Continued growth in tourism over six decades led to the widely held belief in the inherent resilience of the tourism economy. However, consecutive global shocks have demonstrated the importance of building systemic resilience across the tourism ecosystem. This chapter provides analyses policy approaches to support the recovery and enhance the resilience of the tourism economy for the future, with a focus on the COVID-19 pandemic. It considers actions to boost tourism recovery prospects, tackle the long-term consequences of the crisis, and better prepare for future shocks, while encouraging the shift to more resilient, sustainable and inclusive models of tourism. Key policy considerations are identified to set a path forward for policy makers to address structural weaknesses and to build resilience in the tourism ecosystem.

OECD Tourism Trends and Policies 2022

Chapter 2. Building resilience in the tourism ecosystem

Abstract

As the tourism economy recovers from the devastating impacts of the COVID‑19 pandemic, it faces new uncertainties from Russia’s war of aggression in Ukraine. In addressing these immediate and pressing priorities, governments must take action to optimise the strength and quality of the tourism recovery. The crisis triggered by the pandemic is an opportunity to build back greener and more inclusive. There is also a need to enhance the resilience of the sector, undertake structural reform and ensure tourism is better placed to adapt and respond to the impacts of future shocks, natural or man-made. Action is needed now to build on this momentum, or risk being forgotten once the recovery comes.

Resilience is an underdeveloped topic in tourism. Continued growth in tourism over six decades led to the widely held belief in the inherent resilience of the tourism economy. Further work is needed to understand tourism resilience and the implications for tourism planning and development, including capacity building. This is true for policy makers and businesses alike. Current resilience actions in tourism are generally aligned with crisis management and sustainability concepts, and measurement is focused on recovery. Individually, these components help to build resilience in the tourism ecosystem – and enable the sector to adapt and respond in the face of a crisis – but they lack the forward-looking systemic focus needed to drive resilience.

The length and depth of the pandemic and the consequences of Russia’s war in Ukraine mean the tourism sector remains in ‘recovery mode’. While many countries have experienced a rapid return of tourism demand in 2022, rising inflation and the slowdown in economic recovery are likely to have flow-on effects into next year as discretionary spending tightens. Therefore, it might yet take some time to understand the impacts, both direct and indirect, of the pandemic and the tourism response strategies that were effective. As governments and businesses shift focus towards the longer term, it is important to already consider how to minimise or avoid disruptive impacts from future shocks and strengthen the tourism economy more generally.

Tourism has been proven vulnerable to exogenous shocks, but the crisis has also highlighted underlying endogenous weaknesses. It is these endogenous weaknesses that policy makers and businesses must look to proactively address, to build systemic resilience while creating opportunities for future growth. This chapter seeks to better understand the concept of resilience as it relates to tourism. Endogenous vulnerabilities in the tourism ecosystem are explored, with a strong focus on the COVID‑19 pandemic. This is considered through the lens of institutional intervention and support measures. Strategies and frameworks to address these vulnerabilities are presented, drawing on examples of recent actions within the tourism sector, and from resilience work in other sectors. Finally, the chapter sets out a path forward for policy makers to integrate resilience thinking into tourism strategies and decision-making.

Setting the scene: tourism resilience, crisis management and sustainability

Resilience refers to the capacity to absorb disturbance, recover from disruption and adapt to changing conditions while retaining essentially the same function as prior to the shock. It goes beyond risk management and concerns the performance of the economic system once a threat has materialised (Hynes et al., 2020[1]) It is characterised by the speed and strength of recovery, in particular through adaptation and transformation.

Resilience relates to action both before and after an event occurs:

Prior to a shock: Actions to mitigate the risk and limit the size of the impact by detecting endogenous vulnerabilities and reducing the future impact.

After a shock: Actions to promote recovery through adaptation and transformation, particularly through learning from previous crises and adapting to better deal with future threats of a similar nature (OECD, 2021[2]).

Box 2.1. Adapting to changing business tourism trends

There has been a strong shift in business tourism trends since the start of the pandemic, and this is being further impacted by the acceleration of digitalisation and remote working. Pre-pandemic, business travel represented approximately 12% of global international tourism arrivals, or 175 million visitors in 2018 (UNWTO, 2021[3]). The advances in information and communication technology required to sustain economies through prolonged global shutdowns have significantly decreased, at least in the short term, the perceived need for business travel, with in-person meetings and conferences being replaced by virtual and hybrid options.

Some parts of the sector are adapting to the new virtual workspace by promoting ‘digital nomadism’ rather than relying on a complete recovery of business travel. Accommodation provider Accor has recognised that international business travel is unlikely to return to previous patterns, replaced by virtual and hybrid meetings. Instead, Accor is looking to the rise of digital nomadism, especially among younger generations, and its potential to fill some of this gap. Accor is adapting to provide co-living spaces that include hotel services and combine a place to live with a place to work and focus on the local use of hotels (Accor, 2020[4]).

Countries such as Costa Rica, Estonia, Greece and Iceland also looking to build on this trend. Costa Rica has introduced legislation to attract ‘digital nomads’, Iceland has introduced a long-term visa for remote workers, and Estonia introduced a visa for teleworking which allows remote workers to live in Estonia and legally work for their employer or own company registered abroad for up to a year. A new law has been established in Greece to introduce a series of incentives and visas for digital nomads.

The tourism sector has already shown signs of adaptation, shifting to take advantage of new business tourism trends (Box 2.1). However, tourism policies and strategies need to take into account all dimensions of resilience to prepare for future shocks. This includes a particular focus on impact absorption and recovery through adaptation and transformation, which may require different but complementary policy actions.

Crisis management relates to the actions during a crisis to reduce the initial negative impacts. Previous OECD Tourism Committee work has called on policy makers to develop crisis management strategies to better prepare for and respond to largely unpredictable events, such as security incidents, political instabilities, pandemics and natural disasters (OECD, 2018[5]). While strong risk management and crisis management plans are imperative for tourism, the current crisis has highlighted the need to consider also the recovery phase and take action to prepare for future shocks. Resilience builds beyond the initial shock and considers the actions to recover and adapt once the crisis has subsided.

Resilience and sustainability are interdependent but distinct concepts. Sustainable development meets the needs of the present without compromising the ability of future generations to meet their own needs. It requires the harmonisation of economic growth, social inclusion and environmental protection (United Nations, 2022[6]), and can be addressed through initiatives like building a circular economy. Strategies for sustainable tourism development typically take into account existing trends and forecasts, and consider the actions required to shape economic activity for future prosperity. This differs from resilience, which is focused on the ability to endure and recover from a shock.

A tourism business or destination that is economically viable, has minimal negative environmental impact and has positive community outcomes is more likely to be resilient in the face of adversity. There can also be compounding positive effects for resilience, as a more stable and sustainable environment leads to fewer shocks in the future. This is a two-way relationship, as without resilience, a destination would never be able to maintain its sustainability efforts (PATA, 2022[7]).

Tourism is a global sector that relies on the efficient movement and interaction of people and global value chains. This comes with risks that are beyond the control of the tourism sector, and creates vulnerabilities within the tourism ecosystem. Tourism is also a complex, integrated system of actors, each of which is reliant on the actions of another. It is highly fragmented, composed of many small businesses that interact with large global players that structure the global tourism economy. This heightens the need for resilience within the sector, as disruption to any part of the value chain has ramifications for other parts of the sector.

