Ana Damas de Matos

International Migration Outlook 2021

4. The fiscal impact of immigration in OECD countries since the mid‑2000s

Abstract

The fiscal impact of immigrants, that is whether immigrants are net contributors or a burden to the public finances, is regularly at the centre of the public debate on migration. The increased pressure on public finances due to the COVID‑19 pandemic will inevitably bring back the question of the impact of immigration on the labour market and public finances to the forefront of the political debate. In this context, it is critical to have sound, updated and internationally comparable data on how much immigrants contribute and cost to receiving countries. This chapter estimates the yearly net fiscal impact of immigrants in 25 OECD countries over the 2006‑18 period. It also provides a systematic analysis of the differences between the foreign and native‑born populations in each item of government expenditure and revenue, as well as a detailed analysis of the socio‑economic determinants of the fiscal position of immigrants.1

In Brief

This chapter provides a comparison of the fiscal impact of immigrants in 22 European OECD countries, Australia, Canada and the United States, over a 13‑year period, from 2006 to 2018, using a common methodology.

In all countries, immigrants contribute more in taxes and contributions than governments spend on their social protection, health and education.

The contributions of immigrants are large enough to fully cover their share of government expenditure on congestible public goods, and contribute to the financing of pure public goods, such as defence and public debt charges, in a vast majority of countries. In 2017, the contribution of immigrants to the financing of pure public goods represented a total of USD 547 billion in the 25 countries included in the analysis.

When all public expenditure is included, the total net fiscal contribution of immigrants remains positive in about a third of the countries covered by the study. Larger per capita contribution for immigrants compared to the native‑born are recorded in approximately half the countries.

The total net fiscal contribution of immigrants is persistently small during the 2006‑18 period, between ‑1% and +1% of GDP for most countries. This total net fiscal contribution depends on the size and composition of the immigrant population, the structure of the host country’s public budget, and varies over the business cycle.

Including the native‑born children of immigrants in the calculation adds a relatively large education cost. The total net fiscal contribution of immigrants decreases by half a percentage point of GDP on average. However, these results are biased as they do not account for the taxes and social contributions paid by the adult native‑born children of immigrants.

In almost all countries, governments spend less on immigrants per capita than on the native‑born. However, immigrants contribute less per capita than the native‑born in practically all countries. The expenditure per capita on the foreign-born is lower than on the native‑born on old age and survival, sickness and disability, education and health, on average across countries. Conversely, the expenditure per capita on family and children, unemployment, social exclusion and housing is on average larger on the foreign-born.

Differences in the composition of immigrant populations across OECD countries explain a large part of the cross-country differences in the fiscal position of immigrants relative to the native‑born. Differences in the age distribution of immigrants, relative to the native‑born, alone account for 60% of the cross-country differences in relative fiscal position of immigrants. Furthermore, immigrants have a more positive fiscal position in countries where the immigrant population consists mainly of recent labour migrants, than in countries who host mainly humanitarian immigrants.

In European OECD countries, prime‑aged (25‑54) immigrants born in other EU countries have a more favourable fiscal position than immigrants born outside the EU.

In almost all countries, more than half of the immigrants are prime aged – the age group with the most favourable net fiscal contribution. However, the net fiscal contribution of prime‑aged immigrants lags behind that of prime‑aged native‑born.

The fiscal gap between prime‑aged immigrants and natives is driven by immigrants’ lower contributions rather than by higher government expenditure on the foreign-born, and is larger for the highly educated.

Immigrants’ lower employment rates are key in explaining the gap in contributions. Closing the employment gap between the prime‑aged foreign and native‑born of the same age and education could increase the total net fiscal contribution of immigrants by over 0.5% of GDP in Belgium and Sweden, and over a third of a percentage point in Austria, Denmark, Luxembourg and the Netherlands.

Over the 2006-18 period, the net fiscal contribution of immigrants declined most in countries where the share of older immigrants has increased the most during this time, such as Lithuania or Latvia. Conversely, the improvement in the fiscal position of immigrants was largest in countries that received large recent inflows of highly skilled labour migrants, such as the United Kingdom.

