This chapter develops policy recommendations for the transition to a more circular plastics life cycle in Hungary, with focus on the most frequently used polymers in packaging, construction, and single-use plastics beyond packaging. It provides an overview of the current situation and policy landscape, identifies areas for improvement and proposes a set of concrete policy recommendations. The recommendations are supported by international good practices.

Towards a National Circular Economy Strategy for Hungary

7. Transition to a circular life cycle for plastics

Abstract

7.1. Closing the plastics loop is key to the transition to a global circular economy

Plastics are highly versatile, light and affordable. They are found in numerous applications, such as in packaging, construction, transportation and electronics. However, the proliferation of plastics has also led to significant environmental concerns along the entire life cycle of the material (OECD, 2022[1]). The circular economy can help minimise these environmental impacts.

7.1.1. The current plastics life cycle is far from circular

In 1950, global plastics production stood at 2 million tonnes (Mt). Since then, plastics production has increased 230-fold, reaching 460 Mt in 2019 (OECD, 2022[1]). The majority of plastics in use today are virgin (primary) plastics, mostly made from crude oil or gas. Recycled (secondary) plastics are quickly gaining ground, but they only make up 6% of the market share.

Consequently, plastic waste has also increased substantially, doubling since the turn of the century and reaching 353 Mt in 2019 (OECD, 2022[1]). A significant share (almost two-thirds) of plastics applications (such as packaging, consumer products and textiles) has short lifetimes, becoming waste within five years. The vast majority of plastic waste is landfilled (50%) or incinerated (19%). Only 9% of all plastic waste is recycled. The plastics life cycle is, therefore, significantly linear. In addition, a large share (22%) of plastic waste is mismanaged, that is, disposed of in uncontrolled dumpsites or burned in the open.

Mismanaged plastic waste can leak into the environment where it causes significant harm to ecosystems and communities. About 22 Mt of plastics leaked into terrestrial or aquatic environments in 2019 (OECD, 2022[1]). The vast majority of leaked plastics are macroplastics (88%), i.e. they are recognisable items such as littered bottles, which are more than 5 mm in diameter. The remaining plastic leakages can be attributed to microplastics (12%), i.e. solid synthetic polymers less than 5 mm in diameter. Microplastics have been found in food and beverages such as tap water, bottled water and beer. Road transport is also an important source of aerial microplastic pollution from the wear and tear of tyres and brake pads.

The plastics life cycle is also a significant source of global GHG, contributing 1.8 gigatonnes (Gt) of GHG emissions in 2019 (OECD, 2022[1]). The production and conversion of fossil-based primary plastics is the main source of emissions, but end-of-life treatment, such as incineration, is also an important contributor. Beyond leakage to the environment and GHG emissions, plastics have other environmental and human health impacts. They contribute to ozone formation, eutrophication and ecotoxicity in aquatic environments, as well as human carcinogenic and non-carcinogenic toxicity.

In the absence of new and more ambitious policies to curb plastics use along their entire life cycle, the volumes of plastic, waste and leakage to the environment are projected to increase substantially in the future (OECD, 2022[2]). Closing the plastics loop, therefore, remains an important policy objective.

7.1.2. Plastics have a wide variety of features and uses

Plastic materials are polymers, that is, they are made of very large molecules that chemically bind a large number of simpler molecules called monomers. There are many different polymers with diverse features and characteristics, making plastics a highly heterogeneous material. The most commonly used polymers include: i) high density polyethylene (HDPE); ii) low density polyethylene (LDPE); iii) linear low-density polyethylene (LLDPE); iv) polyethylene terephthalate (PET); v) polypropylene (PP); vi) polystyrene (PS); vii) polyurethane (PUR); viii) polyvinyl chloride (PVC); ix) acrylonitrile butadiene styrene (ABS); x) acrylonitrile styrene acrylate (ASA); and xi) styrene acrylonitrile (SAN) (OECD, 2022[2]).

Polymers are often mixed or compounded with a wide range of additives, which can customise and improve the performance of plastics. Additives can prevent ageing, colour the plastic, and make rigid material flexible, among other uses. However, mixing certain polymers and additives used in manufacturing can inhibit the recyclability of plastic waste (OECD, 2022[2]).

Plastic materials can be categorised into monomaterials and composite, multilayer/multimaterials. Monomaterials are made of a single polymer. Plastics materials assemble into multilayered materials can have additional technical features, e.g. resistance to mechanical stress, compatibility with food contact, and opacity. However, multilayer/multimaterial products may prove challenging to reuse and recycle if their component parts are difficult to separate.

There are two main plastics recycling technologies: mechanical and chemical. Mechanical recycling is the traditional method whereby sorted plastic waste items are typically shredded, small pollutants are removed and cleaned, and a homogenous mass of polymer is obtained to be molten again and shaped into a new plastic piece. Chemical recycling is an emerging technology and can also be separated into two sub-categories: plastic-to-plastic and plastic-to-fuel (OECD, 2022[1]). Plastic-to-plastic means transforming the plastics back into feedstock (“feedstock recycling”), which can then be used to manufacture monomers. In the latter case, the plastic is transformed into fuel, which is a form of energy recovery.

7.1.3. The majority of plastics have short lifetimes, but they can be persistent pollutants once in the environment

Plastics are found in a wide range of applications such as food packaging, clothing, construction, transport, and electrical and electronic goods. The application for which a plastic item is used typically determines its lifetime. Plastics found in packaging, consumer products and clothing applications tend to have short average lifetimes (less than 5 years), after which they are discarded (Geyer, Jambeck and Law, 2017[3]; OECD, 2022[1]). However, plastics found in transport and construction applications have longer lifetimes (20 years for transport and 35 years for construction), remaining in use for longer. Plastics in use in any one year will therefore differ from the plastics that become waste.

Plastic items can break and deteriorate relatively easily and the majority of plastics in use have short lifetimes. However, once leaked into the environment, they can also persist for a long time. For example, single-use plastic products (SUPs) like LDPE plastic bags and HDPE milk bottles could have an estimated half-life (the time it takes for the material to lose 50% of its original mass) of 5-250 years on land and 3-58 years in marine environments (Chamas et al., 2020[4]). However, HDPE pipes may need thousands of years to completely degrade, with an estimated half-life of 1 200 years (Chamas et al., 2020[4]).

7.1.4. Biobased and biodegradable plastics only represent a minute share of plastics use

Biobased plastics (often referred to as bioplastics) are derived from biomass such as corn, sugarcane, wheat or residues from other processes. Bioplastics only make up about 2% of global plastics and are projected to retain a small market share in the future (OECD, 2022[1]). Their environmental impact in terms of GHG emissions, however, remains ambiguous. There are important concerns regarding the indirect environmental impacts arising from the monoculture production of corn, sugarcane and wheat used as the feedstock for biobased plastics, especially as it relates to land use. This could place additional pressure on agricultural land and lead to a loss of forests, natural environments and biodiversity, as well as one-off carbon emissions. Sustainably sourcing biobased plastics is therefore an important objective.

Biobased plastics should not be confused with biodegradable plastics. Biodegradable plastics “degrade” in the natural environment, releasing carbon dioxide, water and biomass. However, there are some concerns regarding biodegradability. Some polymers do not biodegrade within a reasonable time under normal circumstances and would therefore persist in the environment (OECD, 2022[1]).

7.1.5. A circular life cycle for plastics can substantially reduce environmental impacts

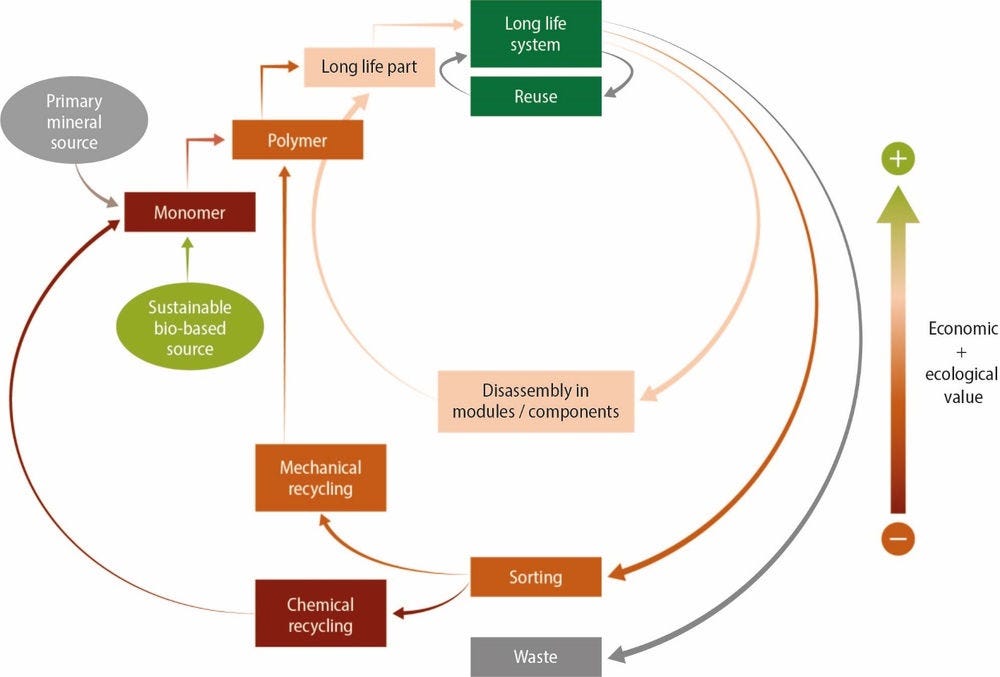

The circular economy provides many opportunities to decrease the environmental damage associated with plastics. But what does the circular economy mean for plastics? especially considering the diversity of plastics and their use in a variety of applications. A circular plastic product is one which is designed to be used and reused over a long period of time. It is manufactured from secondary plastics, whenever possible, and is recycled when discarded. The application of circular economy principles in the plastics industry means guiding decision making to ensure a more circular life cycle, which considers design, production, use and reuse, and end-of-life stages (see Figure 7.1).

