Spain's scientific research capacity is widely respected, and directing this capacity at developing agricultural innovations and facilitating their adoption could further increase its value. The research and innovation performance of the different Autonomous Communities is heterogeneous. This chapter examines the Spanish agricultural knowledge and innovation system (AKIS), presenting its main actors, institutions and governance, the sources and flows of its funding, and the interactions between the national and regional levels. It outlines Spain’s policies to facilitate innovation in the agro-food sector, in areas such as promoting public and private investment in research and development, improving digitisation and connectivity, and protecting intellectual property rights, and compares indicators of innovation performance and adoption. The chapter also assesses the evolution of farm advisory services and the level of skills of Spanish agricultural workers. In the final section, examples of Spanish initiatives to promote innovation for environmental sustainability are presented.

Policies for the Future of Farming and Food in Spain

3. Innovation for sustainability

Abstract

Key messages

Spain has a moderate performance in innovation relative to other EU countries, and there is regional heterogeneity. The country is better in agricultural science than in developing agricultural innovation and facilitating adoption. Low public and private investments, the fragmentation of the agricultural knowledge and innovation system (AKIS), and regional heterogeneity in approaches are the main obstacles to harnessing innovation for a sustainable and resilient agriculture.

The Spanish AKIS involves many actors at the national and regional levels, that would benefit from improved co-ordination. Autonomous communities lead the regional AKIS, which includes research and development (R&D), innovation, and knowledge transfer policies. Central and regional governments exercise competences in relevant R&D and innovation policies within the EU framework.

Spain’s eighteen public agro-food research centres are heterogeneous and relatively small. Some of them have entered into partnerships with other actors for successful R&D projects. The centres are not necessarily well connected and co-ordinated in the whole AKIS system.

Government spending on R&D for the agro-food sector has been increasing in recent years, although it remains below the level observed before the 2008 financial crisis. The private sector has become the main source of agro-food R&D funding, though it relies on increasingly fewer innovative firms.

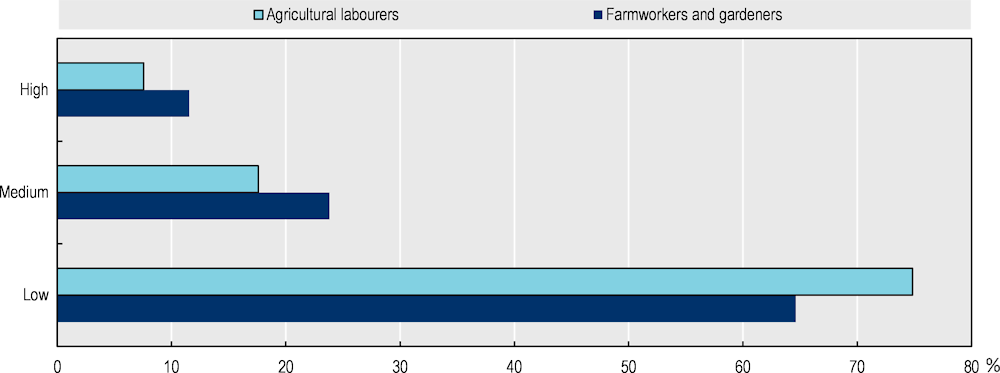

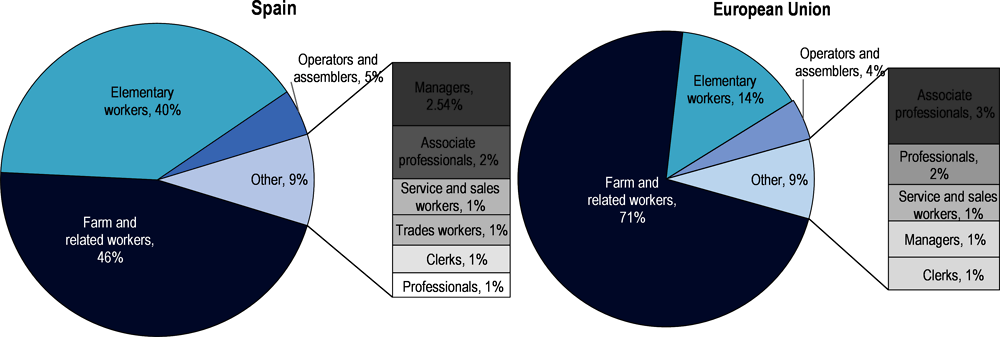

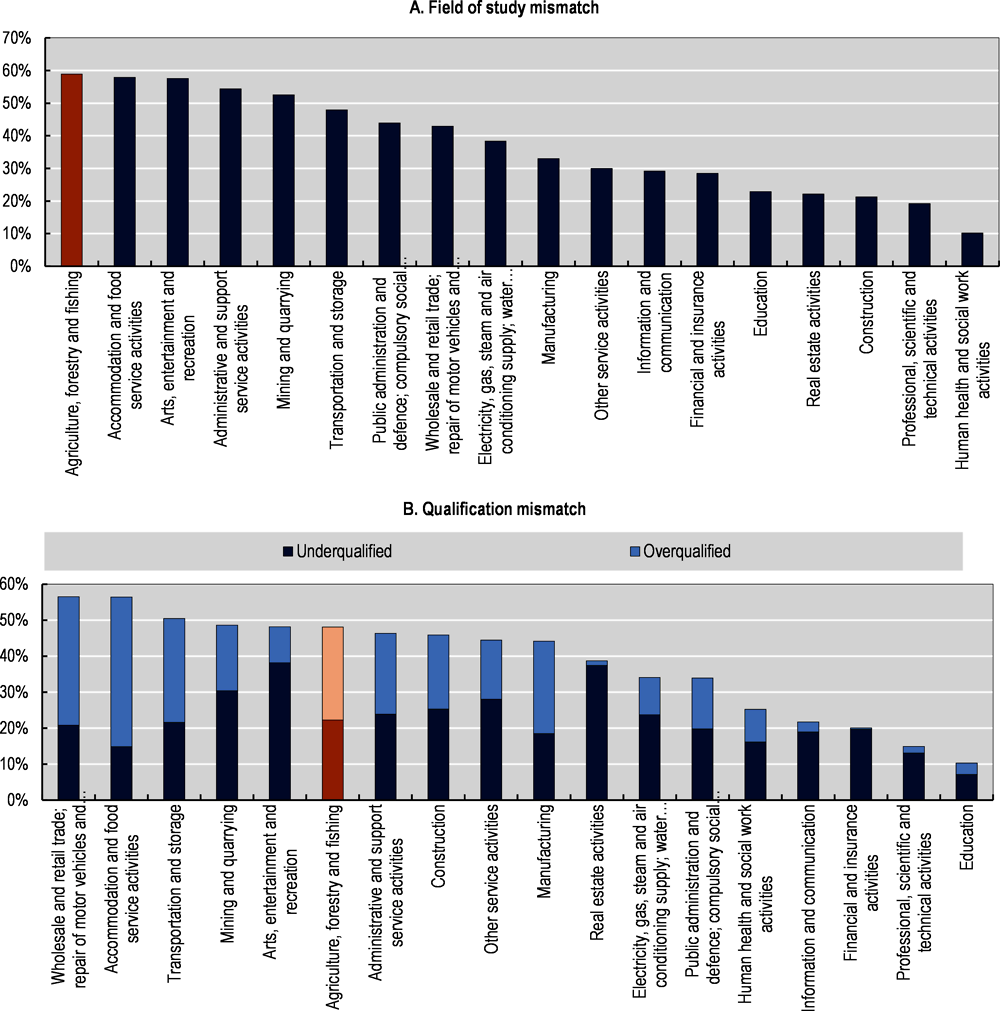

The level of education of most agricultural workers remains well below the EU average. Only 22% of farm managers have a formal training. There is evidence of skills mismatches, which can exert a negative impact on the dynamism and innovation capacity of the sector.

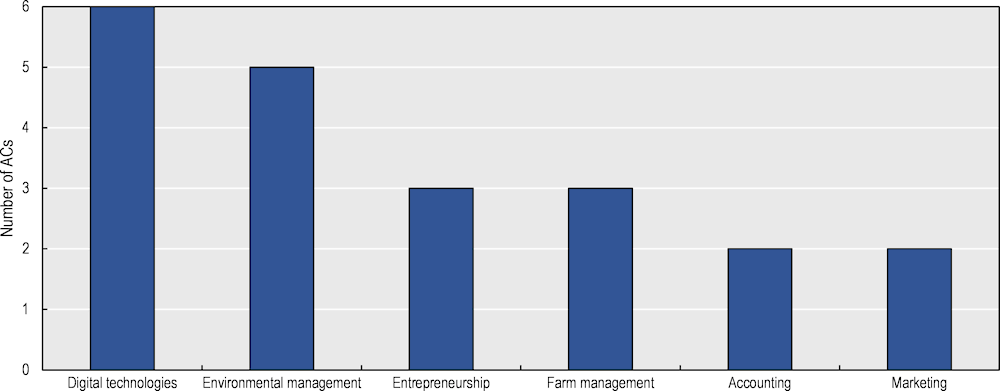

The training needs of the agricultural sector are evolving and need a stronger connection between knowledge transfer systems and the new forms of business and innovation, which require high entrepreneurship, digital and environmental skills to facilitate the adoption of new technologies.

Spain has reduced the rural-urban gap in access to digital technologies. Differences persist between rural and urban areas in access to high quality broadband and in digital use skills.

Spanish advisory services have been transformed in the last three decades. The traditional public agricultural extension services have been partly replaced by private advisors, advisory entities and commercial advisors linked to input providers.

3.1. General innovation profile

3.1.1. Spain is a moderate innovator with regional heterogeneity

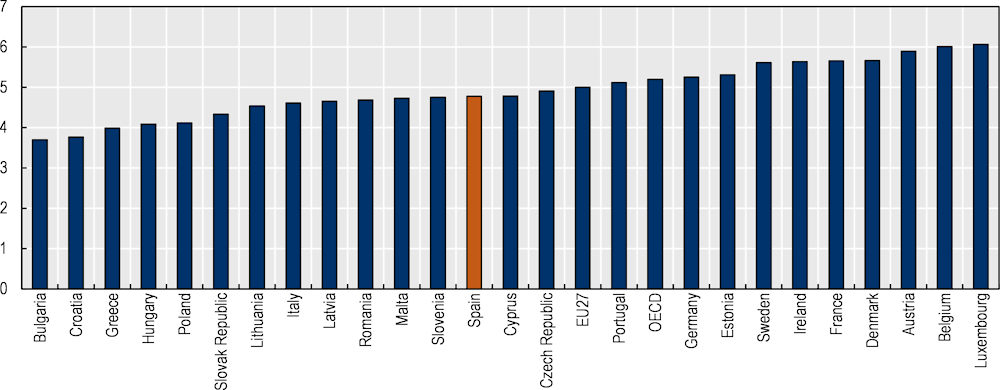

The European Innovation Scoreboard considers Spain as a “moderate innovator”. In 2022, Spain had a performance at 88.8% of the European Union average, below the average of the moderate innovators (89.7%) (European Commission, 2022[1]). This score positions Spain below peers such as Germany, France, and Italy. Spain performs particularly well (above the European Union average) in digitalisation, human capital, and environmental sustainability. The Global Innovation Index (GII) ranks world economies according to their innovation capabilities. In 2022, Spain ranked 29th among the 132 economies featured and 18th among the 39 economies in Europe, improving one position with respect to 2021 (WIPO, 2021[2]; WIPO, 2022[3]).

