1. Digital transformation spurs innovation, generates efficiencies, and improves services while boosting more inclusive and sustainable growth and enhancing well-being. At the same time, the breadth and speed of this change introduces challenges in many policy areas, including taxation. Reforming the international tax system to address the tax challenges arising from the digitalisation of the economy has therefore been a priority of the international community for several years, with commitments to deliver a consensus-based solution by the end of 2020.

2. These tax challenges were first identified as one of the main areas of focus of the OECD/G20 Base Erosion and Profit Shifting (BEPS) Project, leading to the 2015 BEPS Action 1 Report (the Action 1 Report) (OECD, 2015[1]). The Action 1 Report found that the whole economy was digitalising and, as a result, it would be difficult, if not impossible, to ring-fence the digital economy. In March 2018, the Inclusive Framework, working through its Task Force on the Digital Economy (TFDE), issued Tax Challenges Arising from Digitalisation – Interim Report 2018 (the Interim Report) (OECD, 2018[2]) which recognised the need for a global solution.

3. Since then, the 137 members of the Inclusive Framework have worked on a global solution based on a two pillar approach (OECD, 2015[1]). Under the second pillar, the Inclusive Framework agreed to explore an approach that is focused on the remaining BEPS challenges and proposes a systematic solution designed to ensure that all internationally operating businesses pay a minimum level of tax. In so doing, it helps to address the remaining BEPS challenges linked to the digitalising economy, where the relative importance of intangible assets as profit drivers makes highly digitalised business often ideally placed to avail themselves of profit shifting planning structures. Pillar Two leaves jurisdictions free to determine their own tax system, including whether they have a corporate income tax and where they set their tax rates, but also considers the right of other jurisdictions to apply the rules contained in this report where income is taxed at an effective rate below a minimum rate.

4. Consistent with the Policy Note Addressing the Tax Challenges of the Digitalisation of the Economy (OECD/G20, 2019[3]), approved on 23 January 2019 and the Programme of Work (PoW) (OECD, 2019[4]), approved on 28-29 May, 2019, Members of the Inclusive Framework agree that any rules developed under this Pillar should not result in taxation where there is no economic profit nor should they result in double taxation. Mindful of limiting compliance and administrative burdens, Inclusive Framework Members further agree to make any rules as simple as the tax policy context permits, including through the exploration of simplification measures.

5. Following the adoption of the Programme of Work (OECD, 2019[4]) in May 2019, the Inclusive Framework worked on developing the different aspects of Pillar Two. A public consultation was held on 9 December 2019 (OECD, 2019[5]) which received over 150 written submissions, running to over 1,300 pages submitted by a wide range of businesses, industry groups, law and accounting practitioners, and non-governmental organisations, which provided critical input into the design of many of the aspects of Pillar Two. In January the Inclusive Framework issued a progress report on the status of the technical work. Since January, and in spite of the outbreak of COVID-19, all members have progressed the work and the engagement with stakeholders continued through digital channels including through the maintenance of digital contact groups set up by Business at OECD (BIAC).

6. This is a Report on the blueprint for Pillar Two (the “Blueprint”). It identifies technical design components of Pillar Two. It also identifies those areas linked to implementation and simplification, which would benefit from further stakeholder input, and where further technical work is required prior to finalisation. The finalisation of Pillar Two also requires political agreement on key design features of the subject to tax rule and the GloBE rules including carve-outs, blending, rule order and tax rates where, at present, diverging views continue to exist.

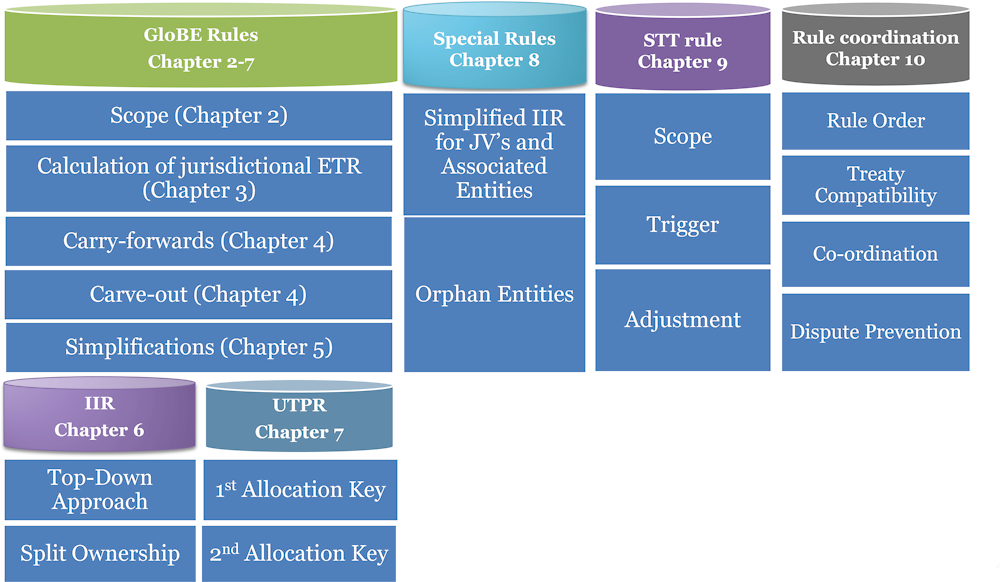

7. The remainder of this Section sets out the overall design consideration, before focusing on administrative and compliance considerations that were important in the design of Pillar Two. It then discusses the co-existence of the United States’ Global Intangible Low-Taxed Income (GILTI) regime, before providing a chapter-by chapter summary complemented by a flow chart.