Chapter 1 provides information on trends in tax revenues in OECD countries, including changes in tax-to-GDP ratios, tax structures, taxes by level of government, non-wastable tax credits and financing of social security-type benefits.

Revenue Statistics 2022

1. Tax revenue trends 1965-2021

Abstract

Revenue Statistics 2022 presents detailed internationally comparable data on tax revenues of OECD countries for all levels of government. The latest edition provides final data on tax revenues in 1965-2020. In addition, provisional estimates of tax revenues in 2021 are included for almost all OECD countries.1

Box 1.1. Revenue Statistics in OECD countries – definitions & classifications

In Revenue Statistics 2022, taxes are defined as compulsory, unrequited payments to the general government or to a supranational authority. Taxes are unrequited in the sense that benefits provided by government are not normally in proportion to their payments.

In the OECD classification, taxes are classified by the base of the tax:

Income and profits (heading 1000)

Compulsory social security contributions paid to general government that are treated as taxes (heading 2000)

Payroll and workforce (heading 3000)

Property (heading 4000)

Goods and services (heading 5000)

Other (heading 6000)

Much greater detail on the tax concepts, the classification of taxes and the accrual basis of reporting is set out in the OECD Interpretative Guide in Annex A of Revenue Statistics 2022.

All the averages presented in this summary are unweighted.

Tax-to-GDP ratios

Tax ratios for 2021 (provisional data)

New OECD data in the annual Revenue Statistics 2022 publication show that, on average, tax revenues as a percentage of GDP (i.e. the tax-to-GDP ratio) were 34.1% in 2021, an increase of 0.6 percentage points (p.p.) of GDP relative to 2020. The increase in the OECD average tax-to-GDP ratio in 2021 occurred against the backdrop of a strong economic recovery following the contraction caused by the COVID-19 pandemic in 2020, which caused widespread falls in both nominal tax revenues and nominal GDP.

In 2021, GDP and nominal tax revenues both rebounded. The tax-to-GDP ratio increased in 24 of the countries for which full 2021 data are available, decreased in 11 and was unchanged in one; on average, the increases were larger than the decreases (1.2 p.p. versus 0.8 p.p.). Chapter 2 of this publication provides more information on the changes in tax revenues for each country, including for different types of taxes, and compares year-on-year changes in 2021 with those in 2020.

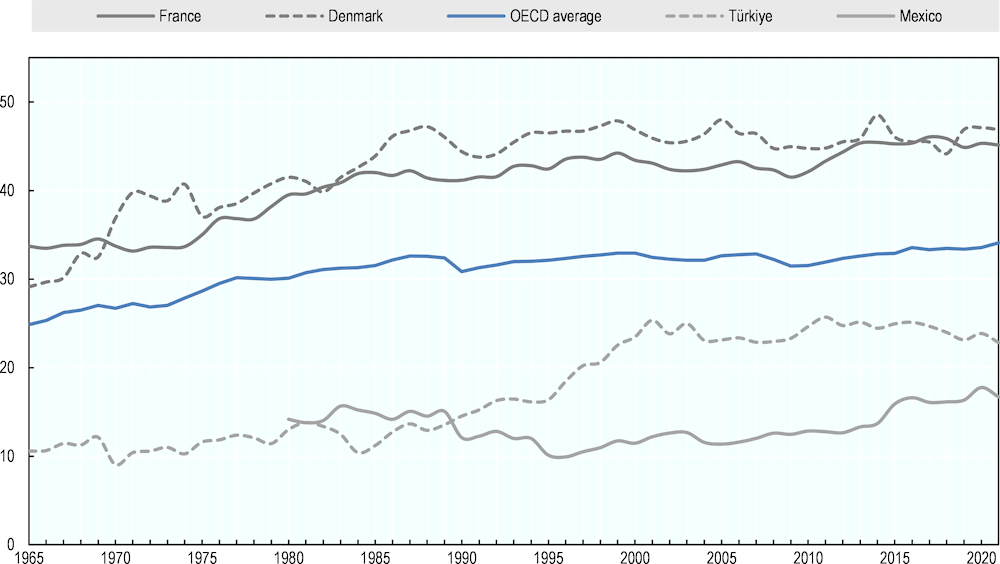

Figure 1.1. Trends in tax-to-GDP ratios, 1965-2021p (as % of GDP)

Notes: Data for 2021 are preliminary. The OECD average in 2021 is calculated by applying the unweighted average percentage change for 2021 in the 36 countries providing data for that year to the overall average tax-to-GDP ratio in 2020.

The 2016 OECD average tax-to-GDP ratio includes the one-off revenues from stability contributions in Iceland. Excluding these revenues, the OECD average tax-to-GDP ratio in 2016 would have been 33.6%.

Source: Table 3.1.

Country tax-to-GDP ratios in 2021 varied considerably (Table 1.1), both across countries and from the level in 2020. Key observations include:

Denmark had the highest tax-to-GDP ratio in 2021 (46.9%), and with the exceptions of 2017 and 2018, in which France was higher, has had the highest tax-to-GDP ratio of OECD countries since 2002. France had the second-highest tax-to-GDP ratio in 2021 (45.1%). Mexico had the lowest tax-to-GDP ratio (16.7%).

Of the 36 countries for which data for 2021 are available, the ratio of tax revenues to GDP rose in 24 compared to 2020, remained unchanged in one and fell in 11.

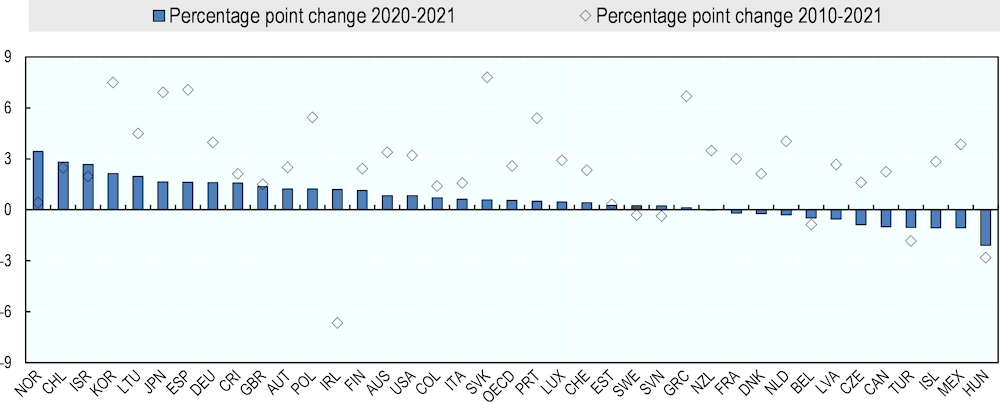

Between 2020 and 2021, the largest tax ratio increase was in Norway, at 3.4 p.p. This was largely due to an increase in revenues from corporate income tax (CIT) as a share of GDP (7.3 p.p.). The second largest increase was in Chile (2.8 p.p.), largely driven by an increase of 1.5 p.p. in revenues from value-added tax (VAT) (see Chapter 2 for more information). Israel and Korea were the other countries with an increase of over 2 p.p. (Figure 1.2).

The largest fall in the tax-to-GDP ratio between 2020 and 2021 was in Hungary, at 2.1 p.p., due to falls in revenues from all major tax types as a share of GDP, in particular a decline of 1.0 p.p. in social security contributions2. Decreases larger than one percentage point were also seen in Iceland and Mexico (both 1.1 p.p.). In Iceland, this was largely due to a decline in revenues from personal income tax (PIT) and in Mexico to a decline in revenues from excises (1.1 p.p. and 0.4 p.p. respectively).

Table 1.1. Revenue Statistics: overview

|

Tax revenue as % of GDP |

Tax revenue as % of total tax revenue in 2020 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

