Questions

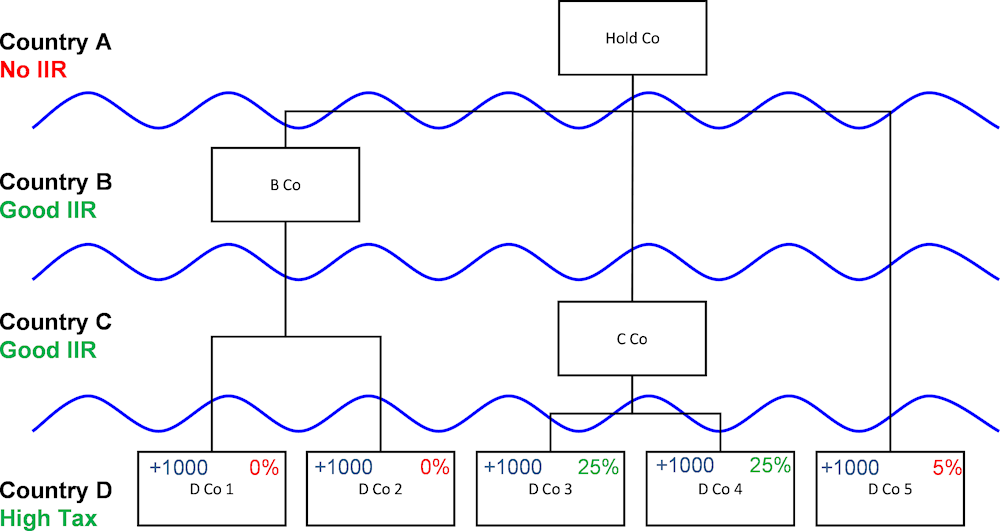

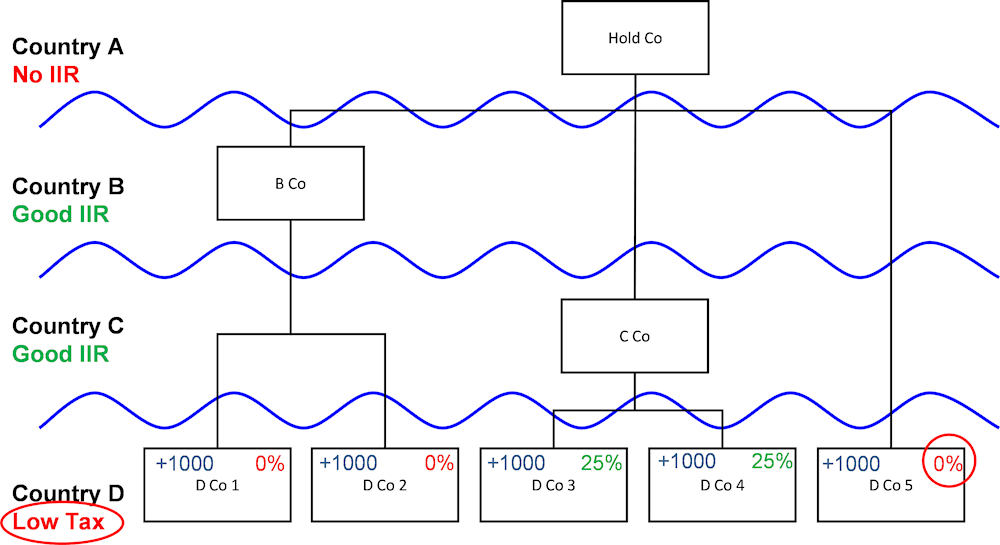

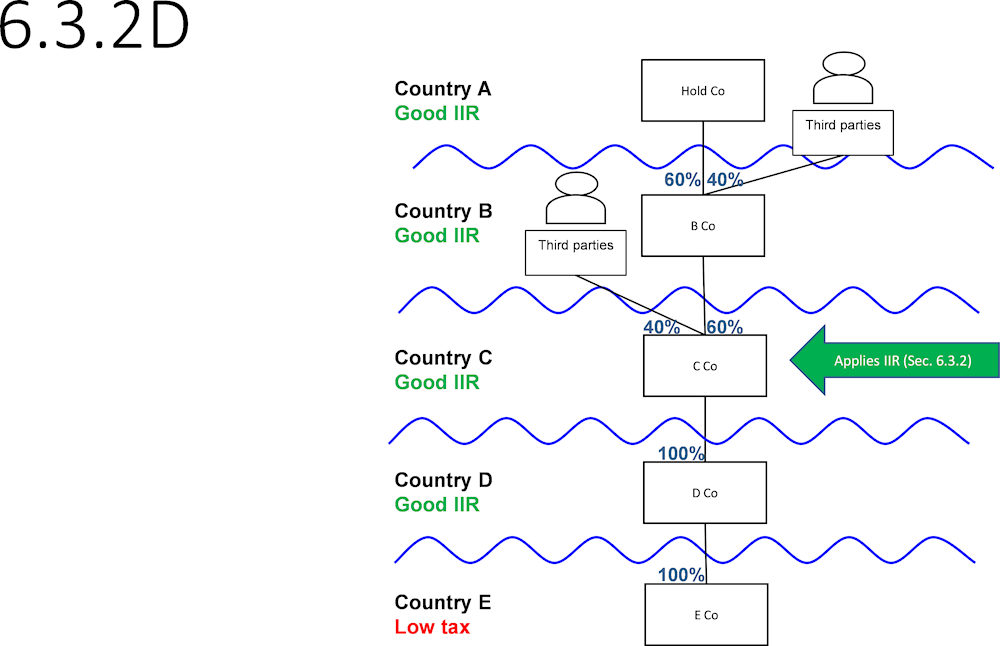

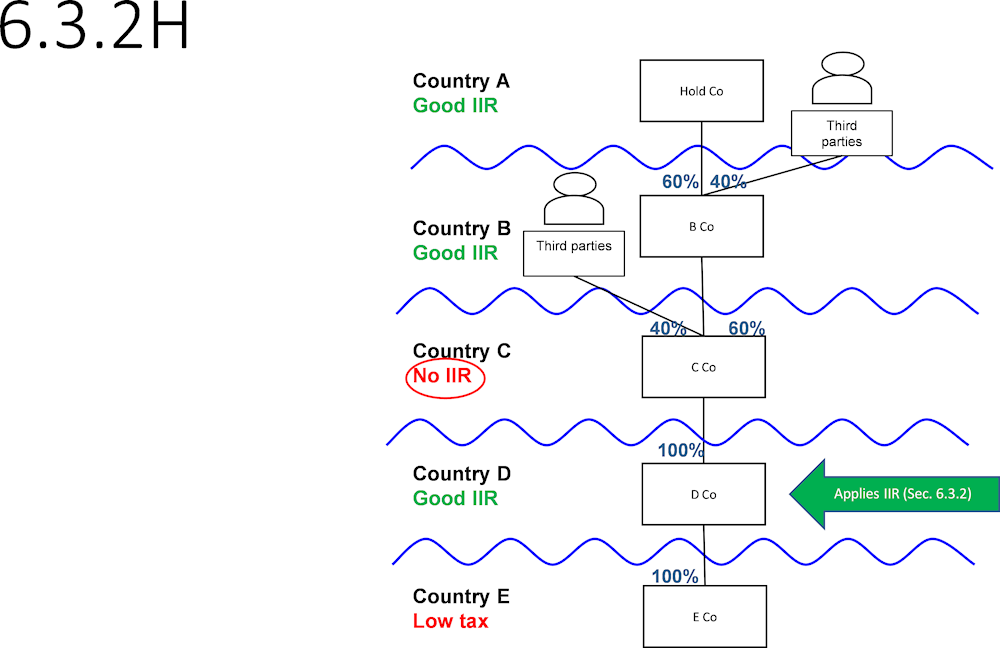

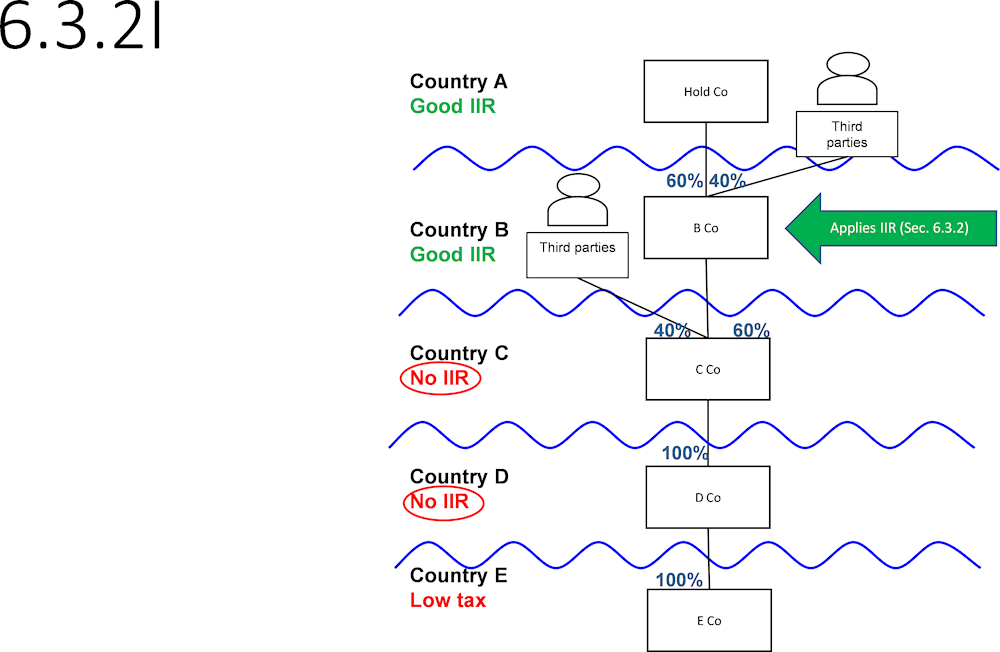

