This chapter presents new data on tax administrations perceptions of MNE and Big Four behaviour. In analysing this data it is combined with previous data on MNE perceptions of tax systems, and the results of roundtable discussions between tax administration officials and business representatives in different regions.

Tax Morale II

2. Results and analysis

Abstract

2.1. Overview

In all regions, routine compliance by large business/MNE/Big Four is generally perceived to be good. However, in more complex and subjective interactions, including trust in information, transparency and openness, behaviour is generally perceived more negatively, with significant variation between regions. Especially in LAC and Africa, tax officials perceive significant challenges with the relationships with MNEs, suggesting tax morale can be improved, although it is notable that officials perceive a high willingness to co-operate when disputes have arisen in all regions. The results from the survey of tax administration perceptions of large business/MNE/Big Four behaviour also show wide variation in perceptions of how power and incentives are used, including concerning minorities perceiving illegal behaviour by business. Figure 2.1 provides an aggregated summary of the results for perceptions of large business/MNE behaviour. In this figure, the results have been normalised from one to five, where five is the best possible outcome. The figure compares simple regional averages for selected variables and groups them in five sub-indexes, presenting their corresponding average. The sub-indexes cover routine compliance; co-operation and trust; openness and transparency; disputes, conflict and resolution; and use of power and incentives. This chapter comprises a section on each sub-index. It also includes sections on two additional issues covered in the survey, staff recruitment, and comparison with local businesses. Detailed results can be found in Annex A and the methodology in Annex C.

Figure 2.1. Overview of authorities' perception of the tax behaviour of large businesses

Note: Simple regional average. Values range from 1 to 5, with 5 being the best score possible. Countries are weighted so that no country represents more than 10% of a regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

While perception surveys are subject to limitations, they are crucial to understanding the relationships between tax administrations and taxpayers. There are well known challenges in using perception surveys, especially in tax, where respondents are often found to behave differently to how they say they will. Some of these challenges are less relevant in this analysis, given the focus is on the perceived behaviour of others, rather than the behaviour of the respondents themselves. There are additional risks however, not least that perceptions of the behaviour of others are skewed by the most memorable experiences of the respondents (either positive or negative) with a small number of actors, rather than a balance of all relevant experience. In the case of reported perceptions by tax officials of the Big Four, tax officials may not have direct experience of the Big Four’s client services. While there is a risk that perceptions are therefore not a perfect proxy for the existing levels of tax morale of MNEs or Big Four behaviour, the data remains highly relevant, as the perceptions held by both tax administrators and businesses will affect how they manage their relationships with each other. These perceptions also indicate the scale of the challenge in building trust and tax morale, as it is only through shifting the perceptions that trust will ultimately be able to be built.

2.2. Routine compliance

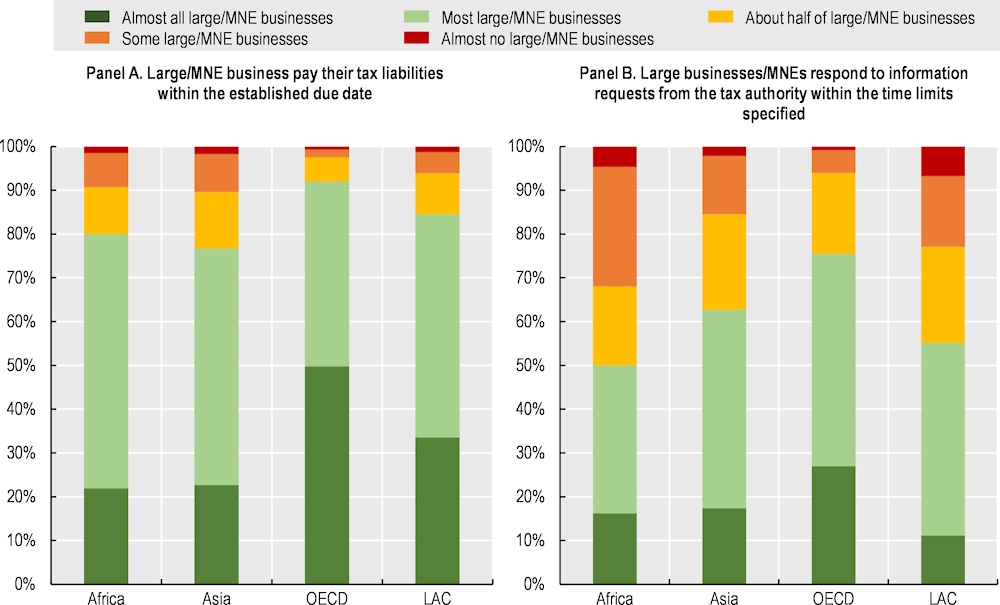

Tax administrations across all regions generally have a positive perception of MNEs as regards paying taxes on time. Timely payment of taxes is fundamental to voluntary compliance. In this respect, there was a fairly uniform perception across all regions that large businesses/MNEs pay their tax liabilities within the established due date, with at least 77% of tax officials across all regions agreeing that most or almost all MNEs pay on time (Figure 2.2, Panel A).

As routine interactions become more complex, perceived compliance begins to diverge across regions. MNEs performance is less well perceived with respect to responding to requests on time and providing information in the correct form, both of which are also routine functions of compliance. In all regions, perceived performance was lower than for paying on time: in the OECD, the proportion of officials saying most large businesses/MNEs respond to requests on time dropped to 75%, while in Asia, Africa and the LAC region, between 65% and 50% of officials answered that most or all MNEs responded on time (Figure 2.2, Panel B). Similarly, perceptions of whether information is provided in the correct form exhibit significant heterogeneity across regions: in the LAC region, less than half (44%) of tax authorities believe that most or all large businesses/MNEs provide the information requested in the correct form. This percentage rises to 54 % in Africa, 61% in Asia and 75% in the OECD.

Figure 2.2. Do large businesses/MNEs pay/answer on time?

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

While there was agreement from MNEs and tax administrations that no reasonable requests for information can be refused, both the roundtables and the survey of MNE perceptions identified challenges to responding to such requests. These included obstacles within businesses as well as in the ways in which information is requested.

The (un)predictability of requirements for taxpayers may affect their ability to respond on time. During the roundtables, several MNEs noted the challenges they face in responding on time when they receive requests without warning and/or with short deadlines, especially if they arrive at busy times for tax compliance, such as at the end of the tax year. Business indicated that their response to requests is often slowed down by factors such as the level of detail of the requests, the use of a language different to that used for internal communication, the format in which data is requested (when it is different from the one in which the company keeps its records) and barriers for accessing information held by other entities within the group. While most of these factors can be addressed by businesses improving their own processes and providing sufficient resourcing to enhance compliance, there are some areas where tax administrations may be able to encourage more effective responses by adjusting how and when they request information.

Businesses also raised questions about the purpose and efficiency of some requests, indicating that a prior understanding of what the administration wishes to analyse would improve their ability to comply and would reduce compliance burdens. Administrations agreed that higher compliance was observed when taxpayers were able to understand ‘why’ they have been asked for certain information. The opinions expressed during the roundtable discussions are supported by data from the survey on MNEs, where unpredictable or inconsistent treatment from the authorities was among the biggest concerns of MNEs (1st out of 21 factors in Asia, 2nd in LAC, 3rd in Africa and 6th in the OECD). The level of bureaucracy (including documentation requirements) is also a major concern (1st in LAC, and OECD, 2nd in Asia and 4th in Africa), in line with the roundtable discussions.

