This chapter introduces the socio-economic context for Germany’s innovation system. Germany’s export-orientated and highly industrialised economy has supported a high level of socio-economic wellbeing. Germany also navigated the COVID-19 pandemic relatively well and has committed to making environmental sustainability a key pillar. An ageing population and the long-standing commitment to limiting annual federal borrowing provide for a challenging context in which to develop Germany’s innovation system for the future.

OECD Reviews of Innovation Policy: Germany 2022

2. The socio-economic context for innovation

Abstract

Introduction

German economic growth continues to be driven by its highly innovative industries, particularly the manufacturing sector. The global competitiveness of Germany’s many export-orientated firms plays a significant role in supporting a generally high level of socio-economic wellbeing. An important plan for the future the new coalition government that came to power in December 2021 has committed to is building greener transitions.

This chapter introduces recent trends in and key structural determinants of Germany’s economy as they relate to innovation. The purpose of the chapter is to frame the broader discussion of the innovation system in this Review.

This chapter proceeds with a brief overview of the items outlined above. Section 2.1 introduces the broad structural context for innovation in Germany, before Section 2.2 presents an overview of the impact of COVID-19 on the German economy. Section 2.3 introduces the sustainability goals of the German government, before Section 2.4 concludes with a discussion on public investment.

2.1. Structural context

Germany’s highly innovative manufacturing and industrial sectors are the cornerstone of its internationalisation and competitiveness. In the euro area, Germany has the highest level of value added and gross output in sectors ranging from chemicals and pharmaceuticals to the automotive and machinery industries. It also has the highest level of fixed capital formation and gross capital stock, both at the aggregate level and in each of these sectors. Investment in medium- and high-level research and development (R&D)-intensive activities, as well as in industry (including manufacturing), is the highest in the European Union (OECD, 2020[1]).

Over the past two decades, the strengths and weaknesses of Germany’s export-oriented economy have come to light. In 2019, Germany was the most open G7 economy: its ratio of total trade to GDP stood at 87.8%. Between 1980 and 2019, exports grew by 5.3% per year on average (BMWi, 2021[2]). It is precisely the export-oriented nature of the economy that allowed Germany to recover so rapidly following the global financial crisis, maintaining consumption despite low domestic spending and investment in 2020, and a 9.3% drop in exports (BMWi, 2021[2]). Yet at the same time, the interconnectedness of its value chains was disrupted during the global pandemic. The supply chain disruptions that resulted from the Russian invasion of Ukraine, which exposed the country’s strong reliance on raw materials from Russia, shed light on a key structural challenge for the German economy and its innovation ecosystem (see Chapter 9 for a discussion of these questions).