Building resilience through a systemic approach would support the tourism sector to endure the shocks and build back by adapting to the new normal, which is often unknown. Policy approaches based on systems thinking recognise that although it is not possible to know what will trigger the next crisis, there are certain factors that will make it more likely and more damaging, and that there are better policy options than waiting for it to happen (OECD, 2020[8]). The processes of systemic resilience also provide the means to pursue multiple policy objectives at the same time (Hynes et al., 2022[9]).

Anticipating the future needs of tourism is challenging while the sector is still in recovery mode, and faces medium and long-term uncertainties (Box 1.1). However, the opportunity exists to use the crises as a catalyst to drive the (often-difficult) structural reforms and transformation widely recognised as necessary in the sector. This requires that resilience is embedded into the ongoing tourism policy response and future planning, without which the sector runs the risk of letting resilience planning fall by the wayside until the next crisis, meaning future impacts are deeper than necessary.

Learning from previous exogenous shocks to address tourism vulnerabilities

The widespread nature of the COVID‑19 pandemic impacted all parts of the tourism ecosystem. Rapid, multi-faceted responses were needed to restore tourism demand, support tourism workers, businesses and destinations, and improve institutional capacity for decision-making.

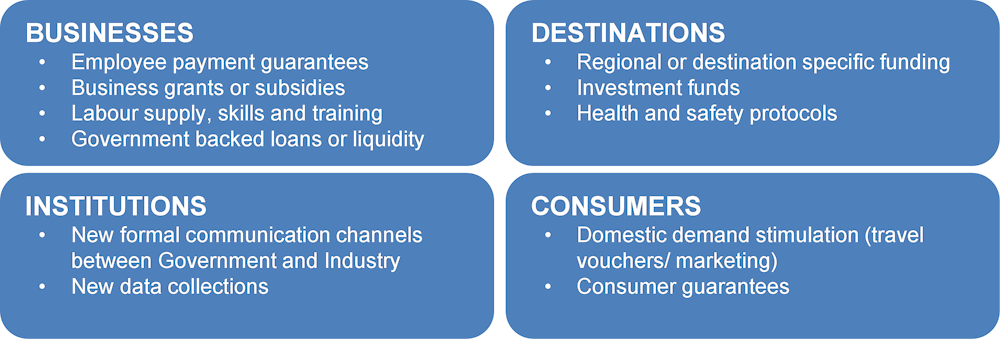

The policies implemented to support the tourism sector in response to the COVID‑19 crisis varied widely across countries but can generally be categorised into 11 key themes. Matching these measures to the intended recipient provides a framework to understand the vulnerabilities within the tourism ecosystem, and the areas that need strengthening for the future (Figure 2.1). This framework is used to analyse the vulnerabilities of the sector in this section and build on pillars adopted by previous OECD resilience work – economy, environment, society and government (or institutions) (Box 2.2).

Figure 2.1. Using COVID-19 support mechanisms to assess tourism vulnerabilities

Box 2.2. Assessing tourism vulnerabilities based on COVID‑19 support mechanisms

Effective policy design generally starts with accurately diagnosing the issue or vulnerability it aims to address. Taking the opposite approach following a shock can also help to understand who or what the mechanism was specifically designed to support. Mapping the key COVID‑19 policy responses against the intended beneficiary, a number of vulnerabilities across multiple elements of the ecosystem are identified:

Businesses: Emergency response and mitigation initiatives mainly focused on providing income continuity for workers and ensuring tourism businesses, and in particular SMEs, were in a position to restart operations when containment measures ended (OECD, 2020[10]). Income support measures were used widely by countries to ensure business-employee ties were maintained through periods of shutdown. Business support mechanisms such as liquidity support measures and tax incentives were implemented to help businesses meet or reduce ongoing fixed costs through periods when operations were restricted or closed. To promote recovery after the pandemic and prepare for future shocks, Denmark provided compensation to tourism businesses, totalling DKK 15 billion. This compensation kept many businesses operational and allowed for the promotion and recovery of tourism once restrictions were lifted.

Destinations: New protocols were put in place to increase tourist and worker safety. Luxembourg’s “Safe to serve” campaign combined a series of initiatives aimed at preserving the health and safety of staff and customers. The campaign included a charter where professionals guarantee their customers a high level of health and safety, designed as a reassurance mechanism and underpinned by legal obligations. Location-specific programmes provided support for tourism-reliant destinations at risk of economic failure without additional support. For example, the Australian Recovery for Regional Tourism Programme provided targeted support for nine regions that were economically reliant on international visitors.

Consumers: Programmes to stimulate demand for travel as restrictions were lifted included travel vouchers or subsidies, marketing and new consumer guarantees particularly related to refunds. Bulgaria provided compensation grants to tour operators to reimburse customers, and Austria provided guarantees for package travel providers to secure down-payments of tourists in 2021 and 2022. In 2020, an additional ISK 3 billion was added to Iceland’s tourism services budget for marketing and promotion, including a domestic travel voucher campaign and international marketing campaign.

Institutions: New procedures have been introduced to enhance timely and evidence-based decision-making for institutions. For example, new formal communication channels were established between the private sector and institutions to help information gathering and ensure targeted support measures would be successful. Brazil made a broad range of official data available through the General Co‑ordination of Data and Information mechanism to support private sector decision-making. Countries also purchased new data sets or signed data sharing agreements, with accommodation and bookings data among the most popular sources.

While this framework is designed based on COVID‑19 support mechanisms, analysis of previous crisis support reveals similar vulnerabilities:

9/11 terrorist attacks in the United States (2001), with wider impacts on the perception of safety for travellers globally. The attacks led to the introduction of global aviation safety measures, many of which remain in place today, including increased airport scanning and co‑operation between the aviation industry and institutions (IATA, 2021[11]).

Global economic and financial crisis (2009), which impacted businesses and consumer spending capacity. The main response was through fiscal stimulus packages, which included tax cuts and spending boosts for businesses and consumers (OECD, 2009[12]).

Previous health crises and pandemics (e.g. SARS, 2002, Swine Flu, 2009), which impacted the movement and interaction of people. Response mechanisms to reduce the spread of the virus included localised lockdowns, then returning consumer sentiment and demand once safe to do so.

Natural disasters (e.g. bushfires, tsunamis, earthquakes and severe weather events) negatively impact tourism, but generally remain isolated. Responses include crisis management, with fiscal packages to restore business and consumer demand at the destination level when safe to do so.

During the COVID-19 pandemic (and previous crises), governments have implemented programmes for consumers to encourage tourism, drive demand and reduce booking hesitancy. Government guarantees and refunds were used to counteract booking hesitancy due to cancellation or business failure. Travel vouchers and subsidies were introduced to drive demand, creating an urgency amongst travellers to book and travel in the short term.

Crises in tourism are underpinned by a need to enable a demand-led recovery driven by consumers travelling again and contributing to each part of the ecosystem organically. This is not necessarily a structural weakness that can be addressed prior to a crisis, but a fundamental requirement to restart the tourism ecosystem to ensure other resilience measures can take effect.

Box 2.3. Exogenous variables impacting the tourism recovery

Exogenous variables are inherently hard to plan for as they cannot be controlled from within the (tourism) system. Recognising these variables and understanding the possible impacts is necessary to respond to the challenges and build system resilience. Exogenous variables that will likely impact tourism in the short to medium term include:

Inflation: Inflationary pressures have intensified since Russia’s invasion of Ukraine and have broadened beyond food and energy, with businesses now passing through higher energy, transport and labour costs (OECD, 2022[13]). Discretionary spending like tourism will be the first to be cut.