The total net fiscal contribution of immigrants, similarly to that of the native‑born, is strongly pro-cyclical. While immigrants lost their jobs at a higher rate during the global financial crisis in many OECD countries, their fiscal position deteriorated similarly to that of the native‑born.

The economic consequences of the COVID‑19 pandemic are putting at risk the improvements observed recently regarding the labour market inclusion of immigrants. This calls for maintaining, if not increasing, investments in the labour market integration of recently arrived and settled migrants as these programmes have a very high fiscal return.

Introduction

The fiscal impact of immigrants, that is whether immigrants are net contributors or a burden to the public finances, is regularly at the centre of the public debate on migration. During the humanitarian migration crisis in 2015/16 in Europe, the issue of the fiscal cost of receiving and integrating large inflows of refugees drew a lot of attention. Although the salience of migration issues has decreased due to the COVID‑19 pandemic, the economic crisis and the increased pressure on public finances will inevitably bring back the question of the impact of immigration on the labour market and public finances to the forefront of the political debate. In this context, it is critical to have sound, updated and internationally comparable data on how much immigrants contribute and cost to receiving countries.

The first OECD comparative study on the fiscal impact of immigrants, (OECD, 2013[1]), showed that, before the 2008/09 economic crisis, immigrants contributed more in taxes and social contribution than they received in social benefits in most OECD countries, and that the net effect of immigrants on the public budget was small everywhere. The net fiscal contribution of immigrants was however generally lower than that of the native‑born due to lower contributions rather than higher benefits received. The chapter highlighted the role of immigrants’ labour market integration in improving their fiscal contribution.

In the past ten years, the composition of immigrants in OECD countries has changed significantly. Recent immigrants are more educated and come from countries that are more diverse (d’Aiglepierre et al., 2020[2]). The share of refugees among the immigrant population has increased in many countries. The demographic and economic context has also changed. Ageing populations put increasing pressure on the fiscal budget of most OECD countries through higher expenditure on old age benefits and health. Finally, the current economic downturn due to the COVID‑19 crisis puts OECD countries under great fiscal pressure and renews the importance of understanding the fiscal impact of immigrants.

This chapter estimates the net fiscal impact of immigrants in 25 OECD countries over the period between 2006‑2018. It uses a top-down accounting approach in which all categories of expenditure and revenue of the public budget, as reported in the national accounts, are attributed to the native‑born and immigrant populations.

This chapter contributes to the literature in three ways. First, it is the first study to provide a broad comparative overview across the OECD by covering both European OECD countries and settlement countries, namely Australia, Canada and the United States. Second, by covering 13 years, the estimations incorporate changes in immigrant populations and show how the fiscal impact of immigrants changes over a longer period and over the business cycle. Third, the chapter provides a systematic analysis of the differences between the foreign and native‑born populations in each item of government expenditure and revenue, as well as a detailed analysis of the socio‑economic determinants of the fiscal position of immigrants.

The first section of the chapter reviews recent studies on the fiscal impact of immigrants in OECD countries. The second section introduces the methodological approach. The third section presents the estimations of the net fiscal impact of immigrants. The first set of results looks at the overall fiscal contribution of immigrants over the whole period of analysis, 2006 to 2018. The second set focuses on the differences in the fiscal contribution of immigrants depending on their age, education and employment status. The last set of results studies the changes over the period in the fiscal contribution of immigrants.

Recent evidence on the fiscal impact of immigration in OECD countries

This section focuses on the literature on the fiscal impact of immigration of the last ten years. A detailed review of the methods and literature until the early 2000s is available in the previous OECD publication on this topic (OECD, 2013[1]).

There are two main types of studies on the fiscal impact of immigration: static and dynamic. Static studies evaluate the net fiscal contribution of immigrants to the public finances at a given point in time, typically a year, using an accounting approach. Dynamic studies measure the fiscal impact of immigrants throughout their entire lifecycle.

The static accounting approach seeks to apportion all revenue and expenditure items of the public budget to the immigrant and native‑born population. A main result of this literature is that the net fiscal contribution of immigrants is small. In line with the literature, OECD (2013[1]) estimates the net fiscal contribution of migrants to be between plus and minus 0.5% of GDP for most OECD countries in 2006 to 2018.

