This chapter begins by setting out the typical barriers faced internationally by start-ups and scale-ups that policy can help to overcome. This is followed by a review of the policies in place in Denmark to support start-ups and scale-ups and a subsequent analysis of how Denmark compares to its peers in terms of the prevalence and impact of start-ups and scale-ups. Finally, there is an analysis of the characteristics and economic contributions of start-ups and scale-ups in Denmark’s 15 sector strongholds and emerging industries.

Promoting Start-Ups and Scale-Ups in Denmark’s Sector Strongholds and Emerging Industries

2. Start-ups and scale-ups in Denmark’s sector strongholds and emerging industries

Abstract

Introduction

A healthy stream of start-ups is a pre-requisite for a dynamic economy. The most productive start-ups within a start-up cohort bring novel products, processes and ideas into the market that are a crucial source of innovation (OECD, 2021[1]). Moreover, challenger firms raise levels of competition by forcing incumbent businesses to either adapt or cede market share (Kritikos, 2014[2]). In addition, scale-up businesses make an outsized contribution to economic growth (Audretsch, 2012[3]). The definitions used in this report for start-ups and scale-ups are detailed in the Box below.

Box 2.1. Defining start-ups and scale-ups

Start-ups are defined in this report as businesses that are 0-5 years old. For example, in 2019, the population of start-ups comprised businesses that were established either in 2014, 2015, 2016, 2017, 2018 or 2019. It is important to note that the adopted definition of a start-up varies between studies, which can lead to differences in observed trends and results.

Scale-ups are defined as businesses that have experienced at least 10% annualised growth in either employment or turnover over a three-year period. An additional criteria for a scale-up is that the business had at least 10 employees at the start of the three-year period. This is in line with the definition of “scalers” used in the OECD’s recent work on understanding firm growth (OECD, 2021[4]) and with the definition used in the OECD-Eurostat Entrepreneurship Indicators Programme underlying the data in the OECD Structural and Demographic Business Statistics database.

Supporting start-ups and scale-ups can help to achieve numerous economic and societal objectives. However, these businesses often face a set of challenges that is distinct from that of more established companies (OECD, 2021[1]). This means that, in order to realise the potential benefits of start-ups and scale-ups, it is necessary to implement tailored policy interventions.

Key barriers to the success of start-ups and scale-ups

Two defining characteristics of most early-stage enterprises is that they are young and small. These attributes result in a number of common challenges as entrepreneurs seek to establish and grow their businesses. In many instances, policy interventions can be effective in ameliorating these issues, thus helping to unlock the benefits that successful entrepreneurs can bring to the economy and society. The following section presents some of the key barriers to the success of start-ups and scale-ups that policy interventions can address.

Access to finance

Given that many entrepreneurs have limited internal resources to invest in their ventures, external finance is essential in helping businesses to start-up, innovate and grow. The largest source of external finance for businesses is bank finance, including bank loans, overdrafts, credit lines and credit cards (Cusmano, 2015[4]) (European Commission, 2021[5]). However, new businesses typically have a limited trading history as well as a lack of collateral, which is a significant obstacle to accessing bank finance (Cusmano, 2015[4]). Moreover, banks may find it more difficult to assess credit risks for start-ups engaged in innovative activities, leading to greater uncertainty and a reduced willingness to lend for this group (Carpenter and Petersen, 2002[6]). On the demand side, young businesses are more likely to have an incomplete picture of the financing options that are available due to their limited experience and reduced access to skills and networks. These information gaps can lead to fewer start-ups and scale-ups receiving bank financing than would be the case in a scenario with perfect information. Alternatives sources of finance include venture capital, angel investors, corporate investors, peer-to-peer business lending and mezzanine financing (Denis, 2004[7]) (Block et al., 2018[8]). Despite these alternative sources of financing, entrepreneurial funding gaps remain a significant issue (Fraser, Bhaumik and Wright, 2015[9]).

Entrepreneurship skills and capabilities gaps

Establishing a successful enterprise is a multi-step process, which involves developing a product or service, setting up a company, and growing a customer base. Each of these steps relies upon a distinct set of skills and knowledge. Product development requires technical skills and an ability to identify economic opportunities, while forming and growing a business requires entrepreneurs to be competent in navigating legal and regulatory frameworks, building networks, accessing external financing, leading teams and recruiting skilled personnel.

The varied and complex nature of the skills required to start a successful business can be an obstacle to many budding entrepreneurs, who may excel in some areas while falling short in others (OECD, 2020[10]). For instance, entrepreneurs with excellent product development skills may subsequently struggle to take their products to market, while others with an aptitude for identifying economic opportunities may lack the technical knowhow to bring their ideas to life. In many instances, entrepreneurs have the option of accessing support from the private sector in order to build their competencies in certain areas. However, it can be difficult for entrepreneurs to quantify the benefits that these investments will deliver. This can lead to an under-utilisation of business support services and a consequent persistence of entrepreneurial skills and knowledge gaps, leaving a space for policy intervention in certain areas (OECD, 2020[10]).

Access to international markets

Exporting can deliver many benefits to businesses, including an enlarged revenue base, risk diversification, technology transfer and an improvement in standards and efficiency (OECD, 2020[10]). However, numerous studies have identified a range of size-related factors that inhibit the ability of smaller businesses to access international markets (Leonidou, 2004[11]). For instance, small firms often have more limited information on export opportunities and processes than their larger counterparts. Small businesses’ relatively low production volumes may also make it difficult for them to compete internationally on price, while the barriers to finance described previously can further inhibit exporting activities.

Access to networks

An integral part of entrepreneurship is forming relationships with other entrepreneurs, research institutions, established businesses, potential customers and investors. Networks can facilitate peer-to-peer learning and the formation of strategic partnerships, improve access to finance and resources, bolster entrepreneurship skills and help entrepreneurs to grow a customer base (OECD, 2020[10]). When new businesses enter the market, they often have more limited access to networks than established businesses, which is a key part of the “liability of newness” experienced by start-ups (Stinchcombe, 1965[12]) (Cafferata, Abatecola and Poggesi, 2009[13]).

Cultural attitudes

People’s willingness to engage in an entrepreneurial venture is influenced by the set of shared ideas, values and norms embedded in the culture in which they operate (OECD, 2020[10]). Therefore, in certain settings, culture can be a barrier to entrepreneurship. By instilling certain attitudes within individuals, culture can lead to preferences and perspectives that are not conducive to becoming an entrepreneur. Furthermore, culture shapes how certain actions will be perceived by others, which in turn feeds into the decisions that people make. Ceteris paribus, individuals in cultures that celebrate and encourage entrepreneurship will be more likely to become an entrepreneur than those in cultures where entrepreneurship is viewed less favourably. Attitudes to entrepreneurship vary considerably across different countries (Bosma et al., 2021[14]).

Summary

Most entrepreneurial ventures internationally experience a number of the barriers to success described above at some point of their development. Many of these issues are an inherent consequence of the age and size of new businesses and are therefore prevalent across most industries. That said, certain challenges are more acute in some sectors than in others. For example, due to higher transport costs, expanding to new markets can be harder for businesses that provide physical goods and services than for those that provide their products through digital platforms (Freund and Weinhold, 2002[15]). This means that difficulties accessing international markets are likely to be more prevalent in sectors that are less digital intensive. Finance gaps also vary across sectors. As an example, deep tech companies face challenges in meeting their large capital requirements due to extended development timelines and the inherent technological and market uncertainty associated with their innovations (Nedayvoda et al., 2021[16]). Similarly, despite increasing investments in green sectors, entrepreneurs in environmental sectors often face greater difficulties accessing finance due to perceived technological and policy risks as well as more extended investment horizons (Demirel et al., 2019[17]). Cultural barriers to entrepreneurship will also vary across sectors, depending on the prevailing attitudes towards different types of entrepreneurial ventures and the operating practices of different industries. For instance, in some sectors, existing working practices and behaviours create an environment that may deter potential women entrepreneurs from entering the field (Bagilhole, Dainty and Neale, 2000[18]).

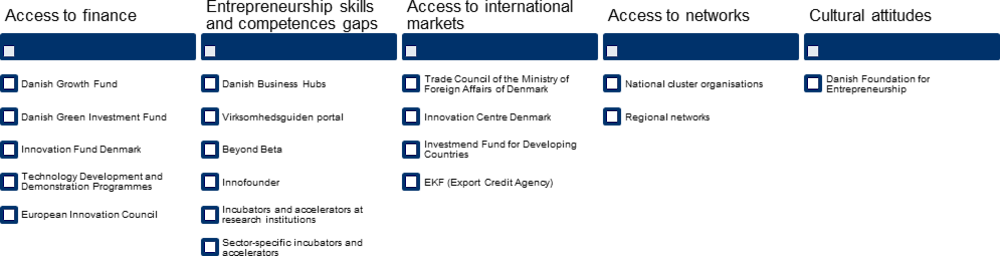

Policy measures in Denmark

This section presents the main public policy measures currently in place in Denmark to support start-ups and scale-ups in overcoming each of the barriers identified previously. These include initiatives that cover all sectors, as well as those that are targeted towards specific sector strongholds or emerging industries. It is important to note that these public policy measures are only part of the wider business promotion system in Denmark, which also includes a number of private organisations and initiatives.

