Chapter 2 examines the impact of COVID-19 on tax revenues in OECD countries in 2021, the second year of the pandemic. In 2021, tax policies supported a rebound in economic activity, employment and revenues across the OECD following the widespread declines in gross domestic product (GDP) and tax revenues experienced in 2020. The chapter uses preliminary data on revenues by tax type to analyse the ongoing impact of the pandemic on personal and corporate income taxes, social security contributions, property taxes, VAT and excises, considering changes in nominal terms and as a share of GDP. It compares revenue changes from different tax types in 2020 and 2021.

Revenue Statistics 2022

2. The impact of COVID-19 on OECD tax revenues

Abstract

Introduction

Although the COVID-19 pandemic continued in 2021, economies across the OECD recovered strongly from the shock experienced in 2020. On average, gross domestic product (GDP) grew by 5.5% in the OECD, following a contraction of 4.6% in 2020, bringing output close to pre-pandemic levels in most countries (OECD, 2022[1]). The development and roll-out of COVID-19 vaccines combined with continued policy support for households and businesses and favourable financial conditions underpinned this recovery, which was accompanied by a recovery in labour markets in many parts of the OECD. The unemployment rate in the OECD in 2021 was lower than the pre-pandemic average.

As discussed in Chapter 1, the economic recovery was accompanied by an upturn in tax revenues. Nominal tax revenues increased in all 38 countries between 2020 and 2021, with the year-on-year increase in tax revenues exceeding GDP growth in a majority of cases. Fiscal positions recovered as a result. On average, the fiscal deficit for OECD countries declined from 10.4% of GDP in 2020 to 7.4% in 2021, but stayed significantly above pre-pandemic levels. At USD 15.1 trillion, central government borrowing also remained well above pre-pandemic levels in 2021, despite declining slightly from USD 16.4 trillion in 2020 (OECD, 2022[2]). However, inflationary pressures emerged over the course of the year: the average inflation rate was 5.2% in the fourth quarter of 2021, versus 1.5% in 2020 and a long-term average of 1.7% (OECD, 2022[1]).

This chapter uses preliminary data for 2021 to analyse changes in tax revenues across the OECD during the second year of the pandemic. It identifies major trends in tax policy in OECD countries in 2021 in the context of a strong recovery from the initial impact of the COVID-19 pandemic. It explores how revenues from different tax types performed in 2021, tracking their changes both in nominal terms and as a share of GDP. It then compares these changes with those observed in 2020, and it analyses the relationship between changes in tax levels and in GDP for the main tax types in both years, thereby showing which taxes have been most affected over the course of the pandemic.

Overview: changes to total tax revenues, GDP and the tax-to-GDP ratio

Impact of COVID-19: changes in 2021 relative to 2020

As highlighted in Chapter 1, the average OECD tax-to-GDP ratio increased by 0.6 percentage points (p.p.) in 2021 relative to 2020 to 34.4% of GDP. Increases in the tax-to-GDP ratio were observed in 26 out of 37 OECD countries for which data is available over the same period1, while 11 countries recorded a decline in their tax-to-GDP ratio.

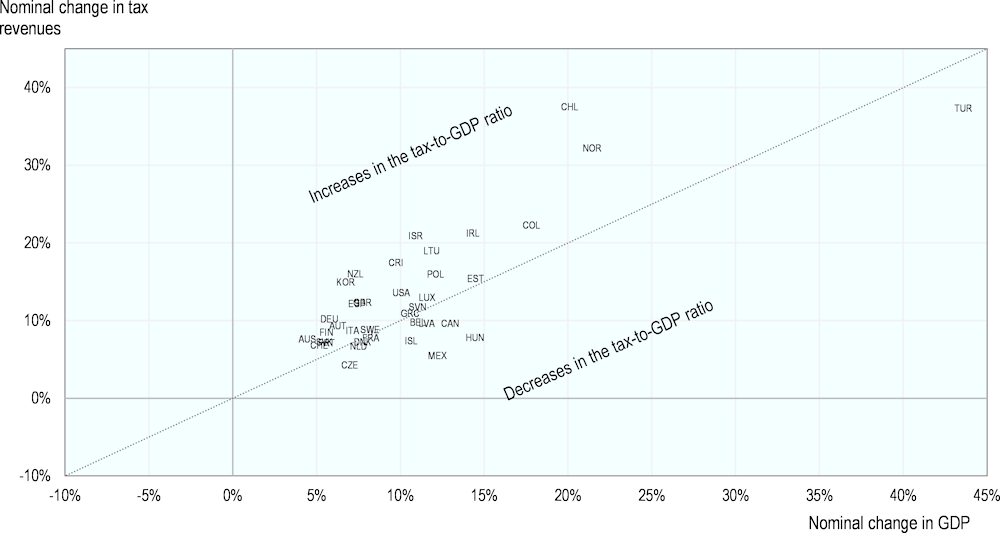

Figure 2.1 shows the increases in nominal taxes and nominal GDP across the OECD between 2020 and 2021. In all 37 countries for which data is available, both tax revenues and GDP increased in nominal terms. In the 26 countries where the tax-to-GDP ratio increased, the relative increases in nominal tax revenues were larger than the relative increases in GDP; in the other 11 countries, the opposite occurred.

In 2021, nominal tax revenues increased by 13.4% from the previous year on average across the OECD. Nineteen countries observed an increase in nominal tax revenues larger than 10%, with largest increases in Chile (37.5%), Türkiye (37.4%) and Norway (32.2%). The increase in tax revenues was larger than the increase in GDP in all 19 countries except Türkiye, where nominal GDP increased by 43.6% in 2021, resulting in a fall of 1.0 percentage point (p.p.) in the country’s tax-to-GDP ratio.

In the 11 countries where the tax-to-GDP ratio declined between 2020 and 2021, revenues grew by less than 10% in nominal terms, with the exception of Türkiye. Among the countries where the tax-to-GDP ratio decreased in 2021, Hungary2 and the Czech Republic also recorded a decline in their tax-to-GDP ratio in 2020.

Figure 2.1. Changes in nominal tax and nominal GDP, 2020-2021

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. Data for Australia and New Zealand show the change between the fiscal years 2019 and 2020, as both countries report tax revenues on a fiscal year basis that includes the first two quarters of 2021 in the 2020 fiscal year. Data for Japan are not included as data on SSC revenues are not available. See Box 2.1 for more information. The diagonal line across the graph represents the point at which the change in tax revenues and in GDP were of the same magnitude and therefore the point at which the tax-to-GDP ratio remained unchanged. Countries above the diagonal line had increases in their tax to GDP ratios; countries below it had falls.

Source: Revenue Statistics 2022 and authors’ calculations.

