Turkey has made some progress towards green growth, increasingly integrating sustainable development into National Development Plans and promoting high levels of investment in renewable energy. Further effort is needed to address environmental issues that will act as a constraint on economic growth, such as water scarcity and air pollution, and to capture market opportunities in growing environmental goods and services markets. This chapter considers several policy levers that could be used to accelerate green growth transition. These include reforming fossil fuel and vehicle taxation; putting a price on carbon, congestion and water; reducing subsidies for fossil fuel use and environmentally harmful agricultural activities; mobilising private sector investment in environmentally beneficial infrastructure; strengthening policy frameworks supporting eco-innovation; and promoting environmentally friendly foreign direct investment.

OECD Environmental Performance Reviews: Turkey 2019

Chapter 3. Towards green growth

Abstract

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

3.1. Introduction

Sustainable development and green growth are important to Turkey’s overall development, as environmental challenges are increasingly impacting economic growth and societal well-being. Water scarcity and quality, air pollution, coastal erosion and temperature extremes, all exacerbated by climate change, will increasingly constrain growth and impose costs on governments, businesses and households.

Turkey has put in place many tools to support a transition towards sustainable development and green growth. The government’s growing emphasis on meeting Sustainable Development Goals (SDGs) holds significant promise to drive additional action to improve environmental performance, reduce health effects of air pollution and improve resilience to water stress. Incentives are helping to drive investment in renewable electricity generation. Increasing rail and other public transit, and the push to develop a national electric car combined with a charging infrastructure, could bring a much-needed shift towards cleaner cities.

However, Turkey faces challenges in transitioning to a more environmentally sustainable economic model. Large energy-intensive industries drive gross domestic product (GDP) growth, and fossil fuels dominate the energy mix. Several measures are slowing down progress. Subsidies for coal production, tax exemptions for petroleum use, and fuel and vehicle taxation that does not reflect environmental criteria are delaying the transition to cleaner energy. Infrastructure investment continues to be more heavily weighted towards road transport than alternatives. Furthermore, few measures are in place to address traffic congestion and urban air pollution.

Financing mechanisms for environmental projects are emerging, but not yet at the scale needed to maximise private sector involvement across all types of investments. Renewable energy investment, for example, is critical to addressing air pollution and greenhouse gas (GHG) emissions in Turkey. However, fees and other project requirements have limited or delayed uptake of renewable energy incentives for some solar projects. Turkey also risks failing to capture growing domestic and international opportunities in environmental goods and services (EGS) markets without further strengthening the policy framework supporting eco-innovation.

3.2. Framework for sustainable development and green growth

Turkey does not have a green growth strategy, but does incorporate the principles of sustainable development into National Development Plans (NDPs). Turkey’s NDP provides overall strategic direction and identifies priorities. The tenth NDP for 2014‑18 includes sustainable development as one of its main principles (Chapter 1). Environmental rights are also enshrined in Turkey’s Constitution, which articulates rights to a healthy and balanced environment. It states that protecting environmental health and preventing pollution is a duty of government and citizens.

The 11th NDP is under preparation, with SDGs forming its central component. Turkey has already made significant progress in several areas, including reducing poverty, increasing enrolment in primary education, reducing rates of child and maternal mortality, and increasing development assistance to developing countries. A 2017 report comparing performance on SDGs across countries found that Turkey ranked 67th out of 157 countries. The report highlighted a need for further progress on a variety of issues. These included obesity rates, years of schooling, female labour force participation, youth unemployment, number of researchers and patents, income inequality, air pollution, municipal solid waste, GHG emissions, protected areas and ocean water quality (BS and SDSN, 2017). To achieve better environmental outcomes, the 11th NDP would need to emphasise reform of tax systems that encourage fossil fuel use and improved incentives for investment in renewable energy, energy efficiency and cleaner vehicles. Improved evaluation is also needed to understand the aggregate and relative effectiveness of environmental measures included in NDPs. The Paris Collaborative on Green Budgeting launched by the OECD, France and Mexico in December 2017 is aimed at supporting governments in their efforts to green fiscal policy and embed environmental objectives into national budgeting and policy frameworks.

In 2016, Turkey approved a rural development action plan that included “environmental improvement and continuity of natural resources” as one of its five strategies. The increased emphasis on sustainable development in rural development programmes is consistent with recommendations made in the OECD’s 2008 Environmental Performance Review (EPR) of Turkey.

The Strategy and Budget Office of the Presidency (former Ministry of Development) prepares NDPs in conjunction with the Ministry of Treasury and Finance and co‑ordinates implementation. The National Sustainable Development Commission (NSDC), operating since 2004, follows up and reviews implementation of SDGs. Members include the Ministry of Foreign Affairs, Ministry of Interior, Ministry of Environment and Urbanization, and the Strategy and Budget Office. Other public institutions, private sector representatives and non-governmental organisations (NGOs) are invited to meetings depending on the agenda. The NSDC may grow in the future, as it takes on greater responsibilities related to SDGs. A strong role for the NSDC will be important to breaking down silos across policy institutions that have impeded transition to an integrated, cross-disciplinary approach; it would also help improve consistency across policies (MoD, 2016).

Indicators are key in assessing the effectiveness and efficiency of policies and programmes related to NDPs and SDGs. Turkey’s sustainable development indicators are relatively comprehensive. However, additional and more disaggregated indicators are needed to monitor progress within the context of SDGs and NDP priorities (MoD, 2016; TurkStat, 2018a). Turkey is ready to publish a set of approximately 80 SDG indicators, which include 20 new indicators, in 2018. The initial set is drawn from the UN Global Indicator Framework of 230 indicators, and focuses on areas where data are available to produce SDG indicators. A number of proxy indicators have also been considered. TurkStat is continuing to explore the development of new indicators through stakeholder workshops. However, financing data collection and generation has been identified as an ongoing challenge (MoD, 2016).

3.3. Greening the system of taxes and charges

Turkey’s overall tax to GDP ratio is among the lowest in the OECD at 25.5% in 2016, compared to an OECD average of 34.3% (OECD, 2017a). Turkey also has higher tax revenues from goods and services taxes and a lower proportion of revenues from taxes on personal and corporate income than the OECD average. A 2018 economic forecast found that Turkey’s Medium-Term Economic Programme provides a prudent fiscal framework (OECD, 2018a).

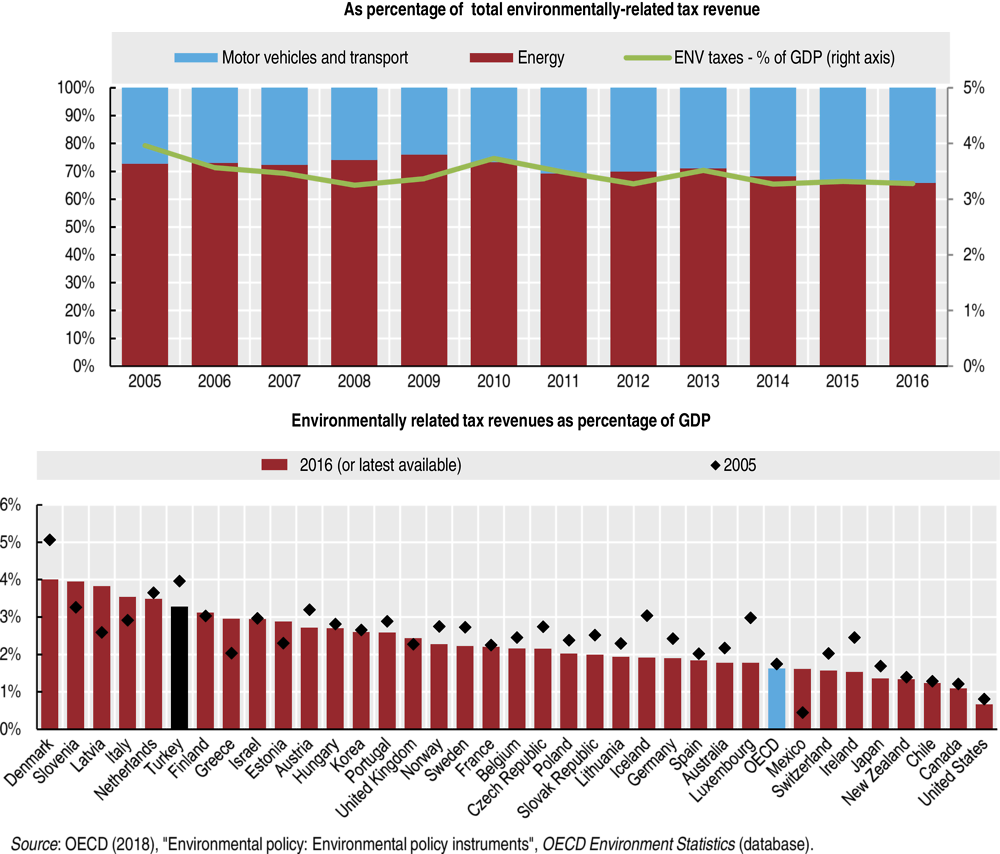

Revenue from environmentally related taxes decreased from 4% to 3.3% of GDP between 2005 and 2016. Despite the decrease, these taxes remain well above the OECD average of 1.6%. The relative proportion of revenue raised from energy taxes decreased over the period, with more revenue raised from motor vehicle and transport taxes (Figure 3.1). Despite high overall environmentally related taxes, gaps remain. For example, there are low taxes on coal and natural gas, higher taxes on gasoline than diesel, and vehicle taxes that do not fully reflect the environmental costs of their use. There are also substantial fuel tax exemptions.

Figure 3.1. Share of environmentally related tax revenues is among the highest in the OECD

3.3.1. Taxes on energy products and carbon pricing

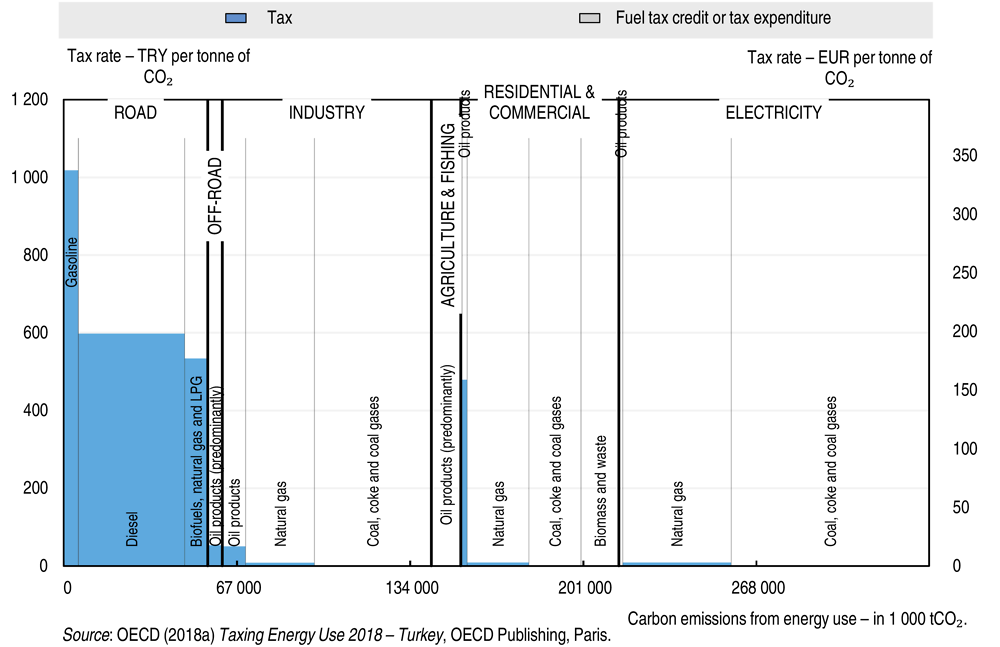

Taxes on energy products continue to provide the lion’s share (66%) of revenue from environmentally related taxes. However, this share is lower than the OECD average of 72% (OECD, 2018b). There are two main taxes on energy products in Turkey. A special consumption tax targets oil products and natural gas across all sectors. An electricity consumption tax applies to both residential (5% of bill) and industrial and commercial (1% of bill) consumers. The road sector faces the highest tax rates, with much lower levels of taxation for industry, agriculture and fishing, residential, and commercial and electricity sectors (OECD, 2018c) (Figure 3.2).

