This chapter provides an overview of the current state of the performance-informed budgeting practices in Flanders. It discusses the recent reform efforts, the structure of the budget, medium-term planning practices, availability of performance information. It assesses the broad comprehensive review practices in Flanders, as well as existence of in-depth spending reviews.

Performance-Informed Budgeting in Flanders, Belgium

2. The current performance-informed budgeting practices in Flanders, Belgium

Copy link to 2. The current performance-informed budgeting practices in Flanders, BelgiumAbstract

2.1. Reform efforts in Flanders

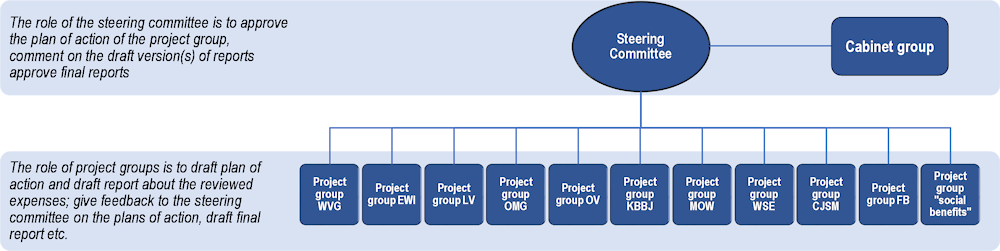

Copy link to 2.1. Reform efforts in FlandersFrom 2014-2019, Flanders embarked on a series of budgetary reforms aimed at improving the integration of policy, management, and budget, to improve efficiency and effectiveness of resource allocation (Figure 2.1). Central to the reform agenda was the concept of performance budgeting, which was first introduced in the Finance and Budget Department's policy paper (2014[1]).

In 2015, recognising the benefits of performance budgeting, the Flemish Government established the working group known as "werkgroep prestatiebegroting", which marked the initial step towards implementing performance-related reforms in budgeting in Flanders. Following the approval of the vision paper by the board of Secretary Generals (Voorzitterscollege) in 2016, the Flemish Government committed to integrating performance indicators into the budgetary process by 2020.

In early 2018, the Department of Finance and Budget conducted a pilot spending review on the Flemish service voucher system (dienstencheques) in co-ordination with the Department of Work and Social Economy and with support from the European Commission. The pilot review aimed at building capacities within the administration and drawing lessons learnt on the design and implementation of spending reviews.

Figure 2.1. Introducing performance-informed budgeting in Flanders: Timeline

Copy link to Figure 2.1. Introducing performance-informed budgeting in Flanders: Timeline

In 2019, the European Commission played a pivotal role in assisting the Department of Finance and Budget in Flanders in integrating spending reviews in the budget cycle by providing technical assistance. The work concluded with a report Integrating Spending Review in the Budgetary System (Cangiano, Ercoli and Hers, 2019[2]). This assistance proved to be instrumental in shaping the Department's approach to spending reviews and provided the Department with a comprehensive approach to integrating spending reviews into the budgetary system.

Following a positive experience with the pilot in-depth review in 2018 and the country-specific recommendations by the European Commission in 2018, in 2020 the Department of Finance and Budget launched the "Spending Reviews - Flemish General Revision and Spending Norm" project as part of the Flemish recovery plan (Vlaamse Veerkracht) and the Belgian National Recovery and Resilience Plan (NRPP).

In the same year, the Flemish government launched the Flemish Broad Comprehensive Review (Vlaamse Brede Heroverweging) (VBH)”. This involved analysing virtually all spending under different policy areas, where the results of the broad comprehensive review informed the 2022 budgetary cycle.

In 2021, the Flemish government selected eight spending review topics to be carried out over the period of 2022-2024 and approved the timeline for the exercise. In 2022, a ninth topic was agreed by the government. During this exercise, at least one topic for each Flemish policy domain would be reviewed:

The rationale of the grants provided by the department of Culture, Youth and Media.

The higher education budget.

Sustainable water usage and the organisation of the waterscape.

Instruments of the housing policy.

Organisational structure of the Flemish government.

Modal shift in Flanders.

The Flemish productivity policy.

Integration of the three care budgets.

Fiscal support measures for families with children.

Since the first broad comprehensive review and the pilot in-depth review, the Flemish government has shown strong commitment to make such reviews a regular exercise. In 2022, the Flemish Public Finance Code was amended to include provisions for broad comprehensive reviews and in-depth reviews, as described in Box 2.1. This legal foundation not only reinforces the commitment to transparent and accountable fiscal management but also institutionalises the practices within the governance structure. By embedding performance-informed budgeting in legislation, Flanders ensures that performance-informed budgeting is not a temporary measure but a permanent feature of its public fiscal management system. This also offers stability and continuity, safeguarding the process against changing political or administrative priorities.

