This chapter provides an overview of employment practices of firms with respect to older workers and factors behind the reluctance of some employers in Japan to retain or hire older workers. It does so by looking at the role of mandatory retirement policies, employment protection rules and government policies such as the Act on Stabilization of Employment of Older Persons. Efforts to manage age diversity in the work place and age discrimination are also examined. The chapter provides various policy solutions and a range of good practice across the OECD in the above areas to enhance employment prospects of older workers.

Working Better with Age: Japan

Chapter 2. Supporting employers to retain and hire older workers in Japan

Abstract

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Introduction

Obstacles to retain and hire older workers often relate to negative perceptions and stereotypes among employers about this group of workers. Nonetheless, a number of objective factors also discourage employers from hiring and retaining older workers, especially the most vulnerable among them. In particular, there needs to be a better match between the costs of employing older workers and their productivity. The Japanese labour market continues to rely strongly on labour practices, such as the mandatory retirement age and seniority based wage and compensation systems, which have undermined efforts to extend working lives in Japan. In addition, relatively rigid employment protection for permanent workers has meant that firms make widespread use of setting a mandatory retirement age, which means that labour adjustment is confined to older workers or prompting firms to turn to non-regular workers.

Employment practices and labour costs of older workers in Japan

Mandatory Retirement Age

Mandatory retirement is a key element of traditional Japanese labour practices. Most Japanese companies continue to require that employees retire upon reaching a specified age. In 1980, the majority of Japanese firms set the mandatory retirement age (MRA) at 55. However, against a background of increases in longevity and rapid population ageing, government exhortation, incentive programmes and progressively tighter legislation have contributed to the elimination of mandatory retirement before the age of 60.

The current system of regulating employment at an older age under the Act on Stabilization of Employment of Older Persons prohibits the setting of a mandatory retirement age of lower than 60. An amendment to the Act in 2004 obliges employers who set a retirement age of lower than 65 to introduce any of the three following measures so as to secure employment for employees until the age of 65. First, abandon the mandatory retirement age altogether. Second, raise the mandatory retirement age to at least 65 – implying that workers remain in their current job until they receive a public pension. Third, re-employ workers in a different type of job function at the same firm.

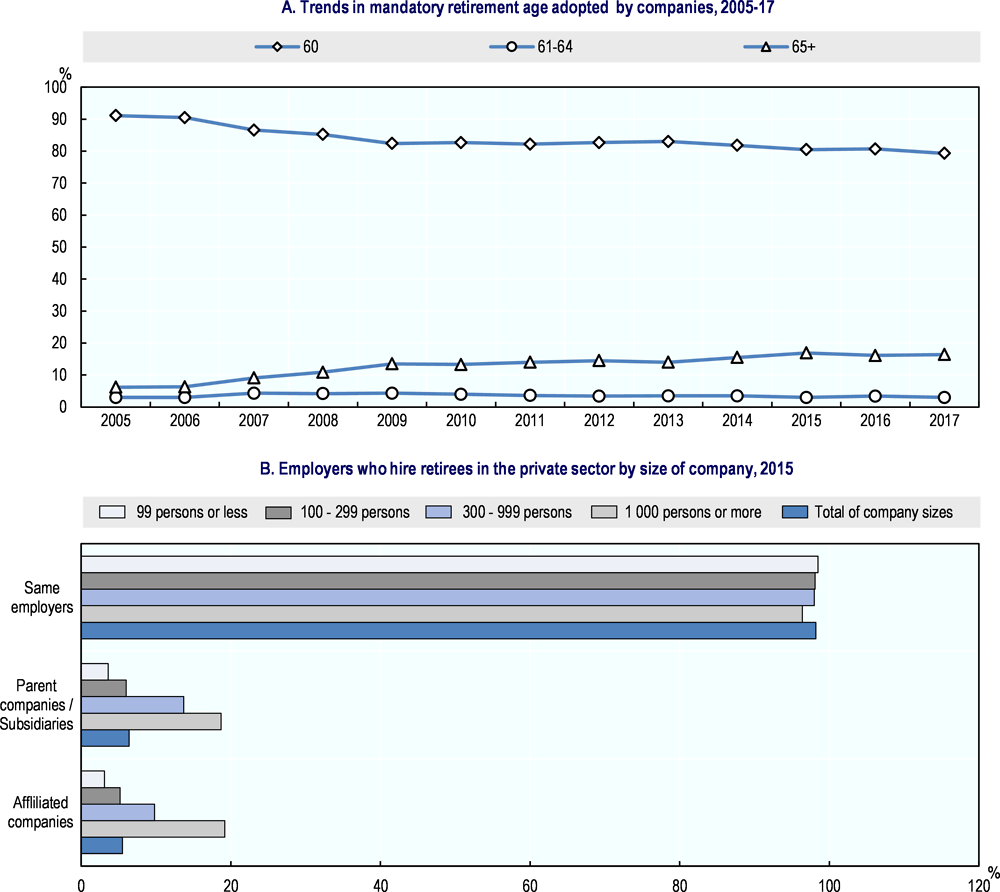

Over the past decade, few large firms have extended their formal mandatory retirement age, but they have increasingly implemented programmes for the continued employment of their older workers up to the age of 65. In 2017, just under 80% of firms had kept their retirement age at 60, representing a small decline of 12 percentage points below that in 2005. Meanwhile, the share of firms adopting a mandatory retirement age at 65 is on the rise (Figure 2.1, Panel A). Furthermore, the vast majority of retirees are rehired by the same firm. This practice prevails in all firms regardless of size.

Figure 2.1. Most firms have kept retirement age at 60

Source: Panel A: Japanese Ministry of Health, Labour and Welfare, General Survey on Working Conditions and Panel B: Japan Institute of Labour Policy and Training Survey of the Employment of the Elderly ("Company Survey").

These reforms have been successful in expanding employment opportunities for older workers over the past decade. Between 2006 and 2017, the employment rate rose by 8.7 and 3.6 percentage points, respectively, for older persons in the age groups 55-64 and 65 and over. However, few companies have opted for the first and second option of the amended legislation due to the associated rise in wage costs. De facto, the reforms have allowed firms to adjust their workforce by re-hiring some workers into low paid and low productive jobs to offset the seniority wage system and relatively strict employment legislation which currently which hamper labour adjustment (see below for further discussions).

Pay rises with seniority are larger in Japan than in other countries

Seniority-based wage-setting practices are perhaps the single most important factor affecting employment outcomes for older workers in Japan. A seniority‑based wage structure may help employers to strengthen the loyalty and motivation of their workers. If wages of workers rise the longer they stay with a firm, this will make them more reluctant to change jobs and they will also work harder to avoid being laid-off because they will not want to forgo the higher earnings that will accrue to them by staying longer with the same firm. However, after workers have reached a certain age, it may no longer be economic for employers to hold onto these workers because they will be paying more in wages than their productive value.