Recent accounting studies have estimated the fiscal impact of immigrants over longer periods and in some cases focussed on specific immigrant groups, such as intra-EU immigrants, following EU-enlargement, or refugees, following the 2015/16 humanitarian crisis. Some of these recent studies also present an estimation of the Net Present Value (NPV) of the fiscal impact of an immigration cohort over their lifecycle. The results of such forward-looking analysis are sensitive to the discount rate used and to assumptions on immigrants’ integration including the taxes they will pay over their lifetime, the benefits they will receive, and how long they will live in the host country.

Recent studies for European OECD countries find small fiscal contributions of immigrants but a more positive contribution for EU migrants. This is the case in Belgium (National Bank of Belgium, 2020[3]), Denmark (Danish Ministry of Finance, 2020[4]), the United Kingdom (Oxford Economics, 2018[5]) for the years 2016/17. A report from the National Bank of Belgium (2020[3]) showed that the lower fiscal contribution of non-EU immigrants is due to their lower employment rates. In the United Kingdom, EU immigrants are shown to contribute more than the native‑born due to higher taxes and contributions. Despite lower yearly fiscal contributions of non-EU migrants, all immigrants arrived in 2016 in the United Kingdom are expected to have a positive net fiscal contribution over their lifetime (Oxford Economics, 2018[5]).

EU immigrants also had a positive net fiscal contribution in Denmark and Sweden in the post-enlargement period. Martinsen and Pons Rotger (2017[6]) show that EU immigrants were not a burden to the welfare state over the years 2002‑13, and in fact made a significant positive net contribution to the Danish public budget. Ruist (2014[7]) estimates that the net fiscal contribution of post-enlargement immigrants to the Swedish public finances in 2007 was small and positive. They generated less public revenue than the population on average, but also costed less. Their total fiscal contribution over their lifecycle is also shown to be positive under reasonably weak assumptions.

Studying over 30 years of immigration to France, Chojnicki, Ragot and Sokhna (2018[8]) showed that the net fiscal contribution of immigrants to the primary budget was negative but small, between plus and minus 0.5% of GDP, over 1979‑2011. The net fiscal contribution of EU immigrants decreased over the period, due to the ageing of this population. Furthermore, the study shows that the fiscal contribution of immigrants decreased after the global financial crisis.

Using data from 1995‑2011, Dustmann and Frattini (2014[9]) show that in the United Kingdom, recent immigrants, arrived in 2000 and later, had a positive net fiscal contribution over ten years, irrespective of their country of origin. Using a similar period for the United States, 1994‑2013, Blau and Mackie (2017[10]) show that while the net fiscal contribution of immigrants is lower than that of the native‑born, controlling for education and ethnicity eliminates a significant part of the difference. Immigrants from more recent cohorts tend to have a more positive fiscal contribution due to higher educational attainment.

A main determinant of the fiscal impact of immigrants is their category of immigration. Labour immigrants are expected to have larger fiscal contributions than family or humanitarian immigrants do. Data by category of migration is only available in a few countries, such as Canada. Zhang, Zhong and de Chardon (2020[11]) model the NPV of the fiscal impact of the 2016 immigrant cohort. They show that the present lifetime net direct fiscal contribution of economic immigrants is positive as long as immigrants arrive in Canada before age 49. In contrast, the net direct fiscal contribution of refugees is negative.

Despite lower fiscal contributions than other immigrants, the fiscal cost of refugees is shown to be relatively small in recent literature. Ruist (2015[12]) estimates the cost of refugees at 1% of GDP to the Swedish public finances in 2007. Ruist (2020[13]) presents estimates that if the European Union received all refugees currently in Asia and Africa, the implied average annual fiscal cost over the lifetime of these refugees would be at most 0.6% of the EU’s GDP.

The fiscal gains of integrating refugees are also put forward in recent studies for European countries, such as Bach et al. (2017[14]) and European Commission (2016[15]). For Germany, Bach et al. (2017[14]) explicitly model the integration of refugees arrived in 2015 until 2030 and show how the fiscal balance improves with efficient language and skill training.

The vast majority of recent studies are country studies. An exception is a study of the fiscal impact of European migrants within the European Economic Area countries over the period 2004‑15 (Nyman and Ahlskog, 2018[16]). Most countries (21 out of 29) benefited from a positive tax impact of intra-European migration. The net fiscal contributions are estimated to be between plus and minus 0.4% of GDP.

