This chapter presents a framework for the assessment of policy, regulatory and institutional settings to help national and subnational governments identify priority reforms that strengthen FDI and SME linkages and their contribution to productivity and innovation. Drawing on good practices from different policy areas and country contexts, it provides a typology of policy instruments that can be used by policymakers and offers guidance on important aspects of policy making.

Policy Toolkit for Strengthening FDI and SME Linkages

2. Tools for policy, regulatory and institutional assessment

Abstract

Introduction

FDI spillovers on domestic SMEs may not materialise automatically. Besides economic and market conditions, public policies and institutional arrangements play an important role in fostering FDI and SME linkages. The quality of the legal and regulatory environment affects the capacity of SMEs to scale up, innovate and join GVCs; it also determines whether a country can attract and embed knowledge-intensive investment that creates spillovers for the host economy. A number of more targeted business support policies can also foster dynamic FDI-SME ecosystems and strengthen the diffusion of knowledge, technology and skills in local economies. Many of these policies are implemented by multiple institutions at different levels of government and belong to different policy domains, i.e. relating to investment promotion, SMEs and entrepreneurship, innovation, and regional development. These laws, regulations and policy initiatives cannot be considered in silos but in the framework of an adequate and coherent policy mix. The main challenge for governments is to ensure that the policy mix takes into account the country’s economic structure and specialisation, industrial capabilities, technological sophistication and economic geography.

The “policy mix” concept refers to the set of policy rationales, arrangements and instruments implemented to deliver one or several policy goals, as well as the interactions that can possibly take place between these elements (Meissner and Kergroach, 2019[1]). An effective policy mix can make use of various policy instruments (e.g. financing, technical support, regulation, rewards and incentives), address several strategic objectives, and cut across different policy domains, reflecting the many pathways to achieving knowledge diffusion from foreign MNEs to local SMEs. It places emphasis on questions of completeness, balance and interaction among strategic objectives, policy goals, instruments, sectors and populations targeted, and institutional actors involved. These policy mix components should be used in complementary and mutually reinforcing ways to achieve the desired outcomes, i.e. strengthening FDI and SME linkages and their impact on productivity and innovation.

The Tools for policy, regulatory and institutional assessment allow policymakers to conduct a thorough assessment of policy initiatives, from national strategies and regulations to financial incentives and technical assistance programmes, to enable FDI and SME linkages. It outlines what institutional settings, regulatory conditions, policies and programmes are important ingredients of an effective policy mix, and provides guidance on important aspects of policy design and implementation, including the sectoral and geographical scope of implemented measures, their degree of selectivity (e.g. SME targeting), the conditions attached to business support schemes, their mode of implementation, and governance framework. The guidance is complemented with a checklist of questions and a list of indicators and other sources of policy information that allow for an assessment of these policy dimensions.

The governance framework for FDI-SME policies

Policy coordination across the investment, SME, innovation and regional development policy areas is necessary to support FDI-SME ecosystems

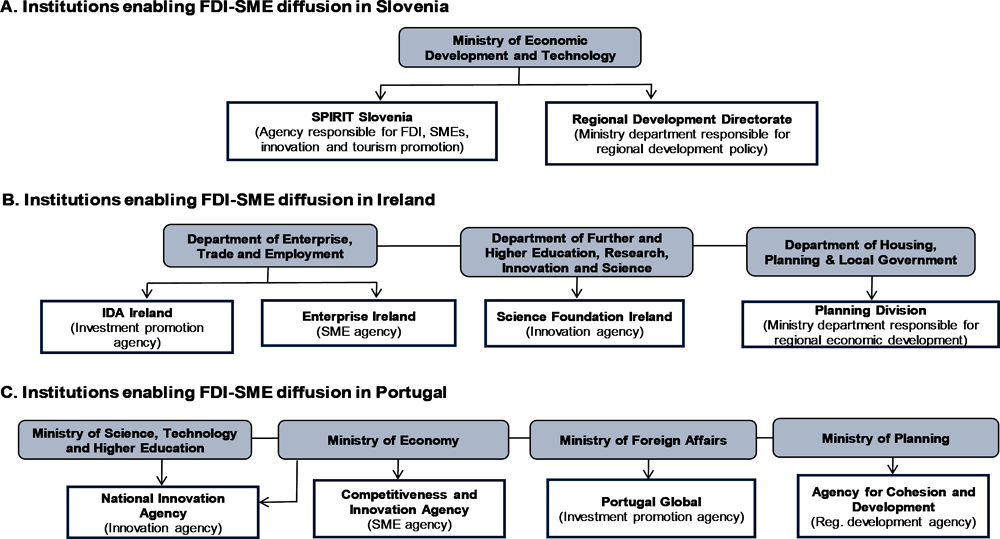

Strengthening FDI and SME linkages and their impact on innovation and productivity requires public action to be taken in different policy domains related to investment promotion, SME development, innovation and regional development. The institutional framework that governs these policy areas differs from country to country (Figure 2.1). In many EU Member States, several implementing agencies operate across these policy areas under the supervision of different ministries. Such institutional settings may induce more complex governance systems with higher risks of information asymmetry, transaction costs and trade-offs. In contrast, other governments (e.g. Croatia, Finland, Lithuania, Slovenia), target the entire FDI-SME ecosystem through a single Ministry or implementing agency to facilitate interaction and synergies across policy areas.

Different governance structures are feasible and one institutional setting is not necessarily better than another as long as appropriate coordination mechanisms are in place to ensure policy alignment across Ministries, implementing agencies, advisory bodies and subnational authorities. Although coordination is a fundamental and longstanding problem for public administration, there is still no standardised method for approaching related issues, and much of the success or failure of attempts to coordinate appear to depend upon country contexts, including the complexity of the institutional environment, the coordination instruments at play, the working culture and incentives for civil servants and public administration staff to collaborate (Peters, 2018[2]).

Figure 2.1. Institutional arrangements for FDI-SME linkages and spillovers in selected EU Member States

Irrespective of the complexity of the institutional setting, the set-up of effective inter-institutional co-ordination mechanisms at the strategic (i.e. policy design) and operational (i.e. policy implementation) levels is key. Instruments of coordination can be formal or informal; based on regulation, incentives, norms and information sharing; top-down relying on the authority of a lead government actor or bottom-up and emergent (Peters, 2018[2]). For instance, high-level policy councils bringing together line ministries and implementing agencies responsible for investment, SME, innovation and regional development policy can help identify priority areas where cross-ministerial policy planning and decision-making is necessary. In many countries, these councils are also responsible for the overall coordination, monitoring and evaluation of national strategies while others have been given broader mandates to foster policy dialogue, convene stakeholders and issue opinions on policy and legislative initiatives (OECD, 2022[4]). In highly fragmented governance settings, where a large number of institutional actors are involved in investment promotion and SME policy, the Centre of Government, i.e. the office serving the highest level of the executive branch of government (e.g. presidents, prime ministers), can also play an important role in bridging bureaucratic boundaries across ministries and improving the enforcement of policy decisions (OECD, 2018[5]). At the policy implementation level, the establishment of inter-agency working groups, committees and task forces can help policymakers pool resources from different parts of government to effectively advance their policy agendas. Inter-agency joint programming can foster a culture of cooperation among civil servants and facilitate the implementation of government initiatives that span several policy areas.

Finally, national strategies and action plans are important instruments for ensuring policy coherence as they are cross-cutting in nature and often require whole-of-government responses to ensure their effective implementation. The development of national strategies also involves public consultations and policy dialogue with various stakeholders, which can serve as an effective bottom-up approach to policy planning and coordination. Although investment and SME policy considerations are often mainstreamed in broader economic reform programmes, adopting dedicated national strategies on investment promotion, SME development and innovation can help overcome policy silos and create an integrated vision across government. As part of their policy response to the supply chain disruptions caused by the COVID-19 pandemic, both Ireland and the Czech Republic have recently developed an SME and entrepreneurship strategy, focusing on strengthening SME productivity, internationalisation and innovation including through linkages with foreign MNEs (OECD, 2021[6]). Such strategic documents allow policymakers to set out quantifiable targets, specific policy pillars, related programme actions and clearly defined roles for all the institutions involved in their implementation. They constitute, therefore, important tools to enhance collaboration among different government actors whose role is important to enable FDI-SME linkages and spillovers.