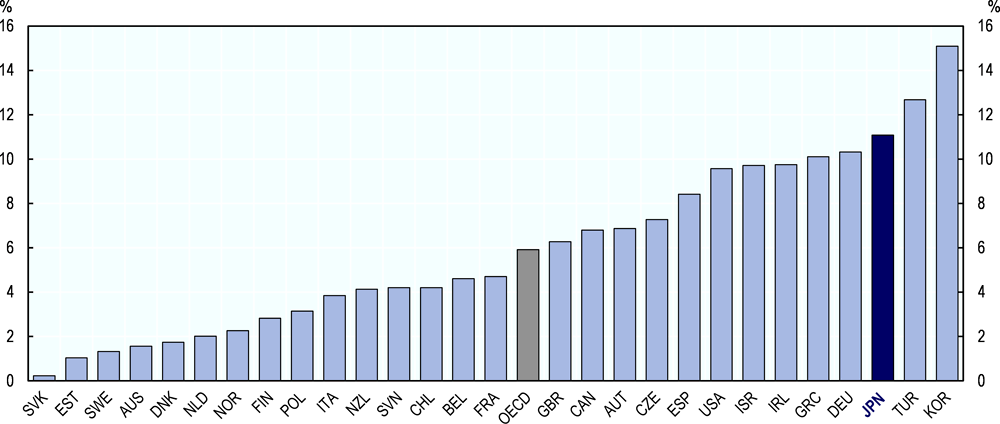

Even though Japan’s wage system has been steadily changed over time, responding to prolonged economic stagnation and a legislative obligation to retain older workers, its seniority aspect remains strong. Figure 2.2 shows the predicted increase of wages in different countries for workers with 20 years of job tenure in a firm relative to those with just 10 years of tenure, conditional on skill levels and other controls for job and worker characteristics. In Japan, ten additional years of tenure increase wages by nearly 11% which is much higher than other OECD countries, except Korea and Turkey where the seniority wage system is also widespread (in the formal sector).

Figure 2.2. Seniority wages remain dominant in Japan

Note: These estimates were obtained from a cross-sectional regression of wages on tenure, squared tenure and controls for: gender, experience, years of education, literacy and numeracy skills, occupation, skill use at work, and educational status of the parents. The OECD is a weighted average and excludes Hungary, Iceland, Latvia, Luxembourg, Mexico, Portugal and Switzerland. Data for the United Kingdom refer to England and Northern Ireland and Belgium to Flanders.

Source: OECD calculations based on the Survey of Adult Skills (PIAAC) (2012, 2015), www.oecd.org/skills/piaac/.

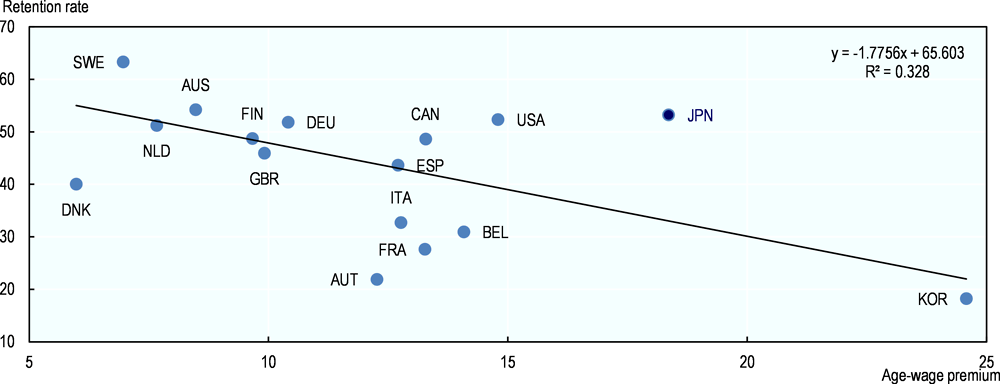

In many OECD countries, concerns have been raised that seniority-based pay schemes may create a barrier to employment of older workers (Frimmel et al., 2015[1]). A cross‑country comparison of the relationship between the age-wage premium (a percent wage growth as age increases from 40-49 to 50-59) and the retention rate of workers aged 60-64 shows a negative trend among OECD countries (Figure 2.3). In Japan, the relatively strong retention rates despite high wages is largely explained by the 2004 amendments to the Act on Stabilization of Employment of Older Persons, under which employers are mandated to either to raise the retirement age to at least 65 – implying that workers remain in their current job until they receive a public pension or re‑employ workers in a different type of job function at the same firm. While employment prospects of Japanese older workers fare well in quantitative terms, the majority experience a sharp decline in their job quality which in turn has negative implications for worker’s job satisfaction and productivity (see Chapter 4).

Figure 2.3. Seniority based pay are negatively correlated with retention of older workers

Note: The wage premium indicates the effects of age and tenure on wages estimated in the same regression as in Figure 2.2. The retention rate is defined as the number of employees aged 60-64 with job tenure of 5-years or more as a percentage of all employees aged 55-59 5-years previously (and 4-years previously for the United States).

Source: OECD calculations based on the Survey of Adult Skills (PIAAC) (2012) and OECD Job Tenure Dataset, http://stats.oecd.org//Index.aspx?QueryId=9590.

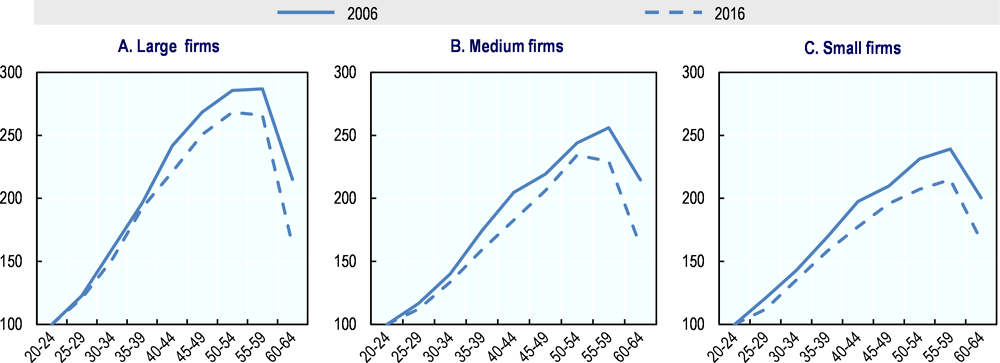

In Japan, wages for men rise quite steeply up to the age of 50‑54, but start to decline thereafter, with a sharp drop occurring between the age groups 55‑59 and 60-64 across firms of all sizes (Figure 2.4). In other words, as a consequence of the seniority wage system, after a certain age, wages fall steeply. The comparisons of wage profiles between 2006 and 2016 reveals that while the legislation on continued employment for older workers after the age 60 may have improved their job retention prospects, it may have also led to larger wage reductions at age of 60‑64. In 2006, most of people aged 60‑64 were not considered to be covered by the employment security law for older workers with the result that the average wage reduction was smaller than observed in 2016 when firms were obliged to hold onto employees who wished to work until 65.