3. How would the GloBE rules operate without split-ownership rules in this situation?

4. What are the issues arising in the absence of split-ownership rules?

Answer

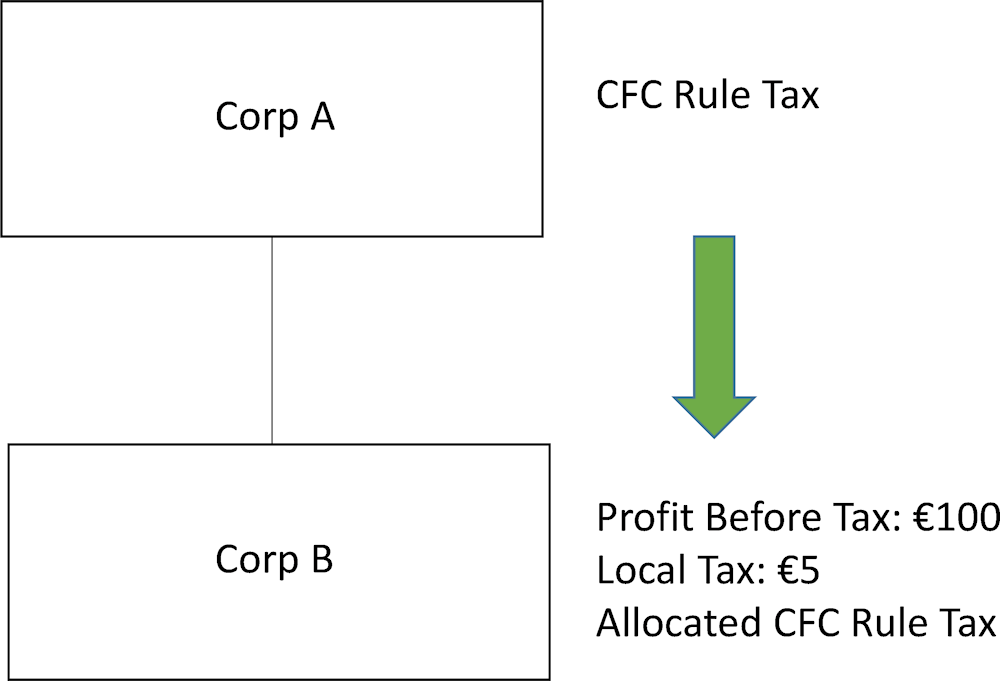