2.3. Co-operation and trust

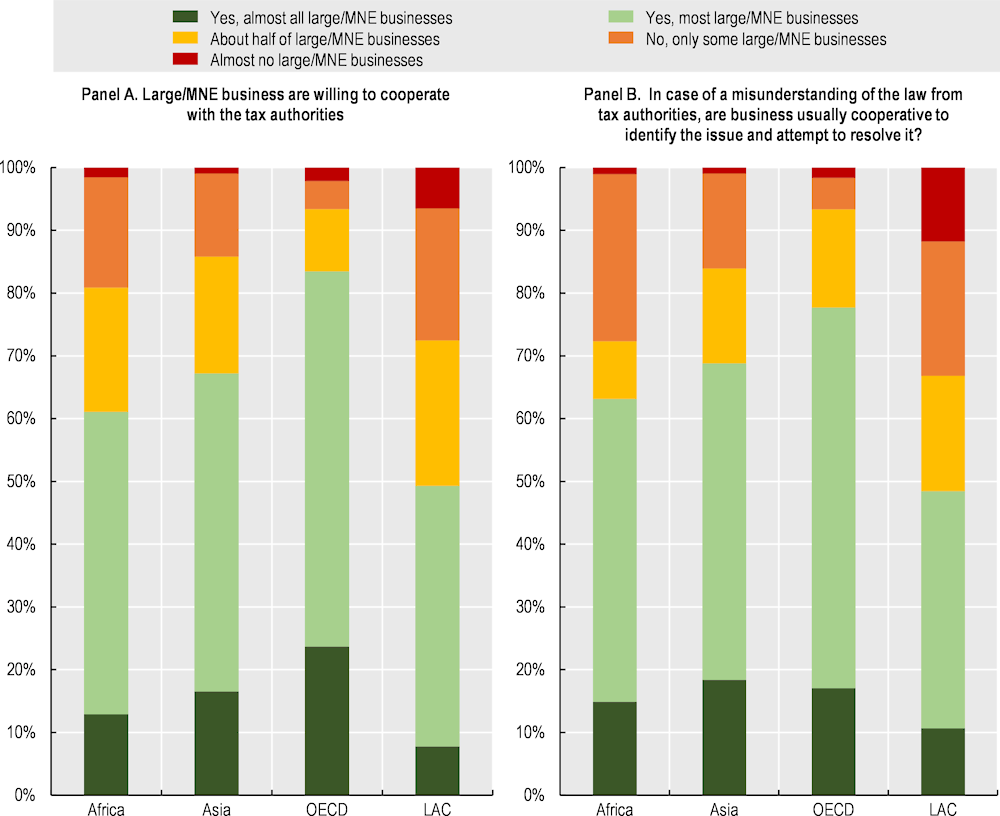

Tax officials outside the LAC region generally perceived MNEs/large businesses and the Big Four to be co-operative. Over 60% of officials in Africa, Asia and the OECD perceived that most or almost all large businesses/MNEs are willing to co-operate with authorities. This dropped to 49% in the LAC region (Figure 2.3, Panel A). A similar pattern is observed with respect to the perceptions of the willingness of the Big Four to co-operate: the LAC region showed lower levels of perceived co-operativeness, with only 27% of officials responding that the Big Four co-operate with the tax authorities in the majority of the cases, in contrast with 45% in Asia, 50% in Africa and 58% in OECD countries.

Co-operation is slightly less well perceived when seeking to resolve misunderstandings of the law but remains high overall. Again, in all regions except in LAC, over 60% of officials considered most business to be co-operative; in LAC the figure was 48% (Figure 2.3, Panel B). Willingness to co-operate in misunderstandings of the law seems to be of mutual interest to MNEs and tax authorities, as MNEs identify various challenges with legislation in achieving tax certainty. Unclear legislation, complexity in legislation, inconsistencies or conflicts in interpretation of international tax standards, and tax legislation not in line with new business models are all high priority issues for MNEs in all regions. During the regional roundtables, several MNEs also raised the importance of being able to share perspectives on the interpretation of the law, both during the policymaking and the auditing processes. The challenge is especially marked in LAC, as while MNEs operating in LAC rate issues of misunderstanding of the law a higher concern than any other region, tax administrations in the LAC region perceive a lower willingness to co-operate to address such misunderstandings.

Figure 2.3. Large businesses/MNEs willingness to cooperate

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020). Survey on MNEs and Big Four Firms tax behaviour.

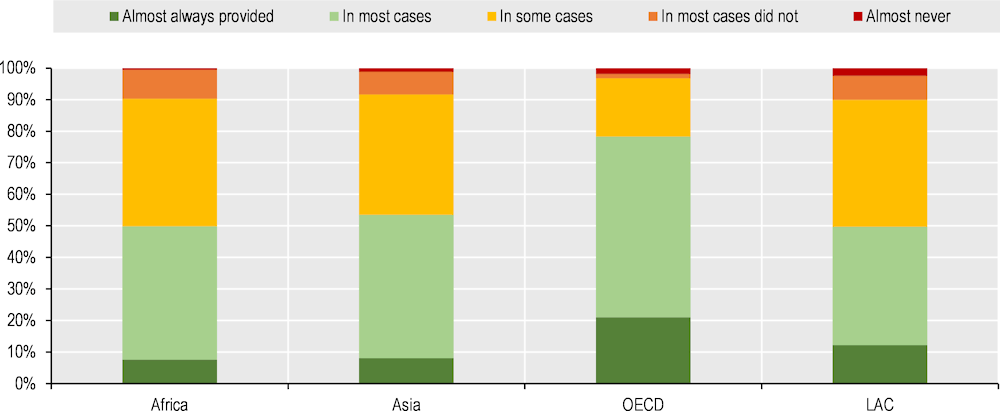

Perceptions of willingness to co-operate are lower when information is not available. When asked how frequently companies provide justification for not providing information and collaborate with the authorities, only around 50% of tax officials in Africa, Asia and LAC respond that in most cases they receive a justification and observe a collaborative attitude (Figure 2.4). This is significantly lower than in the OECD countries (78%), and suggests that access to information may be a particular challenge in Asia, Africa and LAC, something that the roundtables appeared to confirm. Several administrations pointed that the challenges increase when information is held by another entity within the same MNE group, a point also highlighted by several business participants in the roundtables.

Figure 2.4. MNE/large business reaction to request of information by the tax authorities

Note: Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

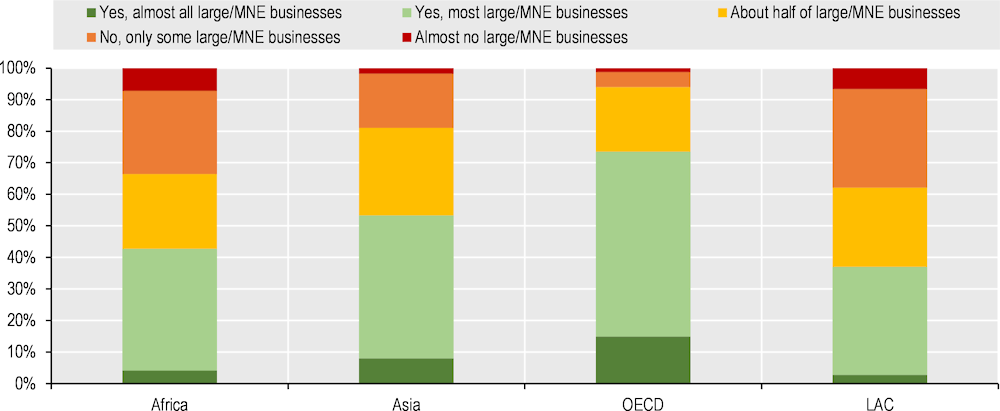

Co-operation may increase once disputes emerge. When asked about perceptions on co-operation when discussing/resolving disputes, only a small share of tax officials perceived a non-cooperative attitude from large businesses/MNEs. Just 5% of officials in Africa saw businesses as non-cooperative in some/all cases, rising to 17% in the LAC region (Figure 2.5). This suggests that once a formal dispute exists, MNEs are more willing to co-operate; in turn, this suggests that the potential exists to promote this attitude before disputes arise.

Figure 2.5. Attitude of large businesses/MNE in resolving disputes

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

Co-operation does not appear to be synonymous with trust. While tax officials may perceive large businesses/MNEs as being co-operative, that does not necessarily mean that tax officials see co-operation as being based on trust, especially regarding trust in the information provided. When officials were asked whether the tax information provided by large MNEs could be trusted, the responses were far less positive than perceptions of co-operation, especially outside the OECD. While 74% of officials from OECD countries say the information from most/all large businesses/MNEs can be trusted, this falls to 53% in Asia, 43% in Africa and 37% in the LAC region. Similarly, while most tax officials see large businesses/MNEs as being co-operative during disputes, a much lower proportion perceive business to be acting in good faith during dispute negotiations (see Disputes, conflict and resolution). This lack of trust between tax administrations and businesses was raised repeatedly in the roundtables, which identified finding approaches to (re)build trust to be a high priority for both tax administrations and business.

