This chapter discusses the implications of Germany’s highly internationalised economy on its innovation system. The chapter introduces the interlinking questions of how foreign demand supports domestic investment in innovation, the role of the German economy in many technologically advanced global value chains, and the challenges of supply chain resilience for the green and digital transformation of the German economy. The chapter also introduces a recommendation concerning the importance of Germany’s international leadership in meeting many of the challenges outlined in this Review.

OECD Reviews of Innovation Policy: Germany 2022

9. The international dimension of Germany’s innovation ecosystem

Abstract

Introduction

The export-orientation of the German private sector has significant implications for innovation in the country and for Europe more broadly. The importance of foreign demand for domestic German innovation and research means that domestic STI is closely linked with the external performance and competitiveness of the German economy. At the same time, the extent of integration of the German economy with global value chains (GVCs) in many strategic industries means that the way German business responds to changes in those industries can have systemic implications, domestically and abroad.

This chapter unpacks a number of these implications, and looks at how the internationalisation of the German economy interacts with innovation performance, competitiveness, and the green transition. There are, broadly speaking, four ways in which ‘the international component’ of the German economy affects innovation capacities and output, interlinked by the question of competitiveness and resilience:

1. Germany relies heavily upon foreign demand to maintain innovation activities in its export-orientated industries. This in part is a reflection of relatively weak increments in domestic demand – also affected by the COVID-19 shock - and high savings rates fuelled by uncertainties as to future developments, including in the context of the Ukraine war. The export-orientated German business sector underpins the country’s competitiveness, since it provides revenues that can be reinvested into research and innovation.

2. German manufacturing – and to a lesser extent, services – play a key role in a number of important global value chains (GVCs), as is the case for the automotive industry. German firms’ prominent positions in these GVCs reflects the innovative leadership of German firms in a broad range of technologies. The German private sector imports a wide range of intermediate goods for use in its most innovative industries. As the value added in manufacturing is increasingly derived from digital or other enabling technologies that Germany imports, there is a risk that the contribution of German firms to value added in manufacturing, and therefore competitiveness, lessens.

3. The reliance on imported primary and intermediary goods can also lead to bottlenecks. During the COVID-19 pandemic a shortage of semiconductors had significant consequences for the automotive industry. An undiversified range of suppliers for certain primary goods, such as rare earths and metals, and intermediary goods, such as semiconductors, has a particular importance in the context of the digital and sustainable transitions, where these materials have important applications.

4. Like many OECD countries, the German government is currently assessing the issue of energy imports and issues linked to dependence upon a narrow range of suppliers. Following the Russian invasion of Ukraine in February 2022, the importance of this issue has risen on the policy agenda. Higher energy costs has significant implications for domestic and international consumption as well as for the competitiveness of industry, which in Germany is a major consumer of electricity and heat produced by oil and gas imported from Russia.

Addressing the challenges the complexities that come with external linkages of the German innovation system requires setting policies within the context of the EU and beyond. The latter is also essential in the context of addressing global challenges, such as the green transition, and provide opportunities to scale up innovations in Europe and avoid their migrating to the United States and offer the advantages of a large unified European market to innovators against large markets in the United States and China.

This chapter begins with a recommendation concerning German leadership in international STI governance and policymaking. This recommendation links to a number of key themes discussed in this Review – particularly those such as strategic European autonomy in key emerging technologies, public and private investment and regulation to accelerate the sustainable transition, and managing greater international uncertainty domestically and in international co-operation – where solutions are unlikely to be found within the confines of any one national boundary. Germany is in a unique position to offer leadership to a coordinated response to these internationally important STI challenges owing to the deep technological expertise of its private sector and research base, as well as the systemic implications for Germany’s success in navigating these challenges, both domestically and in the broader European context.

The Chapter is structured as follows. The Chapter begins with a recommendation on Germany taking a leadership role in EU and global policies with regards to innovation, reflecting the international aspect of many of the challenges discussed in this Review. The Chapter then proceeds in Section 1 with an analytical discussion of the importance of foreign demand for the sustainability of German manufacturing and industry, and by extension the STI systems they support. Section 2 discusses the role of global value chains and the implications for the German business sector and its research base and orientation. The Chapter concludes in Section 3 with a discussion of a number of highly important and interlinking questions concerning the interaction of Germany’s supply chain challenges for the digital and green transitions.

Recommendation 10: Take a leadership role in shaping EU and global policies with regards to innovation

Overview and detailed recommendations

The ability to effectively address many of these recommendations requires leveraging the scale of EU and international co-ordination. Beyond Germany, efforts are needed at the EU and transnational levels to ensure success, including by (i) developing competencies in key enabling technologies for more resilient value chains; (ii) exploiting efficient digital-data infrastructures (R4); (iii) developing a sufficiently large financial market to scale disruptive, high-potential innovations (R6); (iv) defining the desired standards and quality-control procedures (R9); and (v) boosting innovation to promote environmentally sustainable development. To this end, the German government needs to take active leadership in shaping innovation policies at the EU and global levels.

R10.1 Better align domestic STI policies and the EU internal market. As detailed in R9.1, the impact of domestic STI priorities and policies could benefit from a multiplier effect if they were better aligned with the EU and the internal market. The example of data infrastructure is telling, with projects such as GAIA-X able to reach a larger scale than any equivalent national project, as it targets the vast array of industrial and commercial data inputs from across the EU internal market. A similar approach could be taken in other areas of STI, such as the development of specific enabling technologies, the digitalisation and strengthening of industrial supply chains, and the scaling of pre-commercial or pre-public solutions through the internal market in areas such as climate-management technologies. As advocated in R2 (policy laboratory) and R7 (innovative public procurement), Germany could take a leadership role in promoting policies that stimulate demand-side dynamics for innovative solutions at the EU level.

R10.2 Identify potential IPCEI to support enabling technologies. Supply shortages during the COVID-19 challenge highlighted Germany’s dependence on a few global supplies. Germany could take a more direct role in garnering support for IPCEI targeting the development of certain technology fields. This could have multiple benefits for the German economy and the broader European Union, by (i) enabling the development of key technologies within the European Union and key EU partner economies, to increase supply-chain resilience; and (ii) developing key technological competencies that will be sources of competitiveness for the future.

R10.3 Take a leadership role in promoting standards and quality-control procedures at the EU level. Building on the items outlined in R9, and reflecting the multiplier effect of aligning domestic STI policy with EU policy and the internal market, Germany should take the leadership in promoting EU-wide standardisation and quality infrastructure to support the broader competitiveness and innovative strengths of the European Union and its Member States. This would help align the approaches taken by EU economies, and consequently strengthen the position of the internal market in the context of international and systemic competition.