Oil prices: Spurred by oil uncertainty, prices surged in early 2022 – crude oil and jet fuel prices were almost double pre-pandemic prices in April 2022 (IATA, 2022[14]). While oil prices are expected to trend downwards until at least 2023 (IATA, 2022[15]), tourism is reliant on the transport of people and goods and will remain exposed to oil price volatility.

Supply-chain shortages: Global disruption is impacting international supply chains and contributing to inflationary pressures. Shortages and supply delays for raw materials in the construction industry could slow infrastructure investment. This can have wider implications for the growth and competitiveness of the tourism sector, but also the sustainable and digital transitions.

Societal shifts: In many OECD countries, middle-income growth has remained stagnant. Technology is automating semi-skilled jobs that used to be carried out by middle-class workers, reducing the ability of the middle-class to save (OECD, 2019[16]). Coupled with an aging population, especially in the middle to upper-class brackets, this could reduce the pool of travellers.

Climate change: Accelerating climate impacts have negative consequences for tourism, especially in low-lying coastal areas and mountain areas. It also leads to the increased risk of natural disasters, which are expected to become more prevalent. Adaptation measures are required for a resilient tourism sector. Tourism also needs to play its role in mitigation efforts and achieving net zero targets.

Taking stock of the fragilities that have been presented through the COVID-19 pandemic and previous crises provides insights into the areas of focus for the future and when these vulnerabilities may occur. Coupled with strategic foresight exercises, this can help tourism policy makers anticipate alternative futures and inform the development of forward-looking policies (OECD, 2018[5]). While this chapter focuses on the endogenous structural vulnerabilities of the tourism sector, strategic foresight activities seek to scan the horizon to respond to possible scenarios and consider also the impact of exogenous variables on tourism (Box 2.3).

Diversifying destinations to build resilience to shocks

The extent of the economic impact of a shock depends on several broad but interlinked factors. Beyond the nature of the shock itself, these can include the nature of the tourism offer, the impact of travel restrictions on visitor flows, the extent to which the event coincides with peak tourism periods, the extent of damage to the physical tourism infrastructure, the scale and complexity of business operations, the return of main source markets, the size of the domestic tourism market and exposure to international source markets. Additionally, places where there is a lack of economic diversity and a heavy reliance on tourism to support local jobs and businesses are more vulnerable (OECD, 2020[17]).

The impact of shocks on employment and economic activities can be asymmetric and highly localised between and within countries. Countries where tourism makes a large contribution to GDP (e.g. France and Spain) have been more exposed to the negative impacts of the COVID‑19 pandemic (Rusticelli and Turner, 2021[18]). The prolonged halt in tourism activity has impacted the wider economy and required public spending to support the sector. This is also reflected at the destination level, as places where there is a lack of economic diversity and a heavy reliance on tourism to support local jobs and businesses were more vulnerable (OECD, 2020[17]).

In many destinations, an increased economic reliance on tourism, lack of diversity in the visitor mix and product offering, and lack of integration of tourism into wider economic development has increased the risk profile for tourism and the wider economy. This is true for countries, but it is even more evident at the level of regional and local destinations, as consistent tourism growth in the past has created growth-oriented expectations and a focus on targeting high-growth international visitor markets.

In places where tourism accounted for a significant share of economic activity, the loss of tourism presented a devastating situation for the wider local economy. During the pandemic, this saw countries including Australia and Mexico implement regional tourism support packages. The reliance on tourism also led to a strong push and introduction of measures to support the safe reopening of the sector as soon as sanitary conditions allowed and support the sector to pivot to new markets.

In addition to strong economic reliance, these destinations often portrayed other well-documented and often overlapping vulnerabilities including:

Seasonality, with a concentration of visitors during peak periods, as often seen in coastal areas.

Market dependence, with an (over) reliance on specific visitors, either a country source market or a specific visitor type, like business visitors.

Product dependence, based on a single iconic attraction or product offering, like winter sports.

As the tourism economy recovers, these overlapping vulnerabilities need to be addressed, so destinations are stronger and better prepared to adapt in the future. As decision-making competencies vary across national, regional and local levels, and tourism is predominantly made up of small businesses with limited capacity beyond running the day-to-day operations, destination management organisations can play a role to support this (OECD, 2020[19]).

Safety and security remain an important concern for tourists around the world, with perception often as important as reality. These issues can affect the image of the destination, visitor arrivals and tourism growth, and are also an important part of building a more robust and sustainable tourism economy. Tourists who believe they can safely and easily travel to, from and around the destination are more likely to explore secondary attractions.

The pandemic created a new threat and uncertainty for travellers. It put health and safety at the centre of the discretionary travel decision. Portugal’s Clean & Safe label provides a good example of an ongoing initiative to support safe mobility. It not only considers the ongoing health threats caused by COVID‑19, but also extends to consider the impacts of future crises (Box 2.4).

Box 2.4. Reinforcing consumer confidence in Portugal

To reinforce confidence in Portugal as a safe destination for tourists, employees in the sector and the population in general, a new version of the Clean & Safe label was launched in June 2022. This was extended to support companies through crisis management. The Clean & Safe label promotes excellence in company hygienic-sanitary performance, but also act as a tool for future public health crises (e.g. pandemics, heat waves). It now incorporates a new dimension of security for tourist activities, covering risk situations arising from extreme natural events (e.g. rural fires, floods, earthquakes, tsunamis) and international events (e.g. cybercrime, repatriations, refugees). The label was initially developed in close co‑operation with the Ministry of Health. Partnerships with NOVA Medical School, AGIF Management of Rural Fires Agency, the National Emergency and Civil Protection Authority, the High Commissioner for Migration and the National Cybersecurity Centre have also been established. Technical support, including models of Clean & Safe Action Plans and Technical Support Guides, is available on the portugalcleanandsafe.com platform. The Clean & Safe Seal remains optional, free and valid until June 2024.

Strengthening businesses’ preparedness for future shocks, particularly tourism SMEs

Building a more resilient tourism sector requires that businesses of all sizes and types are better prepared to face future shocks. Tourism businesses sustained extended periods from the start of the pandemic where revenues were slashed due to restricted or closed operations and ongoing capacity constraints. This has caused significant disruption to existing business models. Large tourism businesses have seen dramatic losses and have required government support, particularly airlines. Small tourism businesses have faced particular challenges.

SMEs are a key part of the tourism supply chain, making up approximately 85% of tourism businesses, and their survival is essential for the recovery. However, SMEs lack the capacity and resources to cope with the changes and costs that such shocks entail (OECD, 2020[17]) and face unique challenges that create vulnerabilities and inhibit resilience (OECD, 2009[20]). This includes an inability to downsize due to their already small size, less diversified economic activities, and weaker financial structures with fewer financing options. In response, support programmes were introduced to help reduce financial burdens or enhance business cash flow. This included but was not limited to: business cash grants; government‑backed loans; tax incentives; and deferrals for rental and/or utility payments.

Many support mechanisms for SMEs and entrepreneurs came in the form of debt which, if unwound too rapidly, could precipitate a wave of bankruptcies that jeopardise the recovery (OECD, 2021[21]). High levels of debt and delayed recovery of the tourism economy have further raised the already high-risk profile of tourism businesses, making access to finance more difficult and creating new barriers to entry or scaling up.

