This chapter provides the international comparison of the performance-informed budgeting practices in Flanders and OECD countries. The chapter provides suggestions on how the Flemish framework can be strengthened. More particularly, the chapter focuses on the link between spending reviews and the budget cycle, the quality of performance information and ways to improve presentation of performance information in budget documents and communicate it to broader audiences. In addition, the chapter sheds light on the role of the parliamentary budget committee and sectoral committees in scrutinising performance information. The chapter concludes with discussion on the administrative capacities to fully engage in performance-informed budgeting reforms in Flanders.

Performance-Informed Budgeting in Flanders, Belgium

3. Strengthening performance-informed budgeting practices in Flanders, Belgium

Copy link to 3. Strengthening performance-informed budgeting practices in Flanders, BelgiumAbstract

3.1. Improving outcome-orientation of the budget process

Copy link to 3.1. Improving outcome-orientation of the budget processWhile efforts have been made to link budgetary decisions more closely with policy objectives and incorporating performance information into budgetary documents, the transition from a traditional input-based approach to a more comprehensive performance-informed framework is an ongoing process in Flanders. As such, the budget process is still largely focused on the resources allocated rather than on the outcomes or impacts of these allocations. Naturally, the budget process will always focus on inputs up to a certain degree. It is, however, important to shift the discussion around the budget towards the impact of expenditure provided and for departments to state what will be delivered.

Making the budget process more outcome-oriented requires not only procedural and operational changes but a cultural shift in how budgeting is approached and understood within the public sector. Such a transformation involves redefining the mindset and practices of those involved in the budget process, emphasising the importance of aligning budget decisions with priorities and measurable results. Performance-informed budgeting entails new responsibilities for all involved stakeholders and thus requires new skills and competencies such as ability to develop and engage with performance information and take on a more strategic approach to budgeting. Creating a performance culture within the public administration, however, requires long-term efforts. As shown in Box 3.1, similarly to Flanders, Estonia adopted a gradual approach to introducing performance budgeting and is continuously building on existing practices and refining the framework.

Box 3.1. Gradual approach to performance budgeting in Estonia

Copy link to Box 3.1. Gradual approach to performance budgeting in EstoniaEstonia has moved from an input-based budget system to an output-based approach by systematically analysing performance information alongside financial information in the budget process. Performance budgeting, also known as activity-based budgeting in the Estonian context, was first introduced in 2004 in Estonia, with a specific unit responsible for developing and implementing the process. A lack of collaboration between the Ministry of Finance and line ministries, an emphasis on inputs, and planning and budgeting being treated as two separate worlds contributed to the introduction of performance budgeting in Estonia. The main objective of the reform was to increase the use of performance data in budget discussions by adding performance information to the budget documents, and to improve efficiency and transparency of budget discussions.

3.2. Further improving the link between spending reviews and the annual budget

Copy link to 3.2. Further improving the link between spending reviews and the annual budget3.2.1. Timeline for implementing spending reviews

Copy link to 3.2.1. Timeline for implementing spending reviewsIn the last years, efforts have been made to align the broad comprehensive review timeline with the budget calendar. However, in practice, the results of the review were not ready for them to be fully considered in the budget negotiations. Evidence from OECD countries shows that one of the key factors for the successful institutionalisation of spending reviews is to integrate the process with the budget process and the performance management system.

Spending reviews provide valuable information for budgetary decisions, and it is important that decisions on new spending reviews and on the results of ongoing reviews are taken when budget priorities and fiscal outlook are discussed. It is also important to ensure that there is sufficient time to analyse the results of the reviews in time for budget decisions. Spending reviews must fit within the annual budget calendar and the results from spending reviews should be ready before major budgetary decisions take place.

For Flanders, this means that the results of both broad comprehensive reviews and in-depth reviews should be ready by March. For this to happen, the review process should start in May-June of the previous year to allow sufficient time to analyse the policy area and develop actionable and realistic results. It is important to anticipate the workload and ensure all necessary preparatory steps are taken to launch the reviews well in advance. Importantly, smaller in-depth spending reviews can take less time to be completed and several smaller reviews may run in parallel on a rolling basis during the same year.

3.2.2. Reflecting spending review recommendations in the medium-term framework

Copy link to 3.2.2. Reflecting spending review recommendations in the medium-term frameworkCurrently, the results of broad comprehensive reviews are mostly reflected in the annual budget. However, in many cases, the results of spending reviews can only be realised over the medium term and should be reflected in the medium-term budget planning Box 3.2. This medium-term perspective is essential, as most changes to the composition of expenditure and takes time to implement. Longer time horizons increase the range of options governments can consider compared to a review for a single year. Such options can include redesigning the delivery of public services and proposing legislative changes. Including the findings in a multi-annual expenditure framework reflects the proposed implementation of the findings and provides increased transparency and some degree of certainty about future funding paths.