Effective multi-level governance is key to enabling FDI-SME linkages in local economies

Policies that enable FDI-SME linkages can be introduced by various levels of government, including at the regional and local levels. Robust multi-level governance arrangements, i.e. institutional frameworks and territorial governance processes that clearly assign responsibilities and mandates among national, regional and local governments, are therefore instrumental in the effective implementation of policies enabling FDI-SME linkages (OECD, 2017[7]). Such policy interventions often require synergies among various levels of government and complementary expertise from subnational actors who have better knowledge of local market needs and greater potential to interact with local business enterprises, foreign or domestic. Responsibilities assigned to different government levels should therefore be clearly defined to reduce potential duplication and overlaps.

Although establishing sound multi-level governance arrangements is of utmost importance, it is often context-specific and can vary by country, region and policy area (OECD, 2019[8]). There are wide cross‑country disparities in the way responsibilities and mandates are organised between central government institutions and subnational actors. In some countries where inter-institutional coordination is limited, local presence of national implementing agencies in the form of secondary offices may be crucial to ensure that local SMEs in all regions can benefit from tailored support and that foreign investors have access to aftercare services. In other cases, national agencies coordinate activities with subnational actors such as local governments and regional development agencies, who possess knowledge of the local context. In more than two thirds of OECD economies, significant decentralisation reforms have been implemented over the past decades, resulting in an increase in the economic importance of subnational authorities (OECD, 2019[8]). For instance, Belgium, Denmark, Latvia, and Poland largely deliver business development services through subnational governments (OECD, 2019[9]). Likewise, in France, the national IPA collaborates with local autonomous agencies that provide aftercare services to foreign firms in specific regions (OECD, 2018[10]). In these cases, coordination and collaboration with subnational governments is necessary to ensure an end-to-end service to foreign and domestic firms.

The involvement of subnational governments in the design and implementation of policies enabling FDI‑SME linkages can help unlock the growth potential of the territories where these are implemented by drawing on the knowledge and expertise of local actors and linking investment promotion and SME policies to local development strategies (Larrea, Estensoro and Pertoldi, 2019[11]). Proximity can be a strong enabling factor of efficient policy delivery. Recent findings from EU countries show that FDI responds better to the activity of Investment Promotion Agencies (IPAs) operating in closer proximity to investors’ operations (Crescenzi, Di Cataldo and Giua, 2019[12]). Similarly, the availability of appropriate business development services is a local issue because SMEs and entrepreneurs generally access the services within a narrow local area (e.g. approximately 50 kilometres) and are therefore dependent on the quality of local supply (OECD, 2019[9]). Subnational governments should have the necessary financial, human and organisational capacities to participate in whole-of-government policy-setting exercises such as those required by the EU’s smart specialisation framework and play a strategic role in policy design and implementation. This is particularly important for economically weaker regions that may face challenges in mobilising public and private actors in support of local FDI-SME ecosystems.

Aiming for more systematic impact assessments and consulting with foreign investors and local SMEs can improve the effectiveness of the policy mix

Policy evaluations are important instruments to assess the effectiveness of policies enabling FDI-SME linkages, identify potential policy gaps and make adjustments to the policy mix. Some countries have made major steps in recent years to assess the impacts of new laws and regulations on SMEs through ex ante regulatory impact assessments and SME tests (OECD, 2021[13]). However, widespread and systematic SME policy evaluations continue to be lacking (OECD, 2019[14]). Similarly, in a recent OECD survey of 32 investment promotion agencies (IPAs), only 28% of them reported having undertaken quantitative impact evaluations of their services while relatively few use sustainability-related key performance indicators (KPIs) to monitor and evaluate their investment promotion activities (Sztajerowska and Volpe Martincus, 2021[15]).

For many EU and OECD countries, the development of better systems to track and collect reliable statistical data based on international standards is a pre-requisite for effective monitoring and evaluation. Such data often exist within different parts of the public administration. Collaboration among government bodies responsible for investment promotion, SME development, innovation and regional development –for instance through the organisation of joint evaluation exercises, open access to government databases, and sharing of information on supported businesses – can ensure that relevant and reliable information on the impact of policy interventions is available. This is particularly important when measuring impacts on SMEs, which are affected by measures introduced by different parts of the government in multiple policy areas (e.g. taxation, business regulation, competition, social security) (OECD, 2019[14]). The OECD Framework for the Evaluation of SME and Entrepreneurship Programmes and Policies provides governments with a guiding tool for monitoring and evaluating SME and entrepreneurship policies, including national and local programmes as well as cross-cutting initiatives, whose monitoring and evaluation (M&E) requires a whole-of-government approach (OECD, 2023[16]).

The implementation of comprehensive M&E frameworks requires the use of quantifiable outcome-based indicators and robust internal capacities to execute whole-of-government policy assessments. For instance, although the majority of investment promotion agencies favour qualitative evaluation methodologies (e.g. benchmark comparisons, client surveys, stakeholder consultations), such assessments provide only partial information and incomplete or ambiguous results (OECD, 2018[10]). Qualitative tools should ideally be complemented by more quantitative and systematic approaches that integrate sustainability-related KPIs (e.g. econometric impact evaluations, cost-benefit analyses). In the case of IPAs, this would mean using a variety of outcome-based indicators that capture the contribution of supported investment projects to productivity growth, innovation and the capacities of local SMEs. Governments should ensure that implementing agencies have the necessary capacities to systematically collect reliable data and contribute to policy evaluations throughout the policy cycle (ex ante; mid-term; ex post). Capacities for analysis can be supported through the provision of specialised training to raise education and awareness of public servants on M&E good practices.

Beyond policy evaluations, active engagement and consultation with foreign investors and local SMEs is necessary to enhance the effectiveness of policies enabling FDI-SME linkages. Through their interactions with the private sector, government actors are able to understand the challenges and expectations of foreign investors and local SMEs, receive feedback on the relevance of their policy programmes, and enrich policy-making processes with insights from various stakeholders. Mechanisms for regular public-private dialogue within specific sectors and supply chains could be combined with bottom-up communication processes to ensure that local level market needs and perspectives are fed into higher level policy processes. Emphasis can be placed on raising awareness of participatory processes among potentially under-represented segments of the business population, such as young firms and start-ups, which may have less resources to engage in discussions with the public administration.

Assessment tool

Box 2.1 includes a checklist of questions allowing policymakers to assess the governance framework and identify options to ensure clarity in institutional roles and coordination on policy issues affecting the potential for FDI-SME linkages.

Box 2.1. Checklist of questions to assess the governance framework for FDI-SME policies

Are there dedicated national strategies that articulate the government’s action on investment promotion, SME development, innovation and regional development? If yes, do these strategies set out specific policy priorities, actions and institutional arrangements to strengthen FDI-SME linkages?

Are responsibilities across ministries and implementing agencies on investment, SME, innovation and regional development clearly defined, and mutually understood by all actors?

Is there horizontal coordination between different ministries and implementing agencies involved in the design and implementation of policies enabling FDI-SME linkages? Are coordination mechanisms formal (e.g. inter-ministerial councils, working groups, inter-agency committees, joint programming) or informal?

What coordination mechanisms and institutional arrangements are in place to ensure effective multi-level governance?

Are the mandates and internal governance structures of coordinating bodies clearly defined and supported with sufficient human and financial resources?

Do national implementing agencies responsible for investment promotion, SME policy and innovation operate at the subnational level (e.g. through secondary offices)?

What is the role of subnational governments in the design and implementation of FDI-SME policies? Do they have sufficient resources and capacities to fulfill their responsibilities and complement policy efforts undertaken at the national level to strengthen FDI and SME linkages?

