The good governance of economic regulators is an important ingredient of robust and appropriate regulatory policy. Good governance supports better regulation, as well as stability and predictability in regulatory decision making. In the context of rapid changes that are reshaping network sectors such as energy, water, e-communications and transport, good governance can bring confidence that decisions are made with integrity. This chapter discusses the governance of regulators using evidence from the OECD Indicators on the Governance of Sector Regulators. It focuses on governance arrangements to safeguard independence and promote accountability in regulators across OECD and non-OECD member countries.

OECD Regulatory Policy Outlook 2021

5. The governance of sector regulators

Abstract

Key findings

Economic regulators are key actors in delivering essential services, and their governance affects the performance of critical network sectors. Their work often has an impact on the major social, economic, technological and environmental challenges discussed in Chapter 1. Regulators occupy a unique position, interacting with consumers, businesses and government. Their governance and performance affect the quality of service delivery as well as the stability and predictability of regulatory decision making.

OECD data shows that many regulators share core functions to improve the functioning of markets and market outcomes, such as regulating prices, authorising companies to engage in regulated activities and taking final decisions in disputes. A minority of regulators independently issue industry and consumer standards, while many enforce such standards. On average, energy and e-communications regulators have a broader scope of action than regulators in other sectors. Clearly ensuring adequate enforcement and oversight powers is key to the overall effectiveness of the regulatory regime.

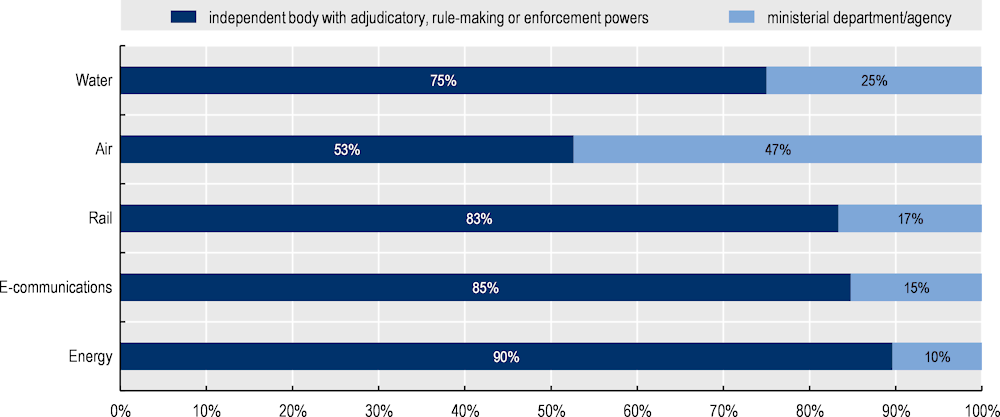

Most OECD countries have delegated the economic regulation of network sectors to independent regulatory bodies, a formal arrangement that signals a commitment to long‑term goals beyond political cycles. Among surveyed regulators, a majority of regulators are independent bodies by law. In OECD countries, a majority of regulators in the energy (87%), e‑communications (84%), rail transport (83%), and water (76%) sectors are independent. Only 50% of OECD air transport regulators are independent. In European Union member countries, EU Directives drive the creation of independent regulators in the energy and rail sectors. Regulators, whether legally “independent” or “ministerial”, can show a range of good-practice governance arrangements to safeguard independence.

Most regulators have legal safeguards regarding appointment, dismissal and post-employment restrictions of leadership to bolster independent decision making. A single government body appoints the leadership of regulators in most of the sample, although the involvement of parliament in appointments (whether making the final appointment or providing an opinion) is not uncommon. While most regulators' leadership can be dismissed through government decisions, limited and defined criteria for dismissal in law limits the possibility of arbitrary termination in most countries. Post-employment restrictions for agency leadership, including cooling-off periods, are a common way to minimise the risk of a revolving door.

While most regulators show a degree of decision making and financial independence, arrangements to preserve budgetary and financial autonomy of regulators could be strengthened further. For most regulators, involvement by the executive in regulators' work programme, individual cases/decisions and appeals is limited. Most regulators preserve a degree of autonomy in setting regulatory fees, with roughly half of the regulators funded through fees setting the fee level themselves, and many others proposing the level for approval by parliament, congress or the executive. However, budget appropriations tend to be annual, while multi-year funding arrangements can insulate the regulator from politically motivated changes.

On average, regulators with a stronger degree of independence use more good-practice accountability mechanisms, which enhances confidence. A positive and statistically significant correlation between independence and accountability scores suggests that regulators with stronger independence arrangements also have stronger accountability practices.

Many regulators report basic measures to promote the accountability of regulators, a vital counterbalance to independence, but there is room to improve reporting on their performance. Most regulators have basic good-practice arrangements related to stakeholder engagement. The majority usually publishes draft decisions for consultation and responds to stakeholder comments. However, there is an opportunity to expand the collection and reporting of information about a regulator’s performance, crucial for assessing the quality of processes and driving improvements. Twenty per cent or more of regulators in the sample do not collect information on the quality of their regulatory processes, their compliance with legal obligations and the organisational governance of the regulator.

Early evidence suggests a correlation between the governance of regulators and certain indicators of market performance in the energy and e-communications sectors. Future research exploring the relationship between governance and market performance may shed light on the existence of causal mechanisms of sector performance that relate to the governance of sector regulators.

Introduction

Economic regulators serve a critical role in network sectors such as energy, e-communications, transport and water. Economic regulators have a key role to play in addressing some of the challenges explored in Chapter 1, often confronting the major social, environmental, technological and economic challenges of the time. They act as rule-setters as well as market referees, ensuring market efficiency and the quality, reliability and affordability of services. In some cases, they also have other functions such as the promotion of competition in markets. They bring confidence to market actors, such as network operators and service providers, by ensuring stable regulatory decision making. This confidence in turn favours the likelihood of necessary investments in the sector, as actors trust that they can expect a reasonable return. The good governance of these vital actors promotes better regulation and stability and predictability in regulatory decision making.

The governance of economic regulators is an important contributor to strong regulatory frameworks that can build trust and weather change. Robust governance that helps strengthen confidence in regulators is increasingly important in the context of dwindling trust in public institutions in some countries. Indeed, OECD data suggests that people’s trust in public institutions has yet to fully recover from the 2009 financial crisis across all OECD countries (OECD, 2019[1]). Regulators themselves play a key role in developing trust between and with actors in a sector, navigating perspectives from government, industry and consumers. A lack of trust in regulators could undermine confidence in their work, the stability they safeguard, and investment in the sectors they oversee. A robust accountability framework is therefore increasingly relevant in the context of changing markets and the potential of increased mistrust in public authorities, and opportunities to collect stakeholder input are critical in the context of changes in markets and the emergence of new market actors.

Governance arrangements that safeguard the independence of regulators provide confidence that decisions are made with integrity, free from undue influence from government, the regulated industry and other stakeholders. At the same time, with greater independence comes greater responsibility to remain accountable. Instruments to promote accountability allow the government, the legislature, regulated entities and the public to assess regulators’ performance against their objectives. These governance arrangements are not ends in themselves, but rather crucial ingredients in the performance of regulatory authorities that are required to make decisions that are technically rigorous, objective and predictable, with the ultimate goal of promoting better sector performance and outcomes for consumers.

Regulators operate in rapidly changing markets, with new developments and uncertainty that directly affect their objectives (OECD, 2018[2]). Good governance supports stability and predictability, even in times of transformation and crisis. In the context of rapid changes in regulated sectors, the economy, politics and society, trust in regulatory decision making becomes even more crucial. Technological innovations are fundamentally transforming regulated markets, shifting the role of the regulator, as well as those of other stakeholders, and providing new tools for regulatory policy (see Chapter 1). Case studies from regulators in the OECD Network of Economic Regulators show that some regulators are reacting to and harnessing emerging technologies, adapting their structures and approaches to better regulate emerging technologies and to better regulate using emerging technologies (OECD, 2020[3]). Rapid changes also occur when crises such as the COVID-19 pandemic, but also economic crises, create more abrupt shocks to the status quo. Regulators’ reactions to the COVID-19 pandemic highlight this aspect of uncertainty from a new angle, emphasising the need for regulators to bolster sector resilience (OECD, 2020[4]). Changing sectors require more agile regulators that are able to adapt while remaining predictable and accountable.

This chapter uses data from the OECD Indicators on the Governance of Sector Regulators to describe the governance arrangements in 163 economic regulators across the energy, e-communications, rail transport, air transport and water sectors in 47 countries.1 The second edition of the indicators, the 2018 edition builds upon the experience of the 2013 indicators, which featured in the 2015 Regulatory Policy Outlook. The indicators reflect governance arrangements to safeguard independence (with respect to budget, staffing and decision making) and promote accountability (to the government, parliament, and the public). They also measure the regulators’ scope of action, the range of functions conducted by the regulator. The OECD designed the indicators, collected and reviewed the data in consultation with members of the Network of Economic Regulators (more information in Box 5.1).

The purpose of this chapter is to provide an overview of trends in the governance of regulatory authorities, drawing from the empirical data in the indicators and normative materials. The results provide a high-level overview of the governance of economic regulators, allowing for comparison across countries and sectors. The chapter provides an empirical and normative foundation for readers to assess and monitor governance arrangements of regulators across OECD and non-OECD countries and identify areas for future improvement.

The data show a group of regulators with diverse constellations of governance arrangements to preserve independence and promote accountability, and highlight some areas for development. Measures to formalise the independence of regulators, such as the statutory establishment of an independent regulator, are common in much of the sample. Most regulators have arrangements to prevent arbitrary termination of leadership and reduce the risk of a revolving door for board members or agency heads. Financing and budgeting arrangements tend to include safeguards to preserve a degree of autonomy in financing and budget execution. Most regulators show independence in decision making as well. Good-practice arrangements to promote accountability and transparency, such as publishing an annual report, are present in most regulators. There is nevertheless room for improvement in performance reporting, especially for data relating to the performance of the regulator itself. Most regulators offer avenues for stakeholder comment on draft decisions, although a greater proportion of regulators in the transport sectors do not publish draft regulatory decisions for stakeholder comment. The indicators paint a picture of a diverse group of regulators showing convergence to good practice in some areas, with opportunities for improvement remaining in others.