Access to finance

Policies that improve entrepreneurs’ access to finance can help to overcome the funding difficulties that start-ups face due to their lack of trading history, networks or collateral (OECD, 2020[10]). Direct financial support can be provided through the allocation of grants (e.g. the Small Business Innovation Research programme in the US), loans (e.g. the start-up loans offered by the Business Development Bank of Canada) and equity injections (e.g. the European Investment Fund’s investments into selected equity funds). Public policies can also help businesses to access funding through the private sector, for instance through government loan guarantees as well as programmes to raise the financial literacy of entrepreneurs (e.g. the US Small Business Administration’s Money Smart for Small Business programme) (OECD Publishing, 2020[19]). Furthermore, governments can establish dedicated organisations that provide funding to start-ups and scale-ups, such as public sector venture capital funds (e.g. the government-backed High-Tech Gründerfonds and Coparion funds in Germany) or angel investors. Below are set out some of the key policy interventions in Denmark relevant to start-ups and scale-ups in these areas.

Grants

The Danish Board of Business Development

The Danish Board of Business Development is a decentralised board that promotes business growth and development by concentrating on the needs of enterprises in the regions. The Board has the task of ensuring that the decentralised business initiatives across the regions are coherent and that there is no overlap between publicly funded actors and programmes.

The Danish Board of Business Development has at its disposal approximately DKK 300 million annually. Additionally, it will implement DKK 1-2 billion worth of EU Structural and Investment Funds in 2022-2027 in areas including, among others, innovation, green transition, business development, skills and entrepreneurship.

Innovation Fund Denmark

Innovation Fund Denmark is a public investment fund, which issues grants to entrepreneurs, businesses and researchers with high risk projects that may otherwise find it difficult to access finance. Projects are evaluated based on social and environmental factors in addition to financial results.

The fund focuses on three areas:

Climate, environment and green change;

Life science, health and welfare technology, and;

Technology and innovation that creates value and growth.

In the agreement on the 2021 research reserve, DKK 1.2 billion of investment was assigned to the Innovation Fund to invest in green research initiatives, DKK 340 million was assigned to life science, health and welfare technology, and DKK 190 million was assigned to technology and innovation that creates value and growth.

Technology Development and Demonstration Programmes

Denmark has in place a number of technology development and demonstration programmes, which are an important source of funding for entrepreneurs looking to develop innovative technologies. The Energy Technology Development and Demonstration programme supports new technologies in the field of energy that contribute to Denmark’s climate objectives. DKK 543 million was made available in the most recent round of funding in 2021. Meanwhile, the Danish Ministry of the Environment oversees the Environmental Technology Development and Demonstration programme. In 2021, DKK 140 million was made available to companies, research institutions or individuals for the development of environmental technology solutions. The Ministry of Food, Agriculture and Fisheries runs the Green Development and Demonstration programme, which funds projects that solve important challenges for the Danish food industry while contributing to food, business and environmental policy objectives. In 2020, the programme had a total budget of DKK 259 million.

European Innovation Council

Funding opportunities are also available to Danish start-ups and scale-ups through the European Innovation Council (EIC), which was established under the European Union’s (EU) Horizon Europe programme. The EIC has a budget of EUR 10.1 billion for the 2021-2027 period, with the aim of developing and expanding breakthrough innovations. In 2022, EUR 1.2 billion was allocated to the EIC Accelerator programme, which provides finance to prospective entrepreneurs, start-ups, SMEs and, in rare cases larger businesses with up to 499 employees. The EIC Accelerator programme offers grants for innovation activities as well direct equity investments and convertible loans to support market deployment and scaling up activities. Meanwhile, a budget of EUR 350 million was allocated to the EIC Pathfinder programme, which distributes grants of up to EUR 4 million to consortia comprising at least three independent entities established in at least three different eligible countries. The purpose of these grants is to help the selected consortia to develop proofs of concept. The EIC Transition scheme, which provides grants of up to EUR 2.5 million to support the validation and demonstration of technologies and the development of market readiness, was assigned a budget of EUR 131 million in 2022.

Loans and equity investments

Danish Growth Fund

The Danish Growth Fund is Denmark’s state investment fund, financed by capital contributions from the Danish Ministry of Business. The fund seeks to fill financing gaps left by the private sector by providing a range of financing support measures to primarily start-ups and SMEs, including start-up loans, growth loans, venture debt loans and loan guarantees. In addition to this, the fund nurtures potential scale-ups, for instance through the provision of convertible loans of up to DKK 3 million to young enterprises with a high growth potential but who are not yet able to access venture capital funding. This scheme targets businesses with a scalable business model, high annual growth rate expectation and a global market for their products. In 2020, the Danish Growth Fund issued DKK 2.9 billion of loans, although this figure is inflated by the DKK 1.8 billion of COVID-19 related loans that were provided that year.

The Danish Growth Fund also makes direct equity investments in Danish companies, which in turn supports potential scale-ups in realising their growth ambitions. In 2020, the fund made DKK 236 million worth of equity investments. Typically, 5-10 companies receive equity investments each year, with most capital injections ranging in value from DKK 5-20 million. In addition to this, the fund provides support to businesses in collaboration with private funds and business angels.

While the vast majority of the Danish Growth Fund’s support mechanisms are accessible to businesses from all sectors, elements of the fund’s operations are more suited to specific areas. In its investment activities, the fund has a strong focus on the IT, medtech and industrial technology sectors. These areas align closely with the digital technologies, life science and welfare technology, and advanced production and manufacturing sector strongholds. The Danish Growth Fund also has a dedicated team that specialises in providing support to agricultural businesses, offering a range of bespoke loan products and loan guarantees.

Danish Green Investment Fund

In partnership with financial institutions, the Danish Green Investment Fund lends up to 60% of the costs of environmentally beneficial projects in the areas of energy, food and agriculture, buildings and infrastructure, materials and resources, and transport and mobility. It provides loans of up to DKK 400 million, with a maturity of up to 30 years. The state guaranteed lending limit currently stands at DKK 8 billion. In 2020, the value of outstanding loans issued by the fund stood at DKK 1 649 million. A recent example of the Green Investment Fund’s work is the agreement of a DKK 100 million loan to GreenMobility in order to fund the expansion of the company’s fleet of electric vehicles. Support is available to private companies of all sizes as well as housing associations and independent public sector institutions, meaning that the fund’s activities are only to a limited extent aimed at start-ups.

As part of the 2022 agreement “Danmark kan mere 1”, the Danish Growth Fund, EKF and the Danish Green Investment Fund will gradually be merged into a single fund: the Danish Export and Investment Fund. The rationale for the merger is to facilitate synergies between the different funding entities and to make it easier for the design of government funding opportunities to adapt to international developments in a coherent manner.

Entrepreneurship skills and capabilities gaps

The public sector often has a role in providing a range of business services to start-ups and scale-ups. This support includes advice, coaching, and mentoring. There are various methods of provision the formation of networks that facilitate peer-to-peer learning, and signposting to services from the private sector (OECD, 2020[10]). Business incubators and accelerators are a key method of delivery of business advice to start-ups and scale-ups. Another type of support provided involves access to public research and innovation knowledge through research and technology organisations.

Advice, coaching and mentoring

Danish Business Hubs

Denmark has six business hubs with branches offering nationwide specialised business service. The hubs are a one-stop shop for business services, providing specialised advice on business development as well as grants, access to financing, networks and support services. The business hubs act as a juncture in the business promotion system, helping companies to navigate the various support measures that are available to companies from a range of different organisations. The business hubs operate the IværksætterDanmark programme, which offers online and in-person courses for businesses on a range of topics. The IværksætterDanmark programme also offers the NextStep course, which provides businesses with demonstrable growth ambitions with access to an experienced business developer as well as grants of up to DKK 255,000.

In 2021, 4 790 businesses received specialised guidance through the business hubs, with three-quarters of these companies also referred to appropriate public or private advisers. The total budget allocated to the six business hubs in 2022 is DKK 171 million. Each hub covers multiple municipalities. More localised business development and government administrative services are provided by the municipal business development offices.

Virksomhedsguiden

In 2019 the Danish Business Authority launched the platform Virksomhedsguiden (virksomhedsguiden.dk). Virksomhedsguiden is a digital one-stop shop, which provides companies with business guidance and information regarding rules and business support services in Denmark. In 2021, the website had approximately 1.5 million page views and 600 000 visitors. Virksomhedsguiden works in close collaboration with the different Danish authorities and the regional business hubs to ensure that accurate and up-to-date information is provided.

Incubators and accelerators

Business incubators and accelerators are a key vessel for the delivery of accommodation, guidance, training, contacts and funding to entrepreneurs (European Commission / OECD, 2019[20]). Business incubators focus on nurturing businesses during their early start-up phase, while business accelerators typically take equity in companies, enrol businesses in fixed-duration programmes to develop scale-up skills and have more stringent performance requirements. Although these organisations are generally privately operated, they often require government support in order to remain viable. Denmark has a large and diverse network of publicly-supported incubators and accelerators. The remainder of this section provides an illustrative overview of the network of publicly-supported incubators and accelerators in Denmark, with examples of initiatives that nurture start-ups and scale-ups from a broad range of fields as well as incubators that focus more narrowly on specific sectors.

Beyond Beta

Beyond Beta runs incubation and acceleration programmes to support entrepreneurs. Accelerace, the Danish Business Hubs and the Danish Design Center jointly founded and operate Beyond Beta. The 14 national cluster organisations are also involved in the programme. The role of the business hubs is to screen the companies entering the programme, while the role of the cluster organisations is to apply their sector-specific knowledge in order to arrange activities for target groups.