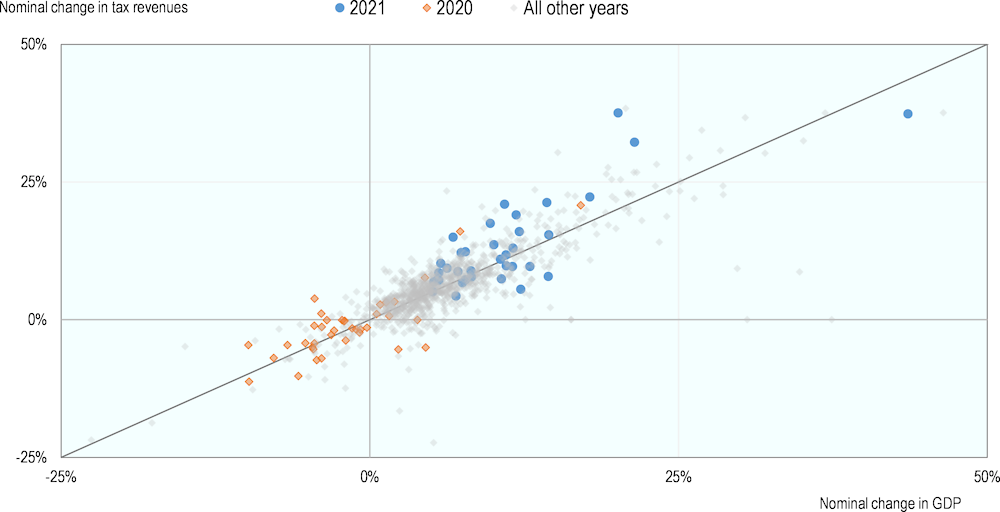

During the first year of the pandemic in 2020, tax-to-GDP ratios increased from the previous year in 20 out of 38 OECD countries and the average tax-to-GDP ratio remained unchanged. However, the increases in 2020 occurred in a context of declining nominal revenues and declining GDP, whereas both rebounded strongly in 2021. This is shown by Figure 2.2, which shows changes in tax revenues and GDP in individual OECD countries in 2020 (the orange dots) and in 2021 (the blue dots).3

Figure 2.2. Changes in nominal tax and nominal GDP, all years

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. Outliers have been excluded to improve the readability of the figure. The grey dots show nominal changes in tax revenues and GDP in OECD countries since 1995.

Source: Revenue Statistics 2022 and authors’ calculations.

As the orange dots in Figure 2.2 demonstrate, tax revenues and GDP declined in nominal terms in 2020 in most OECD countries. In total, 25 countries recorded a decline in GDP and tax revenues in 2020, two countries recorded an increase in tax revenues but a decline in GDP, three recorded a decline in tax revenues but an increase in GDP, and eight recorded an increase in both indicators. Where tax-to-GDP ratios increased in 2020, this tended to be because GDP (the denominator in the tax-to-GDP ratio) in most countries shrunk by more than tax revenues (the numerator) during the first year of the COVID-19 crisis.

In 2021, on the other hand, nominal tax revenues and nominal GDP both rose in all countries in the OECD for which data are available. In general, the increases in tax revenues and GDP recorded in 2021 (as shown by the blue dots in Figure 2.2) were larger than the declines in 2020, suggesting a strong economic rebound and recovery in tax revenues, at least in nominal terms. However, it is important to note that inflation rose sharply over the course of 2021.

Box 2.1. Tax types considered and country coverage

Tax types considered in the analysis

This chapter considers changes in both total tax revenues and several individual categories of tax revenues of particular size or policy significance. These taxes include:

Table 2.1. Individual tax types used in this chapter

|

Detailed tax types |

Acronym |

Corresponding Revenue Statistics 2022 codes |

|---|---|---|

|

Personal income tax |

PIT |

1100 Personal income tax |

|

Corporate income tax |

CIT |

1200 Corporate income tax |

|

Social security contributions & payroll taxes |

SSC |

2000 Social security contributions; 3000 Payroll taxes |

|

Property taxes |

Prop. |

4000 Taxes on property |

|

Value-added taxes |

VAT |

5111 Value-added taxes |

|

Excises |

Exc. |

5121 Excises |

|

Other consumption taxes |

OCT |

All other taxes under 5000 (5112, 5113, 5122, 5123, 5124, 5125, 5126, 5127, 5128, 5200, 5300) |

|

Residual |

Res. |

1300 Unallocable between 1100 and 1200; 6000 Other taxes |

Information is presented for two different indicators: tax revenues in nominal currency and tax revenues as a share of GDP. The GDP data that is used for each country is the same as shown in Table 3.19 of the publication, except for adjustments related to the assumptions about fiscal years noted below. The averages shown in this chapter are unweighted. For the reasons detailed below, they may differ from the other averages for 2021 presented elsewhere in the report.

Caveats for individual countries

All OECD countries other than Australia, Japan and New Zealand provide data on a calendar year basis. In Australia and New Zealand, the fiscal year runs from 1 July of the current year to 30 June of the following year, whereas in Japan the fiscal year runs from 1 April in the current year to 31 March the following year. Japan’s fiscal year 2020 included the first quarter of 2021, while the first two quarters of 2021 occurred in fiscal year 2020 for Australia and New Zealand. In this chapter, the changes shown for Australia and New Zealand are from the 2019 to 2020 fiscal years for consistency between the two countries.

In a few countries, preliminary data for the year 2021 was only partially available at the time this publication was prepared. Data that was unavailable include:

Social security contributions in Japan: This chapter does not present data for SSCs or for total tax revenues for Japan, and Japan is not included in the averages for these two items. Data for Japan is included in the averages for all other tax types.

A breakdown of income tax revenues (between personal income tax [PIT, category 1100] and corporate income tax [CIT, category 1200] and of taxes on goods and services (including VAT [category 5111] and excises [category 5121]) in Greece: In this chapter, data is shown for total income taxes (category 1000) and total taxes on goods and services (category 5000). Greece is not included in the averages for PIT, CIT, VAT or excises.

Tax revenue data are available for most OECD countries on an accrual basis, except for Chile, Colombia, Costa Rica, Israel, Korea, Mexico and Türkiye, which report on a cash basis. Information on PIT in Canada is also reported on a cash basis. In addition, preliminary 2021 data for Hungary are on a cash basis, while the final data for years up to and including 2020 are on an accrual basis.

It is worth noting that tax revenues in the OECD proved more resilient than elsewhere in 2020. In the Asia-Pacific region, tax revenues declined by 8.8% in nominal terms and the average tax-to-GDP ratio fell by 1.2 p.p. between 2019 and 2020 to 19.1%. In Latin America and the Caribbean, tax revenues declined by 8.0% in nominal terms and the average tax-to-GDP ratio fell by 0.8 p.p. between 2019 and 2020 to 21.9%. In Africa, tax revenues declined by 0.5% in nominal terms and the average tax-to-GDP ratio fell by 0.3 p.p. to 16.0%.

Table 2.2 shows the different dynamics of nominal GDP and nominal tax revenues in OECD countries over the first two years of the pandemic. Tax revenues grew more strongly than GDP in 2021 and did not decline as sharply as GDP in 2020, leading to an increase in the tax-to-GDP ratio in 2021, while 2020 remained unchanged. The table also confirms that the mean increase in tax revenues in 2021, of 13.4% in nominal terms, was far larger than the decline in tax revenues in 2020, of 1.8% in nominal terms. Similarly, mean GDP growth across the OECD in 2021, of 10.7% in nominal terms, far exceeded the fall in 2020, of 1.8%.

Table 2.2. Comparison of changes in nominal tax revenues and nominal GDP, 2020-21

Year-on-year % change

|

|

|

Mean |

Lower quartile |

Median |

Upper quartile |

|---|---|---|---|---|---|

|

Tax |

2020 |

-1.8 |

-4.6 |

-1.7 |

-0.1 |

|

|

2021 |

13.4 |

7.8 |

10.2 |

16.0 |

|

GDP |

2020 |

-1.8 |

-4.5 |

-2.2 |

0.8 |

|

|

2021 |

10.7 |

7.0 |

9.9 |

12.0 |

|

Tax/GDP |

2020 |

0.0 |

-0.6 |

0.1 |

0.6 |

|

|

2021 |

0.6 |

-0.2 |

0.6 |

1.3 |

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. The mean tax-to-GDP ratio in 2021 in this table differs from that shown in the other chapters in the report due to the use of the 2020 fiscal years for Australia and New Zealand in this chapter, for the reasons explained in Box 2.1.

Source: Revenue Statistics 2022 and authors’ calculations.