Notably, the legislation articulates the key guiding principles of performance-informed budgeting, providing the region with certain flexibility in terms of implementation. Details on procedures and processes in implementing performance-informed budgeting are included in relevant guidelines. This allows for the operational aspects of the performance-informed budgeting process to be more adaptive and responsive to changes, ensuring that the practices remain relevant and effective.

Box 2.1. Legal basis for performance-informed budgeting in Flanders

Copy link to Box 2.1. Legal basis for performance-informed budgeting in FlandersThe foundations for performance-informed budgeting in Flanders are firmly established within the Flemish Public Finance Code. This legislative framework was updated and amended in 2022 to incorporate specific provisions pertaining to spending reviews and broad comprehensive reviews.

Within this context, Article 10 of the Flemish Public Finance Code emphasises the integration of both comprehensive and in-depth spending reviews into the budgetary cycle:

“The Flemish Government organises the budget of revenues and expenditures of the Flemish Government according to the principles of performance-informed budgeting, in light of a multi-year perspective. Broad comprehensive reviews and spending reviews are used for this purpose. The Flemish Government determines the principles with which the broad comprehensive reviews and spending reviews comply.”

The legislation also underlines the importance of regularity of the spending review process. It mandates that the government conducts at least one comprehensive review per legislative term. At the outset of each legislative term, the government is required to establish an indicative planning of spending reviews for its entire term. These requirements aim to enhance the accountability with regards to public resource allocation and align it with the broader policy objectives of the Flemish government.

2.2. Budget structure and budget calendar in Flanders

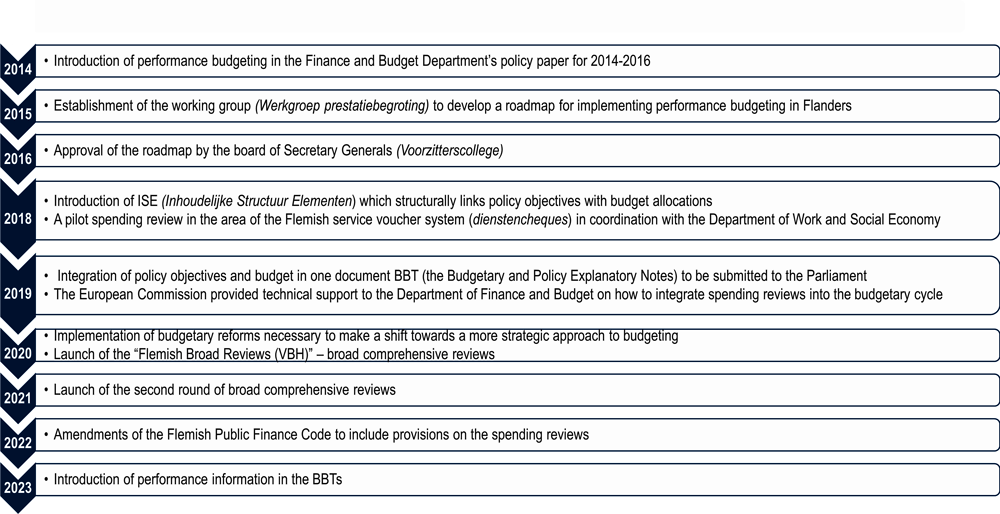

Copy link to 2.2. Budget structure and budget calendar in FlandersThe budget is structured around ten policy domains which are composed of a department and several agencies. An example of a policy domain is Economy, Science, and Innovation, as shown in Figure 2.2. The policy domains are further divided into 80 policy fields or budget programmes that Parliament votes on. Each policy field is further divided into two to five Substantive Structural Elements (Inhoudelijk structuurelement or ISE).

The overall budget structure, which is composed of policy domains, policy fields, and the ISE are not expected to change during the legislative term, whereas strategic and operational objectives can vary depending on the priorities of the government.

Figure 2.2. Budget structure of Flanders

Copy link to Figure 2.2. Budget structure of Flanders

The budget calendar in Flanders starts in the beginning of May, when the budget circular is issued, as shown in Table 2.1. The budget is presented to the parliament in October and Parliament votes on the budget in December.