Box 3.2. Spending reviews in Denmark

Copy link to Box 3.2. Spending reviews in DenmarkSpending reviews have been undertaken for more than 20 years in Denmark. They are led by the Ministry of Finance, with the government using spending reviews to reallocate resources and increase efficiency. The spending reviews inform budget negotiations and decisions on multi-annual budget agreements. The reviews are conducted over a relatively short period, where the decision on which reviews to conduct is taken in January or February and the reviews are undertaken over the ensuing months with the aim of having the findings available by the beginning of May. This ensures the findings of a spending review are available when the government decides on budget priorities in June.

Flanders has a solid medium-term planning framework. The multi-annual estimates are based on the annual budget where the first year is binding, while the out years are estimates. As such, it is important to build on the medium-term planning framework and ensure that findings of reviews are not only reflected in the annual budget, but also over the medium term.

3.3. Improving the quality of performance information

Copy link to 3.3. Improving the quality of performance information3.3.1. Reducing the overflow of performance information

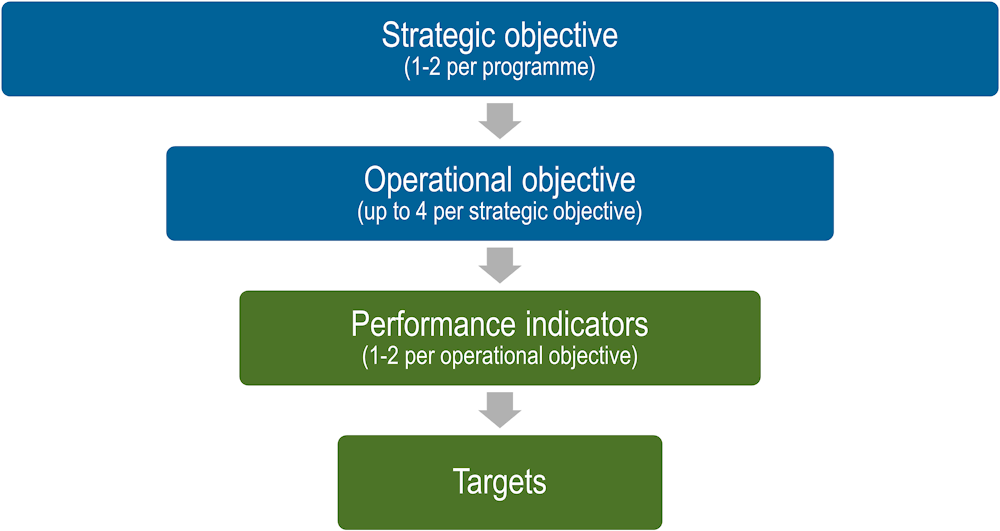

Copy link to 3.3.1. Reducing the overflow of performance informationIn Flanders, line departments prepare a large number of performance objectives as part of the budget. In certain cases, eight to eleven operational objectives per strategic objective are presented, which has led to an overflow of data. To address this challenge, the OECD advises that the Department of Budget and Finance place a numeric limit on the number of performance objectives and indicators, as shown in Figure 3.1. As a rule of thumb, 1-2 strategic objectives per budget programme, with 3-4 operational objectives that are measured by 1-2 performance indicators should be presented. Guidelines on those limits should be included in relevant templates provided to departments.

Figure 3.1. Limiting the number of performance objectives and indicators

Copy link to Figure 3.1. Limiting the number of performance objectives and indicators

3.3.2. Improving the links between performance objectives and indicators

Copy link to 3.3.2. Improving the links between performance objectives and indicatorsDeveloping appropriate performance indicators remains one of the biggest challenges in performance budgeting across OECD countries. While Flanders is in the early stages of developing performance indicators, it is crucial to ensure the connection between performance objectives and indicators from the beginning.