Tax policy reforms and revenue trends in 2021

The differing trends in tax revenues and GDP between 2020 and 2021 discussed in the previous section attest to the strong recovery by OECD countries following the initial shock of the COVID-19 pandemic. Tax policy played an important role in this recovery, as it did in supporting businesses and households during the downturn. This section begins by examining the evolution of tax policy in the second year of the pandemic in the context of this recovery. It then analyses revenues from different tax types in 2021, comparing changes in 2021 with those recorded in 2020 in nominal terms and as a share of GDP.

Tax policy reforms in 2021

Tax policy has been a critical tool in governments’ response to COVID-19 across the OECD. Over the course of the pandemic, the objectives of tax policy have evolved in line with the evolution of the pandemic itself and governments’ broader policy goals. In general, tax policy in 2020 was characterised by measures to protect workers and businesses from the disruptions caused by the pandemic, while there has been greater focus on policies to promote investment and accelerate the post-pandemic recovery in 2021. Some tax policy measures have evolved over the course of the pandemic to become more targeted, while others were eliminated altogether. While a majority of the measures were temporary, most of these temporary measures were extended beyond their initial duration. Other measures became permanent.

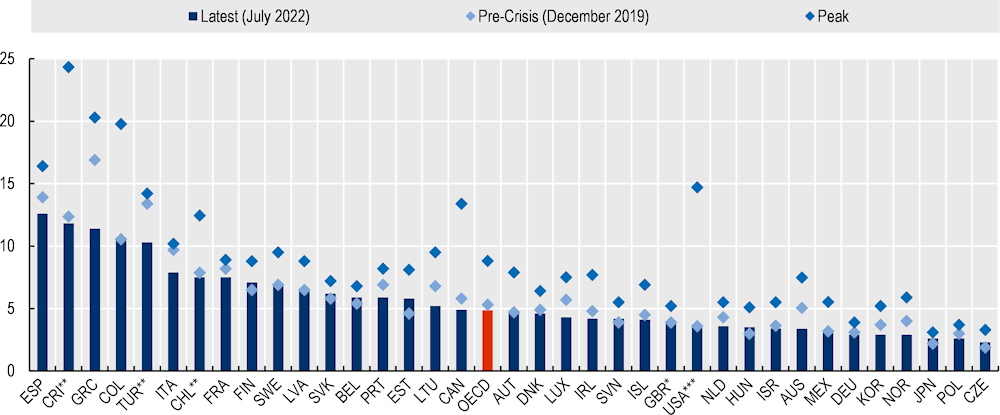

Labour markets rebounded in many parts of the OECD in 2021, with total employment and the unemployment rate returning to pre-pandemic levels by the end of the year on average, as shown in Figure 2.3 (OECD, 2022[3]). However, the recovery in employment has been uneven, with labour force participation and employment rates still below pre-crisis levels in some countries (OECD, 2022[3]). Employment growth has been stronger in high-pay service industries than in low-pay contact-intensive industries. Many young, low-paid and low-skilled workers, who were particularly vulnerable to the pandemic’s initial impact, have benefited relatively little from the recovery in the labour market; the youth employment rate is still below pre-crisis levels in over half of OECD countries. Long-term unemployment remained above pre-pandemic levels in 20 out of 32 countries for which data was available (OECD, 2022[3]).

Figure 2.3. Unemployment rate: pre-crisis, peak, and most recent

Note: For countries marked with *, the latest data refer to May 2022; for those marked with **, the latest data refer to June 2022; and for those marked with ***, the latest data refer to August 2022.

Source: OECD Short-term Labour Market Statistics.

Nonetheless, labour shortages emerged in many countries during the second half of 2021, with vacancy rates reaching historic highs in a number of OECD countries. Labour supply did not keep up with a surge in demand driven by the economic recovery and large-scale recovery plans, leading to shortages across many sectors. However, shortages also reflect workers’ reticence to take jobs in certain sectors due to tough working conditions and/or low pay. It is notable that, unlike the current situation, vacancies remained depressed two years after the Global Financial Crisis of 2008-09 (OECD, 2022[3]).

Changes to labour taxation in 2021 were primarily intended to boost economic growth and promote equity (OECD, 2022[4]). The most common measures were to narrow the base for personal income tax (PIT) in order to raise employment, provide in work-benefits, and support low-income families with children. A small number of countries reduced PIT rates, particularly for low- and middle-income households. Some countries introduced measures to narrow the social security contributions (SSC) base, while a smaller number lowered rates for SSCs, typically on a temporary basis. While many of the measures introduced in 2020 to help workers and households deal with the pandemic were withdrawn or scaled back in 2021, a number of countries introduced new measures in 2021.

The tax burden on labour in OECD countries decreased slightly for most household types on average in 2021, following sharp declines in 2020. However, for most household types in a majority of OECD countries, the tax wedge increased between 2020 and 2021 due to a combination of increases in average wages and the withdrawal of policies introduced in the first year of the pandemic. In most countries, increases to the tax wedge in 2021 more than offset the declines recorded in 2020 and the tax wedge has rebounded to higher levels than in 2019, before the pandemic (OECD, 2022[5]).

In 2021, the policy priority for corporate income tax (CIT) reforms was to stimulate investment and innovation (OECD, 2022[4]). To this end, a number of OECD countries introduced more generous corporate tax incentives, particularly for capital expenditure and research and development to promote environmental sustainability. This tendency contrasts with 2020, when CIT revenues were affected by widespread use of tax measures to support business liquidity and cash flow during the economic shock caused by the pandemic. Measures adopted in 2020 included deferrals of tax payments, filing extensions and flexible tax payment plans, applied in over 70% of OECD countries. Several OECD countries suspended or reduced prepayments of CIT, many of which were targeted at SMEs, and refunds of advance payments and CIT credits were accelerated in many jurisdictions (OECD, 2022[4]).

Also in 2021, 137 jurisdictions agreed to the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy, under which more than USD 125 billion of profits from around 100 of the world’s largest and most profitable multi-national enterprises will be reallocated to countries worldwide. The Two-Pillar agreement will also introduce a global minimum tax set at an effective rate of 15% (OECD, 2022[6]).

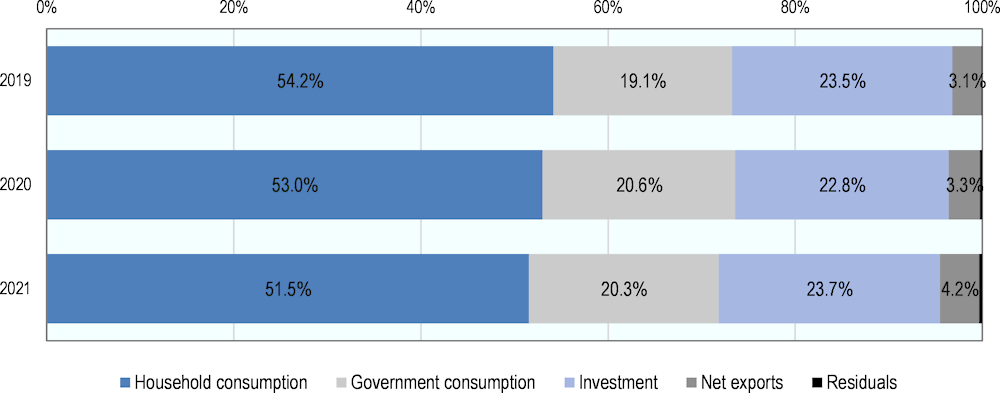

Retail spending grew strongly in 2021 and was well above pre-pandemic levels across the year (OECD, 2022[1]). However, household consumption continued to decline as a share of GDP in 2021, having also fallen in 2020 (Figure 2.4). Measured under the expenditure approach, investment and net exports rebounded strongly in 2021 after recording sharp declines in 2020. The share of government expenditure declined slightly in 2021 after increasing during the first year of the pandemic.