R10.4 Maximise international co-operation to navigate uncertainties and address the complexities of transitional challenges. As with other world economies, the nature of the challenges facing the Germany economy is such that no single government or actor possesses all the answers. While there may be no panacea for the complexity of the sustainability and digital transition, there are nevertheless numerous instances where German policy makers can learn from the experiences and efforts of other countries to navigate these complex challenges, from commercialising decarbonisation technologies to digitalising the public sector within a federal state. As part of the “Germany 2030 and 2050” vision, the government should actively seek international collaboration in priority areas identified by the forum, both within the European Union and beyond.

R10.5 Take a key role internationally in strengthening the global and national innovation ecosystem. This involves shaping the global innovation agenda and the main targets set for key innovation agendas globally, such as in AI and biotechnology. Another important component here is connecting effectively to global innovation efforts, attracting talent and engaging in effective collaborations to support the national innovation ecosystem.

9.1. Export characteristics

Germany is the most important trading country in the EU, and is the third largest trading nation in the world behind China and the USA, accounting for 7.8% of global exports and 6.6% of global imports. In 2021, German exports amounted to almost 47.3% of GDP, the highest in the G20, and significantly higher than all other G7 nations (OECD, 2022[1]). The significance of exports for German growth is notable given the large size of the country’s economy, with domestic consumption within larger economies having a downward influence on the importance of exports. The importance of exports for the German economy, and by extension the innovative private sector that powers the economy, makes Germany’s international position somewhat unique among other large and industrialised economies. A consequence of Germany’s net international trading position combined with high domestic saving has contributed to a significant current account surplus.

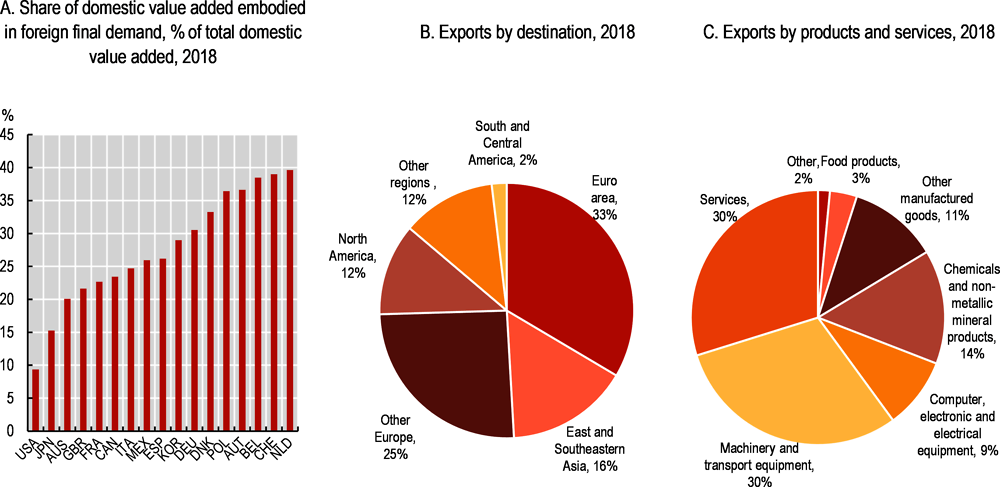

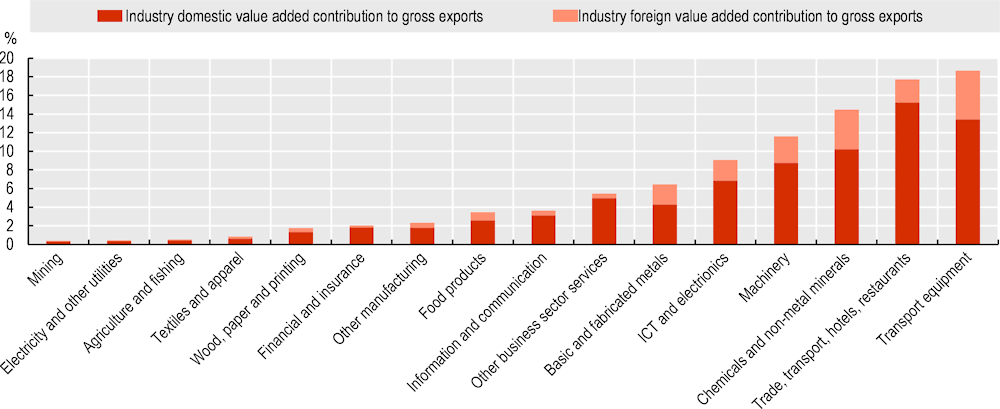

Germany’s exports, particularly high-value manufactured and capital goods, are sustained by foreign demand. Given the size of the German economy, the importance of value added in foreign demand is particularly high – as with exports more generally, larger economies generally have a lower share of domestic value added in foreign demand due to larger domestic markets – and this speaks to the specialisation of German firms in the production of high-value and technologically advanced capital goods as final or intermediary products in GVCs (Figure 9.1).

Capital goods dominate German exports, with road vehicles, machinery and other transport goods accounting for 40% of all exports, followed by other manufactured goods (19%), services (18%) and chemicals (13%). Between 2008 and 2018, the export orientation of most German industries increased, with 60% of value added in the German manufacturing sector driven by foreign demand in 2018, and more than 70% in the basic metals, chemicals and pharmaceuticals, ICT, and other transport equipment industries (OECD, 2022[2]).1

Germany’s most important trading partners are other European and OECD countries, in part due to the location of key manufacturers in the value chains that support and are supplied by German firms. In 2021, the OECD accounted for 78.5% of German goods exports and 72.1% of imports, with the EU27 share being 53.1% and 51.9% (BMWK, 2022[3]). In both these cases, the share is slightly lower than the equivalent in 2006, reflecting the growing importance of Asian markets, particularly China. While the OECD and EU collectively continue to account for the bulk of German trade, the importance of China for German exports and imports has grown significantly in recent decades. In 2021, China’s share of German goods exports was 7.5% and 11.8% of imports, up from 3.1% and 6.8% in 2006. Whilst this reorientation towards China has not dislodged the importance of Germany’s traditional markets, it nevertheless reflects a significant development for the country’s trade-orientated private sector.

Figure 9.1. Germany’s export-orientated industries rely heavily on foreign demand

Note: Panel C: "Other" includes Agriculture, hunting forestry and fishing, mining and quarrying Electricity, gas, water supply, sewerage, waste and remediation activities and construction. "Other manufacturing goods" includes textiles wearing apparel leather and related product, wood and paper products and printing basic metals and fabricated metal products and Manufacturing nec; repair and installation of machinery and equipment.

