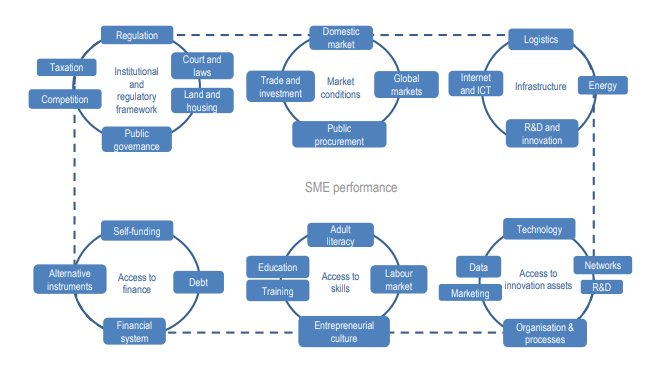

Economic and societal contributions vary widely across businesses, with substantial differences between large firms and SMEs, and within the SME population itself. While dynamic SMEs and start-ups can be major drivers of innovation and economic growth, a large share of new and small firms struggle with low levels of productivity and wages, investment and technology adoption, access to markets and supply chains. Contributions depend to a great degree on conducive framework conditions, such as an effective and transparent regulatory environment, access to public investments in areas such as education, innovation, and infrastructure, as well as on access to strategic resources, such as skills, knowledge networks, data, technology and finance.

SME financing, business conditions and growth

SMEs are a major target of public policy, and they are central to the policy agenda of many governments seeking responses to the challenges raised by ongoing megatrends and major transformations. We provide evidence of how business conditions shape SMEs’ ability to do business and grow, and when targeted policy support is needed. This includes supporting governments in developing a conducive business environment ensuring that SMEs can access and make use of a broad range of strategic resources, such as finance, innovation assets and skills.

Key messages

SMEs that scale up – including high-growth firms – make an important contribution to job creation and economic growth. In a number of OECD countries, they contribute 47% to 69% of all new jobs generated by SMEs, while representing only 13-15% of these. Yet, growth potential exists across all types of SMEs. In fact, the typical scaler is neither a knowledge-intensive nor a high-tech firm, nor a startup, but a mature SME providing less knowledge-intensive services. To avoid missing out on growth opportunities across many different types of firms, scale-up policies need to provide support that is differentiated according to the needs of SMEs with growth potential.

SMEs require access to appropriate sources of financing across all stages of their life cycle - for their creation, development and growth. Swings and shocks in credit markets impact SME access to bank finance, on which they are overly reliant. Persistent challenges include information asymmetries, high transaction costs and insufficient financial skills and knowledge. In addition, the potential of financing instruments other than straight debt often remains underdeveloped. Micro-enterprises, innovative ventures, start-ups and SMEs run by underrepresented groups tend to face particular difficulties in accessing finance. Governments around the world continue to place priority on fostering a diversified financial offer for SMEs and entrepreneurs, in line with the OECD Recommendation on SME Financing. The OECD supports this agenda through a broad programme on SME and entrepreneurship financing.

OECD Country Reviews of SME and Entrepreneurship Policy examine barriers and opportunities for entrepreneurship and SME development in specific countries and provide policy recommendations that adhere to global best practices. They include an assessment of SME and entrepreneurship performance, guidance to governments to strengthen the business environment for SMEs and entrepreneurship, the strategic framework for SME and entrepreneurship policy, the design and delivery of national SME and entrepreneurship support programmes, and the local dimension of SME and entrepreneurship policy.

Context

Effective scale up policies can pay off.

Firm-level analysis shows that that up to two thirds of scalers sustain their new scale over time, with 20% growing further within three years. This indicates potential for a long-lasting transformation and, for some, a virtuous cycle of change. This is driven by multiple forms and combinations of productivity and performance improvements, including innovation, investment, and network expansion. However, designing scale up support policies is complex, due to uncertain outcomes, difficulty to anticipate scalers’ trajectories. and the influence of broader business conditions and the quality of entrepreneurial ecosystems.

The cost of finance has been rising, contributing to a drop in lending to SMEs.

Since 2020, the global economy has been hit by a series of shocks, with strong impacts on SMEs and entrepreneurs and their access to finance. In 2022, the cost of finance increased sharply as governments around the world tightened monetary policy to address the surge in inflation. The rise in policy interest rates was transmitted almost one-to-one to the real economy, with corporate interest rates rising accordingly. The cost of SME financing registered an unprecedented increase, with SME interest rates 30% higher in 2022 than in 2021. This resulted in a lower uptake and offer of SME loans. SME loan applications dropped by 2 percentage points, and new SME loans declined by 1.8% in 2022.

Recognizing SMEs’ vital role in fostering resilient, sustainable, and inclusive growth, governments around the world have been taking measures to facilitate their access to finance. This includes diversifying financial instruments to cater to varied SME needs. The aim is to enable SMEs to continue to operate, invest, grow, and participate in the green and digital transitions.

Related publications

-

5 December 2023

5 December 2023

Related events

-

4 November 2024

4 November 2024 -

14 December 2023

-

7 December 2022

-

Webinar16 January 2024

Programmes

-

Equipping SMEs and entrepreneurs with the skills to contribute to a green and digital transition.Learn more

-

Business start-ups and scale-ups are key drivers of innovation and job creation and are important to renewing the economy.Learn more

-

Across the OECD, about 10-15% of small and medium-sized enterprises (SMEs) that scale up contribute around 50% of new jobs. Which SMEs are scalers? How can policy makers support them?Learn more

-

Cultivating impactful entrepreneurial ecosystems.Learn more

-

Access to appropriate sources of finance is an important prerequisite for SMEs and entrepreneurs to start up, develop and grow, but long-standing challenges persist. Governments around the world continue to place priority on fostering a diversified financial offer for SMEs and entrepreneurs, in line with the OECD Recommendation on SME Financing.Learn more

Related policy issues

-

Small and medium-sized enterprises (SMEs) account for a significant share of global greenhouse emissions according to recent studies. The OECD has been working on analysing and identifying innovative financial instruments and approaches across countries that can reduce SMEs’ environmental footprints and accelerate their contribution to global progress toward sustainability.Learn more

-

Green entrepreneurship is key to developing and propagating innovative green solutions needed to combat climate change.Learn more

-

Following the 2015 Paris Agreement on climate change, governments have made the green transition one of their top policy priorities. With SMEs accounting for a large share of business-sector environmental footprint, it is urgent to involve SMEs and entrepreneurs more closely in this transition. Equally, SMEs and start-ups ae important drivers of the many innovations that can advance sustainable development. OECD work supports governments in the design and implementation of policies that can accelerate the green transition of SMEs and foster green entrepreneurship, including through enhanced energy efficiency and better access to sustainable finance, skills and technologies.Learn more

-

To ensure small and medium-sized enterprises (SMEs) reach their full potential to build a more resilient and sustainable future, it is essential for governments to access timely, granular and comparable data and evidence on the performance of their diverse populations of SMEs, on the business conditions affecting their operations and conduct, and on the effective policies that can support them to transform and scale-up.Learn more

-

Access to global markets is an important driver of growth and productivity for SMEs and their integration into global value chains a significant source of innovation and knowledge. Well-functioning global markets and a global level playing field are key to SME participation. Policies can help SMEs develop capacity to tap into international markets and supply chains, and strengthen linkages with international business and knowledge networks.Learn more