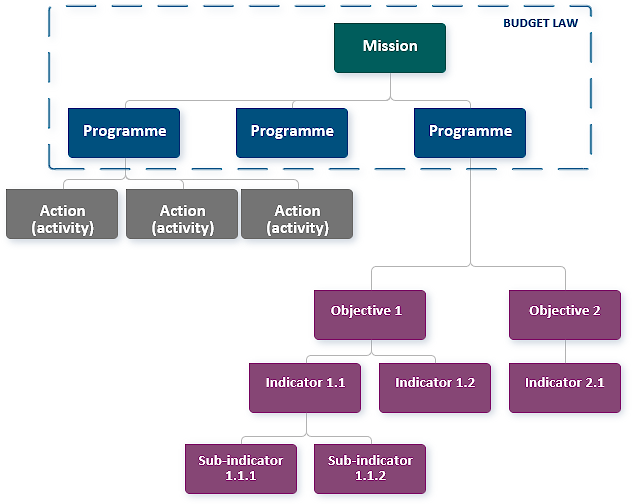

For performance information to be meaningful and usable in decision-making, the structure of performance information is important, where performance objectives are linked to the overall programme structure, and performance indicators measure progress towards achieving performance objectives, as shown in by the French example in Box 3.3.

Box 3.3. Structure of performance information in France

Copy link to Box 3.3. Structure of performance information in FranceIn France, the budget is structured around organic missions (~33), programmes (~138) and actions (or activities) (~2-15 per programme). Performance information is set at the programme level, where performance objectives are linked to the budget structure and the implementation of performance objectives is measured by the performance indicators, as shown in Figure 3.2.

Figure 3.2. Structure of performance information in France

Copy link to Figure 3.2. Structure of performance information in France

Source: Ministry of the Economy, Finance and Industrial and Digital Sovereignty of France (2023[1]), Missions, programmes, actions : trois niveaux structurent le budget général.

Performance indicators without clear links to performance objectives are ineffective in guiding discussions on performance information. A clear link facilitates the management of programmes, and both internal and external oversight of the extent to which programmes are meeting their objectives. Table 3.1 shows practical examples of performance indicators that are clearly linked to the objectives of programmes.

Table 3.1. Examples of performance indicators linked to performance objectives

Copy link to Table 3.1. Examples of performance indicators linked to performance objectives|

Performance objectives |

Indicator |

|---|---|

|

Improve the accessibility of emergency healthcare services in rural areas |

Percentage of emergency calls in rural areas where the response time is less than 25 minutes (%) |

|

Improve educational outcomes of pupils enrolled in secondary education |

Percentage of pupils below 2 (out of 6) PISA level of the International Study on Reading Competences for 15-year-olds (%) |

|

Increase the percentage of students who complete their higher education and have an equal gender distribution |

Proportion of students that graduate tertiary education compared to those that started (%) [men, women and total] |

|

Improve the quality of life of people with disabilities |

Employment rate of people with disabilities (%) |

3.3.3. Establishing quality assurance processes

Copy link to 3.3.3. Establishing quality assurance processesTo avoid an overflow of data and ensure the performance information put forth by departments is relevant and useful, the budget office should engage in discussions with line departments during the budget preparation stage on the quality and relevance of the performance information. During this process it is important to discuss the outcome-orientation of performance information, the links between performance objectives and indicators and if performance information is aligned with the priorities of the ministry and the government, as shown in Box 3.4. The relevance of indicators is identified by analysing adherence to specific criteria, alignment with governmental strategies, and interpretability of performance indicators, among other factors.

Box 3.4. Quality assurance process in Austria

Copy link to Box 3.4. Quality assurance process in AustriaDuring budget preparation, the Federal Performance Management Office (FPMO) in Austria provides quality assurance of the proposed performance objectives and indicators, including checking the alignment of objectives with national and sectoral strategies and other criteria. If the objectives and indicators do not fulfil the quality criteria, FPMO will make recommendations to the line ministries to amend the proposed material during the preparation stage of the budget.

Source: Downes, von Trapp and Jansen (2018[2]), “Budgeting in Austria”.

The Department of Finance and Budget should conduct quality assurance of performance information put forth by line departments to ensure quality and consistency across departments. This quality assurance should be conducted as part of the budget preparation to ensure that the information put forth in the budget documents is relevant in context of the budget. During the quality assurance process, the Department of Finance and Budget should actively engage with departments to ensure that performance information to be included in the BBTs are of good quality, relevant and respect the limit of the number of objectives and indicators to be developed. The main purpose of these discussions is to improve the quality of performance information and ensure it is in line with the priorities of the government and relevant to decision-makers.

3.4. Improving presentation of performance information in budget documents

Copy link to 3.4. Improving presentation of performance information in budget documents3.4.1. Reducing the volume of BBTs

Copy link to 3.4.1. Reducing the volume of BBTsCurrently, the BBTs, where performance information is presented, are extensive and detailed. In addition, the BBTs for different policy domains are of significantly different lengths and level of detail. This can make it challenging to understand the documents and use information included in the documents for decision making.

