This chapter provides an overview of investment promotion agencies (IPAs) in ECOWAS Member States and on their main priorities and efforts to attract sustainable investment. It also draws on the experience of other regions to provide lessons on better targeting FDI to support sustainable development and sharpening the indicators used for this purpose.

Sustainable Investment Policy Perspectives in the Economic Community of West African States (ECOWAS)

3. Promoting sustainable investment

Abstract

Governments design investment promotion strategies to support the achievement of national development objectives through the promotion and facilitation of foreign direct investment (FDI). While sound investment policies are intended to ensure that host countries are attractive and FDI benefits are maximised, investment promotion strategies are designed to influence the kind of investment that is attracted. In this context, most governments prioritise certain types of investments over others, which takes place through the selection of priority sectors, source countries and investment projects (OECD, 2018[1]). This prioritisation occurs because some types of FDI, with certain characteristics, are considered to contribute more to a host country’s development than other types (Sauvant and Mann, 2019[2]). In particular, the issues of sustainability, inclusiveness, and the contribution to the sustainable development goals (SDGs) have become increasingly important and have led some investment promotion agencies (IPAs) to redefine their priorities. This chapter provides an overview of IPAs in ECOWAS Member States and their main priorities and efforts to attract sustainable investment. It also draws on the experience of other regions to provide lessons on better targeting FDI to support sustainable development and refining the indicators used for this purpose.

Promoting and facilitating investment in ECOWAS

The role of national investment promotion agencies

Investment promotion strategies can be designed by the ministry in charge of investment, the investment promotion agency (IPA) or a combination of both or more actors. Whether key contributors or not, IPAs are the main implementors of their country’s investment promotion strategies. All ECOWAS Member States have established an IPA, most of which have been recently created or restructured through governmental decrees. For instance, APIEX (Benin) was created in 2018, as the result of the merger of three state-owned companies in 2018. CEPICI (Côte d’Ivoire) was created in 1993 but underwent an institutional reform in 2012 while Cabo Verde TradeInvest was created in 2016 as the successor agency of Cabo Verde Investimentos. In some cases, agencies were created by executive decrees (Benin, Burkina Faso, Côte d’Ivoire, Guinea, Niger, Senegal, Togo) while in other instances they were established by legislative acts (the Gambia, Ghana, Liberia, Nigeria, Sierra Leone).

The structure and governance of IPAs differ across agencies in the region. Most are public autonomous agencies of an economic and administrative nature. Togo Invest is a state-owned company. Some agencies are placed under the direct supervision of the President or Prime Ministry’s office, including in Benin, Côte d’Ivoire, Ghana, Liberia and Mali. Most IPAs have a board of directors, notably in Benin, Gambia, Ghana, Nigeria, Sierra Leone and Togo. Additionally, almost half of the IPAs in the region (Benin, Cabo Verde, Ghana, Guinea, Mali, Nigeria, Sierra Leone) have branch offices in other cities or regions beside the headquarters located in the capital city. The number of branch offices range from one in Sierra Leone to nine in Guinea.