Figure 2.4. Older workers face large wage declines

Note: Standard employees denote those who are employed by enterprises immediately after graduating schools and have been working for the same firms.

Source: Japanese Ministry of Health, Labour and Welfare Basic Survey on Wage Structure (2006, 2016).

More generally, the age‑wage profile for entire workers has become flatter over time due to the long period of economic stagnation, the reforms to extend working life and the increase in the employment of low‑paid non‑regular workers. However, as discussed in the following section, there is some evidence that firms have progressively included other factors than seniority when determining wages.

Seniority wage system is changing gradually

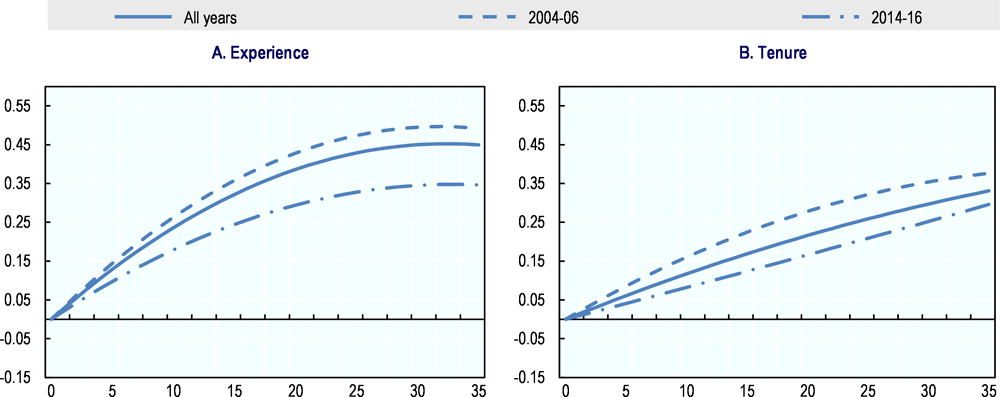

In line with other OECD countries, there are some indications that Japanese firms attach a decreasing value to age in setting wages. Figure 2.5 shows how the wage profile for full‑time male workers (aged 15-59) has changed between 2004-06 and 2014-16 by decomposing wages into experience (age minus years of educations) and tenure effects. Several findings emerge:

First, experience is positively correlated with wages, although with diminishing returns later on in careers i.e. 20 years or more after joining the labour market (Panel A). This can be explained by the result of an implicit contract between the employer and the employee such that wages depend on age or length of service, i.e. seniority, rather than an individual’s work performance.

Second, the return to tenure increases linearly with age i.e. wages increase proportionally with each additional year of tenure (Panel B). This is in line with human capital theory where productivity and earnings rise in the early to mid‑stage of a career because workers acquire new skills after leaving school on and off the job, and decline at older ages as workers and firms invest less in skills.

Finally, the slope of both experience-wage profiles and tenure-wage profiles have become flatter in the period 2014-16 suggesting that firms attach decreasing value to age. In both cases, this reflects a number of economic and policy reforms including firms’ attempts to cut labour costs as a result of economic stagnation and the government’s initiative to raise retirement age through the Employment Stabilization Act enacted in 2006.

Figure 2.5. The Japanese wage system has gradually shifted from its traditional seniority pay system

Note: Mincer-type OLS regression for full-time men aged 15-59.

Source: OECD calculations based on the Japanese Household Panel Survey (KHPS/JHPS) provided by the Keio University Panel Data Research Center.

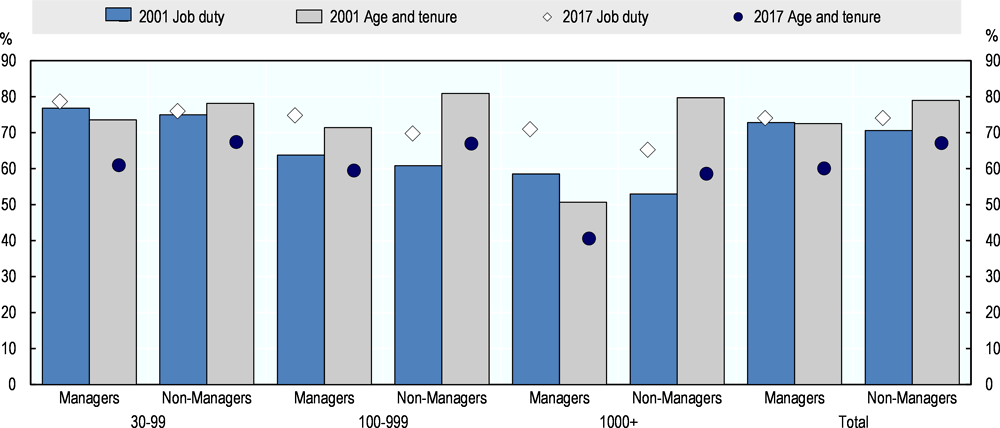

How and in which direction has the pay system been changed? According to the General Survey on Working Conditions in Japan, the percentage of companies that have introduced a job‑based payment for the managerial level has been increasing modestly for both managerial and non–managerial positions. While the share of those setting wages based on age and tenure dropped by almost 12 percentage points respectively between 2001 and 2017 (Figure 2.6). The biggest changes are observed among non-management positions in large firms with more than 1 000 workers: wage setting based on seniority system declined sharply (20% over the same period). Setting wages so that they reflect job function or responsibilities means that the number of firms that are seeking to better align wages and productivity is increasing.

Figure 2.6. More firms are determining wages based on job duties than age and tenure

Source: Japanese Ministry of Health, Labour and Welfare General Survey on Working Conditions, 2001 and 2017.

Besides the economic stagnation facing Japan over the past decade, these changes also reflect the ability of employers to change wage levels more flexibly in the face of the weak bargaining power of workers and fragmented collective bargaining system (OECD, 2017[2]).

Seniority pay strongly influence firms’ retirement policies and may reduce productivity

Evidence suggests that firms whose pay structure includes a greater seniority pay component may be more likely to opt for the option of re-employment including a pay cut, whereas other firms may be more likely to opt for an extension of the mandatory retirement age. This may partly explain variances across industries: Whereas over 96% of firms in the well‑paying finance sector and around 90% of firms in the important manufacturing sector kept their retirement age at 60, nearly one third of firms in the medical healthcare sector have already adopted alternative retirement schemes1 .

A mandatory retirement age of 60 is typically associated with rehiring workers in jobs with less responsibility and allows firms to cut wages significantly. Firms operating pay scales with large increases in wages in line with job tenure tend to resort more often to wage cuts after the (legal minimum) mandatory retirement age of 60. Some wage reduction may be in line with the older worker’s effective productivity. However, in Japan, there is uncertainty over the extent to which wage cuts after age 60 are legal if the job content is unchanged. A further reason is that paying workers differently for the same job may violate feelings of fairness. Wage increases with seniority are much less controversial than wage reductions after the age of 60. Wage increases with age can be justified by workers accumulating valuable experience. Furthermore, younger workers paid less will likely benefit from higher wages in the future also (if they remain with the same firm). By the same rationale, future wage cuts are unpopular not only with the affected workers, but also with younger workers. Justifying reductions in earnings may be easier when workers are given new (and less demanding) responsibilities. The earnings reductions are typically associated with firms reclassifying workers in different jobs. In practice, workers are mostly demoted to more simple tasks.

