This chapter provides a range of actions to help build trust and improve transparency and communication between tax administrations and taxpayers. These cover both existing good practices and new ideas suggested by participants in the roundtable discussions.

Tax Morale II

3. Building trust, improving transparency and communication

Abstract

The survey results clearly indicate a need to build trust between tax administrations and business, while the roundtables discussions demonstrated a willingness from both tax administrations and businesses to improve the relationships and enhance trust between large taxpayers/advisors and tax administrations.

Trust was the focus of much of the discussions at the roundtables, and was identified as integral in other areas, including transparency and communication. ‘Trust’ in this case should be seen as having trust in the processes, and that all parties are engaging in good faith. Tax is complex, and there will be disagreements, especially in international tax issues. While improving the relationships between taxpayers and administrations should reduce disputes, it will not eliminate them. Improved trust, however, should enable disputes to be resolved, with all parties accepting the validity of differing positions and (crucially) the results of a resolution process, without it affecting the willingness of either side to maintain a positive relationship.

Building trust is neither quick nor simple, there is no single solution; nor can trust be built by one party alone. Building trust requires commitments and action from both taxpayers and tax administrations. While the overall objective is to improve the tax morale of taxpayers, it is necessary to look at measures that can be taken by all parties, as there are a range of factors that may affect tax morale. Growing interest among investors, the media, civil society organisations and the public more generally in the tax affairs of large businesses indicates that a wider set of actors may play a role. The specific measures that these other actors can take are, however, outside of the scope of this report.

This section highlights best practices and recommendations that came from the regional roundtables, as well as identifying some areas for further work. These have been grouped together in four clusters; while not entirely mutually exclusive (for example there is/can be a capacity building element to all clusters), these clusters illustrate the different dimensions that need to be considered in building trust between tax administrations and business. The clusters are:

Compliance and Audit strategies

Expectations and accountability of behaviour

Transparency and communication

Capacity building

The measures range from those that are relatively easy to implement, to more comprehensive reforms that may require substantial resources. Especially where resources, both human and financial, are limited, as they are in many tax administrations and businesses, securing agreement to invest the time and resources can be challenging. The potential return on investment in these measures is significant: however, the challenge may be that some of the investments required may not be so familiar, with a focus less on technical processes or skills, but rather professional competences that can build trust and mutual understanding.

While these measures may imply an increased resource commitment for tax administrations to begin with, costs savings should be realised in the medium- and long-term. Over time, improving trust, communications and transparency with taxpayers should lead to cost savings. Stronger relationships will enable better prioritisation of resources, not least through better targeting of audits, which will reduce case-handling time and disputes.

From the business perspective, the potential gains in tax certainty will be of clear benefit. In addition, with tax increasingly a concern for shareholders, especially those applying ESG criteria, an increasing number of MNEs should be able to make an additional case for such investment in measures to increase trust, communications, and transparency.

The largest barrier to committing to approaches that focus on building trust, improving communication, and increasing transparency may be uncertainty regarding whether efforts will be reciprocated. Given that taxpayers and tax administrations stand to benefit, there are clearly good reasons for reciprocity, but change can take time. As such, new approaches should not be viewed as a short-term project, and while results may appear quickly, they should not be expected immediately. In addition, communicating clearly about changes and the expectations accompanying these changes is likely to encourage reciprocal responses, while seeking and acting on feedback will accelerate the process. Developing a clear strategy, with commitment from senior officials, on how to build trust, will therefore be useful. This may entail a comprehensive co-operative compliance approach, but could be more modest to start with.

3.1. Compliance and audit strategies

Creating an environment that encourages compliance is important. While the right strategies can build trust, those that are poorly designed and/or executed can inhibit trust and reduce the willingness to engage openly. The roundtables identified a number of strategic approaches that can build trust and encourage dialogue.

3.1.1. Co-operative compliance

The term ‘co-operative compliance’ refers to approaches that provide a framework to establish a relationship with taxpayers based on co-operation and trust (OECD, 2016[1]). This approach is distinct from a coercive or obligation-based relationship. The concept not only describes the process of co-operation but also demonstrates its goal as part of the revenue body’s compliance risk management strategy: compliance that leads to payment of the right amount of tax at the right time. In dealings with taxpayers, co-operative compliance entails revenue bodies demonstrating understanding based on commercial awareness, impartiality, proportionality, openness through disclosure and transparency, and responsiveness. In return, taxpayers provide disclosure and transparency in their dealings with revenue bodies.

Co-operative compliance was considered desirable in all the roundtables, especially by businesses. In some instances, co-operative compliance was referred to as an enhanced relationship between taxpayer and tax administration. It was noted in the discussions that co-operative compliance may be more appropriately seen as an end point rather than a departure point, as a certain degree of trust needs to be established to enable a comprehensive co-operative compliance framework. This may explain why MNEs identified establishing co-operative compliance programmes as a low priority among the tools to improve tax certainty (between 19th and 21st out of 25 possible measures across all regions).

Co-operative compliance can be a resource-intensive undertaking, but should be resource-efficient in the long run. It may be challenging for developing countries with weak capacity to implement co-operative compliance, at least in full. For example, it may be challenging within existing capacities to manage the ‘real time’ dialogue envisaged in co-operative compliance. In addition, where trust is limited, it may not be possible to move directly to co-operative compliance, even if resources were available: although co-operative compliance can build trust, it requires a certain level of trust to begin with. There were, therefore, discussions about what co-operative compliance ‘lite’ could look like, which focused on the key starting points for countries and businesses seeking to move towards co-operative compliance.

Building an effective co-operative compliance system requires commitment and actions from both taxpayers and tax administrations. Without taxpayers and tax administrations committing to the approach, co-operative compliance will fail. For example, if taxpayers do not commit to the implementation of Tax Control Frameworks (TCFs – see Tax Control Frameworks section below), there is a risk that tax administrations will invest heavily in enhanced services to taxpayers without receiving the amount of information and degree of co-operation from taxpayers that would justify this investment.

Many developing countries appear to be moving towards the co-operative compliance approach. Fifty-three of the 101 developing countries participating in the ISORA1 survey state that a co-operative compliance programme is available for large taxpayers (see Box 3.1 for examples from Latin America). There may, however, be differences in interpretation as to what entails co-operative compliance, with research showing that there is significant variation in the requirements and processes in countries that report co-operative compliance regimes (see (Martini, 2022[2])). While co-operative compliance is likely to vary between countries, not least due to legal and structural differences, too great a variety in approaches labelled co-operative compliance may generate confusion among taxpayers and tax administrations alike. The WU Global Tax Policy Center, together with the International Chamber of Commerce and Commonwealth Association of Tax Administrators, has developed a handbook on co-operative compliance that identifies and explains key elements of successful co-operative compliance programmes (Owens, 2021[3]). Similarly, several of the best practices identified by the roundtables, and summarised in this report, could be components of a co-operative compliance framework.

Box 3.1. Co-operative compliance in Latin America

According to the ISORA data a third of countries in the LAC region state that co-operative compliance is available to large taxpayers. Two countries that provided examples in the LAC roundtable were Chile and Colombia.

Chile

Chile’s Servicio de Impuestos Internos (SII) promotes co-operative compliance through two main tools:

1. Collaboration Agreements for Tax Compliance (ACCT) – currently in a pilot phase. Participating MNEs benefit from opportunities to discuss and regularise any disagreement with the tax administration before an audit process is opened against them or before any fines or penalties are imposed. If inconsistencies are detected during the information cross-checking and validation processes, analysis and conversation with the taxpayer are initiated in the first instance. It is expected that these will serve to correct any discrepancy; only if this does not occur is the action escalated to an audit.

