Technological leadership has long underpinned the economic prosperity and security of OECD countries and has typically involved some measure of protection of technologies from strategic competitors. The growing ascendancy of China in frontier technologies has ushered in a new era of intensified strategic competition, particular in critical technologies that will underpin future economic competitiveness and national security. Governments are putting in place measures to (i) reduce STI interdependency risks and restrict international technology flows; (ii) enhance industrial performance through STI investments; and (iii) strengthen international STI alliances among like-minded economies. These measures could disrupt integrated global value chains and the deep and extensive international science linkages that have built up over the last 30 years. Coupled with a growing emphasis on “shared values” in technology development and research, they could lead to a “decoupling” of STI activities at a time when global challenges require global solutions underpinned by international STI co-operation. A major test for multilateralism will be to reconcile growing strategic competition with the need to address global challenges like climate change.

OECD Science, Technology and Innovation Outlook 2023

2. Science, technology and innovation policy in times of strategic competition

Abstract

Key messages

Technological leadership has long underpinned the economic prosperity and security of OECD countries. Leadership has inevitably involved some measure of protection of technologies from strategic competitors, but such efforts today are complicated by the interdependent and multinational nature of contemporary technological innovation.

The People’s Republic of China (hereafter China) has accumulated increasingly sophisticated technological capabilities over the last two decades and is already a market leader in areas like 5G and at the forefront in others, including batteries and photovoltaics. While China is tightly embedded in global value chains and international science networks, its growing technological ascendancy, made possible by the stability and opportunity the international order provides, has ushered in a new era of intensified strategic competition.

For liberal market economies, China’s ascendancy raises three main areas of concern, each of which is expected to underpin future economic and national security: (i) rising competition in critical technologies that are expected to underpin future economic competitiveness; (ii) diverging values and interests between China and liberal market economies, challenging the existing international rules-based order; and (iii) growing recognition of vulnerability from a lack of diversification in technology supply-chains.

As economic and security policy agendas show signs of growing convergence, concepts like “technology sovereignty” and “strategic autonomy” – which refer to a polity’s capacity to act strategically and autonomously in an era of intensifying global technology-based competition – have emerged as frames for science, technology and innovation (STI) policy. This framing could – and is indeed intended to – disrupt existing technology ecosystems. It could also have unintended effects – for example, on co-operation in basic science.

The chapter focuses chiefly on STI-related policies in China, the European Union and the United States. It shows that countries use, often in combination, three main types of policy intervention to strengthen their technology sovereignty and strategic autonomy:

1. protection measures, such as export controls, foreign direct investment screening, negative lists and research security measures, to restrict international technology flows and reduce supply-chain vulnerabilities

2. promotion measures, such as industrial policies, to strengthen domestic industrial capabilities and performance and reduce dependencies on foreign suppliers

3. projection measures, such as international STI alliances and technical standards, to intensify STI co-operation around shared values and interests and diversify technology supply chains.

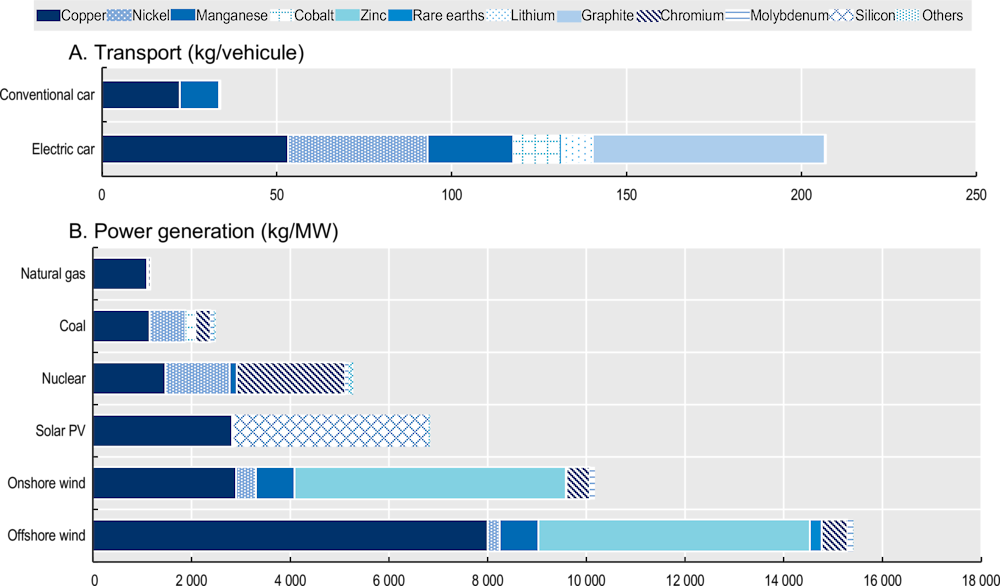

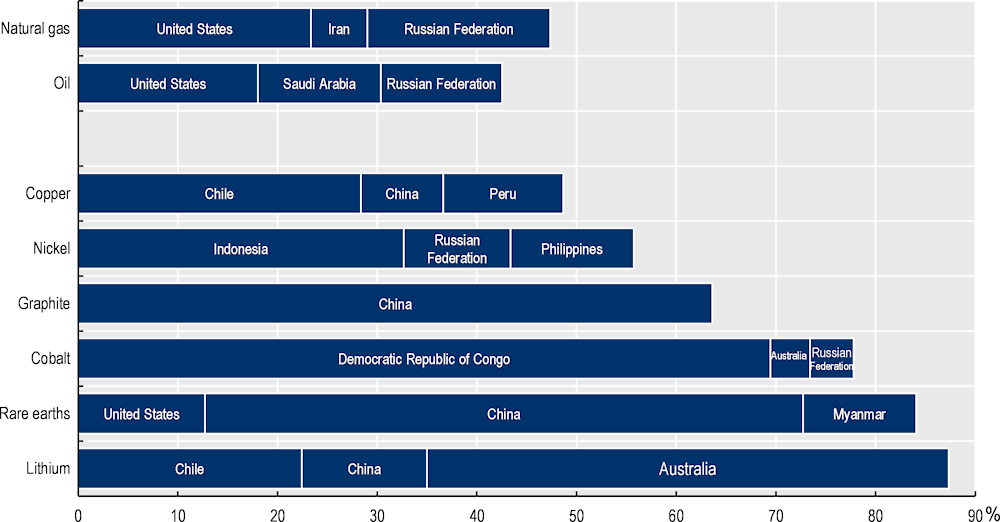

Policy discussions on interdependency vulnerabilities often cite two prime examples: semiconductors and critical minerals. The chapter describes how OECD countries and China are investing heavily in innovation in both areas, using a mix of protection, promotion and projection measures to strengthen their relative positions.

These policies may sacrifice some of the gains derived from specialisation, economies of scale, and the diffusion of information and know-how. They could also undermine future co-operation on global grand challenges. A major test for multilateralism will be to reconcile growing strategic competition with the need to address collectively global challenges like climate change.

Introduction

China’s ascendancy in science and technology has brought many benefits. It has contributed significantly to the world’s stock of knowledge through its scientific research and has accelerated innovation in technology areas that are critical to sustainability transitions. It is already a market leader in some technologies, such as 5G, and at the forefront in others, including batteries and wind turbines. These successes are underpinned by significant growth in R&D expenditures, with China now employing the largest number of researchers globally. They have also been made possible by the stability and opportunity the international order provides.

China’s growing technological capabilities have also ushered in a new era of intensified strategic competition with liberal market economies. Policy concerns stem from growing competition in critical technologies that are expected to underpin future economic competitiveness and national security, diverging values and interests between China and liberal market economies that challenge the existing international rules-based order, and growing vulnerability from supply-chain interdependencies. These concerns have prompted technology leaders, such as the European Union and the United States, to seek greater technological sovereignty and strategic autonomy vis-à-vis China, with the aim of reducing technology supply-chain vulnerabilities and checking China’s ambition to lead in critical technologies like artificial intelligence (AI).

The COVID-19 pandemic and Russia’s war of aggression against Ukraine have also shone a spotlight on global interdependencies, and their benefits and risks. For instance, solutions to the pandemic have drawn upon extensive international co-operation in science and technology. But the pandemic has also disrupted global supply chains on goods ranging from face masks to semiconductors, leading to critical shortages in many OECD countries. The war in Ukraine has exposed disruption vulnerabilities in the supply of Russian hydrocarbons and Ukrainian grains that engendered unprecedented increases in global gas and food prices, with destabilising knock-on economic effects. Both crises have amplified previously existing concerns about a heavy reliance on non-diversified supply chains.

To reduce their mutual technology dependencies, China, the European Union and the United States – which between them account for most of the world’s advanced science and technology developments and production1 – have recently introduced initiatives to strengthen domestic STI capabilities and reduce international technology dependencies. Technology-fuelled industrial policy, underpinned in part by COVID-19 recovery investments, has become newly fashionable, combining security concerns with economic renewal and the need for green transitions. This is most visible in semiconductors, but also extends to other technology fields.

Such policy efforts to reduce technology dependencies could disrupt integrated global value chains, and the deep and extensive international science linkages that have built up over the last 30 years. Coupled with a growing emphasis on “shared values” in technology development and research, these developments could lead to a “decoupling” of STI activities, particularly between the European Union and the United States on the one hand, and China on the other. This is at a time when global challenges, notably climate change, require global solutions underpinned by international STI co-operation. China, the European Union and the United States are each establishing various overlapping and sometimes competing international fora and platforms to co-operate on technology development, governance and diffusion. However, these are not global, and a major test for multilateralism will be to reconcile growing strategic competition with the need for international co-operation to address global challenges.