Oil products are taxed at much higher rates than coal or natural gas. Fuels used for domestic aviation and navigation are untaxed. Meanwhile, petroleum products used for oil exploration and production activities, or by vehicles carrying export goods, receive a full tax reduction (Section 3.4.1) (OECD, 2018c). Ideally, energy taxation should reflect the costs that environmental externalities such as air pollution and GHG emissions impose on society. This would imply a much higher level of taxation for coal in particular, though Turkey’s tax profile does not differ markedly from many other OECD member countries.

Figure 3.2. High effective tax rates on energy use in the road sector, but low in other sectors

Though road fuels face relatively higher taxes, they do not reflect the environmental costs associated with their use. Like many OECD member countries, Turkey maintains a differential between gasoline and diesel tax rates that encourages diesel use. Diesel cars are growing in popularity in Turkey, which has contributed to high levels of air pollution (Chapter 1). In addition, diesel with higher sulphur content is taxed at a slightly lower rate, which is inconsistent with efforts to reduce air pollution from road transport. While Turkey’s tax rates on vehicle fuels have increased since 2008, the differential between gasoline and diesel has remained constant. Effective carbon prices in road transport in Turkey are in the middle range of OECD countries (OECD, 2018d).

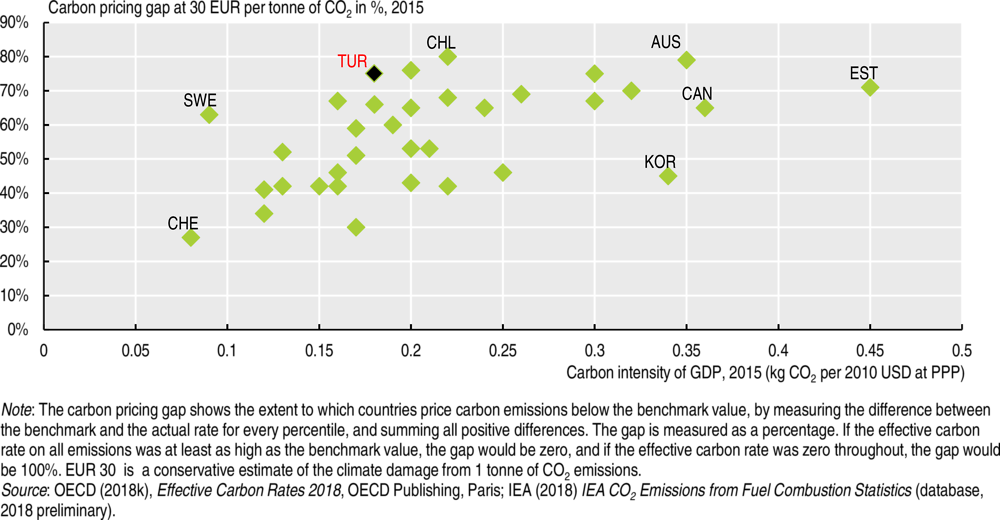

Overall, energy taxes do not reflect the climate costs of fuel use. In 2015, 51% of carbon emissions from energy use were unpriced. Furthermore, only 21% of emissions were priced above EUR 30 per tonne of CO2 (a conservative estimate of the climate damage from 1 tonne of CO2 emissions). This highlights a lag in implementing cost-effective policies to decarbonise the economy relative to other OECD countries (OECD, 2018a) (Figure 3.3). Turkey, however, has lower carbon intensity due to factors such as lower levels of car ownership, greater use of renewables in electricity generation and lower energy use intensity per capita.

As carbon pricing is gaining momentum worldwide, delaying abatement or pursuing mitigation policies in a way that is more costly than necessary may impair Turkey’s long-term competitiveness. Such approaches, for example, may fail to stimulate low-carbon innovation and allow investment in long-lived, carbon-intensive infrastructure. Concerns related to the economic impact of carbon pricing could be addressed through careful design, gradual implementation, revenue recycling and complementary measures that support continued economic growth. Turkey has not committed to domestic carbon pricing, but is seeking carbon credits from international markets to help achieve its 2030 GHG target (Chapter 4).

A study commissioned by the Ministry of Environment and Urbanization analysed a potential roadmap for a GHG emissions trading system (ETS) in Turkey (Ecofys, 2016). The report recommended a Turkish pilot ETS of two-three years. This would consist of a dynamic allowance reserve to allow for growth, grandfathered allowance allocation with a certain share of auctioning, use of domestic offsets registered under existing voluntary standards and no linking of the pilot ETS to other trading schemes (Ecofys, 2016). The government has not announced plans to follow through on the recommendations.

Figure 3.3. Turkey has relatively fewer emissions priced at high levels

To help improve Turkey’s readiness for carbon pricing, the Mid-size Sustainable Energy Financing Facility (MidSEFF) established by the European Bank for Reconstruction and Development (EBRD) has launched a carbon market development programme. It aims to promote participation of Turkish banks and companies in carbon markets in Turkey and abroad through three key measures. It supports capacity building and policy dialogue; provides technical assistance for carbon asset development and monetisation of carbon credits; and trains Turkish partner banks on available carbon market services (MidSEFF, 2018a). Turkey is already the fourth largest supplier of voluntary carbon offsets after the United States, India and Indonesia (MidSEFF, 2018a).

3.3.2. Transport taxes and charges

The transport sector is, together with industry, the highest energy consumer and the fastest growing source of GHG emissions (Chapter 1). Revenue from motor vehicle and transport taxes increased from 27.3% of environmentally related tax revenue in 2005 to 34.2% in 2016 compared to an average of 24.5% in OECD member countries. Vehicle taxes are less efficient than fuel taxes and distance-based charges in reducing emissions of GHGs and local air pollutants. However, they can promote fleet renewal towards cleaner vehicles. As vehicles become more efficient, increased reliance on distance-based charges will better address road transport externalities and provide stable revenue (OECD, 2018e).

Taxes on vehicles

Turkey has two types of vehicle taxes: taxes on the value of the vehicle when purchased (a value-added tax, or VAT and a special consumption tax, or SCT); and an annual motor vehicle tax (MVT). The seller pays SCT on motor vehicles before they are first registered, meaning that purchases of used vehicles are not subject to the tax (as is standard practice). The SCT is a percentage of the net-of-tax price of the vehicle. It ranges from 0% to 160% depending on the type and value of vehicle, and its engine size. Vehicles with smaller engine prices pay a tax based on a smaller percentage of the vehicle value. Cars with an engine capacity over 2 000 cm3 pay 160% of the net-of-tax price of the vehicle. Electric cars pay a lower rate, 3-15%.

This structure, combined with high tax levels, creates a strong incentive to buy new vehicles with small engines or used vehicles, or to lease instead of purchase (GlobalFleet, 2017). While smaller engines are environmentally preferable, used older vehicles are likely to have higher emissions. The average age of registered cars was 13.2 years in 2017, higher than the EU average (MEU, 2015; ACEA, 2018). There are also several exemptions from the SCT: for the disabled, diplomats and petroleum exploration. Renewal of taxis, public transport and commercial cargo vehicles is also exempted from the SCT until 30 June 2019. If a vehicle 16 years or older is exported or scrapped, Turkey allows for up to a TRY 10 000 SCT reduction. This measure, introduced in 2018, aims to encourage the scrappage of older vehicles.

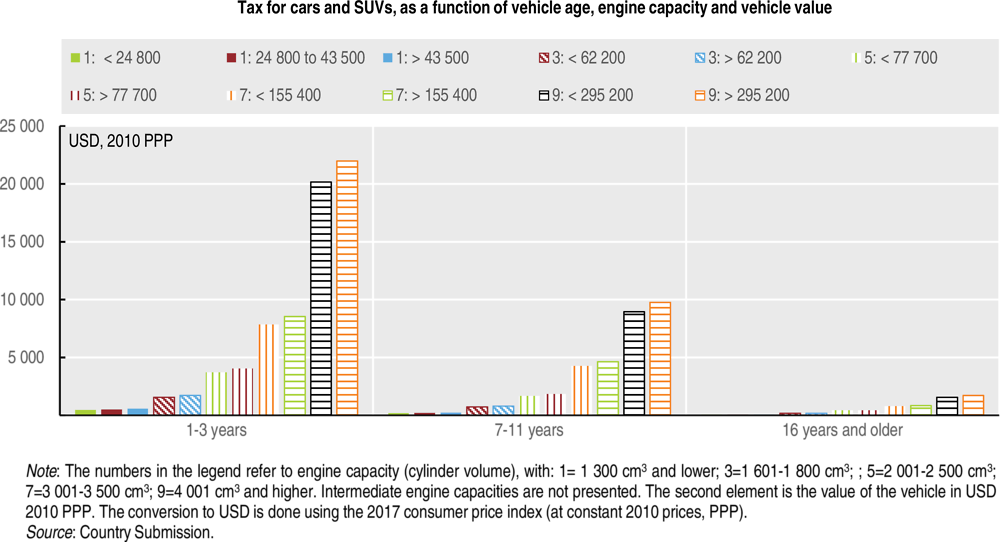

Turkey’s MVT also provides a financial incentive to use older vehicles with smaller engines (Figure 3.4). The previous motor vehicle tax was based on engine capacity and the age of the vehicle, with lower rates for smaller and older vehicles. Decreasing tax rates as the vehicle ages are meant to reflect depreciation of vehicle value over time. The revised tax brought into effect in the 2018 budget added the concept of vehicle value. This is based on the tax base value used to calculate VAT at the time of delivery, acquisition and importation. The budget also increased tax rates to 15% for cars under 1 300 cm3 and 25% for other vehicles. Lower value vehicles now face a lower tax rate.

Figure 3.4. Motor vehicle taxes favour older cars with smaller engines

Turkey’s motor vehicle tax also has positive elements. For example, it applies broadly to cars, sport utility vehicles, motorcycles, buses, trucks, planes and helicopters. Vehicles with heavier weight, such as trucks, are taxed at a higher rate. Higher taxes for larger engine sizes and heavier vehicles are likely to mean that higher emitting vehicles are taxed more for a given vehicle age.

However, the tax is not differentiated based on fuel, air pollutant or GHG emissions. The share of diesel vehicles, which are a larger source of PM2.5 and NOx air pollution, rose from 39% in 2008 to 50% in 2017 (TurkStat, 2018b). The share of lower emitting liquefied petroleum gas vehicles also rose from 17% to 22% over 2008-16. Low-emitting electric or hybrid vehicles represented only 0.01% of vehicle purchases in 2017. Electric vehicles pay only 25% of the MVT imposed on equivalent vehicles, whereas hybrid vehicles are taxed according to their cylinder engine capacity (EAFO, 2018).

