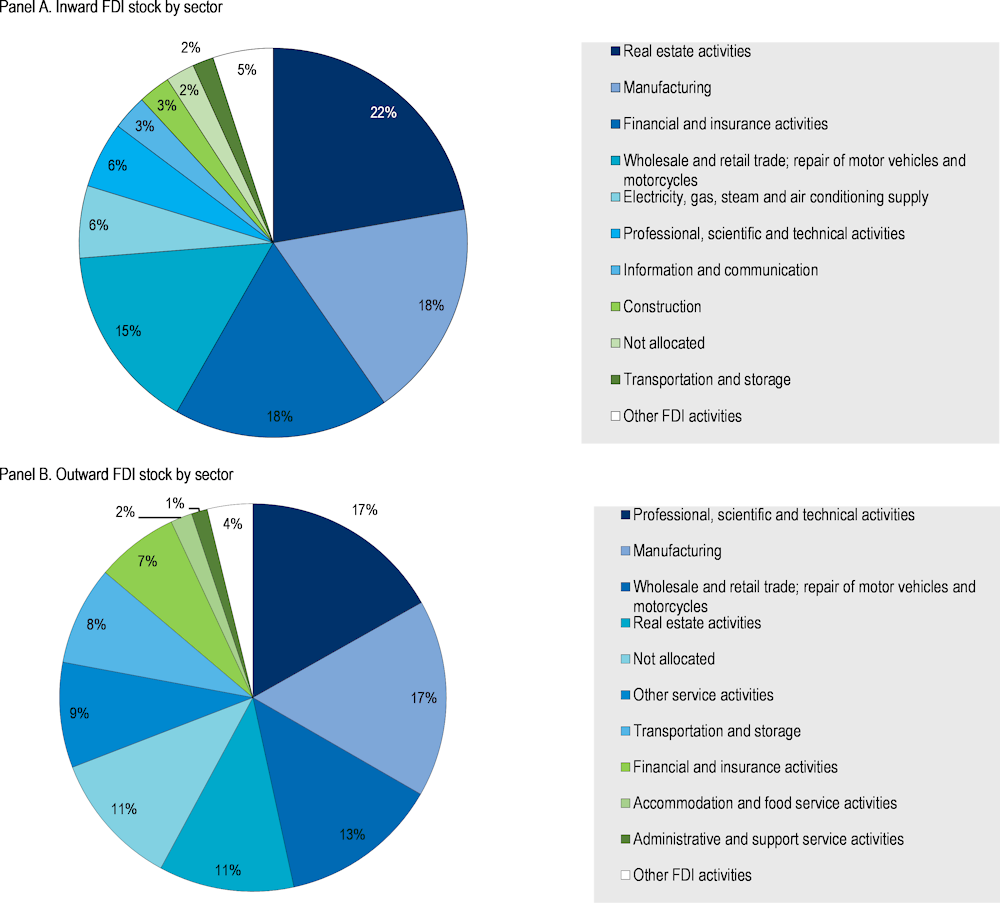

Services account for the majority of FDI stock in Bulgaria

In 2020, services accounted for the majority of FDI stock in Bulgaria. More than half of the inward stock was composed of private services, in particular real estate activities (22%), manufacturing (18%), financial and insurance activities (18%), wholesale and retail trade (15%); electricity, gas steam and air conditioning supply (6%); and professional, scientific and technical activities (5%). Information and communication accounted for 3% and construction accounted for 3%. (Figure 2.11, Panel A). While there is a high variation across countries, generally real estate, accommodation and construction services tend to play a less prominent role in OECD economies, suggesting that there could be scope for diversifying the portfolio of FDI projects in Bulgaria.

Figure 2.11. FDI stock by sector, 2020

Source: Bulgarian National Bank (March 2021).

Activities of Bulgarian companies abroad

As reflected in total outward and inward foreign affiliate statistics, the activities of Bulgarian companies abroad have remained significantly less important than activities of foreign-owned enterprises in Bulgaria. Statistics on outwards activities of foreign-controlled affiliates provide further insights into internationalisation of domestic firms. According to Eurostat, in 2018, 258 Bulgarian companies were operating outside of the EU that jointly employed over 9 717 people and had a total turnover of approximately EUR 1 billion, which represents 0.3% of European firms operating outside of the EU in 2018 (Figure 2.12). These levels are comparable to those encountered in EU economies with similar market sizes and per capita income levels, although they are among the lowest in the EU. Considering the central and strategic location of Bulgaria as well as some robust sectors, such as IT, machinery, and software, there could be scope for further growth in future years. Figure 2.11 (Panel B) above shows that outward FDI stock has been primarily composed of professional, scientific, and technical activities (17%), manufacturing (17%), wholesale, and retail (13%).