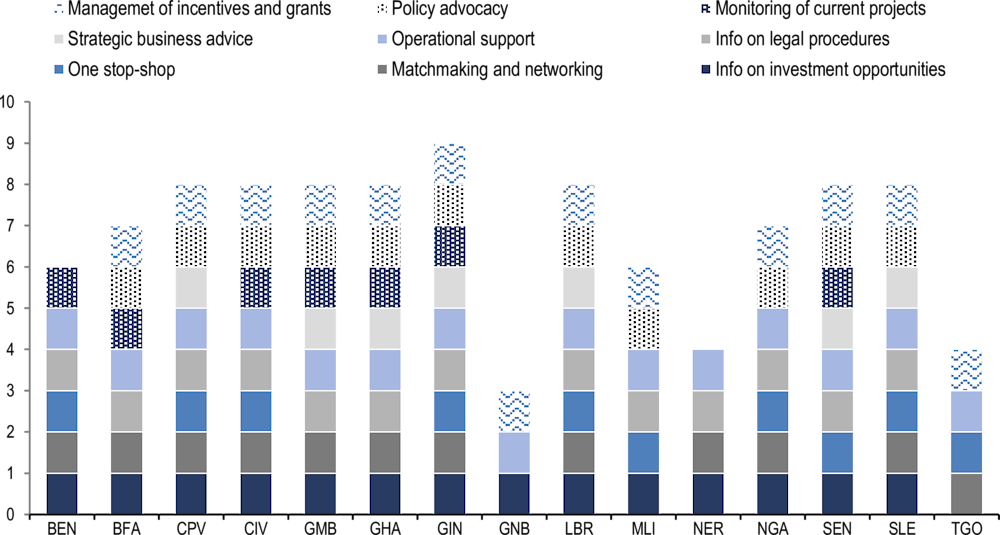

While all IPAs in the region have the mandate to promote FDI into the country, some have additional mandates that go beyond investment. For example, a majority of IPAs in ECOWAS are also tasked to promote domestic investment, including Burkina Faso, Côte d’Ivoire, Ghana, Guinea, Liberia, Mali, Nigeria, Senegal and Togo. Promoting exports into foreign markets is also a mandate for the agencies of Benin, Cabo Verde, the Gambia and Sierra Leone. IPAs in the region offer different services to promote, attract and retain investment in their respective countries (Figure 3.1). The most frequent services provided by ECOWAS agencies are the provision of information on investment opportunities, support in setting up and expanding operations, organising matchmaking events and forums, and providing information and advice on the legal investment framework. Two thirds of IPAs host one-stop shops to centralise the process to establish a business and invest while GIEPA (the Gambia) is currently developing one.

Figure 3.1. Main services provided by ECOWAS IPAs

Source: OECD compilation based on IPAs’ websites.

Promoting investment at regional level

In addition to the national IPAs, ECOWAS Member States are also seeking to co-ordinate their investment promotion and facilitation initiatives. The ECOWAS Investment Policy (ECOWIP), which is inspired by the OECD Policy Framework for Investment (OECD, 2015[3]), includes a chapter on the investment promotion and facilitation policy framework to support its Member States to adopt good international standards (ECOWAS, 2018[4]). Its main policy principles are the following:

Pledge to create a regional IPA to co-ordinate investment-promotion and facilitation activities amongst the national IPAs of the Member States;

Support the creation of national IPAs in those Member States in which none exists;

Promote national IPAs that are autonomous and adequately funded and staffed, and that report directly to the highest political office in the relevant jurisdiction;

Encourage one-stop investment facilitation mechanisms to minimise administrative and regulatory bottlenecks for investment-entry and doing business purposes;

Facilitate national and regional collaboration to initiate reforms that translate into a more competitive regional investment climate in West Africa;

Foster alliances with other regional and international investment-promotion networks;

Encourage the establishment of national databases on investment; and

Promote the publication of annual reports on investment inflows and outflows for each Member State, as well as all applicable national policies, laws regulations, and amendments.

How IPAs support the SDGs: experience from other regions

When governments design their investment promotion strategies, they prioritise certain types of sectors, countries, investment projects or individual investors – either because they have a higher probability of being realised or because they may bring certain benefits to the host economy (OECD, 2018[1]). Prioritisation strategies can have different motivations, depending mostly on the country’s national development objectives, local assets and international context. These strategies allow countries to specialise and target their FDI attraction efforts towards specific government priorities.

As IPAs recognise their role in attracting and boosting investment in support of the SDGs, they focus their efforts increasingly on those investors that are more likely to generate sustainable development impacts. In this light, this section provides a brief comparative analysis of the extent to which IPAs’ investment promotion priorities contribute to sustainable development in member countries of two benchmark regions: the OECD and the Association of Southeast Asian Nations (ASEAN). The findings are based on the results of the OECD survey on IPA Monitoring & Evaluation and Prioritisation.