In the area of value-added tax (VAT), standard rates were largely maintained in 2021 but there were a large number of changes to the base. The majority of temporary changes to VAT rates that were introduced in 2020 to address the pandemic were withdrawn in 2021, except those related to medical supplies used to respond to the pandemic (OECD, 2022[4]). At the same time, some countries applied reduced VAT rates to a wider range of goods and services on a permanent basis in 2021 to address equity concerns. There was strong growth in e-invoicing and digital reporting requirements in 2021 as countries implemented reforms to e-commerce, whose expansion accelerated significantly as a result of the pandemic. Meanwhile, there were further increases in excise duties in 2021, especially on tobacco products (OECD, 2022[4]).

In the final quarter of 2021, a number of countries applied reduced VAT rates and lowered import duties and excise taxes on energy sources in order to shield households and firms from rising prices, a trend that continued into 2022 (OECD, 2022[4]). High energy prices have also prompted policy makers to impose changes to environmentally-related taxes. In 2021, progress on environmentally related taxation continued but at a slower pace than prior to the pandemic. Carbon taxes on fuels were expanded in 2021, and a selection of countries in the European Union introduced a tax on plastic (OECD, 2022[4]).

In 2021, there were fewer reforms to property taxes than in previous years. The majority of measures in this tax category involved increases in tax rates or a broadening of the tax base. These measures were mostly targeted at high net worth individuals or entities that use properties primarily as an investment vehicle. Reforms have increasingly focused on promoting the efficient use of the existing housing stock as well as the fairness of property taxation more generally (OECD, 2022[4]).

Figure 2.4. Composition of GDP (expenditure approach), 2019-21

Note: Data for 2021 are the average of 33 OECD countries for which these data were available.

Source: OECD National Accounts and authors’ calculations (accessed on 18/10/2022).

Changes in revenues from different tax types, 2020-2021

Against the backdrop of evolving tax policies and economic recovery described above, the revenue dynamics of different tax types varied between 2020 and 2021. This section analyses changes in revenues from the main tax categories between 2020 and 2021, both as a share of GDP and in nominal terms. Box 2.1 provides more information on the tax types considered.

Changes in revenues by tax type as a share of GDP

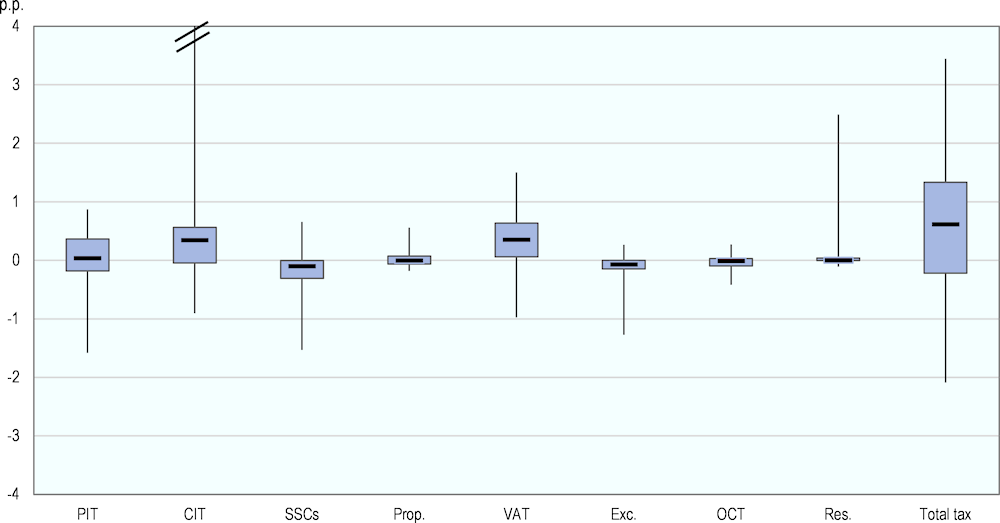

On average, the 0.6 p.p. increase in tax revenues as a percentage of GDP in OECD countries between 2020 and 2021 was driven by higher revenues from CIT and VAT (Figure 2.5).4 CIT revenues rose by 0.5 p.p. on average between 2020 and 2021, having recorded the largest decline of any major tax type between 2019 and 2020 (0.3 p.p.). VAT revenues rose by 0.4 p.p. in the second year of the pandemic, having remained unchanged as a proportion of GDP in 2020.5

Revenues from SSCs, on the other hand, declined by 0.2 p.p. on average in 2021, having risen by 0.3 p.p. in 2020. Revenues from excises also declined by 0.1 p.p., having fallen by the same amount in 2020. PIT revenues, which rose by 0.3 p.p. in 2020, remained unchanged as a share of GDP in 2021, while revenues from property taxes remained unchanged as a share of GDP in both years.

CIT revenues increased as a share of GDP in 24 of the 37 countries for which preliminary data are available in 2021, declined in nine and were unchanged in four. The largest increase was observed in Norway, where CIT revenues rebounded from a 3.6 p.p. decline in 2020 to rise by 7.3 p.p. in 2021 due to an increase in revenues from petroleum extraction following an exceptional decline the previous year. Eleven other countries observed increases in CIT revenues larger than 0.5 p.p. while only Chile observed a decline in CIT revenues in excess of 0.5 p.p. (0.9 p.p.), which was a result of the pandemic’s impact on the economy and policies to mitigate this impact on small firms.

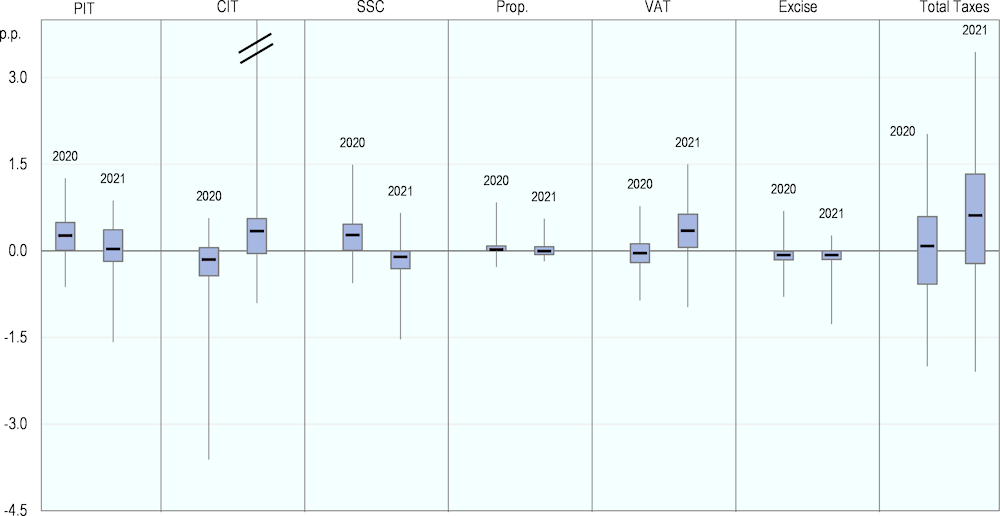

Figure 2.5. Changes in tax revenues by category as a share of GDP, 2020-21

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. In the figure, the lowest point represents the minimum country change for the tax type between 2020-2021; the box represents the changes for countries between the lower and upper quartiles (i.e. 50% of OECD countries had changes within the range shown by each box); and the upper point for each tax type represents the maximum country change. The line in each box represents the median country change (i.e. half of OECD countries were both above and below this line).

Source: Revenue Statistics 2022 and authors’ calculations.

Revenues from VAT increased as a share of GDP in 30 countries in 2021, remained unchanged in three and declined as a share of GDP in three. The increase in VAT revenues exceeded 0.5 p.p. in 13 countries, with the largest increase observed in Chile (1.5 p.p.). The largest decline occurred in Norway, where VAT revenues declined by 1.0 p.p., although in nominal terms revenues from VAT increased by 8.5% in Norway.