The chapter is based on a literature review of some of the main trends and policy responses related to growing strategic competition. It begins with a brief overview of strategic competition and its growing influence on STI policy. The increasing “securitisation”2 of STI is part of a policy push for greater strategic autonomy, whose meaning remains contested, but which broadly aims to (i) reduce STI interdependency risks and restrict international technology flows; (ii) enhance industrial performance through STI investments; and (iii) strengthen international STI alliances among like-minded economies. The chapter includes sections discussing each of these policy goals. This is followed by a section that describes how China, the European Union and the United States are pursuing these policy goals to reduce their vulnerabilities in semiconductors and critical minerals. A final section draws some lessons and presents a brief outlook for STI policy in times of strategic competition.

Strategic autonomy in research and innovation

Technology is central to today’s geopolitical competition (The White House, 2022[1]), and technological leadership has long underpinned the economic prosperity and security of OECD countries. Leadership has inevitably involved some measure of protection of technologies – particularly military technologies, but also civilian ones with dual-use potential – from strategic competitors. These efforts are complicated by the interdependent and multinational nature of contemporary technological innovation, with R&D processes for developing new technology more collaborative and globally distributed than in the past. This means many technologies have diverse origins and rely heavily on other technologies with owners, users and stakeholders in multiple countries. Many also have dual-use potential (National Academies of Sciences, Engineering, and Medicine, 2022[2]).

At the same time, economic and security thinking are converging, with countries increasingly concerned about vulnerabilities arising from excessive dependence on others. This has led to increasing government intervention in the economy – particularly in China – and new policy measures to enhance self-sufficiency and resilience. As a rising economic power, China is faced with an imperative to acquire and develop technologies to climb the global value chain and escape the middle-income trap.3 China has implemented comprehensive industrial policy measures to support “national champions” and engaged in overseas acquisitions to bridge the technological gap (Wigell et al., 2022[3]). However, these are seen by liberal market economies as distortions to the competitive playing field that undermine the rules and norms of the global economy (Goodman and Robert, 2021[4]).

Supply-chain vulnerabilities and geopolitical tensions related to China’s ascendancy have led to growing policy interest in “technology sovereignty”, which refers to a polity’s capacity to act strategically and autonomously in an era of intensifying global technology-based competition (Edler et al., 2021[5]). A related concept, “strategic autonomy”, is broader and refers to a polity’s capacity to act independently in strategically important policy areas. It does not imply isolation or decoupling from the rest of the world, but rather describes a polity’s capacity to develop and manage international relations independently. It is tied to technology sovereignty, insofar as the latter creates opportunities to compete at technological frontiers, with positive impacts on the polity’s ability to influence global affairs (Crespi et al., 2021[6]), (March and Schieferdecker, 2021[7]). Countries’ capacity to successfully develop, integrate and use emerging and disruptive technologies in military applications is a traditional measure of their strategic autonomy (Soare and Pothier, 2021[8]), but this capacity also applies to many commercial technologies, particularly those with dual-use potential.

This intensified era of geopolitical competition is putting pressure on the rules and institutions that govern the international economy. In its latest national security strategy (The White House, 2022[1]), the United States government notes challenges to the post-Second World War rules-based system. These rules have always been subject to dynamic change, driven by the evolving interests of powerful countries and changing global norms (Edler et al., 2021[5]). As China strives for technological leadership, it also seeks to define what these new “rules of the road” should look like. This makes the technological race between China and liberal market economies a competition between different systems and values (Soare and Pothier, 2021[8]), (Edler et al., 2021[5]). This difference lies at the core of strategic competition, since the nature of different political systems determines how technologies are developed and used, and their success will define the broader appeal of these systems in the longer term (Schmidt et al., 2022[9]).

Three types of policy intervention for strengthening strategic autonomy

The policy literature (e.g. (Helwig, Sinkkonen and Sinkkonen, 2021[10]; March and Schieferdecker, 2021[7]; Goodman and Robert, 2021[4])) identifies three main types of policy intervention for strengthening technology sovereignty and strategic autonomy – i.e. protection, promotion and projection, sometimes referred to as the “3Ps” (Figure 2.1):

4. protection: restricting technology flows and reducing dependency risks, e.g. through regulatory policies like export controls, supply-chain diversification measures, etc.

5. promotion: enhancing domestic innovation capabilities and performance, e.g. through holistic innovation policies, mission-oriented innovation policies, national industrial strategies, etc.

6. projection: extending and deepening international STI linkages, e.g. through international technology alliances, active participation in international standards setting bodies, etc.

The challenge facing policy makers is to strike an appropriate balance between these types of policy intervention in their country context. For example, much of the current technology sovereignty debate in the United States centres on the balance between protection and promotion measures, with advocates of a more active industrial policy (promotion) highlighting its centrality for meeting growing technology competition from China. In practice, single policy initiatives, such as national industrial policies, can incorporate elements of all three types of policy intervention. Along these lines, the European Commission (European Commission, 2021[11]) has signalled the need for a coherent mix of industrial, research and trade policies that can facilitate partnership and collaboration with like-minded countries in pursuit of strategic autonomy. These policy areas are often quite independent of one another, and their orchestration presents co-ordination and governance challenges for policy makers (Edler et al., 2021[5]), (Araya and Mavinkurve, 2022[12]). Ultimately, no single formula exists, and an appropriate policy mix will vary depending on countries, technology areas and industrial sectors. This calls for a targeted, risk management-based approach informed by assessments of threats, risks and opportunities.

Figure 2.1. Three types of policy intervention to strengthen technological strategic autonomy

The sections that follow cover each of these types of policy intervention. They explore the issues at stake and point to policy initiatives from China, the European Union and the United States, which together account for most of the world’s science and innovation activities. Specific policy initiatives often combine different types of intervention, and this is highlighted throughout. Table 2.1 lists the main policy initiatives covered. To provide some context, the following section first presents a few selected headline indicators on the science and innovation performance of China, the European Union and the United States.

Table 2.1. Selected recent policy initiatives that incorporate protection, promotion or projection

|

China |

Made in China 2025; 14th Five-Year Plan; Dual Circulation Strategy; Military-Civil Fusion; Government Guidance Funds; China Standards 2035; Belt and Road Initiative |

|

European Union |

NextGenerationEU; New Industrial Strategy for Europe; New European Innovation Agenda; Important Projects of Common European Interest; Chips Act for Europe; EU-US Trade and Technology Council |

|

United States |

CHIPS and Science Act; Inflation Reduction Act; Infrastructure Investment and Jobs Act; Quad; Indo-Pacific Economic Framework for Prosperity; Group of Seven (G7) Partnership for Global Infrastructure and Investment |

Note: The table makes no claim to comprehensiveness, and the policy initiatives listed are limited to examples covered in later sections of this chapter. Note that many of these initiatives cover more than one type of policy intervention (protection, promotion and projection).

How do China, the European Union and the United States compare? Some selected headline indicators

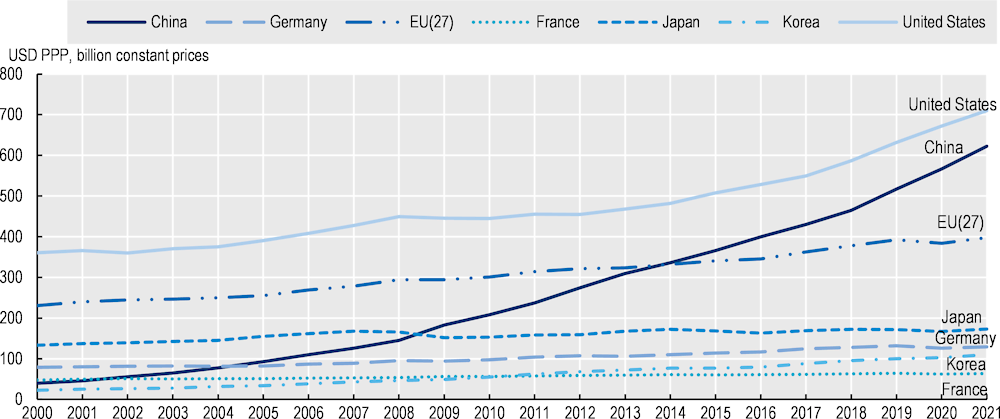

The United States remains the largest absolute spender on R&D in the world, followed by China, which overtook the European Union in 2014 (Figure 2.2). China’s R&D intensity grew from 1.71% in 2010 to 2.45% in 2021. This exceeds the R&D intensity of the European Union (2.15%,) but is still somewhat below the level of the United States (3.46%).

Figure 2.2. Gross domestic expenditure on R&D (GERD), selected economies, 2000-21

Source: OECD R&D statistics, February 2023. See OECD Main Science and Technology Indicators, http://oe.cd/msti, for most up-to-date indicators (accessed on 8 February 2023).