Table 2.1. Budget calendar in Flanders

Copy link to Table 2.1. Budget calendar in Flanders|

Budget cycle |

|

|---|---|

|

Budget circular |

Beginning of May |

|

Preparation of budget proposals by line departments |

May – July |

|

Negotiations with line ministries |

July |

|

September Declaration (the policy and budget declaration) |

fourth Monday of September |

|

Executive budget proposal presented to parliament |

Third week of October |

|

Multi-annual estimates |

Before the 28th of October |

|

Parliamentary scrutiny |

October – mid-December |

|

Parliamentary vote on budget |

December |

|

In-year budget execution reports |

Monthly |

|

Year-end financial statement |

June |

In addition, Flanders has introduced an expenditure benchmark to provide the Flemish government with greater responsibility in managing budgets within predefined parameters. This expenditure benchmark, where each policy domain is allocated a budgetary envelope with a fixed real year-on-year growth, will be applied from the 2025 draft budget.

2.3. Medium-term budget framework in Flanders

Copy link to 2.3. Medium-term budget framework in FlandersThe medium-term budget framework in Flanders spans six years, where the first year is binding and the out years are estimates that are updated on a rolling basis taking the initial budget as a starting point, as shown in Box 2.2.

Box 2.2. Medium-term budget framework in Flanders

Copy link to Box 2.2. Medium-term budget framework in FlandersThe annual budget contains an estimate of the expected revenue (resources budget) and expenditure (expenditure budget) for the upcoming budget. The initial budget is placed in a multi-year perspective. The multi-year estimate is assessed on a yearly basis and adjusted to the changing circumstances, using the initial budget as a starting point. The estimate is thus extended each time by one year.

The multi-year estimate applies to a six-year period including the current year. The multi-year estimate places the unchanged policy and selected policy options in a multiannual budgetary perspective and forecasts the evolution of the Flemish budget.

The multi-year estimate makes a distinction between the forecasts that are prepared on the basis of po policy changes and the budgetary consequences of new policy. In the case of unchanged policy, the underlying assumptions for the applied cost drivers and budgetary commitments are continued in the following years.

Source: Department of Finance and Budget (2022[3]), Multi-year estimate 2022-2027, https://financeflanders.be/wp-content/uploads/2022/11/Multi-annual-Estimate-22-27.pdf.

2.4. Availability and use of performance information in Flanders

Copy link to 2.4. Availability and use of performance information in Flanders2.4.1. Including performance information in budget document

Copy link to 2.4.1. Including performance information in budget documentIn 2023, the Flemish government made efforts to improve the outcome orientation of the budget process by integrating performance indicators into the initial 2024 budget documents. The aim of integrating quantitative performance information into the Policy and Budgetary Explanation Notes (BBTs) was to support policy and budgetary decision-making and improve transparency. In doing so, it provided the Flemish Parliament and citizens with a clearer understanding of the government’s policy and budgetary priorities and achievements. The BBTs are presented as supplementary information alongside budget proposals. These notes serve as comprehensive documents that intend to bridge the gap between policy formulation and the budgeting process, providing detailed information on both policy and budget aspects.

The BBTs follow the same structure as the budget and include a wide range of information, such as the strategic direction of each policy domain, action plans, planned policy developments, and, for the 2024 budget, performance indicators, as shown in Box 2.3. However, the scope and the level of detail of the BBTs differs across different policy domains, some of the BBTs being over 100-pages long.

Box 2.3. Examples of performance indicators included in the the Policy and Budgetary Explanation Notes (BBTs)

Copy link to Box 2.3. Examples of performance indicators included in the the Policy and Budgetary Explanation Notes (BBTs)Examples of performance indicators included in the BBTs:

Human Resource Policy and Audit: overall satisfaction rates of customers of the Agency of Government Personnel (Agentschap Overheidspersoneel, AgO). Measured twice a year through a survey.

Finance and Budget: budgetary balance of the Flemish government.

Sports Flanders: the relative Flemish olympic top sport index (Relatieve Vlaamse Olympische topsportindex). The indicator is calculated on the basis of all the Flemish top eight finishes at Olympic Games, World Championships and European Championships.

The BBTs are submitted to Parliament for scrutiny at a similar time as the draft budget; the budget is presented before 21 October and the BBTs are presented before 28 October each year. This allows Parliament to take performance information into account during budget discussions.

2.4.2. Link between performance and funding

Copy link to 2.4.2. Link between performance and fundingIn line with the OECD good practices, there is not a direct link between funding and performance in Flanders. No OECD country has implemented a system that enforces immediate budget cuts when performance targets are not met. Instead, the focus is on using performance information to inform decision-making, policy improvement, and transparency rather than imposing punitive measures if performance targets are not met.

