Given widespread demand and concentrated supply, international trade will play a key role in satisfying the rapidly growing demand for CRMs such as rare earths minerals, lithium, cobalt, nickel which are essential for renewable energy and digital technologies. This is even more pressing in the short to medium term, as scaling up of new CRM mining and recycling capacities takes time. Indeed, between 2007-09 and 2017-19, the value of trade in CRM expanded faster than overall merchandise trade, growing at 38% while all merchandise trade grew by 31%). Trade in lithium increased spectacularly by 438%, and trade in all ores and minerals on average by 57%.

Export restrictions on critical raw materials

Countries that impose restrictions on exports of raw materials could well compromise achieving global net zero CO2 emissions targets and the digital transformation necessary to ensure economic security. The OECD monitors the use of these restrictions in order to contribute to a better understanding of why countries resort to such measures and their impact on international markets.

Key messages

The annual update of the OECD Database on Export Restrictions on Raw Materials shows a five-fold increase in the export restrictions of CRMs since the OECD began collecting data in 2009, with 10% of global trade in CRMs now facing at least one export restriction measure. Export restrictions on ores and minerals — the raw materials located upstream in CRM supply chains — grew faster than restrictions in the other segments of the CRM supply chain. Export taxes were the largest contributor to the increase in export restrictions worldwide and were the most frequently used type of restriction in 2020. Under WTO rules, quantitative restrictions on exports are generally prohibited, while export taxes are not.

Export restrictions on raw materials undermine the economic viability — and thus decrease output — of domestic extractive industries and benefit domestic downstream users of these materials to the detriment of foreign users. As such, they are often used in domestic industrial policies. Export taxes or quantitative export restrictions, such as export quotas or bans, can also contribute to raising world market prices for the CRM in question, particularly if the exporter holds a large share of the market. Such restrictions also create incentives for other producing countries to introduce similar restrictions, putting yet more upward pressure on international prices . Such spiraling increases in commodity prices have been both a reflection of, and a factor behind, the escalating export restrictions on raw materials.

Context

Production and trade concentration

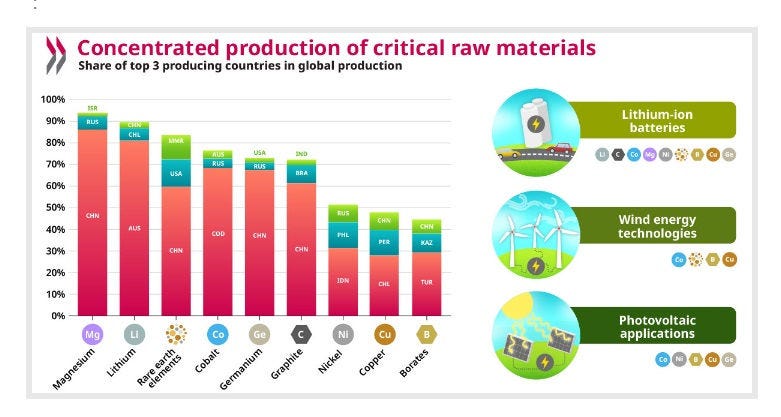

The production and international trade of several raw materials have become more concentrated amongst a handful of extracting and processing locations which account for the bulk of global supply. Concentration of both imports and exports is significant for unprocessed forms of lithium, borates, cobalt, colloidal precious metals, manganese, and magnesium.

OECD Inventory of Export Restrictions on Industrial Raw Materials

The aim of the OECD Inventory of Export Restrictions on Industrial Raw Materials is to improve the transparency of the use of these export restrictions. The inventory covers information on 80 exporting countries and 65 commodities. It is the most comprehensive inventory of its kind related to minerals, metals and wood.

This interactive data visualisation tool includes an inventory of export restricting measures covered in the Inventory for all major minerals exporters and are combined with production figures, known mineral reserves and trade flows. Try it now to see how trade in raw materials stacks up in your country. Trade in Raw Materials visualization represents a subset of the OECD Inventory of export restrictions on industrial raw materials (complete database) which also includes 6 wood products. A detailed methodological note for the Inventory is also available.

Data sources: Exports restrictions are restrictions in place from 2009 to 2022. OECD Members self-report data on restrictions they apply, while data for other exporter countries are collected by experts and subsequently verified by the concerned country’s authorities. In both cases only data substantiated from official sources as verified by the OECD Secretariat are included in the database.

Raw materials are more prone to be targeted in industrial policy and geopolitical rivalries

Given the uniqueness and concentration of production of some raw materials, market power dynamics can come into play and be exploited for economic and non-economic reasons, e.g. via restrictions on output or trade. Raw materials are generally used to produce other goods, i.e. they are positioned “upstream” in domestic and international supply chains. This means that disruptions or policies that affect their supply can have important systemic ramifications which can be used as a reason for state intervention, usually in the form of subsidies, and restrictions on exports or foreign ownership, to support downstream domestic sectors. This occurs despite the mixed evidence as to the efficacy of such policies. Given its systemic importance, raw materials are also more prone to be targets of economic coercion and political rivalries.

Related publications

-

Policy paper29 June 2012

Policy paper29 June 2012