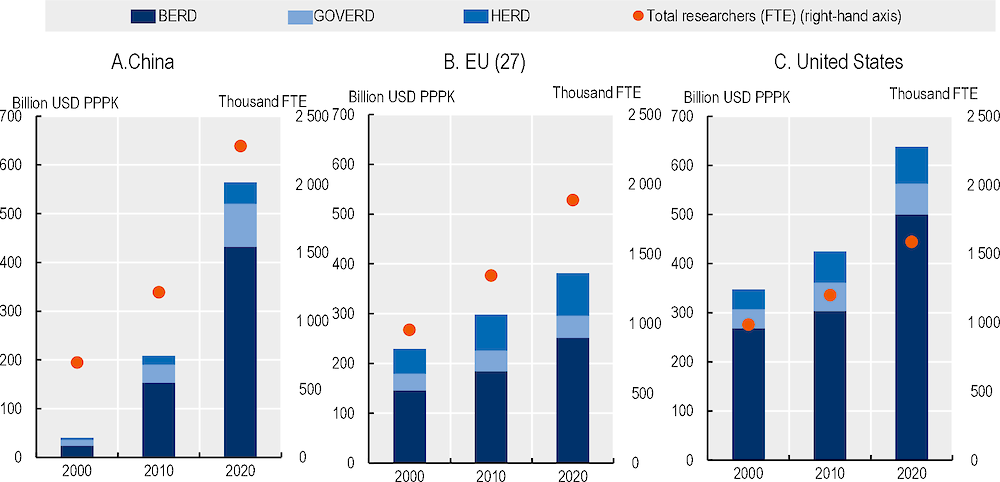

Figure 2.3 shows the absolute R&D expenditures of China, the European Union and the United States over the last two decades. The scale of China’s expenditures today suggest it has critical mass to innovate at the frontier. The business sector accounts for the largest expenditures on R&D in all three areas by far, though the proportion has increased in China in recent decades, from 60.0% in 2000 to 76.6% in 2020. The government sector is the second-largest R&D performer in China, accounting for 15.7% of GERD in 2020, although this is a significant decline compared to 20 years earlier, when it accounted for 31.5%. The higher education sector is the smallest, accounting for just 7.7% of GERD in 2020, a proportion largely unchanged from 20 years earlier (8.6%). This situation is somewhat reversed in the European Union and the United States, where the higher education sector is more prominent than the government sector, with a growing share of GERD over the last 20 years.

Figure 2.3 also shows that China had 2.28 million researchers in 2020 – the largest number of researchers in the world, compared to 1.89 million in the European Union and 1.59 million in the United States.4 While researcher numbers have grown markedly in all three areas over the last two decades, they have more than tripled in China over the past 20 years, marking the greatest expansion compared to other countries. To put this into perspective, China still had only 3.0 researchers per 1 000 in total employment in 2020, which is around one-third of the European Union level, suggesting considerable room for further expansion.

Figure 2.3. R&D expenditures by sector and total full-time employed (FTE) researchers

Note: 2020 R&D expenditure data are provisional for the United States, and estimated for China and the EU27; 2020 researchers’ data for the United States corresponds to 2019.

Source: OECD R&D statistics, September 2022. See OECD Main Science and Technology Indicators Database, http://oe.cd/msti, for most up-to-date OECD indicators.

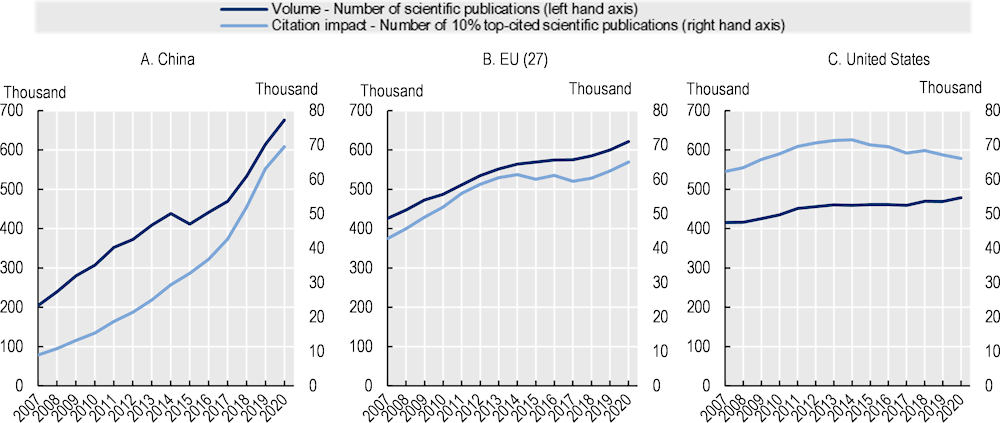

China’s increases in R&D expenditures and personnel have translated into a higher volume and citation impact of scientific publications. Figure 2.4 shows that China produced more scientific publications in 2020 than either the European Union or the United States. It also produced more top-cited scientific publications in 2020. The European Union also increased its volumes of scientific publications and the number of top-cited, though by a smaller margin than China. Increases in the United States were much smaller, although starting from a high level of performance.

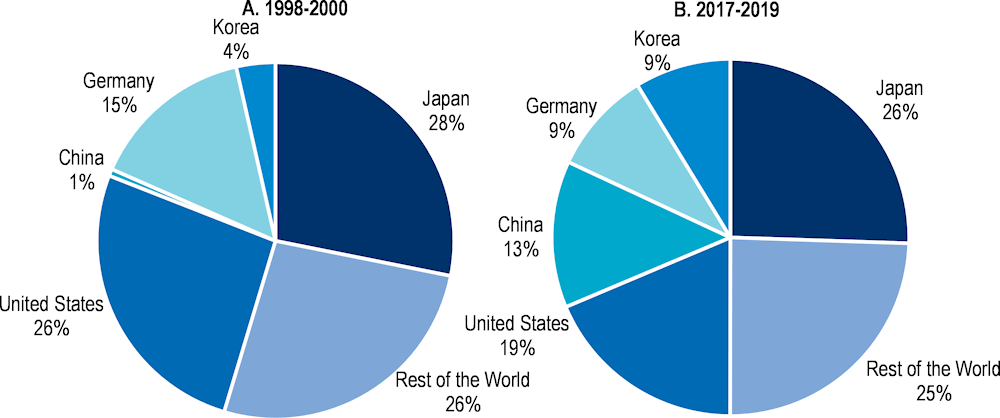

Turning to patents, China accounted for 13% of IP5 patent families5 in 2017-19 compared to just 1% in 1998-2000, surpassing Germany as the third-largest patenting country according to this measure (Figure 2.5). Over the same period, the proportion of IP5 patent families originating in the United States fell from 26% to 19%. Japan remains the top patenting country, accounting for 26% of IP5 patent families in 2017-19, a proportion that is largely unchanged from 1998-2000, when it accounted for 28%. As the preferred measure of internationalisation of innovative activities, inventive performance and diffusion of knowledge, the data on IP5 patent families suggest that China has accumulated increasingly sophisticated technological capabilities over the last two decades thanks to its R&D investments.

Figure 2.4. Trends in volume and citation impact of scientific publications, selected economies

Note: Peer-reviewed scientific publications convey the research findings of scientists worldwide. Subsequent citations by other authors provide an indirect but objective source of information about the quality of research outputs, as implied by their use by the scientific community itself. Despite limitations, such as that citations do not take into account the use of the scientific information by inventors or practitioners who are less likely to publish in peer-reviewed journals, they provide one of the available quality adjustments to raw counts of documents. Their relevance can be considered to be higher in the context of the higher education sector. The indicator of scientific excellence indicates the amount (in %) of a unit’s scientific output that is part of the set of the 10% most-cited papers within their respective scientific fields (see https://www.oecd.org/sti/inno/Bibliometrics-Compendium.pdf).

Source: OECD calculations based on Scopus Custom Data, Elsevier, Version 6.2022, September 2022.

Figure 2.5. Distribution of IP5 patent families for selected countries and the rest of the world

Note: Data refer to families of patent applications filed within the Five IP offices (IP5), by earliest filing date, according to the applicant's location.

Source: OECD, STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats (accessed 9 February 2023).

Protection: Restricting knowledge flows and reducing risks from interdependency

The first type of strategic autonomy policy intervention concerns protection, for example, in the form of barriers to open knowledge and technology flows where there is growing recognition of risks to national security. The COVID‑19 crisis and Russia’s war of aggression against Ukraine have also brought interdependency risks to the fore, raising questions about the resilience of a global production model grounded on international fragmentation and just-in-time logistics. A shift in the balance between the security of supply and efficiency considerations could lead to a reconfiguration of supply chains and the use of suppliers at less distant locations. This reconfiguration could affect the sourcing of high-tech products and components, particularly where there are vulnerabilities from key suppliers based in countries with different geopolitical priorities (OECD, 2022[13]).

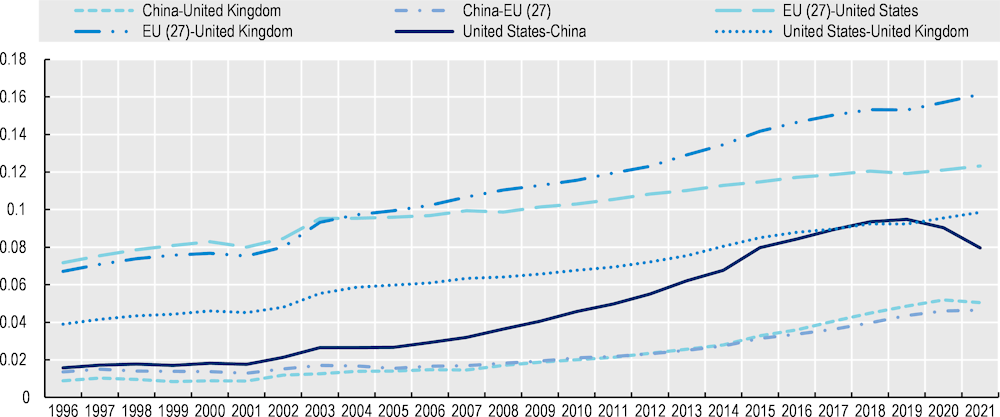

The growing research security agenda outlined in Chapter 1 shows that these concerns extend to basic research, which has traditionally fallen outside of formal controls. International science collaboration has blossomed in the last 20 years, particularly between OECD countries and China. Yet there exists a real possibility that rising geopolitical tensions could limit these linkages and lead to a decline in international science co-operation in the future.