Figure 2.6. Trust in the information provided by large businesses/MNEs

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

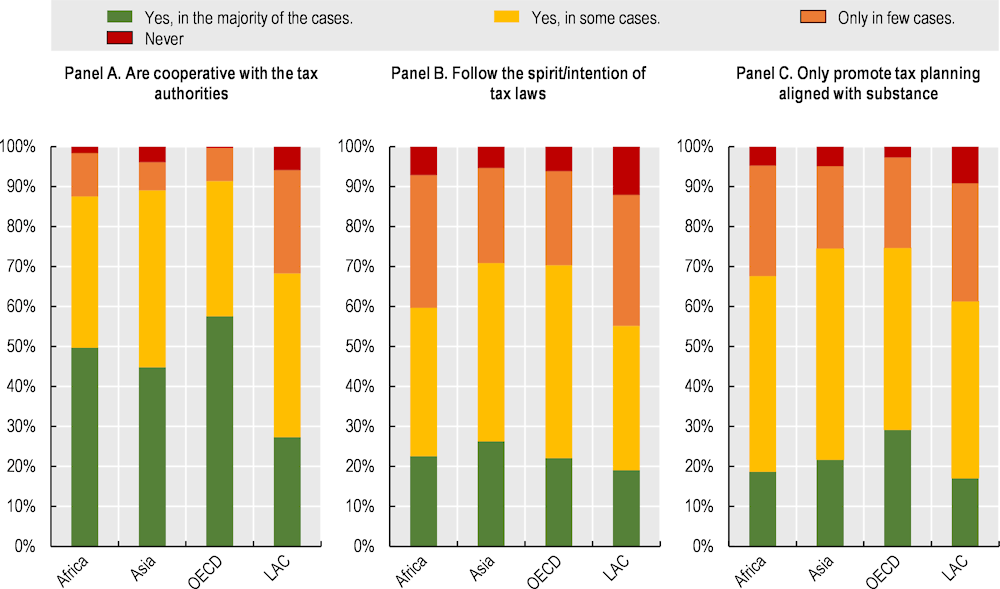

Perceived co-operation by the Big Four is not correlated with perceptions of following the spirit/intention of the law, or willingness to promote artificial tax planning structures. While around 50% of officials (except in the LAC region, where the proportion was 27%) said that the Big Four were co-operative with the authorities in the majority of cases (Figure 2.7, Panel A), this falls to around 25% (19% in LAC) when asked if the Big Four follow the spirit/intention of the tax laws Figure 2.7, Panel B). This may be a reflection that in many countries the tax laws are unclear, and discerning the spirit/intention of the tax laws can be challenging. A similar pattern, however, was seen in response to a question about whether the Big Four only promote tax planning aligned with substance (i.e. do not promote artificial tax-planning structures). Here the pattern was similar to responses on the spirit of the law, with around 20% of officials in Africa, Asia and the LAC region saying that the Big Four promote tax planning aligned with substance in the majority of cases (29% in the OECD) (Figure 2.7, Panel C). Again, there may be differences of opinion regarding substance requirements, but these results suggest that the challenges of building trust are also present in the relationship between tax authorities and the Big Four, at least in a common interpretation of the law.

Figure 2.7. Co-operation, following the spirit of the law and tax planning by the Big Four

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

The roundtable discussions stressed the importance of building trusted relationships between tax administrations and businesses (and advisors). Building such relationships requires actions from all stakeholders. The MNE perceptions survey and roundtable discussions provide valuable additional information on the range of issues that need to be addressed to build trust. The results from the tax administration survey suggest that some businesses (and advisors) may need to review their approach to co-operation with tax administrations, especially those outside OECD countries, not only to focus on the formalities of co-operation but also to improve the quality of co-operation. This is unlikely to be sufficient however, given trust requires actions from all partners; as such the discussions in the roundtables and data from MNEs perceptions can provide valuable additional information on what might be hindering trust and help identify areas to focus on to build mutual trust.

MNEs do not perceive significant problems with their relationship with tax authorities in general. A ‘general poor relationship with the tax authority’ was one of the lowest ranked sources of tax uncertainty for MNEs operating in all regions, ranking 20th of 21 issues in Africa and the LAC region, 19th in Asia and 17th in the OECD. This suggests that, just as most tax officials consider most large businesses/MNEs to be co-operative (at least to some degree), most MNEs do not have a negative view of their overall relationship with tax authorities. This indicates there while there are a range of specific issues to address, there is a reasonably solid basis on which to build trust.

Unpredictable treatment by tax authorities may limit scope for co-operation and hinder trust. Unpredictable or inconsistent treatment by the tax authority was identified as the highest rated source of tax uncertainty in Asia, 2nd in LAC, 3rd in Africa and 6th in the OECD. It was also raised in the roundtables as an issue hindering trust and co-operation, with MNEs highlighting how it is difficult for them to be fully responsive and co-operative in an unpredictable environment.

Unclear legislation and/or considerable bureaucracy may also affect co-operation and trust. Where the requirements for compliance are unclear and/or there is excessive bureaucracy, it may be challenging for companies to fully co-operate. Unclear legislation was the highest rated source of tax uncertainty in Africa (2nd in the OECD, 8th in Asia and LAC), while the level of bureaucracy was the most important issue in LAC and OECD, 2nd in Asia and 4th in Africa.

MNEs also identify tax authorities’ lack of understanding of value chains and concerns over international taxation as challenges to building effective relationships. In all roundtables, MNEs and tax administrations highlighted challenges around tax authorities’ understanding of value chains, which can create confusion and miscommunication, leading to a perception of unwillingness to co-operate and/or lack of trust. Businesses noted this can be exacerbated by concerns over the implementation of international taxation (consistently in the top 10 sources of tax uncertainty for MNEs), where some MNEs noted that their willingness to co-operate can be reduced if they expect that their co-operation will result in treatment that deviates from international standards.

The organisational structure of tax administrations and MNEs affect taxpayers’ willingness to co-operate. Some businesses noted that they felt reluctant to voluntarily share information in negotiations or consultations if they felt there was a risk that those sharing information voluntarily may end up at a greater risk of audit or other enforcement action than similar businesses that were less transparent. Several administrations declared that having different teams or agencies across which to separate the negotiation, auditing, and dispute resolution functions was effective in building trust and providing a sense of impartiality. The internal structure of MNEs might also have an effect: administrations reported better co-operation with large taxpayers that had specific internal governance structures for engaging with tax administrations.

Guidelines may be a useful tool to build trust. Where they exist, most tax officials think that large businesses/MNEs follow them. Guidelines can help clarify requirements and frame the relationship between taxpayers and tax administrations in a transparent and open manner. The surveys provide a range of evidence to support the use of guidelines. In Africa, Asia and the OECD, around 75% of tax officials see most large businesses/MNEs as following the existing guidelines/guidance/procedures for managing the relationship between tax authorities and taxpayers. This proportion drops to 58% in LAC.

There is also a correlation between respondents identifying the existence of specific procedures/guidelines to deal with MNEs and perceiving higher levels of trust in MNEs. Respondents who said that guidelines/procedures existed in their jurisdiction were more likely to perceive that all/most MNEs/large businesses were open and transparent, suggesting that there could be a link between guidelines and improved relationships between taxpayers and tax administrations. More than half (57%) of respondents that said that detailed procedures existed in their jurisdiction also perceived that all/most MNEs/large businesses are open and transparent.

More work may be needed however to ensure use and awareness of guidelines. The data also suggests that, where guidelines/procedures exist, there is a need to ensure their use. This is especially the case in the LAC region, where 29% of tax officials stated that they are almost never used (compared to around 10% in other regions). Efforts are also needed to raise awareness about them, for example, there was significant variance in responses from officials from the same administration on whether such guidelines exist, suggesting awareness within tax administrations is sometimes limited.

MNEs also prioritise guidance. MNEs operating in Africa rated detailed guidance on tax regulations as the most important tool to improve tax certainty, and it was ranked 3rd in Asia, 4th in the OECD and 6th in the LAC region. While this is not exactly the same kind of guidance tax administrators were surveyed on, it indicates that MNEs place a high value on good guidelines, which was further affirmed by MNEs participating in the roundtables. Some MNE participants also highlighted the value of taxpayers’ charters and/or ombudsman functions to provide clarity and accountability on the relationship with tax administrators.