Excise revenues declined as a share of GDP in 21 countries, increased in six and were unchanged in ten. The largest decline, of 1.3 p.p., was recorded in Türkiye, and was caused by an automatic adjustment of taxes on fuel to compensate for higher prices. With the exception of the decreases in Norway (0.5 p.p.) and Mexico (0.4 p.p.), the changes in the other countries did not exceed 0.3 p.p.

PIT revenues increased as a share of GDP in 17 countries in 2021, declined in 14 and remained unchanged in seven. Increases exceeded 0.5 p.p. in seven countries, with the largest increases observed in Korea (0.9 p.p.), attributable to higher wages and employment as well as increases in revenues from capital gains, notably from real estate transactions. Estonia, the United Kingdom and Israel all recorded increases of 0.8 p.p. in PIT revenues; in the case of Estonia, this was partly driven by a pension reform in 2021. The decreases in PIT exceeded 0.5 p.p. in six countries, with the largest declines recorded in the Czech Republic (1.6 p.p.), Iceland (1.1 p.p.) and Denmark (1.0 p.p.). The fall in the Czech Republic was a result of a reduction of the employee tax base and an increase in tax credits.

SSCs increased as a share of GDP in eight countries, declined in 22 and were unchanged in six. The decreases were larger than 0.5 p.p. in five countries, with the largest falls recorded in Norway (1.5 p.p.), Hungary (1.0 p.p.) and Luxembourg (0.8 p.p.). Hungary reduced the SSC rate from 17.5% to 15.5% in July 2020. There was only one country – the Czech Republic – where the increase exceeded 0.5 p.p.; this was caused by an increase in minimum wages and also reflects the fact that SSCs fell sharply in 2020 as a result of a COVID-19 measure.

Property taxes increased as a share of GDP in 11 countries, declined in 13 and were unchanged in 13. None of the changes exceeded 0.3 p.p. except in Korea and Israel, where revenues from property taxes increased by 0.6 p.p. and 0.5 p.p. respectively. The increase in Korea was partly a consequence of higher real estate prices.

Box 2.2. The accuracy of preliminary data during the COVID-19 pandemic

The indicators shown in this chapter are based on preliminary data provided for the year 2021 as part of the data collection round for this year’s edition of Revenue Statistics. Normally, the publication does not place emphasis on these preliminary data as they are subject to revisions in future years. However, due to interest in the impacts of the COVID-19 pandemic on tax revenues, the special features for the 2021 and 2022 editions of Revenue Statistics use preliminary data to provide an initial snapshot of tax revenues during the first two years of the pandemic. While the data should be treated with caution, they nonetheless permit insights into the impact of COVID-19 on tax revenues across OECD countries.

Many macroeconomic indicators, including gross domestic product (GDP), are subject to revisions. Initial estimates are usually released one to two months after the reference period, aiming to strike a balance between the accuracy and timeliness of the results, in order to support economic analysis and decision-making. In most countries, more complete data become available over time and National Statistical Offices progressively revise their estimates to further improve their accuracy. The OECD frequently conducts studies into the size and direction of revisions across OECD countries, the most recent of which occurred in 2018 and provides a benchmark for analysing the scale of revisions for 2020 data.

Last year’s edition of Revenue Statistics advised that ‘initial estimates released during the pandemic may be subject to larger and more frequent revisions than normal’, reflecting unprecedented ‘collection, compilation and methodological challenges’, although it highlighted steps taken by the international statistical community to mitigate these challenges, including alternative or proxy data sources to assist in overcoming specific data gaps (OECD, 2021[7]). It also stated that preliminary data for 2020 might be subject to larger than normal revisions ‘due to the support measures introduced by governments to support households and businesses in the crisis, including the widespread use of tax deferrals, extension of filing deadlines and increased flexibility with the treatment of tax losses’.

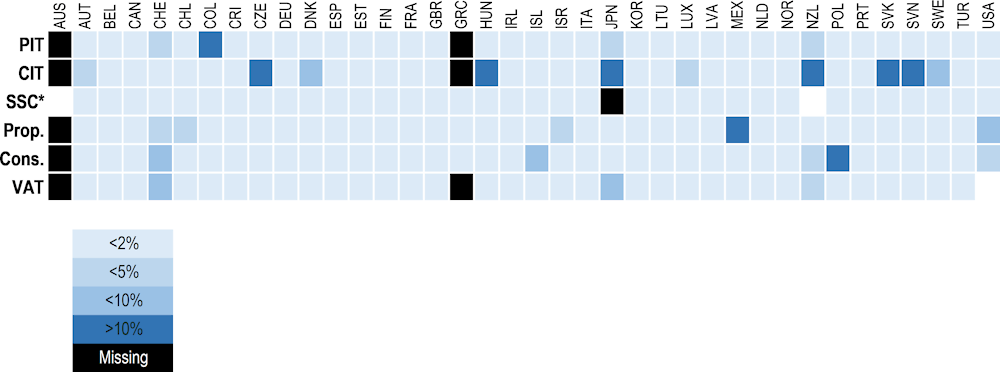

A comparison between the preliminary data for 2020 reported in the special feature of last year’s Revenue Statistics and final data for 2020 shown in Chapter 1 of this year’s edition reveals that a few OECD member states reported large adjustments to data for the first year of the COVID-19 pandemic, but the majority of data revisions were not significant. Figure 2.6 provides a snapshot of the change between preliminary and final data for the main tax types in 38 OECD countries. The shading in blue represents the difference in the share of each tax in GDP between the two datasets, with darker blue indicating larger variations.

Figure 2.6. Change between preliminary and final data for main tax types, 2020

Note: ‘Cons’ includes all consumption taxes (5000) except VAT. No shading indicates that the tax category did not exist in the country while black shading indicates that data was not available.

* ‘SSC’ in the graph refers to category 2000 only, unlike the rest of this chapter, which combines revenues from category 2000 and 3000. Please see Box 2.1 for more details.

Source: Revenue Statistics 2022 and authors’ calculations.

The percentage change in the share of each tax revenue type to GDP was below 2% in all but 27 of the 216 tax categories across all OECD countries. In only nine individual taxes of the 216 categories shown did the change from preliminary to final taxes result in a change greater than 10% of that tax’s share of GDP. Most of these larger changes were recorded in CIT revenues.

Preliminary and final data were also compared to examine whether differences between the two data sets would have significantly changed conclusions about changes in the tax-to-GDP ratios for all tax types between 2019 and 2020. In 137 (63%) of the 216 tax categories, there was little change in the level reported in the publication. Among the remaining 79 categories, there was a change in sign in 22 cases (i.e. one dataset indicated a positive change while the other showed a negative change).

By comparison, when preliminary data for 2018 was compared with final data for that year, five individual taxes out of 216 categories reported a change larger than 10% of that tax category’s share of GDP. When looking at changes in revenues from individual taxes as a share of GDP, revisions between preliminary and final data for 2018 resulted in a change of sign in eight cases.

Source: OECD Statistics and Data Directorate, country inputs and authors’ contributions.