Tourism SMEs face additional challenges linked with the structure and nature of the tourism economy, which are exacerbated in times of crisis. The tourism sector is highly fragmented and heterogeneous and covers a wide range of industries, with many demonstrating a dual structure characterised by a very small group of large businesses combined with many SMEs (OECD, 2021[22]). The sector is globally interconnected and depends on the availability of workers with a mix of skills to deliver quality tourism services, while temporal and spatial concentration is a frequent feature. This is acknowledged, for example, in the G20 Rome Guidelines for the Future of Tourism and the G20 Bali Guidelines for Strengthening Communities and MSMEs as Tourism Transformation Agents, which note that resilience in the tourism sector relates in particular to the needs of SMEs. Recognising these challenges, Greece developed a roadmap to better support tourism SMEs through the recovery, with a particular focus on micro-enterprises and job retention.

Many tourism workers and businesses benefited significantly from whole-of-economy job retention measures, but the sector is still experiencing widespread labour and skills shortages in the wake of the crisis due to:

Loss of workers to more stable and higher paying opportunities in other sectors, when faced with ongoing disruption and uncertainty for tourism businesses.

Reduced mobility of workers within and between countries during the pandemic, compounded by the return of many temporary workers to their home country (OECD, 2021[23]).

Competition from other sectors, as tourism businesses sought to rapidly scale up operations in response to the rebound in demand in a tight labour market.

The struggle to attract and maintain an adequate workforce is presenting significant issues for the tourism sector as it looks to recover. Workforce shortages are constraining the ability of tourism businesses to reopen, leading them to reduce operating hours or capacity.

While the successive shocks caused by COVID‑19 and Russia’s war in Ukraine have been unprecedented and were generally unforeseen, tourism businesses need to be supported to develop and implement comprehensive and iterative risk management plans to better prepare for future crises. Japan has adopted a forward-looking approach, creating and publishing a guidebook for the introduction of tourism crisis management in local governments and tourism-related operators. This was developed by collecting and analysing examples of good practices related to tourism crisis management in Japan and other countries. It is anticipated that each region and tourism operator will create a tourism crisis management plan with reference to these materials, thereby assisting to build crisis resilience in tourism across the country.

Active government responses to reduce the impact of shocks and promote a quick recovery

A resilient society is driven by people, but individual resilience can and should be supported by institutions. This requires institutional resilience, which comprises capacity to deliver and enhance results over time credibly, legitimately and adaptively, as well as the ability to manage shocks and change (OECD, 2020[24]). To support resilience in the tourism sector, institutions need to be prepared, quick to act and agile. More granular and timely data is required to understand the impacts of crises on the tourism sector and enable agile and responsive policy-making that is fit for purpose.

Strategic and adaptive institutional processes can expedite response and transformation measures. However, policy design frameworks are often structured and rigid. Institutions have processes that require proven impacts, multiple levels of approval, and specific implementation methods. In a crisis, these features of good governance can slow the response and increase the length of exposure of businesses and consumers to the shock, resulting in deeper impacts and greater scarring in the recovery phase. The lack of agile and flexible policy design processes limits the quick implementation of targeted policy responses which can be easily adapted, if needed, to meet the intended purpose.

Resilience is built from experiences through learning and adapting to address previous shocks. During the pandemic, countries that had learnt from similar experiences in the past had existing mechanisms in place and were better prepared to respond. Germany, for example, was able to mobilise a labour support programme introduced during the global financial crisis. This, combined with the National Pandemic Preparedness Plan, allowed Germany to react quickly and reduce the financial burden on businesses and employees by supplementing wages.

Quick, targeted, and effective action in a crisis is dependent on reliable data for evidence-based decision‑making. Insufficient data and information have inhibited the development of targeted, evidence‑based policy since the start of the pandemic. The uptake of alternative and complementary data sources such as administrative and ‘big data’ accelerated through the pandemic. Some countries used existing non-tourism data to infer new tourism performance insights (Box 1.12).

While this data provided more timely insights than traditional data, it is not targeted at tourism, which presents limitations. These data sets are not a complete solution to the existing data and information issues; more needs to be done to explore new and improve existing methods.

Building a more resilient tourism ecosystem

Exogenous shocks, like COVID-19 and Russia’s war in Ukraine, are hard to predict and even more difficult to control. This can inhibit the response, particularly in systemic environments like tourism. Working towards greater resilience will support the tourism sector to adapt and transform in the face of acute shocks in the future and continue to adjust to the megatrends of evolving visitor demand, sustainable tourism growth, enabling technologies and digitalisation and changing traveller mobility (OECD, 2018[5]).

Strengthening the resilience of the tourism economy is the focus of much attention, and action is needed if the new and long-standing weaknesses in the tourism economy are to be addressed, or they risk being forgotten after this crisis has passed. Since the pandemic, resilience has been a key theme appearing in tourism recovery guidelines, plans and strategies, at national (e.g. US Travel and Tourism Strategy 2022) and international levels (e.g. European Commission’s Transition Pathway for Tourism, G20 Rome Guidelines for the Future of Tourism). Implementation and action is now key, to build on the platform of change and collaboration from the crisis, better manage tourism development and transition to a stronger, fairer and more sustainable tourism system (Box 2.5).

Adopting integrated, agile and flexible governance systems for tourism

Agile, flexible and well-co-ordinated tourism policy approaches are a key part of responding and adapting to change and building a more resilient tourism system. The cross-cutting nature of tourism means tourism impacts and is impacted by many policy areas. Co‑ordination across policy areas and levels of government is important to ensure that tourism is integrated into broader crisis response and risk management strategies. Once in place, it is also important that policies and programmes can be adapted to meet changing needs, while measures that impede tourism activities do not continue longer than necessary.

The first step in sound policy making is to identify and properly understand a problem, and then develop the appropriate responses to address it (OECD, 2018[25]). This often requires three key steps:

Identifying a specific problem or issue negatively affecting the tourism economy.

Collecting evidence to understand the problem and evaluate its impacts.

Designing a policy that is not only right for the problem but also meets legal and constitutional requirements, aligns with broader government agendas, and meets the expectations of industry stakeholders, who often have competing issues.

Box 2.5. COVID-19 crisis: an opportunity for sustainable and digital action

Crises present serious negative consequences, but they also provide opportunities for adaptation and sustainable development. To analyse resilience without considering the potential opportunities that arise from disruption would be remiss. Taking stock of these opportunities and their potential long-term benefits is necessary. Evidence from business surveys worldwide shows that up to 70% of SMEs intensified their use of digital technologies due to COVID‑19 (OECD, 2021[26]). In tourism, this could include the introduction of digital payment methods, updated ordering and ticketing systems and new contact tracing technology. While born from necessity, this surge in innovation will continue to drive productivity in the sector moving forward. Advancement of digital technologies and development of digital service models offer small businesses enhanced accessibility to business tools, which enable the quick adaptation of activities during crises with limited upfront investment (OECD, 2021[27]).

The reduction in tourists provided an opportunity for governments, destinations, businesses and consumers to rethink the future of tourism, creating a renewed focus on sustainability, green development and community inclusion in destination and community planning. Immediate action is critical to ensure these issues are engrained in future planning, and that the tourism sector does not just revert to previous operations when visitors return. Importantly, these opportunities can co-exist as digital technologies can be a key enabler of the green transition, suggesting that these and ongoing innovations need to be addressed jointly in the recovery phase and beyond. There are synergies and opportunities for double dividends in policy implementation (OECD, 2021[28]).

Selected country approaches:

Finland: In 2020, a call for funding applications was organised for regional tourism organisations to support the recovery of the tourism industry and the regions. The projects responded to local development needs, benefited multiple operators in the regions and brought long-term positive effects for the tourism sector. EUR 4 million was allocated across 28 projects that focused on developing digital capabilities and solutions, increasing year-round tourism, creating new tourism products and reaching target groups.