2.4. Openness and transparency

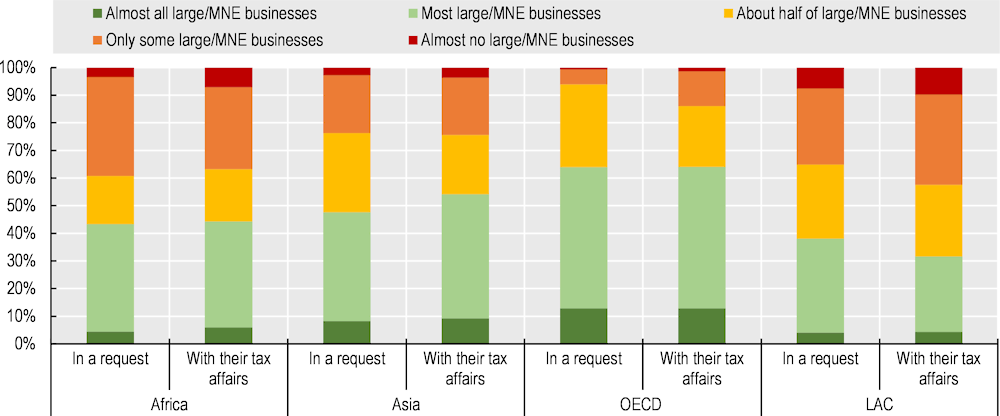

Perceptions on openness and transparency by large businesses/MNEs to tax authorities vary between regions. While 64% of officials in the OECD perceive most/all large businesses/MNEs to be open and transparent, providing all relevant information, that figure drops to 54% in Asia, 44% in Africa and only 32% in the LAC region (Figure 2.8). A similar pattern can be seen when looking at perceptions of transparency in response to requests: while 64% of officials in the OECD perceive most/all large businesses/MNEs answer requests in an open, transparent and straightforward manner, this drops to 48% in Asia, 43% in Africa and 38% in the LAC region (Figure 2.8).

Figure 2.8. Are large businesses/MNEs perceived to be open and transparent?

Note: ‘In a request’ refers to the question “Against the request of tax authorities, large/MNE business answer the tax authorities in an open transparent and straightforward manner”. Similarly with tax affairs refers to the question “When thinking about the large/MNE business in your country, are the following statements accurate? Large/MNE business are open and transparent with the revenue authorities with their tax affairs, and relevant information”. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

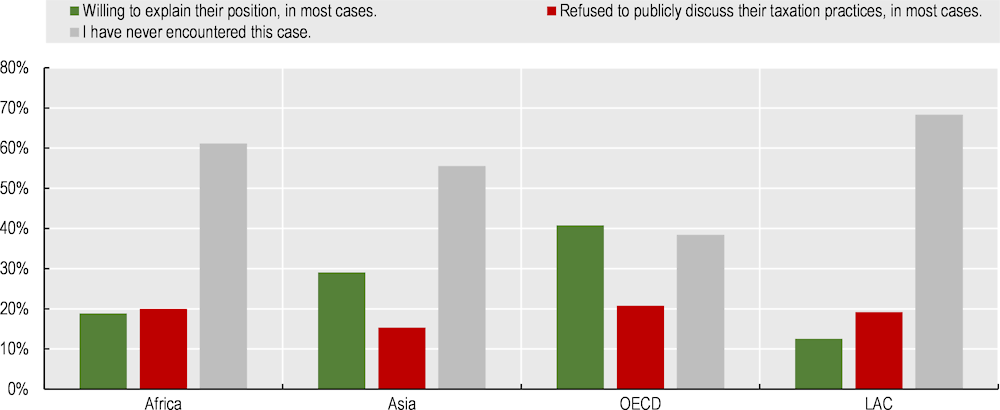

Perceptions of the willingness of large businesses/MNEs to publicly explain their tax practices also vary significantly between regions. Most tax officials are unaware of instances where which large businesses/MNEs have been asked to publicly explain their tax practices. 68% of officials in the LAC region were unaware of such requests in their country, while 61% in Africa, 56% in Asia and 38% in the OECD were similarly unaware. Given there has been much public debate and scrutiny of MNE tax practices in the media, parliaments and civil society in OECD countries, this discrepancy is perhaps unsurprising. Where officials are aware of demands for public discussion of corporate tax practices perceptions differ significantly between regions (Figure 2.9). Around two thirds of officials in OECD and Asia expressing a view see companies as willing to explain in most cases. This drops to just under half in Africa and a third in LAC. It is notable that in the regions where there is greater awareness of requests for public discussion of corporate tax practices, there is also a greater perception of willingness from companies to explain their practices. This may suggest that public pressure on companies to discuss their tax practices positively affects their willingness to engage in public discussion.

Figure 2.9. Willingness of large businesses/MNEs to explain their tax practices publicly

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of a regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

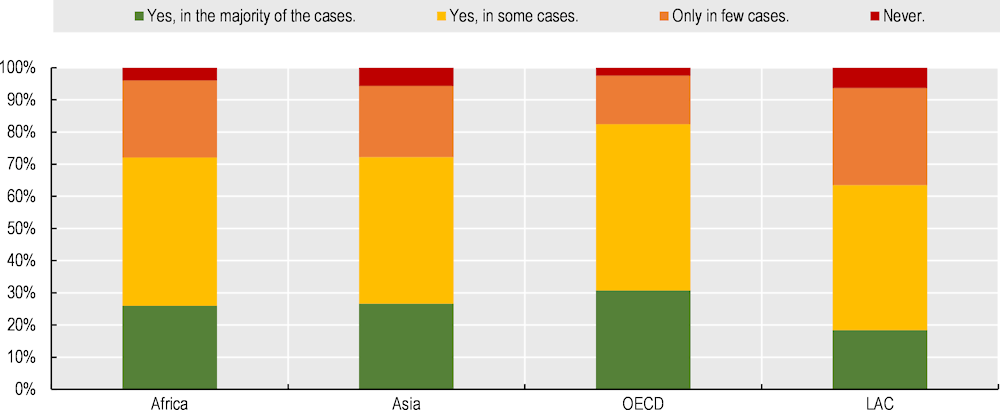

There is much less variation in perceptions of transparency among the Big Four. In contrast to the significant variation on perceptions of transparency of large businesses/MNEs, there is a much more uniform pattern when looking at perceptions of the Big Four. Some 31% of officials in OECD countries consider that the Big Four are transparent and provide all the relevant information when requested in the majority of cases. This proportion is 27% in Asia, 26% in Africa and 18% in the LAC region (Figure 2.10).

Figure 2.10. Perception of transparency of the Big Four firms with tax authorities

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

While legal requirements can enforce a degree of transparency, promoting openness is a two-way process. The roundtables and MNE perceptions survey identified that there may be mutual interest in reforms to improve openness and transparency. While taxpayers should comply with legal requirements for disclosure, such requirements alone are unlikely to develop a willingness to disclose, especially beyond the legal requirements. The discussions in the roundtables, and the data from the MNE perceptions survey therefore provide useful additional context on where the specific challenges may lie in transparency, and what may help encourage MNEs to become more open, while not undermining the need of tax administrations for information.

Obtaining information from overseas was consistently raised in the roundtables as a key issue on transparency. Tax administrations in all regions highlighted that there were often challenges where information requested needed to come from overseas (usually from the MNE headquarters (HQ)). Delays were especially common when information was requested from overseas, and in some cases, there was no response at all. While information exchange between tax administrations is an alternative way for tax administrations to obtain information from overseas, countries highlighted that this can be a time-consuming process, and that information-sharing is still being established in a number of developing countries.

Language barriers and concerns over security of information were also highlighted. Both tax administrations and MNEs highlighted challenges with language, with MNEs (especially when providing information from overseas) preferring to provide information in English, while many non-Anglophone tax administrations noted the challenges when information is provided in English, even when this is not permitted by the regulations. Another concern that hinders transparency is security of information; businesses highlighted that there needs to be confidence in data security safeguards if sensitive information is to be more willingly shared.

High levels of documentation requirements are one of the main concerns of MNEs. While documentation can be an important tool to enhance transparency, considerable bureaucracy, including documentation requirements, was the top concern for MNEs operating in OECD and the LAC region, second in Asia and fourth in Africa. In the roundtable discussions, MNEs highlighted that they were especially concerned about requirements for information where either the purpose is unclear – making it difficult to know what information to provide – or where the type or format of information requested does not appear to match the purpose – requiring more information to be prepared than necessary and/or increasing the likelihood that further requests will be necessary. In some cases, MNEs highlighted that this problem was linked to a lack of understanding of how the business operated, including how the value chain is structured. This concern was also noted to some degree in the tax certainty survey, with MNEs citing lack of understanding of international business as the 7th (out of 21) highest rated concern for MNEs operating in Africa, 11th in Asia, 14th in the LAC region and 10th in the OECD.

The BEPS Actions can help increase transparency, but not all countries are currently benefitting. The BEPS Actions include measures to increase transparency, most notably with the introduction of Country-by- Country (CbC) reporting, which requires large MNEs to prepare a report with aggregate data on the global allocation of income, profit, taxes paid and economic activity among tax jurisdictions in which it operates. This CbC report is used for high level transfer pricing and BEPS risk assessments. Although CbC reports mark a step forward in transparency, very few developing countries are able to receive CbC reports at the time of writing (see (OECD, 2021[1])). The different stages of the application of BEPS Actions globally may therefore explain some of the variations in reported perceptions.