Do relevant institutions systematically evaluate the effectiveness of policy initiatives in promoting FDI-SME linkages? Do implementing agencies have the necessary analytical capacities to monitor and collect information on the impact of their FDI-SME policies?

Are there formal or informal mechanisms for policy dialogue with foreign firms, local SMEs and other actors of the domestic research and innovation ecosystem?

The governance framework for FDI-SME spillovers can be measured and monitored through a range of internationally comparable indicators as well as OECD policy surveys that allow for a qualitative assessment of key governance dimensions, as described in Table 2.1.

Table 2.1. Examples of policy instruments for improving the governance framework and key assessment tools

|

Policy instruments |

Indicators and key assessment dimensions |

Source |

|

|---|---|---|---|

|

Governance |

Centre of Government |

Government Office/Prime Minister’s Office (GO/PMO) expertise (index) |

Sustainable Governance Indicators |

|

Implementing agencies |

Effective policy implementation (index) |

Sustainable Governance Indicators |

|

|

High-level inter-ministerial councils |

Inter-ministerial coordination (index) |

Sustainable Governance Indicators |

|

|

Inter-institutional committees, working groups and task forces |

Availability and quality of coordination mechanisms (qualitative assessment) |

EC/OECD Survey of Institutions and Policies enabling FDI-SME Linkages |

|

|

National strategies and action plans |

Assessment of strategic frameworks for investment promotion, SMEs, innovation and regional development (qualitative assessment) |

EC/OECD Survey of Institutions and Policies enabling FDI-SME Linkages |

|

|

Multilevel governance systems |

Subnational government structure and finance (database) |

OECD Regional Statistics Database |

|

|

Policy evaluations and programme reviews |

Frequency, quality and transparency of regulatory impact assessments and ex post evaluations (index) |

OECD Regulatory Policy & Governance Indicators |

|

|

Use of evidence-based instruments (index) |

Sustainable Governance Indicators |

||

|

Policy dialogue and consultation mechanisms |

Stakeholder engagement in developing regulations (index) |

OECD Regulatory Policy & Governance Indicators |

|

|

Societal consultation (index) |

Sustainable Governance Indicators |

Source: Authors’ elaboration.

Policy options to increase the potential for FDI spillovers

An open, transparent and non-discriminatory regulatory environment is fundamental for attracting knowledge- and technology-intensive investment

An open, transparent, predictable and non-discriminatory regulatory environment is a critical determinant of investment decisions. Open economies with fewer market access restrictions for foreign equity investments are associated with higher FDI stocks (Mistura and Roulet, 2019[17]). FDI liberalisation reforms targeting more productive, innovative and knowledge-intensive sectors can increase the direct impact that foreign firms have through their own activities on productivity growth. Similarly, FDI openness in downstream sectors where domestic SMEs have a comparative advantage and strong absorptive capacities can help attract FDI that creates linkages with the host economy through local sourcing. SMEs in these sectors may benefit from potentially better access to high quality inputs and services from foreign firms. Findings from a recent OECD-UNIDO study of investment trends in Southeast Asia shows that liberalising FDI in services is positively associated with productivity gains in downstream manufacturing industries, where local SMEs benefit in particular (OECD-UNIDO, 2019[18]).

FDI spillovers also tend to be larger in countries that are more open towards trade (Meyer and Sinani, 2009[19]; Havranek and Irsova, 2011[20]; Du, Harrison and Jefferson, 2011[21]). A study on Thailand’s manufacturing sector, found that technology spillovers from FDI to the domestic economy happen predominantly in sectors with low trade restrictions, while evidence from China’s entry into the World Trade Organisation (WTO) suggests that vertical backward spillovers increased after its accession when tariffs were lowered and domestic content restrictions relaxed (Du, Harrison and Jefferson, 2011[21]).

FDI spillovers may not automatically materialise just because a country is able to attract FDI and engage in international trade (Alfaro, 2017[22]). Competition rules that ensure a level playing field for domestic and foreign firms are necessary to attract FDI with a positive footprint on domestic productivity. Industries facing greater competition experience faster productivity growth, because competition allows more efficient firms to enter and gain market share at the expense of less efficient ones (OECD, 2015[23]). Pro-competitive product market reforms and competition policy enforcement can therefore help achieve fairer sharing of productivity gains by foreign firms. Competition authorities should have the necessary power and tools to impose sanctions for infringements and guarantee the transparency of competition policy enforcement procedures.

The potential for FDI spillovers also depends on the willingness of foreign MNEs to transfer their technology, know-how and other market advantage to their affiliates abroad, and the latter’s confidence to share new technologies with domestic firms. A strong legal framework for the protection of intellectual property rights (IPRs) can give foreign firms an incentive to increase the technological intensity of their investments, conduct R&D locally and engage in the development of successful innovations that result in knowledge diffusion within and across economies. Branstetter et al. (2006[24]) found that US MNEs responded to changes in IPR regimes abroad by increasing technology transfer to their affiliates in countries that undertook reforms to strengthen IPRs. Similarly, Javorcik (2004[25]) found that, in Central and Eastern Europe, the strength of patent laws as well as the overall level of IPR protection increased the likelihood of attracting FDI in several high technology sectors where IPRs play an important role.

Incentives for knowledge-intensive FDI should be transparent, targeted and clearly evaluated

Investment incentives are widely used to promote FDI and induce firms to invest in knowledge‑intensive sectors and activities, create jobs, train workers and collaborate with domestic firms. They can take the form of direct financial support (e.g. grants, subsidies loans), tax relief (e.g. tax holidays, tax credits, accelerated depreciation allowances), and regulatory concessions (e.g. fast-track and strategic investment status). Cross-country differences in the generosity of R&D tax allowances can lead to differences in the cost of capital faced by firms – and subsequently encourage or discourage them from increasing their R&D investment or locating their R&D functions in a given country (González Cabral, Appelt and Hanappi, 2021[26]). Incentives can distort competition, however, and are not always cost‑effective in attracting quality investment that creates linkages with the local economy. If used, governments should ensure that they address well-identified market failures such as knowledge asymmetries between foreign and domestic firms, the inherent risks and uncertainty arising from engaging in innovation and the high fixed costs of undertaking technological developments (Martin and Scott, 2000[27]).

Different types of incentives present advantages and disadvantages related to their financial and administrative costs, their impact on economic, social and environmental conditions, and their effectiveness in fostering linkages with local SMEs. There is growing anecdotal evidence suggesting that income-based tax incentives (e.g. tax holidays, preferential tax rates), which reduce the rate applied to profits/income already secured, tend to attract mobile activities rather than long-term FDI projects that are more likely to create linkages with the local economy and generate knowledge spillovers (OECD, 2019[28]; IMF-OECD-UN-World Bank, 2015[29]). Income-based tax incentives may also have limited effectiveness in attracting new investment and often come at a substantial cost to a country by resulting in windfall gains for projects that would already have taken place in the absence of the incentive. In contrast, expenditure-based tax incentives – such as tax deductions and credits, accelerated depreciation and trade tax exemptions – that lower the cost of specific inputs of production factors allow to link investments to performance criteria that support progress towards specific development objectives, including linkages with local SMEs.

OECD research has found that an increasing number of governments designs investment incentive schemes with more targeted eligibility conditions and performance criteria to achieve specific policy goals related to sustainable development. To strengthen FDI-SME linkages and spillovers, for instance, governments can make the granting of financial support conditional to creating linkages with local SMEs, undertaking R&D locally, or investing in more productive, knowledge-intensive and high-tech sectors. Over half of the countries included in the OECD Investment Tax Incentives database use tax incentives with specific design features to boost exports, while 12 of 36 countries use incentives with the objective of creating employment and improving job quality (Celani, Dressler and Wermelinger, 2022[30]).

