This chapter reviews the landscape of policies that could be implemented routinely, as a foundation, to enhance medical product supply chain security. First, it examines initiatives aimed at improving the ability to anticipate or avert risks of shortages, such as enhancing visibility across the whole supply chain. It then looks into policies that aim to mitigate or reduce exposure to these risks, including addressing the root causes of shortages and encouraging flexibility and agility into the system.

Securing Medical Supply Chains in a Post-Pandemic World

2. Policies for enhancing supply chain security routinely

Abstract

Key findings

Shortages of medical goods were common and increasing in frequency prior to the COVID‑19 pandemic, with issues of manufacturing, quality and market dynamics key contributors to supply disruptions. However, the pandemic significantly magnified pre‑existing issues, with unprecedented spikes in demand and bottlenecks in supply exacerbating shortages of essential products.

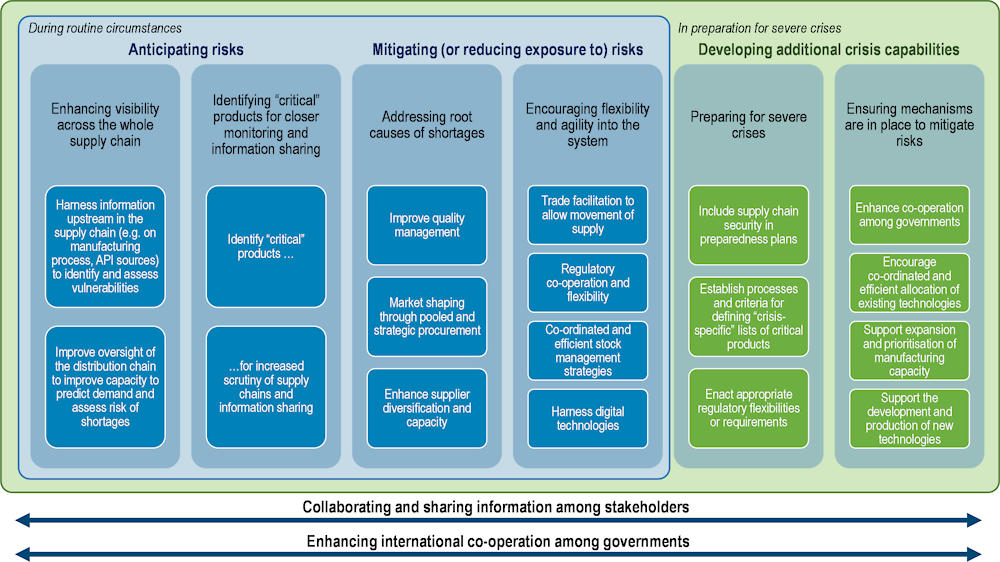

Companies are responsible for and have an interest in ensuring the reliable supply of their products, and, in most cases, they deliver. The proliferation of shortages, however, has drawn policy attention and prompted calls for action. Policies are needed to enhance the resilience of medical supply chains and ensure continuity of supply, both routinely and in times of severe crisis (see Figure 2.1 for an analytical framework). This chapter focuses on the former, while the latter are discussed in Chapter 3.

Policies to enhance medical supply chain security routinely involve 1) better identification, anticipation and aversion of risks, and 2) mitigation of risks of shortages. In general, promoting the long-term resilience of medical supply chains would benefit from collaborative approaches that balance measures best undertaken by the private sector with those more appropriately managed by governments or supranationally.

Anticipating risks

Policy makers would benefit from improved visibility of supply chains to more readily anticipate and, where possible, avert shortages. As a first step, they could harness the information already required by regulatory agencies to identify and evaluate points of vulnerability in supply chains. Regulatory agencies collect information on manufacturing sites potentially involved in supply chains but do not routinely draw on it to analyse risks to supply or evaluate in real-time the impact of a natural disaster, for example. Second, policy makers need better visibility of flows in distribution chains. Although unique identifiers are being implemented for medicines (to fight fraud) and for medical devices (for materio-vigilance and assessment of performance in real world conditions), these systems do not generally allow tracking of the flows of medical products in the distribution chain, albeit with some exceptions (e.g. medicines in Türkiye). Tracking would enable better prediction of supply, demand, and available stocks; characterisation of the nature and scope of notified shortages in real-time (local, national or global) and organisation of effective (re)allocation of available stocks.

Policy makers could also consider implementing closer monitoring of volumes and flows of “critical products” – products identified as both “clinically essential” and having a vulnerable supply chain (according to criteria to be defined). Such a monitoring mechanism would need to be established in partnership with the suppliers of these products.

Gathering granular, real-time, information on supply chains and investing in data analytics are key to anticipating and preventing shortages.

Better anticipation of risks also depends on information sharing among stakeholders. Regulatory authorities should be authorised to share supply chain information with other government agencies and other countries, where appropriate.

Mitigating (or reducing exposure to) risks

The most effective way to reduce exposure to shortage risks is to address the root causes, as identified in former studies, i.e. quality failures, the most frequently reported reason for shortages, pressure on prices in off-patent markets and, to a lesser extent, reducing vulnerabilities arising from excessive concentration of sources of supply.

Improvements in quality management are critical. The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), recently published guidelines that aim to improve manufacturers’ quality risk management programmes, and seven regulatory agencies have already implemented them. Public authorities need to require manufacturers to maintain management systems meeting the highest established standards and to monitor their implementation.

In off-patent markets, excessive pressure on prices is suspected to lead to degradation of quality standards, product withdrawals and market exits, as well as concentration of supply to achieve economies of scale. Further empirical analyses are needed, at local or regional level, to confirm these trends in different contexts. Some policy options, however, may facilitate market shaping. Cross-country pooled procurement can be useful, for example to enhance prediction of demand and to secure supply for small markets that might not be supplied otherwise. The Pan-American Health Organisation’s revolving fund for the purchase of vaccines is a good example. Strategic public procurement approaches that consider criteria other than price alone, such as supply chain security, can also relieve some pressure on prices while elevating the importance of supply security in decision making. The “most economically advantageous tender” (MEAT) criteria for public procurement recommended by the European Commission is a potential vehicle for more strategic procurement. Procurers of medical goods could also consider the diversification of supply as a rationale for splitting awards.

Diversification of supply may require further action beyond improving procurement methods. Re‑shoring and near-shoring policies are high on the policy agendas of several countries seeking to reduce dependency on highly concentrated sources, certain raw materials, active pharmaceutical ingredients (APIs) and finished products. These policies can expand production capacity, reduce concentration, and help meet increasing global demand. However, careful consideration should precede their implementation as they entail substantial cost. They should be focused on “critical products” as previously, ideally, defined at supranational level.

Encouraging agility and flexibility into the system can also help to reduce risks of potentially harmful supply disruptions.

Trade facilitation and harmonisation of regulatory requirements for marketing authorisation can ease movements of medical goods. As an example, e‑leaflets, in particular for hospital-administered products, can facilitate re‑allocation of products across countries with different languages and labelling requirements.

Appropriate inventory strategies and co‑ordinated stockpiling policies can help mitigate shortages due to spikes in demand and/or interruptions in supply chains in the short term, but are of limited effectiveness in long-term disruptions. Countries have adopted a variety of strategies for stockpiling, with differences in the range of products, and in stock management and financing mechanisms. The proliferation of national stockpiling policies, however, can potentially worsen supply gaps. Regional and co‑ordinated stockpiling may be an option for responding to short-term mismatches between supply and demand, by allowing swift re‑allocation of stocks where they are most needed.

Digital technologies, such as big data analytics and artificial intelligence, could be harnessed by all stakeholders to gain a better understanding of and improve predictions of supply and demand, as well as of the movement of goods.