2.5. Disputes, conflict and resolution

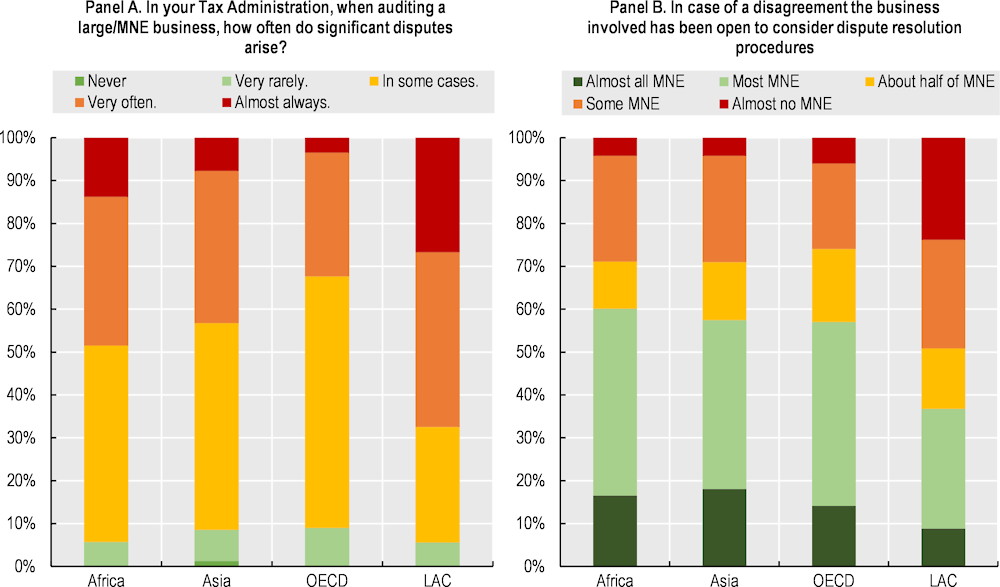

Across regions, tax disputes are fairly common. While disputes are an inevitable part of the tax system, frequent disputes may be both a sign of, and cause of, weaker trust between MNEs and tax authorities, and thus lower voluntary compliance. Disputes were fairly common in all regions, with fewer than 9% of tax officials saying that disputes never or rarely occurred. In the LAC region, 67% of tax authorities stated that disputes occurred almost always or very often, which was considerably higher than in Africa (48%), Asia (43%), and the OECD (32%). Especially notable is that 27% of the tax officials in the LAC region believe that tax disputes arise almost always, significantly higher than any other region (Figure 2.11, Panel A). While disputes are to be expected in any tax system, and perhaps especially when dealing with the complex international tax aspects of MNEs, very high frequency of disputes is a cause for concern, not least for the pressures this places on taxpayers and tax administrations. MNEs openness towards dispute resolution procedures could be improved across regions, with LAC showing again the lowest levels (Figure 2.11, Panel B).

Figure 2.11. Frequency of tax disputes and business attitude to dispute resolution

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

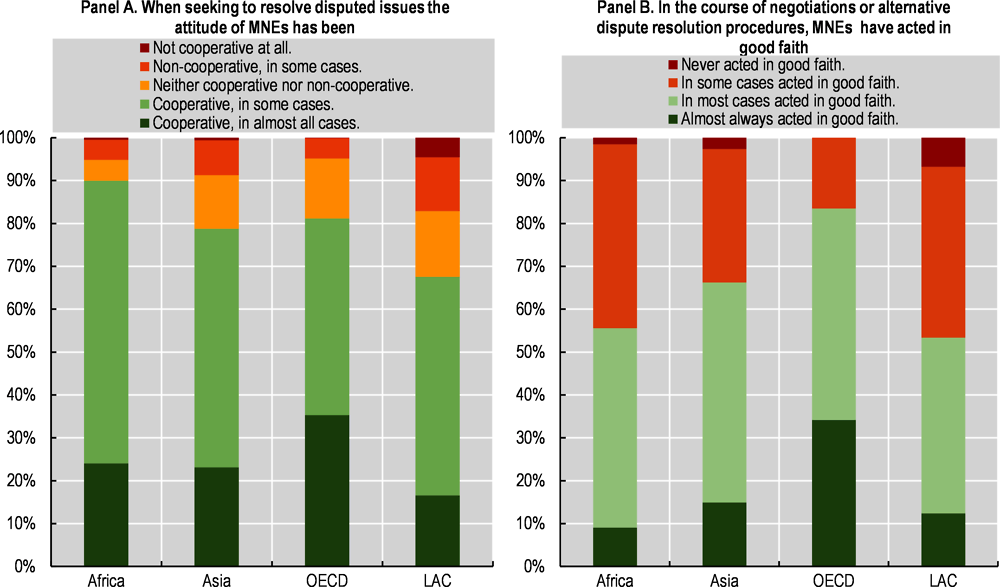

Tax officials generally consider large businesses/MNEs as being co-operative during dispute-resolution processes. Across regions, at least 70% of tax officials perceive large businesses/MNEs to be co-operative in all/most cases when seeking to resolve disputes. The best result is in Africa, where this number reaches 90% (Figure 2.12, Panel A). However, similar to the finding that a perception of co-operativeness is not a synonym for trust, being co-operative is not consistently interpreted as acting in good faith. In emerging regions, a much lower share of tax officials (between 50% and 70%) perceive large businesses/MNEs to act in good faith in all/most cases in the course of negotiations (Figure 2.12, Panel B).

Figure 2.12. Attitude of MNEs once a dispute resolution procedure has actually started

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

While some disputes are inevitable, the approaches taken by tax administrations and businesses can either reduce or increase the risk of disputes. The aggressiveness of businesses tax planning is one of the primary determinants of whether disputes arise; businesses thus have a certain degree of control over the risk of disputes through their approach to tax risk (see (Bruhne, 2022[2]) and (Quentin, 2017[3])). However, as identified in the roundtables, amnesties may in some cases create perverse incentives that alter business risk calculations. Disputes may also arise due to legitimate differences of opinion over how the law is to be interpreted, though as Figure 2.3 showed, some businesses could be more co-operative in seeking to resolve misunderstandings and reduce the risk of disputes. Additionally, as discussed in the roundtables, disputes can also arise as a result of challenges with the processes in the tax system. While tax administrations may have little scope to reduce disputes originating from aggressive tax planning by MNEs, it is a shared interest of both businesses and tax administrations to reduce disputes caused by misunderstandings and processes.

Data from the MNE survey highlight several issues that may lead to disputes and reveal a strong desire by MNEs to improve dispute resolution. For instance, “unclear, poorly drafted tax legislation” was ranked as the greatest source of tax uncertainty in Africa, second in the OECD and eighth in Asia and Latin America. Meanwhile, unpredictable or inconsistent treatment by the tax authority was ranked as the primary source of tax uncertainty in Asia, second in the LAC region, third in Africa and sixth in the OECD. Complexity of the tax legislation was ranked the third-highest source of tax uncertainty in LAC and the OECD (twelfth and sixteenth in Asia and Africa respectively) while inconsistencies or conflicts between tax authorities on their interpretations of international tax standards was ranked third in Asia, fifth in Africa and LAC, and seventh in the OECD. Effective dispute resolution was seen as the most important tool for improving tax certainty in Asia and LAC, second in Africa and third in OECD.

The roundtables suggested there is scope for processes to prevent minor issues escalating into legal disputes. Participants highlighted that a high level of rigidity could lead to unnecessary disputes. For instance, small unintended errors from firms that could be resolved through communication and flexibility from the tax administration can result in a dispute. Businesses perceived that, in some jurisdictions, administrations take an (excessively) arbitrary an approach to audits (rather than basing these on risks); additional problems may arise in the absence of dispute-prevention mechanisms, such as channels to discuss disagreements and penalties without resorting to judicial appeals, increasing the likelihood of disagreements escalating to full-scale lawsuits. This lack of process can create confusion, especially where there is a lack of transparency on how any sanctions/penalties are decided or applied, and can give the impression that tax administrations are too aggressive or unfair. Some businesses also noted a challenge where litigation processes were lengthy, and sometimes/often followed by tax amnesties. This approach not only creates uncertainty but it also imposes costs on compliant taxpayers while effectively rewarding uncompliant ones, creating a perverse incentive structure.