Beyond Beta offers modules to start-ups at varying stages of development. For businesses with a concept or prototype but without a customer or user base, eight industry-specific incubator programmes were available as of March 2022. Through these programmes, businesses are provided with a contact in the relevant national cluster organisation, who then connects the businesses to relevant organisations within the industry. Businesses are also provided with access to mentors, workshops and networks in order to support their further development. For businesses at a more advanced stage, typically with a proof of concept and initial customer base, Beyond Beta offers a pre-accelerator and accelerator programme. The pre-accelerator is a freely available online platform comprised of a series of modules. The subsequent accelerator programme is broken down into three phases, with only selected start-ups progressing through to each new phase. From phase 2 onwards, start-ups can utilise Beyond Beta’s resource platform, which provides access to tools, software, interns and Beyond Beta’s resident CEOs. The final phase sees entrepreneurs introduced to relevant investors and prepared with the skills and knowhow necessary to conduct successful funding negotiations. For the 2021-2023 period, the programme has been assigned a budget of DKK 112 million from the REACT programme, in addition to a core budget of DKK 34 million for the period 2019-2022.

Innofounder

Innofounder is a 12-month development course for entrepreneurs operated by Innovation Fund Denmark. The programme aims to accelerate the process in which innovative entrepreneurial ventures become financially sustainable either through generating sales or through obtaining investment. Programme participants receive a monthly allowance of DKK 27 500 to enable them to work full time on developing entrepreneurial idea. Development grants of DKK 100 000 are also distributed upon commencement of the course, which can cover technological development expenses such as equipment rental, prototype development, software and external advice. During the course, entrepreneurs have access to workshops, mentoring and networking with other entrepreneurs in order to facilitate the development of entrepreneurial skills and capabilities.

Incubators and accelerators at research institutions

Denmark has numerous incubators and accelerators that are housed within publicly-funded research institutions. For instance, the Copenhagen School of Entrepreneurship offers a range of incubation and acceleration services. The Incubator Proof Programme consists of a 3-month proof of concept phase and a 6-month proof of business phase, during which entrepreneurs are provided with office space, professional services, access to a network of start-ups and the opportunity to talk to potential customers. Meanwhile, the Go Grow Accelerator Programme has helped 140 start-ups to scale up. Businesses in the programme are supported through the provision of free specialised consultancy services, expert advice and mentoring, access to investors and office space.

Another example is the Technical University of Denmark’s (DTU) Skylab, which acts as a focal point for innovation and entrepreneurship, providing physical facilities such as labs and work areas alongside networking opportunities, funding and acceleration services. The DTU’s Science Park operates the GreenUp Accelerator, which is a 20-month acceleration programme that provides participants with a DKK 1 million convertible loan and more than 75 hours of free counselling. The ambition is to create climate tech start-ups that are ready to tap into international capital markets upon completion of the programme. DTU also leads an incubator that is part of the European Space Agency’s pan-European network of 22 business incubation centres. The incubator aims to support 40 space-related start-ups in Denmark between 2020 and 2024 by providing access to international networks, funding, business development services and favourable office rates.

Other incubators and accelerators operating within public universities in Denmark include Aarhus University’s Kitchen start-up hub, the SCIENCE Innovation Hub at the University of Copenhagen, the University of Southern Denmark’s Entrepreneurship Labs and the Aalborg University Inkubator.

Other publicly-funded incubators and accelerators

Significant public funding is provided to a number of private organisations that are important in the provision of incubation and acceleration support. For example, in partnership with Digital Hub Denmark, Copenhagen Fintech runs the Nordic Fast Track Programme. The two-month programme is for non-Danish fintech start-ups with a live product or prototype. The aim is to bring these solutions to the Danish and European markets by providing start-ups with local contacts and accelerating the process of learning about the Danish market. Similarly, Game Hub Denmark is an incubator with public funding that focuses on start-ups in the computer games industry. With a presence in several Danish cities, Game Hub Denmark provides a variety of services including office space, mentoring, certifications, access to workshops and conferences, and legal and financial consulting. Another publicly-funded incubator is the Odense Robotics StartUp Hub, which is housed within the Danish Technological Institute and aims to accelerate the growth of promising start-ups in the field of robotics. It does this by offering access to a network of companies in the industry as well as high-quality testing facilities and coaching. Start-ups are also supported in accessing financing from investors. Since 2015, the hub has helped start-ups to secure more than EUR 20 million from external investors.

Access to research and technology

Open Entrepreneurship

The Open Entrepreneurship initiative, which is led by the Danish Industry Foundation and the Danish Ministry of Higher Education and Science, seeks to connect entrepreneurs with researchers in order to create new commercial opportunities. Several Danish universities are partners in the initiative, as well as the University of California, Berkeley. Each participating university has an Open Entrepreneurship business unit, where entrepreneurs and investors can obtain a desk in order to become embedded in the research environment. The Open Entrepreneurship initiative also places researchers within companies, and runs a 3-6 month accelerator programme.

GTS Institutes

In Denmark, there are seven government-approved Research and Technology Organisations, which are referred to as the GTS Institutes. These organisations work on developing technologies, knowledge, solutions and standards for Danish businesses, which in turn supports start-ups and scale-ups in remaining competitive. The degree of specialisation and research focus varies from institute to institute. For instance, DHI specialises in the water, environment and health sectors, while DBI focuses on fire safety. Meanwhile, the Danish Technological Institute works across a broader range of areas.

Technology Transfer Offices

Many of Denmark’s public universities, including the University of Copenhagen and Aarhus University, house technology transfer offices. These work to facilitate collaborations between universities and other actors, encourage the development of spin-out companies, assess the commercial potential of research outputs, and manage intellectual property.

Access to international markets

Exporting can be an effective way for a business to scale-up. Indeed, tapping into global value chains can encourage investment, specialisation, organisational change and knowledge spillovers, each of which contribute to overall business growth (OECD, 2019[21]). Measures to help start-ups and scale-ups to export include tax incentives, export credit guarantees (e.g. the German government’s issuance of export credit guarantees through Hermes Cover), informational campaigns and the provision of advice and logistical support services (e.g. the US Department of Commerce’s Startup Global initiative) (OECD, 2020[10]). Trade missions can also promote a country’s businesses to buyers in overseas markets.

Trade Council

The Trade Council of the Ministry of Foreign Affairs of Denmark provides support and expertise to Danish companies in order to help them realise their export aspirations. Each year, it assists around 3 000 Danish companies. The Trade Council has a presence in more than 70 countries, meaning that it can provide knowledge of local markets, as well as relevant contacts at overseas companies and trade organisations. There are teams of expert advisors that specialise in specific sectors such as design, furniture and fashion, energy, technology, water and the environment, health, and food and agriculture.

The Trade Council offers the Export Sparring Programme to SMEs, which provides assistance in developing an export plan followed by up to 15 hours of free sessions with a Trade Council export advisor. Additionally, the Trade Council operates a Strategic Business Alliance programme, which seeks to bring together Danish companies that are looking to export, thus facilitating the exchange of local market expertise, networks and resources. Furthermore, the SCALEit programme helps businesses to expand internationally. The scheme includes preparatory workshops based in Denmark as well as a networking week during which Danish start-ups and SMEs are connected with ecosystem actors in overseas markets.

Through its Incubator Scheme, the Trade Council offers physical and virtual incubation services at 23 locations in 15 countries. The incubators provide Danish businesses with office space, access to meeting rooms and bespoke advice. The incubators also provide companies with a local address in an overseas location, which in turn can boost local sales and streamline administrative processes.

Innovation Centre Denmark

Innovation Centre Denmark introduces companies and research institutions to strategic partnerships, technology networks and investment opportunities, utilising the Trade Council’s knowledge and contacts in overseas markets. Innovation Centre Denmark has innovation centres in Boston, Munich, New Delhi, Sao Paulo, Seoul, Shanghai, Silicon Valley and Tel Aviv. These centres promote Danish competencies internationally in order to attract investment. Innovation Centre Denmark also provides access to targeted learning programmes in order to support and accelerate business development.

Investment Fund for Developing Countries

The Investment Fund for Developing Countries (IFU) provides risk capital to companies in developing countries and emerging markets. Investments are made on commercial terms with a focus on businesses that are contributing to the green transition and economic and social development. The IFU has invested DKK 25 billion in more than 1 300 companies. While the IFU’s operations are principally overseas, the fund has co-invested with more than 900 Danish companies, helping these businesses to access international markets.

EKF (Export Credit Agency)

EKF is Denmark’s export credit agency. It provides assistance to businesses that are looking to export through a variety of channels including credit guarantees, acceleration services and the provision of information on overseas markets.

EKF Green Accelerator

EKF – Denmark’s export credit agency – operates an accelerator programme dedicated to Danish companies looking to export clean technologies. A total of DKK 30 million has been made available to finance preparatory business activities as well as short-term visits to potential export markets.

Guarantees

One way that businesses can attract international customers is by offering competitive financing, whereby payments are made by the customer after the delivery of the goods or services. EKF’s guarantees allow Danish businesses to offer finance to their overseas customers without assuming any credit risk and receiving payment immediately upon delivery. In effect, these guarantees represent the extension of finance from EKF to Danish exporters’ international customers. EKF also helps Danish exporters to obtain bank financing to fund their expansion plans by issuing capital guarantees, through which EKF assumes the banks’ credit risks.