Figure 2.12. Data on EU-controlled foreign affiliates in selected EU 28 countries, 2018

Source: Eurostat (2021).

In 2018, 20 Bulgarian companies were among the top 500 largest firms in Central and Eastern Europe, according to the ranking compiled by COFACE (COFACE, 2019). Utilities and public services as well as oil, minerals, wholesale and retail trade dominated the list of companies. Still, outward FDI is an incipient phenomenon in Bulgaria. Active export promotion and investment promotion policies (see Chapter 6), including for outward FDI and the overall improvements in the country’s investment climate, could have a role to play in promoting Bulgarian investments abroad.

Outlook

FDI has played an important role in Bulgaria’s development over the past two decades. While Bulgaria experienced a relatively slow start due to political instability in the early 1990s, it experienced rapid growth in FDI in the late 1990s and the 2000s – with a peak in 2007, the year that it became an EU member, with FDI inflows amounting to EUR 10.1 billion. Recent years have nevertheless been challenging for Bulgaria, with foreign direct inflows going up and down. Bulgaria received approximately EUR 1.6 billion in 2017 and EUR 2.1 billion in 2020, more than in 2019 when it attracted EUR 1.5 billion. FDI in the first three months of 2022 stood at EUR 1.06 billion, more than during the same period of 2021 when FDI was EUR 244.1 million.

Improving further the framework conditions for foreign investment has become among the authorities’ foremost priorities for boosting economic growth and improving citizens’ well-being. The relative concentration of FDI in trading and retail activities and real estate, which account for most of the foreign investment in Bulgaria, suggests that there could be scope for diversifying the portfolio of FDI projects in Bulgaria through improvements of the business climate and targeted investment promotion policies, discussed in the following chapters.

While the prominence of European countries in terms of FDI inflows is understandable, extra efforts may be needed to attract investments from other regions, including large emerging economies. There is also considerable potential to increase outward investment and the internationalisation of Bulgarian companies, especially as immediate non-EU neighbouring countries accelerate their journey towards European integration.

References

Bulgaria (2021), National Development Programme BULGARIA 2030, www.minfin.bg/upload/43546/Bulgaria+2030_EN.pdf

CMS Law & Tax (2018), Greenfield investments in CEE, https://cms.law/en/media/local/cms-china/files/publications/greenfield-investments-in-cee-2018-english.

Council of Ministers of Bulgaria (2020), National Development Programme: Bulgaria 2020 (NDP BG 2020),

www.strategy.bg/StrategicDocuments/View.aspx?lang=bg-BG&Id=766

COFACE (2019), CEE Top 500 Companies, www.cofacecentraleurope.com/News-Publications/Coface-CEE-Top-500.

European Commission (2021), “European Economic Forecast Spring 2021”, European Economy Institutional Papers, Luxembourg: Publications Office of the European Union 2021, https://ec.europa.eu/info/sites/default/files/economy-finance/ip149_en.pdf.

EUROSTAT (2021), Statistics on the structure and activity of foreign affiliates (FATS), https://ec.europa.eu/eurostat/web/structural-business-statistics/global-value‑chains/foreign-affiliates

IMF (2019), Bulgaria: 2019 Article IV Consultation-Press Release; Staff Report; Staff Supplement; and Statement by the Executive Director for Bulgaria, IMF Country Report No. 19/83, www.imf.org/en/Publications/CR/Issues/2019/03/22/Bulgaria-2019-Article-IV-Consultation-Press-Release-Staff-Report-Staff-Supplement-and-46702.

Ivanova, N. and E. Ivanov (2017), “The Role of Bulgaria in Global Value Chains”, Discussion Papers, No. 105/2017, Bulgarian National Bank, www.bnb.bg/bnbweb/groups/public/documents/bnb_publication/discussion_2017_105_en.pdf.

NSI (2019a), Foreign direct investments in non-financial enterprises as of 31.12.2019 by statistical regions and districts, www.nsi.bg/en/content/6196/foreign-direct-investments-non-financial-enterprises-3112-statistical-regions-and.