Tax treatment of company cars and commuting expenses

In Turkey, the number of commercial cars, small trucks and motorcycles is relatively small, growing from 2.5% of the total fleet in 2004 to 2.6% in 2017 (TurkStat, 2018c). Individuals are not taxed on the provision of a company car provided they use it for business (KPMG, 2017). Tax treatment of the benefit associated with the use of a company car for personal purposes and the treatment of commuting expenses can be environmentally significant in countries with a large proportion of company cars (Harding, 2014).

A company car used for personal purposes is considered in-kind remuneration, and thus taxed as personal income. Corporations can deduct the expense of vehicles owned or leased by the business from the net corporate income. However, they cannot deduct the VAT paid on the purchase of passenger vehicles, given the high likelihood of also using company passenger vehicles for personal use.

In Istanbul, government workers receive free transit passes for use in their duties. Corporations could also encourage public transit by providing free or discounted transit passes. The tax system could provide an incentive for this, allowing the expense to be deducted from net corporate income in the same way as vehicles.

Road pricing

Turkey has serious air pollution problems (Chapter 1). Four cities are among the top 100 most congested cities in the world, with Istanbul ranked sixth (TomTom, 2018). Congestion pricing can be an effective way to control traffic congestion and limit air pollution, particularly when combined with investment in public transit. Charges that apply to those that drive into a congested area of a city can encourage other forms of transportation. Charges that vary with the time of use of a highway or bridge can help reduce congestion at peak times of the day. Lanes on a highway can also be differentially priced. High occupancy toll (HOT) lanes, for example, encourage car-pooling. Lanes can also provide access to certain vehicle types such as electric cars. Technology has improved considerably to enable effective and efficient pricing systems.

In Turkey, all motorways charge tolls based on distance travelled. A number of bridges are also tolled. All other state roads in Turkey are free of charge. Toll revenue more than doubled between 2001 and 2012. The length of motorways increased from 1 667 km in 2005 to 2 542 km in 2016 (KGM, 2013; Turkstat, 2018d). Tolls have been an important source of financing for major bridge and motorway projects.

As a city of around 15 million people, Istanbul is a logical place to move beyond tolls on highways and bridges and consider other forms of congestion pricing. It could be introduced gradually, with district pilot projects. At the same time, an educational campaign could highlight the benefits of congestion pricing. A 2017 survey of people in the Taksim district of Istanbul found that the majority did not believe congestion pricing would be effective (Özgenel and Günay, 2017). International experience shows that public support for congestion pricing generally increases once the system is introduced. However, this support depends on whether the system demonstrably reduces congestion and pollution, and whether revenue is used for high-value transportation projects (Box 3.1. Lessons learned from congestion pricing experience).

Box 3.1. Lessons learned from congestion pricing experience

Experience with congestion pricing in London, Stockholm and Singapore has shown the importance of careful system design and effective public engagement. It has also demonstrated success in reducing traffic volume, limiting pollution and raising revenue that can be used to invest in valuable transportation infrastructure such as public transit.

|

Type of System |

Benefits |

|

|---|---|---|

|

London (2003) |

Cordon pricing using automatic plate recognition technology, plus addition of new buses, park-and-ride spaces and improved bicycle and pedestrian infrastructure. |

Investment of approximately EUR 2.9 billion of revenue into public transit between 2003 and 2013. Traffic volume in 2013 was 9.9% lower than in 2000, despite 20% population growth. Particulate matter emissions declined by 15.5% after introduction. |

|

Stockholm (2007) |

Cordon pricing using automatic plate recognition technology, plus addition of new buses, park-and-ride spaces and improved bicycle and pedestrian infrastructure. |

Net revenue of around EUR 131 million per year. Traffic delays decreased by 30-50%. Particulate matter emissions declined by 9% after introduction. |

|

Milan (2012) |

Cordon pricing using automatic plate recognition technology, with a flat daily fee. |

Net revenue of around USD 20 million per year. Traffic reduction of 38%. Particulate matter reduction of 18%. |

|

Singapore (1998) |

Electronic road pricing on specific routes, with variable pricing responding to congestion in real time, plus increased parking fees in certain zones, new buses, high-occupancy-vehicle lanes, park-and-ride spaces, and improved bicycle and pedestrian infrastructure. |

Net revenue of around EUR 80 million per year. Traffic in inner city reduced by 24% despite strong population growth. 10 kg reduction in particulate matter. |

Sources: ED (2006); Croci and Ravazzi (2014); C40 (2015); Börjesson (2017); TSTC (2017).

The Ministry of Transport and Infrastructure is co‑ordinating the drafting of a regulation on energy efficiency, which will include low-emission zones. As part of this process, the Istanbul Metropolitan Municipality has studied several options such as congestion pricing at peak hours and restrictions for heavy duty vehicles. Other measures, such as more restrictive cordon pricing and increased parking fees, may also be needed to encourage alternative forms of transport and address air pollution.

3.3.3. Feed-in tariff for renewable energy

In 2010, Turkey adopted a Renewable Energy Law to help meet its 30% renewable power target by 2023 (Chapters 1 and 4). The law adjusted and increased Turkish feed-in tariffs. Renewable producers that bid on government tenders are guaranteed the tariffs for ten years and receive an 85% discount on transmission costs. Rates are higher for solar and biomass (0.13 USD/kWh) than for geothermal (0.105 USD/kWh) and hydro and wind (0.073 USD/kWh) energy. The law also includes bonus payments for hardware components made in Turkey to support domestic manufacturing (IEA, 2015). Local content premiums also help make projects more attractive to investors (IEA, 2016a).

While the feed-in tariff provides an important incentive to develop renewable energy projects, high contribution fees required as part of the bidding process decreased profitability for investors. This has delayed or stalled some licensed solar projects. For example, Turkey’s first tender for 600 MW of solar PV in 2013 was over-subscribed, but only 82 MW had been installed by September 2018. Small, unlicensed solar PV projects built outside of the tender process have, however, been flourishing. Around 4 800 MW of such projects were installed as of September 2018. Tenders for wind power projects have also been successful, with a licensed wind capacity of 6 800 MW as of September 2018. Future tenders of 3 000 MW of renewables are planned, split evenly across offshore wind, onshore wind and solar. Growth may slow down in the future as unlicensed projects are expected to be required to pay power distribution companies higher fees to transport the electricity generated (Tsagas, 2018).

3.4. Eliminating environmentally harmful subsidies

Turkey continues to provide environmentally harmful subsidies. They encourage fossil fuel production and use through both direct expenditure and tax exemptions. However, there have been some improvements in agriculture, such as the elimination of subsidies for water use and the introduction of payments for soil conservation and organic farming.

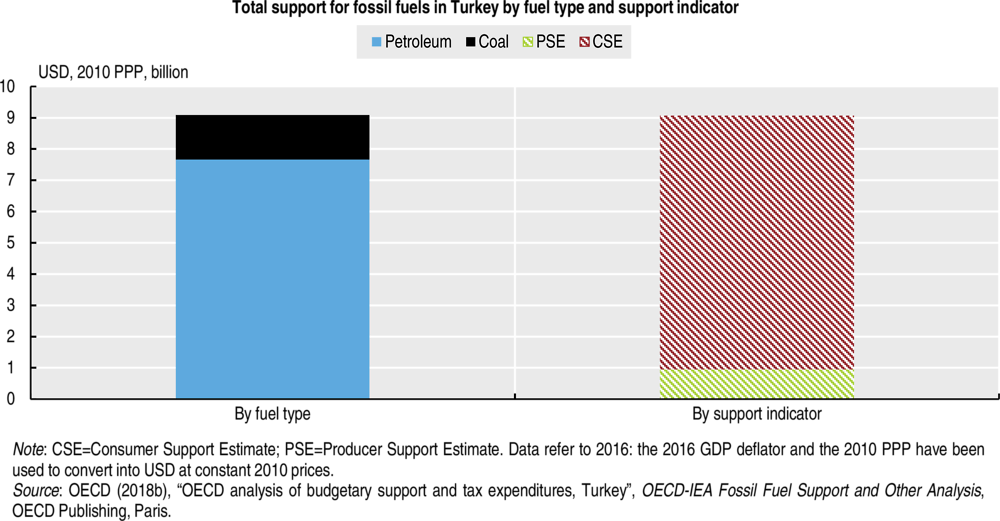

3.4.1. Support for fossil fuel production and consumption

Previous OECD estimates of fossil fuel support showed relatively low levels for Turkey, but recent updates to include new data and measures resulted in estimates over nine times higher in 2016 than in 2008 (TRY 13 billion compared to TRY 1.4 billion) (OECD, 2018f) (Figure 3.5). Most measures provide consumer support for fossil fuel use, though producer support remains significant. The support is likely to increase further, given a new regulation introduced in 2018 to stabilise fuel prices in the face of fluctuations in international oil prices and exchange rates. The regulation essentially caps taxes on fuel products where prices are increasing (AA, 2018a).

Over the past decade, the most significant fossil fuel support has come from a range of fuel tax exemptions, with significant tax expenditures related to high-emission bitumen and petroleum coke fuels that are used as inputs in many industry sectors. In terms of direct budgetary transfers, coal aid to poor families for heating represents the most significant form of support. Expenditure for the programme more than doubled from TRY 433 million in 2008 to over TRY 1 billion in 2016 (OECD, 2018f). Providing coal to poor families encourages its use for residential heating and contributes to health impacts, local air pollution and GHG emissions. Turkey is working to transition communities to natural gas heating and gradually phase out coal subsidies. All provinces will be supplied with natural gas by the end of 2018. Greater use of incentives for alternatives such as expanded geothermal heating could also be explored. There are already 120 000 households and greenhouses heated by geothermal and solar energy.

In addition to supporting fossil fuel use, the government also provides support for coal production. For example, production costs for hard coal of the state-owned Turkish Hard Coal Enterprises averaged TRY 619 per tonne in 2013, while the average selling price was only roughly one-third of that amount at TRY 194. The government financed the difference. The government has also supported oil, natural gas and coal exploration since 2010 to help reduce dependence on foreign fuel sources (OECD, 2016a). If Turkey removed incentives for coal, it could reduce projected GHG levels by an estimated 5.4% by 2030 (IPC, 2016).

Figure 3.5. Turkey provides significant support for fossil fuel use and production

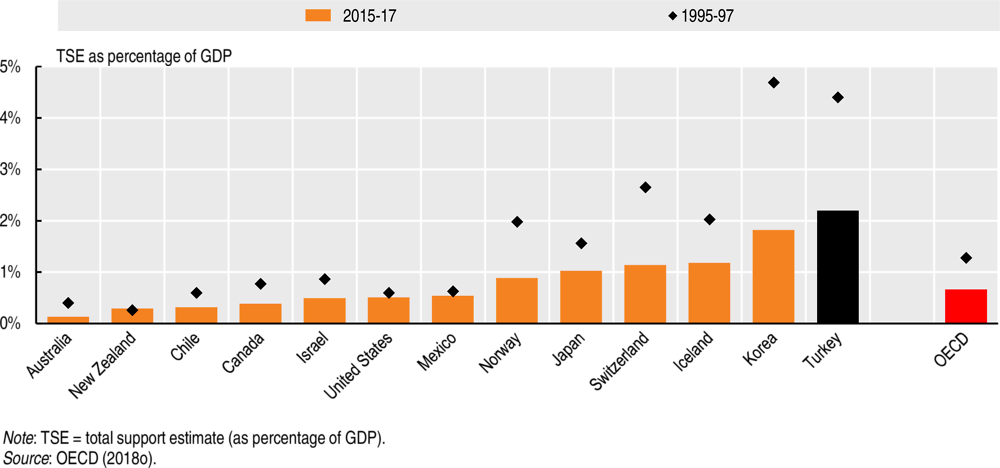

3.4.2. Agricultural subsidies

The level of support for agricultural production in Turkey has declined significantly over the past two decades, but remains higher than in most OECD member countries as a percentage of GDP (Figure 3.6). Input subsidies are considered one of the most distorting forms of support for production and trade. An estimated 91% of Turkey’s support is considered distorting, which is significantly higher than the OECD average of 51% (OECD, 2017b). Turkey provides subsidies for diesel and fertiliser use, but they are provided by area to encourage farmers to be more efficient (OECD, 2017c).