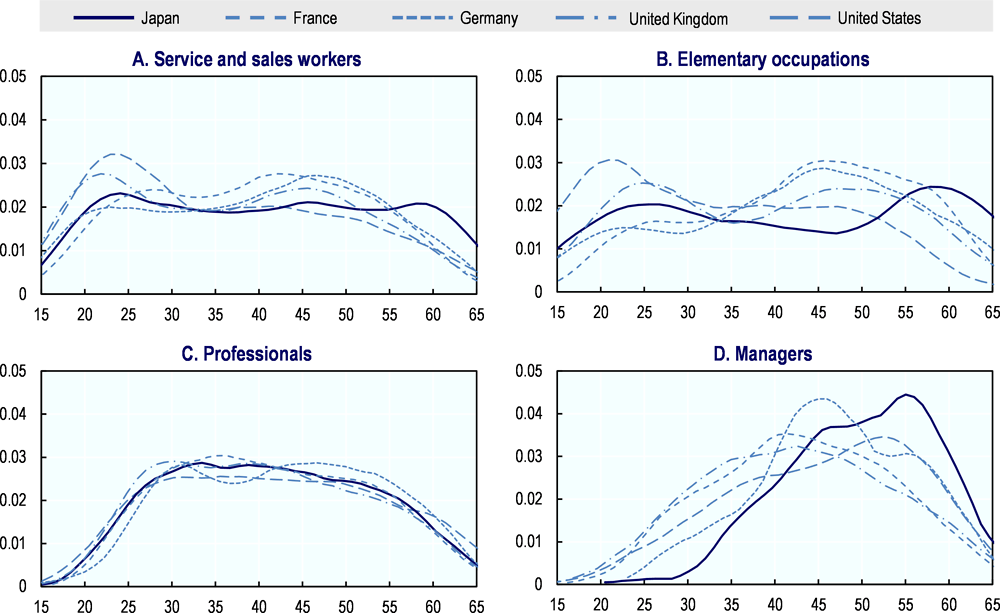

Rehiring may reduce productivity if workers are demoted because that is the only option firms see to reduce older workers labour costs independent of individual capacities. The fact that older workers above the age of 60 are frequently rehired leads to a change in occupations which is quite unique internationally, with older workers over‑proportionally represented in sectors with low productivity such as the “elementary occupations” (Figure 2.7, Panel B). Skills which are especially valued by older workers – for example their capacity to supervise younger colleagues (see Chapter 4) – are then less likely to be utilised then for workers who continue in their jobs.

Figure 2.7. Worker age profiles by occupation differ across countries

Note: Figures depict the smoothed age distribution of workers within a specified 1 digit ISCO 08 occupation group. Data for the United Kingdom refer to England and Northern Ireland.

Source: OECD calculations based on the Survey of Adult Skills (PIAAC) (2012, 2015), www.oecd.org/skills/piaac/

Employment Protection Legislation in Japan

Employment protection laws can play an important role in increasing the stability and quality of workers’ jobs. Nevertheless, overly rigid employment protection laws can diminish employment outcomes for vulnerable social groups, thus compounding existing labour market dualities between younger and prime-age workers; women and men; low- and high-skilled workers; and regular and non-regular employees (OECD, 2013[3]). In particular, employment protection laws can have an important influence over employers’ decisions around hiring and retaining older workers.

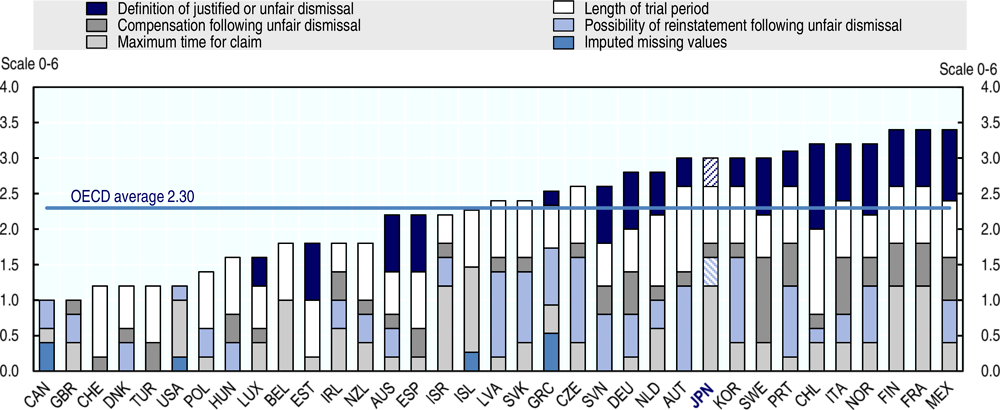

The index of protection of permanent workers against individual dismissals in Japan is above the OECD average (Figure 2.8), mainly due to the components of maximum time for claim, length of trial and definition of justified and unfair dismissals (difficulty of dismissal). Even though only a few requirements for dismissal are set in the law, the courts request firms to justify the fairness of redundancies by demonstrating appropriate past efforts to avoid the action (e.g. through in-house transfers or retraining) and by showing that the procedures are reasonable.

Specifically, the Labour Contract Act of 2007 states that any dismissal of workers that “If a dismissal lacks objective, reasonable grounds and is not considered to be appropriate in general societal terms, it is treated as an abuse of power and is invalid”. This very general formulation leaves the legal system considerable discretion in applying this standard. Judicial precedents have established four elements to determine whether employment adjustment as a result of corporate downsizing can be deemed an abuse of power by the employer:

The employer must establish the economic necessity for reducing its workforce.

The employer must demonstrate that all reasonable efforts to avoid dismissals (i.e. reducing overtime hours, re-assigning or seconding staff, offering voluntary retirement packages) have been made.

The employer must establish reasonable and objective criteria for selecting which workers will be dismissed.

The employer must show that the overall dismissal procedure is acceptable, for example by showing that unions or worker representatives were adequately consulted.

If an employer is judged to have failed to meet these criteria – all of which leave considerable room for interpretation – when dismissing a worker, the dismissal may be rendered invalid. In such cases, the court may order reinstatement with back pay. There is no time limit on when former workers may make a claim of unfair dismissal, although courts have sometimes disallowed complaints filed long afterwards, based on the principle of good faith.

This virtually hinders firms from dismissing staff for economic reasons. As a result, they make widespread use of the mandatory retirement age, which means that labour adjustment is confined to older workers or occurs by turning to non-regular workers.