Many countries also make use of tax incentives with explicit reference to sectors or sub-sectors (Celani, Dressler and Wermelinger, 2022[30]). Countries may prefer to target narrowly, instead of providing incentives broadly to all activities within a sector, if their development or upgrading takes an important part of their economic strategy. Narrow sector targeting may also contribute to a smaller share of investors qualifying for a certain incentive, reducing the potential forgone revenue resulting from an incentive. The benefits and costs of narrow as opposed to broad sector targeting are currently not extensively developed in the tax incentive literature.

The conditions and criteria for the granting of incentives should be transparent, clearly defined and rules-based to facilitate their verification and avoid discretionary and distortive granting decisions (Celani, Dressler and Wermelinger, 2022[30]). They should be also reviewed periodically to ensure that benefits materialise and outweigh the costs, and that their scope continues to reflect the evolving market needs and capacities of the domestic production base. Serious policy consideration should be also given to the impact that incentive schemes have on the complexity of the tax system and the capacity of the public administration to implement such targeted approaches. Country contexts and institutional arrangements discussed in the previous section should be considered.

When incentives take the form of regulatory concessions, governments should ensure that these do no lead to a “race to the bottom” in terms of social and environmental standards. Special regulatory regimes for investments deemed to be of strategic importance for the host economy are often predicated on certain conditions such as creating a number of jobs, investing in knowledge-intensive sectors or benefitting specific geographic areas. However, the benefits of reducing the regulatory burden on business should be weighed against potential risks, in particular in industries driven by digital innovation, which often rely on alternative business models and may lead to new and more precarious forms of employment or weakened social protection conditions (OECD, 2020[31]). In fact, regulation should mitigate the potential socio-economic risks arising from the adoption of new, innovative and digitally enabled business models while at the same time ensuring that regulatory responses are proportional, set out some level of certainty and predictability, and do not stifle the innovation potential of the economy (Davidson, Kauffmann and de Liedekerke, 2021[32]).

Investment promotion and facilitation can help embed foreign investors in the host economy

IPAs are key players in promoting investment with higher potential for knowledge-intensive linkages with the host economy. Effective investment promotion includes raising potential investors’ awareness of the host country’s strengths, branding the country as an attractive investment destination, and directly reaching out to potential investors to generate leads and investment projects (OECD, 2018[10]). IPAs should review and identify specific economic activities where they see a potential to enhance productivity growth and strengthen the technological sophistication and knowledge base of the economy. On this basis, they can design investment promotion packages geared towards these objectives, combining a variety of investment generation tools such as intelligence gathering (e.g. raw data analysis, market studies), sector-specific events (e.g. road-shows, business fora and fairs, country missions), and pro-active investor engagement (one-to-one meetings, email/phone campaigns, enquiry handling). These activities provide potential investors with information that allows them to identify investment opportunities with the highest potential for spillovers, including information on the host country’s knowledge infrastructure and the capabilities of domestic SMEs.

Implementing investment prioritisation strategies aligned with the economy’s industrial capabilities is another way through which IPAs can influence the impact of FDI on productivity and innovation. Most IPAs prioritise certain types of investments over others by selecting priority sectors, countries or investment projects, and allocating resources accordingly (OECD, 2018[10]). Such an approach allows governments to focus on investments that have a higher probability of being realised and may bring unique benefits to the host economy. Evidence from 97 IPAs worldwide shows that the prioritisation of specific economic activities translates into higher levels of FDI in the targeted sectors (Harding and Javorcik, 2011[33]). Recent OECD evidence from 32 OECD IPAs also shows that investment policymakers increasingly take into account sustainable development considerations when setting their prioritisation strategy, with 90% of them using productivity and innovation-related indicators to prioritise investment attraction (Sztajerowska and Volpe Martincus, 2021[15]).

To leverage the potential of FDI for productivity spillovers, IPAs can prioritise FDI in knowledge and technology-intensive sectors, target countries with higher average productivity levels, or focus on specific types of foreign investors such as top R&D performers. Targets and promotional activities should be coherent with national strategies and reasonably reflect the country’s production capacities, knowledge base and innovation potential. The use of prioritisation tools such as sustainability-related KPIs, scoring mechanisms, surveys and big data analytics, can help IPAs focus their limited resources on the most valuable deals (Sztajerowska and Volpe Martincus, 2021[15]).

Assessment tool

Box 2.2 includes a checklist of questions allowing policymakers to assess the policy environment and identify policy options to strengthen the potential for FDI spillovers.

Box 2.2. Checklist of questions to assess the policy framework for FDI spillovers

Are sectors that drive productivity growth and innovation open to FDI and trade? Are there any regulatory restrictions in downstream sectors? Does the government impose any restrictions or performance requirements (e.g. local content requirements) for foreign investors to gain market access?

What steps has the government taken to ensure that laws and regulations dealing with investments and investors, and their implementation and enforcement, are clear, transparent, readily accessible and do not impose unnecessary burdens?

Do competition rules ensure a level playing field for foreign and domestic firms alike?

What laws and regulations are in place to protect intellectual property rights (IPRs)? Is IPR legislation effectively enforced?

Has the government enacted investment incentive schemes targeting productive and knowledge-intensive activities or sectors where SME absorptive capacities are strong? Are the criteria for the granting of incentives clearly defined, transparent, and rules-based?

What types of incentives are provided (e.g. grants, profit-based tax incentives, cost-based tax exemptions, regulatory concessions) and what eligibility criteria or performance requirements apply (e.g. R&D, supplier linkages, skills development, size)?

If regulatory incentives are made available to foreign investors, are accompanying measures and standards in place to avoid a regulatory “race-to-the-bottom” and mitigate potential socio-economic risks?

Within the agency(ies) responsible for investment promotion and facilitation, are there clear goals and sectoral targets defined to help attract productivity-enhancing and knowledge-intensive FDI that creates linkages with the local economy? Are there sufficient staff and resources available to achieve these goals?

How does the agency(ies) responsible for investment promotion and facilitation divide its resources among its core functions, i.e. image building, investment generation, investment facilitation and aftercare, and policy advocacy? How does this compare to international experience?

Are specific sectors, markets and investors targeted as part of the investment promotion activities undertaken by the government? If so, what are the investment prioritisation criteria used for the implementation of these activities?

What information pertaining to investment measures and the capacities of domestic SMEs is made readily available, or available upon request, to foreign investors? What are the main vehicles of information on investment measures of interest to foreign investors?

The policy framework for investment promotion can be measured and monitored through a range of internationally comparable indicators as well as OECD policy surveys that allow for a qualitative assessment of key policy dimensions, as described in Table 2.2.

Table 2.2. Examples of policy instruments for increasing the potential for FDI spillovers and key assessment tools

|

Policy instruments |

Indicators and key assessment dimensions |

Source |

|

|---|---|---|---|

|

Regulatory framework |

FDI and trade openness |

Regulatory restrictions to FDI (index) |

OECD FDI Regulatory Restrictiveness Index |

|

Barriers to trade and investment (index) |

OECD Product Market Regulation Indicators |

||

|

Restrictions on foreign entry (index) |

OECD Services Trade Restrictiveness Index |

||

|

Restrictions to services trade (index) |

OECD Services Trade Restrictiveness Index |

||

|

Barriers to trade facilitation (index) |

OECD Trade Facilitation Indicators |

||

|

Competition law and policy |

Restrictions in product market regulations (index) |

OECD Product Market Regulation Indicators |

|

|

Barriers in service and network sectors (index) |

OECD Product Market Regulation Indicators |

||

|

Barriers to competition (index) |

OECD Services Trade Restrictiveness Index |

||

|

Involvement in business operations (index) |

OECD Product Market Regulation Indicators |

||

|

IP protection |

Perception of IP protection (index) |

WEF Global Competitiveness Index |

|

|

Investment incentives |

Regulatory incentives |

Design features of investment incentives (qualitative assessment):

Eligibility conditions (qualitative assessment):

Legal basis and governance framework (qualitative assessment):

|

EC/OECD Survey of Institutions and Policies enabling FDI-SME Linkages |

|

OECD Investment Tax Incentives Database |

|||

|

Financial incentives |

|||

|

OECD R&D Tax Incentives Database |

|||

|

Investment promotion |

Targeted investment generation activities |

IPA’s resource allocation and scope of activities:

Prioritisation strategies for FDI generation:

|

EC/OECD Survey of Institutions and Policies enabling FDI-SME Linkages |

|

Pro-active investor engagement |

OECD Survey on Prioritisation and Monitoring & Evaluation of IPAs |

||

|

OECD Mapping of Investment Promotion Agencies |

|||

|

Information services |

|||

|

OECD Investment Policy Reviews |

Source: Authors’ elaboration.