2.6. Use of power and incentives

While most officials perceived that companies use their power legitimately, there are a significant minority of tax officials that perceive widespread abuse of power. The potential for large businesses/MNEs to abuse their economic and political power is a widespread concern. The survey results provide perceptions across several areas where such power could be abused: actions in negotiations; lobbying for, and use of, incentives; and staff recruitment. The results also provide perceptions on the legitimacy of the Big Four’s use of power to lobby. These questions showed that while most tax officials see most large businesses/MNEs and the Big Four using their power legitimately, there is a large minority, especially in Africa and the LAC region, that perceive illegitimate behaviour. There was less discussion on these issues in the roundtables, as many participants highlighted that the opportunities for such abuse of power sat elsewhere (e.g. with ministries/politicians granting incentives). There is also limited information on MNE perceptions beyond the importance of tax incentives.

In all regions, a majority of tax officials perceive large businesses/MNEs acting legally and in good faith during most negotiations and dispute resolution, but by only a small margin in the LAC region and Africa. As highlighted in the previous section, while over three quarters of officials in OECD countries see good faith engagement in all or most cases, this falls to just 56% in Africa and 53% in the LAC region, suggesting there is significant scope for improvement (Figure 2.12, Panel B).

Improving domestic dispute resolution may provide an opportunity to reduce scope for abuse of power, as well as improving tax certainty for business. While businesses themselves have the primary obligation to ensure they are acting legally and in good faith, there may be scope for tax administrations to improve procedures, enhance the incentives for businesses to act in good faith, and reduce the scope to exert illegal influence. This demand for improved dispute resolution appears to be shared by MNEs, as effective dispute resolution is one of the top three tools requested by MNEs in all regions.

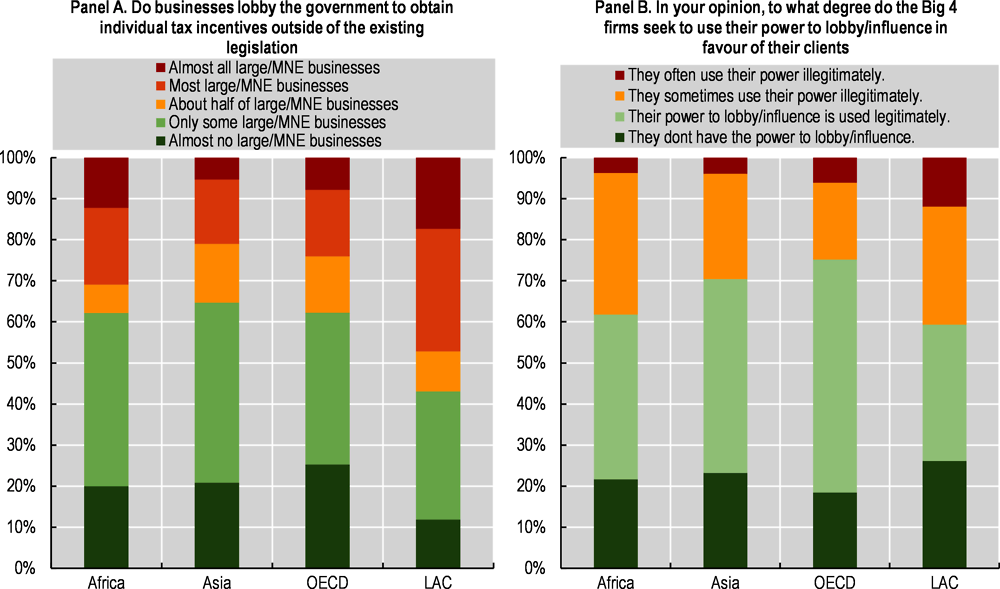

Perceptions of lobbying behaviour are fairly consistent, especially among tax officials in the OECD, Africa and Asia, with a majority perceiving limited and legitimate lobbying. Questions on lobbying covered large businesses’ lobbying for tax incentives and the Big Four on both clients’ individual cases, and tax policy more generally. Regarding the Big Four, tax officials in OECD countries were the least likely to see the Big Four as having no power to influence either individual cases or tax policies/laws, but most likely to view that power is used legitimately. In all regions, over 59% of officials saw the Big Four as having either no power, or using their power legitimately in both individual cases and tax policies/laws. Between 20-35% see the Big Four as sometimes using their power illegitimately, while a small minority see a frequent pattern of illegitimate behaviour (Figure 2.13, Panel B). Increased transparency by both authorities and the Big Four may help both build confidence that most interactions are legitimate, as well as reduce the scope and increase the accountability, for illegitimate interactions. In respect to large business/MNE lobbying to obtain tax incentives outside of existing legislation, perceptions are similar across the OECD, Africa and Asia, with around 60% of officials reporting no/some engagement in lobbying, this is much lower in the LAC region (43%). While around a quarter of tax officials in Africa, Asia and OECD see most/all businesses lobbying for specific incentives, this increases to 47% in the LAC region (Figure 2.13, Panel A).

Figure 2.13. Perceptions of lobbying behaviour

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

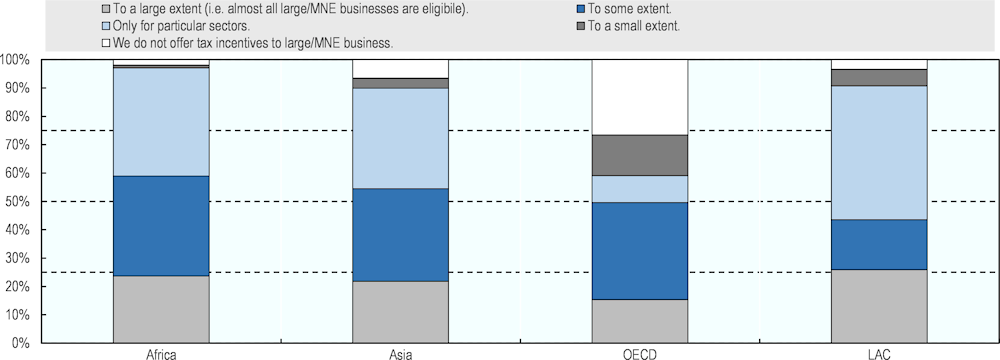

Tax incentives for investment are much more widespread outside the OECD and more likely to be perceived as not being used as intended by legislation. Some 41% of tax officials in OECD countries responded that either no tax incentives were offered or tax incentives were offered to only a small extent, compared with around 10% in Asia and the LAC region, and 3% in Africa (Figure 2.14). Sector-specific incentives account for most of that difference: just 10% of OECD officials responded that tax incentives were only available for specific sectors, compared with around 36% in Africa and Asia, and 47% in the LAC region. Greater use of sector-specific incentives, which may create uncertainty over which firms are eligible for the incentive, may be part of the reason why businesses are more likely to be perceived as using incentives in a way not intended by legislation outside the OECD. While 70% of officials in the OECD say most or all businesses use incentives as intended, this drops to 59% in Asia, 51% in Africa and 48% in the LAC region.

Despite the widespread use of tax incentives outside the OECD, MNEs only identify tax incentives as one of the most important tax factors affecting investment location in the LAC region. Tax incentives were ranked 3rd most important out of 12 issues affecting investment in the LAC region, compared with 7th in Asia and 8th in Africa and OECD. The introduction of the global minimum tax as agreed by the Inclusive Framework as pillar two of the two pillar solution to addressing the tax challenges of the digitalising economy is likely to change perceptions concerning the value of tax incentives, and should help encourage the reform of tax incentives. The roundtables noted the importance of reforms to increase the transparency and accountability of tax incentives so as to reduce the opportunity for, and improve the identification of, illegitimate behaviour.

Figure 2.14. How often are tax incentives provided to large businesses/MNEs?

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

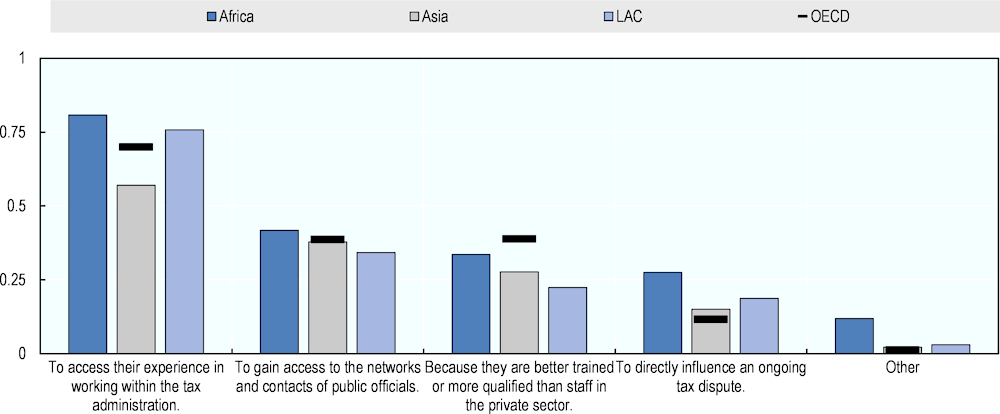

More than a quarter of African tax officials perceive that MNEs and/or the Big Four hire tax officials to directly influence ongoing tax disputes. Some 28% of African tax officials perceive this behaviour, substantially more than elsewhere (19% in the LAC region, 15% in Asia, 12% in the OECD) (Figure 2.15). This suggests that in Africa, especially, there is a need for new policies and processes, by both governments and by MNEs/the Big Four, to reduce this practice. Such measures could also seek to ensure that networks and contacts are not used illegitimately, as gaining access to the networks and contacts of public officials was seen as an important motivation for hiring public sector tax officials in all regions. While the use of such networks can be legitimate, safeguards are needed to ensure there is no impropriety.

