The Czech FinTech sector consists of more than one hundred regulated or unregulated firms operating in a market heavily dominated by banks. Czech consumers embrace digitalisation, yet the current allocation of financial assets is conservative and the capital market is under-developed. Current dialogue between the Czech Authorities and FinTechs may not be optimal and results of the OECD FinTech market questionnaire indicate that regulation is perceived as a key challenge, followed by access to market and funding.

Supporting FinTech Innovation in the Czech Republic

1. Assessment of the Czech FinTech ecosystem

Abstract

The Czech FinTech ecosystem includes over 100 FinTech companies operating across various segments of activity falling inside as well as outside the regulatory perimeter of supervision. The level of digitalisation is quite high, in the payments service providers sector in particular, which is also a main segment of activity for Czech FinTechs. Findings of the OECD (OECD, 2022[1]) open questionnaire on FinTech activity in the Czech Republic presented at the end of this chapter point to several perceived impediments to FinTech development in the country; these include access to financing, operability of APIs for accessing data, entry barriers by dominant incumbents, and perceived hurdles regarding regulatory issues.

The analysis of the Czech FinTech ecosystem identified several such manifests of regulatory and supervisory hurdles to FinTech growth, such as the “wait and see” approach taken by the supervisors and regulators as opposed to a more proactive approach taken by several other EU Member States; the lack of prioritisation of promoting competition within the financial sector; lengthy licensing procedures for payment institutions; and the cultural differences between the supervisor and the FinTech firms. Additional non-regulatory identified gaps that may impede FinTech growth include banking sector dominance; the lack of sufficient funding sources for Czech SMEs, start-ups included; challenges with regards to data access; dependence on foreign firms for innovation dissemination and the lack of qualified human capital; the low level of business ICT integration; and the conservative investment outlook of the Czech population.

1.1. Nascent local FinTech sector

The development of FinTech activity has followed a pattern of constant growth both globally and domestically in the Czech Republic. The COVID‑19 pandemic accelerated and intensified the digitalisation trend that pre‑existed in the financial markets and increased both the offer and the demand for innovative FinTech solutions (OECD, 2022[1]). Apart from FinTechs, traditional financial institutions, such as banks and insurance companies, are also active in terms of innovation (OECD, 2022[1]). On the demand side there is openness to new digital financial products, services and solutions, and the business sector is relatively quick in adopting financial services innovations (ICLG, 2021[2]).

1.1.1. Small FinTech sector offering a variety of financial services

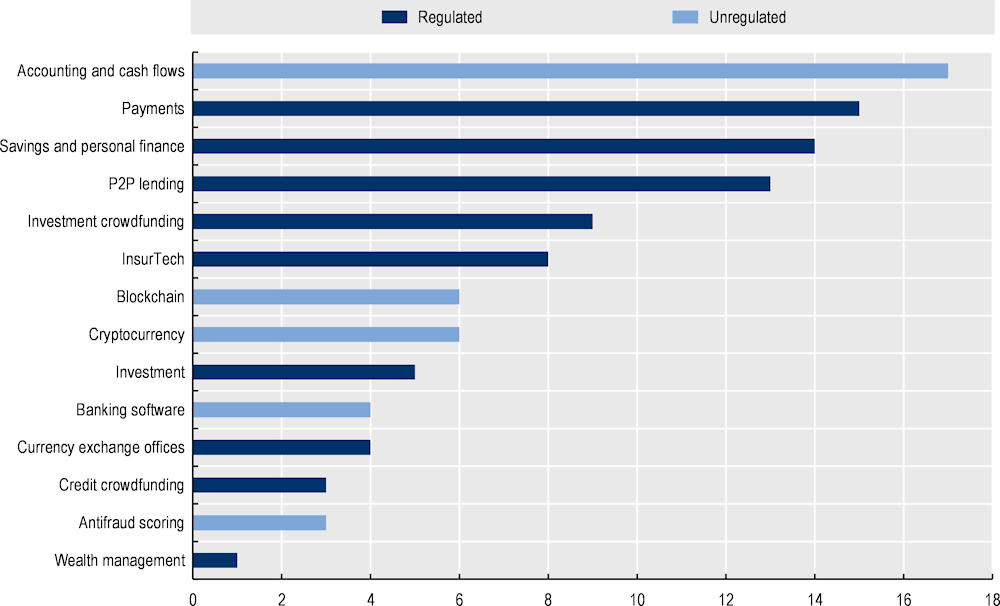

There are 113 Czech FinTech companies in the Czech Republic active across a large number of different sectors of regulated and unregulated activity (FinTech Cowboys, 2022[3]). Based on maturity and performance, Czech FinTech firms rank in the bottom third among European countries based on some recent industry studies (McKinsey, 2022[4]). Czech FinTechs mostly provide services in areas such as accounting, payments, personal finance management, peer-to-peer (P2P) lending or crowdfunding (Figure 1.1). Open banking application created on the basis of the PSD2 framework have also become popular. Historically, innovation has consistently been strong in the payment providers sector; in particular around contactless card payments, where the country has been consistently among the top five countries worldwide in the usage of contactless card payments for the half decade (Visa, 2022[5]).

P2P lending platforms represent some of the biggest FinTech companies in the Czech Republic in terms of number of customers or valuation, and crowdfunding as a form of alternative financing1 is becoming increasingly popular in the country. However, the per capita funding volume of alternative finance platforms in the Czech Republic is among the lowest in Europe (CCAF, 2021[6]). Regulatory changes spanning the crowdfunding sector are underway in the Czech Republic, making these platforms subject to various regulatory requirements under certain conditions. Regulation could increase the attractiveness of this type of investment through crowdfunding platforms (Advokátní deník, 2022[7]).

Figure 1.1. Number of Czech FinTech firms, July 2022

Source: OECD construction based on data from FinTech Cowboys (2022[3]), Fintechová mapa České republiky – jaro 2022: přes 100 fintechů, https://fintechcowboys.cz/fintechova-mapa-ceske-republiky-jaro-2022-pres-100-fintechu/.

1.1.2. Consumer openness to digitalisation drives demand for FinTech activity

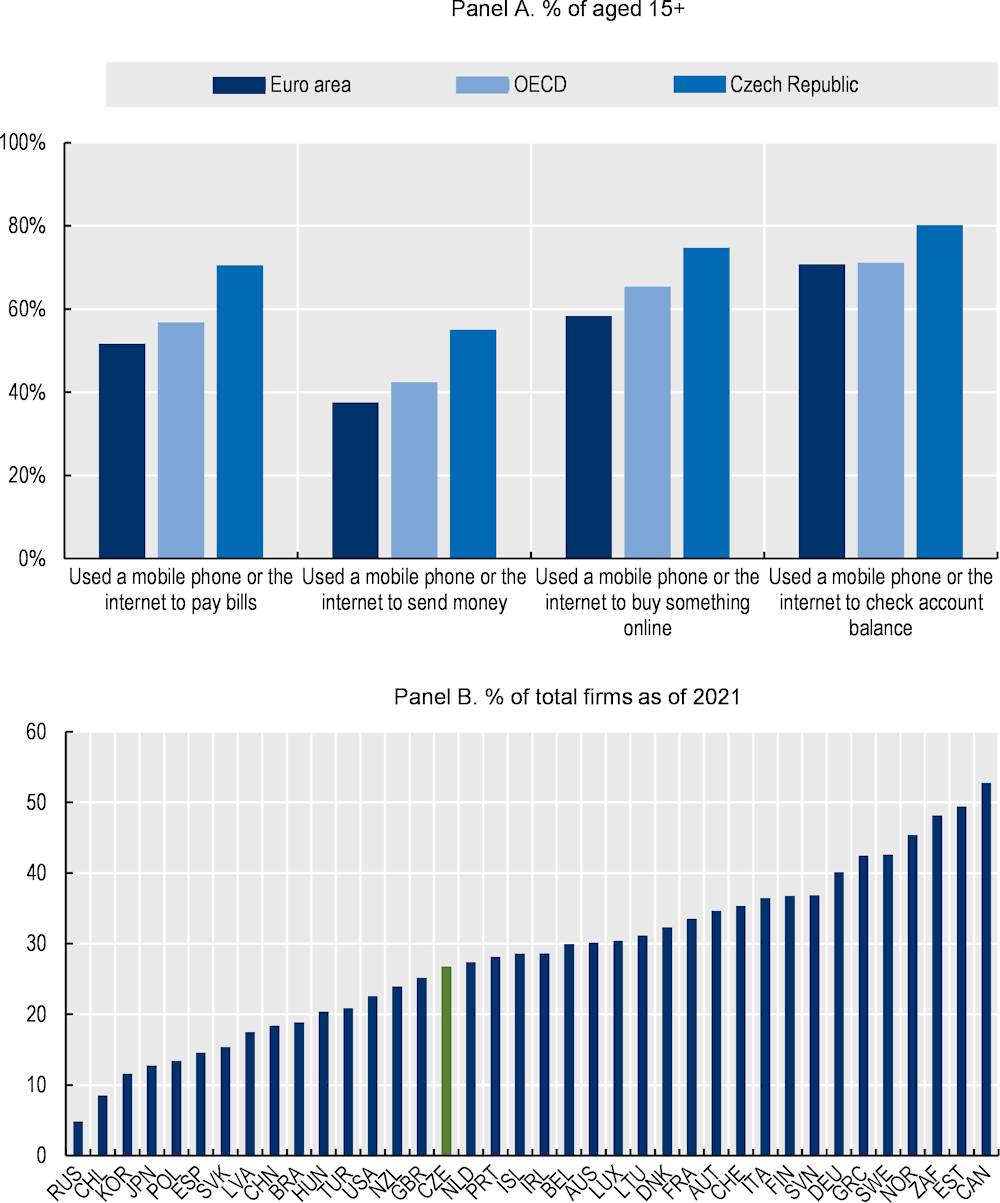

Czech citizens are open to the use of digitalised services and products and frequently use financial services through on-line applications for purposes such as paying bills, sending money or viewing account information (World Bank, 2021[8]) (Figure 1.2). They are also accustomed to online purchasing, with the Czech Republic ranking 8th among EU Member States on the share of local consumers shopping online (Ecommerce Europe and EuroCommerce, 2022[9])

Figure 1.2. Use of digital financial services and productive innovative firms in the Czech Republic, as of 2021

Source: OECD (2022[10]), Business innovation statistics and indicators, https://www.oecd.org/sti/inno-stats.htm#indicators; World Bank (2021[8]), The Global Findex Database 2021, https://www.worldbank.org/en/publication/globalfindex.