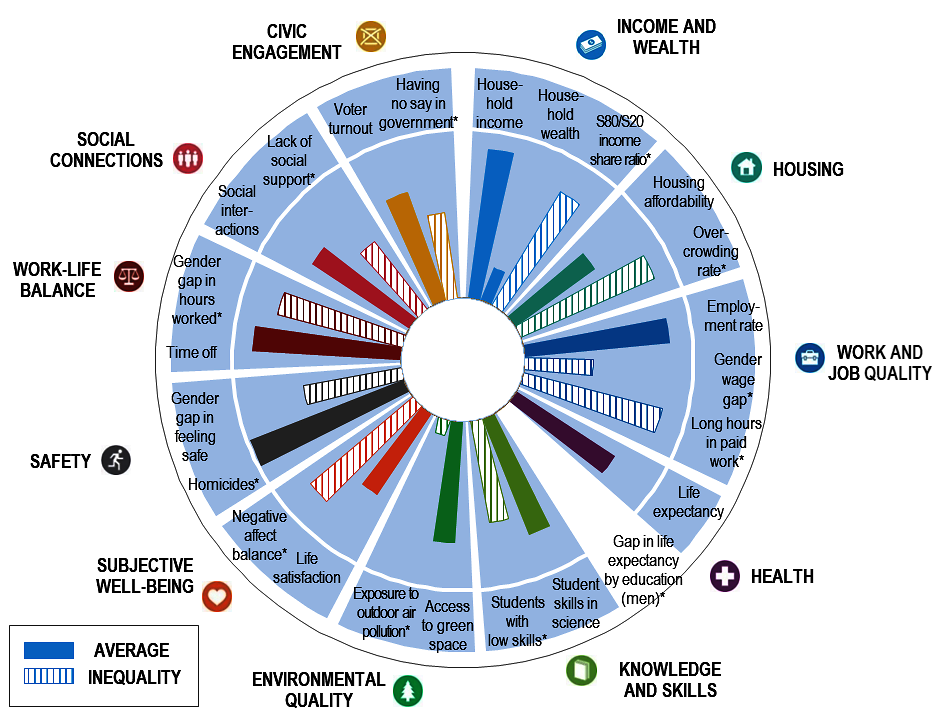

Robust economic performance has underpinned high living standards and well-being. Germany ranks among the leading OECD countries in a range of OECD Better Life Index indicators, including in categories such as education, skills and self-reported levels of personal satisfaction (Figure 2.1). Around 75% of people in the 25-64 age group are employed, and the country’s labour-force participation rate of 84.4% is among the highest in the OECD. Similarly, 87% of adults in the same age group have completed upper-secondary education, more than the OECD average (78%), although only 35% of 25-34 year-olds have completed tertiary education, lower than the OECD average (45.6%) (OECD, 2020[3]). This relatively low level of tertiary graduates likely reflects Germany’s strong competencies in vocational education and training, which is a particular asset for the country’s innovation system. In addition to higher educational attainment, Germany has a highly skilled work force, with Germany scoring significantly above the OECD average in literacy, numeracy and problem solving in technology-rich environments as measured in the OECD Survey of Adult Skills (PIAAC) (OECD, 2019[4]).

Figure 2.1. Well-being in Germany: The OECD Better Life Index (2020)

Note: This chart shows Germany’s relative strengths and weaknesses in well-being compared to other OECD countries. Longer bars always indicate better outcomes (i.e. higher well-being), whereas shorter bars always indicate worse outcomes (lower well-being) – including for negative indicators, marked with an *, which have been reverse-scored. Inequalities (gaps between top and bottom, differences between groups, people falling under a deprivation threshold) are shaded with stripes, and missing data shaded in white.

Source: OECD (2020[3]), "How’s Life in Germany?", in How's Life? 2020: Measuring Well-being, https://doi.org/10.1787/fe07a6b7-en, https://www.oecd.org/statistics/Better-Life-Initiative-country-note-Germany.pdf.

Like other advanced economies, Germany faces age-related demographic pressures, accentuating the productivity challenge. The country’s old-age dependency ratio (the ratio of people older than 64 to those aged 15-64) is 35%, already among the highest in Europe and forecasted to grow to 47.3% by 2030. With a shrinking working-age population, Germany will face growing pressures on growth and inclusion, as well as on the services and finances of public health and social care institutions. As with other aspects of socio-economic well-being in Germany, demographic challenges due to ageing have a marked regional dimension, with some regions likely to be more affected than others (Eurostat, 2021[5]). Demographic pressure also affects the future availability of skilled workers for innovation, raising questions about how to deal effectively with skilled migration (this is discussed in chapter 6 of this Review).

Germany has a highly federated system of governance, with subnational units enjoying significant levels of autonomy in many areas related to science, technology and innovation (STI). Governing responsibilities are distributed across 16 Länder (states), the largest being Bavaria, the wealthiest Baden-Württemberg and the most populous North Rhine-Westphalia. These three Länder also account for a high proportion of the country’s most innovative and commercially successful enterprises. In 2019, the Federal Government accounted for only 29.3% of tax receipts, the lowest share of the eight federal OECD countries; the majority of tax revenues were redistributed to regional and local governments, which possess significant autonomy and discretion in spending and redistribution (OECD, 2021[6]).