Figure 2.1. Analytical framing of policies to improve medical supply chain security

Note: API active pharmaceutical ingredient. “Routine circumstances” refers to routine or “business as usual” situations in which minor or major supply disruptions occur absent a major crisis. Severe crises refer to major events (e.g. pandemic, other type(s) of major events or health threats).

Chapter 2 presents a range of policy options that could be implemented routinely to enhance the resilience of medical product supply chains. The overall objective is to improve the ability to anticipate and assess the risks of shortages (Section 2.1) but also to mitigate or reduce exposure to these risks (Section 2.2) by addressing the root causes of shortages and encouraging flexibility and agility into the system. In recent years, the issues of supply chain security and resilience have been high on the agenda of policy makers, particularly in light of the COVID‑19 pandemic. Many different initiatives spanning a range of policy areas have been developed, or are currently being discussed at national, regional, and international levels. Annex A presents some examples of these initiatives, although it should not be considered as an exhaustive list. As an example, in October 2023, the European Commission published a communication on “Addressing medicine shortages in the EU” (European Commission, 2023[1]). This wide‑ranging document covers many different topics, including the strengthened mandate of the European Medicines Agency (EMA), the expansion of the Commission’s Health Emergency Preparedness and Response Authority (HERA), the Union Civil Protection Mechanism and the proposed reform of the European Union (EU) Pharmaceutical legislation. The communication sets out steps for mitigating shortages of critical products in the short and medium term, as well as more structural mid and long-term measures (ibid.). Other international efforts are ongoing in this space, particularly in the context of severe crises. These are discussed further in Chapter 3. Addressing rapid responses to shortages at the point of care, while important to mitigate the direct impact of shortages on patients, is out of scope of this particular report.

2.1. Anticipating (or averting) risks of shortages

Anticipating the risks of supply chain disruptions relies mainly on effective oversight (i.e. visibility) of the whole supply chain. Ensuring the reliability of manufacturing supply chains is generally the responsibility of the marketing authorisation holder (MAH). Companies have an interest in sustaining supply and matching demand for their products. Until recently, public authorities had focused their attention on the quality of the manufacturing process, as part of their mandate to ensure access to safe and quality-assured products. The multiplication of shortages, however, has pushed many of them to act and no longer rely only on companies to ensure security of supply. This section examines regulatory agencies’ oversight on supply chains visibility and their ability to help prevent shortages, and suggests new approaches for more effective risk anticipation and prevention.

2.1.1. Enhancing visibility and harnessing information across the whole supply chain

Enhancing visibility and monitoring of the stages, participants, flows and stocks in supply chains are critical not only to preventing or anticipating disruptions, but also to mitigating their effects when they occur. The COVID‑19 pandemic brought this issue to the forefront of health authorities’ attention, with many countries struggling to assess vulnerabilities in the supply of essential medical goods during the dramatic first months of the crisis, while also facing challenges in forecasting demand. Shortage management in non-crisis situations can also be severely hampered by a lack of visibility. Without accurate data from both supply and demand sides, it is very challenging to assess the nature, extent, and severity of a “shortage” (local, national or global, due to bottleneck in manufacturing and or distribution, etc.) or to identify how best to mitigate its impact.

Enhanced visibility across the whole supply chain would require data from several stakeholders, including MAHs, distributors, hospitals, and pharmacies, as well as some sophisticated digital IT infrastructure to gather and analyse them. Some of these data would be considered commercially sensitive, thus it is important to consider for whom improved visibility is essential, for what purpose, and for which products, as well as whether requirements for data collection can be harmonised. However, before attempting to embark on the establishment of a global system, it is important to clarify the nature and the extent of the data that are currently available and how they are used, and what supplementary data should be collected. As a first step towards improving visibility, the following sections describe the nature of the information currently available on manufacturing processes (i.e. sourcing of raw materials, primary manufacturing of active ingredients, secondary manufacturing of finished products) and on the flows of goods within distribution chains (e.g. through distributors, to hospitals and pharmacies).

Harnessing available information on manufacturing processes to assess vulnerabilities in supply chains

As part of this study, the OECD conducted a survey of regulators’ visibility of medicine and medical device supply chains, receiving responses from 24 countries and the European regulatory agency (European Medicines Agency – EMA).1 Information presented in the following paragraphs reflects insights drawn from responses to this survey (summarised in Table 2.1) and additional desk research.

Medicines

Regulatory agencies already collect information on manufacturing sites involved in the production of medicines approved for sale in their respective jurisdictions (see Table 2.1). Companies are required to declare all sites potentially involved in the production of the final product and these sites, wherever they are located, may be subject to quality inspections. In some jurisdictions, for example the United States, the regulatory agency is not allowed to publicly disclose this information. The New Zealand regulatory agency MedSafe, by contrast, makes this information available to the general public on its website. However, regulatory agencies do not generally use this information to assess vulnerabilities in supply chains. The information is not always structured in a way that would enable them to address questions such as whether any part of the manufacturing of a particular product is concentrated in a single site or which products in a domestic market might be affected by a natural disaster in any part of the world.

Requesting information on volumes produced in each site involved in the manufacture of a product for a specific market would be a step further. Companies generally regard this information as confidential and sensitive, making them hesitant to share it. In addition, when a company relies on several suppliers and serves several markets, it may apply some flexibility and adjust sourcing to fluctuations in domestic markets. Providing information to regulators in real-time would not only require goodwill but also a powerful digitalised and interoperable system. From policy makers’ point of view, however, only centralised information on volumes produced by individual sites would address questions such as: do all generics of active substance X have the same and unique active pharmaceutical ingredient (API) source?

According to OECD’s 2023 survey on supply chain visibility, some regulators already request information on volumes sold in their domestic markets. Since 2020 and the adoption of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the United States, all US Food and Drug Administration (FDA) registered establishments are required to report annually the monthly quantities of each listed drug that they produce. They must also disclose their suppliers of components, but are not required to share information on the quantities provided by each of them (US Congress, 2020[2]; HHS, 2022[3]).

In some jurisdictions, MAHs are required to submit information on volumes only in certain circumstances. For example, EU regulation that expanded the mandate and responsibilities of EMA (EU Regulation 2022/123) requests MAHs to submit data on demand and supply volumes to EMA only during public health emergencies or major events, and for those medicines included in lists of critical medicines, to monitor and mitigate/prevent shortages (European Council and Parliament, 2022[4]). The EMA has no mandate to request volume data from industry at national level. Individual countries may, however, impose different rules. In Germany, in case of critical shortages, when requested, MAHs are required to submit data on production, sales, and demand to the national competent authorities. They are also required to submit this information every two months for certain “high risk” medicinal products. Data on the available stocks of medicinal products can also be obtained at wholesaler level, as well as from hospitals and hospital pharmacies. In Spain, this information is also collected in specific circumstances, for critical shortages, or every three months for medicines susceptible to shortages.

In other OECD countries that responded to the survey, regulatory authorities do not have access to this information. In Korea, for example, company data on volumes are considered trade secrets that can only be accessed through a legal procedure to obtain disclosure.