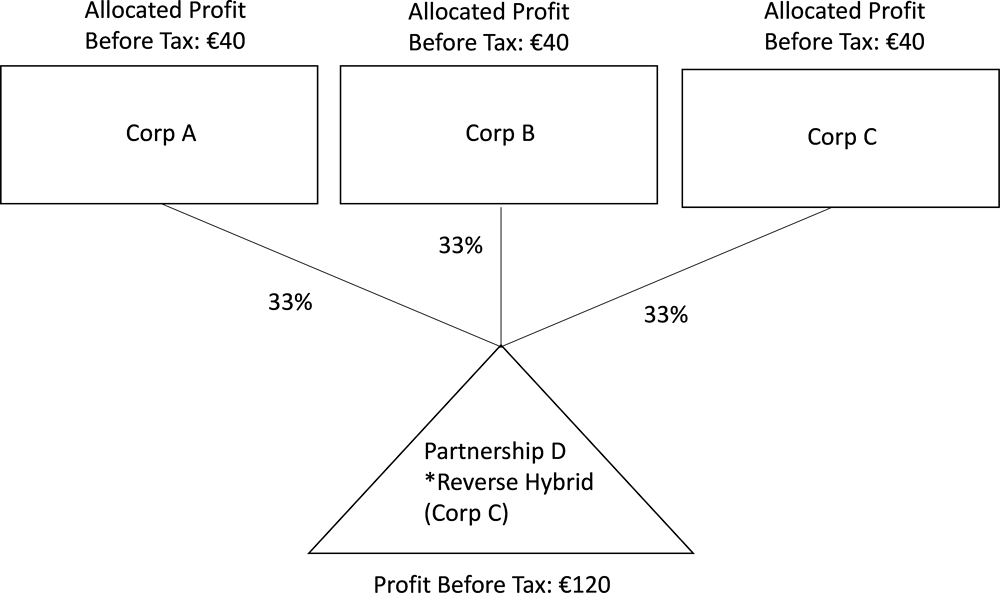

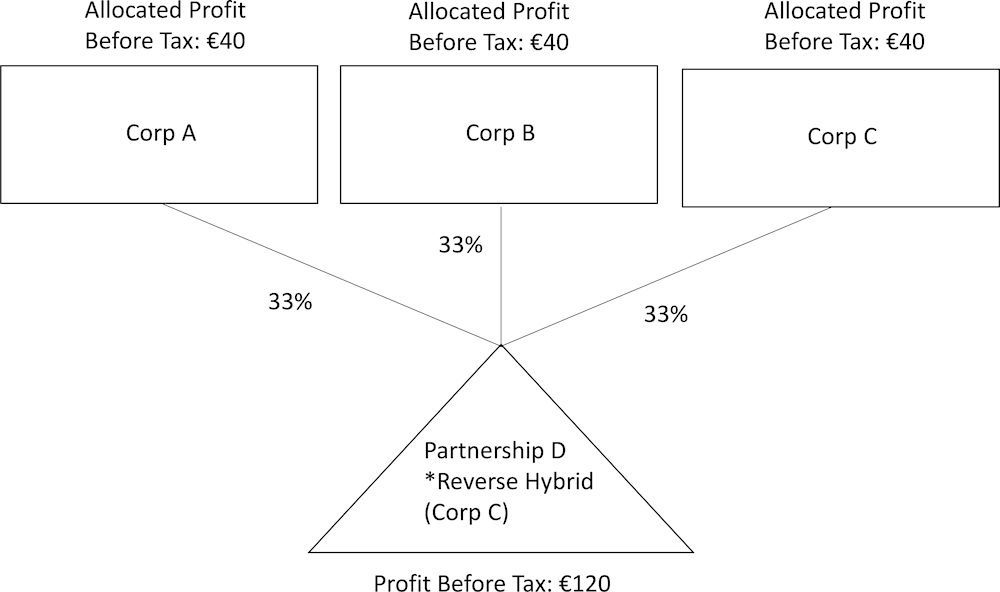

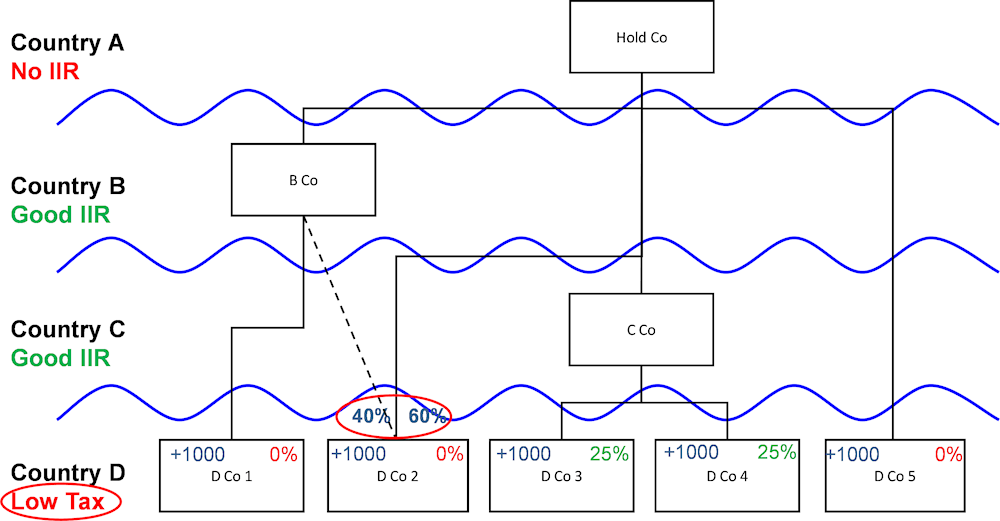

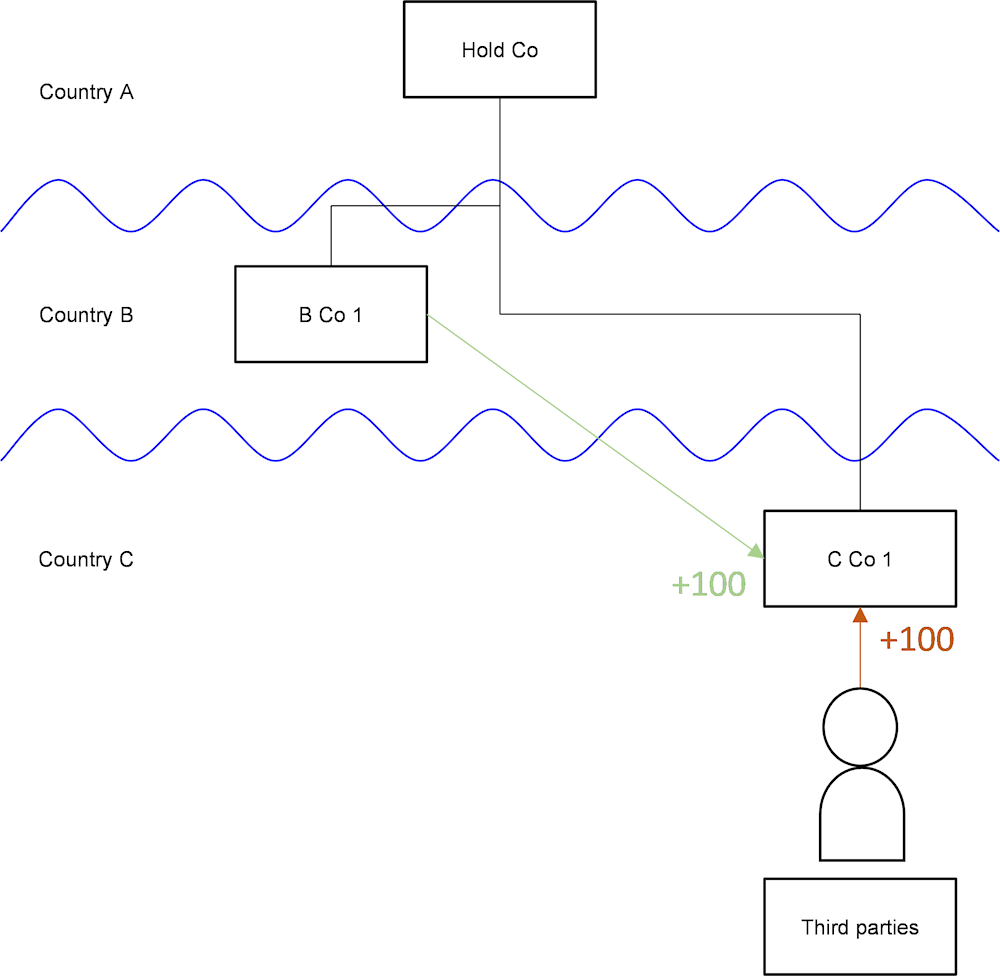

5. In this case, B Co would be required to apply the IIR because Hold Co is located in a jurisdiction that has not adopted the IIR. B Co would be required to apply the IIR with respect to 60% of the income of C Co because that it’s the ownership percentage owned by the UPE. Hold Co would be effectively taxed at 36% because it owns 60% of the equity interests of the Parent applying the IIR, the remaining 24% would be borne by the minority interest holders.