Canada: Announced in 2021, the Canada Digital Adoption Program was established to help SMEs, including in the tourism sector, realise their full potential by adopting digital technologies. The CAD 4 billion programme comprises two separate funding components, including Grow Your Business Online grants for smaller, consumer-facing businesses, including those in service industries like tourism.

Greece: As part of the National Recovery and Resilience Plan, a key area of focus is on the digital transformation of SMEs, including in tourism. This includes support for investments in digital technologies and services, including electronic payments, digital advertising tools, business analytics, upgrading of digital skills, artificial intelligence, integrated solutions for seamless service, cyber security systems, and POS ecosystem upgrade.

In times of crisis, these steps have to be taken more rapidly and in quicker succession than under normal circumstances. Implementation takes time and often requires wide stakeholder engagement and multiple levels of approval.

During the pandemic, countries moved quickly to introduce unprecedented, economy-wide measures to cushion people, businesses and communities from the full impact. While tourism has benefited from these supports, experience has also highlighted how whole-of-economy approaches to policy making can lead to gaps in support mechanisms, particularly when introduced quickly. The highly fragmented and heterogeneous nature of tourism meant that businesses often ‘fell through the cracks’ when they did not meet the criteria for support, particularly when non-employing and subject to strong seasonal incomes. When asked about the key lessons learned through the crisis (in September 2021), Canada and New Zealand acknowledged issues in creating targeted support to the tourism sector, particularly SMEs, while Estonia added that addressing issues was a process of ‘learning by doing’.

Reflecting on the lessons from the pandemic response and adapting future processes will create better preparedness in the face of future crises. Learning from the pandemic response is a core part of the EC Transition Pathway for Tourism, in order to put in place the right structures, procedures and rules to be able to deal quickly with future exceptional circumstances with minimal disruption to travel and tourism (European Commission, 2022[29]).

Both horizontal and vertical policy co‑ordination are essential for tourism resilience (OECD, 2018[5]). Policy decisions are made across all levels of government, but a unified approach, with common goals, underpinned by strong co‑operation and planning is required to create a resilient sector. National governments might hold budgetary decisions, but local governments are often better placed to administer programmes and ensure the implementation meets the needs of tourism businesses. Local governments can be more closely connected with businesses, and this can help to better design and implement programmes, evaluate the outcomes, and respond if changes are required. Germany has implemented a new central instrument to help develop the next national tourism strategy in a co‑ordinated way (Box 2.6).

Box 2.6. Integrated tourism policy development in Germany

In May 2022, Germany established a steering committee consisting of high-ranking members across all relevant ministries to tourism in Germany. The main task of this steering committee is to develop key points for the National Tourism Strategy and to agree upon a working programme for the Federal Government. Germany is now creating the national platform “Future of Tourism” as the central instrument for co‑operation and integration for the development of a National Tourism Strategy. The platform will be expanded to include representatives of the sixteen federal states and stakeholders of the tourism sector early in 2023. Within this platform, all actors will work together to evaluate, adjust and amend the measures of the working programme. This will utilise different working groups to ensure the right people are addressing the right issues.

Effective multi-level governance also requires clarification on how responsibilities are assigned to different government levels, and that this process is explicit, mutually understood and clear for all actors. A periodic review of jurisdictional responsibilities should be made to ensure flexibility in the system (OECD, 2021[30]).

Building resilience also requires co‑operation and action by both the public and private sectors. Close collaboration between government and the private sector allows for a faster and more targeted response in a crisis, reducing the impact of crises and increasing the effectiveness of response and recovery measures. Throughout the COVID‑19 pandemic, many countries implemented communication and collaboration strategies between government and industry bodies, including partnerships, frequent bilateral meetings and information and data sharing. This created a platform to develop trust-based relationships and enhance evidence-based decision-making. Maintaining these relationships beyond the crisis would provide support for a quicker, more holistic response to future shocks, and well-targeted policy design more broadly, with institutional actions based on industry needs.

This is being addressed through the establishment of formal advisory groups and taskforces for the ongoing development of tourism (explored further in Chapter 1 – Box 1.2), but also through the establishment of new communication channels for information sharing. In the Slovak Republic, unifying all stakeholders that participate in tourism is a priority. The Slovak Republic is setting up new information channels on a national level through regional tourism offices, the national tourism board, municipalities and private entities. With great ambition for collaboration, the Slovak Republic will also seek to set new communication channels between national and overseas stakeholders, especially in EU countries, under the 2030 National Sustainable Tourism Strategy.

Strategic foresight and futures-oriented institutional planning approaches can support countries to foresee and prepare for possible scenarios and be ready to react quickly to events when they do happen. Similar to resilience, strategic futures and foresight methods embrace uncertainty, and encourage the analysis and consideration of a range of future possibilities to inform decision-making and public policy (OECD, 2020[31]). Strategic foresight exercises can help tourism policymakers anticipate alternative futures and inform the development of forward-looking policies (OECD, 2018[5]). The principles for strategic foresight in tourism are set out in Box 2.7.

Collaborative governance frameworks help to align initiatives and processes, allowing for quicker design and implementation of policies when required. Such frameworks also provide mechanisms for greater peer learning and an integrated approach to future policy challenges, rather than just responding to shocks. In exploring potential policy measures to support the tourism sector, Australia considered key developments and initiatives being introduced internationally to help streamline the policy making process by learning and understanding various approaches to support measures internationally. This provided an opportunity to identify gaps and establish an evidence base on the broad range of tourism support programmes introduced globally and their impact in addressing challenges. Drawing insights from various demand-driving incentive measures (e.g. voucher schemes, travel discounts) was useful for the development and implementation of the Tourism Aviation Network Support programme, designed to boost travel and increase confidence.

Box 2.7. Principles for effective use of strategic foresight in tourism policy making

Strategic foresight can assist policymakers to anticipate possibilities for the future and design forward‑looking policies. Various strategic foresight methods can be used to analyse trends, envision various plausible futures and prepare effectively for the challenges and opportunities the future holds. Some broad principles can provide guidance to tourism policymakers to maximise the value of strategic foresight as a policy tool. These include:

Agility: Utilise existing evidence and projections, while being agile enough to adapt to emerging realities, acknowledging that they will be faced with unanticipated opportunities and challenges.

Multiplicity: Prepare for and think about alternative futures when designing policies and programmes – the future cannot be predicted with certainty and there are many possible futures.

Proactivity: Take proactive steps to work towards the desired future. Current action or inaction are both going to influence the future.

Long-term sustainability: Consider the impact of policies on future generations and take responsible actions in the present. Policy decisions should not just be geared towards short‑term or medium-term goals.

Engagement and inclusion: Engage with diverse stakeholders that represent a range of perspectives and interests. This will help to avoid narrow visions of the future.

International collaboration: Policies and decisions need to be globally sustainable. The world is becoming increasingly globalised. Policymakers cannot operate in silos and must collaborate internationally to ensure tourism gains are inclusive, equitable and globally sustainable.

Source: OECD (2018), Analysing megatrends to better shape the future of tourism (OECD, 2018[5]).

Promoting diversified, robust and stable tourism destinations

Steady growth in tourism over many years led to a widely held belief in the inherent resilience of tourism, and at times fostered a focus on ‘growth above all else’. This contributed to the tourism management and unbalanced development issues that were already facing the sector before the pandemic. This includes, for example, an over-reliance on tourism as a driver of economic development and job creation, as well as an (over) dependence on key source markets and service offerings, and a high spatial and temporal concentration of tourism activities. This lack of diversification makes the sector more susceptible to shocks and inhibits recovery, thus making it less resilient, and less competitive.