2021p |

2020 |

2019 |

2000 |

1100 Taxes on income, individuals (PIT) |

1200 Taxes on income, corporates (CIT) |

2000 Social security contributions (SSC) |

4000 Taxes on property |

5111 Value added taxes |

Other consumption taxes3 |

All other taxes4 |

|

|

OECD Average2 |

34.1 |

33.6 |

33.4 |

32.9 |

24.1 |

9.0 |

26.6 |

5.7 |

20.2 |

11.9 |

2.5 |

|

Australia |

.. |

28.5 |

27.7 |

30.4 |

40.1 |

18.8 |

0.0 |

10.1 |

12.4 |

14.1 |

4.5 |

|

Austria1 |

43.5 |

42.2 |

42.6 |

42.3 |

22.2 |

5.1 |

36.8 |

1.4 |

17.6 |

9.5 |

7.5 |

|

Belgium1 |

42.0 |

42.5 |

42.4 |

43.8 |

27.8 |

7.7 |

32.0 |

8.0 |

15.0 |

9.4 |

0.0 |

|

Canada |

33.2 |

34.3 |

33.1 |

34.7 |

36.9 |

11.8 |

14.3 |

12.0 |

13.2 |

8.3 |

3.5 |

|

Chile |

22.2 |

19.4 |

21.0 |

18.7 |

10.2 |

24.3 |

8.0 |

5.3 |

41.1 |

13.7 |

-2.7 |

|

Colombia |

19.5 |

18.8 |

19.7 |

15.7 |

7.7 |

23.0 |

9.9 |

9.7 |

28.7 |

12.7 |

8.2 |

|

Costa Rica |

24.2 |

22.7 |

23.4 |

21.1 |

6.8 |

8.4 |

36.1 |

2.0 |

19.7 |

13.6 |

13.4 |

|

Czech Republic |

33.8 |

34.7 |

34.8 |

32.3 |

13.4 |

9.4 |

45.5 |

0.6 |

21.3 |

9.8 |

0.0 |

|

Denmark1 |

46.9 |

47.1 |

46.9 |

46.9 |

54.2 |

6.1 |

0.1 |

4.2 |

20.8 |

9.9 |

4.8 |

|

Estonia |

33.5 |

33.3 |

33.5 |

31.1 |

18.1 |

4.9 |

36.5 |

0.6 |

26.7 |

13.2 |

0.0 |

|

Finland |

43.0 |

41.8 |

42.3 |

45.8 |

30.0 |

5.1 |

27.4 |

3.6 |

22.1 |

11.7 |

0.1 |

|

France1 |

45.1 |

45.3 |

44.9 |

43.4 |

21.0 |

5.1 |

32.7 |

8.7 |

15.4 |

11.7 |

5.3 |

|

Germany |

39.5 |

37.9 |

38.6 |

36.4 |

27.0 |

4.3 |

39.7 |

3.3 |

17.2 |

8.5 |

0.0 |

|

Greece |

39.0 |

38.9 |

39.5 |

33.4 |

16.3 |

3.1 |

33.2 |

7.8 |

20.1 |

18.4 |

1.0 |

|

Hungary |

34.0 |

36.1 |

36.4 |

38.5 |

14.6 |

3.6 |

30.8 |

2.9 |

27.1 |

18.1 |

3.0 |

|

Iceland |

35.1 |

36.1 |

34.9 |

35.9 |

43.1 |

6.1 |

8.3 |

6.2 |

22.0 |

9.6 |

4.6 |

|

Ireland |

21.1 |

19.9 |

21.9 |

30.8 |

32.9 |

16.1 |

16.6 |

5.0 |

17.2 |

11.1 |

1.0 |

|

Israel |

32.2 |

29.6 |

30.0 |

34.1 |

21.9 |

9.2 |

17.4 |

10.3 |

23.9 |

11.5 |

5.9 |

|

Italy |

43.3 |

42.7 |

42.3 |

40.5 |

26.8 |

4.8 |

31.8 |

5.7 |

14.1 |

12.8 |

3.9 |

|

Japan |

.. |

33.2 |

31.5 |

25.3 |

18.7 |

11.7 |

40.4 |

8.1 |

14.9 |

6.0 |

0.3 |

|

Korea |

29.9 |

27.7 |

27.2 |

20.9 |

18.8 |

12.1 |

28.0 |

14.2 |

15.1 |

9.3 |

2.4 |

|

Latvia |

31.2 |

31.8 |

30.9 |

29.0 |

19.3 |

2.3 |

31.4 |

3.0 |

27.5 |

16.5 |

0.0 |

|

Lithuania1 |

32.8 |

30.8 |

30.3 |

30.8 |

23.0 |

5.1 |

33.2 |

1.0 |

25.6 |

12.1 |

0.0 |

|

Luxembourg1 |

38.6 |

38.1 |

39.6 |

37.0 |

25.5 |

12.5 |

29.2 |

10.0 |

14.9 |

7.9 |

0.1 |

|

Mexico |

16.7 |

17.8 |

16.3 |

11.5 |

21.0 |

20.1 |

13.9 |

1.9 |

23.8 |

13.4 |

5.9 |

|

Netherlands |

39.7 |

40.0 |

39.3 |

36.9 |

22.9 |

7.8 |

34.1 |

4.3 |

18.5 |

11.9 |

0.5 |

|

New Zealand |

33.8 |

33.8 |

31.3 |

32.5 |

38.5 |

15.4 |

0.0 |

5.5 |

30.6 |

7.4 |

2.6 |

|

Norway |

42.2 |

38.8 |

40.1 |

41.7 |

29.4 |

6.2 |

28.9 |

3.4 |

23.6 |

8.5 |

0.2 |

|

Poland1 |

36.8 |

35.5 |

35.1 |

32.9 |

14.8 |

6.4 |

37.9 |

3.6 |

22.4 |

13.8 |

1.0 |

|

Portugal |

35.8 |

35.3 |

34.5 |

30.9 |

19.9 |

7.9 |

29.6 |

4.2 |

23.8 |

13.7 |

1.0 |

|

Slovak Republic |

35.8 |

35.2 |

34.6 |

33.6 |

10.8 |

8.6 |

43.9 |

1.4 |

21.0 |

13.5 |

0.7 |

|

Slovenia1 |

37.4 |

37.2 |

37.0 |

37.7 |

14.1 |

5.2 |

45.2 |

1.7 |

20.2 |

13.5 |

0.1 |

|

Spain |

38.4 |

36.7 |

34.7 |

33.0 |

23.7 |

5.3 |

37.4 |

6.7 |

17.1 |

9.6 |

0.0 |

|

Sweden |

42.6 |

42.3 |

42.8 |

50.0 |

28.8 |

7.0 |

21.4 |

2.2 |

21.6 |

6.9 |

12.1 |

|

Switzerland1 |

28.0 |

27.5 |

27.3 |

27.0 |

32.1 |

11.0 |

25.2 |

8.1 |

11.3 |

8.7 |

3.7 |

|

Türkiye |

22.8 |

23.9 |

23.1 |

23.5 |

13.2 |

8.7 |

29.7 |

4.4 |

19.2 |

23.8 |

1.0 |

|

United Kingdom |

33.5 |

32.1 |

32.2 |

32.7 |

28.6 |

7.3 |

21.0 |

11.6 |

20.2 |

11.0 |

0.4 |

|

United States |

26.6 |

25.8 |

25.2 |

28.3 |

40.6 |

4.9 |

24.8 |

12.4 |

0.0 |

17.2 |

0.1 |

.. Not available

1. The total tax revenue has been reduced by the amount of any capital transfer that represents uncollected taxes.

2. 2021 provisional average calculated by applying the unweighted average percentage change for 2021 in the 36 countries providing data for that year to the overall average tax to GDP ratio in 2020.

3. Calculated as 5000 Taxes on goods and services less 5111 Value added taxes.

4. Includes 1300 Unallocable between personal and corporate income tax, 3000 Taxes on payroll and workforce and 6000 Other taxes.

The OECD average tax-to-GDP ratio was higher in 2021 than in 2010, when it was 31.5% of GDP on average. Across countries, the tax-to-GDP ratio was higher in 2021 than in 2010 in 32 countries. The largest increases were seen in the Slovak Republic (7.8 p.p.) and Korea (7.5 p.p.); increases of over 5 p.p. were also seen in Spain, Japan (2020 figure), Greece, Poland and Portugal. Decreases since 2010 were seen in the remaining six countries. The largest fall has been in Ireland, from 27.7% in 2010 to 21.1% in 2021, largely due to the exceptional increase in GDP in 2015. The next largest decrease was seen in Hungary (2.8 p.p.) (Figure 1.2).

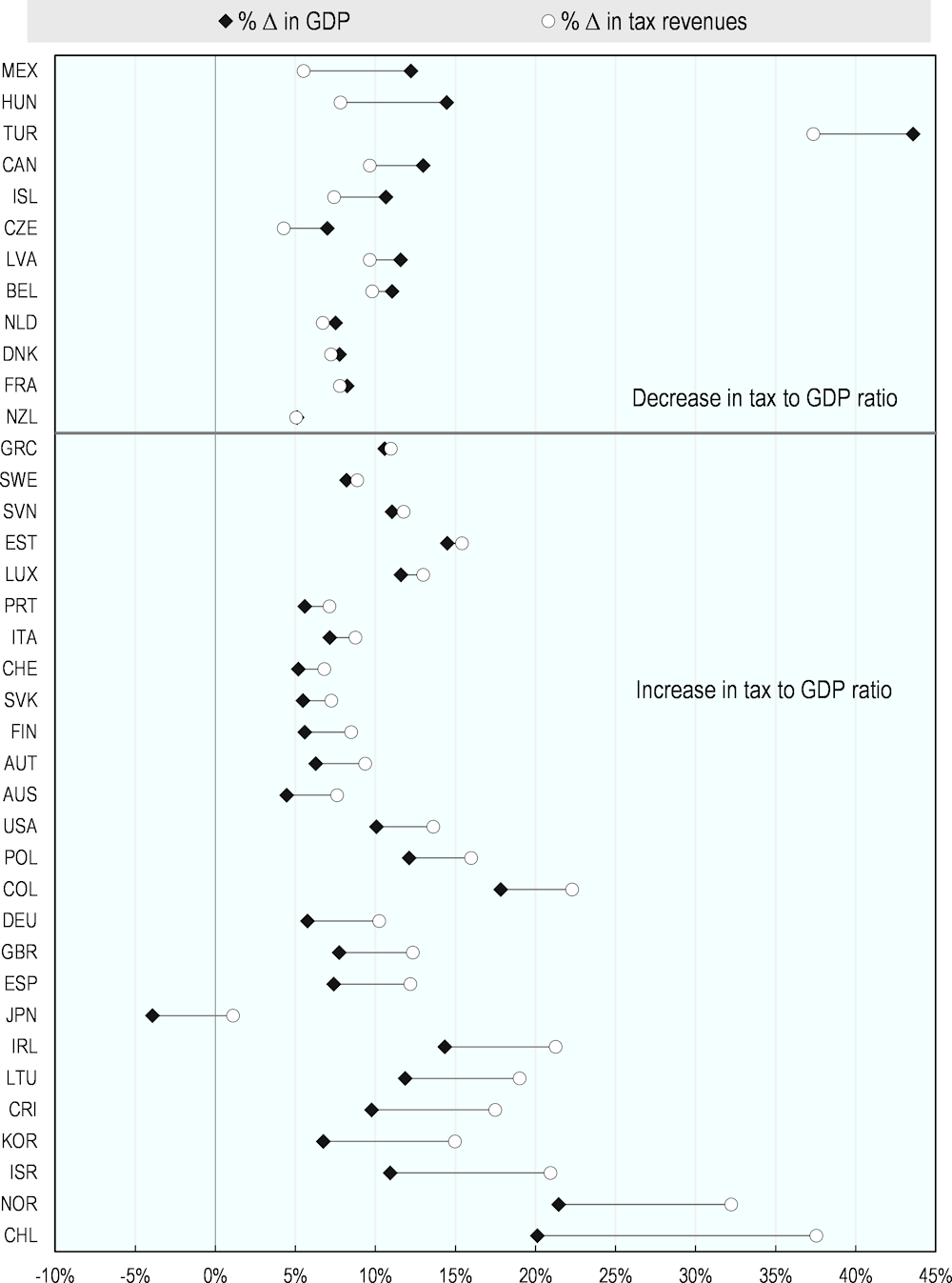

Changes in the tax-to-GDP ratio are driven by the relative changes in nominal tax revenues and in nominal GDP. From one year to the next, if tax revenues rise more than GDP (or fall less than GDP) the tax-to-GDP ratio will increase. Conversely, if tax revenues rise less than GDP, or fall further, the tax-to-GDP ratio will go down. Therefore, a higher tax-to-GDP ratio does not necessarily mean that the amount of tax revenues has increased in nominal, or even real, terms.