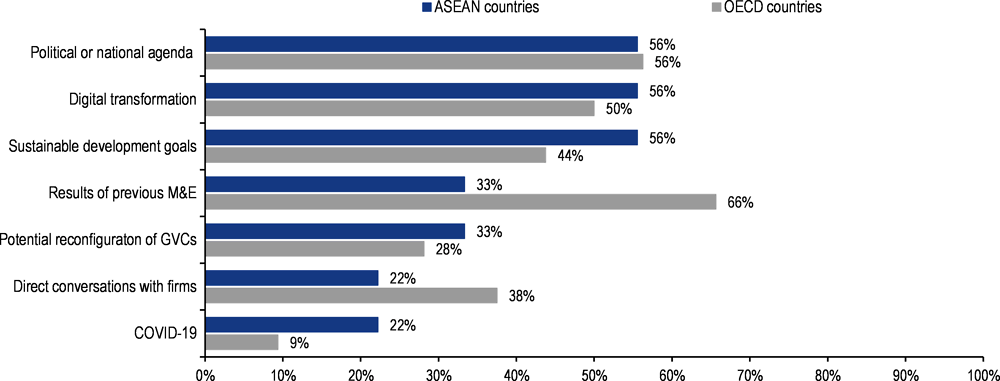

When asked about top factors influencing their investment promotion priorities, 56% of ASEAN IPAs rank jointly first the contribution to the SDGs, the political/national agenda and digital transformation (Figure 3.2). This share is higher than among OECD members (44%), where agencies adopt a rather pragmatic approach and select the results of previous monitoring and evaluation (M&E) as the most important factor. A robust M&E system can indeed capture different relevant aspects, including related to sustainability, and guide strategic orientations accordingly (Sztajerowska and Volpe Martincus, 2021[5]). The overall political or national agenda, which is also deemed important in both ASEAN and OECD countries, can underpin other factors as well, such as digitalisation and sustainability (OECD, 2023[6]).

Figure 3.2. Top factors motivating IPAs’ current priorities in ASEAN and OECD countries

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD countries, 2021; ASEAN countries, 2022).

Conversely, the COVID-19 crisis is considered as a top factor by much fewer agencies. Although the pandemic has had a strong immediate effect on FDI flows and investment promotion activities around the world, prompting IPAs to change their priority actions and ways of working (OECD, 2020[7]), the crisis has not shifted their main concerns beyond key priorities such as sustainability and digitalisation. It has rather prompted governments and IPAs to accelerate their response to these global imperatives as a way to reinforce economic resilience.

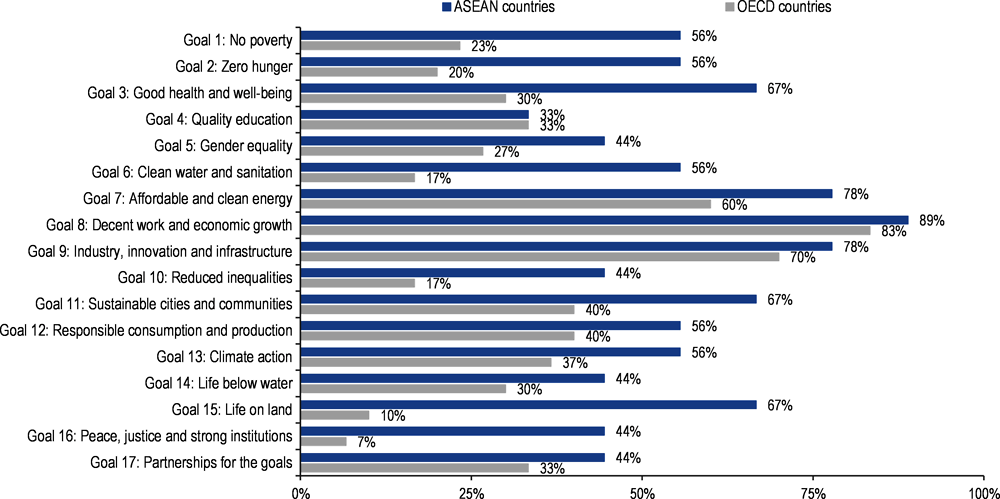

As IPAs are increasingly targeting sustainable investment, they can contribute to some SDGs more than others. In both ASEAN and OECD countries, the SDGs relating to promoting economic growth and employment (Goal 8); supporting resilient infrastructure, industrialisation and innovation (Goal 9); and ensuring access to modern and clean energy (Goal 7) are mentioned by most IPAs (Figure 3.3). This is not a surprising result since these objectives correspond most closely to IPAs’ usual tasks. ASEAN IPAs also focus more systematically than OECD IPAs on contributing to social and environmental sustainability, particularly good health and well-being (67%), sustainable cities and communities (67%), life on land (67%), poverty reduction (56%) and climate action (56%). ASEAN agencies are also more often integrated in the ministry in charge of investment or have a broader economic role, thereby giving them a wider field of action on key aspects related to the SDGs (OECD, 2023[6]). IPAs in the OECD are often more specialised and autonomous, focusing on selected tasks and priorities. IPAs in ECOWAS typically share a similar institutional profile to OECD agencies and may therefore display similar trends in terms of priorities. Preliminary evidence from a subset of ECOWAS countries that participated in the same survey shows that IPAs in the region prioritise the SDGs to a similar extent as OECD countries in their investment promotion strategies. The results also reveal that ECOWAS countries predominantly focus on the economic-oriented SDGs, particularly SDG 9, as well as SDGs 7 and 8, rather than the more sustainability-oriented ones.