Another recent cross-country study for European countries shows that immigrants had a more positive net fiscal contribution in 2015 than the native‑born (Christl et al., 2021[17]). However, the fiscal contribution over their lifecycle was estimated to be larger for the native‑born than for immigrants, and larger for EU immigrants than non-EU immigrants. The contribution of non-EU immigrants is shown to be lowest relative to the native‑born in traditional welfare states.

In the last ten years, there was also a significant development of Dynamic Applied General Equilibrium Models (DAGEM) to study the fiscal impact of immigration. These models incorporate general equilibrium effects such as the impact of an increase of immigration on the labour supply and wages of natives, and hence on their fiscal contributions.

Chojnicki, Docquier and Ragot (2011[18]) found that post-war immigration (1945‑2000) to the United States, was found that beneficial for all cohorts of natives and for all skill levels. This is the result of a large positive fiscal impact and moderate labour market impact of immigration. The post-war immigration, compared to a zero immigration scenario, is estimated to have reduced the share of public transfers in GDP by 0.3 percentage points.

Chojnicki and Ragot (2015[19]) show that immigration contributes to reducing the tax burden related to the ageing of the French population. However, the financial gains are relatively moderate in comparison to the implied demographic changes. A 20 to 30% fiscal burden reduction would imply a two‑fold increase in the current immigrant share of the population by the end of the century, holding the age and qualification of the immigrant population fixed.

Hansen, Schultz-Nielsen and Tranæs (2017[20]) take a similar approach and look at the contribution of immigration to lower the tax burden of ageing in Denmark. Immigrants from Western countries have a positive impact on Danish public finances, while those from non-Western countries have a significant negative impact. The lower employment rate of non-Western immigrants explains the difference in the fiscal impact between the two groups of immigrants.

Berger et al. (2016[21]) calibrated and simulated an identical DAGEM for four European countries (Austria, Germany, the United Kingdom and Poland). They found that the contribution of future immigration is equivalent to 2.1 percentage points labour income taxes in the United Kingdom, 3.9 points in Poland, 5.7 points in Austria and 7.3 points in Germany in 2060. These heterogeneous impacts are explained by differences in expected size and composition of immigration flows but also by cross-country differences in the pension systems.

Colas, Sachs and Weizsäcker (2021[22]) estimate the indirect fiscal benefits of low-skilled immigration in the United States to be positive and large enough that they partly, or completely, offset the estimated negative direct fiscal impact of low-skilled immigrants estimated in the literature.

Finally, some recent papers present a dynamic model-free approach by estimating VAR (vector autoregressive) models. D’Albis, Boubtane and Coulibaly (2019[23]) estimate a VAR model on a panel of 19 OECD countries for 1980‑2015. In this set up, increased migration has a positive impact on the fiscal balance, through its increase of the working-age population and consequently of GDP per capita, and through a decrease in per capita net transfers from the government.

Measuring the fiscal impact of immigration

How much do immigrants contribute to government revenue in the host country and how much do they cost in terms of government expenditure? To answer this question, this chapter estimates for each country and each year the net fiscal contribution of immigrants, that is the difference between the tax contributions made by immigrants and the government expenditure on public benefits and services they receive.

This accounting approach provides a snapshot of the contribution to the fiscal balance of all immigrants living in the host country in a given year. However, the accounting approach in this chapter is not fully static. The chapter uses over ten years of data to show the evolution of the fiscal contribution of immigrants over the 2006‑18 period.

The target group are all foreign-born residents of the host country

The analysis focuses on foreign-born individuals living in the host country in each year.2 It uses labour force surveys for the different countries as a representative base of the resident population.3 These data contain basic demographic information (age, gender, country of birth), relevant variables to disaggregate the immigrant population (region of origin, immigration cohort), as well as information on skills and labour market status shown to be important determinants of the individual’s net fiscal contribution.

A question in the literature is whether the native‑born children of immigrants – the so-called second generation – should be included in the target population. While some studies define immigrants as the foreign-born, including foreign-born children, others argue that the costs and revenue of the native‑born children of immigrants are directly attributable to their parents.

