This chapter offers a glance of the mining regulation arrangements in three OECD member countries: Australia, Chile, and Mexico. Each case study explains the institutional and regulatory framework that underpins the mining sector in each jurisdiction. In particular, the section describes at length the regulatory setup and the governance arrangements of the regulatory agency or agencies. Additionally, the chapter covers the regulatory policy tools used by mining regulatory agencies in the three countries.

Regulatory Governance in the Mining Sector in Brazil

5. Mining regulation in selected countries

Abstract

Mining regulation in Australia

Australia is a country with vast natural resources, including large mineral reserves of coal, metal ores, and non-metallic minerals, among others. In the country, there are over 300 mines and 2 200 quarries distributed across all states, the Northern Territory and Christmas Island (Senior et al., 2021[1]). The resources sector is of high relevance for the economic activity and accounted for approximately 9% of the GDP and 60% of the exports’ value in 2018-19. The sector employs 1.9% of Australia’s workforce and is a source of work for over 6 000 indigenous workers (The Productivity Commission, 2020[2]).

Institutional and regulatory framework for the mining sector in Australia

The regulatory landscape for the mineral sector in Australia is complex, as multiple jurisdictions have a role to play (The Productivity Commission, 2020[2]). The Constitution confers the central government with exclusive powers to draft laws for a limited range of subjects under the scope of the Commonwealth jurisdiction. This is the case for defence, external affairs, environmental matters of national significance, certain heritage aspects, and Commonwealth land or waters beyond some distance limits. Additionally, the Australian Commonwealth government administers policy for mineral and petroleum exploration in offshore areas through the Offshore Mineral Act of 1994 and the offshore petroleum legislation. On the other hand, states have the powers to regulate where the Commonwealth does not have direct influence. As ownership of minerals and onshore and some offshore gas remains under the scope of states and territories, they regulate mining activities in their own territories.

Each state (and territories) has its own legislative framework for the granting of rights, the provision of permits, licences or leases titles for exploration. Sub-national regulation also includes royalties’ payment to the State and compensations for owners or occupiers. A range of Commonwealth laws (environmental, employment, foreign ownership and native title) oversees commissioning of a mining project. The following subsection presents the main governance characteristics of the resources regulator in New South Wales.

New South Wales

New South Wales is an important producer of metallic and industrial minerals, as well as of coal. The institutional setup that underpin the mineral industry in the states includes the Resources and Geoscience Division of the Department of Planning and Environment and the New South Wales Resources Regulator (NSW-RR). The Resources and Geoscience Division is in charge of producing geological and geophysical information, grants mining exploration and exploitation authorisations, ensure environmental protection and attract investments to the sector. On the other hand, NSW-RR is the health and safety independent regulator for mines and petroleum sites in the state and is at arm’s length of the Department of Planning, Industry and Environment. The regulatory agency assesses complaints and alleged breaches of the Mining Act, provides guidance about safety regulations, conducts inspections and investigations, and grants licencing among other functions (see Box 5.1 for a general description of regulator’s duties). Additionally, NSW-RR’s attributions include compliance and enforcement activities, with special emphasis on mine rehabilitation (NSW Resources Regulator, 2019[3]).

NSW-RR’s primary objective is on compliance activities within the New South Wales’s mining sector, including compliance with the Mining Act and regulating safety and health performance at mines and petroleum sites. The NSW Resources Regulator Strategic Approach for the period 2017-2020 outlines the following priority areas for the sector (NWS Resources Regulator, 2017[4]):

business improvement to ensure that the regulator has the right systems and tools to regulate effectively

partnership to improve regulatory performance by working with other actors

one team to establish an unified and integrated regulatory approach

industry engagement to ensure that industry understands its obligations and regulator’s expectations

Likewise, NSW-RR administrates health and safety obligations to implement an incident prevention strategy governed by:

Work Health and Safety (Mines and Petroleum Sites) Act 2013

Work Health and Safety Act 2011

Explosives Act 2003

Radiation Control Act 1990

Box 5.1. Attributions of the NSW Resources Regulator

Duties of the New South Wales Resources Regulator include the following:

receiving and considering complaints, alleged breaches of the Mining Act and safety incident notifications;

providing information and guidance about safety and other regulatory obligations to protect and support industry, workers, the community and the state;

conducting probity and compliance checks on applicants for grant/renewal/transfer title applications;

conducting inspections and investigations;

assessing licensing, registration applications and grants applications for occupational licences (practising certificates and certificates of competence);

regulation of exploration activities including the issuing of Activity Approvals and ensuring compliance with title conditions and Codes of Practice;

taking enforcement action such as issuing prohibition and other statutory notices and taking prosecution action;

providing advice to the appropriate development consent authority regarding the appropriateness of rehabilitation strategies included in development applications, including advice on conditioning;

supporting and administering the NSW Mine Safety Advisory Council and NSW Mining and Petroleum Competence Board; and

administering the mine and petroleum site safety fund (mine safety levy).

Source: NSW Government (n.d.[5]), NSW Resources Regulator, https://www.resourcesregulator.nsw.gov.au (accessed 5 October 2020).

The Mining Act from 1992 is the main regulatory instrument for mining operations in the state. The act describes the objectives of the regulation and establishes rights, authorisations, restrictions and renewals. It also provides guidance to treat mining activities without authorisation, social provisions, leasing schemes, as well as co-ordination with government authorities. The act also provides a framework for management plans, audits, environmental assessments and royalties (NSW Government, 1992[6]). At the time of preparation of this report, the NSW-RR was conducting a public consultation (until November 2020) to gather feedback on the Standard Conditions of Mining Leases amendment of the Mining Act (NSW Government, 2020[7]).