Access to networks

Networks can bring many advantages to start-ups and scale-ups, including reduced costs of obtaining information, enhanced access to technological, human and financial resources, links to potential customers and suppliers, and reputational benefits (Hayter, 2013[22]). Porter defines clusters as geographic concentrations of interconnected companies and institutions in a particular field (see, for example the Czech Republic’s Nanoprogress cluster, AFBW in Germany and Media City Bergen in Norway) (Porter, 1998[23]). Clusters aim to stimulate innovation and enterprise development by harnessing local knowledge and relationships, and are an effective way of embedding entrepreneurs into networks of businesses, investors and customers. Policy can strengthen clusters through direct funding as well as by supporting research collaborations and providing infrastructure, networks, education and training (OECD, 2009[24]). Denmark has numerous publicly supported cluster organisations, including the 14 national cluster organisations and a variety of regional networks, which are described below. However, it is important to note that cluster organisations can have varying degrees of public involvement, and Denmark is also home to a number of private cluster organisations.

National cluster organisations

In order to strengthen innovation and co-operation within the sector strongholds and emerging industries identified by the Business Promotion in Denmark 2020 – 2023 strategy and the Minister for the Ministry of Higher Education and Science, 14 national cluster organisations were launched on 1st January 2021. The national cluster organisations corresponding to each of the sector strongholds and emerging industries are as follows:

Environmental technology: CLEAN

Energy technology: Energy Cluster Denmark

Food and bio resources: Food & Bio Cluster Denmark

Maritime industry and logistics: MARLOG

Life science and welfare technology: Danish Life Science Cluster

Construction and building: We Build Denmark

Design, fashion and furniture: Lifestyle & Design Cluster

Advanced production: Manufacturing Academy of Denmark (MADE)

Digital technologies: Digital Lead

Finances and financial technology (Fintech): Copenhagen Fintech

Robot and drone technology – emerging industry: Odense Robotics

Animation, games and film – emerging industry: Vision Denmark

Defence, space and security – emerging industry: Centre for Defence, Space and Security (CenSec)

Sound technology – emerging industry: Danish Sound Cluster.

The numbers of members of the cluster organisations range from approximately 200 to upwards of 500. The public funding allocated to the national cluster organisations between 2021 and 2024 is approximately DKK 640 million.1 In addition, most cluster organisations also receive funding from various national initiatives and EU funded programmes.

The national cluster organisations aim to promote innovation and build a bridge between Denmark’s research and business communities, providing platforms to bring companies, research institutions and policymakers together. Knowledge sharing is strengthened through the creation of professional networks, such as the Danish Sound Cluster’s network groups for audio companies. The national cluster also establish international networks in order to pool knowledge across different countries. For instance, the Danish Life Science Cluster is building a Danish-German partner network to drive innovation in the healthcare sector and address shared challenges. The national clusters support start-ups by supporting activities that focus on increasing innovation through e.g. knowledge and networks that can be a particular challenge for new businesses. By connecting businesses with potential domestic and overseas partners to spur innovation, national clusters also support scale-ups in realising their growth aspirations. For instance, the CLEAN cluster is a partner of the EU Techbridge project, which matches North American customers with European SMEs with innovative water and energy solutions. The share of members that are start-ups varies significantly between the national cluster organisations. For instance, the Manufacturing Academy of Denmark (MADE) has historically had few start-ups among its members, whereas other (regional level) cluster organisations have many start-ups as members, e.g. Odense Robotics and Copenhagen Fintech.

Further information on the national cluster organisations in the case study sector strongholds is provided in the next section.

Regional networks

In addition to the 14 national cluster organisations, there are also a number of publicly supported network organisations with a more regional focus. For instance, Copenhagen Science City is a partnership between the City of Copenhagen, three universities and a number of other entities including science parks and co-working areas. Copenhagen Science City seeks to identify synergies within its network and raise awareness of the facilities for innovation that are available. Another example of a regional network organisation is Life Science Innovation North Denmark (LSI). Through a variety of projects and events, LSI aims to bring together and foster collaboration among key players in North Jutland’s health and welfare innovation ecosystem. Other regional networks with support from the public sector include Science City Lyngby and Medicon Valley Alliance (MVA). Science City Lyngby seeks to promote innovation and entrepreneurship in Lyngby by bringing together local businesses, public entities and research institutions. MVA is a bi-national cluster covering the island of Zealand and the Skåne region of Southern Sweden. Its core function is to foster co-operation between businesses, research institutions and public organisations in order to strengthen the health and life science sector. MVA also works to market the Medicon Valley internationally.

Cultural attitudes

Public initiatives have a role to play in creating a culture that is conducive to entrepreneurship. Entrepreneurship education programmes (EEP) have the potential to increase entrepreneurial capacities and intentions, although it should be noted that previous impact evaluations of EEPs have yielded mixed results (Charney and Libecap, 2011[25]) (Oosterbeek, van Praag and Ijsselstein, 2010[26]). Entrepreneurship can also be championed through the organisation of events, awards and competitions for new businesses.

The Danish Foundation for Entrepreneurship was established by four Danish government ministries in 2010, with the goal of embedding entrepreneurship education into all stages of the education system. The Foundation had a budget of DKK 49 million in 2020. The Foundation’s 2020-25 strategy sets out an aim for 300 000 pupils and students to receive entrepreneurship education during the 2023-24 school year. Another objective is for 20 000 teachers and educators to receive training from the foundation during the strategy period. Entrepreneurship education is supported through dedicated entrepreneurship programmes for pupils, students and teachers, the allocation of funding to entrepreneurship projects in educational institutions and the distribution of knowledge through events, networking and collaboration. In order to encourage young people to pursue their entrepreneurial ideas, the Foundation also provides grants of up to DKK 50 000 to new enterprises established by students.

Summary

Taken together, the suite of policy measures and initiatives that are in place in Denmark provide considerable support to start-ups and scale-ups. Public financing schemes help both start-ups and scale-ups to overcome the funding challenges associated with their often limited history in the market. Meanwhile, Denmark’s entrepreneurship education initiatives, regional business hubs and national clusters improve businesses’ competencies, knowledge and networks, which is of particular benefit to young businesses given their relative inexperience. A more structured pathway for transitioning from an idea to a start-up and from a start-up to a scale-up is provided by the network of incubators and accelerators in Denmark. Danish scale-ups are further supported by policy initiatives that make it easier to tap into overseas markets, enabling them to realise their growth potential. While some of Denmark’s policy interventions target start-ups and scale-ups in specific sectors, such as the Green Investment Fund, the national cluster organisations and industry-specific incubators, most public policy support measures are available to businesses across a broad range of sectors. The interviews with stakeholders in the advanced production, energy technology, and food and bio resources sectors, together with the review of international examples of best policy practice, indicate that there is space for more tailored policy initiatives in some cases, as outlined in Chapters 3, 4 and 5 of this report and summarised in Chapter 6.

Figure 2.1. Summary of public policy measures to support start-ups and scale-ups in Denmark

Introduction to the national cluster organisations

Manufacturing Academy of Denmark

The establishment of the Manufacturing Academy of Denmark (MADE) as the national cluster organisation for the advanced production stronghold has provided opportunities to address the challenges faced by start-ups and scale-ups and enhance market opportunities throughout the supply chain. The basis of MADE’s operation is a collaboration between companies, universities and Research and Technology Organisations (RTOs) in research, innovation and education.

MADE is a non-profit organisation, with members charged an annual membership fee that varies in size depending on the type of organisation and the number of employees. Members are then granted access to a variety of activities, events and services. Start-ups can join MADE free of charge, which means that they have ready access to expertise and networks across the supply chain through engagement with MADE’s membership, which currently comprises of more than 220 companies, 5 universities, 3 RTOs and 8 educational institutions. MADE also provides start-ups with better access to EU networks. These networks provide start-ups and scale-ups with a better understanding of market opportunities and sources of support for innovation activity, which in turn can encourage them to enter the supply chain.

MADE's innovation activities are designed to introduce Danish companies to state-of-the-art knowledge, technologies, methods and processes. MADE also helps SMEs with the practical implementation of new technologies and knowledge by providing access to leading experts as well as support for demonstration projects. Furthermore, it has a Digital Innovation Hub, which positions and represents Denmark in international platform collaborations and projects.

Energy Cluster Denmark

Energy Cluster Denmark (ECD) has a key role in promoting start-ups and scale-ups in the energy technology sector stronghold and addressing some of the barriers faced. Half of ECD’s 200 members are SMEs, and its core activities are to run, facilitate, help and fundraise, in order to facilitate engagement in innovation and collaboration. The ECD innovation model begins with concrete demand and ends with commercialisation. Many of its members are present across the whole supply chain. Over time, new firms from the digital, drone and robotics sectors may become integrated into the energy technology supply chain.

Food & Bio Cluster Denmark

Food & Bio Cluster Denmark has taken responsibility from other major industry organisations for supporting start-ups and scale-ups in the food and bio resources sector, particularly with respect to innovation. By introducing disruptive technologies, new firms are a key source of innovation in the food & bio sector and an important driver of the green transition. Around one-fifth of the members of Food & Bio Cluster Denmark are start-ups. Furthermore, the cluster organisation has a clear strategy for supporting its start-ups through networking with other companies and universities and directing them towards funding sources. The cluster organisation also supports the incubation process, with three different incubators in three separate locations. Discussions are in progress regarding the launch of a large accelerator for start-ups with a narrow focus on a specific field, for example alternative proteins. This is where there is expertise in the cluster organisation. There is evidence that the business environment is now much more promising and the cluster organisation saw three real scale-ups financed in 2020 including for robots and new intelligent farming machinery and the first insect farm in Denmark.2 The evidence suggests that there are promising prospects for scale-ups. 60-65 companies are hosted in the incubator and another 68 start-ups are located in the cluster. That is far from the entire group of relevant start-ups. There may be in total some 500 start-ups and scale-up companies, of which 200 are pre-start-ups, 200 that are really interesting, and 25-30 that are already scaling up.