1.1.3. Local innovation is driven by foreign-controlled firms and external funding in the presence of local funding constraints

According to the European Innovation Scoreboard for 2022, the Czech Republic is placed among moderate innovator countries with performance at 92.6% of the EU average (European Commission, 2022[11]). The country’s performance gap to the EU is, however, narrowing; the Czech Republic has increased its performance twice as fast as the EU average since 2015, and improvement was in particular high from 2021 to 2022 (European Commission, 2022[11]).

Innovative firms in terms of product innovation2 position the Czech Republic slightly below the average among OECD countries (Figure 1.2). However, the Czech financial and insurance activities are more innovative than the overall business sector, which puts the sector in a leading position of innovation locally, even though it is not usually in that position in other countries (OECD, 2022[10]).

Innovation in the Czech market is currently attributed to foreign-owned firms; the Innovation Strategy of the Czech Republic 2019‑30 shows that the majority of innovating enterprises in the Czech Republic were foreign-controlled, mainly large industrial enterprises, in 2016 (R&D&I Council, 2019[12]). Similarly, the share of foreign firms in the Czech Republic is higher among the top productive firms compared to the overall business sector (OECD, 2020[13]). The European Innovation Scoreboard 2022 places the Czech Republic as the third highest in the share of added-value contributed by foreign-controlled enterprises (European Commission, 2022[14]). It should be noted that the presence of foreign firms is not considered to be a sufficient condition for (large‑scale) innovation diffusion to take place (OECD, 2020[13]).

Local innovation activities are primary challenged by the lack of sufficient funding, whether from external, internal, or public sources (R&D&I Council, 2019[12]; Czech Statistical Office, 2022[15]). This is despite the goal set up by the Czech Government in 2020 to become an innovation leader within ten years, planning to increase public spending in this area to 2.5% of GDP in 2025 and 3% by 2030 (OECD, 2020[13]). Local enterprises also cite the lack of qualified workers as a major non-financial challenge (Czech Statistical Office, 2022[15]).

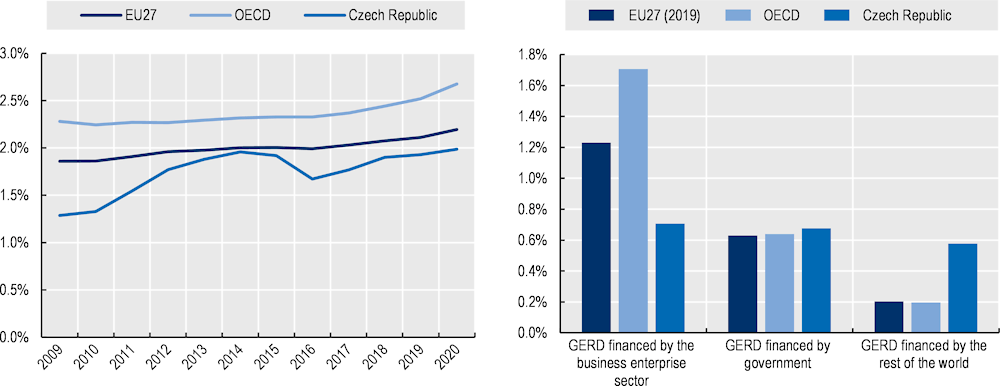

Statistics on research and development (R&D) investment at country level show a steady growth of such expenditure in recent years in the Czech Republic, albeit not fast enough to close the gap with EU and OECD countries, in particular as R&D expenditures have accelerated for OECD countries in 2022 (Figure 1.3, LHS). The dependence of innovation on external sources is apparent in R&D investments as well; R&D sourced by the local business sector in the Czech Republic is particularly low compared to EU/OECD countries, while investment coming from abroad is high (Figure 1.3, RSH).

Figure 1.3. Gross domestic expenditure on R&D

Source: OECD (2022[16]), Science, Technology and Innovation Scoreboard, https://www.oecd.org/sti/scoreboard.htm#publications.

As for information and communication technologies (ICT), Czech enterprises portray higher than EU average presence of their business on-line, corresponding to the high ratio of Czechs performing on-line purchasing. At the same time, less than the EU average share of enterprises are connected to high-speed internet, and fewer enterprises use business software (Czech Statistical Office, 2022[17]). Use of cloud storage for financial data by enterprises, a prerequisite for many innovative financial applications for businesses, is still quite low in the Czech Republic.

1.2. Underdeveloped financial services sector dominated by banks

Czech FinTechs operate in the financial services sector which is dominated by banks in most segments of the financial markets. Small local capital market limits the funding sources of FinTechs but also the variety of services that FinTechs are able to offer to consumers and SMEs in an economy with few existing financial products, and limited options for unbundling financial services. Financial literacy gaps and conservative savings allocation by consumers may limit the adoption of innovative financial services or result in a mismatch between services and consumers and increase the build-up of financial risks.

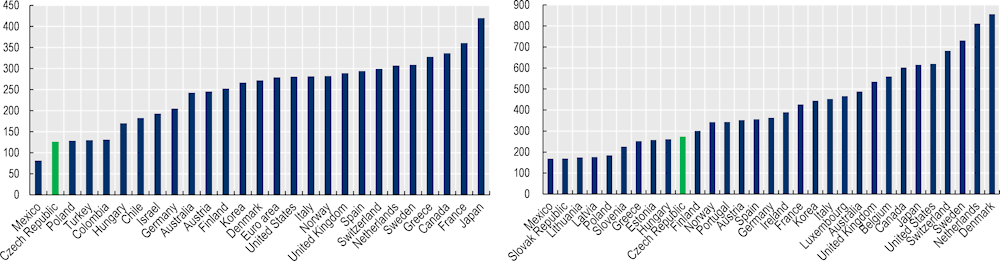

The assets of the banking system as of March 2022 comprise 85% of the total assets of the domestic (regulated) financial system including pension and investment funds, insurance companies and others (CNB, 2022[18]). Overall credit levels to the private sector in the Czech Republic are low compared to OECD countries, potentially leaving room for growth facilitated by FinTechs (Figure 1.4). In recent years, innovative lending platforms have experienced a boom, especially in the fields of P2P consumer lending and crowdfunding platforms (OECD, 2022[1]).

Figure 1.4. Total credit to the non-financial sector and financial assets of households

Note: Households includes non-profit institutions serving households (NPISHs)

Source: OECD (2022[16]), Science, Technology and Innovation Scoreboard, https://www.oecd.org/sti/scoreboard.htm#publications.

The Czech Authorities have concluded that the capital market in the Czech Republic is underdeveloped and not sufficiently fulfilling its main function (i.e. to efficiently redistribute free financial resources from savers and investors (households) to entrepreneurs who need to finance their development) (MFCR, 2019[19]). One of the likely reasons for that is that traditional bank financing prevails, while there is also a strong reliance on EU subsidies (but not necessarily in the FinTech sector) (MFCR, 2019[19]). This bias towards bank financing is supported by conservative asset allocation of households, low savings for old age on top of the mandatory pension provisions, low awareness among entrepreneurs of the possibilities of financing business and research through the capital market, and a small range of domestic investment instruments available to retail investors compared to Western Europe (OECD, 2022[1]).

There are no specific regulatory barriers preventing FinTech businesses from co‑operating and entering into arrangements with traditional financial services providers, except for the requirements applicable to specific services such as bank outsourcing rules that may be perceived as overly burdensome by the smallest start-ups. However, the traditional financial services providers prefer established, well-known vendors when searching for new digital solutions or improvements to their current offerings, especially in core banking systems, customer relationship management, and trading platforms. However, this is evolving and even though banks have been historically rather reluctant to co‑operate with FinTechs, they are starting to focus more on better user experience to ensure greater customer loyalty and more user-friendly, cheaper services to retain clients amid increasing competition in the market driven by the FinTechs. As a result, the level of overall digitalisation of the Czech banking sector and the availability of new innovative solutions or products offered by banks has improved significantly throughout the past decade (OECD, 2022[1]).

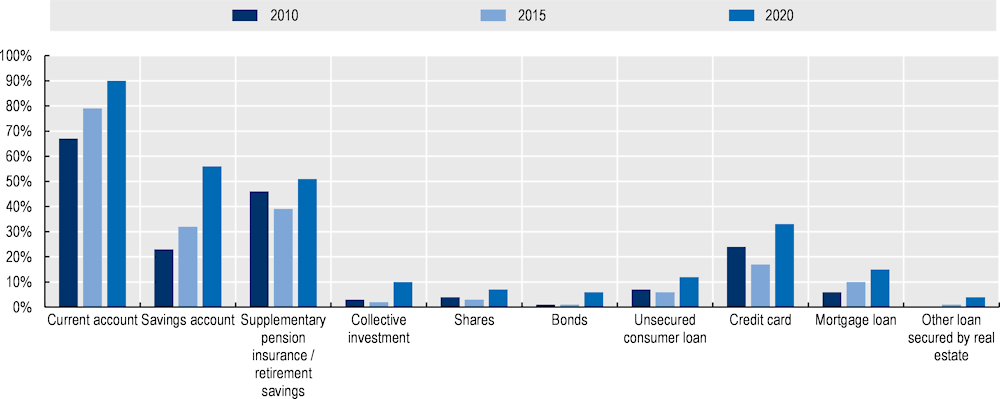

1.2.1. Czech consumers channel savings mainly to bank deposits

Over the past decade, financial inclusion of Czech consumers regarding traditional financial products has increased. Current and saving account ownership has grown fast. However, Czechs households stick to a conservative investment outlook – despite a high savings rate within the Czech economy, Czech households rank in the bottom of OECD countries with regard to overall financial assets held (Figure 1.4). More than half of households’ savings are held in cash and deposits and only a tiny fraction of savings enters the capital market (MFCR, 2019[19]). Only a small portion of assets is managed outside the banking system; assets under management in pension funds and insurance companies comprised less than 20% of the Czech GDP in 2021 (OECD, 2022[1]).

Compared with OECD countries, Czech households have taken out less loans and hold fewer outstanding mortgages than the average across countries (World Bank, 2021[8]). Few consumers reported using consumer and mortgage debt in 2010 and though this ratio increased somewhat (Figure 1.5), current levels of consumer debt remain relatively low. Supplementary savings have not grown almost at all, and the investment in equity and bonds is extremely low. Given the current setting, there is less business rational for the operation of personal financial advisors or applications for cost comparison at a large scale.

Figure 1.5. Active use of financial products by Czechs

Source: OECD construction based on data from MFCR (2020[20]), Financial Literacy Measurement Results 2020, https://financnigramotnost.mfcr.cz/cs/pro-odborniky/mereni-urovne-financni-gramotnosti/2020/postoje-k-financim-a-chovani-3272/.