There are disparities in the level of innovation of Spain’s Autonomous Communities (ACs). According to the Regional Innovation Scoreboard, the Basque Country and the Madrid Community are strong innovators, while Andalusia, the Canary Islands, Castile-La Mancha, Ceuta, Extremadura, the Balearic Islands and Melilla are emerging innovators. The remaining ACs are classified as moderate innovators (European Commission, 2022[1]).

3.1.2. Policy approach and framework: National strategies and regions

Agro-food R&D, innovation, and knowledge transfer are highly decentralised

The governance of Spain’s public system of research is to a large extent the by-product of historical factors that have resulted in a system with intertwined policy responsibilities for the central government and the autonomous regions (OECD, 2021[4]). This has led to an Agricultural Knowledge and Innovation System (AKIS) with a multiplicity of actors that is more disperse and fragmented than in other EU countries where the AKIS is integrated, such as Ireland, Denmark, and France (Knierim, 2015[5]).

According to Knierim (2015[5]), a fragmented AKIS is characterised by several independent knowledge networks that operate in parallel, which are typically not well co-ordinated, rarely co-operate and might even compete. Conversely, an integrated AKIS features a co-ordinating structure, often a public body, and the system is supported by national policies on AKIS and advisory services that frame the interactions of AKIS actors. The fragmentation of the Spanish AKIS is partially explained by the distribution of powers established in the Spanish Constitution in which the ACs assume responsibility for agriculture and livestock, in accordance with the general organisation of the economy and for the promotion of research, while the central government has exclusive competence for the promotion and general co-ordination of scientific and technical research (MAPA, 2021[6]; MAPA, 2021[7]). The level of development of the AKIS and, therefore, the performance of these systems also differs among the ACs.

The government has recognised the need to improve co-ordination to ensure that the high level of fragmentation does not result in overlaps or gaps. As planned in the 2023-27 CAP Strategic Plan (CSP), the Ministry of Agriculture, Fisheries and Food (MAPA) is working on the creation of the “AKIS Co-ordination Body”, a collegiate body of a mixed nature that will ensure the co-operation, participation, and co-ordination of the AKIS system with the main actors on a national scale and in the ACs. Likewise, the MAPA is working on the development of a platform that will gather information on advisory services, courses, and training.

Spain does not have a specific strategy for agro-food innovation. The general framework, provided by the Spanish Science, Technology, and Innovation Strategy (EECTI) 2021-2027, is a strategic cross-sectoral plan to organise research and innovation, which is defined by the central government. Concrete measures of this strategy are outlined in the State Scientific, Technical and Innovation Research Plan (PEICTI) for 2021-2023 – currently under implementation. The PEICTI 2021-2023 has six thematic priorities. One of them focuses on food, bioeconomy, natural resources, and environment. Regional governments can define and carry out regional research priorities within the national framework.

Having a diversity of science, technology, and innovation policy experiences at the regional level offers lessons for policy making at the national level and can help promote innovation initiatives that are more targeted to regional needs. However, a recent expert assessment noted that the lack of adequate integration through governance mechanisms and knowledge flows, adapted to the reality of AKIS structures in Spain, has indeed affected the system’s efficiency (MAPA, 2021[7]). Specifically for the agricultural sector, several analyses identify a low co-ordination between the different agents and levels of the AKIS (i2Connect, 2020[8]; MAPA, 2021[6]). This low level of communication can make it difficult to align regional and national strategic priorities and to develop critical mass and synergies.

There are also limitations in the availability of information: the absence of an integrated information and follow-up system at the national level, as well as the lack of specific and detailed information at the regional level on innovation in agro-food are weaknesses of the sector and might be indicators of the low co-ordination (MAPA, 2021[6]).

3.2. Actors, institutions, and governance of the Agricultural Knowledge and Innovation System (AKIS)

3.2.1. Main actors of the Spanish AKIS and their role in agricultural innovation

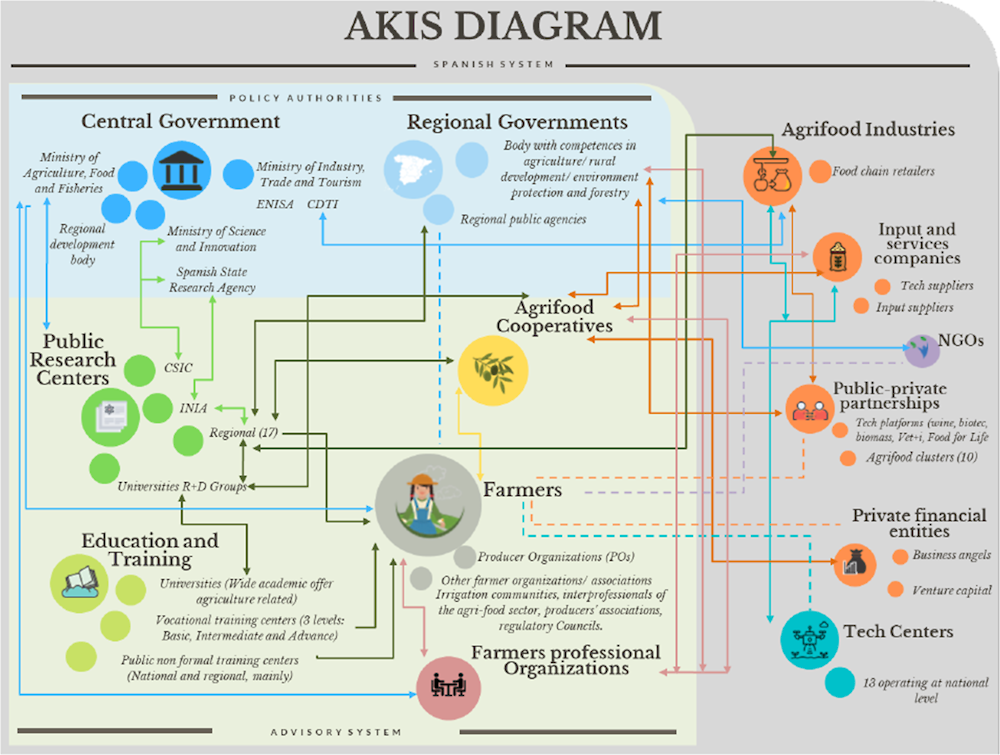

The Spanish AKIS is a network of actors that shape and stimulate research, development and innovation (R&D&I). It is very diverse, involving numerous actors at national and regional level, with different degrees of co-ordination between them. The wide network of actors in the Spanish AKIS generate, disseminate, and apply knowledge and innovation for the agro-food sector.

In a schematic way, the Spanish AKIS can be divided in five main groups of actors, consisting in central and regional governments, public and private research centres, education and training, technology centres, and the private sector. They play different roles in the generation, adaptation and adoption of new technologies and the promotion of innovation for sustainability in the agro-food sector. Despite having different roles and contributing in varying ways to the AKIS, they are expected to focus on generating knowledge that is useful for farmers to meet consumer and societal demands.

Several drivers, such as new demands for public goods and services, climate change, circular bioeconomy, emerging technologies, changes in food consumption, sustainability, agricultural digitisation, and a redefinition of public and private relationships, have led to the emergence of multiple sources and flows of knowledge, also accelerating the processes of generating knowledge and innovation (Cruz, Sayadi and Albisu, 2021[9]).

Figure 3.1 shows a representation of the Spanish AKIS. Given that the system is composed by a varied set of actors with complex interrelations between them, it is not uncommon to find overlaps between the actors and in the limits of their roles and functions with respect to knowledge. Knowledge flows can be more complex than those depicted by the figure.

Farmers (and their organisations) should be at the core of the AKIS. Managing agricultural production and its links with land and natural resources, they take decisions based on the knowledge they can generate and receive and, thus, are one of the main actors generating and using innovations for sustainability.

The central government defines the basic national objectives and provides guidelines of the general research policy, including agricultural-related research, and is in charge of the overall co-ordination of the agricultural-related projects. Also, the central government sets the overall legislative framework, co-finance initiatives, and can influence the strategy and activity of shared institutions through co-governance mechanisms (OECD, 2021[4]).

Figure 3.1. Innovation for agriculture involves a complex system with multiple actors and knowledge flows

Notes: Actors’ categories are represented in circles. Under one category, there are several actors (e.g., education and training). Impartial agricultural advisory system includes some of the relevant AKIS actor’s categories (green box). The lines represent the linkages between AKIS actors (dashed lines for weak linkages, and solid lines for strong linkages).

Source: i2Connect (2020[8]).

Regional governments can define and carry out regional research priorities within the national framework, based on their own regional innovation strategies (regional research and innovation strategies for smart specialisation (RIS3 strategies)). RIS3 strategies, as the national research and innovation strategy, are economy-wide; yet – in most regions – they include specific priorities for the agricultural sector and the bioeconomy. In the decentralised system of Spain, regional bodies play an important role in linking farmers’ needs with public authorities. Furthermore, as in any complex system, for it to be efficient and effective there is an important need of co-ordination between regions and the central government (i2Connect, 2020[8]).

Public research centres and universities are relevant players in generating knowledge that can lead to innovation for sustainability. Similarly, there are also examples of private and public-private research centres. Universities also provide training together with public non-formal training centres at the national and regional level. In general, the education and training sector is composed by universities at the regional and national levels, vocational training schools at the regional level, and some private institutions providing education for agriculture. These actors generate knowledge that helps improve the functioning of the AKIS and helps create and acquire agricultural skills for farmers.

Spain has a wide diversity of advisory providers from the public and private sector. Advisory services play a fundamental role in linking farmers with the knowledge generated by research centres, universities, or government authorities. Often, they also act as a channel for farmers to transfer their knowledge and innovation to other actors and institutions of the AKIS. Advisory services have gone through important transformations and many roles of the traditional public advisory service are now performed by the private sector.

The private sector is composed by a wide variety of heterogeneous actors such as farmers, small and medium enterprises (SMEs), multinational enterprises (MNEs), input and services companies, self-employed workers, co-operatives, firms from agro-food industries, and agro-food industry associations. They can also act in partnership with the public sector, and they are increasingly active in performing R&D&I activities.

Other actors, such as farmers’ professional organisations, public-private partnerships and non-governmental organisations (NGOs), complete the landscape and play different roles in generating knowledge in the Spanish AKIS.