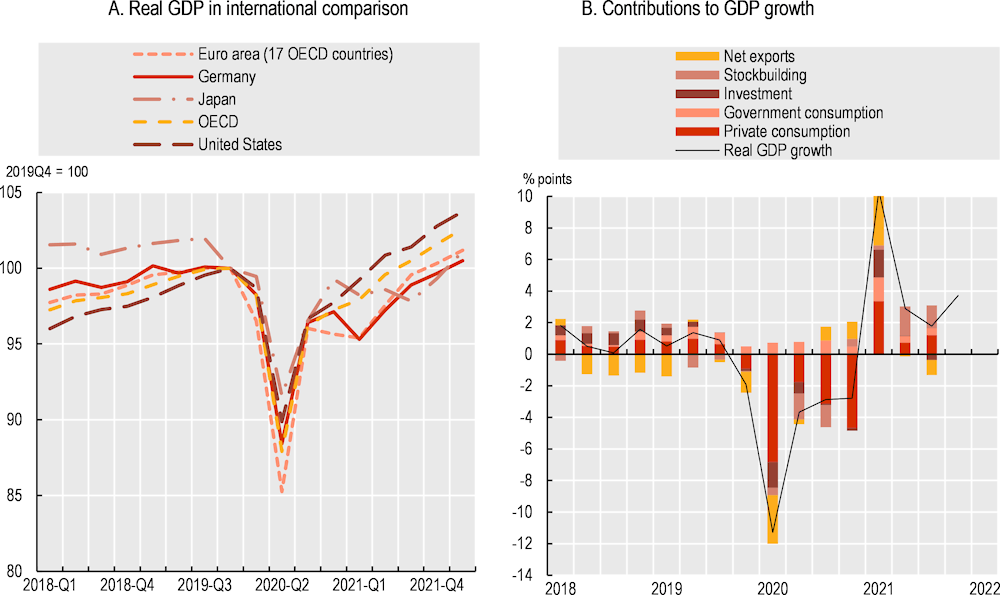

2.2. Recent trends with the COVID-19 crisis

Real GDP growth in Germany has largely tracked the OECD average. After 2000, the country experienced several years of low – and at times negative – growth, but had reached 3-4% growth in the two years preceding the 2008-09 global financial crisis (GFC). As with other developed economies, the GFC induced a sharp recession in the German economy, which contracted by almost 6% in 2009 – a deeper recession than the OECD average (3.3%) – before rebounding to 4.2% in 2010, outpacing the OECD average. Annual growth has somewhat decelerated since then, remaining however relatively stable before contracting significantly (4.6%) in 2020 owing to the COVID-19 crisis (OECD, 2022[7]). Germany’s economic recovery in 2021 (2.9%) was already hampered by shortages in key manufacturing inputs, global economic uncertainty and supply-chain problems. These issues will likely be exacerbated by the 2022 war in Ukraine, furthering delaying recovery, with growth likely to fall short of the December 2021 projection of 4.1% for 2022 (OECD, 2022[8]).

COVID-19 affected some demand – but mostly supply – for Germany’s industry. Although the impact of the COVID-19 crisis on the German economy was substantial, it was also relatively short-lived (Figure 2.2). While exports were affected during the pandemic due to falling external demand, demand quickly rebounded. The more severe impact of the crisis on Germany’s economy stemmed from supply-chain issues, which severely limited the manufacturing sector’s production capacities. A survey conducted by the Ifo Institute for Economic Research found that 45% of firms are facing bottlenecks in supply, the highest value since 1991 and higher than the 7.5% reported in October 2020 (Ifo, 2021[9]). The most severely impacted firms are manufacturers of rubber and plastic goods (71.2%), which have struggled to source raw materials, and vehicle (64.7%) and computer (63.3%) manufacturers.