Figure 3.6. Turkey provides relatively high levels of distortionary agricultural support

Turkey reformed its agricultural subsidies in 2016 to rationalise crop and livestock production by region based on the most suitable conditions (OECD, 2017b). The policy divides Turkey into 941 agricultural basins based on climate and soil, and only provides subsidies to strategic crops in each basin. Livestock subsidies were increased, and producers of breeding animals are able to lease grassland for grazing (FAS, 2016). The environmental impacts of the changes are mixed. Encouraging certain types of crops in areas most suitable to them could reduce pressures in areas of water scarcity. Conversely, encouraging livestock production is likely to increase pressures on land-use and species habitat loss, as well as aquatic ecosystems vulnerable to agricultural run-off.

Turkey ended its subsidy for water use in 2007. However, agricultural water pricing is still not tied to consumption volume, except when pumping systems are used. The price of irrigation water is based on overall operation and maintenance costs. It is charged on a per hectare basis, differentiated according to the crop. Consequently, there is limited incentive for investment in water-use efficiency.

Turkey introduced payments for soil conservation in 2006 and concessional loans for adoption of organic agriculture and good agricultural practices in 2009 (OECD, 2017c). However, these transfers represent a very small share of total support (OECD, 2016b). Organic farming increased from 0.5% to 2.2% of total agricultural land over 2005‑15 (MEU, 2015). The Turkish government aims to increase this share to 3% by 2023 (Chapter 1).

3.5. Investing in the environment to promote green growth

Given the rapid pace of growth and urbanisation, transitioning towards green growth will require significant investment in a relatively short time. Foundational policies such as carbon pricing are needed to drive investment towards more environmentally friendly forms of infrastructure. However, innovative approaches that maximise leveraging of private sector financing from both domestic and international sources will also be essential. Instruments such as public-private partnerships and green bonds are beginning to emerge in Turkey, with support from multilateral development banks and other institutions.

3.5.1. Environmental expenditures

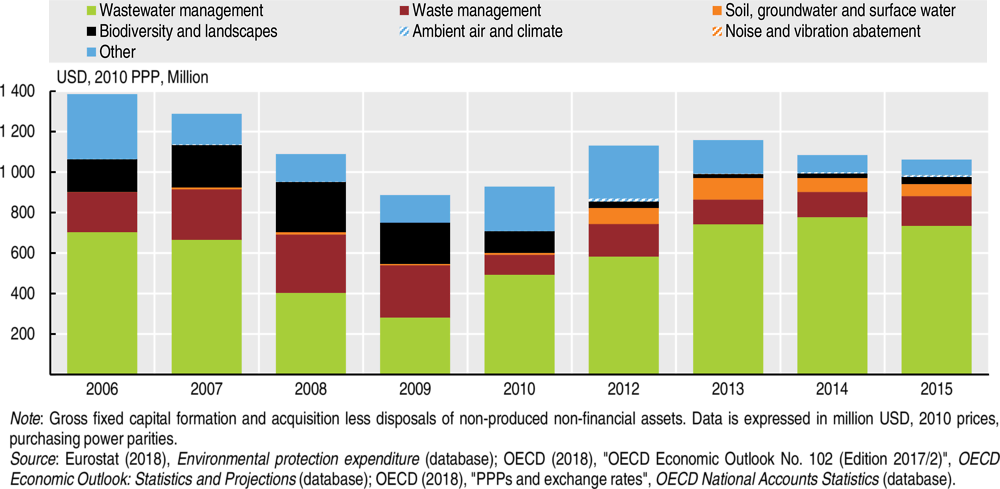

Government expenditures

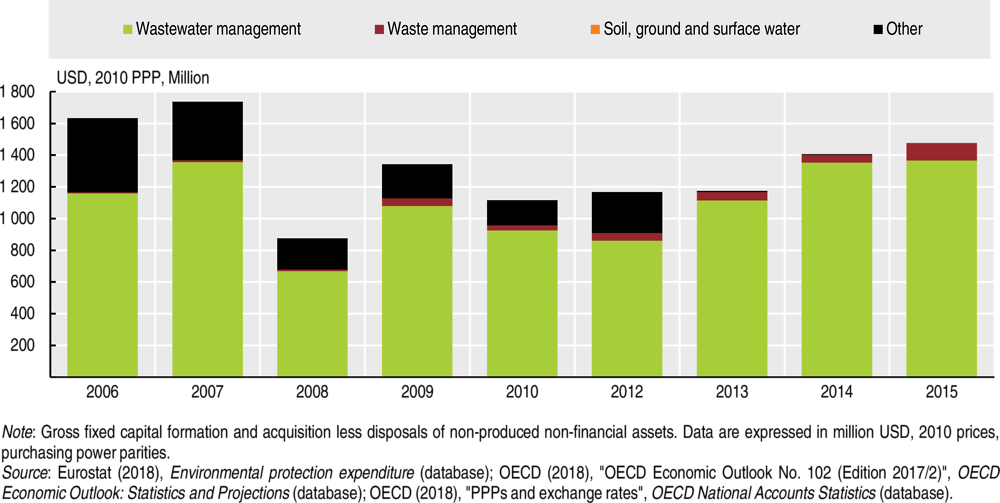

Public environmental protection investments were lower in 2015 in real terms than in 2006 (Figure 3.7). Most spending focuses on wastewater and waste management services (83% in 2015), more than the EU average of 67% the same year (EuroStat, 2018). Municipalities account for around 86% of public sector environmental expenditures, which is consistent with their mandate for wastewater and waste management. Local administration unions only account for around 2% of expenditures (MEU, 2015).

Figure 3.7. Public investment on environmental protection has declined

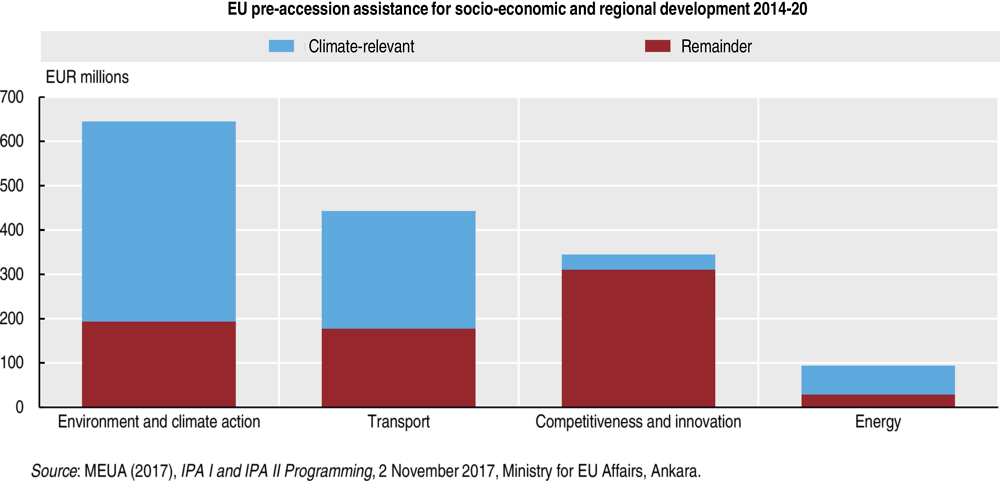

EU funding

EU funding contributes to environmental expenditure in Turkey. The EU’s Pre-Accession Assistance (IPA) aims to enhance institutional capacity, and the quality of both legislation and implementation. The second IPA for Turkey covers 2014‑20 and uses a sectoral approach to allocate funds. Environment-related funds, amounting to over EUR 1.1 billion over 2014-20, are allocated for environment, climate action and energy; transport; and competitiveness, innovation and agricultural and rural development (Figure 3.8). In total, around 33% of EU funds were allocated to environment-relevant areas over 2014-20.

Figure 3.8. European Union provides significant environment-related financial assistance

The Environment and Climate Action portion of the IPA 2014‑20 identifies priorities related to water, waste and environmental management. The water priority includes technical assistance to develop river basin management plans, drought and flood risk management plans, and water-related climate adaptation, as well as financing for water-related infrastructure. The waste priority includes technical assistance for collection, reuse and recovery, as well as support for waste reduction, recycling and environmentally friendly disposal. The environmental management priority focuses on technical assistance for sustainable development in a variety of areas. These include preventing industrial pollution, adopting market-based instruments, protecting nature and ecosystem services, promoting climate change adaptation and mitigation, and improving the Disaster and Emergency Management System (MEUA, 2017).

Private expenditures

While business expenditures on environmental protection have grown since 2008, spending in 2015 remains below 2007 levels once inflation is considered (Figure 3.9). Most spending remains focused on wastewater management (Chapter 5). Business spending in other areas, including air and climate, is very low.

Figure 3.9. Environmental business expenditure focused on wastewater management

A significant barrier to increasing environmental requirements for businesses, and industry in particular, is the concern that it will impact the competitiveness of the sector or company. Several studies have shown, however, that such policies do not affect trade patterns or productivity significantly (OECD, 2017d, 2016e). Even without more stringent requirements, businesses could improve both environmental performance and long-term competitiveness. Energy efficiency, for example, can lower energy costs and improve energy security while reducing air pollution and GHG emissions. Turkey’s industry has large potential for investment in energy efficiency (MidSEFF, 2018b). However, it could be better promoted through financial incentives and energy reporting requirements (Box 3.2. Enhancing incentives for industrial energy efficiency).

Box 3.2. Enhancing incentives for industrial energy efficiency

Turkey requires industrial establishments consuming more than 1 000 toe to be certified to the ISO 50001 energy management system standard. Energy management systems (EnMS) provide a structure to monitor energy consumption and identify opportunities to save money on energy costs while improving environmental performance. EnMS are particularly valuable in energy-intensive industrial sectors, where energy is a significant input cost. The use of EnMS is growing around the world, driven by policy and financial incentives.

The number of global certifications for the ISO 50001 standard for energy management grew to nearly 12 000 in 2015, with 85% of certifications in Europe. In 2016, Turkey was estimated to have only around 100 of 1 200 (8%) large energy-intensive industrial installations applying the ISO 50001 standard. A UNDP/UNIDO project is promoting greater use of energy management systems in Turkey through targeted training and information. Several European countries provide significant tax exemptions for EnMS certification (e.g. electricity tax exemptions in Germany).

Companies in Turkey can also enter into a voluntary agreement to reduce their energy intensity by an average of 10% over three years in exchange for having 20% of their energy costs subsidised during the first year. To date, only seven voluntary agreements have been completed, while another eight are within the three-year monitoring period. Additional incentives may be needed to increase the involvement of industrial installations in energy efficiency programming.