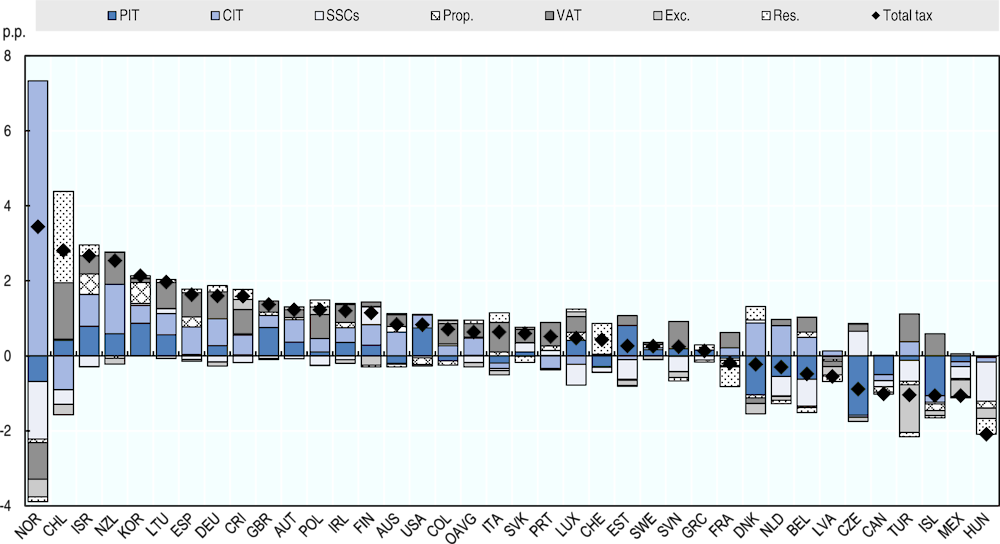

Figure 2.7 shows the decomposition of changes to the tax-to-GDP ratio in 37 OECD countries included in this analysis. In 18 of the 25 countries where the tax-to-GDP ratio increased between 2020 and 2021 (not including Greece for reasons of data aggregation), an increase in either CIT or VAT revenues was the main driver of the rise. However, it is notable that PIT increased as a share of GDP in 17 of these 25 countries – two fewer than was the case for CIT. PIT revenues declined as a share of GDP in all but two of the 11 countries whose tax-to-GDP decreased in 2021, underlining the importance of variations in this tax type to overall revenue levels.

Sixteen of the 26 countries whose tax-to-GDP ratio increased overall in 2021 experienced a decline in SSCs, while all but three of the countries whose tax-to-GDP ratio decreased overall experienced a decline in SSCs. Korea was the only country to record an increase across all the main tax types as a share of GDP between 2020 and 2021, while Canada and Hungary were the only countries not to record an increase in revenues from any of the main tax types as a share of GDP over the same period.

Figure 2.7. Decomposition of change in OECD tax-to-GDP ratios by tax category, 2020-21

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. This graph includes the change between years 2019 and 2020 for Australia and New Zealand, as both countries report tax revenues on a fiscal year basis that includes the first and second quarters of 2021 in the 2020 fiscal year. Due to data availability, the average excludes Japan; it also excludes Greece for PIT (category 1100), CIT (category 1200), VAT (category 5111) and excises (category 5121) due to disaggregated data for these categories not being available. Greece’s PIT data in the graph refers to its total income tax revenue.

Source: Revenue Statistics 2022 and authors’ calculations.

Changes in nominal tax revenues by tax type

Revenues from all tax types increased in nominal terms between 2020 and 2021. In total, mean tax revenues increased by 13.4%, while the median increase was 10.2%. Nominal GDP registered a mean increase of 10.7% and a median increase of 9.9% over the same period. Table 2.3 compares the distribution of changes in revenues from different tax types in nominal terms between 2020 and 2021 with the changes observed between 2019 and 2020, the first year of the pandemic.

In 2021, the largest increase in mean tax revenues was observed for CIT, which rose by 23.1% in nominal terms in 2021. This contrasts with results for 2020, when CIT revenues fell by 9.8%, the largest decline of any tax type in that year. CIT revenues increased in nominal terms in 34 out of the 37 countries for which data are available in 2021, with eight countries observing increases in excess of 40%.

Mean VAT revenues increased by 17.3% in nominal terms between 2020 and 2021. Revenues from VAT rose in all countries, with the increase exceeding 20% in nine. VAT revenues declined by 2.4% in nominal terms in 2020. Meanwhile, excise revenues registered the weakest mean growth in 2021, of 5.5% (versus a 5.4% decline in 2020). Excise revenues rose in nominal terms in 29 countries and declined in eight. The increase exceeded 10% in six countries while the decline exceeded this threshold in two countries.

Mean nominal revenues from PIT increased by 11.7% in 2021 while SSCs rose by 9.0%. PIT revenues rose in every country except one, with the increase exceeding 20% in seven countries. SSCs rose in every country that levies SSCs except one; the increase exceeded 10% in eight countries. In 2020, PIT was the only main tax category to record an increase in revenues in 2020 in nominal terms (of 1.9%); SSCs declined by 0.3% in nominal terms between 2019 and 2020. Revenues from property taxes, which rose by 0.1% in nominal terms in 2020, registered mean growth of 10.6% in 2021, rising in all but two countries. The increase in nominal revenues from property taxes was larger than 20% in five countries.

Changes in total tax revenues were closely correlated with changes in GDP in 2020 and 2021. However, there are some notable differences in the correlation of changes in different tax types with GDP between 2020 and 2021. In both 2020 and 2021, changes in VAT revenues were closely correlated with fluctuations in GDP. However, the correlation of changes in PIT revenues with GDP was significantly stronger in 2021 than in 2020, while the correlation between changes in GDP and revenues from CIT and excises became weaker over the same period, turning negative in the case of excises. Revenues from property taxes and SSCs were more closely correlated with GDP in 2021 than was the case in 2020.

Table 2.3. Distribution of nominal revenue changes by tax category and of GDP

|

2020-2021 |

2019-2020 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

Mean |

Lower quartile |

Median |

Upper quartile |

Correlation with GDP |

Mean |

Lower quartile |

Median |

Upper quartile |

Correlation with GDP |

|

PIT |

11.7 |

6.1 |

10.0 |

16.0 |

58.4 |

1.9 |

-1.1 |

1.0 |

4.7 |

22.1 |

|

CIT |

23.1 |

6.9 |

22.1 |

36.9 |

29.5 |

-9.8 |

-17.1 |

-8.6 |

-1.4 |

51.3 |

|

SSC |

9.0 |

5.2 |

7.5 |

9.7 |

31.9 |

-0.3 |

-2.9 |

0.4 |

2.2 |

30.1 |

|

Prop. |

10.6 |

4.5 |

9.1 |

15.4 |

42.8 |

0.1 |

-4.5 |

0.3 |

3.3 |

37.2 |

|

VAT |

17.3 |

9.7 |

14.4 |

19.7 |

80.4 |

-2.4 |

-8.1 |

-1.7 |

1.4 |

66.4 |

|

Exc. |

5.5 |

2.6 |

5.1 |

8.4 |

-3.8 |

-5.4 |

-11.0 |

-5.3 |

-1.7 |

70.8 |

|

Total Tax |

13.4 |

7.8 |

10.2 |

16.0 |

78.5 |

-1.8 |

-4.6 |

-1.7 |

-0.1 |

76.4 |

|

GDP |

10.7 |

7.0 |

9.9 |

12.0 |

.. |

-1.8 |

-4.5 |

-2.2 |

0.8 |

.. |

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details.

The correlation for CIT revenues and GDP in 2020 excludes Latvia, which saw a significant increase in CIT revenues in nominal terms (346.4%) due to the correction following abnormally high repayments in 2019, see the discussion above for more information) and the relatively low share of CIT to GDP in Latvia (0.2% in 2019 and 0.7% in 2020). If Latvia were included in the correlation for nominal CIT revenues in 2020, it would be 4.7%. Norway’s growth in CIT revenues in 2021 (of 394.6% in nominal terms) is excluded from calculations.

Source: Revenue Statistics 2022 and authors’ calculations.