This section is divided into two parts. The first provides a few selected headline indicators to show the growth and extent of interdependencies between economies, particularly China, the European Union and the United States. The second part looks more closely at recent policy trends that aim to reduce vulnerabilities from interdependencies and considers what they could mean for future research and innovation activities.

Getting a measure of STI interdependency

Since the end of the Cold War, several types of STI linkages have deepened and expanded. These include international science collaboration, international mobility of scientists and engineers, and global value chains in high R&D-intensive economic activities, as briefly described below.

International science collaboration

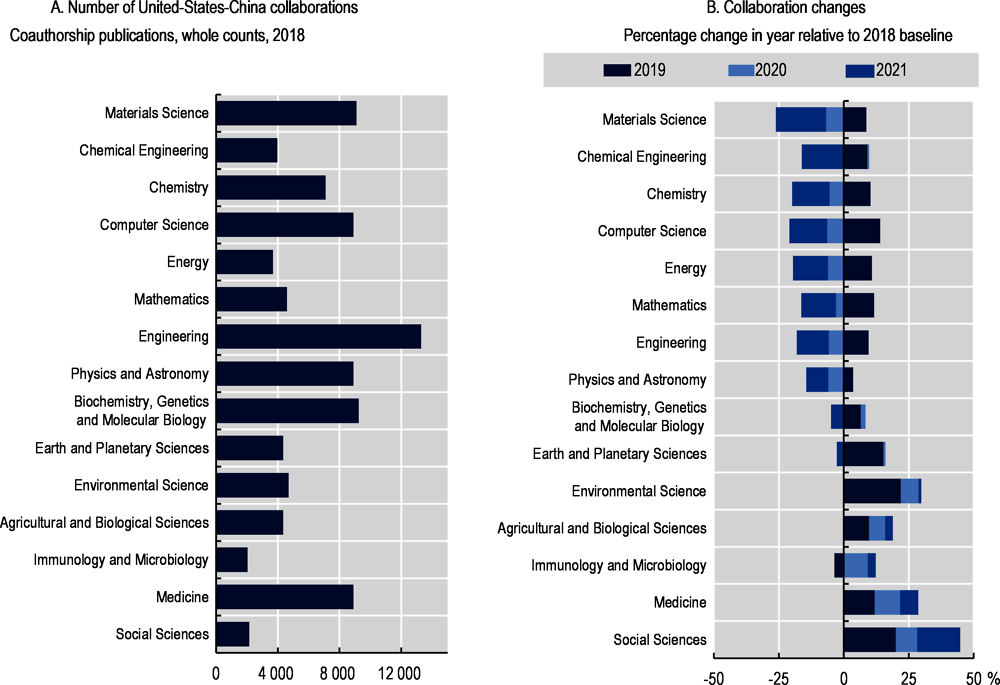

Science depends on the global knowledge commons for progress, and around one-fifth of scientific publications are co-authored internationally. As China’s scientific capabilities have grown in recent years, it has developed strong research links with OECD countries. Data on collaboration based on scientific publications – calculated using whole counts of internationally co-authored documents – shows international collaboration between China and the United States grew rapidly over the last few decades (Figure 2.6). In fact, between 2017-19, US co-authorship with China was more prevalent than with the United Kingdom. This has since fallen quite sharply, allegedly owing to pandemic travel restrictions and denial of visas that restricted Chinese students and scholars from travelling overseas (Wagner and Cai, 2022[14]). Most of the decline – which started in 2020 and accelerated in 2021 – is in engineering and natural sciences fields, which account for the bulk of bilateral research collaboration between China and the United States (Figure 2.7). In the meantime, collaboration in other research fields, such as life and health sciences and social sciences and humanities, continued to grow over the same period. These patterns could be early signs of China-US disengagement from bilateral collaboration in research fields that are critical to strategic competition. They could also signal that bilateral collaboration in other areas, such as medicine and environmental sciences, where strategic competition is less prominent, could continue to grow.

Figure 2.6. Bilateral collaboration intensity trends in scientific publications, 1996-2021

Note: The indicator of bilateral collaboration intensity between two economies is calculated by dividing the number of scientific publications by authors with affiliations in both economies (whole counts) by the square root of the product of the publications for each of the two economies (whole counts). This indicator is therefore normalised for publication output. Publications refer to all citable publications, namely, articles, reviews and conference proceedings.

Source: OECD calculations based on Scopus Custom Data, Elsevier, Version 6.2022, February 2023

Figure 2.7. Top 15 fields of collaboration between the United States and China

Note: Collaboration between China and the United States is defined by the number of co-authored publications between both countries (whole counts). Publications refer to all citable publications, that is articles, reviews and conference proceedings. The top-15 in the chart corresponds to those fields where more than 2 000 US-China co-authorship publications were recorded in 2018 (whole counts). Panel A shows the number of 2018 collaborations, in absolute terms. Panel B shows the changes in collaborations for each year versus the previous year, as a percentage of 2018 collaborations.

Source: OECD calculations based on Scopus Custom Data, Elsevier, Version 6.2022, February 2023.

Foreign-born human resources for science and technology

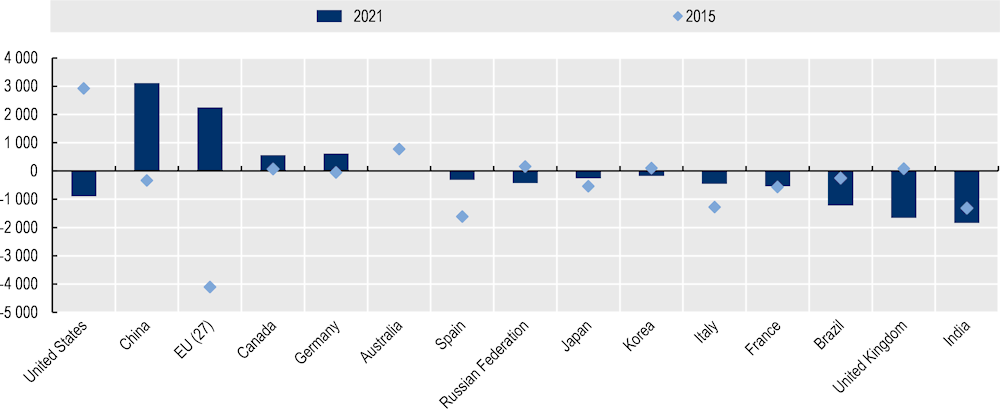

Some of the largest research performers in OECD countries rely heavily on foreign-born PhDs and postdocs to perform their R&D. In the United States, for example, foreign-born workers comprised 19% of the science, technology, engineering and mathematics (STEM) workforce in 2019, up from 17% in 2010; 45% of workers in science and engineering occupations at the doctorate level were foreign-born, with the highest shares among computer and mathematical scientists. Around half of foreign-born workers in the United States whose highest degree was in a science and engineering field are from Asia, with India (22%) and China (11%) as the leading birthplaces (National Science Board, 2022[15]). Indeed, China and India make up almost half of foreign-born students in the United States (Figure 2.8). Data on net flows of scientific authors show recent declines in the United States, becoming a net outflow in 2021 (Figure 2.9). Net inflows of scientific authors into China mirror these declines to some extent, which points to Chinese scientists returning from the United States. The European Union’s growing attractiveness for scientific authors is partly a result of Brexit, with EU scientists returning from the United Kingdom.

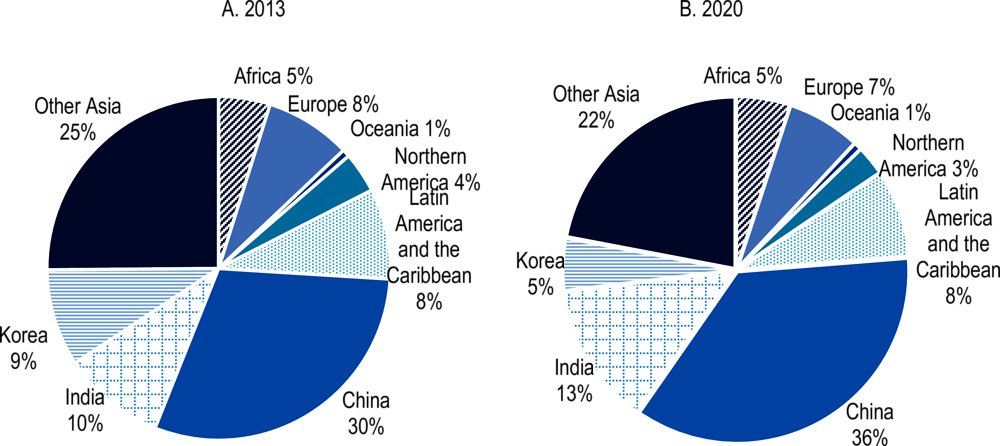

Figure 2.8. Foreign-born origin studying in the US tertiary education system

Figure 2.9. Net flows of scientific authors, top publishing countries, 2015 and 2021

Note: Estimates are based on differences between annual fractional inflows and outflows of scientific authors for the reference economy, as indicated by a change in the main affiliation of a given author with a Scopus ID over the author’s indexed publication span. An inflow is computed for year t and economy c if an author who was previously affiliated to another economy is first seen to be affiliated to an institution in that economy and year. Likewise, an outflow is recorded when an author who was affiliated to c in a previous period is first observed to be affiliated in a different economy in year t. In the case of affiliations in more than one economy, a fractional counts approach is used. In the case of multiple publications per author in a given year, the last publication in any given year is used as reference, while others are ignored.