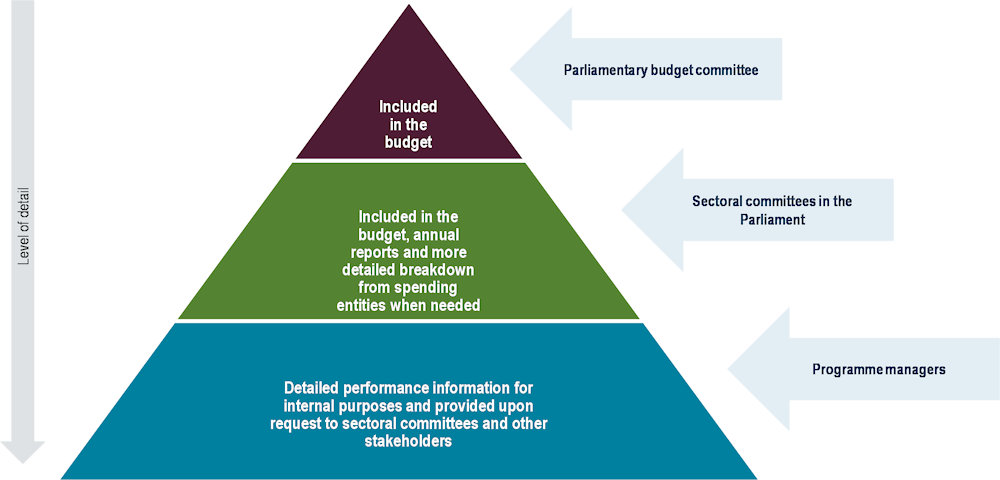

Importantly, information included in the BBTs should be relevant to decision-makers. Different type of information can be relevant to different stakeholders, as shown in Figure 3.3, and it is important to avoid overloading the budget with information. When performance budgeting is being rolled out, it is quite common that departments want to put a lot of information forth for decision makers to understand all the activities of that department. It is, however, important that the Department of Finance and Budget communicates to line departments to only put forth what is relevant in context of the budget in the BBTs.

Naturally, policy domains require in-depth information to guide the day-to-day operational decisions. On the other hand, parliamentarians should receive performance information that directly relate to budgetary decisions. A more detailed breakdown of performance information can be maintained internally by each policy domain and provided upon request. The goal is to have a BBT that is comprehensive yet succinct, providing all necessary information without overwhelming the reader.

Figure 3.3. Performance information provided to different stakeholders

Copy link to Figure 3.3. Performance information provided to different stakeholders3.4.2. Using standard templates to ensure consistency and relevance

Copy link to 3.4.2. Using standard templates to ensure consistency and relevanceTo ensure that performance information is concise and relevant, OECD countries use standard outline for such documents and provide line ministries with binding templates to be completed during the budget preparation stage. Using such templates provides a structured approach to ensure consistency and standardise data collection. This consistency enables a standardised presentation of performance information across departments and can help provide meaningful comparisons across performance objectives and indicators. Templates often include well-defined data fields, ensuring that all relevant aspects of performance are considered. For example, in Iceland, line ministries are required to fill out a standard template for 34 expenditure areas during the budget preparation stage, as shown in Box 3.5. The outline of the document is standard across all expenditure areas.

Box 3.5. Budget documentation in Iceland

Copy link to Box 3.5. Budget documentation in IcelandPerformance information in Iceland is presented in the main body of the budget. The budget document is structured around 34 expenditure areas. Each chapter focused on one expenditure area follows the same outline. These chapters are concise and usually around eight pages long.

The outline of the chapter focused on one expenditure area:

Scope of the expenditure area in a couple of lines

Budget

Future vision and high-level objective

Financing

Key focus for 2021-2025

Programme

The main projects of the programme

Key challenges

Opportunities for improvement (e.g. upcoming spending review)

Risk factors

Objectives and indicators:

|

Objective |

Indicator |

Status 2022 |

Target 2024 |

Target 2028 |

|---|---|---|---|---|

|

XXX |

XXX |

XXX |

XXX |

XXX |

In Flanders, the Department of Budget and Finance should require the use of standardised templates for policy domains t when putting forth performance information as part of the budget. All departments and relevant agencies should be required to use the templates as this ensures a consistent approach and that the performance budgeting principles are respected. The templates should explain what is expected of line ministries, how they should put forth the information, the length of each section, number of objectives and indicators, link to existing strategies or priorities of the government, as well as the responsible authority. Including summary tables in such templates, as shown in Table 3.2, helps to improve linkages between performance objectives and performance indicators over time and allows policymakers to quickly assess performance against set targets. Incorporating colour coding into summary tables improves the ease and clarity of assessing the status of targets (e.g., green for targets that have been achieved, and orange or red for those that have not been achieved).