In terms of R&D expenditure, the pandemic had a diversified effect: pharmaceuticals companies, especially biotechnology firms, strongly increased their expenditure in 2020 (+20%); others, such as information and communication technology services (+6%), could not match the growth of previous years; yet other firms in the chemical (-2%), automotive (-5%) and machinery industries (-9%), other manufacturing industries (-7%) and all other industries (-7%) experienced declining R&D expenditure. A relatively high exposure to the supply-chain issues described above, as well as demand effects and other negative economic impacts of the pandemic, were particularly relevant for the typically R&D-intensive machinery and automotive sectors. Overall, firms’ innovation activities during the pandemic varied widely. A survey conducted in April 2021 found that firms which continuously or occasionally invested in R&D before the pandemic had tended to prolong the running time of their innovation activities, with some even launching new innovation activities. However, firms which had pursued mainly non-R&D innovation activities before the pandemic, had rather not prolonged their activities or started new ones. Across the board, the second most common response was that firms cut back on innovation projects owing to a lack of innovative ideas or impulses. Strategically, many firms set out to increase their internal level digitalisation, along with digitalising their offers and distribution channels. While these measures tended to be permanent, others, such as further reducing the internal costs of production/service delivery, were more temporary.

Figure 2.2. COVID-19 resulted in a consumption-fuelled economic contraction in Germany

Note: Contribution to GDP growth relative to the same quarter of the previous year. Projection from December 2021

Source: OECD (2022[10]), Real GDP forecast (indicator). https://doi.org/10.1787/4537dc58-en (Accessed on 05 April 2022)

2.3. Germany’s sustainability goals

The new coalition government (December 2021) has made environmental sustainability a key pillar of its agenda. In 2016, Germany was one of the original signatories to the Paris Agreement on Climate Change, which committed the signatories to achieving global carbon neutrality by 2050. In 2021, the German Federal Government amended the country’s Climate Change Act (CCA), increasing key emission-reduction goals over the medium- and long-term. In its Intergenerational Contract for the Climate, the government now aims to achieve 65% lower carbon dioxide (CO2) emissions than 1990 levels by 2030, up from the previous target of 55%; the target is now 88% less CO2 by 2040 and climate neutrality by 2045 (Bundesregierung, 2021[11]).

Successive governments have set out to simultaneously decarbonise energy supply and use in Germany and shut down nuclear electricity production. Thanks to a co-ordinated multilevel governance effort, different energy programmes have fed into Germany’s Energiewende (“energy transformation”). While its legal basis was set in 2000 through the Renewable Energy Act and strengthened in the Energy Concept of 2010, the policy is also guided by periodic developments within the Conference of the Parties, such as Germany’s obligations under the Paris Agreement on Climate Change. More detail on this policy is provided elsewhere in the review.

Despite its strong commitments to environmental sustainability, Germany needs to step up the implementation and performance of its carbon-reduction and sustainability policy agenda if is to meet its ambitions. The contrast of Germany’s good socio-economic performance in the OECD Better Life Index with the poorer results achieved in areas related to environmental-related quality illustrates some of the complex challenges, and often countervailing forces, facing the country. The social impact is significant, with over 90% of the German population exposed to small particle air pollution above the World Health Organization (WHO)-recommended threshold of 10 micrograms per cubic metre, considerably more than the 59% OECD average (OECD, 2020[12]). The public health impact of this pollution is estimated at around 53 800 premature deaths per year (European Environment Agency, 2021[13]).

Moreover, key sectors of the economy including manufacturing and those that are leading innovation performance, are highly polluting (IEA, 2020[14]). While greenhouse gas emissions per capita are below the OECD average, they are higher than in most EU countries, and the reduction in carbon intensity since 2000 has lagged behind the OECD average.