Figure 2.8. Japan has relatively strong protections for permanent workers

Note: The figure presents the contribution of different subcomponents to the indicator for difficulty of dismissal. The height of the bar represents the value of the indicator for difficulty of dismissal. For the sole purpose of calculating the indicator of difficulty of dismissal, missing values of specific subcomponents are set equal to the average of other non-missing subcomponents for the same country, excluding the maximum time for claim.

Source: OECD Employment Protection Database, http://dx.doi.org/10.1787/lfs-epl-data-en.

A reform of employment practices could raise the hiring and retention of older workers

Further reforms of the Employment Stabilisation Act and mandatory retirement policies are needed

Despite the relative success of government reforms in shifting the standard age for retirement from companies from 55 to 65, the current system has a number of drawbacks. First, mandatory retirement requires firms to dismiss efficient workers whose productivity is still above the seniority-based wage at age 60, while high employment protection forces them to hoard inefficient workers until age 60. Second, the ability to hire retired workers on fixed-term contracts increases participation, but at the same time, the accompanying large declines in wages and poor quality jobs may encourage many workers to leave the labour force. Furthermore, large companies reduce workers’ responsibilities in line with the decreased wage level rather than seeking to maintain or increase the productivity of older workers.

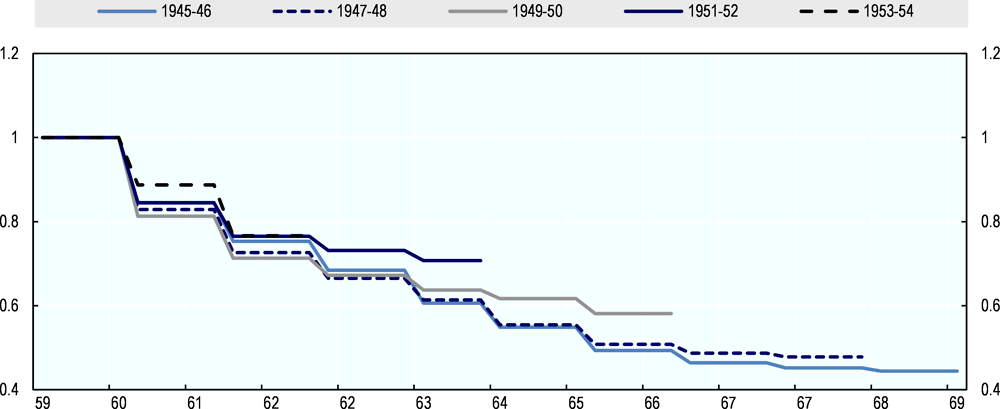

Re-aligning the mandatory retirement age with the pensionable age would be a major step forward to encourage firms to retain older workers and provide incentives for firm to invest in training to increase workers’ productivity. Evidence suggests that pension policy has a direct impact on people’s work decision. OECD analysis using the Longitudinal Survey of Middle-aged and Elderly Persons (LSMEP) suggests that recent pension reforms in Japan have helped to increase the labour force participation of older workers (See Box 2.1 for details on the gradual increase of pension eligible age and continued employment scheme for different cohorts). Figure 2.9 shows that the probability of employment has increased among younger cohorts as they face an increasing pension age. For example, when comparing the cohort of 1949 to 1950 in which the fixed rate of the pension age and age of continued employment rose from 64 to 65 with the cohort of 1947 to 1948, the employment rate at age 64 increased by 6.5 percentage points.

Other potential factors may have had an impact on this increase in the employment rate, such as macroeconomic conditions and individual specific effects, which are not controlled for. However, several studies report the positive effect of pension policy when controlling for other policy measures such as the Act on Stabilization of Employment of Older Persons (Kondo and Shigeoka, 2017[4]).

Figure 2.9. Increasing pension age has increased the chances of workers staying in the labour market

Note: The survival analysis calculates workers’ probability of still being employed at a given age from age 59 by birth-cohort.

Source: Japanese Ministry of Health, Labour and Welfare, Longitudinal Survey of Middle-aged and Elderly Persons (2005-2015).

In general, rising the eligibility age for social security pensions is unpopular with voters so that policy makers tend to avoid the discussion. However, there is an implicit consensus in the Japanese society that the working life should be longer in line with a longer healthy life expectancy given Japanese ethical values to remain in the labour market.

The current proposals on further raising the pension age – as discussed under the Fiscal System Council in the Ministry of Finance (May 2018) – should go hand-in-hand with reform of the mandatory retirement age. In the long run, Japan should consider abolishing the mandatory retirement age as has occurred in many other OECD countries (See Box 2.2 for details). Moreover, recent reforms of the Employment Insurance system which extended the eligible criteria for Employment Insurance (EI) to age 65 and above also bode well for creating a favourable environment for longer working lives.

Box 2.1. Legislative linkage between pensionable age and continued employment system

Japan has a public pension system consisting of two tiers: a basic flat-rate scheme and an earnings-related plan. By 2030, the pensionable age for both schemes will be at 65 and for both men and women. For men, it is already at 65 for the flat-rate component, but for the earnings-related component it will only reach 65 in 2025. For women, it will reach 65 for the basic component in 2018 and will rise to 65 only in 2030 for the earnings related component, beginning in 2018.

Thus, people face different legislative pensionable ages according to their birth cohort and gender as well as the corresponding age for the continued employment system. The table below summarises these ages for the public pension and the continued employment system. This natural policy experiment can be used for the quantitative assessment of the institutional impact of changes in the pension age on employment at older ages.

Table 2.1. Schedule of pension eligible age and continued employed system

|

Birth year (between April and March) |

Continued employment |

Pension fixed-rate tier |

Pension earnings-related tier |

|||

|---|---|---|---|---|---|---|

|

Men |

Women |

Men |

Women |

Men |

Women |

|

|

1945 |

60 |

63 |

60 |

60 |

60 |

|

|

1946 |

63 |

61 |

||||

|

1947 |

64 |

64 |

||||

|

1948 |

62 |

|||||

|

1949 |

65 |

65 |

||||

|

1950 |

63 |

|||||

|

1951 |

||||||

|

1952 |

64 |

|||||

|

1953 |

61 |

|||||

|

1954 |

65 |

|||||

|

1955 |

62 |

|||||

|

1956 |

||||||

|

1957 |

63 |

|||||

|

1958 |

61 |

|||||

|

1659 |

64 |

|||||

|

1960 |

62 |

|||||

|

1961 |

65 |

|||||

|

1962 |

63 |

|||||

|

1963 |

||||||

|

1964 |

64 |

|||||

|

1965 |

||||||

|

1966 |

65 |

|||||

Source: Japanese Ministry of Health, Labour and Welfare administrative materials.

Box 2.2. How other countries extend pension age while minimising negative effects on firms’ profits and ensuring employment for older people

In Germany, where the employment rate of people aged 60-64 (largely above OECD average in 2016) and 65-69 has strongly risen over the past decade, major pension policy reforms have raised the statutory retirement age, and have limited access to early retirement. Many labour contracts and collective wage agreements are based on the assumption that the labour contract ends no later than the statutory retirement age (which increasing to age 67 by 2030). However, pension reform in 2014 has facilitated temporarily prolonging the employment contract after reaching that age (OECD, 2018[5]). In addition to the effects of pension reforms, the general labour market context of falling unemployment and rising labour shortages have been a driver of higher employment rates for older workers.

