Marion Devaux

Alexandra Aldea

Yvan Guillemette

Jane Cheatley

Laura Suhlrie

Aliénor Lerouge

Michele Cecchini

Marion Devaux

Alexandra Aldea

Yvan Guillemette

Jane Cheatley

Laura Suhlrie

Aliénor Lerouge

Michele Cecchini

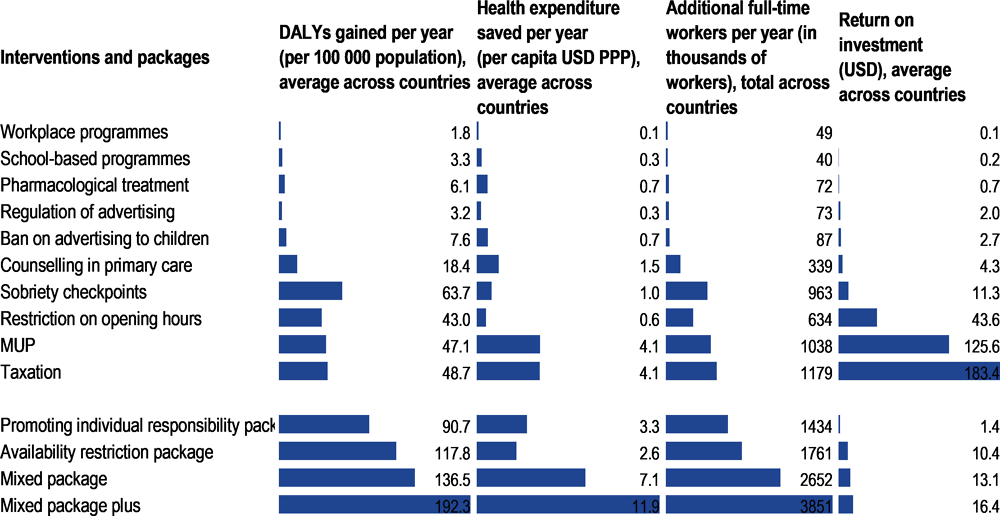

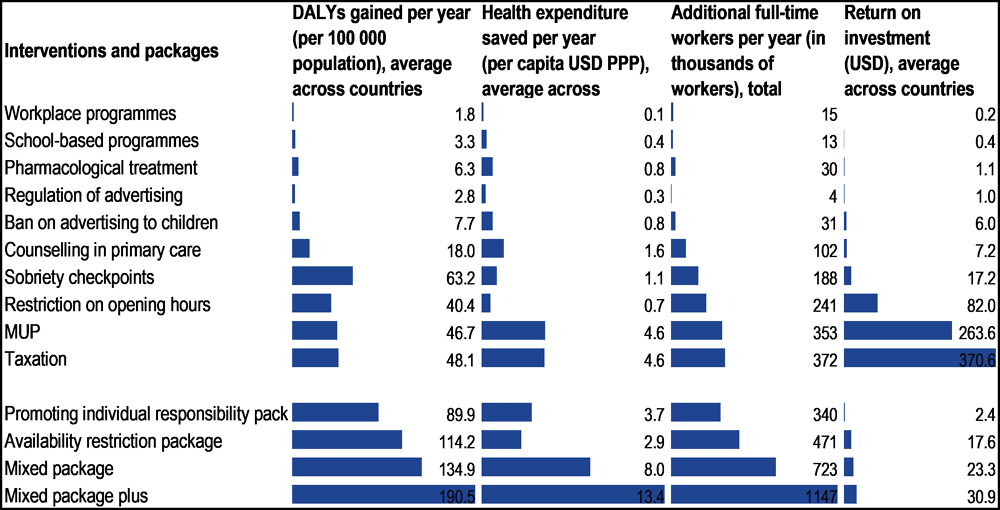

This chapter presents results from modelling the implementation of ten policy interventions, including workplace and school-based programmes; increased alcohol taxation and minimum unit pricing; restrictions on outlet opening hours and drink-driving; regulation of alcohol advertising and statutory bans on advertising to children; counselling in primary care; and personalised pharmacological treatment of alcohol dependence. In addition, the impact of four policy packages is shown, including a mixed package of mostly existing policies; a modified version of the mixed package, boosted by innovative policies; a package of alcohol availability restriction measures; and a package of policies promoting individual responsibility. Results are presented for 48 countries, including OECD countries, other non-OECD European Union (EU27) member states and Brazil, the People’s Republic of China, Costa Rica, India, the Russian Federation and South Africa. A particularly innovative aspect of this analysis is its focus not only on health outcomes but also on economic outcomes, including the policy impacts on health spending, employment and productivity of workers and gross domestic product (GDP) of countries.

According to the simulation, population-wide interventions such as increased taxation, minimum unit pricing (MUP) and sobriety checkpoints will produce the largest health gains, resulting in between 1.1 million and 1.5 million life years (LYs) gained annually in the 48 countries included in the analysis.

MUP will help avoid the largest number of alcohol dependence cases annually in all the modelled countries (2.4 million), and sobriety checkpoints the largest number of injuries annually (1.5 million). Advertising regulation and workplace and school-based programmes will generally have the weakest effect on disease incidence.

The effect of interventions is larger on disability-adjusted life years (DALYs) than on LYs. This is especially true for measures to counter drink-driving and restrictions on outlet opening hours, as these interventions largely affect lethal and non-lethal injuries.

All interventions will have a significant impact on health expenditure. After adjusting for purchasing power parity (PPP), cumulatively savings range from USD PPP 6 billion (for workplace programmes) to USD PPP 207 billion (for MUP) between 2020 and 2050 in the 48 countries studied.

The medical expenditure savings resulting from taxation, MUP and sales hours restrictions are greater than the cost of running the interventions. In a few cases, the cost of running the intervention is higher than the health expenditure savings, as in the cases of advertising regulation and bans, counselling in primary care and sobriety checkpoints in Colombia, Mexico, non-OECD European Union (EU27) and Group of 20 (G20) countries. For three interventions (workplace programmes, school-based programmes and treatment of dependence), the cost of running the interventions is higher than the health expenditure savings in virtually all countries studied.

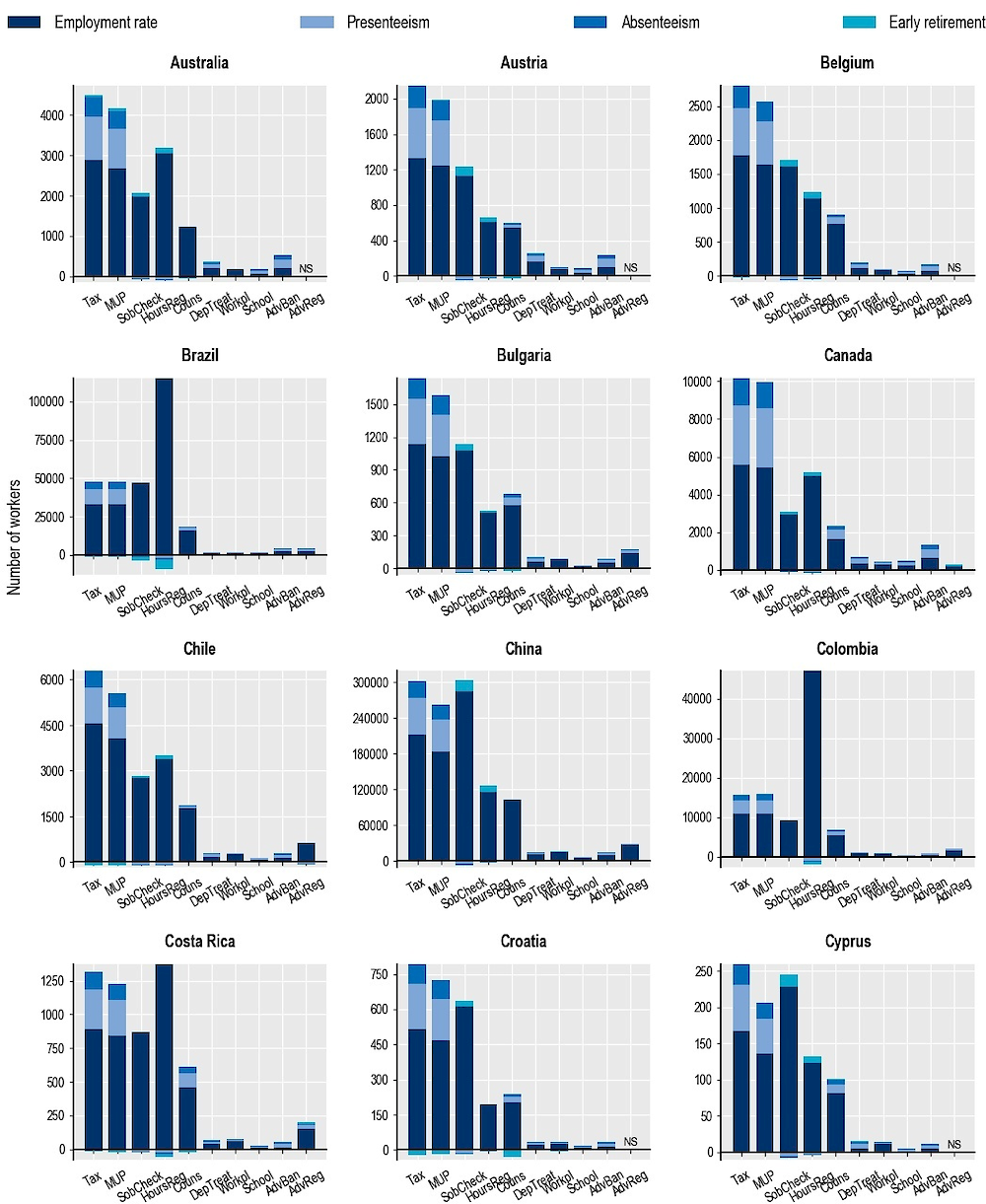

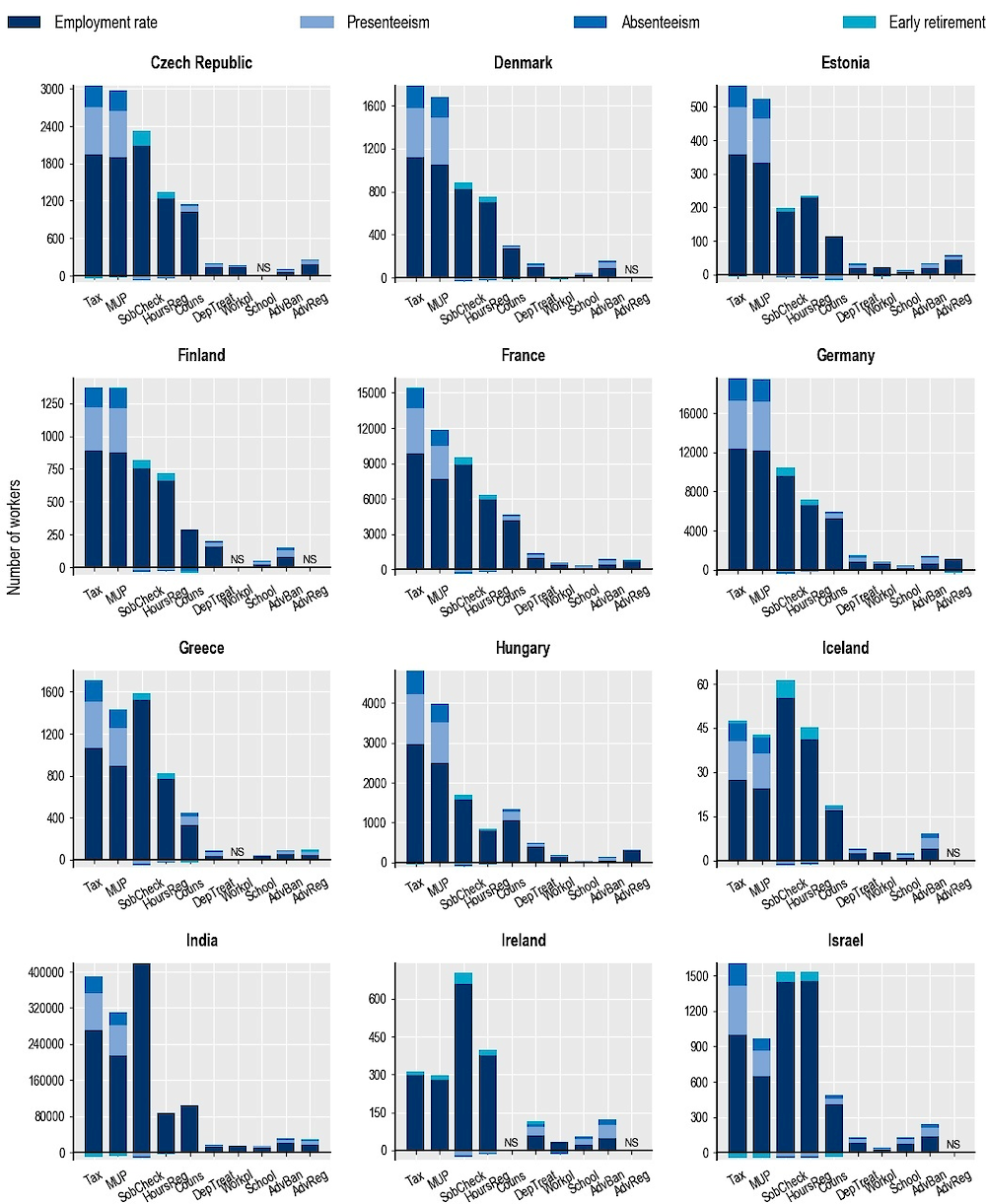

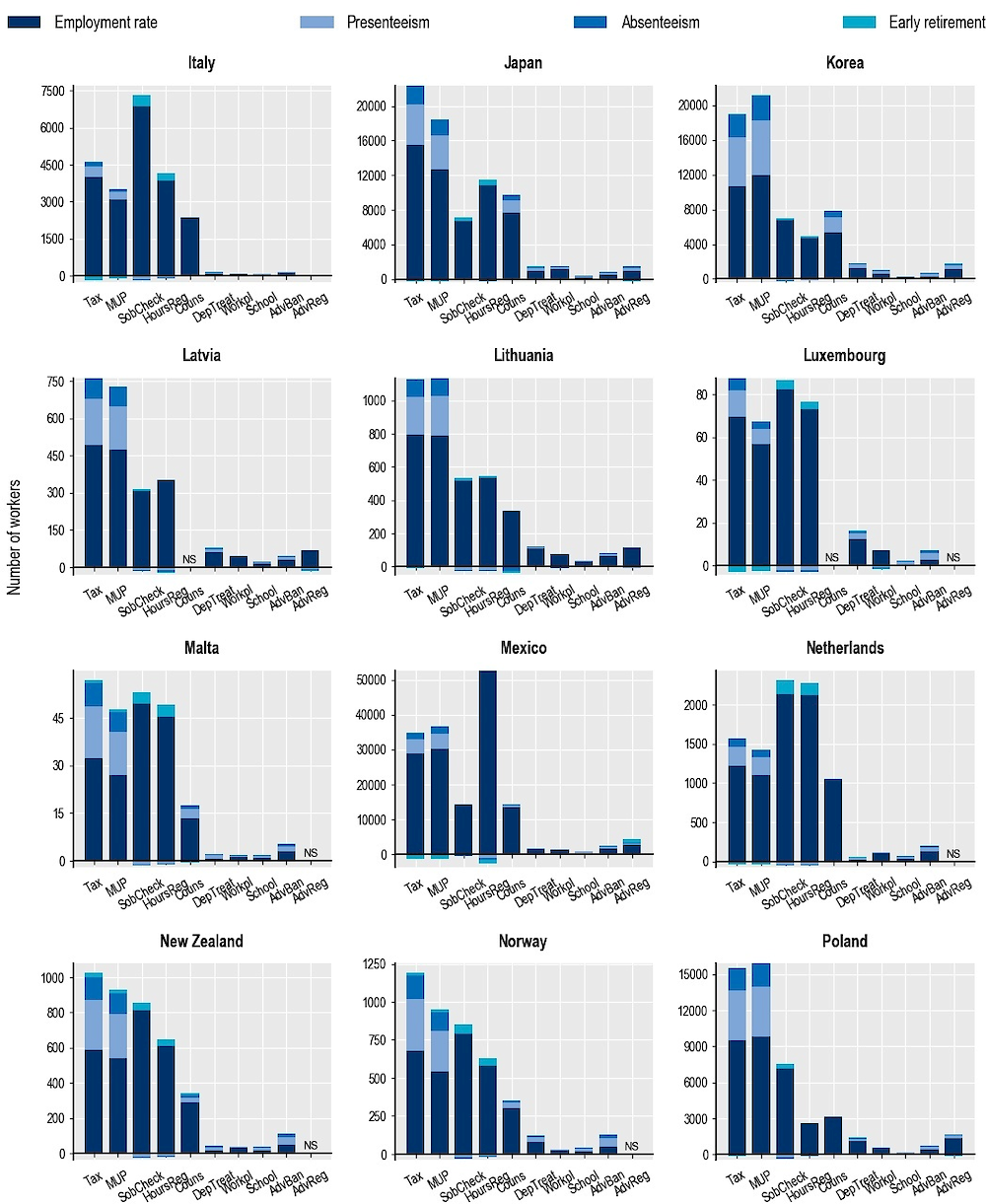

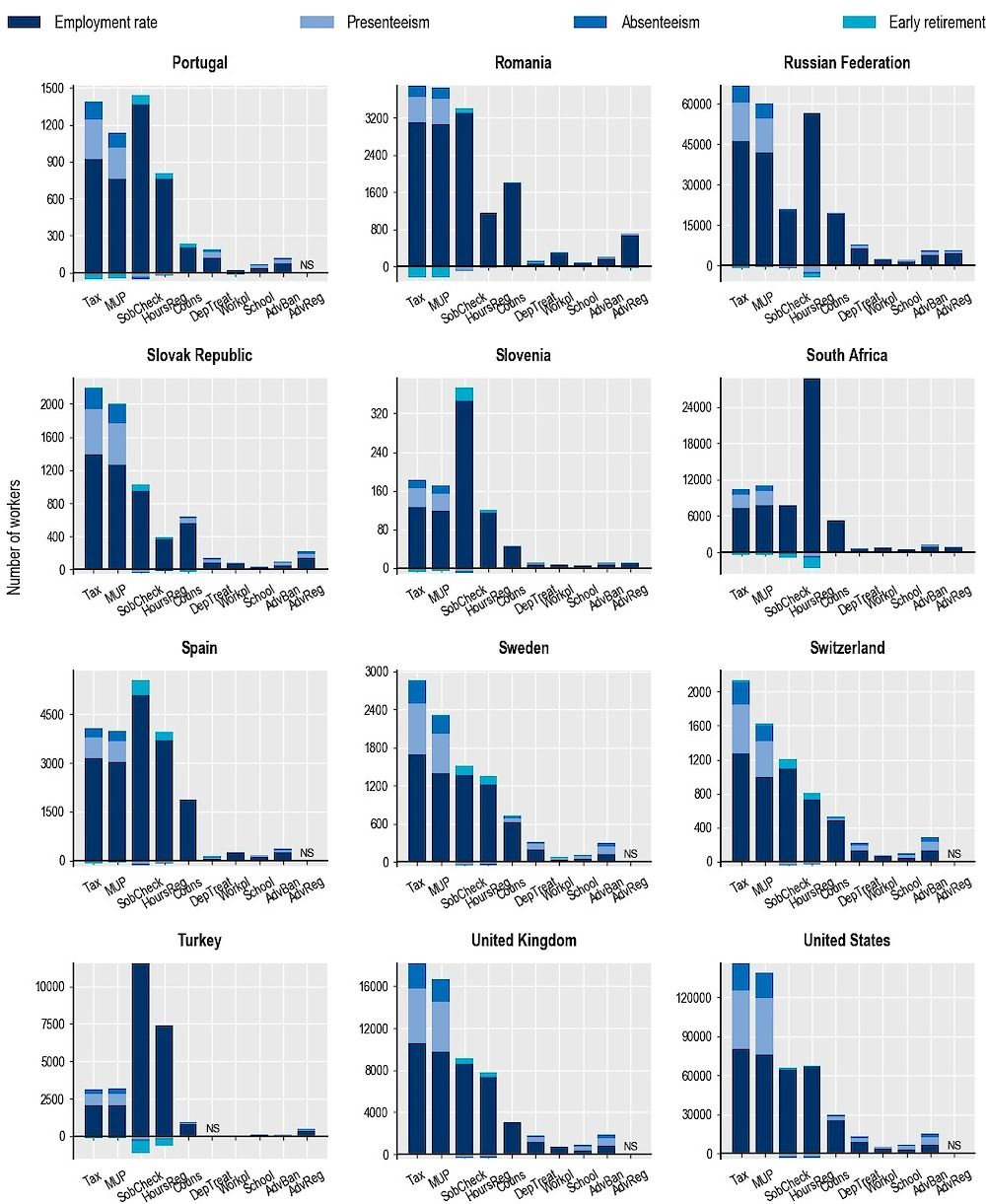

Most interventions are predicted to have a significant impact on employment and productivity. For example, taxation will help add 1 180 000 workers to the workforce each year in all countries. Most of this effect will come from an increase in employment rates (809 000 workers), followed by reductions in presenteeism (267 000 workers) and absenteeism (122 000 workers). The effect on early retirement is small.

Investing in interventions to tackle harmful alcohol use is very profitable for countries. For every USD PPP 1 invested in seven out of ten interventions, countries will see a return between USD PPP 2 and USD PPP 183 in the form of economic benefit each year.

There are regional differences in policy intervention effect, but they are outcome‑dependent. For example, the interventions that performed the best overall – taxation, MUP and sobriety checkpoints – will have a larger impact on the population-standardised health burden in the Russian Federation, the Baltic countries, Hungary and Poland, mainly owing to higher alcohol consumption there. On the other hand, their effect on population-standardised health expenditure will be stronger in the United States, Luxembourg, Austria, Germany and Denmark (even after adjusting for PPP), primarily owing to the higher medical costs in these countries.

Combining interventions in prevention packages will return higher benefits. Investing in a mixed package to upscale policies already in place in many OECD countries will result in a gain of 3.5 million LYs per year across all the 48 countries included in the analysis and will save about USD PPP 16 billion annually in health expenditure.

A mixed package complemented by innovative, promising interventions (MUP and statutory bans on alcohol advertising targeting children) shows the best results. The “mixed package plus” will result in a gain of 4.6 million LYs per year across all countries and in health expenditure savings of USD PPP 28 billion annually.