3.2.2. Funding, funding bodies, and main national and regional authorities within Spain’s AKIS

Spain has a complex governance system in which central and regional governments exercise competences in R&D&I policies relevant for agriculture, within the EU framework

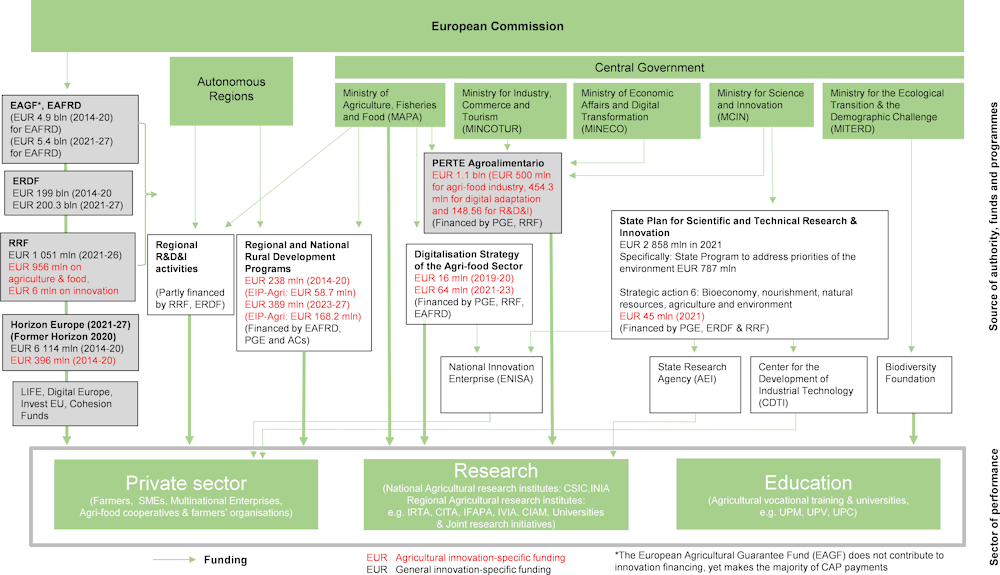

The Spanish AKIS is characterised by the combination of the features of national with those of regional governance systems based on the country’s decentralised political landscape, while entailing the additional attributes resulting from the EU membership. The result is a complex governance system in which central and regional governments exercise competences in R&D&I policies relevant to agriculture within the EU framework.

The central government has the exclusive responsibility for the promotion and general co-ordination of scientific and technical research. At a national scale, the Ministry for Science and Innovation (MCIN) together with the Ministry of Agriculture, Fisheries and Food (MAPA) lead the definition of the general national strategic research priorities and execute and fund most R&D&I policies for agriculture. Most often, they delegate their tasks to different implementing agencies that co-ordinate the defined policy programmes and earmark the corresponding funds. The regional governments perform and implement R&D&I tasks based on their own regional plans and budgets, within the national framework and in co-ordination with ministries and implementing agencies. Public funding is provided by the European Union, the national government, and the regional governments. The main sectors of performance of R&D that use the funding are the private, the research, and the education sectors.

Figure 3.2 provides an overview of the funding ecosystem of the Spanish AKIS, depicting the main authorities and implementing agencies, the most important funds, funding streams, and relevant R&D&I performing actors, which include private and public actors, such as partnerships, research centres, and universities.1

Figure 3.2. Funding of the Spanish System of Agricultural Research and Innovation

Note: This is a stylised and non-comprehensive infographic. PGE is the Spanish abbreviation for General State Budget. Bolded arrows indicate funding for the three sectors of performance, i.e. the private sector, research, and education.

Source: Authors, based on official sources and informal information from meetings.

European Union funding

Spain, with its eligible entities, received the largest share of Horizon 2020 funding under societal challenge 2, which covers agro-food

The European Union contributes to different national and regional programmes with several types of funds from different programmes. Some of them are directly linked to agriculture and to agricultural R&D&I while most are not sector-specific and do not fund these activities separately.

The European Union contributes with directly managed funds (except in the case of partnerships that have co-financing) through its main innovation programme Horizon 2020 (2014-20) and its successor Horizon Europe (2021-27). Spanish entities obtained over EUR 6.1 billion in funds from the Horizon 2020 programme, making Spain the fourth beneficiary of this programme, with 10.4% of the total EU-28 funding. Moreover, Spanish entities received the largest share of the available Horizon 2020 funding under its societal challenge 2 – which covers the agro-food sector – in 2014-20, with the total grants amounting to EUR 396.3 million (12.4% of the EU-28) (CDTI, 2021[10]; MAPA, 2022[11]). Spanish entities have been involved in 454 funded activities and 107 of these have been co-ordinated by Spanish organisations (CDTI, 2021[10]).

Under the new Framework Program for Research and Innovation 2021-27, Horizon Europe, most funding for the agro-food sector will be provided under Cluster 6 “Food, Bioeconomy, Natural Resources, Agriculture and Environment’’. In this context, the European Union aims at fostering knowledge, building capacities and developing novel solutions to promote sustainable land use and a more sustainable, resilient and inclusive agricultural sector, for example through activities such as partnerships, research networks and initiatives. Also, Interreg, LIFE, Digital Europe, Invest EU, Cohesion Funds, and other European programmes have been a source of funding for the entities of the Spanish AKIS.

The Common Agricultural Policy (CAP) of the European Union is another key tool to fund R&D&I activities in the agricultural sector. The CAP’s Pillar 2 fund, the European Agricultural Fund for Rural Development (EAFRD) has part of its funds directed to R&D&I activities in the sector, as it channels the European Union’s rural development policy. Specific measures to fund R&D&I in agriculture under Pillar 2 of the CAP include knowledge transfer, advice and innovation through co-operation. Particularly, the European Innovation Partnership for Agricultural Productivity and Sustainability (EIP-AGRI) cooperation-innovation measure of the rural development programmes for the period 2014-22 and the co-operation intervention within the CAP Strategic Plan serve this purpose. It is co-financed by the European EAFRD and country funds (national and regional) and managed by the country. In Spain, the EIP-AGRI innovation was programmed at the supra-autonomous level within the National Rural Development Program (NRDP) 2014-22 – managed by MAPA and funded with EAFRD and funds from the State Public Budget (PGE) – and at the regional level in 15 ACs, with funds from the EAFRD, PGE, and ACs.

The European Union provides additional R&D&I funding through the European Regional Development Fund (ERDF), which can contribute to innovation for a sustainable agro-food sector through smart specialisation strategies. These strategies help to identify research and innovation priorities in strategic sectors in specific regions of the country, including agriculture and food, to channel knowledge-based investments and co-operation. In this context, the European Union supports, for example, health and safe food in Andalusia through innovation in the agro-food industry targeting consumers’ food habits and food traceability, among others (European Commission, 2022[12]).

The Recovery and Resilience Facility (RRF), the European Union’s recovery instrument in response to the COVID-19 crisis, is implemented through a series of aids managed by the General State Administration through various ministries, with different tools and funds, some of which are direct transfers to the ACs. One stream is dedicated to agriculture and supports, for example the Spanish rural development programmes (RDPs) and the Digitalisation Strategy of the Agro-food and Forestry Sector of the PERTE Agroalimentario (Section 3.3.2).

National bodies, funding, and programmes

PERTE Agroalimentario is one of several strategic projects of the Spanish Recovery, Transformation and Resilience Plan (RTRP) and which receives funding from the RRF and the central administration (2022-25). The PERTE includes a set of measures that seek to strengthen the agro-food chain with tools to confront the environmental, digital, social and economic challenges of the next decade. It has a budget of around EUR 1 800 million, which is divided in three parts. The first has a budget of EUR 500 million (initially EUR 400 million), is implemented by the Ministry of Industry, Trade and Tourism (MINCOTUR) and seeks to strengthen the agro-food industry; the second has a budget of EUR 454.4 million and is implemented by MAPA and the Ministry of Economic Affairs and Digital Transition (MINECO); finally, the third part, with a budget of EUR 148.6 million, focuses on research, innovation and technology transfer, and is implemented by MCIN and MAPA with the support of CDTI and complementary plans between regions and MCIN.2

The PERTE Agroalimentario includes programmes and measures such as the Digitalisation Strategy of the Agro-food and Forestry, the establishment of the AKIS advisory and knowledge exchange digital platform, as well as the creation of a Digitalisation Observatory for the agro-food sector which was recently kick-started with the signature of a collaboration agreement with the financial institution CAJAMAR (Gobierno de España, 2022[13]). It also includes the establishment of a Digital Innovation Hub, which aims to promote the implementation of digital technologies. Also linked to this strategy are the actions under AgroInnpulso, a financing line established between MAPA and the state-owned company Empresa Nacional de Investigación S.A. (ENISA) to provide credit to agro-food SMEs to implement digital and innovative technology-based projects (MAPA, 2021[14]).

The Ministry of Science and Innovation (MCIN) holds the main responsibilities for research, technological development, and innovation policies across sectors and is in charge of the EECTI and PEICTI. It is the main R&D&I funding body and encourages R&D&I, co-ordinating with the ACs and overseeing the public research organisations. Among the latter, the most relevant is the Spanish National Research Council (CSIC). The role of the CSIC has become increasingly important for agro-food since 2021, when the National Institute for Agricultural and Food Research and Technology (INIA) was integrated under its umbrella (Section 3.2.5).

The Spanish State Research Agency (AEI) – created in 2015 and attached to the MCIN – plays a significant role as it is the agency responsible for the management of the PEICTI. Its programmes, measures, and corresponding funds are financed from the General State Budget and co-financed with EU funds.

Other relevant institutions that depend on the MCIN are the Spanish Foundation for Science and Technology (FECYT), a public foundation that seeks to strengthen the link between science and society, and the Centre for the Development of Industrial Technology (CDTI), which is a public business entity that promotes innovation and the technological development of Spanish companies. It channels the requests for aid and support for R&D&I projects from Spanish companies, both nationally and internationally. The CDTI supports projects by granting economic aid to companies and facilitating access to funding from third parties (such as the EU Framework Programme, the European Space Agency funds, or international multilateral initiatives for technological co-operation such as Eureka and Iberoeka).3 In 2020, the CDTI provided funding of EUR 819 million for 1 601 R&D&I projects involving companies. The sectors that benefitted the most from the CDTI’s contributions were industry (36% of the total), ICT (20%) and food, agriculture, and fisheries (18%) in 2020. The allocation of funding shows a strong territorial imbalance, indicative of the uneven development of the industrial sector in Spain (CDTI, 2021[10]).

The Ministry of Agriculture, Fisheries and Food (MAPA) is responsible for proposing, formulating, and implementing government policy in the areas of agriculture, agro-food, nutrition, livestock and fisheries and rural development. Additionally, it represents the state in international organisations dealing with these topics and co-ordinating the actions of ACs in these areas. Moreover, the MAPA manages and provides support at the supra-autonomous level (i.e. in two or more ACs) to operational groups and innovative projects of the EIP-AGRI. To this end, MAPA has co-financed 177 supra-autonomic operational groups under the RDP 2014-2022 and financed the implementation of 124 innovative projects of general interest to the agro-food sector with EUR 62.4 million of total public expenditure granted so far. Beyond that, MAPA develops demonstration thematic networks to encourage knowledge transfer and knowledge exchange programmes among AKIS stakeholders and implements different aid programmes to support training and advisory services in digitalisation (MAPA, 2022[15]).