Table 3.2. Presenting performance information: Linking objectives, indicators, and targets

Copy link to Table 3.2. Presenting performance information: Linking objectives, indicators, and targets|

High-level goal |

Performance objective |

Indicator (unit of measurement) |

Target |

Output |

Target |

Target |

Status |

|

2022 |

2022 |

2023 |

2024 |

||||

|

To provide safe and accessible healthcare where patients are guaranteed an easy way to the right service in the right place |

Improve the accessibility of primary healthcare services to all citizens |

Average waiting time to see a primary care physician (days) |

30 |

32 |

30 |

25 |

The target for 2022 was not met due to XYZ reasons. Over the next years, the ministry is taking actions A, B, C to ensure the delivery of the targets. |

|

Patient satisfaction rate with their primary health physician (%) |

60 |

60 |

63 |

65 |

The target for 2022 was met. |

||

|

Ensure early detection of diseases to improve healthcare outcomes of citizens |

Share of preventive colon cancer screenings in target population (50-75) as of total target population (%) |

65 |

65 |

70 |

75 |

The target for 2022 was met. |

The templates should be updated based on new developments and feedback from stakeholders, such as departments and Parliament. Once available, the template should be integrated into the IT systems to facilitate data collection and monitoring efforts.

3.5. Improving the scrutiny of performance information by the Parliament

Copy link to 3.5. Improving the scrutiny of performance information by the Parliament3.5.1. Strengthening the role of sectoral committees

Copy link to 3.5.1. Strengthening the role of sectoral committeesThere is limited engagement by parliamentarians and other decision-makers in Flanders on performance information in the budget. The budget committee (parliamentary working group on the legible budget) and sectoral committees within the Flemish Parliament currently play a limited role in using performance information to hold line departments accountable.

International experiences highlight the crucial role of sectoral committees in scrutinising performance information from spending entities. The OECD Best Practices for Parliaments in Budgeting (OECD, 2023[4]) highlight that sectoral committees should scrutinise performance information included in budget documentation and reporting documents and provide recommendations to the budget committee.

Box 3.6. OECD Best Practices for Parliaments in Budgeting

Copy link to Box 3.6. OECD Best Practices for Parliaments in BudgetingThe legislature should maintain a Budget Committee with overall responsibility for budget scrutiny.

The Budget Committee should promote co-ordination and consistency in legislative budget action and facilitate fiscal discipline, ensuring that the budget’s totals and aggregate sectoral allocations approved by the legislature are respected.

The Budget Committee should co-ordinate recommendations from sectoral committees on their areas of specialisation as input to its report on the budget to be put before the plenary.

Chairing of the Budget or Audit or Public Accounts Committee by an opposition member enhances oversight and reinforces the commitment to operate these committees in a nonpartisan and consensual manner.

The Budget Committee should be adequately staffed and have the opportunity and resources to consult or employ outside experts and to consult other oversight entities.

Sectoral committees should review relevant portions of the budget in their portfolios and make recommendations to the Budget Committee.

Sectoral committees have a particular role to play in reviewing performance budgeting information or spending reviews relevant to their portfolios.

Source: OECD (2023[4]), “OECD Best Practices for Parliament in Budgeting”.

The budget committee in Flanders should delegate the responsibility of scrutinising the performance of individual chapters to respective sectoral committees by assigning specific chapters of the budget to different sectoral committees based on their areas of expertise and relevance. These sectoral committees are then responsible for a detailed examination of the performance information related to the responsibilities of the committee.

The sectoral committees should actively engage with the corresponding policy domains. This engagement should involve direct discussions and reviews of the performance data, enabling the committees to gain a deeper understanding of how the departments are performing against their objectives and budget allocations. Such an approach would ensure a more focused scrutiny of performance information, leveraging the expertise of the sectoral committees in their respective domains. Additionally, this would relieve the budget committee from the burden of examining the entire budget in detail, allowing it to focus on broader fiscal oversight and co-ordination.

3.5.2. Presenting the achievements of the public service during the Accountability Day

Copy link to 3.5.2. Presenting the achievements of the public service during the Accountability DayOne way to engage parliaments in discussions on performance is during the budget execution stage where performance reports are presented to parliament on a dedicated day. For example, the Netherlands discuss the results achieved during the Accountability Day each year, as shown in Box 3.7.

Box 3.7. Accountability Day in the Netherlands

Copy link to Box 3.7. Accountability Day in the NetherlandsAccountability Day in the Netherlands, held on the third Wednesday of May, serves as a crucial moment for parliamentary oversight of the government's actions. On this day, the Minister of Finance presents the Central Government's annual financial report to the House of Representatives, detailing the government's achievements, activities, and associated costs over the past year.