In 2021, nominal tax revenues and GDP increased in all OECD countries from the previous year. Twenty-four countries experienced an increase in their tax-to-GDP ratio relative to 2020 as a result of the increase in revenues exceeding the growth in GDP. In 11 countries, tax revenues rose by less than GDP, resulting in a decline in the tax-to-GDP ratio (Figure 1.3)3. In Figure 1.3, changes between 2019 and 2020 are shown for Australia and Japan, where the tax-to-GDP ratio is not available in 2021. In both countries, the tax-to-GDP rose between 2019 and 2020: in Australia this was because nominal tax revenues increased by more than GDP, while in Japan nominal tax revenues increased but GDP declined.

Figure 1.2. Changes in tax-to-GDP ratios, p.p., 2020-21p and 2010-21p

Note: Preliminary data for 2021 was not available for Australia and Japan. For these countries, the comparison shown is 2019-2020 and 2010-2020 data.

Source: Secretariat calculations based on Table 3.1.

Box 1.2. Methodology: the tax-to-GDP ratio

The tax-to-GDP ratios shown in Revenue Statistics 2022 express aggregate tax revenues as a percentage of GDP. The value of this ratio depends on its denominator (GDP) as well as its numerator (tax revenue). The denominator – GDP – is subject to historical revision.

The numerator (tax revenue)

For the numerator, the OECD Secretariat uses revenue figures that are submitted annually by correspondents from national Ministries of Finance, Tax Administrations or National Statistics Offices. Although provisional figures for most countries become available with a lag of about six months, finalised data become available with a lag of around one and a half years. Final revenue data for 2020 were received during the period May-August 2022.

In 35 OECD countries the reporting year coincides with the calendar year. Three countries - Australia, Japan and New Zealand – have different reporting years. Reporting year 2019 includes Q2/2019 – Q1/2020 (Japan) and Q3/2019 – Q2/2020 (Australia and New Zealand) respectively (Q = quarter).

The denominator (GDP)

For the denominator, the GDP figures used for Revenue Statistics 2022 are the most recently available in October 2022. At that point, the 2020 and 2021 GDP figures were available for all OECD countries.

Using these GDP figures ensures a maximum of consistency and international comparability for the reported tax-to-GDP ratios.

The GDP figures are based on the OECD Annual National Accounts (ANA – SNA) for the 35 OECD countries where the reporting year is the actual calendar year.

Where the reporting year differs from the calendar year, the annual GDP estimates are obtained by aggregating quarterly GDP estimates provided by the OECD Statistics Directorate for those quarters corresponding to each country’s fiscal (tax) year.

The average shown in this publication is an unweighted average of all countries for which data is available. The 2021 provisional average is calculated by applying the unweighted average percentage change for 2021 in the 36 countries providing data for that year to the overall average tax-to-GDP ratio in 2020.

Figure 1.3. Relative changes in nominal tax revenues and nominal GDP (%), 2020-21p

Note: Data for Australia and Japan show the change between 2019 and 2020, as preliminary data for 2021 was not available for Australia and Japan.

Source: Secretariat calculations based on Chapter 4 (tax revenues) and Table 3.19 (GDP).

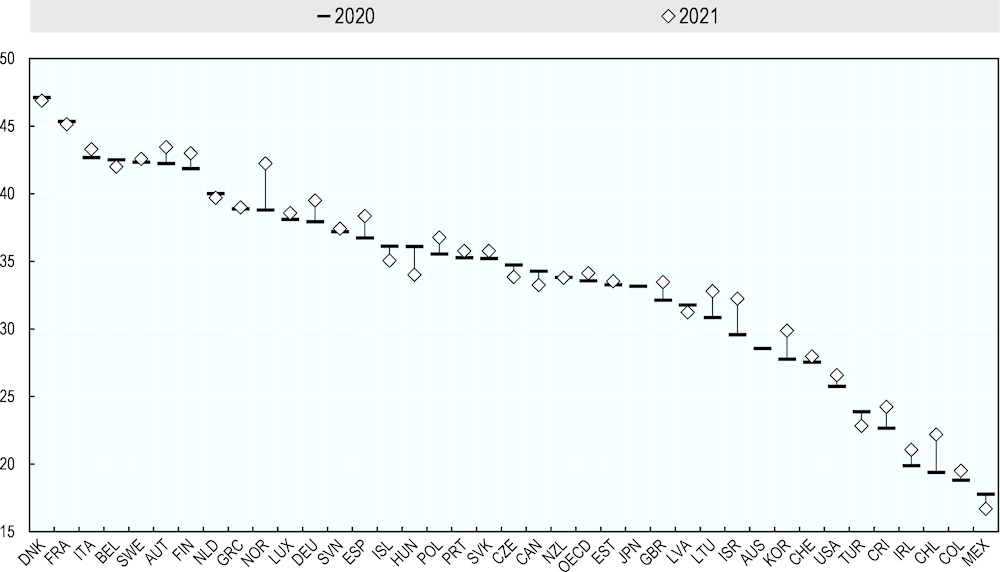

Figure 1.4. Tax to GDP ratios in 2020 and 2021p (as % of GDP)

Note: Preliminary data for 2021 were not available for Australia and Japan.

Source: Secretariat calculations based on Table 3.1

Tax-to-GDP ratios for 2020 (final data)

The latest year for which tax-to-GDP ratios are based on final revenue data and available for all OECD countries is 2020 (Figure 1.4). These data show that tax ratios varied considerably across countries:

In 2020, Denmark had the highest tax-to-GDP ratio (47.1%), followed by France (45.3%). Five other countries had tax-to-GDP ratios above 40% (Austria, Belgium, Finland, Italy and Sweden).

Mexico had the lowest ratio at 17.8% followed by Colombia (18.8%), Chile (19.4%), Ireland (19.9%), Costa Rica (22.7%) and Türkiye (23.9%). No other countries had a tax-to-GDP ratio lower than 25% in 2020 and five other countries had ratios below 30% (Australia, Israel, Korea, Switzerland and the United States).

The tax-to-GDP ratio in the OECD area as a whole (un-weighted average) was 33.6% in 2020. In 2019, it was 33.4%.

Relative to 2019, overall tax ratios rose in 22 OECD member countries and fell in 16.

The largest increases in the tax-to-GDP ratio were in New Zealand (2.5 p.p.) and Spain (2.0 p.p.). Canada, Iceland, Japan and Mexico all recorded increases in excess of 1.0 p.p.

The largest declines were in Ireland (2.0 p.p.) and Chile (1.6 p.p.).

Between 2019 and 2020, the increase in the average tax-to-GDP ratio was driven by increases in revenues from PIT and social security contributions (0.3 p.p. each), which more than offset by a decline in CIT revenues (0.2 p.p.).

Table 1.2. Tax structures in the OECD area, selected years (unweighted average as % of GDP)

|

1965 |

1990 |

2000 |

2007 |

2010 |

2015 |

2018 |

2019 |

2020 |

|

|---|---|---|---|---|---|---|---|---|---|

|

Total tax revenue |

24.9 |

30.8 |

32.9 |

32.8 |

31.5 |

32.9 |

33.5 |

33.4 |

33.6 |

|

1000 Taxes on income, profits and capital gains |

8.7 |

11.5 |

11.4 |

11.7 |

10.2 |

10.9 |

11.3 |

11.3 |

11.3 |

|

of which: |

|||||||||

|

1100 Taxes on income, profits and capital gains of individuals |

6.8 |

9.3 |

8.5 |

7.8 |

7.2 |

7.9 |

7.9 |

8.0 |

8.3 |

|

1200 Taxes on income, profits and capital gains of corporates |

2.1 |

2.4 |

3.1 |

3.6 |

2.7 |

2.8 |

3.1 |

3.0 |

2.8 |

|

2000 Social security contributions (SSC) |

4.5 |

7.1 |

8.4 |

8.2 |

8.6 |

8.8 |

8.9 |

8.9 |

9.2 |

|

3000 Taxes on payroll and workforce |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.5 |

0.5 |

|

4000 Taxes on property |

1.9 |

1.7 |

1.7 |

1.7 |

1.6 |

1.8 |

1.8 |

1.8 |

1.9 |

|

5000 Taxes on goods and services |

9.4 |

9.9 |

10.8 |

10.7 |

10.5 |

10.8 |

10.8 |

10.7 |

10.6 |

|

of which: |

|||||||||

|

5111 Value added taxes |

0.7 |

5.1 |

6.3 |

6.5 |

6.4 |

6.6 |

6.7 |

6.7 |

6.7 |

|

5121 Excises |

3.5 |

2.5 |

2.8 |

2.6 |

2.6 |

2.5 |

2.4 |

2.3 |

2.3 |

|

6000 Other Taxes |

0.1 |

0.4 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

Note: Percentage share of major tax categories in GDP. Data are included from 1965 onwards for Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, Türkiye, United Kingdom and United States; from 1972 for Korea; from 1980 for Mexico; from 1990 for Chile, Colombia and Costa Rica; from 1991 for Hungary and Poland; from 1993 for the Czech Republic and from 1995 for Estonia, Israel, Latvia, Lithuania, the Slovak Republic and Slovenia. The figures for the 2016 OECD average includes the one-off revenues from stability contributions in Iceland.

Source: OECD (2022), "Revenue Statistics: Comparative tables",OECD Tax Statistics (database).

Tax ratio changes between 1965 and 2020

Between 1965 and 20204, the average tax-to-GDP ratio in the OECD area increased from 24.9% to 33.6%, an increase of 8.7 p.p. (Figure 1.1). Before the first oil shock (1973 to 1974), strong, almost uninterrupted income growth enabled tax levels to rise in all OECD countries. In part, tax levels rose automatically through the effect of fiscal drag on PIT schedules. From 1975 to 1985, the tax burden in the OECD area increased by 2.9 p.p. After the mid-1970s, the combination of slower real income growth and higher levels of unemployment apparently limited the revenue raising capacity of governments. But during and after the deep recession following the second oil shock (1980), countries in Europe saw tax levels rise further, to finance higher spending on social security and rein in budget deficits.