Changes in revenue by tax type in 2020 and 2021

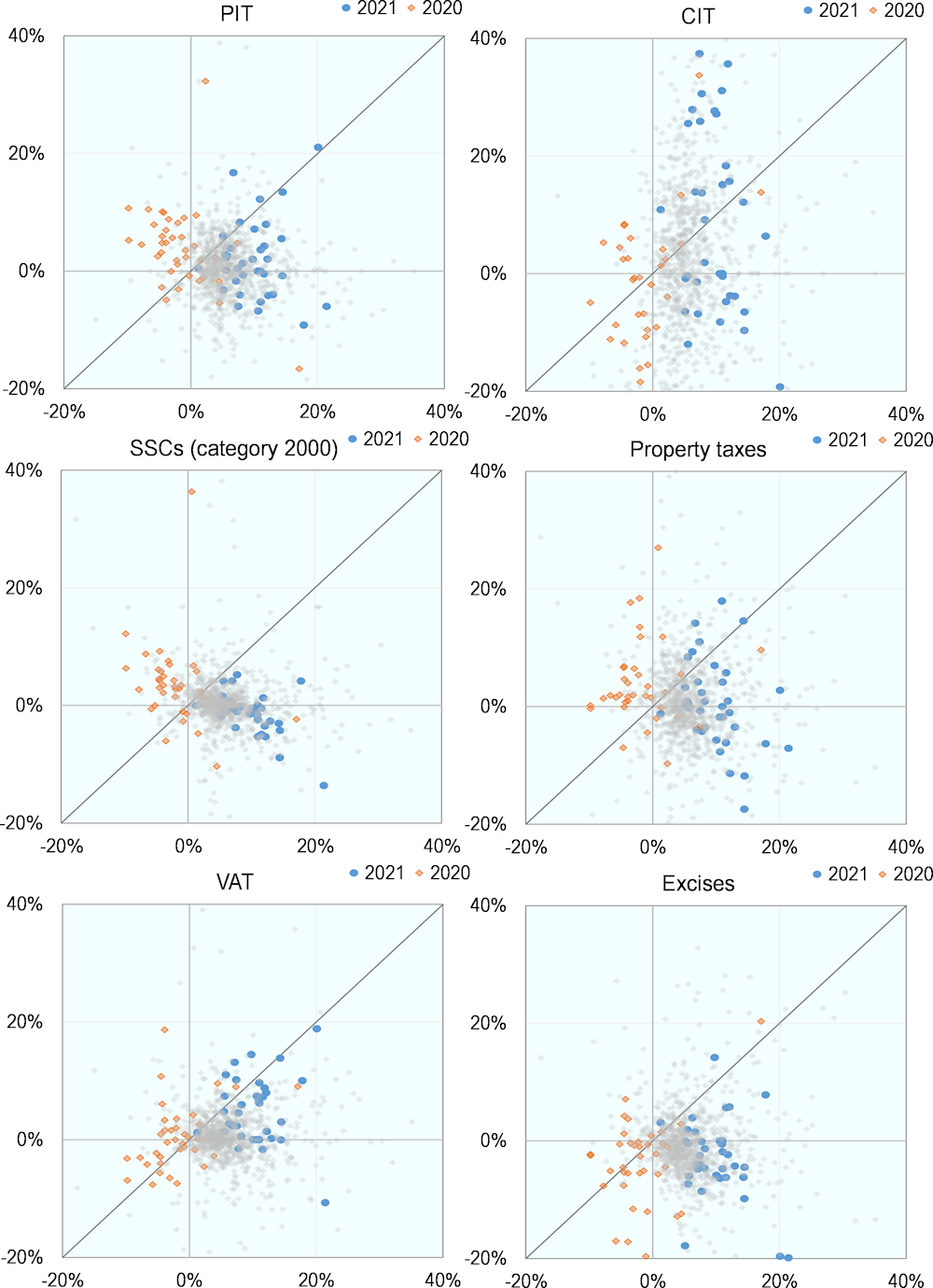

Figure 2.8 shows the distribution of changes in revenues from different taxes as a percentage of GDP in 2020 and 2021 respectively. The changes in overall tax revenues were more widely distributed in 2021 than in 2020; the largest change (positive or negative) observed in 2021 exceeded the largest change observed in 2020, while there was much greater variation among the middle 50% of the distribution. The graph underlines the different trends among different tax types across OECD countries during the first two years of the pandemic. In 2020, PIT and SSCs were most resilient, increasing on average and in a majority of OECD countries as a share of GDP. In the same year, there was a clear fall in CIT revenues as a share of GDP across the OECD while VAT revenues remained steady on average and varied within a relatively narrow range across OECD countries

In 2021, a strong rebound in CIT revenues as a percentage of GDP was observed across the OECD, along with widespread increases in VAT revenues. PIT remained unchanged as a percentage of GDP in 2021, with only slightly more countries experiencing increases than declines, and there were widespread declines in SSCs, leading to a fall in SSCs as a percentage of GDP on average. For the other tax types, the graph shows that changes in revenues from property taxes across the OECD were very similar in both years while declines in revenues from excises were more widespread in 2021, although the average fall was only marginally larger than that observed in 2020.

Figure 2.8. Distribution of changes in revenues by tax types

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. In the figure, the lowest point represents the minimum country change for the tax type; the box represents the changes for countries between the lower and upper quartiles (i.e. 50% of OECD countries had changes within the range shown by each box); and the upper point for each tax type represents the maximum country change. The line in each box represents the median country change (i.e. half of OECD countries were both above and below this line).

Source: Revenue Statistics 2022 and authors’ calculations.

References

[1] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/62d0ca31-en.

[3] OECD (2022), OECD Employment Outlook 2022: Building Back More Inclusive Labour Markets, OECD Publishing, Paris, https://doi.org/10.1787/1bb305a6-en.

[2] OECD (2022), OECD Sovereign Borrowing Outlook 2022, OECD Publishing, Paris,, https://doi.org/10.1787/b2d85ea7-en.

[4] OECD (2022), Tax Policy Reforms 2022: OECD and Selected Partner Economies, OECD Publishing, Paris, https://doi.org/10.1787/067c593d-en.

[5] OECD (2022), Taxing Wages 2022: Impact of COVID-19 on the Tax Wedge in OECD Countries, OECD Publishing, Paris, https://doi.org/10.1787/f7f1e68a-en.

[6] OECD (2022), Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy (FAQs), OECD Publishing, Paris, https://www.oecd.org/tax/beps/faqs-two-pillar-solution-to-address-the-tax-challenges-arising-from-the-digitalisation-of-the-economy-july-2022.pdf.

[7] OECD (2021), Revenue Statistics 2021: The Initial Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/6e87f932-en.