Design. Circular plastic products are designed in such a way that they remain in the materials loop for as long as possible, and once they become waste, they can be seamlessly recycled. The application of circular design principles ensures that the product can be repaired and reused so that it does not become obsolete once defective, thereby maximising the longevity of the product. If the product is to be discarded then its circular design facilitates sorting and enables separate processing without cross-contamination, allowing for greater recyclability.

Production. Circular plastics are manufactured to the greatest extent possible from secondary feedstock for as long as the technical features and requirements of the product allow. Secondary feedstock comes from local supply chains whenever this is economically and logistically viable. If primary feedstock is used for manufacturing, for instance, when the performance of secondary plastics is insufficient to meet technical requirements, the harmful chemicals and additives that hamper recyclability are avoided.

Use and reuse. A more circular use of plastics ensures that plastic products stay in use for as long as possible. Products that have long lifetimes and high reusability are therefore favoured over SUPs with short lifetimes. Products that can be disassembled, and whose parts are reused, repaired and replaced, in case they become obsolete or non-functional, are also treated preferentially.

End-of-life. A circular end-of-life treatment of plastics means ensuring that a large percentage of plastics is recycled once a product is discarded. This means a higher rate of separate collection, a higher purity of sorted plastic waste, and thus a higher quality of secondary plastic. Plastic waste that cannot be recycled is treated in the formal waste management system and leakage to the environment is thus avoided.

Figure 7.1. The circular plastics life cycle keeps materials in a closed loop

The introduction of circular economy principles in the production of plastics significantly interacts in the life cycle stages of the product. For example, a plastic product designed for durability will be more circular in its use, while better recycling can produce higher quality secondary feedstock for manufacturing. Well-aligned strategies will therefore encourage the adoption of circular economy principles. One such strategy is to design for circularity, which can be an important tool in improving the longevity of plastic products, while bolstering higher recycling rates. Another strategy to lessen the demand for plastics is to cut back on the plastics-intensity of intermediary products, and therefore the amount of plastics found in final products, thereby reducing the excessive quantities of plastics in circulation. Promoting recycling also remains a central strategy in closing the plastics loop (OECD, 2022[1]).

7.2. Plastics and the economy: context and developments in Hungary

This section reviews the main trends in the plastics industry in Hungary and provides key information to help understand the role plastics play throughout their entire life cycle, from production to use and their end-of-life stage.

7.2.1. Plastics are a staple of the Hungarian economy

The plastics industry is strategically important to the Hungarian economy. In 2019, the gross value added (GVA) of manufactured rubber and plastic products represented almost 10% of manufacturing GVA in 2019 (OECD, 2020[5]). The economic importance of plastics mainly lies in them being a key input to several sectors, such as: i) the transport equipment sector; ii) the computer, electrical and electronic products sector; iii) the food products, beverages and tobacco sector; iv) the pharmaceuticals sector; v) the construction sector; and vi) the services sector. The manufacture of rubber and plastic products produces intermediary products (e.g. packaging, components, pipes, cables and flooring), which are then used in the assembly and manufacturing of other products, for example, in buildings, and also in the wholesale and retail trade (Pogány, 2020[6]).

7.2.2. Four main polymers dominate domestic production in Hungary

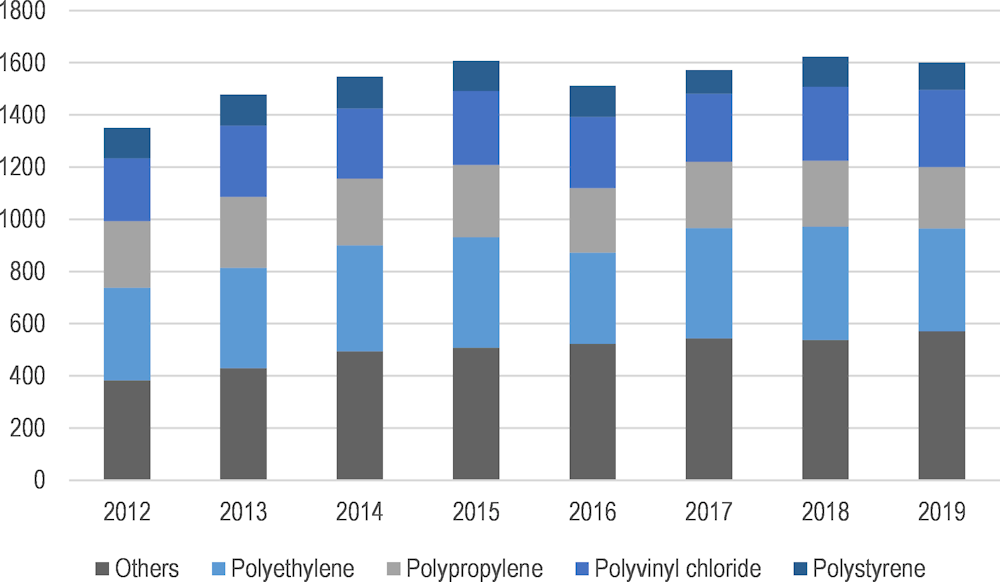

In Hungary, plastics production reached 1.6 Mt in 2019 (Pogány, 2020[6]). In the same year, polyethylene (PE) production represented around 25% of all plastics produced, polyvinyl chloride (PVC) represented the second largest polymer production at 18.5%, polypropylene (PP) production made up 15% of domestic production, and polystyrene (PS) represented around 6.5% (see Figure 7.2). The rest was made up of a mixture of different polymers, which tend to have specific applications, such as for Acrylonitrile butadiene styrene (ABS), Styrene acrylonitrile (SAN), among others.

Hungary’s demand for plastics in manufacturing is not completely met by domestic production. This means that trade in plastics is also important for the economy, not least because Hungary is a very open economy, that is, it is deeply embedded in international markets. Export volumes of plastics reached 1.67 Mt while imported volumes reached 1.06 Mt in 2019 (Pogány, 2020[6]).

Figure 7.2. Four main polymers make up two-thirds of all plastic production in Hungary

7.2.3. Despite a highly concentrated plastics industry, SMEs play an important role

The plastics industry is characterised by some large industrial players, but SMEs also play an important role. In the manufacture of polymers, additives and other plastics-related products, a number of large players dominate the industry, such as MOL Petrochemicals and Borsodchem. These two firms have more than 1 000 employees and a sizeable revenue, approximately EUR 1 billion. For the conversion of plastics to products, the concentration of the domestic industry is also high, i.e. the 25 biggest firms converting plastics manufactured about 0.5 Mt of plastic products in 2019 (Pogány, 2020[6]). However, more than 300 firms produced an equal amount (0.5 Mt) in terms of weight of plastic products in the same year, showing that SMEs, when taken together, can have the same economic importance as the biggest players.1

7.2.4. In Hungary, the share of plastic packaging use is higher than the global average

The main applications of plastics in Hungary are comparable to those at the global level. The most important application is packaging (40% of total plastics use in Hungary, 31% globally), followed by construction (15% in Hungary, 17% globally), transportation (11% in Hungary, 12% globally), electrical and electronic products (9% in Hungary, 4% globally), and other miscellaneous uses (Pogány, 2020[6]; OECD, 2022[1]). The main polymers used for packaging are PE and PP, covering almost 90% of packaging. In the construction sector, PVC (at 45%) and PS (at 25%) are the most frequently used polymers (Pogány, 2020[6]). In the transport sector, the main polymer used is PP, representing 38% of the total uses.

Plastic packaging makes up 25% of total packaging used in Hungary (Eurostat, 2022[7]). With living conditions improving and household disposable income increasing, there has been a boost in demand for goods and services, leading to the consumption of products that often contain plastics. Plastic packaging is one such component. The strong demand for packaging products is exemplified by the rise in consumption of bottled water, which has grown almost five-fold within two decades, from 28 litre/capita in 1999 to 131 litre/capita in 2019 (Pogány, 2020[6]; Hungarian Mineral Water, Juice and Soda Association, 2022[8]). Other emerging trends, such as the uptake of e-commerce and take-away foods, especially in the wake of the pandemic, have led to an even greater demand for plastic packaging (Ministry for Innovation and Technology, 2021[9]).