The pandemic revealed the vulnerabilities of an over-reliance on international visitors in many countries, with governments introducing support to help destinations and businesses shift the focus to the domestic market early in the pandemic. Many destinations have become more aware of the international visitor mix and the negative impacts of an (over) reliance on individual source markets. A recent survey of OECD member and partner countries identified that closed borders in key markets remains a significant barrier for the tourism recovery, identified by almost half of responding countries.

Destinations and tourism businesses alike need to ensure that the product offering has broad appeal to be able to maintain a base operation through disruption. This includes the spatial spread of tourists and attractions to ensure tourism can continue in the case of localised crises. Achieving a more geographically and temporally diverse tourism sector is also a policy priority in most countries. This has led to a wider discussion around destination management and the approaches required to ensure tourism is more sustainable, inclusive and resilient for the future (Box 2.8).

Box 2.8. Managing tourism development for a more resilient, sustainable and inclusive future

An integrated approach to tourism policy is key to achieving a sustainable and inclusive future, with input and support from industry and civil society. Particular emphasis is needed on environmental sustainability, inclusiveness, diversification, and innovation, prioritising visitor management over visitor attraction. There is no one-size-fits-all solution. Destinations are adopting a multiplicity of approaches to place sustainability at the centre of their tourism development. However, common to all is the overarching objective to evolve, sometimes radically, current tourism business models. It will be critical for all destinations to establish effective and representative multi-level governance mechanisms. Key policy considerations to help avoid potential pitfalls of the pre-COVID-19 era, and implement a sustainable vision for the future include:

Reconsidering perceptions of tourism success.

Adopting an integrated policy-industry-community approach.

Mainstreaming sustainable policies and practices.

Developing more sustainable tourism business models.

Implementing better measurement for better management.

Source: OECD (2021) Managing tourism development for sustainable and inclusive recovery (OECD, 2021[30]).

Diversification can involve adapting the tourism offering to reduce seasonality. Mountain, national parks and coastal tourism activities and destinations are examples of tourism offerings where the annual economic activity can be condensed into a short period of time, sometimes just a few months or even weeks. Seasonal tourism can put substantial strain on local infrastructure and exacerbate environmental damage caused by the sector. For instance, marine litter in the Mediterranean region has been found to increase by up to 40% during peak tourist season (One Planet, 2022[32]). Diversifying the product offering to increase visitors in the shoulder and off-peak periods can help to lessen the impact of disruption in peak periods and help lead to sustainable year-round jobs and businesses.

Slovenia, supported by React EU funding, committed EUR 69 million across 20 projects to transform mountain destinations into year-round resorts for active holidays outside of the traditional ski season. This will help to restructure the facilities and invest in new and existing accommodation. Similarly, in France the Mountain Futures Plan (Plan Avenir Montagnes) launched in 2021 aims to support mountain areas to implement a tourism development strategy to promote the diversification of the tourism economy, and adaptation to the challenges of ecological transition. Ensuring that destinations have access to infrastructure and resources to provide diversified products and reduce seasonal reliance is a key part of the plan.

A strong destination management framework is key to enhance destination resilience. This emphasises the broader functional view for destination management organisations (DMOs) that goes beyond being solely a marketing entity. This contemporary and more managerial view suggests that a DMO should be concerned with tourism development in its widest sense (OECD, 2020[19]). The understanding of the need to transition away from destination marketing towards destination management and stewardship is also reflected in the Pacific Asia Tourism Association’s Tourism Destination Resilience Programme (Box 2.9).

Box 2.9. Enabling resilience at the tourism destination level

The Pacific Asia Travel Association’s Tourism Destination Resilience programme was developed to help destinations recover from the COVID‑19 crisis and, at the same time, prepare them for future crises that will come. The end goal is to help build a more resilient tourism industry.

The programme enables destinations to ‘withstand adversity and bounce forward from crises’. To help destinations build capacity around risk assessment, risk management and adaptive capacity, PATA built a course which covers the steps towards destinations’ resilience and long-term sustainability. Potential outcomes from the course include:

Understanding the need to transition away from destination marketing towards destination management and stewardship.

Identifying the key capacities that need to be strengthened in the destination in order to build resilience.

Reframing the destination’s values and business models to be more holistic, thus including diverse stakeholders in a destination’s journey towards resilience.

Recognising the long-term benefits of resilience for the community, the environment and the economy.

Understanding how to secure investments for resilience programmes and projects.

Many countries are still transitioning their governance structures to represent a contemporary destination management style. In the United Kingdom, an independent review of the destination management structures in 2021 found that DMOs in England were underutilised and required better funding structures to move beyond business-centric marketing and support the implementation of policies to ensure destination competitiveness and sustainability. The UK Government has committed to a number of key actions to address these findings (Box 2.10).

Box 2.10. Independent review of destination management structures in the United Kingdom

In 2021, an independent review of destination management structures in England was commissioned in recognition of the important role DMOs can play in driving growth in regional visitor economies, and involved a significant amount of stakeholder engagement conducted over a short time span. The review identified a number of recommendations to improve the functioning and structure of DMOs. In response, the UK Government has committed to a number of key actions, including:

Changing the name of DMOs to Local Visitor Economy Partnerships (LVEPs) to capture the wider strategic focus on the visitor economy and the breadth of activity and relationships they will establish to support the local visitor economy.

Introducing a new accreditation system in 2022‑23, with new funding allocated to VisitEngland to develop and administer the scheme. The new national portfolio of accredited, high-performing LVEPs aims to reduce fragmentation and bring coherence to the destination management landscape, helping actors across the private and public sectors.

Piloting a tiered approach for LVEPs and providing multi-year core funding in a region of England. This will give one top tier LVEP, or collection of LVEPs (a Destination Development Partnership), the space and firm foundation to engage in a wide range of destination management activities as well as prompt increased private sector investment.

Source: UK Government (2021) The de Bois Review: an independent review of Destination Management Organisations in England (UK Government, 2021[33]).

Greece elaborated a governance framework to strengthen destination management with the enactment of their Destination Management and Marketing Organisation Law, while Iceland formalised new DMOs and updated regional destination management plans. Governance frameworks with strong links between national and destination decision-making provide opportunities to ensure recovery and future growth align with national policy agendas.

There is a substantial overlap in policies that make economies resilient and regions economically prosperous, including policies to support a dynamic business environment, diversified industrial base and local skills development (OECD, 2022[34]). Resilient destinations also promote sustainable development, well-being and inclusive growth. There is growing recognition of the importance of social inclusion and community sentiment in destination management, as seen for example through New Zealand’s Mood of a Nation survey, measuring residents’ perceptions of tourism. Place-based approaches are another way to enhance the incorporation of the wants and needs of the local community. Decision-makers need to understand the destination and invest in planning and development that can both improve resilience and enhance human connectivity to places (Chand, 2018[35]).

Place-based tourism policies are gaining traction in a number of countries. In Sweden, a place-based approach is a key pillar of the National Strategy for Sustainable Tourism and a Growing Tourism Industry, acknowledging that sustainable development and resilience requires strong local roots, which is facilitated if the local community is considered and treated as a key stakeholder. The Netherlands Centre of Expertise on Leisure, Tourism and Hospitality (CELTH) has put together a multi-year knowledge agenda under the “Conscious Destination”. CELTH specifically opts for the destination level because that is where all the different sub-sectors and actors come together. In a conscious destination, parties strive for an outcome which has the most positive possible social, ecological and economic impact and in which it leads to the highest possible quality of life, experience and work.