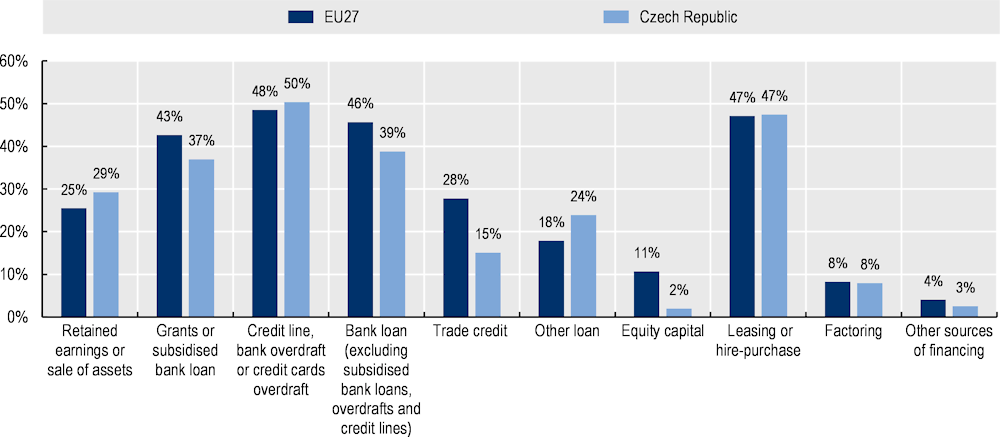

1.2.2. Czech SMEs lack sufficient funding sources

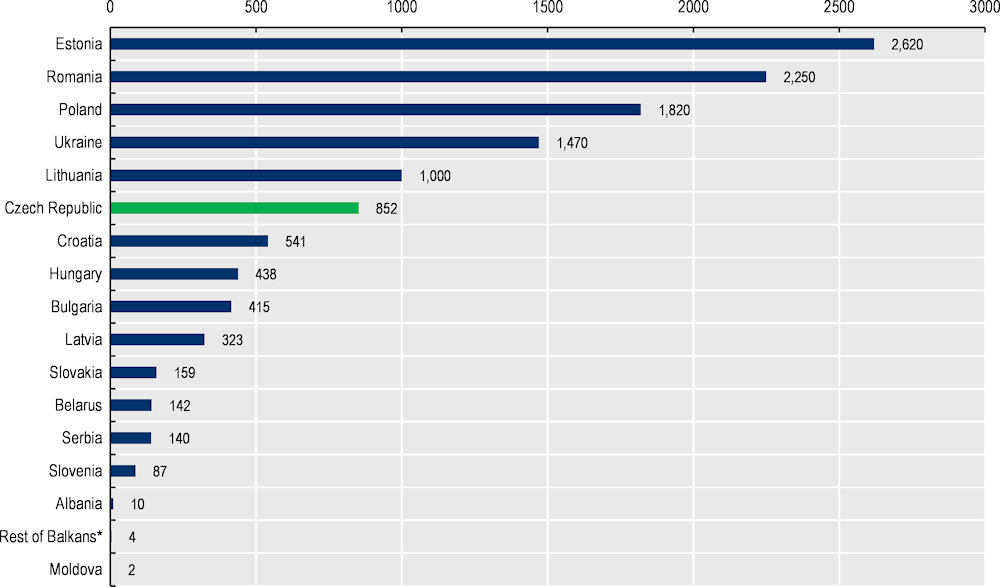

There is little Venture Capital (VC) available (Figure 1.6) in the Czech Republic, which, given lack of vibrant equity capital markets, creates a financing gap for early-stage innovative firms in need of capital with high risk tolerance. Lack of equity funding was reiterated by stakeholders from the Czech Republic during discussions and interviews with the OECD in 2020; the availability of finance for innovative start-ups, especially in the very early stages of their life cycle (the so-called proof-of-concept stage), was repeatedly described as problematic (OECD, 2020[13]). Bank credit might not always be accessible for young start-ups without any previous financial history or finished product (OECD, 2020[21]). Banks are generally unwilling to lend to this segment of the enterprise population, while much of the public financial support is not geared to these ventures either (OECD, 2020[13]).

Data from the Survey on the Access to Finance of Enterprises (SAFE) carried out once a year by the European Commission support these findings and suggest that the local bank credit market lacks depth and is less inclusive; among different funding options, Czech SMEs show a low use of bank loans, trade credit and equity to fund their operations and growth. In contrast, the use of credit lines, leasing and hire‑purchase and factoring by Czech SMEs is similar to SMEs across the EU. This might indicate that credit sourced at banks is used for ongoing operations of the firm but less for the purpose of investment, business expansion, etc. Moreover, the rejection rate by banks is higher in the Czech Republic compared with the EU average, 16% and 7% respectively. SMEs in other EU countries have a greater ability to receive a partial amount of the loan application or a loan with a high interest rate, with more alternatives for risky borrowers. Equity is rejected almost completely as a potential source of funding for Czech SMEs even up to three years after the START3 stock trading has been set up [(Figure 1.7), (European Commission, 2021[22])].

Figure 1.6. Venture capital investment by country

Note: (*) North Macedonia, Kosovo, Montenegro, Bosnia and Herzegovina.

Source: OECD construction based on data from Google for Startups, Atomico and dealroom.co (2021[23]), Coming of age: Central and Eastern European startups, https://dealroom.co/reports/coming-of-age-central-and-eastern-european-startups.

Low credit levels by consumers and SMEs could be the result of a combination of underling factors, and the legal design of the insolvency resolution regime which affects the demand and supply of credit is one of them. Large personal and economic costs associated with distress resolution reduce credit attractivity to consumers and businesses, and such costs also raise the initial price of credit as lenders internalise the possible expected loss. In the comparison of insolvency regimes performed, the Czech Republic scored worst in personal costs to failed entrepreneurs and lack of prevention and streamlining (Mcgowan and Andrews, 2018[24]). In contrast, the Czech Republic scored highest (best) in a third category – barriers to restructuring. This could mean that the design of the court-managed local regime is appropriate, however the “penalty” to failing firms and their entrepreneurs is high and there is inefficiency with regard to early resolution and out-of-court resolution. Regimes should be designed in a way to encourage debtors to take appropriate actions sufficiently early on in their financial difficulties, thereby increasing the chances of a successful restructuring (Mcgowan and Andrews, 2018[24]). A legal framework for preventive restructuring is in discussions at the Czech Republic (Lukas Valusek and Lenka Kučerová, 2022[25]).

Figure 1.7. Sources of financing for SMEs

Source: European Commission (2021[22]), Data and surveys – SAFE, https://single-market-economy.ec.europa.eu/access-finance/data-and-surveys-safe_en.

Limited access to foreign financing is another factor possibly underlying the low credit levels of Czech consumers and SMEs. According to the 2019 SBA Fact Sheet of the European Commission, the Czech Republic has the worst performance among EU member states on SME internationalisation. Formalities are relatively cumbersome with limited digitalisation, and SMEs trade less often in goods outside of the EU compared to their counterparts in other EU countries (European Commission, 2019[26]). These observations were echoed by policy makers and other stakeholders, who often reported limited access to foreign markets for most businesses, a few exceptions (of mainly large companies) notwithstanding (OECD, 2020[13]).

Prior research has shown that FinTech lending and the deployment of alternative credit scoring methods could be particularly beneficial in expanding access to credit to underbanked SMEs (OECD, 2022[27]). The MFCR has prepared a National Strategy for Development of the Capital Market in the Czech Republic 2019-23 which was approved by the government and suggests four main actions, each targeted at a different group of stakeholders – households, businesses, market infrastructure and the public sector (OECD, 2022[1]). The strategy suggests an extensive set of policy actions and reforms. All proposed actions include a time frame for execution, however interim assessment regarding the fulfilment of the strategy is not publicly available (MFCR, 2019[19]). One of the implemented actions includes the launch of an informational website called Capital Guide which is intended for SMEs looking for alternatives to bank financing (MFCR and EU, 2022[28]).

1.2.3. Banks hold the data that FinTechs seek to access

Results from the OECD questionnaire shared with Czech FinTechs during the summer of 2022 highlight the central role of data in their business model, the type of data used, and the current difficulties in accessing it as well as limitations of scope. The vast majority of respondents to the questionnaire highlighted the importance of accessing financial data for their business (88%), with APIs being the most frequent venue allowing for data accessibility (88%), demonstrating the important effect that a regulatory obligation for incumbents within the framework of the PSD2 had on the business model of new service providers. More than half (54%) of respondents placed PSD2 regulation as having a high impact on their activity.

Under the PSD2,4 which went into effect in Czech legislation during 2018 and lays down the legal basis for open banking, banks are required to make their APIs available to payment account information service providers (MFCR, 2017[29]). The PSD2 framework however is not being exploited to its full potential; more than 46% of firms responding to the OECD Questionnaire have had problems accessing customer data from financial intermediaries. Anecdotal evidence by some FinTechs operating in the Czech Republic suggests that FinTechs experience technical issues and other challenges that prevent them from connecting directly to the banks’ APIs on a regular basis. FinTechs turn to aggregators to collect the data for them in a centralised way – aggregators and special data purchases from specialised firms are used by more than half of FinTechs (58%). There is currently only a small handful of aggregators operating in the Czech financial market such privately-owned Bank APIs Aggregation Platforms (BAAPI) called Trask and Finbricks. There are also private contracts between banks and FinTechs that allow data sharing (OECD, 2022[1]).

Shortcomings of PSD2 with regard to increased competition in retail payments have been recognised at the EU level (EBA, 2022[30]). The European Commission has been promoting legislation for making data more easily available in a secure way, as part of its long-term strategy on data (European Commission, 2020[31]). The strategy aims at creating a single EU market for data, personal as well as non-personal data, including sensitive business data. Within the scope of this broad strategy, the European Commission has recently proposed legislations on the re‑use of publicly held, protected personal and non-personal data that applies to data intermediaries (proposed regulation on harmonised rules on fair access to and use of data) and rules on who can use and access which data and for which purposes (proposed regulation on European data governance) (European Commission, 2022[32]; European Commission, 2022[33]).

More specific to financial data, in 2021, the Commission established an expert group on European financial data space to engage with stakeholders. A year later, a subgroup on open finance was created as open finance is considered to be an integral part of the European financial data space, along with data contained in public disclosures of firms as well as supervisory data (European Commission, 2022[34]). The access and reuse of customer data, with consent, across a range of financial services has already been referred to in the EU Digital Finance Strategy (European Commission, 2020[35]).

In parallel, the Czech Banking Association introduced a Czech Standard for Open banking, which aims at a uniform implementation of the PSD2 API standard in the Czech market. However, the standard is not mandatory, so it is up to the discretion of individual banks to decide whether they want to adhere to the standard or not. One of the most prominent use cases to have evolved from the Open banking standard was the Bank ID implementation: an interface that allows for digital verification of identity owned by nine of the Czech banks.5 This service seems to be an improvement for consumers, although it may also be valuable for banks to collect data on their customers as to their commercial habits and to verify the data collected within the identification process in public registries, thus reinforcing the advantage of incumbent banks in access and ownership of data, even though direct information on the activity of users within the commercial or governmental site is not visible to the validating bank (OECD, 2022[1]).