Source: OECD (2022[2]), "Trade in value added", OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en (accessed on 16 May 2022).

The question of foreign demand for domestic value added has several important implications for the German STI system and the economy more broadly. For example, and as discussed above, Germany’s export-orientated sectors are a key driver of domestic GDP growth. Germany’s export-orientated private sector has major implications for domestic – and regional – employment. Within Germany, 27.1% of domestic employment is embodied in final demand – e.g. in export-orientated activities – with the share rising to 39% when considering only the business sector (OECD, 2022[4]; OECD, 2022[5]). These figures are significant, and are all the more so when one considers the linkages between foreign demand for German goods and the regional supply chains within Europe that support German firms. The 39% figure falls within the generally observed share in Europe, where the share of business sector employment embodied in final demand is between 30% and 50% (OECD, 2022[6])

There are differences at an industry level, with 64.3% of employment in the German automotive industry, for example, driven by foreign final demand. The equivalent figures for other European countries with large automotive industries, such as the Slovak Republic and Czech Republic are higher (93.8% and 88.7%), but the total number of persons employed in each of these countries within this industry varies significantly, with direct automotive manufacturing employment in Germany accounting for 920 000 jobs, compared to 82 000 in the Slovak Republic and 182 000 in the Czech Republic (European Automobile Manufacturers’ Association, 2022[7]). The interaction between foreign final demand and business sector innovation is particularly stark in Germany when one considers that 1 in 4 private sector R&D positions are in the automotive industry (GTAI, 2021[8]).

9.1.1. Exports and innovation performance

What defines Germany’s export-orientated economy is the sophistication of the products that it exports. This is directly linked to innovation and by extension competitiveness, since for Germany’s exported products to be internationally competitive their production must be either more efficient than other exporting nations – including through lower labour cost – or of higher quality. A key characteristic of the German economy, and of its manufacturing sector in particular, has therefore been to use cutting-edge technology to innovate in mature products and to improve the efficiency of production of those products. The recent policy focus on Industry 4.0 is yet another example of Germany’s private sector integrating – and indeed developing – the most advanced digital technologies and ICTs to remain globally competitive.

Germany’s focus on product quality has therefore allowed the economy to remain competitive internationally despite higher costs of domestic production, and by extension, to retain manufacturing as a key pillar of socio-economic well-being and growth. Germany is an outlier in this respect among other advanced and industrialised nations, but the approach has been successful. For example, in contrast to the fate of manufacturing as a source of employment in other several OECD countries, the share of manufacturing jobs in Germany in total employment has increased over the past 15 years.

Germany’s international position, and the domestic and regional jobs and investment which such a position supports, will rely on how firms perform in the context of the twin transitions of digitalisation and environmental sustainability. From a technological and product perspective, the challenge is that the value added in many exported goods will shift from areas where Germany has traditionally had leading competencies to those – such as in digital technologies – where the private sector’s international leadership is clear-cut. Similarly, the way in which the industrial sector operates will be profoundly affected by the sustainability transition.

The sophistication of Germany’s manufacturing sector is observable through the products the economy exports. For example, Germany has the second most ‘complex’ export basket in the G7, and the fourth most complex globally, owing to the broad range of sophisticated, innovative products exported by German firms.2 Anecdotally the sophistication of German manufacturing is observable through the leading export-orientated companies, such as BMW and Mercedes in automotive manufacturing, which generally compete in premium product categories. Future competitiveness of the German economy therefore implies continued sophistication and quality in German manufacturing output that is at least equal to if not better than the equivalent output of other export-orientated manufacturing economies.

9.2. Trade and value chain linkages in the German business sector

Another important international factor for Germany’s economy beyond the reliance on export markets are the global production linkages that involve the sourcing of key inputs of diverse types (machinery, intermediaries and primary goods) for Germany’s production of intermediary or final products.

9.2.1. Dynamics and characteristics of Germany’s value chain linkages

Many of the most innovative German firms are highly integrated in GVCs. German firms source inputs from abroad as well as providing intermediary inputs to firms in other countries. These GVC linkages can happen within firms – e.g., within multi-national enterprises that have globalised activities – or across firms. This integration also allows firms, within Germany as elsewhere, to outsource less complex activities whilst focussing on ones that create more value added, such as R&D. The foreign added value content in Germany’s gross exports – an indication of the significance of value chains outside of Germany – accounted for 22.9% in 2018, the most recently available.