As regards renewable energies, Germany retains a significant proportion of fossil fuels in its energy mix used for electricity production. Sector-specific transition plans, such as those laid out in Germany’s initial Climate Action Plan 2050, amended by the CCA in 2021, must contend with the unsustainably high levels of fossil fuels in energy and electricity production – particularly in the absence of commercially viable alternative energy production for industry and manufacturing. High levels of fossil fuels also result in very high reliance on imports from Russia (see discussion in Chapter 9). Consequently, Germany has set ambitious goals to expand renewable energies and has a number of national strategies – including the Energiewende and technologically specific strategies, such as on hydrogen – to expedite the development and commercialisation of technologies that could help to decarbonise the energy sector and, by extension, the industries that depend upon it.

2.4. Public debt and investment

The direction of public finance and investment has several implications when it comes to supporting innovation in Germany. Germany has the third-highest level of government support for research and innovation (R&I): government-financed gross domestic expenditure on research and development (GERD) represented 0.88% of GDP in 2019, the latest year for which data are available (OECD, 2022[15]). Yet within this vast and well-resourced innovation system, policy makers must ask whether programmes and support sufficiently target the needs of the future economy, rather than those of previous years and decades. Germany is a country where the vast majority of innovation expenditure originates in the business sector, with enterprise R&D underpinning decades of strong innovative performance. Yet whether the current orientation and trajectories of German industry can generate the types of innovation necessary for a more sustainable German economy remains to be determined, nor is it clear whether Germany can maintain its international competitiveness in a global context where decarbonisation and advanced digitalisation are prerequisites for success. Given that many of Germany’s leading incumbent firms operate in carbon-intensive sectors, which may be more prone to disruption, policy makers must reckon with whether – and to what extent – the public sector should invest more to shift the country’s innovation system in a direction that more explicitly supports sustainability. Lastly, innovation requires high-quality infrastructure, both public and private. This is particularly salient in Germany, where a significant public investment backlog may have a negative externalities for the country’s innovative – and potentially innovative – firms (see also the discussion in Chapter 6) (OECD, 2020[12]).

Policy debates around innovation support are taking place in the context of Germany’s long-standing and constitutionally binding commitment to limiting annual federal borrowing to 0.35% of GDP, with Germany’s pre-pandemic (2019) gross government debt (68% of GDP) the lowest in the G7 (OECD, 2020[12]). This “debt brake” was codified in the German constitution in 2009 and sets stricter limits on the federal states, which are required to run balanced budgets from 2020 onward. These national commitments occur within the context of the EU Fiscal Compact, where ratifying countries, including Germany, have committed to a medium-term structural deficit limit of 0.5% of GDP. Deviation from the 0.35% federal rule is directed to a control account, with consolidation measures implemented during upswings if the control account exceeds a negative balance of 1% of GDP. The COVID-19 pandemic and the resulting fiscal recovery package enacted by the Federal Government, one of the largest in the world at 6% of Germany’s GDP, marked a significant departure from previous years’ relatively conservative approach to borrowing. This level of borrowing was made possible by a clause that allows structural borrowing in excess of 0.35% in emergency situations, such as that declared by the government in 2020.

In recent years, public investment, both at the national and EU levels, has increasingly focused on achieving sustainability goals, demonstrating a political recognition of the need to support society and the economy in moving towards a sustainable future. The COVID-19 recovery stimulus package introduced by the Federal Government will inject EUR 50 billion into the economy in the form of direct public investment and incentives for private investment. Complementing these funds are additional investments disbursed through the EU Recovery and Resilience Facility (RRF), which at EUR 806.9 billion is the largest stimulus package in EU history. The funding priorities in Germany’s RRF applications are indicative of the direction in which policy makers wish to take the country’s economy. In addition to providing short-term support to SMEs and the private sector, the RRF also supports reforms and investments targeting the digital and green transitions, and economic resilience and inclusivity more broadly. Projects financed by the RRF must fall under six categories (“pillars”): green transition; digital transformation; smart, sustainable and inclusive growth; social and territorial cohesion; health, and economic, social and institutional resilience; and policies for the next generation. As part of the RRF, the Federal Government requested EUR 27.9 billion for 50 items across all 6 mission areas within the pillars defined by the European Commission. The six mission areas outlined by the European Commission are: Climate change and energy transition; Digitalisation of the economy and infrastructure; Digitalisation of education; Strengthening social inclusion, and; Strengthening a pandemic-resilient healthcare system; Modern administration and reducing barriers to investment. In Germany, the largest amount of financing targeted projects within the “climate policy and the energy transition” mission (40.3% of total funds) and “digitisation of the economy and infrastructure” mission (21.1%). Given that a major component of financing through the RRF will go towards R&I, the concentration of planning and funding in these two areas is indicative of the STI challenges the government anticipates in the context of transition and resilience.