Within the MAPA, the Directorate-General for Rural Development, Innovation and Agro-food Training co-ordinates and spurs the advisory, training, and knowledge transfer systems in the agro-food sector. To this end, it works on the national AKIS and takes part in various multi-actor projects under Horizon related with the European AKIS (such as FairShare and i2connect under Horizon 2020, and EU farmbook, and Modernakis under Horizon Europe). Additionally, it manages EIP-AGRI innovation aid of rural development at supra-autonomous level, directs the co-ordination and the dialogue with other ministries regarding R&D&I and digitalisation, and is in charge of exchanging with the European Commission on EIP-AGRI related matters.

The Ministry of Industry, Trade and Tourism (MINCOTUR) develops national policies for industrial innovation with relevance to the agro-food sector. ENISA is integrated into the MINCOTUR. It collaborates closely with the MAPA through AgroInnpulso. These projects are expected to result in a business project with a clear innovative and digital component that will contribute to the profitability and competitiveness of the beneficiary SME. Also, MINCOTUR implements the first line of the PERTE Agroalimentario.

The Ministry for the Ecological Transition and the Demographic Challenge (MITERD) relates to the MAPA’s work as it has various competencies with respect to the agro-food sector, particularly in environment and forestry, waste management, energy and demographic challenges. To this end, it develops strategies, by proposing and implementing policies and elaborates state legislation in its fields of responsibility. Especially its strong focus on climate change mitigation and biodiversity protection should be highlighted. Attached to MITERD is the Biodiversity Foundation, a publicly owned entity. It executes activities related to the study, conservation, and sustainable resource use of the environment, specifically natural habitats, and biodiversity. Its main goals include fostering scientific education and research in the area and serving as a platform for exchange. Moreover, it supports innovative projects and entrepreneurial activities in biodiversity matters and has launched funding lines for sustainable agriculture projects.

Additionally, the Ministry of Universities and the Ministry of Education and Vocational Training (MEFP) define and co-ordinate education policies, with important implications on innovation capacities for sustainable agriculture, and the Ministry of Economic Affairs and Digital Transition (MINECO) also runs several programmes of digital development with repercussions in the agricultural sector.

Regional bodies

The allocation of funding shows some territorial imbalances, indicative of the heterogeneity of the Spanish regions

One of the most important changes derived from the decentralisation process is that competencies in agriculture, research and education were transferred to the ACs. This led to the development of local entities with their own and diverse dynamics, which form regional AKIS. Despite the general trend towards a greater involvement of regional governments in science and innovation policies, there are large differences in the scale and scope of such policies driven by income inequalities across autonomous regions, the heterogeneity of regional industrial specialization patterns, their different institutional profiles, and their different use of EU structural funds over the past decades (OECD, 2021[4]).

In brief, the funding for agricultural research at the regional level comes from regional sources (such as EIP-AGRI regional co-operation projects or regional R&D&I projects funded by the departments responsible for research and innovation), national sources (such as the PEICTI calls managed by the AEI, national co-operation measures of the EIP-AGRI, projects funded by the CDTI, and the PERTE Agroalimentario), and from European sources (from programmes such as Horizon 2020, LIFE, Interreg POCTEP, Interreg Sudoe and Interreg Atlantic Area, among others).

Advisory services are under the responsibility of the ACs and funded through their regional budget or support granted to them in the regional RDP. Formal training (both vocational and university training) is funded by the ACs, while non-formal training is funded by the regional RDP (Section 3.4.1).

3.2.3. The Autonomous Communities

According to the OECD survey of AC authorities, seven out of the eight ACs that responded have a long-term strategy for agro-food innovation (OECD, 2022[16]). However, the ACs are very heterogeneous in several areas. In terms of R&D&I, the interregional differences are due to differences in the level of economic and scientific development and of political support and commitment.

Unfortunately, the information on R&D investment for the agricultural sector at the regional level is not available. However, as an indicator to illustrate the heterogeneity, Table 3.1 shows the differences in the total investment on R&D in all sectors and the share of each AC. Two ACs, Madrid and Catalonia add up to 50% of total R&D, while smaller ACs do not even reach 1% of total funding. Similarly, there is high disparity in the number of employees and researchers in the different ACs. More importantly, the indicator of R&D per researcher also shows heterogeneity, indicating that the differences are not only related to the different sizes of the ACs but also to differences in available resources. The information on agricultural R&D&I for the regions is not easy to gather, reflecting the need of more public information and a co-ordinating agent for the generation of systematic data on the agro-food innovation efforts in Spain across all ACs.

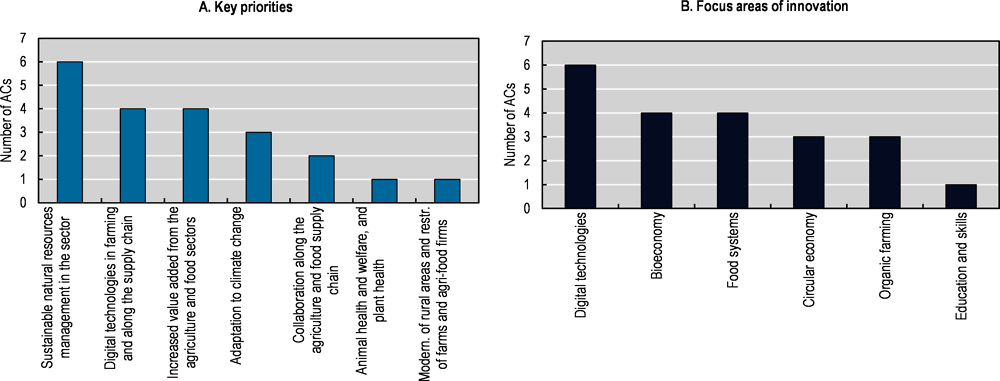

The left panel of Figure 3.3 shows some differences in the key priorities and the focus areas of innovation in the ACs, according to the survey (OECD, 2022[16]). Six out of the eight responding ACs indicated that sustainable natural resources management in the agro-food sector is a key priority. Digital technologies in farming and along the supply chain, and increased value added from the agriculture and agro-food sectors are key priorities in four out of eight ACs. Other less common priorities are adaptation to climate change (three out of eight), collaboration along the agriculture and agro-food supply chain (two out of eight), and animal health and welfare and plant health. Only one AC identified modernisation of rural areas and restructuring of farms and agro-food firms as a key priority. Similarly, the right panel of Figure 3.3 shows that digitisation is a main research area for innovation in six out of eight ACs. It is followed by bioeconomy and food systems (four out of eight), circular economy and organic farming (three out of eight), and education and skills (indicated by only one AC).

In brief, the differences seem to be linked to the specific features of each region that derive from a variety of factors such as the stability of regional governments that allows to develop long-term projects; the strategic planning at regional level for the agro-food sector; the regional economic development; the relevance of the agro-food sector in the regional economy; and improvements in the administrative structure of the centres, especially regarding the economic and human management, which have increased their capacity to compete.

Table 3.1. Two Autonomous Communities contribute half of Spain’s total R&D expenditure

Expenditure (from all sources) and personnel in internal R&D by autonomous communities where R&D activities were carried out, 2021

|

Internal R&D |

Employment |

R&D / Researcher |

|||

|---|---|---|---|---|---|

|

Autonomous Community |

Thousands of EUR |

% |

Employees |

Researchers |

|

|

Total |

17 249 249 |

100.0 |

249 648 |

154 147 |

111.9 |

|

Madrid |

4 536 155 |

26.3 |

61 120 |

38 128 |

119.0 |

|

Catalonia |

4 078 729 |

23.6 |

55 885 |

31 579 |

129.2 |

|

Andalusia |

1 703 533 |

9.9 |

27 044 |

15 543 |

109.6 |

|

Basque Country |

1 666 316 |

9.7 |

21 504 |

14 431 |

115.5 |

|

Valencia |

1 358 519 |

7.9 |

22 178 |

13 962 |

97.3 |

|

Castile and Leon |

795 797 |

4.6 |

11 120 |

7 223 |

110.2 |

|

Galicia |

697 484 |

4.0 |

11 435 |

7 462 |

93.5 |

|

Navarra |

389 937 |

2.3 |

5 300 |

3 163 |

123.3 |

|

Aragón |

386 705 |

2.2 |

6 671 |

4 356 |

88.8 |

|

Murcia |

351 404 |

2.0 |

6 787 |

4 559 |

77.1 |

|

Castile - La Mancha |

339 418 |

2.0 |

3 861 |

1 975 |

171.8 |

|

Canary Islands |

238 546 |

1.4 |

4 009 |

2 947 |

81.0 |

|

Asturias |

204 172 |

1.2 |

3 384 |

2 391 |

85.4 |

|

Extremadura |

149 074 |

0.9 |

2 766 |

1 868 |

79.8 |

|

Balearic Islands |

146 031 |

0.8 |

2 997 |

2 244 |

65.1 |

|

Cantabria |

133 156 |

0.8 |

2 159 |

1 382 |

96.3 |

|

La Rioja |

65 065 |

0.4 |

1 308 |

842 |

77.3 |

Note: All sources include the public sector, the business sector, non-profit private enterprises (IPFL), and the higher education sector.

Source: Authors’ calculation based on INE (2020), https://www.ine.es/dynt3/inebase/es/index.htm?padre=8351&capsel=8352.

Figure 3.3. The sustainable management of natural resources is a priority in many regional innovation strategies

Note: Partial results based on the replies of the following Autonomous Communities: Aragón, Asturias, Basque Country, Cantabria, Catalonia, Castile and León, Galicia, and Madrid.

Source: OECD (2022[16]).

3.2.4. Public national and regional R&D&I organisations

The CSIC is the main public research organisation in Spain. It provides R&D&I services in many sectors and has 13 330 employees (4 345 of which are researchers). In 2021, the CSIC had revenues of EUR 799 million. The CSIC is organised in 121 research institutes (50 of them are joint centres with other organisations) and three national centres, among them the National Institute for Agricultural and Food Research and Technology (INIA). It produces an important scientific output. In 2021, the CSIC took part in 4 226 national projects and 586 projects of the Framework Programme. In addition to the research activities, the national centres provide expert technical advice to the public sector. CSIC’s institutes are spread all over the country, although with a large concentration in Madrid (42 institutes), Andalusia (20 institutes) and Catalonia (18 institutes). The CSIC is the Spanish organisation receiving more funding from the Horizon 2020 programme. The CSIC has 36 centres or institutes related to agro-food sector, 215 research groups, and 1 694 projects in progress.4 Particularly relevant are the Centre for Edaphology and Applied Biology of Segura (CEBAS-CSIC) in Murcia, the Aula Dei experimental station (EEAD) in Zaragoza and the Institute for Sustainable Agriculture (IAS), in Córdoba.