7.2.5. Plastic packaging waste has grown significantly in recent years

Plastics are an important part of waste streams in Hungary. Given its vast number of uses, data on plastic waste is surprisingly incomplete. Nevertheless, the existing information provides a partial picture of the challenges faced by Hungary in its end-of-life management of plastic waste.

Plastic waste can be found both in industrial waste and municipal waste. Industrial plastic waste is often pure and homogenous, and can be collected and recycled more readily, although in some cases this may not be feasible owing to health and food restrictions. These “residues” are therefore discarded, i.e. they are either incinerated or landfilled. In 2018, industrial plastic waste from the plastics industry amounted to about 67 000 tonnes (Ministry for Innovation and Technology, 2021[9]). Trends for industrial waste, in general, have shown that despite an increase in industrial activity, waste generation has not increased significantly, pointing to the possible adoption of more efficient technologies and better internalisation of the value of waste.

Municipal plastic waste is typically composed of plastic packaging, SUPs, sanitary waste, consumer durables, household products and business-to-business packaging. In line with the trend for more packaging applications, plastic packaging waste generation increased by more than 60% in Hungary between 2010 and 2019 compared to the EU average of 25% (Eurostat, 2022[7]). However, there appears to be some convergence with plastic packaging waste now at 35 kg per capita in Hungary, which is similar to the EU average of 34 kg per capita (Eurostat, 2022[7]).

7.2.6. Landfilling of waste continues to dominate

More than half of all municipal plastic waste in Hungary is landfilled, which is higher than the global average. However, less than one-quarter of plastic waste is recycled in Hungary, which is among the lowest in Europe (Plastics Europe, 2020[10]). In addition, the share of recycled plastic waste is less than the average recycling rate of municipal waste (at 34%), as separately collected municipal plastic waste has a high-level of impurities, showing that it is a particularly problematic waste stream.

Despite the majority of municipal plastic waste comprising disposable packaging, only about one-third of all plastic packaging waste was recycled in 2019, which is below the EU average of 41% (Eurostat, 2022[7]). Recycling capacities in Hungary reached 242 000 tonnes per year, of which less than half was utilised (Ministry for Innovation and Technology, 2021[9]). This means that there is a significant idle (unused) recycling capacity, although some import of plastic waste is present. Nevertheless, total plastic packaging waste amounted to approximately 350 000 tonnes in the 2018-2020 period (Ministry for Innovation and Technology, 2021[9]). There would therefore be insufficient capacity if more than 70% of plastic packaging waste were to be recycled, potentially creating bottlenecks for domestic recycling. In addition, separate collection is not uniformly accessible throughout the country and the geographic distribution of sorting plants is also uneven, further hampering recycling efforts.

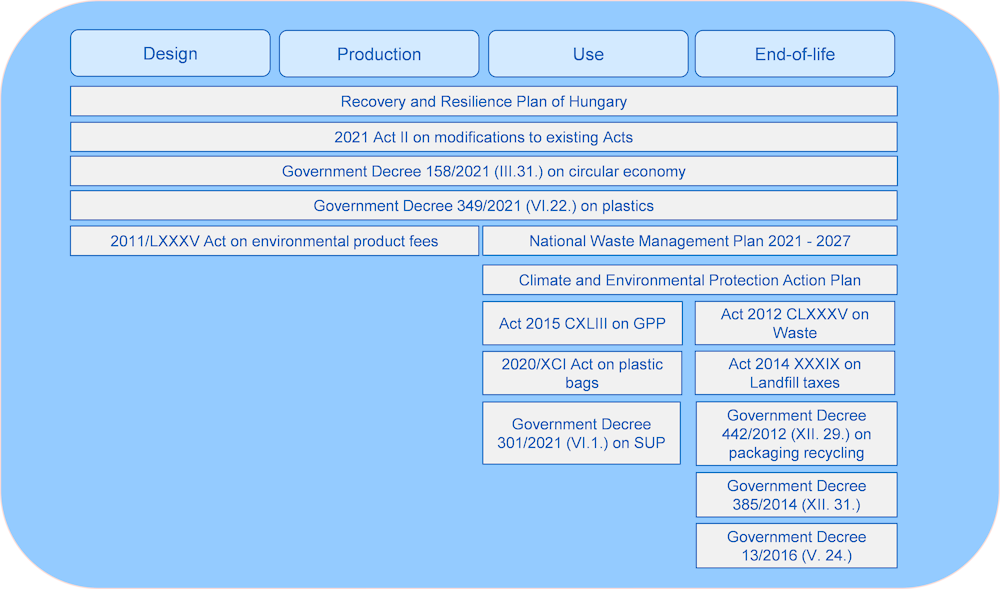

7.3. Hungarian policy landscape and legal context of plastics

This section provides an overview of Hungary’s policy landscape covering plastics. There are already policies and legislation in place in Hungary to tackle the challenge of plastics, often with the aim to align Hungarian policies with EU measures. The plastics policy landscape has been dynamic at the EU and international levels. Several EU policy documents have been put in place to help transition towards a circular economy and a circular use of plastics. A number of policies affect how plastics are produced, used and disposed of in Europe, including the European Strategy for Plastics in a Circular Economy (European Union, 2018[11]) and – in line with its vision – the Single-Use Plastics Directive (SUPD) (European Union, 2019[12]), the “Plastics own resource” measure (European Union, 2020[13]), and the Sustainable Products Initiative, which is yet to be adopted (European Union, 2022[14]) (see Annex Box 7.A.1).

Although Hungarian legislation stipulates the need to prevent and minimise waste, as well as favouring higher steps of the waste hierarchy, it has not yet led to the development of a more circular life cycle for plastics. Plastics-specific legislation was only recently introduced in Hungary, and policy alignment with the EU is often faithfully complied without aiming at supplementary measures. In addition, with Hungary unable to tackle the root causes of a linear plastics life cycle, the country is unlikely to meet the ambitious targets set out by the EU.

7.3.1. Upstream, policy focuses on regulation and niche applications

Only a few policy instruments have been implemented that intervene at the upstream production or design stage of the life cycle, of which the most prominent instrument is the environmental product fees for plastic packaging that was recently updated in Act 2020 XCI (Parliament of Hungary, 2020[15]), which modifies Act 2011 LXXXV (Parliament of Hungary, 2011[16]) (see Figure 7.3). As such, current Hungarian legislation remains focused on regulatory instruments targeting the use stage for niche applications, such as carrier bags and SUP items. Hungary has aligned its policy with recent EU policy documents, such as the SUPD (European Union, 2019[12]) through Act 2020 XCI (Parliament of Hungary, 2020[15]) and Government Decree 301/2021 (VI. 1.) (Government of Hungary, 2021[17]). However, this narrow focus on certain plastic items needs to be broadened. The SUPs tend to be small volume items that only make up a fraction of plastic waste. In the absence of policy that goes beyond niche applications, the impact on critical applications and polymers will remain limited.

7.3.2. Downstream, policy lacks coherence and clout to bring about change

Several policy documents identify downstream activities as crucial issues, such as the low rate of separate collection and recycling. The NWMP 2021-27 (Ministry for Innovation and Technology, 2021[9]) discusses in detail the plastic waste data and the low rates of separate collection and recycling, which will not reach the mandated EU targets if current trends continue. The Recovery and Resilience Plan for Hungary (Government of Hungary, 2021[18]) also highlights the difficulties faced with regard to the recycling of plastic waste. In order to reach EU waste targets and to align with the SUPD, the Government Decree 158/2021 (III. 31.) (Government of Hungary, 2021[19]) mandates minimum recycling targets for plastic packaging waste, with similar recycling targets already present in other legislation, for example, Government Decree 442/2012 (XII. 29.) (Government of Hungary, 2012[20]). In addition, the Government Decree 349/2021 (VI. 22.) (Government of Hungary, 2021[21]) mandates an increase in separate collection rates for beverage bottles in line with the SUPD. However, mandates alone may not be enough to reach these targets. Further policy intervention may be necessary, not least because Hungary’s low performance on this front is due to a lack of policy coherence and insufficient incentives. Without such coherence, and in the absence of incentivisation, achieving the ambitious EU targets will remain difficult.

Figure 7.3. Overview of Hungary’s plastics policy landscape

7.4. Life cycle gap analysis and policy recommendations towards more circular plastics

The previous sections provided an overview of the current state of play in Hungary, including the most recent trends in plastics production, use and waste generation. It also mapped the plastics policy landscape in order to understand the developments at the EU level and in Hungary. Plastics are used throughout the Hungarian economy: from production to general use and waste generation. Packaging and construction represent over half of all plastics used in Hungary, and the three most common polymers (PE, PP, PS) and PVC together represent two-thirds of the polymers produced. The consumption of plastic products, especially packaging and SUPs, has also increased in recent years, not least because of improving living standards and other trends, which gathered pace during the COVID-19 pandemic.