In France, mandatory retirement before the age of 70 has been prohibited in the private sector since 2010 and constitutes unfair dismissal. France also took a number of decisive steps to raise the statutory retirement age and to restrict access to early retirement. The long‑career scheme introduced in 2003 is the main early retirement measure that remains. Since 2012, this scheme allows workers to qualify for long-career early retirement at 60. In addition, options still exist for retirement before the statutory minimum age. First, there are so‑called “active” categories in the public service and special schemes, which are defined by decree and include occupations involving arduous work or a particular risk. The 2013 pension reform created the individual arduous work account in order to enhance early recognition of arduous work rather than simply reward it at the end of a worker’s career through an early retirement option. Compared with Japan, Germany, the United States and the United Kingdom, the net replacement rate of pensions is higher in France (near the OECD average) (OECD, 2017[6]).

Sweden, where the employment rate of older workers (55-64) is higher than in Japan, has no fixed statutory retirement age. Major reforms of the public pension system dating back to 1999 (and becoming fully operational in 2003) allow for flexible and actuarially neutral retirement from the age of 61 for both men and women. As a result of the pension reform of 1999, a person can withdraw a full or partial pension after this age and continue to work full time. The number of pension recipients who are working increased considerably between 1997 and 2012. While in 2012, the share of the population aged 55‑69 reported combining pensions and work was the highest among 21 EU countries (OECD, 2017[6]), the share of pensioners who reported they were continuing to work for financial reasons was among the lowest in the EU (Eurofound, 2016[7]). Unlimited deferral of retirement is possible in the pension system with automatic actuarial adjustments, but the employer’s consent is required after the age of 67 (this age limit will be increased to 69) (OECD, 2018[8]). Note, however, that the employment rate of 65-69 years old in Sweden is slightly below OECD average, and markedly below the one of Japan.

Overhaul of the Seniority wage system

As highlighted above, Japanese companies are beginning to offer wage contracts to workers according to their duties while weakening the seniority elements. Larger companies are shifting away from the seniority system, and job-duty is given more weight in determining a firm’s basic wage. However, greater efforts are needed to weaken the link between compensation and seniority in order to fully reap the benefits of the increase in the pension age and mitigate the negative externalities from premature labour force exit and a shrinking labour force.

The Japanese Ministry of Health, Labour and Welfare (MHLW) provides subsidies to help Small and Medium-sized Enterprises (SMEs) incorporate worker performance and ability into their wage and personnel systems. The subsidy called Jinzai Kakuhotou Shien Zyoseikin (Jinzai Hyoka Kaizentou Zyosei course) was established in 2018 and is provided to encourage firms to establish a personnel evaluation system that is not based on regular and automatic pay raises but on workers’ vocational ability. Under this scheme, employers receive an initial amount of (JPY 500 000, around EUR 3 850) upon submitting their personnel evaluation reform plan to the local labour bureau. The plan must focus on vocational ability. Subsequently, a plan must put stress on vocational ability and the total wage cost of permanent and permanent-equivalent workers should be projected to increase by 2% a year later. Subsequently, a second subsidy (JPY 800 000, around EUR 6 150) is provided if firms’ labour turnover rate is actually decreased by 1% point, while total wage cost is increased by 2% points a year after their application and labour productivity by 6% points three years after their application.

There is no data available on the take-up of the subsidy though the current design suggests that employers could be discouraged as the preparation of the application is burdensome and complicated. Furthermore, the subsidy requirements seem to exclude older workers in the calculation of total wage cost because one of the conditions requires firms to show over 2% change in total wage cost of permanent and permanent-equivalent workers aged 25-60 compared to their previous year’s total wage cost. Potentially, firms can offset this cost increase by lowering the wage level of rehired older workers, which may widen the wage separation between permanent workers and older workers. In addition, employers have to wait for three years after the personnel change to get the second subsidy. The government should monitor barriers to high take-up including the eligibility criteria, and assess the effectiveness of the newly established subsidy to minimize deadweight losses.

Among other support, JEED (Japan Organisation for Employment of the Elderly, Persons with Disabilities and Job Seekers) also provides a consultancy service to employers to help them change their seniority wage system. To encourage firms to hire workers beyond 65 or increase the mandatory retirement age beyond 65, contracted consultants at JEED provide firms with recommendations on a broad range of personnel management reform, such as evaluation schemes, wage design (away from a seniority-based system towards a job‑related/competency‑related wage system), workplace improvement, and training/health management.

Ultimately, wage policy is determined primarily by the social partners. The levers for action available to the authorities in terms of fixing wage are therefore limited. However, the authorities can give an example in public-sector wage-setting arrangements by introducing performance pay and limiting automatic rises in salary with tenure and encourage the social partners in the private sector to follow their example (see Box 2.3).

Box 2.3. Country examples of wage-setting reforms in the public sector

In Croatia, an Action Plan 2015-16 for regulating of the wage system in the public sector was adopted in July 2015 establishing a system of objective and impartial evaluation for motivating and/or sanctioning civil and public servants for their work and rewarding employees based on ratings, as well as enabling a change of pay grades without formal career promotions. In Hungary, in the public sector the principle of seniority continues to exist, but newly established career schemes emphasise personal competencies and efficiency rather than age, time served or automatic wage progression.

Finland is another good example of this policy. Since 1994, a New Pay System (NPS) has been gradually adopted for central government employees. It was mainly developed during 2003-06 and was finalised in 2007. The NPS was introduced through a collective labour agreement including, as an essential part, the salary tables for job demand levels and personal performance levels. Its purpose was to decentralise pay and to manage staff by objectives. In 2008 the pay system was further developed and improved within the framework of collective and sector labour agreements. Also in the local government sector, an individuals’ wage is determined by work experience, individual competence and work performance. However, in 2013 about still 6.5% of total pay by the local government was still linked to the length of service (OECD, 2018[9]).

Encouraging firms and the public sector to engage more in so-called “secondary hiring” may also help, i.e. hiring workers at different points in their careers and not only immediately after college. Since graduate hiring is the modus operandi of the largest corporations with particularly well-paid jobs, the system restricts career options for individuals who choose not to join large firms after education. Hiring at different points over the lifecycle would allow workers to put firms into competition to each other. Currently, younger workers accept lower pay in exchange for a promise of higher pay in the future. With more competition across firms, workers may be able to negotiate for higher wages and better working conditions at younger ages. Higher wages for younger workers may then be a step towards loosening the role of tenure in pay scales. The public sector could for example provide an impetus by hiring at different ages. Removing institutional obstacles for workers to change jobs in their mid-career would be also important. Currently, tax deductions on a worker’s retirement allowance rise disproportionately after 20 years of tenure discouraging workers to change their employers before this limit. To facilitate labour mobility in mid-career, the government should remove the kink in the tax deductions at 20 years of tenure.