Source: OECD calculations based on Scopus Custom Data, Elsevier, Version 6.2022, September 2022.

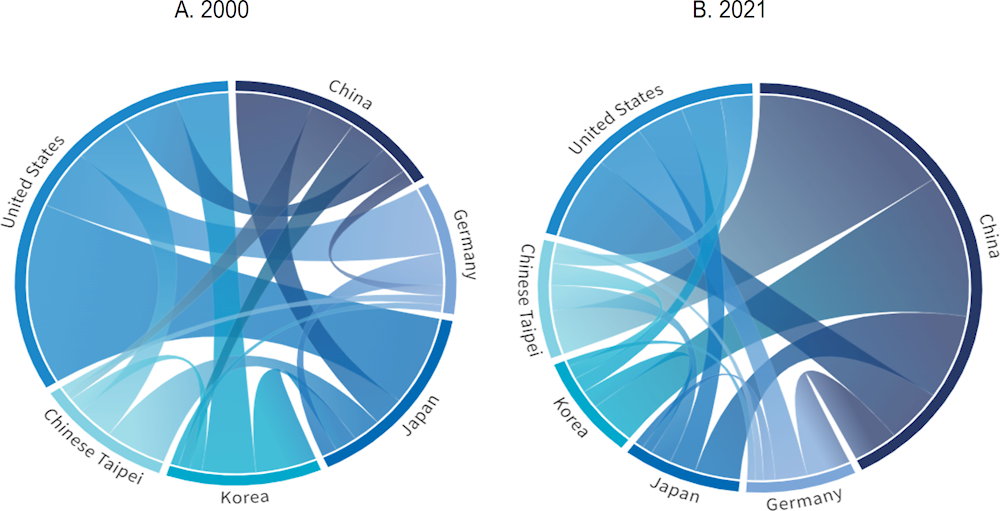

Global value chains in high R&D-intensive sectors

Changes in recent decades in the major importers6 of intermediate products in high and medium-high R&D-intensive economic activities highlight how economies have become increasingly interconnected in global value chains. At the beginning of the 21st century, the United States was the largest importer of intermediate products in high and medium-high R&D-intensive economic activities, with Japan its most significant supplier. Twenty years later, China has become the largest importer (and exporter) of such intermediate products. It is also the main supplier to its neighbouring economies (Japan, Korea and Chinese Taipei) and the second-largest supplier to the United States, after Mexico (Figure 2.10). These interdependencies would make potential decoupling between China and OECD countries highly disruptive and costly.

Figure 2.10. Flows of intermediate products in high and medium-high R&D-intensive economic activities, selected economies

Note: Intermediate products in high and medium-high R&D-intensive economic activities are defined in https://www.oecd-ilibrary.org/science-and-technology/oecd-taxonomy-of-economic-activities-based-on-r-d-intensity_5jlv73sqqp8r-en. They include products from the following industrial International Standard Industrial Classification of All Economic Activities, Fourth version (ISIC 4) sectors: D20 Chemicals and chemical products; D21 Basic pharmaceutical products and pharmaceutical preparations; D26 Computer, electronic and optical products; D252 Weapons and ammunition; D27 Electrical equipment; D28 Machinery and equipment n.e.c.; D29 Motor vehicles, trailers and semi-trailers; D302A9 Railroad equipment and transport equipment n.e.c.; D303 Air and spacecraft and related machinery; D304 Military fighting vehicles; D325 Medical and dental instruments and supplies. Panel B: 2021 data for Korea corresponds to 2020. This selection of imports flows represented 20 % of the World imports of intermediate products in high and medium-high R&D-intensive economic activities in 2021.

Source: (OECD, 2023[17]) (accessed 6 February 2023).

Reconfiguring interdependencies?

Managing international co-operation in science

The figures on international scientific collaboration illustrate that researchers from different countries work together regardless of governments’ ideological positions. Scientific discovery occurs in an interconnected ecosystem that draws upon collective intellect, know-how, talent, financial resources and infrastructure from around the world. The impressive growth in China’s scientific capabilities over the last two decades make it an attractive partner for many researchers in OECD countries, and vice versa. Furthermore, global challenges like the COVID‑19 pandemic, climate change and other complex socio-economic issues cannot be tackled without international research collaboration (OECD, 2022[18]).

At the same time, it is likely that global research networks have yet to internalise fully the implications of growing technological sovereignty, particularly in research areas with dual-use potential. Declining collaboration between China and the United States in natural sciences and engineering since 2020 could accelerate (Figure 2.7). While much uncertainty remains, excessively risk-averse policies could trigger a more abrupt and extensive intellectual decoupling and disengagement. The policy challenge for OECD member countries is to enable their researchers to continue robust and principled academic engagement while protecting their interests and standing up for their values in a complex geopolitical environment (see Chapter 1). This will not be easy, and managing the risks and benefits of internationalisation will need to be informed by frequent data-driven mapping of research relationships to determine which areas are essential for more open science, and which are not (Joseph et al., 2022[19]). Researchers will also need to diversify their international linkages, drawing on support from research-funding agencies, which could do more to deepen their contacts with a wider range of partner organisations globally (Deutsche Forschungsgemeinschaft, 2022[20]).

Securitising high-tech commercial flows

The rapid pace of product and financial market integration at the global level, combined with the relentless pursuit of efficiency gains through global supply chains, have brought economic benefits but also exposed vulnerabilities to disruption, as shown during the COVID-19 pandemic. Increasing complexity has introduced logistical fragility into global supply chains, with mounting geopolitical tensions raising the risk of coercion to extract gains from partner countries elsewhere in the chain (OECD, 2021[21]).

As Figure 2.10 shows, China’s growth and integration into the world economy has seen manufacturing firms in OECD countries use China increasingly as a source of high-tech inputs and a platform for final assembly. This has caused growing technological interdependency between China and OECD economies (e.g. in semiconductors), but also raised concerns about supply-chain vulnerabilities in critical technologies. In parallel, China has accumulated increasingly sophisticated technological capabilities and is already a market leader in some areas – such as 5G – and at the forefront in others, including AI, drones and other technologies with potential military applications (Goodman and Robert, 2021[4]).

These developments have raised national security concerns among OECD countries, leading to a growing “securitisation” of high-tech commercial flows. This is evidenced in the increasing use of barriers to direct market access, such as negative lists, export controls7 and tightened foreign direct investment (FDI) screening, and indirect barriers, like national standards. OECD economies are also looking at options to diversify supply chains, making them more resilient and less vulnerable to disruptions and shocks. This could entail boosting global capacities to produce multiple reliable and sustainable sources of materials and inputs, intermediate goods and finished goods in priority sectors, as well as enhance logistics infrastructure capacity (US Department of State, 2022[22]).

Whether these new arrangements will end up being as efficient as current ones is an open question, but they could see distinct and decoupled technology ecosystems emerge in China and liberal market economies (European Chamber of Commerce in China and Mercator Institute for China Studies, 2021[23]).8 The resulting re-division of the world into blocs separated by barriers will likely sacrifice some of the gains from specialisation, economies of scale, and the diffusion of information and know-how (OECD, 2022[13]).9 It will also lead to competition that may undermine future co-operation on global grand challenges, and could signal the weakening of any notion of economic interdependency acting as a bulwark against future conflict.

Promotion: Enhancing industrial performance through STI investments

The second type of strategic autonomy policy intervention concerns promotion – notably in the form of holistic industrial policy, in which STI policy plays a prominent part. A revival of industrial policy has been the subject of active debate for more than a decade (e.g. (Rodrik, 2014[24]; Warwick, 2013[25]; Criscuolo et al., 2022[26])), particularly in light of the need for rapid sustainability transitions and the competitiveness threat posed by China’s industrial policies. While the industrial and innovation policy mix in most OECD economies remains largely focused on R&D, tax incentives and earlier-stage investment support, there has been a resurgence in targeted interventions that are rationalised by geopolitical tensions, supply-chain concerns and various “green” targets (DiPippo, Mazzocco and Kennedy, 2022[27])10. Decarbonisation, in particular, calls for what has been termed an “industrial revolution against a deadline”, where relying on price signals alone may mean the technological change needed to reach net-zero happens too late (Tagliapietra and Veugelers, 2020[28]) (see Chapter 3).

Most economists accept there exist sound theoretical rationales for industrial policies but are sceptical of governments’ abilities to achieve well-targeted, timely and effective interventions in practice, mostly on account of informational asymmetries between the public and private sectors, and the political risks of policy capture by powerful insiders and special interests. Rodrik (2014[24]) argues that these hurdles are not insurmountable and in fact apply to most areas of government policy. Rather, the debate concerns the design of industrial policies, as well as the strong need for their evaluation and regular reassessment (Warwick, 2013[25]).

In this regard, the OECD has outlined a framework for formulating industrial policy mixes that emphasises the potential complementarities between instruments along several lines (Criscuolo et al., 2022[29]; Criscuolo et al., 2022[26]). These include the distinction between horizontal and targeted policies, demand-pull and supply-push instruments, and policies that improve firm performance and those that affect the framework conditions for innovation. Chapter 3 outlines a similarly broad research and innovation ecosystem framework, focusing on holistic STI policies for promoting sustainability transitions. Mission-oriented innovation policies (MOIPs) incorporate a similar ecosystem perspective, but with a narrower focus on fulfilling a specific mission, such as achieving net-zero greenhouse gas (GHG) emissions by 2050. MOIPs are the subject of Chapter 5. This section briefly outlines the industrial strategies and some of their main policy instruments in China, the European Union and the United States.