International comparisons of Denmark’s start-up and scale-up performance

Start-ups in Denmark

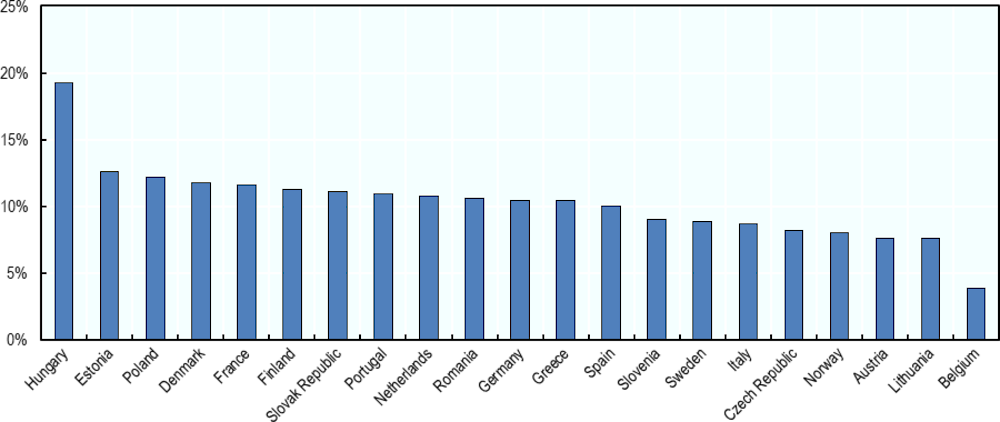

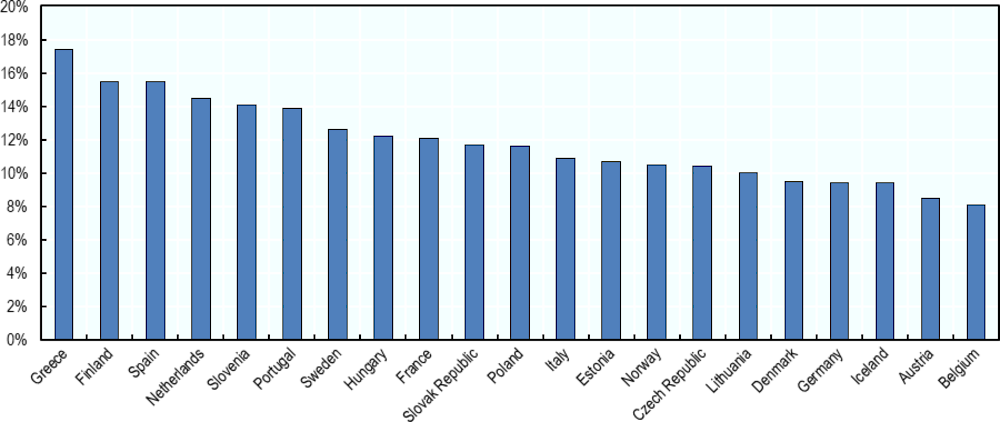

By international standards, Denmark has a dynamic start-up ecosystem. In 2019, the birth rate of employer enterprises in Denmark was 11.8%, which is higher than in most other OECD countries.

Figure 2.2. Birth rate of employer enterprises, 2019

Source: OECD Structural and Demographic Business Statistics

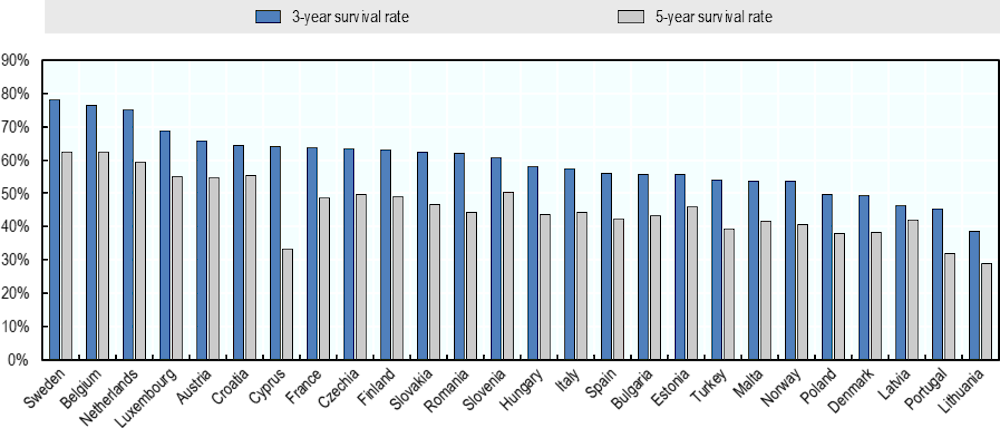

However, the share of newly created businesses that go on to close down in subsequent years is relatively high in Denmark. In 2019, the 3-year business survival rate in Denmark was 49%. This is the fourth lowest business survival rate in Europe. Meanwhile, the 5-year business survival rate in Denmark in 2019 was 38%, the fifth lowest in Europe.

Figure 2.3. Business survival rates

Source: Eurostat

Scale-ups in Denmark

Denmark lags behind its peers when it comes to the rapid growth of its businesses. In 2019, 9.5% of Danish enterprises with at least 10 employees were scale-ups. This figure is among the lowest in the OECD.

Figure 2.4. Rate of high growth enterprises as a percentage of the total population of active enterprises with at least 10 employees, 2019

Note: The chart displays the share of businesses with at least 10% average annualised growth of employment over three years, with an employment level of at least 10 at the start of the three-year period.

Source: OECD Structural and Demographic Business Statistics

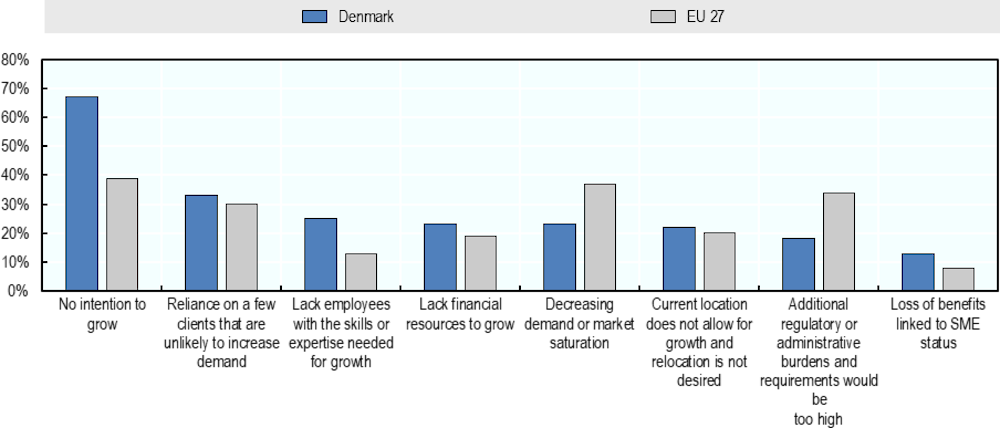

In 2020, a European Commission Flash Eurobarometer survey examined some of the key factors that constrain business growth in different countries (European Commission, 2020[27]). Where Denmark stands out is in the share of businesses that do not have the intention to grow beyond their current size. Among Danish businesses that are not planning to grow, 67% indicated that they had no intention to grow, which is the highest share in Europe. This suggests that a lack of growth ambitions among many Danish companies is an important factor underlying the low scale-up rates in the country. This finding is consistent with the Global Entrepreneurship Monitor’s (GEM) Adult Population Survey (APS), which in 2014 found that fewer than one in five (19.1%) of Danes involved in early-stage entrepreneurial activity expected to create six or more jobs over the subsequent five years. With that being said, the share of Danish businesses citing skills shortages and financial constraints as barriers to growth in the Eurobarometer survey is also higher than the EU average (European Commission, 2020[27]).

Figure 2.5. Barriers to scale up for companies not planning to grow

Source: European Commission Flash Eurobarometer 486

While business creation statistics provide useful insights into the volume of entrepreneurs in a country, it is also important to consider the extent to which these entrepreneurs deliver wider benefits. The innovations associated with entrepreneurial activities are a key way in which these ventures support economic growth. Survey evidence indicates that Danish entrepreneurs perform well in this area. Indeed, in 2020, the European Commission’s Flash Eurobarometer survey found that 68% of Danish businesses had introduced an innovation over the preceding 12-month period. This compares to an EU-average of 58% (European Commission, 2020[27]). Moreover, in the 2014 edition of the GEM survey, nearly half (46%) of Danes involved in early-stage entrepreneurial activities stated that their product or service is new to at least some customers and that few or no businesses offer the same product. This is the second highest share out of the 30 European and North American countries covered by the 2014 GEM, with Luxembourg being the only country in this group to score higher. The European Commission’s Flash Eurobarometer survey suggests that the legal and administrative environment is the largest barrier to innovation in Denmark, with 44% of Danish businesses identifying this factor as a barrier to innovation. Only Spain saw a higher share of businesses citing this factor (European Commission, 2020[27]).

Summary

The results presented above indicate that Denmark’s entrepreneurial ecosystem is relatively successful in generating a healthy pipeline of new and innovative businesses. However, the low prevalence of scale-up businesses shows that the entrepreneurial ecosystem is less effective in producing the types of rapidly expanding companies that can make a significant contribution to economic growth.