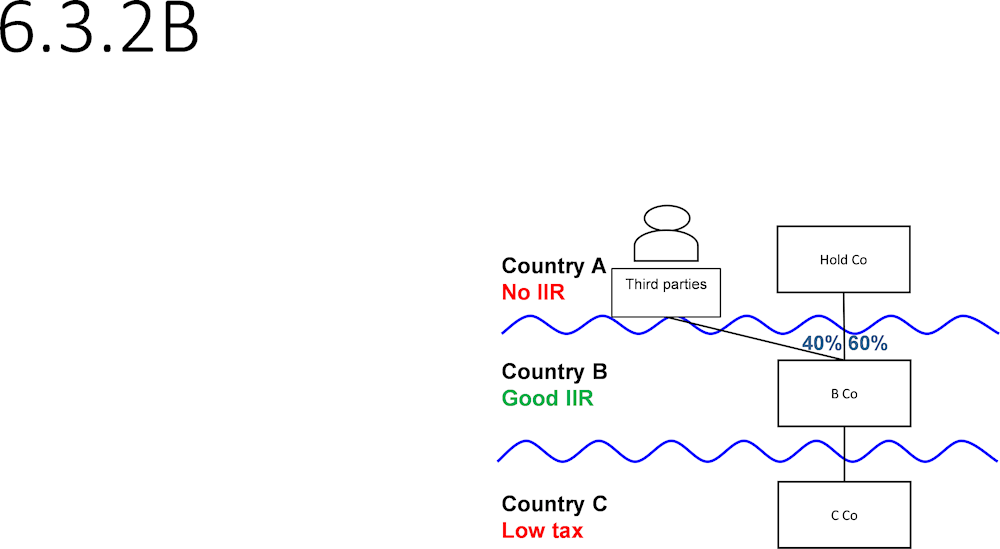

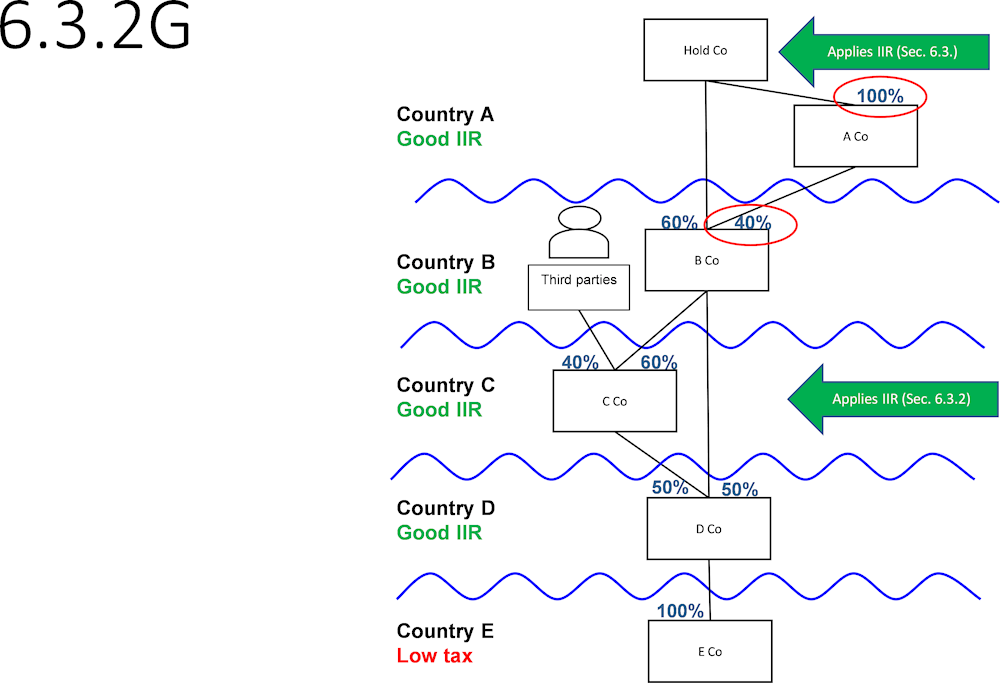

6. The UPE would be subject to a lower IIR liability if the top-up tax is paid by an intermediate parent which is partially-owned. The minority interest holders would be impacted by part of the top-up tax that belongs to the UPE, even if the policy rationale was to exclude minorities.

Analysis

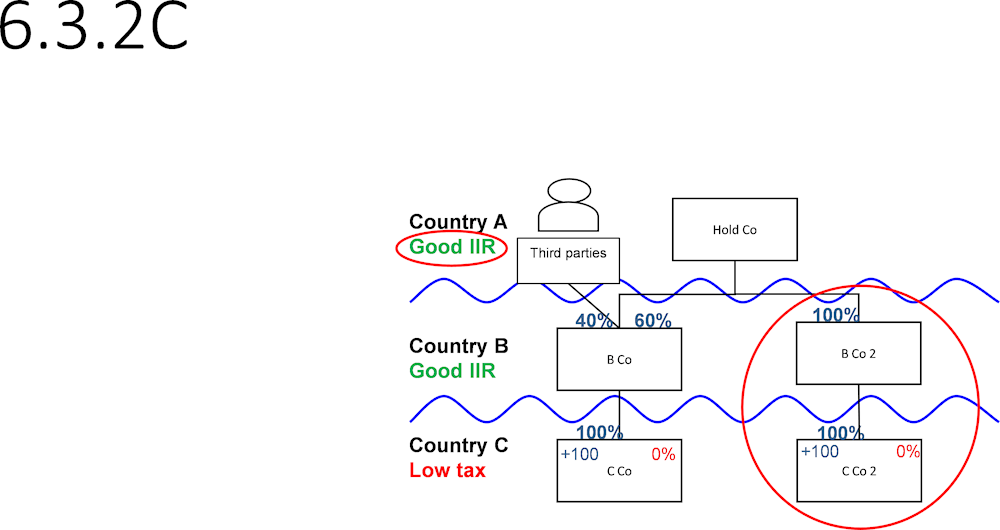

7. The GloBE could have adopted an approach in which the ETR and top-up tax are computed based on the UPE’s ownership share of the low-taxed entity. If the UPE applies the IIR or if it is applied by an intermediate parent wholly owned by the UPE, then the rules work perfectly fine (regardless of exempting income belonging to minorities) because the ETR and top-up tax are computed based on the UPE’s ownership percentage on the low-taxed income.

8. However, if an intermediate parent entity that is not wholly-owned by the UPE is required to apply the rule, then a flaw in the IIR system would occur because the UPE would be subject to lower tax burden. In this case, the income belonging to minorities would be taxed even if the policy was to exclude these minority interests.