China’s “indigenous innovation” drive

Despite its remarkable economic success, China is still at risk of being caught in the middle-income trap. To escape this prospect, the Chinese government has launched several high-level initiatives over the years to promote technology development and the upgrading of its manufacturing base.11 The “indigenous innovation” campaign launched in 2006 as part of the Guidelines on National Medium- and Long-term Programme for Science and Technology Development (2006-20) highlighted China’s resolve to catch up with advanced industrialised nations and reflected a renewed focus on state intervention in technology development (Arcesati, Hors and Schwaag Serger, 2021[30]). The guidelines sought to support a comprehensive system of implementation by co-ordinating policies on R&D investment, tax incentives, financial support, public procurement, intellectual property and education (OECD, 2017[31]). Another watershed moment came in 2015 with the launch of the Made in China 2025 industrial policy, which shifted the focus from catching up to leapfrogging OECD countries at the innovation frontier, with a view to turning China into an STI “superpower” by 2049.

Since then, China has made rapid progress towards becoming a global leader in some technology areas. It has already forged ahead in fields such as 5G networks, and secured a strong position in areas like AI and electric-vehicle batteries (Zenglein and Holzmann, 2019[32]). It invests heavily in research, and its R&D intensity has already surpassed that of the EU27 (see Figure 2.2). The government also deploys some unique industrial policy instruments, especially government guidance funds, the state-owned financial sector, non-financial state-owned enterprises and the party-state’s political guidance of private firms, to develop domestic technological capabilities.12 As a whole, this industrial policy support means that China spends far more on supporting its industries than any other economy, an amount estimated at more than twice the level of the United States in dollar terms in 2019 (DiPippo, Mazzocco and Kennedy, 2022[27]).

Rising tensions with the United States in recent years have caused China’s perspective on globalisation and interdependence to shift, with “technology security” emerging as a core dimension of the Chinese government’s all-encompassing national security concept (Arcesati, Hors and Schwaag Serger, 2021[30]). Faced with an increasingly turbulent and unpredictable external environment, the Chinese government is looking to innovate its way out of many of the challenges it faces, and extols the importance of indigenous innovation as crucial to becoming self-reliant (China Power Team, 2021[33]). The 14th Five-Year Plan for National and Economic Social Development 2021-25) and its underpinning Dual Circulation Strategy, both of which are described below, aim to achieve self-sufficiency in core technologies and reduce China’s reliance on foreign technologies such as advanced semiconductors, where it has critical dependencies.

The most recent initiatives covered in this chapter are Made in China 2025, the 14th Five-Year Plan, the Dual Circulation Strategy and Military-Civil Fusion, all briefly outlined in Box 2.1. These important initiatives are both highly general and concise, setting key goals, directions, priorities and frameworks. They are usually followed by more detailed and implementation-oriented action plans utilising tools and measures such as government investments, R&D programmes, demonstration projects, tax incentives, financing support and human-resource policies (OECD, 2017[31]). In fact, China has a very comprehensive set of STI planning documents from high-level strategies to the sectoral level, and many are replicated at the province level. China’s government uses a sophisticated “strategic intelligence” system to monitor and scan domestic and foreign STI policies, strategies, inputs and outputs, and provides strategic advice to decision makers. The system draws on extensive databases managed by the Institute of Scientific and Technical Information of China, a research institute under the Ministry of Science and Innovation. The institute gathers and disseminates data covering domestic patents, talents, and the achievements of major science and technology-funding programmes. It also gathers and disseminates “open-source” intelligence on foreign STI sources, trends and achievements, promoting technology transfer from foreign sources to national industries (Center for Security and Emerging Technology, 2021[34]; Arcesati, Hors and Schwaag Serger, 2021[30]).

Box 2.1. Selected Chinese industrial policy initiatives

Made in China 2025

Launched in 2015, Made in China 2025 was an important milestone in Chinese STI policy as the first of a series of national ten-year strategic initiatives covering the long-term comprehensive development of China’s manufacturing industry (OECD, 2017[31]). Its aim is to build a world-class innovation system and achieve global dominance in key technologies, to achieve major breakthroughs over the next decades (Zenglein and Holzmann, 2019[32]). While Made in China 2025 called for a broader upscaling of manufacturing capabilities, it prioritised progress in ten key industries.1 It identified nine paths for achieving its ambition, including making various enhancements to Chinese innovation capabilities, promoting digitalisation, and targeting priority technologies and products. Within these nine paths, it further identified eight directions for implementation related to system reform, fair market competition, finance, tax, human resources, SMEs, international openness and co-ordination mechanisms. A technology roadmap for priority technologies and products was also published in 2015, and later updated (OECD, 2017[31]).

14th Five-Year Plan (2021-25)

While China’s five-year plans are wide-ranging, its 14th Five-Year Plan for National Economic and Social Development places technology and innovation at the heart of China’s modernisation drive (Arcesati, Hors and Schwaag Serger, 2021[30]). It echoes many of the ambitions outlined in Made in China 2025, emphasising the goal of reducing China’s reliance on foreign technology as quickly as possible through industrial modernisation and domestic technological innovation efforts, to become ultimately a global leader in strategic emerging industries, frontier technology and basic science (Grünberg and Brussee, 2021[35]). The 14th Five-Year Plan includes a commitment to formulating and implementing strategic scientific plans and projects related to national security and economic development, focusing on seven areas. It promises to establish a number of national laboratories and to support the development of new types of research universities and institutes. It also commits to boosting spending on basic research, an area where China has historically lagged (China Power Team, 2021[33]). It aims to develop and implement a ten-year action plan for basic research, acknowledging its role in the development of indigenous breakthroughs in key science and technology fields. The plan incorporates innovation indicators, including a commitment to increasing R&D expenditures by 7% per year, almost doubling innovation patents over the plan’s five-year period, and increasing the digital economy’s share of GDP to 10% by 2025 (Xinhua News Agency, 2021[36]). For the first time, the Five-Year Plan also includes a medium-term outlook (until 2035).

Dual Circulation Strategy

The Dual Circulation Strategy is China’s overarching plan for economic development and global integration. Its name derives from the dual goals of strengthening innovation capabilities domestically (via ”internal circulation”) while maintaining global ties (via ”external circulation”) (Bilgin and Loh, 2021[37]). It is enshrined in the 14th Five-Year Plan and seeks to solve China’s core development challenges in the next decades, ranging from domestic issues (such as insufficient innovation capacity, income disparity and environmental degradation) to external risks (such as growing protectionism and technological dependence) (Brown, Gunter and Zenglein, 2021[38]). The strategy aims to do this by (i) reducing external demand as a driver of economic growth, by boosting domestic consumption; (ii) positioning China as a global manufacturing powerhouse in high value-added products; (iii) attaining higher levels of self-sufficiency in key areas, by enhancing innovation; and (iv) ensuring access to critical inputs, by diversifying supply chains and funnelling investment into specific sectors (China Power Team, 2021[33]). As China becomes more self-reliant through this strategy, it could provide the grounds for greater decoupling. On the other hand, the Dual Circulation Strategy does not aim for complete autarky, and foreign technology and capital are viewed as vital for China to become more self-sufficient and upgrade its economic structure (Bilgin and Loh, 2021[37]).

Military-Civil Fusion

Inspired in part by the success of the United States in developing productive linkages between its civil and defence technology ecosystems, China has been pursuing a Military-Civil Fusion initiative for several years. This was subsequently mainstreamed in 2018 as part of its 13th Five-Year Plan. The initiative aims to create and exploit synergies between economic development and military modernisation, and encourages defence and commercial firms to collaborate and synchronise their efforts by sharing talent, resources and innovations. It has expansive ambitions, from enhancing co-operation in big data infrastructures to mobilising national defence (Kania and Laskai, 2021[39]).

1. The key industries are as follows: Information Technology (AI, IoT, smart appliances); Robotics (AI, machine learning); Green Energy and green vehicles (energy efficiency, electric vehicles); Aerospace equipment; Ocean Engineering and high-tech ships; Railway equipment; Power equipment; New materials; Medicine and medical devices; and Agriculture machinery.

The European Union’s “open strategic autonomy” agenda

While expenditures by the European Commission on STI and industry policies are a fraction of those of EU Member States, they have a strong influence on the direction of European policies. EU policy has played a central part in promoting the concept of “open strategic autonomy” in Europe as part of the green and digital ”twin transitions” agenda. EU Member States have different views on the meaning and implications of strategic autonomy. Some prefer a European industrial policy that targets specific sectors, while others prefer more horizontal measures that create the conditions for innovation (Lewander et al., 2021[40]). On the eve of the COVID-19 pandemic, the European Commission presented a new industrial strategy to support the twin green and digital transitions, make EU industry more competitive globally, and enhance Europe’s open strategic autonomy (European Commission, 2020[41]). It updated the strategy in 2021 to reflect lessons from the pandemic, notably the need for a better understanding of Europe’s strategic dependencies, how they may develop in the future and the extent to which they could lead to vulnerabilities. The industrial strategy proposed strengthening and diversifying external trade on the one hand, and strengthening Europe’s innovation capacity in key strategic areas on the other, using tools such as Important Projects of Common European Interest (IPCEIs) (see Box 2.2), industrial alliances, and funding from Horizon Europe and the European Defence Fund (EDF) (European Commission, 2021[11]).