The prevention packages also have a significant effect on the labour market and the economy. The mixed package and mixed package plus will save between USD PPP 55 billion and USD PPP 90 billion per year in labour market costs in all countries owing to lower rates of absenteeism, presenteeism and early retirement, and to higher employment. For every USD PPP 1 invested in one of these two packages, countries will see a return of at least USD PPP 13 in the form of economic benefit each year.

A package to restrict alcohol availability is predicted to produce smaller – but still significant – effects, leading to a gain of 2.6 million LYs each year and saving USD PPP 4 billion in health expenditure and USD PPP 27 billion in labour-related costs per year in the 48 countries.

A package to promote individual responsibility is predicted to produce a gain of 2.2 million LYs each year and save nearly USD PPP 7 billion in health expenditure and USD PPP 21.5 billion in labour-related costs per year in the 48 countries.

Harmful use of alcohol causes important direct and indirect human and financial costs for societies. The findings presented in Chapter 4 show that consuming more than 1 drink1 per day for women and 1.5 drinks per day for men is responsible for a reduction in life expectancy of about 0.9 years across OECD countries and that treating alcohol-related diseases costs, on average, about 2.4% of the health expenditure of these countries. The burden of disease caused by consuming more than 1 drink per day for women and 1.5 drinks per day for men also has an impact on the broader economy: a reduction in workforce size and in productivity affects gross domestic product (GDP) and leads to an increase in fiscal pressure.

Many effective policy interventions exist to scale up national policy action to deal with the burden of harmful alcohol use. Policy actions include reinforcing regulation and pricing policy, increasing people’s awareness and empowerment through information and education, and prevention and treatment within the health care sector. As shown in Chapter 6, nearly all OECD, EU27, G20 and OECD accession and selected partner countries have adopted a national written policy on alcohol, while only one‑third have an aligning action plan to implement the national policy. Policy gaps remain either because, as the available evidence suggests, some of the policies currently in place would be more effective if they were redesigned or strengthened – for instance, restrictions on sales hours or advertising regulations – or because countries can now choose to implement additional policy interventions such as minimum unit pricing. This chapter reports the findings of an analysis model (Box 7.1) developed to help countries close these policy gaps. This assesses and compares the health and economic impact of a number of policy interventions aligned with the key areas for national action listed in the 2010 World Health Organization (WHO) Global Strategy to Reduce the Harmful Use of Alcohol (WHO, 2010[1]), and with the WHO “best buys” to reduce harmful use of alcohol and NCDs (WHO, 2017[2]).

The main objective of the analysis is to evaluate whether the implementation of a selected number of policy interventions, scaled up to national levels, can reduce the health and economic burden of harmful alcohol use; the extent of that reduction; and whether those actions would represent a good investment for governments. The choice of the interventions to be modelled is based on a number of criteria, including the availability of high-quality quantitative evidence to feed the OECD Strategic Public Health Planning for non-communicable diseases (SPHeP-NCDs) model (for more information see Box 4.1 in Chapter 4). The effects of each intervention are presented, along with the possible impact of combining different interventions. Results are presented for 48 countries including OECD countries, non-OECD EU27 member countries as well as Brazil, the People’s Republic of China, Costa Rica, India, the Russian Federation and South Africa.2 All interventions are modelled on the assumption that they were implemented in 2020, and their effectiveness is assessed over the period 2020‑50.

The evaluation of policy interventions employs the OECD SPHeP-NCD model described in Box 4.1 in Chapter 4.

Whether a particular policy intervention will work in a given context depends on a number of factors, some of which can be location-specific. For example, the return on investment of an intervention may depend not only on its general efficacy but also on the local medical costs of treating related diseases and complications; demographic structure; epidemiological burden and the cost of intervention implementation. Within the OECD SPHeP-NCDs model, interventions are modelled using the following four key parameters:

Effectiveness of interventions at the individual level. This parameter captures how individual behaviour changes following exposure to the interventions. As far as possible, this evidence is taken from peer-reviewed meta‑analyses – preferably from randomised controlled trials.

Time to the maximum effectiveness achieved and effectiveness over time. The effects of an intervention can be time‑limited and/or time‑dependent, with the relationship generally becoming stronger at first and then fading out. This parameter describes changes in the effectiveness of interventions over time.

Intervention coverage, including descriptions of eligible populations and their exposure. For example, some interventions may only affect a subset of a population (such as individuals in certain age groups or with particular risk factors). In addition, in some cases, only a proportion of the eligible population may be exposed, such as only those who visit primary care providers and are willing to participate.

Implementation cost. The implementation of an intervention may entail a number of costs including, for example, costs related to its planning, administration, monitoring and evaluation and so on. In addition, interventions may involve providing some form of equipment or material to be delivered to the target population (e.g. brochures). The evaluation of both costs and benefits take a societal perspective. So, for example, the cost category considers spending for running the interventions (e.g. expenditure on pharmaceuticals), while benefits used to calculate the return on investment include health expenditure saved by the government, by the social insurance schemes or by individuals. The intervention costs are estimated based on the WHO CHOosing Interventions that are Cost-Effective (WHO-CHOICE) methodology (WHO, 2003[3]), taking into account differentials in relative prices (as measured by differences in PPPs and exchange rates). All the costs are expressed in 2015 USD PPPs.

Data to model the interventions are retrieved from the literature and are based, as much as possible, on systematic reviews and meta‑analyses, which are considered to provide the highest quality of evidence. If multiple systematic reviews and meta‑analyses are available, those that are judged of the highest quality are prioritised. However, by its nature, the quality of evidence on the effectiveness of policies – which cannot be tested in randomised controlled trials – is more limited than in other fields of research. For example, a recent quality assessment of systematic reviews in the field of alcohol policy concluded that the majority of reviews are based on observational studies (Siegfried and Parry, 2019[4]).

To gauge the population-level effectiveness and the return on investment of interventions designed to tackle harmful alcohol use, interventions are evaluated against a “business-as-usual” scenario, in which age‑ and sex-specific exposures to risk factors remain unchanged during 2020‑50 and the provision of preventive and health services is implemented at the current levels, specific to a country. The comparison between the business-as-usual and the intervention scenarios corresponds to the impact of an intervention, and it is carried out by considering all the relevant dimensions including, for instance, differences in health, health costs, labour market productivity and so on. In order to assess the uncertainty of the effectiveness of an intervention, a sensitivity analysis was undertaken to look at the variability of the estimates of the impact of the policy interventions. This provides all the information needed to carry out a return on investment analysis.

For more information on the OECD SPHeP-NCDs model, see the SPHeP-NCDs Technical Documentation, available at: http://oecdpublichealthexplorer.org/ncd-doc.

The analysis presented in this chapter considers ten interventions, categorised into four policy domains based on the OECD framework described in Sassi and Hurst (2008[5]):

policy interventions influencing lifestyles through information and education: specifically workplace programmes and school-based programmes

policy interventions to increase alcohol prices: raising alcohol taxation and setting a minimum unit price

policy interventions to regulate or restrict alcohol availability: regulations on alcohol advertising, statutory bans on advertising targeting children, measures to counter drink-driving such as sobriety checkpoints and restrictions of outlet opening hours

policy interventions within the health care sector: specifically counselling by a general practitioner and pharmacological treatment of dependence.

A policy of screening and brief interventions in the workplace (employing at least 50 people) was simulated, based on the experience of a large Australian postal network (Richmond et al., 2000[6]). Participation is assumed to be voluntary and anonymous for workers reporting excessive levels of alcohol consumption or heavy episodic drinking. The intervention consists of three phases plus a “kick-off” period to promote participation by distributing brochures and posters. The initial screening process is carried out during phase one, which lasts four to five months. Workers are administered a questionnaire about their health and weekly alcohol consumption during the previous three months. Those reporting a high daily intake of alcohol are asked to fill in a more comprehensive questionnaire (phase two), whose results are used to tailor a subsequent brief intervention (one 20‑minute visit) delivered by a general practitioner. During the visit, the patient is provided with a booklet and receives information about the health effects of harmful alcohol consumption and advice on how to reduce consumption. Ten months after the start of the programme, a final assessment is carried out, with a procedure similar to phase one.

The proportion of medium or large enterprises is specific to countries, and data are taken from the OECD’s Entrepreneurship at a Glance 2016 (OECD, 2016[7]). Patients with a diagnosis of alcohol dependence are excluded from this intervention but are referred to an appropriate treatment centre. It is furthermore assumed that only 12.3% of the potential targets will agree to participate in the programme (Richmond et al., 2000[6]). It is assumed that 50% of enterprises will agree to participate.

The modelled workplace intervention is assumed to decrease the consumption of alcohol by 41 g per week (5.9 g per day) after 12 months for both men and women (Ito et al., 2015[8]). Evidence of long-term effectiveness is weak. Consistently with the modelling of counselling in primary care, the effectiveness of workplace interventions in changing alcohol consumption is assumed to last for five years, staying constant until year 4 and then declining linearly until year 5. If a person participates in the programme, they can be exposed again in subsequent years, once the effectiveness of the intervention is over for them.

The estimated total cost of this intervention is USD PPP 3.7‑5.4 per capita per year across the countries included in the analysis. Although the intervention is delivered in the workplace, it is assumed to take place as part of a government-sponsored programme. However, the time spent in the programme by participating employees is not assumed to be subsidised. The most expensive single component of this intervention is the counselling delivered by a medical doctor. Other cost items include printed materials (booklets, leaflets, posters, questionnaires) and administrative support.

The intervention modelled in the analysis involves the delivery of a skill-based educational programme for school students aged 10 to 15. The intervention is modelled based on a Cochrane Review of school interventions targeting multiple behavioural risk factors (MacArthur et al., 2018[9]). More precisely, the intervention design broadly reflects the former Michigan Model for Health Study that took place in 52 elementary schools in Michigan and Indiana, the United States (O’Neill, Clark and Jones, 2011[10]), which consisted of 53 lessons (20‑50 minutes long) delivered over a two‑year period (grades 4 to 5). Over time, the programme has been extended from pre‑kindergarten to twelfth grade. Lessons comprise four topics: social and emotional health; alcohol, tobacco, other drugs; safety; and nutrition and physical activity. It is assumed that ten lessons dedicated to alcohol are delivered over a six‑year period to children aged 10 to 15. As well as mastery of techniques, skill development and practice are delivered.

Based on a Cochrane Review (MacArthur et al., 2018[9]) that found a 28% reduction in alcohol use, combined with evidence of a reduction in drinking initiation (O’Neill, Clark and Jones, 2011[10]), the model assumes that the probability of drinking initiation among students who have attended the school-based programme is reduced by 20%. The effectiveness is active as long as the students are exposed (from ages 10 to 15); when they turn 16, the effectiveness goes back to zero linearly over 12 months, as the evidence suggest no long-term effect (MacArthur et al., 2018[9]). Moreover, as a result of the intervention, students who initiate drinking at older ages will benefit from a reduced probability of dependence in adulthood. Evidence suggests that early onset of drinking leads to 30% higher probability of dependence; conversely, people who start drinking after the legal drinking age have a lower risk (Hingson, Heeren and Winter, 2006[11]). All students aged 10 to 15 are eligible to be exposed to this intervention, although 90% will actually be exposed.

The cost per child is estimated at USD PPP 10‑15 per year across the countries included in the analysis, while the fixed cost is estimated at USD PPP 0.5‑0.7 per capita per year. This reflects the cost of scaling up the policy at the national level. The cost includes training costs for teachers and basic materials for children and teachers in digital and print formats. Teachers are assumed to be trained at the beginning of the project and updated with ongoing technical support online.

The intervention assumes a raise in taxation sufficient to lead to a 10% price increase across all types of alcoholic beverages. It assumes that the increase of the tax almost immediately triggers an increase in the price of the alcoholic drinks, and that the level of taxation is continually revised to maintain constant affordability over the period of the simulation. The intervention does not entail any specific assumptions on how the price increases would be achieved – for example, by increasing excise duty rates, modifying other existing taxes or introducing new fiscal measures. The data used to model the effect of price increase come from a meta‑analysis that also includes studies measuring how changes in price affect consumption rather than changes in sales, and therefore take into account – at least to some extent – potential increases in consumption of alcohol from illicit sources (which is relatively low in the majority of studied countries, with higher levels observed in the Russian Federation and Greece (see Figure 8.2 in Chapter 8)).

A systematic review and meta‑analysis was carried out to estimate the price elasticities on alcohol consumption, for which 665 estimates from 133 studies were extracted from the literature, including 181 estimates for beer, 182 for wine and 168 for spirits and liquor. Price elasticities (Table 7.1) were estimated along three dimensions: type of beverage, age of drinker and category of drinking. These were combined with the level of per capita alcohol consumption in each country. This approach allows the model to take into account cross-country differences and to produce outputs that reflect national specificities. This choice is supported by evidence in the literature suggesting that:

Young drinkers are less responsive to price changes than adults (Gallet, 2007[12]).

Moderate drinkers are more price‑sensitive than heavy drinkers (Fogarty, 2006[13]; Dave and Saffer, 2008[14]; Meier, Purshouse and Brennan, 2010[15]; An and Sturm, 2011[16]; Fogarty, 2008[17]).

Alcohol own-price elasticities3 vary by type of beverage (Gallet, 2007[12]; Sornpaisarn et al., 2013[18]; Wagenaar, Salois and Komro, 2009[19]; Nelson, 2013[20]; Fogarty, 2006[13]; Fogarty, 2008[17]). The relative market share of different types of alcohol is also an important factor in explaining changes in consumer demand at the national level (Fogarty, 2006[13]).

Results presented in Table 7.1 are broadly aligned with those from six previous meta‑analyses that found that beer is the least price‑sensitive beverage (with price elasticities ranging from ‑0.29 to ‑0.83) compared to wine (‑0.46 to ‑1.11) and spirits (‑0.54 to ‑1.09) (Gallet, 2007[12]; Sornpaisarn et al., 2013[18]; Wagenaar, Salois and Komro, 2009[19]; Fogarty, 2008[17]; Nelson, 2013[20]).

|

Type of beverage |

Age of the drinker |

Category of drinking |

Price elasticity |

|---|---|---|---|

|

Beer |

<25 |

Below 40 g/day for men and 20 g/day for women |

‑0.47 |

|

Beer |

<25 |

Above 40 g/day for men and 20 g/day for women |

‑0.41 |

|

Beer |

≥25 |

Below 40 g/day for men and 20 g/day for women |

‑0.62 |

|

Beer |

≥25 |

Above 40 g/day for men and 20 g/day for women |

‑0.56 |

|

Spirits |

<25 |

Below 40 g/day for men and 20 g/day for women |

‑0.55 |

|

Spirits |

<25 |

Above 40 g/day for men and 20 g/day for women |

‑0.49 |

|

Spirits |

≥25 |

Below 40 g/day for men and 20 g/day for women |

‑0.70 |

|

Spirits |

≥25 |

Above 40 g/day for men and 20 g/day for women |

‑0.64 |

|

Wine |

<25 |

Below 40 g/day for men and 20 g/day for women |

‑0.49 |

|

Wine |

<25 |

Above 40 g/day for men and 20 g/day for women |

‑0.43 |

|

Wine |

≥25 |

Below 40 g/day for men and 20 g/day for women |

‑0.65 |

|

Wine |

≥25 |

Above 40 g/day for men and 20 g/day for women |

‑0.59 |

Note: A price elasticity of ‑0.47 means that a 10% increase in the price of beer would lead to a reduction by 4.7% in the quantity of beer purchased.

Source: OECD estimates.

The intervention in the model is assumed to affect the whole population (100% coverage), and to last as long as the policy is in place.

The cost of this intervention is estimated as USD PPP 0.05‑0.08 per capita per year across the countries included in the analysis. The estimated cost of an increase in taxation includes basic administration, planning, monitoring and enforcement at the national level, with the last of these accounting for most of the total cost. Additional tax revenues are not accounted for in the analysis as they represent transfers rather than costs.

The MUP intervention entails an increase in the alcohol unit cost for alcoholic products in the cheapest segment of the market. Specifically, the cost per unit of alcohol is increased to a pre‑defined threshold. For example, in the United Kingdom (Scotland) the threshold was set at GBP 0.50 per unit of alcohol, while in Canada the threshold varies by type of beverage and across provinces, as illustrated in Box 6.3 in Chapter 6.

The intervention is modelled on three key dimensions: the share of alcohol sold below the price set as the minimum threshold; the price increase needed to ensure that the price per unit of alcohol meets the pre‑defined threshold; and changes in consumption following the price increase. Two analyses using consumer scanner data reported information by type of alcohol product and category of drinker for the first two dimensions: the share of alcohol units affected by the increase and the average price increase (as a percentage) per unit of alcohol in this group. Inputs reported in Table 7.2 broadly correspond to the effects of the MUP as implemented in the United Kingdom (Griffith, O’Connell and Smith, 2017[21]; Angus et al., 2015[22]). The third dimension – the change in consumption following the introduction of MUP – is modelled using the same parameters used to model an increase in taxation (Table 7.1).

|

Type of beverage |

Age of the drinker |

Category of drinking |

Share of alcohol units sold below the MUP threshold (%) |

Average percentage price increase needed to reach the MUP threshold |

|---|---|---|---|---|

|

Beer |

<25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

36.73 |

|

Beer |

<25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

36.73 |

|

Beer |

≥25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

36.73 |

|

Beer |

≥25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

36.73 |

|

Spirits |

<25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

23.40 |

|

Spirits |

<25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

23.40 |

|

Spirits |

≥25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

23.40 |

|

Spirits |

≥25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

23.40 |

|

Wine |

<25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

23.50 |

|

Wine |

<25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

23.50 |

|

Wine |

≥25 |

Below 40 g/day for men and 20 g/day for women |

19.34 |

23.50 |

|

Wine |

≥25 |

Above 40 g/day for men and 20 g/day for women |

37.94 |

23.50 |

Source: Adapted from Griffith, O’Connell and Smith (2017[21]) and Angus et al. (2015[22]).

The rollout of this intervention is assumed to start in 2020 and last until the end of the simulation period, with constant effects starting immediately after implementation of the policy and lasting as long as the policy is in place.

The cost of this intervention is estimated at USD PPP 0.07‑0.11 per capita per year across the countries included in the analysis. The main drivers of the cost are basic administration, planning, monitoring and enforcement at the national level, the last of which accounts for most of the total cost.

Interventions aimed specifically at reducing driving under the influence of alcohol include enforcement of blood alcohol concentration (BAC) laws, sobriety checkpoints, alternative transportation and ongoing innovative programmes such as the Driver Alcohol Detection System for Safety Programme, an in-vehicle technology that prevents the driver from driving if the BAC level exceeds the limit set by law (Box 7.2). The policy scenario modelled in the analysis focuses on a tightening of the enforcement of sobriety checkpoints to reduce drink-driving.

The policy intervention accounts for new published evidence on the effectiveness of sobriety checkpoints. The design of the policy is broadly based on the example of a sobriety checkpoint programme implemented in Charlottesville (Virginia, the United States), thoroughly described and evaluated in a published study (Voas, 2008[23]). The programme involved five‑officer checkpoint teams working four hours per night to stop and test drivers’ sobriety on weekend (Friday and Saturday) nights each week. Sites were chosen in advance and signs warned drivers of the checkpoints and breath testing. In one year, 94 checkpoints operations were conducted, for a total of 1 880 hours of work for the officers concerned. Around 24 000 vehicles were stopped, and 290 drivers were arrested.

Sobriety checkpoints were found to be most effective in the first half year after implementation. The decline in (fatal and non-fatal) traffic accidents over time, as estimated in the meta‑analysis by Erke, Goldenbeld and Vaa (2009[24]), started from 29% after three months, decreasing to 21% at 6 months and becoming almost stable between years 1 and 8 (with estimates ranging from 13% to 11%). Results from this meta‑analysis were updated with 15 new studies (published either before 1990 or after 2009) to reflect the most recent evidence. As a result, the implementation of sobriety checkpoints in the present analysis is modelled as a reduction in traffic-related injuries (fatal and non-fatal, in constant proportions) equivalent to 25% in the first year and 15‑16% in the following years.

The modelled intervention covers 80% of the population of all ages. This proportion corresponds to the share of people living in urban areas with traffic targeted by the policy (World Bank, 2018[25]). There is no restriction by age of the drinker or by level of drinking, since all people – who can be involved in a traffic accident independently of whether they have had a drink – can benefit from the policy. The policy rollout starts from 2020 and the intervention is implemented continuously until the end of the simulation period.

The cost of this intervention includes the manning of checkpoints – the most expensive item – and a media campaign. It is estimated as USD PPP 0.6‑0.8 per capita per year across the countries included in the analysis.

Among the suite of policies developed to counter drink-driving, breath alcohol ignition interlock programmes have gained a great deal of attention. This safety system aims to curb impaired driving by preventing a driver with a measurable BAC from starting the car. Specifically, a fuel-cell breath test incorporated in the vehicle records the driver’s BAC and sends a signal to the engine not to start if the BAC result is higher than the pre‑determined limit. Moreover, random retests are required while the car is running, as a measure to prevent circumvention of the device.

Overall, alcohol ignition interlock systems seem to be effective tools as long as they are installed in the vehicle. However, their potential is currently limited by low participation rates and the lack of a persistent beneficial effect beyond the installation period.

As discussed in Chapter 6 (Section 6.2), ignition interlock laws have been introduced for drink-driving offenders and/or professional drivers in the United States, and lately also in a few European countries. Nevertheless, the installation rate of such devices is still low. In the United States, only 20% of those arrested for impaired driving actually installed interlocks in their vehicles in 2012 (Roth, 2012[26]; GAO, 2014[27]).

The evidence for the effectiveness of interlocks on recidivism is strong; however, the effect vanishes as soon as the system is removed. Installation of interlocks decreases the probability of being re‑arrested (with a relative risk of 0.36 (Willis, Lybrand and Bellamy, 2004[28]) and a median relative risk of 0.25 (Elder et al., 2011[29])).

The evidence on alcohol-related crashes relies on single studies only and is much weaker. Three recent studies show evidence for the effectiveness of interlocks to reduce alcohol-related fatal crashes, with a reduction varying between 0.20% and 15% (McGinty et al., 2017[30]; Vanlaar, Mainegra Hing and Robertson, 2017[31]; Kaufman and Wiebe, 2016[32]). While the in-vehicle interlocks decrease alcohol-related crashes, the overall crash risk resulting from installation of interlocks is higher than the risk associated with having a suspended licence (Vézina, 2002[33]; DeYoung, Tashima and Masten, 2005[34]).