MNEs wishing to enter into these agreements are required to have in place a solid corporate tax governance structure and an internal fiscal control framework that guarantees that the tax returns and information submitted to the tax administration are complete and correct. Such Tax Control Frameworks (TCF - see below) are a key feature of co-operative compliance and help build trust.

2. Collaboration Agreements (ACT) with sectorial or trade associations of taxpayers of different sizes (large, medium and small companies), which to leverage these associations to encourage tax compliance. The tax administration develops a Work Plan of preventive and collaborative actions to reduce tax compliance gaps and mitigate risks with taxpayers belonging to the association. Work Plans include actions such as:

Workshops on tax issues of interest to the association;

Field visits and workshops held by the associations to allow SII officials to learn about the business and industry model that the association represents;

Special attention units to resolve remotely any doubts about tax declarations;

Workshops with members who present gaps in compliance to seek collaborative solutions;

On-site assistance to taxpayers;

Working groups between the association and the SII; and

Production of guidelines and support material on topics of interest.

Additionally, on a periodic basis, the SII team responsible for overseeing the implementation of the Agreement reviews the tax compliance status of its members with the association in each of the four categories of tax obligations (register, report, declare and pay).

This type of collaborative work opens a direct channel for associations with the SII to receive support and training on tax issues, answer tax inquiries or resolve doubts regarding common problems of their members. It also allows associations to receive personalised reports with the main gaps to be corrected, to detect risks and non-compliance, and to seek collaborative solutions.

Since 2017, Chile has signed 51 Agreements with trade associations, and it has established indicators for the explicit and objective evaluation of the results of this compliance programme (such as tracking the completion of activities included in the Working Plans, conducting qualitative evaluations and analysing the evolution of tax compliance gaps among members). These evaluations show that, on average, these taxpayers display better tax compliance rates than taxpayers not included in an ACT.

Colombia

Colombia’s Dirección de Impuestos y Aduanas Nacionales (DIAN) promotes co-operative compliance through several different initiatives. All the initiatives listed below follow three key principles to ensure co-operative compliance programmes are fair, efficient and transparent: i) programmes are based on a legal framework that establishes the steps and procedures that regulate their application, eliminating the margin of discretion; ii) tax penalties are applied in the same way for all taxpayers, regardless of whether they participate in a cooperative compliance programme; and iii) the programmes establish indicators for the explicit and objective evaluation of the results of the compliance.

Advanced Pricing Agreements (APAs) – APAs are agreements between the taxpayer and tax administration determining the transfer pricing methodology to be used, providing certainty for the duration of the agreement (so long as the terms and conditions are adhered to).

‘Account Executives’: tax administration officials with knowledge of DIAN processes provide large taxpayers with personalised attention regarding the services offered by the tax administration. The assistance is provided remotely, if possible, in order to eliminate barriers such as distance/location or the hours of reception of requests. They provide assistance in procedures related to internal and international tax, customs and foreign trade; provide responses and follow-up to petitions, complaints and claims; link them with other agencies or departments when necessary; and generate warnings and early alerts for taxpayers.

Personalised communications informing taxpayers in advance of the expiration dates of their obligations or of the inconsistencies found in them, in order to allow them to regularise their situation before taking a decision on further measures and avoiding future litigation.

Roundtables with unions or professional interest groups, in which the tax authorities explain common inconsistencies that appear in tax audits. They seek rapprochement between the administration and large taxpayers by highlighting that the tax administration has noticed the tax planning practices frequently found in the audit of the tax returns filed.

Tax queries: taxpayers can request tax authorities to issue interpretations on tax matters. The interpretation must be followed by officials assigned to the entity, providing tax certainty.

Source: Inter-American Center of Tax Administrations (CIAT)

3.1.2. Risk-based approaches to audit

Both businesses and tax authorities participating in the roundtables highlighted the benefits of taking and/or improving risk-based approaches to audit. For tax administrations the benefits include improving the efficiency and effectiveness of audits, enabling limited resources to be used more effectively, while for taxpayers it can reduce compliance costs for low-risk taxpayers.

Risk-based audit strategies may also provide indirect benefits by influencing taxpayers’ approach to compliance. When risk-based approaches are in place, companies are likely to be incentivised to reduce risky behaviour and improve internal control procedures to reduce risk; conversely, when risk-based approaches are absent, the appetite for tax risk increases, not least as there would be no guarantees that adopting a low tax risk would increase tax certainty. A study of 15 514 firms across 54 countries found that the use of risk-based audits is associated with a lower level of tax avoidance. The same research also found that the use of risk-based audits decreased the cost of enforcement and improved the performance of tax authorities (Eberhartinger, 2021[4])

While risk-based approaches to audit may reduce the cost of enforcement in the long run, establishing such approaches may increase resourcing needs in the short term, creating a challenge for some developing countries. There are increasingly sophisticated tools available to help analyse data to assess risk, which can be resource intensive to design. Tax administrations therefore need to establish systems of risk analysis that are tailored to the precision and sophistication of the resources (both human and financial) available, remembering that absolute precision is not the aim since that is the objective of the audit itself. Such an approach will need to establish key risk indicators, of which there may be several types (e.g. indicators reflecting general tax risk of different taxpayer groups, indicators relating to taxpayers’ past behaviour, indicators relating to deviations of current performance from norms, and information from informants). CIAT has developed the Manual on Non-Compliance Risk Management for Tax Administrations (CIAT, 2020[5]) to guide tax administrations in their risk-management approaches.

The development of risk-based approaches can help with other challenges identified in the roundtables, especially issues around the volume of information requested. By focusing on key risks in both the initial filing requirements and any subsequent requests for additional information, the information demands should become smaller but more targeted, making it easier for tax administrations to carry out analysis and for taxpayers to comply. It should be noted that risk-based approaches create new challenges regarding information. It is necessary to ensure that the information used for risk analysis can be trusted and is not subject to bias; this may require investment in the tools to clean and sort data, especially when automated algorithms are used.

While risk-based approaches can help administrations make more effective use of data, they do not eliminate the need for dialogue beyond data exchanges. Sometimes there are differences in interpretation between tax administrations and taxpayers, but a risk-based approach can provide a structure for dialogue and ensure that it focuses on the most pertinent issues.

Tax administrations adopting risk-based approaches have to decide how much information to share regarding their approach. Transparency can be an effective tool to encourage specific changes in taxpayer behaviour and can build trust However, if too much information is shared, it could encourage clustering of behaviour just below thresholds. There is also scope for tax administrations to share information between themselves to help identify risks. For example, CIAT has established a Database of Transnational Cases Involving the Erosion of the Taxable Base to facilitate exchange between CIAT member countries on abusive tax planning.

3.2. Expectations/accountability of behaviour

There was strong agreement across participants in the roundtables that it is easier to build relationships when there are clear expectations for behaviour, and even more so where there is some form of accountability. This applies to taxpayers and tax administrations alike, although the mechanisms will differ. In addition, discussions on reducing scope for bribery and illegitimate behaviour also focussed on the need for accountability.