After the mid-1980s, most OECD countries substantially reduced the statutory rates of their personal and corporate income tax, but the negative revenue impact of widespread tax reforms was often offset by reducing or abolishing tax reliefs. By 1999, the average OECD tax-to-GDP ratio had risen to 33.0%, the highest recorded level at that time. It fell back slightly between 2001 and 2004, but then rose again between 2005 and 2007 before falling back during the global financial crisis in 2008 and 2009. Taking these changes together, the average tax level in the OECD area increased by 1.4 p.p. between 1995 and 2020 (Figure 1.1).

The OECD average conceals great variety in national tax-to-GDP ratios. In 1965, tax-to-GDP ratios in OECD countries ranged from 10.6% in Türkiye to 33.7% in France. By 2020, the corresponding range was from 17.8% in Mexico to 47.1% in Denmark. The trend towards higher tax levels over this period reflects the need to finance a significant increase of public sector outlays in almost all OECD countries.

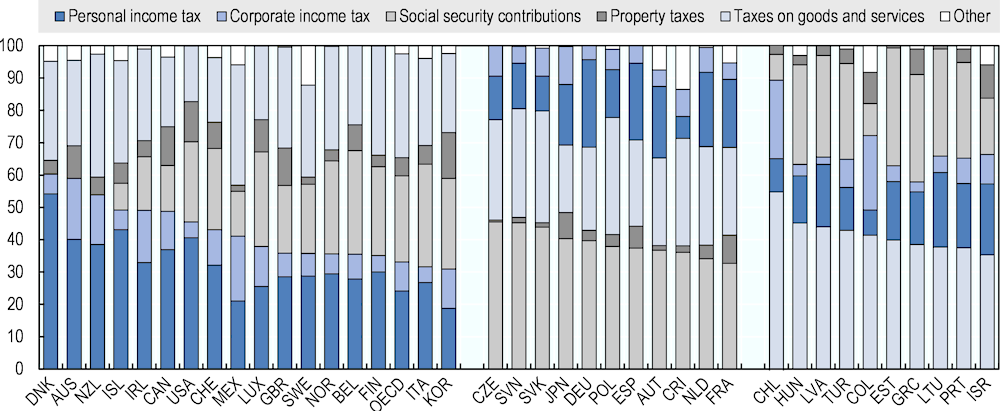

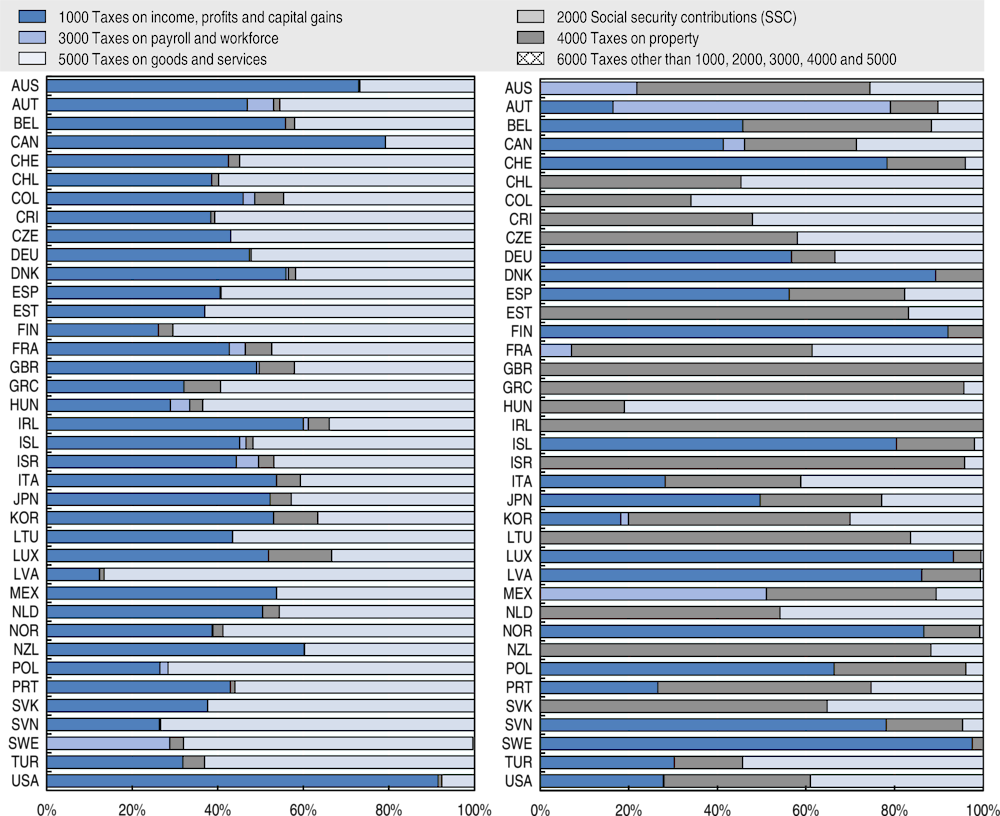

Tax structures

Tax structures are measured by the share of major taxes in total tax revenue. In 2020, the tax structures of OECD countries varied. Seventeen countries raised the largest part of their revenues from income taxes (both corporate and personal), eleven countries raised the largest part of their revenues from social security contributions and 10 countries raised the largest part of their revenues from consumption taxes (including VAT). Taxes on property and payroll taxes played a smaller role in the revenue systems of OECD countries in 2020, both on average and within most countries (Figure 1.5).

Figure 1.5. Tax structures in 2020 (as % of total tax revenue)

Note: Countries are grouped and ranked by those where income tax revenues (personal and corporate) form the highest share of total tax revenues, followed by those where social security contributions, or taxes on goods and services, form the highest share.

Source: Secretariat calculations based on data in chapter 4.

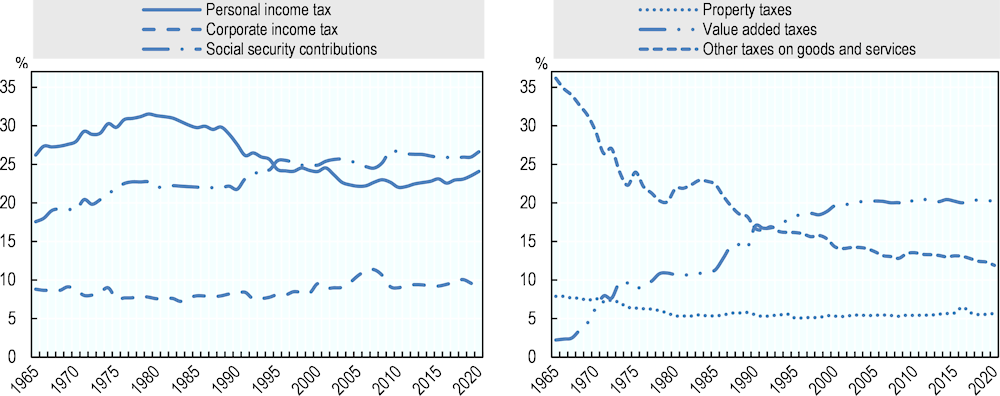

While tax levels have generally been rising on average, the tax structure or tax ‘mix’ has been remarkably stable over time. Nevertheless, several trends have emerged up to 2020 – the latest year for which data is available for all 38 OECD countries. These trends are discussed further below.

Taxes on income and profits

On average, in 2020, OECD countries collected 33.7% of their tax revenues through taxes on income and profits (personal and corporate income taxes taken together). Taxes on personal and corporate incomes remain the most important source of revenues used to finance public spending in 17 OECD countries, and in nine of them – Australia, Canada, Denmark, Iceland, Ireland, Mexico, New Zealand, Switzerland and the United States – the share of income taxes in the tax mix exceeded 40% in 2020.

Figure 1.6. Trends in tax structures (1965-2020, as % of total tax revenue)

Note: The OECD average tax revenue in 2016 from main categories includes the one-off revenues from stability contributions in Iceland. This predominately affects the average revenues from property taxes, as a percentage of total tax revenues, in that year only.

Source: Secretariat calculations based on Tables 3.8 to 3.14.

Within taxes on income and profits, the share of PIT and CIT varies:

Revenues from personal income taxes generated 24.1% of total taxes on average in 2020 compared with around 30% in the 1980s. About two percentage points of this reduction can be attributed to the impact on the average of a number of relatively recent entrants to the OECD from Eastern Europe and Latin America for which tax revenue data is only available from the 1990s onwards. These countries tend to have relatively low personal income tax revenues and high revenues from social security contributions or corporate income taxes, but this impact is observed in the post-1990 data only.

The variation in the share of PIT between countries is considerable. In 2020, it ranged from 6.8% in Costa Rica to 43.1% in Iceland and 54.2% in Denmark (Figure 1.5).

CIT revenues represented between 8% and 9% of total tax revenues, on average, throughout the period 1965 to 2003. They then increased to a high of 11.3% in 2007, before dropping to 9.0% in 2010, directly after the global financial crisis. They remained at between 9.0% and 10.0% of total revenues thereafter, except in 2018, when they accounted for 10.1%. CIT generated 9.0% of revenues in 2020.

The share of CIT in total tax revenues in 2020 varied considerably across countries from less than 5% (Estonia, Germany, Greece, Hungary, Italy, Latvia and the United States) to over 20% in Mexico (20.1%), Colombia (23.0%) and Chile (24.3%). Apart from the spread in statutory CIT rates, these differences are partly explained by institutional and country-specific factors, including:

the degree to which firms are incorporated,

the breadth of the CIT base; for example some narrowing may occur as a consequence of generous depreciation schemes and tax incentives,

the degree of cyclicality of the corporate tax system, for which one of the important elements is loss offset provisions,

the extent of reliance upon tax revenues from the exploitation of oil and/or mineral deposits, or

other instruments to postpone the taxation of earned profits.