Start-ups and scale-ups in Denmark’s sector strongholds and emerging industries

Scale of sector strongholds and emerging industries

There is a high degree of variation in the scale of Denmark’s sector strongholds and emerging industries. In terms of the population of businesses and the level of employment, construction and building is the largest sector, with 7 212 businesses and 287 865 jobs in 2019.3 However, the advanced production sector has the largest economic footprint in terms of revenue, with turnover of DKK 843 billion in 2019. The sector strongholds with the next highest revenue figures are the food and bio resources and construction and building sectors, with turnover of DKK 670 billion and DKK 669 billion in 2019. The smallest sector in terms of employment is the defence, space and security emerging industry, with an employment level of just 13 639 in 2019. Businesses in this sector generated DKK 11 billion in revenue in 2019, which is also the lowest figure out of the sectors analysed. The sector stronghold with the highest productivity is the energy technology sector. In 2019, the revenue per employee in this sector stood at DKK 6.3 million, which is more than double the economy wide average.

Table 2.1. Count, employment, revenue and productivity of businesses in sector strongholds and emerging industries, 2019

|

|

Number of businesses |

Employment |

Revenue (DKK millions) |

Revenue per employee (DKK millions) |

|---|---|---|---|---|

|

All economy |

282,487 |

1,385,073 |

4,111,653 |

3.0 |

|

Case study sectors |

||||

|

Food and bio resources |

45,123 |

207,824 |

669,930 |

3.2 |

|

Advanced production |

13,637 |

256,046 |

843,452 |

3.3 |

|

Energy technology |

9,211 |

89,979 |

564,898 |

6.3 |

|

Other sector strongholds and emerging industries |

||||

|

Construction and building |

73,212 |

287,865 |

668,761 |

2.3 |

|

Design, fashion and furniture |

32,399 |

132,936 |

369,367 |

2.8 |

|

Life science and welfare technology |

21,619 |

95,863 |

329,645 |

3.4 |

|

Maritime industry and logistics |

21,474 |

171,575 |

688,674 |

4.0 |

|

Tourism |

21,272 |

108,991 |

169,824 |

1.6 |

|

Digital technologies |

19,256 |

120,963 |

313,948 |

2.6 |

|

Animation, games and film - emerging industry |

11,336 |

28,558 |

72,662 |

2.5 |

|

Sound technology |

9,670 |

39,750 |

99,821 |

2.5 |

|

Finances and financial technology (Fintech) |

9,588 |

86,680 |

59,863 |

0.7 |

|

Environmental technology |

9,381 |

33,003 |

78,223 |

2.4 |

|

Robot and drone technology - emerging industry |

7,376 |

59,125 |

145,115 |

2.5 |

|

Defence, space and security |

686 |

13,639 |

10,614 |

0.8 |

Note: Data include sole proprietorships, limited partnerships, unlimited partnerships and limited liability corporations. Funds, self-owning institutions, government institutions, foreign firms, subsidiaries and cooperatives are not included in the data. The employment figures cover private sector business activity only, not total economy activity. The total employment level in the Danish economy in 2019 was 2 280 998.

Source: Statistics Denmark and the Danish Business Authority

Start-ups within sector strongholds and emerging industries

Economic footprint of start-ups

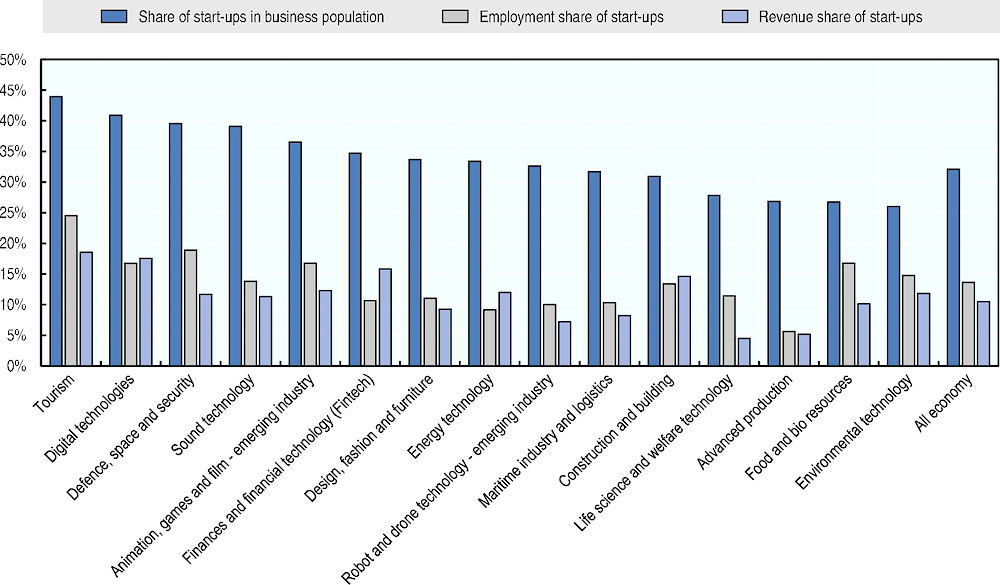

On average across the 15 sector strongholds and emerging industries, 34% of businesses were start-ups (i.e. aged five years old or younger) in 2019. This is just above the average for the Danish economy. The share of start-ups ranges from 26% in the environmental technology sector to 44% in the tourism sector. In terms of the absolute number of start-ups, the construction and building sector stands out, with 22 656 start-ups in 2019.4 Food and bio resources, which was the sector with the next highest number of start-ups, had 12 076 start-ups in 2019. These are also the two sectors that had the highest total population of businesses in 2019. The advanced production and energy technology sectors had 3 662 and 3 076 start-ups in 2019.

Among the sector strongholds and emerging industries, start-ups’ contribution to total employment in 2019 ranged from 6% in the advanced production sector to 24% in the tourism sector. In the food and bio resources and energy technology sectors, start-ups’ contribution to employment stood at 17% and 9%, respectively. Meanwhile, across the 15 sectors, start-ups’ contribution to total revenue ranged from 5% in the life science and welfare technology sector to 19% in the tourism sector.

Figure 2.6. Share of start-ups in business population, employment and revenue, 2019

Source: Statistics Denmark and the Danish Business Authority

Characteristics of start-ups

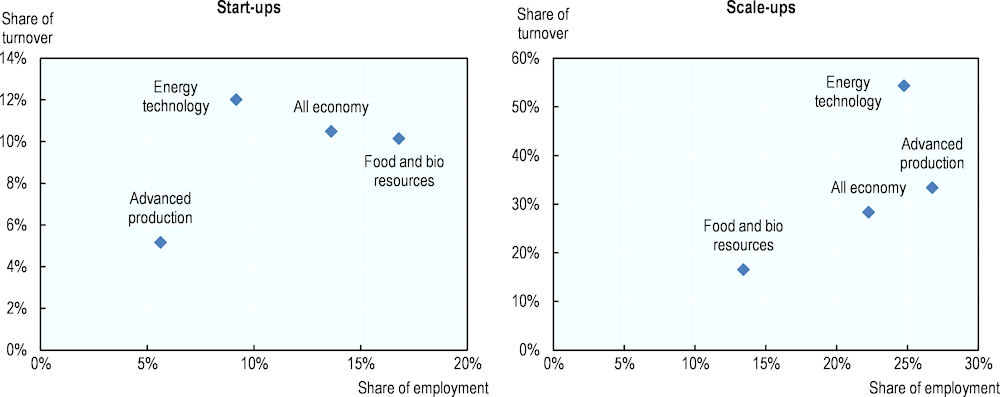

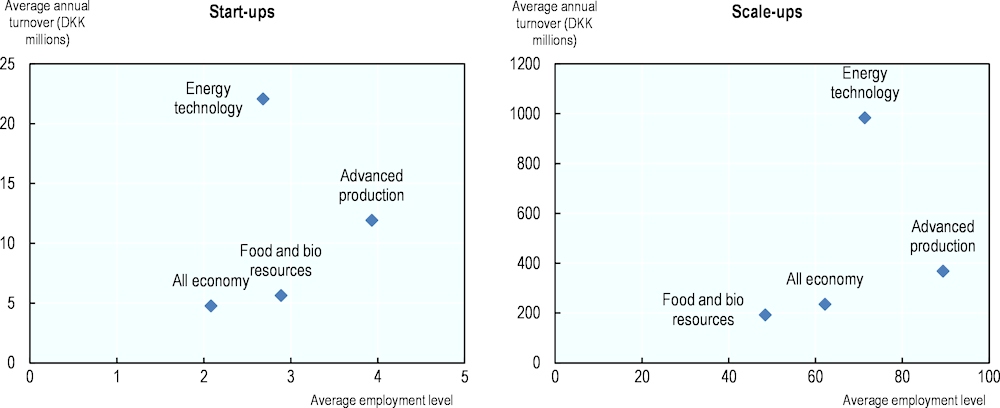

In 2019, the average employment level in Danish start-ups was two employees. Across the 15 sectors, the average level of employment in start-ups ranged from one employee in the animation, games and film, design, fashion and furniture, and sound technology sectors to ten in the defence, space and security sectors. Among the three case study sectors, the average number of employees is highest in the advanced production sector, where the average start-up had an employment level of four in 2019. In the energy technology and food and bio resources sectors, the average employment level was three.