Box 5.1. OECD work on the governance of regulators

The OECD supports regulators in their efforts to improve governance and performance through its Network of Economic Regulators (NER), normative guidance, data collection and analysis and in-depth peer reviews.

The OECD NER, established in 2013, provides a unique forum for regulators across a range of regulated sectors such as e-communications, energy, transport and water from across the world (including regulators from OECD and non-OECD member countries). The network allows participants to exchange first-hand experiences and good practices, discuss challenges and identify innovative solutions.

Key documents provide the normative framework for the governance of regulators that guides additional OECD work in this area. The 2012 Recommendation of the Council on Regulatory Policy and Governance defines the high-level policies that governments can take to promote good regulatory policy and governance. The seventh principle relates directly to regulatory agencies - “Develop a consistent policy covering the role and functions of regulatory agencies in order to provide greater confidence that regulatory decisions are made on an objective, impartial and consistent basis, without conflict of interest, bias or improper influence” (OECD, 2012[5]).

The NER and the Regulatory Policy Committee developed the Best Practice Principles for the Governance of Regulators in 2014. The seven principles provide guidance on institutional arrangements, processes and practices for regulators (OECD, 2014[6]). Other publications have delved deeper into the governance of regulators. For example, the publications “Being an Independent Regulator” and “Creating a Culture of Independence” explore de facto and de jure elements of independence and the publication “Governance of Regulators’ Practices: Accountability, Transparency and Co-ordination” examines accountability frameworks and co-ordination mechanisms (OECD, 2016[7]; OECD, 2017[8]; OECD, 2016[9]). The principles provided the basis for the development of the Indicators on the Governance of Sector Regulators that are the foundation of this chapter.

In the framework of the Network of Economic Regulators, the OECD carries out in-depth peer reviews that assess and strengthen regulators’ performance assessment and governance frameworks. The Performance Assessment Framework for Economic Regulators (PAFER) provides the methodology for these reviews, informed by the normative framework above and built on lessons learnt from the NER.

Source: OECD (n.d.), “Performance of Regulators”, www.oecd.org/gov/regulatory-policy/performance-of-regulators.htm (accessed 10 June 2020); OECD (n.d.), “Publications of the Network of Economic Regulators”, www.oecd.org/gov/regulatory-policy/publications-of-the-network-of-economic-regulators.htm (accessed 10 June 2020).

The OECD Indicators on the Governance of Sector Regulators

The 2018 Indicators on the Governance of Sector Regulators map the governance arrangements of economic regulators in 47 countries and five network sectors (energy, e-communications, rail and air transport, and water). The database contains data from 163 distinct regulators. The governance arrangements captured in the indicators comprise three components: independence, accountability and scope of action, as described below.

The independence component maps governance arrangements that safeguard the regulator’s ability to operate independently and with no undue influence. It consists of questions gauging the regulator’s independence in terms of its budgeting, staffing and relationship with the executive.

The accountability component measures the regulator’s accountability to government, parliament, stakeholders and the broader public. It reflects the use of certain aspects of stakeholder engagement and the collection, use, publication and reporting of performance information.

The scope of action component reflects the breadth of regulators’ competences. It asks questions about the regulators’ attributions – from price setting to taking final decisions in disputes – and asks whether the regulator carries out its functions independently or with other bodies.

A questionnaire completed by regulators and governments then reviewed by the OECD Secretariat forms the basis of the indicator scores, which are calculated by averaging equally weighted questions and sub‑questions on a standard questionnaire. The methodology uses equal weighting to avoid imposing judgements about the importance of elements within the composite indicators, but this should not be understood as showing that components lack weights entirely. While the indicators do not reflect the relative importance of its components, it provides an indication of the relative degree to which a regulator’s governance arrangements reflect good practice, which can be supplemented by observed differences within the underlying data. Other methods capture the importance of the indicator components to the final composite; the OECD Handbook on Constructing Composite Indicators reviews equal weighting and alternative methods for weighting elements of composite indicators. The methodology scores answers on a scale from zero (most effective governance arrangement) to six (least effective governance arrangement). A score closer to zero in the independence and accountability component indicates that the regulator has governance arrangements in place that more closely reflect the good practices. In the scope of action section, a score closer to zero indicates that the regulator engages in a broader range of the activities.

The 2018 indicators build upon the experience of the 2013 edition of the indicators, as presented in the 2015 Regulatory Policy Outlook. The questionnaire has changed between vintages. The 2013 indicators covered economic regulators in six network sectors – electricity, gas, telecom, railroad transport infrastructure, airports and ports. In 2018, the sector coverage changed to sector coverage of the indicators changed to better reflect an evolving regulatory landscape. The 2018 indicators focuses on the following sectors: energy (previously electricity and gas), e-communications (previously telecommunications), rail transport, air transport (previously airports only) and water (new). The content of the questionnaires also changed, notably with an update to the independence section of the questionnaire to capture practical arrangements as well as formal mechanisms. Finally, the data validation process changed between the two surveys, with data reviewers ensuring that each question was answered in the 2018 review (Casullo, Durand and Cavassini, 2019[10])

The Indicators on the Governance of Sector Regulators complement the OECD Product Market Regulation survey. For more information about the methodology of the indicators and the questions included in the questionnaire, see (Casullo, Durand and Cavassini, 2019[10]).

The landscape of economic regulators

Following important early predecessors, modern economic regulators have grown in number in the past 40 years, created to accompany market reforms and restructuring. In an attempt to improve the performance of monopolised infrastructure sectors and in light of new opportunities for competition in these sectors, many countries pursued regulatory reform and restructuring programmes. These programmes became common in many countries in the 1970s and 1980s. The programmes attempted to introduce competition in some sector segments to reduce reliance on price and entry regulation, and were often accompanied by a shift in supply responsibility to private companies. The introduction of economic regulators are a key part of the liberalisation process; economic regulators’ role includes the continuing regulation of certain sector segments that remain as natural and/or legal monopolies, as well as overseeing competitive access to networks (Joskow, Killiam and Killiam, 2000[11]).

The Interstate Commerce Commission, established in the United States in 1887 in part to correct abuses in the railroad sector, is an ancestor of today's independent economic regulators (Gilligan, Marshall and Weingast, 1989[12]). The United Kingdom pioneered a new brand of economic regulation in the 1980s and 90s, introducing autonomous, sector-specific regulators with oversight over newly privatised industries (House of Lords, 2007[13]). Inspired by the pioneering work of Stephen Littlechild on the topic, the UK model of incentive regulation and distinct sector regulators spread rapidly (Littlechild, 1983[14]). The trend for the creation of economic regulators gained momentum outside of Western Europe and the United States, in particular in Latin American countries from the 1980s (Box 5.2) and in South Asia, East Asia and the Middle East in the 2000s (Jordana, Levi-Faur and Marin, 2011[15]); (Gassner and Pushak, 2014[16]).

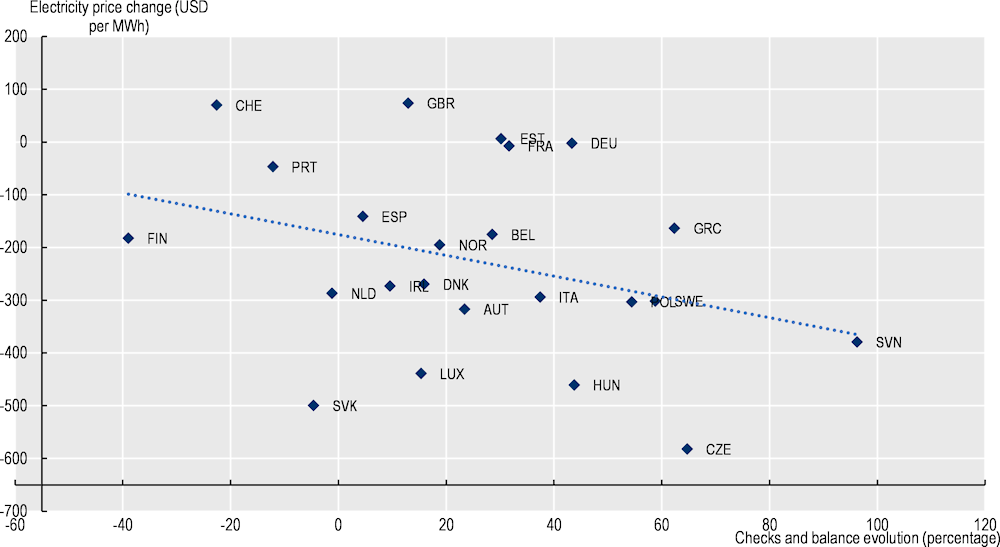

The functions assigned to regulators and the breadth of the scope of action of regulators vary within the sample. The scope of action component of the Indicators on the Governance of Regulators asks regulators whether they engage in a range of functions, including price regulation, reviewing contract terms, information collection, issuing industry and consumer standards, issuing guidelines/codes of conduct, enforcement, mediation, and more.2 While the functions included in the indicators are not comprehensive of all of the possible functions of a regulator, the scores show the breadth of activities (conducted independently and with others) within those included in the survey. Regulators in the transport and water sectors tend to have narrower scopes of action, while e-communications and energy regulators report the broadest scope of action on average (Figure 5.1).

Figure 5.1. Energy and e-communications regulators have the greatest scope of action

Note: The Indicators on the Governance of Sector Regulators are a composite shown on a scale of zero to six. In the scope of action component, a lower score indicates a broader scope of action and a score closer to six suggests the regulator has a narrower scope of action. The indicators are aligned with the Product Market Regulation indicators.