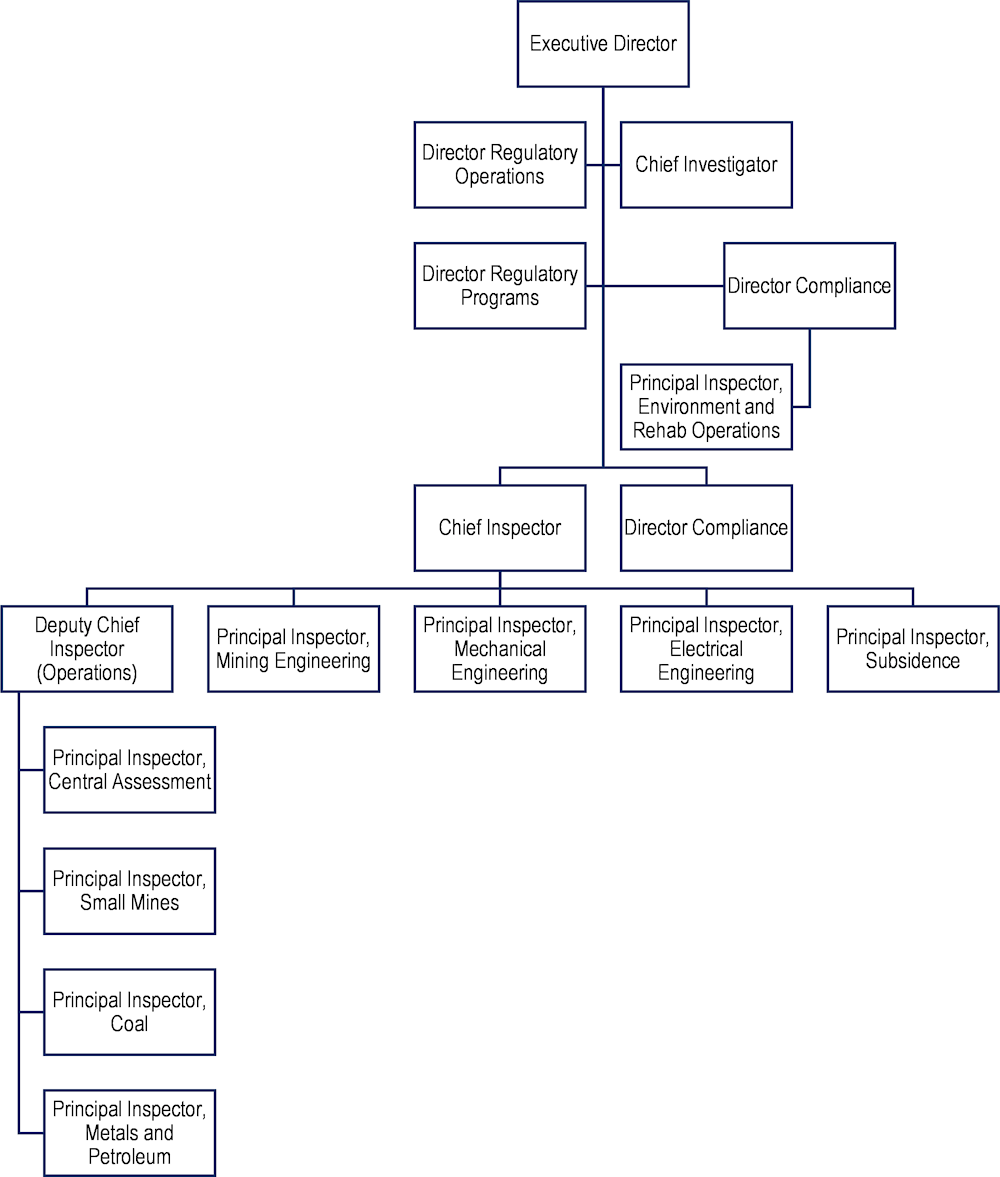

NSW-RR’s organisational structure comprises an Executive Director, who manages the affairs of the agency and provides strategic direction, along with specialised senior staff on inspections, regulatory programmes, regulatory compliance and regulatory operations (see Figure 5.1 for a complete description of the regulator’s organisational chart).

Figure 5.1. NSW resources regulator

Source: NSW Government (n.d.[5]), NSW Resources Regulator, https://www.resourcesregulator.nsw.gov.au (accessed 5 October 2020).

NSW-RR’s funding

NSW-RR has two main sources of funding; the mine safety levy and the administrative levy, which are underpinned by the Mine Safety (Cost Recovery) Act 2005 and the Mining Act 1992. The Mine and Petroleum Site Safety Fund gathers the contributions levied on mining industry employers to cover the regulator’s costs of implementing mine safety and health rules. The value of the fee is calculated based on NSW-RR’s plan of mine safety and health activities and the regulator’s available funds from previous periods. As a measure to ensure transparency and accountability by NSW-RR, the regulatory agency is required to produce an annual report on the way resources are used (NSW Resources Regulator, 2018[8]).

On the other hand, the administrative levy covers the NSW-RR’s administrative expenses and the rehabilitation of abandoned mining sites. All mining titles are subject to the tax, which amounts to 1% of the rehabilitation security deposit, with a minimum contribution of 100 AUD (NSW Resources Regulator, 2019[3]).

Engagement with stakeholders

NSW-RR’s strategy acknowledges the importance of understanding the sector’s needs, operations and challenges (NWS Resources Regulator, 2017[4]). To do this, it gathers feedback and opinions from all relevant stakeholders through different channels during the elaboration or modification of strategic documents and regulations. The regulator focuses its resources and efforts by following the IAP2 Public Participation Spectrum, which defines five levels of engagement with stakeholders based on the level of participation expected from the public. The public participation spectrum comprises; inform, consult, involve, collaborate, empower (IAP2 International Federation, 2018[9]). NSW-RR carries out four different kinds of consultations (NSW Resources Regulator, 2020[10]):

Statutory boards

Open public consultation

Targeted stakeholder consultation

Representative stakeholder steering group

NSW-RR provides feedback on the information collected through the consultation process. It publishes summaries on the submissions and outcomes from the NSW-RR’s consideration and notifies participants of the actions taken with respect to their comments (NSW Resources Regulator, 2020[10]).

Compliance and enforcement activities by NSW-RR

NSW-RR’s holistic approach to compliance and enforcement follows a risk-based methodology to achieve clearly defined objectives. One of the main assumptions of the regulator is that a successful compliance strategy requires that regulated parties know and understand their responsibilities and are able and willing to comply with them (NSW Resources Regulator, 2019[11]). To ensure that mining operators know what is expected from them, the regulatory agency engages with stakeholders through the provision of information and guidance, and by making clear the compliance priorities for the next six months (NSW Resources Regulator, 2020[12]).

NSW-RR has a wide range of enforcement actions, which grants the regulator enough tools and flexibility promote a long-lasting change in the regulated party’s behaviour. The application of enforcement actions is proportional to the level of risk that the non-compliance entails. This means that deliberate or serious non-compliance actions (those that could evolve into events with impacts on the industry, workers, the community and the state) are treated with the most severity, while non-compliance that have a low risk level are managed through a collaborative process (NSW Resources Regulator, 2019[11]).

Regulatory policy, best practices and challenges

Given Australia’s fragmented regulatory framework for mining and the amount of regulatory requirements at each stage of mining projects, it is difficult to map the legislative landscape completely (see Table 5.1 for a list of regulatory requirements based on the stage of the project). This situation generates challenges for companies who face administrative burdens and are required to deal with several government institutions during the lifecycle of the mineral operation. According to the Productivity Commission (2020[2]), there have been few efforts to standardise mineral laws among states; however, since there are common features across the board, the country has a relatively uniform legal approach to mining.