2.4.3. Developing performance information in Flanders

Copy link to 2.4.3. Developing performance information in FlandersDepartments are responsible for developing the performance objectives and indicators that are to be included in the BBTs. Departments can choose to set strategic objectives for the policy or ISE, while operational objectives must be set for the ISE. The Department of Finance and Budget provides departments with a template for presenting performance information. However, this template is not binding and in practice, departments can decide how performance information is presented.

The Department of Finance and Budget provides departments with guidelines on how to develop relevant performance information. The guidelines were included in the budget instructions for the 2024 budget. They note that a performance indicator should be SMART and importantly, it is clearly noted that the number of indicators should be limited to avoid an overload of information, although there is no limit on the number of indicators. In addition, the guidelines note that indicators should have a clear link to the strategic and operational objectives. It is also recommended that indicators are not subject to the influence of the Flemish government should be avoided, underlining the significance of focusing on actionable and relevant performance metrics to ensure accountability.

2.4.4. Role of Parliament in using performance information

Copy link to 2.4.4. Role of Parliament in using performance informationThe Flemish Parliament has a critical role in scrutinising the annual budget. The parliamentary working group on the legible budget (Leesbare Begroting) supports the Parliament in this task by providing explanations and support material. Recently, there has been a rising interest within the working group to make use of performance information and the findings from spending reviews as part of the scrutiny process.

The sectoral committees within the Flemish Parliament play a vital role in the examination of BBTs. As it is now, the main focus during committee discussions is on policy aspects outlined in the BBTs and less attention is directed towards the budgetary and performance components contained within the BBTs.

2.5. Broad comprehensive spending reviews in Flanders

Copy link to 2.5. Broad comprehensive spending reviews in FlandersIn the Flemish administration, broad comprehensive reviews, known as a “Flemish Broad Reviews” or VBH, are defined in the Flemish legislation as “comprehensive examinations of policies with a budgetary impact, aimed at offering policy options for a more efficient or effective approach to underpin possible policy choices for the future of Flanders in the longer term.” Legislation stipulates that there should be at least one broad comprehensive review per legislative term.

The Flemish broad comprehensive review framework aligns with most of the OECD Best Practices for Spending Reviews (Tryggvadottir, 2022[4]), as shown in Table 2.2.

Table 2.2. Alignment of the Flemish broad comprehensive review framework with the OECD Best Practices

Copy link to Table 2.2. Alignment of the Flemish broad comprehensive review framework with the OECD Best Practices|

OECD Best Practices for Spending Reviews |

OECD assessment of the broad comprehensive review framework in Flanders |

|---|---|

|

1. Formulate clear objectives and specify the scope of spending reviews |

|

|

2. Identify distinct political and public service roles in the review process |

|

|

3. Set up clear governance arrangements throughout the review process |

|

|

4. Ensure alignment with the budget process |

|

|

5. Implement recommendations in an accountable and transparent manner |

|

|

6. Ensure full transparency of spending review reports and the review framework |

|

|

7. Update the spending review framework periodically |

|

2.5.1. Objectives

Copy link to 2.5.1. ObjectivesThe primary goal of the broad comprehensive reviews is to increase the quality of public finances, by identifying saving options and by improving efficiency and effectiveness of public spending. This has been instrumental in enabling the Flemish government to achieve a balanced budget by 2027.

The commitment to actively seek saving options was openly communicated by the Flemish government when launching the initial round of the broad comprehensive review process in 2020. In their official communication, the Flemish government made it explicit that the broad comprehensive review process had to result in substantial saving options for policymakers to consider. This approach is distinct from resorting to across-the-board budget cuts, emphasising a strategic approach to fiscal management.

However, the broad comprehensive reviews do not focus solely on finding saving options, but evaluate the efficiency and effectiveness of public policies, indicating a broader and more nuanced approach to fiscal analysis.

2.5.2. Scope

Copy link to 2.5.2. ScopeIn total, the first-round of the broad comprehensive review process in 2020 encompassed eleven thematic reviews. Ten of these reviews were aligned with each of the Flemish policy domains, while the 11th review addressed cross-cutting issues.

Initially, the Flemish government’s focus was primarily on the examination of large expenditure items. However, as the process evolved, a decision was made to include all expenditures within the review’s scope. Nevertheless, as the broad comprehensive review process unfolded, certain expenditure items had to be excluded from the analysis. This exclusion was due to various factors, including data limitations, pre-existing commitments, such as those outlined in the Coalition Agreement, and specific recovery arrangements.

At the time of this report, the second round of broad comprehensive reviews is being carried out, which includes nine thematic reviews.