Meanwhile, the plastics policy landscape is recent and is aligned with EU developments. Upstream, regulation focuses on narrow applications, while downstream, low separate collection and recycling rates remain hard to overcome without a mixture of coherent policies. These main polymers and applications should therefore form part of the scope of Hungary’s plastics strategy, while the issues identified upstream and downstream point to the specific challenges faced by the country.

What policies should Hungary implement along the plastics life cycle to overcome the acute challenges it faces? This section provides policy recommendations to help bridge the existing gaps, intervening at the most appropriate life cycle stage to ensure the greatest impact. Gaps represent the difference between the current state of play in Hungary compared to both the existing targets and goals at the EU level as well as Hungary’s own ambitions. Policy best practices in other countries are then drawn upon to understand how such policies can work in practice. As meaningful policy should aim to target applications and polymers which are most common, these aspects are taken into consideration throughout the analysis. Finally, policy alignment throughout the entire life cycle of plastics remains important in order to ensure that the effectiveness and impact of policies are maximised and that they support the closing of the plastics loop to the greatest extent possible. Detailed policy recommendations that respond to the specific gaps identified are presented in the next section.

7.4.1. To curb plastics use, policy action should first target design and production

Plastics production stood at 1.6 Mt in Hungary in 2019 (Pogány, 2020[6]). Plastics are a key input to a number of sectors, and contribute to almost 10% of manufacturing GVA (OECD, 2020[5]). Early decisions taken at the design and manufacturing stage can already put plastics on a circular trajectory from the outset. When businesses are faced with a choice between maintaining the status quo or choosing circular options, the odds are often stacked against the circular economy. Policy making can help level the playing field and make the circular option more attractive. However, in Hungary, there is an absence of instruments currently in place to steer producers towards favouring plastics that are recycled or are easier to recycle. A mix of economic and regulatory policy instruments can ensure that circular solutions are already favoured at the design and production stage. These instruments include minimum recycled content requirements, information on designing for recyclability, the eco-modulation of environmental product fees, and taxes on primary plastics.

Minimum recycled content requirements encourage the use of secondary materials

Design requirements are the non-negotiable conditions (i.e. needs) to be met by the designed product and the negotiable conditions (i.e. wants) that are deemed desirable (OECD, 2021[22]). Sourcing is relevant for all types of products and include the selection of a base polymer (secondary or primary). Favouring secondary feedstock (i.e. secondary plastics from recycled plastic waste) is a prime requirement for a more circular life cycle. However, the use of secondary plastics is not without challenges. Primary plastics are usually engineered with specific features in mind, but secondary plastics may not meet these requirements. This is the case, for instance, for food contact grade packaging, which is only available from recycled PET beverage bottles. There are also issues relating to the quality of secondary feedstock, which can often vary significantly, as well as issues of quantity owing to relatively low recycling rates. Other issues may also emerge, including the limited selection of colours and colour variations, as well as possible low olfactory performance (PolyCE, 2021[23]).

Minimum recycled content requirements are one of the core elements of the EU SUPD. More eco-design requirements can be expected in the Ecodesign Directive (European Parliament and Council, 2009[24]) and in the Sustainable Products Initiative (SPI) legislative package. Hungary will therefore have to implement these measures in its national legislation and develop the necessary policy instruments.

A concrete example of targets with minimum recycled content is well underway in the United States. Under California’s 2020 Assembly Bill 793, beverage bottles must contain at least 15% of recycled plastic (PET and HDPE bottles) by 2022, increasing to 25% by 2025 and 50% by 2030 (CalRecycle, 2022[25]). Non-compliant companies face penalties of USD 0.20 per pound (lb) of shortfall from the minimum requirement. However, only the largest companies were able to meet these requirements, with many smaller manufacturers unable to even report enough data. With Hungarian SMEs playing a pivotal role in the plastics industry, similar bottlenecks should already be expected. Guidelines for designing products with recycled content, including for verification schemes, will therefore be essential. A variety of such guidelines from a number of organisations and businesses in different countries is already available to help companies make this transition (see Annex Box 7.A.2).

Designing for recyclability can contribute to higher quality and quantity of secondary plastics

The other side of the coin is to design products that are easier to recycle. This is an important circular plastics strategy. Many products are designed with certain features and technical performance targets in mind and, in order to achieve these goals, manufacturers make design choices that hamper recyclability. For instance, composite and multi-material designs or the use of hazardous chemicals and additives (e.g. fibreglass) could make an otherwise homogenous waste stream highly differentiated and therefore more difficult to recycle. As such, design considerations should include: i) polymer selection so that waste is minimised; ii) a simplification of design, to include as few polymers as possible; and iii) a choice of recyclable materials, which can be recycled at the highest quality possible (OECD, 2021[22]). Other considerations may include the choice of polymer that matches secondary market demand, as well as ensuring transparency in terms of information on the chemical composition of products (e.g. materials passports at the chemical level).

With the presence of a few large players and an important number of SMEs in the plastics industry in Hungary, it is important to ensure that the proliferation of design choices can be harmonised, to the extent possible, to ensure that plastic products are recyclable and that their design contributes to recyclability. Legislation stipulating the need to produce packaging that is easier to recycle exists (see Government Decree 442/2012 (XII. 29.)) (Government of Hungary, 2012[20]). Nevertheless, in the absence of guiding principles, manufacturers are more likely to make design choices that satisfy business needs but do not take into consideration needs further along the plastics life cycle, particularly at the end-of-life stage. There are several guidelines that can support businesses with gaining the know-how and understanding the logic of design for recyclability (see Annex Box 7.A.3) (PolyCE, 2021[23]). It has been shown that since knowledge spillovers and productivity is lowest among SMEs in general in Hungary, they face barriers in catching up with large multinational companies (OECD, 2019[26]; OECD, 2019[27]). Information instruments of this nature, if targeting manufacturers, can contribute to knowledge spillovers and capacity building at the level of SMEs.

Eco-modulated extended producer responsibility fees can incorporate waste management costs at an early stage of the plastics life cycle

Extended producer responsibility (EPR) is a policy approach by which producers bear the costs of the product’s end-of-life stage (OECD, 2016[28]). The EPR schemes consist of several policy instruments to steer producers towards take-back requirements, advance disposal fees and deposit-refund schemes. The effectiveness of an EPR scheme in achieving circular economy goals is determined by its design, which includes correctly setting up the producer’s fees and requirements to fully cover the costs of waste management. A nuanced EPR scheme is especially important for plastics because of their variety, their different waste treatment costs and their recycling properties.

In order to capture the true end-of-life costs of a product under an EPR scheme, it is important to determine the producer’s fees based on a product’s environmental criteria. These can be based, for example, on recyclability, durability, biodegradability or the availability of recycling facilities (Watkins et al., 2017[29]). Fees can be modulated based on recyclability criteria, the use of secondary raw materials or eco-modulation, which can bring about changes that reduce the end-of-life costs of a product.

In Hungary, environmental product fees on packaging already provide a basis for incentivising a shift away from plastic packaging materials, however, they are insufficiently differentiated.2 Although the current environmental product fee for plastic packaging is three-times higher than for other materials, such as paper packaging (19 HUF/kg), it is steady at 57 HUF/kg. This means that there is no distinction made in the environmental product fee levied on packaging made from different types of plastics (e.g. based on polymer, use of additives, etc.). This does not therefore allow the difference in relative prices to incentivise the shift towards using more recyclable plastics packaging or packaging made from secondary feedstock. The eco-modulation of the forthcoming EPR fees for plastics packaging is therefore recommended, especially given the policy of environmental product fees currently in place.

This practice is already seen in other EU Member States. For instance, producer fees in Belgium for plastic packaging range from EUR 0.1 per kg for easy-to-recycle transparent colourless PET bottles to more than EUR 1 per kg for plastics which tend to be harder to recycle (see Annex Box 7.A.4). Such an advanced eco-modulation of fees provides a clear financial incentive for producers to use more sustainable and recyclable materials. Beyond implementing the eco-modulation of fees, it also remains important to harmonise modulation criteria with those used in other European Member States to ensure that the measure has the greatest possible impact.

A tax on primary plastics can reduce demand for the most challenging applications of plastics

Market-based instruments, such as taxes or subsidies, are commonly used to stimulate the transition to a circular economy (OECD, 2020[30]). Taxes on plastic materials, certain types of polymers or certain uses of plastics (e.g. single-use packaging) can help reduce the quantities consumed and drive demand away from such items through substitution. Well-designed taxes should lead to the use of more durable and more sustainable alternatives and level the playing field between primary plastics and secondary plastics. To improve markets for secondary plastics, which remain vulnerable to trends in the primary plastics markets and to oil prices, an increase in taxes on primary materials is recommended (OECD, 2018[31]).

There is no tax on primary plastics currently in place in Hungary.3 The absence of such a tax is a barrier to reducing the share of primary plastics in production and using more secondary plastics and alternative materials instead. Hungary should therefore plan to implement a tax on problematic primary plastics applications such as packaging.