A policy scenario was modelled entailing restrictions in on-premise outlet opening hours, leading to a two‑hour reduction, with a view to cutting the incidence of alcohol-related injuries, particularly from assaults and traffic crashes. This policy was assumed to target the most densely populated areas of the countries concerned, corresponding to medium-sized and large cities. The policy scenario also involves increased enforcement efforts by the relevant licensing and law enforcement authorities.

Based on a study by Rossow and Norström (2012[35]), a two‑hour reduction in on-trade outlet opening hours was associated with a 34% reduction in assault-related injuries. This is also supported by evidence from Kypri et al. (2011[36]), which found that the impact of a mandatory closing time of 03:30 for on-trade outlets and a lockout at 01:30 (meaning no new customers to be admitted) led to a 37% reduction in assault-related injuries. In addition, a 1.5% reduction in traffic-related injuries was modelled, based on the lower end of the range used by Chisholm et al. (2004[37]).

The policy of restricting on-premise opening hours applies to people of all ages living in urban areas (World Bank, 2018[25]). In subsequent years, those who did not receive the intervention in 2020 will not be exposed (because they live outside the catchment areas of at least medium-sized cities), and the only group that will have a chance to be exposed will be newborns/immigrants. Those who initially received the intervention will continue to be exposed as long as they are drinkers.

The total cost of this intervention is estimated at USD PPP 0.1‑0.2 per capita per year across the countries included in the analysis. The intervention involves basic administration at the local level and law enforcement. It is estimated that enforcing the new regulations represents the most expensive component of the intervention.

The advertising regulation policy scenario is not modelled as a comprehensive ban, but as a series of regulatory measures that would lead to a 25% reduction in advertising expenditure, limiting exposure to alcohol advertising for different types of consumer. This regulatory intervention assumes that restrictions would be applied to traditional and new media, sponsorships, branding and point-of-sale displays. Enforcement would be undertaken by existing regulatory authorities, as the necessary infrastructures are already in place in most OECD countries. This intervention assumes that individuals living in a country are not exposed to a considerable amount of advertising from a neighbouring country that does not implement the same intervention. In other words, the model does not account for any significant cross-border marketing. Policy rollout is assumed to start from 2020.

Based on a meta‑analysis of 322 estimates of advertising elasticities by Gallet (2007[12]), a 25% decrease in advertising expenditure is expected to produce a 0.8% decrease in alcohol demand. However, there is evidence that young people are more responsive to changes in alcohol advertising, so their response was modelled on the basis of a study by Saffer and Dave (2006[38]), which reported elasticities of 0.034 for any drinking and 0.065 for binge drinking during the past month. For the modelled intervention, these elasticities translate into a 0.84% reduction of average consumption in young drinkers (aged 18 or under), and a 1.6% reduction in the number of binge drinkers (all ages). In addition, the model assumes that for drinkers older than 18, there will be a reduction of alcohol consumption by 0.8%.

The population coverage for the eligible group is assumed to be 100%. Once exposed, the drinkers (of all ages) will continue to be exposed until the end/until they stop drinking. In subsequent years, all new drinkers will be exposed to the intervention on alcohol advertising regulation.

The intervention cost is estimated at USD PPP 0.3‑0.4 per capita per year across the countries included in the analysis. The intervention involves basic administration and planning costs at the national and local levels. In addition, minor training may be required for communication authority staff charged with the task of overseeing implementation of the scheme. Finally, the estimation includes the cost of monitoring and enforcing the new regulation, which represent the most expensive components of the intervention.

This intervention is modelled as a comprehensive ban for all forms of media (TV, radio, newspapers, billboard, internet, social media), limiting exposure to alcohol advertising for children and young adults. This regulatory intervention assumes that restrictions would be applied to traditional and new media, sponsorships, branding and point-of-sale displays. Enforcement would be undertaken by existing regulatory authorities, as the necessary infrastructures are already in place in most OECD countries. The population coverage for the eligible group is assumed to be people aged 0‑17. This intervention also assumes that individuals living in a country are not exposed to a considerable amount of advertising from a neighbouring country that does not implement the same intervention. In other words, the model does not account for any significant cross-border marketing. Policy rollout is assumed to start from 2020.

This intervention is modelled based on a study by Tanski et al. (2015[39]), which covers any form of marketing and develops a perceptivity score (based on exposure, liking and brand identification). Assuming a 10% failure rate, a total ban on advertising to children would reduce early onset of drinking by 35% in individuals aged 17 years or below. In addition, the model assumes a relationship between early onset of drinking and the probability of dependence, based on evidence that people starting to drink after the legal drinking age have a risk of dependence 30% lower than those who drink while underage (Hingson, Heeren and Winter, 2006[11]).

The intervention cost is estimated at USD PPP 0.3‑0.4 per capita per year across the countries included in the analysis. The intervention involves the same costs as the advertising regulation intervention.

The intervention consists of detecting patients at risk for heavy drinking when they visit a general practitioner, and of delivering brief counselling about the alcohol-related harms and ways to reduce alcohol consumption. The programme targets hazardous and harmful drinkers (regular or episodic), excluding individuals dependent on alcohol, aged 18‑70 (Kaner et al., 2018[40]). The recruitment of participants occurs opportunistically by screening patients who visit a health care facility for a non-alcohol-related problem. The screening is carried out with the use of a questionnaire (the Alcohol Use Disorders Identification Test or equivalent) requesting information on health status and alcohol consumption, either delivered on the spot or mailed to the patient’s address. Angus et al. (2019[41]) found that up to 5% of patients – increased to 10% for modelling purposes – were screened for excessive alcohol consumption, of whom almost half were diagnosed positive and received a brief intervention. In other words, between 1% and 3% of the population received a brief intervention. In the OECD SPHeP-NCD model, it is assumed that each year 20% of non-alcohol-dependent heavy drinkers benefit from the intervention (about 2% of the population).

The effectiveness of the intervention is modelled based on findings from a recent Cochrane Review by Kaner et al. (2018[40]). During the course of the intervention, male drinkers reduce their alcohol consumption by 42.21 g per week (about four standard drinks per week) and female drinkers by 30.27 g per week (about three drinks per week).

There is evidence that similar interventions can have lasting effectiveness – for at least four years (Fleming et al., 2002[42]) and up to seven years (Angus et al., 2014[43]). Therefore, the effectiveness of the modelled intervention is assumed to last for five years, declining linearly during the final year. The full effect will be achieved after 12 months. Once people have had an intervention, they will be eligible again in the following years (after the effect has completely disappeared), with the same probability of being enrolled in the intervention (i.e. 20%).

The intervention cost accounts for basic expenses for administration, monitoring and training for doctors and nurses delivering the intervention. The main drivers of the cost are the time of doctors and nurses, followed by provision of printed material for patients. Even if counselling is provided by facilities already in place and delivered by specialist health personnel, programme and training costs account for a significant part of the total expenditure per target individual because all the costs of the intervention are spread over a relatively small population subgroup. The cost of delivering the intervention is estimated at USD PPP 24‑35 per year per enrolled person across the countries included in the analysis. Organisational and planning costs (i.e. fixed costs) are estimated at USD PPP 0.2‑0.3 per capita per year.

This intervention is a pharmacological treatment based on precision medicine, which customises the therapy according to patients’ peculiarities and different needs. The intervention entails two types of treatments assigned to two categories of patients: acamprosate is prescribed to people not diagnosed with alcohol dependence but affected by alcohol use disorders (AUDs), while naltrexone is prescribed to drinkers diagnosed with alcohol dependence.4

For the patients treated with acamprosate, the therapy entails six months of daily administration of the medicine (without psychotherapy support), with a dosage adjusted for the patient’s body weight. For higher effectiveness, patients first need to be detoxified and must avoid alcohol intake in the week prior to treatment initiation (Kampman et al., 2009[44]). The eligible population consists of individuals aged between 18 and 65 who fulfil the diagnostic criteria of AUDs according to the Diagnostic and Statistical Manual of Mental Disorders, but that are not diagnosed as dependent drinkers. Based on the results of the meta‑analysis by Maisel et al. (2013[45]), combined with results from Poldrugo (1997[46]), the intervention is assumed to reduce alcohol consumption by 31% (corresponding to 55.5 more days of cumulative abstinence over six months). The pattern of effectiveness is modelled as a linear reduction in alcohol consumption during the six months of the medication administration period, reaching its maximum level at the sixth month. The effectiveness remains constant throughout the six months following cessation of the treatment (Poldrugo, 1997[46]). The effectiveness is then modelled to vanish linearly in the following 12 months. The cost for the acamprosate medication is estimated at USD PPP 355‑521 per year per patient across the countries included in the analysis,5 while the fixed cost is estimated at USD PPP 0.2‑0.3 per capita per year.

For the patients treated with naltrexone, the therapy consists of three months of continuous medication administered on a daily basis (50 mg/day), followed by five months of targeted medication (taken on an “on-demand” basis, only when craving is high) in conjunction with coping cognitive behavioural sessions (Heinälä et al., 2001[47]). This psychological therapy involves a total of four visits of 90 minutes each (Stein and Lebeau-Craven, 2002[48]) carried out by a trained therapist in weeks 1, 2, 5 and 12 in a group setting, based on the Relapse Prevention Model proposed by Marlatt and Gordon (1985[49]).The eligible population is made of people diagnosed with alcohol dependence. Currently, only 10% of the diagnosed population receive pharmaceutical treatment for alcohol dependence (VisionGain, 2008[50]). The modelled intervention assumes double this proportion, reaching 20% of people diagnosed with AUDs. Based on the results of the meta‑analysis by Maisel et al. (2013[45]), combined with results from Heinälä et al. (2001[47]), the intervention is associated with a decline in alcohol intake equal to 122 g per week (17.4 g per day). The pattern of effectiveness was assumed to increase linearly throughout the medication period, reaching its peak at the sixth month and remaining constant thereafter until the end of treatment (eighth month) (Heinälä et al., 2001[47]). This is followed by linearly declining effectiveness, fading completely two months after the end of the therapy. The per treatment cost for the naltrexone medication together with the psychological therapy is estimated at USD PPP 171‑251 per year across the countries included in the analysis,6 while the fixed cost is estimated at USD PPP 0.2‑0.3 per capita per year. A large proportion of the cost (approximately 30%) is represented by the drug itself (a three‑month course). The psychological programme, primary care visit and follow-up visits managed by a nurse account for about 20% of the total cost. The remaining costs are for materials handed to patients and programme organisation.

Table 7.3 provides a brief summary of the key inputs to model the policy interventions described above.

|

|

Workplace |

School-based |

Taxation |

MUP |

Sobriety checkpoints |

Sales hours restriction |

Regulation of advertising |

Ban on advertising to children |

Counselling |

Treatment of dependence |

|---|---|---|---|---|---|---|---|---|---|---|

|

Target age |

18‑65 |

10‑15 |

all |

all |

>18 |

all |

all |

<18 |

all |

all |

|

Exposure |

0.9‑2.5% |

90% |

100% |

100% |

80% |

40‑99% |

100% |

90% |

20% |

20% |

|

Effectiveness |

Alcohol consumption: ‑41 g/week |

Drinking initiation: ‑20%; Dependence: ‑30% |

10% price increase reduces alcohol consumption by: 4% to 7% |

Alcohol consumption: ‑0.6% to ‑3.3% |

Traffic injuries: ‑25% (year 1), 15% (year 2), ‑16% thereafter |

Assault injuries: ‑34%; Traffic injuries: ‑1.5% |

Alcohol consumption in young people: ‑0.84%; Number of binge drinkers: ‑1.6% |

Underage drinking: ‑35%; Probability of dependence: ‑30% |

Alcohol consumption: ‑42 g/week (men), ‑30 g/week (women) |

Alcohol consumption: acamprosate: ‑31%; naltrexone: ‑122 g/week |

|

Per capita cost, USD PPP |

3.7‑5.4 |

0.5‑0.7; per child: 10‑15 |

0.05‑0.08 |

0.07‑0.11 |

0.6‑0.8 |

0.1‑0.2 |

0.3‑0.4 |

0.3‑0.4 |

0.2‑0.3; per treated patient: 24‑35 |

0.2‑0.3; per treated patient: 171‑521 |

Source: OECD analyses of the literature; meta‑analyses.

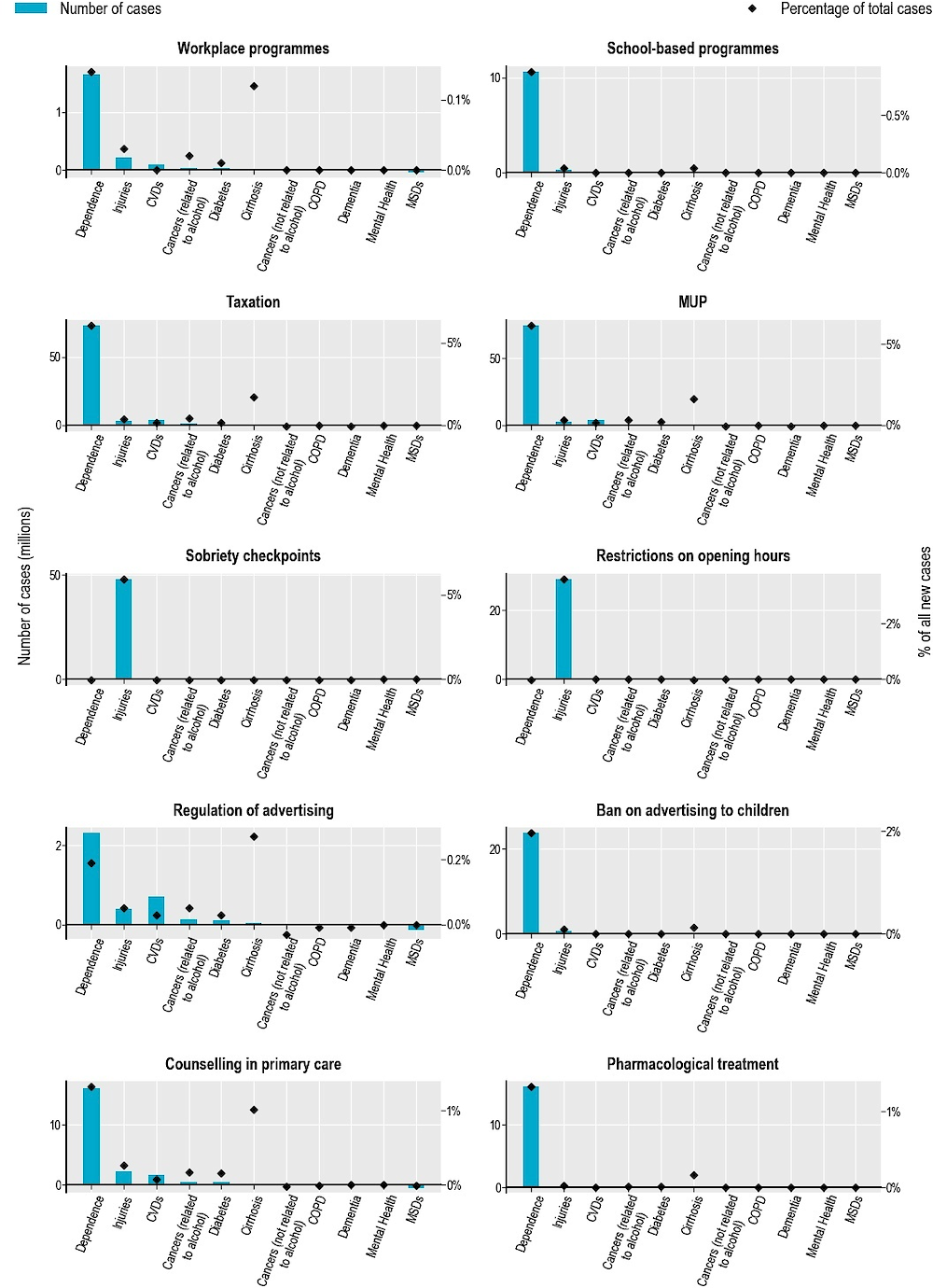

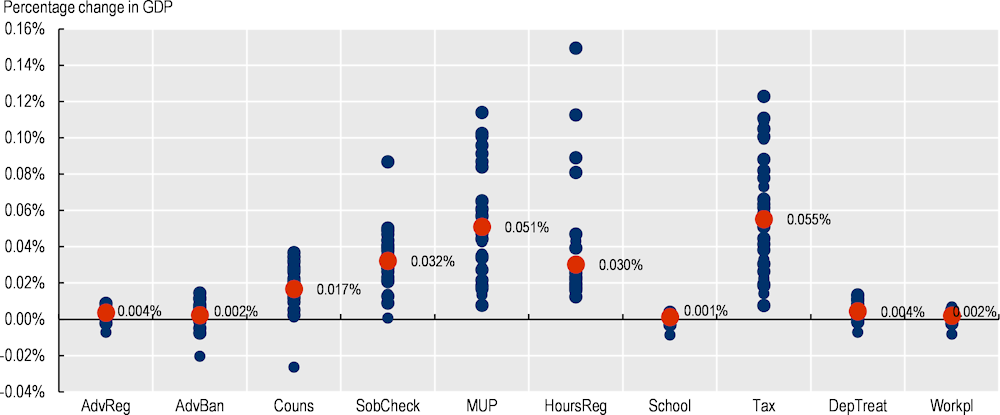

All the interventions are predicted to have a positive effect on population health.7 The largest absolute reductions are expected to occur for alcohol dependence and injuries: the MUP intervention leads to avoidance of up to 74 million cases of dependence (or 2.4 million annually) and sobriety checkpoints lead to avoidance of up to 48 million cases of injury (or 1.5 million annually) between 2020 and 2050 (Figure 7.1Figure 7.1). In general, MUP, taxation and sobriety checkpoints are evaluated as the most effective interventions, while advertising regulation and workplace programmes produce a smaller impact. Restrictions on opening hours have a significant impact on reduced injuries. Counselling in primary care and treatment of dependence notably reduce cases of dependence and cirrhosis. Bans on advertising to children and school-based programmes help to reduce early drinking initiation in young ages and reduce the probability of dependence later in life. The largest impact on the number of new cases avoided – as a share of total new cases – is predicted for dependence, with a reduction of up to 7% in the cases of MUP and taxation.

To put this in context, 74 million new cases of dependence avoided as a result of implementing MUP represent only about 7% of all dependence cases attributable to alcohol (see Figure 4.4 in Chapter 4). Therefore, there is large scope for potential further action to either upscale existing interventions or introduce new ones to make a substantial impact on alcohol-attributable disease incidence.