1.3. Financial regulation and supervision in the Czech Republic

1.3.1. Unified financial supervision

Financial market activity in the Czech Republic, including FinTech activity, is supervised by the Czech National Bank (CNB) and regulated by the Ministry of Finance of the Czech Republic (MFCR). The CNB is the sole unified supervisory authority for the financial markets in the Czech Republic.6 The CNB lays down rules in the form of decrees and provisions; it authorises, regulates, supervises and issues penalties for non-compliance with these rules. In co‑operation with the Czech Ministry of Finance, which is responsible for the preparation of laws in the financial market area, the CNB participates in the preparation of primary legislation and is responsible for the preparation of secondary legislation (CNB, 2022[36]). The CNB’s objective in the area of supervision, as defined by law, is to ensure financial stability and the safe and sound operation of the financial system in the Czech Republic, contributing to achieving its primary objective: price stability. It is worth noting that the CNB has no official mandate with regard to fostering competition in the financial sector (CNB, 2022[37]).

The CNB has historically maintained a technology-neutral approach towards innovation in finance, similar to other OECD countries. According to the CNB, all providers of relevant products and services must comply with those conditions regardless of the innovative aspects of those activities. Nonetheless, in November 2019, the CNB established a FinTech contact point aimed at helping resolve unclear regulatory issues – including licensing and supervisory ones – so as to facilitate compliance with the duties imposed on enquirers by financial market regulations. Opinions of the CNB provided via the contact point do not substitute for authorisations or approvals granted in licensing proceedings and are not binding in any way (CNB, 2022[38]).

1.3.2. The Ministry of Finance acts as the financial regulator

The MFCR is responsible for developing the financial market policy in the area of capital markets and drafting legislation governing the capital markets, as well as setting the stage for innovation-related projects. The Czech Ministry of Finance performs regular capital market analyses and ensure the Czech membership in the international financial institutions and bodies of the European Union in the capital market area (MFCR, 2022[39]).7

In 2019, the MFCR introduced the National Strategy for the Development of the Capital Market in the Czech Republic 2019 –23. Within the government-approved strategy, it was noted that the Czech capital markets fail to sufficiently fulfil the function of efficient allocation of unutilised savings towards enterprises who need funding and that the banking system prevails. The Strategy for market development called, among others, for more diversity in the SME financing offering with alternatives to bank financing and subsidies from the European Union, as well as greater support for innovation in finance (MFCR, 2019[19]). Regarding the regulatory approach, the Strategy stresses the need to remove unnecessary regulatory burdens and costs, except for those that draw from the requirements of EU law. In addition, regulatory stability was highlighted as important.

1.3.3. Assessing the current regulatory and supervisory frameworks as they relate to FinTech activity

“Wait and See” approach taken by the CNB

The primary regulatory framework in the Czech Republic with regard to the financial sector is set by the EU regulatory framework. With regard to innovations in finance, the Czech Republic has so far followed a “wait and see” approach when it comes to new forms of activity (e.g. crowdfunding). In the absence of an EU regulation specific to some innovative digitally enabled financial services, where existing frameworks are not applicable, the Czech Republic has in the past avoided introducing a custom national legislative framework for such services. This has often resulted in either new actors, including some FinTechs, remaining outside the regulatory perimeter, or an interpretation of existing regulatory framework to extend to the new services, requiring their providers to apply to a license already defined.

The “wait and see” approach taken by Czech policy makers might be sought to avoid fragmentation across the EU and reduce regulatory burden, in particular for innovative activities in early stages of development and at a point in time when they pose low systemic risk. However, on average, bespoke regulatory frameworks for alternative finance provide for a wider range of permitted activities than pre‑existing frameworks, while they also create more explicit obligations (World Bank and CCAF, 2019[40]). Previous empirical evidence suggests that the introduction of explicit regulation appears to significantly increase retail crowdfunding volumes (Rau, 2020[41]).

The separation between underlying technology used to perform traditional financial services and completely new financial services enabled by innovative technology are becoming increasingly unclear. The introduction of the Artificial Intelligence (AI) Act proposal by the EU (European Commission, 2021[42]) may in some way be seen as an acknowledgement that complete technological neutrality may not be possible, given the fact that some technologies introduce completely new risks into the financial sector. In contrast, the use of application programming interfaces (APIs) has been leveraged by regulation to create open banking frameworks in the EU and elsewhere. Further, technological innovation now spurs outside the financial sector and is replicated or adjusted to financial services by non-financial firms such as big techs. This changes significantly the composition of financial sector actors and is a constant challenge to supervision that is entity-based.

Promoting competition is currently a secondary order objective, with possible impact on consumer interests

Neither the CNB nor the MFCR have an official mandate with regard to promoting competition in the financial sector, although the CNB considers competitiveness in the payment service providers sector as part of its mission to keep financial stability and credibility (CNB, 2023[43]). The Office for the Protection of Competition follows the legislation in Act No. 143/2001 Coll., on the Protection of Competition.8 The office focuses on anti-competitive conduct investigations and mergers market share assessments. Competition in the financial services sector has not been at the focus of attention in the past years in the Czech Republic (ÚOHS, 2023[44]). Regarding FinTech activity, this lack of prioritisation might enable incumbents to give rise to barriers to entry of FinTechs, related for example to the reported difficulties in accessing consumers’ banking data (see Section 1.2). The complementary and disruptive role of FinTechs to the activity of incumbents may not supported by Czech authorities and their supervisory compliance is mostly viewed through a micro-prudential and even risk averse perspective, rather than embracing their possible competitive advantages. Encouraging consumers to compare financial services options (“shopping” for financial services) and providers and the unbundling of products is not part of the existing financial literacy campaigns.

According to CNB officials, consumer protection issues are integrated within the work of the two supervision departments, where those departments need to balance both micro-prudential and consumer protection objectives, as well as AML/CFT requirements. Feedback from CNB officials indicate that actions in the area of consumer protection are often performed in reaction to complaints while CNB-initiated examinations do not happen often. According to the CNB, monitoring of fees and analysis of market organisational aspects such as market concentration and barriers to entry are located beyond the scope of the CNB financial supervision.

Efforts to better align the current consumer protection framework with recommended best-practices could be considered by Czech Authorities. According to the G20/OECD High-Level Principles on Financial Consumer Protection, “there should be oversight bodies (dedicated or not) explicitly responsible for financial consumer protection, with the necessary authority to fulfil their mandates. They require clear and objectively defined responsibilities and appropriate governance; operational independence; accountability for their activities; adequate powers; resources and capabilities; defined, effective and transparent enforcement framework and clear and consistent regulatory processes” (OECD, 2022[45]). According to other best practices with respect to consumer protection, “operating as a stand-alone [consumer protection] department provides the benefits of independence and greater levels of resources and authority… Regardless of organisational structure, there should be a clear separation between financial consumer protection supervision and prudential supervision, or else prudential supervisory priorities will often end up dominant” (Jaeger, Chien and Fathallah, 2014[46]).

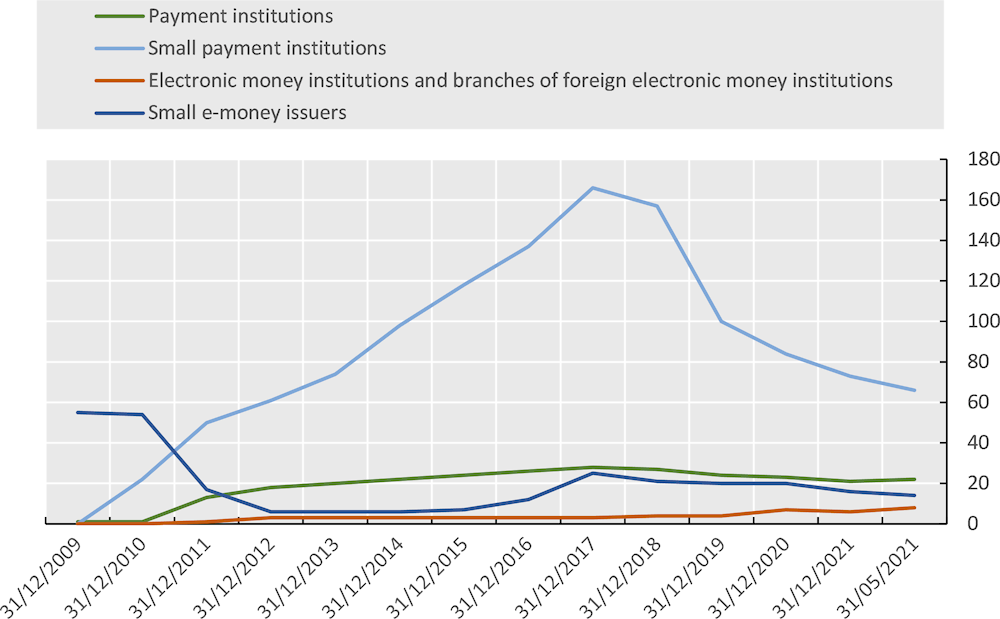

Supervision in the area of payment services providers

The CNB has been facing elevated demand for authorisation for the various payment entities, a prominent sector among Czech FinTechs, since the implementation of PSD2 in 2018 (CNB, 2020[47]). In parallel, the CNB has been expressing dissatisfaction with the quality of application submitted and approval ratios have been quite low in the payment sector in the past several years. As regards AML/CFT compliance in the payments area, the CNB assessed that a large number of non-bank payment service providers were risky from this perspective in 2020 (CNB, 2021[48]). Since the enactment of the current Act on Payments in 2018, the number of non-bank payment service providers, both small and “large”,9 has been declining according to CNB statistics. In particular, the number of small payment service providers, which required only a registration and not a lisence prior to 2018, has sharply declined (Figure 1.8). The incidence of suspended proceedings or rejected applications in the payments sector has been higher than in other financial market sectors (OECD, 2022[1]).

The CNB has identified small payment institutions and small e‑money issuers as having exploited the domestic legislative environment for their business activities, without often having at least minimum ties with the Czech market neither from an ownership nor from a clientele perspective (CNB, 2021[48]). On-site examinations identified recurring inconsistencies between the business plans submitted in the licensing proceedings and the entity’s actual activities and shortcomings arising from the formal regulation of processes and activities in internal rules, which do not correspond to the actual functioning of these entities (CNB, 2021[48]).