Table 2.1. Regulatory authorities’ visibility of supply chains of medicines and medical devices

Based on responses to the 2023 OECD country survey on supply chain visibility

|

EU/EEA countries |

Non-EU/EEA countries |

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

EMA |

BEL |

BGR |

CZE |

DNK |

EST |

FIN |

DEU |

LTU |

LUX |

NLD |

NOR |

POL |

ESP |

SWE |

AUS |

CAN |

CRI |

ISR |

JPN |

KOR |

MEX |

TUR |

CHE |

USA |

||

|

Medicines |

RA requires information on production sites |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Changes in suppliers must be notified to the RA |

√ |

√ |

√ |

√ |

√ |

X |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√1 |

√ |

√ |

√1 |

|||

|

RA requires information on production volumes |

√2 |

√ |

X |

X |

X |

√3 |

X |

√4 |

X |

X |

√3 |

X |

X |

√5 |

√6 |

√ |

X |

X |

X |

X |

√ |

X |

√ |

X |

√7 |

|

|

Changes in production volumes must be notified to the RA |

√8 |

√ |

√ |

√5 |

√ |

√ |

√5 |

√9 |

X |

√ |

X |

X |

||||||||||||||

|

RA can share data on sites and/or volumes to third parties to address shortages |

√ |

X |

√ |

√10 |

√ |

X |

X |

√ |

√ |

X |

X |

X |

√ |

√ |

X |

√11 |

X |

√ |

X |

√ |

X |

√ |

X |

|||

|

RA conducts site inspections for GMP |

X |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

RA is part of an international co‑operation network for mutual recognition of site inspections |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

X |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|||

|

The country implemented a full national track-and-trace system |

X |

√12 |

X |

√ |

X |

X |

√ |

X |

X |

X |

X |

√ |

X |

√ |

X |

√ |

||||||||||

|

The country implemented an end-to‑end national track-and-trace system |

X |

√13 |

√ |

X |

X |

√ |

√14 |

√ |

X |

√ |

√ |

X |

X |

X |

X |

X |

X |

|||||||||

|

Medical Devices |

RA/NB requires information on component manufacturers and production sites 15 |

√ |

X |

X |

X |

X |

X |

√ |

√ |

X |

√ |

X |

√ |

√ |

X |

√ |

√ |

√ |

√ |

X |

√ |

|||||

|

RA can share information on component manufacturers and production sites to address shortages |

√ |

X |

X |

X |

X |

√ |

√ |

√16 |

X |

X |

X |

X |

X |

|||||||||||||

|

Quality inspections performed for sites involved in production |

√ |

X |

√ |

√ |

√ |

√ |

√ |

X |

√ |

√ |

√ |

√ |

√ |

√ |

X |

√ |

√ |

√ |

X |

√ |

||||||

|

The country implemented a UDI system |

√ |

√ |

X |

X |

√ |

√ |

√ |

√ |

X |

√ |

√ |

√ |

√ |

√ |

X |

X |

X |

√ |

√ |

X |

√ |

√ |

||||

Notes: The authors have exceptionally revised country response to reflect more detailed descriptions and ensure consistency.

EU European Union; EEA European Economic Area; EMA European Medicines Agency; RA Regulatory Authority; GMP Good Manufacturing Practices; NB Notified Body; UDI Unique Device Identification.

√ indicates that the answer was “Yes” in dark cells, or “Yes, partly” in lighter cells. X indicates that the answer was “No”. Empty cells mean that the country did not answer.

1. Only for major changes.

2. Only in case of severe crisis or major event and for critical medicines listed for the crisis (e.g. COVID‑19, mPox).

3. Batch size range must be provided for products and related substances (at the time of application for marketing authorisation for the Netherlands).

4. Information on production provided on RA’s request in case of critical shortage. For some high-risk products, data must be provided every 2 months.

5. Only in some circumstances (shortages or crisis).

6. Upon request.

7. Every registered company must report annually the amount of listed drugs that are manufactured, prepared, propagated, compounded, or processed for commercial distribution.

8. Changes in batch size only.

9. Marketing authorisation holders have to report any breach in Minimum Stockpiling requirement.

10. Only information on manufacturing sites.

11. Shared within a specific stakeholders’ groups to prevent shortages.

12. Wholesalers and retailers (including hospital pharmacies in medical institutions) are obliged to submit data daily, at the end of the day. Marketing authorisation holders submit data weekly.

13. Limited to prescription medicines.

14. Wholesalers must report information monthly.

15. For all EU countries, information on sites involved in the production of medical devices and in-vitro diagnostics is required for all sites covered by the Quality Management System (QMS) of the manufacturer. The QMS differs across risk classes. The information is held by Notified bodies in charge of certification. Regulatory agencies do not have direct access to this information. The EUDAMED database, in development, will include information on sites involved in the manufacturing of the final product.

16. Only with marketing authorisation holder permission or for safety reasons.

Source: OECD survey on regulatory visibility of medicine and medical device supply chains, 2023.

Another important feature of the system is the ability of regulatory agencies to share information about production sites and/or volumes with third parties for the purpose of addressing shortages. In the EU, according to Heads of Medicines Agencies (HMA)/EMA Guidance on the identification of commercially confidential information, information on production sites cannot be shared with third parties, unless authorised by MAHs, except information already made public lawfully (e.g. for biologicals) (HMA/EMA, 2012[5]). A general exception is permission to share confidential information (such as production sites) with other EU/EEA national competent authorities on a case‑by-case basis. Permission to share information with other government agencies varies across countries; Lithuania may share information on volumes with the public, while Spain and Sweden may share information with their respective health ministries.

As regulator visibility of upstream supply chain information from which to assess supply vulnerability is generally poor, regulators mainly rely on notifications of shortages (or risks of shortages) by manufacturers. However, definitions, reporting methods, and requirements for shortage notifications, vary widely by country (see Box 1.4 in Chapter 1 and (Chapman, Dedet and Lopert, 2022[6]).

In some cases, regulators have discretionary powers to impose fines for non-reporting, on a case‑by-case basis. Half of the 24 countries surveyed by Vogler and Fisher (2020[7]) indicated that fines may be applied to MAHs that do not comply with shortage reporting requirements. For example, the French agency for the safety of medicines and health products (ANSM) has the power to impose sanctions where companies fail to notify current or potential future shortages. Fines can be levied for amounts as high as 30% of the firm’s revenue from the product in shortage, determined according to a set of criteria that take into account the gravity and duration of the shortage, the degree of co‑operation by the supplier in addressing the issue, and whether the supplier has repeatedly failed to fulfil its supply obligations (ANSM, 2022[8]). Since the release of the 2020 study, several countries have introduced legislation allowing regulators to sanction non-compliance with shortage reporting. In Sweden, new regulations came into force in July 2023 that impose fines ranging from EUR 2 200 to as much as EUR 8.7 million (Kleja, 2023[9]). By contrast, in the United States, the FDA does not have the authority to apply financial sanctions to manufacturers that do not comply with notification requirements.

Medical devices

According to the 2023 OECD survey, regulators have even less visibility of this information for medical device supply chains. Only a minority of countries indicated that regulatory authorities or notified bodies (for EU countries) collect information on all manufacturing sites involved in the production of medical devices and their main components (see Table 2.1), and this mainly applies to high-risk devices.

Improving knowledge of distribution chains to enhance supply-demand forecasting

Tracking the movement of medical goods in the distribution part of the supply chain offers an opportunity to improve the security of supply in several ways. In the event of local or regional shortages, knowing where existing stocks are being held within the distribution network may help, allowing stakeholders to co‑operate to move stocks where they are most needed.2 This information could also be used to better predict changes in demand. For example, Snowdon and Forest (2021[10]) mention the case of Alberta, Canada, where a highly digitised supply chain infrastructure capable of tracking the location and utilisation of every product across the entire health system, enabled leaders to source personal protective equipment (PPE) in December 2019, well in advance of nearly every other jurisdiction. This degree of visibility requires the use of unique identifiers (UIs) to follow products to the last part of the supply chain. UIs are being implemented for medicines and medical devices in some parts of the world, for different reasons. Until now, they have not been used to prevent or address shortages.