Finally, the government legislated Equal Pay for Equal Work as part of an agenda to modernize the labour market under the motto “Workstyle reform”. On the one hand, the principle of equal pay for equal work may lead to a reform of strongly seniority-based pay schedules, increasing the role of performance-based pay. On the other hand, there is a risk that it may further cement the strong and sudden downgrading of the jobs of workers after reaching the age of 60 if there would be a possibility that substantial pay cuts can be justified by a corresponding modification of the job tasks and taking into account other working conditions.

Simplifying employment protection legislation for permanent workers

Together with the seniority wages, unless the employment protection rules are reformed, employers will continue to resist raising the mandatory retirement age. The key problem of employment protection in Japan is not its strictness but its ambiguity. The unpredictability of judicial procedures to review ex post employment adjustment increases the cost and uncertainty for firms, thus discouraging them from hiring workers on indefinite contracts. Indeed, international evidence demonstrates that the creation of temporary jobs is a common response by firms to high costs of reducing permanent jobs. (Kahn, 2010[10])

Moving forward, it would therefore be particularly important to clarify the conditions under which companies can dismiss workers on permanent contracts for economic reasons. Such reforms were recently undertaken in both Spain and France. In Spain, since the 2012 labour market reform, a dismissal is always justified if the company faces a persistent decline (over three consecutive quarters) in revenues or ordinary income. In addition, and perhaps more importantly, the firm does not have to prove that the dismissal is essential for the future profitability of the firm (OECD, 2014[11]). In France, since the 2016 labour market reforms, a dismissal on economic grounds will be justified if sales or orders fall for: four consecutive quarters in comparison to those of the previous year for firms with 300 or more employees; three consecutive quarters for firms with at least 50 but fewer than 300 employees; two consecutive quarters for firms with at least 11 but fewer than 50 employees; and one quarter for firms with fewer than 11 employees.

Finally, it is important to reduce the gap of employment protection between regular and non-regular workers in order to reduce employer’s incentives to rehire workers on short term contracts. This could include a reduction in employment protection for regular workers, even though this is difficult to implement in practice. In some European countries, it has been achieved through grandfathering – allowing current workers to keep current levels of employment protection but not newly‑hired workers (OECD, 2017[12]). Another option would be to compensate regular workers for a reduction in employment protection through reforms that also accomplish the goal of improving work-life balance. For example, regular workers could be given additional leave, the right to refuse involuntary relocations and a reduction in overtime work. Such measures would reduce the incidence of “karoshi” (death caused by overwork), an issue of concern in Japan.

Age management policies and age discrimination

Towards better practices on age discrimination

Unlike many other OECD countries, Japan does not have general age discrimination legislation. Currently, discrimination on the basis of age is ruled out during recruitment by the Employment Measure Act enacted in 2007. Under this requirement, employers cannot set age limits in job offers in principle. When they need age limits, employers have to explain the reasons for the provision.

To the extent that employers have stereotypical views of older workers, this could give rise to age discrimination in hiring, firing, compensating, training and promoting older workers (OECD, 2006[13]). Further efforts should be made for the prevention of age discrimination and to change the attitudes of employers towards older workers. For example, comparing the recent situation in four OECD countries (France, Netherlands, Norway and Switzerland), these initiatives include legislation (except in Switzerland), awareness campaigns, development of “tool kits”, promotion of best-practices as well as consultation and co-operation with the social partners (Sonnet, Olsen and Manfredi, 2014[14]).

Some countries have revisited legislation to better tackle age discrimination issues. This is particularly the case of Sweden. A new act that entered into force in 2009 prohibits discrimination on the grounds of age. The Discrimination Act applies to working life, educational activities, labour market policy activities, employment services not under public contract, the hiring policies of those starting or running a business, professional recognition, and membership of certain organisations. The Equality Ombudsman is charged with monitoring compliance with the act. The Ombudsman’s tasks also includes raising awareness and disseminating knowledge and information about discrimination and the prohibitions against it among both those who risk discriminating against others and those who risk being subjected to discrimination. Also in Ireland, the Equality Mainstreaming Approach initiative, managed by the Irish Human Rights and Equality Commission and involving the social partners, facilitates and supports institutional change within providers of vocational education and training, labour market programmes and SMEs.

Age management: good practice from other OECD countries

Promotion of age management policies in Japan is also limited compared to other OECD countries. There is ample evidence suggesting that age management policies can help older workers to improve their productivity and support their retention. Research and the collection of best practice examples, which have been carried out mainly since the 1990s, have shown that holistic age management approaches, including work organisation, training, health measures, working time policies and other measures are the most valuable. These studies demonstrate a positive link between the quality of work and workers’ productivity.

Going forward, Japanese government could develop tools and schemes that support employers especially SMEs similar to that in other OECD countries. Notably in Germany, the United Kingdom, United States and France, companies have put into practice age management strategies aimed at avoiding a decline in productivity, maintaining or improving the productivity of their older workers. Many of these initiatives require collaboration between firms, social partners and the Government to reap their full benefits (See Box 2.4 for details). More concretely, the Japanese Government should consider developing a tripartite body or an overarching committee including a range of stakeholders at the national level to assess the current landscape of age management policies and make recommendation on better workplace practices and reforms of wage setting.

Box 2.4. Promoting age management strategies to keep older workers productive – experiences from OECD countries

Initiatives by firms, social partners and governments in various OECD countries highlight the opportunities of active age management across economies, industries or for individual firms.

1) Since 2007, the German car producer BMW has been developing an innovative, bottom-up approach for improving productivity in light of workforce ageing that is now being applied in plants in the United States, Germany and Austria. This initiative was developed in BMW’s power train plant in Dingolfing. In the most labour-intensive lines of production, health care and skill development were promoted, alongside the workplace environment and more access to part-time was granted. As a result, productivity increased by 7% in one year, erasing productivity differences with other plants with younger staff (Christoph et al., 2010[15])These results are in line with (Börsch-Supan and Weiss, 2016[16]) who find individual productivity increases in a large car manufacturer in Germany until age 65. While older workers are slightly more likely to make errors, they hardly ever make severe errors.

2) A collective agreement for the construction industry in Switzerland put in place arrangements for early retirement at a higher age than the usual exit age in the sector. As a result, more workers continue in employment later in life and employers have been improving working conditions (OECD, 2014[17]).

3) In the German chemical industry, the social partners signed a collective agreement “lifelong working time and demography”. The agreement covered training, skill development, work organisation and lifelong working time models. The agreement obliged all companies to analyse their age structure as a starting point for company‑specific age management strategies. To finance measures such as gradual retirement schemes, health, training programmes and other schemes promoting a good work-life balance, demography funds were also set up, financed by firms with EUR 300 per staff member per year. The use of the funds is negotiated at the firm and workplace level with the works councils (Latniak et al., 2010[18]).