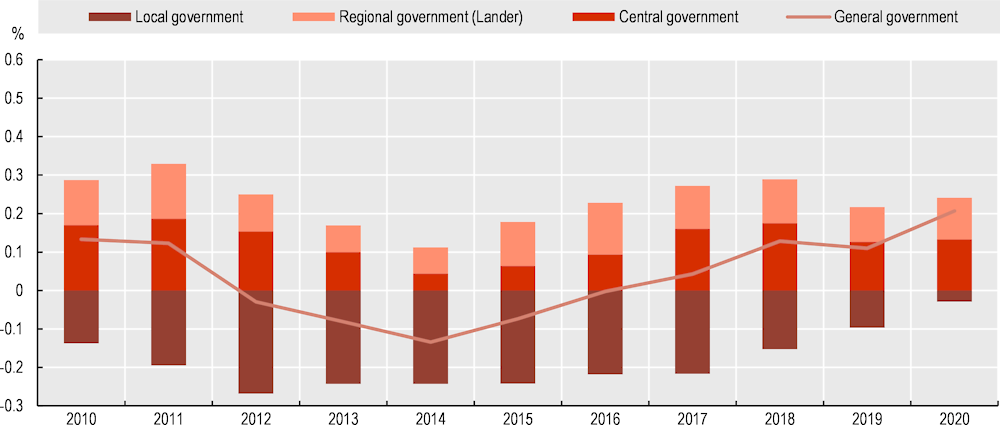

Although public investment has increased since 2015, there remain significant demands, particularly for schools, transportation, and green and digital infrastructures (Figure 2.3). This is particularly true at the municipal level, where net public investment remains negative. A recent joint paper by the German Economic Institute and the Institute for Macroeconomics and Business Cycle Research estimated that EUR 450 billion in public investment will be needed over the next ten years to overcome the existing backlog, expand early education and schooling, decarbonise and modernise transport networks (Bardt et al., 2020[16]). Since 2003, the net municipal capital stock has declined by around EUR 80 billion, contributing to an estimated local backlog of EUR 147 billion, with a particular need for investment in schools and transport (OECD, 2021[17]).

Figure 2.3. Public investment has increased, but net municipal investment remains negative

Note: Net public investment = public gross fixed capital formation less depreciation.

Source: OECD National Accounts Database (2020[12]), https://doi.org/10.1787/888934200717.

In a number of cases, the government has made funds available for public investment, but local administrative hurdles hold up disbursement. Challenges in receiving funds, rather than their allocation itself, were a common theme during interviews with several public- and private-sector stakeholders. Delays in disbursement are particularly problematic given the time-sensitive nature of the digital transition. This applies to investments not only in digital infrastructure, but also in sectors (such as transport) with high levels of emissions. It is therefore important that continued and increased transfers to local municipalities go hand in hand with efforts to reduce constraints in local planning, construction and policy implementation. Investment in Germany’s connectivity infrastructure in particular would benefit from streamlined administrative approvals for new initiatives, such as infrastructure sharing.