Medicines

The progressive introduction of UIs for medicines began with the main objective of fighting falsification, fraud and counterfeiting. In theory, UIs allow the implementation of full track-and-trace systems in which participants in the supply chain can authenticate products and transmit digital data to a central management system that stores relevant information (e.g. expiry dates, recalls, falsification alerts) (Kootstra and Kleinhout-Vliek, 2021[11]). Current systems, however, are generally not capable of this.

For the time being, two types of track-and-trace systems exist:

In the “Point-of-dispense check” or “end-to‑end” system, finished products are only scanned at the beginning and end of the distribution process of the supply chain (i.e. point of dispensing or administration). The main purpose is to protect patients by verifying the authenticity of a product by validating them at the dispensing points with a code designated in the manufacturing process (WHO, 2021[12]). This does not require scanning of products at every stage of the supply chain or at different transaction points (e.g. between wholesalers and distributors). Many European countries have implemented these systems, which are less costly to manage than full track-and-trace systems. Since February 2019, all prescription medicines, unless explicitly exempt, have been required to comply with safety measures specified in the Delegated Regulation (EU) 2016/161, which mandates the assignment of a unique identifier in packages. The European Medicines Verification System (EMVS) was created for this purpose. Packages are only scanned at the production and dispensing stages of the supply chain, and in many cases, only where there are concerns about falsification. As a result, unique identifiers cannot be used to track medicines throughout the supply chain in order to anticipate and mitigate risks of shortages. Moreover, the data centralised in the EMVS may only be accessed by regulatory authorities on request, for the purposes of investigating potential incidents of falsification, reimbursement or pharmacoepidemiology and pharmacovigilance (European Commission, 2016[13]). At the time of writing, the system had been implemented in all EU/EEA countries except Greece and Italy, which have their own serialisation systems. The deadline for these countries to comply with the EU regulation is February 2025. However, even with full participation, the EMVS cannot readily be used as a full track-and-trace system, which would require legal and technical adaptation.3 In the interim, the European Federation of Pharmaceutical Industries and Associations (EFPIA) has suggested that the information collected through the current systems, used with complementary data sources, could nonetheless be used to providing additional intelligence in monitoring shortages (Bouvy and Rotaru, 2021[14])

A “full” track-and-trace system follows products throughout the entire distribution chain, through a scan validation at every transfer of ownership, beginning with release from the manufacturer. It allows for real-time tracking and stock management along each stage of the distribution chain, thus facilitating timely detection and prevention of shortages, targeted recalls, and reduction of fraud, theft, and medication errors (Parmaksiz, Pisani and Kok, 2020[15]). Only a few countries that responded to the OECD survey reported having such a system (Bulgaria, Estonia, Norway, Korea, Türkiye and the United States). The Turkish and the US systems are described in Box 2.1. These systems have not been used so far to anticipate or avert shortages.

Box 2.1. Full track-and-trace systems for medicines

Ilaç Takip Sistemi (ITS), the Turkish track-and-trace system for essential medicines

ITS, the full track-and-trace system, was introduced in Türkiye in two phases. The first phase began as a pilot in 2010 with a point-of-dispense check system managed using software developed by the Ministry of Health. The system was originally implemented to fight reimbursement fraud. The second phase was launched in 2012, this time by a private company, and for the first time encompassing all actors within the regulated supply chain. The company and the Ministry of Health are jointly responsible for the maintenance and development of the platform. The data are pooled in a centralised database managed by the ministry, which provides the authorities with visibility of the supply chains of relevant products.

The system is based on cross-checking movements of products between each participant in the supply chain. A central database stores all information, and a cross-checking system compares sales and purchasing notifications at every step. Sales are disabled when notifications cannot be matched. A notification of provision is required for reimbursement by national health insurance (NHI).

The industry bears the costs of compliance with the regulation, investing in adding the track-and-trace system to their production and distribution flows. The obligation to comply with established rules to trigger reimbursement by NHI was a strong incentive, since 95% of the Turkish population are covered by NHI.

Since ITS registers purchases and sales throughout the entire supply chain up to dispensing, it allows health authorities to monitor stocks of medicines, and gives manufacturers, wholesalers, and pharmacies control over and visibility of inventories (Parmaksiz, Pisani and Kok, 2020[15]). However, the Ministry of Health recognises that the system is largely reactive, and that the data produced by ITS could be used more effectively to help avert shortages and stock-outs. For this reason, the government is looking to implement a proactive alert system that provides a notification when a particular product’s supply falls below a specified threshold (ibid.).

Track-and-trace system for medicines in the United States

In the United States, the Drug Supply Chain Security Act, enacted in November 2013, defined a procedure to implement an interoperable, electronic tracing of medicinal products to identify and trace certain prescription drugs as they are distributed. The system is intended to identify and remove potentially dangerous medicines from the supply chain and requires manufacturers, re‑packagers, wholesale distributors, and dispensers to comply with standards for package‑level tracing of medicines and data exchange of product tracing between participants in the supply chain (FDA, 2023[16]). Operators were initially expected to comply with this regulation by sharing information electronically or on paper. The implementation of an “all electronic” system was expected by November 2023. The FDA recently published guidance for suppliers to support this implementation (2023[17]), and operators were given one additional year in which to implement it (FDA, 2023[18]). For the time being, the regulation stipulates that regulatory authorities may only ask trading partners to share product tracing information in the event of a recall, or for the purposes of investigating a suspect or illegitimate product.

In March 2021, the World Health Organization (WHO) published a policy paper on the traceability of finished medicinal products from manufacture (i.e. lot/batch release) to the point of dispensing (i.e. pharmacies) or administration (e.g. hospitals) (WHO, 2021[12]). The paper outlines some of the main features of existing traceability systems that are designed to be used to identify falsified and substandard products and offers guidance for developing regulation on the topic. The findings were developed in consultation with regulators from WHO Member States, as well as in collaboration with the International Coalition of Medicines Regulatory Authorities (ICMRA) and the European Directorate for the Quality of Medicines and HealthCare (EDQM). The paper emphasises, inter alia, the importance of establishing an appropriate governance process, identifying costs and benefits of different approaches, and using global standards to maximise international interoperability. While not the intended purpose of most existing traceability systems, the paper also recognises their potential use in maintaining efficient stock management at different levels, and in identifying shortages and monitoring the reasons behind them.

In August 2021, ICMRA published a technical document with recommendations for interoperability of track-and-trace systems at global level that would enable different systems to exchange and use relevant information on medicines and their supply chains to advance various public health goals. The document recognises the potential benefits of traceability systems for supply chain management and mitigation of medicine shortages (ICMRA, 2021[19]).

In the absence of performant track-and-trace systems, initiatives relying on information from the distribution chain have helped to identify and address shortage issues, albeit on a more “reactive” basis (see Box 2.2). Furthermore, increasing the predictability of demand through better forecasting, where possible, and surveillance systems, as well as ensuring appropriateness of prescribing according to clinical guidelines, would help to anticipate and prevent shortage issues. In the vaccine space, for example, vaccine manufacturers have emphasised the importance and value of early collaboration between decision-makers and manufacturers in anticipating changes in demand (e.g. the introduction of a new vaccine to a national immunisation programme) in order to plan for adjustments to supply or increased production capacity (Jongh et al., 2021[20]). In other cases, inappropriate prescribing has resulted in shortages of some products (e.g. azithromycin during COVID‑19). More recently, several agencies have called for appropriate use of a GLP‑1 analogue that has been extensively promoted in social media and is being prescribed widely and inappropriately off-label for weight loss while at the same time being in short supply for authorised use in diabetes (Brafman, 2023[21]; TGA, 2023[22]).