This chapter focuses on the foreign-born. This choice is driven by data availability. Indeed, in most surveys, there is no direct information on the country of origin of the parents, which prevents us from identifying the children of immigrants once they leave parents’ household.

However, Box 4.1 presents estimations in which the native‑born children of immigrants are considered part of the immigrant population as long as they are aged 15 or younger, and are part of their immigrant parent’s household.4 The estimations of the net fiscal contribution of immigrants are a lower bound as the costs of the “second generation” early in their lifecycle, which are health and education costs, are attributed to immigrants, whereas their contributions in taxes later in life are attributed to natives.

Several strategies are used to apportion each expenditure and revenue item of the public budget to the foreign or native‑born populations

Data on the public budget of OECD countries over time comes from the OECD National Accounts Statistics database (OECD, 2021[24]). Data are internationally comparable by following the System of National Accounts 2008 (SNA 2008). The level of analysis used is that of the general government. This includes not only the central government but also consolidated accounts that include state and local government, as well as social security funds.

Four main expenditure items considered in the analysis are expenditure on public goods, health, education and social protection. These four main items are further split into 15 items, which are the items that are apportioned to the foreign and the native‑born. Annex 4.B describes all the expenditure items used in the analysis in more detail.

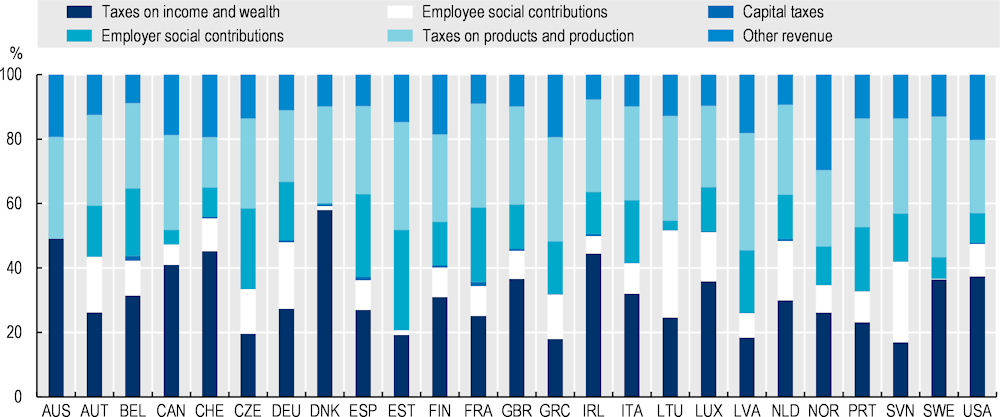

The revenue items considered in the analysis are direct taxes (taxes on wealth and income), indirect taxes (taxes on products and production), capital taxes, social contributions and other revenue.5 The main taxes on products are VAT, excises, and taxes on imports. Taxes on production are taxes on land, use of fixed assets, professional licenses, etc. Capital taxes exist only in some of the countries and are exceptional taxes such as taxes on inheritances.

Education and health expenditures are demographically modelled

Expenditure on education for the different levels (pre‑primary and primary, secondary, post-secondary, and tertiary) is attributed per capita to each immigrant and native‑born individual attending the corresponding education levels. Similarly, health expenditure is also apportioned based on the age distribution of the immigrant and native‑born populations. The estimation strategy consists in applying the OECD’s estimates of cost-age curves6 by country (Lorenzoni et al., 2019[25]) to the immigrant and native‑born population in the (Labour Force Survey) LFS to apportion the total expenditure on health reported in the national accounts.

A limitation of this approach is that the health costs of same age immigrant and native‑born are assumed the same. This is due to the lack of cross-country data on the relative use of public health services. However, it is likely that immigrants and the native‑born of the same age represent a different cost for the health system. The literature has emphasised different reasons for potential cost differences. For example, immigrants tend to be positively selected and hence in better health than the average population. Immigrants also tend to use health services less than the native‑born, sometimes due to lack of knowledge of the health system, lack of language skills or other barriers. Similarly, the education costs of immigrants and natives may also differ given that immigrant and native‑born families may have different propensities to enrol their children in public versus private education.