Start-ups’ average revenue in 2019 was DKK 4.8 million, which compares to an average of DKK 14.6 million among the wider business population. Start-ups in the energy technology sector had the highest turnover, averaging DKK 22.1 million in 2019. Meanwhile, start-ups in the advanced production sector had an average revenue of DKK 11.9 million in 2019. The corresponding figure for start-ups in the food and bio resources sector was DKK 5.6 million.

Table 2.2. Number of start-ups and average employment and turnover in start-ups by sector, 2019

|

|

Number of start-ups |

Average employment level of start-ups |

Average turnover of start-ups (DKK millions) |

|---|---|---|---|

|

All economy |

90,621 |

2.1 |

4.8 |

|

Case study sectors |

|||

|

Food and bio resources |

12,076 |

2.9 |

5.6 |

|

Advanced production |

3,662 |

3.9 |

11.9 |

|

Energy technology |

3,076 |

2.7 |

22.1 |

|

Other sector strongholds and emerging industries |

|||

|

Construction and building |

22,656 |

1.7 |

4.3 |

|

Tourism |

9,340 |

2.9 |

3.4 |

|

Design, fashion and furniture |

10,903 |

1.3 |

3.1 |

|

Digital technologies |

7,876 |

2.6 |

7.0 |

|

Maritime industry and logistics |

6,800 |

2.6 |

8.3 |

|

Animation, games and film - emerging industry |

4,141 |

1.2 |

2.2 |

|

Finances and financial technology (Fintech) |

3,331 |

2.8 |

2.8 |

|

Life science and welfare technology |

6,021 |

1.8 |

2.5 |

|

Environmental technology |

2,441 |

2.0 |

3.8 |

|

Sound technology |

3,780 |

1.5 |

3.0 |

|

Robot and drone technology - emerging industry |

2,406 |

2.5 |

4.4 |

|

Defense, space and security |

271 |

9.5 |

4.6 |

Note: Data include sole proprietorships, limited partnerships, unlimited partnerships and limited liability corporations. Funds, self-owning institutions, government institutions, foreign firms, subsidiaries and cooperatives are not included in the data.

Source: Statistics Denmark and the Danish Business Authority

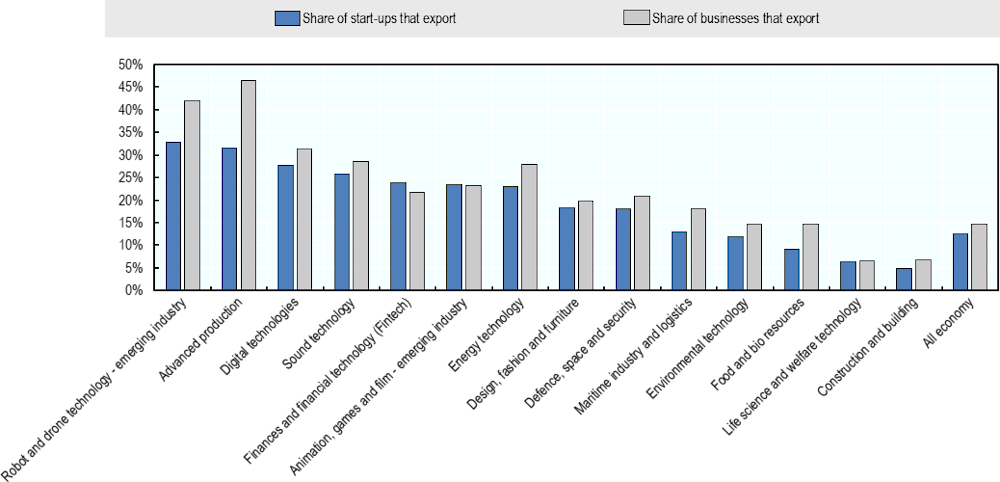

Export activity of start-ups

In all of Denmark’s sector strongholds and emerging industries with the exception of animation, games and film emerging industry and the finances and financial technology sector, start-ups are less likely to export than older businesses. For instance, in the food and bio resources sector, only 9.2% of start-ups were exporters in 2019, compared to a figure of 14.6% for businesses in the sector as a whole. In the advanced production sector, 31.6% of start-ups were exporters in 2019. While this is the second highest share out of the 15 sector strongholds and emerging industries, the figure is 15 percentage points lower than the share of all businesses that export in the advanced production sector.

Figure 2.7. Share of start-ups that export compared to share of all businesses that export, by sector, 2019

Note: The tourism sector has been omitted from the chart because the export concept works differently in tourism. Figures reported here exclude businesses with sales made in Denmark to overseas visitors, which is important in tourism.

Source: Statistics Denmark and the Danish Business Authority

Summary

There is not a large degree of variation in the share of start-ups in the business population between the different sector strongholds and emerging industries. Indeed, the share of start-ups in eight out of the 15 sectors is within five percentage points of the economy-wide average. In terms of employment, the profile of the average start-up across the different sectors is also relatively stable. In 14 out of the 15 sectors, the average number of employees in start-ups was less than five in 2019. In the energy technology and advanced production sectors, start-ups’ average revenue was more than double the economy-wide average for start-ups in 2019. Excluding these two sectors, the average revenue of start-ups was within the range of DKK 2.2 million and DKK 8.3 million.

Scale-ups within sector strongholds and emerging industries.

Economic footprint of scale-ups

Scale-up businesses are a rare phenomenon. In 2019, there were 4 957 scale-up businesses in Denmark, representing just 2% of the business population. The construction and building sector had 1 347 scale-ups in 2019, which is by far the highest out of the 15 sector strongholds and emerging industries. In the advanced production, energy technology and food and bio resources sectors, there were 766, 312 and 576 scale-ups in 2019, respectively.

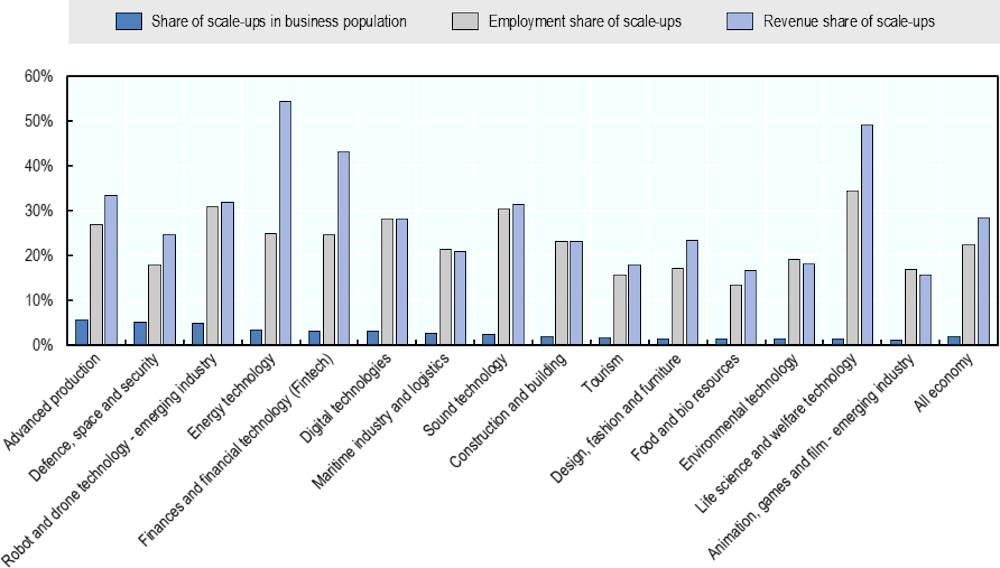

On average across the 15 sectors, scale-ups accounted for 2.6% of businesses in 2019. The advanced production sector had the highest share of scale-ups in 2019, with 5.6% of businesses falling into this category. The lowest share was observed in the animation, games and film emerging industry, where just 1.0% of businesses were scale-ups.

Despite their scarcity, scale-ups have a sizeable economic footprint. In the sector strongholds and emerging industries, scale-ups accounted for an average of 23% of employment and 29% of revenue in 2019. In some sectors, scale-ups’ contribution is even greater. For instance, in the life science and welfare technology sector, scale-ups accounted for 34% of employment in 2019. The employment footprint of scale-ups is lower in the three case study sectors. In 2019, scale-ups accounted for 27% of employment in the advanced production sector, 25% of employment in the energy technology sector and 13% in the food and bio resources sector. Meanwhile, scale-ups generated 33% of turnover in the advanced production sector and 17% of turnover in the food and bio resources sector in 2019. This is significantly below the figure of 54% in the energy technology sector.

Figure 2.8. Share of scale-ups in the business population, employment and revenue, 2019

Source: Statistics Denmark and the Danish Business Authority

Characteristics of scale-ups

The average scale-up business in Denmark employed 62 people in 2019 and had a turnover of DKK 235 million. The average employment level of scale-ups in 2019 ranged from 42 in the animation, games and film emerging industry to 121 in the life science and welfare technology sector. Scale-ups in the advanced production sector had an average employment level of 89 in 2019, which was the highest among the three case study sectors. In the energy technology and food and bio resources sectors, the average employment level among scale-ups was 71 and 48, respectively. The average revenue among scale-ups in the energy technology sector was DKK 984 million in 2019, which was the highest out of the 15 sector strongholds and emerging industries. Scale-ups in the advanced production sector had an average turnover of DKK 368 million in 2019, while those in the food and bio resources sector had an average turnover of DKK 192 million.