Administrations, taxpayers and advisors should all consider how objectives and performance targets affect relationships. Some businesses raised concerns that evaluating an auditor’s performance based solely/primarily on their achievement of certain tax assessment targets could be detrimental to building trust, as it may promote more aggressive approaches to audit from the administration. Similarly, businesses and advisors should also consider whether their policies could be incentivising an overly aggressive approach. One suggestion in the roundtable was that investors evaluate a company’s performance based on its pre-tax earnings, in order to avoid incentivising tax minimisation strategies.

While beyond the scope of this report, it should also be noted that ESG reporting increasingly includes reporting on tax. Tax is included in certain ESG reporting standards, such as the Global Reporting Initiative and the World Economic Forum International Business Council ESG reporting metrics. While adhering to such standards is voluntary, businesses are increasingly expected to align their tax behaviour accordingly (especially public disclosures), compliance with these standards is increasingly required for those businesses that wish to be included in ESG investment portfolios.

3.2.1. Guidelines

The existence of guidelines for large businesses correlates with an increased perception of trust in large taxpayers. Where such guidelines exist, taxpayers are generally perceived to follow them, suggesting they are effective in setting expectations for behaviour. MNEs also see guidance as a high priority for increasing tax certainty (see Chapter Two). When preparing new guidelines, care must be taken to ensure that they are sufficiently detailed; some businesses highlighted challenges where guidelines are not sufficiently detailed, since this can lead to unpredictable interpretation and an unclear decision-making process.

It is important to ensure widespread awareness of guidelines. As outlined in Chapter Two, some tax officials perceive that the guidelines that exist are never used, and there is some evidence to suggest differing levels of awareness of the existence of guidelines across tax officials within the same administration. Thus, internal awareness raising is also needed in addition to ensuring that taxpayers are aware of guidelines.

The OECD Guidelines for Multinational Enterprises (OECD, 2011[6]) provide internationally agreed guidelines for MNEs operating in or from adhering countries, together with a network of National Contact Points (NCPs) to resolve issues related to the implementation of the Guidelines. These Guidelines are the only multilaterally agreed and comprehensive code of responsible business conduct that governments have committed to promoting, and include a chapter on taxation. The taxation chapter states that MNEs should comply with both the letter and spirit of tax laws in the countries in which they operate. It also highlights the need for MNE boards to adopt tax risk-management strategies. NCPs provide for a non-judicial grievance process that allows any individual or organisation with a legitimate interest to submit a case to an NCP regarding an MNE operating in or from the country of the NCP that has not observed the guidelines. At the time of writing, there have been 18 cases brought under the taxation chapter of the MNE Guidelines.

3.2.2. Taxpayers’ charters and ombudsmen

Taxpayers’ charters provide clear expectations of service for taxpayers, while a tax ombudsman service plays a useful role in resolving procedural and administrative issues. Many countries have established taxpayers’ charters, which provide a reference point for the standards of administrative service taxpayers can expect. Such charters outline the rights and obligations of taxpayers and explain what to expect when dealing with the tax administration. The perception of several businesses participating in the roundtables was that the value of such charters lies in improving the training and internal governance of tax administrations, rather than as a reference point for specific instances where it is felt that the charter is not being adhered to.

Even with taxpayers’ charters, difficulties may arise with the administrative actions of the tax office. In these circumstances, the ability to refer to a tax ombudsman can resolve issues quickly and rebuild trust. A tax ombudsman is independent from a tax administration and will usually accept complaints only after a tax administration’s internal complaints procedure has been exhausted. In most cases, the findings and/or directives of the ombudsman will be binding upon the tax authority, and as such referral to the ombudsman can be a quicker and cheaper process than recourse to the courts. In addition to playing a valuable role in resolving individual cases, an ombudsman can identify systemic or emerging issues to be highlighted to the tax authorities. The roundtables identified a tax ombudsman as a valuable institution for maintaining and rebuilding trust between tax authorities and taxpayers, and they identified a number of essential features for an effective tax ombudsman (see Box 3.2).

While a tax ombudsman focuses on the tax administration functions, clear expectations on legal processes are also required. This issue was not widely discussed in the roundtables, as it goes beyond the control of the tax administrations, but it is a significant concern. Unpredictable or inconsistent treatment by the courts was the 5th highest source of tax uncertainty in Asia and 7th in LAC (11th in Africa and 12th in the OECD). Countries may need to identify ways to provide assurances concerning treatment by the legal system, for example on provisions to ensure General Anti-Avoidance Rules will be applied objectively, such as the use of panels of experts and providing transparency on cases.

Box 3.2. Key design features of a tax ombudsman

A number of key features for an effective tax ombudsman were identified in the roundtable discussions, these include:

The ombudsman should be established through legislation that specifies its mandate, limits on authority, access to information and obligation to maintain taxpayer confidentiality

The ombudsman must be independent from the tax authorities

The scope of matters to be dealt with by the ombudsman must be clearly defined and limited – i.e. they should be related to the service received from the tax authorities or should be of procedural or administrative nature

Taxpayers should exhaust internal remedies first before referring to the ombudsman to avoid bypassing the processes of tax authorities

The ombudsman must have access to information from the tax authority

The ombudsman’s findings/directives should be binding on the tax authorities

The ombudsman should report periodically to the tax authorities, as well as to the oversight body (e.g. minister of finance/parliament)

The ombudsman should keep the public informed as to its function and availability

The ombudsman service should be accessible to all taxpayers (i.e. free to use)

Source: Summary of inputs from roundtable participants

3.2.3. Tax control frameworks

Tax control frameworks (TCF) have evolved alongside co-operative compliance, and in many countries, taxpayers are required to have a TCF in place as a condition of entry to a co-operative compliance programme. A TCF is the part of the system of internal control that assures the accuracy and completeness of the tax returns and disclosures made by an enterprise. Its importance lies in its ability to provide a verifiable assurance that the information and returns submitted by a taxpayer are both accurate and complete. This goes above and beyond the obligation to provide accurate tax returns, by placing additional emphasis on disclosure and transparency. In this respect, disclosure signifies the willingness of the taxpayer to make the revenue body aware of any tax positions taken in the return that may be uncertain or controversial, and being ready to go beyond their statutory obligations to disclose, while transparency refers to the sharing sufficient information about the taxpayer’s internal control system to enable the tax administration to justify trust in the taxpayer. In this respect, the TCF may be a useful part of the risk analysis (see risk-based approaches to audit). In many cases, a TCF will be a part of the broader business control framework of an enterprise.

The 2016 publication Co-operative Tax Compliance: Building Better Tax Control Frameworks (OECD, 2016[1]) outlines the six essential features of TCFs. They are: that a tax strategy is established and owned by the senior management of the enterprise; it is applied comprehensively, such that all transactions capable of affecting the tax position are covered by the TCF; responsibility should be clearly assigned, with the board ultimately accountable, while the tax department is responsible (and resourced) for implementation; the governance of the TCF needs to be such that it ensures that not only are all relevant transactions and events reviewed, but also documented; there should also be regular monitoring and testing of the TCF. Taken together, the first five of these features should enable the sixth to be fulfilled; providing assurance that tax risks are subject to proper control. The exact design and implementation of TCFs will vary between enterprises, especially across sectors.

An increasing number of MNEs already have TCFs in place. Ideally these TCFs cover the worldwide operations of the MNE rather than just the jurisdictions that require a TCF as part of co-operative compliance regimes; where TCFs do already exist this may provide a useful tool to start building trust. Where MNEs adopt TCFs, this may be a useful first step towards co-operative compliance that may encourage tax administrations to adopt the approach. Tax administrations unfamiliar with TCFs may need support in developing processes to test/assess TCFs; such guidance and training could be integrated into capacity building on co-operative compliance.