The INIA is an institute of reference in the agro-food science and technology research at national and international level. It participates in numerous projects in the areas of biotechnology, environment, animal genetics improvement, plant protection, animal breeding and food technology. The main sources of funding are the PEICTI and Horizon 2020. The INIA collaborates closely with the MAPA through specific mandates or contracts. At the European level, the INIA-CSIC represents Spain in the Standing Committee on Agricultural Research (SCAR), which is responsible for co-ordinating agricultural research in Europe. Moreover, the INIA-CSIC participates in different European networks of national and regional funding agents, such as ERA-NET or PRIMA. Some of the institutes or centres attached to the INIA are the Forest Science Institute (ICIFOR), the Animal Health Research Centre (CISA), the Biotechnology and Plant Genomics Centre (CBGP), and the Plant Genetic Resources and Sustainable Agriculture Centre (CRF).

The regional agricultural research centres show large differences in terms of resources and interests

All ACs have a public research centre focusing on R&D&I in the agro-food sector. These regional centres have focused their research in the areas more relevant and in line with the needs of agriculture in their region. In addition to undertaking research projects, regional research centres have other duties: promoting the conservation of plant varieties, performing official food and agricultural analysis, and organising technology transfer actions for the agricultural sector (field trials, technical seminars, visits, etc.).

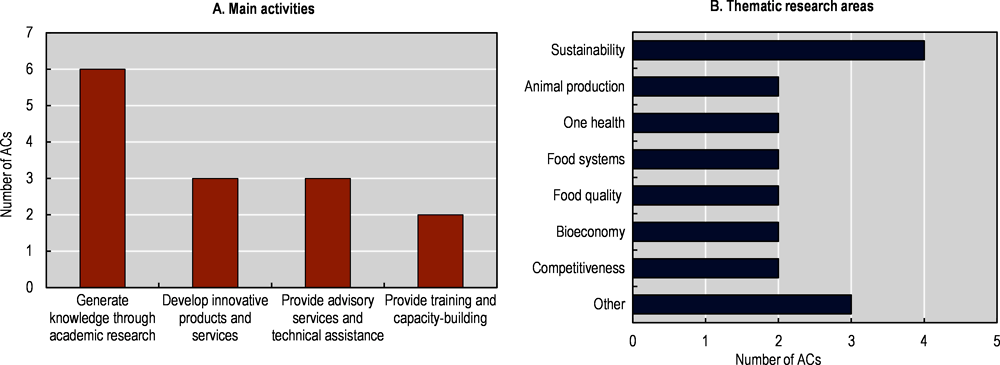

Altogether, the regional centres employ more than 3 500 people, including more than 850 researchers, and manage a budget of over EUR 250 million for personnel costs, infrastructure, and R&D&I.5 In addition, some of the regional centres have additional functions beyond research, such as advisory services, testing laboratories, analysis services and ensuring food quality, among others. Figure 3.4 (left panel) shows that almost all the regional agricultural research centres have the aim of generating knowledge through academic research as one of their main activities. Others also aim at developing innovative products and services, providing advisory services and technical assistance, and providing training capacity building. In the right panel of Figure 3.4, we observe that half of the responding regions have sustainability as one of the thematic research areas. Animal production, one health, food systems, food quality, bioeconomy, and competitiveness are thematic research areas mentioned by less ACs, but nonetheless relevant.

The development of the regional research centres in the last decades has been heterogeneous both in terms of funding levels and staff increase. This has led to divergences not only in terms of the research carried out, but also in terms of transfer of results and advisory services. Some ACs such as Catalonia, Andalusia or the Basque Country have very robust centres, while the centres of other ACs have lost relevance due to the low public investment and lack of a clear commitment from some regional governments with agricultural innovation.

Figure 3.4. Sustainability is an important research area for some regional centres

Note: Partial results based on the replies of the following Autonomous Communities: Aragón, Asturias, Basque Country, Cantabria, Catalonia, Castile and León, Galicia, and Madrid.

Source: OECD (2022[16]).

Table 3.2. Regional agricultural research centres have different sizes and legal forms

Regional agro-food institutes belonging to the regional agricultural research centres-AC network

|

Region |

Name of the institute |

Legal status |

Staff |

|---|---|---|---|

|

Andalusia |

Institute for Research and Training in Agriculture, Fisheries, Food and Ecological Production (IFAPA) |

Independent body |

797 |

|

Aragón |

Agro-food Technology and Research Centre (CITA) |

Public-law entity |

249 |

|

Asturias |

Regional Agro-food Research and Development Service (SERIDA) |

Public research organisation |

169 |

|

Balearic Islands |

Agriculture and Fisheries Research and Training Institute (IRFAP) |

Administrative organisation with no legal personality |

14 |

|

Canary Islands |

Canarian Institute for Agricultural Research (ICIA) |

Independent body |

140 |

|

Cantabria |

Agricultural Research and Training Centre (CIFA) |

Administrative unit |

32 |

|

Castile-La Mancha |

Regional Institute for Agro-food and Forestry Research and Development (IRIAF) |

Independent body |

204 |

|

Castille and León |

Castilla-León Agricultural Technology Institute (ITACyL) |

Public entity subject to private law |

144 |

|

Catalonia |

Institute for Research and Technology in Food and Agriculture (IRTA) |

Public company under private law |

882 |

|

Extremadura |

Extremadura Scientific and Technological Research Centre (CICYTEX) |

Public-law entity |

259 |

|

Galicia |

Galician Agency for Food Quality (AGACAL) |

Public agency |

331 |

|

La Rioja |

Directorate-General for Research and Rural Development |

Administrative unit |

... |

|

Madrid |

Madrilenian Institute for Agricultural Research and Agriculture and Food Rural Development (IMIDRA) |

Independent body |

335 |

|

Murcia |

Murcia Institute for Agriculture and Food Research and Development (IMIDA) |

Independent body |

190 |

|

Navarra |

Navarrese Institute for Agro-food Technology and Infrastructure (INTIA) |

Public company |

223 |

|

Basque country |

NEIKER Tecnalia, Basque Institute for Agricultural Research and Development |

Public company |

191 |

|

Valencia |

Valencia Institute for Agricultural Research (IVIA) |

Independent body under private law |

222 |

Source: Authors, based on expert’s input and websites of the regional agricultural research centres.

Over the last 20 years, many ACs have developed their agricultural research management, aiming to enhance the autonomy of the research centres through the creation of organisations with their own legal personality to have greater operational capacity to achieve their goals within the AC. These changes aimed at finding more agile and specialised practises for staff management, promoting public-private collaboration, and facilitating access to funding. Some centres have adopted the form of societies and public companies with greater autonomy for economic and staff management. Others took the form of agencies or other bodies governed by public law; these have been more affected by public expenditure and recruitment limitations established in the aftermath of the 2008 economic crisis.

Most of the regional agricultural research centres are agencies or bodies governed by public or private law (Table 3.2). In the regions with more developed systems, they tend to be public companies. For instance, this is the case of the INTIA in Navarra, the NEIKER in the Basque country and the IRTA in Catalonia.

3.2.5. The role of the agricultural research centres as agents of knowledge generation and transfer

The INIA is the co-ordinator of the regional agricultural research network, though successive reforms have limited its role and competences

Different reforms enacted since the 1980s have caused the INIA to lose some of its competences. As part of the decentralisation process, the responsibilities around agriculture were transferred to the ACs. This included the transfer of research material, human, and budgetary resources from the national level, with the purpose of building the regional research services. The ACs took on very broad powers in agricultural research. Among them are directing and managing the research units transferred; implementing national research projects and those linked to international agreements; processing agricultural research projects of interest for their territories; selecting, implementing, monitoring and controlling agricultural research projects not included in the national programmes; co-ordinating agricultural research, experimentation, dissemination and information in their territories; and negotiating and reaching agricultural research and experimentation agreements with public and private entities.

The responsibilities maintained by the national government maintained include: establishing the basic national objectives and general guidelines for agricultural research policy; directing and managing the units that were not transferred to the regions; implementing research projects under the responsibility of these units; co-ordinating the projects included in the national agricultural research programmes; maintaining international scientific relations in the area of agricultural research; and disseminating the results of national agricultural research programmes (Fundación Alonso Martín Escudero, 2003[17]).

The Co-ordinating Commission on Agricultural Research was created in 1987. This collegial body involves the central state administration through the INIA (which holds the presidency), the ministry in charge of the public administration, the MAPA and the representatives from the 17 ACs. The INIA was chosen as co-ordinator because it had been leading agricultural research through the Regional Centres for Agricultural Research and Development until the transfer of responsibilities to the regions.

Up until 2017, the INIA acted as a research centre and a funding body for the regional research centres, managing calls for proposals, for pre and postdoctoral researchers, for infrastructure and to invest in machinery, laboratory equipment, etc. These calls were vital for the regional centres – especially the less competitive ones and those that received less funding – as they allowed them to fund research directed at the problems of regional agriculture through restricted calls where they did not have to compete with public research organisations, universities and others. In 2017, INIA’s funding competences were transferred to the AEI, and the INIA only maintained its research responsibilities. In 2021, the INIA merged into the CSIC, losing its status as a public research organisation of the MCIN. This watered down its importance within the AKIS and its capacity to effectively lead and co-ordinate the network of regional research centres. Responsibility for the INIA has also been assigned to different ministries: while it initially belonged to MAPA, it was later transferred to the Ministry of Education, and later to the MCIN, under which it currently operates.

The existence of a decentralised set of research centres can be a source of strength and diversity to the extent that they are integrated through adequate mechanisms to facilitate the flow of knowledge and the co-operation in innovation activities. A scattered set of resources that are not aligned through a strategic vision of priorities may undermine the capacity of the innovation system to respond to the big challenges ahead of the agro-food sector.

3.2.6. The role of the private sector

The private sector has an increasingly important role promoting innovation…

The agro-food private sector comprises a variety of players: companies of different sizes, from SMEs to multinational enterprises, industry associations, farmers, farmers’ organisations, and agro-food co-operatives. These actors play a key role in the adoption of new technology and the promotion of innovation in the agricultural sector.

Agro-food companies often have links with the business-supporting public authorities and research centres to facilitate knowledge flows and the promotion of their innovations. They do so, for example, by participating in the EIP-AGRI funding lines implemented both at a supra-autonomous level by the MAPA and at an autonomous level by the ACs. By including the participation of the private sector, operational groups seek to engage companies in the innovative project, for it to respond to a need of the sector and to improve the adoption of innovations.

Another example are public-private partnerships through technology platforms or Agro-food Clusters/Innovative Enterprise Clusters (IEC). Technology platforms are industry-led exchange networks where relevant actors of the AKIS collaborate on technological research and innovation needs. In Agro-food Clusters/IECs, companies collaborate with public/private research and training centres on specific topics of the sector within a region. Such initiatives are often promoted by the national administration (MINCOTUR). There exist several examples of agro-food technology platforms (Wine Technology Platform, Spanish Technological Platform for Plant Biotechnology, Spanish Technological Platform for Biomass – BIOPLAT, Spanish Technology Platform Food for Life – Spain), and agro-food clusters or IECs (INOLEO, AEI of the olive sector, AGROFOOD, Agro-food Cluster Foundation of the Region of Murcia, VITARTIS, Association of the Food Industry of Castilla y León, CLUSAGA, Food cluster of Galicia) (i2Connect, 2020[8]).