The recently introduced plastic packaging tax in the United Kingdom provides an example of an international best practice that Hungary can adapt to its own circumstances. This tax (at GBP 0.20/kg) applies to all plastic packaging with recycled content of less than 30% in weight of chargeable plastic packaging components. The aim of the tax is to provide a clear economic incentive for businesses manufacturing plastic packaging to use recycled plastic in their products (see Annex Box 7.A.5).

7.4.2. To turn the tables on the use and reuse of plastics, restrict and shift demand from primary plastics to alternatives

As of July 2021, Hungary’s Government Decree 301/2021 (VI. 1.) bans plastic in balloon sticks, earbuds, cutlery, plates, straws, stirrers, and polystyrene food containers and plastic bags with a wall thickness of above 15 microns (except those made of biodegradable plastics) (Government of Hungary, 2021[17]). However, these measures are mainly regulatory in nature and target narrow applications. This limits the scope of the policy, making it inflexible to evolving market developments and consumer demands. Hungary should therefore consider using economic instruments to boost the efficacy of its regulatory efforts.

Economic instruments can diminish the use of primary plastics and shift demand towards secondary plastics or substitutes made from sustainable alternative materials. However, Hungary has few such instruments in place. The most prominent economic instrument is Act 2020 XCI, which substantially increases levies on plastic bags with a wall thickness of under 50 microns, from HUF 57 kg to HUF 1 900/kg for plastic carrier bags, and HUF 500 /kg for biodegradable plastic carrier bags (Parliament of Hungary, 2020[15]). As such, there is a greater need for economic instruments at this life cycle stage and the broadening of applications beyond SUPs. Green public procurement is one such instrument.

Green public procurement can shift demand away from primary plastics and promote the use of sustainable alternatives

GPP sets sustainability standards for suppliers and products purchased by the public sector. In EU countries, where public procurement accounts on average for 18% of GDP annually, GPP has the potential to improve markets for greener products (Ellen MacArthur Foundation, 2016[32]). GPP can also introduce further criteria relevant to the circular economy, such as product lifespan. The demand for sustainable plastic products can be improved by introducing mandatory criteria (e.g. recycled content) on plastic products. These criteria can include the use of secondary materials, recycled content or reusability and recyclability of the plastic product, among others.

Hungary’s contracting authorities used environmental aspects in only 9% of their procedures (European Commission, 2019[33]). This is because although Act 2015 CXLIII (Parliament of Hungary, 2015[34]) on public procurement allows public authorities to take environmental aspects into account during their public procurement procedures, it does not make it mandatory. Hungary should consider expanding the GPP criteria and introducing mandatory GPP as these measures create demand, especially for products and applications where markets have not yet emerged in Hungary.

There are a few international best practice examples on GPP criteria for plastics that could guide Hungary. The municipality of Lolland in Denmark, for example, has introduced recycling and recyclability criteria for packaging in their tender for cleaning services. In Sweden, GPP criteria related to plastics are applied in the procurement of office IT equipment. In Germany and Belgium, bans on certain single-use products were introduced. Japan also uses GPP criteria on plastic products, where the higher the recycled content share in an evaluated good, the higher the evaluation score for that good. For instance, stationary products should contain at least 40% recycled plastics in terms of weight (see Annex Box 7.A.6).

Labelling schemes can help consumers in their purchasing decisions

Consumer-oriented information and labelling schemes can help shift demand towards more circular plastics products (Laubinger and Börkey, 2021[35]). They can empower consumers by helping them distinguish products based on their environmental impact. In the absence of such information, consumers are more likely to make uninformed purchase decisions, leading to worsened unintended environmental impact.

In Hungary, there are already policy changes underway on this front. A key legislation on the labelling of SUPs is Government Decree 349/2021 (VI. 22) (Government of Hungary, 2021[21]). According to this decree, producers would be required to clearly label plastic products (sanitary pads, wet tissues, cigarette butts and cups) to inform consumers of their plastic content and on their correct disposal. The decree mandates an additional type of labelling so as to raise awareness on the environmental impacts of littering these products as well as food containers, flexible packaging, beverage bottles (up to three litres), consumer balloons and light carrier bags.

7.4.3. Policies at the end-of-life phase can make or break the plastics loop

As explained above, Hungary is facing the challenge of meeting the EU’s waste targets, which is to increase separate collection and recycle plastic packaging waste, and divert waste from landfills. More than half of all municipal plastic waste is landfilled and less than one-third is recycled. In terms of plastic packaging waste, the consumption of which has increased faster than the EU average, only about one-third was collected for recycling in 2019, which is well below EU targets. While policy changes are pointing towards a more favourable policy landscape, given Hungary’s low performance on this front, policy stringency and coherence needs to be strongest for the end-of-life stage of the plastics life cycle.

The Hungarian waste management system is currently being reformed under a new concessionary system, which is an opportunity to rationalise waste management and also to better incorporate economic instruments that can steer behaviour. For instance, a Deposit Refund System (DRS) for plastic beverage bottles (as well as glass bottles and metal cans) is being developed and is expected to be in place in Hungary by 1 January 2024 (OECD, 2022[36]). This instrument will be an important first step towards ensuring higher recycling rates. However, a DRS alone can only go so far. Other instruments, such as improved landfill taxes, enhanced “pay-as-you-throw” schemes and door-to-door collections, as well as the separate collection of plastic CDW, should also be considered to bolster Hungary’s performance and to ensure that it can meet ambitious EU targets.

Increasing landfill taxes will boost recycling

Economic instruments, such as a landfill tax, have proven to be good policy practices. Studies suggest a strong correlation between landfill tax levels and the percentage of waste sent to landfill (BIO Intelligence Service and European Commission, 2013[37]). Indeed, without the right level of incentives to divert plastic waste away from landfills, many other policies that aim to increase plastics recycling could be less effective than intended. It is also essential to ensure that there are other flanking measures in place, such as an incineration tax, to ensure that waste originally destined for landfills does not end up being incinerated.

In Hungary, separate collection and recycling are not well incentivised, not even as part of government policy to keep consumer costs low. Hungary’s Act 2012 CLXXXV (annex 5, via Act 2014 XXXIX) regulates landfill taxes (Parliament of Hungary, 2012[38]), which would have seen linear increases in taxes from HUF 3 000 per tonne to HUF 12 000 per tonne. However, landfill taxes have been frozen at EUR 15 per tonne (HUF 6 000)4, which is lower than in most EU Member States. In addition, without adjustments to inflation, the tax becomes less effective at discouraging landfilling. As such, this could explain the observed high landfill rates for municipal waste, including plastic waste and low separate collection and recycling rates. With the introduction of the “plastics own resource” contribution, which requires EU Member States to contribute based on the amount of non-recycled plastic packaging, there are even more reasons to act in this space. Hungary should therefore consider increasing its landfill taxes and putting in place other supportive measures, such as an incineration tax, to ensure stronger enforcement.

Landfill taxes are widely used in EU Member States, but they range from no tax (Malta) to more than EUR 100/tonne (Belgium) (Cewep, 2021[39]). The tax is typically charged on the weight or volume of waste delivered to landfill sites. In addition, landfill taxes do need not to be at a flat rate and can be modulated based on sorting rate to further incentivise the reduction of mixed waste. This is especially important in the case of plastic waste, which tends to be an important part of municipal solid waste streams. Hungary’s neighbour, Slovak Republic, has already introduced modulated landfill taxes. Incineration taxes, such as those in place in France, the Netherlands and Sweden, can also be used to further lessen the incentive to avoid waste recycling (see Annex Box 7.A.7).

Beyond landfill taxes, enforcement is also an important aspect to consider as the illegal dumping of waste remains an issue in Hungary. Hungary’s Climate and Environmental Protection Action Plan envisions a more systematic curbing of illegal dumping, which includes the pollution of transboundary rivers (Government of Hungary, 2020[40]). The Tisztítsuk meg az Országot! [Clean up the country] initiative and HulladékRadar [Waste radar] application have been implemented under the auspices of the action plan. Similarly, the initiative TeSzedd! Önkéntesen a tiszta Magyarországért [Voluntary clean up action for a clean Hungary] has been initiated and continues to rein in littering and illegal dumping. These measures target the identification of illegal landfills and clean-up. The next step, however, will require enforcement so that discarded waste ends up in the formal waste management system, the foundations of which can already be found in Act 2021 II (Parliament of Hungary, 2021[41]).

A PAYT scheme and door-to-door collection can boost the separate collection of plastic waste

The PAYT waste collection scheme can steer behaviour towards waste reduction and better separate collection. The PAYT is a principle whereby waste producers are charged based on the actual amount of waste generated. Countries with recycling rates above 45% have a certain PAYT scheme in place. Meanwhile, countries with recycling rates below 20% tend not to have a PAYT scheme in place (European Environmental Agency, 2016[42]). The effective operation of PAYT schemes requires a well-developed infrastructure for separate waste collection, including door-to-door collection.