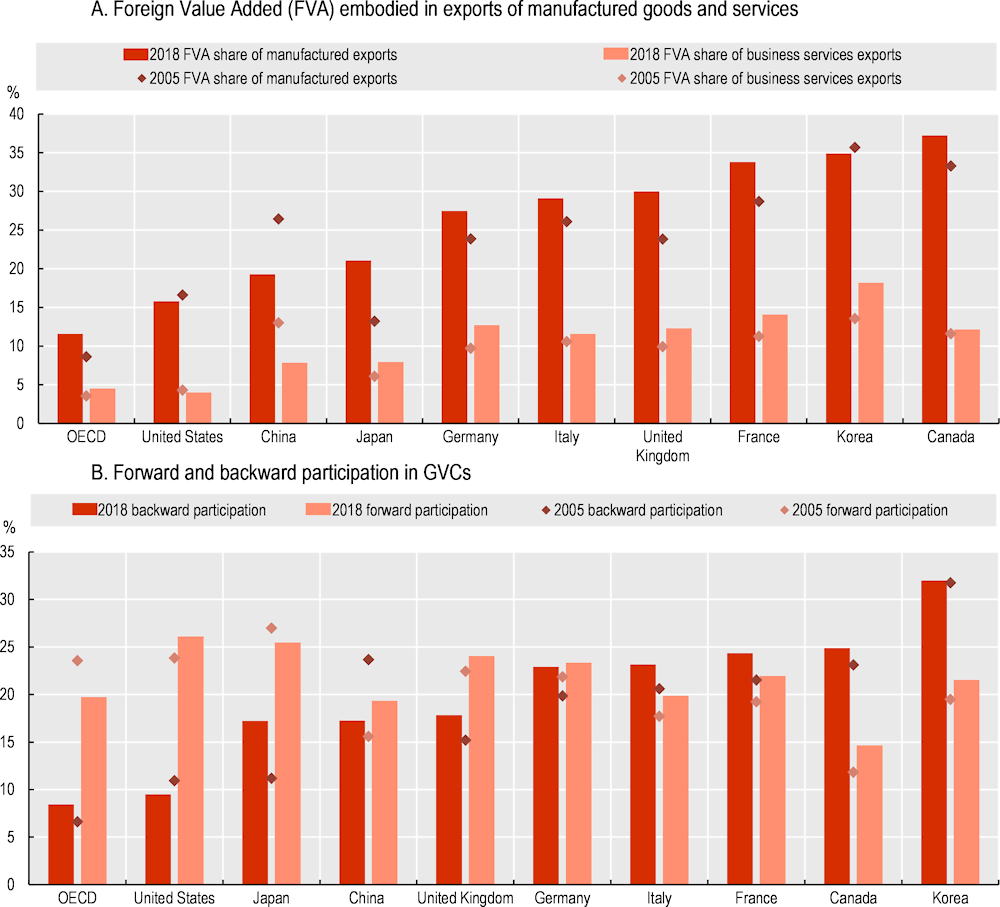

Unlike other OECD economies, Germany’s integration within GVCs – measured in terms of foreign value added (FVA) embodied in exports of goods and services and forward and backward participation in GVCs – has increased since 2005 (Figure 9.2 panel A). For example, the FVA share of manufactured German exports was 27.5% in 2018, the latest year for which data are available, indicating a growing importance of foreign inputs for domestic export-orientated industries. A similar dynamic is observable with OECD computations of Germany’s ‘forward’ (the degree of reliance of exports of a given country on demand from foreign countries) and ‘backward’ (the degree of FVA from foreign suppliers of input) participation in GVCs, where Germany’s global position has remained relatively stable since 2005 (Figure 9.2 panel B). In Germany, the increase in GVC participation and specialisation in medium-intensive and high technology intensive industries over the period 2005-2015 have been accompanied by employment growth and social outcomes (i.e. reduction of income inequality) well above the OECD average (OECD, 2017[9]).

Figure 9.2. GVC integration: Germany in international comparison

Source: OECD (2022[2]), "Trade in value added", OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en (accessed on 17 May 2022).

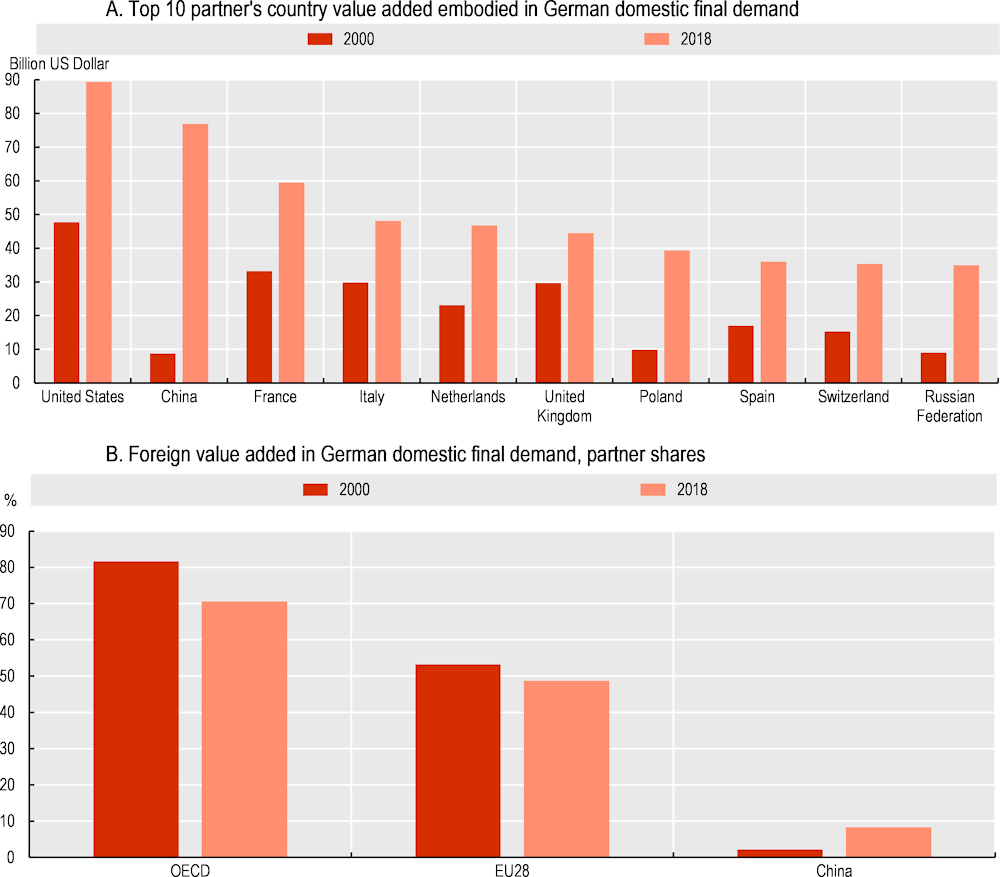

Taken together, the German economy appears to be deepening its global integration, with the importance of foreign inputs for domestic production (e.g., FVA) and foreign demand both continuing to grow. Equally important to general GVC dynamics is how and where the German economy is integrated globally. The biggest change in the origin of value added embodied in German exports – e.g., where Germany has sourced inputs that it has then used in exported goods – has come from China. In 2000, China accounted for USD 7.8 billion of value added that was latterly embodied in German exports. By 2018, this amount had grown to USD 77.7 billion (Figure 9.3 panel A). The contribution of other countries to value added in German exports also grew over this period, but none with the magnitude of China, whose contribution to value added in German exports grew from 2.7% in 2000 to 11.1% in 2018, making China the single largest contributor (Figure 9.3 panel B).