Addressing supply-side fragilities, with a focus on tourism SMEs

The large number of SMEs in the tourism sector brings opportunities for entrepreneurship, employment and economic benefits to local economies. However, it also brings inherent vulnerabilities. Since the start of the pandemic, the capacity of many tourism SMEs to adapt has been limited by operational constraints, skills deficiencies and lags in the adoption of digital technologies (OECD, 2021[27]).

Building SME resilience, individually and collectively, is vital for sector-wide resilience in tourism, and the economy more broadly. Firstly, there needs to be a better understanding of what it takes for a tourism business to be resilient. However, it needs to be positioned as an iterative process which is updated as the business or environment changes. From the private sector perspective, resilience can be enhanced through strengthened risk management and due diligence strategies that emphasise awareness, transparency, accountability and agility (OECD, 2021[2]).

Encouraging tourism businesses of all sizes to adopt proactive risk identification approaches that consider the possible impacts of wider economic and societal events will better prepare these businesses to react in future crises. Initiatives like the Wharf Hotel’s ‘living manual’ provide a concrete, practical example of how tourism businesses can be more proactive. The living manual refers to crisis management system and risk register that is updated as the operating environment changes. This requires ongoing scanning of the economic, environmental and political climate to ensure the responses are up to date. This idea of continued adaptation and transparent communication presents a starting point for the evolution of resilient businesses. Such an approach can be scaled and adapted to tourism businesses of all sizes.

Even with the implementation of ‘future-proof’ strategies, SMEs will maintain fundamental vulnerabilities, particularly in relation to cash flow. Decision-makers need to take stock of the pain points for tourism businesses and be better prepared to address these in the future. In July 2022, Chile launched a new reactivation plan, which targets the reactivation of MSMEs. The Chile Supports Tourism 2022 Programme is designed to finance training, business planning, consultancy, technical assistance, working capital and/or investment projects. It will run in all 16 regions of the country and will finance 100% of the costs of tourism-related projects, up to CLP 4 million. Continued evaluation of the support measures introduced throughout the pandemic is needed to understand their effectiveness and gaps to underpin the preparation of future responses.

SMEs also require targeted support to access finance, including green finance, which they often struggle to obtain due to knowledge, financial, policy and size barriers. It is important to expand structures, strategies, incentives, and policies that are tailored to the needs of smaller players, as well as to raise their awareness of existing mechanisms (UNEP, 2021[36]). Without targeted assistance, SMEs will often find it financially unfeasible to implement measures to become more sustainable, and therefore more resilient.

Not all tourism businesses will survive a crisis, with resilience built on the ability to adapt and transform. Unprecedented support for tourism SMEs limited business bankruptcies through the pandemic. However, this can reduce business dynamism, causing a slowdown in sector innovation, reduced competition and decreased efficiency, highlighting the importance of ensuring that support measures are targeted and temporary. In addition, governments can remove unnecessary regulatory barriers to competition, reduce entry barriers into the sector like increased scrutiny and risk profiling from financial institutions, improve judicial efficiency and bankruptcy regulations, and ensure the vigorous enforcement of competition laws (OECD, 2021[2]). Credit risk appetite frameworks have had some observed adjustments for vulnerable sectors, with most banks adjusting their underwriting standards, with an evident tightening for sectors like energy, tourism, arts and recreation (BIS, 2022[37]).

Embracing digitalisation can help tourism businesses exploit the opportunities new technologies open up for marketing, product and destination development, as well as investing in human capital and skills to retain and develop a skilled workforce (OECD, 2021[22]). Korea is supporting the digital transformation of tourism by providing vouchers to enhance the digital competency of tourism SMEs. This includes knowledge sharing with MSMEs and traditional travel operators to harness the digital transformation through new business model development, undertake professional training on new trends, and create digital capacity-building programmes to understand systems, processes, digital content creation and planning.

Finland’s DataHub aims to support the digitalisation of tourism SMEs, which typically lag behind in the adoption of digital technologies. It is a national database for the tourism sector, providing all tourism businesses the opportunity to have a digital presence for free, with ongoing marketing opportunities through the Visit Finland digital channels (Box 2.11). Policy responses and initiatives for digital transformation have been enhanced in some countries to help the sector build resilience and respond to the accelerated pace of digitalisation, but still remain substantially underdeveloped more generally.

However, these initiatives have had challenges in engaging tourism SMEs, and smaller businesses in particular. This may stem from systemic challenges to helping those firms most likely to benefit from digital transformation. Some countries are looking to the natural links of DMOs to SMEs to demonstrate and promote those benefits (OECD, 2021[22]). The “Tourist Office 3.0” initiative in Switzerland is an action to support digitalisation by bringing together technology partners, tourist offices and other stakeholders locally to analyse the future significance and function of the tourist office against the background of digitalisation and the changing needs and expectations of guests and service providers in a priority sector for the Swiss national tourism strategy. The Swiss strategy recognises that the wider DMO sector has the potential to promote digitalisation by example and through its natural links to connect with local SMEs.

The EC Transition Pathway for Tourism acknowledges that SMEs face several challenges in engaging with the digital transition, including a lack of knowledge of existing good practices and access to tools to implement them. It recommends establishing a collaboration platform for tourism SMEs and destinations that supports their access to information, specific tools, best practices and knowledge-sharing opportunities to support their engagement in the twin transition (European Commission, 2022[29]).

Box 2.11. Building a national database of tourism businesses and services in Finland

The DataHub is a national database which allows tourism businesses in Finland to store and showcase information about the business and the products and services offered. Visit Finland aims to grow the most comprehensive database of Finland's tourism offer, both regionally and by product category. International and domestic tourism operators can search for and publish product information on DataHub's interface, for example in marketplaces and product catalogues. The DataHub information is available via the DataHub web interface, and can be easily integrated into third-party apps. The product information will also be utilised for marketing purposes in Visit Finland's digital channels, including the new visitfinland.com website. The service is free for users and Visit Finland is committed to the development and maintenance of DataHub. Since its launch in August 2021, the DataHub had gained almost 1500 registered companies and organisations as well as close to 5 000 tourism products by October 2022.

Improving conditions to promote a skilled and inclusive workforce

Tourism is highly labour-intensive and offers strong potential to support a job-rich recovery. The sector is also dependent on quality human resources to develop and deliver a competitive tourism offering. However, workforce issues have been a long-standing vulnerability for the tourism sector. Many countries faced labour and skills shortages in tourism before the pandemic, generated from a complex web of underlying drivers including: a lack of skilled workers; a high reliance on international labour; low wages; high levels of informal and casual work; seasonal work; and the perception of tourism being a short-term job, not a long-term career option.

The pandemic exacerbated long-standing issues impacting the ability of the sector to attract and retain workers (e.g. job insecurity, salary levels, career prospects, competition from other sectors). The interconnected nature of the sector means that shortages in one part of the tourism ecosystem has knock on impacts during the sector. For example, labour shortages in the aviation sector are preventing people from reaching their destination, hotel and other tourism activities. A recent survey of OECD member and partner countries found that labour shortages remain one of the key barriers for the recovery of the tourism sector, behind economic and energy insecurity and inflation. However, there is evidence from some countries, such as Ireland, that businesses are increasing wage levels and changing shift patterns to attract workers (Box 2.12).