Co-operation among jurisdictions appears to have improved over the last decade; however it is not systematic. One of the avenues that the Australian Administration followed to manage intragovernmental affairs is the creation of the Energy Council by the Council of Australian Governments (COAG). The Energy Council addressed issues affecting investment in resources exploration and development, develop a nationally consistent approach to clean-energy technology, promote efficiency and investment in generation and networks, and other duties that may have impacts on mining activities. Nonetheless, the COAG has been disbanded and a new set of arrangements for improving co-operation are being developed.

Table 5.1. Spheres of regulatory requirement for resources activities

A stylised life-cycle

|

Project element |

Areas of regulatory requirement |

||

|---|---|---|---|

|

Tenement and land access |

|

Public consultation throughout decision-making processes Decisions may be subject to reviews or appeals |

|

|

Assessments and approvals |

|

|

|

|

Operations stage |

|

||

|

End of project life |

|

||

Source: The Productivity Commission (2020[2]), Resources Sector Regulation, The Productivity Commission, https://www.pc.gov.au/inquiries/current/resources/draft/resources-draft.pdf (accessed 30 September 2020).

The best regulatory approaches require regulators to deliver clear, evidence-base policy objectives, while imposing the least burden on businesses. Nonetheless, the situation in the Australian mineral sector still has opportunity areas as regulatory requirements during the life cycle of mining projects entail administrative burdens, costs and barriers for investors and lead to negative externalities for citizens and the environment. For this reason, the Productivity Commission has performed an ex post evaluation of the regulatory framework to identify main challenges, opportunity areas but also best practices to promote effective implementation of regulation (2020[2]). As part of this exercise, the Commission defined an a series of assessment criteria to identify the best regulatory approaches for the sector (Table 5.2).

Table 5.2. Assessment criteria for leading-practice regulation

|

Regulatory design |

Regulator governance |

Regulator conduct |

|---|---|---|

|

|

|

Source: The Productivity Commission (2020[2]), Resources Sector Regulation, The Productivity Commission, https://www.pc.gov.au/inquiries/current/resources/draft/resources-draft.pdf (accessed 30 September 2020).

These assessment criteria helped identify policy issues, opportunity areas and leading practices for the mining sector. Several good practices fall under the scope of regulatory policy tools as public consultation and stakeholder engagement, risk assessment and regulatory impacts, regulatory governance, among others. Furthermore, the evaluation process also provided states and with insights to further improve their regulatory processes and governance. Table 5.3 presents a summary of the main policy concerns and leading practices in mining identified through the ex post review performed by the Productivity Commission.

Table 5.3. Policy concerns and leading practices in mining

Regulatory practices in Australia

|

Subject |

Policy issues |

Leading practices (examples) |

|

|---|---|---|---|

|

Resources management |

Resources companies are required to navigate a range of regulatory processes in order to explore for and extract resources. There are a number of preconditions for the approval process for resources projects. |

To promote data access, confidentiality periods before public release of private exploration and production reports generally should be shorter than the tenure of a project. New South Wales’ new regulations are one example of this practice. |

Thorough assessments of potential licence holders address the risk of repeated non-compliance. Leading practice involves regulators taking a risk-based approach to due diligence when granting or renewing tenements. While all jurisdictions undertake some due diligence, none fully follows leading practice. |

|

Land access |

Each State and Territory has developed processes through which resources companies and landholders can negotiate conditions of land access across the different types of land tenure. This situation can remain contentious. |

Requiring early personal engagement between resources companies and landholders can ease potential tensions and be less costly than a negotiated agreement. The Queensland Land Access Code’s notification requirements provide a leading-practice example of this approach. |

Low-cost dispute resolution methods that take an investigative approach to resolving problems between parties can reduce tensions between landholders and resources companies. The recently established Queensland Land Access Ombudsman provides an example. |

|

Approval processes |

Every jurisdiction’s environmental approval process is different but there are some common characteristics around Australia. The most pressing issues include: Application through to assessment Approval and conditioning Post-approvals Review process |

A leading-practice on environmental impact assessment involves application of a risk-based approach, where the level and focus of investigations are aligned with the size and likelihood of environmental risks that projects create. |

Timelines provide information about how long the regulatory processes ought to take. They also focus regulators’ attention and public reporting of regulator performance in meeting those timelines. Western Australia and South Australia report on the share of mining proposals and other approvals finalised within target timelines. |

|

Managing environmental and safety outcomes |

Several high-profile incidents may be indicative of non-compliance with conditions or ineffective regulations. |

Regulators’ experiences in monitoring compliance provide useful information about the efficacy of approval conditions in protecting the environment. Leading practice involves regulators employing a “feedback loop” between the compliance monitoring and condition-setting processes, where any findings of redundant or ineffective approval conditions are communicated to the bodies responsible for setting those conditions. |

Effective regulators continually improve methods, and for actions they could take beyond their routine monitoring and enforcement activities that could address specific problems. The New South Wales Environment Protection Authority’s involvement with a study examining emissions from coal trains, and the New South Wales Resources Regulator’s targeted programmes provide examples of these practices. |

|

Factors affecting investment |

Regulatory processes directly affect the resources sector investment. These include policy and regulatory uncertainty and inconsistency, regulation of industrial relations and other workforce issues, foreign investment policies and taxation. |

Early public consultation on new policy proposals, accompanied by clear evidence-based articulation of why a proposed change is the best way of addressing an issue (through regulatory impact assessments) can avoid policy surprises. Clear policy objectives aid consistent and predictable regulatory decision-making. Policy-makers can achieve this by avoiding the use of vague language in policy documents and providing clearly articulated guidance on the intention and interpretation of policies and legislation. |

|

|

Community engaging and benefit sharing |

Some actors consider that companies should do more to address the negative impacts of resources extraction. While many businesses seek to build relationships with the communities in which they operate to some degree, in some cases there is pressure from the local communities on governments to require some level of benefit sharing. |

Guidance on social impacts that should be considered in the approvals process helps to improve the quality of social impact assessments. The New South Wales Government has issued guidance outlining: what social impacts should be considered, how to engage with the community on social impacts, how to scope the social impacts and prepare the assessment. |

Co-ordination between local communities and resources companies can improve the effectiveness of benefit sharing activities. Co-ordination can involve formal partnerships, as in Rio Tinto and the City of Karratha, or community consultation, such as that established by Hillgrove Resources in Kanmantoo and Callington |

|

Improving regulator governance, conduct and performance |

Regulators face capability challenges and can lack transparency, diminishing the quality of their decisions and imposing unnecessary costs and risks undermining public confidence in regulatory efforts. |

Regular independent review and evaluation of regulatory frameworks and objectives drives continuous improvement and ensures they remain fit for purpose. The Independent Review of the New South Wales Regulatory Policy Framework has highlighted that a ‘lifecycle’ approach for managing regulation over time ensures that frameworks remain fit for purpose. |

|

Source: The Productivity Commission (2020[2]), Resources Sector Regulation, The Productivity Commission, https://www.pc.gov.au/inquiries/current/resources/draft/resources-draft.pdf (accessed 30 September 2020).