3.2.4. Business principles

Voluntary business principles on tax are a relatively recent development that provide one way for businesses to clarify what others should expect from their behaviour on tax, and provide an opportunity to introduce some degree of accountability. The questions for the tax administration survey that provided the basis for this report were based on the Business at OECD best practices. While most questions were designed to enable some accountability on performance against the principles, several questions were included to understand the awareness of, and perceived utility of these principles, as well as possible ways to improve them.

An overwhelming majority of officials across regions found that the Business at OECD statement of best practices is useful for improving their relationship with large businesses. However, awareness about these commitments was low. Over 80% of officials in all regions (92% in the LAC region, 87% in Asia, 85% in OECD countries and 80% in Africa) stated that they found the statement of best practices useful, though many had not previously encountered them, with only 23% of officials in Africa, 33% in OECD, 34% in Asia, and 36% in the LAC region stating that they were aware of the best practices prior to taking the survey. In addition, higher levels of awareness of the principles correlate with higher perceptions of usefulness, which suggests that increasing communication on the principles could yield positive results.

In addition to increasing awareness of the principles, there is also scope to improve them. Around 50% of tax officials (48% OECD, 50% LAC, 55% Africa, 60% Asia), stated that the principles could be enhanced, and provided suggestions for improvement.

Some of the suggestions for improvement referred to the number or detail of the commitments. These include developing in greater detail references to transfer pricing and BEPS-related practices (given that the principles were developed prior to the launch of the BEPS Project); clarifying the meaning of some terms (such as “reasonable and relevant"); adding new principles, such as a specific commitment to extend the obligations to all entities in a group (“all related entities, including parent companies, should facilitate the flow of information with other group members”); a principle to avoid the request of deferrals or extensions unless they are duly justified (and never with dilatory purposes); and explicit references to the reparation of environmental damages and externalities, including complying with and supporting environmental taxation legislation, and the commitment to work towards a public-private alliance against corruption. More broadly, participants encouraged entities to commit to disclose relevant information concerning capital gains, transfer prices, new types of transaction or new business processes whenever possible.

Other suggestions indicate areas where there is scope for developing additional guidance. Developing region-specific and country-specific principles adapted to the local context, sector-specific principles to capture sectoral characteristics that might impact compliance, and specific guidance on how large businesses should interact responsibly with the tax authorities in Special Economic Zones (SEZs), were mentioned as important priorities. Administrations proposed developing similar principles for tax officials (which could complement Charters of Taxpayers’ Rights) and practical guidance that outlines how officials should behave, and what procedures administrations can put in place, to encourage a positive behaviour from MNEs. Several respondents across regions suggested publishing best practices and case studies that show how the principles translate into practice, including examples of good co-operation with large taxpayers and of good business behaviour, as well as practices for preventing and dealing with audit disputes.

A final set of suggestions focused on the implementation of principles. While some respondents proposed a sanctioning mechanism be developed, others advocated for promoting good behaviour by developing a system of recognition for businesses/MNEs regarded as compliant with the principles. Specific indicators for monitoring the implementation of the commitments (both within administrations and within MNEs) were also mentioned. Regarding awareness-raising, respondents stressed the need to make the statement available in languages other than English (in particular, Spanish and French) and to increase the number of trainings, seminars and communication campaigns to sensitise officials and taxpayers about its existence and importance, including through on-line trainings.

The survey data and roundtable discussions indicated further issues that could be considered for inclusion in a revised statement of best practices. The challenge of obtaining information from overseas was raised in all roundtables as a challenge, and several MNEs suggested that improvements should be possible. Methods for staff recruitment may also be useful to consider; for example MNEs could both commit to supporting training in country, and considering the impact of recruitment on tax administration capacities. In addition, the results may provide suggestions on where further detail concerning best practices may be useful, for example providing more information on what co-operation means in practice and highlighting some of the types of information that may be useful to share (including information that goes beyond strictly tax information, such as value chain descriptions).

Other voluntary principles that have emerged may provide inspiration on how to improve the principles. The B Team which brings together business and other leaders to call for, and demonstrate, a better way of doing business, established a set of responsible tax principles in 2018 (The B Team, 2018[7]), which have been endorsed by 24 MNEs at the time of writing2. In addition, The B Team is also publishing a series of case studies on how the principles translate into action within endorsing MNEs3. The B Team principles provide more detail on the behaviours expected; as such some of the principles developed by The B Team address issues highlighted in this report. For example, in respect to the relationship with authorities, The B Team principles commit to providing information held in other jurisdictions, where relevant (see (The B Team, 2018[7]) principle 4B), which was identified as a key challenge by many administrations. While The B Team is showing one approach to providing accountability on adherence to voluntary principles, further work is needed. Insofar as the principles map onto TCFs (where these exist), these may provide some degree of accountability, especially where tax administrations are assessing TCFs as part of co-operative compliance programmes. Another option is incorporating principles into the guidelines/expected standards of behaviour for both tax administrations and taxpayers. Providing more examples (as in The B Team case studies) of practical compliance with the principles will be useful in giving administrations the confidence to recognise non-compliance.

One way to increase accountability is for countries to integrate best practices into taxpayers’ charters and/or other statements of expectations of behaviour. Given that the best practices have been developed and agreed by MNEs themselves, they represent a ready-made set of standards for tax authorities to use as a reference point. Incorporating best practices into domestic accountability mechanisms could encourage adherence to the best practices, as well as empowering tax administrations to recognise behaviour that falls below the standards expected. Such an approach may also increase awareness of the best practices among subsidiaries of MNEs, especially in developing countries, and among tax administrations.

The primary source for accountability is within the enterprises themselves. Where the principles go beyond legal requirements in a jurisdiction, it is likely to be challenging for tax administrations to hold taxpayers to account. It will therefore be incumbent primarily upon the enterprise to set up systems and processes to ensure compliance with principles. In large multinational organisations, establishing consistent behaviour across all subsidiaries may be challenging, especially where there can be subjectivity in what falls within or outside the organisation’s policy. Internal accountability processes may therefore be useful to help ensure consistency throughout the organisation. PricewaterhouseCoopers (PwC) has established Tax Policy Panels (TPP) for this purpose (see Box 3.3)

Box 3.3. PwC Tax Policy Panels

PwC’s baseline with respect to tax advice is reflected in a Global Tax Code of Conduct (GTCC). Principles applied are:

1. Tax advice which results in positions taken in a client’s tax return must be supported by a credible basis in tax law.

2. No tax advice relies for its effectiveness on any tax authority or having less than the relevant facts. Advice that a PwC firm gives includes consideration of, and is based on, the assumption that the client will make relevant disclosures that both comply with the law and enable tax authorities to make further enquiries should they wish to do so.

3. Tax advice is given in the context of the specific facts and circumstances as provided by the client concerned and is appropriate to those facts and circumstances.

4. Tax advice involves discussion of the wider considerations involved, as appropriate in the circumstances, including economic, commercial and reputational risks and consequences arising from the way stakeholders might view a particular course of action.

5. PwC firms advise clients of appropriate options available to them under the law having regard to all of the principles contained in this code.