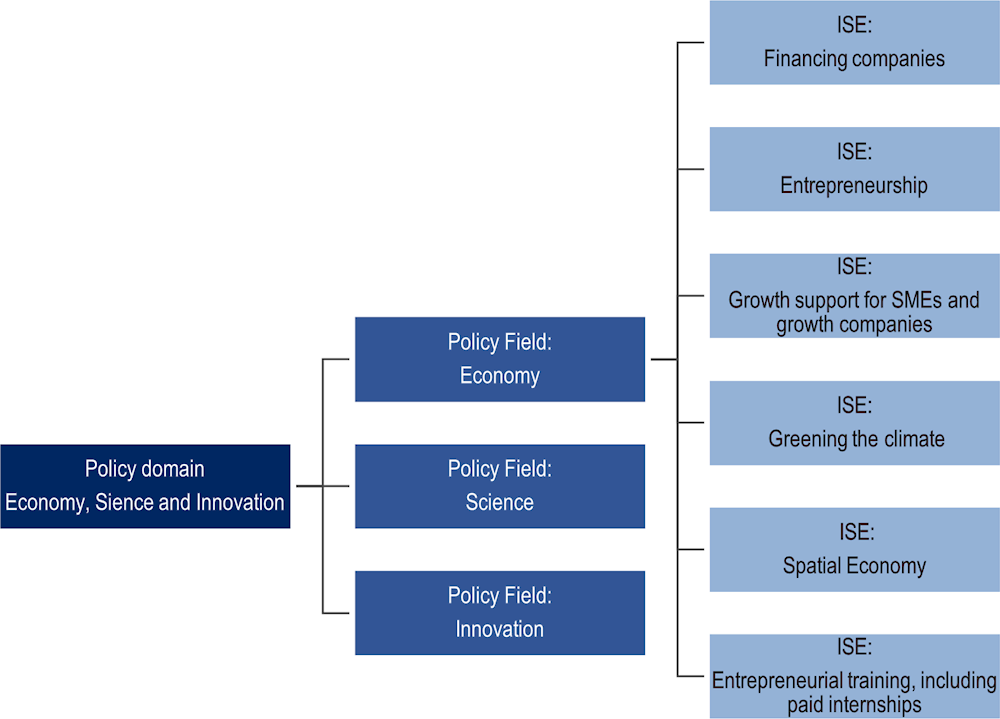

2.5.3. Timeline

Copy link to 2.5.3. TimelineThe government announced the launch of the broad comprehensive review in December 2020, and the results were expected to be ready before September 2021, as shown in Figure 2.3. The results were intended to inform and guide the formulation of policies and resource allocation decisions for the 2022 budgetary cycle.

To meet this timeline, the setup of the governance arrangements, preparation of action plans, and drafting of the broad comprehensive review reports had to occur within a relatively short window, spanning from January to June 2021. During this phase, the groundwork for the analysis, including data collection and research, was undertaken. Some of the reports were only ready in July 2021, making it difficult to take the results into account during the preparation of the budget.

The limited time available led to a focus on identifying “quick-wins” and easy-to-tackle expenditure items, which sometimes overshadowed a more thorough examination of the most important questions. This highlights the importance of balancing the need for timely results with the depth of analysis required to address complex policy issues effectively.

Figure 2.3. The broad comprehensive review process: Timeline

Copy link to Figure 2.3. The broad comprehensive review process: Timeline

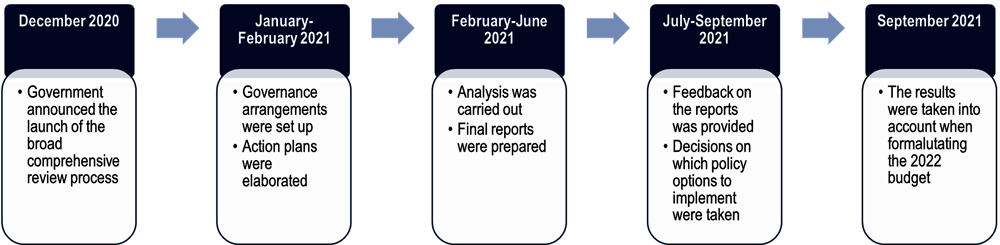

2.5.4. Governance arrangements

Copy link to 2.5.4. Governance arrangementsThe broad comprehensive review process was supervised by a steering committee and conducted by project groups established for each selected topic, as shown in Figure 2.4. The Finance and Budget Department was represented in each of the project groups and supported the work of the steering committee.