In response to the COVID-19 pandemic, the European Union launched the NextGenerationEU fund in 2020, worth EUR 750 billion (euros) (in 2018 prices). The purpose of the fund is to mitigate the economic and social impact of the pandemic, and make European economies and societies more sustainable, resilient and better prepared for the challenges and opportunities of the green and digital transitions. The Recovery and Resilience Facility (RRF) is the key instrument at the heart of NextGenerationEU. The European Union views the RRF as a unique opportunity to accelerate the development and transformation of STI systems in Member States. The (European Commission, 2022[42]) has estimated the overall expenditure for research and innovation in Member States’ recovery and resilience plans at around EUR 44.4 billion, typically representing between 4% and 13 % of a country’s RRF allocation. These investments target the green transition, digital technologies and health, and are accompanied by STI policy reforms in some countries.

Although the European Commission continues to channel much of its support for research and innovation through Horizon Europe and the structural funds, the toolkit of its innovation policy has expanded over the years to cover the whole innovation chain. This had led to new initiatives, including the European Innovation Council, established in 2021 with a budget of EUR 10 billion over seven years.13 The European Commission adopted a New European Innovation Agenda in 2022 to position Europe at the forefront of what is described as a new wave of ”deep-tech” innovation. Deep tech is rooted in cutting-edge science, technology and engineering, and calls for breakthrough R&D and large capital investments. The agenda outlines dedicated actions to improve access to finance for European start-ups and scale-ups; experiment new ideas through regulatory sandboxes; help create “regional innovation valleys”, including in lagging regions; attract and retain talent in Europe; and improve the STI policy framework (European Commission, 2022[43]). Many of the actions are based on existing measures, which will be extended or better linked to other measures.

Box 2.2. Important Projects of Common European Interest (IPCEIs)

The Treaty on the Functioning of the European Union provides the possibility to approve state aid for IPCEIs. While these provisions have been used very rarely until recently, there is now strong momentum to use IPCEIs more extensively to achieve the European Union’s quest for strategic autonomy (Szczepański, 2020[44]). IPCEIs are ambitious cross-border breakthrough innovation and infrastructure projects led by EU Member States, which identify the scope of the project, select participating companies and agree on project governance. Since Member States’ support constitutes state aid under EU rules, IPCEIs have to be notified to the European Commission for assessment and must meet various criteria for approval (European Commission, 2021[45]). The IPCEI on microelectronics was the first to be approved in 2018, followed by an IPCEI on batteries in 2019. A second IPCEI on batteries was approved in 2021 and aims to support research and innovation throughout the battery value chain – from extraction of raw materials, through the design and manufacturing of battery cells and packs, to the recycling and disposal in a circular economy – with a strong focus on sustainability (European Commission, 2021[45]). A further IPCEI on the hydrogen-technology value chain was approved in 2022, covering the generation of hydrogen, fuel cells, storage, transportation and distribution of hydrogen, and end-users applications, particularly in the mobility sector (European Commission, 2022[46]). To give a sense of the scale and coverage of IPCEIs, the second battery initiative was established by 12 Member States, which will provide up to EUR 2.9 billion in funding, to be complemented by an expected EUR 9 billion in private investments; the hydrogen initiative involves 15 Member States providing up to EUR 5.4 billion in public funding, with an expected private-sector investment of EUR 8.8 billion.

Growing emphasis on dual-use technologies

Well before Russia’s war of aggression against Ukraine, it was already apparent that the European security environment had shifted, with Europe’s democratic systems challenged by a mix of hybrid threats (European Commission, 2021[47]). The European Commission considers investment in innovation and better use of civilian technology in defence as key to enhancing Europe’s technological sovereignty and reducing its strategic dependencies (EEAS, 2022[48]). Many critical technologies for security and defence increasingly originate in the civilian domain, and use critical components with dual-use possibilities. The European Commission published the “Action Plan on Synergies between civil, defence and space industries” in 2021, which aims to enhance complementarities between civil and defence EU programmes and instruments, promote “spin-offs” from defence and space R&D for civil applications, and facilitate “spin-ins” of civil-driven innovation into European defence co-operation projects (European Commission, 2021[49]). It followed this up in 2022 with its “Roadmap on critical technologies for security and defence”. The roadmap identifies technologies critical for EU security and defence. It seeks to ensure that defence considerations are better incorporated in civilian European research and innovation programmes, and vice versa. It also aims to promote from the outset an EU-wide strategic and co-ordinated approach for critical technologies for security and defence, and to reduce strategic dependencies and vulnerabilities in the value and supply chains associated with these technologies (European Commission, 2022[50]).

In practice, plans like these have translated into increasing co-operation and co-ordination between civil programmes like Horizon Europe and defence initiatives like the EDF, to make more effective use of resources and technologies and create economies of scale (European Commission, 2020[51]; European Commission, 2020[41]; Finkbeiner and Van Noorden, 2022[52]). Established in 2021 with a budget of EUR 8 billion over seven years, the EDF promotes R&D co-operation between public research (typically research and technology organisation, rather than universities) and firms. It supports competitive and collaborative projects throughout the entire R&D cycle, including design, prototyping and testing.14 The action plan also includes the new Observatory on Critical Technologies for the space, defence and related civil sectors, which will begin work in 2023. The observatory will identify, monitor and assess critical technologies, including their potential application and related value and supply chains, and any root causes of strategic dependencies and vulnerabilities (European Commission, 2022[50]).

United States: A “modern American industrial strategy”

Although the United States has tended to eschew a formal national industrial strategy, publicly funded R&D and procurement in defence-related sectors have historically underpinned development and US leadership in many technologies, including integrated circuits, GPS and the internet. Breakthroughs like these are the result of civil-military integration involving a world-class network of US universities and firms collaborating closely, for example, through federal organisations like the Defense Advanced Research Projects Agency (Kania and Laskai, 2021[39]). China’s recent ascendancy in emerging critical technologies like 5G has led several American policy makers and analysts to question whether this approach is sufficient for the 21st century, amid calls for a more active national industrial strategy that serves not only economic development interests, but also national security (Guile et al., 2022[53]). Following this line of argument, the United States needs to take a more formal, systemic and integrated approach to industrial policy if it is to prevail in its technological rivalry with China. Such an approach should cover all economic sectors that contribute to the country’s overall technical capabilities and production resilience, and aim to enhance the innovation-enabling “operating environment” in which firms, institutions and individuals work (Atkinson, 2020[54]; Allison et al., 2021[55]; SCSP, 2022[56]).

Somewhat along these lines, the Biden Administration has signed three major bills with bipartisan support:

The CHIPS and Science Act (2022) is discussed below (Box 2.3). Briefly, it aims to ensure the United States maintains and advances its scientific and technological edge by investing in R&D, skills and manufacturing in semiconductors, as well as in other technological areas such as nanotechnology, clean energy, quantum computing and AI. It also aims to unlock STI opportunities beyond a few regions on the coasts and targets those groups who have been historically left out (The White House, 2022[57]). The US Department of Commerce (2022[58]) has since published a USD 50 billion implementation strategy for the “CHIPS for America Fund”, which will disburse a large tranche of the act’s funding. The National Science Foundation has also established a technology, innovation and partnerships directorate to strengthen the commercialisation of research and technology.15

The Inflation Reduction Act (2022) targets small businesses through measures that include (i) doubling the refundable R&D tax credit for small businesses, from USD 250 000 to USD 500 000; (ii) issuing domestic content requirements and offering targeted tax incentives to spur the growth of American supply chains across technologies like solar, wind, carbon capture and clean hydrogen; (iii) supporting the deployment of distributed zero-emission technologies through a new “Clean Energy and Sustainability Accelerator”, which will prioritise over 50% of its investments in disadvantaged communities; and (iv) assisting rural electric cooperatives by funding clean energy and energy efficiency upgrades (The White House, 2022[59]).

The Infrastructure Investment and Jobs Act (2021) aims to strengthen domestic production to revitalise the US industrial base. It includes commitments to build zero-emission vehicles and their components domestically, using grants to support battery and battery component manufacturing, manufacturing facilities, and retooling and retrofitting of existing facilities. It also aims to invest in advanced energy manufacturing facilities and clean energy demonstration projects in communities where coal mines or power plants have been shut down (The White House, 2021[60]).

According to The White House (2022[61]), a strong vision of a “modern American industrial strategy” unifies these laws. This strategy commits to making substantial public investments in three key areas, namely infrastructure, innovation and clean energy. It seeks to “crowd in” private investment and spur innovations that work towards achieving core economic and national security interests. These laws are all multi-year mobilisation efforts but are expected to spur investments at a historical scale, totalling USD 3.5 trillion over the next decade when counting both public capital and private investment.

The industrial strategy strongly emphasises developing manufacturing capabilities, since these create well-paid jobs, decrease supply-chain vulnerabilities, and are the basis for building and maintaining technological leadership. As such, they are part of the strategy to contribute to a more resilient and secure US economy, better positioning the United States to weather future shocks. Addressing inequality is a critical part of the approach, and many of the strategy’s instruments target disadvantaged groups and areas. Moreover, for all its emphasis on developing domestic technological and manufacturing capabilities, the strategy recognises the importance of international partnerships to fulfil its mandate (The White House, 2022[61]).

Strengthening international STI alliances

The third type of strategic autonomy policy intervention is rooted in the projection of national interests in international regulations, norms, standards and alliances. The confluence of issues related to trade, technology and democracy has broadened perspectives on the role of technology in shaping and driving new international alignment and alliance patterns (Soare and Pothier, 2021[8]). At one level, these alliances are forged between like-minded democracies, such as OECD countries, which can gain (for example) from regulatory co-operation to jointly set global technology standards based on shared values (Bauer and Erixon, 2020[62]). At another level, they aim to project competing norms and values globally through technology investments and assistance, particularly in low- and middle-income economies. Examples of related policies include China’s Belt and Road Initiative (BRI), and the G7 Partnership for Global Infrastructure and Investment initiative.