Figure 1.8. Summary of regulated and registered payment and electronic money institutions in the Czech Republic

Source: Based on data from CNB (2022[49]), Regulated institutions and registered financial market entities lists, https://apl.cnb.cz/apljerrsdad/JERRS.WEB07.INTRO_PAGE?p_lang=en.

Timelines for licence approvals for payment institutions and for small payment institutions were the longest compared with other types of licenses issued by the CNB, 25 and 18.3 months on average, respectively, in 2021. For comparison, average length of proceedings completed in 2021 for credit institutions and non-bank consumer lenders was 13.1 and 14.1 months respectively. In addition, the application rate for these types of licences, and small-scale payment institutions’ licences in particular, has been high in recent years.

Cultural differences between CNB and FinTechs could partially explain lack of co‑operation

The culture of an organisation might be an elusive concept to define, let alone to quantify. Regulatory rules do not involve the determination of the culture of firms. The dominant culture among financial regulators and supervisors in the Czech Republic resulted from past financial events and is prescribed by the legal objectives of each organisation. The CNB’s objective in the area of supervision, as defined by law, is to ensure financial stability and the safe and sound operation of the financial system in the Czech Republic, contributing to achieving its primary objective – price stability. The main components of the functional organisation of supervision are prudential supervision, conduct of business supervision and also AML/CFT supervision. The choice of a particular organisational structure of financial supervision entails trade‑offs and no one structure is considered superior. Despite benefits of an integrated supervision, in this respect, prudential and conduct of business supervision require different approaches and cultures and a single institution might not be able to have the flexibility to effectively encompass both (Llewellyn, 2006[50]). Clear autonomy and independence of the consumer protection department within an integrated regulator/supervisor could alleviate such tensions at least in the on-going supervision of entities.

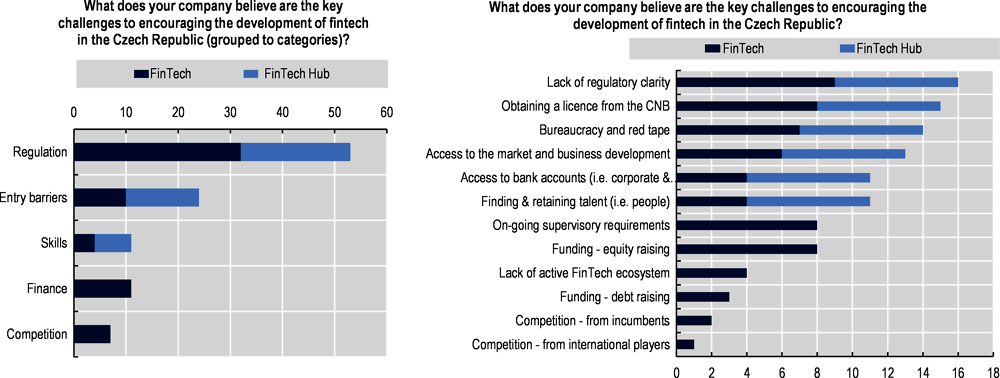

Cultural differences between the CNB and FinTechs might partially explain some difficulty in the co‑operation by both sides revolving around the licensing and supervision in the payment service providers’ sector discussed earlier. Results of the OECD (2022[1]) questionnaire focused on Czech FinTechs show that lack of regulatory clarity, obtaining a license from the CNB and red tape are the highest-ranked challenges to FinTechs development.

1.4. OECD questionnaire findings

In June 2022, the OECD (2022[1]) launched an online open questionnaire on FinTech activity in the Czech Republic. As of 25 August 2022, 22 FinTech companies provided detailed responses to this questionnaire, out of a total universe of c.100 Czech FinTech companies. These companies are headquartered in the Czech Republic or in the Slovak Republic, and 42% of these FinTechs target only the Czech market. In terms of geography of operations, more than half have headquarters in the Czech Republic, but equally, half of responding FinTechs have operations on a pan-European level through passporting rights.10 The possibility of foreign non-EU FinTech companies benefitting from a relatively lower regulatory burden and of prey firms establishing in the Czech market is a possible concern to Czech authorities, given potential risks to customer safety and investor protection (OECD, 2022[1]).

Furthermore, most respondent firms operate in the payments and electronic money services provision and the majority of respondent firms are in the seed stage of their lifecycle. Firms in the seed and early stages usually are the ones that benefit the most from the collaboration and interaction with industry mentors and government officials (World Bank, 2022[51]), to navigate regulatory requirements and to learn from veteran experiences.

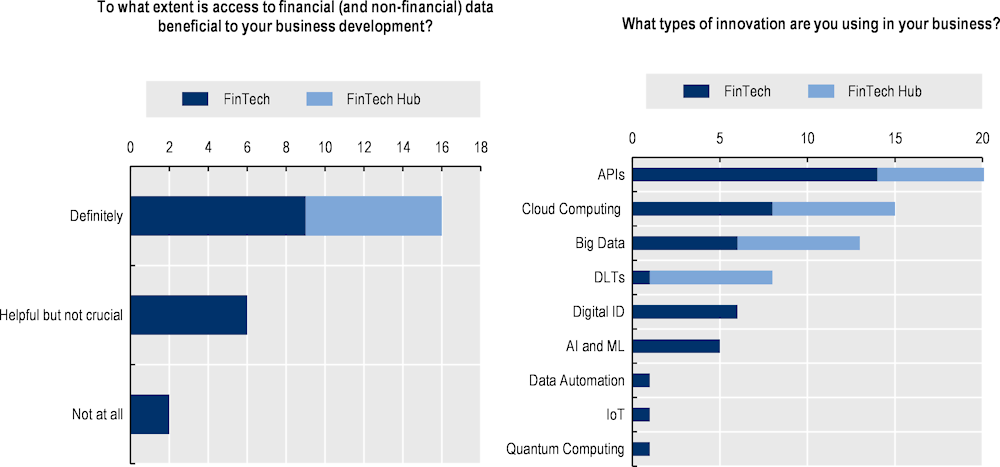

1.4.1. Data accessibility is core for FinTechs and mostly accessed through APIs

Access to data is critical for FinTechs and data is at the core of most FinTech activity (e.g. artificial intelligence business models in trading; lending; blockchain-based finance (OECD, 2021[52]). FinTechs are technology-native and combine the agility of start-ups with data processing and crunching abilities. Indeed, more than 60% of respondents to the OECD questionnaire stated that access to both financial and non-financial data is beneficial to their business development (Figure 1.9). The OECD survey shows that most innovations used by respondent Czech FinTechs evolve around data, data sharing and data usage for the development of products and services. Ninety-one percent of firms use API innovation, more than half of respondent firms use big data and 68% of firms use cloud computing – all evolving around data at the core of their business model (Figure 1.9).

Figure 1.9. Czech FinTech perceptions on data availability and types of innovation used

Note: The FinTech Hub is an association that aims to increase the level of innovation and competitiveness of the digital market in the Czech Republic and Central Europe. This category includes seven responses from FinTechs operating under their aegis.

Source: OECD (2022[1]), The FinTech Ecosystem in the Czech Republic, https://doi.org/10.1787/068ba90e‑en.

Given the key role data plays in FinTech innovation, unequal access to data and potential dominance in the sourcing of big data by few large players could reduce the capacity of smaller players to compete in the market for Fintech innovation-based products and services (OECD, 2021[52]). To that end, greater availability of data can be conducive to the development of start-up companies with possible beneficial impact on competitive conditions in financial markets.

Incumbent financial firms usually have costly legacy and potentially obsolete infrastructure and rather inefficient processes associated to such infrastructure, which, combined with cultural reluctance for change may prevent or slow down in-house FinTech innovation. As FinTechs operate with third-party data, interdependences are created with data and digital service providers that might pose new risks to the system, such as the concentration on new dominant unregulated players. The accelerated adoption of digital technologies and FinTech products and services by customers as well as heightened demand for such products, particularly since the COVID‑19 pandemic, is driving co‑operation between incumbent financial institutions and FinTechs which can facilitate their access to data.

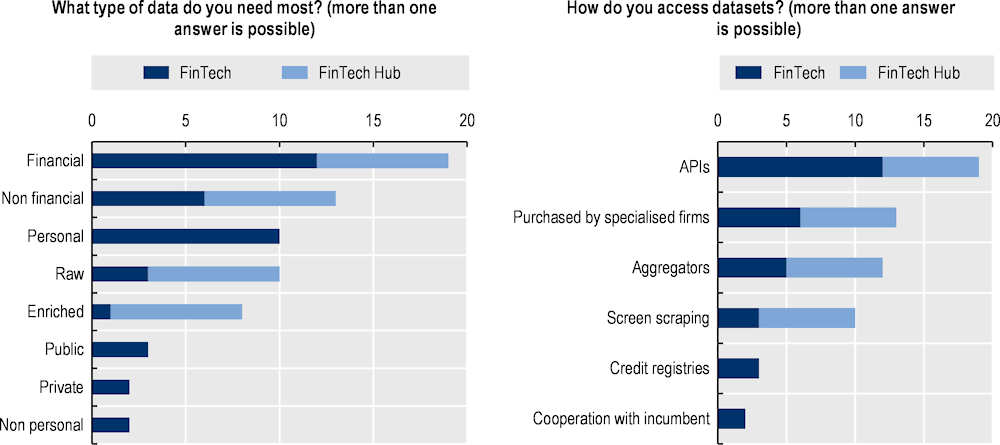

Most respondents to the questionnaire highlighted the importance of accessing financial data for their business (80%), and more than 50% highlighted the need to access personal data, which serves for the personalisation of products and services, along with non-financial data (59%), potentially spurring the financial inclusion of underbanked customers (LHS of Figure 1.10).

APIs are the most frequent form of tool allowing for data accessibility by FinTechs (86%), along with aggregators and special purchases from specialised firms (59%). Screen scraping (own data production) is also a frequent form of data gathering, used by 55% of respondents to the questionnaire (RHS of Figure 1.10).

When it comes to FinTechs sharing their own data, 77% of respondents reported that they do not share data beyond what is required by law, for different reasons. For larger firms, data is part of their key inputs; for early-stage firms, data is not part of their monetisation case yet.

Figure 1.10. Czech FinTech reported data needs

Note: The FinTech Hub is an association that aims to increase the level of innovation and competitiveness of the digital market in the Czech Republic and Central Europe. This category includes seven responses from FinTechs operating under their aegis.

Source: OECD (2022[1]), The FinTech Ecosystem in the Czech Republic, https://doi.org/10.1787/068ba90e‑en .

Even when it comes to data sharing secured by formal regulatory arrangements and frameworks such as PSD2, data accessibility is not guaranteed. More than 45% of firms responding to the OECD Questionnaire have had problems accessing customer data from financial intermediaries. There are technical and strategic reasons explaining the problems: respondents reported that external APIs do not function properly in many cases, while others claimed that banks should be required by law to digitally sign documents.