Box 2.2. When distribution information assists the management of shortages

In Spain, the Centre for Information on the Supply of Medicines (CISMED) is a pharmacy-based system which automatically detects supply issues affecting patients. The information provided by pharmacies can be used by health authorities to visualise and respond to shortages in supply on a regional or national level. From November 2019, Digital Health Europe, with funding from the European Commission, has launched a cross-border mechanism for information sharing on medicine supply chains between Spain, France, Italy and Portugal. Analyses of standardised shortages data provided by pharmacies has enabled the identification of similarities in trends in stockouts among the participating countries, such as increasing shortages of neurological medicines between 2019 and 2020 (Consejo General de Colegios Oficiales de Farmacéuticos, 2023[23]). The collaboration between pharmacy associations has illustrated how countries can work together to exchange valuable information on medicine shortages, and suggests that co‑operation like this could be implemented at the European level (Digital Health Europe, 2023[24]). Learnings from this initiative could also help inform the implementation of the European Shortages Monitoring Platform.

In France, two systems have been implemented. In TRACStock, manufacturers feed stock level data into the system, which is managed by a third-party to ensure the appropriate utilisation of any sensitive or confidential information. Developed by the association representing the pharmaceutical industry (LEEM) TRACKStock can detect possible disruptions in advance and indicate alternative therapeutics for medicines in shortage, if any. While this tool is industry-led, the French agency for the safety of medicines and health products, ANSM, has full access. Another system, DP-Ruptures, was developed by the French Chamber of Pharmacists. It tracks pharmacies’ shipping requests and automatically notifies the MAH if a delivery is taking longer than 72 hours. The MAH can then inform pharmacists of any recurring issues in supply, the measures being taken to resolve the issue, and possible alternative medicines that could be substituted for the one in shortage. When more than 5% of pharmacies using DP-Ruptures report late deliveries of supplies, the shortage is included in a list and ANSM is notified (Ordre National des Pharmaciens, 2022[25]). Apart from keeping retailers better informed about disruptions in supply, MAHs can also benefit from greater transparency in the logistic systems delivering their medicines, which can aid the assessment of stock and production levels.

Medical devices

The progressive implementation of Unique Device Identifiers (UDIs) in the medical device sector has a different history and very different objectives: it was designed to improve materio-vigilance and to collect data to build real-world evidence on the performance of medical devices. The UDI system for medical devices, promoted by the International Medical Devices Regulators Forum (IMDRF) in a 2013 guidance document, provides a globally harmonised system for identification and coding of medical devices (WHO, 2021[12]; IMDRF, 2013[26]; IMDRF, 2019[27]). It is composed of two parts: the device identifier UDI-DI, which identifies a manufacturer’s product and package configuration; and the production identifier UDI-PI, which identifies the unit of device production. While the system was intended to provide globally accepted identification of medical devices, it also supports inventory management, pre‑ and post-market surveillance, vigilance, and reimbursement (WHO, 2021[12]).

The implementation of UDI systems began with high-risk medical devices, such as implantables. In Europe, EU regulations have required UDIs for some medical devices since May 2021 and for in-vitro diagnostics (IVDs) since May 2022.4 The data are kept in an electronic “UDI database”, part of the European Database on Medical Devices (EUDAMED), which is not yet fully operational. Manufacturers are responsible for the placement of the UDI in the labelling and packaging of the device, as well as the registration of the UDI in the EUDAMED database before the device is placed on the market (European Commission, 2020[28]). Outside the EU, Japan, Korea, Türkiye and Switzerland report having systems in place (see Table 2.1). To date, however, UDI information systems have not been used to track movements of goods in health systems or predict demand for specific devices.

In the United States, with the Unique Device Identification System Rule enforced in 2013, the FDA established a system to identify medical devices from manufacturing through distribution to patients. The system requires labelers (e.g. manufacturers) to include a UDI on labels and packages and to submit information on their devices to the Global Unique Device Identification Database (GUDID), available to the public. The GUDID only includes information on the labeler and the version or model of the device (FDA, 2023[16]; FDA, 2013[29]). The UDI system in the United States is in its final phase of implementation, and when fully deployed is expected to improve patient safety and post-market surveillance.

In Australia, the Therapeutic Goods Administration (TGA) launched three consultation processes (in 2019, 2020 and 2022) for the implementation of a UDI system. The system aims to strengthen patient safety by allowing tracking and tracing of medical devices, including patient use. However, the system has not yet been implemented (Department of Health and Aged Care, 2023[30])

Canada is currently assessing the feasibility of introducing a UDI system. In June 2021, Health Canada opened a public consultation to gather feedback on a proposal for the implementation of a UDI on devices and packaging, and the submission of the information to a database open to the public (Health Canada, 2021[31]).

Gathering real-time, granular information on supply chains and investing in data analytics are key to anticipating and averting shortages

Real-time information about medical devices and medicines can help issues to be anticipated and addressed quickly. Interest in greater supply chain visibility at different points in the supply chain and the use of real-time information has been highlighted by various stakeholders, for example by respondents to a recent public online consultation by Health Canada’s Drug Shortages Task Force (Health Canada, 2023[32]) (Annex A). Greater confidence in predicting the required supply may provide some lead time for manufacturers to buffer capacity (Chen et al., 2021[33]). Reporting platforms could also be improved through the development of new information systems, using data analytics to detect shortages in advance based upon real-time variations in supply and demand. Some countries already have such stock monitoring systems in place. Caution, however, must be made that any forecasts consider the possibility of stockpiling at any level (e.g. including at institutional level, in pharmacies and hospitals). Technologies such as smart labelling may also help to improve the transparency and traceability in medicine and medical device supply chains. Diprivan® (a brand of propofol), for example, is one of the first medications to benefit from a radio-frequency identification system (Fresenius Kabi, 2020[34]). So called “smart labels” may also help hospitals with inventory management and allow manufacturers to anticipate changes in demand.

In addition, various supply chain technologies (including digital technologies relying on predictive analytics, artificial intelligence and blockchain) are available to monitor supply chains and anticipate risks (Ye et al., 2022[35]). For example, encrypted blockchain technology can help build trust along the value chain, while also facilitating the exchange of information and collaborative relationships (Hosseini Bamakan, Ghasemzadeh Moghaddam and Dehghan Manshadi, 2021[36]). Governments can assist by ensuring that regulatory environments are favourable to the deployment of digital technologies, and by addressing issues such as governance, data ownership, privacy and security in data transmission, that are particularly important in the context of health systems (see Section 2.2.2 on harnessing digital technologies).

2.1.2. Identifying “critical” products for closer monitoring and increased information sharing

Given the vast array of medical products – particularly medical devices – available in the market, supply chain resilience efforts are best directed towards those products deemed “critical” by national (or regional) authorities. The definition of “critical” varies from country to country, in part depending on disease burden and the availability of alternatives, and may change with the advent of a major issue of public health concern. The terms “critical” and “essential” are being used with variable meanings. Different lists are being developed at national and supranational levels: lists of medical products deemed important for inclusion in the range of benefits covered by health systems; those that are deemed “essential” to always have in adequate quantities; and those that are deemed to be “critical” in the event of a major crisis. The last group is discussed in more detail in Chapter 3.

The subsections below outline examples of countries’ efforts to identify “critical” medical products for their national markets for objectives relating to supply chain security. While a “common language” is still missing, to improve supply chain security for these products it is pertinent to consider mechanisms for increasing visibility and information sharing, beyond those already described in Section 2.1.1. For example, sharing information on supply and demand volumes between relevant stakeholders would help in both anticipating risks and mitigating the impact of any supply disruptions on patients. In other cases, these lists may be used to guide stockpiling or re‑shoring efforts.