Policy options to strengthen the absorptive capacities of local SMEs

The quality of the regulatory environment affects SMEs’ capacity and incentives to engage in innovation, gain productivity and scale up

Regulation in product and labour markets, taxation, competition, insolvency regimes, license systems and public governance are critical for business activity and to ensure that firms of all sizes compete on a level playing field. Regulatory processes and administrative procedures disproportionately impact SMEs, however (OECD, 2019[34]) (OECD, 2021[6]). Overly burdensome regulations often perpetuate informality, particularly of smaller and less productive firms, with less capacity to screen the regulatory landscape and allocate the necessary resources to address legal and regulatory requirements. Conditions for regulatory compliance are therefore a critical factor shaping an SME’s ability to become more competitive and engage in knowledge-intensive collaborations with foreign MNEs.

To allow SMEs to improve their absorptive capacities, an effective regulatory environment that provides clear rules of the game and incentives to scale up is necessary. Enhanced policy consideration should be given to simplifying administrative procedures, cutting red tape, streamlining information on businesses’ regulatory obligations, and facilitating the provision of public services through digital channels (OECD, 2018[35]). Efforts to reduce tax compliance costs through the introduction of electronic filing and payment systems can substantially reduce the administrative burden for smaller firms. Information on licensing and permit systems and business development services could also become easily accessible to SMEs through digital instruments such as government portals and online one‑stop‑shops (OECD, forthcoming[36]). Such an approach would improve transparency, allow small firms to access higher quality and more customised services, and ease their interaction with the public administration.

Similarly, lengthy and complicated insolvency processes which significantly affect the chance of starting a business again, can be reduced through increased digitalisation of courts and the promotion of alternative dispute settlement mechanisms such as arbitration, mediation and conciliation (OECD, 2019[34]; OECD, 2021[37]). The court system can be made more efficient by strengthening the independence of judges, ensuring the effective execution of judgements and, when significant delays in court decisions are observed, creating specialised commercial courts to handle business disputes. An efficient civil justice system should be coupled with a robust legal framework for contract enforcement to improve the predictability of business relationships and help SMEs engage in new business partnerships more efficiently (Johnson, McMillan and Woodruff, 2001[38]).

Stringent regulations can deter innovation by imposing high compliance costs that limit the capacity of entrepreneurs to experiment with alternative business and production models (Davidson, Kauffmann and de Liedekerke, 2021[32]). Given the increasing digitalisation of many economies, policymakers should ensure that laws and regulations are sufficiently flexible and forward-looking to anticipate and adapt to fast-changing technologies. One option for ensuring that regulatory framework conditions do not stifle the competitiveness and innovation of SMEs is to systematically evaluate their costs and benefits against the intended policy goals. Regulatory impact assessments (RIA) and SME tests have become a widespread practice to improve the quality and outcomes of regulation (OECD, 2019[34]). Enhancing the application of RIAs requires coordination and consistency across tiers of government, strong political commitment, and significant investment to build a culture of evaluation in the public administration.

Competition rules that provide a level playing field for all firms and legal frameworks for the protection of intellectual property rights are also essential to encourage SME growth (OECD, 2019[34]). These aspects of the regulatory framework are examined in the following section on strengthening knowledge spillovers through competition effects.

A comprehensive mix of business support services is necessary to help SMEs access strategic resources such as knowledge, technology, finance and skills

Beyond regulatory framework conditions, strengthening the absorptive capacities of SMEs requires whole-of-government policy approaches that help SMEs access the strategic resources they need to improve their productivity, including skills, finance, knowledge and technology (OECD, 2019[34]) (OECD, 2021[6]). An effective policy mix should reflect that SME growth requires efforts on several fronts by integrating complementary and mutually reinforcing types of instruments into comprehensive SME support packages, involving financing, technical assistance, training, capacity building and infrastructure (OECD, 2022[39]).

Public interventions that facilitate SME access to innovation assets can help them keep pace with the industrial and technological transformations at play. Many innovation promotion and SME support agencies offer technology extension services (TES) to improve the use of “new-to-firm” innovation by SMEs (OECD, 2021[40]; Shapira, Youtie and Kay, 2011[41]). The main objective of these services is to facilitate the adoption of existing technologies through diagnostic assessments of a firm’s operations, processes and technological maturity; information services to bring awareness of new business models and practices; benchmarking to identify areas for improvement; consulting, training and technical assistance to implement internal organisational changes.

The integration of SME policy imperatives into innovation policies has been noticeable in the design of financial incentives. In many EU countries, grants and subsidised loans are provided to SMEs to help them invest in R&D and undertake innovation and internationalisation activities. Tax incentives have also become a popular instrument in support of business innovation and are increasingly geared towards subgroups of the SME population such as start-ups and young high-growth firms (Appelt et al., 2022[42]; OECD, 2021[43]) (OECD, 2019[34]). Many of these financial support schemes include additional incentives for the development of products and services through science-to-business (S2B) and business-to-business (B2B) collaboration, including with foreign firms and higher education institutions (HEIs), reflecting the importance of networks in creating, accessing and exploiting knowledge (OECD, forthcoming[44]).

As the digitalisation of economies accelerates, intangible assets have come to make up a significant part of a firm’s value resulting in firms, in particular growth-oriented ones, being increasingly data driven or likely to use data to scale up their business. Improved access, use and protection of data – in short, improved data governance – is therefore becoming a strategic issue for an increasing number of SMEs. With data emerging as a key driver of firm performance, and potentially also the broader deployment of more sustainable, energy- and resource-efficient business models, there is a need to accelerate public efforts in this relatively new policy field, with particular attention to the needs and challenges faced by small businesses (OECD, 2022[39]). Emphasis should therefore be placed on improving SMEs’ digital readiness and their capacities to engage in e-commerce, leverage data to optimise supply chain operations and improve service delivery, and reinforce their digital security practices (OECD, 2019[34]) (OECD, 2021[37]) (OECD, 2022[39]) (Bianchini and Michalkova, 2019[45]).

Improved use of digital solutions and data enables more automation and greater productive capacity, which in turn can leverage SME performance through greater product differentiation and cost efficiency. Measures to support SMEs move operations online include assistance to set up e-business systems (e.g. technology audits, diagnostic tools), financial incentives for digital uptake (e.g. IT vouchers, grants for acquiring digital accounting, CRM and EPR software) and online platforms providing access to data and other IT-enabled services. Given that SMEs tend to rely on external sources of support for digitalising their operations and compensate for weak internal capacities, governments can serve as facilitators in connecting SMEs with digital solution providers and knowledge networks (OECD, 2021[6]).

Addressing the financing challenges of SMEs across all stages of their cycle is of particular importance to help them invest in technology upgrading and improve the quality of their products and services in line with the needs of foreign investors (OECD, 2022[46]; OECD, 2015[47]; OECD, 2019[34]). Public support to SME financing takes a variety of forms, from loans and credit guarantees to grants, equity and quasi-equity schemes, which are often geared towards specific types of business activities (e.g. trade finance, R&D funding). The G20/OECD High-Level Principles on SME Financing provide guidance to G20 and OECD governments for the development of cross-cutting policy strategies on SME financing, highlighting in particular the need for a diverse range of bank-based and alternative financing instruments and the importance of safeguarding financial stability, transparency and investor protection (G20/OECD, 2015[48]). However, monetary tightening resulting from recent inflationary pressure in most OECD countries makes bank-based instruments more expensive for SMEs and, ultimately, may reinforce their need to turn to alternative financing instruments.