There is a role for competition authorities to reduce barriers to market entry by limiting abusive dominant practices that impede competition and create risks of market concentration with detrimental impact on financial consumers, as well as systemic risk. At a minimum, existing frameworks for data sharing arrangements should be promoted and their correct implementation safeguarded.

1.4.2. Reported hurdles to FinTech innovation primarily in regulation

Financial regulation existing across the board for financial services safeguards market integrity, consumer protection and promotes financial stability (OECD, 2022[53]). From the industry standpoint, it provides for legal certainty that allows companies with innovative business models to develop and grow. At the same time, regulatory compliance is usually perceived by young start-up firms as a hurdle, given the associated cost and time commitment (World Bank, 2022[]; OECD, 2020[21]) although it is unanimously agreed that regulation is essential to keep customers safe and to preserve the stability of the system. According to the findings of the OECD questionnaire, the most important reported hurdles to FinTech innovations in the Czech Republic are related to regulation: lack of regulatory clarity (68%), red tape (64%), licensing and supervisory requirements (64%), followed by entry barriers (55% of respondents) (Figure 1.11) (World Bank, 2020[]). According to the OECD 2020 Czech Survey, resolving commercial disputes (“enforcing contracts”) takes longer than on average in the OECD, and is more costly to businesses (OECD, 2020[21]).

For 11% of the respondents, finding a retaining talent seems to be a concern, and could be related to the fact that these companies employ innovative technologies and mechanisms that require specialised skillsets by highly skilled employees. Nevertheless, when it comes to digitalisation skills, the Czech Republic is clustered in the group of OECD countries characterised by the highest skills proficiency (Citibank, 2022[]). In 2020, the European Commission suggested in its country report that although the Czech Authorities are committed to the development and integration of new digital technologies, such effort is hampered by persistently low skills levels. For example, the Czech Republic still lags behind frontier Member States in terms of research and patent activities in this area (European Commission, 2020[]).

Access to funding is one of the most commonly impediments to entrepreneurship across many OECD and developing economies (OECD, 2015[]) and a reported challenge to Czech FinTech development (Figure 1.11). Overall, SMEs financing gaps may stem from an overreliance on the bank credit intermediation channel, which may be constraint particularly in times of stress. Lack of awareness about alternative funding sources and a reluctance of founders and entrepreneurs to relinquish ownership in exchange for equity financing are additional challenges. When it comes to market debt financing, SMEs have substantial structural disadvantages in obtaining such financing compared to large corporates given deal sizes and related economics of small transactions and disproportionate costs associated with such issuances (Nassr and Wehinger, 2015[]). The European Commission has also recommended support towards SMEs by making greater use of financial instruments to ensure liquidity support, reducing the administrative burden, and ensuring access to finance for innovative firms (European Commission, 2020[]).

There may be a need to clarify processes for regulatory processes such as licensing and authorisation and/or to educate new market entrants around applicable regulatory frameworks, particularly in areas of FinTech innovation, to address some of the reported impediments to FinTech development. It could also be noted that, interestingly, most Czech FinTechs operate in non-regulated sectors; the perceived burden of regulation evidenced by the OECD questionnaire could perhaps further incentivise FinTechs to develop activity in non-regulated sectors to avoid such burden. The complex administrative procedure of establishment was also identified as one of the main obstacles for start-ups in the Czech Republic by the European Commission (European Commission, 2022[]). The Commission therefore recommended that Czech Authorities remove the barriers hampering the development of a fully functioning innovation ecosystem (European Commission, 2019[]).

An additional challenge signalled by FinTech respondents is the issues of access to market and business development (OECD, 2022[1]). Regulatory sandboxes are one of the policy tools used to assist companies in overcoming the challenges on market access, as by creating an open dialogue between the regulator and the firm, they provide agility to the supervisory and regulatory framework (World Bank, 2020[61]; 2020[62]). Indeed, regulatory sandboxes are beneficial to both parties: they allow innovators to test on a small scale their products, services and delivery mechanisms (as evidenced by the United Kingdom experience), while providing the regulator with intelligence on developments, trends and emerging risks (Bromberg, Godwin and Ramsay, 2017[]; World Bank, 2020[]; Kalifa, 2021[]; World Bank, 2020[]).

Figure 1.11. Czech FinTech challenges

Note: More than one answer is possible. The FinTech Hub is an association that aims to increase the level of innovation and competitiveness of the digital market in the Czech Republic and Central Europe. This category includes seven responses from FinTechs operating under their aegis.

Source: OECD (2022[1]), The FinTech Ecosystem in the Czech Republic, https://doi.org/10.1787/068ba90e-en.

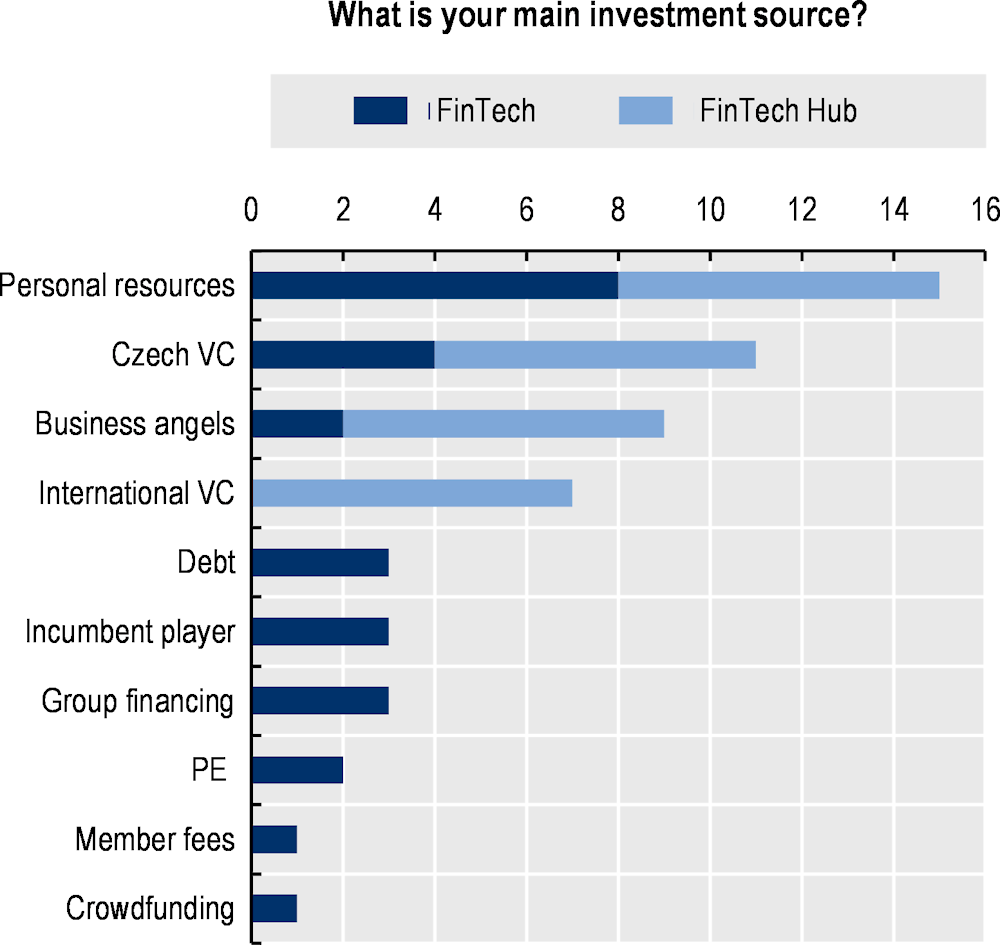

1.4.3. Czech FinTechs are heavily dependent on personal resources for funding

Access to finance constitutes one of the challenges for FinTech companies in the Czech Republic (see Section 1.2). Based on the responses to the OECD Questionnaire, the main investment source for Czech FinTechs is personal resources (37% of respondents), which is consistent with start-up and SME companies deploying own funds and friends and family financing (Berger and Udell, 2003[]). Czech entrepreneurs rely mainly on their own resources and seed capital (68% of companies secured seed capital from own sources while only 48% were able to find an investor in a recent industry survey (Deloitte Česká Republika, 2022[]). 14% of start-ups raised initial funding from family or relatives and friends, while 5% took a loan from a bank.

Domestic VC funding appears to be the second most important funding source in the group of respondents (18%). When combined with international VCs, this source of funding becomes the most widely used in the group (33% combined VC). These responses reflect the increase in VC activity by domestic funds in the Czech Republic although there is still room to develop VC funding further in the country relative to the levels observed in the rest of Europe (see Section 1.2). Czech FinTechs are also looking for VC as their main investment source in the future (Figure 1.12).

It should be also noted that none of the FinTech firms responding to the OECD Questionnaire received funding from the public sector (local or national) (Figure 1.12).

Most respondents have a neutral or favourable opinion of the Czech Republic as an easy place to raise investment (OECD, 2022[1]). A caution note can be made on this assertion, as only FinTechs who have successfully raised funding for their innovation have answered the OECD Questionnaire, so there is a possible survival bias and sample selection bias in this exercise (Keogh and Johnson, 2021[]).

Figure 1.12. Czech FinTech access to finance, 2022

Note: The FinTech Hub is an association that aims to increase the level of innovation and competitiveness of the digital market in the Czech Republic and Central Europe. This category includes seven responses from FinTechs operating under their aegis.

Source: OECD (2022[1]), The FinTech Ecosystem in the Czech Republic, https://doi.org/10.1787/068ba90e-en.

Another interesting observation of the responses to the OECD Questionnaire relates to the exit strategy of responding FinTechs: the majority of FinTechs report to be in the business to be acquired by incumbents or larger FinTechs/BigTechs (M&A accounting for more than 64% of the responses). Although this is understandable, it is not conducive to increased competition in the market for financial services and are subject to the terms of the acquisitions (OECD, 2022[1]).