Figure 2.15. Reasons why MNEs and/or the Big Four hire public officials

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

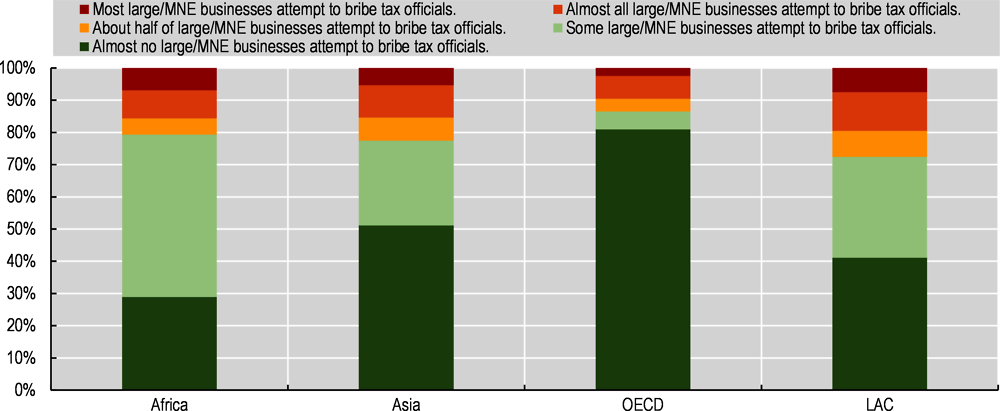

2.6.1. Bribery

A zero-tolerance policy towards bribery and a shared culture of integrity are essential to ensure fair implementation of the tax system. The interactions required between auditors and business and the complex application of tax laws in practice (which often involves a degree of discretion and interpretation) place revenue administrations at high risk of bribery attempts and corruption. The survey measured perceptions of bribery and corruption by asking tax officials to indicate the extent to which they agreed with the statement “Large/MNE business usually do not attempt to bribe tax officials in order to obtain beneficial outcomes”.

A small but worrying percentage of respondents perceived bribery attempts as common. Responses to the bribery question must be interpreted with caution, as the number of respondents who decided not to answer or declared not to be aware varies widely across regions (from 34% in Asia to 55% in the LAC region), making regional comparisons difficult. Among those who did answer, a small but worrying percentage of respondents perceived bribery attempts as common: 15% of officials in Asia, 20% of officials in the LAC region, and 16% of officials in Africa view half or more of MNEs/large businesses as attempting to bribe tax officials. The proportion drops to 10% in OECD countries (Figure 2.16). OECD countries also have the highest percentage of any region of officials perceiving that almost no business attempts to bribe (81%). Despite its limitations, the data suggests that some large businesses/MNEs are attempting to bribe. This is a concern for all regions – including the OECD – in an area where there needs to be zero tolerance.

Figure 2.16. Perception of bribery by large businesses/MNE

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample. Respondents who answered “I am not aware.” were not included. For Africa they accounted for 49%, for Asia 34%, for LAC 55% and for the OECD 49%.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

MNEs identify corruption as a major challenge, although corruption in the tax administration is less of a concern than corruption in the economy as a whole. Corruption is mentioned as a key factor for investment decisions in all regions, and is identified as the most important factor in the LAC region and Asia. In OECD countries, corruption was ranked as the 2nd most important factor affecting investment choices, while it was the 3rd factor of concern for MNEs in Africa. When asked specifically about the tax-related factors that influence their decisions, corruption in the tax system appears less important, MNEs operating in LAC ranked corruption in the tax system 6th out of 21 sources of tax uncertainty, above Asia (13th), Africa (14th) and OECD countries (20th). MNEs therefore seem to perceive corruption as a bigger challenge in the LAC region whereas tax officials appear to view bribery as a bigger challenge in Asia, although this may in part be because officials in Asia are more willing to disclose their perceptions of bribery.

Participants in the roundtables reiterated the need for zero tolerance on bribery, and for concrete steps to reduce opportunities for corruption. The roundtables highlighted the benefits of digitalisation in reducing the scope for bribery, as well as the need for effective oversight. Absence of audit and risk committees, as well as countries not having layered dispute resolution processes, were also identified as creating scope for bribery, especially of auditors. The roundtable discussions recognised a tension between facilitating increased and more informal interactions between taxpayers and tax administrations, and the increased opportunity for bribery/illegitimate behaviour that these might create. Various approaches to reduce risks were shared, including regular staff rotations (while ensuring continuity and certainty for taxpayers), the need for multiple staff to be present at all meetings, and keeping records of interactions with taxpayers. Administrations also stressed the importance of promoting a culture of public integrity.

The roundtables also highlighted the impact of perceived corruption on tax morale. One speaker highlighted the wide body of evidence showing that perceptions of corruption are a key factor affecting tax morale. Research shows that low perceptions of corruption at different levels of the executive branch (president’s office, government officials, or tax authorities) have a significant and positive impact on tax revenues (Boly, Konte and Shimeles, 2020[4]). Fighting corruption (or eliminating it altogether) also has a significant and negative impact on the share of income evaded, suggesting spillover effects from anticorruption to tax morale (Banerjee, Roly and Gillanders, 2020[5]). This matches findings in the 2019 OECD report on tax morale (OECD, 2019[6]).

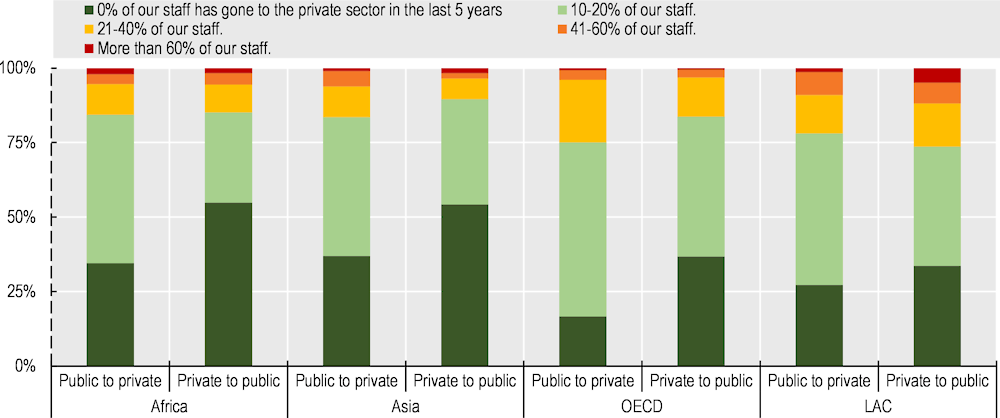

2.7. Staff recruitment

While movement of staff between the tax administration and the private sector is relatively limited on average, turnover can be very high in some cases. At least 75% of tax administrations in all regions reported that 20% or less of staff have been lost to the private sector in the last five years (Figure 2.17), and almost 90% in all regions report less than 20% of staff were lost to the Big Four in the same period. However, some officials report extremely high levels of loss to the private sector; it is especially concerning that in Africa, the region where tax administrations have the lowest capacity, 2% of officials report that over 60% of staff have been lost to the private sector in five years, a higher share than any other region. In terms of recruitment from the private sector, it appears that tax administrations in LAC are the most likely to recruit from the private sector, with 26% of officials reporting 20% or more staff were recruited from the private sector in the last five years, over 10 percentage points more than any other region.

Figure 2.17. How often do public officials go to work for the private sector and vice versa?