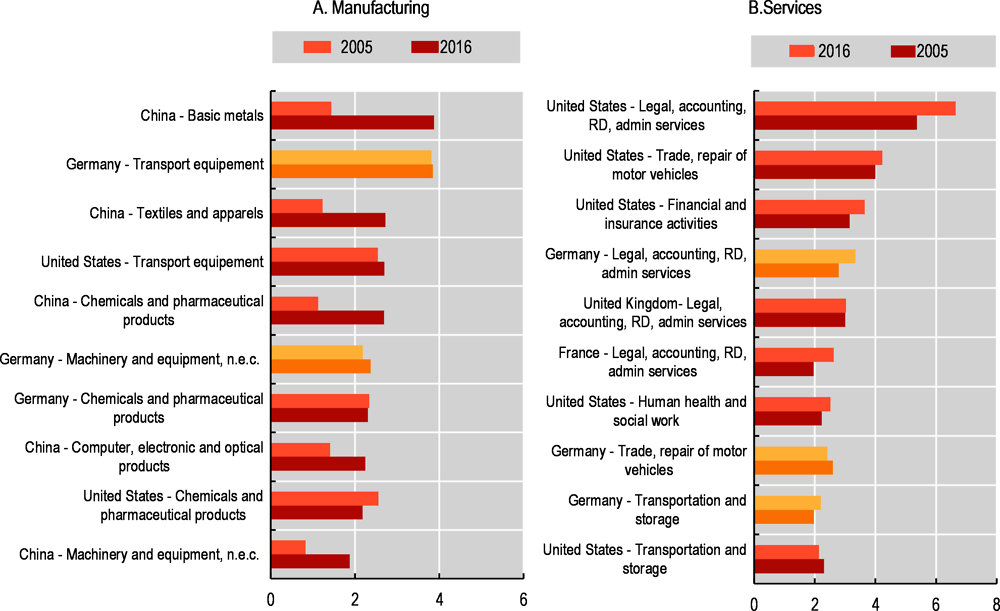

Nevertheless, despite a downwards shift that has come at the expense of South East Asian economies and China, the OECD and EU continue to account for the majority of imports that are subsequently embodied in German exports, which in part reflects the geographical concentration of value chains for key industries in Europe, such as vehicle production. Moreover, as shown in Figure 9.4, Germany has maintained its position as one of the most central global hubs in the value chains of two of its key industries, transport equipment (e.g. vehicle manufacture) and machinery and equipment (Figure 9.4 panel B). In the service sector, the 2016 centrality metrics confirm the central position of high-income economies, including Germany, as key hubs for business services, including financial, insurance, and legal services (Figure 9.4 panel B) (Criscuolo and Timmis, 2018[10]). The other dominant hub locations across manufacturing and services are respectively China and the United States.

Figure 9.3. Origin of value added embodied in imports (2000 and 2018)

Source: OECD (2021[11]), OECD SME and Entrepreneurship Outlook 2021, OECD Publishing, Paris, https://doi.org/10.1787/97a5bbfe-en, based on OECD (2021), “Global value chains: Efficiency and risks in the context of COVID-19”, OECD Policy Responses to Coronavirus (COVID-19) Paper. OECD calculations based on OECD (2018) Inter-Country Input-Output (ICIO) database http://www.oecd.org/sti/ind/inter-country-input-output-tables.htm.

Figure 9.4. Top ten most central hubs in global value chains

Note: Total centrality is computed as average of forward and backward centrality. Forward centrality captures the importance of a country -or a sector- as a seller of value added in intermediates for the production of exports of a specific partner. Backward centrality measures the importance of a country – or a sector- as a buyer of value added in intermediates for the production of its own exports. The manufacturing sector excludes construction while the service sector excludes electricity, gas, and water supply services. (OECD calculations based on OECD (2018) Inter-Country Input-Output (ICIO) database).

Source: OECD (2021[11]), OECD SME and Entrepreneurship Outlook 2021, OECD Publishing, Paris, https://doi.org/10.1787/97a5bbfe-en based on OECD (2021[12]), “Global value chains: Efficiency and risks in the context of COVID-19”, OECD Policy Responses to Coronavirus (COVID-19) Paper. OECD calculations based on OECD Inter-Country Input-Output (ICIO) database, http://oe.cd/icio.

Reflecting the centrality of certain German industries in GVCs, the international component of the German economy has more importance in certain sectors than in others. For example, the FVA contribution to gross exports of key manufacturing industries such as transport equipment (including vehicles and vehicle components) (5.2%), chemicals (4.3%) and machinery (2.9%) is much higher than other industries where Germany has a less central role in the GVC (Figure 9.5). The prominence of the transport equipment is all the more important in a context where a general reallocation of value added has taken place within the EU automotive value chain from countries such as France, Italy and Belgium towards CEE countries such as Poland, Czech Republic, Romania, Slovakia and Hungary. Germany, however, has been resilient to this trend, maintaining its position as the main supply hub in the EU automotive value chain (Fana and Villani, 2021[13]; Balcet and Ietto-Gillies, 2019[14]; Chiappini, 2012[15]).

Figure 9.5. Sectoral contributions to domestic and foreign value added

Source: OECD (2022[2]), "Trade in value added", OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en (accessed on 16 May 2022).

9.2.2. The impact of Russia’s war in Ukraine on German value chains

Russia’s war in Ukraine has impacted Germany’s value chains in three significant ways, primarily through the impact of trade sanctions on German imports of Russian primary and intermediary goods. The first is the impact of trade sanctions on Russian oil and gas, as discussed in section 3.2. The second way is the impact of trade sanctions on the share of Russian value added embodied in German output, which is of around 1.25% and also to a large proportion linked to oil and gas imports from Russia (OECD, 2022[16]). The third and related impact is on German multinationals present in Russia.

Another important way in which Russia’s war in Ukraine affects German value chains is the impact of trade and economic sanctions on German multinational firms that are active in Russia. For example, foreign affiliates in Russia accounted for 4.8% of gross output (data is from 2016, the latest that is available, and comes from the OECD Activity of Multinational Enterprises database), with the OECD countries that have enacted sanctions the largest investors in the country (OECD, 2017[17]). The most exposed of these multinationals to trade sanctions are those in the motor vehicles industry, with a hypothetical cessation of foreign-owned production in that industry in Russia potentially leading to a 62% drop in the sector’s value added. Of the multinational firms in Russia, the highest contributions to foreign-owned gross output are the United States (22.4%), Germany (16.9%) and France (11.4%).

9.2.3. Implications for the STI system

Germany’s GVC linkages interact with the STI system in a number of important ways:

For one, the internationalisation of the German business sector ties firms’ resources available for innovation and research within that sector to the trade performance of the German economy more generally. Disruptions or depressed external demand therefore have a direct and significant impact on domestic BERD. At the same time, depressed local demand may be counterbalanced by external demand. The nature of the shock will shape the impacts.

Secondly, the importance of foreign inputs for domestic innovative industries means that supply disruptions or shortages more generally can have significant consequences for domestic output, affecting consequently revenues. The impacts of disruptions, however, depend on the nature of the shock, on how diversified the sourcing of inputs is as well as on the extent to which production is reliant on inputs. The next section discusses this in more detail.

Thirdly, the central role of German firms as a source of inputs for many industries at a global level means that the German economy is affected by changes within those industries at a systemic level and is also in position to affect them. All of these characteristics have policy implications for STI, since the STI system must both support current demands of export-orientated sectors as well as supporting those same industries in adapting to change and disruption, particularly in the context of the digitalisation and environmental sustainability transitions.