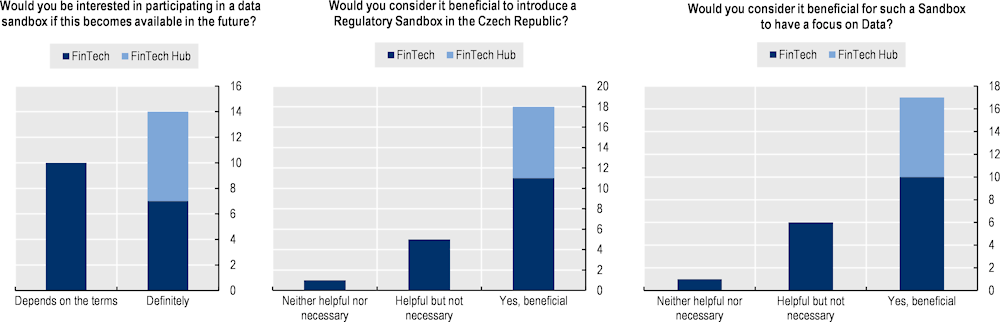

1.4.4. Czech FinTechs are interested in a regulatory sandbox

More than 77% of respondents to the OECD Questionnaire believe that it would be beneficial to introduce a regulatory sandbox in the Czech Republic. According to the OECD survey, 73% of respondent FinTechs would be interested in a sandbox with a focus on data if it were to become available (Figure 1.13). Two-thirds of these would only be interested depending on the terms of such a sandbox. This highlights the importance of a well-thought design and structure of any future sandbox arrangement. It also highlights a possible lack of clear understanding of what a sandbox involves from the FinTech side, underscoring the importance of clear communication and a required educational effort that may need to be undertaken in such effort.

Sandbox arrangements enable firms to test innovative financial products and services and develop business models that are based on the use of innovative technologies and mechanisms, subject to the specific rules applied by the competent supervisory authorities. Although sandboxes can involve the use of legally provided discretions by supervisory authorities, the baseline assumption for regulatory sandboxes is that firms are required to comply with all relevant rules applicable to the activity they are undertaking (BIS, 2018[]). In addition, sandboxes do not entail the disapplication of regulatory requirements that must be applied because of EU law (ESMA, EBA and EIOPA, 2019[]).

Figure 1.13. Perceived interest in a regulatory or data sandbox

Note: The FinTech Hub is an association that aims to increase the level of innovation and competitiveness of the digital market in the Czech Republic and Central Europe. This category includes seven responses from FinTechs operating under their aegis.

Source: OECD (2022[1]), The FinTech Ecosystem in the Czech Republic, https://doi.org/10.1787/068ba90e-en.

Regulatory sandboxes can foster innovation in the financial sector while allowing supervisors to observe and address emerging risks of the deployment of innovative technologies in finance, with benefits that extend to all stakeholders involved. They allow supervisors to enhance their understanding of innovative mechanisms deployed by FinTechs that may alter the risk profile of certain financial activities, which, in turn, may have a beneficial impact on the development of adequate policy responses to such innovations. Importantly, they reduce regulatory uncertainty for FinTechs and can help lower the perceived regulatory burden that has been observed in the OECD survey of FinTechs in the Czech Republic. In terms of funding, empirical evidence suggests a beneficial impact of sandbox participation for fundraising of companies, facilitating access to finance which has been highlighted as one of the most important impediments to the establishment and growth of SMEs in the Czech Republic and beyond (Cornelli et al., 2020[]). Sandboxes can also promote competition, and allow the development of new products and services, diversifying financial consumer offering and possibly promoting financial inclusion or other policy objectives, such as sustainability (FCA, 2022[])

When it comes to a data sandbox, this could conceptually involve a controlled environment on which FinTechs could test innovations based on data sharing, data usage and business models that rely heavily on data, without a regulatory component in the sandbox. For example, the development, testing and validation of artificial intelligence‑based products and of machine‑learning-based models could be envisaged in a controlled environment of a data sandbox, or the development of distributed ledger technology-based activity for the recording and analysis of large volumes of (unstructured) data. Indicatively, such data sandbox could provide real and synthetic datasets available through the sandbox or collected through API calls or could consist of an effort to collectively gather such datasets in co‑operation with participating firms and depending on their needs.

1.5. Opportunities for policy makers to address challenges and close gaps with best practices

To observe the legal mandates of supervisors – i.e. market integrity, ensure financial stability, protect consumers – and at the same time unleash the potential of data in financial services and stimulate innovation in the financial sector, it is crucial to look at key characteristics and best practices in the fields of FinTech policies and data in finance.

FinTech companies have the potential to boost economic growth, create skilled jobs, and leverage the power of data for the benefit of clients. Thanks to data portability rules in the context of open banking, FinTech-developed products allow customers to benefit from cheaper or more personalised services and change financial services providers with more ease. FinTechs are widely seen as crucial facilitators for more effective and competitive financial markets, as well as for extending access to credit for people who have historically been underserved (OECD, 2022[27]).

There are indications that the current dialogue between the CNB and FinTechs may not be optimal and would benefit from an improved setting for constructive dialogue and exchange of information that would benefit both sides. FinTechs report regulatory requirements and supervisory actions as prominent hurdles to their operations, while at the same time, CNB officials are showing dissatisfaction with license applications, as well as lack of preparedness. This brings rise to opportunities for policy makers to address the main hurdles found in the FinTech ecosystem. With the best practices in mind, the current Czech practices are analysed and possible gaps and challenges are noted. The identified gaps form the basis of the recommendation for considering the implementation an innovation facilitator in the form of a regulatory sandbox as one of the ways to alleviate some of the most important gaps and challenges for FinTech development in the Czech Republic.

1.5.1. Regulatory sandboxes as a tool to optimise communication between Authorities and FinTechs

While the CNB shows dissatisfaction with FinTech license applications and holds a ‘wait and see’ approach for regulation/supervision of new forms of activity, FinTechs perceive regulatory and supervisory issues are the main hurdles to their development, citing regulatory unclarity as a main issue. This results in multiple rounds of formalised exchanges between the two sides during license application processes, contributing to a longer authorisation process. As FinTechs are often small enterprises that do not enjoy deep financial pockets as their incumbent counterparts, speed to market is imperative and the slowing of this speed could compromise their financial viability.

Customised guidance, which can take the form of greater transparency and clear guidance to prepare for the submission of an application for license, would benefit individual FinTechs and Authorities alike. While FinTechs could as a result make more informed decisions, identify potential opportunities, develop tailored strategies, and ensure compliance with applicable regulations, regulators could better monitor the activities of FinTechs and ensure compliance with the applicable regulatory framework without the bending of any rules. The current CNB FinTech contact point, although perfectly adequate in terms of quality, may be insufficient in terms of capacity and perhaps unable to cover forthcoming likely increasing demand for guidance by FinTechs, considering new of upcoming regulations in the EU space (Markets in Crypto‑assets (MiCA) Regulation, Distributed ledger technology (DLT) pilot regime, Artificial Intelligence (AI) Act proposal).

A form of innovation facilitator could be a way to promote the diffusion of understanding and knowledge of regulations, supervision and norms, while at the same time informing the regulatory/supervisory authorities of the impacts of regulations, thus not only driving innovation in the market, but also within the regulatory/supervisory bodies. While continuing to apply current rules and regulations, innovation facilitators can enhance legal certainty without bending the rules for FinTechs.

Two main categories of innovation facilitators are identified in the European Union according to the European Supervisory Authorities (ESA’s) Joint Report on Regulatory Sandboxes and Innovation Hubs (ESMA, EBA and EIOPA, 2019[]):

Innovation hubs: these provide a dedicated point of contact for firms to raise enquiries with competent authorities on FinTech-related issues and to seek non-binding guidance on the conformity of innovative financial products, financial services or business models with licensing or registration requirements and regulatory and supervisory expectations.

Regulatory sandboxes: these provide a scheme to enable firms to test, pursuant to a specific testing plan agreed and monitored by a dedicated function of the competent authority, innovative financial products, financial services or business models. Sandboxes may also imply the use of legally provided discretions by the relevant supervisor (with use depending on the relevant applicable EU and national law) but sandboxes do not entail the disapplication of regulatory requirements that must be applied because of EU law.

General analysis of strengths, weaknesses, opportunities and threats

The potential benefits of innovation facilitators are widely acknowledged by OECD members. Regulatory sandboxes are a suitable approach to address fast technological development in the European market. A recent study of the European Commission states that they are essential in areas such as FinTech, to prevent pre‑mature market exclusion for emerging business models that do not comply with existing regulatory frameworks without giving these models an opportunity to prove that they can offer adequate levels of protection of users (European Commission, 2019[]).

Possible weakness of the facilitator might arise from an inadequately chosen design. This means either a design that does not provide sufficiently appealing functionalities addressing FinTech needs; or a design that does not fit the characteristics of the local FinTech – and broader financial services – market environment. For this reason, an extensive analysis is required before any specific design characteristics are recommended to ensure the feasibility of the recommended design.

Regulatory sandboxes can provide the opportunity for advancing regulation through proactive regulatory learning, enabling regulators to gain better regulatory knowledge and to find the best means to regulate innovations based on real-world evidence (European Union, 2020[]).

At the same time, regulatory sandboxes need to respect and should foster the application of the principles of subsidiarity and of proportionality, as well as of the precautionary principle (European Union, 2020[]). Proper framework for governance and accountability of the innovation facilitator is vital to enable the regulator to evaluate internally the performance and achievements of the innovation facilitator as well as for the purposes of accountability (European Parliament, 2020[]).

Viability evaluation

The benefits of innovation facilitators to markets can be seen by multiple such initiatives taken over several years of experience across both the European Union as well as globally. Several OECD economies have opted for the regulatory sandbox approach to regulate FinTech while enhancing an innovative ecosystem and preserving the stability of the financial sector. Regulatory sandboxes have come to be associated with FinTech innovation (World Bank, 2020[]). A regulatory sandbox might provide an open dialogue environment to assess motivations, business models and common understanding of FinTech activities and regulatory measures (ESMA, EBA and EIOPA, 2019[]). The jurisdiction historically driving the development is the United Kingdom, where the first ever sandbox was implemented in 2016. Another leading example in FinTech innovation regulation is Singapore, where the Monetary Authority of Singapore (MAS) policy intent was based on a balanced approach in promoting financial development and ensuring a safe and sound financial sector, and in sync with its objective to harness technology and to improve the efficiency of the financial markets (Fan, 2018[]). In advanced economies, the Central Bank, the Financial Supervisory Authority or the Securities Regulator oversees regulatory sandboxes (see Table 1.1).

Table 1.1. Sandbox arrangements across OECD and non-OECD economies

|

Country |

Type of Regulator |

Year of implementation |

|---|---|---|

|

United Kingdom |

2016 |

|

|

Australia |

2016 |

|

|

Singapore |

2016 |

|

|

Canada |

2017 |

|

|

Japan |

2017 |

|

|

Netherlands |

2017 |

|

|

Lithuania |

2018 |

|

|

Norway |

2018 |

|

|

Switzerland |

Financial Supervisor, Other Govt. Body |

2018 |

|

Taiwan |

Financial Supervisor |

2018 |

|

Denmark |

2019 |

|

|

South Korea |

Securities Regulator, Financial Supervisor |

2019 |

|

Austria |

2019 |

|

|

Denmark |

2019 |

|

|

Spain |

2020 |

|

|

Hungary |

2020 |

|

|

Poland |

Financial Supervisory Authority and Ministry of Finance |

2020 |

|

Greece |

2021 |

|

|

Italy |

Central Bank, Securities Regulator, Insurance Supervisor and Ministry of Finance and Economy |

2021 |

|

Latvia |

2021 |

|

|

Slovak Republic |

2022 |

Source: Presentation delivered at the OECD Workshop in Prague on 24 November 2022.