Countries and businesses need to implement long-term plans to address these fundamental issues and ensure the ability to rebound after crises is not impeded. New Zealand is pursuing an immigration rebalance policy, which, over time, will limit the flow of lower-paid temporary migrants, with the aim to raise wages and conditions, and create more career pathways for New Zealanders. They are also utilising the government-funded Go with Tourism organisation to undertake activities to change New Zealander’s perceptions of tourism as a career and attract New Zealanders to the sector. Accor have recognised the need for change and have introduced ‘work your way’ and ‘same day hire’ programmes in the Pacific regions. This looks to increase flexibility for workers and fast-track recruitment processes. They have also improved career development opportunities through the Accor Academy and cross-country opportunities.

Box 2.12. Improving working conditions to address workforce shortages in Ireland

In the wake of the pandemic, workforce shortages were viewed as a key inhibitor for the recovery of the tourism sector in Ireland. Some reports estimated a shortage of up to 40 000 workers in the sector at the beginning of 2022. A survey of tourism businesses found that 30% of those surveyed were facing closure if recruitment challenges were not resolved. Key barriers for employees were noted as the rate of pay and the working conditions, but they would be willing to return to the sector if these issues were resolved. In October 2022, workforce shortages remain a key challenge for Ireland’s tourism sector, but pressure has started to ease as employers increase pay rates, introduce more flexibility in shift patterns and introduce penalty rates. This saw vacancies reduce from 40 000 to 22 000 in tourism and hospitality jobs. This was facilitated by a campaign by state tourism officials and industry leaders to address the foundational issues behind the sector staffing crisis and capability-building initiatives to support businesses to leverage this campaign and stand out in a competitive labour market. A Learning Hub has been created to provide free high-quality and self-directed learning courses to help upskill staff and build capability within businesses.

Increased digitalisation, green technology and an aging population will all impact skills requirements for the future. The digital transition will require developing knowledge on the supply and demand of digital skills in the tourism sector, improving incentives to develop digital skills and ensuring they are easily accessible to both workers and managers (OECD, 2021[22]). Ensuring that the workforce is equipped with the right skills to meet future needs will require working closely with the industry and education providers (OECD, 2018[5]). Portugal is investing in innovative equipment and infrastructure to position the teaching of tourism at a higher level and allow training to be adapted to the new needs and demands of consumers. Greece implemented a programme working with Google to enhance digital skills for the tourism workforce.

The green transition will require new skills to meet the growing demand from environment-conscious travellers. ‘Green skills’ can include how to conduct energy audits, measure the sustainability of tourism activities, as well as training staff on recycling programmes (European Commission, 2022[38]).

Tourism has the potential to promote a job-rich recovery, in particular for young people still reeling from some of the shocks of the pandemic, as well as women and migrants who face persistent challenges to labour-market integration. The tourism workforce has strong female participation, but from an inclusion perspective, increased participation of minority groups could help to address labour shortages. Greater participation of women and minority groups in senior leadership positions is also vital. This is not an easy problem to address, nor is there a one size fits all solution. More work needs to be done to understand both the needs and the barriers for employees and employers alike to create a stronger, more resilient workforce. Egypt has taken stock of their tourism workforce, both formal and informal, as a first step to setting up an emergency fund to support them during future crises. Chile’s updated Strategic Plan for Human Capital for the period 2023‑26, which will be implemented through a public-private commission, will bring together different actors from the tourism sector to develop and strengthen human capital.

Strengthening data, insights and indicators to measure and monitor tourism resilience

Improving the evidence base to inform policy and business decisions through information gathering, research and data analysis is imperative for resilience. Reliable and consistent data, insights and indicators are needed to evaluate the effectiveness of programmes and initiatives introduced to respond and adapt to a crisis and monitor progress on tourism recovery and resilience in the longer-term (OECD, 2020[39]). Developing methods to quantify resilience are pivotal so that trade-offs between a system’s efficiency and resilience can be made explicit (OECD, 2020[8]). Policymakers also need adequate tools to detect the vulnerabilities that can result in severe crises, while taking timely actions before it is too late (OECD, 2021[2]).

In an ideal environment, this would involve the development of real-time data tools that integrate data and automate a selection of management alternatives, based on explicit policy trade-offs in real-time (OECD, 2020[8]). However, the tourism data environment is currently not capable of this. The pandemic has highlighted shortcomings in the availability of timely, comparable, granular data in quickly evolving situations (OECD, 2020[39]). While many institutions and businesses adapted their existing capabilities, this was often not adequate to meet the data requirements for effective decision-making in a timely manner.

Governments and the private sector should consider the data deficiencies that hindered decision-making and explore solutions while it is still fresh. Greece is one country that is taking steps in this direction, through work to assess and evaluate the data gaps and needs exposed by the pandemic, to improve data gathering to measure the impact of the pandemic and to better cope with future shocks. This includes the recent launch of a web platform to share timely tourism data and information, which is intended to be expanded to include new data sources.

The EC Transition Pathway for Tourism, meanwhile, acknowledges the need to improve the coverage of tourism statistics, which will most likely require revisiting the legal basis for harmonised data collection, including to develop Tourism Satellite Accounts, and innovative approaches to statistical sources (European Commission, 2022[29]). With significant advances in data capability through the crisis, international co‑operation and learning across institutions and industry will be vital to understand tourism data capability moving forward.

The complex nature of tourism has led to a reliance on traditional survey methods for measurement. These are often costly and time-consuming and require aggregation for reporting. These methods provide reliable, robust and comparable statistics, but may not be granular or responsive enough for decision‑making. Reliably harnessing new data that becomes available through digital transformation to improve timeliness and granularity, and continuing to adapt as new sources become available, opens up opportunities for more responsive evidence-based decision-making.

Box 2.13. Use of new data sources to inform policy making: selected country examples

Australia: reviewed the data landscape in 2017 to determine how well official data met the needs of tourism data consumers and the suitability of alternative data sources for tourism statistics. The review identified gaps related to visitor pathways, visitor sentiment, experience quality and data granularity. Australia has further increased their knowledge of alternative data sources through multiple proof-of-concept projects. The combined learnings have led to priority work on mobility and bookings data. Testing of mobility data has demonstrated the capacity of the data to define and measure a range of insights for domestic tourism at more granular geographic levels.

Japan: enables accelerated evidence-based policy making for local governments through the Regional Economy and Society Analysing System (RESAS). It provides insights on industrial structures, demographic movements and population flows, and creates easy-to-understand visualisations of economic and social data compiled from government and private sector sources. RESAS analyses tourist behaviour and search rankings for tourist destinations. Local governments can identify popular stopping places by RESAS and design sightseeing routes which connect these sites for tourists. V - RESAS analyses and visualises the economic impact of COVID‑19 in Japan in real-time, using data such as location information for cellular phones, accommodation and food and goods consumption. The data is used to formulate policies in relation to COVID‑19 for local government.

Indonesia: uses mobile positioning data to supplement its official surveys to fill data gaps for international arrivals, domestic tourism, and outbound travel. Statistics Indonesia entered a commercial relationship with Positium, an Estonian company that specialises in mobile positioning data for official statistics. Utilising mobile positioning data was challenging, but it has provided more accurate, detailed and frequent data, which has had a positive impact on business performance.

New Zealand: utilises aggregated electronic card transaction data to develop regional tourism indicators. This provides granular and reliable estimates that were not possible with the International Visitor Survey and the Domestic Travel Survey. Beyond tracking long-term growth and changes in tourism spending, the regional tourism indicators assess the impact of marketing efforts and other factors affecting tourism spending. As the data is published with less than one month delay, the indicators provide policymakers and tourism operators with regular and timely updates of tourism spending and growth at a pace and depth never before achievable.