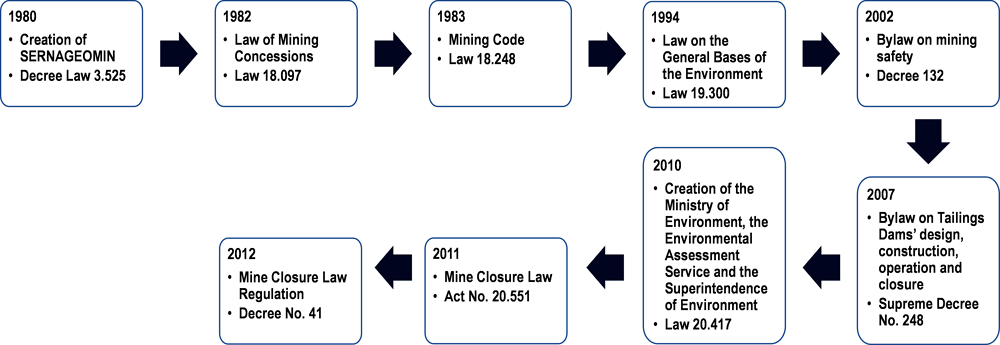

Mining regulation in Chile

Chile established the regulatory and institutional basis for the development of the mining sector in the early 1980s. The introduction of a strong regulatory framework and a peaceful transition to democracy offered the legal certainty and incentives necessary to attract investments to the country in the 1990s. During this decade, the mining industry in Chile became an important driver of economic growth and represented a significant contribution to the country’s GDP. The commodities boom (2004-2014) reinforced the role of the mineral activity in the country’s macroeconomic context and marked the start of reforms regarding the environmental and fiscal regulation of mining activities. Even after the global decrease of mineral prices, mining – and particularly copper – still represents a major component of the Chilean economy and in 2019 it accounted for approximately 9.4% of Chile’s GDP and 56% of its exports (SERNAGEOMIN, 2020[13]).

Figure 5.2. Regulatory framework of mining in Chile

This case study focuses on two main aspects of the mining industry in Chile: its key institutions and the use of regulatory policy tools to the sector.

Institutional framework for the mining industry

The legal framework relevant to the mining sector in Chile allocates the regulatory attributions across several government agencies, with no single mining regulatory agency. The Judicial branch of the government is directly involved in the granting of exploration and exploitation permits and the Executive, through the National Service of Geology and Mines, offers technical advice. While the Treasury is responsible for collecting mining royalties, the Environmental Assessment Service oversees the environmental impact assessment system. The following subsection presents the institutional landscape and describes each of the entities in terms of their attributions and legal framework.

Ministry of Mining

The Ministry of Mining dictates and evaluates the national mining policy in Chile. It fosters the development of the mining industry by supporting investment and promoting the collaboration between the private and public sectors and by reducing regulatory uncertainty. In fact, the latter has been one of the pillars for the development of the mining industry in Chile, as regulations tend to be stable and clear (Poveda Bonilla, 2019[14]). Currently, the Ministry is leading the elaboration of the National Mining Policy 2050, a collaborative effort that involves the participation of a broad number of stakeholders. The policy gathers inputs from residents of all regions in the country and focuses on four thematic areas (Ministerio de Minería, 2020[15]):

Economic sustainability of the mining sector

Environmental sustainability of the mining sector

Social sustainability of the mining sector

Governance for sustainability

National Service of Geology and Mines (SERNAGEOMIN)

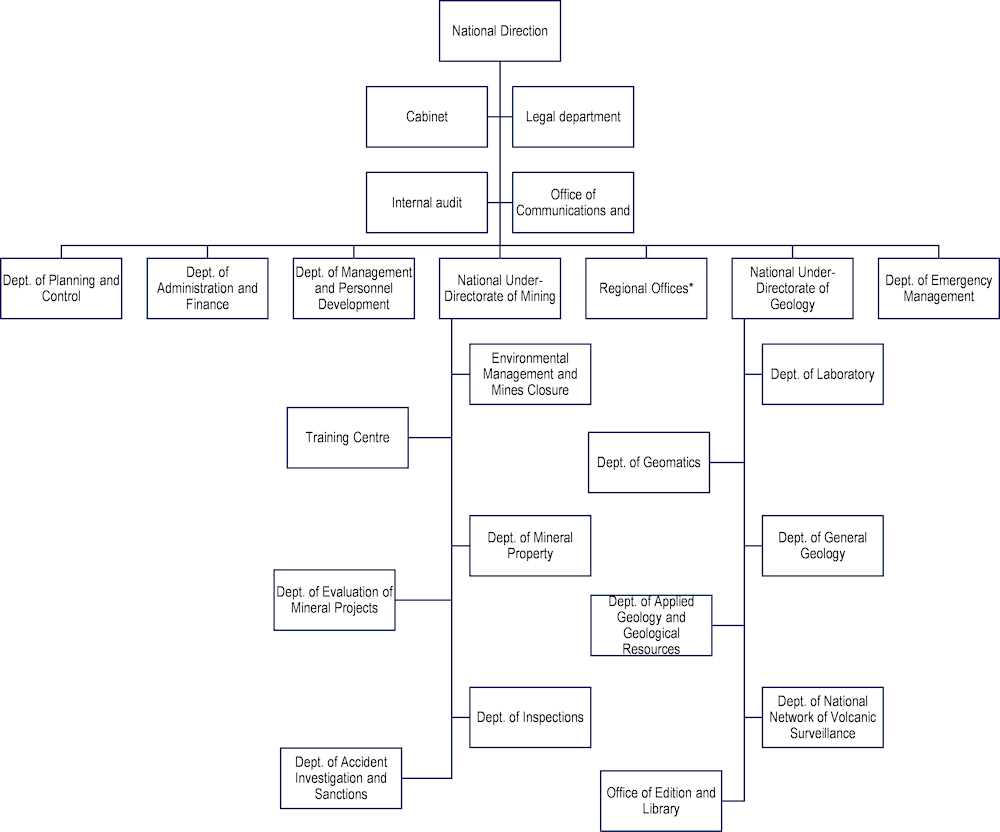

The National Service of Geology and Mines is a decentralised body from the Ministry of Mines and Energy created by the Decree Law 3.525/1980. SERNAGEOMIN’s responsibilities include the inspection and enforcement of mining regulations in terms of safety, property and closure plans, the provision of technical advice to the Courts of Justice in matters related to mining rights and offers technical opinions on projects that have an environmental impact, and the generation, maintenance and spreading geological information of the country.