Annex 2.A. Changes in tax-to-GDP ratios by country and tax type

Annex Table 2.A.1. Changes in tax-to-GDP ratios, 2020-2021, by tax type

Year-on-year change, percentage points

|

|

PIT |

CIT |

SSCs |

Prop. |

VAT |

Excises |

OCT |

Res. |

Total Taxes |

Basis of reporting* |

|---|---|---|---|---|---|---|---|---|---|---|

|

Australia |

-0.2 |

0.6 |

0.0 |

0.2 |

0.3 |

0.0 |

-0.1 |

0.0 |

0.8 |

Accrual (1998) |

|

Austria |

0.4 |

0.6 |

-0.1 |

0.1 |

0.2 |

0.1 |

-0.1 |

0.1 |

1.2 |

Accrual |

|

Belgium |

-0.6 |

0.5 |

-0.7 |

0.1 |

0.4 |

0.0 |

-0.1 |

0.0 |

-0.5 |

Accrual |

|

Canada |

-0.5 |

-0.2 |

-0.2 |

-0.1 |

0.0 |

-0.1 |

0.0 |

0.0 |

-1.0 |

Accrual (1999)* |

|

Chile |

0.4 |

-0.9 |

-0.4 |

0.0 |

1.5 |

-0.3 |

-0.1 |

2.5 |

2.8 |

Cash |

|

Colombia |

-0.1 |

0.3 |

0.0 |

-0.1 |

0.5 |

0.1 |

0.0 |

0.0 |

0.7 |

Cash |

|

Costa Rica |

0.0 |

0.5 |

-0.2 |

0.0 |

0.6 |

0.3 |

0.3 |

0.0 |

1.6 |

Cash |

|

Czech Republic |

-1.6 |

0.0 |

0.7 |

0.0 |

0.2 |

-0.1 |

0.0 |

0.0 |

-0.9 |

Accrual |

|

Denmark |

-1.0 |

0.9 |

0.1 |

-0.1 |

-0.1 |

-0.3 |

-0.1 |

0.4 |

-0.2 |

Accrual |

|

Estonia |

0.8 |

-0.1 |

-0.5 |

0.0 |

0.3 |

-0.1 |

0.0 |

0.0 |

0.3 |

Accrual |

|

Finland |

0.3 |

0.5 |

0.5 |

0.0 |

0.1 |

-0.2 |

-0.1 |

0.0 |

1.1 |

Accrual |

|

France |

-0.1 |

0.2 |

-0.1 |

-0.1 |

0.4 |

0.0 |

-0.4 |

-0.1 |

-0.2 |

Accrual |

|

Germany |

0.3 |

0.7 |

-0.2 |

0.0 |

0.7 |

-0.1 |

0.2 |

0.0 |

1.6 |

Accrual (2002) |

|

Greece |

0.2 |

|

-0.1 |

-0.1 |

|

|

0.1 |

0.0 |

0.1 |

Accrual (1998) |

|

Hungary |

0.0 |

-0.1 |

-1.0 |

-0.2 |

0.0 |

-0.3 |

-0.4 |

0.0 |

-2.1 |

Accrual (2002)* |

|

Iceland |

-1.1 |

-0.2 |

0.0 |

-0.2 |

0.6 |

-0.1 |

-0.1 |

0.1 |

-1.1 |

Accrual (1998) |

|

Ireland |

0.4 |

0.4 |

-0.1 |

0.1 |

0.5 |

-0.1 |

0.0 |

0.0 |

1.2 |

Accrual (1998) |

|

Israel |

0.8 |

0.8 |

-0.3 |

0.5 |

0.5 |

0.0 |

0.0 |

0.2 |

2.7 |

Cash |

|

Italy |

-0.2 |

-0.1 |

-0.1 |

0.1 |

0.8 |

-0.1 |

0.0 |

0.3 |

0.6 |

Accrual (2000) |

|

Japan |

0.0 |

0.4 |

|

0.0 |

0.1 |

0.0 |

0.0 |

|

|

Accrual |

|

Korea |

0.9 |

0.5 |

0.1 |

0.6 |

0.1 |

0.0 |

0.0 |

0.0 |

2.1 |

Cash |

|

Latvia |

0.0 |

0.1 |

-0.1 |

-0.1 |

-0.1 |

-0.2 |

-0.2 |

0.0 |

-0.5 |

Accrual |

|

Lithuania |

0.6 |

0.6 |

0.1 |

0.0 |

0.7 |

-0.1 |

0.1 |

0.0 |

2.0 |

Accrual |

|

Luxembourg |

0.4 |

-0.2 |

-0.5 |

0.2 |

0.4 |

0.1 |

0.1 |

0.0 |

0.5 |

Accrual |

|

Mexico |

-0.2 |

-0.1 |

-0.3 |

0.0 |

0.1 |

-0.4 |

0.0 |

0.0 |

-1.1 |

Cash |

|

Netherlands |

-0.6 |

0.8 |

-0.5 |

0.0 |

0.2 |

-0.1 |

0.0 |

-0.1 |

-0.3 |

Accrual (1999) |

|

New Zealand |

0.6 |

1.3 |

0.0 |

-0.1 |

0.9 |

-0.2 |

0.0 |

0.0 |

2.5 |

Accrual |

|

Norway |

-0.7 |

7.3 |

-1.5 |

-0.1 |

-1.0 |

-0.5 |

-0.1 |

0.0 |

3.4 |

Accrual (2000) |

|

Poland |

0.1 |

0.4 |

-0.2 |

0.0 |

0.6 |

0.2 |

0.2 |

0.0 |

1.2 |

Accrual (2002) |

|

Portugal |

0.0 |

-0.3 |

0.1 |

0.1 |

0.6 |

0.0 |

0.0 |

0.0 |

0.5 |

Accrual |

|

Slovak Republic |

0.1 |

0.0 |

0.2 |

0.0 |

0.4 |

0.1 |

-0.2 |

0.0 |

0.6 |

Accrual |

|

Slovenia |

0.2 |

0.0 |

-0.4 |

0.0 |

0.7 |

-0.1 |

-0.1 |

0.0 |

0.2 |

Accrual |

|

Spain |

0.0 |

0.7 |

-0.1 |

0.3 |

0.6 |

-0.1 |

0.1 |

0.0 |

1.6 |

Accrual (2000) |

|

Sweden |

0.2 |

0.1 |

0.1 |

0.0 |

0.1 |

-0.1 |

0.0 |

0.0 |

0.3 |

Accrual (2000) |

|

Switzerland |

-0.3 |

0.0 |

-0.1 |

0.0 |

0.0 |

0.0 |

-0.1 |

0.9 |

0.4 |

Accrual |

|

Türkiye |

-0.1 |

0.4 |

-0.6 |

-0.1 |

0.7 |

-1.3 |

-0.1 |

0.0 |

-1.0 |

Cash* |

|

United Kingdom |

0.8 |

0.3 |

-0.1 |

0.1 |

0.3 |

0.0 |

0.0 |

0.0 |

1.4 |

Accrual |

|

United States |

0.7 |

0.3 |

0.0 |

-0.2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.8 |

Accrual |

|

Average |

0.0 |

0.5 |

-0.2 |

0.0 |

0.4 |

-0.1 |

0.0 |

0.1 |

0.6 |

|

Note: Data for 2021 are preliminary and should be interpreted with caution; please see Box 2.2 for more details. This graph includes the change between years 2019 and 2020 for Australia and New Zealand, as both countries report tax revenues on a fiscal year basis that includes the first two quarters of 2021 in the 2020 fiscal year. Due to data availability, the average excludes Japan for SSCs (category 2000) and for total tax revenues; it also excludes Greece for PIT (category 1100), CIT (category 1200), VAT (category 5111) and excises (5111) due to disaggregated data for these categories not being available.

* The basis of reporting reported here is as indicated in chapter 5 under each country table. The year indicated in brackets is the year from data on an accrual basis are available if this was later than 1995. Please also note: CAN: data are on accrual basis except that personal income taxes are on a modified cash basis; HUN: preliminary data for 2021 are on a cash basis; TUR: SSCs are reported on an assessment basis.

Source: Revenue Statistics 2022 and authors’ calculations.

Annex Figure 2.A.1. Changes in tax-to-GDP ratios, 2019-2021, by tax type

Notes

← 1. Japan is not included in this sample because it was unable to provide preliminary data on all major tax types for 2021. Data for the 2020 fiscal year is used for Australia and New Zealand, as this period covers the first two quarters of 2021. Please see Box 2.1 for further details.

← 2. Hungary reports revenues on a cash basis for the preliminary year. Its tax revenue data for 2021 may therefore change in future editions of the publication once accrual data are available. Please see Table 2.A.1 for further information.

← 3. The mean tax-to-GDP ratio in 2021 in this chapter differs from that shown in the other chapters in the report due to the use of the 2020 fiscal years for Australia and New Zealand, as explained in Box 2.1

← 4. Annex Figure 2.A.1. shows changes in tax-to-GDP ratios for each tax type analysed in this section for each country as a share of GDP in 2020 and 2021.