Sources: Siciliano (2014); ACEEE (2016); Janssen (2016); IEA (2017); MidSEFF (2018b).

3.5.2. Investment in environment-related infrastructure

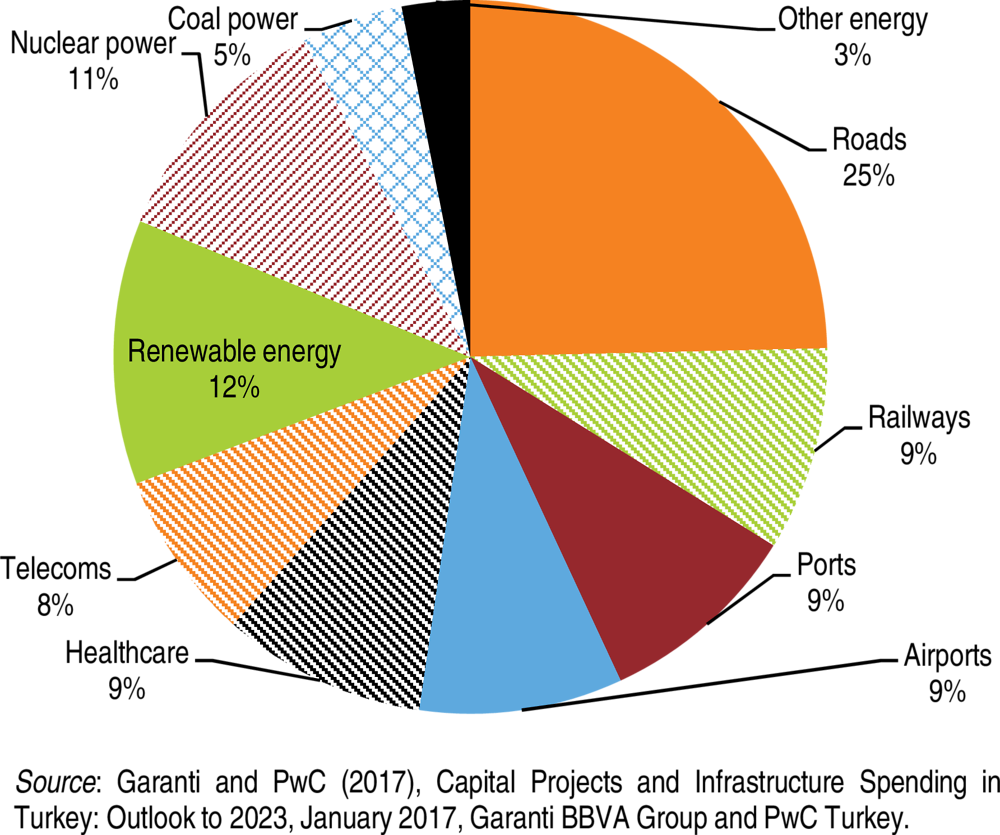

Between 2012 and 2017, Turkey invested more than USD 100 billion in capital projects and infrastructure. The Turkish government has planned an ambitious infrastructure investment programme in advance of the centenary of the Turkish Republic in 2023 that will triple that amount of investment. However, Turkey’s ability to borrow in foreign markets and attract foreign investment may be affected by the significant drop in value of the Turkish lira in 2018 (OECD, 2018g). New investment, estimated in 2016 at USD 325 billion, is slated to be spent on transportation, healthcare, telecom and energy capital projects and infrastructure between 2017 and 2023, with a large proportion of private sector financing (Garanti and PwC, 2017). Over half of the investment is expected to be spent on transport-related projects such as roads, railways, ports and airports. About one-third of the investment is likely to go towards energy projects, including renewable, nuclear and coal power generation (Figure 3.10). These long-lived investments will significantly influence Turkey’s environmental performance for decades to come.

Turkey should improve cost-benefit analysis (CBA) for all large infrastructure investments, considering environmental externalities such as air pollution and GHG emissions. Such an approach would likely favour renewable energy over coal power, and public transit over roads. OECD countries are increasingly considering elements such as GHG emissions in CBA of large investments, particularly in the transport and energy sectors. However, thresholds for conducting CBA, and values used to incorporate environmental externalities, vary (OECD, 2018h).

Figure 3.10. Roads and power generation will dominate infrastructure spending to 2023

Transportation

Turkey has significantly increased spending on transportation infrastructure. For example, it has expanded its high-speed rail network, investing TRY 8.9 billion in 2017. It plans TRY 14.2 billion in investments in 2018 (Simsek, 2017). Between 2017 and 2023, it expects to invest double that amount in railways. Over 2014‑23, the government aims to increase the share of passengers using railways from 1% to 10% and the share of cargo by rail from 4.4% to 15% (Garanti and PwC, 2017). Turkey’s railway networks are less dense than the EU average, the dominant mode of transport being road (Chapter 1).

Road transport will also increase substantially, accounting for around 25% of capital investment expected over 2017-23. The majority will be spent on new toll motorways. Other large investments include Kanal Istanbul, which will connect the Black Sea to the Sea of Marmara. A three-level Grand Istanbul Tunnel under the Bosporus Strait will provide two levels for road traffic and one level for rail (Simsek, 2017). Additional roads, tunnels and bridges may relieve congestion in the short term, as well as alleviate local pollution hotspots. In the long term, however, these additions are likely to lead to more congestion and pollution by inducing greater demand. Complementary policies such as congestion pricing and incentives for low emission vehicles will be important to limit impacts on air pollution (Section 3.2).

Istanbul’s new airport is one of the largest infrastructure investments in the world. In 2009, the Directorate General for Civil Aviation launched a “green certificate” programme to improve the environmental performance of airports. “Green Airport” certificates halve the cost of permits and licences. To be eligible, all organisations and establishments at the airport must achieve the ISO 14064 standard for GHG reporting and the ISO 14001 standard for environmental management. In addition, the programme offers “Green Company” certificates to any company operating at the airport that meets some of the ISO requirements; in this case, they are eligible for a 20% fee reduction. As of 2017, 157 companies held a Green Company certificate, while 3 airports received a Green Airport certificate (Uşak, Adana and Tokat). A similar programme is also available for ports.

Renewable energy

Renewable energy as a share of total primary energy supply has remained stable at around 12% over 2005-17 (Chapter 1). Growth was slowed by a decline in biofuel and waste energy, as well as perceived risks for renewable investors (IEA, 2016a). In 2017, however, Turkey ranked in the top five countries in the world for net capacity additions of geothermal power, geothermal heat, hydropower, solar photovoltaic and solar water heating (REN21, 2018).

Turkey’s 2005 Law on the utilisation of Renewable Energy in Electricity Generation enables renewable energy generators to sell their electricity directly to market or to use the feed-in tariff (Section 3.3.3). Laws in 2011 and 2013 further provided investment incentives. First, they exempted renewable energy generation below 1 MW from licensing. Second, they provided a discount for land acquisition for projects commissioned before 2020. The 2012 New Investment Incentives Programme builds on these laws. It provides value-added tax and custom duty exemptions for renewable sources; regional investment incentives that encourage investment in under-developed areas; and strategic and large-scale investment incentives (IEA, 2016a). Turkey also has significant capacity for renewable heat, in terms of geothermal and waste heat, and is developing new heat supply legislation aimed at establishing a well-functioning domestic heat market.

Renewable electricity is to receive more than double the investment in coal-fired power generation by 2023 (Garanti and PwC, 2017). The Turkish government has said it will issue tenders for 10 000 MW of solar and 10 000 MW of wind over the next ten years. In 2017, they held tenders for 1 000 MW of solar and 1 000 MW of wind. A similar amount is expected in 2018, with a focus on offshore wind. The 2017 wind tender was won by a consortium that included German company Siemens and Turkish companies Türkerler and Kalyon Enerji holdings for USD 1 billion (AA, 2018b). For the 2018 tenders, a Chinese company expressed interest in investing USD 1 billion in Turkish renewable energy (Hurriyet, 2018a). Licensed solar installations have been slower to progress, but unlicensed installations under 1 MW have grown rapidly (Section 3.3.3). In 2016, the Turkish government announced plans to commission 101 new hydropower plants (IEA, 2016a).

A 2018 report demonstrated that Turkey could go further on renewables, with the potential to supply more than 50% of electricity output by 2026, with as much as 30% from wind and solar (SHURA, 2018). In its 2016 review of Turkey, the International Energy Agency highlighted several challenges to renewable energy investment. These included high licence and connection fees, delays in grid connection and expansion, regulatory uncertainty for distributed generation and exchange rate risks (IEA, 2016a). Addressing these concerns will be important to further expanding renewable energy investment.

Water, wastewater and waste

By 2023, USD 9.8 billion in investment is estimated to be needed in the water and wastewater sector (MEU, 2016). Turkey also plans to increase use of desalination plants and reuse of water to address water shortages that are expected to reach critical levels by 2030.

Agriculture is the primary consumer of water in Turkey, representing almost 90% of freshwater withdrawals. Consequently, investment in irrigation efficiency will be critical to reducing water use and building resilience to water shortages (Chapters 1 and 4). Turkey has significantly increased investment in irrigation. Annual investments were over three times higher in 2015 than they were in 2008 (OECD, 2016b). New projects are being designed with drip and sprinkler irrigation systems and open canals are being turned into closed canal systems.

To meet the goals of Turkey’s Waste Management Action Plan, about USD 7 billion is estimated to be needed by 2023. This will include developing regional solid waste processing and recycling facilities, new sanitary landfills, and upgrading and remediating unsanitary landfills.

3.5.3. Financing green growth

Turkey’s ambitious infrastructure plans and efforts to meet its own targets for improved environmental performance will require significant investment. Non-government financing is coming from the domestic private sector, the international private sector and international institutions. Private sector financing can be leveraged through public-private partnerships, domestic green banks, green bonds and other tools. Multilateral development banks also play an important role in providing and leveraging financing.

Public-private partnerships

Turkey has successfully used public-private partnership financial models for infrastructure, airports, highways, energy and health infrastructure. A few water and rail projects have also used this model. This is consistent with OECD recommendations in the 2008 Environmental Performance Review of Turkey. Between 1986 and 2016, almost half of transport, energy and hospital projects included some aspect of public-private partnership (Simsek, 2017). If structured appropriately, with sufficient revenue streams, public-private partnerships can attract both domestic and international investors for most types of projects, including rail, public transit, water and wastewater infrastructure (PPIRC, 2016).

Domestic financial sector

Local commercial banks and investors have been the main driver behind financing of infrastructure projects in Turkey to date. In 2016, the government’s Privatisation Administration established a new Turkish Wealth Fund. It will support infrastructure projects deemed strategic, but details on which projects will be financed have not yet been made public (Garanti and PwC, 2017). İLBANK, a bank that provides credit support to municipalities, generally provides national funding for municipal infrastructure. These banks could be an important source of financing for public transit, renewable energy, wastewater, waste and clean technology projects. Green banks in Australia, Japan, several US states and Malaysia have been used to concentrate expertise and fill a gap in financing from risk-averse traditional institutions. Green banks can use credit guarantees and other instruments to help protect investor capital and reduce real or perceived risk that is keeping traditional investors out of a particular market (GBN, 2016).