The decree of creation of the Service defines its governance structure as well as its funding mechanisms. SERNAGEOMIN’s structure has four major components: the National Direction, the National Under‑Directorate of Mining, the National Under-Directorate of Geology and the territorial offices (Figure 5.3). The President of the Republic appoints the Director of the Service, who in turn designates the Under-Directors. SERNAGEOMIN’s budget is composed of the funds granted by the National government, revenue from the provision of services, donations and internal or external financial aid.

Figure 5.3. SERNAGEOMIN’s organisational structure

Note: Regional offices include 11 offices across the country.

Source: SERNAGEOMIN.

Beginning of mining activities

Before a mining company can start operations in Chile, it must comply with a series of requirements before the Courts of Justice, the Environmental Assessment Service, among others. While SERNAGEOMIN does not grant the concession titles nor the environmental licence, the Service is engaged in both processes as technical advisor in the case of the Courts and reviewer of specific aspects related to the Environmental Impact Assessments and Environmental Impact Declarations. In general, SERNAGEOMIN offers opinion on the Environmental Impact Assessments and Environmental Impact Statements referring to mining projects (see section on Environmental Assessment Service for more details). In particular, SERNAGEOMIN assesses three kinds of requests (Decree 40/z of the Ministry of Environment, articles 135, 136 and 137):

Licence for the construction and operation of tailings dams

Licence to establish a dump of sterile or mineral accumulation

Permission for the approval of the closure plan of a mineral operation

Between the years 2011-2016, SERNAGEOMIN offered its opinion to 97% of the mining projects that submitted either an Environmental Impact Assessment or an Environmental Impact Statement (Comisión Chilena del Cobre, 2017[16]). Furthermore, SERNAGEOMIN is involved in the assessment of the proposals that enter the Environmental Impact Assessment System regarding the mining activities enlisted in Table 5.4.

Table 5.4. Mining activities comprised in the Bylaw of Mining Safety

|

Activity |

|---|

|

Exploration and prospection of deposits and activities related to the development of mining projects |

|

Construction of mining projects |

|

Exploitation, extraction and transportation of minerals, sterile, products and sub-products inside the industrial mining area |

|

Transformation and refining of mineral substances and its products |

|

Disposal of sterile, waste and residues. Construction and operation of civil structures for these objectives. |

|

Inland boarding activities of mineral substances and/or their products. |

|

Exploration, prospection and exploitation of natural deposits of fossil substances and liquid or gas hydrocarbons and fertilisers. |

Source: Decree 132/2002, Bylaw of Mining Safety.

Once the mining operator receives the mining concession and the Environmental Assessment Service defines the requirements that the mining activity is obliged to fulfil, the operator must prepare and submit to SERNAGEOMIN a proposal detailing the technical characteristics of the tailings dam before its construction for the approval by SERNAGEOMIN (Comisión Nacional de Productividad, 2020[17]). It is worth pointing out that the Service oversees and inspects the design, construction, operation and closure of tailings dams (Supreme Decree 248/2007).

Operation of mining activities

SERNAGEOMIN’s Department of Mining Safety and Inspections is responsible for the enforcement of safety regulations when the mining operations are already functioning. It investigates and generates data on mining accidents. The Decree 132/2002 and its modification, the Supreme Decree 34/2013, lay out the safety rules for mining operations in Chile, distinguishing between small mining operations (those that extract 5 000 tons or less per month) and mayor mining projects that extract over 5 000 tons per month. In both cases, regulated companies are required to submit monthly data on mining accidents through the Digital System of Mining Information. Additionally, the Service offers training and capacity-building activities on risk and environmental damage to workers of mining operators in the country.

In environmental terms, SERNAGEOMIN oversees the compliance of Environmental Qualifications Resolutions (Resolución de Calificación Ambiental, RCAs) following the inspections plan that the Superintendence of Environment defines. RCAs establish the environmental baseline and requirements that must be fulfilled during the lifetime of the project in accordance to the Environmental Impact Assessment or the Environmental Impact Statement (Comisión Chilena del Cobre, 2017[16]). Inspection plans specify the number of mining operation projects to be supervised each month, in each region. For instance, in 2021 SERNAGEOMIN should carry at least 36 environmental inspections (Resolution No. 2583/2020, Superintendencia de Medio Ambiente).

Closure of mining operations

Regarding the closure of mining operations, the Service oversees, inspects and regulates the mine closure plans that companies submit (Law 20.551/2011). SERNAGEOMIN approves the plans before the beginning of mining operations and verifies that the company complies with the actions described in the plan before it ends all its activities in the mine. The plans should take into consideration the environmental specificities approved by the Environmental Assessment Services through the RCA as well as the economic valuation and economic guarantee.

Environmental Assessment Service

The Environmental Assessment Service (Servicio de Evaluación Ambiental) is a decentralised institution from the Ministry of Environment and was created by Law 20.417/2010. It is the entity responsible for the regulation and management of the Environmental Impact Assessment System, which ensures that a given project complies with the relevant environmental regulation and offsets its potential significant environmental impacts. According to the impacts that a project entails, the Environmental Assessment Service can require either an Environmental Impact Statement (Declaración de Impacto Ambiental, DIA) or an Environmental Impact Assessment (Evaluación de Impacto Ambienta, EIA), with the latter being the more stringent one. An Environmental Impact Assessment is required if the project generates at least one of the following impacts (Law 20.417/2010, art. 11):

Health risk for the population due to the quantity and quality of the emissions and residues.

Significant adverse effects on the quantity and quality of the renewable natural resources, including soil, water and air.

Resettlement of human communities or significant modification to the life systems and customs of human groups.

Located in or next to populations, resources and protected areas, priority areas for conservation, protected wetlands, glaciers, susceptible to impacts, as well as the environmental value of the area where the project would be located.

Significant alteration, in terms of magnitude or duration, of the landscape or tourist value of an area.

Alteration of monuments, areas with anthropological, archaeological, historical and cultural value.