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

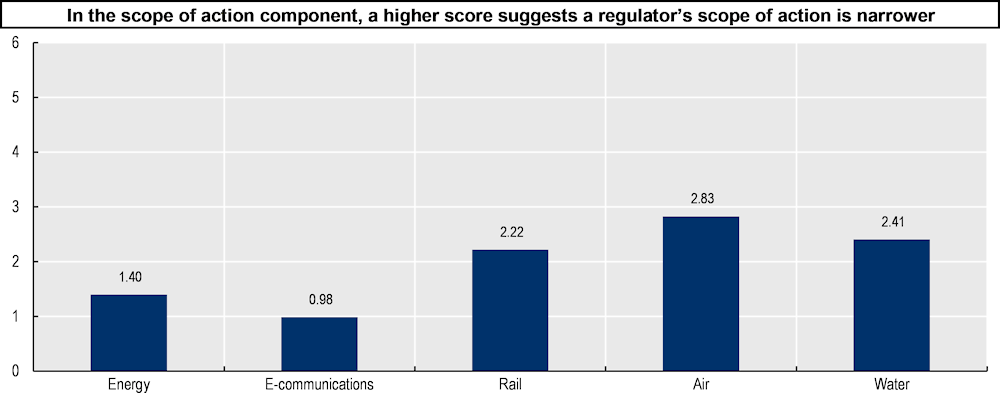

Economic regulators may have the power to conduct their activities independently or in conjunction with other actors. More energy and e-communications regulators tend to perform functions independently when compared to regulators of other sectors (Figure 5.2). Most regulators across all sectors regulate prices, such as network usage and connection tariffs. Indeed, a strong majority of regulators in e-communications and energy sectors (89% and 83%, respectively) regulate prices independently. The lowest proportion of regulators with the power to regulate prices either independently or in co-operation with other bodies is the rail sector (with 60% of regulators reporting this function). Regulators in the water sector often regulate prices in co-operation with other agencies or bodies such as the government (with 29% regulating with other bodies). Most regulators also issue or revoke licenses, and mediate in disputes. Overall, a minority of regulators independently issue industry and consumer standards, while many enforce such standards. In cases where a regulator carries out its functions with other actors, promoting role clarity and managing stakeholder expectations about the scope of the regulator’s role are important aspects of the governance of regulators.

Figure 5.2. Dispute resolution, regulating prices, enforcing compliance, and issuing and revoking licenses/authorisations are common activities for regulators in the sample

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

In many jurisdictions, regulators have competences in more than one sector. The database contains data from 21 multi-sector regulators (Casullo, Durand and Cavassini, 2019[10]). Thirteen of these regulators are bi-sector, with two sectors covered in the survey falling under their purview. Certain sectors, especially transport sectors and energy and water, tend to be placed together within one regulator. Indeed, most of the bi-sector regulators group the rail and air transport sectors or the energy and water sectors under the umbrella of a single regulator. Some multi-sector regulators were created with multiple sectors under their purview from the outset. For example, the Latvian Public Utilities Commission (PUC) was given competencies in the e-communications, energy and water sectors. Some regulators have absorbed new sectors after their establishment. For example, the Croatian regulator HAKOM absorbed the rail regulator in 2014. In 2019, Finland merged the Finnish Transport Safety Agency, the Communications Regulatory Authority, and certain functions of the Transport Agency into a single agency. Other regulators also serve as competition authorities, such as the Australian Competition and Consumer Commission and the Authority for Consumers and Markets in the Netherlands.

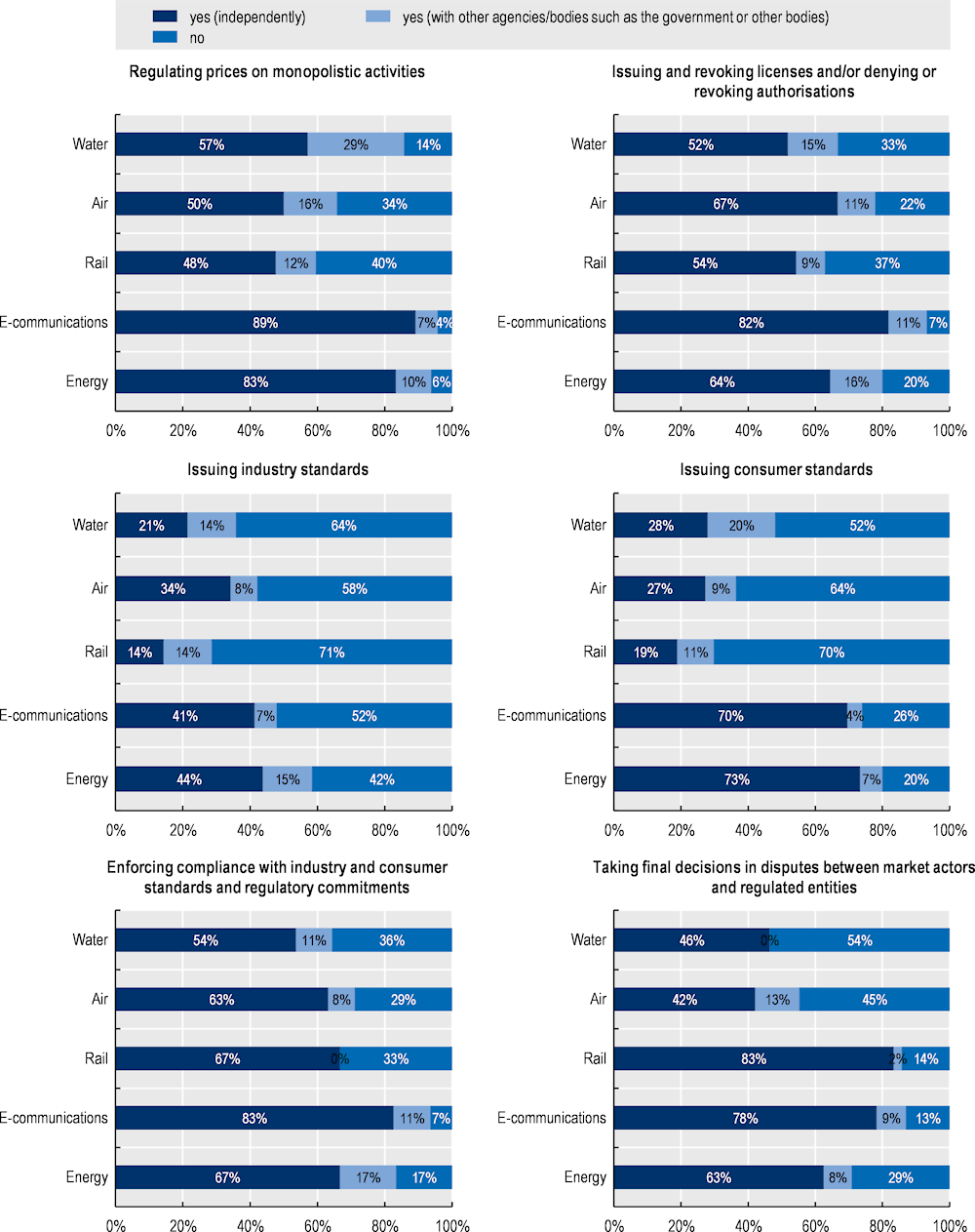

Regulators can be useful partners for governments in policy making, given their proximity to markets and the market performance data they collect. Their mandate allows them to closely monitor the impact of government policies on sector actors and market structures. When regulators make recommendations or issue opinions on important legislative changes in regulated sectors, this can improve the quality of new policies by the government. While policy making is the responsibility of the executive, input from the regulator can provide data and evidence on the issues that need to addressed (OECD, 2016[9]). In many cases, regulators possess industry expertise and data that can be an important input to the policy-making process and government planning for the regulated sector. Moreover, through issuing opinions and recommendations, regulators can identify possible consequences of government policies for their governance and performance. Most regulators make recommendations or issue opinions on draft legislation proposed by the executive. While not in all cases through a formal process, more than 90% of the regulators in the energy, e-communications, water and rail sectors do so. The situation differs for air transport regulators, with less than half of them making recommendations or issuing opinions through a formal process and around a quarter not doing so at all (Figure 5.3).

Figure 5.3. Nearly a quarter of air transport sector regulators do not issue recommendations or opinions on draft legislation or policy documents

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Box 5.2. Regional focus: Economic regulators in Latin American countries

Reform in the infrastructure sectors in Latin America over the last decades has transformed the landscape of regulation. The OECD Indicators on the Governance of Sector Regulators include data from 30 regulators in 7 countries from the region: Argentina, Brazil, Chile, Colombia, Costa Rica, Mexico and Peru. Chile, Colombia, Costa Rica and Mexico are OECD member countries.

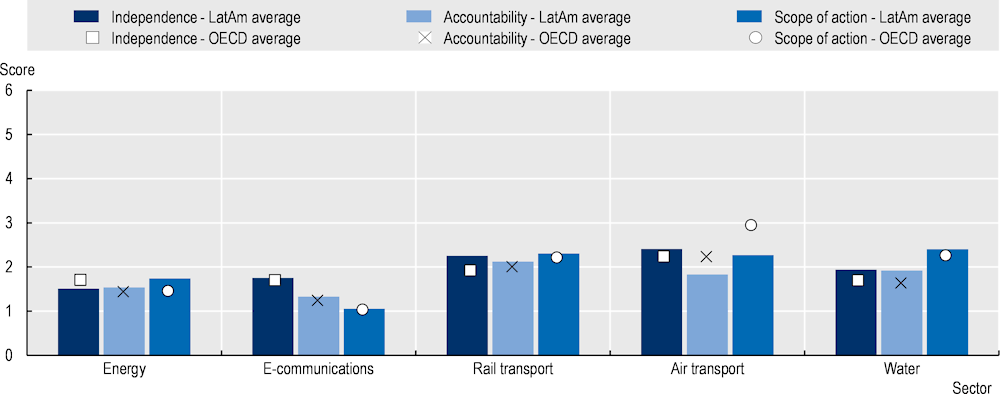

Regulators in these countries tend to be independent (although there is variation between sectors) and focus on a single sector. The governance arrangements in Latin American regulators surveyed in five network sectors tend to be robust, relative to the OECD average.3 The governance arrangements in place to preserve independence of the energy regulators and the accountability of air transport regulators are particularly strong in the Latin American countries. However, there is scope for improvement in the independence of rail, air transport and water regulators and the accountability of water regulators. Scope of action scores show that Latin American regulators engage in a similar number of activities as OECD countries in e-communications, rail transport and water. However, they have a narrower scope in the air transport sector and a broader scope in the energy sector.

Figure 5.4. Latin American regulators’ governance arrangements in independence and accountability tend to be robust, relative to OECD average

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

A culture of independence supports the integrity of regulatory decisions

The independence of regulatory decision making is a product of many factors and safeguards. Formal or de jure independence is the degree to which legal arrangements protect the regulator’s independence. However, independence by law is insufficient to guarantee an impartial regulator, free from undue influence (OECD, 2017[8]). The practical implications of formal arrangements, as well as staff behaviour and institutional culture, determine the de facto independence that regulators experience in practice. A culture of independence fosters trust amongst stakeholders that decisions show integrity, respecting long-term goals even when circumstances change.