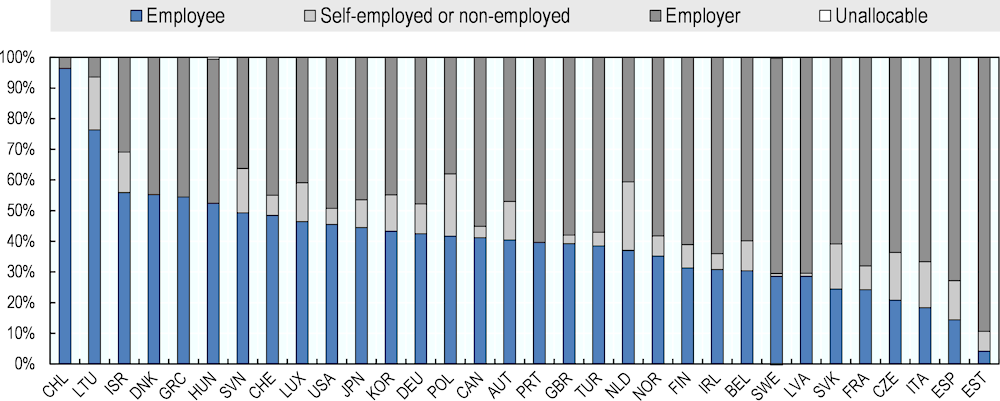

Social security contributions

Social security contributions (SSCs) accounted for 26.6% of total tax revenues on average across the OECD in 2020. They were highest in the Czech Republic, Slovenia and the Slovak Republic (45.5%, 45.2% and 43.9%, respectively). In contrast, Australia and New Zealand do not levy social security contributions.

There was wide variation across OECD countries in the relative proportions of social security contributions paid by employees and employers in 2020 (Figure 1.7):

Ten countries (Chile, Denmark, Greece, Hungary, Israel, Lithuania, Luxembourg, Poland, Slovenia and Switzerland) raise more revenues from employee SSCs, whereas the remainder raise more from employer SSCs.

The highest share of employee SSC revenues is found in Lithuania, at 25.3% of total revenues. Germany, Greece, Hungary, Japan, Poland and Slovenia also have employee SSC revenues of over 15% of total tax revenues. Denmark had the lowest share, at 0.1% of total revenues. Apart from Denmark, only Estonia had revenues from employee SSCs of less than 5% of total revenues.

The highest share of employer social security contribution revenues is found in Estonia, at 32.6% of total tax revenues. The Czech Republic (28.9%), Spain (27.3%) and the Slovak Republic (26.7%) also had employer SSC revenues of over 25% of total tax revenues. Denmark and Chile had the lowest shares, at 0.1% and 0.3% of total revenues respectively.

The highest share of self-employed or non-employed SSC revenues are found in the Netherlands and Poland, at 7.6% and 7.7% of total revenues respectively.

Figure 1.7. Composition of social security contributions, as % of total social security contributions, 2020

Note: Australia, Costa Rica, Colombia, Iceland, Mexico and New Zealand are not included within figure 1.7. Although Colombia, Costa Rica, Iceland and Mexico collect social security contributions, disaggregated data is not available. New Zealand and Australia do not levy social security contributions.

Source: Secretariat calculations based on data in chapter 4.

Property taxes

Between 1965 and 2020, the share of taxes on property fell from 7.9% to 5.7% of total tax revenues on average across the OECD (Figure 1.6). In Australia, Canada, Israel, Korea, the United Kingdom and the United States, property tax revenues amounted to more than 10% of total revenues in 2020. By contrast, property taxes accounted for less than 1% of total revenues in the Czech Republic, Estonia and Lithuania.

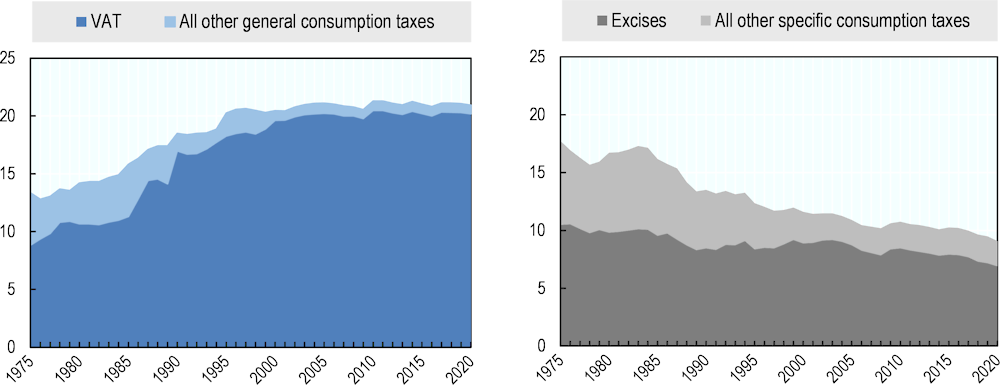

Consumption taxes

The share of taxes on consumption (general consumption taxes plus specific consumption taxes) fell from 38.4% to 32.1% between 1965 and 2020 (Figure 1.6).

During this period, the composition of taxes on goods and services has fundamentally changed. A fast-growing revenue source has been general consumption taxes, especially VAT, which is imposed in 37 of 38 OECD countries.5

General consumption taxes accounted for 20.9% of total tax revenue in 2020, compared with only 11.9% in the mid-1960s. In 2020, the vast majority of this was from VAT (20.2% of total tax revenues).

The increased importance of VAT has served to counteract the diminishing share of specific consumption taxes, such as excises and custom duties.

Between 1975 and 2020, the share of specific taxes on consumption (mostly on tobacco, alcoholic drinks and fuels, as well as some environment-related taxes) almost halved, from 17.7% to 9.1% of total revenues. In 2020, excises were the largest single category of total revenues under this heading, accounting for 6.9% of total revenues (Figure 1.8).

Rates of taxes on imported goods were considerably reduced across all OECD countries, reflecting a global trend to remove trade barriers.

Nevertheless, countries such as Greece, Hungary, Latvia, Lithuania, Mexico, Poland, Portugal and the Slovak Republic (between 11%-15%) and Türkiye (22.4%) still collected a relatively large proportion of their tax revenues through taxes on specific goods and services in 2020.

Figure 1.8. Share of general consumption tax revenues (left panel) and specific consumption revenues (right panel) as % of total revenues, 1975-2020

Note: The unweighted average for each year includes all countries which report revenue in the categories shown in that year. The OECD averages for 2016 include the one-off revenues from stability contributions in Iceland.

Source: Secretariat calculations based on chapter 4.

Taxes by level of government

This section discusses the relative share of tax revenues attributed to the various sub-sectors of general government in 2020. The different sub-sectors are:

Central government

State government (federal and regional countries only)

Local government

Social security funds

Supranational authorities (EU countries only)

The guidelines for attributing these revenue shares to the different levels of government are based on the final version of the 2008 System of National Accounts. These guidelines are discussed in the special feature S.1 in the 2011 edition of OECD Revenue Statistics.

Revenues of sub-national government in federal and unitary countries

Eight OECD countries have a federal structure. Among these countries, central government received 51.9% of total revenues in 2020 on average. The second-highest share of revenues on average was received by social security funds, which are a sub-sector of general government, at 22.2% of total revenues, followed by 17.8% at the state level and 7.9% at the local level (Table 1.3). However, within countries there was considerable variation around these means:

In 2020, the share of central government receipts in the eight federal OECD countries varied from 27.5% in Germany to 80.9% in Australia.

In 2020, the share of the states varied from 2.1% in Austria, 3.9% in Mexico and 11.1% in Belgium to 39.2% in Canada. The share of local government varied from 1.5% in Mexico to 15.5% in the United States and 15.7% in Switzerland.

Between 1975 and 2020, the share of federal government revenues declined by over 15 p.p. in Belgium and by more than 6 p.p. in Canada and the United States.

The share of federal government revenues increased in Austria by over 11 p.p. There was little change in Australia.

Of the seven federal countries with social security funds, five increased the share of revenue between 1975 and 2020. The exceptions were Canada and Mexico, where the share declined between 1975 (1980 for Mexico due to data availability) and 2020.

Colombia and Spain, which are classified as regional rather than unitary countries because of their highly decentralised political structure, have very different compositions by level of government. In Colombia, the share of central government receipts was 71.9% in 2020, with regional governments receiving 4.8% of total revenues and local governments receiving 13.3%. In Spain, the share of central government receipts in 2020 was 37.4% compared with 16.6% for regional governments and 8.8% for local governments.

Table 1.3. Attribution of tax revenues to sub-sectors of general government as % of total tax revenue, federal countries

Per cent

|

Supranational |

Central government |

State or Regional government |

Local government |

Social Security Funds |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

|

|

Federal countries |

|||||||||||||||

|

Australia |

.. |

.. |

.. |

80.1 |

77.5 |

80.9 |

15.7 |

19.0 |

15.7 |

4.2 |

3.4 |

3.4 |

0.0 |

0.0 |

0.0 |

|

Austria1 |

.. |

0.4 |

0.4 |

51.7 |

64.7 |

63.1 |

10.6 |

1.8 |

2.1 |

12.4 |

4.1 |

3.2 |

25.3 |

29.0 |

31.1 |

|

Belgium1 |

1.4 |

1.0 |

0.9 |

65.3 |

60.1 |

49.5 |

.. |

1.8 |

11.1 |

4.4 |

4.8 |

5.1 |

28.8 |

32.2 |

33.4 |

|

Canada |

.. |

.. |

.. |

47.6 |

39.1 |

41.1 |

32.5 |

37.1 |

39.2 |

9.9 |

9.8 |

10.2 |

10.0 |

14.0 |

9.5 |

|

Germany |

1.2 |

0.6 |

0.5 |

33.5 |

31.4 |

27.5 |

22.3 |

21.6 |

24.0 |

9.0 |

7.4 |

8.2 |

34.0 |

39.0 |

39.7 |

|

Mexico |

.. |

.. |

.. |

.. |

73.9 |

80.7 |

.. |

2.8 |

3.9 |

.. |

1.5 |

1.5 |

.. |

21.8 |

13.9 |

|

Switzerland1 |

.. |

.. |

.. |

30.7 |

31.7 |

33.5 |

27.0 |

24.0 |

25.6 |

20.3 |

17.5 |

15.7 |

22.0 |

26.8 |

25.2 |

|

United States |

.. |

.. |

.. |

45.4 |

41.4 |

38.6 |

19.5 |

20.0 |

21.1 |

14.7 |

13.3 |

15.5 |

20.5 |

25.2 |

24.8 |

|

Unweighted average |

1.3 |

0.7 |

0.6 |

50.6 |

52.5 |

51.9 |

21.3 |

16.0 |

17.8 |

10.7 |

7.7 |

7.9 |

20.1 |

23.5 |

22.2 |

|

Regional countries |

|||||||||||||||

|

Colombia2 |

.. |

.. |

.. |

.. |

63.2 |

71.9 |

.. |

5.5 |

4.8 |

.. |

8.6 |

13.3 |

.. |

22.7 |

9.9 |

|

Spain2 |

.. |

0.8 |

0.6 |

48.2 |

51.1 |

37.4 |

.. |

5.0 |

16.6 |

4.3 |

8.6 |

8.8 |

47.5 |

34.6 |

36.6 |

.. Not available

1. The total tax revenue has been reduced by the amount of any capital transfer that represents uncollected taxes.

2. Colombia and Spain are not constitutionally federal countries, but both have a highly decentralised political structure, with high autonomy of their territorial entities.