The Industrial Development Bank of Turkey (IDBT) and the Turkish Development Bank are also important sources of financing. They use loans from the European Investment Bank (EIB) to fund mainly renewable energy and energy efficiency projects. Since 2008, environment-related projects funded by the EIB in Turkey have totalled 2.6 USD billion (2010 prices). The IDBT issued the first-ever Turkish Green Sustainable Bond in May 2016, worth USD 300 million. It attracted 13 times more demand than the issue size, from 317 institutional investors in international markets. The funds will be used for renewable energy, energy efficiency, climate change adaptation and GHG reduction projects, as well as healthcare, electricity transmission and ports.

The Banks’ Association of Turkey issued voluntary sustainability guidelines for the banking sector in 2014. The government is also developing a template for banks to report their sustainability activities. The template is intended to increase awareness, encourage best practices and enable the Banking Regulation and Supervision Agency to measure and assess progress of the Turkish banking sector. The guidelines are an initial step that partly responds to recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures. To that end, the guidelines encourage reporting of sustainability measures and plans, but do not yet put sufficient emphasis on disclosing risks related to global and domestic environmental policy, and climate change impacts (Chapter 4).

Multilateral development banks

Multilateral development banks (MDBs) can also play a role in providing and leveraging financing (Chapter 4). MidSEFF provides loans through seven Turkish banks to support financing of mid-size investments in renewable energy, waste-to-energy and industrial energy efficiency. The World Bank has provided Turkey with hundreds of millions of dollars for sustainable cities projects, including public transport, energy services and water, sanitation and waste management. It has also provided loans to Turkish public banks to improve access to energy efficiency finance for small and medium-sized enterprises, support geothermal investment and alleviate energy infrastructure capacity constraints. In addition, since 2009 Turkey has received over USD 300 million from the Clean Technology Fund, channelled through MDBs.

3.6. Promoting eco-innovation

Eco-innovation will be an essential component of achieving green growth in Turkey. Companies in Turkey have significant potential to expand in the areas of electric vehicles, solar thermal energy, geothermal energy, and wind and solar power. With a young work force and high proportion of engineering and mathematics graduates, a supportive set of policies could catalyse a wave of eco-entrepreneurship that could support economic growth and lower the costs of achieving environmental goals.

3.6.1. Overall innovation performance and policy

Turkey’s environment for innovation remains challenging, but has improved significantly since 2008. Turkey’s gross expenditure on research and development (GERD) remains low relative to the OECD average (0.9% of GDP vs. the OECD average of 2.4% in 2015). However, it grew by 119% over 2008-15, mainly as a result of increased defence and space research. Business expenditures on research and development (R&D) are also low (0.44% of GDP vs. the OECD average of 1.63%), but growing (OECD, 2016c). The Supreme Council for Science and Technology has set targets for GERD at 3% and for business expenditure on research and development at 2% by 2023 (IPP, 2016).

The tenth Development Plan and the National Science, Technology and Innovation Strategy (2011-16) guide Turkey’s science, technology and innovation policy. The Turkish Scientific and Technological Research Council promotes, conducts and co‑ordinates research and development in line with national targets and priorities. It has several grant programmes that can support companies’ R&D projects, including those related to energy or the environment.

Turkey has implemented several measures to encourage business innovation and entrepreneurship, including the International Incubation Centre (2015); the R&D Centres of International Enterprises (2014); and investment support, promotion and marketing for technological products (2013-14) (IPP, 2016). Turkey has also introduced cluster support programmes to promote the internationalisation of key clusters of interconnected businesses and improve capabilities to engage in international markets and global supply chains (OECD, 2016d). In 2016, Turkey was among the top 20 economies in terms of cited scientific publications related to machine learning and has a number of start-ups in the information and communication technology sector (OECD, 2017e). Entrepreneurs continue to face challenges in attracting international financing and expanding to international markets, however (Farrell, 2016).

A 2016 law greatly improved intellectual property right protections in Turkey, merging and modernising a series of decrees used previously. The law included improved patent office capacity, and a better framework for commercialisation and technology transfer. Enforcement, however, remains a challenge with counterfeit goods and software piracy continuing to flourish. A 2012 law on title-deed registration also removed requirements for foreign purchasers of real estate to partner with Turkish individuals or companies, though investors continue to be cautious (SDOIA, 2017).

3.6.2. Eco-innovation performance and policy

Turkey has historically performed poorly on most indicators of eco-innovation, but has recently shown some signs of improvement. A fundamental element of such performance is strong domestic demand, which is a function of the coverage and stringency of environmental policies. Turkey is falling short in both areas relative to other OECD member countries (OECD, 2018i). Eco-innovations also need a level playing field with existing technologies. Fossil fuel subsidies and other policies favouring incumbents can restrict new entrants (Section 3.4).

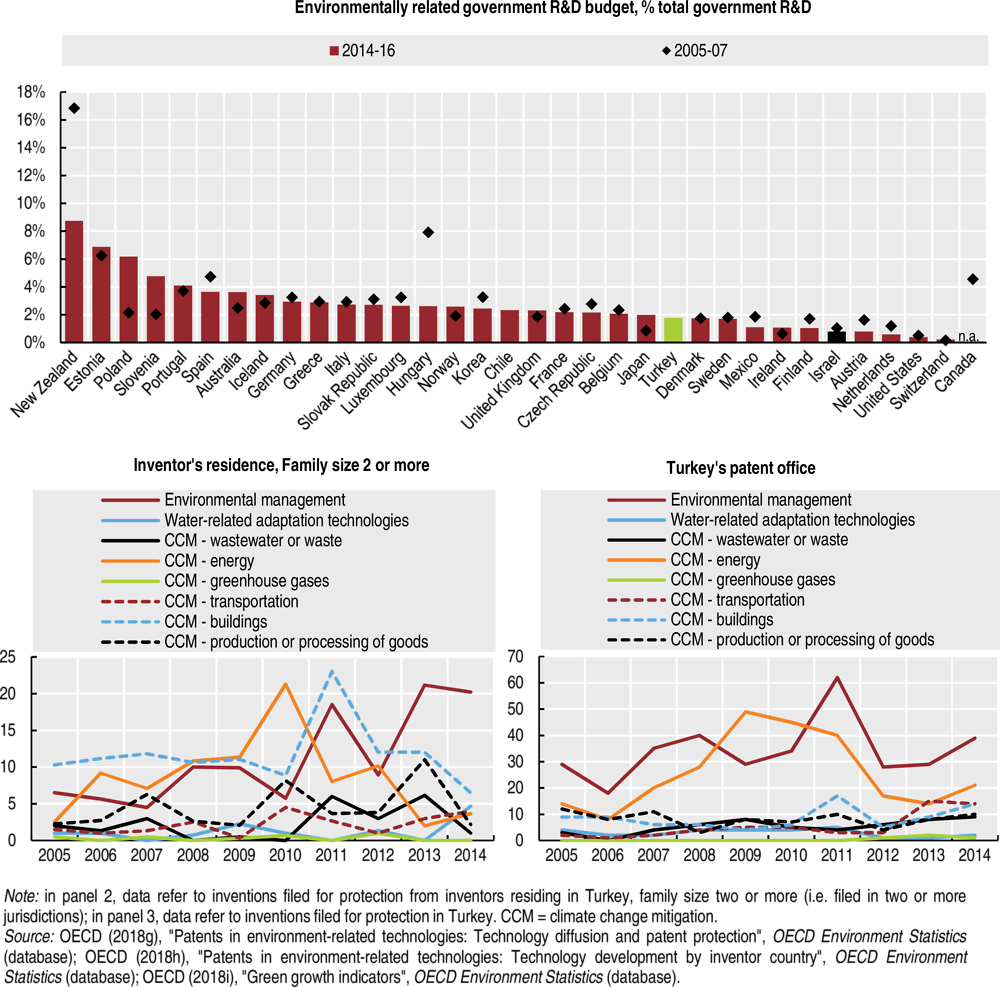

In addition, policy frameworks that support idea creation linked to environmental solutions are critical. Turkey has several programmes, but does not have an integrated approach to support clean technology development from early-stage R&D through to commercialisation and exportation. General innovation support will benefit clean technology entrepreneurs, but targeted policies are often needed to overcome barriers. These barriers can include demand and technology uncertainty; lack of clean technology knowledge and capacity across investors; and large capital requirements with long pay-back periods. Environment-related government R&D spending in Turkey as a percentage of total R&D spending remains low relative to other OECD member countries (Figure 3.11). Patent applications in environment-related technologies represent a relatively small percentage of total patent applications (6% compared to the OECD average of 10.9% for 2012‑14). However, there are some recent signs of growth (Figure 3.11).

New supportive policies are also emerging in Turkey. For example, Turkey encourages demand for energy efficiency technologies through public procurement policies. These policies promote the purchase of services and commodities that comply with minimum energy efficiency criteria. In 2018, Turkey introduced ecolabel legislation in line with the EU Ecolabel regulation. Its implementation initially covers textile, ceramic and paper products, and will later expand into other sectors. Ecolabelling is one way to highlight the environmental credentials of products to consumers.

In addition, the Scientific and Technological Research Council of Turkey and the Global Environment Facility – which brings together UN agencies, MDBs and international NGOs – have partnered to develop a USD 3 million fund to support clean innovation. The programme targets small and medium-sized enterprises (SMEs) and start-ups that work on energy and water efficiency, renewable energy, waste management, green buildings and transportation (Hurriyet, 2018b). Turkey’s Environment and Cleaner Production Institute also contributes to national R&D activities in line with SDGs, with a focus on best available techniques.

Figure 3.11. Environmental R&D is relatively low, but green patents are growing

3.6.3. Markets for environmentally related products

Turkish companies have the potential to capture a share of growing domestic and global EGS markets in a number of areas. For example, Turkey’s automotive sector is the fifth largest in Europe. An industrial consortium of five companies and the Union of Chambers and Commodity Exchanges was formed in 2018 to launch a Turkish electric car. The Ministry of Industry and Technology, the Union of Chambers and Commodity Exchanges, and members of the Joint Venture Group of companies are working to establish a domestic company that will own the intellectual and industrial property rights to the car. Turkey’s Automobile Sector Strategy Document and Action Plan (2016‑19) commits to new legislation and physical infrastructure to support widespread use of electric, hybrid, hydrogen and compressed natural gas vehicles. Policies such as carbon pricing, vehicle emission standards and phasing out gasoline and diesel tax exemptions would help to further increase demand for cleaner vehicles.

Another Turkish EGS industry that has not received a lot of attention is solar thermal. Turkey has two solar thermal companies (Solimpeks and Eraslanlar) that rank in the top 12 of global flat plate collector manufacturers, the dominant technology in Europe (Epp, 2018). Turkey is the second largest solar thermal market after the People’s Republic of China (hereafter “China”). Most of its applications target water heating in multi-family houses. Solar thermal energy has also been used for space cooling in hotels and shopping malls, for drying agricultural products and for heating greenhouses. A solar “combi set” that combines solar water and space heating, and works alongside gas boilers, is also becoming popular for villas and hotels. The Turkish government has installed solar water heaters in social housing, hospitals and prisons, but has not yet provided specific support for the sector (IEA, 2016b). Turkey has the potential to expand district heating systems using solar thermal, geothermal or waste heat energy to reduce the need for coal and natural gas heating. New heat supply legislation should help to realise some of this potential, though details on specific measures to be included were not yet available at the time of writing. Phasing out subsidies for coal heating and increasing incentives for renewable and district heating would further help to expand Turkey’s domestic market.