Survey data on income is used to apportion social protection expenditure as well as taxes and social contributions

The apportionment of all categories of social protection, as well as that of direct taxes and social contributions, is based on survey data on income. The surveys used are the European Survey on Income and Living Conditions (EU-SILC) for European OECD countries, the Household Expenditure Survey (HES) and the Survey of Income and Housing (SIH) for Australia, the Current Population Survey (CPS) for the United States, the Survey of Labour and Income Dynamics (SLID) and the Canadian Income Survey (CIS) for Canada.

In a first step, the host country’s population is divided into 14 groups based on country of birth (foreign and native‑born), age and education.7 For each group, in each year and in each country, mean values of the different types of benefits, taxes and contributions are estimated using the surveys on income. For example, we estimate the mean unemployment benefits received by prime‑aged immigrants (25‑54 years old) with tertiary education in Italy in 2016.

In a second step, each revenue and expenditure item in the government’s budget is apportioned to the population sub-groups using the estimated means from the income surveys and the population counts from the LFS89.

Following this approach implies that the national account items are apportioned to immigrants and natives (of different age and education groups) proportionally to the observed mean differences in the income surveys. However, the population totals for each subgroup used are those from the LFS. This strategy overcomes the limitation of income surveys, in particular of EU-SILC, that they may not be fully representative of the immigrant population.10 For the United States, the CPS directly contains information on benefits and taxes. Only the CPS is used to apportion the national account items in this case.

Indirect taxes, which are taxes on products and production, are apportioned based on individualised household disposable income information available in the income surveys. The apportionment of taxes on products would ideally be based on survey data on consumption baskets of immigrants and the native‑born. Unfortunately, cross-country survey data with this level of detail is not available. Instead, the apportionment done in this chapter assumes that consumption baskets do not differ between immigrants and the native‑born, and that total consumption expenditure is linear in disposable income. Under these assumptions, taxes on products can be apportioned to immigrants and the native‑born based on their relative disposable incomes.11

Taxes on production are apportioned in the same way as taxes on products, i.e. proportionately to each group’s disposable income. Ideally, taxes paid by companies would be apportioned to company holders and stockholders. There is currently no cross-country data available to support such an analysis. In any case, taxes on production represent a small share of indirect taxes (an average across countries of approximately 15%).

How should expenditure on public goods be apportioned?

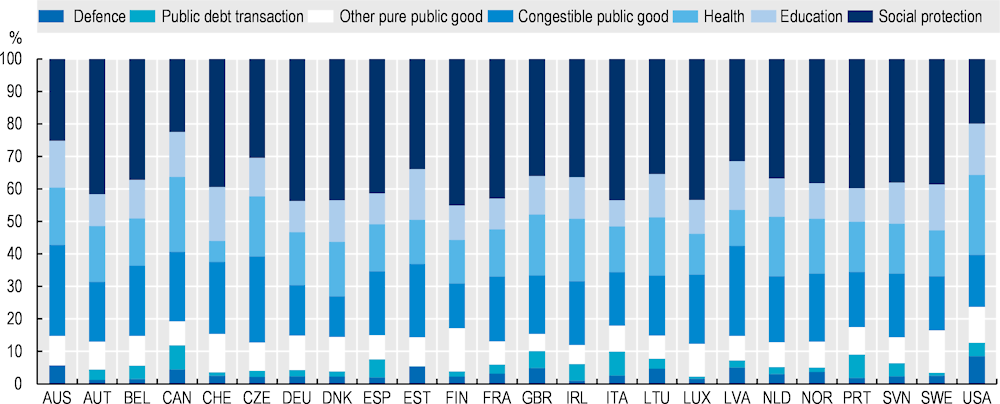

Expenditure on public goods represents an average across countries of 40% of total expenditure and varies widely across countries, from 31% in Denmark to 48% in Latvia and the United States. In line with the literature on the fiscal impact of immigration, the expenditure on public goods is divided into expenditure on congestible public goods and pure public goods.

Congestible public goods are public goods for which the cost of provision increases with population size. Examples of congestible public goods are the provision of water and utilities, police services or public transports. For simplicity, the assumption in most studies is that the marginal cost of provision equals the average cost so that the government’s expenditure on congestible public goods is apportioned per capita to the native‑born and immigrants alike. This is also the approach taken in this chapter.