Figure 3.3. The SDGs to which IPAs in ASEAN and OECD contribute

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD countries, 2021; ASEAN countries, 2022).

Priority sectors and sustainability in ECOWAS

Like IPAs in the OECD and ASEAN regions, agencies in ECOWAS seek to prioritise certain sectors over others in their investment promotion efforts. Agriculture is promoted by all IPAs. Other highly promoted sectors include construction and infrastructure; energy; technology and communication; and tourism and hospitality (Table 3.1). IPAs also promote specific sectors, such as the creative industry in Cabo Verde, the iron and steel industry in the Gambia and retail, timber and brewing industries in Nigeria. While the IPAs from Benin and Ghana promote the largest array of sectors on their websites, those from Mali, Senegal and Sierra Leone are the most selective.

Several agencies in the region put a particular emphasis on promoting sustainable investment, especially through the promotion of specific sectors such as renewable energy. The IPAs from Benin, Burkina Faso, Cabo Verde, the Gambia, Ghana, Guinea, Mali, Niger, Sierra Leone and Togo list the promotion of FDI in renewable energy sectors on their websites. But only a few provide detailed information on investment opportunities in these sectors and related incentives and legal background (Cabo Verde, the Gambia, Ghana, Mali and Sierra Leone). In some cases, these measures are part of broader overarching sustainable development strategies. The Gambia, for example, focuses particularly on attracting large-scale projects in the solar energy sector as part of a broader strategy to develop the solar energy industry. Some of the priorities of Cabo Verde’s IPA are guided by the Ambição 2030 - Declaration of Commitment for Sustainable Development. In Sierra Leone, attracting FDI in the renewable energy sector aims to support the country’s strategic vision to make it Africa’s first zero-carbon middle-income economy by 2040. The IPA of Niger is seeking to attract investment that can support the country’s Economic and Social Development Plan, including its “sustainable management of the environment” axis.

Table 3.1. Main sectors promoted by ECOWAS IPAs

|

BEN |

BFA |

CPV |

CIV |

GMB |

GHA |

GIN |

GNB |

LBR |

MLI |

NER |

NGA |

SEN |

SLE |

TGO |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Agriculture |

|||||||||||||||

|

Construction / infrastructure |

|||||||||||||||

|

Education |

|||||||||||||||

|

Energy |

|||||||||||||||

|

Incl. renewable energy |

|||||||||||||||

|

Finance / insurance |

|||||||||||||||

|

Fishing |

|||||||||||||||

|

Health / pharmaceutical |

|||||||||||||||

|

Livestock |

|||||||||||||||

|

Manufacturing |

|||||||||||||||

|

Mining |

|||||||||||||||

|

Technology / communication |

|||||||||||||||

|

Textile / garments |

|||||||||||||||

|

Tourism / hospitality |

|||||||||||||||

|

Trade / commerce |

|||||||||||||||

|

Transport / logistics |

Source: OECD compilation based on IPAs’ websites.

Côte d’Ivoire, for its part, is focused on attracting FDI in waste management and recycling, more particularly in: (i) plastic waste recycling for the manufacture of packaging, (ii) cardboard and paper recycling, (iii) paper production based on cellulosic waste, (iv) used broken glass recycling, and (v) hollow and pressed glass manufacturing. Senegal does not focus its attraction efforts on the renewable energy sector but seeks to make some of its target sectors more sustainable, notably by attracting sustainable mining projects and ecotourism investors. Togo aims to attract investment in an aquaculture project that favours an environmentally friendly and long-term sustainable fish farming model.

IPAs should not only focus on promoting sustainable investment through new investments, but also use the SDGs to guide them in the way they deliver investment facilitation and aftercare services to existing investors who wish to expand or reinvest. IPAs in ECOWAS could, for example, consider focusing aftercare activities on those investors with the highest sustainability impacts. They could also take advantage of these services to better promote responsible business conduct within the existing business community and encourage investors to comply with sustainability-related laws more systematically, as well as to embrace responsible practices in their business operations (see Section on Responsible Business Conduct).