A broader set of policy reforms will be required to continue expanding Turkey’s domestic EGS market. This market was valued at USD 7.3 billion in 2016, more than double the USD 2.9 billion estimated in 2004 (DoC, 2017). Turkey’s exports of environment-related products grew between 2002 and 2015 from 4.8% to 6.4% of total exports, but Turkey remains below the OECD average (OECD, 2017f). Anticipated investment growth in renewable energy, public transportation, irrigation, water reuse, water and wastewater treatment, and waste management infrastructure will support growth. However, more stringent regulations for reductions in air pollution and GHGs, carbon pricing, vehicle emissions standards, elimination of fossil fuel subsidies and expanded procurement policies will be needed to fully realise Turkey’s market potential (DoC, 2017).

3.7. Contributing to the global environmental agenda

Turkey can make a significant contribution to the global environmental agenda in the coming decade. It can do this both through efforts to improve domestic environmental performance and through international trade, investment and development co‑operation. International sources of financing already play an important role in shaping environmental characteristics of Turkey’s rapid growth. They support cleaner energy, transportation and urban development solutions. Foreign investors and governments can also encourage best practices in sustainability and corporate social responsibility. However, domestic policy will continue to be the driving force behind environmental performance.

3.7.1. Development co‑operation

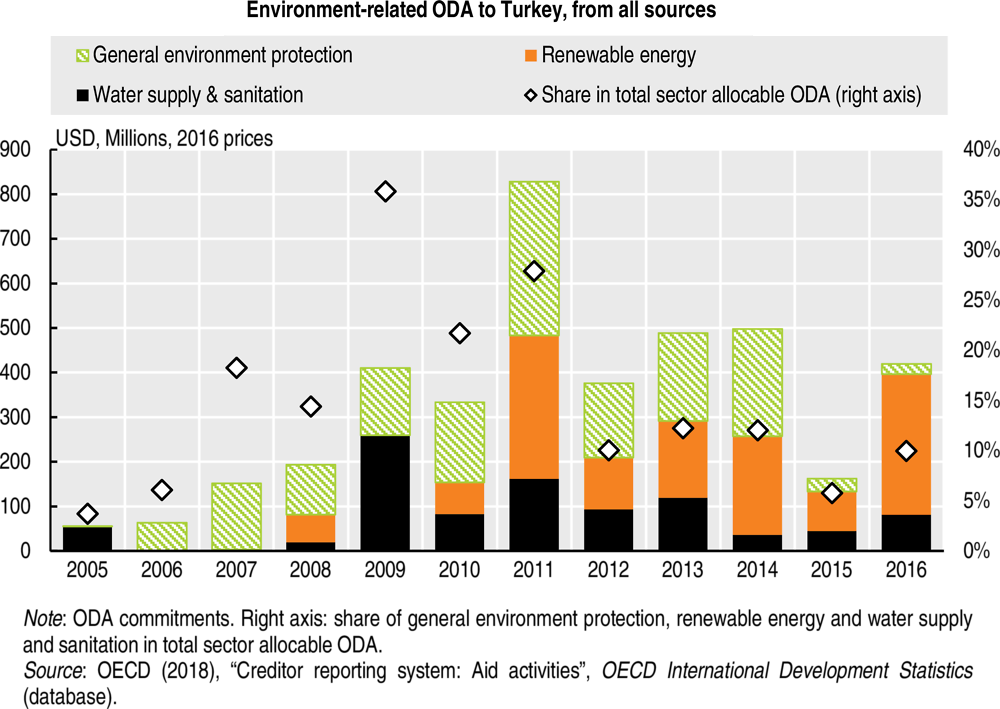

Turkey is considered an upper-middle income country, and is both a provider and recipient of development co‑operation. Since 2011, Turkey’s total receipts of official development assistance (ODA) and disbursements have increased. Turkey remains the third largest recipient of net ODA in the world, receiving almost USD 5 billion in 2016. Per capita ODA commitments also increased in real terms, rising from USD 24.4 to USD 65.3 over 2005‑16 in 2016 prices (OECD, 2018j). Environment-related ODA has fluctuated since 2008, but renewable energy ODA has increased (Figure 3.12).

Turkey’s net ODA disbursements increased from USD 604 million in 2005 to USD 9.1 billion in 2017 (2016 prices). This represents 0.95% of gross national income, above the 0.7% UN target (OECD, 2018k). Turkey undertakes development co-operation activities with African, Central Asian and neighbouring countries. Turkey does not have a strong environmental focus in its development co‑operation. However, it does provide aid for water, sanitation and hygiene, as well as a training programme for industrial energy efficiency (MFA, 2018).

Figure 3.12. Renewable energy ODA has grown significantly recently

3.7.2. Trade and the environment

Trade agreements

Turkey is linked to the European Union by a Customs Union agreement that came into force in 1995. Turkey is also a member of the Euro-Mediterranean partnership, and has signed free trade agreements (FTAs) with several countries (EC, 2018).

The European Union is Turkey’s largest import and export partner. Secondary export markets include Iraq, the United States, Switzerland, the United Arab Emirates and Iran (EC, 2018). Consumer goods represent almost half of Turkey’s exports, while intermediate and capital goods each represent around one-third of imports (World Bank, 2016a).

The European Council is discussing a 2016 proposal to modernise the Customs Union with the European Union and extend bilateral trade relations to services, public procurement and sustainable development. Preparatory work for the proposal considered the environmental impacts of the EU’s Bilateral Preferential Trade Framework with Turkey, including the Customs Union. Overall, it determined that the influence was negligible. For example, increased economic activity, and the composition of that activity, has increased GHGs and air pollutants, but reduced emissions from energy and steel production largely offset the increase (BKP/Panteia/ALSA, 2016). The report concluded that Turkey’s own environmental policies are of greater relevance to environmental performance than trade-related agreements with the European Union.

Environmental provisions are also included in Turkey’s FTAs with Chile, Korea, Lebanon and Malaysia. The FTA with Chile includes a provision on environmental co‑operation. FTAs with Malaysia and Lebanon include several provisions on environmental collaboration, while the FTA with Korea contains a full chapter dedicated to trade and sustainable development.

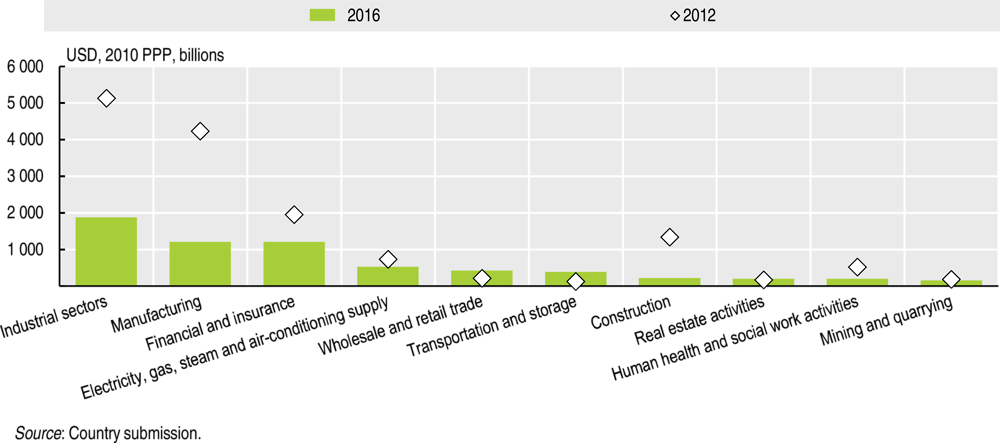

Foreign direct investment

The Turkish government has introduced investment incentives such as customs duty and VAT exemptions to encourage foreign direct investment (FDI). All investment incentives are provided equally to foreign and domestic investment sources, although some specify local content requirements. The value of FDI inflows dropped from USD 19.9 billion in 2008 to USD 12.3 billion in 2016. However, the number of companies with international capital has continued to grow steadily, with 53 200 companies with foreign capital operating in Turkey as of December 2016 (Government of Turkey, 2017). The main sectors that attract FDI are industry, manufacturing, and finance and insurance, as well as electricity production (Figure 3.13).

Europe continues to be the largest source of FDI, but Asian investors are growing in importance. To decrease dependence on energy imports, Turkey has sought international investors in domestic renewables and coal power projects. Turkey’s 2016 Centres of Attraction programme, which provides interest-free credit and low-interest working capital loans for certain investments, had attracted 53 Chinese companies as of September 2017. There have also been major Turkey-China deals relating to coal and nuclear plants, as well as wind projects (Gündoğan and Turhan, 2017). The Russian Federation’s role in nuclear expansion in Turkey may also increase beyond the plant under construction if additional plants are approved (DS, 2018). Investment from Japan in areas such as automotive, consumer electronics, energy and food is also increasing, as work to finalise an FTA with Turkey continues. International investors may influence the environmental performance of projects in the future. China, for example, has committed to greater consideration of environmental risk in overseas investment (GFCC, 2017).

Figure 3.13. FDI inflows have declined since 2012, but remain important for several sectors

Corporate social responsibility

Pressure from international investors and consumers is starting to impact private sector interest in demonstrating sustainability. Borsa Istanbul (Turkey’s stock exchange) established a Sustainability Index in 2014 to help institutional investors find companies that have high environmental, social and governance performance. This provides an incentive for Turkish companies to meet requirements (Borsa Istanbul, 2017). Several large private entities are already taking action beyond what is required by the Turkish government (Box 3.3).

The Turkish government could do more to support corporate social responsibility related to the environment. For example, it could highlight best practice examples and provide guidelines and financial incentives for continual improvement. Many such actions will not only benefit the environment, but also reduce costs and increase the attractiveness of companies to foreign consumers and investors. At the time, they could improve resiliency to climate change, resource constraints, and future domestic and international environmental policy changes.

Box 3.3. Private sustainability initiatives illustrate potential for progress

Turkish company Arçelik A.Ş., which manufactures household appliances, air conditioners and televisions, is listed on the Borsa Istanbul Sustainability Index. It has achieved “A list” ranking on CDP’s Climate Performance Leadership Index, and was rated “AAA” on the MSCI Global Sustainability Index. It reduced CO2 emissions from its Turkish operations by 56% between 2010 and 2016, and reduced water withdrawal per product by 31% between 2012 and 2016. The company’s annual Sustainability Report provides detailed accounting of GHGs, energy consumption, water withdrawal, use of raw materials and waste. With 10 R&D centres in Turkey and more than 1 300 R&D staff, the company has significant potential for eco-innovation. A Supplier Sustainability Index planned by Arçelik A.Ş. will also help drive improved environmental performance across suppliers and increase demand for environmental goods and services.

OYAK Group is one of Turkey’s largest conglomerates, with operations in mining, metallurgy, cement, concrete, energy (coal), chemicals, financial services, automotive and logistics. It developed a sustainability strategy in 2011. With 2016 revenues of USD 8.5 billion and exports of USD 3.5 billion, OYAK Group action on sustainability can have significant influence on demand for environmental goods and services in Turkey. OYAK Group companies report increased environmental investments of 36.6% between 2015 and 2016, but long-term trends are not provided. They are making progress in substituting waste materials for raw inputs, reusing water and improving energy efficiency. However, further work is needed to provide a detailed annual account of performance on a range of environmental indicators, including GHGs, air pollutants and resource use.

Sources: Arçelik, 2016; OYAK, 2016.