In some respects, these efforts at alliance-building represent a “recoupling” with like-minded and trustworthy allies – sometimes referred to as “friend-shoring”. Strategic autonomy should not be conflated with isolationism, and no single country has all the technological capabilities required to successfully compete in the global economy and preserve its national security. Countries can amplify their domestic innovation strengths through well-chosen strategic alliances, while at the same time enhancing their own national security by supporting the technological capabilities of others.

This section starts with China, highlighting the science and technology aspects of its ambitious BRI and its recent push to shape international technological standards. It then turns to new technology alliances forged by the European Union and the United States.

China’s Belt and Road Initiative and standardisation push

Belt and Road Initiative (BRI)

Initially launched in 2013, the BRI is China’s signature foreign policy initiative, surpassing the post-Second World War Marshall Plan as the largest global infrastructure project ever undertaken. Chinese banks and businesses have invested billions of dollars under the BRI to fund and develop telecommunications infrastructure, power plants, ports and highways in dozens of countries. Its scope has since expanded to include a Digital Silk Road aiming to improve recipient countries’ telecommunications networks, AI capabilities, cloud computing, and e-commerce and mobile payment systems (among other high-tech areas), as well as a Health Silk Road aiming to put China’s vision of global health governance into action (Council on Foreign Relations, 2021[63]). China is also using the BRI, particularly its Digital Silk Road component, to complement its efforts to promote domestic standards in international standards organisations and industry groups (see below) and advance regulatory harmonisation. By 2021, the BRI encompassed over 140 countries, representing close to 40% of global output and 63% of the world’s population (Huang, 2022[64]).

The BRI includes STI activities that address developmental challenges, particularly in agriculture, energy and health care. Already in 2016, the Ministry of Science and Technology, the National Development and Reform Commission, the Ministry of Foreign Affairs and the Ministry of Commerce jointly released the Plan on Cooperation in Science, Technology and Innovation under the BRI (MOST (China Ministry of Science and Technology), 2017[65]). Science and Technology Daily (2022[66]) reports that by the end of 2021, China had engaged in STI co-operation with 84 countries through the BRI, supporting 1 118 joint research projects and establishing 53 joint laboratory projects. Furthermore, more than 30 bilateral or multilateral technology transfer centres between China and other countries had been built thanks to the BRI. Since 2016, the BRI has supported the exchange and training of around 180 000 science and technology personnel in China, and over 14 000 young scientists for short-term research work. While it is difficult to estimate the costs of these activities, Chen (2019[67]) estimates that the Chinese Academy of Sciences alone had already provided around USD 268 million to STI projects associated with the BRI by 2019, a figure that is likely much larger today.16

The Chinese Academy of Sciences also established in 2018 the Alliance of International Science Organizations (ANSO), a non-profit, non-governmental international scientific organisation that aims to support the needs and scientific capacity-building of the Global South through partnerships and co-operation with its member countries and institutions. ANSO currently has 67 members from 48 countries, including 27 national academies, 23 universities, 10 national research institutes and agencies, and 7 international organisations. It funds and organises fellowships and scholarships, training programmes and collaborative research, and offers awards and prizes to both individuals and organisations. Its budget is modest – around USD 13 million in 2021, most of which funded scholarships and collaborative research projects.17

China Standards 2035

Standards are critical to innovation: they provide a foundation for technology development and interoperability, and safeguard global market access to technologies (Blind, 2013[68]). Following the Made in China 2025 strategy, the Chinese government launched China Standards 2035 in 2018. This strategy aims to optimise the governance of standardisation in China, enhance its effectiveness and improve the level of internationalisation of China’s standards.18 In particular, it aims to improve the traditionally weak interaction between standardisation and technological innovation in China, and establish a formal mechanism to link scientific and technological projects and standardisation work (Xinhua News Agency, 2021[36]). This will be important for China as it seeks to develop R&D ecosystems that elevate whole-sector capacities, particularly in critical and emerging industries like AI, quantum computing and biotechnology (Wu, 2022[69]). China Standards 2035 also aims to promote compatibility between Chinese standards and the international standards systems, including through mutual recognition and co-ordinated development of domestic and foreign standards. The strategy also promotes standards co-operation within the BRI (Xinhua News Agency, 2021[36]).

International standards emerge from a variety of sources, with international standard-setting organisations playing important roles.19 Firms collaborate internationally with other players (including competitors) within these organisations to develop and adopt standards created through co-ordinated technical efforts (Shivakumar, 2022[70]). Thanks to their technological supremacy, US firms have taken the lead in creating and setting international standards in these fora for much of the post-Second World War era. However, as China’s innovation capacity grows in key technologies, its capability to influence international standards is also set to increase (Wigell et al., 2022[71]). This is creating considerable uncertainty, as the United States (and other like-minded countries) and China have different styles of engagement and hold different values. While participants in these bodies include a mix of government and private-sector researchers from member countries, the US approach has been to let the private sector take the lead, leveraging its extensive technical expertise and experience, and its knowledge of market need and demands (Goodman and Robert, 2021[4]). By contrast, China (and to some extent, the European Union) takes a more government-led approach, which some interpret as a politicisation of what has been widely perceived until now as a technocratic process. Technical standards also set the norms that govern the privacy and security of different technologies, particularly digital technologies. Since these have so far been based on the values and norms of liberal market economies, there are concerns that China’s increasing domination in standard-setting organisations could pose a strategic risk to their integrity owing to diverging values (Wigell et al., 2022[71]). These tensions have led to fears that the role of international standard-setting organisations in establishing fair and credible standards will be undermined, ultimately damaging technological progress and market competition (Shivakumar, 2022[70]).

New alliances involving the European Union and the United States

Both the United States and the European Union have made recent pronouncements on the importance of international engagement to promote democracy-affirming norms and values, and reduce risks to national security inherent in technologies with dual-use potential. For example, in its industrial strategy plans, The White House acknowledges the importance of supply chain diversification, including through efforts to “friend-shore” some production (The White House, 2022[61]).

EU-US Trade and Technology Council

Having convened for the first time in 2021, the EU-US Trade and Technology Council aims to promote the responsible use of technologies, in line with democratic values and protection of human rights. It seeks to enhance trans-Atlantic co-operation on a range of issues, including export controls and FDI screening, in defence of national security, secure supply chains (especially with regard to semiconductors) and technology standards, including co-operation on AI. In all, it aims to ensure joint leadership in setting global norms for emerging and other critical technologies, and counter authoritarian influence in the digital and emerging technology space (EU-US Trade and Technology Council, 2021[72]). The council has established ten working groups to explore co-operation on these topics, in full respect of each side’s regulatory autonomy.20

Other regional groupings

The Quad is a loose grouping between Australia, India, Japan and the United States that promotes shared democratic values and respect for universal human rights in the ways technology is designed, developed, governed and used (The White House, 2021[73]). Its focus includes critical and emerging technologies (for which it recently issued “Principles for Critical Technology Supply-Chain Security”, organised around the pillars of security, transparency, autonomy and integrity),21 climate-change mitigation and adaptation, and space technologies. The Quad also launched the Quad Vaccine Partnership in 2021 to advance equitable access to safe and effective vaccines in the Indo-Pacific region (Huang, 2022[64]). The Quad operates through expert working groups and international meetings, including biennial leaders’ summits.

A new, larger grouping covering the Asia-Pacific region was launched in 2022, known as the Indo-Pacific Economic Framework for Prosperity.22 One of its chief aims is to diversify supply chains to ensure secure access to semiconductors, critical minerals and clean energy technology (The White House, 2022[74]). The United States also announced the Americas Partnership for Economic Prosperity in 2022 to help supply chains in the region be more resilient against unexpected shocks, and to promote innovation in both the public and private sectors (The White House, 2022[75]).

Group of Seven (G7)

The G7’s agenda has long covered STI issues, and the initiatives outlined here are among the latest in a long line. The largest initiative to date is the Partnership for Global Infrastructure and Investment (PGII), announced during the 2022 G7 Leaders’ Summit. The partnership aims to mobilise USD 600 billion in global infrastructure investments by 2027, with up to EUR 300 billion in investments channelled through the European Union’s Global Gateway initiative,23 and USD 200 million coming from the United States (The White House, 2022[76]). Through blended finance, the PGII seeks to mobilise public and private resources in pursuit of values-driven, high-quality and sustainable infrastructure development. The European Union’s Global Gateway initiative focuses on digital, climate and energy, transport, health, and education and research, and is underpinned by a values-based approach promoting democratic values, high standards, strong governance and transparency (Liao and Beal, 2022[77]). The US initiative focuses on clean energy, secure digital networks and infrastructures, advancing gender equality and health security (The White House, 2022[78]). Both initiatives emphasise the competitiveness benefits of these investments for their domestic firms, in addition to their job creation potential. Both also call for a whole-of-government approach, given the levels of investments involved and their expansive coverage.

Other recent relevant G7 initiatives include the Working Group on the Security and Integrity of the Global Research Ecosystem, which was established to develop principles, best practices, and a virtual academy and toolkit for research security and integrity (G7-Summit, 2022[79]); and a new Climate Club to accelerate climate action and increase ambition, with a particular focus on the industrial sector (G7, 2022[80]).

Strengthening strategic autonomy in action: Semiconductors and critical minerals

Policy discussions on technological sovereignty and vulnerabilities from interdependency often cite two prime examples: semiconductors and critical minerals. OECD countries and China are investing heavily in both areas, using a mix of protection, promotion and projection policies, as described below.

Semiconductors