Figure 2.4. Governance structure for the broad comprehensive reviews in Flanders

Copy link to Figure 2.4. Governance structure for the broad comprehensive reviews in FlandersSteering committee

Copy link to Steering committeeA steering committee was established to oversee the entire process of the broad comprehensive review. The key responsibilities of the committee included assessing and evaluating the action plans (terms of reference), commenting on the draft reports, and evaluating the final reports. Importantly, by the end of the process, the steering committee provided insights and lessons learned from the review and put forth recommendations for future broad comprehensive reviews.

The steering committee was chaired by an external person to provide an independent perspective. The other members of the steering committee included:

One representative of the Belgian Court of Audit (Belgisch Rekenhof).

One representative of the Social Economic Council of Flanders (Sociaal-Economisch Raad van Vlaanderen, SERV).

Maximum of two external experts with expertise in policy evaluation.

Two representatives of the President's College.

One leading official from the Flemish Finance and Budget Department.

Two representatives from the Finance and Budget Department handled the secretarial functions for the steering committee. The committee met all working groups regularly, where the groups reported on the progress and challenges encountered. No individual meetings were organised with working groups.

For future broad comprehensive reviews, the formal steering committee function will not exist. Instead, the Department of Finance and Budget will take on a co-ordination role.

Project groups

Copy link to Project groupsIn total, 11 project groups were established for each of the selected topics during the first round of broad comprehensive reviews. The project groups were responsible for conducting and carrying out the analysis of the respective reviews. The project groups consisted of a maximum of ten members:

One co-president appointed by the Department of Finance and Budget.

One co-president appointed by the department responsible for the policy area concerned.

At least one external expert.

At least one representative from the Inspectorate of Finance.

Experts from the policy area concerned with policy and/or budget experience.

Given the broad scope of the policy area ‘Chancellery, Public Governance, Foreign Affairs and Justice’ (Kanselarij, Bestuur, Buitenlandse Zaken en Justitie, KBBJ), nine smaller working groups were established under the overarching project group. The formation of these working groups was based on a strategic clustering of policy fields, aligning them with the structure and objectives outlined in the BBTs.

The key responsibilities of the project groups included drafting a plan of action, preparing the final report, and providing feedback to the steering committee on the progress made and milestones achieved. The project groups had the freedom to decide their own work processes and methods as long as the predetermined set of key questions (Box 2.4) were covered by the review.

For future broad comprehensive reviews, representatives from the Department of Finance and Budget will be co-ordinating the work of project groups. However, the representatives from the Department of Finance and Budget will no longer be co-presidents of the project groups. In addition, the president of the project group will be appointed in consultations with the Department of Finance and Budget.

Sounding board group

Copy link to Sounding board groupRepresentatives from the cabinets formed a sounding board group (klankbordgroep). This group followed the progress of the project groups carrying out the comprehensive reviews but had no decision-making power in their work. The steering committee provided them with feedback on the progress of the reviews.

2.5.5. Preparing action plans

Copy link to 2.5.5. Preparing action plansProject groups were required to develop an action plan for the broad reviews, where they specified how the review would be set up, the key areas to be analysed and how the review would be carried out. More specifically, the action plan included information on the budgetary scope of the review, a description of the theme, a timeline, and those involved in the review besides the Finance Inspectorate and the Department of Finance and Budget. This practice is in line with the OECD good practices, where the topic, key issues within the examined area, roles and responsibilities and the timeline are included in a Terms of Reference.

Each action plan included a set of key questions that all reviews had to cover in addition to specific questions relevant to each review, as explained in Box 2.4. Importantly, the action plans included a savings target, to encourage working groups to think fundamentally about how policies can be delivered more cost-efficiently.

Box 2.4. Six key areas considered during the broad comprehensive review in Flanders

Copy link to Box 2.4. Six key areas considered during the broad comprehensive review in FlandersEach review undertaken in Flemish policymaking addressed a set of key questions:

Effectiveness Assessment: Are the current policies effective in achieving their objectives? What are the strengths and weaknesses within the policy domain under the review?

Best Practices Analysis: What lessons can be drawn from international best practices within similar policy areas?

Task Division Optimisation: Is the distribution of responsibilities for implementing policies across different levels of government and between the public and private sectors effective?

Reduction of Administrative Burdens: How can the administrative burdens and bureaucracy be reduced within the policy area under examination?

Achieving Savings Targets: How can savings of 5% and 15% be achieved within the examined policy area?

The steering committee provided comments on the draft action plans. The steering committee noted that initially, the action plans did not follow the same format, and consequently, common templates were developed at later stages in co-operation with the Department of Finance and Budget. The final action plans were discussed and approved by the Flemish Government.

2.5.6. Preparing the final reports

Copy link to 2.5.6. Preparing the final reportsThe final reports were prepared by the project group under the supervision of the steering committee.