The Spanish Federation of Food and Beverages Industries (FIAB) is another example of a private sector organization promoting innovation. This federation groups almost fifty associations and represents the Spanish agro-food industry while working on the future challenges of the sector. It aims at promoting and fostering the sector economically, socially, and environmentally, with innovation at the core of its activities. To promote business innovation, FIAB collaborates with companies and actors that perform research to boost R&D&I in the industry. At the national level, FIAB is actively engaged in some of the public administration’s R&D&I projects, tackling issues concerning the consolidation of public-private collaboration in R&D&I.6 In collaboration with MAPA and the Plataforma Tecnológica Food for Life-Spain (PTF4LS), FIAB gives out the Ingenia Startup Prizes, rewarding innovation and entrepreneurship efforts in private R&D&I efforts.7

There are also important technological centres such as the National Centre for Technology and Food Safety (CNTA), the Extremadura National Agro-Food Technological Centre (CTAEX), and the Technological Institute of Food (AINIA), a private technology centre with more than 30 years of experience in R&D&I (Box 3.1). The Spanish Federation of Technology (FEDIT) has worked since 1996 to encourage innovation, technology development and private research so as to increase the competitiveness of companies by improving technology via 43 technology centres across the country.

In addition to agro-food companies, Professional Agricultural Organizations (OPAs) and agro-food co-operatives play a key role in knowledge transfer and innovation on the farm . In particularly, several OPAs work closely with farmers, acting on their behalf , and as the bridge linking research, politics, and farmers as recognised partners of the government. There are three main OPAs: the Co-ordinator of Organizations of Farmers and Stockbreeders (COAG), the Agricultural Association of Young Farmers (ASAJA), and the Union of Small Farmers (UPA).

Box 3.1. AINIA

Adding to the country’s R&D efforts are private technology and research centres, such as AINIA, based in Paterna (Valencia). AINIA aims at increasing companies’ competitiveness by means of innovation, and offers consulting, specialised training, analytical services, and certified industrial services besides its research activities. The private technology centre has 700 associated companies and 1 600 clients and is driven by its values of sustainable development, integrity, personal connection, and profitability for growth. With over 230 staff members, it conducts innovation-targeting research in a series of areas, including food-related topics, as well as sectors such as cosmetics, packaging, and pharmacy. Specific research and innovation relate to the future of food studies, fermented foods, plant-based foods, and alternative proteins, among others. Underscoring its commitment for a sustainable society, AINIA is a member of the United Nations Global Compact for sustainability and has received awards for SDG 6-related efforts and for its commitment to equality.

Source: https://www.ainia.es/.

… but the role of the private sector still depends on the interaction with public entities and on public R&D&I for knowledge generation

Although private companies have taken on an increasingly relevant role in the Spanish AKIS, it is still below international comparatives. Spanish companies leave most of the responsibility for high-level knowledge generation to the public sector (OECD, 2021[4]). Therefore, the AKIS is highly government-driven, and private innovative outputs to promote a sustainable agro-food sector are low. Among the reasons for the low private sector contribution is the low rate of collaboration between private business actors and public research. The limitation in the usage rights of research results from public funding is one of the reasons. Another reason is the limited scope of the central government’s R&D programmes financing, which are not necessarily tailored to the private sector’s needs.

Private investments are still low, especially considering that the mobilisation of private funding for R&D&I activities will be critical to sustain investments once European recovery funds run out, and a prerequisite to avoid a sharp funding reversal as damaging as that caused by the global financial crisis (OECD, 2021[4]).

3.3. Policies facilitating innovation

3.3.1. Public and private investments in agricultural R&D

Total research and development (R&D) funding in Spain is mostly financed and performed by the business sector

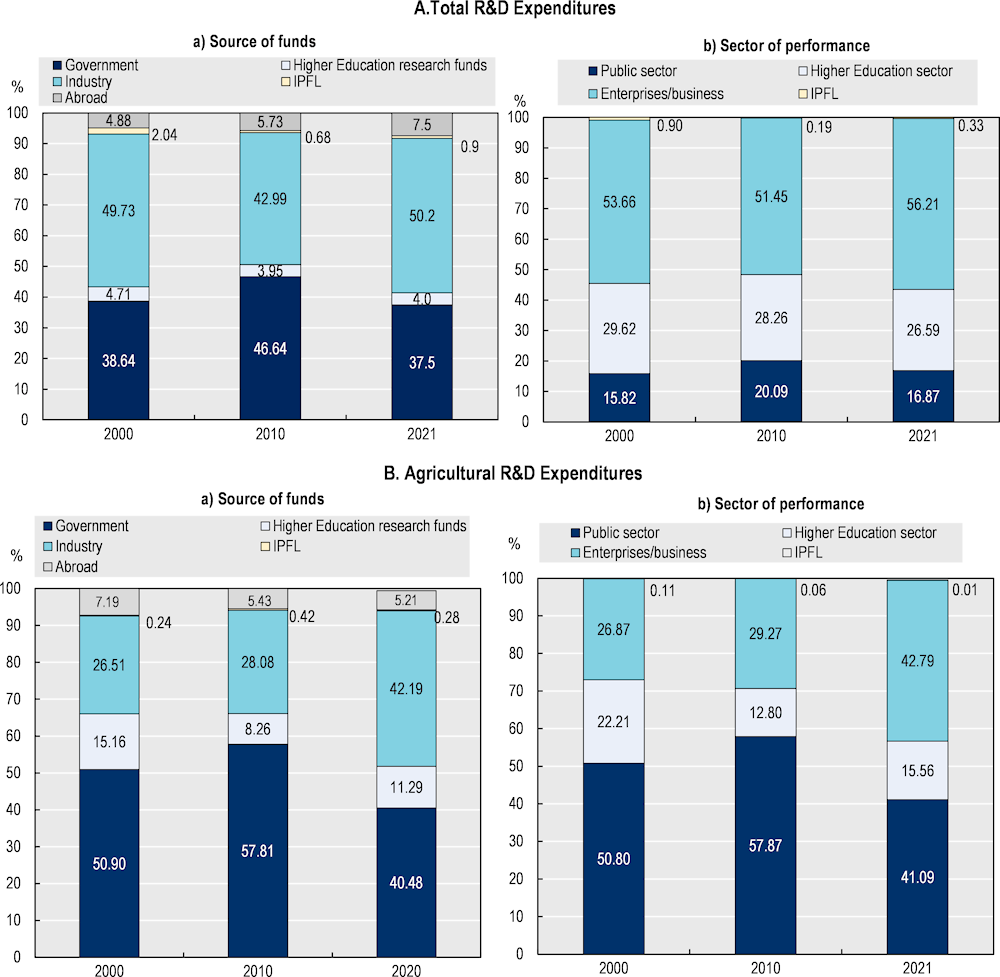

The business sector is the main source of funding for R&D (upper panel of Figure 3.5), accounting for 50.2% of the funds (2021), followed by the government (37.5%). It is also the main actor undertaking R&D activities (56.2%), followed by the higher education sector (26.6%) and the government (16.9%).

Figure 3.5. Business is the main source of funds for agricultural R&D

Notes: Agro-food sector includes Agriculture, livestock, forestry and fishing, and Manufacture of food, beverages and tobacco (Classification CNAE 10,11,12). IPFL refers to non-profit private enterprises. Abroad includes funds from European Union Funds. 2021 figures are estimated.

Source: Authors’ calculation based on INE (2021) (Estadísticas sobre actividades en I+D). https://www.ine.es/dynt3/inebase/es/index.htm?padre=8853&capsel=8859.

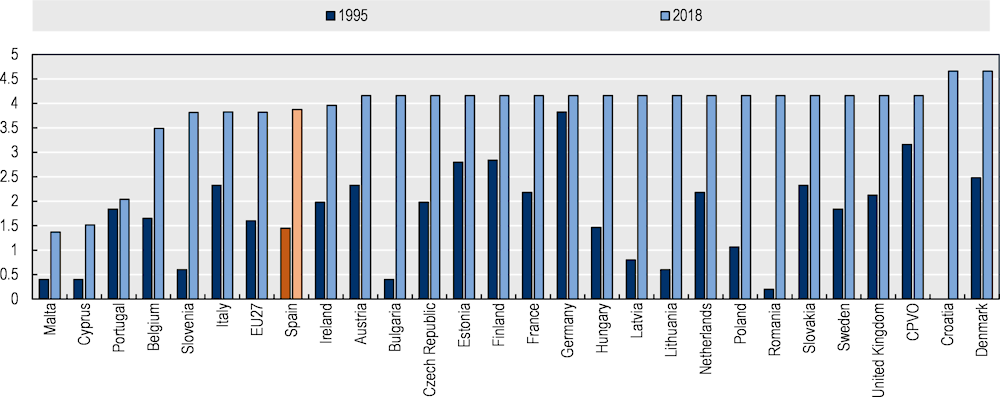

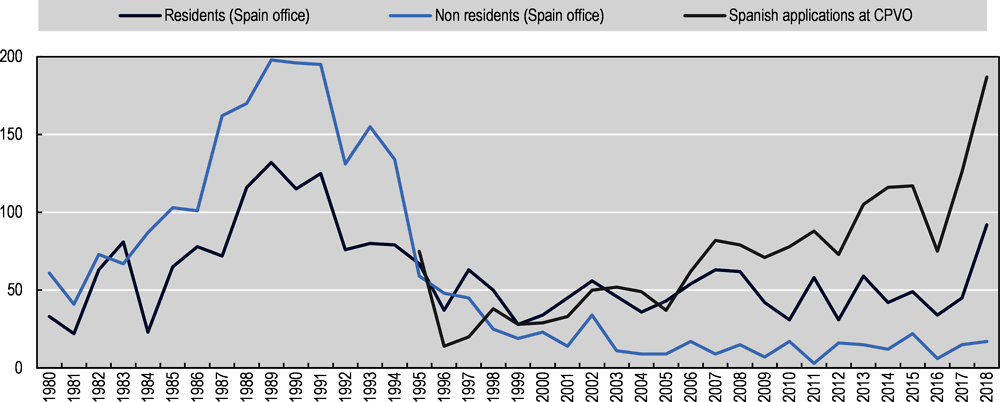

In the specific field of agro-food, the source of funds changed significantly in recent years (lower panel of Figure 3.5). The share of the government decreased with respect to previous years while the share of the business sector notably increased from 26.5% in 2000 to 42.2% in 2021. Agro-food companies stand out as important investors in R&D, however, the number of innovative firms in the agro-food sector has decreased in the last ten years (MAPA, 2022[11]). According to the National Statistics Institute’s (INE) Innovation in Businesses Survey, which includes companies with more than ten employees, there a total of 2 103 companies in the agro-food sector (Agriculture and Forestry, and Food, Beverages, and Tobacco) were carrying out innovation activities in 2020 with an expenditure of EUR 959 million. The data show that 22.5% of companies in the Food and Beverages sector invest in R&D activities, higher than many other manufacturing sectors in Spain (Instituto Nacional de Estadística, 2020[18]). This not the case, however, in the primary sector, where only 7.4% of firms with more than ten employees invest in R&D and innovation activities, which is below the average of all sectors.