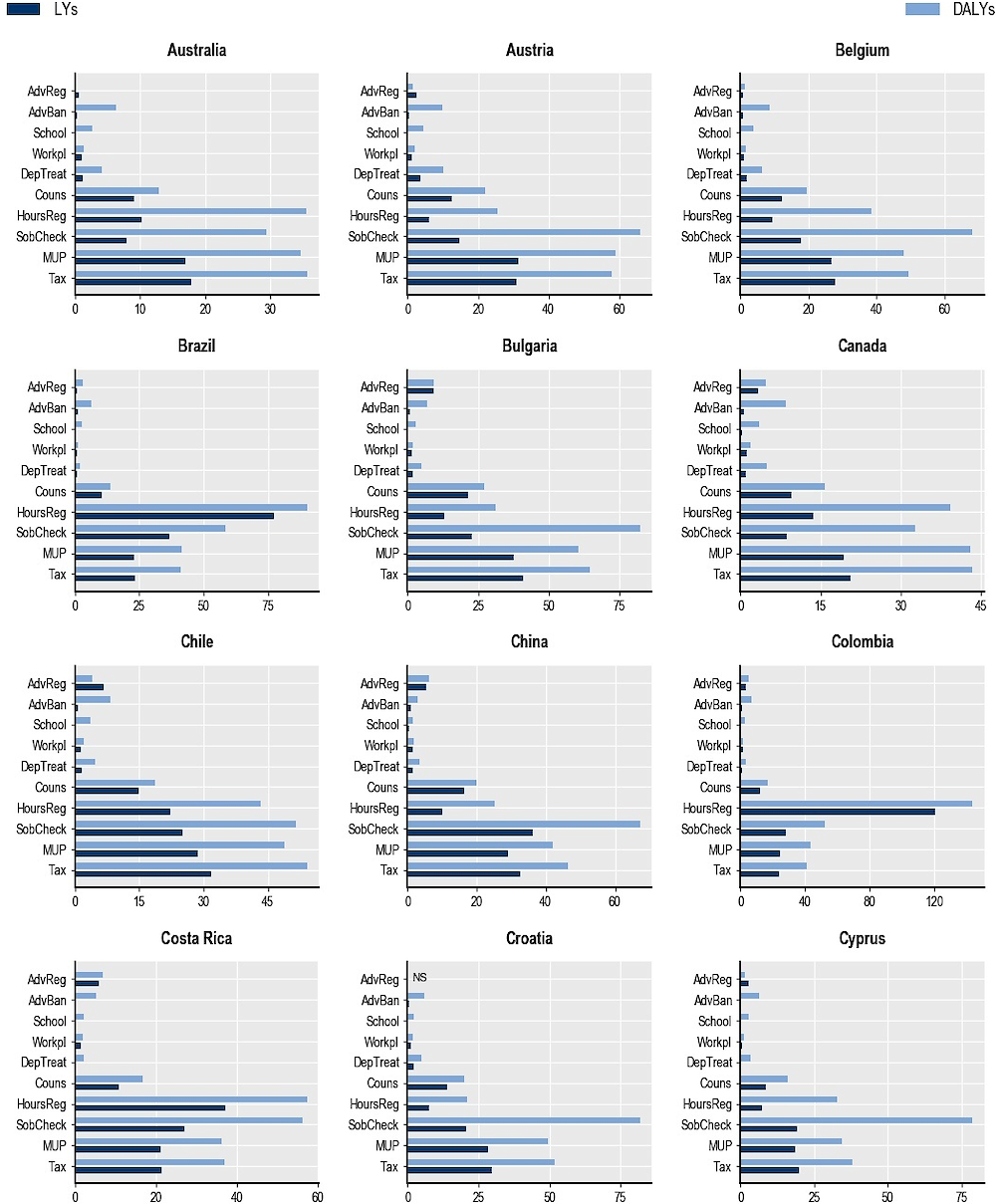

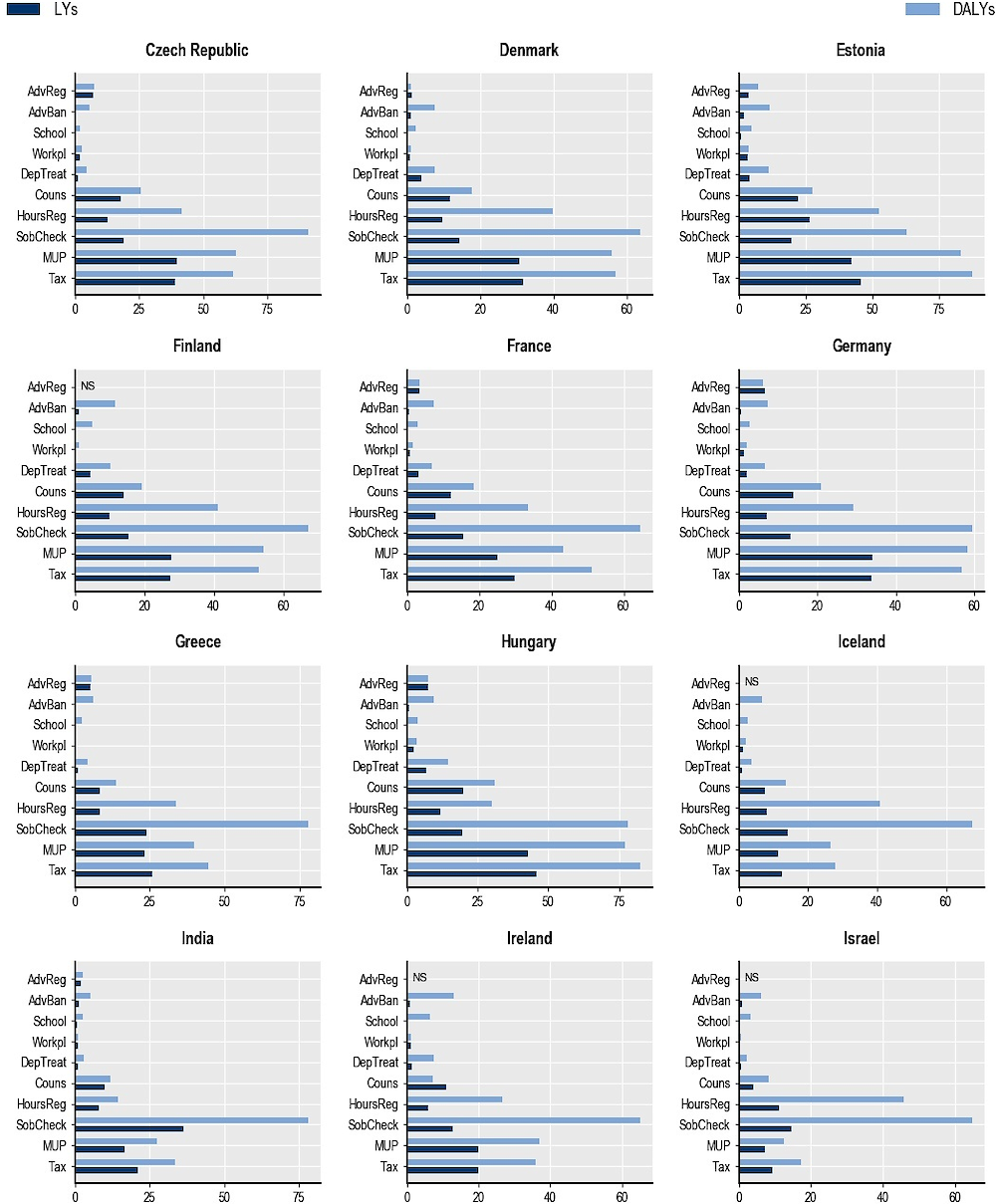

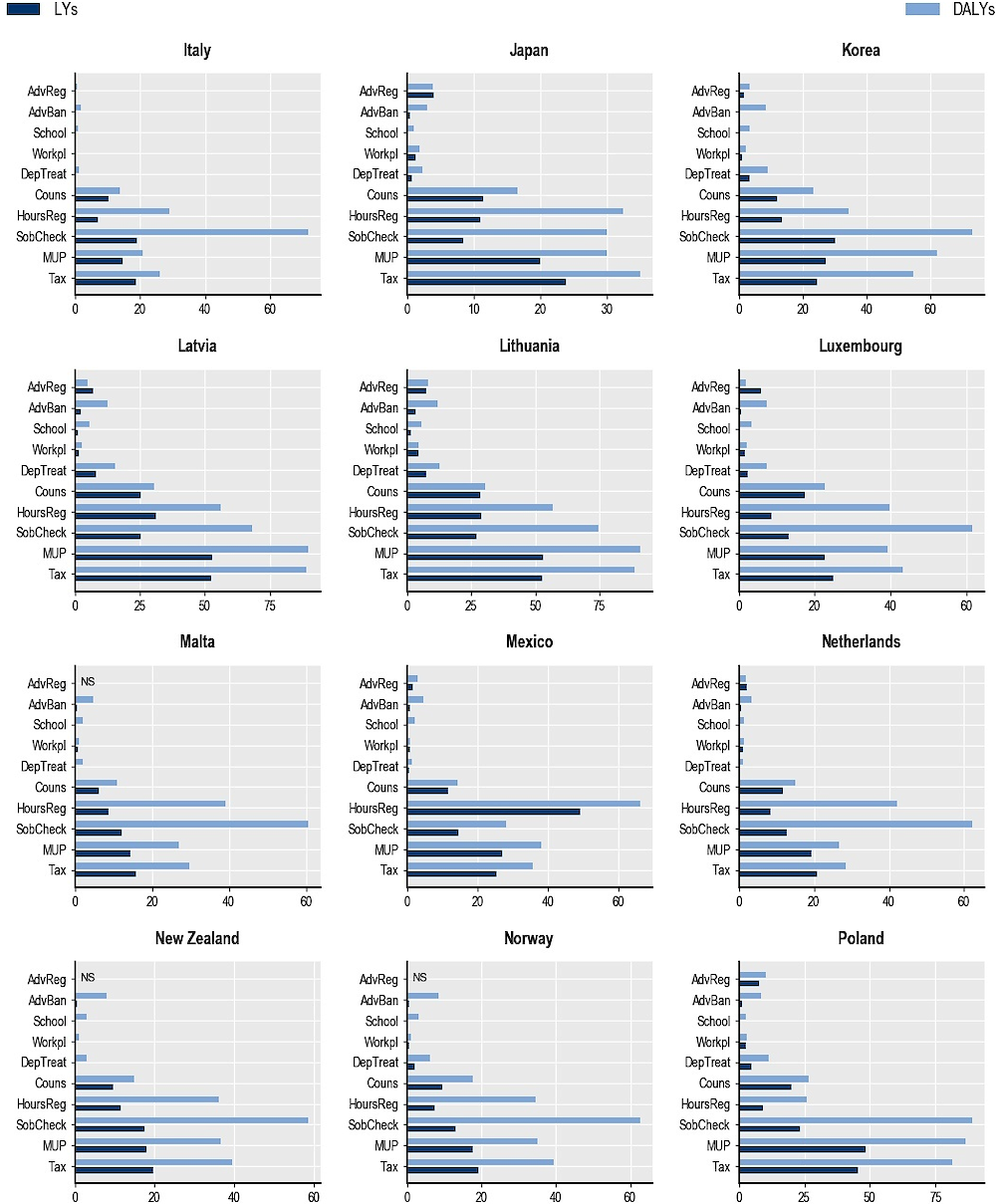

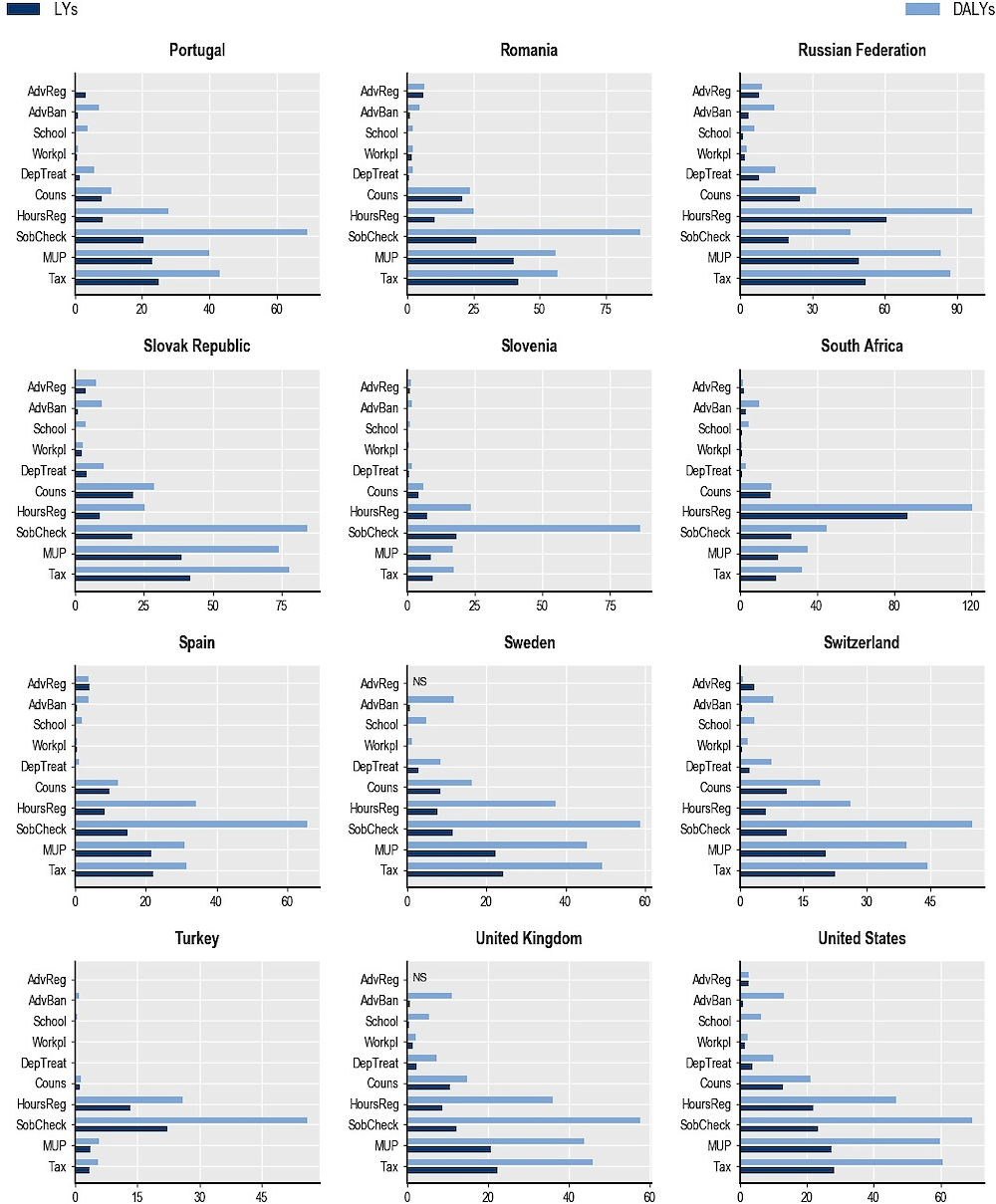

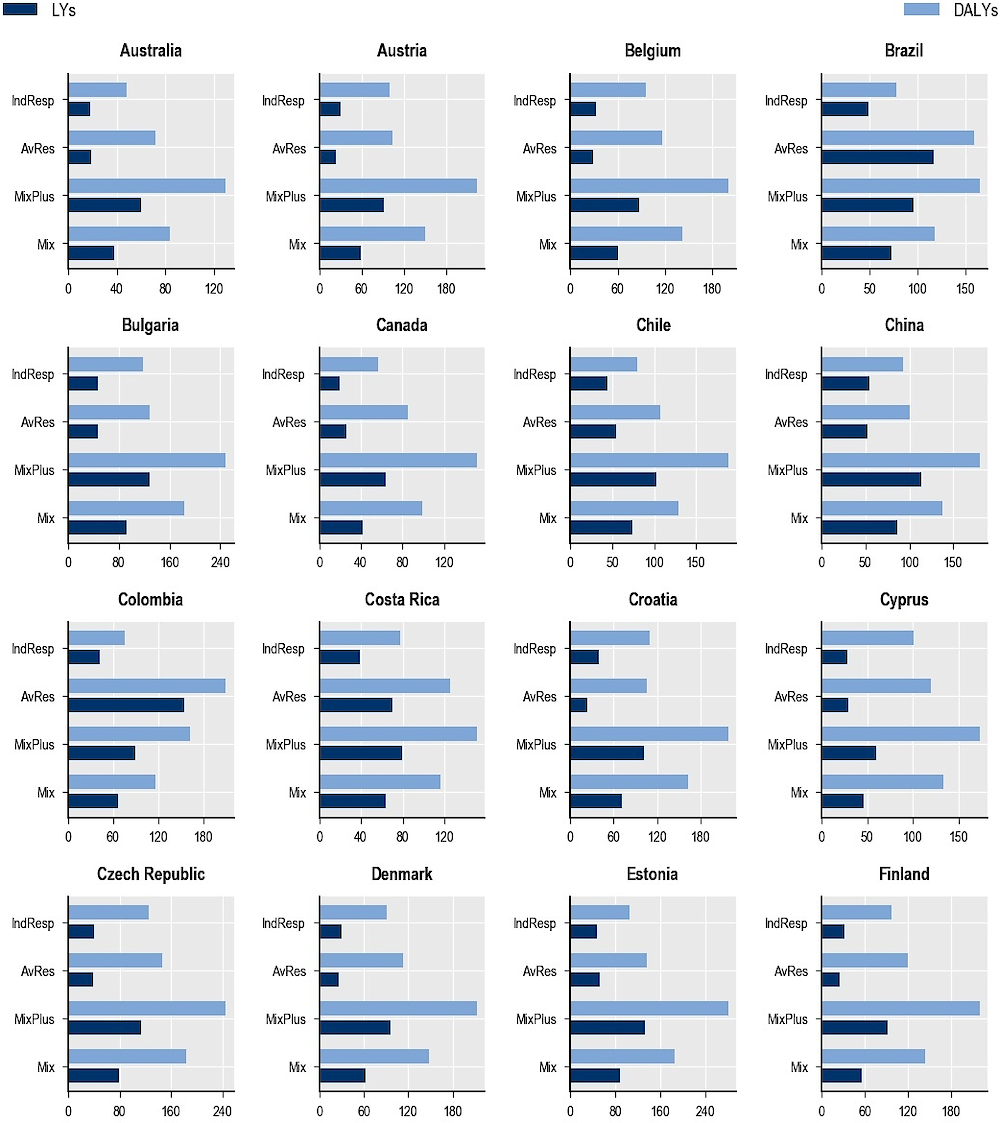

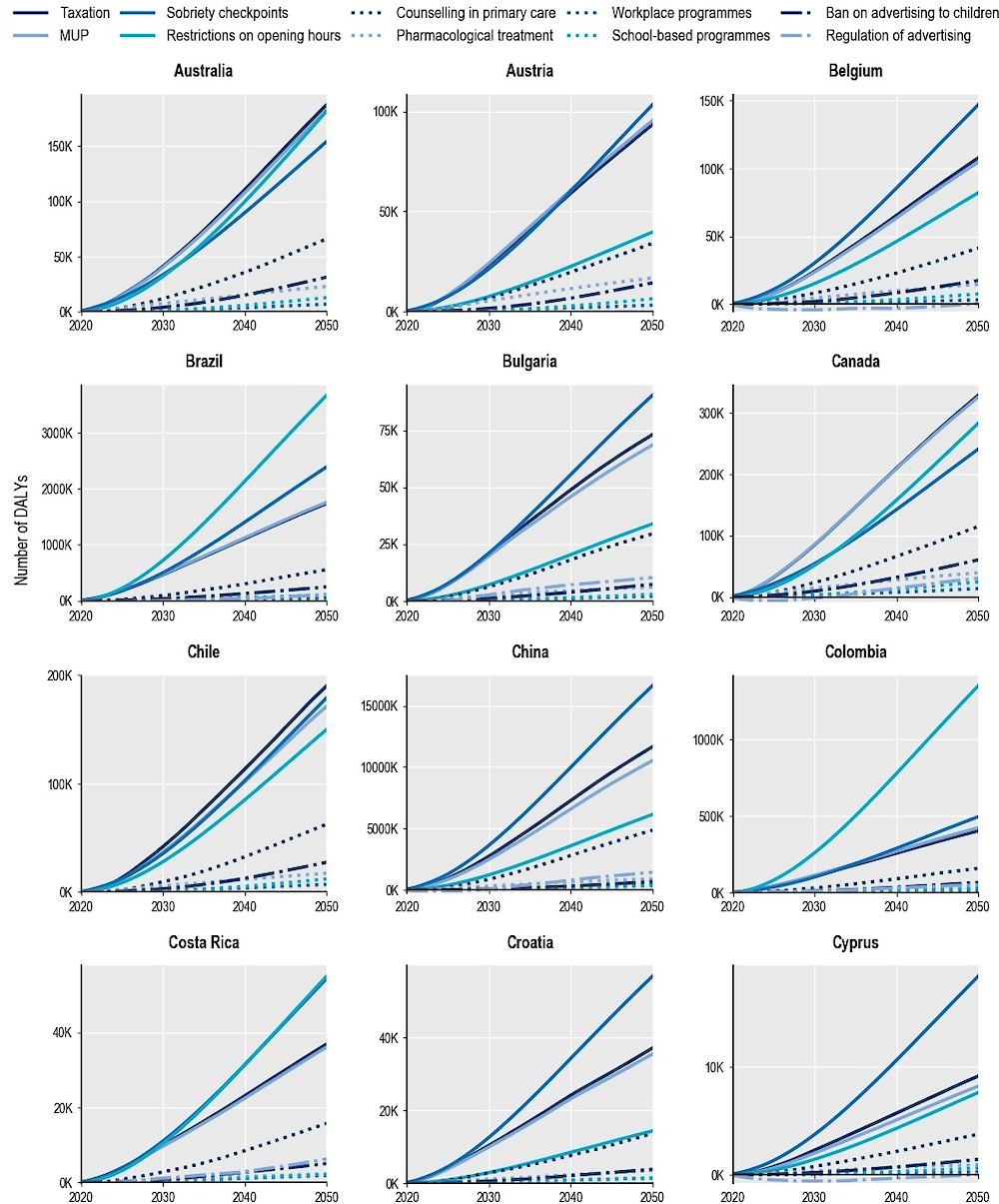

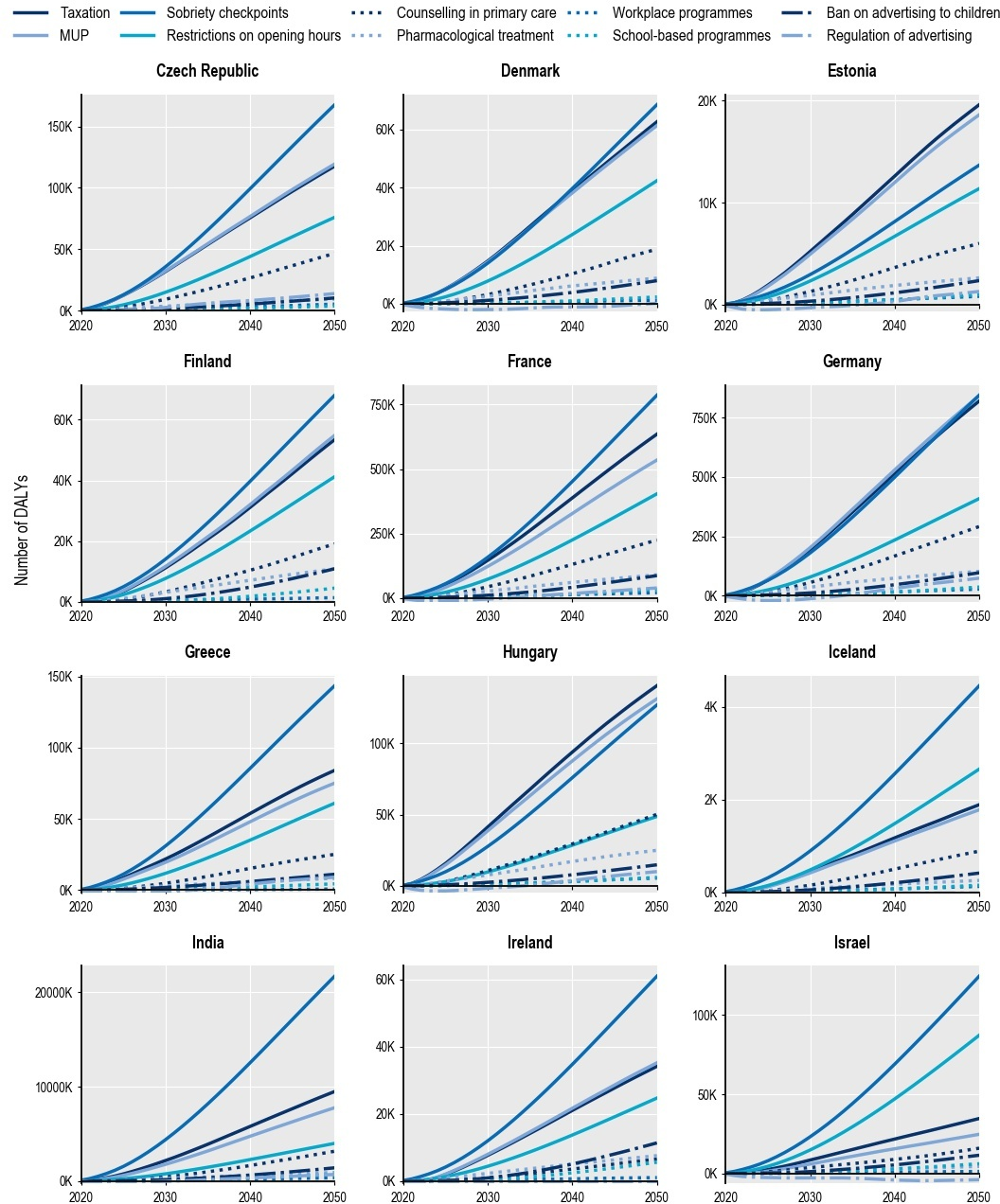

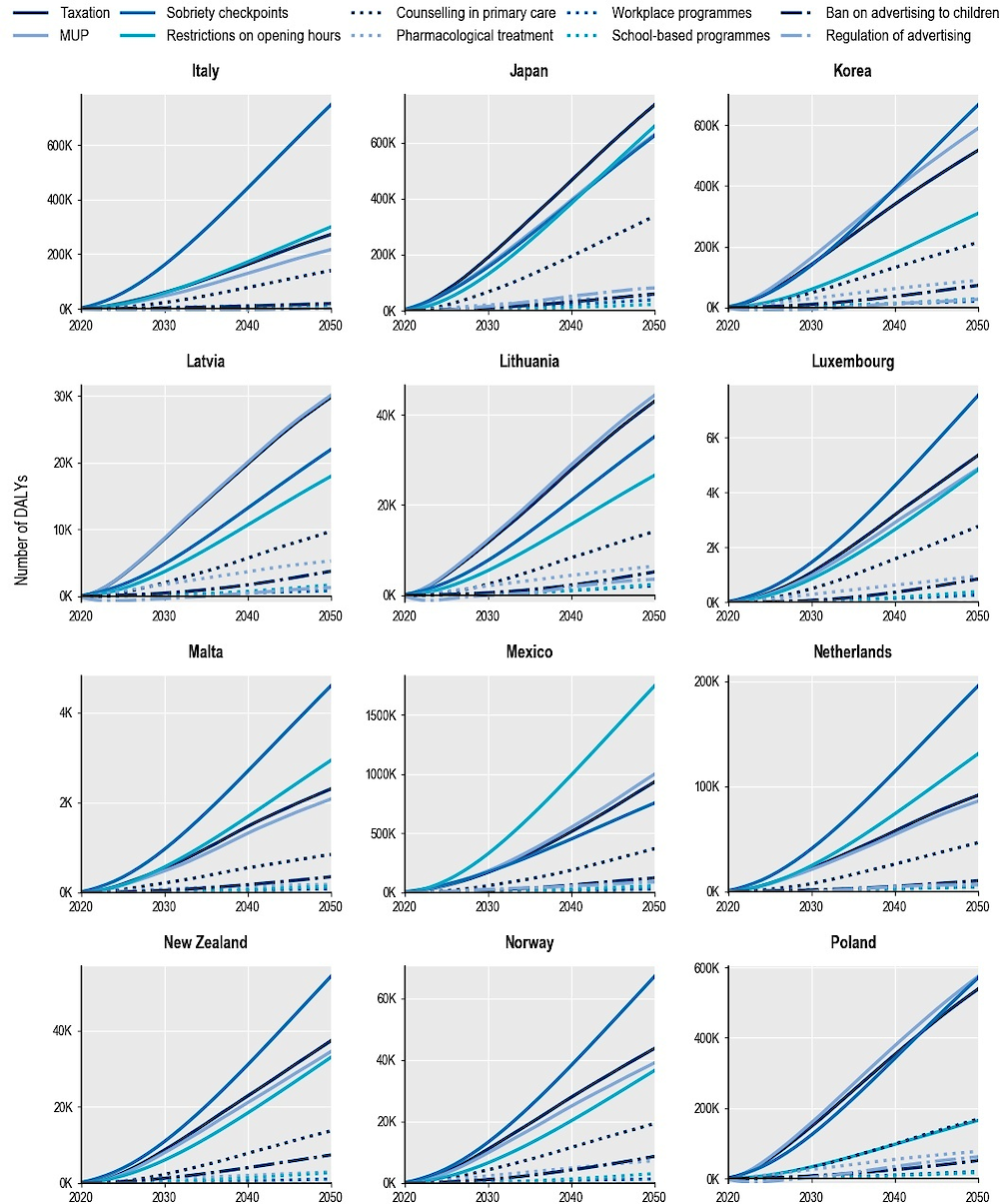

When considering the policy effect on aggregate measures of the population, population-wide interventions such as taxation, MUP and sobriety checkpoints produce the largest health gains, resulting in between 1.1 million and 1.5 million LYs gained annually in the 48 countries included in the analysis. Sobriety checkpoints are also predicted to perform best in terms of the impact on DALYs (see Annex Figure 7.A.1), with a gain of 57.4 million DALYs cumulatively by 2050 in all 48 countries combined. This category is followed by taxation, saving up to 37.7 million DALYs by 2050, then MUP (34.5 million) and restrictions on outlet opening hours (28.7 million). The largest cumulative effect on DALYs is predicted in China and India, and the lowest in Malta and Iceland. It is also notable that the effect of these interventions on DALYs does not decline over time, even after discounting the value of future outcomes when converting to a present value (Annex Figure 7.A.1), suggesting that it pays off to wait as new cohorts of people are affected in the future.

Once results are standardised by population size, all the interventions are predicted to lead to gains in LYs and DALYs, with the effect on DALYs (measuring morbidity) generally larger than that on LYs (measuring life expectancy) (Figure 7.2). This means that by reducing the occurrence of diseases and lethal and non-lethal injuries, the interventions have an effect on quality of life greater than the mortality risk reduction.