Changes in the context in which a regulator operates can influence the independence it exhibits in practice, and decrease clarity on its role and competencies. Over the course of time, regulators may experience “pinch-points” where there might be potential for greater undue influence (OECD, 2017[8]). In other cases, changes will create a discrepancy between the regulatory framework and practice. A recent example is the COVID-19 pandemic, causing rapid changes across regulated sectors worldwide, which affect the role of the regulator and its interactions. In response to the pandemic, a number of regulators reported closer co-ordination and exchange of information with the executive, and more frequent contacts with both the executive and other stakeholders (OECD, 2020[4]). Shocks to the system could harm wider credibility and trust in a sector, crucial ingredients for markets to perform. Therefore, especially in times of change, regulators need to engage in a close and continuous dialogue with the executive and other stakeholders. By doing so, regulators can improve clarity on their role, and assess whether governance arrangements and legal competencies are still sufficient for the regulator to deliver upon its objectives independently and efficiently.

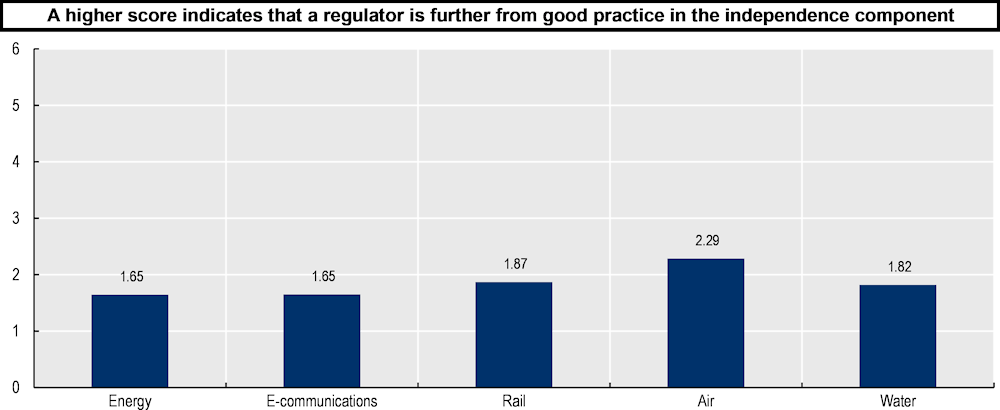

Figure 5.5 shows the independence safeguards for economic regulators across sectors. Among the regulators included in the sample, arrangements that safeguard the independence of regulators are closest to good practice in the energy and e-communications sectors.

Figure 5.5. Energy and e-communications regulators have more good-practice measures to promote independence than other sectors

Note: The Indicators on the Governance of Sector Regulators are a composite shown on a scale of zero to six. In the independence component, a lower score shows that a regulator better reflects good practice, while a score closer to six suggests that a regulator is further from good practice.

The Spanish National Commission of Markets and Competition (CNMC, with indicator data in the energy, e-communications and rail transport sectors) is subject to approval of different Ministries concerning essential decisions to hire and retain its permanent staff and to design and expend its allotted budget. Budget restrictions apply in particular to human resources and the possibility to hire studies or special assistance services, like research or IT. Likewise, any modification of the organisation of the CNMC requires a legal act adopted by the Government.

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Economic regulators of network sectors in OECD countries are overwhelmingly defined by law as independent bodies

An elementary measure of de jure independence is the legal status of the regulator relative to the executive. Through legislation, a regulator can be set up as an independent body outside the ministry structures, or as an administrative unit within the ministry. As mentioned in the 2012 Recommendation of the Council on the Regulatory Policy and Governance, “independent regulatory agencies should be considered in situations where:

There is a need for the regulatory agency to be independent in order to maintain public confidence;

Both the government and private entities are regulated under the same framework and competitive neutrality is therefore required; and

The decisions of regulatory agencies can have significant economic impacts on regulated parties and there is a need to protect the agency’s impartiality” (OECD, 2012[5]).

Most regulators in the sample are defined by law as independent bodies with adjudicatory, rule-making or enforcement powers. EU Directives for energy and rail, mandating the creation of independent national regulatory authorities (NRAs) in EU member states, may be one reason for this (European Parliament and the Council of the European Union, 2009[17]; European Parliament and the Council of the European Union, 2009[18]; European Parliament and the Council of the European Union, 2012[19]).4 Given the high presence of EU countries across the OECD sample and the wider sample of countries,5 trends among EU countries can affect sample observations. However, also across the sample of non-EU regulators in OECD and non-OECD countries, most regulators qualify as independent bodies according to their legal status.6 Among OECD countries, the share of legally independent regulatory bodies is 87% for the energy sector, 84% for the e-communications sector and 83% for the rail sector. In the air transport and water sectors, the share of independent regulators is lower, with 50% of air transport regulators and 76% of water regulators qualifying as independent bodies. These percentages are roughly the same across the broader sample of both OECD and non-OECD countries (see Figure 5.6).

Within the two archetypes of independent and ministerial regulators, regulators may be equipped with a range of good-practice governance arrangements to safeguard independence. As well as asking regulators whether they are defined by law as independent or ministerial bodies, the questionnaire underlying the Indicators on the Governance of Sector Regulators captures a range de jure and de facto characteristics that contribute to the independence a regulator may experience in practice. The sub-sections that follow show how regulators reflect common attributes to encourage independence.

Figure 5.6. The energy sector has the highest share of regulatory bodies with an independent legal status

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

The de jure independence of regulators is complemented by restrictions on leadership activities to prevent undue influence in most jurisdictions

Boards or agency heads are ultimately responsible for the regulator’s decisions, and therefore potentially subject to greater pressure from government and industry bodies than professional staff (OECD, 2016[7]). Sound leadership arrangements can prevent potential conflicts of interest, and thereby bolster the independence of the board or head of the agency.

There are a number of patterns across regulators in the arrangements regarding the agency’s leadership. First, most regulators are led by a board. Only in the air transport sector is this different, where the majority of regulators have a single agency head instead. In general, a board may be considered more reliable for decision making as a multi-member decision making body is expected to ensure a greater level of independence and integrity (OECD, 2010[20]). However, the potential value of a multi-member compared with a single-member decision making model depends on several factors. For example, this may be affected by the potential commercial/safety/social/environmental consequences of regulatory decisions or the degree of judgement required where regulation is principles-based or particularly complex (OECD, 2014[6]).

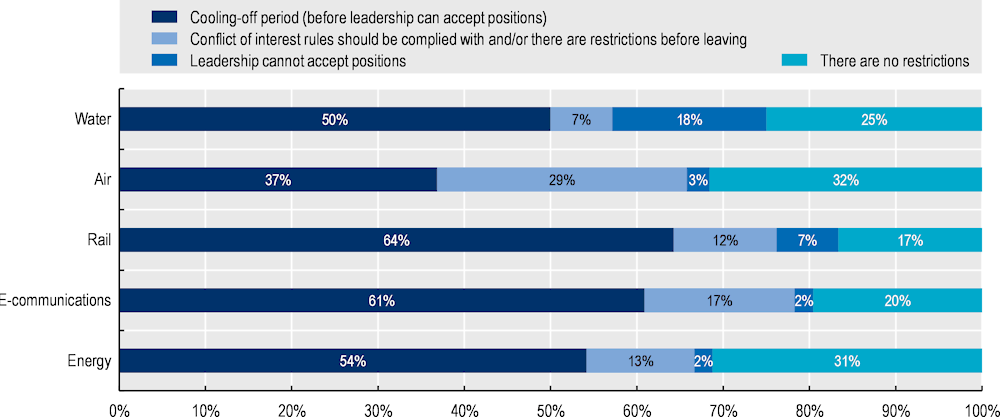

Second, while restrictions on past employment for leadership exist only in a minority of cases, the legislation does usually define the skills required for members of the leadership. Moreover, restrictions on external activities during their term in office and in the immediate post-employment period are common. For a majority of regulators in the sample, leadership face restrictions in accepting jobs in the government and/or the regulated sector after their term of office, such as a cooling-off period (Figure 5.7).

Figure 5.7. The leadership of most regulators cannot accept government and/or industry positions related to the regulated sector directly after term

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

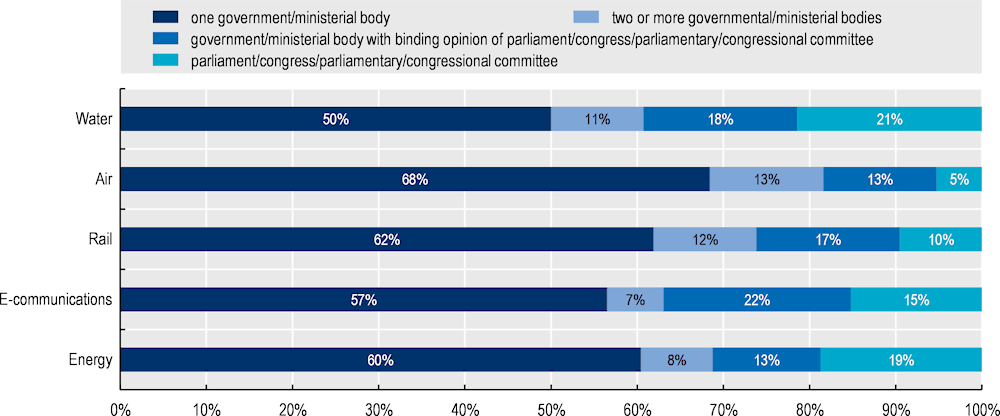

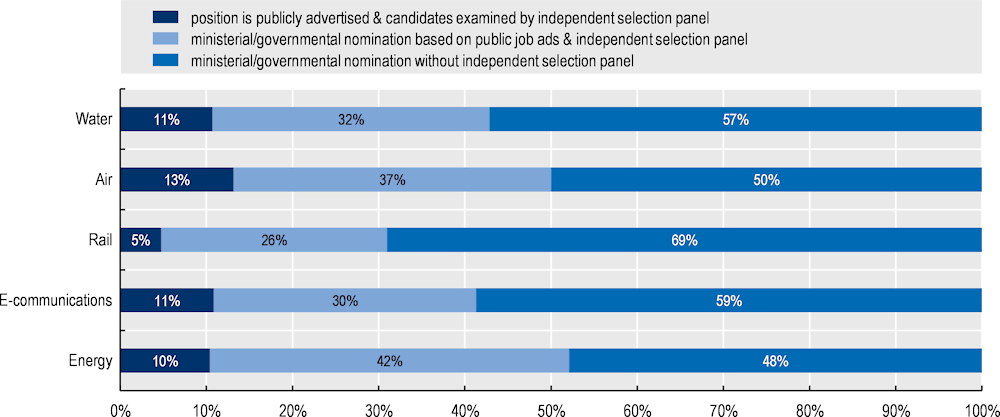

Third, in most cases, a government or ministerial body appoints the members of the leadership of regulators (Figure 5.8). The results build upon findings in the 2018 Regulatory Policy Outlook, and show that a government or ministerial body has the legal authority to appoint the regulator’s leadership in a majority of cases in all sectors (OECD, 2018[2]). In selecting the new leadership, there is a need for transparency in the nomination and appointment process (OECD, 2017[8]). Among 44% of the regulators in the sample, the selection process of the agency head or board members involves an independent selection panel (Figure 5.9). Among OECD countries, this is slightly higher, with an independent panel being involved for 47% of the regulators.