The remaining twenty-eight OECD countries have a unitary structure. In these countries, an average of 62.4% of revenues were derived at the central level in 2020, with 26.1% accounted for by social security funds. A further 11.1% were raised by local governments. Among unitary OECD countries:

The share of central government receipts in 2020 varied from 32.1% in France to 93.9% in New Zealand.

The local government share varied from 0.8% in Estonia to 36.8% in Sweden.

Between 1975 and 2020, there were increases in the local government share in excess of 5 p.p. in six countries: France, Iceland, Italy, Korea, Portugal and Sweden. Decreases of 5 p.p. or more in the other direction occurred in three countries: Ireland, Norway and the United Kingdom.6

Between 1975 and 2020, there were increases in the share of social security funds of 7 p.p. or more in four countries (Finland, France, Japan and Korea) and corresponding decreases in two countries (Italy and Norway).

Table 1.4. Attribution of tax revenues to sub-sectors of general government as % of total tax revenue, unitary countries

Per cent

|

Supranational |

Central government |

State or Regional government |

Local government |

Social Security Funds |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

1975 |

1995 |

2020 |

|

|

Unitary countries |

|||||||||||||||

|

Chile |

.. |

.. |

.. |

.. |

89.9 |

84.6 |

.. |

.. |

.. |

.. |

6.5 |

8.7 |

.. |

3.6 |

6.7 |

|

Costa Rica |

.. |

.. |

.. |

.. |

65.5 |

55.2 |

.. |

.. |

.. |

.. |

1.6 |

3.1 |

.. |

33.0 |

41.6 |

|

Czech Republic |

.. |

.. |

0.4 |

.. |

57.7 |

53.1 |

.. |

.. |

.. |

.. |

0.9 |

1.0 |

.. |

41.4 |

45.5 |

|

Denmark1 |

1.0 |

0.5 |

0.3 |

69.1 |

68.2 |

72.8 |

.. |

.. |

.. |

29.8 |

31.3 |

26.9 |

0.1 |

0.0 |

0.1 |

|

Estonia |

.. |

.. |

0.5 |

.. |

84.3 |

81.3 |

.. |

.. |

.. |

.. |

0.8 |

0.8 |

.. |

14.9 |

17.4 |

|

Finland |

.. |

0.4 |

0.4 |

56.0 |

46.6 |

47.5 |

.. |

.. |

.. |

23.5 |

22.3 |

24.7 |

20.4 |

30.8 |

27.4 |

|

France1 |

0.7 |

0.7 |

0.5 |

51.2 |

42.5 |

32.1 |

.. |

.. |

.. |

7.6 |

11.0 |

13.5 |

40.6 |

45.8 |

53.9 |

|

Greece |

.. |

0.6 |

0.5 |

67.1 |

66.3 |

63.6 |

.. |

.. |

.. |

3.4 |

2.0 |

2.5 |

29.5 |

31.0 |

33.3 |

|

Hungary |

.. |

.. |

0.4 |

.. |

63.8 |

64.2 |

.. |

.. |

.. |

.. |

2.5 |

5.2 |

.. |

33.6 |

30.2 |

|

Iceland |

.. |

.. |

.. |

81.3 |

79.2 |

70.2 |

.. |

.. |

.. |

18.7 |

20.8 |

29.8 |

0.0 |

0.0 |

0.0 |

|

Ireland |

2.3 |

1.5 |

0.6 |

77.4 |

83.1 |

83.8 |

.. |

.. |

.. |

7.3 |

2.7 |

1.1 |

13.1 |

12.7 |

14.6 |

|

Israel |

.. |

.. |

.. |

.. |

79.0 |

74.7 |

.. |

.. |

.. |

.. |

7.1 |

7.9 |

.. |

13.9 |

17.4 |

|

Italy |

.. |

0.4 |

0.4 |

53.2 |

62.7 |

56.7 |

.. |

.. |

.. |

0.9 |

5.4 |

11.0 |

45.9 |

31.5 |

31.8 |

|

Japan |

.. |

.. |

.. |

45.5 |

41.2 |

36.6 |

.. |

.. |

.. |

25.6 |

25.2 |

23.0 |

29.0 |

33.6 |

40.4 |

|

Korea |

.. |

.. |

.. |

89.0 |

69.2 |

53.0 |

.. |

.. |

.. |

10.1 |

18.7 |

19.0 |

0.9 |

12.1 |

28.0 |

|

Latvia |

.. |

.. |

0.6 |

.. |

43.5 |

51.1 |

.. |

.. |

.. |

.. |

19.5 |

17.9 |

.. |

36.9 |

30.4 |

|

Lithuania1 |

.. |

.. |

0.9 |

.. |

71.7 |

64.9 |

.. |

.. |

.. |

.. |

2.3 |

1.1 |

.. |

26.1 |

33.2 |

|

Luxembourg1 |

0.8 |

0.4 |

0.8 |

63.6 |

66.4 |

66.6 |

.. |

.. |

.. |

6.7 |

6.5 |

4.2 |

29.0 |

26.6 |

28.4 |

|

Netherlands |

1.5 |

1.3 |

1.1 |

58.9 |

56.0 |

61.3 |

.. |

.. |

.. |

1.2 |

3.1 |

3.5 |

38.4 |

39.5 |

34.1 |

|

New Zealand |

.. |

.. |

.. |

92.3 |

94.7 |

93.9 |

.. |

.. |

.. |

7.7 |

5.3 |

6.1 |

0.0 |

0.0 |

0.0 |

|

Norway |

.. |

.. |

.. |

50.6 |

57.6 |

83.1 |

.. |

.. |

.. |

22.4 |

20.0 |

16.9 |

27.0 |

22.4 |

0.0 |

|

Poland1 |

.. |

.. |

0.5 |

.. |

61.2 |

49.2 |

.. |

.. |

.. |

.. |

8.5 |

12.4 |

.. |

30.3 |

37.9 |

|

Portugal |

.. |

0.8 |

0.5 |

65.4 |

72.3 |

64.1 |

.. |

.. |

.. |

0.0 |

5.4 |

7.2 |

34.6 |

21.5 |

28.2 |

|

Slovak Republic |

.. |

.. |

0.4 |

.. |

62.6 |

54.9 |

.. |

.. |

.. |

.. |

1.3 |

2.1 |

.. |

36.1 |

42.6 |

|

Slovenia1 |

.. |

.. |

0.4 |

.. |

50.6 |

45.1 |

.. |

.. |

.. |

.. |

6.2 |

9.7 |

.. |

43.2 |

44.8 |

|

Sweden |

.. |

0.4 |

0.3 |

51.3 |

46.9 |

50.3 |

.. |

.. |

.. |

29.2 |

30.9 |

36.8 |

19.5 |

21.8 |

12.6 |

|

Türkiye |

.. |

.. |

.. |

.. |

75.1 |

60.9 |

.. |

.. |

.. |

.. |

12.8 |

9.4 |

.. |

12.1 |

29.7 |

|

United Kingdom |

1.0 |

1.0 |

0.4 |

70.5 |

77.5 |

73.0 |

.. |

.. |

.. |

11.1 |

3.7 |

5.6 |

17.5 |

17.8 |

21.0 |

|

Unweighted average |

1.2 |

0.7 |

0.5 |

65.2 |

65.6 |

62.4 |

.. |

.. |

.. |

12.8 |

10.2 |

11.1 |

21.6 |

24.0 |

26.1 |

.. Not available

1. The total tax revenue has been reduced by the amount of any capital transfer that represents uncollected taxes.

Composition of central and sub-central government revenues

Figure 1.9 shows revenues from each major category of tax revenue for central and sub-central governments. For federal and regional countries, the sub-central level includes revenues received by both state and local governments. Figure 1.9 demonstrates that:

Central government revenues in almost all OECD countries are predominantly derived from taxes on income and on goods and services, with a negligible share from property taxes.

At the subnational level, property taxes provide a much larger share of revenues than at the central level, and account for over 90% of revenues in four countries (Israel, Ireland, Greece and the United Kingdom).

By contrast, the share of income taxes and taxes on goods and services is lower at the sub-central level, the exceptions being Finland, Luxembourg and Sweden, where over 90% of sub-central revenues are derived from income taxes.

Figure 1.9. Composition of revenues of federal or central government (left) and sub-national government (right), 2020

Note: The left-hand panel (a) refers to only those taxes which are classified as central government taxes. Social security contributions paid to social security funds are excluded. The right-hand panel (b) refers only to those taxes which are classified as sub-central taxes (local and (where relevant) state taxes). Social security contributions paid to social security funds are excluded.

Source: Secretariat calculations based on tables 3.16 to 3.18.