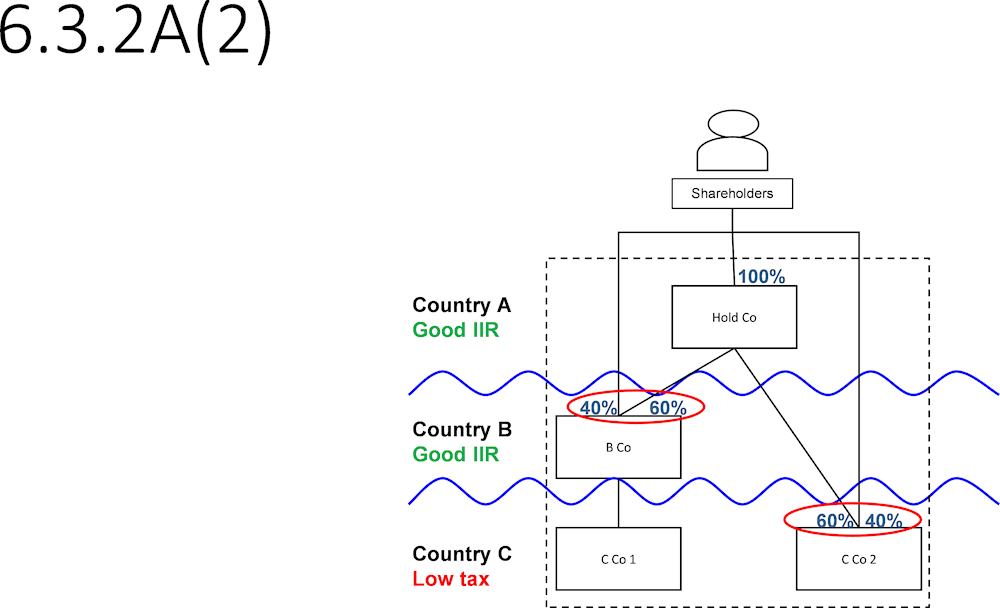

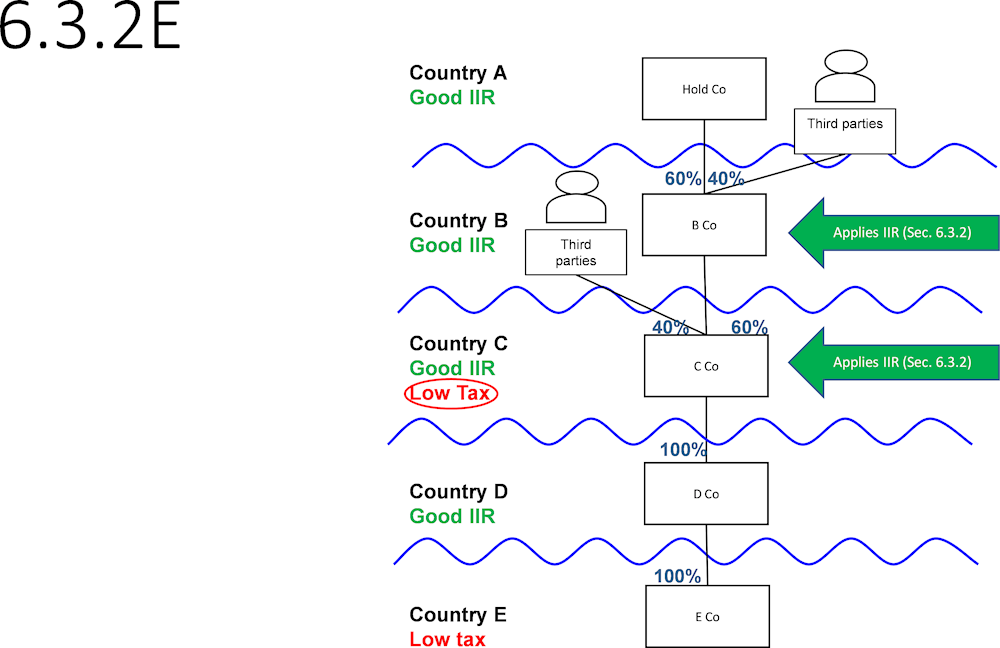

9. In this example, the top-up tax imposed by B Co’s jurisdiction is limited to the Ultimate Parent Entity’s ownership percentage of C Co. Therefore, B Co would apply the IIR with respect to 60% of the income of C Co. This means that Hold Co would effectively be paying top-up tax with respect to 36% of its ownership percentage (60% x 60% = 36%). The remaining 24% would indirectly impact the returns of the minority interest holders as they also own B Co, the entity subject to the IIR tax.