Indicators to prioritise and measure sustainability outcomes of FDI

A key question is the way and degree to which IPAs can track their contribution to national sustainable development objectives, beyond the actual sectors they target. A closer look at their key performance indicators (KPIs) is necessary to understand and evaluate the extent to which investment promotion strategies contribute to attracting and facilitating sustainable investment. IPAs need to rely on specific and consistent indicators to ensure that: (i) they attract the right investments, and (ii) the attracted FDI actually generates sustainability outcomes.

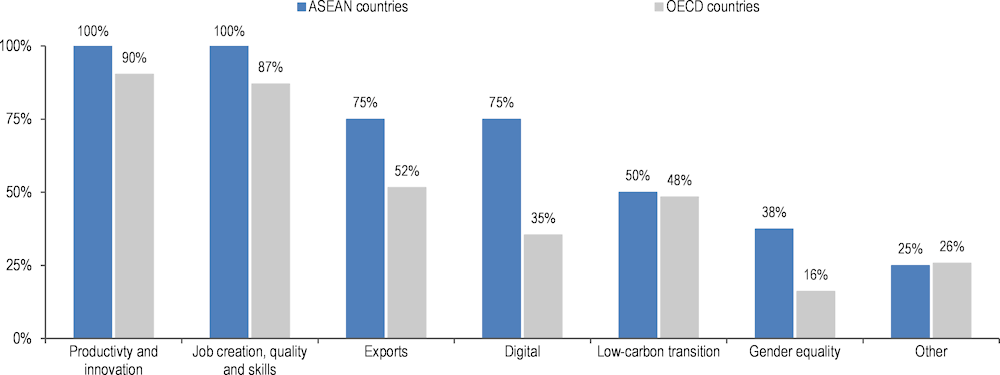

To select priority firms and guide their decision on whether to assist a particular investment project, IPAs rely on KPIs related to outcomes, some of which aim to assess the contribution of a project to local development and sustainable growth. These can be grouped into several broad categories. The most used KPIs in both ASEAN and OECD countries are those relating to productivity and innovation, and those on job quantity and quality (Figure 3.4). This is likely to be the case in ECOWAS as well, as these are the prime objectives of IPAs.

Figure 3.4. Types of KPIs used for FDI prioritisation by ASEAN and OECD agencies

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD, 2021; ASEAN, 2022).

IPAs can also use KPIs that are related to the SDGs but do not appear in the categories in the figure. For example, the Philippines uses indicators to prioritise investment projects that have a positive impact on nature conservation and the protection of sea and coastline. Similarly, Indonesia uses a different type of prioritisation indicator relating to the geographical dispersion of FDI and measured by the value of investment realisations outside Java (OECD, 2023[6]). Promoting investment in support of regional development has also become a high priority in OECD countries. As 92% of agencies have the mandate to promote and facilitate FDI in support of regional development, 69% use FDI distribution across regions as a KPI (OECD, 2022[8]).

KPIs related to the low-carbon transition are used by approximately half of the agencies for FDI prioritisation in ASEAN and OECD countries. Indicators to prioritise low-carbon FDI can be very diverse from one agency to the other – depending on the priorities but also the resources and capacities of these agencies – and are often still in development. Several more sophisticated mechanisms are emerging and increasingly used, however (Box 3.1).

Box 3.1. Environmental sustainability KPIs for prioritisation in selected ASEAN and OECD IPAs

Different indicators have been developed and are used differently by IPAs. Many of them set a target and track the number of attracted and realised projects according to their target sectors and countries.

IDA Ireland has set a target to win 60 environmental sustainability investments in 2021-24. In identifying priority investments, IDA has developed an approach guided by the six sustainable activities set out in the European Union taxonomy on sustainable investment and by an analysis of the sustainability opportunities which align with Ireland’s core strengths, and which are deemed to present the greatest opportunity to win FDI.

Business Sweden has embraced the long-term national ‘Pioneer the Fossil Free’ initiative, by setting clear objectives to accelerate green investments to Sweden to become fossil free by 2045. The agency identifies companies, solutions and expertise that can support reducing CO2 emissions in Sweden and monitors and adapts its investment promotion priorities and activities accordingly.