Revenues paid to a supranational authority

The 22 member states of the European Union (EU) that are also members of the OECD collect taxes on behalf of the EU, as did the United Kingdom prior to 2020. These taxes primarily consist of customs duties and Single Resolution Fund (SRF) contributions.7 Both taxes are collected on behalf of the EU by national tax administrations and are included in the total tax figures under headings 5123 and 5126 at the SUPRA level of government. In addition, they are shown as a memorandum item separately from the main figures since they represent a tax imposed by the EU and collected by national administrations.8

Table 1.5 shows the level of taxes collected on behalf of supranational governments in EU countries that are also OECD members, divided into those countries in the Euro area and other EU member countries.

Table 1.5. Levies collected on behalf of the European Union, as % of GDP

Per cent

|

2000 |

2005 |

2010 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021p |

|

|---|---|---|---|---|---|---|---|---|---|---|

|

Euro area |

||||||||||

|

Austria, total supranational |

0.2 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.0 |

0.1 |

0.1 |

|

Belgium, total supranational |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

|

of which: Customs duties |

0.4 |

0.4 |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.3 |

0.3 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Estonia, total supranational |

.. |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

.. |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: SRF contributions |

.. |

.. |

.. |

.. |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Finland, total supranational |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.0 |

0.1 |

0.1 |

0.0 |

0.1 |

0.1 |

0.1 |

|

France, total supranational |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.0 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Germany, total supranational |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Greece, total supranational |

0.2 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.0 |

0.1 |

0.0 |

|

Ireland, total supranational |

0.2 |

0.1 |

0.1 |

0.1 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

|

of which: Customs duties |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions1 |

.. |

.. |

.. |

.. |

0.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

Italy, total supranational |

0.1 |

0.1 |

0.1 |

0.3 |

0.2 |

0.3 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions2 |

.. |

.. |

.. |

0.1 |

0.0 |

0.1 |

0.1 |

0.0 |

0.1 |

0.1 |

|

Lithuania, total supranational |

.. |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

of which: Customs duties |

.. |

0.2 |

0.2 |

0.3 |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Latvia, total supranational |

.. |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

.. |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Luxembourg, total supranational |

0.1 |

0.1 |

0.0 |

0.1 |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.4 |

|

of which: Customs duties |

0.1 |

0.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.3 |

0.3 |

|

Netherlands, total supranational |

0.4 |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.5 |

|

of which: Customs duties |

0.3 |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Portugal, total supranational |

0.2 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Slovak Republic, total supranational |

.. |

0.1 |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

|

of which: Customs duties |

.. |

0.1 |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

|

of which: SRF contributions |

.. |

.. |

.. |

.. |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Slovenia, total supranational |

.. |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.2 |

0.2 |

|

of which: Customs duties |

.. |

0.1 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Spain, total supranational |

0.2 |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

0.1 |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.2 |

|

of which: SRF contributions |

.. |

.. |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Non-euro area |

||||||||||

|

Czech Republic, total supranational |

.. |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.2 |

|

of which: Customs duties |

.. |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.2 |

|

Denmark, total supranational |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: Customs duties |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Hungary, total supranational |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: Customs duties |

.. |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Poland, total supranational |

.. |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

of which: Customs duties |

.. |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

Sweden, total supranational |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

of which: Customs duties |

0.1 |

0.1 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

United Kingdom, total supranational3 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

.. |

|

of which: Customs duties |

0.2 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.1 |

.. |

.. Not available

Note: SRF figures may differ slightly from those published on the SRB website. These differences are primarily due to timing. Details on these revenues for each country can be found in Chapters 4 and 5.

1. In 2016, the figure includes the 2016 payment of 99.12 and also a payment of 75.89 which was due in Quarter 4 of 2015 but was paid in Quarter 1 of 2016. The figures in this table were reported by the Central Statistics Office and are gross amounts and therefore due to adjustments will differ from the figures reported on the SRB website, which are net figures.

2. The “Bank contribution to the unique European Resolution Fund” amount includes not only the European but also the National Resolution Fund, as required by Eurostat classification.

3. Supranational taxes reported by the United Kingdom are reported until 2020 in Revenue Statistics. From 2021, at the end of the Brexit transition period, this came to an end and taxes subsequently introduced by the United Kingdom are reflected in the appropriate tax category at the national or subnational levels of government, as appropriate.

Source: Revenue Statistics 2022, supplemented by discussions with delegates.

In 2020, the combined total of payments collected for the EU was highest in Belgium and the Netherlands, at 0.4% of GDP. Levels above 0.2% of GDP were also seen in France, Germany, Greece, Lithuania, Luxembourg and Spain. All other EU countries that are also members of the OECD collected revenues on behalf of the EU equivalent to between 0.1% and 0.2% of GDP. In all countries except Finland, France and Luxembourg, customs duties were the majority source of these revenues.

Non-wastable tax credits

OECD countries apply two kinds of tax credits to income taxes (both personal and corporate):

Non-payable or wastable tax credits are those that can only ever be used to reduce or eliminate a tax liability. They cannot be paid out to either taxpayers or non-taxpayers as a benefit. They are, therefore, the same as a tax allowance or relief.

In contrast, payable or non-wastable tax credits can be partitioned into two parts. One part is used to reduce or eliminate a tax liability in the same way as a wastable tax credit. The other part can be paid directly to recipients as a benefit payment when the benefit exceeds the tax liability.

The OECD methodology for classifying non-wastable tax credits is set out in paragraphs 25 and 26 of the Interpretative Guide. These state that only the part of a non-wastable tax credit that is used to reduce or eliminate a taxpayer’s tax liability should be subtracted in the reporting of tax revenues. This is referred to as the ‘tax expenditure component’ of the credit. In contrast, the part of the tax credit that exceeds the taxpayer’s tax liability and is paid to that taxpayer is treated as an expenditure item and not subtracted in the reporting of tax revenues. This part is referred to as the ‘transfer component’.

Table 1.6. Effect of alternative treatments of non-wastable tax credits, 2020

|

Non-wastable tax credits in billions of national currency |

Total tax revenue in billions of national currency |

Total tax revenue as a percentage of GDP |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Total value |

Transfer component |

Tax expenditure component |

Net basis |

Split basis (per current guidance) |

Gross basis |

Net basis |

Split basis (per current guidance) |

Gross basis |

|

|

Australia |

10.1 |

6.6 |

3.5 |

584.2 |

590.7 |

594.2 |

28.2 |

28.5 |

28.7 |

|

0.3 |

0.1 |

0.2 |

160.1 |

160.2 |

160.4 |

42.2 |

42.2 |

42.3 |

|

|

Belgium2 |

1.1 |

0.3 |

0.9 |

193.8 |

194.1 |

194.9 |

42.4 |

42.5 |

42.7 |

|

Canada3 |

18.3 |

13.6 |

4.7 |

742.4 |

756.0 |

760.7 |

33.6 |

34.3 |

34.5 |

|

Chile4 |

298.0 |

223.0 |

74.9 |

38 817.2 |

39 040.3 |

39 115.2 |

19.4 |

19.5 |

19.5 |

|

Czech Republic |

38.9 |

7.9 |

31.1 |

1 974.7 |

1 982.6 |

2 013.6 |

34.6 |

34.7 |

35.3 |

|

Denmark2 |

3.0 |

0.2 |

2.9 |

1 094.7 |

1 094.8 |

1 097.7 |

47.1 |

47.1 |

47.2 |

|

France2 |

26.1 |

14.3 |

11.7 |

1 033.2 |

1 047.6 |

1 059.3 |

44.7 |

45.3 |

45.8 |

|

Germany |

51.9 |

20.3 |

31.5 |

1 270.7 |

1 291.0 |

1 322.6 |

37.3 |

37.9 |

38.8 |

|

Iceland |

4.4 |

4.4 |

0.8 |

1 056.7 |

1 061.1 |

1 061.9 |

36.0 |

36.1 |

36.1 |

|

Ireland |

0.4 |

0.0 |

0.4 |

.. |

74.0 |

74.4 |

.. |

19.9 |

20.0 |

|

Israel |

1.3 |

0.0 |

1.3 |

420.6 |

420.6 |

421.9 |

29.6 |

29.6 |

29.7 |

|

Italy |

12.1 |

1.8 |

10.4 |

705.0 |

706.7 |

717.1 |

42.5 |

42.7 |

43.3 |

|

0.2 |

.. |

.. |

.. |

.. |

24.7 |

.. |

.. |

38.1 |

|

|

Mexico |

50.5 |

0.5 |

50.0 |

4 148.2 |

4 148.7 |

4 198.7 |

17.8 |

17.8 |

18.0 |

|

New Zealand |

3.0 |

1.4 |

1.5 |

114.2 |

115.6 |

117.1 |

33.4 |

33.8 |

34.2 |

|

Norway |

4.0 |

3.2 |

0.8 |

1 319.9 |

1 323.1 |

1 323.9 |

38.7 |

38.8 |

38.8 |

|

Slovak Republic5 |

0.4 |

.. |

.. |

.. |

.. |

32.4 |

.. |

.. |

35.2 |

|

Spain |

3.0 |

1.7 |

1.2 |

410.2 |

412.0 |

413.2 |

36.6 |

36.7 |

36.8 |

|

United Kingdom6 |

23.9 |

19.9 |

4.0 |

670.6 |

690.5 |

694.5 |

31.2 |

32.1 |

32.3 |

|

United States |

526.6 |

433.7 |

93.0 |

4 946.6 |

5 380.2 |

5 473.2 |

23.7 |

25.8 |

26.2 |

.. Not available

Note: In Revenue Statistics 2022 the tax revenue data are reported on a split basis, unless indicated otherwise.

1. The children’s tax credit is not regarded as a tax credit in Revenue Statistics and is treated entirely as an expenditure provision.

2. The total tax revenue has been reduced by the amount of any capital transfer that represents uncollected taxes.

3. Some non-wastable tax credits cannot be split into the transfer and tax expenditure components. Their total values have been added to the transfer component.

