This section provides context behind the in-depth feasibility study performed on the FinTech ecosystem in the Czech Republic, of which the main findings are presented in Chapter 1, which formed the basis of the recommendations presented in this report for the implementation of a regulatory sandbox presented in Chapter 2. The purpose, objectives, activities, and all relevant details regarding the execution of the feasibility study for a regulatory sandbox in the Czech Republic are presented here, as per the Action underpinning this project.

Supporting FinTech Innovation in the Czech Republic

Annex A. Background to the feasibility report and lessons learned

Purpose and objectives of the feasibility study for a regulatory sandbox in the Czech Republic

The mission of the Directorate General for Structural Reform Support (DG REFORM) of the European Commission is to promote the European Union’s economic, social and territorial cohesion by supporting Member States’ efforts to implement reforms. The Czech Republic has requested support from the European Commission under Regulation (EU) 2021/240 establishing a Technical Support Instrument (“TSI Regulation”). Following the assessment, the European Commission has decided to fund the request and provide technical support to the Czech Republic, together with the Organisation for Economic Co‑operation and Development (OECD). The technical support was provided in the area of administrative and regulatory reform, with the purpose of establishing a regulatory sandbox for Financial Technology (FinTech)1 companies in the Czech Republic.

FinTech can improve the efficiency of the financial sector, all the more so in the context of the digitalisation trend that was intensified during the COVID‑19 pandemic. However, modern technologies and the advantages of the Czech IT sector (technical capacities, skills) are not used to their full potential, and there is no innovation facilitator dedicated to FinTechs in the Czech Republic. Importantly, the level of innovation and technical complexity of FinTech applications lead to perceived uncertainty about the existence and/or applicability of relevant regulatory and supervisory frameworks.

The objectives of the Action were to analyse the current and potential use of data in finance and related policy frameworks and to support the growth of FinTech in the Czech Republic by providing recommendations on the design of a regulatory sandbox with a dedicated testing data-sharing and data usage infrastructure to harness the potential of FinTech innovation while limiting emerging risks and safeguarding the financial system.

Activities and outputs outlined in the action

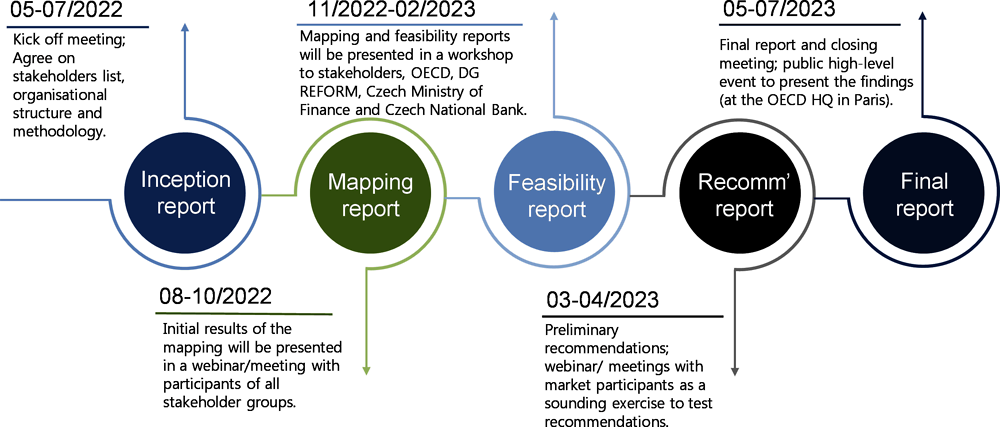

In order to achieve the objectives of the Action, The OECD has implemented the Action in a gradual manner, producing several intermediate reports (Figure A A.1), through continuous consultation with relevant Czech stakeholders and several workshops dedicated to presenting best practices and findings related to the Czech ecosystem, spur a discussion and receive feedback.

Figure A A.1. Project outputs

The Action was launched with a kick-off event that took place on 5 May 2022, in Prague, with attendees representing all stakeholder groups concerned by the Action. In parallel, the OECD team initiated an outreach effort towards many relevant stakeholders, with requests for physical meetings/interviews and tailored questionnaires. Extensive consultations took place with the Czech National Bank, the Czech Ministry of Finance and Czech FinTech organisations. Several other stakeholders have provided the team with written answers to questions. With a focus on start-ups and SMEs, the OECD published an online questionnaire, focusing on the following issues: people and skills; corporate finance; innovation and data management; compliance and risk. An inception report was submitted to DG REFORM on 1 July 2022 and presented the operational aspects of the Action including the organisational structure; description of activities; timeline; information needs; methodology; communication arrangements; external communication plans; feedback processes and potential risks associated with the implementation of the Action.

On 20 September 2022 the OECD organised a webinar where it presented the preliminary findings of the Czech FinTech sector and ecosystem mapping and received feedback from participants. Given that there was no comprehensive country study describing the FinTech sector of the Czech Republic, the mapping report was published as an OECD report to improve visibility of the Action and provide a solid basis for local and international stakeholders (including investors). It was submitted to DG REFORM on the 14th of October 2022 and publicly launched at an event on 24th of November 2022 in Prague.