Indeed, better infrastructure – and infrastructure governance – could have a significant positive impact on firm productivity and innovation. The recent OECD Economic Survey of Germany highlighted three ways in which better infrastructure governance could benefit firm-level productivity (OECD, 2020[12]). First, strategic planning could be used more systematically to ensure the selection of the highest quality projects, with the OECD Recommendation on the Governance of Infrastructure emphasising the importance of long-term strategic vision for infrastructure, taking into account synergies across sectors. In the transition period of decarbonisation and digitalisation, ensuring a co-ordinated approach to infrastructure planning is particularly important. Second, policy makers should seek to streamline local planning processes as overly onerous and regionally specific procedures delay investment, sometimes causing local authorities to block projects that were committed at the national level. Third, Germany could better leverage data to improve value for money in procurement practices, as a continued lack of federal co-ordination undermines the potential for inter-municipal learning.

References

[16] Bardt, H. et al. (2020), For a sound fiscal policy: Enabling public investment, IW-Policy Papers, No. 6/2020, Institut der Deutschen Wirtschaft, Koln, https://ideas.repec.org/p/zbw/iwkpps/102019a.html.

[2] BMWi (2021), Fakten zum deutschen Außenhandel, Bundesministerium für Wirtschaft und Energie (BMWi), https://www.bmwi.de/Redaktion/DE/Publikationen/Aussenwirtschaft/fakten-zum-deuschen-aussenhandel.pdf.

[11] Bundesregierung (2021), Intergenerational contract for the climate, Bundesregierung, https://www.bundesregierung.de/breg-de/themen/klimaschutz/climate-change-act-2021-1936846.

[13] European Environment Agency (2021), Health impacts of air pollution in Europe, 2021: Briefing no. 19/2021, European Environment Agency, Copenhagen, Denmark, https://www.eea.europa.eu/publications/air-quality-in-europe-2021/health-impacts-of-air-pollution (accessed on 1 March 2022).

[5] Eurostat (2021), Old-age dependency ration increases across EU regions, Eurostat, Brussels, https://ec.europa.eu/eurostat/web/products-eurostat-news/-/edn-20210930-1.

[14] IEA (2020), Energy Policy Review: Germany 2020, Energy Policy Reviews, IEA, Paris, https://iea.blob.core.windows.net/assets/60434f12-7891-4469-b3e4-1e82ff898212/Germany_2020_Energy_Policy_Review.pdf.

[9] Ifo (2021), Procurement bottlenecks could slow recovery in German manufacturing, Ifo, https://www.ifo.de/en/node/63076.

[8] OECD (2022), Germany Economic Snapshot, OECD, Paris, https://www.oecd.org/economy/germany-economic-snapshot (accessed on 1 July 2022).

[7] OECD (2022), Gross domestic product (GDP), OECD, Paris, https://doi.org/10.1787/dc2f7aec-en.

[10] OECD (2022), Real GDP forecast (indicator), https://doi.org/10.1787/1f84150b-en (accessed on 15 June 2022).

[15] OECD (2022), STI Scoreboard, OECD, Paris, https://www.oecd.org/sti/scoreboard.htm.

[17] OECD (2021), OECD Economic Outlook, Volume 2021 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/edfbca02-en.

[6] OECD (2021), Revenue Statistics 1965-2020: The Initial Impact of COVID-19 on OECD Tax Revenues, OECD, https://www.oecd-ilibrary.org/docserver/6e87f932-en.pdf?expires=1639498067&id=id&accname=ocid84004878&checksum=87C36E37898CEAFBFCEA449C21EAA13F.

[3] OECD (2020), “How’s Life in Germany?”, in How’s Life? 2020: Measuring Well-being, OECD Publishing, Paris, https://doi.org/10.1787/fe07a6b7-en.

[12] OECD (2020), OECD Economic Surveys: Germany 2020, OECD Economic Surveys, OECD, Paris, https://www.oecd-ilibrary.org/economics/oecd-economic-surveys-germany_19990251.

[1] OECD (2020), STAN Industrial Analysis (2020 ed.), OECD, Paris, https://stats.oecd.org/Index.aspx?DataSetCode=STANI4_2020.

[4] OECD (2019), Skills Matter: Additional Results from the Survey of Adult Skills, OECD Skills Studies, OECD Publishing, Paris, https://doi.org/10.1787/1f029d8f-en.