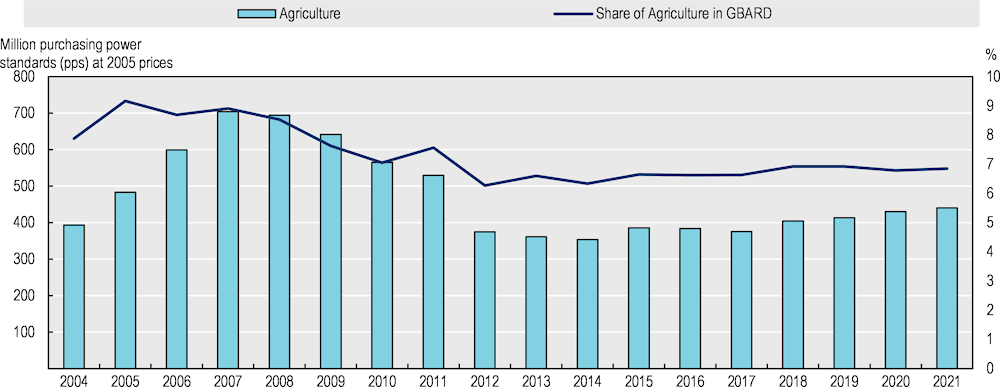

Agricultural R&D investments are relatively high, but the levels are well below those existing before 2008

The Spanish Government supported R&D aimed at promoting agriculture with nearly 7% of the entire R&D budget in 2021 (Figure 3.6). This significantly exceeds the EU27 average of 3%. An additional percentage is dedicated to support agricultural and veterinary science through funding for the general advancement of knowledge.

Figure 3.6. Government funds for agricultural R&D have not recovered their pre-crisis levels

Note: Government budget allocation for R&D (GBARD) is a funder-based approach for reporting R&D, which involves identifying all the budget items that may support R&D activities and measuring or estimating their R&D content. It enables linking these budget lines to policy considerations through classification by socioeconomic objectives. However, it provides only a partial indicator of investment in public agricultural research, since it refers to research funding instruments dedicated specifically to agriculture.

Source: Authors’ calculation based on Eurostat (2022), [Joint OECD-Eurostat international data collection on resources devoted to RD] GBARD by socioeconomic objectives (NABS 2007) (database), [GBA_NABSFIN07], (Eurostat, 2022[19]) (accessed August 2022).

However, resources directly allocated to R&D for agriculture decreased in real terms from their peak in 2007 at a faster rate than the entire R&D budget between 2007 and 2021, with the main decline following the financial crisis of 2008 and continuing until 2014. Since 2017, the total government budget allocation for R&D for agriculture has been slowly increasing in real terms, although there is still a large difference with respect to the pre-crisis levels.

Agricultural R&D intensities are below the EU average although higher than in Italy and France, but low shares go to the private sector

Spain’s overall gross domestic expenditure on R&D (GERD, which covers public and private expenditure on R&D carried out by all residents in a country) increased by 18% in real terms between 2006 and 2019 (OECD, 2022[20]). It reached 1.4% in 2019, below the 2.2% of the European Union (Table 3.3). This level was comparable with those of Italy, Portugal and Canada, but significantly lower than in the Netherlands, France, and Germany.

Table 3.3. The agricultural R&D intensity in Spain is close but below the EU average

|

Field of R&D |

All |

Agriculture |

All |

Agriculture |

All |

Agriculture |

Food and beverages |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Sector of performance |

All sectors |

Public (government and higher education) |

All sectors |

All sectors |

Business |

Business |

Business |

|||||||

|

Source of funds |

All sources |

All sources |

Government |

Government |

All sources |

All sources |

All sources |

|||||||

|

Indicator |

GERD1 total as a % of GDP |

Public GERD on Ag. science2 as a % of sector’s value added |

GBARD3 total as a % of GDP |

GBARD on Agriculture4 as a % of sector’s value added |

BERD5 total as a % of GDP |

Agriculture BERD6 as a % of sector’s value added |

Food and beverages BERD7 as a % of sector’s value added |

|||||||

|

|

2006 |

2019 |

2006 |

2019 |

2006 |

2020 |

2006 |

2020 |

2006 |

2020 |

2009 |

2019 |

2009 |

2019 |

|

EU27 |

1.70 |

2.20 |

... |

... |

0.66 |

0.77 |

1.42 |

1.33 |

1.07 |

1.44 |

0.29 |

0.43 |

0.86 |

0.95 |

|

Spain |

1.18 |

1.36 |

1.41 |

1.21 |

0.67 |

0.62 |

2.42 |

1.34 |

0.65 |

0.78 |

0.23 |

0.31 |

0.86 |

0.90 |

|

Portugal |

0.95 |

1.62 |

1.90 |

1.04 |

0.41 |

0.37 |

0.47 |

0.41 |

0.44 |

0.92 |

0.05 |

0.30 |

1.31 |

1.48 |

|

France |

2.05 |

2.35 |

.. |

.. |

0.79 |

0.74 |

0.79 |

0.93 |

1.29 |

1.56 |

0.49 |

0.59 |

0.83 |

0.85 |

|

Germany |

2.47 |

3.14 |

3.97 |

3.70 |

0.74 |

1.10 |

2.26 |

4.15 |

1.73 |

2.11 |

0.77 |

0.68 |

0.89 |

0.61 |

|

Italy |

1.08 |

1.53 |

1.05 |

0.86 |

0.59 |

0.67 |

1.21 |

0.89 |

0.53 |

0.93 |

0.01 |

0.07 |

0.63 |

0.96 |

|

Netherlands |

1.74 |

2.29 |

1.21 |

2.96 |

0.73 |

0.79 |

1.83 |

1.72 |

0.94 |

1.54 |

0.68 |

1.94 |

2.36 |

2.07 |

|

Canada |

1.94 |

1.70 |

... |

... |

0.56 |

0.49 |

... |

2.04 |

1.1 |

0.86 |

0.59 |

0.38 |

0.71 |

0.49 |

Notes: 2006, 2008, 2019 and 2020 or the nearest available year.

1. Gross domestic expenditure on R&D (GERD) is defined as the total expenditure (current and capital) on R&D carried out by all resident companies, research institutes, university and government laboratories, etc., in a country. It includes R&D funded from abroad but excludes domestic funds for R&D performed outside the domestic economy.

2. Gross domestic expenditure on R&D (GERD) for agricultural and veterinary.

3. Government budget allocation for R&D (GBARD) is a funder-based approach for reporting R&D, which involves identifying all the budget items that may support R&D activities and measuring or estimating their R&D content. It enables linking these budget lines to policy considerations through classification by socioeconomic objectives.

4. Government budget allocation for R&D (GBARD) on Agriculture covers all R&D aimed at the promotion of agriculture, forestry, fisheries and foodstuff production, or furthering knowledge on chemical fertilisers, biocides, biological pest control and the mechanisation of agriculture, as well as concerning the impact of agricultural and forestry activities on the environment. This also covers R&D aimed at improving food productivity and technology. It does not include R&D on the reduction of pollution; on the development of rural areas; on the construction and planning of buildings; on the improvement of rural rest and recreation amenities and agricultural water supply; or on energy measures.

5. Business Expenditure on R&D (BERD) is the measure of intramural R&D expenditures within the business enterprise sector (regardless the sources of R&D funds).

6. Business Expenditure on R&D (BERD) on Agriculture, forestry and fishing.

7. Business Expenditure on R&D (BERD) on Manufacture of food products, beverages and tobacco products.

Source: Authors’ calculation based on OECD (2022[20]), Research and Development Statistics (database), [Gross domestic expenditure on R&D by sector of performance and field of R&D (FORD); Government budget allocations for R&D; Business enterprise R-D expenditure by industry (ISIC 4)]; MSTI Main Science and Technology Indicators (database), [BERD as a percentage of GDP]; and National Accounts (database), [Value added and its components by activity, ISIC rev4], https://stats.oecd.org/ (accessed February 2020).

Similarly, the intensity of the agricultural R&D in Spain from all sources was relatively low and has decreased in time: public gross domestic expenditure on R&D on agricultural innovation represented 1.2% of the sector’s value added, lower than in some EU peers and other leading OECD countries, and lower than the 1.4% shown in 2006. However, an examination of the data by source and sector of performance shows a mixed picture. The government budget allocation for R&D as a percentage of sector’s value added (1.34%) was slightly above the EU aggregate of 1.33% and higher than for France, Italy, the Netherlands, Canada, and Portugal. Moreover, in 2020, the investment from all sources for private R&D as a percentage of the GDP (BERD) was 0.8%, and in 2019, the investment from all sources for the development of private R&D in the agricultural sector (BERD) was of 0.3%, both figures below most OECD countries and the EU27 average. In the food and beverages sector, it was of 0.9% of the sector’s value added, which was close to the EU total and above the shares of Germany and France.

The investment intensities for private R&D in agriculture and in the food and beverages sector have both increased between 2009 and 2019. Conversely, the intensity of the government investment in agriculture (GBARD on Agriculture) has decreased, as has the intensity of the public R&D from all sources.

3.3.2. Digitisation, connectivity, deployment and use of digital technologies

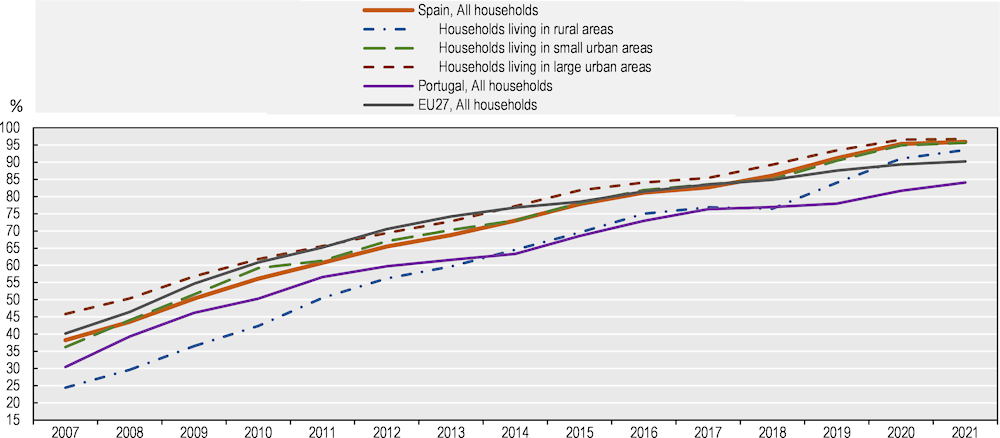

In recent years, Spain made remarkable progress in reducing the gap in access to digital technologies between rural and urban areas

Spain has a generally well-developed communication infrastructure, notably high-quality broadband, such as fibre networks. The country has made considerable progress in improving access and in reducing the difference in access between urban and rural areas.