Diversifying the finance mix of SMEs requires government action to address both supply-side barriers (i.e. insufficient market incentives for investors) and demand-side barriers (i.e. lack of financial knowledge and guarantees among SMEs) (OECD, 2022[39]). Given the challenges that many SMEs face in accessing traditional bank financing and recognising the need to avoid SME over-indebtedness, many governments are increasingly shifting their focus towards alternative financing instruments such as equity, venture capital and fintech solutions. The use of equity instruments has several advantages over debt support since they lower the cost of borrowing of SMEs and enable more funds to be channelled to them through co-investments from the private sector (OECD, 2020[49]) (OECD, 2021[6]). To promote these alternative finance sources, policymakers can provide incentives for collaboration between banks and other private investors; capacity building to improve the way SME managers present their business model to potential funders; public tenders to encourage joint financing between several investors; and establishing platforms with easily accessible information on financing tools for growth-oriented SMEs. As some entrepreneurs may associate equity instruments with a loss of control over their business, policy makers can also use hybrid instruments, i.e. combining debt and equity. This option has the double benefit of further diversifying the funding mix of SMEs while addressing an important demand-side barrier (OECD, 2015[50]).

There is also strong rationale for targeted interventions aimed at upgrading managerial and workforce skills in SMEs. Skills are key assets for technology and innovation absorption and for managing the organisational changes needed to foster knowledge-intensive linkages with foreign MNEs (OECD, 2019[34]; OECD, 2015[51]). Public policy may aim to create incentives for SMEs and entrepreneurs to invest in skills by reducing the cost of training and streamlining information on skill development programmes (training); supporting SMEs in navigating the employment market and identifying and attracting talent (hiring); and connecting SMEs with specialised intermediary organisations (outsourcing) (OECD, forthcoming[44]). Common mechanisms to support human capital development include tax exemptions and training vouchers that encourage on-the-job training; statutory rights for employees for training leave; and local or sectoral training networks (e.g. group training associations, sector skills councils) (Marchese et al., 2019[52]). Linking the development of SME workforce skills to vocational education and training (VET) frameworks can also foster greater collaboration between employers and vocational schools and help SMEs access highly skilled young employees through apprenticeship programmes. By combining school-based education and on-the-job training, apprenticeships stimulate company productivity and profitability. Evidence from countries for which data are available show that more than half of all apprentices work in companies with 50 employees or fewer (OECD, 2021[37]).

Policies that improve the quality of network and knowledge infrastructure can enhance SME scale up and productive capacities

SMEs are in general more dependent on obtaining relevant resources and expertise from outside their own firm boundaries (OECD, 2019[34]). The rise of open and distributed innovation has amplified the importance of integrating knowledge networks and markets (OECD, 2013[53]), thus reinforcing smaller firms’ need to operate in connection – sometimes co‑operation – with outside institutions, e.g. academic institutions or (local) governments. Connecting to and expanding relevant networks is thus instrumental for SMEs to access knowledge, technology, data and skills, and benefit from innovation spillovers. Networks can also allow firms to find new business partners, as well as access new markets or finance.

First, the absorptive capacities of SMEs are strongly influenced by the accessibility of knowledge infrastructure, often at local level, which remains the primary scale of operations of smaller businesses. This infrastructure includes technology transfer offices, applied research centres, collaborative laboratories, incubators and accelerators, universities and other public or private facilities that contribute to the creation and diffusion of knowledge (OECD, forthcoming[44]) (OECD, 2021[6]). Through these facilities SMEs gain access to technological premises, equipment, manpower, information and data, and the results of universities’ and public research institutes’ activities that they could not have conducted independently otherwise.

Over the past decades, there has been a rapid increase of intermediary technology institutes (ITIs) and technology transfer offices (TTOs) in many EU and OECD economies (Rossi et al., 2020[54]) as a means for governments to accelerate the commercialisation of public research results and their materialisation into socio-economic benefits (OECD, 2013[55]). These facilities seek to address the market failure, which exists in taking innovative ideas forward to commercial application by providing resources, competences and expertise that SMEs often lack. Their role is to provide from the earliest possible moment hands-on support in innovation processes and help SMEs undertake foresight exercises, focused technology development, and manage intellectual assets. In many cases, particular emphasis is placed on collaborative projects between companies and between companies and research institutions. Hence, they also play the role of an innovation broker creating “communities of innovators” and allowing foreign and domestic firms to work together on specific topics.

At the same time, digitalisation has become increasingly instrumental for SME network expansion beyond physical interactions and the constraints of space. Digital platforms in particular increase firms’ ability to benefit from network effects and access a larger portfolio of innovation assets at reduced cost, as they allow to centralise software, technology or databases (e.g. through cloud computing services), ideas and solutions (e.g. through crowdsourcing and collaborative platforms on specialised software solutions), or user and client data (e.g. through e-commerce platforms) (OECD, 2019[34]) (OECD, 2021[37]). Platforms have also been instrumental to the deployment of open innovation practices by enhancing system integration, interoperability and data sharing and openness (OECD, 2017[56]) (OECD, 2022[39]).

Business incubators and accelerators allow entrepreneurs and start-ups to experiment with new business models, access frontier know-how and technologies that they can use to further develop their innovative ideas (OECD, 1999[57]; OECD/European Commission, 2019[58]). By acting as interfaces between start-ups and foreign MNEs, these business support facilities also contribute to reinforcing FDI-SME ecosystems and boosting collaboration, especially in knowledge‑intensive activities.

Efficient network infrastructure is also a key pillar of a conducive business environment (OECD, 2019[34]). Their accessibility, reliability and affordability are particularly critical for SMEs to compete in knowledge‑intensive production systems. Policy initiatives that improve the quality of physical and digital infrastructure (e.g. transport, energy, information and communications technology – ICTs) are therefore relevant for improving SME absorptive capacities. A key quality aspect relates to cybersecurity as digitalisation has dramatically increased the interconnectedness of network infrastructure, and hyperconnectivity creates vulnerabilities and breaches in both the physical and digital spaces.

Public action for consolidating the network infrastructure can come in the form of public investments and public-private partnerships (PPPs) for addressing the investment gap, and through a whole-of-government approach to better coordinating efforts across policy domains and levels of government. Securing resources and making infrastructure networks more attractive for private involvement is possible by improving the efficiency of service delivery, facilitating investor access to land, and creating a level playing field between State-owned infrastructure operators and private investors (OECD, 2015[59]). Improving the public procurement regime can also increase value for money of public infrastructure investment (OECD, 2019[34]). Developing national infrastructure plans and setting up supportive institutional arrangements (e.g. dedicated PPP units, policy coordination bodies) are essential to ensure efficient public investment and alignment (OECD, 2021[60]). Subnational governments can play a vital role in the infrastructure landscape since they are responsible for key policy areas such as transport, energy, broadband and spatial planning (OECD, 2019[34]). Strengthening their involvement in the design and implementation of regional infrastructure policies can help address infrastructure constraints that are relevant to SMEs.

Enhanced policy attention should be given to the scope, coherence and delivery of SME policies

In addition to a diverse mix of policy instruments, supporting business development also requires striking a balance between generic approaches and targeted initiatives aiming at specific sectors or segments of the SME population (OECD, 2019[34]; OECD, 2022[61]; OECD, 2022[39]; Meissner and Kergroach, 2019[1]).