The project groups were given the option to carry out the analysis and draft the broad comprehensive review reports themselves or commission a study from external providers. In most cases, however, the analysis part of the broad comprehensive review process was outsourced and carried out by consulting firms. In many cases, this was due to lack of capacities within departments to carry out the analysis and time pressures to deliver the results. While this allowed policy domains to deliver substantive reports based on independent analysis, in certain cases, it created a lack of ownership, potentially hindering the implementation of the results of the review. When the reports were prepared by external bodies, the project groups prepared in-depth research questions outlined in the action plans and provided comments on the intermediate drafts of the reviews.

In cases where project groups chose to prepare the broad comprehensive review report by themselves, it was required to ensure the independence of the assessment by involving external people in the project group.

Co-operation between various policy areas was encouraged during the review process to ensure access to relevant data and policy insights whenever relevant, although an evaluation from the steering committee highlighted that cross-policy interactions could be improved for the next round of reviews.

Due to time constraints, limited availability of relevant data, and differing capacities across policy domains, the quality of the final reports varied. Some reports were quite extensive, emphasising relatively minor budget details rather than addressing the central issues. In other instances, the reports adopted a defensive tone, aiming to demonstrate the efficient allocation of funds. Notably, there were no standard templates for the final reports provided at the outset of the process.

The final reports were presented to the Cabinet to make decisions on which saving options to implement in the 2022 budget.

2.5.7. Implementing the results of broad comprehensive reviews

Copy link to 2.5.7. Implementing the results of broad comprehensive reviewsThe managers of respective departments were required to ensure that the findings and decisions of reviews were incorporated and integrated into the budget proposals for the subsequent budgets.

Box 2.5 shows examples of the impact of the broad comprehensive reviews in Flanders.

Box 2.5. Impact of the broad comprehensive reviews in Flanders

Copy link to Box 2.5. Impact of the broad comprehensive reviews in FlandersRoad tax for old-timer vehicles

Copy link to Road tax for old-timer vehiclesAs a result of the broad comprehensive review, the road tax due for old-timer veichles was raised to 100 euros. The analysis revealed that the very low flat rate did not correspond to the needs of contemporary policy.

Tax deductions for secondary residence

Copy link to Tax deductions for secondary residenceMeeneembaarheid is a policy, under which the buyer of a second family home to, under certain conditions, was allowed to deduct the sales tax paid on a previous home from the sales tax payable on a subsequent family home purchased. The broad comprehensive review revealed that meeneembaarheid did not achieve the stated policy objective of promoting mobility and also proved to be very complex. As a result, the measure was discontinued.

Reduction of compensation for kilomter charge (kilometerheffing) in the transport sector

Copy link to Reduction of compensation for kilomter charge (<em>kilometerheffing</em>) in the transport sectorIn the framework of the broad comprehensive reviews, the subsidies within the Mobility and Public Works Department were examined, including the subsidy for Ecological and Safe Transport. The analysis revealed, among other things, that a large share of equipment that can be subsidised is already part of standard truck equipment. As a result, it has been decided to systematically reduce the amount of the subsidies. From 2024, the subsidy will be discontinued.

2.5.8. Publishing the final reports

Copy link to 2.5.8. Publishing the final reportsIn line with the OECD best practices, the final reports and other relevant material were published on the dedicated websites of the Department of Finance and Budget (accessible here) and the Flemish Parliament (accessible here). In addition, the websites include the survey conducted by the steering committee evaluating the broad comprehensive review process, the lessons learnt and recommendations for the next steps as well as all external studies supporting the broad comprehensive review process.

2.5.9. Monitoring the results

Copy link to 2.5.9. Monitoring the resultsThe Inspectorate of Finance has a role of monitoring the implementation of the results of the broad comprehensive review. During the preparation of the budget, the Inspectorate of Finance assesses the budget proposals and examines if the approved recommendations from the broad comprehensive review are considered.

The Department of Finance and Budget keeps track of the progress in implementing the spending review results, although there is no tracking mechanism (e.g. using the traffic light system) in place.

2.5.10. Enabling environment for conducting broad comprehensive reviews in Flanders

Copy link to 2.5.10. Enabling environment for conducting broad comprehensive reviews in FlandersRoles of different stakeholders in the process

Copy link to Roles of different stakeholders in the processDifferent actors within the Flemish administration take on distinct roles in the broad comprehensive review exercise, as shown in Table 2.3. Overall, the roles are clearly defined. The Department of Finance and Budget has a role in setting up the overall framework and supporting the implementation of the framework. The policy domains are responsible for conducting and implementing broad comprehensive reviews by conducting the analysis and implementing the results of spending reviews. The Inspectorate of Finance has a prominent role in monitoring the implementation of the results.