Less than 40% of households in Spain had internet access in 2007, close to but below the 40% in the European Union, and above the 30% of households in Portugal (Figure 3.7). Coverage has increased dramatically since then, reaching almost 96% in 2021. The average number hid notable differences between the households living in rural areas and those living in small and large urban areas that have been diminishing over time. In 2007, only 25% of the households in rural areas had broadband internet access at home, while 46% of households in large urban areas could access internet at home. Although the gap persisted through the years, it has recently narrowed. In 2021, 94% of households in rural areas, 96% in small urban areas, and 97% in large urban areas had broadband internet access at home.

Figure 3.7. Overall broadband coverage has increased, and the urban-rural gap has narrowed

Source: OECD (2022), Information and Communication Technology database (ICT Access and Usage by Households and Individuals table), http://stats.oecd.org/.

Despite improvements in recent years, the digital divide persists in access to high quality broadband

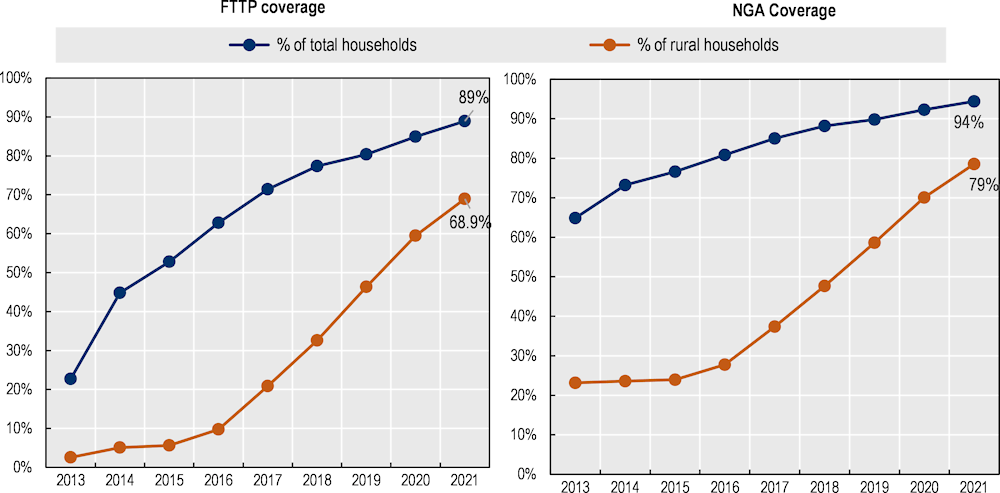

Despite this progress, other indicators still show a gap between rural and urban households’ digitisation. Large differences persist in the coverage of high-quality broadband access and in next generation access, which includes fixed-line broadband access technologies capable of achieving download speeds meeting the EU Digital Agenda objective of at least 30 Mbps coverage (Figure 3.8). The indicator of Fibre to the Premises (FTTP) coverage shows that a gap remains, even if it has become smaller. In 2016, the digital divide in this area was of 53%. In 2021, this difference had narrowed to 20%, as coverage reached 89% of total households and 69% of rural households. Regarding Next Generation Access (NGA), the digital divide also decreased from 53% in 2016 to 16% in 2021.

Figure 3.8. An urban-rural gap in high quality broadband coverage persists, albeit smaller

Note: Fibre to the Premises (FTTP) is a “full-fibre” service, meaning the fibre optic cabling runs all the way into homes. This can deliver incredible performance, but it's costly to install, so coverage is much smaller than FTTC and Virgin Media fibre at present. FTTC is also known as Fibre to the Home (FTTH). Next Generation Access (NGA) includes fixed-line broadband access technologies capable of achieving download speeds meeting the Digital Agenda objective of at least 30 Mbps coverage, such as combination of VDSL, DOCSIS 3.0, and FTTP.

Source: OECD (2022[20]).

According to the SWOT analysis done for the preparation of the new CAP Strategic Plan, this significant gap in connectivity is because the infrastructure deployment plans have so far been based on the distribution of population rather than on the territorial distribution (MAPA, 2021[6]). The private sector is the largest source of investment in communication infrastructure in Spain. Rural and remote areas are less attractive for commercial operators given deployment costs, as core networks are typically located closer to densely populated areas, thus requiring further investment (OECD, 2021[21]).

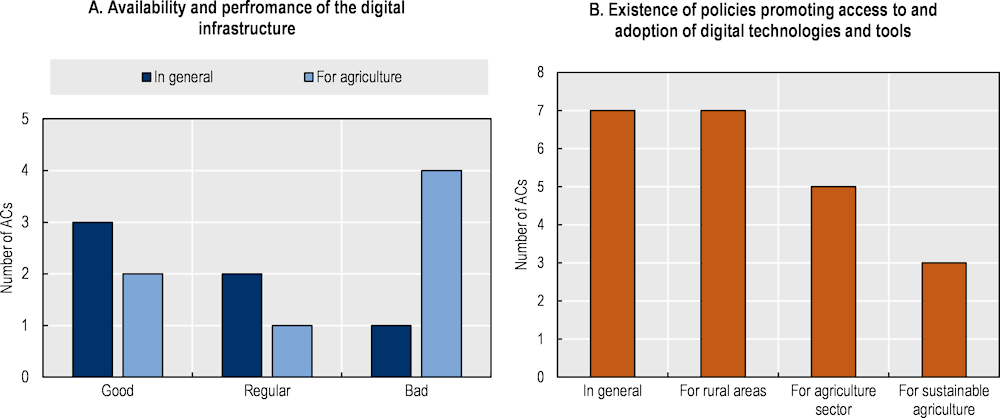

The OECD survey also reveals differences between digitisation in ACs and, within ACs, between agriculture and in general. While availability and performance in general are seen as good, they are mostly perceived as being of bad quality for agriculture. Figure 3.9 shows that the availability and performance of the digital infrastructure in agriculture is evaluated as good in two ACs, regular in one AC, and bad in four (OECD, 2022[16]).Similarly, the survey reveals differences in the existence of policies promoting access to and adoption of digital technologies and tools. All seven ACs that replied to this question have a general policy as well as a specific policy for rural areas. However, five have a specific policy for the agricultural sector and only three have a policy for sustainable agriculture.

The European Commission has recommended that Spain expands broadband coverage in rural and remote areas to achieve the EU Green Deal Target of 100% fast broadband coverage by 2025. Spain should also accelerate the digital transition of its farming sector through large-scale training efforts and by exploiting the most advanced technology to better monitor and optimise agricultural production processes (European Commission, 2020[22]).

Figure 3.9. The availability and performance of digital infrastructure are perceived as worse for agriculture in some ACs

Note: Partial results based on the replies of the following Autonomous Communities: Aragón, Asturias, Basque Country, Cantabria, Catalonia, Castile and León, and Galicia.

Source: OECD (2022[16]).

Beyond coverage, there is another digital divide on skills and the ability to use digital technologies

Several studies have identified a large divide in the use of digital technologies, which is due to both economic and educational factors (OECD, 2021[21]; MAPA, 2021[14]). Although Spain ranks 10th in the EU-27 in terms of digital skills, only 64% of the Spanish population has at least basic digital skills. This is slightly above the EU average, but still far from the goal of 80% of the European population having at least basic digital skills by 2030 (European Commission, 2022[23]). In addition, 36% of the Spanish workforce still do not have basic digital skills, which hinders the progress of the digitisation of companies and the acceptance of advanced digital technologies. The gender imbalance remains significant and the percentage of women among all information and communication technologies specialists is still only 10% (in line with the EU average) (European Commission, 2022[23]).

A recent study revealed that only 3% of farms owners are under 35 years, which indicates that a generational change in Spanish farms is still far off. This generation, the so-called “agro-millennials”, consider agriculture to be a long-term stable job (87%) and express a high level of satisfaction for the daily performance of their professional activity (8.48 out of 10). They are usually informed by social networks (76%) and digital press (55%), and much less by traditional media such as radio (38%), television (36%), and print media (10%). They argue that excessive bureaucracy and access to land are the main obstacles to their generation becoming farmers. They understand digital transformation as a necessary tool to achieving more profitable and sustainable farms (Juventudes Agrarias COAG, 2022[24]). Young people who join the agricultural sector have a higher than average academic education for their generation. Almost four out of ten have a university degree and at least 65% have a bachelor's degree or higher vocational training, compared to 48.7% for the Spanish population overall.

Public and private measures of digitalisation that can help improve farms’ sustainability

The Digitisation Strategy for the Agro-food and Forestry Sector and Rural Areas, which started being developed by MAPA in 2019 and financed by the Next Generation EU Funds through the Spanish Recovery, Transformation and Resilience Plan (RTRP) and the PERTE Agroalimentario, defines the strategic lines and measures necessary to boost digital transformation in the agro-food and forestry sector and rural areas, and the instruments for their implementation. It follows three key objectives: 1) better connectivity between rural and urban areas; 2) better use of agricultural data; and 3) fostering business development and new business models while leveraging the potential of new technologies.

The general aims of these measures are to reduce barriers to the digital transformation of rural areas, encourage the use of data, and promote economic growth and development of new business models. As stated in the European Green Deal and the Farm to Fork strategy, there is a need for a smarter agriculture to improve productivity and reduce the environmental impacts of the sector. To that end, it is essential to improve connectivity and training, so smart solutions can be developed for farmers, businesses, and rural communities.

One of the measures financed by Next Generation EU funds contemplates the implementation of a support programme to encourage the use of precision farming and technologies 4.0 in the agricultural sector, to speed up the modernisation of the equipment and the use of technologies. This is expected to promote a more efficient use of natural resources in production. It also allows the use of equipment that is more energy efficient, increasing the environmental performance of the agricultural sector.

Beyond the Next Generation EU innovation projects of the Spanish RTRP, there are diverse examples of measures and actions to promote digitalisation in agriculture, provide training and advice in digital skills and in information generation and processing, and support digital entrepreneurship.

One example is the development of the farm information system SIEX (Section 1.2.2), which aims to simplify the relations between farmers and the national and regional administrations by integrating all the information that farmers must provide, including the new Digital Farm Notebook for crops and the ECOGAN registry for livestock farms (see also Section 2.4.2).

The Smart Specialisation Platform reports ten Spanish DIHs specialised in the agro-food sector of different characteristics and that are located in different regions: the Andalucía Agrotech Digital Innovation Hub; ARAGÓN DIH; Catalonia Digital Innovation Hub (DIH4CAT); CIDIHUB ‒ Canary Islands Digital Innovation Hub; DATAlife; DIGIS3 Smart Sustainable & CoheSive Digitalization; i4CAMHUB (Innovation for Competitiveness and Advanced Manufacturing); INNDIH: Valencia Region Digital Innovation Hub; IRIS: European Digital Innovation Hub Navarra; and DIH Extremadura Tech4E in Extremadura. The MAPA is working on the creation of a Digital Innovation Hub for the agro-food sector to promote the implementation of digital technologies.

Box 3.2. DATAlife, an example of collaboration for improving digitisation

Three interesting cases of Digital Innovation Hubs (DIH) that stand out are DATAlife in Galicia, IRIS European DIH in Navarra, and Andalucía Agrotech located in Andalusia.