Mining operations require an environmental assessment, which tends to be an Environmental Impact Statement for exploration activities and an Environmental Impact Assessment for exploitation and construction activities. Once the Environmental Assessment Service concludes de evaluation of the EIA or DIA, it emits the Resolution of Environmental Qualification. The RCA contains the final opinion of the Service (e.g. approved, rejected or approved with conditions for the project) and the requirements and conditions that the project will have to fulfil (Superintendencia del Medio Ambiente de Chile, 2018[18]).

Courts of Justice

The local justice courts are responsible for granting the exploration and exploitation concessions in Chile. According to the Organic Law of Mining Concessions (Law 18.097/1982) and the Mining Code, SERNAGEOMIN can provide advice and prepare a report assessing the technical contents of the concession requests, which the courts can use as input for their analysis. It is worth mentioning that in the case of lithium, the concession regime varies from that of other minerals. Since 1979, there are three alternatives for the exploitation of lithium: by state-owned companies, through administrative concessions or through Special Lithium Operation Contracts (Contratos especiales de operaciones de litio), which the Ministry of Mines grants and that the Chilean Nuclear Energy Commission must approve.

Chilean Cooper Commission

The Chilean Cooper Commission (Cochilco) is a technical body created in 1976 through the Decree Law 1349/1976. Cochilco’s objectives include the development of studies, reports and statistics that support the elaboration, implementation and evaluation of public policies related to the mineral sector in Chile and foster evidence-based decision-making. The Commission provides guidance to the government on topics related to the production of metallic and non-metallic mineral substances (it does not include oil and carbon). Furthermore, the Commission inspects and evaluates the management and investment actions of the state-owned mining companies (CODELCO and ENAMI) and reviews and audits contracts for copper and its by-product exports for all mining companies in the country.

The managing structure of the Commission includes a directive board and an executive vice president. Representatives from the Ministry of Mines, the Treasury, the Central Bank and two representatives appointed by the President are part of Cochilico’s directive board. The President of the Republic appoints the executive vice president, who is responsible for the administration and implementation of the resolutions dictated by the directive board. Cochilco’s administrative structure is divided in three areas: Research and Public Policies, Investment Evaluation and Strategic Management and Inspections.

Regulatory policy in the mining sector

In Chile, the Ministry of Economy, Development and Tourism and the Ministry General Secretariat of the Presidency lead the regulatory policy agenda in the country. Since 2018, the government of Chile has enacted regulations focused on the promotion of administrative simplification measures and the revision of the regulatory stock (Presidential Instructive No.4/2019). Additionally, Regulatory Impact Reports (Informe de Impacto Regulatorio) are mandatory for law proposals from the Executive and presidential or ministerial decrees (Presidential Instructive No. 3/2019).

In the mining sector, administrative simplification measures and sectorial evaluations of regulations have driven the regulatory policy actions. Although these efforts are welcome, there is room for improvement, particularly in terms of licensing and regulatory overlapping across institutions. SERNAGEOMIN and the Environmental Assessment Service have taken steps to digitalise processes and formalities. Moreover, both entities provide guidance for the use of the digital tools in place, which reduces the time that business representatives and citizens devote to understanding and complying with the requirements.

The National Productivity Commission carries out ad hoc reviews of key economic sectors for the country with the objective of providing recommendations to improve the national productivity. These reviews complement the administrative simplification measures and provide a process perspective that go beyond specific procedures or formalities. In 2020, the Commission published a review of the regulatory quality of key sectors in Chile, including mining. The report provides specific recommendations to improve response times and eliminate overlaps between institutions (e.g. SERNAGEOMIN and the General Direction of Water) as well as highlighting barriers to compliance based on the regulatory requirements (Comisión Nacional de Productividad, 2020[17]).

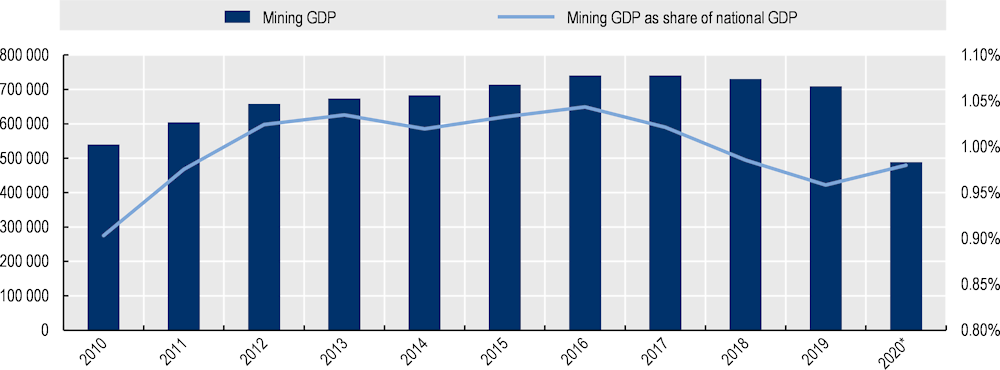

Mining regulation in Mexico

The mining industry in Mexico is an important component of the country’s GDP. In 2018, the mining-metallurgical sector, which includes the extractive mining and metallurgy sub-sectors, contributed to around 2.4% of the total GDP and to 8.2% of the industrial GDP. Additionally, it generated approximately 381 000 direct jobs and 2.3 million indirect jobs (Ministry of Economy, 2020[19]). The mining GDP flows account for approximately 1% of the country’s GDP (INEGI, 2020[20]). In 2015, the mining industry represented the country's fifth largest source of foreign income, with an export value of USD 17 053 million (Federal Supreme Audit, 2015[21]). Figure 5.4 shows the total mining GDP and its share as part of the national GDP over the last ten years (2010-20).

Figure 5.4. Mining GDP in Mexico

* Data for 2020 is up to the third quarter. GDP data does not consider oil and gas.

Source: INEGI (2020[20]), Banco de Información Económica [Bank of Economic Information], https://www.inegi.org.mx/sistemas/bie/ (accessed 18 December 2020).

Mexico is one of the most important mining countries in the world (Ministry of Economy, 2020[19]), due to the ample variety of minerals and the amount of specific minerals that it extracts. It ranks first in silver production worldwide and is among the top 10 producers of 16 different minerals.1 In 2020, Mexico ranked second in the mining exploration budget in Latin America and fifth worldwide, and fifth in attracting investments for mining during 2018. In terms of direct investment, the mining sector invested USD 4 897 billion in 2018, which meant a 13.8% increase compared to 2017.