Table 2.3. Number of scale-ups and average employment and turnover in scale-ups by sector, 2019

|

|

Number of scale-ups |

Average employment level of scale-ups |

Average turnover of scale-ups (DKK millions) |

|---|---|---|---|

|

All economy |

4,957 |

62.2 |

235.3 |

|

Case study sectors |

|||

|

Advanced production |

766 |

89.4 |

367.7 |

|

Food and bio resources |

576 |

48.4 |

192.5 |

|

Energy technology |

312 |

71.4 |

983.7 |

|

Other sector strongholds and emerging industries |

|||

|

Construction and building |

1,347 |

49.1 |

114.1 |

|

Digital technologies |

568 |

59.5 |

155.4 |

|

Maritime industry and logistics |

553 |

65.8 |

260.2 |

|

Design, fashion and furniture |

429 |

52.7 |

200.0 |

|

Robot and drone technology - emerging industry |

348 |

52.3 |

132.9 |

|

Tourism |

321 |

53.2 |

94.5 |

|

Finances and financial technology (Fintech) |

285 |

74.5 |

90.4 |

|

Life science and welfare technology |

272 |

120.9 |

595.4 |

|

Sound technology |

222 |

54.0 |

141.0 |

|

Environmental technology |

130 |

48.6 |

107.9 |

|

Animation, games and film - emerging industry |

113 |

42.2 |

99.3 |

|

Defense, space and security |

34 |

71.3 |

76.7 |

Note: Data include sole proprietorships, limited partnerships, unlimited partnerships and limited liability corporations. Funds, self-owning institutions, government institutions, foreign firms, subsidiaries and cooperatives are not included in the data.

Source: Statistics Denmark and the Danish Business Authority

Summary

Although the share of scale-ups in the business population is less than 5% in 14 out of the 15 sectors, the variation in the share of scale-ups across sectors is somewhat higher than is the case for start-ups. In the advanced production, robot and drone technology, and defence, space and security sectors, the share of scale-ups is more than double the economy-wide average. The average employment and turnover of scale-ups is in the same order of magnitude in each of the sector strongholds and emerging industries. With that being said, the characteristics and challenges of a company with 42 employees (the average employment level among scale-ups in the animation, games and film emerging industry) will differ from those of a company with 121 employees (the average employment level among scale-ups in the life science and welfare technology sector). This suggests that it could be beneficial to tailor policy interventions in a way that reflects the characteristics of scale-ups in the targeted sector.

Growth of sector strongholds and emerging industries

All businesses

Between 2010 and 2019, employment levels increased in all of the 15 sector strongholds and emerging industries with the exception of the finances and financial technology sector, where employment declined at an annualised rate of 1.3%. The average annualised growth rate of employment between 2010 and 2019 was 1.6% among the 15 sector strongholds and emerging industries, which was in line with the total business economy. Revenue increased in all of the sector strongholds and emerging industries with the exception of the finances and financial technology sector. The average annualised growth rate of revenue across the 15 sectors was 4.0% between 2010 and 2019.

Start-ups

Across all sectors of the Danish economy, 143 113 businesses were created between 2010 and 2019. The construction and building sector had 33 871 new businesses created during this period, which is the highest out of the 15 sector strongholds and emerging industries. The next highest value was in the food and bio resources sector, with 21 746 businesses created between 2010 and 2019. In the advanced production sector, 5 638 new businesses were formed between 2010 and 2019, while in the energy technology sector there were 5 173 newly created businesses. As a share of the business stock in 2010, new business creation in 2010-2019 was relatively high in energy technology, but below the all economy average in food and bio resources and advanced production. Start-up rates over this period were particularly high in digital technologies; tourism; defence, space and security; sound technology; and animation, games and film.

Table 2.4. Number of businesses created between 2010 and 2019, by sector

|

Sector |

Number of businesses created between 2010 and 2019 |

Number of businesses created between 2010 and 2019 as a share of business population in 2010 |

|---|---|---|

|

All economy |

143,113 |

55% |

|

Case study sectors |

||

|

Food and bio resources |

21,746 |

44% |

|

Advanced production |

5,638 |

42% |

|

Energy technology |

5,173 |

60% |

|

Other sector strongholds and emerging industries |

||

|

Construction and building |

33,871 |

50% |

|

Design, fashion and furniture |

17,956 |

61% |

|

Tourism |

15,509 |

85% |

|

Digital technologies |

13,008 |

85% |

|

Maritime industry and logistics |

10,190 |

47% |

|

Life science and welfare technology |

7,594 |

37% |

|

Animation, games and film - emerging industry |

6,699 |

72% |

|

Sound technology |

5,448 |

73% |

|

Finances and financial technology (Fintech) |

5,048 |

54% |

|

Environmental technology |

3,983 |

44% |

|

Robot and drone technology - emerging industry |

3,575 |

52% |

|

Defense, space and security |

423 |

78% |

Note: Data include sole proprietorships, limited partnerships, unlimited partnerships and limited liability corporations. Funds, self-owning institutions, government institutions, foreign firms, subsidiaries and cooperatives are not included in the data.

Source: Statistics Denmark and the Danish Business Authority

Between 2010 and 2019, the population of Danish start-ups declined at an annualised rate of 0.1%. Only six out of the 15 sector strongholds and emerging industries experienced an increase in the number of start-ups between 2010 and 2019. The economic contribution of start-ups in many sectors was also on the decline during this period. Indeed, employment in start-ups fell between 2010 and 2019 in ten out of the 15 sector strongholds and emerging industries. The sharpest drop took place in the design, fashion and furniture sector, where employment in start-ups contracted at an annualised rate of 4.6% between 2010 and 2019. Start-ups’ collective turnover fell in eight out of the 15 sector strongholds and emerging industries during the same period.

Scale-ups

Overall, the economic footprint of scale-ups has been growing. The number of scale-ups increased in all of the sector strongholds and emerging industries between 2010 and 2019. Meanwhile, employment in scale-ups increased between 2010 and 2019 in 11 of the sectors. The fastest growth was seen in the construction and building sector, where employment in scale-ups rose at an annualised rate of 7.8% between 2010 and 2019. Revenue generated by scale-ups rose in 13 of the sector strongholds and emerging industries between 2010 and 2019, although declines were registered in the defence, space and security sector and the animation, games and film emerging industry.

Table 2.5. Annualised rate of growth of the number, employment and revenue of start-ups, scale-ups and all businesses in sector strongholds and emerging industries between 2010 and 2019

|

Start-ups |

Scale-ups |

All businesses |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Number |

Employment |

Revenue |

Number |

Employment |

Revenue |

Number |

Employment |

Revenue |

|

|

All economy |

-0.1% |

-0.1% |

0.5% |

5.2% |

2.7% |

7.3% |

1.0% |

1.6% |

4.2% |

|

Case study sectors: |

|||||||||

|

Energy technology |

0.0% |

-0.9% |

5.7% |

6.2% |

2.1% |

17.4% |

0.7% |

2.0% |

6.9% |

|

Advanced production |

-0.9% |

-1.0% |

-0.6% |

6.6% |

2.7% |

6.3% |

0.2% |

1.6% |

5.6% |

|

Food and bio resources |

0.1% |

2.1% |

0.1% |

3.4% |

-1.5% |

2.3% |

-1.1% |

2.3% |

3.0% |

|

Other sector strongholds and emerging industries: |

|||||||||

|

Sound technology |

1.9% |

0.5% |

0.0% |

4.8% |

3.5% |

7.2% |

2.9% |

1.0% |

2.8% |

|

Digital technologies |

1.2% |

4.1% |

8.0% |

4.0% |

0.7% |

0.7% |

2.7% |

1.4% |

3.4% |

|

Defence, space and security |

0.0% |

15.7% |

10.2% |

3.9% |

-4.8% |

-1.5% |

2.6% |

0.7% |

4.6% |

|

Animation, games and film - emerging industry |

0.9% |

-2.4% |

-3.9% |

2.6% |

-2.3% |

-3.4% |

2.2% |

0.7% |

1.7% |

|

Tourism |

2.2% |

2.1% |

0.6% |

4.0% |

-2.7% |

0.6% |

1.8% |

3.5% |

3.4% |

|

Design, fashion and furniture |

-0.2% |

-4.6% |

-4.8% |

5.2% |

4.3% |

8.8% |

1.0% |

1.0% |

3.1% |

|

Construction and building |

-0.8% |

0.0% |

3.2% |

10.2% |

7.8% |

11.9% |

1.0% |

2.0% |

4.6% |

|

Robot and drone technology - emerging industry |

-0.2% |

-0.5% |

-1.4% |

6.4% |

5.4% |

7.9% |

0.9% |

2.3% |

4.7% |

|

Life science and welfare technology |

-2.8% |

0.4% |

-1.0% |

4.1% |

1.8% |

6.2% |

0.6% |

2.6% |

6.0% |

|

Environmental technology |

-2.0% |

-2.5% |

-7.4% |

5.0% |

0.4% |

4.1% |

0.3% |

2.3% |

3.1% |

|

Finances and financial technology (Fintech) |

-1.1% |

-1.0% |

-1.8% |

2.2% |

2.5% |

7.9% |

0.3% |

-1.3% |

-0.1% |

|

Maritime industry and logistics |

-0.6% |

-3.1% |

-0.7% |

2.7% |

1.4% |

6.3% |

-0.2% |

1.1% |

7.1 |

Note: Data include sole proprietorships, limited partnerships, unlimited partnerships and limited liability corporations. Funds, self-owning institutions, government institutions, foreign firms, subsidiaries and cooperatives are not included in the data. Source: Statistics Denmark and Danish Business Authority

Summary