Generic policies for all SMEs irrespective of their size, age, sector or location can be effective in setting supportive framework conditions for business growth, or in countries where much of the business population is made of SMEs (e.g. small countries). Public support measures with limited checks and broad eligibility criteria can also facilitate fast delivery and reach a large number of beneficiaries in a short time span, as it has been the case during the COVID-19 crisis, when governments had to urgently address sudden market disruptions and avoid a wave of bankruptcies (OECD, 2021[62]) (OECD, 2021[6]). However, such an approach may raise questions about whether the support reached those segments of the SME population that needed it the most. For instance, micro firms with low productivity may not be able to benefit from broad schemes that are not designed to take the circumstances of the most vulnerable SMEs into account. Depending on the context and timing of public action and the strategic objectives pursued, combining generic policy approaches with more targeted and sector-specific measures may help tailor the policy mix to the diversity of business profiles and SME trajectories and thereby improve the effectiveness of policy interventions.

The tailoring of SME support may take into account the higher potential for FDI-SME linkages and spillovers in specific value chains (or value chain segments), e.g. those that are more knowledge- and innovation-intensive (Chapter 1). Targeted support may be provided to SMEs depending on whether they operate in low-technology (e.g. retail trade) or high‑technology (e.g. advanced manufacturing) industries. This may imply targeting measures towards priority industries deemed to hold stronger potential for innovation spillovers, or adjusting support to the different innovation paths of high‑ and low-tech companies. For example, programmes for upgrading managerial skills in SMEs are found to hold a stronger economic rationale in knowledge‑intensive sectors than in low‑tech sectors (Marchese et al., 2019[52]). Also, if technology upgrading programmes may help low-tech SMEs scale up their innovation capacity, SMEs that are already innovation-intensive may benefit more from R&D and innovation programmes, or access to high-tech infrastructure and networking facilities with frontier HEIs.

Targeted policies aiming to strengthen SME performance in priority industries and activities can also be aligned with a country’s or a region’s smart specialisation objectives (Box 1.5). A strong SME base can act as a magnet for attracting productivity-enhancing FDI in industries or activities where the place has (or holds potential to develop) a comparative advantage. It could also contribute to discourage divestment and maintain FDI locally, enhancing resilience in strategic value chains (OECD, forthcoming[44]; Kergroach, 2018[63]) (OECD, 2021[6]). At same time, sector-targeted approaches entail the risk of missing emerging innovation opportunities in other industries, or neglecting the cross-sectoral dimension of clusters, business networks and ecosystems, which also play an important role in supporting SME upgrading (Lilischkis, 2011[64]).

Targeted support can be provided through ad hoc interventions or integrated into national strategies and action plans with a longer time span. Strengthening SME productivity and innovation may indeed require a long-term perspective, especially in situations where policy impact is only likely to become visible in the mid- to long-run. Ensuring the coherence of SME support policies requires robust monitoring and evaluation mechanisms, with relevant data and methodologies, and results have to inform the design and implementation of new initiatives (OECD, 2022[61]). Policy coherence is also needed across government entities and levels, and across the diverse policy areas that can influence SME&E performance (Section above).

Not all policies reach SMEs in the same way; many programmes have low take-up rates among smaller firms (OECD, 2019[34]). One of the greatest challenges for the public administration is to raise awareness and create demand for existing support services. In a recent pilot survey on the online sales and hybrid retail practices of SMEs, only 15% of the respondents declared being aware of existing public support programmes for selling online and only 60% of the informed businesses made use of them (OECD, forthcoming[65]). In addition, some policy instruments are more suitable to SMEs’ uptake. For instance, tax‑based measures are more likely to be used by large firms due to their relative complexity and the higher level of expertise needed to track changes in the tax system and optimise tax strategies. On the other hand, direct subsidies and technical assistance programmes are more likely to reach and involve SMEs. Adjusting the design of existing programmes with preferential provisions for SMEs, organizing information campaigns and providing support for the application process may help address barriers to uptake. In principle, programme rules and activities could be kept simple to cater to smaller firms, which do not have sufficient resources to go through lengthy application procedures.

However, the delivery of tailor-made SME support often requires robust administrative capacities, technical expertise, skills and evidence that governments often do not have. To address these challenges, governments can cooperate with intermediary organisations, such as training institutes, consulting firms, chambers of commerce and business associations, in light of their own expertise and proximity to business. Local or sectoral cooperation between public and private sector actors can facilitate the pooling of resources for implementing targeted actions, with benefits arising from economies of scale, increased involvement of SMEs, and reduced transactions costs in administration (Marchese et al., 2019[52]). Conversely, too many layers of intermediation up to final beneficiaries would require effective monitoring and evaluation of the quality of services provided and impact assessment.

Assessment tool

Box 2.3 includes a checklist of questions allowing policymakers to assess the policy environment for SMEs and identify policy options to strengthen SME performance.

Box 2.3. Checklist of questions to assess the policy framework for SME absorptive capacities

How does the government ensure that laws and regulations do not impose an unnecessary burden on SME growth and upgrading? Are there built-in mechanisms or processes such as SME tests and regulatory impact assessments (RIAs) to periodically review these burdens?

How does the government streamline administrative procedures to improve SMEs’ capacity to do business with foreign investors? What are the available means for informing and assisting SMEs in obtaining the necessary licenses, permits, registration and other administrative formalities?

Is the system of dispute settlement effective and widely accessible to SMEs? What alternative systems of dispute settlement are available to manage commercial disputes?

Do government institutions provide financial support (e.g. training or innovation vouchers, R&D grants, tax relief) and technical assistance (e.g. technology extension services, business diagnostics, advisory services) to strengthen the productivity and innovation of SMEs? Are there specific programmes to help SMEs digitalise and facilitate their access to finance?

What measures are in place to improve SMEs’ access to innovation-related skills in the domestic labour market and address potential skill shortages in FDI-intensive value chains (e.g. digital skills, managerial skills, workforce skills)?

Does the country have a well-developed knowledge transfer infrastructure (e.g. technology transfer offices, business incubators, applied research centres, networking facilities and platforms)? Does the available infrastructure have sufficient financial and human resources to provide SME support services?

Has the government put forward policy initiatives for the development of the country’s network infrastructure (e.g. transport, energy, information and communications technology) with the aim to support business growth, in particular for SMEs? What policies are in place to mobilise public and private investments in infrastructure?

Do business support policies take into account the heterogeneity of the SME population in terms of size, age, capacities, sector/value chain and growth trajectory? Are policies sufficiently tailored to the specific needs and circumstances of different types of SMEs?

What is the sectoral targeting of SME policies and how is this aligned with the country’s or the region’s economic specialisation and the activities of foreign investors?

What is the take-up rate of SME support policies, i.e. the share of eligible SMEs that actually benefit from available support? How does the government ensure that SMEs are aware of, and can easily apply to, business support services?

The policy framework for SMEs can be measured and monitored through a range of internationally comparable indicators as well as OECD policy surveys that allow for a qualitative assessment of key policy dimensions, as described in Table 2.3.

Table 2.3. Examples of policy instruments for increasing SME absorptive capacities and key assessment tools

|

Policy instruments |

Key assessment tools and indicators |

Source |

|

|---|---|---|---|

|

Regulatory framework |

Tax, licensing and permit systems |

Administrative burden on start-ups (index) |

OECD Product Market Regulation Index |

|

Simplification and evaluation of regulations (index) |

OECD Product Market Regulation Index |

||

|

Complexity of regulatory procedures (index) |

OECD Product Market Regulation Index |

||

|

Statutory corporate income tax rate (CIT), small businesses (%) |

OECD Tax database |

||

|

Share of SMEs using e-government services (%) |

OECD ICT use by Businesses Database |

||

|

Share of firms identifying licensing, permits, tax administration, customs and trade regulations as a major constraint (%) |

World Bank Enterprise Surveys |

||

|

Number of days needed to obtain an operating license, construction permit, and import license |

World Bank Enterprise Surveys |

||

|

Judicial system and contract enforcement |

Share of firms identifying the court system as a major constraint (%) |

World Bank Enterprise Surveys |

|

|

Share of firms believing the court system is fair, impartial and uncorrupted (%) |