The Netherlands Court of Audit plays a pivotal role in this process by auditing the annual reports and presenting its own report to the House of Representatives on Accountability Day. This report assesses the government's policy execution, questioning whether policy goals were met and if legal regulations were followed. In mid-June, both the House of Representatives and the Senate hold debates on these reports, discussing the implementation, results, and costs of various policy programmes. This process allows for an immediate evaluation of the previous year's plans, enabling the Cabinet to incorporate feedback into the next year's National Budget and make necessary policy adjustments or changes.

Source: House of Representatives (2023[5]), Accountability Day.

Flanders should organise an 'Accountability Day' in early Spring, mirroring practices seen in other countries. On this day, budget execution reports and actual achievements of the performance targets should be presented and examined in Parliament. This event would not only provide a platform for scrutiny and discussion of the government's achievements but also serve as an opportunity for public accountability.

3.6. Communicating performance information to broader audience

Copy link to 3.6. Communicating performance information to broader audienceIn Flanders, the information on the results achieved by the public service is not presented in accessible manner for broader audiences to consider. Having performance information accessible and presented in user-friendly manner increases the transparency and facilitates accountability. Tools such as visually pleasing budget at a glance and dashboards are commonly used in OECD countries in this regard.

3.6.1. Budget at a glance

Copy link to 3.6.1. Budget at a glanceBudget summaries or "budget at a glance" serve the purpose of conveying essential budget information to key stakeholders. Importantly, these materials are not only beneficial for citizens but can also aid parliaments in grasping critical issues and evaluating the performance of key policy areas and increase their overall engagement with performance information. To achieve this effectively, it is vital to identify the key policy domains to be included in the document. Typically, countries focus on areas such as social security, education, health, and environmental policies within these summaries.

As shown in Box 3.8, budget at-a-glance documents include both key financial data and performance information on the expected and actual results achieved by the public service. The integration of visual elements is crucial to enhance comprehension, making the information easily accessible and understandable for a broader audience.

Box 3.8. Budget at a glance of Lithuania

Copy link to Box 3.8. Budget at a glance of LithuaniaLithuania publishes the budget at a glance in Lithuanian and English. This document includes the statement from the minister of finance, budget calendar, information on funding and revenues for each performance area and includes the associated performance indicators and targets.

The outline of the 2022 budget at a glance:

Foreword

Budget structure

State budget preparation cycle

Macroeconomic projections

General government balance indicator

Budget revenue and expenditure

Structure of budget revenue

Budget expenditure by performance areas (including performance indicators)

Main developments in 2022

Source: Ministry of Finance of Lithuania (2022[6]), Budget at a glance.

Developing a "Budget at a Glance" document in Flanders can assist in presenting the key achievements of the public service in a manner that is easily accessible and understandable to a wide audience. The focus should be on distilling complex budgetary information into a clear, concise, and visually appealing format, including a concise statement on the key priorities for the fiscal year, budgetary timeline, key expenditure areas and associated performance indicators. It is useful to use infographics, charts, and brief summaries to highlight major accomplishments, spending efficiency, and the impact of various programmes and initiatives. The aim is to provide a snapshot that captures the essence of the budget's impact, making it easier for the public, media, and other stakeholders to quickly grasp the effectiveness of public spending. Such a document not only enhances transparency and public understanding but also serves as a valuable tool for promoting accountability and fostering trust.

3.6.2. Including performance information in dashboards

Copy link to 3.6.2. Including performance information in dashboardsAnother way to communicate financial and performance information to various stakeholders is through interactive dashboards. Such dashboards are currently unavailable in Flanders. However, as the IT systems mature, opportunities might exist to develop such dashboards as they provide a user-friendly and visually engaging way to present complex financial and performance data.

By leveraging charts, graphs, maps, and other visual elements, governments can make information more comprehensible and engaging for a broader audience. This transparency is a key component of accountability, as it enables public scrutiny and informed dialogue about government decisions and performance. Many dashboards include regularly updated data, allowing for ongoing monitoring of government performance and spending and allowing fostering a culture of continuous oversight, as shown in Box 3.9. Dashboards often allow for the comparison of performance data across different entities, municipalities, or time periods. This benchmarking capability helps identify areas of inefficiency or underperformance, prompting governments to take corrective actions and justifying those actions to the public.