Medicines

Most OECD countries already have lists of medicines deemed important for their populations and covered by health insurance or national schemes. Not all of these medicines would be considered “essential”, according to the WHO definition. Since 2007, WHO has established and regularly updates a Model List of Essential Medicines (WHO EML), which as of the year 2023 includes 643 medicines (and 143 therapeutic alternatives) (WHO, 2023[37]). The list is intended as a guide for countries in the development and updating of their national essential medicine lists. The inclusion of medicines in the WHO EML considers disease burden and public health relevance, safety and efficacy, and comparative cost-effectiveness. In OECD countries, the range of medicines covered is usually wider than the EML.

Several OECD countries have developed lists of critical medicines, although with different objectives and criteria for inclusion or exclusion. In 2021, Germany, the Slovak Republic and Spain had compiled their own national lists of critical medicines and medicines at high risk of shortage, and at least eight other European countries were considering doing so (Jongh et al., 2021[20]). Since then, several other countries have created lists, including Denmark and France. Some examples are included below:

Germany’s list was developed by a multi-stakeholder advisory board at the Federal Institute for Drugs and Medical Devices, with representation from patients, doctors, pharmacists, and industry, and focuses on prescription medicines that are relevant for the entire population (Bundesamt für Justiz, 2022[38]; BfArM, 2023[39]). For the ~400‑500 medicines on the list, specific actions may be taken to avert or mitigate supply shortages. For example, stockpiling may be requested in the case of medicines containing a “supply critical active substance”. Electronic information on available stocks, API production and manufacturing sites, sales volumes etc., may be requested from manufacturers, wholesalers, and pharmacies.

Portugal has identified a list of ~250 “essential medicines of critical nature” for which specific measures may be applied (regulatory, economic, or other) in order to ensure access in the Portuguese market (Diário da República, 2023[40]; Infarmed, 2023[41]). The criteria include that a medicine must be considered an essential medicinal product; have a data protection period that is still valid; have a history of shortages; have identified vulnerabilities in the manufacturing and distribution chain (from raw material to final product) etc.

Spain’s national list of strategic medicines, developed by the Spanish Agency of Medicines and Medical Products, AEMPS, contains medicines that requires specific actions to ensure their availability (AEMPS, 2023[42]). The selection methodology takes into consideration two complementary criteria – the clinical importance of the medicines, and the availability of adequate alternatives – including only those medicines for which there are only one or two authorised medicines available with the same active(s) substance(s), strength, and dosage form. For each of the criteria, one of three risk levels (low, medium and high) is assigned to the product of interest.

France developed a list of essential medicines, published in June 2023, to serve as the basis of a roadmap for managing shortages (Ministère de la Santé et de la Prévention, 2023[43]; Ministère de la Santé et de la Prévention, 2023[44]). Based on the work of several learned societies, the list of nearly 450 medicines includes those based on criticality of need and therapeutic area (e.g. infectious diseases, anaesthesia, intensive care etc). The overall criticality of the medicine is determined by simultaneously considering (1) the required frequency of dosing (e.g. once a day, once a week) and (2) the significance of a disruption in supply (e.g. no alternative, and life‑threatening if not available, significant impact, limited consequence of a delay, etc). The final list also includes 50 medicines for which production should be relocated or reinforced (see Box 2.4) (Ministère de l'Économie, 2023[45]).

The United States has taken a slightly different approach, and following Executive Order 13 944 in August 2020, established a “list of essential medicines, medical countermeasures and critical inputs that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage forms” (FDA, 2022[46]; FDA, 2020[47]). This list, developed by the US FDA in consultation with federal partners, also aims to ensure protection against emergency events such as infectious diseases, chemical, biological, radiological, and nuclear threats. It includes ~230 products in the drug category and ~100 devices. There are specific criteria for inclusion of medicines in the list, which preference products used in the treatment of severe acute conditions and those that can be used for the widest public health impact (see Box 2.3) (FDA, 2020[48]).

Building on these efforts, and in response to an Executive Order in February 2021 (The White House, 2021[49]), a prioritised list of essential medicines was developed for an initial analysis of supply chains in the United States (ASPR/ARMI/NextFAB, 2022[50]). Through comprehensive consultations with clinical stakeholders, the original FDA Essential Medicines List was narrowed to 86 medicines considered to be the most critical in acute care (e.g. life‑saving, stabilising patients in hospital for discharge, emergency surgery). Some categories of medicines on the original list were excluded because of the specificity of their supply chains (e.g. blood and plasma products). The next steps will involve identifying specific supply chain and manufacturing vulnerabilities for the most critical of these medicines, to tailor any possible solutions.

Although the creation of national “critical” medicines lists has escalated since COVID‑19, the idea of assigning “criticality” of medicines in shortage management is not new. In their analysis of shortage notification databases, Chapman, Dedet and Lopert (2022[6]) found that several countries (e.g. Australia, France, Switzerland and the United States) only report or publish data on shortages affecting a subset of medicines deemed to be critical or essential to their respective health systems. In Ireland, stakeholders agreed on a gradation of “low” and “medium or high” to describe the potential impact of a shortage, based on the existence of therapeutic alternatives and the likely effects on patient health (HPRA, 2023[51]).

More broadly, the European Medicines Agency published the Union list of critical medicines in December 2023. The first version contains 268 listed products (EMA, 2023[52]). The work on the list was initiated under the Structured Dialogue on the Security of Medicines Supply and the 2022 Staff Working Document (Directorate-General for Health and Food Safety, 2022[53]), and progressed under the planned guidance of the Joint Heads of Medicines Agencies (HMA)/European Medicines Agency (EMA) Task Force on the Availability of Authorised Medicines for Human and Veterinary Use (TF AAM) (EMA, 2023[54]; EMA, 2022[55]). The list includes medicines that are considered the most critical for EU/EEA health systems and need to be available at all times (i.e. not just during crises). It identifies those with a significant public health impact for which measures should be taken to strengthen security of supply. For these critical medicines, supply chain vulnerabilities will be assessed, EMA will be able to make recommendations on appropriate security of supply measures, and the Commission will be able to introduce measures to strengthen these. According to the EMA, the “criticality” of medicines is initially based on two criteria: (1) therapeutic indication and (2) availability of alternatives, with low, medium and high-risk levels assigned to each criterion. For example, medicines for acute life‑threatening conditions are classified as high risk under criterion (1) while medicines without available alternatives are classified as high risk under criterion (2). The resulting risk matrix determines the categorisation of medicines as either “critical medicines”, “medicines at risk” or “other”. After assigning a risk category, an analysis of supply chain vulnerabilities is performed for “medicines at risk” to determine whether they should be upgraded to “critical medicines” (Directorate-General for Health and Food Safety, 2022[53]). Further details of the methodology for assessing supply chain vulnerabilities are not yet available. However, as an indication, in a report commissioned by the European Commission to analyse causes of medicine shortages and policy options, the supply chain of the product Epipen® (auto‑injectors of adrenaline) was assessed as “vulnerable” because the product was in a dominant position in the market and the manufacturing capacity was highly concentrated (Jongh et al., 2021[20]). The analysis being carried out by the EMA will also draw from the Critical Medicines Alliance, a multi-stakeholder policy dialogue launched by the Belgium presidency of the Council of the EU in January 2024. The alliance will focus on a first subset of medicines from the Union critical medicine list and seek expert advice on the most appropriate tools and actions to address the most pressing issues. The alliance is planned to last for an initial five year period, with a first meeting scheduled for April 2024 (European Commission, 2024[56]) (see Annex A).

Beyond the preparation of this Union list of critical medicines, EMA is also in charge of developing specific lists in response to emergencies (see Chapter 3).