Figure 5.8. A government or ministerial body usually appoints the regulator’s leadership

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Figure 5.9. In most cases, the selection process does not involve an independent selection panel

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Fourth, regarding arrangements for the dismissal of leadership, the government can dismiss members of the board in the majority of the regulators. In most cases however, dismissal is only possible within a given set of criteria. This provides a safeguard against arbitrary dismissal of the leadership, which could threaten the regulator’s independence.

There is room for improvement in the regulators’ funding arrangements, to increase their independence

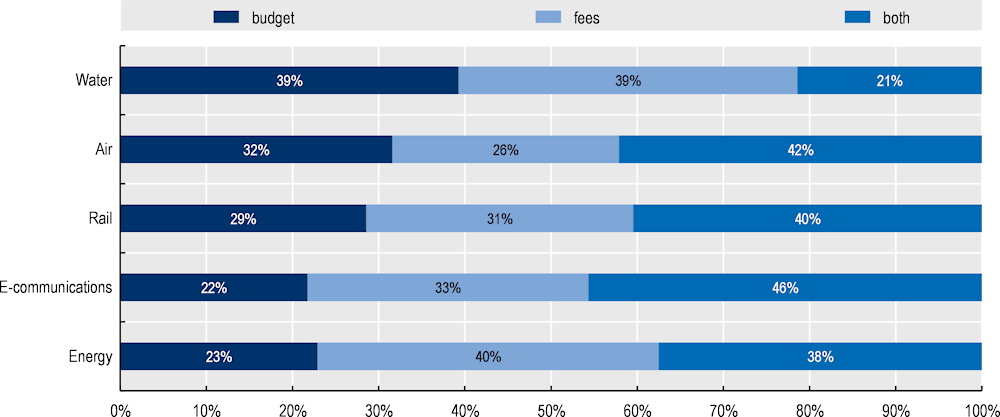

The way in which a regulator is funded may affect its ability to carry out its mandate independently. Not only does a regulator need sufficient funding to deliver upon its objectives, but the funding should also be determined in a way that prevents undue influence. Broadly speaking, regulators obtain their funding through fees from industry, the state budget, or a mix of both (Figure 5.10). The share of regulators funded exclusively through state budgets is highest in the water sector, while the energy sector has the greatest proportion of regulators funded exclusively through fees. For e-communications and the transport sectors, the dominant mode is a regulator funded through a mix of both fees and state budget.

Figure 5.10. The share of regulators funded exclusively through the state budget is highest in the water sector

Notes: The authors derived this information from responses to two questions on the Indicators of the Governance of Sector Regulators questionnaire, and confirmed the information with desk research. The Indicators on the Governance of Sector Regulators survey does not ask outright whether regulators are funded through budget, fees, or a combination of the two. Rather, it asks (1) “If the regulator is financed in total or in part through fees paid by the regulated sector, who sets the level of the fees?” and (2) “If the regulator is financed in total or in part through the national budget, who is responsible for proposing and discussing the regulator’s budget?” If the regulator specified a responsible body for both questions, it was assumed that the regulator was funded through a mix of both. If the regulator only specified a responsible body for one of the two questions, and answered the other question with ‘n/a’, it was assumed that the regulator was funded exclusively through that specific source.

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

In case the regulator is funded through fees, these can be paid by the regulated entities as a percentage of their net turnover or income, or in other cases based on the entity’s activity level (such as cubic meter of water supplied in case of a water company). An appropriate cost-recovery mechanism is essential to set the right level of the fee and make sure the regulator has sufficient funding (OECD, 2016[7]). Regulators funded through fees enjoy greater freedom where they are able to set the level of fees themselves within criteria set in legislation. For regulators in the sample that are funded by fees, roughly half of them sets the level of the fees themselves. In most other cases, the regulator proposes the fee for approval by either parliament, congress or the executive.

When the executive is responsible for proposing and discussing the regulator’s budget, or can set the level of the fees, it may be able to exercise undue influence on the regulator’s activities by reducing the regulator’s resources and capacity to act. Certain safeguards can prevent this from occurring. For example, multi-annual budgeting through a transparent and clearly defined process will be less contingent to short‑term pressure from political or electoral imperatives (OECD, 2017[8]). However, for the regulators in the sample, budget appropriations tend to be annual.

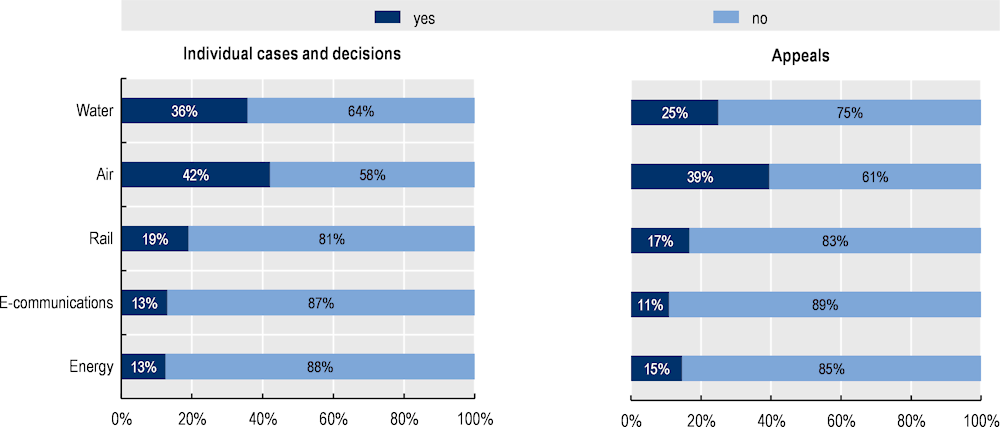

Regulators usually only receive guidance on their long-term strategy, which enhances their independence

Regulators need to make and implement impartial, objective and evidence-based decisions that will inspire trust in public institutions and encourage investment. The role of the regulator should be made clear in legislation, and guidance from the government outside the legislative process that directs the regulator in its role and actions should be avoided (OECD, 2017[8]). While receiving guidance from the government on its long-term strategy can ensure that its strategy is in line with broad policy objectives, more direct government involvement in the regulator’s work programme, individual regulatory decisions and appeals processes limits independence.

Most regulators do not receive government guidance on individual cases or regulatory decisions and on their handling of appeals. The air transport sector shows the greatest proportion of regulators that receive guidance in these topics, with roughly 40% of air transport regulators reporting that they do receive government guidance in individual cases or regulatory decisions and appeals (Figure 5.11).

Figure 5.11. Air transport sector regulators receive more guidance from the government in their day-to-day work than regulators in other sectors

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Figure 5.12. Most regulators do not receive guidance from the government on their work programmes

Notes: The questionnaire asks whether regulators receive government guidance on work programmes, which it defines as a document and/or statement outlining how the regulator intends to implement priorities and objectives. This work programme is generally on a shorter-term horizon (1 year, for instance). Most regulators do not receive guidance from the government on their work programmes (The exception is in the air transport sector, where more than half of regulators receive government guidance on their work programmes.)

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

The questionnaire asks regulators whether they receive guidance from the government on their long-term strategy, a document and/or statement outlining priorities and objectives of the regulator with a longer-term horizon (for example, three or five years). In all sectors except rail transport, a majority of regulators receive government guidance on their long-term strategy (Figure 5.13).

Figure 5.13. Government guidance on long-term strategy is common in all sectors but rail transport

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

By receiving government guidance on long-term strategies, regulators are able to take on board long-term policy goals by the government when setting their strategic objectives, without necessarily being influenced by the day-to-day political environment in the execution of their tasks.