9.3. International linkages, resilience and the green transition

This section introduces a number of issues relating to the highly internationalised nature of the German economy and the implications for the green and digital transition of the country. The section begins with an overview of some of the challenges that emerge from the internationalisation of the German economy and the deep integration of the business sector in global value chains. The section then proceeds with two interlinking discussions. The first is a short discussion on the challenges facing Germany in terms of energy diversification and diversification of suppliers, building on the discussion of this topic in Chapter 11. The second is a discussion on the related challenge of supply chain disruptions and resilience, building on the discussion above on the importance of GVCs for German manufacturing but extending this explicitly to the topics of inputs required for the digital and green transitions.

9.3.1. Implications of reliance on foreign demand for resilience

The strong reliance on foreign demand for domestic production and investment means that exogenous forces and trends affecting markets abroad affect the domestic economy. This will be less the case where the domestic market is the principal purchaser of output. The export-market reliance can be a source of resilience, depending on the nature of the demand shock (which countries and what products are affected). During the Global Financial Crisis of 2008-09, where external demand sustained domestic German BERD despite global financing constraints. This in part was linked to growing demand from China, which helped Germany to recover from the crisis more quickly and to suffer less long-term scarring than many other OECD countries. Between 2010-2020, China accounted for 53.9% of the growth in German exports, rising from USD 69 billion in 2010 to USD 106 billion in 2020 (Observatory of Economic Complexity, 2022[18]).

However, the COVID-19 pandemic illustrated that export-orientation does not support resilience when the global economy halts investments. In the first year of the COVID-19 pandemic, demand for German capital goods plunged as investment halted temporarily (OECD, 2020[19]). This means that, ultimately, specifically smaller firms will require support where shocks affect the economy as their capacity to invest in innovation, which relies to an important extent on internal resources, will be more affected by downturns (Paunov, 2012[20]). The introduction of the R&D tax credit among other support tools for innovation activities in these smaller firms during downturns, will consequently be important.

9.3.2. Energy security, raw material reliance and renewable energy

The Russian invasion of Ukraine exposed Germany’s high dependence on Russian gas, oil and coal, with around one-third of primary energy supply coming from Russia – a significant source of vulnerability for the German economy (IEA, 2020[21]). The war has spurred a drive for rapid diversification of energy suppliers in Germany, much as it has in many other EU countries. In the short-term, the impact of sanctions on Russian oil and gas has increased energy prices in Germany. The severity of the price increases in oil and gas will also depend on responses from other oil and gas producers, affecting the cost of adjustments. This has already led to a significant reduction in the share of Russian energy imports, with the Russian oil import share falling from 35% to 12% by late April 2022, while the coal import share had fallen from 50% to 8% by the same period (OECD, 2022[22]). The Russian share of Germany’s gas supply fell from 55% to 35% of total gas supply by the end of April 2022.

In addition to looking for alternative sources of energy suppliers, the federal government has emphasised stronger support for the development of renewable energy domestically to increase energy security. In April, the Federal Government put forward a legislative package – including amendments to the ‘Renewable Energy Sources Act’ (EEG) – which are designed to hasten the development and deployment of renewable energies, linking this explicitly with the country’s energy security. The new legislation will increase auctions for wind and solar power, easy regulatory barriers to setting up windmills to increase the capacity of the country’s wind and solar energy capacities. The plans also include incentives to expand the use of solar panels on residential rooftops, while making it obligatory for new commercial buildings to be equipped with solar panels (Curry, Andrew, 2022[23]). Achieving these plans, as well as those aimed at expanding the use of biomass and hydrogen fuels, will take significant innovation and, importantly, time if they are to substitute for traditional energy sources. In the case of solar and wind power, many of the technologies are now widely available and competitive with hydrocarbon equivalents, due in part to the long-term subsidies given to these energies by the Federal Government. The challenge in expanding their use is primarily one of investment and supply chain issues, as discussed below. For other energy sources, many of the technologies remain at a very early stage of technological readiness, something that is discussed in greater detail in Chapter 11 of this Review. The ability of the Federal Government to meet its ambitious renewable energy targets and aims for industrial decarbonisation depend in large part on the rapid advancement in areas of technology that remain far from a commerciable state of readiness (IEA, 2019[24]; IEA, 2021[25]). In addition, the development of these technologies – particularly without adequate signals from the government or market that they are needed more quickly – takes significant time to develop, something also noted by the IEA in their assessment of technological readiness of technologies for applications such as decarbonisation of the cement industry or the development of solar photovoltaic energy (IEA, 2018[26]; IEA, 2015[27]).To this end, subsidies and demand-side signals such as those set out in the EEG are important levers for the acceleration of innovation in these areas.

Another challenge for building the resilience for the green transition is the concentrated global supply of primary inputs that are needed for renewable energy. This includes rare earth elements (REEs), which are essential to many technological solutions, for example the permanent magnets that are vital for wind turbines and EV motors, or the huge amounts of copper necessary for the renewal of electricity networks. REEs are a family of seventeen elements comprising fifteen elements in the lanthanides group, plus scandium and yttrium. Although each REE is used in different applications, there are four elements – neodymium, dysprosium, praseodymium, and terbium – that are of particular importance to the clean energy sector. Starting around the mid-1990s, China has emerged as a major – in some case sole – producer of these REEs, leading to a highly undiversified range of suppliers of these key inputs for the green transition (IEA, 2022[28]). By 2010, China’s share of REE production reached 95%, but it had fallen to just over 60% by 2019 owing to growing production in the United States, Myanmar and Australia. Nevertheless, processing operations – such as separation and refining – remain concentrated in China, which continued to have over 90% of global market share in 2019. In 2021, there were only four processing plants outside of China, with these processing only light REEs, whilst the processing of heavy REEs (less common, with demand often outpacing supply, and frequently used in clean energy technologies) remains dominated by China. These dependencies can only be addressed in a limited way by innovation – by reducing the requirement of quantities of those inputs – and highlight the role to combine strategic efforts to diversify processing of resources where available for innovation to support energy security.

9.3.3. Supply chain resilience in raw materials and key enabling technologies

Aside from relying on energy, supply chain resilience is challenged by the need for primary inputs but also for a number of intermediary products. The COVID-19 pandemic led to a number of disruptions due to supply problems, with lockdowns across the world leading to temporary closures of factories and mines and therefore shortages of goods. Surveys of the German business sector have made clear that continuing supply chain fragilities is a barrier to innovation and the transformation of the German economy more generally, with the disruptions caused by the COVID-19 pandemic and the 2022 Russian invasion of Ukraine demonstrating that firms can face unforeseen barriers in both procuring key components and exporting those in which they excel. Despite a gradual reopening of the global economy, German industry and manufacturing continues to grapple with supply chain issues. In the November 2021 edition of the monthly ifo survey of 9,000 firms, some 74.4% of surveyed firms reported bottlenecks and problems procuring intermediate and raw products (ifo, 2021[29]). The number of companies reporting supply chain problems among the surveyed business population was higher than in previous surveys in almost all industries, with the exception of manufacturers of electrical equipment – though the decrease was only 5 percentages points and from an already high 90% of surveyed firms. Of manufacturers of machinery and automotive firms, the figures were 86% and 88%, respectively. An earlier ifo survey in April 2021 found that some 45% of firms were facing bottlenecks in supplies, the highest value since 1991, and significantly higher than the 7.5% reported in October 2020 (Ifo, 2021[30]).