Box 2.3. Criteria for inclusion in the United States’ list of essential medicines, medical countermeasures, and related critical inputs

Selection of essential medicines

Approved medicines considered necessary to address immediately life‑threatening medical conditions in acute care settings, and that are used to stabilise patients with these conditions to facilitate hospital discharge;

Medicines for longer-term chronic management are excluded;

Selection of the medicines, including dosage form and presentation, is based on those that can be used for the widest populations encountered (e.g. if multiple medicines or medicine classes treat the same condition, the product that can treat the widest population is included; if more than one medicine class is identified, there is a preference for the option with a better safety profile; consideration for the inclusion of more than one medicine in a class in certain circumstances).

Selection of medicines included as medical countermeasures

Based on the definition of “Medical Countermeasures” included in the Executive Order 13 944, the selection included “qualified countermeasures” (all approved products in the Strategic National Stockpile), “qualified pandemic or epidemic products” (approved vaccines and antiviral medicines to treat influenza), and “security countermeasures” (approved products associated with prevention, mitigation or treatment of chemical, biological, and radiological/nuclear threats);

Selection was informed by available lists of medical countermeasures by FDA and other agencies;

Limited to medicines approved or legally marketed in the United States.

For each medicine or medical countermeasure, the list further identifies related critical inputs, i.e.:

All active pharmaceutical ingredients (APIs);

All active ingredients or starting materials for biological or natural source products; and

Other ingredients or constituents that possess unique attributes essential for the use of the product.

Source: FDA (2022[46]), Executive Order 13944 List of Essential Medicines, Medical Countermeasures, and Critical Inputs, www.fda.gov/about-fda/reports/executive‑order‑13944-list-essential-medicines-medical-countermeasures-and-critical-inputs.

Medical Devices

Progress on the creation of national lists of critical medical devices is less advanced. WHO has developed several lists of priority medical devices (WHO, 2023[57]) In 2021, it introduced a list of over 500 priority medical devices essential for managing cardiovascular diseases and diabetes across all healthcare levels (WHO, 2021[58]), including in emergency situations such as cardiac arrest and stroke. This list offers clinical guidelines for specific conditions and associated interventions, encompassing surgical instruments, PPE, and diagnostic tools. Under the Priority Medical Device Project, WHO is continually updating lists for the management of high-burden diseases such as cancer and COVID‑19, as well as for specific populations such as older adults, pregnant women, and neonates. The selection process involves reviewing clinical guidelines, determining the devices necessary for each care level, and consulting with a multidisciplinary group of experts. These lists support countries in developing or revising their national essential or priority lists to advance universal health coverage.

In the United States, critical device medical countermeasures are included in the list already described above (FDA, 2022[46]). The device medical countermeasures list includes products such as diagnostic testing kits and supplies for rapid test development, PPE, vital sign monitoring devices, vaccine delivery devices, and devices to manage acute conditions such as ventilators. Devices are included if it is medically necessary to always have an adequate available supply and they cannot be substituted with another device on the list. Critical inputs (i.e. components) of these devices are also included if they are essential for the use/manufacture of a device, reasonable substitutes are not easily available, and substitutions would require reassessment of device safety and performance. Critical inputs are also listed if they are a component common across multiple devices of a specific type.

Following a consultation with the private sector, the French agency for the safety of medicines and health products, ANSM, resolved to rely on companies to self-assess the risk that a shortage of an “indispensable” medical devices or IVDs would lead to a “critical situation”, i.e. a critical impact on patient health. The assessment considers the critical role of the medical device or IVD (e.g. no alternative or market share > 50%, and severe disease) as well as possible mitigation measures involving all actors (company, purchasers, healthcare institutions). If there is a significant risk of shortage, the information should be circulated as rapidly as possible to allow all stakeholders to contribute to mitigation efforts (ANSM, 2021[59]). Since 2021, the ANSM publishes a list of medical devices and IVDs at risk of, or in shortage, with reasons. (ANSM, 2023[60]). The system was originally established on a voluntary basis, but since 2023, companies have been required to declare any risk of disruption, and may face financial sanctions if they fail to do so. At least one company was fined for not having reported issues in its supply chain that led to a shortage of tests for Down Syndrome.

2.2. Mitigating (or reducing exposure to) risks of shortages

2.2.1. Addressing root causes of shortages

Quality issues and pressure on prices are most frequently cited as the root causes of shortages, particularly for medicines, and to a lesser extent, vulnerabilities arising from excessive concentration of manufacturing capacity (see Chapter 1). The sections below describe some policy options aimed at addressing these root causes, from improving quality management, to market shaping, as well as strategies to diversify supply.

Encouraging improvements in quality management

Companies selling medical products are responsible for quality management in their supply chains, in accordance with standards set by regulators. Requirements for marketing authorisation are already stringent in most OECD countries, encompassing quality management standards for companies and inspections by regulatory authorities. For example, in guidance published in February 2023, the European Medicines Agency outlined manufacturers’ role in optimising quality management systems in the context of strengthening the reliability and resilience of supply (see Annex Table 2.A.1). Quality breaches nevertheless happen, potentially leading to shortages. An important issue for regulators is to ensure that this strict regulation is adhered to in the context of complex supply chains. In that respect, co‑operation between regulatory agencies is being explored by several of the stringent regulators. For example, since 2011 an international active pharmaceutical ingredient inspection programme has enabled participating authorities to share information on good manufacturing practice (GMP) inspections related to API / active substance manufacturers, as well as planning and organising joint inspections. The programme currently includes 12 participating authorities, several European institutions, as well as those from Australia, Canada, Japan, the United Kingdom, the United States, and the World Health Organization (EMA, 2018[61]).

In January 2023, the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH)5 adopted a revised version of its Q9 guideline that aims to improve current quality risk management programmes. The guidance invokes more objective risk assessments, which have the potential to reduce quality defects and, as a consequence, drug shortages. ICH guidelines are not binding, but many companies and national and supra-national regulatory agencies choose to follow their recommendations. At the time of writing, the new ICH Q9 guideline has been implemented by several regulatory agencies, including those in the European Union, Japan, the United Kingdom, the United States and Switzerland, and is currently being implemented in Canada and Korea (ICH, 2023[62]).

The International Medical Device Regulators Forum (IMDRF) is a voluntary group of medical device regulators worldwide that aims to accelerate international medical device regulatory convergence in several areas. Established in 2011, it builds on foundational work of the Global Harmonization Task Force on Medical Devices. OECD countries/regions that are current members of the IMDRF include Australia, Canada, the European Union, Japan, Korea, the United Kingdom and the United States. Individual working groups also draw upon expertise from various stakeholders such as healthcare professionals, patients, the industry, and academia. The improvement and alignment of quality management systems and risk management procedures are the focus of an ongoing working group of the IMDRF (IMDRF, 2023[63]).

Market shaping through pooled and strategic procurement

Pressure on prices, especially in off-patent markets, is often cited as an important issue affecting the reliability of supply. Low prices and limited profitability are thought to affect the ability to maintain high-quality supply chains, in some cases, leading to the exit of some players and market concentration, further adding to the vulnerability of supply. Empirical evidence is available mainly for the US generic market, which is quite specific. Vertically integrated joint ventures between large wholesale drug distributors and major retail drugstore chains have emerged, and in 2021 the three largest joint ventures were estimated to account for as much as 90% of all US generic drug purchases (FDA, 2019[64]).

In OECD countries, pharmaceutical markets are generally subject to a mix of price regulation and competition. Price regulation generally applies to “reimbursed” medicines sold by retail pharmacies, and often takes the form of a list of maximum reimbursement prices. Actual prices may be lower than these maximum prices, especially for off-patent products. Medicines purchased by hospitals are generally not subject to price regulation, with multi-source products often procured through tendering.