PwC firms are expected to conduct rigorous technical analysis of advice to clients. But the principles embodied in the GTCC are much broader than just of technical nature. PwC tax advisors are expected to submit projects to Tax Policy Panels (TPP) if certain criteria, including some that are similar to mandatory disclosure hallmarks, are met. A TPP will then review the project against the background of the GTCC and will assess the project beyond its technical merits, in particular consider tax policy, systemic, economic, commercial and reputational risk and the way stakeholders might view a particular course of action. Decisions by TPPs are strong guidance for the practice. Recognising that different PwC firms act in different territories and in different legal cultures, the chairpersons of the TPPs convene regularly in order to discuss matters that have come before the panels; the goal of these meetings is to come to international convergence in review of the cases.

The establishment and operation of PwC’s TPPs have contributed to much more holistic tax advice that takes on board the societal context in which tax advice is rendered.

As of 30 June 2021, TPPs had been established in 34 territories. During FY21, over 560 matters were considered and discussed by the TPPs.

Source: PwC

3.2.5. Reducing opportunities for bribery

The survey results indicate a small but worrying perception of bribery in every region. Both taxpayers and tax administrations need to take strong actions to both reduce the opportunity and incentives for bribery.

Clear Codes of Conduct for both tax administrations and MNEs reduce the risk of misconduct. Incorporating examples into these Codes of Conduct (e.g. no gift policy) might help. Insights from behavioural science show that exposing individuals to real-life scenarios of moral dilemmas or conflicts of interest reduces the risk of misbehaviour. When individuals have the opportunity to consider a dilemma beforehand, they are more likely to act with integrity when confronted by it (OECD, 2018[8]). A similar approach could be taken to integrate ethical considerations into technical seminars and training, rather than the usual approach of presenting ethics as a stand-alone issue.

Administrations reported that clear communication protocols in which auditors debrief to colleagues their interactions with the taxpayer has helped in reducing the risk of misbehaviour. Introducing a standard governance process to review large taxpayer audit conclusions, possibly together with statistical analysis of tax collection that could identify inconsistencies, could also be useful. Increasing the number of auditors involved in audits, and as a minimum ensuring no one-to-one meetings between taxpayers and tax administrations, was also cited as a successful policy against misbehaviour.

Governments should ensure that legislative, policy and administrative frameworks support their anti-corruption efforts. The OECD Recommendation on Public Integrity provides a comprehensive framework to foster integrity by combining enforcement and deterrence with the promotion of a culture of integrity. The OECD Public Integrity Handbook (OECD, 2020[9]) provides practical guidance for implementing this Recommendation.

Governments can use legislation to support public integrity in companies. For example, many governments have legislation requiring companies to establish an anti-bribery compliance programme, which includes anti-corruption corporate policies, capacity building, reporting channels, risk management and internal control functions (OECD, 2020[9]).

Governments can combat the supply side of bribery by signing the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions4. This anti-corruption instrument criminalises bribery of foreign public officials and reduces incentives by explicitly disallowing the tax deductibility of bribes to foreign public officials. Signatories to the anti-bribery convention commit to establish the bribery of foreign public officials as a domestic offence. Such domestic legislation with extra-territorial reach can be an effective tool to improve business culture. The UK Bribery Act was introduced in 2011 and in section 7 created a ‘failure to prevent bribery’ offence. Research suggests that this legislation has resulted in a significant change in MNE policy and practices, both within MNEs subject to the Act and their suppliers (see for example (Goldstraw-White and Gill, 2016[10]) and (LeBaron, 2017[11])).

3.3. Transparency and communication

Transparency and communication are closely linked. The roundtable discussions noted that poor communication is likely to affect willingness to be transparent with tax administrations. A number of recommendations were made and best practices identified, not only covering direct communication between taxpayers and administrations but also the wider landscape, including the need to increase the transparency around the processes regulating the relationship between large taxpayers and tax administrations, to build trust among the wider public. Given the findings from the survey that perceptions of co-operativeness are higher than perceptions of trust and openness in the information provided, it seems likely that the challenge in many countries is not participation in the formal processes, but rather improving the commitment to and content of the dialogue.

The roundtables highlighted the willingness of MNEs and tax administrations to facilitate a more open and ongoing dialogue between taxpayers and tax authorities, not only on the occasion of tax audits or assessments, but also on a regular basis. There are various approaches being implemented that increase the available channels of communication between taxpayers and administrations, as well as improving the existing channels. These approaches range from engagement at the time of policy development, to improving requests for information during audits. They have a shared interest in facilitating more effective communication and reduce disputes. While participants in the roundtables were, in general, in favour of enabling greater and more frequent informal dialogue to prevent formal disputes, clear policies and processes are still needed to reduce the risk of creating opportunities for corruption or other improper behaviour.

3.3.1. Multilateral dialogue

Several businesses with experience of the International Compliance Assurance Programme (ICAP) highlighted its benefits in facilitating open and co-operative multilateral engagements between MNEs and tax administrations. While it was acknowledged that ICAP may not be suitable for many developing countries, there was support in the roundtables for providing an avenue for more flexible, higher-level multilateral dialogue between MNE groups and tax administrations.

Providing a route to facilitate multilateral dialogue between MNEs and tax administrations in developing countries outside of ICAP could provide benefits on both sides. As many MNEs have reported challenges with tax administrations understanding their structures and value chains, opportunities to discuss and explain these with several jurisdictions simultaneously could be valuable. For tax administrations, especially those with limited capacities, dialogue with MNEs together with peers could be useful in building skills and understanding. In addition, it would open to MNEs participating to voluntarily provide additional information, such as country by country reports, which may not otherwise be accessible by developing country tax administrations.

Further work is needed to establish the viability of a voluntary multilateral dialogue process, to gauge demand from both MNEs and tax administrations, and, assuming demand exists, to define the parameters of a programme. The OECD will seek to work with others, including Her Majesty’s Revenue and Customs capacity development unit, to scope a programme, and if viable to establish pilots.

3.3.2. Stakeholder forums

Several administrations have established forums where stakeholders, including tax officials and MNEs, meet on a regular basis to discuss and offer advice on tax issues and procedures. Tax administrations can use these forums to communicate changes in regulations or processes, or to receive feedback on how bureaucratic procedures can be simplified. Businesses and tax administrations highlighted the benefits of such forums, which can help identify issues that are shared across many taxpayers. In addition, they can also facilitate peer learning, including among taxpayers, and helping improve the capacity to comply.

Some businesses also reported that such forums can improve the perception of the tax administration by demonstrating its willingness to engage positively with taxpayers, as well as its commitment to fairness and transparency with taxpayers. Of course, for such benefits to arise, such forums need to be designed to be open and transparent, with wide participation. It also needs to be shown that such forums have an impact in addressing the issues raised therein.

Consideration should be given to how stakeholders are engaged and when there is a need for forums to focus on specific topics. Where there are common challenges across many taxpayers, broad-based forums can be useful; as issues become more specific, it can be more challenging for forums to play an effective role unless the forums also become more specific. Similarly, relying on joint inputs from taxpayers/taxpayers’ associations to such forums can be useful for some issues but can sometimes result in responses that have to generalise to ensure broad agreement across all signatories to the inputs, which can lessen the utility of the inputs to the administration. The Kenya Revenue Authority (KRA) established a Stakeholder Engagement Framework in 2015 to help manage relationships with stakeholders, which provides a range of different modalities to engage with taxpayers and across government. Box 3.4 outlines how stakeholder engagement worked with the introduction of a new Value Added Tax (VAT) refunds formula.