As for regional differences, the interventions will have a larger impact on health outcomes in the Russian Federation, the Baltic countries and Poland, with a cumulative effect for the ten interventions higher than 350 DALYs per 100 000 gained annually (Figure 7.2). This is more than twice as large as the cumulative effect for the ten interventions in the countries showing the lowest impact in Figure 7.2. The stronger effect of pricing policies on DALYs in the first set of countries is mostly due to the relatively higher level of alcohol consumption (see Figure 2.1 in Chapter 2), the large burden of premature mortality caused by related chronic diseases and injuries (see Figure 4.5 in Chapter 4) and the greater prevalence of alcohol-related diseases and injuries in these countries.

Finally, pricing policies and health care policies are expected to perform particularly well in the Russian Federation, the Baltic countries, Poland, Hungary and the Slovak Republic, while restrictions on outlet opening hours will do so in South Africa, Colombia, the Russian Federation and Brazil, with more than 90 DALYs per 100 000 gained annually from this policy. The main reason outlet opening hours restriction is predicted to perform so well in emerging countries is because this intervention has an effect on assault-related injuries, whose prevalence is particularly high in these countries.

Cases avoided, total, 2020‑50

Note: CVDs = Cardiovascular diseases; COPD = Chronic obstructive pulmonary disease; MSDs = Musculoskeletal disorders. Bars represent absolute reduction in the number of new diseases cases; the markers represent percentage reductions in the number of total new cases, as a share of total new cases, between 2020 and 2050.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

LYs and DALYs gained per 100 000 population annually, 2020‑50

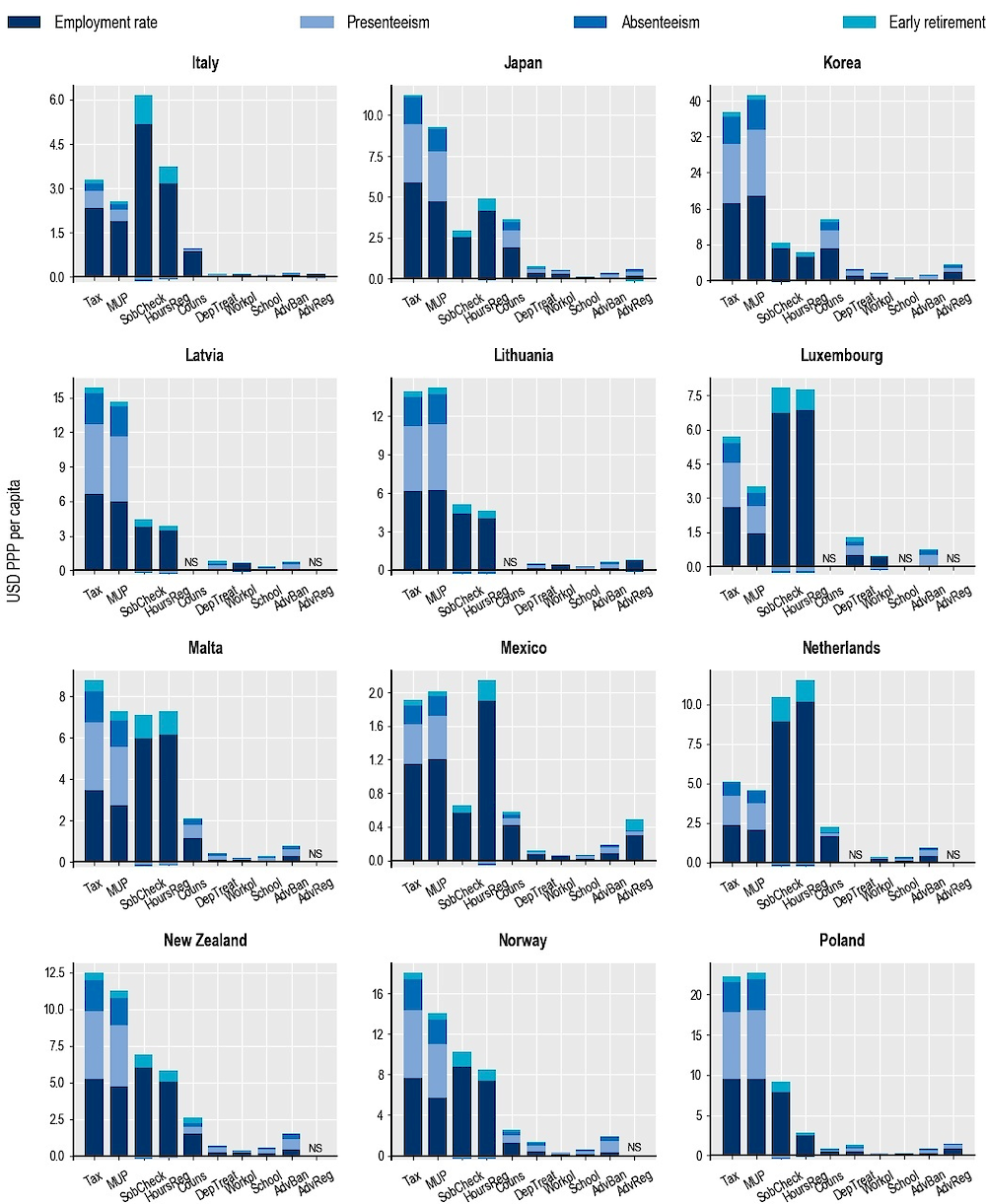

Note: AdvReg = regulation of advertising; AdvBan = ban on advertising to children; School = school-based programmes; Workpl = workplace programmes; DepTreat = pharmacological treatment of dependence; Couns = counselling in primary care; HoursReg = restrictions on opening hours; SobCheck = sobriety checkpoints; MUP = minimum unit pricing; Tax = taxation. NS = not significant.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