Pure public goods are public goods for which the marginal cost is zero. The cost of providing pure public goods does not change with population size. Examples of pure public goods are defence services, interest on public debt, or running executive and legislative organs.

How public goods are apportioned to the foreign and the native‑born is a key factor in understanding estimations of the fiscal impact of immigrants. In a cross-country analysis, this is even more important given the differences across countries in the shares of expenditure allocated to items such as defence or public debt transactions.

Given that an inflow of immigrants should not change the government’s expenditure on pure public goods, many studies apportion this expenditure per capita to the native‑born only (Rowthorn, 2008[26]). Alternatively, others consider that the average cost of what are usually classified as pure public goods may be correlated with the country’s GDP and population size, particularly so when the analysis covers a long period. Hence, they apportion all public goods, congestible and pure, per capita to the native‑born and immigrants alike.

The empirical analysis in this chapter presents results with and without taking into account pure public goods. The comparison of the different sets of results is insightful into the role immigrants play in the fiscal balance in different countries.

A limitation of the analysis is that some of the services classified under public goods are in reality targeted at specific population groups. Ideally, these items would be identified in the national accounts and apportioned to the relevant sub population, instead of per capita. Unfortunately, the expenditure data in the national accounts is not detailed enough to do so. For example, integration programmes for immigrants (including language training) are not separately identified in the data and hence cannot be attributed to immigrants only. In this setting, they are classified under congestible public goods. Similarly, active labour market policies (including lifelong learning), firm support (including for small and medium enterprises and micro enterprises), and other programmes are not specifically allocated to their target populations.

The fiscal impact of immigrants in OECD countries, 2006‑18

The net fiscal contribution of the immigrant population, 2006‑18

Immigrants pay more in taxes and social contributions than they receive in benefits and services

The first part of the results in this chapter look at the fiscal contribution of the overall immigrant population in each country on average over the 13 years for which data is available. Table 4.1 presents the estimated net fiscal contribution of both immigrants and natives in percentage of the host country’s GDP under different specifications. The net fiscal contribution of a group is the difference between their taxes and contributions and the costs of the benefits and public services they receive.

Specification A in Table 4.1 includes only government expenditure and revenue items that are apportioned to different individuals based on their personal characteristics. These are expenditure on health, education and social protection, as well as revenue from direct and indirect taxes, and social contributions. The items excluded are those that are apportioned per capita.