While the role for innovation with regards to primary inputs is limited, there are strategic questions regarding capacities in key enabling technologies, such as advanced materials, micro and nano electronics such as semiconductors, and advanced digital technologies such as artificial intelligence. To illustrate the strategic issues, in the case of semiconductors, production is concentrated among a small number of companies global, yet the downstream use of these components concerns a wide array of industries, making the semiconductor industry strategic for many economies. Production of semiconductors is generally very complex with high barriers to entry, and there are no single companies that provide all the different types of semiconductors that are used downstream (those used, for example, for autonomous driving may differ to those used in consumer electronics).

The role of semiconductors is strategically important for Germany in the context of digitalisation, which will see the digital component of manufacturing output increasingly dominate value added (as discussed in Chapter 11). Without the capacities in some component fields, it may also be harder to then innovate effectively in certain sectors. This includes such products as integrated circuit boards – an electronic circuit built on a semiconductor. Over the period 2014-19, annual German imports of monolithic integrated circuit boards, commonly used in the production of electronic equipment – increased by 3000% (USD 0.5 billion to 14.5 billion), with over 50% of this increase coming from Asian markets (Observatory of Economic Complexity, 2022[18]). Similar dynamics are visible in a range of other technologies. Imports of parts used for data processing increased by 177% (USD 5 billion to 13.8 billion) over the same period, for data storage units the figure was 128% (USD 4.6 billion to 10.5 billion). These components may be key elements for their respective products as is the key issue of batteries for electric cars and consequently having capacities in their production may turn out to be critical to be a leading innovator in these markets.

The impact of disruptions to global trade and global demand caused by COVID-19 on the manufacturing of semiconductors is indicative of the broader challenges in supply chain resilience facing the German economy. The impact of growing demand for consumer electronics and latterly with the recovery of demand for cars, coupled with the impact of rising prices of inputs such as minerals and energy, have caused the price of semiconductors to rise dramatically since the beginning of the pandemic. The rise in price has affected economies differently, perhaps linked to the extent of domestic manufacturing capacities in this area. It is notable, for example, that the average price of integrated circuits for German importers rose significantly above that seen for the United States, Korea, and China (OECD, 2022[16]). Even if supply chains remain open, the pandemic demonstrated that the cost of keeping these supply chains open differs across economies.

The Federal Government of Germany is aware of the need to develop competencies in these fields, and, as discussed in Chapter 3, has set out a wide number of strategy documents to this end. For example, in addition to the High-Tech Strategie, the government has numerous technology specific strategy documents for areas such as artificial intelligence, batteries and microelectronics, all of which reflect the strategic importance of these key enabling technologies for the German economy. To mitigate the high costs and risks involved in establishing semiconductor research and manufacturing capacities in Europe, a number of EU countries – including Germany – are participating in an ongoing IPCEI on microelectronics (Breton, 2021[31]).

The development of competencies and production capacities in certain key enabling technologies critically requires international collaborations (Fraunhofer ISI, 2020[32]). The example of Germany’s participation in Important Projects of Common European Interest (IPCEI), such as those for the development of hydrogen and battery technologies, speaks to the government’s awareness of the need for a strategic approach to developing innovative competencies in the key enabling technologies of the future. One of the key advantages of the IPCEI projects is that it removes potential conflicts with EU state-aid rules, in effect clearing the way for some EUR 8 billion of national subsidies for hydrogen projects. As of late 2021, BMWK had selected 50 projects for potential financing, including projects on electrolyzers and pipelines (Franke, 2021[33]). The transport ministry has also selected a number of projects, with these concerning fuel cell systems and refuelling infrastructure. Final decisions on the financing of these projects is expected later in 2022.

9.3.4. Green transition and international linkages

The systemic role of the German economy in GVCs, as outlined in the sections above, means that the country is in a unique position to drive decarbonisation of trade at a global level. Linked with the discussion on quality infrastructure and standards, changes in how Germany innovates and conducts business can shape processes elsewhere due to the integral importance of German output in many global industries. As set out in Recommendation 10 at the beginning of this chapter, Germany therefore can act as a global leader in driving an issue of international importance and consequence. Concretely, the Federal Government, through pushing the decarbonisation of domestic industry, can link this process with internationally agreed goals on emissions reduction, as well as ensuring that the capital goods inputs used in industries of developing economies do not lock them into high polluting activities but ensure that these economies develop in a way that is economically beneficial to their countries as well as sustainable in an environmental sense.

These leadership issues, which are linked to economic wellbeing but go beyond it, extend also to issues of ethical procurement of inputs, something which is likely to increase in importance as companies seek more raw materials which, in many cases, are exported by countries with poor oversight of labour and business processes. This creates a significant problem for firms regarding due diligence and maintaining ethical standards in the procurement of a number of critical rare minerals as laid out in the OECD responsible business conduct guidelines (OECD, 2016[34]). Attention has also been increasingly paid to the importance of responsible sourcing of rare earth materials for critical technologies for German manufacturing, such as batteries, as set out in the JRC technical report on the sustainable sourcing of raw materials for this technology (Joint Research Centre et al., 2020[35]).

References

[14] Balcet, G. and G. Ietto-Gillies (2019), “Internationalisation, outsourcing and labour fragmentation: the case of FIAT”, Cambridge Journal of Economics, https://doi.org/10.1093/cje/bez013.

[3] BMWK (2022), Fakten zum deutschen Außenhandel, Federal Ministry for Economic Affairs and Climate Action (BMWK), Berlin, https://www.bmwk.de/Redaktion/DE/Publikationen/Aussenwirtschaft/fakten-zum-deutschen-aussenhandel-2022.pdf?__blob=publicationFile&v=10 (accessed on 3 August 2022).

[31] Breton, T. (2021), IPCEI on microelectronics – A major step for a more resilient EU chips supply chain, European Commission, https://ec.europa.eu/commission/commissioners/2019-2024/breton/blog/ipcei-microelectronics-major-step-more-resilient-eu-chips-supply-chain_en.