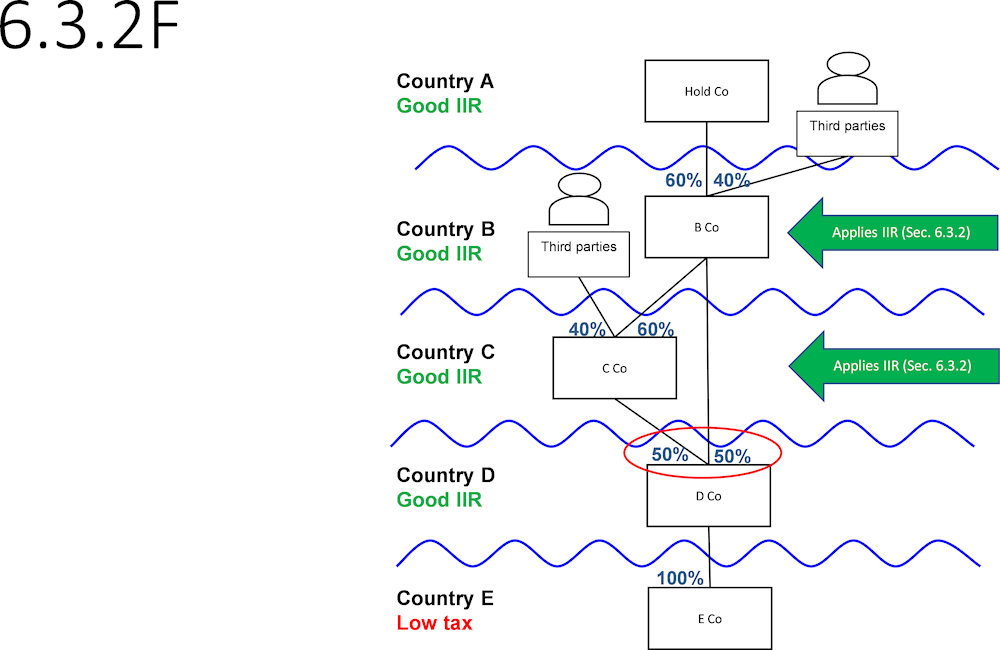

10. A way to solve this problem would be by applying the income inclusion rule based on the intermediate parent’s proportionate share of the low-taxed income. This ensures that the Ultimate Parent Entity is indirectly subject to the income inclusion rule based on its proportionate share of the low-taxed income. In the example, this would mean that B Co would be required to apply the IIR with respect to 100% of the income of C Co. However, the effective tax rate and top-up tax computation would be changing depending on the parent entity or entities apply IIR, which would create another series of issues.

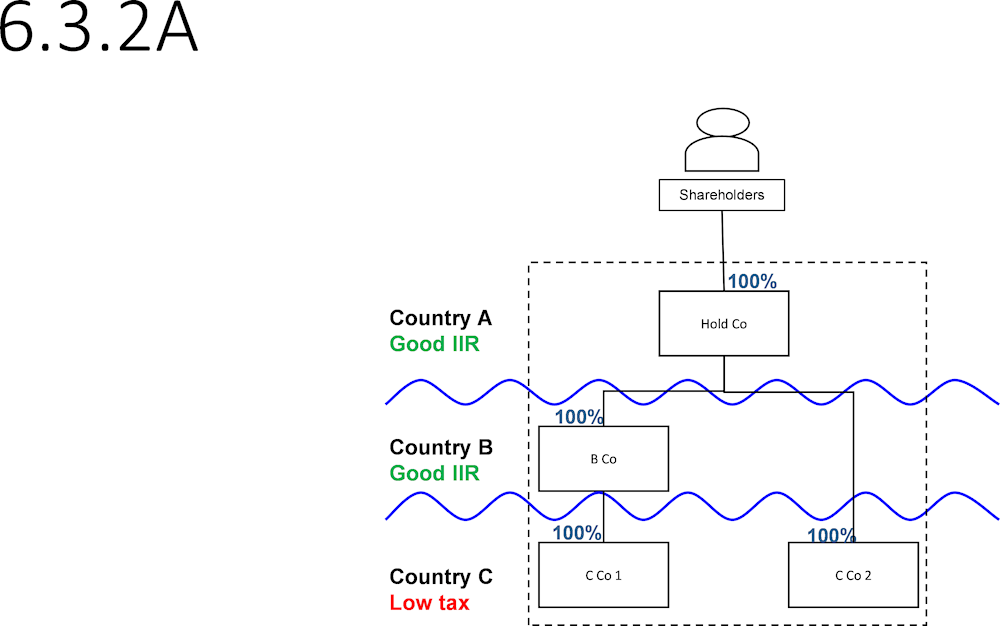

Adopted approach

11. Under the adopted approach the top-up tax percentage computed for Country C is 11% (11% minimum rate – 0% ETR). Accordingly, the top-up tax computed for C Co is 11 [(100 (income) x 11% (top-up tax percentage)]. B Co computes its share of the top-up tax of C Co based on its ownership percentage of C Co, 100%, and pays 11 of top-up tax. Consequently, Hold Co effectively pays 6.6, while the remaining 4.4 of the tax cost is borne by the minority shareholders of B Co.

12. The top-up tax percentage computed for Country C is 11% (11% minimum rate – 0% ETR). If the top-up tax under the GloBE rules was based on Hold Co’s ownership percentage of C Co, then Hold Co would be required to pay 6.6 of top-up tax (100 x 60% x 11%). However, Hold Co is located in a jurisdiction that has not adopted the GloBE rules. Therefore, under the top-down approach, B Co is required to apply the income inclusion rule. If B Co were required to pay 6.6, then Hold Co would be effectively paying 3.96. The tax cost of the remaining 2.64 would be borne by the minority shareholders.