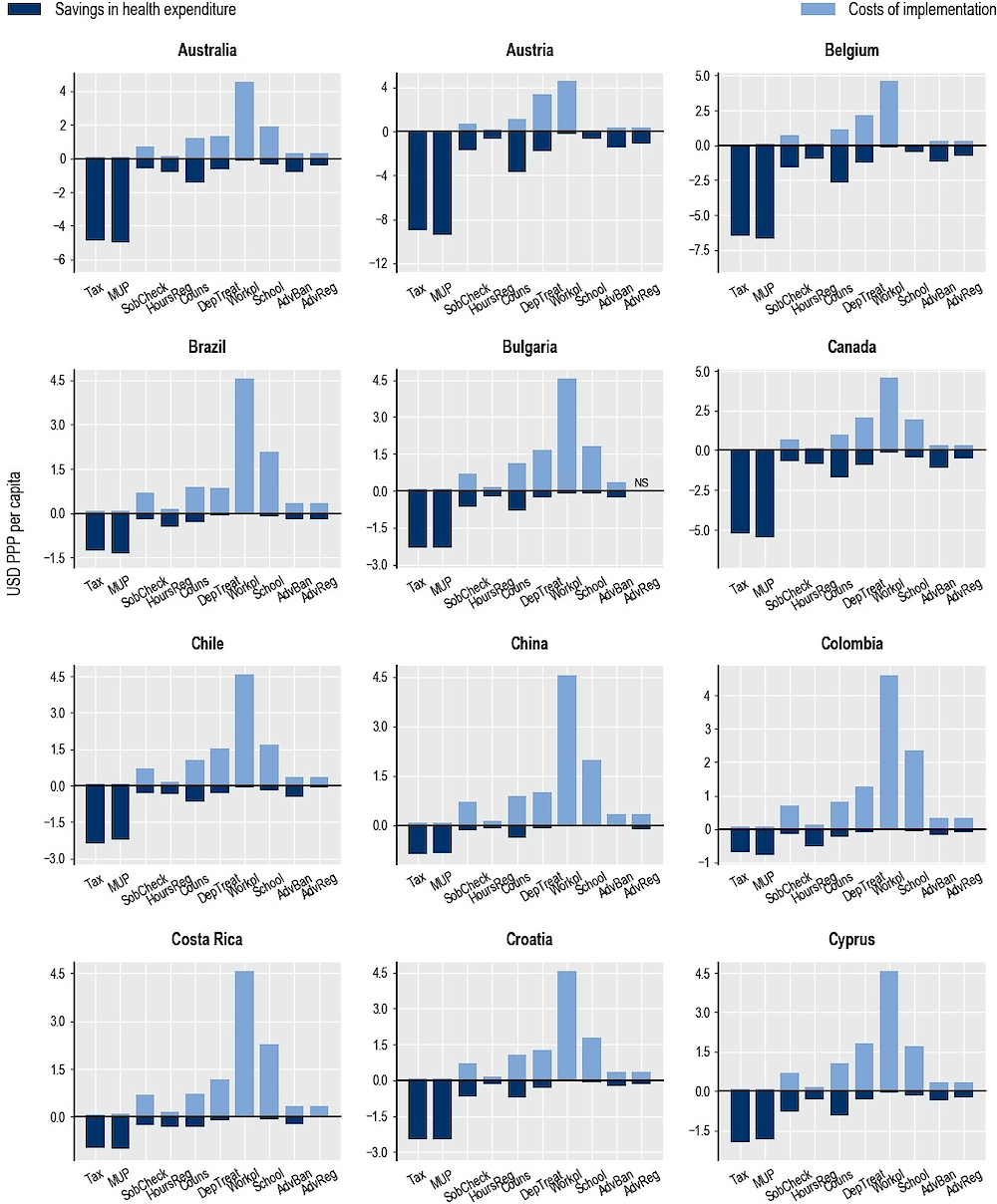

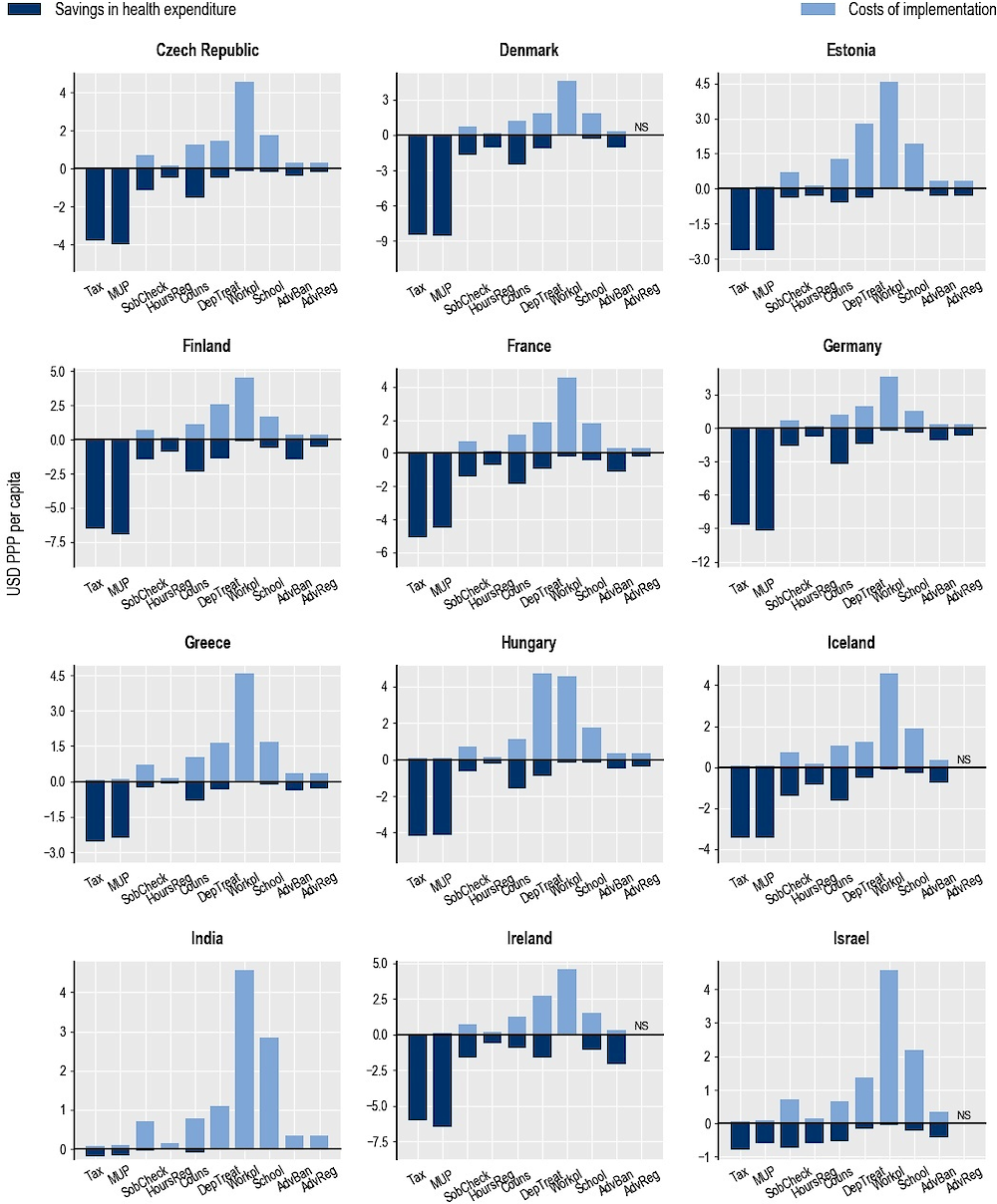

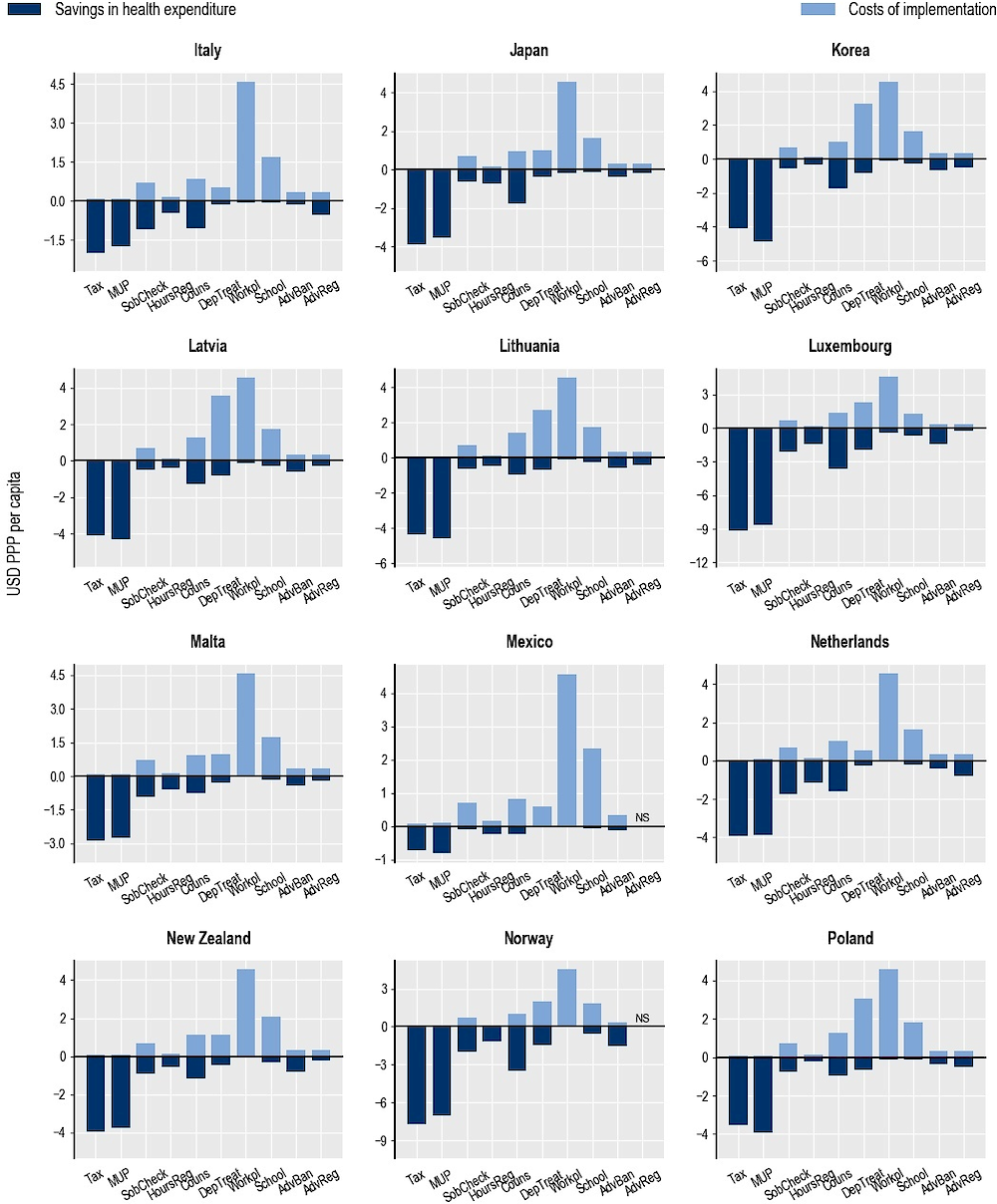

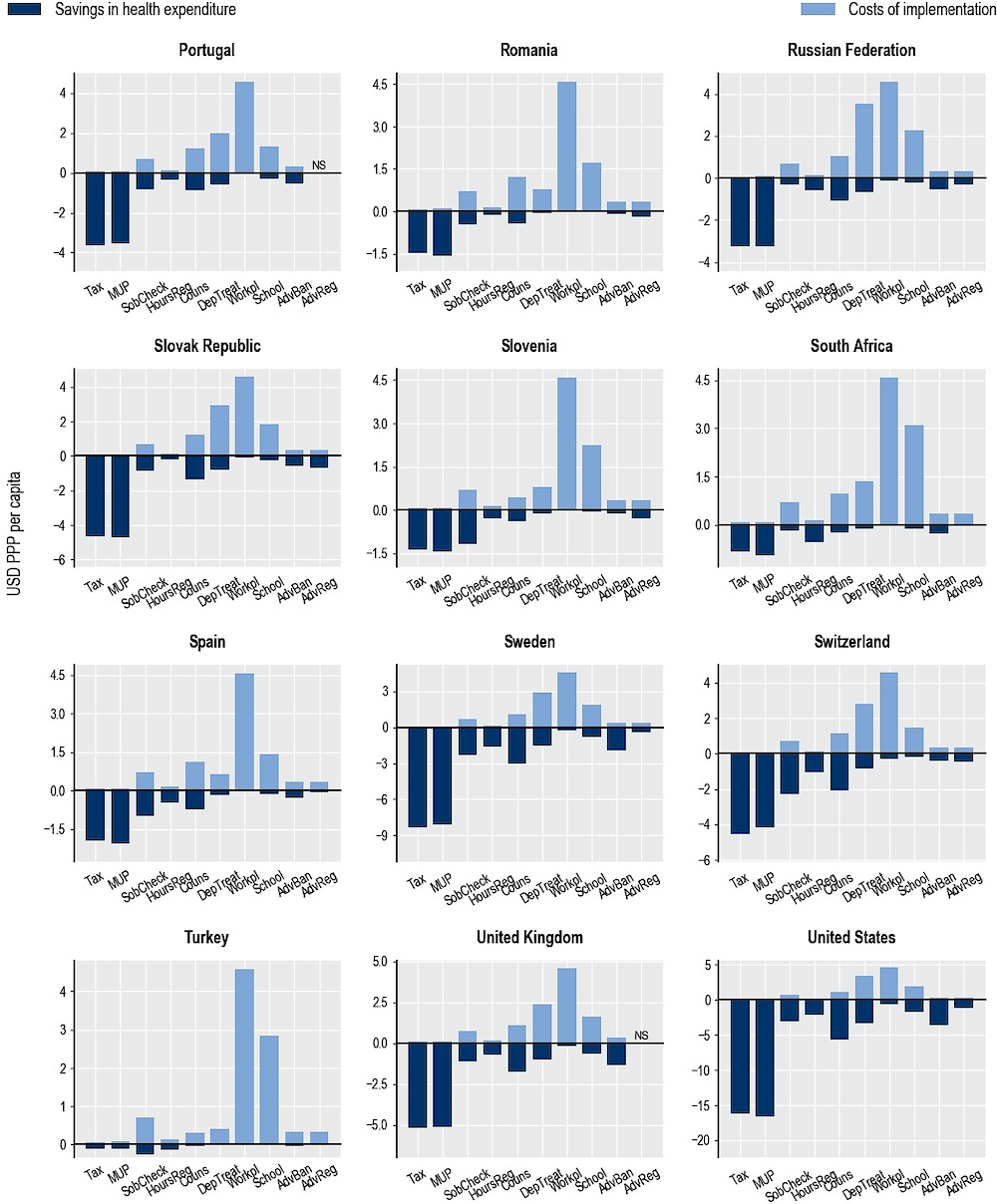

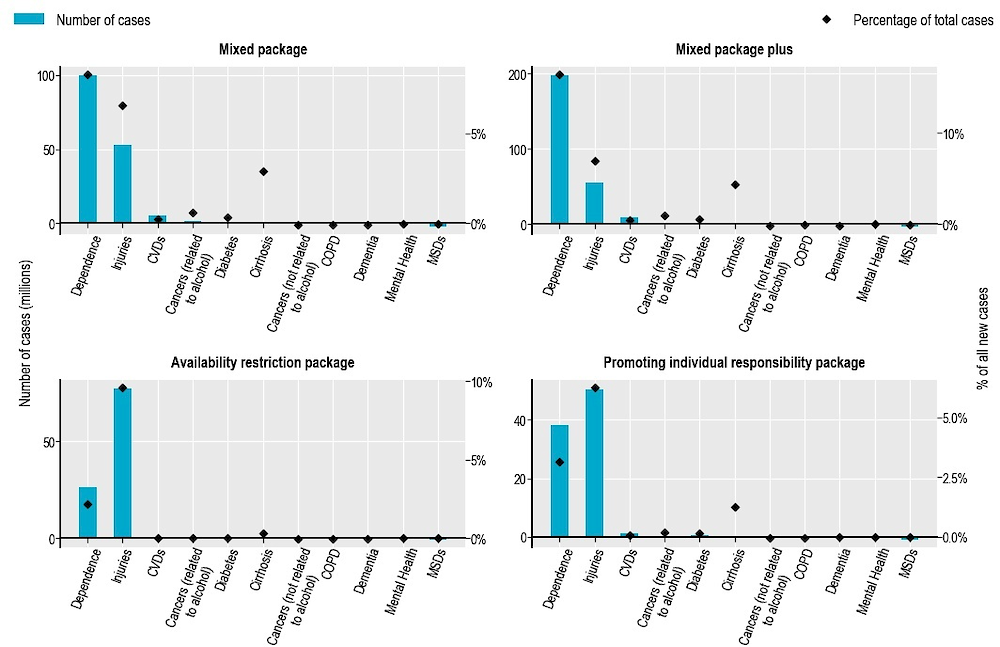

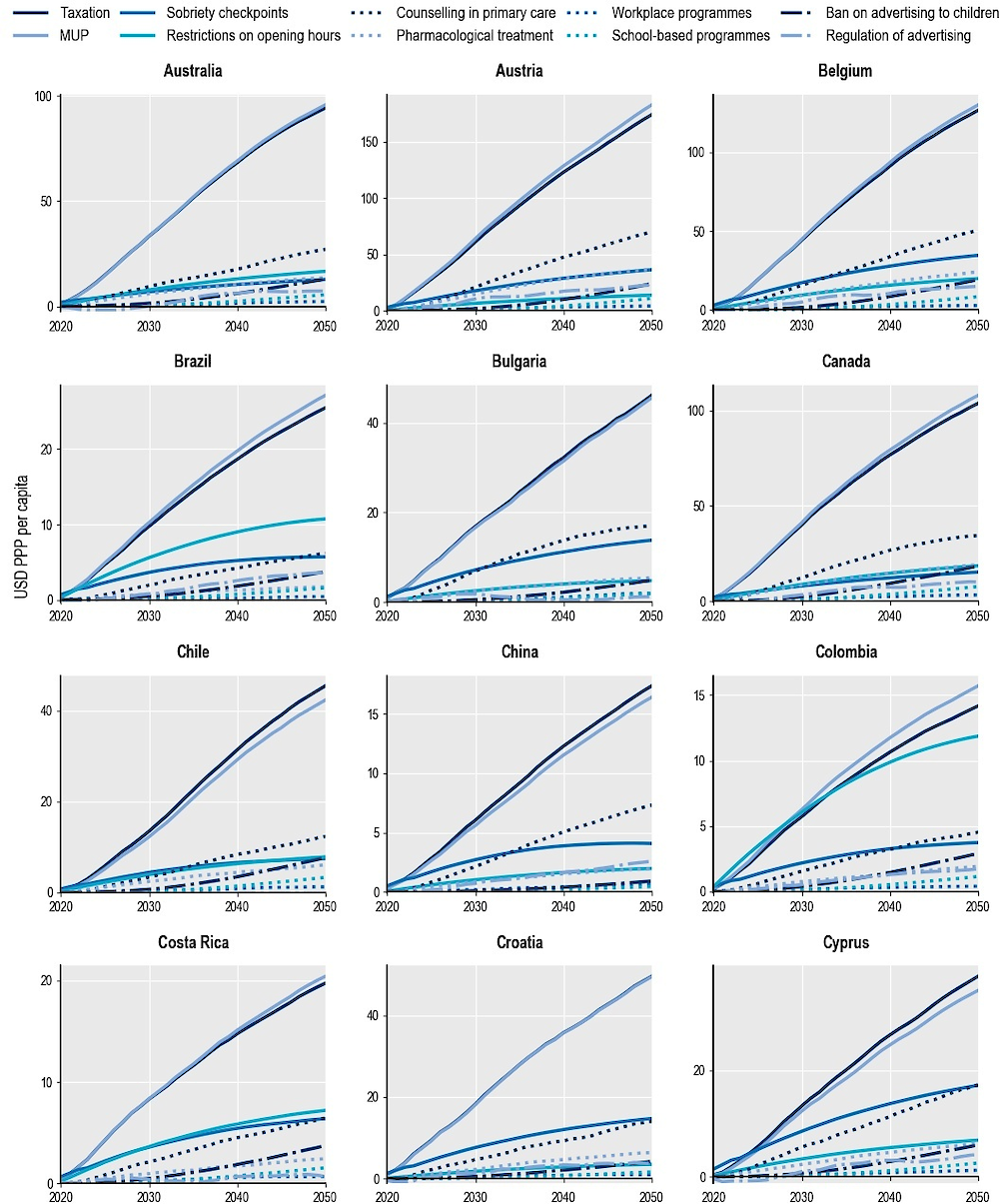

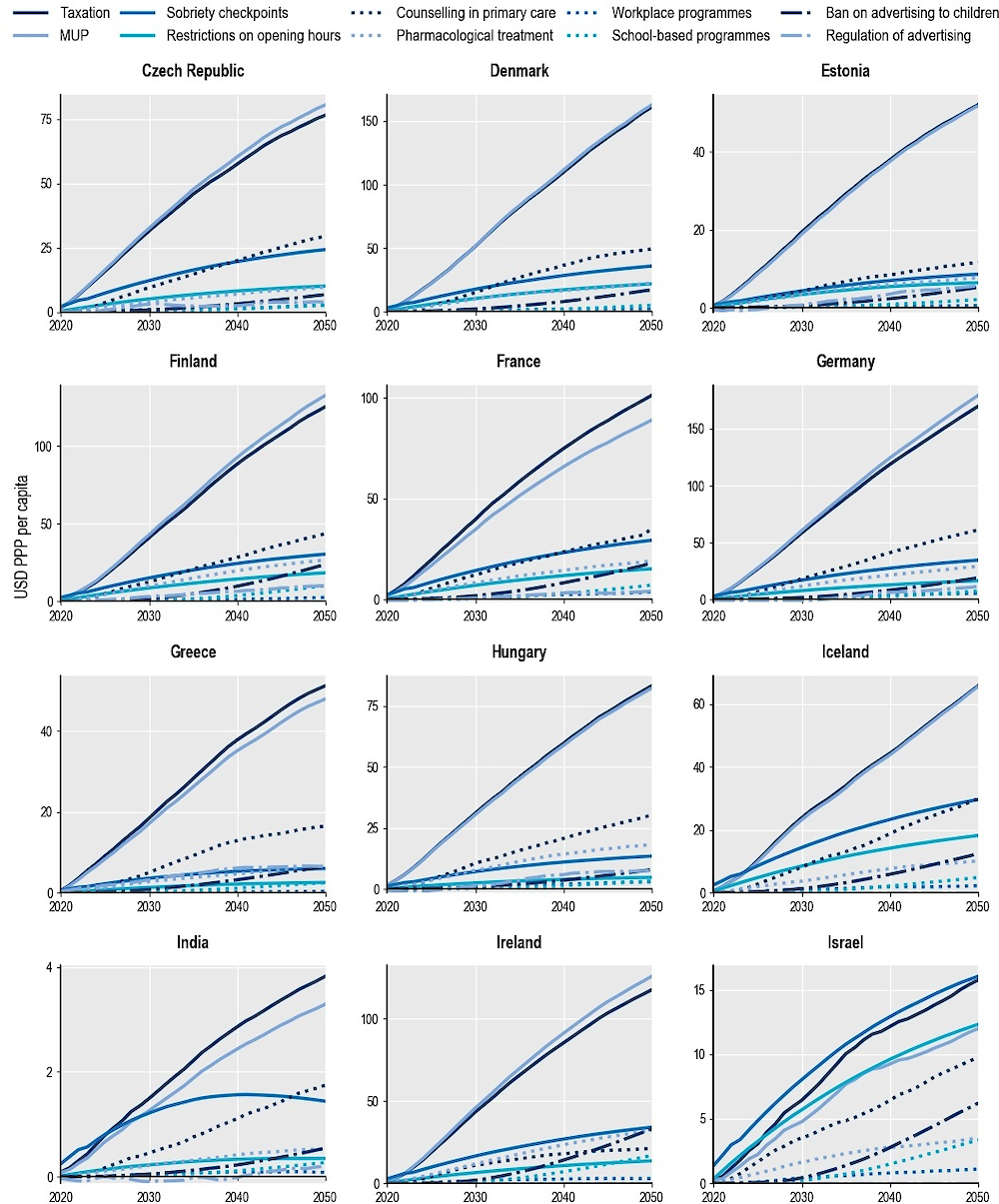

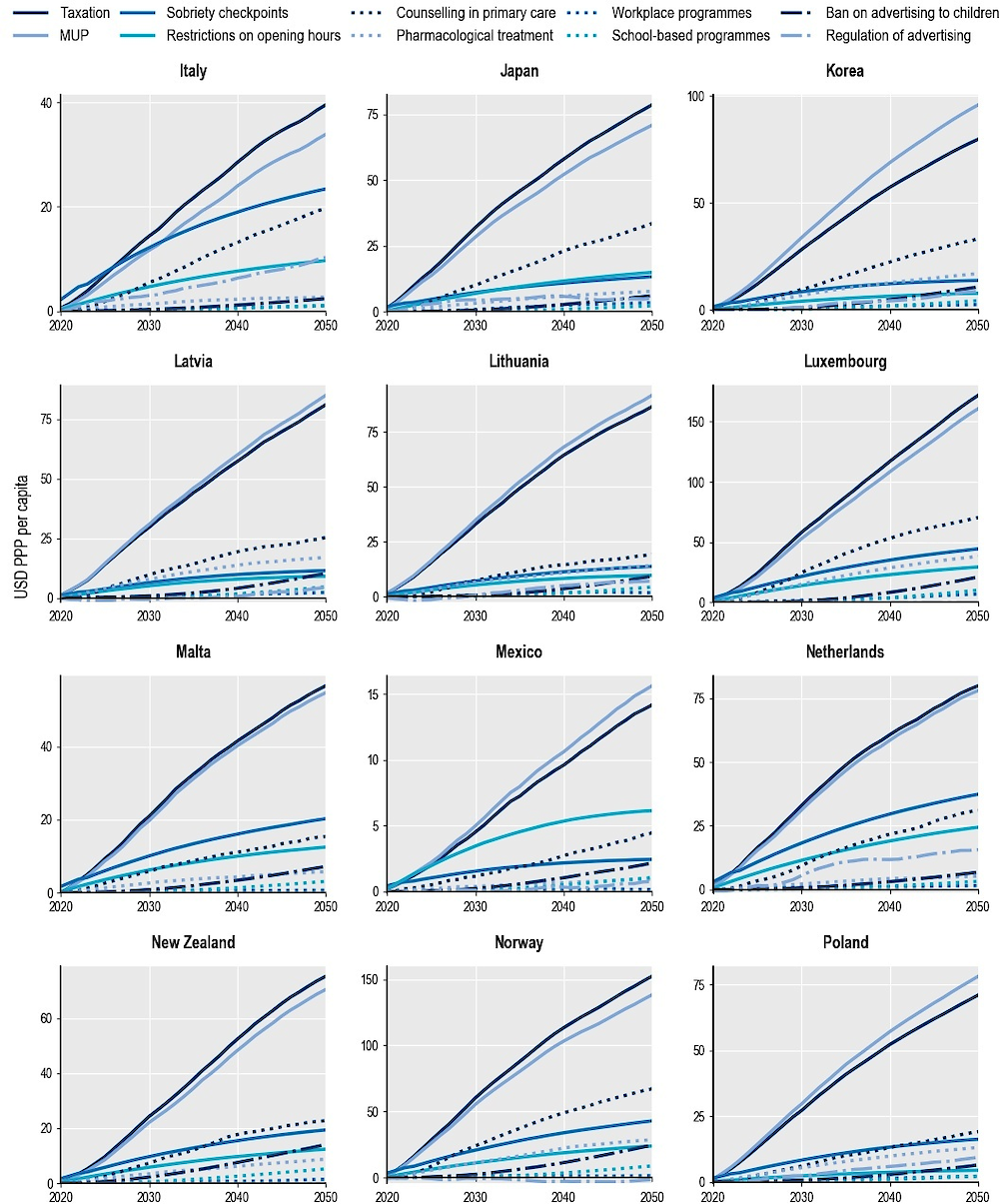

Although it might seem intuitive to expect that reducing the alcohol burden should lead to health expenditure8 savings, this is by no means guaranteed. People who avoid alcohol-related conditions as a result of preventive interventions may still suffer from other diseases and/or accumulate health expenditure as a result of living longer (Grootjans-van Kampen, Engelfriet and van Baal, 2014[51]). Nevertheless, findings from the OECD SPHeP-NCDs model suggest that this is not the case for the set of assessed policy interventions: all the interventions are predicted to contribute to reductions in health expenditure. The effects of two interventions in particular stand out: taxation and MUP. On average, MUP can save USD PPP 4 per capita annually across the 48 countries studied – the largest impact compared to the other interventions. The impact of taxation is in the same order of magnitude. The other interventions will produce average savings in health expenditure ranging from USD PPP 0.1 to USD PPP 1.4 per capita per year. Scaled up to the national level, MUP is predicted to save more than USD PPP 207 billion across all 48 countries cumulatively by 2050 (or USD PPP 6.7 billion in undiscounted costs annually), with the largest cumulative savings predicted in the United States (USD PPP 108 billion by 2050), China (USD PPP 17 billion by 2050), Germany (USD PPP 12 billion by 2050), the Russian Federation (USD PPP 7 billion by 2050) and Japan (USD PPP 7 billion by 2050). Counselling in primary care and pharmacological treatment of dependence produce sizeable savings in medical expenditure of about USD PPP 70 billion and USD PPP 40 billion by 2050 across all countries. School-based and workplace programmes and regulation of advertising are predicted to make a smaller impact on health expenditure, mostly due to the short exposure duration for the school-based intervention, the relatively low coverage of the population receiving the workplace intervention and the relatively low effectiveness of advertising regulation. While sobriety checkpoint measures to counter drink-driving and restrictions on outlet opening hours produce moderate savings in health expenditure (USD PPP 24 billion and USD PPP 14 billion by 2050 across all countries), these interventions make a significantly more pronounced impact on employment and productivity, as discussed in the following section.

There are important geographical differences in the impact of the interventions. Taxation and MUP generally perform best in the United States, where up to USD PPP 320 per capita in medical expenditure can be saved cumulatively by 2050. This is followed by Austria, Germany, Denmark and Luxembourg, with health expenditure savings of between USD PPP 160 and USD PPP 180 per capita by 2050 (Annex Figure 7.A.2). On the other hand, the lowest savings per capita for these interventions are predicted in China, Colombia, Costa Rica, India, Israel, Mexico, South Africa and Turkey. This pattern can be explained by the low level of alcohol consumption in Israel and Turkey, and by the low medical costs in Colombia, Mexico and non-OECD G20 countries.

For restrictions on outlet opening hours, while the health gains are particularly high in emerging countries (see Section 7.2.6: in particular South Africa, Colombia, the Russian Federation and Brazil), the per capita savings in health expenditure in these countries are small. Two main reasons can explain this pattern. First, medical treatments in these countries are generally less expensive than in other countries; therefore, a decrease in the number of cases to treat has a lower impact on total savings on health expenditure. Second, the growth in life expectancy caused by preventive interventions, which is particularly pronounced in these countries, increases the probability that individuals will develop other diseases that bring additional expenditure later in life.