The mapping report reviewed the current regulatory and supervisory framework in terms of (i) different types of licenses and authorisations, (ii) the relevant processes, and (iii) the involved stakeholders. An assessment of the potential impact of the new EU legislative proposals on the local FinTech market has also been done. This assessment was based on thorough analysis of the implications expected at the current proposed regulatory framework compared with the existing supervisory and regulatory framework.

The report assessed that there were more than 100 the Czech FinTech companies operating in the Czech Republic at the time, active across a number of regulated and unregulated sectors of activity. Financial market activity in the Czech Republic is regulated by the Ministry of Finance of the Czech Republic (MFCR) which develops and enacts the financial market policy and drafts legislation. The Czech National Bank (CNB) is the sole unified supervisory authority for the financial markets in the country. In November 2019, the CNB established a FinTech contact point. The contact point aims at helping resolve unclear regulatory issues – including licensing and supervisory ones – so as to facilitate compliance with the duties applied to market participants by financial market regulations. Opinions of the CNB provided via the contact point do not substitute for authorisations or approvals granted in licensing proceedings and are not binding in any way. EU legislation proposals under way are expected to bring more entities into the regulatory scope, to achieve a harmonised legal framework across the EU. This will ultimately increase the number of entities that the CNB will need to authorise and supervise.

Twenty-four FinTech companies provided detailed responses to the online questionnaire as of 5 October 2022, representing almost a quarter of the Czech FinTech companies’ universe. Access to data is critical for FinTechs and data is at the core of most FinTech activity (e.g. artificial intelligence business models in trading; lending; blockchain-based solutions in finance). Indeed, more than 67% of respondents to the OECD Questionnaire stated that access to both financial and non-financial data is beneficial to their business development. When it comes to data sharing secured by formal regulatory arrangements and frameworks, such as PSD 2, data accessibility is not guaranteed. More than 46% of firms responding to the OECD Questionnaire have had problems accessing customer data from financial intermediaries.

According to the findings of the OECD Questionnaire, the most important reported hurdles to FinTech innovations in the Czech Republic are related to regulation: lack of regulatory clarity (67%), red tape (63%), licensing and supervisory requirements (58%), followed by entry barriers (54% of respondents). According to the OECD survey, 71% of respondent FinTechs would be interested in taking part in a sandbox with a focus on data, if it were to become available. Two-thirds of these would only be interested in participating depending on the terms of such a sandbox. The answers highlighted the importance of a well-thought design and structure of any future sandbox arrangement, and also a possible lack of clear understanding of what a sandbox involves from the FinTech side, underlining the importance of clear communication and the required educational effort that may need to be undertaken ahead of a possible future establishment of a sandbox.

The 2nd Workshop of the Action was held on 24th of November at the Czech Republic Ministry of Finance in Prague. The Workshop gathered 62 participants from the public sector, the private sector including FinTechs and associations representing the industry, academia and other local and international authorities’ representatives. A preliminary analysis on gaps was presented and an open discussion with participants from all parts of the ecosystem around the identified gaps and the alternative policies to fill in gaps and alleviate constraints to the development of the Czech FinTech ecosystem was held. The workshop also included knowledge sharing session on data sharing arrangements, and a roundtable discussion on the Czech FinTech ecosystem.

The feasibility report, submitted to DG REFORM in January 2023, highlights best practices in policy frameworks across OECD economies in order to support the development of FinTech. With these best practices in mind, the report then analyses the current regulatory and supervisory framework implemented in the Czech Republic and documents gaps and barriers related to other aspects of the Czech financial markets that may hinder the development of the Czech FinTech sector. The report highlights financial literacy and capital market development as areas where improvements are needed in the Czech Republic in order to align with best practices. There are indications that the current dialogue between the CNB and FinTechs may not be optimal. This is why the report recommends the establishment of a form of innovation facilitator, as a way to promote the diffusion of understanding and knowledge of regulations, supervision, and norms, while at the same time informing the authorities of the impacts of regulations, thus not only driving innovation in the market, but also within the authorities.

In particular, an innovation facilitator, such as a regulatory sandbox, could reinforce the limited capacity of the FinTech contact point, especially in light of forthcoming changes to the FinTech-related regulatory environment and the associated higher needs for guidance by FinTechs. The final report develops specific recommendations as a result of the analysis, in close consultation with the Czech National Bank and the Ministry of Finance, on the design of a sandbox for the Czech Republic. These recommendations draw on experience of sandbox models in other jurisdictions and are adjusted to cater for the specific needs of the Czech financial ecosystem.

The recommendation for the Czech sandbox is to commence with the establishment of a ‘standard’ sandbox, fully managed by the Czech Authorities, and to the extent feasible, provide data-sharing when the conditions allow it. The feasibility of this option will be based on (i) availability of datasets and ability to make these available; (ii) capacity of the authorities participating in the sandbox. The recommended scope for the Czech sandbox would be firms offering an innovative product or service, with no restrictions as to the sector of activity, provided that these fall under the remit of the financial supervisor (CNB) directly or indirectly. Therefore, any financial activity could be considered for participation in the Czech sandbox, provided that applicant firms comply with eligibility criteria provided. The recommended structure for the Czech sandbox advises against the provision of any waivers; restricted authorisations or other relaxation of existing applicable rules, which would anyway be against EU rules. It is recommended that a proportional application of existing regulatory and supervisory requirements, as embedded in EU financial services regulation, is used as appropriate and at the discretion of the supervisor for firms participating in the Czech sandbox. The sandbox should offer firms individual guidance and attractive timelines for the various phases of the test.