At present, consumers do not fully understand the true costs of waste generation in Hungary, not least due to the government policy on “reducing consumer costs for utilities”. There is thus a strong need to ensure that consumers are sufficiently incentivised to increase the amount of sorted waste, thereby reducing their mixed waste generation. Although there is door-to-door collection in Hungary since 2015 (OECD, 2018[43]), and waste disposal fees have volume and frequency-based components, they have not led to the desired performance in separate collection. Indeed, purely volume and frequency-based PAYT schemes, which are subscription based, often do not allow consumers to appreciate the cost of waste generation. This is especially true in densely populated urban areas where fees are split among several households. Indeed, the Hungarian Central Bank has advocated for enhanced PAYT schemes that differentiate rates based on average per capita waste generation and not just volume. This would mean that households generating above average amounts of waste would pay a premium (Hungarian Central Bank, 2022[44]). At the same time, low performance in this area has a regional component, that is, in smaller or less developed municipalities, separate collection is particularly low because of the differences in the provision of services, which also highlights the uneven distribution of waste management services across the country.

Conversely, there might be concerns that an enhanced PAYT scheme in Hungary would increase illegal dumping and littering, for which there is evidence elsewhere (Bucciol, Montinari and Piovesan, 2011[45]). However, a well thought out PAYT scheme, one which is rolled out at different speeds across the country and takes into account of Hungarian sensitivities and concerns, could be an important turning point. Hungary should therefore consider enhancing its PAYT scheme and door-to-door collection to improve its separate collection of plastic waste.

Hungary could be inspired by success stories seen in other countries. In Belgium, in particular, there is a widespread use of a unit-based system using special bags for waste. In this system, the bag for mixed municipal waste is the most expensive (up to EUR 2 per bag). The price of bags for the sorting of plastics, however, is typically much lower. This provides a clear financial incentive for households to separate their waste (see Annex Box 7.A.8). Such a system could also help overcome some of the difficulties with separate collection in densely populated urban areas. In addition, door-to-door collection is organised for recyclables, including for plastic packaging. In the Brussels region, where there is door-to-door collection of various recyclable waste streams, including plastics, recycling rates have increased significantly from 25% in 2005 to 43% in 2017 as a result of separate collection (OECD, 2021[46]).

The separate collection of plastics in CDW can improve the recycling of problematic polymers such as PVC

Plastic waste from construction applications should be treated separately to allow for more efficient recycling. An extension of the EPR scheme that includes construction products and materials can provide a solution to setting up a separate collection of plastics in CDW. The construction sector represents the second largest share of plastics in total use. Construction plastics, in particular, tend to have long lifetimes (35 years on average), which likely means that they will be part of the waste stream for decades to come.

With the recent expansion in construction in Hungary, as well as the possible modernisation of the building stock, in line with the country’s ambition to reach climate goals, it is important that there are mechanisms in place that ensure that hard to recycle, problematic plastics in CDW, including PVC, can be treated. Hungary could include plastics in CDW as a separately collected waste stream under its EPR system, which is currently under reform.

The recently introduced EPR platform (Valobat) in France provides an example of such a scheme. This EPR scheme lists categories of CDW that can be recycled, including pipes, insulators, window frames, floors, water and gas supply, and all forms of plastics. Such a system can ensure that hard-to-recycle and problematic plastic waste, often made of PVC, are treated as plastic waste, as opposed to treated as CDW only, which allows for synergies across circular economy priority areas (see chapter 6).

7.4.4. Flanking horizontal tools can support the transition to a more circular use of plastics

Efforts could be ineffective if flanking measures are not in place to put the country on the trajectory of closing the plastics loop. It is therefore essential to use horizontal tools that can support the more targeted policies along the life cycle of plastics. At present, Hungary is not sufficiently exploiting the opportunities that exist in this area. Horizontal tools include soft instruments such as education and information campaigns, research and development grants, as well as data collection and monitoring. Horizontal tools also have the benefit of potentially having positive spillovers. As such, they not only form an integral part of a circular plastics strategy but they can also pave the way towards long-term improvements.

Well-informed consumers are more likely to properly dispose of and sort plastic waste

Soft instruments, such as education (capacity building), remain important tools in the transition to a circular economy and can be employed to affect material flows at all stages of a product’s life cycle. Knowledge and capacity building includes a better understanding of the environmental implication of waste generation, the benefits of re-using products, and favouring repair over buying new products, among others. Consumers are more likely to comply with waste management regulation and respond to incentives if they have the necessary information on how to properly sort waste and have a better understanding of how sorted waste is used for recycling. Expenditure on recycling education is also considered to be a cost-effective measure to increase recycling rates (Sidique, Joshi and Lupi, 2010[47]).

The fact that the share of impurities can be as much as 40% in separately collected plastic packaging waste possibly points to issues related to the lack of awareness in Hungary (Ministry for Innovation and Technology, 2021[9]). Even if all the right economic incentives and regulations are in place, consumer compliance must be underpinned by education and information campaigns. Hungary should ensure that adequate capacity-building resources are available, and that a targeted communication and information campaign is conducted in conjunction with policy efforts. Although resources such as the website Szelektalok.hu (Szelektalok, 2022[48]) are available, the knowledge and information they contain have not been adequately mainstreamed and dispersed among the population. Most efforts and resources are targeted mainly at students through the incorporation of separate collection concepts in the National Curriculum [Nemzeti Alaptanterv], and through programmes such as Eco-schools [Ökoiskola] (Oktatási Hivatal, 2012[49]). However, these topics tend to be marginalised, highlighting the need to strengthen their role in education.

Information campaigns play an important role in ensuring the proper disposal of plastic waste, particularly because of the variety of polymers. Waste management policies, such as an enhanced PAYT scheme, should therefore be appropriately accompanied by awareness-raising campaigns and programmes. Communication campaigns conducted in the city of Treviso and in the region of Apulia (Italy) have shown that PAYT schemes can help push recycling rates to above 80% when such communication efforts are present (see Annex Box 7.A.9).

Research and development efforts should target innovation in recycling technologies

Research and development (R&D) can be promoted at every stage of the plastics life cycle, from the introduction of new materials in the production phase to new technologies for waste sorting or recycling. However, given the “public good” nature of innovation, it is imperative to have strong intellectual property rights and adequate framework conditions to ensure that the optimal level of innovation occurs. Direct government support to R&D activities, via grants and loans, can further enable the emergence of technologies with a strong public good component.

Given the acute need for improved recycling and separate collection in Hungary, funding for innovation in recycling technologies remains crucial. The high level of contamination of separately collected waste in the country often impedes efficient recycling. For instance, polylactic acid (PLA), one of the most common biodegradable plastics used in packaging, is considered a severe contaminant, but conditions for the separate collection and further treatment of biodegradable plastics, such as PLA, are not yet available in Hungary. Recycling facilities in Hungary tend to have 10-15 year-old technology, which is often not sufficiently sophisticated to allow for efficient sorting of contaminated waste (Government of Hungary, 2021[18]). Investments are foreseen to increase Hungary’s chemical recycling capacity under Hungary’s RRP. Research on this emerging technology would therefore also be an important complement. Hungary could provide research grants to groups and SMEs that are close to promising technological breakthroughs that can help overcome issues relating to the contamination of waste streams. There are already strong precedents for this through the various R&D programmes, such as the “KKV start innováció” programme for SMEs, which has awarded grants for innovation on plastics, although the programme does not specifically target plastics. More targeted R&D grants on plastics can thus help and also encourage the emergence of circular business models, which can further help close the material loops (OECD, 2019[50]).

Hungary could try to look for good practices at the international level and use these as a starting point for enhancing its R&D efforts on plastics. For example, the United States Department of Energy has been funding research into various plastics technologies to combat plastic waste. The most recent project announced USD 14.5 million in funding, specifically targeting SUPs. Seven innovative recycling technology projects, including on chemical recycling, were awarded with funding averaging USD 2 million (see Annex Box 7.A.10).

Data collection, monitoring and digitalisation could be an important tool for tracking developments in plastics trends

Plastics and plastic waste, in particular, are especially difficult to track given their ubiquity and how they are embedded in other products. In addition, the most problematic waste streams, such as mismanaged waste and littering, are often the most challenging to track as they constitute the fraction that falls through the cracks. Nevertheless, efforts to gather better data and monitor the evolution of materials and waste flows are at the core of the circular plastics life cycle.

As stated previously, although existing data provides a partial picture of the challenges that Hungary faces with regard to plastics throughout their life cycle, data is still incomplete. However, there are systems in place to gather data on the management of various waste streams (e.g. OKIR, EHIR), although this system would need to be broadened to provide sufficient granularity on plastics material flows throughout their life cycle (Ministry for Innovation and Technology, 2021[9]). For instance, currently, there is detailed disaggregation at the regional and sectoral level for plastic waste and well-detailed disaggregation of industrial plastic waste, however, municipal plastic waste data is less detailed. Given the wide variety of plastics, more granularity would allow for more targeted interventions, especially for problematic waste streams such as mixed waste. Some elements, however, that move towards an updated data monitoring and collection system can be observed in the Hungarian EPR system from Act 2021 II as well as from Government Decree 349/2021 (VI. 22.) (Parliament of Hungary, 2021[41]; Government of Hungary, 2021[21]). For instance, the decree foresees that producers would have to be registered in a national system and would be required to collect data on the weight and quantities of SUP products produced as well as their origin, recycled content and generated waste. Such data collection requirements will enable better monitoring of waste from SUP products. However, a narrow focus on SUPs might not make data collection and monitoring efforts sufficiently impactful as these items only make up a small share of total plastics material streams. Conversely, broadening data collection and monitoring will require the modernisation of such a system. Digitalisation of data collection and monitoring, through the entire life cycle of plastics, can be an important enabler in this effort.