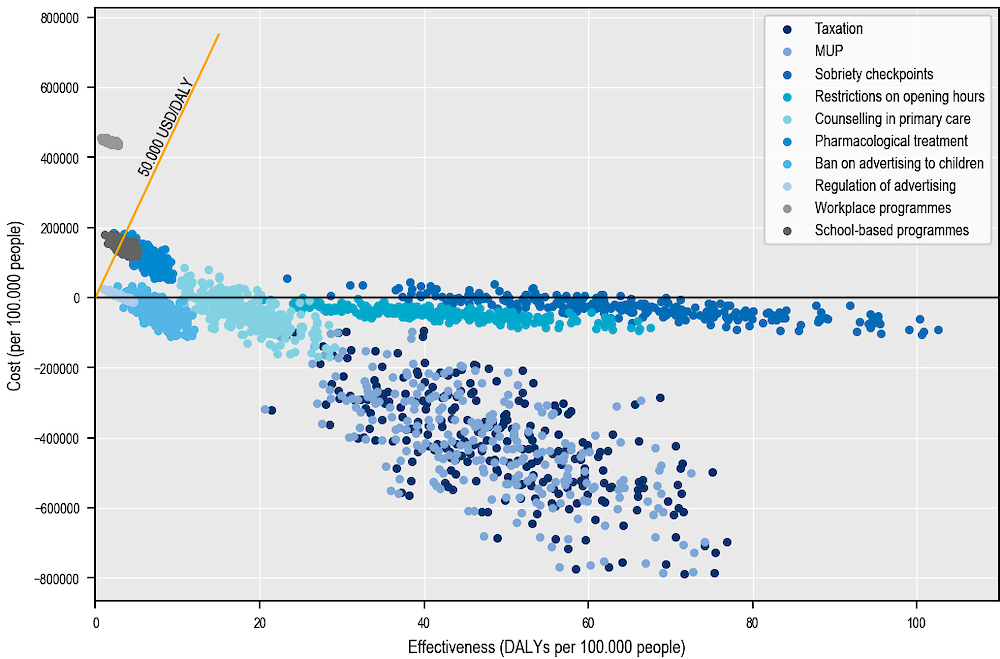

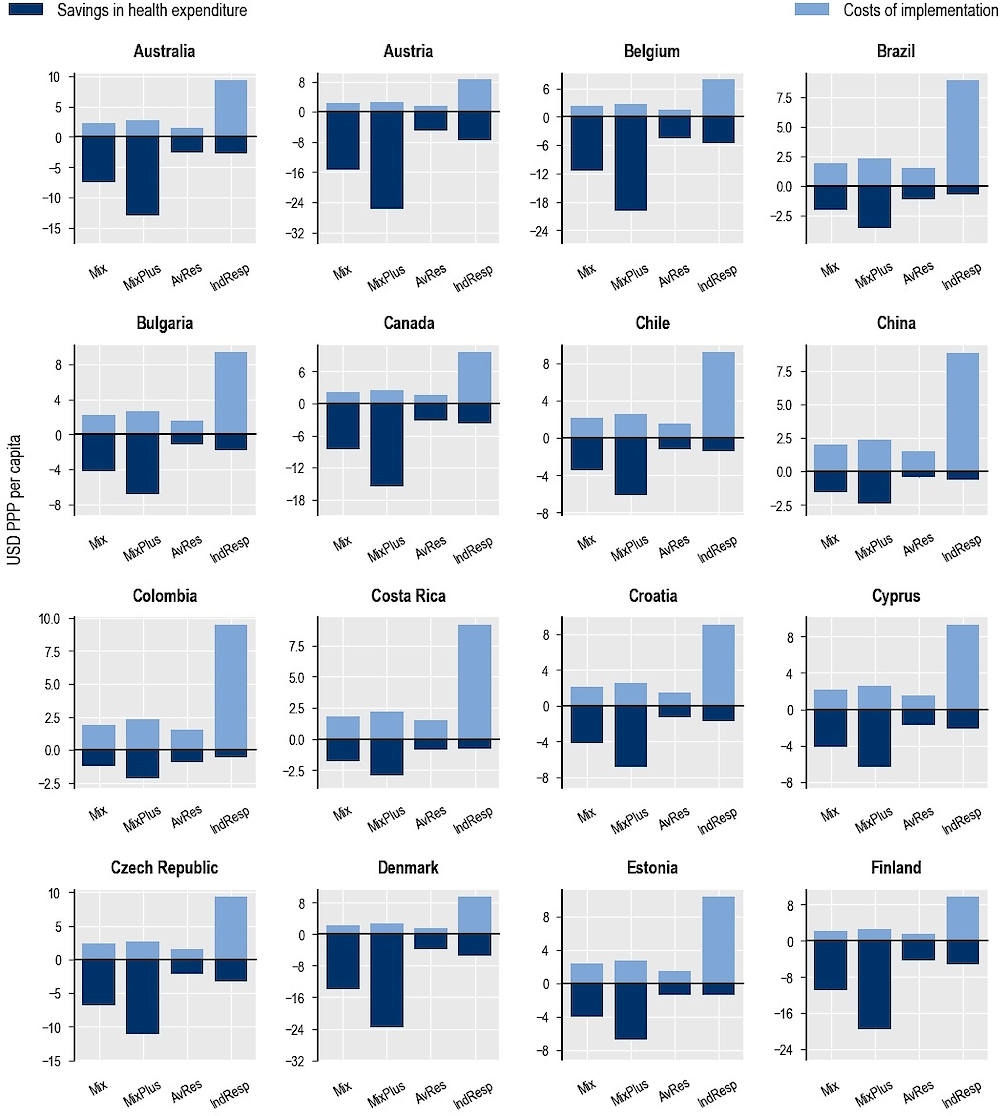

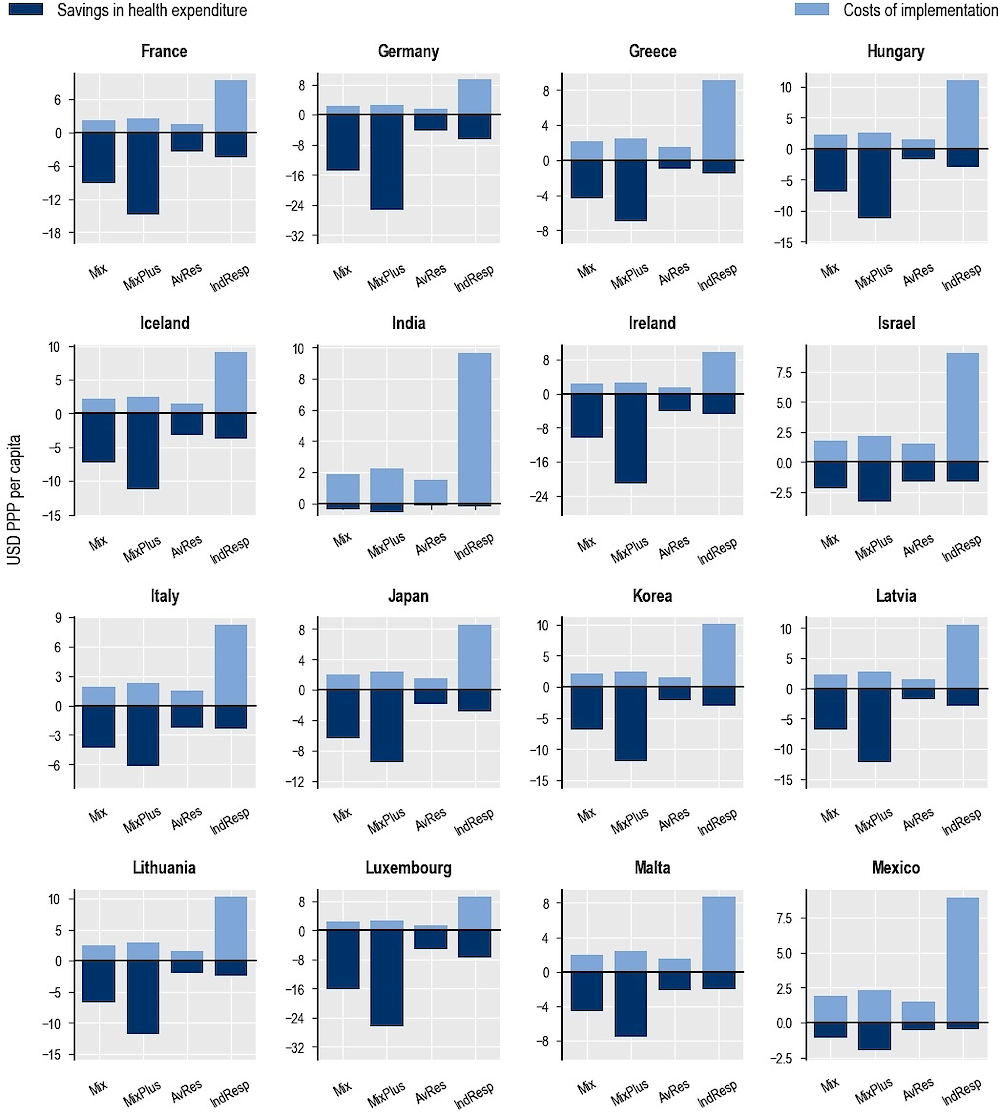

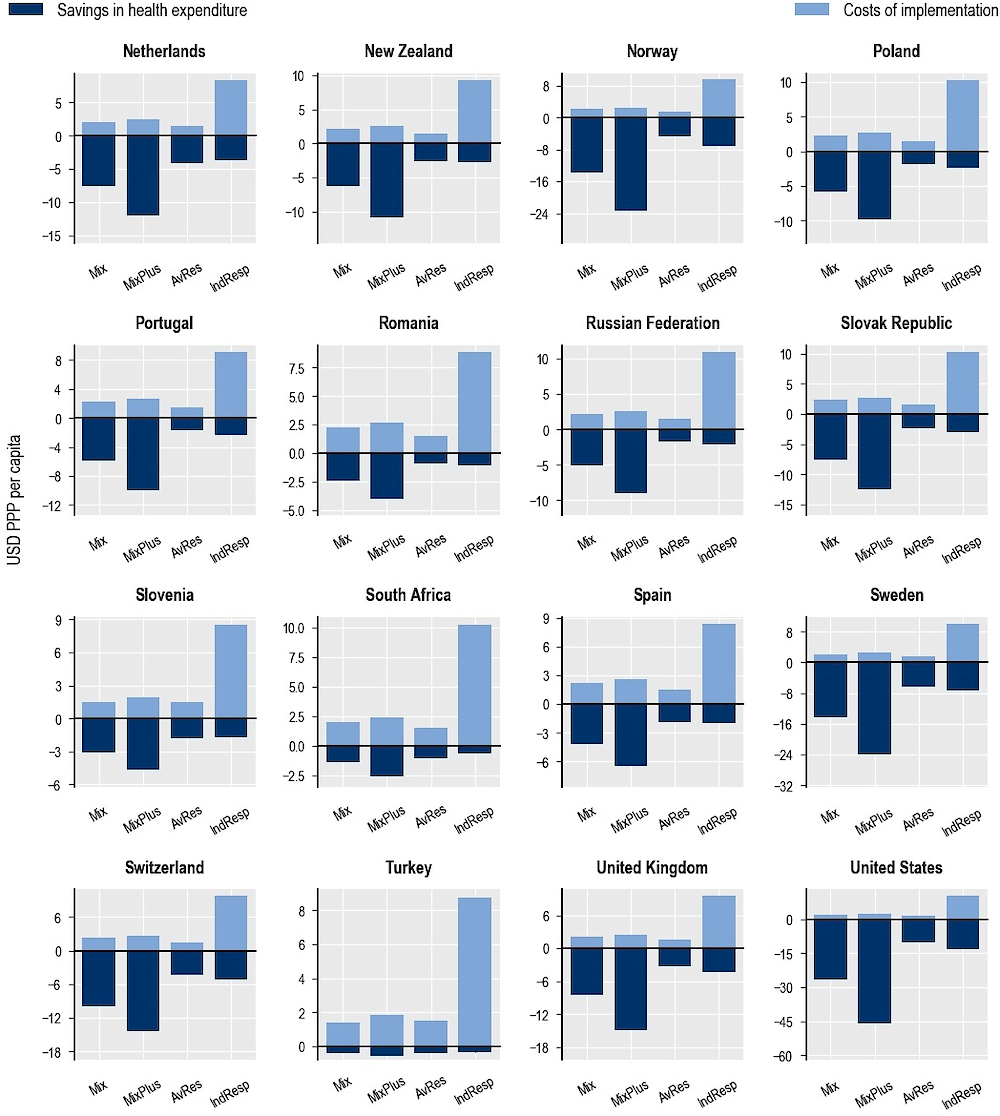

Figure 7.3 compares the per capita annual cost of implementing the interventions and the reductions in associated health expenditure. In the cases of taxation and MUP, the costs of implementing the intervention were assumed to be very small – close to zero. In general, the health expenditure savings resulting from the policy implementation significantly outweigh the intervention costs, meaning that the intervention is cost-saving, as is shown for MUP, taxation and opening hours restriction. However, in some cases, the cost of running the intervention is higher than the health expenditure savings. This is the case for advertising regulation and bans, counselling in primary care and sobriety checkpoints in Colombia, Mexico, non-OECD G20 and non-OECD European countries, and for workplace and school-based programmes and treatment of dependence in virtually all countries studied. Nevertheless, this does not necessarily indicate that these interventions represent poor value for money, as the wider economic impact has to be taken into account.

A sensitivity analysis was carried to test the uncertainty around the effectiveness of the interventions. Results confirm that MUP, taxation and restriction in opening hours produce significant gains in healthy LYs while being cost-saving. Six of the other interventions are cost-effective since they save healthy LYs at a cost below USD 50 000/DALY, while school-based and workplace programmes produce health gains at a cost above or close to this threshold (see Annex Figure 7.A.3).

USD PPP per capita, annually, 2020‑50

Note: AdvReg = regulation of advertising; AdvBan = ban on advertising to children; School = school-based programmes; Workpl = workplace programmes; DepTreat = pharmacological treatment of dependence; Couns = counselling in primary care; HoursReg = restrictions on opening hours; SobCheck = sobriety checkpoints; MUP = minimum unit pricing; Tax = taxation. NS = not significant.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

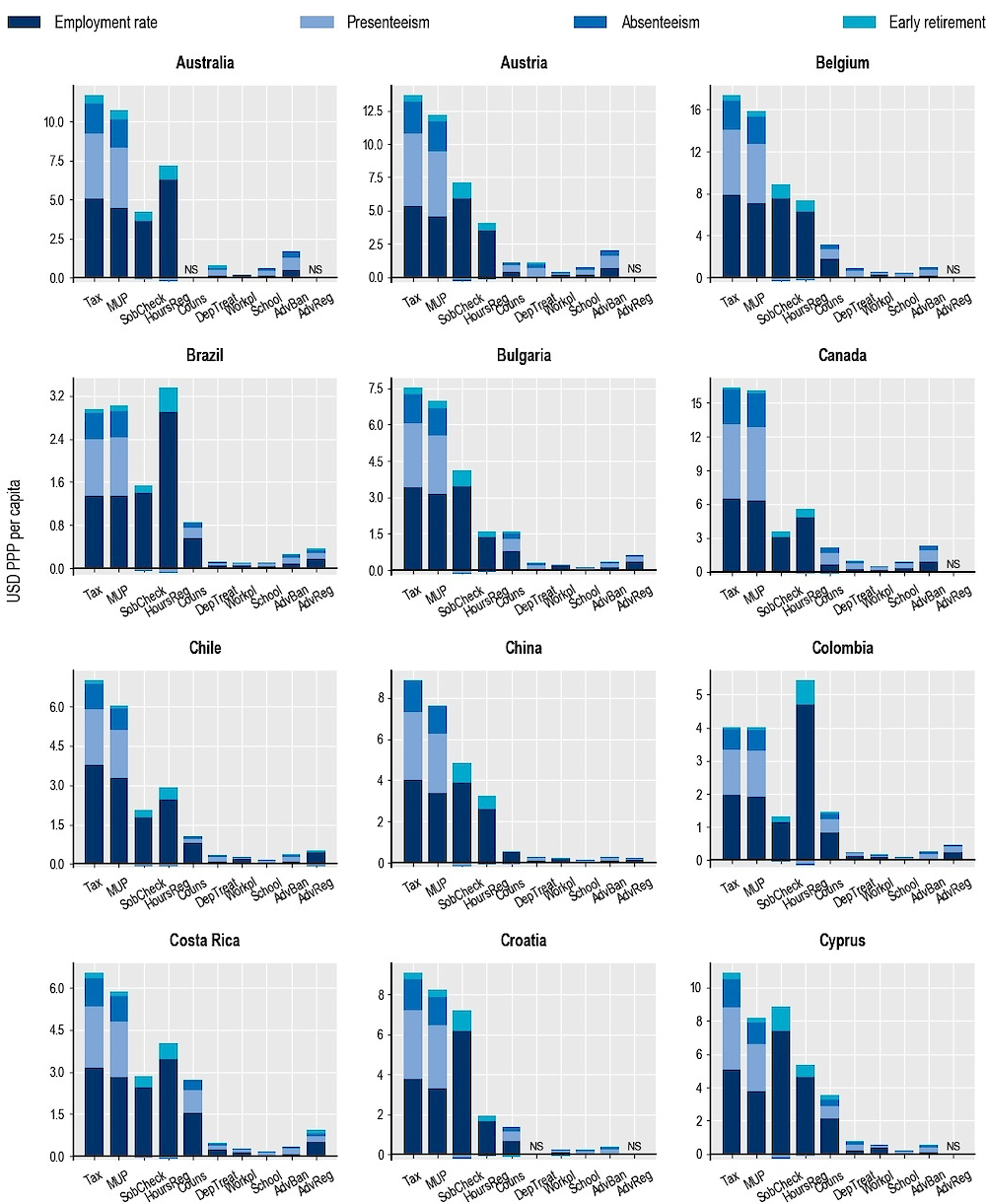

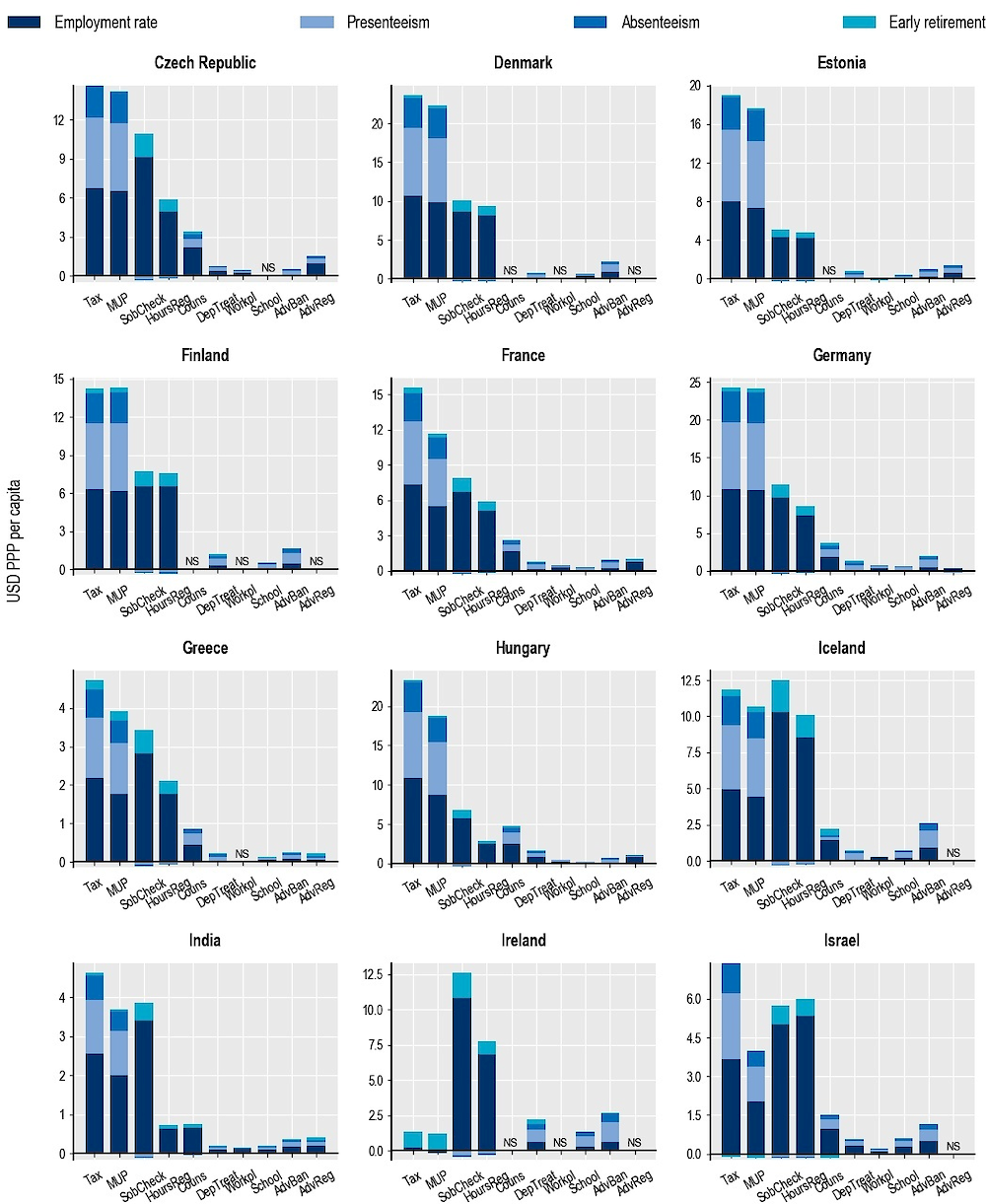

Alcohol-related conditions cause lower employment rates, greater absenteeism and presenteeism, and increases in the number of people who retire early. Therefore, implementation of policy interventions designed to reduce the burden of alcohol provides an opportunity to reduce economic costs associated with suboptimal utilisation and productivity of the labour force. This section focuses on the cost borne by the government, while the cost to the industry is examined in a subsequent chapter (see Chapter 8).

Results confirm that the interventions affect such costs in the expected direction. Thus, across all 48 countries, taxation will add 809 000 more people to the total in employment annually, while MUP will add 706 000 more people and sobriety checkpoints 970 000 more people. When considering the effect on total employment, which also takes into account missed days of work due to illness, being less productive at work and missed work due to early retirement, taxation will help add up to 1 180 000 workers to the workforce each year in all countries, and MUP about 1 040 000 workers. This effect is predicted to be the largest in the United States, Brazil, China, India and the Russian Federation, where 60 000 to 380 000 individuals can be added to the workforce annually as a result of taxation or MUP (Annex Figure 7.A.4), while the lowest effect is predicted to be in Malta and Iceland, where only 40‑60 individuals will be added to the workforce annually in the case of taxation or MUP.

On a per capita basis, taxation will have the strongest impact on employment and productivity, followed by MUP, sobriety checkpoints and restrictions on outlet opening hours. The effect will be lowest for regulation of advertising and for workplace and school-based programmes. Taxation is predicted to make the largest impact on employment and productivity in the Russian Federation, the Baltic countries and Hungary, by increasing the number of people in employment annually by more than 45 per 100 000.

When expressed in monetary terms using average wages, in total each year about USD PPP 93 billion in labour market costs can be saved in all 48 countries combined as a result of implementing the modelled policy interventions. This total comprises the following components: increase in employment rate (53 billion), reduction in presenteeism (24 billion), reduction in absenteeism (11 billion) and reduction in early retirement (5 billion). Among the policy interventions, the largest effect is due to the implementation of taxation and MUP, with corresponding expected savings of USD PPP 31 billion and USD PPP 28 billion in labour market costs in all the countries combined. When standardised by population size (Figure 7.4), the combined employment and productivity costs avoided as a result of taxation will be highest in the United States with up to USD PPP 43 per capita saved, followed by Korea (USD PPP 37 per capita) and Switzerland (USD PPP 27 per capita). This is mainly driven by the fact that the average wage in these countries is higher than in other countries. The lowest reductions in employment and productivity costs are observed in Turkey, South Africa and Ireland. This is due to the low level of alcohol consumption in Turkey, the relatively low employment rate in South Africa and a combination of factors in Ireland.9

USD PPP per capita, annually, 2020‑50

Note: AdvReg = regulation of advertising; AdvBan = ban on advertising to children; School = school-based programmes; Workpl = workplace programmes; DepTreat = pharmacological treatment of dependence; Couns = counselling in primary care; HoursReg = restrictions on opening hours; SobCheck = sobriety checkpoints; MUP = minimum unit pricing; Tax = taxation. NS = not significant.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

While for some interventions the costs of running the intervention are generally predicted to outweigh health expenditure savings, they may still offer a good return on investment, especially after a number of years. In fact, interventions usually require up-front investment that, in many cases, may be very large relative to the health improvements they produce and to the gains in terms of health expenditure, especially in the early years. However, over time, implemented interventions may represent increasingly good value for the money invested, especially if their effect on employment and productivity is also taken into account.