4. In Revenue Statistics 2022, the tax revenue data for Chile are reported on a net basis.

5. In Revenue Statistics 2022, the tax revenue data for Luxembourg and Slovak Republic are reported on a gross basis.

6. Please note that the non-wastable tax credit data for the United Kingdom is on a cash basis and includes estimates in some years. Please see the footnotes in the table for the United Kingdom in Chapter 5 for more information.

Table 1.6 provides information on the non-wastable tax credits in 2020 for those countries reporting them in Revenue Statistics 2022 (although it may be that some countries with non-wastable tax credits do not appear in the table). It shows the amount of the non-wastable tax credits and their two components together with the results of using the figures to calculate tax revenue values and the associated tax-to-GDP ratios. Table 1.6 also shows two alternative treatments:

The ‘net basis’, which treats non-wastable tax credits entirely as tax provisions, so that the full value of the tax credit reduces reported tax revenues, as shown in columns 4 and 7.

The ‘gross basis’ is the opposite, treating non-wastable tax credits entirely as expenditure provisions, with neither the transfer component nor the tax expenditure component deducted from tax revenues, as shown in columns 6 and 9. This is the approach followed by the GFSM and the SNA.

Table 1.6 shows that, with some exceptions, the choice of method for reporting non-wastable tax credits has only a small impact on the ratio of total tax revenue to GDP. For the countries with available data, the difference between the ratios on a net basis and on a gross basis is one percentage point or more in only France, Germany, the United Kingdom and the United States, and between half a percentage point and one percentage point in Canada, the Czech Republic, Italy and New Zealand.

Financing of social security-type benefits in OECD countries

A memorandum item9 in Revenue Statistics 2022 describes the financing of social security-type benefits in OECD countries. Unlike social assistance benefits, which are funded from general government revenues, social security-type benefits are funded via contributions to social security or to private insurance schemes, or by other earmarked sources of funding. These sources of financing include:

Earmarked financing from tax revenues:

1. Social security contributions (category 2000 in the OECD classification)

2. Other taxes earmarked for social security-type benefits

Earmarked financing from non-tax revenues:

3. Voluntary contributions to the government (VCG)

4. Compulsory contributions to the private sector (CCPS)

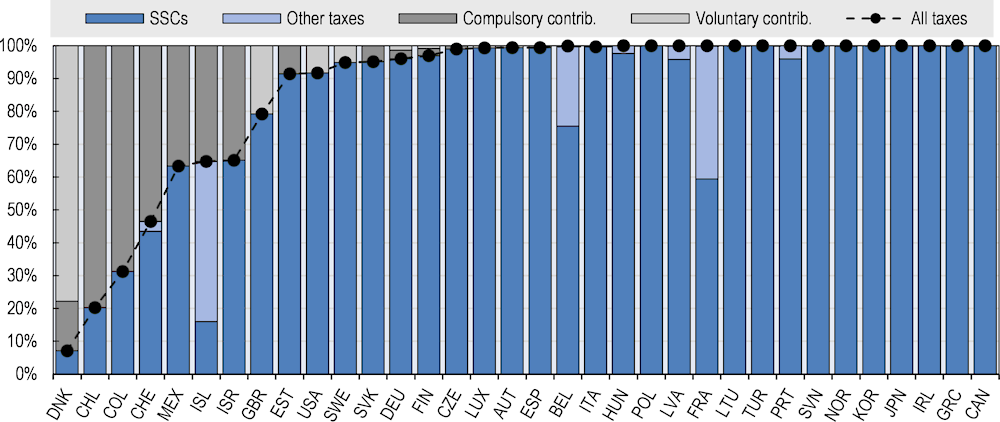

Figure 1.10 shows the relative contribution of each of these sources to financing for social security-type benefits in OECD countries, based on data provided by countries for inclusion in the memorandum item in Revenue Statistics 2022.

Figure 1.10. Composition of earmarked financing for social security-type benefits, 2020

Note: Two countries (Australia and New Zealand) provide social benefits via social assistance rather than via social security, so are not included in the table. In addition, Costa Rica and the Netherlands are also not included in the figure as complete data on contributions were not available in Revenue Statistics. The figures for Denmark should be interpreted with care as the level of social security-type benefits is very small compared to the level of social assistance benefits. Further, there may be borderline issues in some countries when distinguishing between quasi-compulsory and voluntary schemes.

Source: Secretariat calculations based on chapter 4

Taxes represent the largest source of earmarked financing for social security-type benefits, predominantly via social security contributions. Together, social security contributions and other earmarked taxes account for over 90% of the financing of social security-type benefits in 26 OECD countries and 100% in 11 countries. In the remaining nine OECD countries that provide this data, compulsory contributions to the private sector play a larger role, at 79.7% in Chile, 68.7% in Colombia and 53.5% in Switzerland, with smaller shares in Iceland, Mexico and Israel. Few countries received significant shares of voluntary contributions: only in the United Kingdom and Denmark do these exceed 10% of financing.

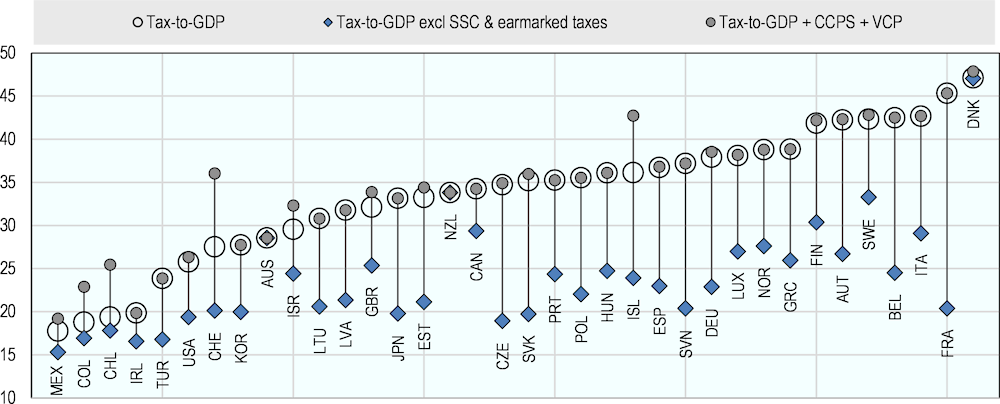

Figure 1.11 shows tax-to-GDP ratios (as in Table 1.1 and Figure 1.4) both exclusive of earmarked funding for social security-type benefits (i.e. tax-to-GDP ratios less social security contributions and other earmarked taxes) and inclusive of all non-tax earmarked financing for social security-type benefits (i.e. tax-to-GDP ratios - including social security contributions and other earmarked taxes - plus compulsory contributions to the private sector and voluntary contributions to government).

The countries with the largest share of social security-type schemes financed by non-tax earmarked contributions are Switzerland (8.5% of GDP), Iceland and Chile (6.6% and 6.1% respectively), which materially affects their rankings:

Switzerland has a relatively low tax-to-GDP ratio among OECD countries, at 27.5%, but its combined ratio is above halfway in the OECD distribution.

Iceland has a tax-to-GDP ratio of 36.1%, in the top-third of OECD countries, and a combined ratio of 42.7%, which is the fourth-highest in the OECD.

Chile has the third-lowest tax-to-GDP ratio and the fifth-lowest combined ratio.

Figure 1.11. Tax-to-GDP ratios and earmarked social security financing (% of GDP, 2020)

Note: Costa Rica and the Netherlands are not included in the figure as complete data on social security financing in both countries were not available.

Source: Secretariat calculations based on data in chapter 4.

Excluding earmarked financing for social security benefits from the tax-to-GDP ratio does not affect Australia, Denmark and New Zealand, where benefits are funded out of general taxation. Figure 1.11 highlights that the largest share of earmarked funding for social security-type benefits is seen in France, at 25.0% of GDP, as indicated by the difference between the highest and lowest points on the figure. Belgium, Iceland, the Slovak Republic and Slovenia have the next highest shares, at between 16% and 19% of GDP.

Notes

← 1. Provisional 2021 figures are not available for Australia and provisional figures on social security contributions in Japan are also not available as at the time Revenue Statistics 2022 was published.

← 2. As Hungary reports revenues on a cash basis for the preliminary year, data for 2021 in this edition of Revenue Statistics may change in future editions of the publication once accrual data are available.

← 3. The difference between the increase in nominal tax revenues (5.06%) and nominal GDP (5.12%) in New Zealand is only visible on the second decimal place, such that the chapter refers to the tax-to-GDP ratio being unchanged between 2020 and 2021 even though nominal GDP rose by slightly more than nominal tax revenues.

← 4. In 2016, Iceland received revenues from one-off stability contributions from entities that previously operated as commercial or savings banks and were concluding operations. The revenue from these contributions led to unusually high tax revenues for a single year and consequently, Iceland’s tax-to-GDP ratio rose from 35.1% in 2015 to 50.3% in 2016, before dropping to 37.1% in 2017. This led to an artificial high in the OECD average tax-to-GDP ratio in 2016 of 33.6%. Without these one-off revenues in Iceland, the OECD average tax-to-GDP ratio would have been 33.1%, an increase of 0.2 p.p. relative to 2015.

← 5. The terms “value-added tax” and “VAT” are used to refer to any national tax that embodies the basic features of a value-added tax by whatever name or acronym it is known e.g. “Goods and Services Tax” (“GST”).

← 6. For 1975, please see Table 1.4 of Revenue Statistics 2022.

← 7. The Single Resolution Fund (SRF) has been in place since 2015. Countries in the Eurozone are required to make SRF contributions under the Single Resolution Mechanism (Regulation (EU) No 806/2014). Contributions are paid on an ex-ante basis and contributions are transferred from the national authorities to the SRF. So far, contributions have been collected for the years 2015 to 2021.

← 8. In addition, EU civil servants pay income taxes and social security contributions directly to the EU. These revenues are not included in the data for total tax revenues in this publication as they are not paid to or collected by a national government. However, for the four countries with the highest number of EU civil servants (Belgium, Luxembourg, Italy and Germany), a memorandum account at the end of the respective country table in Chapter 5 provides information on the scale of these payments.

← 9. The financing of social security-type benefits is shown in Table 4.77 on a comparable basis (percentage of GDP) and in Table 5.39 on a national currency basis.