Box 3.4. Stakeholder engagement in Kenya – VAT Refunds Formula

The KRA Stakeholder Engagement Framework was established in 2015, and has been accompanied by a Stakeholder Engagement Secretariat and a mechanism to ensure centralised monitoring and escalation of stakeholder issues.

The introduction of the VAT refund formula as part of the 2017 VAT regulations created challenges, especially for exporters, who were unable to utilise their tax credits and were suffering from cash flow and liquidity challenges.

To address this challenge, the KRA systematically engaged with taxpayers and other stakeholders across government in a series of activities, which ultimately led to the VAT (Amendment) Regulations 2019, implementing a revised formula for refunds, which addresses the challenges taxpayers had been facing. These engagements included:

Five Weekly Working Groups with technical teams to identify options

Three monthly Sector/Technical Consultative Forums with industry, to review outputs from working groups

Two Commissioner and Commissioner General Roundtables, held quarterly, enable KRA policy to be determined

Three consultations with National Treasury – enabled face-to-face dialogue between KRA, Treasury and Industry on policy

Two parliamentary engagements – to demonstrate the need to review the formula, including evidence from affected stakeholders.

The feedback from this approach has been positive, with the Kenya Association of Manufacturers highlighting both the importance of the revised refund formula and the role of KRA’s stakeholder engagement in unlocking challenges the industry had been facing.

Source: Adapted from Achieving Effective Stakeholder Engagement: A Case Study of VAT Refunds Formula – available at https://www.kra.go.ke/images/publications/Achieving-Effective-Stakeholder-Engagement_A-Case-Study-of-VAT-Refunds-Formula.pdf

3.3.3. Consultation on new regulations

MNEs and administrations emphasised the benefits of involving taxpayers in the process of drafting new regulations. Bringing taxpayers (and advisors) into the process of designing new regulations can improve the effectiveness of administration as well as strengthening taxpayers’ awareness of and confidence in regulations, as they feel a degree of ownership.

Ensuring that consultations are open and transparent is important to build confidence that legitimate consultation is not perceived as (or can morph into) illegitimate lobbying (see Lobbying and public transparency).

3.3.4. Language

Non-Anglophone countries repeatedly highlighted language challenges when dealing with MNEs, as well as when requesting information from other tax administrations. While MNEs may be used to working in English as a common global language, this is not the case in many tax administrations. In many multi-lingual developing countries, especially those with a colonial-era language as an official language, tax administration officials may already be working in a second language. MNEs may also face a challenge in working directly in the local language, as it may prevent senior staff within the MNE from being able to sign off on documents if they are not fluent in the relevant language.

Taxpayers need to respect local language requirements when submitting documents and to provide high-quality translation. Care is particularly needed where there is the risk of specific terminology being interpreted differently, and all parties should seek to ensure a shared understanding of the terms being used. Where language skills are present in the tax administration, administrations may wish to consider accommodating English in certain circumstances, where it may facilitate quicker responses or enhance dialogue with the taxpayers’ more senior staff; where translated material is required, sufficient time should be allowed for a high-quality translation. Improving the balance between requesting smaller volumes of information rather than large quantities of data (see Information and data) is likely to make it easier for taxpayers to provide translated information quickly, as will allowing flexibility in terms of format (where feasible).

3.3.5. Information and data

A common theme across the roundtables was the need to focus on securing access to useful information rather than just data. As highlighted in the survey results and the roundtables, tax administrations experience challenges in the responsiveness to requests for information, both from taxpayers, and from other administrations when using exchange of information mechanisms. Meanwhile, businesses raised concerns that requests for information can be unclear, can request information in an unusual form, or can request vast quantities of data rather than specific information. Improving the precision of information requests, versus demanding large quantities of data from taxpayers, provides benefits for both tax administrations and taxpayers. For taxpayers, it reduces the compliance cost/burden, while tax administration is likely to be more efficient if officials do not have to wade through vast quantities of data. It is also likely to help build trust over the longer term as taxpayers become more willing to respond to more limited, comprehensible, requests for information.

Improving the information collected through the initial tax return, as well as ensuring access to data held elsewhere in government and third-party data, can reduce the need for additional information to be requested later. In some cases countries tax returns do not request sufficient information, resulting in a requirement for significant additional data to be requested later. Ensuring the tax return asks for sufficient (but not unnecessary) information is therefore a starting point for improving the information gathering processes. In addition, being able to consult data held elsewhere in government (e.g. customs data) or third-party data, can help the tax administration with risk analysis and reduce and focus further information demands on taxpayers. Access to, and policies and processes for the use of, external data remain a challenge in many developing countries. Removing internal government restrictions on information sharing and gaining access to third-party data may therefore be useful starting points to improve the overall information gathering process, but needs to be accompanied by reforms to enable such data to be used effectively.

A number of recommendations and best practices were identified to improve information gathering by tax administrations. These included:

Make use of automated process to both gather and analyse information. This can reduce compliance costs and ensure that further requests for information are more targeted. Challenges can exist where the tax administration’s data interfaces do not align with those of taxpayers, which can make compliance complicated or create confusion with asymmetry of data.

Provide opportunities to discuss the objectives of the information request, to determine whether it can be fulfilled more easily. Examples were given in the roundtables of discussions to identify the specific issues at stake and refining the information requirements accordingly. In some cases, the volume of information requested was just 20% of the initial request. Such discussions have also covered the format in which the data needs to be provided; flexibility on this point can significantly reduce the time taken by taxpayers to comply while still ensuring the information is provided to the tax administration. The earlier such dialogues are opened, the more effective they can be in improving the quality and speed of information requests.

Facilitate learning from experience. Refining the information-gathering exercises in one year only to start from the beginning in subsequent years is both frustrating and inefficient. Continuity of personnel is an obvious means of reducing this risk, especially when as sector-specific knowledge is developed. Other approaches can include post-audit discussions, which enable the administration and taxpayer to review the audit and identify opportunities for compromises/solutions for future years. Such discussions can be minuted (and in some countries provide binding commitments on certain aspects) such that even if personnel changes, there is a record on how to address specific issues.

The timeframes provided for information requests should be considered. Where large volumes of data are requested, especially if in unfamiliar formats, taxpayers can struggle with tight deadlines. Tax administrations should therefore ensure that they are setting realistic deadlines in their requests for information.

The availability of information held in other jurisdictions was cited as a challenge in all roundtables, with tax administrations highlighting challenges with both MNEs and foreign tax administrations responding to requests. While improvements in how and what information is requested from the tax administration is likely to help, this needs to be matched by a willingness from MNEs to provide relevant information held elsewhere when requested, and for foreign tax administrations to be willing to respond to requests for information, including recognising that those requesting information from developing countries that have recently joined exchange of information networks may lack experience in making requests.

Taxpayers require guarantees on information security. Ensuring that their information remains confidential is an important concern of taxpayers, and an important pre-condition before taxpayers are likely to be willing to volunteer any additional information, especially if it is sensitive. As such, tax administrations may need to provide reassurance on (and where necessary improve) information security policies as part of efforts to build trust with taxpayers.