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample. Public to private refers to the percentage of staff has been lost to the private sector? Private to public refers to the percentage of staff recruited from the private sector.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

The private sector is perceived to recruit tax administration staff primarily for their experience. That tax administration officials are recruited for their experience of working within the tax administration is unsurprising. However, it is notable that while at least 70% of officials in Africa, OECD and LAC countries cite this factor, only 57% of Asian officials do. A much lower share believes tax administration staff are recruited by the private sector because they are better trained and/or qualified than other staff in the private sector (see Figure 2.15). This view is most common among OECD tax administrators, suggesting that the capacity gap between the private and public sectors may be greater outside the OECD. Reducing the value of experience of working within the tax administration may help reduce loss of staff to the private sector, in countries where this is a problem. For example, increasing the transparency of tax administration functioning may help in this regard.

Lack of experienced staff in tax administrations is a significant concern for MNEs, suggesting a shared interest in ensuring tax administrations are able to retain staff. MNEs cited lack of expertise in tax administrations on international taxation as one of the leading sources of tax uncertainty (6th out of 21 sources in Africa, 9th in Asia,10th in the LAC region and 13th in OECD countries), highlighting that retaining experienced staff is a shared priority for tax administrations and the private sector. While challenges in staff retention are not solely due to staff leaving for the private sector (for example, this might arise from routine staff rotation in many administrations), it can be a contributory factor. This shared interest among the public and private sector may make it easier to develop processes and procedures to regulate the movement of staff between the two. Such movement should not be stopped entirely, as there are mutual benefits to enabling relevant skills and experience to flow in both directions. However, it would be beneficial to establish clear guidelines and boundaries to regulate this movement, especially where turnover is very high and/or where there are concerns about illegitimate behaviour (see Use of power and incentives).

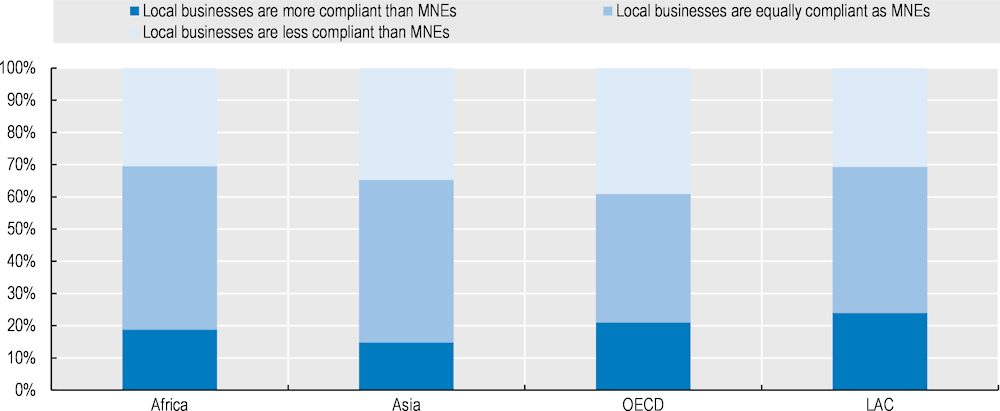

2.8. Comparison with local businesses

The survey asked for perceptions of the behaviour of MNEs and the Big Four relative to that of local businesses. To help contextualise the results and address the risk that the difference between perceived behaviour of local and foreign businesses may skew the results, the survey asked officials about their perception of local businesses in comparison to MNEs, and about local advisory firms in comparison to the Big Four. These results were not discussed in detail during the roundtables, and there is not relevant data from the MNE tax certainty survey to provide additional context.

The most common view in all regions was that compliance is similar between local businesses and MNEs. Where a difference was perceived officials were more likely to view MNEs as more compliant than local businesses. In Africa and Asia, almost 50% of officials see compliance as equal between local businesses and MNEs, this was slightly lower in LAC, and lowest in the OECD. The officials from the OECD were most likely to see local businesses as less compliant than MNEs, with 40% expressing that view, although all regions were in the range of 30%-40%. The range that saw local businesses as more compliant was also fairly narrow, ranging from 13% in Asia to 24% in the LAC region (Figure 2.18).

These results suggest that improving tax morale is at least equally important in domestic businesses. Given that MNEs are more likely to be seen as compliant, there may be a role for MNEs to show leadership in encouraging compliance, including through their value chains.

Figure 2.18. Are local businesses more compliant than large/MNE business?

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

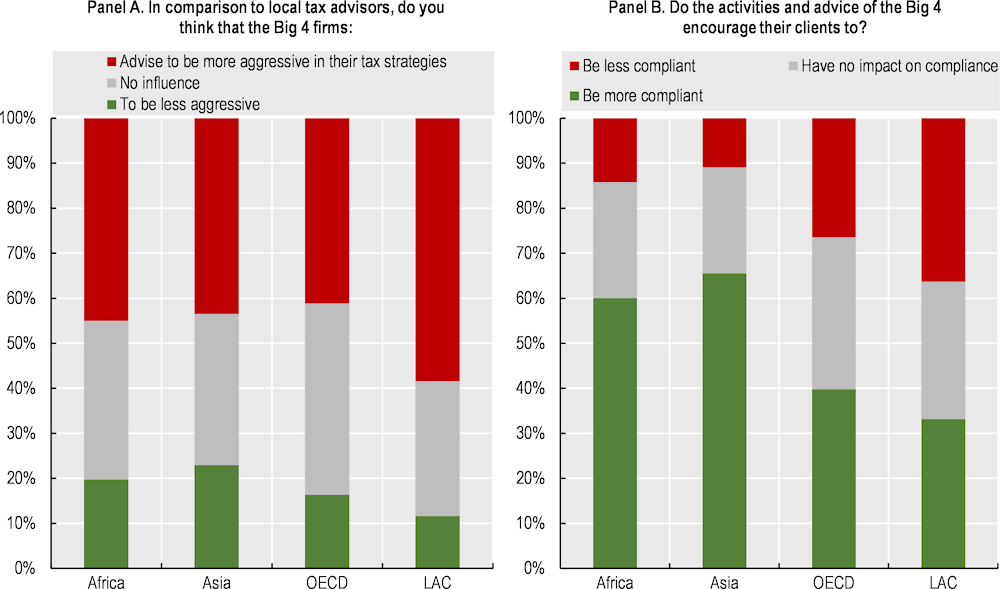

Officials in all regions were more likely to perceive the Big Four as advising their clients to be more aggressive in their tax strategies than local advisors. In Africa, Asia and the OECD, 42%-45% of officials viewed the Big Four as advising clients to be more aggressive than local firms; this figure rose to nearly 60% in the LAC region. The proportion of officials perceiving the Big Four to advise clients to be less aggressive was highest in Asia, at 24%, and lowest in the LAC region at 12% (Figure 2.19, Panel A).

Figure 2.19. Influence of the Big Four on their clients’ tax behaviour

Note: Simple regional average. Countries are weighted so that no country represents more than 10% of their regional sample.

Source: OECD (2020), Survey on MNEs and Big Four Firms tax behaviour.

The Big Four are more likely to be perceived as encouraging their clients to be more compliant and willing to pay tax, except in the LAC region. This was most apparent in Africa and Asia, where around 60% of officials view the Big Four as encouraging compliance and willingness to pay tax (compared to 40% in the OECD and 33% in the LAC region) (Figure 2.19, Panel B). This regional difference may, at least in part, be a reflection of the tax morale of the populations as a whole, as previous research identified tax morale as being lower in Africa and Asia than in the OECD and LAC (OECD, 2019[6]).

References

[5] Banerjee, R., A. Roly and R. Gillanders (2020), Anti-tax evasion, anti-corruption and public good provision: an experimental analysis of policy spillovers, https://doi.org/10.2139/ssrn.3652411.

[4] Boly, A., M. Konte and A. Shimeles (2020), Corruption and Tax Morale in Africa, Working Paper Series N° 333, African Development Bank, https://www.afdb.org/fr/documents/working-paper-333-corruption-and-tax-morale-africa.

[2] Bruhne, A. (2022), Defining and Managing Corporate Tax Risk: Perceptions of Tax Risk Experts, https://doi.org/10.1111/1911-3846.12785.

[1] OECD (2021), Developing Countries and the OECD/G20 Inclusive Framework om BEPS: OECD Report for the G20 Finance Ministers and Central Bank Governors, October 2021, Italy, OECD, https://www.oecd.org/tax/beps/developing-countries-and-the-oecd-g20-inclusive-framework-on-beps.htm.

[6] OECD (2019), Tax Morale: What Drives People and Businesses to Pay Tax?, OECD Publishing, https://doi.org/10.1787/f3d8ea10-en.

[3] Quentin (2017), “Risk-Mining the public Exchequer”, Journal of Tax Administration, Vol. 3/2, pp. 22-35, http://jota.website/index.php/JoTA/article/view/142/118.