Box 3.9. Use of dashboards and visual tools

Copy link to Box 3.9. Use of dashboards and visual toolsIreland

Copy link to IrelandIreland has developed a webpage: "Where your money goes", which highlights key spending areas in easily understandable manner. At the moment, it does not include performance information. However, the Irish are considering to eventually embed performance information within this website.

Estonia

Copy link to EstoniaEstonia has developed "Tree of truth", where they highlight whether performance targets have been achieved. It uses colour coding to highlight which targets were or were not achieved. Green indicates that the goal has been met, orange – progress towards the expected result and red – no progress towards expected result.

Canada

Copy link to CanadaGovernment of Canada InfoBase allows visualising performance and budgeting information. The results are presented visually allowing to identify the share of targets met or not met. The interactive dashboard allows building tables with relevant information and download it in csv format.

France

Copy link to FranceFrance displays performance information on a dedicated website. Users can filter information by mission and see the snapshot of the financial information and share of targets that have or have not been met.

Source: Government of Ireland (2023[7]), Where your money goes?; Statistics Estonia (2023[8]), Tree of truth; Government of Canada (2023[9]), GC InfoBase; Ministry of the Economy, Finance and Industrial and Digital Sovereignty of France (2023[10]), Performance data.

3.7. Building administrative capacities to engage in performance-informed budgeting

Copy link to 3.7. Building administrative capacities to engage in performance-informed budgetingFlanders has been improving the capacities of public service for conducting broad comprehensive reviews, in-depth spending reviews and developing performance information. Investing in capacities and raising awareness of the benefits of the reforms across the administration will facilitate the institutionalisation of performance-informed budgeting. It is important that capacities are built both internally within the Department of Finance and Budget and in other departments.

3.7.1. Capacities to conduct broad comprehensive reviews and in-depth spending reviews in-house to ensure ownership of the results

Copy link to 3.7.1. Capacities to conduct broad comprehensive reviews and in-depth spending reviews in-house to ensure ownership of the resultsDuring the 2020 broad comprehensive review cycle, most of the reviews were conducted by external parties. While reviews conducted externally can offer unbiased perspectives on public spending, this approach might result in a lack of ownership over time and thus the lack of integration of spending review outcomes into the budget cycle. Experiences from OECD countries suggest that the process is generally more effective when kept within the administration, ensuring that the recommendations and policy options are feasible and realistic. As shown in Table 3.3, when the review function and process are external to the government, there is a risk of these exercises being viewed as external audits and evaluations, rather than as integral parts of the budgetary process. This perception can affect the implementation of the findings.

Table 3.3. Costs and benefits of spending reviews conducted by external parties

Copy link to Table 3.3. Costs and benefits of spending reviews conducted by external parties|

Costs |

Benefits |

|---|---|

|

Lack of ownership within Ministry of Finance and Line Departments |

Provides appearance of objectivity and impartiality in the review |

|

Limited linkage to budget process (recommendations can be ignored by the government) |

Dedicated staff that carries out the review and is not burdened with other duties at the same time |

|

Confusion as an external audit or evaluation |

|

A sustained approach to building in-house capacities for conducting broad comprehensive reviews and in-depth spending reviews in Flanders is essential to ensure ownership of the results. Over time, there is a risk that externally conducted reviews are seen as audits or external evaluations, and line departments become less engaged, leading to results not being implemented.

To build capacities in-house, Flanders should focus on developing the necessary skills and knowledge within the administration. Initially, this could start with focused training programmes to equip staff with the required analytical and financial skills. Such training should cover areas like data analysis methods, public financial management principles, how to develop budget-relevant policy options. It is useful to hold an information session at the launch of the review when working groups are formed as it provides line departments and other stakeholders involved to get aquatinted with the process and ask any relevant questions.

3.7.2. Central unit within the Department of Finance and Budget to co-ordinate reform efforts

Copy link to 3.7.2. Central unit within the Department of Finance and Budget to co-ordinate reform effortsIn Flanders, the development of the performance-informed budgeting framework is a responsibility shared by staff from both the budgetary and policy sections within the Department of Finance and Budget. They play a crucial role in ensuring consistency across various departments and organising capacity-building measures. Despite this, there is not a singular point of contact within the Department to serve as a reference for line departments. This lack of a centralised contact point can potentially lead to co-ordination challenges and inconsistencies in the implementation and understanding of the performance-informed budgeting framework across different departments.

To address this challenge, several OECD countries have established specific units within budget departments or appointed at least one person within the budget department to have a formal responsibility of co-ordinating the spending review and performance budgeting process across the administration, as shown in Box 3.10.