3.3.6. Relationship-building and management

There were various references in the roundtables to the benefits of good interpersonal relationships between taxpayers and tax administrations, as well as recognition of the need to ensure safeguards to prevent such relationships being misused. Consistency of personnel was highlighted as beneficial by many, with both taxpayers and administrations recommending that changes to teams, and especially contact persons, be kept to a minimum. From a behavioural economics perspective, the importance of the messenger effect (i.e. the impact that the perception of the messenger delivering the message has) was highlighted as potentially important for relationships, although it was acknowledged that this has not been explored to any depth in taxpayer/tax administration relationships thus far.

Further research is needed to understand the drivers of effective relationship building between MNEs and tax administrations, especially in developing countries, where there are a range of potential dynamics including power, culture, race, and fluency in English that could influence interpersonal relationships. The OECD will seek to identify partners to investigate these issues further.

The capacity/expertise of staff may be a factor in building effective dialogue between taxpayers and tax administrations. As many developing countries have very small numbers of staff trained in the more complex international tax issues, seeking to engage in a more open dialogue with MNE taxpayers can be challenging. Similarly, where MNEs have small tax functions locally there may not be suitable individuals in country to engage in a more open dialogue. While capacity building can ease these problems over the long term, in the short-term processes will be needed to use the limited resources in an efficient way. This may include looking to clarify which staff will be needed for, and at what stage of, the dialogue between taxpayers and the tax administration.

3.3.7. Governance structures to facilitate dialogue

Clear governance structures and processes for dialogue can reduce confusion among taxpayers and tax administrations. Tax administrations suggested that MNEs could formalise internal governance structures to engage with tax administrations (e.g. Delegation of Authorities, communication policies), thereby facilitating dialogue and co-operation. In addition, ensuring clarity on the role of advisors is important. While advisors can play a mediating role between the tax administration and taxpayers, where the role of advisors is unclear it can increase confusion, for instance where advisors are requested to provide information to which they do not have access from the taxpayer. Clear governance structures in the tax administration are also important. Several businesses in the roundtables raised concerns on lack of clarity of functions and highlighted the importance of clarity on how information they divulged would be used, as well as reassurance that disputes will be dealt with impartially.

Digitisation and automation provide additional tools to govern interactions between taxpayers and administrations. The provision of on-line taxpayer services was perceived by several round-table participants to have resulted in better co-operation from MNEs by facilitating the fulfilment of tax obligations remotely, increasing the speed of payments (and thus fostering respect of deadlines), facilitating payment execution by MNEs for payments requiring authorisation of departments located abroad, and giving the possibility to parent companies to follow tax declarations and payments made by their subsidiaries. In this regard, it was stressed that it is important to test and pilot new on-line services to ensure that they are user-friendly, incorporating feedback from taxpayers while they are being developed.

In some countries, a post-audit dialogue functions as a ‘lessons learnt’ process between auditor and taxpayer. This allows joint identification of areas for improvement for future audits, thus making future audits easier. In some cases, the process can lead to formal agreements on how certain complex issues will be dealt with in future years.

3.3.8. Lobbying and public transparency

There was relatively little discussion in the roundtables on lobbying, primarily because the participants viewed themselves as less directly involved. Participants perceived lobbying as an activity that takes place elsewhere, often through engagements with politicians and/or more senior officials than were involved in the roundtables. Thus, whereas the perceptions from tax officials on most of the other survey questions were based on their own experience of interactions with taxpayers, in this area the perceptions relate more to what they believe is happening elsewhere.

There was clear agreement that transparency in interactions between taxpayers and officials/politicians can help. Registers of interests, and public records of meetings of ministers and senior officials are used in many countries. Businesses can similarly produce their own publicly available records of meetings.

Clear governance procedures can reduce the potential for illegitimate lobbying. Ensuring that tax incentives have to be provided for in the tax code and cannot be granted arbitrarily by ministers beyond the finance ministry ministers, reduces the scope to lobby for company-specific incentives. Open and transparent consultations and forums for discussing new legislation and regulations build confidence that such laws are not being unduly influenced by lobbying. In respect to individual cases, many of the measures highlighted to assist with reducing bribery are also relevant in respect to lobbying.

Tension in respect to lobbying will remain, as there will always be a perception bias: what one person may perceive as raising a legitimate concern on how a new regulation will affect business, another may perceive as illegitimate lobbying. These perception gaps can be reduced by building trust and providing increased transparency on the policy making process, and contacts between the administration and private sector/lobbyists. The OECD principles for transparency and integrity in lobbying (OECD, 2014[12]) provide useful directions and guidance to help decision makers foster integrity and transparency.

Officials in regions where there is a higher perception of large businesses willing to explain their tax positions and decisions in public appear to have higher trust in the information provided by large businesses, suggesting there may be benefits for MNEs improving public transparency. While this correlation should be treated with caution as the question on how willing large businesses/MNEs are to publicly explain their tax positions was only answered by a fraction of respondents, this may suggest that a willingness to explain taxes in public improves communication and trust in the confidential relationships with tax administrations as well. One challenge for MNEs may be that it is easier to be more open in the HQ country, where senior staff are available to speak to press/parliament as well as the tax administration; further consideration may be needed on how to facilitate a more open dialogue on taxation where subsidiaries operate.

3.4. Capacity-building programmes

As many of the approaches to building trust identified in this report require trained staff to deliver, capacity building programmes play a valuable role, both in tax administrations and in companies/advisory firms. Enhancing capacity in international taxation, especially transfer pricing issues, has consistently been a high priority for capacity-building in tax administrations. The need for capacity-building on international taxation is also recognised by businesses, with lack of expertise in administration of international taxation identified as one of the top ten (out of 21) sources of tax uncertainty for MNEs operating in Africa (6th), Asia (9th) and LAC (10th).

While technical skills are clearly important, there is also a need to build capacity in less tax-specific professional competencies, especially in communication. Such competencies are not often routinely included in existing capacity-building programmes; further work is therefore needed to identify how best to build the full range of skills needed to support the development of effective dialogue between taxpayers and tax authorities.

3.4.1. Tax Inspectors Without Borders

Tax Inspectors Without Borders (TIWB) programmes provide hands-on peer-to-peer support on live cases. This enables the experts providing support to identify specific issues and discuss potential responses with the revenue authority. While much of the focus on TIWB has been on the revenues raised as a direct result of the TIWB engagement in cases (USD 1.6 billion to end 2021), there is also growing anecdotal evidence of the wider impact of TIWB programmes on encouraging compliance.

By working hand-in-hand with tax administrations on live cases, over a sustained period, TIWB programmes provide the opportunity to build capacity not only on technical issues but also on the processes involved in auditing MNEs and the associated professional competencies As outlined in Box 3.5, these programmes are an opportunity to build capacity in several of the areas highlighted in this report, including improving risk analysis and communication. In a growing number of countries where TIWB programmes have run, administrations are reporting impacts beyond revenues from the specific companies audited: compliance from MNEs has been perceived to improve, with increased filing on time and responsiveness.