Institutions and regulatory powers in mining activities

In Mexico, nine government agencies regulate different aspects of the mining sector, e.g. taxes, labour, the environment, land tenure and the mining activity regulation (see Table 5.5, for more details). However, only two ministries directly regulate the mining policy: the Ministry of Economy (SE) and the Ministry of Environment and Natural Resources (SEMARNAT). The Ministry of Economy is in charge of the promotion, regulation and oversight of the mining activity. Specifically, the SE regulates the mining activities in the country through the General Directorate of Mines (DGM) and General Directorate of Mining Development (DGDM) and through two deconcentrated bodies: the Mexican Geological Service (SGM) and the Mining Development Trust (FIFOMI). It is worth to mention that the SE focuses on the activities before the granting of the concession title. On the other hand, the Ministry of the Environment and Natural Resources focuses on the environmental regulation of the mining activity and carries out its activities mainly through the Federal Environmental Protection Agency (PROFEPA).

Table 5.5. Government agencies with attributions

|

Government agency |

Regulatory attributions |

|---|---|

|

Ministry of Finance |

Taxes |

|

Ministry of Labour and Social Security |

Labour regulation |

|

Mexican Institute of Social Security |

Social Security and Services |

|

Ministry of Environment and Natural Resources |

Environmental regulation |

|

Ministry of National Defence |

Regulation of explosives use |

|

Ministry of Agrarian, Territorial and Urban Development |

Land tenure regulation |

|

Ministry of Economy |

Regulation of mining activities |

Source: Ministry of Economy (n.d.[22]), Guía de Procedimientos Mineros (Mining Procedures Guide), https://www.gob.mx/cms/uploads/attachment/file/112613/guia_de_procedimientos_mineros_0414.pdf (accessed 17 December 2020). Federal Supreme Audit (2015[21]), Política Pública de Minería [Mining Public Policy], https://www.asf.gob.mx/Trans/Informes/IR2015i/Documentos/Auditorias/2015_1579_a.pdf (accessed 18 December 2020).

The General Directorate of Mines (DGM) is the main regulator for the sector. The DGM aims at guaranteeing a transparent implementation of mining regulation and at monitoring its compliance. It is the administrative unit responsible for the granting process of mining concessions and the allocation of titles. The General Directorate authorises the performance of mining works and projects for the exploration and exploitation of minerals. The DGM co-ordinates with all the competent authorities to discharge its responsibilities according to the Mining Law, the Hydrocarbon Law, the Electric Industry Law and all of its bylaws. In particular, the DGM co-ordinates with the General Directorate of Standards for the development and revision of the Mexican Official Standards (NOM) and of the Mexican Standards (NMX) on mining. Additionally, the DGM contributes to the analysis, review, formulation, evaluation and monitoring of provisions that promote sustainable mining, along with the DGDM.

The DGM manages and defines the necessary actions to foster regulatory compliance. To achieve this, it designs and implements the inspection and sanction processes. In case of non-compliance, the DGM is allowed to impose administrative sanctions, and suspend or cancel the concessions’ rights of ongoing mining works and projects.

On the other hand, the DGM develops sectoral, institutional, regional and special programmes in mining matters. In addition, it is in charge of requesting and managing the information on production, revenue and destination of minerals, geology of ore deposits and reserves, as well as all economic and accounting statements of mining and metallurgical companies in the country.

The General Directorate of Mining Development (DGDM) seeks the development of the mining sector through actions that stimulate investment and competitiveness with a sustainable vision. The DGDM is in charge of disseminating economic information on the Mexican mining industry, as well as of the analysis of the sector. It also establishes collaboration and co-ordination links with private sector organisations to carry out joint actions to promote mining activity and the development of the regions.

The DGDM prepares and disseminates studies on the national and international mining environment and elaborates diagnoses and mitigation proposals for the problems of the sector. Additionally, the General Directorate is in charge of the co-ordination of studies to determine the feasibility of projects in order to promote the exploration and exploitation of the mineral resources.

The Mining Development Trust (FIFOMI) provides support through training, technical assistance and financing of SMEs. The financing programme focuses on the exploration, exploitation, beneficiation, industrialisation, commercialisation and consumption of minerals and their productive chain. The objective of the SMEs financing programme is to increase competitiveness in the sector by offering help to:

Acquire capital goods such as machinery and equipment, industrial warehouses, benefit plants, and investment rescue.

Permanent and/or revolving working capital.

Financing of suppliers of goods and services, introducing mineral, contractors, clients in the mining sector and their production chain.

Lease of machinery, specialised transport equipment and industrial warehouses.

Pay liabilities with financial institutions, suppliers and creditors that have been generated by activities inherent to the business.

The Mexican Geological Service’s (SGM) objective is to encourage the best use of the country’s mineral resources by promoting and elaborating geological, mining and metallurgical research and to generate the basic geological information of the nation. The SGM is a decentralised body with its own legal personality and assets, which come from the contributions from the Federal Government, discovery bonuses and economic compensation from tenders, income from services it provides and goods it acquires by any other means (Government of Mexico, 2014[23]).

As a specialised office, the SGM advises, supports and certifies mining projects, and integrates a portfolio of projects. Moreover, it has to localise exploration targets and projects, propose areas for competition, promote agreements and give consultancies in the field of exploration and evaluation of minerals.

The Federal Environmental Protection Agency (PROFEPA) is a decentralised administrative body of the Ministry of the Environment and Natural Resources (SEMARNAT) with technical and operational autonomy. It seeks environmental justice through the application and enforcement of the federal environmental legislation through inspection, verification and oversight for guaranteeing the protection of natural resources. The PROFEPA aims to prioritise the preventive approach over the corrective one, as well as actions of social participation. PROFEPA carries this out by responding to public complaints and through inspection, verification, oversight and the use of voluntary instruments (Government of Mexico, 2020[24]).

Table 5.6 consolidates the activities that correspond to each of the government bodies in charge of the mining policy in Mexico.

Table 5.6. Mining policy and the responsible agencies

|

Mining phase |

Activities |

Government body responsible |

|---|---|---|

|

Exploration |

|

|

|

Promotion |

|

|

|

Regulation |

|

|

|

Operation |

|

|

|

|

Source: Federal Supreme Audit (2015[21]), Política Pública de Minería (Mining Public Policy), https://www.asf.gob.mx/Trans/Informes/IR2015i/Documentos/Auditorias/2015_1579_a.pdf (accessed 18 December 2020).

Better regulation tools

In Mexico, regulatory impact assessment and public consultation on draft regulations have been mandatory for all regulatory proposals coming from the executive since 2000. The new General Law on Better Regulation, besides modernising the policy, also establishes the National System of Better Regulation (CONAMER), specifying the duties and responsibilities of autonomous bodies and state and municipal governments (OECD, 2018[25]).