The Malaysian Investment Development Authority targets companies that adopt green technologies and the reuse and recycling of activities, as well as projects applying the circular economy model (e.g. pollution and waste management) to prioritise investment. The Philippine Board of Investments uses indicators to prioritise investors with green processes and the use of modern and clean technology.

Some agencies are also developing sustainability scoring mechanisms. For example, Germany Trade & Invest developed an integrated scoring model, where FDI projects are assessed and scored against a set of qualitative and quantitative indicators for sustainability. The agency then adjusts its promotion and advisory services to investors accordingly. Similarly, Invest in Canada has recently introduced a scoring mechanism to prioritise investment opportunities based on two dimensions: FDI impact and investment potential. The former evaluates the likelihood that the investment will benefit Canada and one variable focuses on social and sustainable development. The agency uses Bloomberg terminal and its scoring system to measure Environmental, Social and Governance (ESG) related impact.

Source: OECD survey on IPA monitoring & evaluation and prioritisation (OECD countries, 2021); direct interactions with IPAs.

To ensure that prioritisation is effective, it is important to have a strong M&E system with relevant indicators. While it is key to prioritise certain investments over others to respond to sustainability objectives, it is equally important to understand and track their contribution to the desired outcomes. Integrating sustainability indicators in IPA M&E systems is necessary to measure the results of the agency and the effective contribution of companies assisted by the IPA to sustainable development, including the decarbonisation of the economy. In OECD countries, many IPAs still tend to rely predominantly, or exclusively, on metrics relating to the number and value of investment projects or on the number of jobs created (Sztajerowska and Volpe Martincus, 2021[5]).

Some agencies, however, increasingly pay more attention to sustainability-related KPIs and track the number of projects in relation to their priority sectors. For example, the Turkish IPA measures the number of projects that are realised in the targeted low-carbon sectors, namely recycling, renewable energy, and the development of energy efficient components and technologies. The Finnish agency has introduced an impact assessment mechanism based on direct interviews with investors. Advisors from the agency ask questions to representatives of any new investment project dealing with their carbon impact. The answers provided allow them to formulate outcome indicators on the contribution of the investments attracted to the country’s low-carbon transition.

To conclude, in their efforts to achieve the SDGs through FDI, ECOWAS Member States need to ensure that the actual indicators used by their IPAs to prioritise investments and to measure their outcomes are aligned with the overarching investment promotion priorities. Effective sustainable investment promotion strategies require granular indicators and measurements. Additionally, KPIs used for M&E should ideally be aligned with those used for prioritisation to ensure consistency between the set targets and the desired outcomes.

References

[4] ECOWAS (2018), ECOWAS Investment Policy, https://wacomp.projects.ecowas.int/wp-content/uploads/2020/03/ECOWAS-INVESTMENT-POLICY-ENGLISH.pdf.

[6] OECD (2023), “Enabling sustainable investment in ASEAN”, OECD Business and Finance Policy Papers, No. 23, OECD Publishing, Paris, https://doi.org/10.1787/eb34f287-en.

[8] OECD (2022), “The geography of foreign investment in OECD member countries: How investment promotion agencies support regional development”, OECD Business and Finance Policy Papers, No. 20, OECD Publishing, Paris, https://doi.org/10.1787/1f293a25-en.

[7] OECD (2020), Investment promotion agencies in the time of COVID-19, https://read.oecd-ilibrary.org/view/?ref=132_132715-6ewiabvnx7&title=Investment-promotion-agencies-in-the-time-of-COVID-19.

[1] OECD (2018), Mapping of Investment Promotion Agencies in OECD Countries, https://www.oecd.org/investment/investment-policy/mapping-of-investment-promotion-agencies-in-OECD-countries.pdf.

[3] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

[2] Sauvant, K. and H. Mann (2019), “Making FDI More Sustainable: Towards an Indicative List of FDI Sustainability Characteristics”, Journal of World Investment & Trade, Vol. vol. 20 (Dec. 2019), pp. pp.916-952, https://ssrn.com/abstract=3509771.

[5] Sztajerowska, M. and C. Volpe Martincus (2021), Together or Apart: Investment Promotion Agencies’ Prioritisation and Monitoring and Evaluation for Sustainable Investment Promotion, OECD Investment Insights, Paris, https://www.oecd.org/daf/inv/investment-policy/Investment-Insights-Investment-Promotion-Prioritisation-OECD.pdf.