Lessons learned during the implementation of the Action

Importance of building communication channels between different stakeholders in the FinTech ecosystem

Effective communication between all stakeholders involved in the FinTech ecosystem is of paramount importance for the development of the FinTech market. Without functioning and collaborative communication channels in place, it is difficult to advance and foster the FinTech market, as differing standpoints and perceptions may not be known or well-understood by stakeholders involved. In the case of the Czech FinTech ecosystem, FinTechs perceived the CNB as siding with the large incumbent institutions and lacking the intention to help foster the business environment for FinTechs and promote their growth. The CNB, on the other hand, may not have fully reaped the benefits of interacting with FinTech firms to promote its understanding of their business models or to address the perceived impediments to their growth.

Communication gaps between the CNB and FinTechs caused issues in the payments service provider licensing process. An example of a hurdle encountered by FinTech firms in the area of Payment Service Providers is obtaining a license. The CNB has been facing elevated demand for licensing authorisations by various payment entities since the implementation of PSD2 regulatory framework, while at the same time expressing dissatisfaction with the quality of such applications. Approval ratios for these entities are low and the number of payments services providers has been declining since 2018 due to stricter requirements of the new PSD2 rules, as well as CNB’s enforcement of them and of AML requirements.

A regulatory sandbox can improve dialogue and reduce burdens encountered or perceived by the FinTech industry. To have a deeper understanding of the main hurdles that FinTechs are encountered with, the OECD conducted a questionnaire to gather insights from an industry perspective. The main reported issues were primarily around regulation; the lack of regulatory clarity, red tape, and licensing requirements being on the top of the list. The findings indicate that there indeed is reason for improving the communication channels between the supervisor and FinTechs, and a regulatory sandbox could be one of the ways to improve dialogue and alleviate some of the reported burdens encountered by this sector, with benefits for both authorities and FinTechs.

A form of innovation facilitator set up by the authorities could have an important signalling effect

There are conflicting perceptions between FinTech firms and regulators/supervisor. Related to the issue of lack of communication, there seems to be clashing perceptions between FinTech firms and regulators/supervisor. Authorities on the one hand may somehow perceive many FinTechs as endeavours that are unwilling or unable to invest into understanding and ensuring compliance with existing rules (which they label as “red tape”) and wish to remain outside the scope of the regulator for regulatory arbitrage purposes. FinTechs on the other hand seem to perceive regulators and supervisors as unwilling to provide guidance or help the development of the FinTech industry, despite the potential of these firms to produce possible efficiencies and other benefits towards society at large. Such generalised perceptions are counter-productive and do not reflect the reality of the situation since regulation and oversight provides for shared benefits and strives for common objectives between FinTechs and authorities, such as safeguarding consumer protection which will increase the confidence of consumers in innovative services.

A regulatory sandbox could serve as an important signalling tool used by authorities to demonstrate their willingness to foster safe and resilient development of the FinTech industry. From a signalling perspective, the regulatory sandbox could still extend benefits to the FinTech ecosystem irrespective of whether the sandbox is big or small in scale and contains few or multiple features. The initiative could signal the effort made by authorities in attempting to promote a better dialogue with FinTechs firms and foster the development of a safe FinTech ecosystem. It could therefore ameliorate the current perception held by many in the FinTech industry about a possible negative stance that regulatory and supervisory bodies take towards innovation within the financial sector. In parallel, it is important to allocate the appropriate capacity and offer real measurable benefits to sandbox participants, such as customary guidelines and attractive timelines, alongside a true intention to support innovation, to improve the current perception.

There is a lack of education of FinTechs on the role and need for regulation in safeguarding themselves, their customers, and the financial markets

Many Czech FinTechs, especially the young start-ups among them, lack understanding of the important role that regulation plays in the safeguarding of their own activities, the financial consumers that form the base of their customers, and the financial markets within which they operate. Many of the FinTechs that were consulted during the exploration and analysis phases of the project lacked a solid understanding around the fundamental objectives of regulation in the financial markets and of the specifics of regulatory and supervisory requirements of financial activity. While this is not uncommon for many FinTech firms in advanced economies, there is a possible need for increased financial education efforts towards FinTechs (and micro, small and medium enterprises MSMEs more broadly).

Increased financial education towards FinTechs may be needed. The possible establishment of an innovation facilitator in the form of a regulatory sandbox could also contribute to such efforts as a positive by-product given the close collaboration of the supervisor with participating firms.

Note

← 1. According to the Financial Stability Board (FSB), Financial Technology (FinTech) can be defined as “technology-enabled innovation in financial services that could result in new business models, applications, processes or products and could have an associated material effect on financial markets and institutions and how financial services are provided”.