Regarding the emission and supervision of mineral regulations, the Ministry of Economy is responsible for overseeing the development of draft technical regulations and standards by line ministries and agencies, including ensuring the adoption or consideration of international practices. The draft technical regulations and standards must then follow the RIA process defined by the National Commission on Better Regulation. For instance, the addition of a plot to the mineral reserves requires a RIA where market prices of mineral reserves of probable or potential mineral reserves are calculated, as well as the potential benefit of using the plot or its mineral reserves for another activity. Additionally, the Bylaw of the Mineral Law (2012), includes provisions focused on decreasing red tape fostering and administrative simplification. The bylaw defines the maximum number of days that the administration uses to assess a formality or a request.

The National Commission on Better Regulation is a deconcentrated body of the Ministry of Economy with technical and operational autonomy, which aims to promote transparency in the development and enforcement of regulations and the simplification of procedures. CONAMER is in charge of validating the RIAs from draft regulation, overseeing the public consultation process, co-ordinating and monitoring the regulatory planning agenda, promoting simplification programmes and reviewing the existing stock of regulations (OECD, 2018[25]).

References

[16] Comisión Chilena del Cobre (2017), Análisis del proceso de evaluación ambiental de los proyectos mineros, https://www.cochilco.cl/Listado%20Temtico/Analisis%20proceso%20de%20evaluaci%C3%B3n%20ambiental%20proyectos%20mineros.pdf (accessed on 3 February 2021).

[17] Comisión Nacional de Productividad (2020), Calidad Regulatoria en Chile: Una revisión de sectores estratégicos, https://www.comisiondeproductividad.cl/wp-content/uploads/2020/03/Informe_Calidad_Calidad_Regulatoria_Sectores_Estrategicos-2020-03-11.pdf (accessed on 12 February 2021).

[21] Federal Supreme Audit (2015), Política Pública de Minería [Mining Public Policy], https://www.asf.gob.mx/Trans/Informes/IR2015i/Documentos/Auditorias/2015_1579_a.pdf (accessed on 18 December 2020).

[24] Government of Mexico (2020), PROFEPA, https://www.gob.mx/profepa/que-hacemos (accessed on 23 December 2020).

[23] Government of Mexico (2014), Ley Minera [Mining Law].

[9] IAP2 International Federation (2018), IAP2 Spectrum of Public Participation, https://cdn.ymaws.com/www.iap2.org/resource/resmgr/pillars/Spectrum_8.5x11_Print.pdf (accessed on 3 May 2021).

[20] INEGI (2020), Banco de Información Económica [Bank of Economic Information], https://www.inegi.org.mx/sistemas/bie/ (accessed on 18 December 2020).

[15] Ministerio de Minería (2020), Insumos para la Política Nacional Minera 2050, http://www.politicanacionalminera.cl/wp-content/uploads/2020/06/Insumos-para-la-PNM-2050.pdf (accessed on 4 December 2020).

[19] Ministry of Economy (2020), Minería [Mining], https://www.gob.mx/se/acciones-y-programas/mineria (accessed on 18 December 2020).

[22] Ministry of Economy (n.d.), Guía de Procedimientos Mineros [Mining Procedures Guide], https://www.gob.mx/cms/uploads/attachment/file/112613/guia_de_procedimientos_mineros_0414.pdf (accessed on 17 December 2020).

[7] NSW Government (2020), Mining Amendment Regulation 2020, https://www.nsw.gov.au/have-your-say/mining-amendment-regulation-2020 (accessed on 1 October 2020).

[6] NSW Government (1992), Mining Act No 29, https://legacy.legislation.nsw.gov.au/~/pdf/view/act/1992/29/whole (accessed on 1 October 2020).

[5] NSW Government (n.d.), NSW Resources Regulator, https://www.resourcesregulator.nsw.gov.au (accessed on 5 October 2020).

[12] NSW Resources Regulator (2020), Compliance priorities: January-June 2021, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0011/1278830/Compliance-priorities-Jan-to-June-2021.pdf (accessed on 29 April 2021).

[10] NSW Resources Regulator (2020), Policy: Engagement and public consultation, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0008/1205297/Resources-Regulator-Policy-Public-consultation.pdf (accessed on 3 May 2021).

[11] NSW Resources Regulator (2019), Compliance and Enfrocement Approach, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0003/537384/Resources-Regulator-Compliance-and-Enforcement-Approach.pdf (accessed on 29 April 2021).

[3] NSW Resources Regulator (2019), Overview of the NSW Resources Regulator, Government of NSW, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0003/819183/Resources-Regulator-Overview.pdf (accessed on 1 October 2020).

[8] NSW Resources Regulator (2018), Mine and Petroleum Site Safety Levy: Fact Sheet, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0005/71348/Mine-Safety-Levy-fact-sheet-November-18.pdf (accessed on 29 April 2021).

[4] NWS Resources Regulator (2017), NSW Resources Regulator - Strategic Approach 2017-2020, NSW Resources Regulator, https://www.resourcesregulator.nsw.gov.au/__data/assets/pdf_file/0004/721390/strategic-approach-2017-2020.pdf (accessed on 1 October 2020).

[25] OECD (2018), OECD Regulatory Policy Outlook 2018, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264303072-en.

[14] Poveda Bonilla, R. (2019), Estudio de caso sobre la gobernanza del cobre en Chile, Comisión Económica para América Latina y el Caribe (CEPAL), Santiago, https://repositorio.cepal.org/bitstream/handle/11362/44777/1/S1900453_es.pdf (accessed on 4 December 2020).

[1] Senior, A. et al. (2021), Australia’s Identified Mineral Resources 2020, Geoscience Australia, http://dx.doi.org/10.11636/1327-1466.2020 (accessed on 29 April 2021).

[13] SERNAGEOMIN (2020), Anuario de la minería de Chile, 2019, https://www.sernageomin.cl/pdf/anuario_2019_act100720.pdf (accessed on 28 October 2020).

[18] Superintendencia del Medio Ambiente de Chile (2018), Estrategia de Fiscalización Ambiental 2018-2023, https://portal.sma.gob.cl/wp-content/uploads/2018/11/estrategia-de-fiscalizacion-ambiental-2018-2023.pdf (accessed on 5 February 2021).

[2] The Productivity Commission (2020), Resources Sector Regulation, The Productivity Commission, https://www.pc.gov.au/inquiries/completed/resources/report/resources.pdf (accessed on 30 September 2020).

Note

← 1. Silver, bismuth, fluorite, celestine, wollastonite, cadmium, molybdenum, lead, zinc, diatomite, salt, barite, graphite, gypsum, gold and copper.