[15] Chiappini, R. (2012), “Offshoring and Export Performance in the European Automotive Industry”, Competition & Change, Vol. 16/4, pp. 323-342, https://doi.org/10.1179/1024529412z.00000000020.

[10] Criscuolo, C. and J. Timmis (2018), “GVCS and centrality: Mapping key hubs, spokes and the periphery”, OECD Productivity Working Papers, No. 12, OECD Publishing, Paris, https://doi.org/10.1787/d4a9bd6f-en.

[23] Curry, Andrew (2022), How the Ukraine war is accelerating Germany’s renewable energy transition, National Geographic, https://www.nationalgeographic.com/environment/article/how-the-ukraine-war-is-accelerating-germanys-renewable-energy-transition (accessed on 1 June 2022).

[7] European Automobile Manufacturers’ Association (2022), Direct automotive manufacturing jobs in the EU, by country, European Automobile Manufacturers’ Association (ACEA), https://www.acea.auto/figure/direct-automotive-manufacturing-jobs-in-the-eu-by-country/ (accessed on 2 May 2022).

[13] Fana, M. and D. Villani (2021), , European Commission, Seville, https://joint-research-centre.ec.europa.eu/system/files/2021-02/jrc123473.pdf.

[33] Franke, A. (2021), Germany shortlists 62 hydrogen projects with 2 GW capacity for IPCEI state aid, S&P Global Commodity Insights, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/052821-germany-shortlists-62-hydrogen-projects-with-2-gw-capacity-for-ipcei-state-aid (accessed on 1 March 2022).

[32] Fraunhofer ISI (2020), Technology sovereignty - From demand to concept, Fraunhofer Institute for Systems and Innovation Research ISI, Karlsruhe, Germany, https://www.isi.fraunhofer.de/content/dam/isi/dokumente/publikationen/technology_sovereignty.pdf.

[8] GTAI (2021), The Automotive Industry in Germany, German Trade and Invest (GTAI), Berlin, http://www.gtai.de/resource/blob/64100/817a53ea3398a88b83173d5b800123f9/industry-overview-automotive-industry-en-data.pdf.

[28] IEA (2022), The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris, https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed on 1 April 2022).

[25] IEA (2021), ETP Clean Energy Technology Guide, IEA, Paris, https://www.iea.org/articles/etp-clean-energy-technology-guide.

[21] IEA (2020), Energy Policy Review: Germany 2020, Energy Policy Reviews, IEA, Paris, https://iea.blob.core.windows.net/assets/60434f12-7891-4469-b3e4-1e82ff898212/Germany_2020_Energy_Policy_Review.pdf.

[24] IEA (2019), Innovation Gaps, IEA, Paris, https://www.iea.org/reports/innovation-gaps.

[26] IEA (2018), Low-Carbon Transition in the Cement Industry, IEA Technology Roadmaps, International Energy Agency, Paris, https://doi.org/10.1787/9789264300248-en.

[27] IEA (2015), Solar Photovoltaic Energy, IEA Technology Roadmaps, OECD Publishing, Paris, https://doi.org/10.1787/9789264238817-en.

[30] Ifo (2021), Procurement bottlenecks could slow recovery in German manufacturing, ifo Institute – Leibniz Institute for Economic Research at the University of Munich, Munich, https://www.ifo.de/en/node/63076.

[29] ifo (2021), Shortage of Materials Intensifies in German Manufacturing, ifo Institute – Leibniz Institute for Economic Research at the University of Munich, Munich.

[35] Joint Research Centre, N. et al. (2020), Responsible and sustainable sourcing of batteries raw materials : insights from hotspot analysis, corporate disclosures and field research, Publications Office of the European Union, https://publications.jrc.ec.europa.eu/repository/handle/JRC120422.

[18] Observatory of Economic Complexity (2022), Country Profile: Germany, https://oec.world/en/profile/country/deu?compareImports0=comparisonOption5&depthSelector2=HS6Depth&tradeScaleSelector2=tradeScale2 (accessed on 1 May 2022).

[6] OECD (2022), Measuring the impact of foreign demand on domestic labour markets, OECD, Paris, https://www.oecd.org/sti/ind/trade-in-employment.htm (accessed on 1 March 2022).

[22] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 1 - Preliminary version, OECD Publishing, Paris, https://doi.org/10.1787/62d0ca31-en.

[5] OECD (2022), Trade in employment (TiM) 2021 ed, OECD, Paris, https://stats.oecd.org/Index.aspx?DataSetCode=TIM_2021 (accessed on 1 June 2022).

[1] OECD (2022), Trade in goods and services (indicator), https://doi.org/10.1787/0fe445d9-en (accessed on 1 June 2022).

[2] OECD (2022), “Trade in value added”, OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en (accessed on 2 August 2022).

[4] OECD (2022), Trade in Value Added: Germany, OECD, Paris.

[16] OECD (2022), Trade Policy Update, OECD, Paris.

[12] OECD (2021), “Global value chains: Efficiency and risks in the context of COVID-19”, OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/67c75fdc-en.

[11] OECD (2021), OECD SME and Entrepreneurship Outlook 2021, OECD Publishing, Paris, https://doi.org/10.1787/97a5bbfe-en.

[19] OECD (2020), OECD Economic Surveys: Germany 2020, OECD Economic Surveys, OECD, Paris, https://www.oecd-ilibrary.org/economics/oecd-economic-surveys-germany_19990251.

[17] OECD (2017), AMNE Database: Activity of Multinational Enterprises, OECD, Paris, https://www.oecd.org/fr/sti/ind/amne.htm.

[9] OECD (2017), OECD Skills Outlook 2017: Skills and Global Value Chains, OECD, Paris, https://www.oecd-ilibrary.org/docserver/9789264273351-en.pdf?expires=1662635563&id=id&accname=ocid84004878&checksum=AA1FDC23199F69AC8F882F6CE00FB2C7.

[34] OECD (2016), OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Third Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264252479-en.

[20] Paunov, C. (2012), “The global crisis and firms’ investments in innovation”, Research Policy, Vol. 41/1, pp. 24-35, https://doi.org/10.1016/j.respol.2011.07.007.

Notes

← 1. Industries refer to the International Standard Industrial Classification of All Economic Activities (ISIC) Revision 4.

← 2. Complexity here refers to the ‘Economic Complexity Index’ (ECI) used by the Observatory of Economic Complexity, which was developed by AJG Simoes and CA Hidalgo at MIT. The ECI is a measure of an economy’s capacity inferred from data connecting locations to activities that are present within them. At an intuitive level, the ECI allows insights into how ‘complex’ an economy is by looking at the sophistication of the products that it trades.