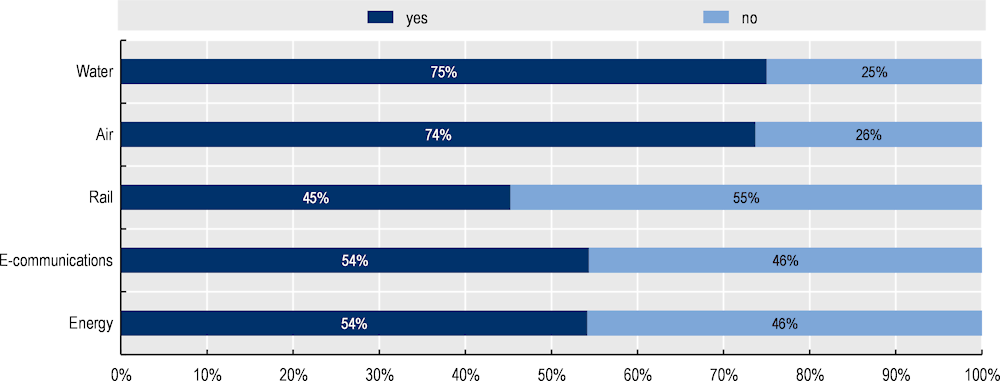

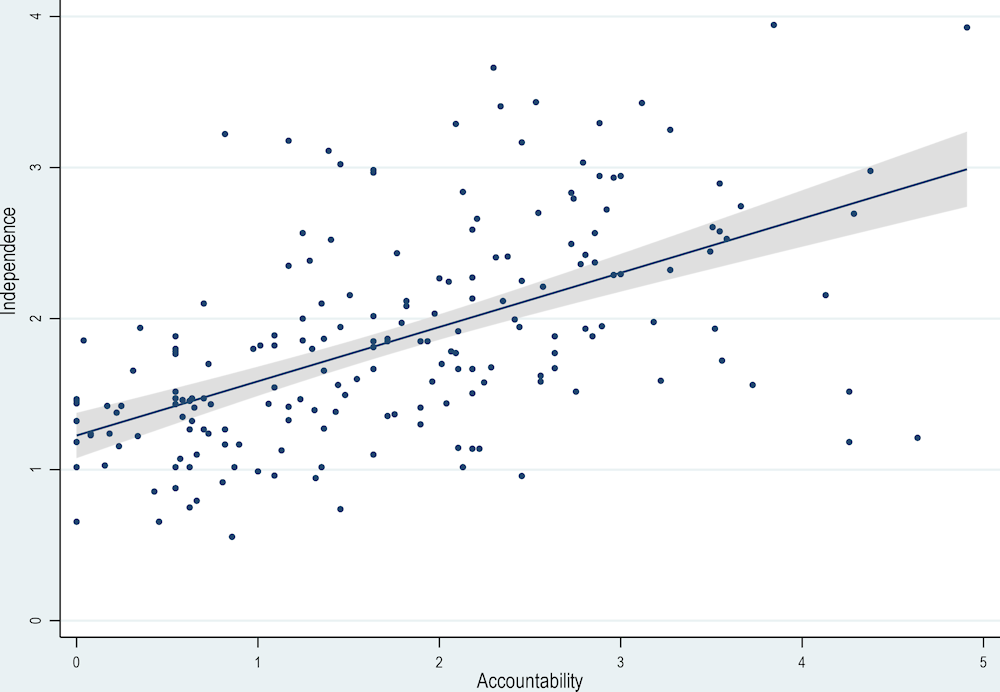

Regulators’ accountability arrangements vary between sectors

Well-designed arrangements to promote accountability, also discussed in chapters 2 and 3, provide information and opportunities for appropriate input from stakeholders. Measures to enhance the transparency of a regulator’s actions also serve to collect important input for regulatory actions. Measures to safeguard independence and allow for regulatory discretion need to be balanced with measures that facilitate appropriate oversight from the executive, legislature, judiciary, regulated entities and the public, in order to hold regulators to account. For this reason, accountability can be seen as the other side of the coin of independence (OECD, 2014[6]). The data on the governance of regulators confirms that accountability and independence go hand-in-hand in practice, as on average regulators showing greater adoption of good-practice independence arrangements also show a greater adoption of accountability arrangements (Figure 5.14).

Figure 5.14. Regulators with greater independence are also more accountable

Notes: The Indicators on the Governance of Sector Regulators are a composite shown on a scale of zero to six. In the independence and accountability component, a lower score shows that a regulator better reflects good practice, while a score closer to six suggests that a regulator is further from good practice. Grey area indicates a 95% confidence interval based on a linear fitted regression line in Stata. Spearman’s rank correlation coefficient is equal to 0.6034 (with a p-value of 0.0000). Total number of observations is 200.

The Spanish National Commission of Markets and Competition (CNMC, with indicator data in the energy, e-communications and rail transport sectors) is subject to approval of different Ministries concerning essential decisions to hire and retain its permanent staff and to design and expend its allotted budget. Budget restrictions apply in particular to human resources and the possibility to hire studies or special assistance services, like research or IT. Likewise, any modification of the organisation of the CNMC requires a legal act adopted by the Government.

Source: Based on OECD calculations.

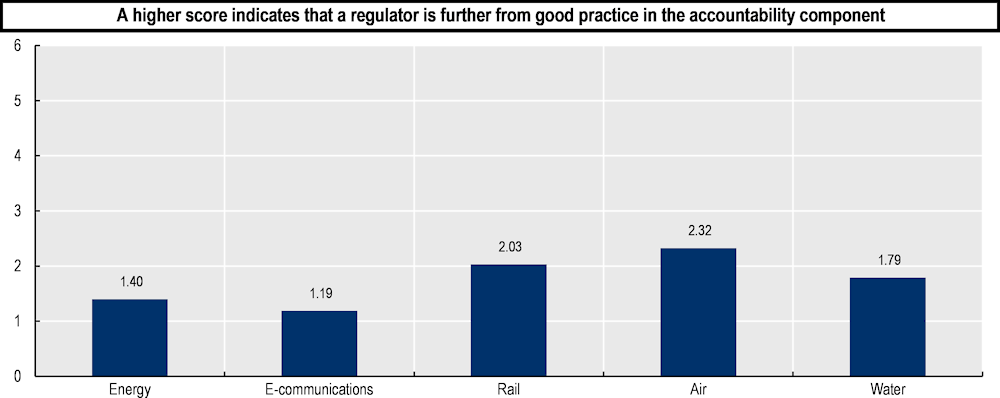

On average, lower scores for regulators in the energy and e-communications sectors show that regulators in these sectors have adopted more of the good-practice arrangements to safeguard accountability identified in the survey Figure 5.15). Regulators in the water and transport sectors show lower adoption of these arrangements. While beyond the scope of this chapter to analyse in-depth, it is important to note that the market characteristics of regulated sectors are among the determinants for the appropriate institutional design of regulators including the design of accountability and independence arrangements, alongside political, cultural, and practical considerations.

Figure 5.15. Regulators in the energy and e-communications sectors have the strongest governance arrangements to promote accountability

Note: The Indicators on the Governance of Sector Regulators are a composite shown on a scale of zero to six. In the accountability component, a lower score shows that a regulator better reflects good practice, while a score closer to six suggests that a regulator is further from good practice.

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

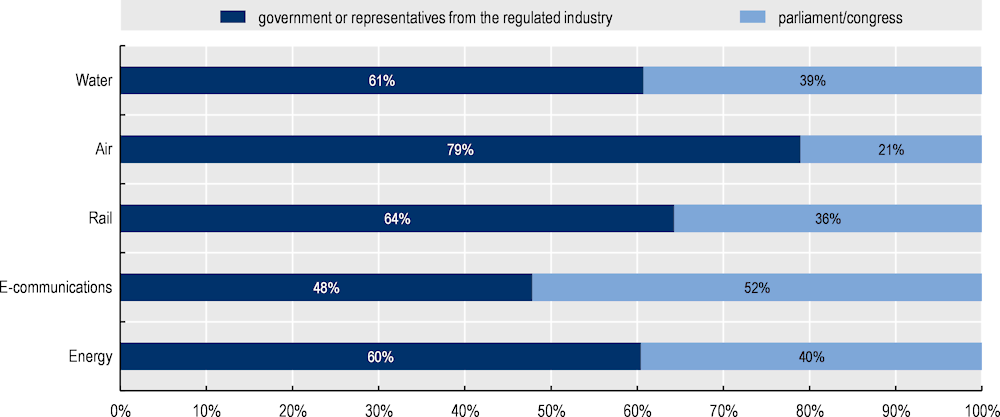

Regulators maintain direct lines of accountability to government or parliament

Defining formal arrangements for accountability is one of the key elements in a more accountable governance framework, whether that be direct accountability to the legislature or to the government or representatives of the regulated industry. Most regulators in the sample are accountable to the government or representatives from the regulated industry (Figure 5.16). Good practice for maintaining accountability differs depending on the degree of independence of the regulator and whether the regulator reports to the executive or the legislature. The importance of defined procedures and mechanisms for reporting is particularly relevant for independent regulators that are accountable to government, in order to avoid compromising the actual or perceived independence of decision making (OECD, 2014[6]).

Figure 5.16. E-communications is the only sector in which a majority of regulators are directly accountable to the legislature

Note: The questionnaire response options for this question are “government or representatives from the regulated industry” and “parliament/congress”

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Regardless of whether regulators report to government or to parliament, independent regulators’ reporting should occur through clear and systematic channels. One such channel is a regular activity report. The data show that most regulators are required to produce a report on their activities on a regular basis (86% across all sectors). Regular presentations to parliament serve an additional purpose: raising awareness of the value of the regulator. When regulators present an activity report in person, it allows regulators to discuss with legislators and answer any questions. The data show that fewer regulators present this activity report to the legislature in person, both among regulators directly accountable to parliament and those accountable to the government or industry. The majority of regulators directly accountable to parliament present an activity report to parliamentary committees. Among those accountable to government or the regulated industry, less than one-third of regulators present a report on their activities to the legislature.

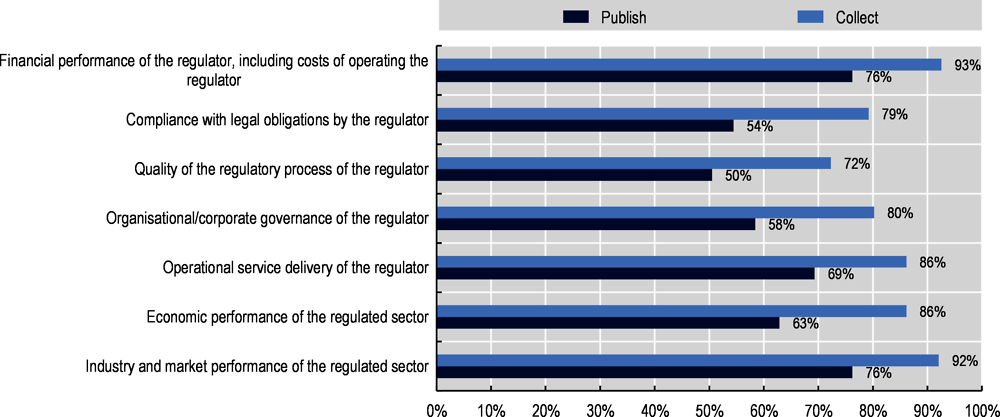

There is room for improvement on performance reporting

Performance measures both of the sector and of the regulator are critical inputs to decision making. Measuring sector performance helps regulators identify issues and understand the impact of regulation. Understanding and reporting on the regulator’s performance is just as important to demonstrate the effectiveness of the regulator and drive improvements (OECD, 2014[21]). The Indicators on the Governance of Sector Regulators capture whether the regulator collects and publishes certain information about the performance of the sector, including the market performance of the regulated sector (for example, the number of network faults or levels of investment and service performance for users) and the economic performance of the regulated sector (such as level of competition and investment outcomes). It also captures whether regulators collect and publish information on the regulators’ performance, including the following:

Operational service delivery of the regulator: information relating to the delivery of the functions and responsibilities of the regulator (for example the number of inspections, licensing/permit provision).