Recommendations on green growth

Framework for sustainable development and green growth

Continue prioritising sustainability and green growth in public policies, better align fiscal policies and budget allocations with environmental commitments, leveraging all available domestic and international sources of financing.

Continue to integrate SDGs into NDPs and action plans across institutions and sectors; enhance implementation efforts; finance data collection needed to monitor progress and programme effectiveness.

Greening the system of taxes and charges

Reform the system of vehicle and fuel taxation to remove exemptions and integrate emissions criteria; introduce congestion pricing in Istanbul to limit traffic and air pollution.

Closely monitor the uptake of incentives for renewable energy to ensure that fees, project size requirements and approval processes do not deter investment.

Eliminating environmentally harmful subsidies

Phase out tax exemptions for fossil fuel consumption; gradually replace coal aid to poor families with support for transition to cleaner alternatives.

Tie water pricing in agriculture to the volume of water used and increase financial incentives for organic and other environmentally friendly practices.

Investing in the environment to promote green growth

Improve consideration of environmental externalities in evaluation of major investments by using tools such as comprehensive cost-benefit analysis.

Expand the use of instruments that leverage private sector investment in environmental projects, including public-private partnerships for rail and public transit, green banks to reduce risk for traditional investors, and green bonds.

Promoting eco-innovation

Evaluate strategic opportunities identified in domestic and global EGS markets; develop an integrated approach to support clean technology entrepreneurs from early stage R&D through to commercialisation and export.

Strengthen the policy framework for eco-innovation by increasing spending on environmental R&D, supporting technology demonstration and commercialisation with an expanded number of clean technology incubators, and integrating greater awareness of EGS market opportunities into education and skills programming.

Contributing to the global environmental agenda

Promote corporate social responsibility initiatives such as sustainability reporting, certification, internal environmental performance targets and investment in environmental projects.

References

AA (2018a), “Turkey to stabilize consumer fuel tax with new rule”, 17 May 2018, Anadolu Agency, www.aa.com.tr/en/energy/transportation-fuel-oil/turkey-to-stabilize-consumer-fuel-tax-with-new-rule/20091.

AA (2018b), “Turkey to hold 20,000- megawatt wind and solar tenders”, 17 April 2018, Anadolu Agency, www.aa.com.tr/en/energy/regulation-renewable/turkey-to-hold-20-000-megawatt-wind-and-solar-tenders/19687.

ACEA (2018), “Average Vehicle Age”, webpage, European Automobile Manufacturers Association, www.acea.be/statistics/tag/category/average-vehicle-age (accessed 6 June 2018).

ACEEE (2016), “Turkey”, webpage, American Council for an Energy Efficient Economy, https://aceee.org/sites/default/files/pdf/country/2016/turkey.pdf (accessed 26 February 2018).

Arçelik A.Ş. (2016), Sustainability Report 2016, Arçelik A.Ş., Istanbul, www.arcelikas.com/page/204/Sustainability_Report.

Bauza, V. (2017), “A new market for infrastructure financing helps Izmir thrive”, Creating Markets #IFC Markets, June 2017, International Finance Corporation, Washington, DC, www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/cm-stories/a-new-market-for-infrastructure-financing-helps-izmir-thrive.

Börjesson, M. (2017), “Long-term effects of the Swedish congestion charges”, presentation at the ITF roundtable on social impacts of time and space-based road pricing, Auckland, 1 December 2017, www.itf-oecd.org/road-pricing-roundtable.

Borsa Istanbul (2017), BIST Sustainability Index website, www.borsaistanbul.com/en/indices/bist-stock-indices/bist-sustainability-index (accessed 25 February 2018).

BKP/Panteia/ALSA (2016), “Study of the EU-Turkey bilateral preferential trade framework, including the Customs Union, and an assessment of its possible enhancement”, report commissioned by the European Commission, October 2016, http://trade.ec.europa.eu/doclib/docs/2017/january/tradoc_155240.pdf.

BS and SDSN (2017), SDG Index and Dashboards: 2017, report commissioned by the SDSN Secretariat, www.sdgindex.org/.

C40 (2015), “Milan’s Area C reduces traffic pollution and transforms the city center”, C40 Cities, 24 March 2015, www.c40.org/case_studies/milan-s-area-c-reduces-traffic-pollution-and-transforms-the-city-center.

Croci, E. and A. Ravazzi (2014), Urban Road Pricing: The Experience of Milan, http://ic-sd.org/wp-content/uploads/sites/4/2016/06/Milan-Urban-Road-Pricing_07.08.15.pdf.

DoC (2017), 2017 ITA Environmental Technologies Top Markets Report: Turkey Case Study, U.S. Department of Commerce International Trade Administration, Washington, DC, www.trade.gov/topmarkets.

DS (2018), “Russia willing to build more nuclear plants in Turkey”, Daily Sabah, 6 April 2018, Istanbul, www.dailysabah.com/energy/2018/04/07/russia-willing-to-build-more-nuclear-plants-in-turkey.

EAFO (2018), Turkey: Summary, European Alternative Fuels Observatory, Brussels, www.eafo.eu/content/turkey.

EC (2018), Countries and Regions: Turkey, European Commission Directorate-General for Trade, Brussels, http://ec.europa.eu/trade/policy/countries-and-regions/countries/turkey/.

Ecofys (2016), “Roadmap for the consideration of establishment and operation of a greenhouse gas emissions trading system in Turkey”, report commissioned by the Ministry of Environment and Urbanization, Ankara, www.ecofys.com/en/publications/roadmap-for-an-emissions-trading-system-in-turkey/.

ED (2006), Singapore: A Pioneer in Taming Traffic, Environmental Defense, New York, www.edf.org/sites/default/files/6116_SingaporeTraffic_Factsheet.pdf.

Epp, B. (19 March 2018), “World’s largest flat plate collector manufacturers in 2017”, Solar Thermal World blog, http://solarthermalworld.org/taxonomy/term/44061.

Eurostat (2018), Environmental Protection Expenditure (database), http://ec.europa.eu/eurostat/web/environment/environmental-protection-expenditure/database (accessed 7 June 2018).

Farrel, R. (2016), “What is holding back Turkey’s startups?”, 3 January 2016, Wamba, www.wamda.com/2016/01/what-is-holding-back-turkeys-startups.

FAS (2016), “New Turkish agricultural policy and projected impacts”, GAIN Report, No. TR6053, 14 November 2016, USDA Foreign Agricultural Service, Washington, DC, https://gain.fas.usda.gov/Recent%20GAIN%20Publications/New%20Turkish%20Agricultural%20Policy%20and%20Projected%20Impacts_Ankara_Turkey_11-14-2016.pdf.

Garanti and PwC (2017), Capital Projects and Infrastructure Spending in Turkey: Outlook to 2023, January 2017, Garanti BBVA Group and PwC Turkey, www.pwc.com.tr/en/hizmetlerimiz/danismanlik/sirket-birlesme-ve-satin-almalari/yayinlar/turkiye-altyapi-yatirim-harcamalari-raporu.html.

GBN (2016), “Green Bank Network Members”, webpage, http://greenbanknetwork.org/members/ (accessed 26 February 2018).

GFCC (2017), Environmental Risk Management Initiative for China’s Overseas Investment, Green Finance Committee (GFC) of China Society for Finance and Banking, 5 September 2017, http://unepinquiry.org/wp-content/uploads/2017/09/Environmental-Risk-Management-Initiative-for-China---s-Overseas-Investment.pdf.

GlobalFleet (24 May 2017), “Taxation drives Turks towards leasing”, Features blog, www.fleeteurope.com/en/features/taxation-drives-turks-towards-leasing-0.

Government of Turkey (2017), FDI in Turkey, Invest in Turkey, Ankara, www.invest.gov.tr/en-US/investmentguide/investorsguide/Pages/FDIinTurkey.aspx.

Gündoğan, A.C. and E. Turhan (2017), “China’s role in Turkey’s energy future”, 26 September 2017, China Dialogue, www.chinadialogue.net/article/show/single/en/10047-China-s-role-in-Turkey-s-energy-future.

Harding, M. (2014), “Personal tax treatment of company cars and commuting expenses: Estimating the fiscal and environmental costs”, OECD Taxation Working Papers, No. 20, OECD Publishing, Paris, http://dx.doi.org/10.1787/5jz14cg1s7vl-en.

Hayim, L. (2017), “Turkey’s solar growth continues despite challenging requirements on recent tender”, 26 January 2017, PV Europe, www.pveurope.eu/News/Markets-Money/Turkey-s-solar-growth-continues-despite-challenging-requirements-on-recent-tender.

Hurriyet (2018a), “Chinese company plans to invest $1 billion in Turkey’s green energy market”, 5 April 2018, Hurriyet Daily News, www.hurriyetdailynews.com/chinese-company-plans-to-invest-1-billion-in-turkeys-green-energy-market-129862.

Hurriyet (2018b), “Turkey’s TUBİTAK to support entrepreneurs in clean technology”, 4 February 2018, Hurriyet Daily News, www.hurriyetdailynews.com/turkeys-tubitak-to-support-entrepreneurs-in-clean-technology-126752.

IEA (2018), IEA CO2 Emissions from Fuel Combustion Statistics (database, 2018 preliminary), https://doi.org/10.1787/co2-data-en (accessed 7 June 2018).

IEA (2017), Energy Efficiency 2017, International Energy Agency, Paris, www.iea.org/efficiency/.

IEA (2016a), Energy Policies of IEA Countries: Turkey 2016 Review, International Energy Agency, Paris, www.iea.org/publications/freepublications/publication/EnergyPoliciesofIEACountriesTurkey.pdf.

IEA (2016b), Country Report – Turkey, Solar Heating and Cooling Programme, International Energy Agency, Paris, www.iea-shc.org/country-report-turkey.

IEA (2015), Renewable Energy Law 2010: Turkey, International Energy Agency, Paris, www.iea.org/policiesandmeasures/pams/turkey/name-24961-en.php.

IPC (2016), Coal Report: Turkey’s Coal Policies Related to Climate Change, Economy and Health, April 2016, Istanbul Policy Centre, Istanbul, http://ipc.sabanciuniv.edu/wp-content/uploads/2016/01/Coal-Report-Turkeys-Coal-Policies-Related-to-Climate-Change-Economy-and-Health.pdf.

IPP (2016), STI Outlook 2016 Country Profile: Turkey, Innovation Policy Platform, Washington, DC, www.innovationpolicyplatform.org/content/turkey.

Janssen, R. (2016), “Turkey: Industrial energy efficiency strategy”, 17 October 2016, Energy Efficiency in Industrial Processes, Brussels, www.ee-ip.org/articles/detailed/7cc969ab93f80c76a54ecc339c544ae9/turkey-industrial-energy-efficiency-strategy/.

KGM (2013), Otoyol ve Köprü Gelirleri (2001-12), Highway and Bridge Income, KGM, www.kgm.gov.tr/SiteCollectionDocuments/KGMdocuments/Istatistikler/OtoyolMaliBilgileri/OtoyolveKopruGelirleri(2001-2012).pdf.

KPMG (2017), Turkey – Income Tax, 28 February 2017, https://home.kpmg.com/xx/en/home/insights/2011/12/turkey-income-tax.html.

MEU (2018), Turkey’s Third Biennial Report under the United Nations Framework Convention on Climate Change, January 2018, Ministry of Environment and Urbanization, Ankara, http://unfccc.int/national_reports/biennial_reports_and_iar/biennial_reports_data_interface/items/10132.php.