World Bank Enterprise Surveys |

||

|

SME tests and regulatory impact assessments |

Frequency, quality and transparency of regulatory impact assessments (index) |

OECD Regulatory Policy & Governance Indicators |

|

|

Adoption of “stock-flow linkage” rules |

OECD Regulatory Policy & Governance Indicators |

||

|

Access to innovation assets |

Technology extension services |

EC/OECD Survey of Institutions and Policies enabling FDI-SME Linkages |

|

|

Business diagnostic / advisory services |

|||

|

Regulations on SMEs access to innovation assets (e.g. data) |

Balance and density of the policy mix:

|

EC/OECD Survey of institutions and policies for growth financing and data governance to support SME scale up |

|

|

Innovation vouchers |

|||

|

Public grants for innovation and internationalisation activities |

|||

|

Public grants for technology acquisition and digital transformation |

OECD SME&E Data lake |

||

|

Access two finance |

Public loans and guarantees for innovation and internationalisation activities |

Policy design:

|

|

|

Public loans and guarantees for technology acquisition and digital transformation |

OECD R&D Tax Incentives Database |

||

|

Public risk-sharing schemes (e.g. government-backed equity financing) |

|||

|

Bank loans |

EU SME Performance Review Indicators and SBA Fact Sheets |

||

|

Alternative debt (corporate bonds, securitized debt, covered bonds, private placements, crowdfunding) |

|||

|

Hybrid instruments (subordinated loans/bonds, silent participation, profit participation rights, convertible bonds, bonds with warrants) |

Policy implementation:

|

||

|

Equity instruments (private equity, venture capital, business angels, specialized platforms for public listing of SMEs, equity crowdfunding) |

EC-OECD Science, Technology and Innovation Policy Compass Database |

||

|

Trade finance |

|||

|

Asset-based finance (asset-based lending, factoring, purchase order finance, leasing) |

|||

|

Tax incentives for R&D and innovation activities |

OECD Skills Studies |

||

|

Access to skills |

Skill development programmes |

||

|

Tax relief on training expenses |

|||

|

Direct training subsidies schemes and training vouchers |

|||

|

Statutory training leave |

OECD Studies on SME and Entrepreneurship Policy |

||

|

Apprenticeship programmes |

|||

|

Network and knowledge infrastructure |

Business support centres |

||

|

Technology transfer offices |

OECD Reviews of Innovation Policy |

||

|

Business incubators and accelerators |

|||

|

Science and technology parks |

|||

|

Infrastructure development policies |

Source: Authors’ elaboration, based on the OECD Data Lake on SMEs and Entrepreneurship (OECD, 2023[66]).

Policy options to strengthen the economic and geographical conditions that enable FDI-SME spillovers

New industrial policies can help strengthen domestic SME performance, attract quality FDI and reinforce FDI-SME linkages

Although there is no clear consensus about the approach to follow, industrial policies have raised increasing interest of OECD governments in search for a response to slowing productivity, rising global competition and pressing environmental challenges (Box 2.4). New industrial policy has increasingly been seen as a means for achieving sustainable development goals (OECD, 2021[67]), a new way for governments and industry to work together, and a new approach to reconciliate industrial policy and competition policy (OECD, 2016[68]). Selective industrial policies have traditionally raised concerns about their anticompetitive effects (“picking winners” possibly feeding vested interests) and the risks of suboptimal use of public funds. In fact, while industrial policy has arguably worked in some countries and during certain periods, it has also led to costly failures in other cases (Warwick, 2013[69]). Yet, although high uncertainty remains about the effectiveness of individual industry policy instruments, there is also a new understanding of the relevance of its broad principles and that associated risks could be minimised (OECD, 2016[68]) (Wilkes, 2020[70])) (Criscuolo et al., 2022[71]) (Sunley et al., 2022[72]).

Box 2.4. The rise of new industrial policies

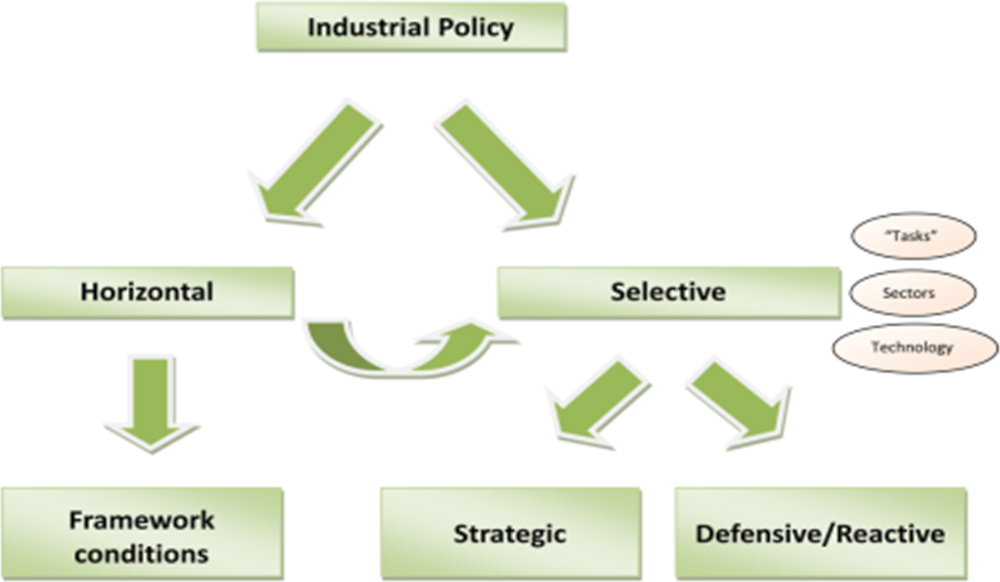

There is no consensus on the industrial policy paradigm and no widely acknowledged definition of it, “industrial policy” being commonly used for competitiveness, productivity or industrialisation policy. There are overall two main meanings of the term (OECD, 2016[68]). One refers to a declared intention of governments to alter the structure of the economy and the structure of production, toward sectors, technologies or activities that are expected to offer better prospects for economic growth and societal welfare (Criscuolo et al., 2022[71]) (Warwick, 2013[69]). The second refers to more horizontal (and not sector-specific) approach for enabling a supportive environment for industry and the business.

The regain of interest in industrial and manufacturing policies has followed the 2008-09 crisis, as policy makers aimed to find new sources of growth, address the structural productivity slowdown and growing competition in GVC segments of higher value added, and seize the potential of emerging technologies to drive the next production revolution (OECD, 2016[68]) (OECD, 2017[73]). Environmental pressure has also led governments to reconsider the merits of industrial policy in order to curve path-dependency and redirect change towards cleaner technologies (Aghion, Boulanger and Cohen, 2011[74]).

Beyond the sectoral orientation, new industrial policy embeds strong technology- or mission-oriented- focus with a view to contributing to the transformative industrial change (Warwick, 2013[69]) (Criscuolo et al., 2022[71]). Sectoral strategies (e.g. focusing on the information and communication technologies -ICT- or automotive sectors), increasingly co-exist with mission-oriented (e.g. green action plans), and technology-focused (e.g. digital transformation and artificial intelligence -AI- strategies) frameworks. There may be catch-up or frontier industrial policies; comparative advantage-following or comparative advantage-defying policy orientation; and strategic or defensive/reactive policy orientation. A strategic industrial policy for a country or a region that is far from the technology frontier is for instance likely to be different from what it might be for a country or a region that is at or close to it (Warwick, 2013[69]).

Yet, one key feature of new industrial policy is its greater emphasis on improving systems, by building networks, improving co-ordination and securing strategic alignment (Warwick, 2013[69]). There is therefore a move away from support for single firms, and away from state aids, tariff protection, market-failure correcting subsidies and product market-focused interventions, towards minimising the risks of government failure, e.g. building adequate business framework conditions (e.g. sound competition, trade openness, well-functioning capital markets), and enhancing entrepreneurial ecosystems, with the use of complementary policy instruments and policy packages (OECD, 2016[68]).

Figure 2.2. Typology of industrial policies by policy orientation