Organisational/corporate governance performance of the regulator: information relative to the internal functioning of the regulator (for example, the timeliness of completion of planned activities, staff survey results and information about leadership performance).

Quality of regulatory process of the regulator: information about the performance of the tools and processes used in decision making such as impact assessment, stakeholder engagement, and ex-post evaluation.

Compliance with legal obligations by the regulator: information about the regulators’ compliance with legal requirements (such as the fulfilment of information obligations or the proportion of decisions taken that are upheld).

Financial performance of the regulator: information including the costs of operating the regulator, budget spending, revenue, and direct and indirect costs incurred.

Figure 5.17 shows that most regulators collect and publish information about the performance of the sectors they regulate, including the economic performance of the sector and the industry and market performance of the sector. Regulators also commonly collect and publish information about their financial performance, with 93% collecting such information and 76% publishing.

Other categories of regulators’ performance information are less commonly collected and published. Twenty per cent or more of regulators in the sample do not collect information on the quality of their regulatory processes, their compliance with legal obligations and the organisational governance of the regulator. Less than 60% publish this information on their website. While 86% collect information about the operational service delivery of the regulator, only 69% publish this information. Given the importance of performance evaluation in informing the actions of the regulator, further work on performance evaluation is warranted (see Chapter 2).

Figure 5.17. Fewer regulators collect and publish some types of performance information

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Regulators have the opportunity to enhance or build upon traditional tools to better understand and communicate sector performance. The OECD working paper “Shaping the future of regulators: The impact of emerging technologies on economic regulators” highlights examples of regulators that harness the power of data to improve transparency and create incentives to improve market functioning. A data-driven approach provides the opportunity for regulators to provide targeted information to stakeholders, including about service quality, to facilitate informed choices by consumers. For example, the French e‑communications regulator (l'Autorité de régulation des communications électroniques – ARCEP) publishes maps with data and information about operators’ coverage and service quality across the country. This “sunshine regulation” approach is expected to create incentives to improve overall market functioning (OECD, 2020[3]).

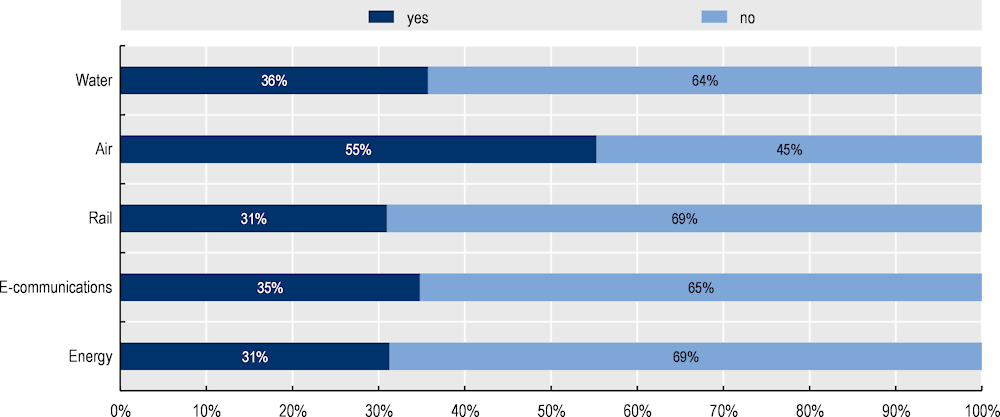

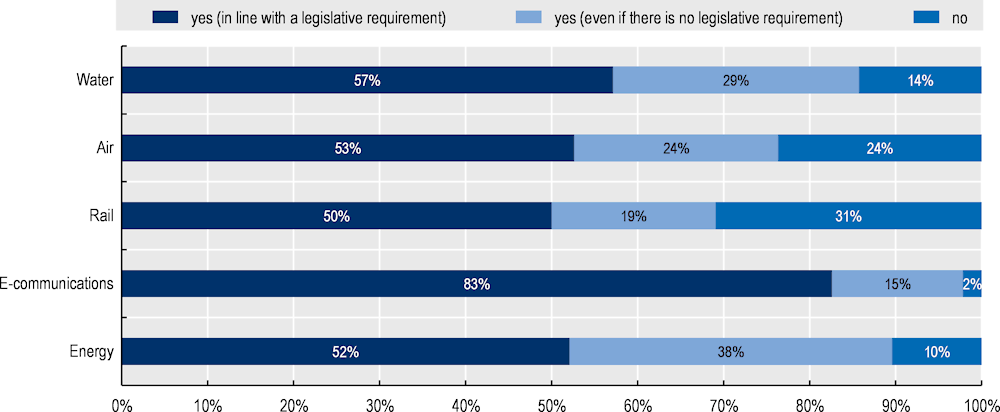

Most regulators publish draft decisions and collect feedback from stakeholders

Stakeholder engagement is an important component of accountability and transparency, and helps regulators collect input for decision making. Regulators may conduct stakeholder engagement relating to regulatory decisions as well as other aspects of their work, such as operational policies (OECD, 2014[6]). Most regulators publish draft decisions and collect feedback from stakeholders, even if there is no formal requirement to do so (Figure 5.18). Compared to peers in other sectors, a greater proportion of regulators in the transport sectors do not publish draft decisions for stakeholder comment. Box 5.3, which summarises results from the expansion of the indicators to twelve energy regulators in francophone African countries, shows that stakeholder engagement is an area for improvement in this group.

Figure 5.18. Most regulators publish draft decisions and collect feedback from stakeholders

Source: 2018 OECD Indicators on the Governance of Sector Regulators.

Box 5.3. Regional focus: Energy regulators in Francophone African countries

The OECD expanded the Indicators on the Governance of Sector Regulators to 12 energy regulators in francophone African countries (these data are not included in the figures and charts in the rest of the chapter). Twelve regulators participated covering Algeria, Benin, Burkina Faso, Burundi, the Central African Republic, Côte d’Ivoire, Madagascar, Mali, Mauritania, Niger, Senegal, and Togo. This sample showed that many of these regulators report sharing some formal governance arrangements to their longer-established OECD peers, especially in the independence component of the indicators. The greatest differences between this sample and energy regulators in OECD countries lie in the “scope of action” component, with OECD regulators tending to have broader powers.

Most of the surveyed regulators are independent authorities (83%). Many have good-practice measures in place to safeguard independence in staffing and budgeting. However, some regulators lack good‑practice protections against government interference in regulatory decision making, with more than half of surveyed regulators reporting that they could receive direction from the government on independent cases or regulatory decisions. Additionally, selection, appointment and termination processes for agency leadership show a gap between practice in the sample and in regulators in OECD countries. The legislation defines the skills required by agency leadership in only around one-quarter of regulators in the sample, compared to 58% of the OECD sample. A single government body appoints the leadership of the majority (75%) of regulators in the sample (compared to around 62% of the OECD sample). Government decisions alone can terminate the leadership of the majority of regulators in the sample (85%, compared to around 78% of regulators in OECD countries), although terminations in most regulators must occur within set criteria.

The data show an opportunity for improvement in the accountability of regulators in this sample, including through the use of stakeholder engagement. More than half of the regulators in the sample do not publish draft decisions for comment by stakeholders. While two-thirds of regulators must publish a report on their activities, none of the regulators present an activity report to the legislature.

Source: OECD 2018 Indicators on the Governance of Sector Regulators.

Many regulators publish responses to comments to increase transparency of decision making and demonstrate appropriate consideration of input received from stakeholders. The data show that most regulators that do publish their draft decisions for comment also provide feedback on comments received from stakeholders (only 6% of these regulators do not respond to comments).

While careful and strategic planning can help regulators provide timely and meaningful opportunities for engagement to stakeholders, situations arise where regulators may have to adapt consultation processes. The COVID-19 crisis provides an example; in the face of an unforeseen crisis, regulators had to adapt public consultation processes during the pandemic’s early stages. Some public consultations were delayed, deferred, or held remotely in light of stakeholders’ limited ability to engage. Other consultation processes related to COVID-19 measures were expedited in order to collect stakeholder input into urgent decisions rapidly. For example, the United Kingdom’s Financial Conduct Authority offered a consultation period on measures to ease the financial burden for retail lending consumers over a period of 72 hours. In this rapidly evolving context, regulators encounter trade-offs between their ability to offer full-length, timely consultations and their need to take quick action (OECD, 2020[4]).

Researchers attempt to uncover the relationship between governance of regulators and sector performance

Exploring the links between the governance of regulators and the performance of regulated sectors can increase our understanding of the value of economic regulators. This is a challenging research field. Issues include how to define sectoral performance, how to account for the lag between decisions and their effects in downstream and upstream markets, or how to isolate the effects of the governance of regulators on sector performance, as the counterfactual is usually absent.

Recent and original research by Université Paris Dauphine (described in Box 5.4) uses data on the European members of the OECD included in the Indicators on the Governance of Sector Regulators to understand relationships between the governance of economic regulators and sectoral performance.

The preliminary results indicate correlations between governance arrangements and sector outcomes such as price levels and investment. Further research is needed to understand the drivers of the relationship between evolutions in governance and changes in sector performance, including the unraveling of the potential causal mechanisms. The results nevertheless provide interesting insights and promising avenues for research to understand better the links between the governance of regulators and the performance of the sectors they oversee.

Box 5.4. New research using the OECD Indicators on the Governance of Sector Regulators

Université Paris Dauphine researchers have used the data from the Indicators on the Governance of Sector Regulators to explore relationships between the governance of economic regulators and sectoral performance (Brousseau, Eric and Gonzalez-Regalado, forthcoming[22]). The researchers apply text modelling and algorithmic analysis to the database behind the indicators. These methods allow the researchers to identify dimensions according to their degree of correlation. This approach differs from the OECD Indicators on the Governance of Sector Regulators methodology, which results in composite indicator scores developed from equally weighted components. The indicators group data using ex ante assumptions, while this methodology reflects the importance of elements based on the statistical analysis of observations.