Box 3.10. Building up capacities for Spending Reviews

Copy link to Box 3.10. Building up capacities for Spending ReviewsLatvia: In 2016, Latvia integrated spending reviews into the state budget. Since then, Latvia has looked at how to improve the process by analysing spending and strengthening capacities within the administration. In 2018, a separate division (Budget Development Division) was established in the Ministry of Finance, to consider possible revisions to public expenditure.

Norway: The Ministry of Finance has a spending review unit to build capacity and scale up the use of spending reviews. The unit is located within the budget department and works closely with line ministries to prepare recommendations on spending review reports for government.

Flanders should create a team of 2-3 policy analysts that support the implementation of performance-informed budgeting practices, co-ordinate the broad spending review efforts across the administration, and engage with line departments on the quality of performance information and other operational elements related to the reform. Importantly, this unit should closely collaborate with staff responsible for budgetary affairs to ensure the linkages with the budget process and avoid the performance framework becoming a parallel system. It is important that the staff of this unit is composed of senior enough staff to be able to effectively engage with senior officials from the line departments but also should have sufficient time to overlook relevant process and consult stakeholders on methodological issues upon request.

3.7.3. Performance-informed budgeting community to exchange on the progress made and gaps to be addressed

Copy link to 3.7.3. Performance-informed budgeting community to exchange on the progress made and gaps to be addressedTo strengthen administrative capacities, it can be beneficial to identify good practices within the administration and create a platform where those practices can be shared with peers. Estonia, for example, created a platform where ongoing spending reviews were discussed, and stakeholders within line ministries and the finance ministry could brainstorm on what is needed to improve the process, as shown in Box 3.11. A similar format can be adapted for broader performance-informed budgeting reforms.

Box 3.11. Building a spending review community in Estonia

Copy link to Box 3.11. Building a spending review community in EstoniaEstonia has been gradually implementing spending reviews since 2016 and focused on building up capacities for carrying out spending reviews since 2019. In this context, the Ministry of Finance in Estonia has built up a “spending review community” consisting of people from the Ministry of Finance, selected line ministries, the government’s office, National Audit Office and potentially from other agencies. This serves as a platform where the Ministry of Finance gathers these stakeholders and discusses the progress of the spending review process in Estonia. This kind of platform enhances a broader ownership of the process and facilitates a sound review process.

The spending review community is a sounding board where these key stakeholders can have an open discussion on important aspects such as:

Necessary capacity building within line ministries.

Development of the overall process; what is working well and what can be improved.

What additional training is needed.

Possible topics for the next rounds.

The MoF is the moderator, but the discussions within the community are open, transparent and focused on a joint goal of strengthening the spending review process. The community is responsible for spreading the benefits of the process within relevant organisations.

Flanders should consider establishing an inter-departmental platform where issues concerning the implementation of performance-informed budgeting can be discussed. This allows line departments to share ideas, thoughts, and concerns over the reforms.

References

[2] Downes, R., L. von Trapp and J. Jansen (2018), “Budgeting in Austria”, OECD Journal on Budgeting, Vol. 18/1, https://doi.org/10.1787/budget-18-5j8l804wg0kf.

[9] Government of Canada (2023), GC InfoBase, https://www.tbs-sct.canada.ca/ems-sgd/edb-bdd/index-eng.html#infographic/gov/gov/results.

[7] Government of Ireland (2023), Where your money goes?, https://whereyourmoneygoes.gov.ie/en/.

[5] House of Representatives (2023), Accountability day, https://www.houseofrepresentatives.nl/accountability-day.

[6] Ministry of Finance of Lithuania (2022), Budget at a glance, https://finmin.lrv.lt/uploads/finmin/documents/files/BIUDZETAS%20GLAUSTAI_2022_EN.pdf.

[1] Ministry of the Economy, Finance and Industrial and Digital Sovereignty of France (2023), Missions, programmes, actions : trois niveaux structurent le budget général, https://www.budget.gouv.fr/reperes/budget/articles/missions-programmes-actions-trois-niveaux-structurent-le-budget-general.

[10] Ministry of the Economy, Finance and Industrial and Digital Sovereignty of France (2023), Performance data, https://datavision.economie.gouv.fr/performance/.

[4] OECD (2023), “OECD Best Practices for Parliaments in Budgeting”, OECD Journal on Budgeting, Vol. 23/1, https://doi.org/10.1787/33109e15-en.

[8] Statistics Estonia (2023), Tree of truth, https://tamm.stat.ee/tulemusvaldkonnad/riigivalitsemine/indikaatorid/191?lang=en.

[3] Tryggvadottir, A. and I. Bambalaite (2024), “OECD Performance Budgeting Framework”, OECD Journal on Budgeting, Vol. 23/3.