NSI (2019b), Population and demographic process in 2019, www.nsi.bg/sites/default/files/files/pressreleases/Population2019_en_XE8MEZL.pdf.

OECD(2022), Bulgaria Economic Snapshot: Economic Forecast Summary (June 2022), https://www.oecd.org/economy/bulgaria-economic-snapshot/

OECD (2021), OECD Economic Surveys: Bulgaria 2021: Economic Assessment, OECD Publishing, Paris, https://doi.org/10.1787/1fe2940d-en.

OECD (2020), OECD Foreign direct investment flows in the time of COVID‑19,

OECD (2019), OECD Investment Policy Reviews: Croatia 2019, OECD Investment Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/2bf079ba-en.

World Bank (2020a), “Spring 2020: Fighting COVID‑19”, Europe and Central Asia Economic Update, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/33476.

World Bank (2020b), World Development Indicators database, https://databank.worldbank.org/data/source/world-development-indicators.

World Bank (2020c), Global Investment Competitiveness Report 2019/2020: Rebuilding Investor Confidence in Times of Uncertainty, World Bank, Washington, DC, https://openknowledge.worldbank.org/bitstream/handle/10986/33808/9781464815362.pdf?sequence=2&isAllowed=y.

WTO (2020), Member Information: Bulgaria and the WTO, www.wto.org/english/thewto_e/countries_e/Bulgaria_e.htm.

WTO (2003), Trade Policy Review: Secretariat Report, www.wto.org/english/tratop_e/tpr_e/tp220_e.htm

Notes

← 1. See World Bank country classification, https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups.

← 2. Bulgarian National Bank, Metronomic Indicators as of 26 March 2021, www.bnb.bg/Statistics/StMacroeconomicIndicators/index.htm.

← 3. The employment rate refers to the 20‑64 age group of Bulgaria’s population.

← 4. The unemployment rate is determined as the share of the registered unemployed in the economically active population aged 15‑64, established in the 2011 Census.

← 5. See www.nsi.bg/en/content/6503/unemployed-and-unemployment-rates-national-level-statistical-regions-districts.

← 7. The percentile rank of a score is the percentage of scores in its frequency distribution that are equal to or lower than it. For example, a test score that is greater than 75% of the scores of people taking the test is said to be at the 75th percentile, where 75 is the percentile rank.

← 8. “Bulgaria’s auto parts industry powers up”, Financial Times, 29 November 2016.

← 9. World Bank (2020), World Bank national accounts (database), https://data.worldbank.org/country/bulgaria.

← 10. National Statistical Institute, Gross Domestic Product annual data, published on 9 March 2021, www.nsi.bg/en/content/5490/gdp-final-expenditure-percentageE2%80%93-total-economy

← 11. Ministry of Labour and Social Policy Employment Agency, information about the unemployment, the active employment policy and the implementation of the operational programme “human resources development” in April 2020, www.az.government.bg/bg/stats/view/2/312/.

← 12. Ministry of Labour and Social Policy Employment Agency, Information about the unemployment, the active employment policy and the implementation of the operational programme “human resources development” in December 2020, www.az.government.bg/bg/stats/view/2/331/.

← 13. Actual individual consumption, abbreviated as AIC, refers to all goods and services actually consumed by households. It encompasses consumer goods and services purchased directly by households, as well as services provided by non-profit institutions and the government for individual consumption (e.g. health and education services). In international comparisons, the term is usually preferred over the narrower concept of household consumption, because the latter is influenced by the extent to which non-profit institutions and general government act as service providers. See Eurostat Glossary: Actual individual consumption (AIC), https://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary: Actual_individual_consumption_(AIC).

← 14. Gini index measures the extent to which the distribution of income (or, in some cases, consumption expenditure) among individuals or households within an economy deviates from a perfectly equal distribution. A Gini index of 0 represents perfect equality, while an index of 100 implies perfect inequality, https://datacatalog.worldbank.org/gini-index-world-bank-estimate-1.

← 15. See Eurostat, “Downward trend in the share of persons at the risk of poverty or social exclusion in the EU”, News release, 158/2019, 16 October 2019, https://ec.europa.eu/eurostat/documents/2995521/10163468/3-16102019-CP-EN.pdf/edc3178f-ae3e-9973-f147-b839ee522578.