Using these methods, the researchers define four dimensions to help describe the governance of regulators in the sub-sample. While these dimensions use the same terms as the components of the indicators (namely, independence and accountability), the two categorisations are distinct. The four dimensions are: independence from government, the stringency of scrutiny over the regulator (“checks and balances”), the scope of market monitoring capabilities of the regulator, and the strength of its bureaucratic ability to monitor operators. While independent from each other, the first two dimensions together characterise the degree of independence and accountability of the regulatory agency, while the latter two capture the scope and the vectors of its authority over the sectoral stakeholders.

The research compares the 2013 and 2018 surveys to capture evolutions in governance arrangements over time, and looks for correlations between these evolutions and sector performance. Other explanatory factors, such as national income, geography, institutional quality or market regulation stringency were taken into consideration to check these correlations.

There are however limitations to the methodology. Changes in a dimension score between years might be associated with variations in other dimensions. Nevertheless, indicators are correlated to OECD and World Bank indicators on governance, suggesting that the measures are consistent with alternatives.

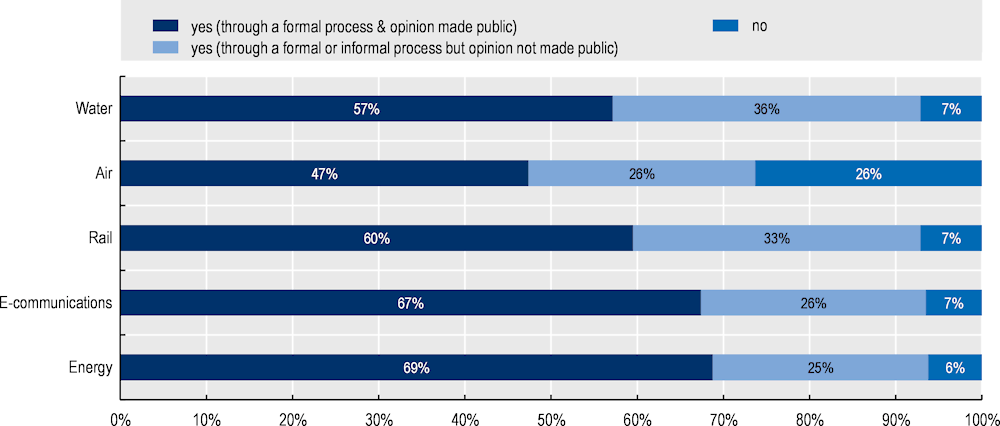

An example from the energy sector

When applied to the energy sector, the analysis finds that the scores on the four dimensions, as well as their evolution over time, are correlated with sector outcome variables such as prices. For example, improvements in the checks and balances dimension are correlated with lower nominal energy prices for users. Between 2013-2018, the average electricity price decreased in the European Union. Countries that saw improvements in the checks and balances dimension, through reinforced scrutiny of the regulator by the parliament, courts and the public, on average experienced greater price reduction.

Figure 5.19. Reinforced checks and balances are correlated with lower nominal energy prices

Conclusion

Effective governance structures are increasingly relevant in the context of changes in sectors and shocks, which requires strong regulators that are able to adapt while providing stability and predictability. The 2018 OECD Indicators on the Governance of Sector Regulators provide a snapshot of complex and multi‑dimensional governance arrangements of economic regulators that allows for direct comparison between sectors and benchmarking between countries, as well as an empirical study of the governance of regulators.

While the constellation of governance arrangements varies between regulators, and the suitability and impact of these arrangements are highly dependent on context, patterns exist. On average, independence and accountability arrangements are closest to good practice in energy and e-communication sectors, and regulators in these sectors have the broadest scope of action. Across sectors and countries, there are common trends among regulators, with a majority set up as independent bodies and with post-employment restrictions in place for the leadership. Regulators tend to contribute to the policy-making process by issuing recommendations or opinions, and consult on their regulatory decisions with stakeholders. Moreover, regulators in most sectors usually only receive guidance from the executive on their long-term strategy, but not on their work programme and day-to-day work and decisions.

However, not all areas show clear trends, and there are still gaps. Regulators differ significantly in terms of their scope of action, funding arrangements and to whom they are directly accountable. There is room for improvement in collecting and reporting information on the quality of the regulatory processes and compliance with legal obligations. Finally, research on exploring the relationship between the governance structures of regulators and sector performance is still in its infancy. Although preliminary results suggest a positive relationship, further research is needed to robustly capture and unravel possible causal mechanisms between the two.

References

[22] Brousseau, Eric and Gonzalez-Regalado (forthcoming), Comparative analysis of regulatory governance regimes in the OECD, Dauphine University, Paris.

[10] Casullo, L., A. Durand and F. Cavassini (2019), “The 2018 Indicators on the Governance of Sector Regulators - Part of the Product Market Regulation (PMR) Survey”, OECD Economics Department Working Papers, No. 1564, OECD Publishing, Paris, https://dx.doi.org/10.1787/a0a28908-en.

[19] European Parliament and the Council of the European Union (2012), “Directive 2012/34/EU of the European Parliament and of the Council of 21 November 2012”, Official Journal of the European Union L343, pp. 57-60.

[17] European Parliament and the Council of the European Union (2009), “Directive 2009/72/EC of the European Parliament and of the Council of 13 July 2009”, Official Journal of the European Union L211, pp. 80-85.

[18] European Parliament and the Council of the European Union (2009), “Directive 2009/73/EC of the European Parliament and of the Council of 13 July 2009”, Official Journal of the European Union L211, pp. 121-126.

[16] Gassner, K. and N. Pushak (2014), “30 years of British utility regulation: Developing country experience and outlook”, Utilities Policy, Vol. 31, pp. 44-51, http://dx.doi.org/10.1016/j.jup.2014.09.003.

[12] Gilligan, T., W. Marshall and B. Weingast (1989), Regulation and the Theory of Legislative Choice: The Interstate Commerce Act of 1887.

[13] House of Lords (2007), UK Economic Regulators, Committee on Regulators 1st Report of Session 2006-07, http://www.parliament.uk/parliamentary_committees/parliamentary_committees26.cfm (accessed on 10 June 2020).

[15] Jordana, J., D. Levi-Faur and X. Marin (2011), “The Global Diffusion of Regulatory Agencies: Channels of Transfer and Stages of Diffusion”, Comparative Political Studies, Vol. 44/10, pp. 1343-1369, http://dx.doi.org/10.1177/0010414011407466.

[11] Joskow, P., E. Killiam and J. Killiam (2000), “Introduction”, in Joskow, P. (ed.), Economic Regulation, MIT Press, Cambridge, https://www.amazon.fr/Economic-Regulation-Paul-L-Joskow/dp/1858989477 (accessed on 22 August 2020).

[14] Littlechild, S. (1983), Regulation of British Telecommunications’ profitability: report to the Secretary of State.

[3] OECD (2020), Shaping the Future of Regulators: The Impact of Emerging Technologies on Economic Regulators, The Governance of Regulators, OECD Publishing, Paris, https://dx.doi.org/10.1787/db481aa3-en.

[4] OECD (2020), When the going gets tough, the tough get going: How economic regulators bolster the resilience of network industries in response to the COVID-19 crisis, http://www.oecd.org/coronavirus/policy-responses/when-the-going-gets-tough-the-tough-get-going-how-economic-regulators-bolster-the-resilience-of-network-industries-in-response-to-the-covid-19-crisis-cd8915b1/.

[1] OECD (2019), Government at a Glance 2019, OECD Publishing, Paris, https://dx.doi.org/10.1787/8ccf5c38-en.

[2] OECD (2018), OECD Regulatory Policy Outlook 2018, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264303072-en.

[8] OECD (2017), Creating a Culture of Independence: Practical Guidance against Undue Influence, The Governance of Regulators, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264274198-en.

[7] OECD (2016), Being an Independent Regulator, The Governance of Regulators, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264255401-en.

[9] OECD (2016), Governance of Regulators’ Practices: Accountability, Transparency and Co-ordination, The Governance of Regulators, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264255388-en.

[21] OECD (2014), OECD Best Practice Principles for Regulatory Policy: The Governance of Regulators, OECD Publishing, Paris, https://www.oecd-ilibrary.org/docserver/9789264209015-en.pdf?expires=1585646606&id=id&accname=ocid84004878&checksum=f2f1bb7e832aeea65477cc6aad1accf0 (accessed on 31 March 2020).

[6] OECD (2014), “The Governance of Regulators”, OECD Best Practice Principles for Regulatory Policy, https://www.oecd-ilibrary.org/docserver/9789264209015-en.pdf?expires=1591541331&id=id&accname=ocid84004878&checksum=652e5c50b55160a562809d73a4f1899c (accessed on 7 June 2020).

[5] OECD (2012), Recommendation of the Council on Regulatory Policy and Governance, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264209022-en.

[20] OECD (2010), Making Reform Happen: Lessons from OECD Countries, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264086296-en.

Notes

← 1. The database contains data from regulators in Argentina, Australia, Austria, Belgium, Brazil, Bulgaria, Canada, Chile, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Romania, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States.

The questionnaire merges the electricity and gas sectors because most countries do not have separate gas and electricity regulators. Two countries with distinct gas sector regulators (Argentina and Brazil) completed two surveys, one for each regulator; the resulting indicator scores were averaged into a single country score for the energy sector.

The figures referring to the United States for the water sector include data from two state regulators – the New York Public Service Commission and the Public Utility Commission of Texas – as the economic regulation of this sector occurs on the state level.

← 2. The full list is available in the schemata for the questionnaire in Casullo, Durand and Cavassini (2019[10]).

← 3. The Latin American sample partially overlaps with the OECD sample, as Chile, Colombia, Costa Rica and Mexico are OECD member states. While the authors cannot consider the two samples to be independent because of the partial overlap, this box alludes to the OECD average for reference.

← 4. Among EU countries, 100% of energy and rail regulators qualifies as an independent body with adjudicatory, rule-making or enforcement powers.

← 5. Twenty two out of the 38 OECD countries included in the sample are EU countries, which is a share of 58%. Across the wider sample, the share of EU countries is slightly smaller, with 27 out of 47 countries belonging to the EU (57%).

← 6. The share of legally independent regulators in non-EU countries in the sample is 66%, and among non‑EU OECD countries in the sample 62%. The share of legally independent regulators among non-EU regulators is particularly low in the air transport sector (only 47% of non-EU air transport regulators in the sample is independent).