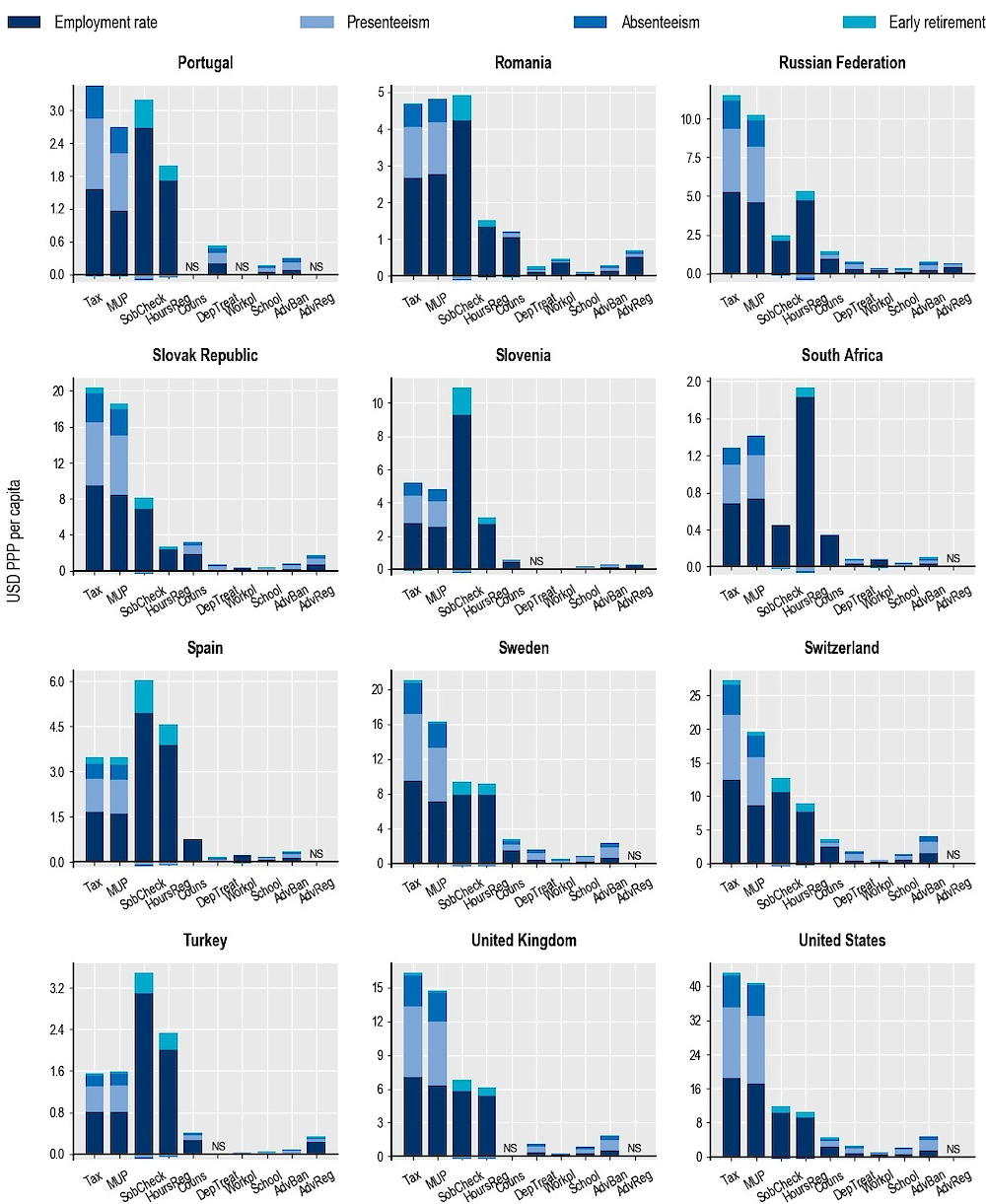

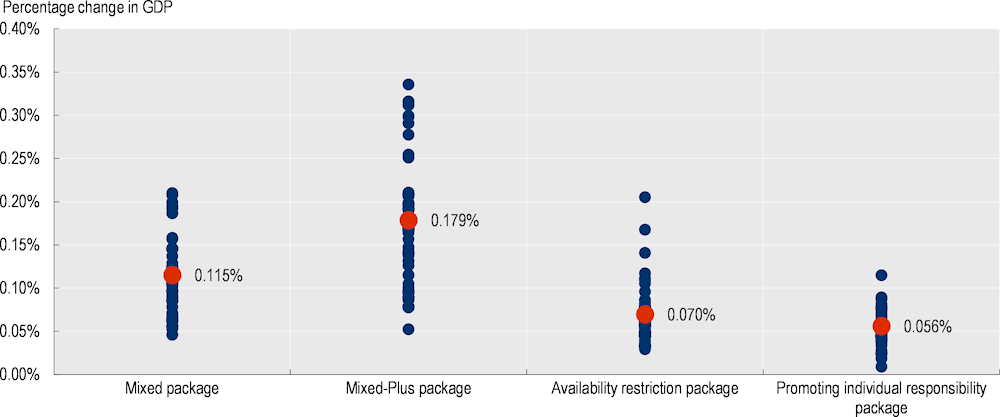

The analysis in this chapter shows that economic gains from increased employment and productivity will in general considerably exceed the savings from reduced health expenditure. This echoes findings in Chapter 4 (compare Figure 4.8 with Figure 4.10). If such labour market costs are taken into account, the return on investment for some interventions will improve even further, in many cases leading to cost savings.10 The simulated effect on GDP supports this expectation. In most countries, interventions are expected to contribute to an increase of GDP in the range 0.001‑0.055% annually (Figure 7.5). Taking 0.001% as a conservative assumption, this corresponds to an increase of USD PPP 964 million in GDP for the 45 countries included in this analysis.11 For instance, the two most effective interventions – taxation and MUP – would result in GDP increases of about USD PPP 10‑11 per capita per year, followed by sobriety checkpoints and restrictions on outlet opening hours, with GDP increases of about USD PPP 5‑6 per capita per year.

Percentage change in GDP due to intervention, average 2020‑50

Note: AdvReg = regulation of advertising; AdvBan = ban on advertising to children; Couns = counselling in primary care; SobCheck = sobriety checkpoints; MUP = minimum unit pricing; HoursReg = restrictions on opening hours; School = school-based programmes; Tax = taxation; DepTreat = pharmacological treatment of dependence; Workpl = workplace programmes.

Blue dots are countries analysed; red dots are the average across countries.

Source: OECD analyses based on the OECD SPHeP-NCDs model and OECD long-term economic model, 2020.

Comparing the increase in GDP to the cost of implementing the interventions in all countries, most of the interventions appear to provide good value for money. The four policies with the highest return on investment (sobriety checkpoints, outlet opening hours restrictions, taxation and MUP) cost between 1% and 9% of the conservatively predicted benefit to the economy. In particular, for taxation and MUP, for each USD PPP 1 invested, around USD PPP 125‑183 will be returned in the form of the economic benefit on average each year over 2020‑50. The costs of implementing regulation or bans on alcohol advertising and counselling in primary care are about 20‑50% of the benefit in terms of GDP. In other words, for each USD PPP 1 invested in one of these three interventions, around USD PPP 2‑4 will be returned in the form of the economic benefit on average each year over the next 30 years. For the pharmacological treatment of dependence, the total return in GDP across the 45 countries is roughly equal to the total cost of implementing the intervention in all countries. For more expensive interventions, such as workplace and school-based programmes, the total return in GDP across the 45 countries analysed is USD PPP 0.12 and USD PPP 0.18 for each USD PPP 1 invested. Results of the return on investment are displayed together with the health and economic impacts later in the chapter, in Figure 7.9. All the interventions except regulation of advertising show a higher return on investment when calculated across OECD countries only (Annex Figure 7.A.5).

Combining policy interventions into prevention packages provides multiple advantages. The causes of harmful use of alcohol are multifaceted, and packages of interventions can address these multiple causes simultaneously. In addition, packages can target different population groups simultaneously, producing greater results at the population level. Finally, policies within a package can work together and build synergies, sustaining positive behavioural changes in a more than additive fashion. Analyses carried out with the OECD SPHeP-NCDs model take into account these first two components but adopt a conservative assumption on the potential super-additivity of combining policies in packages: no additional effect is considered. The following four policy packages were evaluated:

The mixed package: focusing primarily on the most effective interventions, scaling up interventions already in place. Interventions include raising alcohol taxation, regulation of alcohol advertising, sobriety checkpoints to counter drink-driving and alcohol counselling in primary care. These are already implemented in many, but not all, OECD countries, with significant variability in terms of implementation and design.

The mixed package plus: further boosting the mixed package with promising innovative interventions. The package includes, in addition to the four policies in the mixed package, MUP and statutory bans on alcohol advertising targeting children.

The availability restriction package: focusing primarily on interventions to limit the accessibility to alcoholic beverages. This includes regulation of alcohol advertising, statutory bans on advertising targeting children, sobriety checkpoints to counter drink-driving and restrictions on outlet opening hours. The package entails implementation of the most effective versions of these interventions, scaling up interventions already in place.

The promoting individual responsibility package: focusing on interventions that are less intrusive for individuals and less politically sensitive to implement. This encompasses sobriety checkpoints to counter drink-driving, workplace and school-based programmes, alcohol counselling in primary care and pharmacological treatment of dependence.

Upscaling the mixed package plus is predicted to have the largest effect on health outcomes, followed by the mixed package, the availability restriction package and then the promoting individual responsibility package. Specifically, by 2050, the mixed package plus is expected to prevent almost 198 million cases of dependence (6 million cases annually); 55.8 million cases of injury (1.8 million cases annually), 9.2 million cases of cardiovascular disease (298 000 cases annually), 2 million cases of alcohol-related cancer (66 000 cases annually), 1.5 million cases of diabetes (49 000 cases annually) and 550 000 cases of cirrhosis (18 000 cases annually) in the 48 analysed countries (Figure 7.6). For the cases of dependence, the impact of the package is more than the sum of the component interventions belonging to the mixed package plus: the six separate interventions, implemented in isolation, are predicted to avoid 189 million cases of dependence. For the other diseases, the impact of the mixed package plus is comparable to or smaller than the sum of the interventions taken in isolation. The share of dependence cases as a proportion of total cases avoided varies notably across packages (from 2% to 16%), while the share of injuries and other diseases is quite similar across packages (about 6‑10% for injuries) (Figure 7.6).

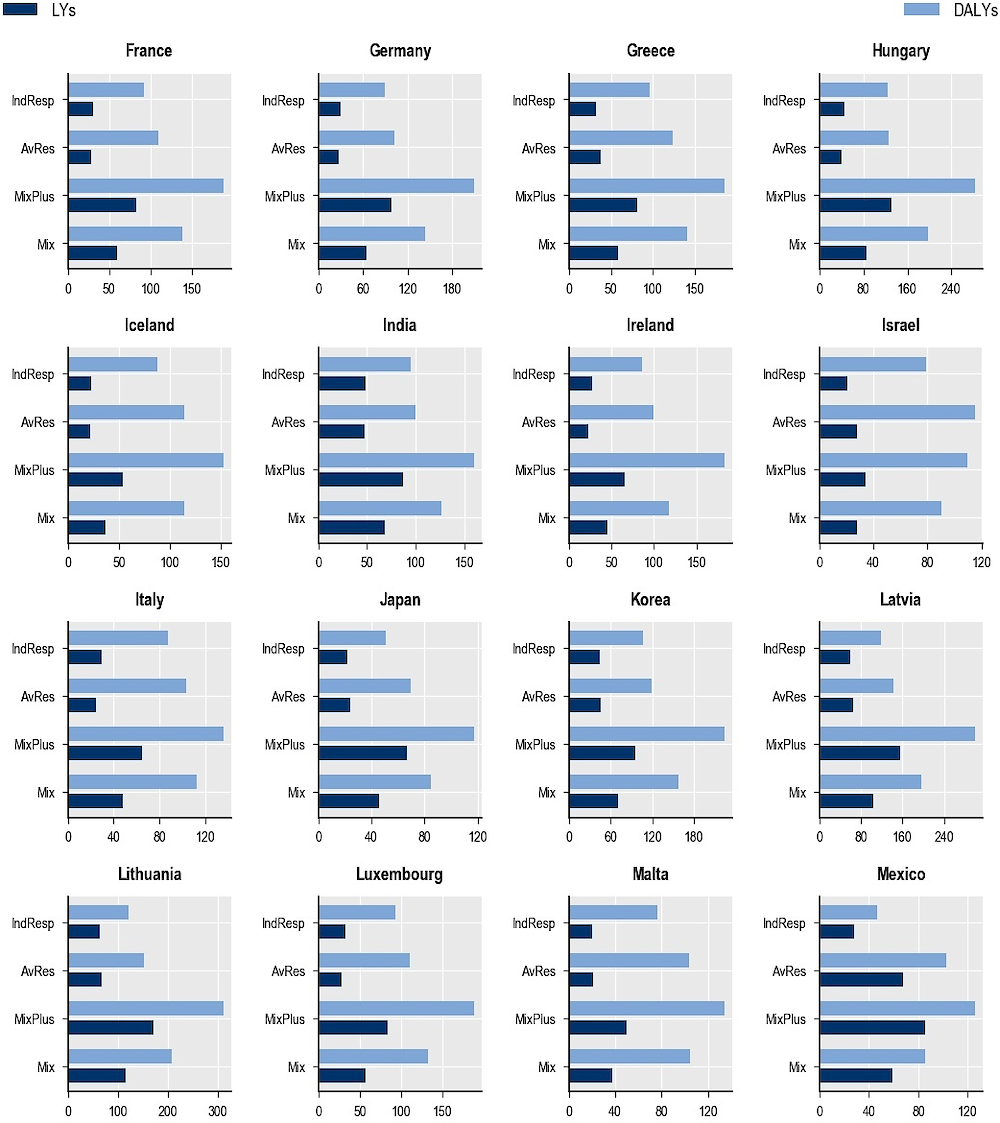

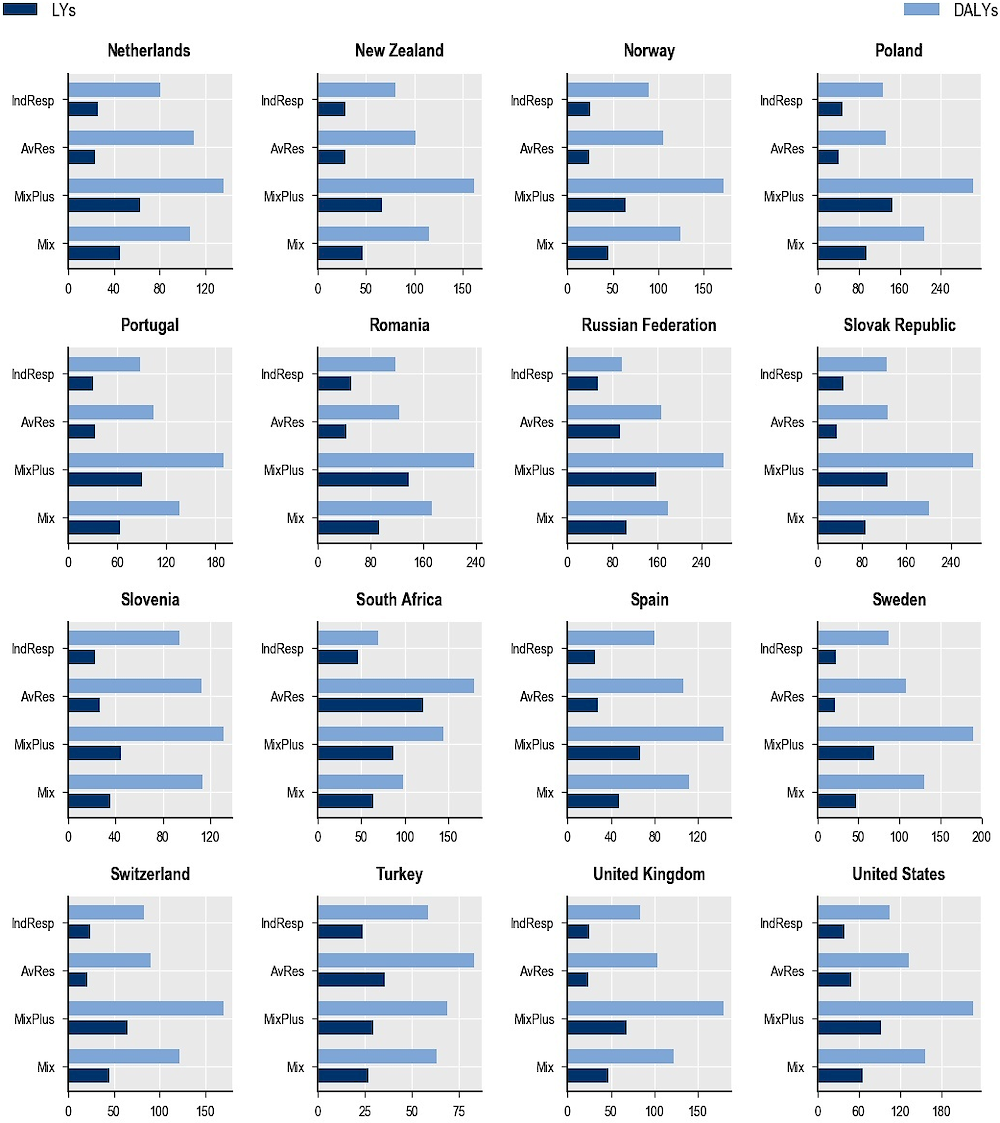

The mixed package plus will also have the strongest impact on DALYs and LYs gained compared to the other three packages. For example, investing in the mixed package plus to upscale interventions already in place in many OECD countries and boost the effects with innovative promising interventions can result in a gain of 4.6 million LYs per year across all the 48 countries included in the analysis. The impact of the mixed package plus will be greatest in the Baltic countries, Poland, Romania and the Russian Federation, with up to 170 LYs gained annually per 100 000 people in Lithuania (Figure 7.7). Again, this finding is consistent with the large alcohol-related burden observed in Central and Eastern European countries, and the potential of these interventions to make a difference there.

The mixed package plus is also predicted to have the largest impact on health expenditure and, as a rule, the savings in health expenditure will be higher than the cost of implementing the interventions (Annex Figure 7.A.6). Further, the savings in health expenditure resulting from the package are higher than the sum of the component interventions belonging to this package. The mixed package plus is predicted to save about USD PPP 28 billion annually in the 48 countries studied. The largest annual effect of this will be observed in the United States (USD PPP 46 per capita), followed by Austria, Germany and Luxembourg (USD PPP 25‑26 per capita), while the smallest effect will be observed in India and Turkey (USD PPP 0.6). The health expenditure savings will generally be greater in the United States and in Western and Northern Europe.

Total number of cases, 2020‑50

Note: CVDs = Cardiovascular diseases; COPD = Chronic obstructive pulmonary disease; MSDs = Musculoskeletal disorders. Bars represent absolute reductions in the number of new disease cases; the markers represent percentage reductions in the number of total new cases as a share of total new cases, between 2020 and 2050.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

LYs and DALYs gained per 100 000 population annually, 2020‑50

Note: Mix = mixed package; MixPlus = mixed package plus; AvRes = availability restriction package; IndResp = promoting individual responsibility package.

Source: OECD analyses based on the OECD SPHeP-NCDs model, 2020.

The mixed package plus is predicted to make the largest impact on labour-related costs, with a saving of nearly USD PPP 90 billion per year in all the countries combined. This is due to the following components: USD PPP 12 billion in absenteeism-related costs; USD PPP 26 billion in presenteeism; USD PPP 48 billion due to the employment rate and USD PPP 4 billion in early retirement costs. The economic gains in labour-related costs resulting from the package are higher than the sum of the component interventions in the mixed package plus. When standardised by population size, the largest reductions will be in the United States and Korea, with savings around USD PPP 110 per capita annually, followed by Switzerland (USD PPP 90 per capita), Germany (USD PPP 77 per capita) and Sweden (USD PPP 72 per capita). In addition, each year 3 million more people will be in employment as a result of the mixed package plus; 2.2 million as a result of the mixed package, 1.7 million as a result of the availability restriction package and 1.4 million as a result of the promoting individual responsibility package. On a per capita basis, the largest increase in employment will be in Lithuania (172 per 100 000 annually), followed by the Russian Federation (168 per 100 000 annually) and Estonia, Latvia and Poland (around 150 per 100 000 annually).

The mixed package also shows significant results, with almost 3.5 million LYs gained annually in the 48 countries, health expenditure savings of USD PPP 16 billion annually and gains in labour-related costs of USD PPP 55 billion. The availability restriction package is predicted to produce smaller but still significant effects, leading to a gain of 2.6 million LYs and saving USD PPP 4 billion in health expenditure and USD PPP 27 billion in labour-related costs per year in the 48 countries. The promoting individual responsibility package is predicted to produce a gain of 2.2 million LYs and to save nearly USD PPP 7 billion in health expenditure and USD PPP 21.5 billion in labour-related costs per year in the 48 countries. The four packages would also avoid between 77 million and 152 million DALYs in all 48 countries cumulatively by 2050.

The impact on GDP will be also substantial, with the mixed package and mixed package plus expected to produce an impact on GDP of about 0.12% and 0.18% in all 45 countries included in the analysis, with variation between 0.05% and 0.34% across countries (Figure 7.8). The other two packages will produce a smaller effect on GDP, of about 0.07% for the availability restriction package and 0.06% for the promoting individual responsibility package.

Percentage change in GDP due to intervention, average 2020‑50

Note: Blue dots are countries analysed; red dots are the averages across countries.

Source: OECD analyses based on the OECD SPHeP-NCDs model and OECD long-term economic model, 2020.

As described in Box 4.7 in Chapter 4, fiscal pressure is measured as government primary revenue (as a percentage of GDP) needed to stabilise the public debt ratio, and is equivalent to an overall tax rate. Implementing the policy packages will affect fiscal pressure, with the mixed package and the mixed package plus lowering the tax rate by 0.05 and 0.08 percentage points of GDP in all the countries included in the analysis.

Overall, for each USD PPP 1 invested in the mixed package plus, USD PPP 16.4 will be returned in the form of economic benefits each year (Figure 7.9). The return on investment in all countries is estimated, each year in the period 2020‑50 for each USD PPP 1 invested, at around USD PPP 13.1 returned for the mixed package, USD PPP 10.4 for the availability restriction package and USD PPP 1.4 for the promoting individual responsibility package. All policy packages show a higher return on investment when calculated across OECD countries only (Annex Figure 7.A.5). The return on investment for policy packages is lower than for some specific interventions. The implementation cost of policy packages is greater than the implementation cost for single interventions – in particular for taxation, MUP, restrictions on opening hours and sobriety checkpoints (Table 7.3). It should be remembered, however, that the return on investment is not the only dimension of select interventions, and policy packages have much greater effectiveness for example, on population health) than single interventions, which is another element to take into account in the policy-making process.

Average per year for the period 2020‑50

Note: Estimates for the return on investment are the result of the total increase in GDP in the 45 countries produced by the policy divided by the total cost of implementing the policy in these countries.

Source: OECD analyses based on the OECD SPHeP-NCDs model and OECD long-term economic model, 2020.