Hungary could look at international practices for inspiration. In Antwerp (Belgium), waste data collection was improved by creating a data warehouse for all types of data (e.g. sensor data, static, historical, geographical) in order to increase insight into the waste management of the city and to disclose waste management data to different stakeholders, thus also increasing transparency (see Annex Box 7.A.11).

7.5. Concluding reflections on the key policy recommendations

The gaps that Hungary has to overcome in order to reach EU targets and to achieve its own ambitions have been presented. The main gaps identified are as follows:

There are no instruments in place to steer producers to favour recycled and easier to recycle plastics.

Measures to reduce the use of plastics lack an economic dimension. Current and upcoming measures are primarily regulatory in nature.

Separate collection and recycling rates are low and there are not enough economic incentives in place to motivate economy-wide behavioural change.

There is a need for flanking instruments that can support the transition of plastics to a more circular life cycle.

For each of these gaps, the analysis provided policy recommendations, building on the detailed logic of intervention and the possibilities that exist in Hungary, while also drawing examples from international best practices (Table 7.1). It identified a mix of instruments, ranging from economic, regulatory to information instruments that could be deployed to make the plastics life cycle more circular. The recommendations target the most frequently used polymers, often used in the most problematic applications, such as packaging, SUPs and construction. It also takes into consideration the role of SMEs in the Hungarian context, and the possibilities that lie in education and awareness raising, as well as research and development efforts. Finally, as the policy recommendations target the entire life cycle of plastics, their alignment can ensure that they synergise in order to make the plastics life cycle more circular. As such, these recommendations should not be treated as piecemeal actions but rather deployed together so that they can reinforce one another.

Table 7.1. Gap analysis and policy recommendations

|

Life cycle stage |

Gaps |

Policy recommendations |

|---|---|---|

|

Design and Production |

There are no instruments in place to steer producers to favour recycled and easier to recycle plastics |

Implement minimum recycled content requirements for plastic beverage bottles |

|

Promote design for recyclability among businesses |

||

|

Eco-modulate EPR fees on plastic packaging |

||

|

Introduce a tax on primary plastics packaging |

||

|

Use |

Measures towards reducing the use of plastics lack an economic dimension. Current and upcoming measures are primarily regulatory in nature |

Expand GPP criteria and introduce mandatory GPP to reduce the use of primary plastics and promote the use of secondary plastics and sustainable alternatives |

|

End-of-Life |

Separate collection and recycling rates are low and there are not enough economic incentives in place to motivate economy-wide behavioural change |

Increase landfilling taxes and strengthen enforcement of waste regulation |

|

Enhance PAYT schemes and door-to-door collection |

||

|

Expand EPR to ensure the separate collection of plastics in CDW |

||

|

Horizontal |

There is a need for flanking instruments that can support the transition of plastics to a more circular life cycle |

Educate and inform consumers on proper disposal and sorting of plastic waste |

|

Provide grants and loans for innovative plastics technologies, especially recycling technologies |

||

|

Support detailed downstream data collection, monitoring and its digitalisation |

References

[72] About Hungary (2022), Hungary’s waste management system transforms from next July, https://abouthungary.hu/news-in-brief/hungarys-waste-management-system-transforms-from-next-july (accessed on 21 October 2022).

[64] ADEME (2017), Etude comparative de la taxation de l’elimination des dechets en Europe [Comparative study of the taxation of waste disposal in Europe], http://www.ademe.fr/mediatheque.

[37] BIO Intelligence Service and European Commission (2013), Use of economic instruments and waste management performances, https://op.europa.eu/fr/publication-detail/-/publication/566f28fd-3a94-4fe0-b52d-6e40f8961c7e.

[45] Bucciol, A., N. Montinari and M. Piovesan (2011), “Do Not Trash the Incentive! Monetary Incentives and Waste Sorting”, SSRN Electronic Journal, https://doi.org/10.2139/ssrn.1781916.

[25] CalRecycle (2022), Plastic Minimum Content Standards (AB 793), https://calrecycle.ca.gov/bevcontainer/bevdistman/plasticcontent/.

[39] Cewep (2021), Landfill taxes and bans overview, https://www.cewep.eu/wp-content/uploads/2021/10/Landfill-taxes-and-bans-overview.pdf.

[4] Chamas, A. et al. (2020), “Degradation Rates of Plastics in the Environment”, ACS Sustainable Chemistry & Engineering, Vol. 8/9, pp. 3494-3511, https://doi.org/10.1021/acssuschemeng.9b06635.

[55] Council of the European Union (1999), Council Directive 1999/31/EC of 26 April 1999 on the landfill of waste, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A31999L0031 (accessed on 1 March 2023).

[65] Dri, M. et al. (2018), Best Environmental Management Practice for the Waste Management Sector, https://publications.jrc.ec.europa.eu/repository/handle/JRC111059 (accessed on 1 March 2023).

[32] Ellen MacArthur Foundation (2016), The New Plastics Economy: Rethinking the future of plastics, https://ellenmacarthurfoundation.org/the-new-plastics-economy-rethinking-the-future-of-plastics.

[52] European Commission (2020), A new Circular Economy Action Plan: For a cleaner and more competitive Europe, https://eur-lex.europa.eu/resource.html?uri=cellar:9903b325-6388-11ea-b735-01aa75ed71a1.0017.02/DOC_1&format=PDF.

[33] European Commission (2019), The Environmental Implementation Review 2019 Country Report Hungary, https://ec.europa.eu/environment/eir/pdf/report_hu_en.pdf (accessed on 16 March 2021).

[54] European Commission (2016), EU Construction and Demolition Waste Management Protocol, https://ec.europa.eu/docsroom/documents/20509/ (accessed on 2 February 2022).

[51] European Commission (2015), Closing the loop - An EU action plan for the Circular Economy, https://eur-lex.europa.eu/resource.html?uri=cellar:8a8ef5e8-99a0-11e5-b3b7-01aa75ed71a1.0012.02/DOC_1&format=PDF.

[61] European Commission (2012), Green Public Procurement: A collection of good practices, https://ec.europa.eu/environment/gpp/pdf/GPP_Good_Practices_Brochure.pdf (accessed on 1 March 2023).

[42] European Environmental Agency (2016), Municipal waste management across European countries, https://www.eea.europa.eu/publications/municipal-waste-management-across-european-countries/copy_of_municipal-waste-management-across-european-countries.

[53] European Parliament (2008), Directive 2008/98/EC of the European Parliament and of the Council of 19 November 2008 on waste and repealing certain Directives (Text with EEA relevance), https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32008L0098&from=EN (accessed on 1 March 2023).

[24] European Parliament and Council (2009), Directive 2009/125/EC establishing a framework for the setting of ecodesign requirements for energy-related products, https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32009L0125.

[14] European Union (2022), Sustainable Products Initiative, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12567-Sustainable-products-initiative_en.

[13] European Union (2020), Council Decision (EU, Euratom) 2020/2053 of 14 December 2020 on the system of own resources of the European Union and repealing Decision 2014/335/EU, Euratom, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32020D2053&qid=1609775612824.

[12] European Union (2019), Directive (EU) 2019/904 of the European Parliament and of the Council of 5 June 2019 on the reduction of the impact of certain plastic products on the environment, https://eur-lex.europa.eu/eli/dir/2019/904/oj.

[11] European Union (2018), A European Strategy for Plastics in a Circular Economy, https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1516265440535&uri=COM:2018:28:FIN.

[7] Eurostat (2022), Packaging waste by waste management operations, https://ec.europa.eu/eurostat/databrowser/view/env_waspac/default/table?lang=en.

[58] Fostplus (2022), Green dot rates, https://www.fostplus.be/en/members/green-dot-rates (accessed on 1 March 2023).

[3] Geyer, R., J. Jambeck and K. Law (2017), “Production, use, and fate of all plastics ever made”, Science Advances, Vol. 3/7, p. e1700782, https://doi.org/10.1126/sciadv.1700782.

[74] Government of Hungary (2022), Hulladékgazdálkodási törvénytervezet társadalmi egyeztetése, https://kormany.hu/dokumentumtar/hulladekgazdalkodasi-torvenytervezet-tarsadalmi-egyeztetese (accessed on 3 November 2022).