To ensure efficient functioning of the innovation facilitator and usefulness for the local Czech market, the design should consider both local needs as well as best practices taken from existing initiatives to support financial innovation. Equal access opportunities to innovation facilitators and transparent eligibility criteria are essential to ensure a level playing field. Clear and transparent objectives need to be combined with sufficient resources and tools to create an environment for the envisioned knowledge transfer and viable functioning of the innovation facilitator.

The detailed recommendations provided thereafter on the optimal design of an innovation facilitator and the substantive arguments backing such recommendations provide the necessary but not sufficient conditions for the undertaking of this project by the Czech Authorities. Institutional buy-in and political willingness to consider the establishment of a regulatory sandbox by Czech Authorities is a prerequisite for the success of such an endeavour. The necessary internal set-up for such a facilitator to be effective, including organisational independence and a clear mandate from the relevant authorities are additional parameters to promote the successful implementation of such endeavour. The lack of deployment of necessary resources, both in scale and in skill, for the establishment of an innovation facilitator at the organisational and operational level would be a major risk to the implementation of this recommendation. The identified barriers to FinTech growth provided earlier in the process, combined with the current feasibility analysis, provide for evidence‑based arguments for the need of such facilitator in the Czech Republic as one of the ways to alleviate constraints to FinTech development in the Czech Republic. The recommendations provided thereafter are taking into consideration the feasibility of such endeavour in the context of the Czech financial markets environment, FinTech ecosystem, regulatory and supervisory environment and European-level developments in the financial innovation space.

Expected impact of a regulatory or a data sandbox in the Czech Republic

The European Commission’s Digital Finance Strategy in Chapter 4.1 highlights that “Firms should be able to rely on close co‑operation between national supervisory innovation facilitators within the European Forum of Innovation Facilitators (EFIF), and a new EU digital finance platform.” (European Commission, 2020[]). That puts Czech innovative companies in a possibly disadvantaged position. Although the Fintech contact point of the Czech National Bank participates in the meetings of the EFIF, it is a contact point with limited scope, giving Czech innovators limited options compared to their competitors from other EU member states, particularly when it comes to cross-border collaboration of European regulatory sandboxes.

A Czech regulatory sandbox could bring benefits to regulators, innovators and consumers and ensure that Czech FinTechs do not lose their competitiveness. It could directly address the need for better dialogue between the supervisor and the Czech FinTechs and would cover for the possibly limited capacity of the current contact point in a future environment of growing needs by FinTechs considering new or forthcoming EU regulatory frameworks, or current shifts in the financial services market. The facilitator will allow the supervisor to gain traction with innovative business models that can be tested in the facilitator to inform their supervisory activity. This may mean identifying potential risks and hazards to the sector and providing better data and technology to support financial regulators and supervisors. Importantly, it may reduce regulatory uncertainty for FinTechs and may help lower the perceived regulatory burden for FinTechs in the Czech Republic that has been observed in the OECD consultation (OECD, 2022[1]).

The establishment of an innovation facilitator, such as a regulatory sandbox, can foster innovation in the financial sector while allowing supervisors to observe and address emerging risks of the deployment of innovative technologies in finance, with potential benefits that extend to all stakeholders involved. They may allow supervisors to enhance their understanding of innovative mechanisms deployed by FinTechs that may alter the risk profile of certain financial activities, which, in turn, may have a beneficial impact on the development of adequate policy responses to such innovations.

Financial facilitators in the form of data sandboxes could provide enhanced data-sharing capabilities, building a platform for companies to test data-based business models or innovative ideas based on real or synthetic data accessible in a controlled environment. A data sandbox could conceptually involve a controlled environment on which FinTechs would use specifically prepared data to test business models or innovative ideas that rely heavily on data, without a regulatory component. Indicatively, such data sandboxes could provide tailor-made real and synthetic datasets available to sandbox participants, provided data can be gathered from public authorities and/or market participants.

References

[7] Advokátní deník (2022), “Crowdfunding se nově zařadí mezi běžné investiční nástroje”, https://advokatnidenik.cz/2022/04/28/nova-zakonna-regulace-zaradi-crowdfunding-mezi-bezne-investicni-nastroje/ (accessed on 4 August 2022).

[66] Berger, A. and G. Udell (2003), Small Business and Debt Finance, Springer-Verlag, https://doi.org/10.1007/0-387-24519-7_13.

[69] BIS (2018), “Implications of fintech developments for banks and bank supervisors”, Basel Committee on Banking Supervision, Sound Practices, http://www.bis.org (accessed on 29 August 2022).

[63] Bromberg, L., A. Godwin and I. Ramsay (2017), “Fintech sandboxes: Achieving a balance between regulation and innovation”, Journal of Banking and Finance Law and Practice, Vol. 28/4, pp. 314-336.

[6] CCAF (2021), The 2nd Global Alternative Finance Market Benchmarking Report, CCAF, https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/the-2nd-global-alternative-finance-market-benchmarking-report/ (accessed on 25 January 2022).

[55] Citibank (2022), Digital Money Index, https://www.citibank.com/icg/sa/digital_symposium/digital_money_index/ (accessed on 29 August 2022).

[43] CNB (2023), Regulace a dohled nad platebními institucemi a institucemi elektronických peněz - Česká národní banka, https://www.cnb.cz/cs/dohled-financni-trh/vykon-dohledu/postaveni-dohledu/regulace-a-dohled-nad-platebnimi-institucemi-a-institucemi-elektronickych-penez/ (accessed on 20 January 2023).

[18] CNB (2022), ARAD - Time Serie System - Czech National bank, https://www.cnb.cz/cnb/STAT.ARADY_PKG.STROM_DRILL?p_strid=0&p_lang=EN (accessed on 4 August 2022).

[38] CNB (2022), CNB launches FinTech contact point - Czech National Bank, https://www.cnb.cz/en/cnb-news/press-releases/CNB-launches-FinTech-contact-point (accessed on 20 June 2022).

[36] CNB (2022), Financial market supervision - Czech National Bank, https://www.cnb.cz/en/supervision-financial-market/ (accessed on 16 June 2022).

[37] CNB (2022), Long-term supervisory strategy of the Czech National Bank - Czech National Bank, https://www.cnb.cz/en/supervision-financial-market/long-term-supervisory-strategy-of-the-czech-national-bank/ (accessed on 24 June 2022).

[49] CNB (2022), Regulated institutions and registered financial market entities lists, https://apl.cnb.cz/apljerrsdad/JERRS.WEB07.INTRO_PAGE?p_lang=en (accessed on 17 June 2022).

[48] CNB (2021), Financial Market Supervision Report 2020, https://www.cnb.cz/export/sites/cnb/en/supervision-financial-market/.galleries/aggregate_information_financial_sector/financial_market_supervision_reports/download/fms_2020.pdf (accessed on 22 June 2022).

[47] CNB (2020), Financial Market Supervision Report 2019, https://www.cnb.cz/export/sites/cnb/en/supervision-financial-market/.galleries/aggregate_information_financial_sector/financial_market_supervision_reports/download/fms_2019.pdf (accessed on 22 June 2022).

[71] Cornelli, G. et al. (2020), “Inside the regulatory sandbox: effects on fintech funding”, BIS, https://www.bis.org/publ/work901.htm (accessed on 29 August 2022).

[17] Czech Statistical Office (2022), Information Society in Figures 2022 Czechia and EU, http://www.plzen.czso.cz (accessed on 9 November 2022).

[15] Czech Statistical Office (2022), Innovation activities of enterprises - 2018 to 2020 | CZSO (in Czech), https://www.czso.cz/csu/czso/inovacni-aktivity-podniku-20182020 (accessed on 9 November 2022).

[67] Deloitte Česká Republika (2022), Jak se v Česku daří startupům, https://www2.deloitte.com/cz/cs/pages/press/articles/jak-se-v-cesku-dari-startupum.html (accessed on 29 August 2022).

[30] EBA (2022), Opinion of the European Banking Authority on its technical advice on the review of Directive (EU) 2015/2366 on payment services in the internal market (PSD2).

[9] Ecommerce Europe and EuroCommerce (2022), European E-Commerce report 2022, http://www.ecommerce-europe.eu (accessed on 20 January 2023).

[70] ESMA, EBA and EIOPA (2019), FinTech: Regulatory sandboxes and innovation hubs, https://ec.europa.eu/info/publications/180308-action-plan-fintech_en (accessed on 5 May 2023).

[34] European Commission (2022), Consultation document - Targeted consultation on open finance framework and data sharing in the financial sector, EUROPEAN COMMISSION DIRECTORATE-GENERAL FOR FINANCIAL STABILITY, FINANCIAL SERVICES AND CAPITAL MARKETS UNION, https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/2022-open-finance-consultation-document_en.pdf (accessed on 10 May 2022).

[59] European Commission (2022), Country Report-Czechia Accompanying the document Recommendation for a COUNCIL RECOMMENDATION on the 2022 National Reform Programme of Czechia and delivering a Council opinion on the 2022 Convergence Programme of Czechia, https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A52022SC0605 (accessed on 29 August 2022).

[11] European Commission (2022), European Innovation Scoreboard - Country Profile - Czechia, https://ec.europa.eu/assets/rtd/eis/2022/ec_rtd_eis-country-profile-cz.pdf (accessed on 9 November 2022).

[14] European Commission (2022), European Innovation Scoreboard 2022 and Regional Innovation Scoreboard 2021, https://ec.europa.eu/research-and-innovation/en/statistics/performance-indicators/european-innovation-scoreboard/eis (accessed on 9 November 2022).

[33] European Commission (2022), Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on harmonised rules on fair access to and use of data (Data Act), https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A68%3AFIN (accessed on 3 August 2022).

[32] European Commission (2022), REGULATION (EU) 2022/868 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 30 May 2022 on European data governance and amending Regulation (EU) 2018/1724 (Data Governance Act), https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022R0868 (accessed on 3 August 2022).

[22] European Commission (2021), Data and surveys - SAFE, https://single-market-economy.ec.europa.eu/access-finance/data-and-surveys-safe_en (accessed on 4 November 2022).

[42] European Commission (2021), Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL LAYING DOWN HARMONISED RULES ON ARTIFICIAL INTELLIGENCE (ARTIFICIAL INTELLIGENCE ACT) AND AMENDING CERTAIN UNION LEGISLATIVE ACTS, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0206 (accessed on 3 August 2022).