Multiple public and private actors purchase medical products at different levels within healthcare systems. While some countries have national procurement bodies that provide a range of medicines and medical devices to their healthcare systems (e.g. Denmark), most countries take a more decentralised approach, with pharmacies and hospitals purchasing products directly. The ways in which these systems are structured can be important in influencing how markets function and, consequently, on the availability of essential medical products. Procurement practices have the potential to create incentives for manufacturers to remain in the market, continue supply, and even develop buffer capacity. By adapting the duration, conditions and award criteria of public procurement contracts, governments can influence how medical supply chains work.

Collective cross-country purchasing of medical products (also known as joint procurement) is one of the key policies that countries can consider implementing to ensure market access and continuity of supply. Although generally regarded as a strategy to obtain lower prices for medical goods through purchasing higher volumes of products, pooled procurement can also enhance the availability of medicines and improve access to high-quality products, especially in smaller markets (Parmaksiz et al., 2022[65]). Huff-Rousselle (2012[66]) also mentions more rationalised choice processes through better-informed selection and standardisation, as well as less corruption, as additional advantages of implementing joint procurement.

Current cross-country pooled procurement initiatives vary in terms of the range of products covered, governance strategies and main objectives. Since 1977, the Pan American Health Organization (PAHO) has implemented a revolving fund for the collective purchasing of vaccines and immunisation supplies, for 41 countries in Latin America and the Caribbean region. The Fund is responsible for conducting multiple steps in the tendering process, from supporting and collecting countries’ demand forecasts, to preparing tenders, awarding bidders, and distributing supplies. More recently, the Nordic countries (Norway, Sweden, Denmark, Iceland and Finland) have also implemented a pooled procurement scheme, the Nordic Pharmaceutical Forum (NPF), which aims to increase their leverage in procuring older medicines, such as paracetamol and ampicillin.

As ensuring security of supply is not generally regarded as one of the main objectives of pooled procurement, these initiatives have not been assessed against this criterion (Parmaksiz et al., 2022[65]; Vogler, Salcher-Konrad and Habimana, 2022[67]). Nevertheless, they may improve the availability of medicines in countries not considered attractive for companies because of the size of the markets. This is particularly relevant for Iceland (Nordic Pharmaceutical Forum, 2023[68]) and several of the smaller Latin American countries.

Pooled procurement can also enhance the predictability and reliability of demand, which can facilitate better planning of production and supply, and may also reduce production shortfalls (DeRoeck et al., 2006[69]). Technical assistance with demand forecasting provided by PAHO is considered a key aspect of the Revolving Fund’s effectiveness. In contrast, other pooled procurement initiatives have been less successful due to a lack of co‑ordinated net demand measurements. This was the case with some of the EU Joint Procurement Agreements (JPA) for medical equipment implemented during the COVID‑19 pandemic, where national demand for equipment was duplicated through multiple procurement channels (local, national, and European) (MedTech Europe, 2021[70]). Thus in order for pooled procurement to be an effective tool for ensuring the accessibility and continuous supply of medical products, it is important that participating countries demonstrate a commitment to securing a share of supplies from the pooled mechanism. However, there is no evidence that pooled procurement reduces stock-outs of medicines per se (Parmaksiz et al., 2022[65]; Seidman and Atun, 2017[71]). PAHO’s revolving fund has already experienced vaccine shortages, particularly for products originating from sole suppliers. A 2006 study found that half the countries utilising the fund had reported delays in deliveries from PAHO (DeRoeck et al., 2006[69]).

One important factor that can undermine the ability of pooled procurement to improve security of supply is tenders awarded based solely on price. Strong pressure on bidders can push prices to non- or only marginally profitable levels, leading to the market exit of generics companies and fewer suppliers. To address this issue, procurement processes that capture multiple policy objectives in the award criteria can influence market practices and potentially improve supply security. EU Directive 2014/24, which regulates public procurement, requires public contracts to be awarded based on the most economically advantageous tender (MEAT) criteria, which can include environmental, quality, social and security of supply factors. Even though the directive has led to an increase in security of supply as an award criterion, the use of MEAT approaches only accounts for 24% of public procurement contracts for medicines in the EU, the European Free Trade Area (EFTA) and the United Kingdom (Vogler, Salcher-Konrad and Habimana, 2022[67]).

In designing its tender bidding procedures, the NPF has adopted several criteria that go beyond price alone. Supply chain security can account for 15 to 20% of bid scores, while price accounts for 25 to 55%, depending on the product and other included criteria (Sverrisson, 2023[72]). As one of the main goals of the procurement scheme, ensuring timely availability of supply is a top priority in tender contracts. In parallel with implementing the MEAT criteria, NPF tenders also apply other strategies to enhance supply security, such as longer contract periods (3 years being the norm) and awarding tenders to multiple winners. Although the impact of MEAT and other policies have not been evaluated explicitly, supply data for medicines procured by the NPF from the Norwegian Medical Products Agency indicate that availability for products procured this way has remained stable, even during the pandemic (Sverrisson, 2023[72]). According to a study on public procurement practices for medicines in the EU, EFTA and the United Kingdom, 10 out of 27 responding countries indicated that security of supply was a criterion applied when evaluating at least some tenders (see Table 2.2) (Vogler, Salcher-Konrad and Habimana, 2022[67]).

Experts have also raised the potential advantages of contracting multiple suppliers for the same product, to secure supply if one or more suppliers fail. Several purchasers have adopted this strategy, including pooled procurement mechanisms such as PAHO’s revolving fund and UNICEF’s vaccine procurement. However, while pre‑arranged, multi-source contracts can improve continuity in supply, they cannot be effective in all circumstances, in particular if all contracted suppliers rely on a single API contractor who fails to supply. Dube et al. (2022[73]) found the literature on whether single or multi sourcing is more effective in improving supply resilience of ventilators inconclusive, with trade‑offs applicable to both strategies – single sourcing may enable the establishment of a collaborative relationship with a supplier, while having multiple sources facilitates responsiveness to disruptions. Wiedmer et al. (2021[74]) noted that multi-sourcing can actually worsen the impact of a shock when it occurs, but facilitate faster recovery of volumes afterwards. The authors suggest that sourcing from multiple suppliers tends to aggravate disruptions during a crisis, as buyers have to contact and co‑ordinate with multiple suppliers dealing with their own disruptions. However, greater volumes can then be sourced from these multiple suppliers in the recovery phase. A recent IQVIA analysis of medicine shortages in the United States showed that multi-source generic molecules are more likely to be in shortage (9% of multi-source generics) than single‑source molecules (7% of single‑source generics) (IQVIA, 2023[75]). The report concluded that market predictability for single‑source suppliers may allow them to manage stocks more effectively and mitigate the impact of market volatility (ibid.). In EU countries, utilisation of multi‑award winner contracts for the supply of medicines through public procurement has generally been adopted, but often limited to certain products, where shortages are more frequent or have more severe impact (see Table 2.2).

Public procurement-based policies may follow a “stick or carrot” approach in their relations with suppliers. In one scenario, procurement contracts may offer financial incentives (e.g. higher prices) to companies that accept additional requirements (e.g. increased supply reliability, stockholding requirements etc.). On the other hand, purchasers may apply harsh penalties for poor compliance with contractual obligations. In some cases, a mix of both “stick” and “carrot” approaches may coexist. A review of policies for addressing shortages in 24 countries undertaken in 2020 found that only 6 responding countries relied on sanctions in cases of non-supply by manufacturers, and the level of enforceability of penalties was reported to be generally low (Vogler and Fischer, 2020[7]).

Table 2.2. Procurement practices and supply chain security

2022 Review of EU, EFTA countries and the United Kingdom

|

Country |

Use of multi‑award procedures |

Use of the MEAT criteria in tenders |

Use of security of supply as a criterion |

Use of local production as a criterion |

|---|---|---|---|---|

|

Austria |

Yes (mainly for products where shortages have a severe impact) |

Yes |

No |

No |

|

Belgium |