[19] Government of Hungary (2021), 158/2021. (III. 31.) Korm. rendelet. A körforgásos gazdaságra történő átállás érdekében egyes kormányrendeletek módosításáról, https://magyarkozlony.hu/dokumentumok/2aace6b5b1ff4f8d1f88d3829cd9d47188eb52b6/letoltes.

[17] Government of Hungary (2021), 301/2021. (VI. 1.) Korm. rendelet az egyes egyszer használatos, valamint egyes egyéb műanyagtermékek forgalomba hozatalának korlátozásáról, https://net.jogtar.hu/jogszabaly?docid=A2100301.KOR&searchUrl=/gyorskereso%3Fkeyword%3D301/2021.

[21] Government of Hungary (2021), 349/2021. (VI. 22.) Korm. rendelet az egyes műanyagtermékek környezetre gyakorolt hatásának csökkentéséről, https://net.jogtar.hu/jogszabaly?docid=A2100349.KOR&searchUrl=/gyorskereso%3Fkeyword%3D301/2021.

[18] Government of Hungary (2021), Helyreállítási és Ellenállóképességi Eszköz (RRF), https://www.palyazat.gov.hu/helyreallitasi-es-ellenallokepessegi-eszkoz-rrf.

[40] Government of Hungary (2020), Nyolc pont köré szerveződik a Klíma- és természetvédelmi akcióterv, https://2015-2019.kormany.hu/hu/innovacios-es-technologiai-miniszterium/hirek/nyolc-pont-kore-szervezodik-a-klima-es-termeszetvedelmi-akcioterv.

[20] Government of Hungary (2012), 442/2012. (XII. 29.) Korm. rendelet a csomagolásról és a csomagolási hulladékkal kapcsolatos hulladékgazdálkodási tevékenységekről, https://net.jogtar.hu/jogszabaly?docid=a1200442.kor.

[44] Hungarian Central Bank (2022), Fenntartható egyensúly és felzárkózás - 144 javaslat, https://www.mnb.hu/letoltes/fenntarthato-egyensuly-es-felzarkozas-144-javaslat-20220519.pdf.

[8] Hungarian Mineral Water, Juice and Soda Association (2022), Ásványvíz fogyasztási adatok, https://asvanyvizek.hu/mit-kell-tudni-az-asvanyvizrol/asvanyviz-fogyasztasi-adatok/.

[73] Interreg Danube Transnational Programme MOVECO (2017), Extended Producer Responsibility Schemes and their influence on innovation in the TransDanube region, https://www.interreg-danube.eu/uploads/media/approved_project_output/0001/13/6c86df84731067e51f0b71f488ecffef4b7ae842.pdf (accessed on 21 October 2022).

[71] Interreg Europe (2022), Waste Management Data Warehouse, https://www.interregeurope.eu/good-practices/waste-management-data-warehouse (accessed on 1 March 2023).

[70] Interreg Europe (2020), A Policy Brief from the Policy Learning Platform on Environment and Resource Efficiency, https://www.interregeurope.eu/sites/default/files/inline/Separate_waste_collection_Policy_brief.pdf (accessed on 1 March 2023).

[60] Jones, M., I. Kinch Sohn and A. Lysemose Bendsen (2017), Circular Procurement: Best Practice Report, https://sppregions.eu/fileadmin/user_upload/Resources/Circular_Procurement_Best_Practice_Report.pdf (accessed on 1 March 2023).

[35] Laubinger, F. and P. Börkey (2021), “Labelling and Information Schemes for the Circular Economy”, OECD Environment Working Papers, No. 183, OECD Publishing, Paris, https://doi.org/10.1787/abb32a06-en.

[67] Laurieri, N. et al. (2020), “A Door-to-Door Waste Collection System Case Study: A Survey on its Sustainability and Effectiveness”, Sustainability, Vol. 12/14, p. 5520, https://doi.org/10.3390/su12145520.

[9] Ministry for Innovation and Technology (2021), Országos Hulladékgazdálkodási Terv 2021-2027, https://kormany.hu/dokumentumtar/orszagos-hulladekgazdalkodasi-terv-2021-2027 (accessed on 17 May 2022).

[63] Ministry of the Environment of Government of Japan (2020), Act on Promotion of Procurement of Eco-Friendly Goods and Services by the State and Other Entities (Act on Promoting Green Procurement), https://www.env.go.jp/en/laws/policy/green/index.html (accessed on 1 March 2023).

[66] Morlok, J. et al. (2017), “The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany”, Resources, Vol. 6/1, p. 8, https://doi.org/10.3390/resources6010008.

[36] OECD (2022), Environment Ministers’ commitments on plastics: National-level visions, actions and plans announced at the 2022 OECD Council at Ministerial Level (MCM), https://www.oecd.org/environment/ministerial/outcomes/Environment-Ministers-commitments-on-plastics.pdf.

[1] OECD (2022), Global Plastics Outlook: Economic Drivers, Environmental Impacts and Policy Options, OECD Publishing, Paris, https://doi.org/10.1787/de747aef-en.

[2] OECD (2022), Global Plastics Outlook: Policy Scenarios to 2060, OECD Publishing, Paris, https://doi.org/10.1787/aa1edf33-en.

[22] OECD (2021), A Chemicals Perspective on Designing with Sustainable Plastics : Goals, Considerations and Trade-offs, OECD Publishing, Paris, https://doi.org/10.1787/f2ba8ff3-en.

[46] OECD (2021), OECD Environmental Performance Reviews: Belgium 2021, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/738553c5-en.

[5] OECD (2020), Annual National Accounts - Value added and its components by activity, ISIC rev4, https://stats.oecd.org/Index.aspx?datasetcode=SNA_TABLE6A (accessed on 7 November 2020).

[30] OECD (2020), “Improving resource efficiency and the circularity of economies for a greener world”, OECD Environment Policy Papers, No. 20, OECD Publishing, Paris, https://doi.org/10.1787/1b38a38f-en.

[50] OECD (2019), Business Models for the Circular Economy: Opportunities and Challenges for Policy, OECD Publishing, Paris, https://doi.org/10.1787/g2g9dd62-en.

[26] OECD (2019), “Hungary”, in OECD SME and Entrepreneurship Outlook 2019, OECD Publishing, Paris, https://doi.org/10.1787/7c8ff164-en.

[27] OECD (2019), OECD Economic Surveys: Hungary 2019, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-hun-2019-en.

[31] OECD (2018), Improving Markets for Recycled Plastics: Trends, Prospects and Policy Responses, OECD Publishing, Paris, https://doi.org/10.1787/9789264301016-en.

[43] OECD (2018), OECD Environmental Performance Reviews: Hungary 2018, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264298613-en.

[28] OECD (2016), Extended Producer Responsibility: Updated Guidance for Efficient Waste Management, OECD Publishing, Paris, https://doi.org/10.1787/9789264256385-en.

[49] Oktatási Hivatal (2012), Ökoiskola, https://www.oktatas.hu/kozneveles/pedagogiai_szakmai_szolgaltatasok/fenntarthatosagra_neveles/okoiskolak_Magyarorszagon (accessed on 12 July 2022).

[41] Parliament of Hungary (2021), 2021. évi II. törvény egyes energetikai és hulladékgazdálkodási tárgyú törvények módosításáról, https://mkogy.jogtar.hu/jogszabaly?docid=A2100002.TV.

[15] Parliament of Hungary (2020), 2020. évi XCI. törvény egyes egyszer használatos műanyagok forgalomba hozatalának betiltásáról, https://mkogy.jogtar.hu/jogszabaly?docid=A2000091.TV.

[34] Parliament of Hungary (2015), 2015. évi CXLIII. törvény a közbeszerzésekről, https://net.jogtar.hu/jogszabaly?docid=A1500143.TV&searchUrl=/gyorskereso%3Fkeyword%3D2015%2520CXLIII%2520.

[38] Parliament of Hungary (2012), 2012. évi CLXXXV. törvény a hulladékról, https://net.jogtar.hu/jogszabaly?docid=A1200185.TV&searchUrl=/gyorskereso%3Fkeyword%3D2012%2520CLXXXV.

[16] Parliament of Hungary (2011), 2011. évi LXXXV. törvény, https://net.jogtar.hu/jogszabaly?docid=A1100085.TV&searchUrl=/gyorskereso%3Fkeyword%3D2020%2520XCI%2520.

[59] Parliament of the United Kingdom (2021), Finance Act 2021, https://www.legislation.gov.uk/ukpga/2021/26/enacted (accessed on 1 March 2023).

[62] Plastic Smart Cities (2022), Public Procurement, https://plasticsmartcities.org/products/public-procurement?_pos=1&_sid=824b1c339&_ss=r (accessed on 1 March 2023).

[10] Plastics Europe (2020), Plastics - the Facts 2020, https://plasticseurope.org/wp-content/uploads/2021/09/Plastics_the_facts-WEB-2020_versionJun21_final.pdf.

[6] Pogány, K. (2020), “Magyarország műanyagipara 2019-ben”, Polimerek: Műanyagipari szaklap, http://polimerek.hu/2020/08/24/magyarorszag-muanyagipara-2019-ben/.