Table 2.3. Roles of stakeholders in the broad comprehensive reviews in Flanders

Copy link to Table 2.3. Roles of stakeholders in the broad comprehensive reviews in Flanders|

Department of Finance and Budget |

Policy domains |

External participants |

The Cabinet |

Inspectorate of Finance |

Parliament |

|---|---|---|---|---|---|

|

- Setting up the framework - Providing expertise - Preparing guidelines and templates - Participating in the project groups for each review - Supporting the work of the steering committee - Monitoring the implementation of the results |

- Participating in the project groups of reviews - Preparing the final reports - Implementing the results |

- Chairing the steering committee and leading the project groups - Providing feedback on the outputs - Drawing the lessons learnt and providing recommendations on the next steps |

- Providing political support to implementing broad comprehensive reviews - Taking decisions on the topics - Approving the action plans - Deciding on which saving options to implement |

- Monitoring the implementation of the results |

- Scrutinising the final reports - Requesting explanations from relevant ministers on the progress in implementing the results |

Capacities to conduct the broad comprehensive reviews

Copy link to Capacities to conduct the broad comprehensive reviewsCapacities within departments to conduct the broad comprehensive reviews varied, where some policy domains had more capabilities to deliver high-quality reports. To enhance capacities, the Department of Finance and Budget provides capacity-building exercises to departments. As part of capacity building efforts, multidisciplinary teams within departments were formed to gather knowledge about broad comprehensive reviews and in-depth spending reviews.

Availability of guidelines to conduct the broad comprehensive reviews

Copy link to Availability of guidelines to conduct the broad comprehensive reviewsThe Flemish Finance and Budget Department and the Inspectorate of Finance prepared a Code of Conduct on Spending Reviews to guide the policy domains in designing and setting up their reviews. The ground rules outlined in the Code are also embedded within the Decision of the Flemish Government Implementing the Flemish Government Finance Code (BVCO).

Some departments noted that guidelines were not sufficiently specific for their policy domain, while other departments found the guidelines useful and comprehensive.

Availability of relevant data

Copy link to Availability of relevant dataThe availability of data and relevant indicators varies from one sector to another, largely influenced by the culture within different departments. Some departments have embraced a culture of performance assessment and evaluation, resulting in the availability of comprehensive data. Other departments have conducted fewer evaluations, leading to less data.

Despite considerable efforts to develop relevant performance information, the broad comprehensive review process faced significant challenges in terms of the time spent on collecting and formatting the necessary data into editable formats. From the OECD’s perspective, this is to be expected during the initial stages of implementing spending reviews and importantly, spending reviews can be an important source of information on data gaps.

2.6. In-depth spending reviews in Flanders

Copy link to 2.6. In-depth spending reviews in FlandersIn 2018, the Department of Finance and Budget, in co-operation with the Department of Work and Social Economy, conducted a pilot spending review of Service Vouchers. The 2019 report by the European Commission, which assessed the pilot spending review exercise, concluded that the primary purpose of the pilot spending review was to develop capacities and gather practical insights for conducting future spending reviews (Cangiano, Ercoli and Hers, 2019[2]). Since the pilot exercise, in-depth spending reviews have been embedded in legislation and defined as: “Systematic, in-depth and specific studies of expenditure categories with a substantial budgetary impact in order to improve the effectiveness or efficiency of the policy under constant policy”.

Over the course of 2023, policy domains started implementing in-depth spending reviews which are expected to be finalised in 2024 spring. Similar procedures and governance arrangements to those of broad comprehensive reviews have been applied.

References

[2] Cangiano, M., R. Ercoli and J. Hers (2019), Integrating Spending Review in the Budgetary System, European Commission, https://fin.vlaanderen.be/wp-content/uploads/2023/06/MC_Flanders_-_Technical_Assistance_Mission_Report_-Master-V5.pdf.

[3] Department of Finance and Budget (2022), Multi-year estimate 2022-2027, https://financeflanders.be/wp-content/uploads/2022/11/Multi-annual-Estimate-22-27.pdf.

[1] Department of Finance and Budget (2014), Beleidsnota 2014-2019, https://publicaties.vlaanderen.be/view-file/15680.

[5] SERV (2022), The Flemish Broad Review: A Review of the Process, Results Further Steps.

[4] Tryggvadottir, Á. (2022), “OECD Best Practices for Spending Reviews”, OECD Journal on Budgeting, Vol. 22/1, https://doi.org/10.1787/90f9002c-en.