4) Norway’s Inclusive Workplace Agreement (IA Agreement) is a central framework for tripartite co-operation between social partners and the government on age management (OECD, 2013[19]), encouraging companies to develop a more senior‑friendly policy and implement special measures to retain older workers. It was launched in 2001 and has been renegotiated every four years since then. The agreement has three goals: i) a 20% reduction in sick leave; ii) increased employment of people with reduced functional ability; and iii) extending the effective labour force exit age for an employee aged 50 by six months compared with 2009. In 2012, 58.4% of Norwegian employees worked in firms with an IA Agreement.

5) In France, the government passed a law obliging companies to develop an age management action plan or to conclude collective agreements at the sector or enterprise level in order to keep older workers in employment. The action plans cover recruitment, career development, working conditions, training, knowledge‑transfer and mentoring. However, the implementation of age management measures remains weak (OECD, 2014[20]).

6) In 2010, the Australian Government introduced a Productive Ageing Package to reduce barriers to employment for older workers. One component of the initiative included the creation of the Consultative Forum on Mature Age Participation, which concluded its work in 2012. The forum, made up of representatives from diverse social partners, shared best practices and recommendations for supporting older workers in the workforce through various publications, some of which specifically for employers.

Summary and Recommendations

Japan has made considerable efforts in recent years to address both supply-side as well as demand-side measures to encourage older people to remain in work longer. While past reforms have been successful in expanding employment opportunities for older workers, they have also allowed firms to adjust their workforce by re-hiring some older workers in low paid and low productive jobs. There is still scope for further action in the areas of employment protection legislation, pay practices and mandatory retirement policies to effectively increase the duration and quality of working lives.

Box 2.5. Key Recommendations

Gradually increase the mandatory retirement age as this will reduce the risk that older workers are re-hired as non-regular workers. In the long-term, consider abolishing the retirement age as has occurred in other OECD countries.

Ensure that further amendments to the legislation concerning employment of older workers are combined with adequate implementation of the work-style reforms that pursue the equal-pay principle to eliminate the transition of older workers into poor quality and low productive jobs.

Tackle labour market segmentation between regular and non-regular workers through a comprehensive strategy to lower employment protection for regular workers, in part by setting clear rules for the dismissal of workers, and to expand social insurance coverage and training programmes for non-regular workers. This would reduce the incentive for employers to have recourse to precarious forms of employment and to switch the status of older workers from regular workers to non-regular workers after reaching the mandatory age of retirement.

Evaluate the effectiveness of the new subsidy system to support SMEs to reform their seniority-wage system and abolish or reform as necessary.

Promote government services on advising firms on broader contents of personnel reform and wage design in a more systematic and co-ordinated fashion. In particular, Hello Work should promote the HRM advisory services provided by JEED.

Facilitate labour mobility in mid-career by removing the kink in tax deductions on retirement allowances at 20 years of tenure. Currently, these tax deductions rise disproportionately after 20 years of tenure discouraging them to change their employers before this limit.

Set up a tripartite body including social partners and the government at a national level for promoting better workplace practices (especially age management and reforming wage setting). This would help to seek consensus on ways forward to reform the seniority pay system as well as exchange best practice among employers on their policies on age diversity.

Complement age discrimination measures with other initiatives to promote age diversity, such as positive and affirmative action.

References

[16] Börsch-Supan, A. and M. Weiss (2016), “Productivity and age: Evidence from work teams at the assembly line”, The Journal of the Economics of Ageing, Vol. 7, pp. 30-42, http://dx.doi.org/10.1016/j.jeoa.2015.12.001.

[15] Christoph, L. et al. (2010), The Globe: How BMW Is Defusing the Demographic Time Bomb, https://hbr.org/2010/03/the-globe-how-bmw-is-defusing-the-demographic-time-bomb (accessed on 29 November 2018).

[7] Eurofound (2016), “Sustainable work throughout the life course: National policies and strategies European Foundation for the Improvement of Living and Working Conditions”, http://dx.doi.org/10.2806/34637.

[1] Frimmel, W. et al. (2015), “Seniority Wages and the Role of Firms in Retirement”, http://hdl.handle.net/10419/114065 (accessed on 24 May 2018).

[10] Kahn, L. (2010), “Employment protection reforms, employment and the incidence of temporary jobs in Europe: 1996–2001”, Labour Economics, Vol. 17/1, pp. 1-15, http://dx.doi.org/10.1016/J.LABECO.2009.05.001.

[4] Kondo, A. and H. Shigeoka (2017), “The effectiveness of demand-side government intervention to promote elderly employment: Evidence from Japan”, Industrial and Labor Relations Review, http://dx.doi.org/10.1177/0019793916676490.

[18] Latniak, E. et al. (2010), Umsetzung demografiefester Personalpolitik in der Chemischen Industrie Inhaltliche und prozessuale Analyse betrieblicher Vorgehensweisen, http://www.boeckler.de (accessed on 04 December 2018).

[9] OECD (2018), Key policies to promote longer working lives. Country note 2007 to 2017, Finland, http://www.oecd.org/els/employment/olderworkers (accessed on 09 November 2018).

[5] OECD (2018), Key policies to promote longer working lives. Country note 2007 to 2017, Germany, http://www.oecd.org/els/employment/olderworkers (accessed on 08 November 2018).

[8] OECD (2018), Key policies to promote longer working lives. Country note 2007 to 2017, Sweden, http://www.oecd.org/els/emp/Sweden_Key%20policies_Final.pdf (accessed on 08 November 2018).

[12] OECD (2017), OECD Economic Surveys: Japan 2017, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-jpn-2017-en.

[2] OECD (2017), OECD Employment Outlook 2017, OECD Publishing, Paris, https://dx.doi.org/10.1787/empl_outlook-2017-en.

[6] OECD (2017), Pensions at a Glance 2017: OECD and G20 Indicators, OECD Publishing, Paris, http://dx.doi.org/pension_glance-2017-en.

[20] OECD (2014), Ageing and Employment Policies: France 2014: Working Better with Age, Ageing and Employment Policies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264207523-en.

[11] OECD (2014), The 2012 Labour Market Reform in Spain: A Preliminary Assessment, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264213586-en.

[17] OECD (2014), Vieillissement et politiques de l'emploi : Suisse 2014, Ageing and Employment Policies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264222823-fr.

[19] OECD (2013), Ageing and Employment Policies: Norway 2013: Working Better with Age, Ageing and Employment Policies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264201484-en.

[3] OECD (2013), OECD Employment Outlook 2013, http://dx.doi.org/empl_outlook-2013-en.

[13] OECD (2006), Live Longer, Work Longer, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264035881-en.

[14] Sonnet, A., H. Olsen and T. Manfredi (2014), “Towards more inclusive ageing and employment policies: the lessons from France, the Netherlands, Norway and Switzerland”, De Economist, http://link.springer.com/article/10.1007/s10645-014-9240-x (accessed on 27 June 2017).