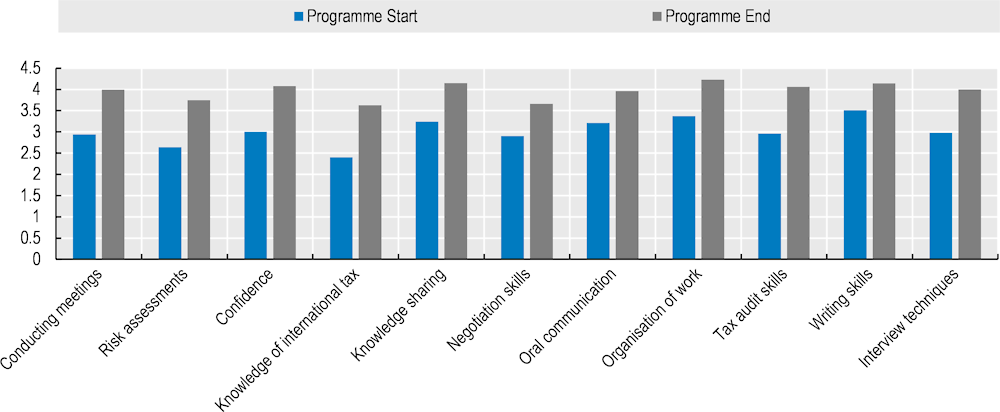

TIWB is increasingly trying to monitor its impact beyond revenues, recognising that these impacts may have as much, if not more, long-term impact on compliance than additional revenues from individual cases. Figure 3.1 shows the impact of TIWB programmes on auditors’ competencies. Tracking impacts beyond revenues is significantly more challenging, and direct causation can be difficult to determine. This is a common challenge in seeking to track capacity building in more abstract areas and creates a risk that focus moves to areas where the impact is easier to track. As the evidence in this report demonstrates, to achieve desired long-term improvements requires a focus on more abstract variables such as trust alongside initiatives to enhance specific technical capacities.

Figure 3.1. Self-reported competencies of auditors participating in TIWB

Note: Auditor self-assessments performed at start and end of TIWB programmes in 11 categories, rated on a scale from 1 (Poor) to 5 (Excellent)

Source: TIWB Secretariat

Box 3.5. TIWB’s role in improving taxpayer relations

The experience of TIWB programmes shows that efficient administration of the audit process contributes to raising compliance. In a recently completed programme in Côte d’Ivoire’s Direction Générale des Impôts (DGI), tax officials conducting audits were faced with generic, absent, incomplete or delayed answers from taxpayers. Some taxpayers even reported in languages that were unknown to the audit team, nullifying the effort and resources deployed by the DGI. Supported by an expert from the Belgium Tax Administration, DGI officials adopted a new audit strategy based on several key factors:

Standardisation of the audit processes: focusing on strengthening the audit methodology to ensure certainty in the conduct of audits both from the perspective of the tax administration and taxpayers. To that purpose, the DGI invested in an international comparables database to make sure it could challenge taxpayer transactions despite not having domestic arm’s length examples. It also created a specialised Transfer Pricing Unit to build up the expertise of its tax officials, further facilitating exchanges with taxpayers’ fiscal teams.

Increased communication with taxpayers: increasing contacts between tax administration and taxpayers requires smooth channels of communications. In this regard, centralising the communication around a key contact fosters taxpayers’ ability to follow-up on each request and increase accountability towards the audit process.

Focus on taxpayer education: helping taxpayers anticipate and adapt to constantly evolving tax legislation, thus raising certainty and trust towards the tax administration and its officials. This may encompass mutual learning opportunities during information sessions or networking events, especially regarding sector-specific situations, which the tax administration may not be aware of.

Overall, facilitating and multiplying the exchanges between taxpayers and managing expectations helps building strong relationships with taxpayers and may lead first to more revenues for the tax administration and in turn to an enhanced tax morale, or voluntary compliance among taxpayers.

Source: TIWB Secretariat

3.4.2. Value chains/business structures

MNEs consistently raised concerns that a lack of understanding around value chains and business structures creates mistrust and confusion. This problem has been apparent for some time, but finding solutions has been challenging. Given that expertise primarily sits within businesses, utilising expertise from the business sector is the preferred option for training. While OECD-led capacity-building with business participation has been extremely well received, it has been challenging to find business representatives to participate. As such, the reach of such training has been limited.

Virtual learning programmes may make it easier to engage business expertise to raise understanding of value chains. Such programmes have become much more common following the restrictions imposed by the COVID-19 pandemic. One option to consider is to develop e-learning programmes in collaboration between the OECD, BIAC and Regional Tax Organisations.

3.4.3. Capacity building within businesses

While most focus on capacity building is on tax administrations, businesses may also need to build their capacities. Such capacity building can enable mutual dialogue to be effective, and reciprocal trust to be built.

Businesses may have particular challenges maintaining standards in more remote jurisdictions, especially where there are limited local staff and infrequent contact with senior management. This problem can be especially marked in jurisdictions where the business has relatively small operations and there is no local tax function, meaning the tax function may be undertaken by the finance staff. In such instances, clear policies/processes are needed to ensure all staff know their responsibilities, and that local staff are effectively supervised by the relevant tax function. It is also important to ensure the dialogue between local and more senior staff is reciprocal, and that senior staff are clear on the differences/challenges that exist in a developing country context to help inform the development of both the local and global approach to tax.

Where businesses have committed to voluntary principles for behaviour on taxation, those principles should be explained to all relevant staff. Some businesses have mandatory staff training on voluntary principles. There may be additional challenges where functions are outsourced to local advisory firms that may have capacity challenges and not be aware of how to interpret a client company’s voluntary principles (see Box 3.6 for how Anglo American trains its external suppliers of tax services on its principles). In addition, businesses may need to reflect on how to ensure compliance with their tax principles in different jurisdictions. Jurisdictions with lower capacity and/or less advanced legislation may present greater opportunities for tax planning that were not intended by the authorities; in these cases, tax-planning strategies may require more careful consideration to ensure alignment with principles.

Box 3.6. Anglo American external supplier training

Anglo American is a UK-listed global mining company with headquarters in London whose Tax Strategy1 and annual Tax & Economic Contribution Reports2 give information to all stakeholders on how it seeks to meet its ambitions for responsible behaviour in tax.

Anglo American has recognised need to take external advice in relation to its tax affairs, and to work with advisers in partnership to ensure it is compliant with laws and meets all the other elements of its Tax Strategy. However, it has also recognised the risks that could undermine these objectives if those advisers are not clear on the Group’s expectations of them, Anglo American has therefore decided to formally educate key suppliers of tax services on key issues for the company.

The training is in the form of a video, introduced by the Group Head of Tax and presented by senior members from across the organisation from Supply Chain, Business Assurance Services as well as the Group Tax Team. It gives practical advice on core components of the Group’s core principles and governance in relation to tax. This includes:

The Group Code of Conduct, which explains (among other things) how decisions are made that are within the spirit of the law, and includes explicit reference to the Tax Strategy and the zero-tolerance approach to tax evasion and facilitation of tax evasion

The Group Responsible Sourcing programme, which outlines key requirements and steps for suppliers to demonstrate their ESG and sustainability practices

The Group Tax Strategy, including its key principles, pillars, and proof points of how it operates in practice

The Group Tax Governance Framework, including Tax Control Frameworks, Group Tax Policies, the Anti-Tax Evasion Strategy, and how compliance with them is monitored

The Group’s Covid-19 Tax Concessions Policy, which outlines in detail which concessions should never be accepted, and which might be considered where there is a business need (more details are publicly available in the 2020 TEC Report).

Expectations of advisers, including understanding and abiding by these policies, knowledge of priorities and red lines, and who to speak to if further guidance is required.

As part of the Tax Control Framework that the Group has implemented, key suppliers globally are required to attest on a yearly basis via an online form they are aware of and in compliance with the policies covered by this training. The training has also been translated into Spanish and Portuguese for the benefit of Anglo American Group Tax’s suppliers primarily based in Latin America.

Source: Anglo American

References