Table 4.1. The net fiscal contribution of the foreign and native‑born

In percentage of GDP, 2006‑18 average

|

|

Foreign-born |

Native‑born |

|||||

|---|---|---|---|---|---|---|---|

|

A |

B/C1 |

C2 |

A |

B |

C1 |

C2 |

|

|

Items at the individual level only |

With congestible public goods apportioned per capita to all |

Items at the individual level only |

With congestible public goods apportioned per capita to all |

||||

|

No pure public goods |

Pure public goods apportioned to the foreign and native‑born |

No pure public goods |

Pure public goods apportioned to the native‑born only |

Pure public goods apportioned to the foreign and native‑born |

|||

|

AUS |

3.46 |

1.52 |

-0.41 |

6.02 |

1.84 |

-4.24 |

-2.31 |

|

AUT |

1.67 |

0.83 |

‑0.50 |

8.76 |

4.76 |

‑2.93 |

‑1.60 |

|

BEL |

1.38 |

0.12 |

‑1.28 |

13.56 |

6.68 |

‑2.57 |

‑1.16 |

|

CAN |

2.16 |

0.73 |

‑1.19 |

9.62 |

5.41 |

‑2.17 |

‑0.25 |

|

CHE |

3.18 |

2.46 |

0.84 |

5.63 |

3.85 |

‑1.79 |

‑0.17 |

|

CZE |

0.37 |

0.13 |

‑0.04 |

11.35 |

3.71 |

‑1.77 |

‑1.60 |

|

DEU |

1.54 |

0.93 |

‑0.28 |

9.24 |

6.11 |

‑1.18 |

0.02 |

|

DNK |

0.87 |

0.71 |

‑0.08 |

9.51 |

8.09 |

‑0.54 |

0.25 |

|

ESP |

1.70 |

0.79 |

‑0.15 |

6.55 |

0.69 |

‑6.22 |

‑5.29 |

|

EST |

0.05 |

‑0.66 |

‑1.53 |

9.86 |

6.16 |

0.66 |

1.53 |

|

FIN |

0.13 |

0.18 |

‑0.18 |

7.16 |

8.47 |

‑0.66 |

‑0.30 |

|

FRA |

1.02 |

0.25 |

‑0.85 |

9.31 |

4.17 |

‑4.35 |

‑3.25 |

|

GBR |

2.02 |

1.20 |

0.23 |

5.33 |

0.24 |

‑6.68 |

‑5.71 |

|

GRC |

1.24 |

1.05 |

0.04 |

7.25 |

4.87 |

‑8.55 |

‑7.54 |

|

IRL |

1.57 |

0.62 |

‑0.21 |

2.87 |

‑2.00 |

‑6.95 |

‑6.12 |

|

ITA |

1.87 |

1.48 |

0.57 |

9.91 |

5.85 |

‑4.54 |

‑3.63 |

|

LTU |

0.23 |

‑0.03 |

‑0.31 |

8.16 |

3.23 |

‑2.49 |

‑2.21 |

|

LUX |

7.64 |

5.21 |

2.89 |

4.47 |

1.38 |

‑3.92 |

‑1.59 |

|

LVA |

0.28 |

‑0.72 |

‑1.58 |

9.54 |

3.95 |

‑1.79 |

‑0.92 |

|

NLD |

0.85 |

0.38 |

‑0.36 |

7.87 |

4.24 |

‑2.15 |

‑1.42 |

|

NOR |

1.34 |

1.91 |

1.22 |

10.80 |

15.67 |

9.30 |

9.99 |

|

PRT |

1.79 |

1.56 |

0.89 |

5.36 |

2.39 |

‑6.85 |

‑6.18 |

|

SVN |

0.68 |

0.22 |

‑0.43 |

7.69 |

3.04 |

‑3.99 |

‑3.34 |

|

SWE |

1.00 |

0.68 |

‑0.83 |

10.00 |

8.51 |

‑0.30 |

1.21 |

|

USA |

1.00 |

1.00 |

‑0.68 |

1.91 |

1.86 |

‑7.92 |

‑6.25 |

|

Average |

1.56 |

0.88 |

-0.16 |

7.90 |

4.64 |

-2.93 |

-1.90 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Specification B adds all remaining items in the public budget, except pure public goods. These are mainly congestible public goods, such as provision of water and utilities, police services or public transports, and revenue items classified under other government revenue, described in detail in Annex 4.B. These expenditure and revenue items are apportioned per capita to foreign and native‑born adults. Specification C adds expenditure on pure public goods, apportioned per capita to native‑born adults only (Column C1) or to both foreign and native‑born adults (Column C2).12

Once all items of the government’s budget are taken into account (Columns C1 and C2), the net contribution of immigrants plus that of the native‑born add up to the government’s budget balance. Apportioning pure public goods also to the foreign-born (Column C2) shifts part of the expenditure from the native‑born to immigrants relative to when pure public goods are apportioned to the native‑born only (Column C1). The net fiscal contribution of the native‑born improves once pure public goods are apportioned to immigrants also, because the cost of pure public goods, such as defence or public debt transactions, are split over a larger population.

The individualised net fiscal contribution of immigrants is positive for all countries in column A. This means that immigrants contribute more in taxes and social contributions than they receive in benefits and services. The magnitude of this net fiscal contribution varies significantly across countries, from zero in Estonia to 7.7% of GDP in Luxembourg, where over 40% of the population is foreign-born.13

Immigrants contribute to the financing of pure public goods

The net fiscal contribution of immigrants remains positive in all countries, with the exception of the Baltic countries, once expenditure on congestible public goods and the remaining items of the government’s revenue are included (Column B). This implies that, in almost all countries, immigrants fully finance their share of expenditure on congestible public goods and contribute to the financing of pure public goods.

In 2017, this contribution of immigrants to the financing of pure public goods represented a total of USD 547 billion in the 25 countries included in the analysis.

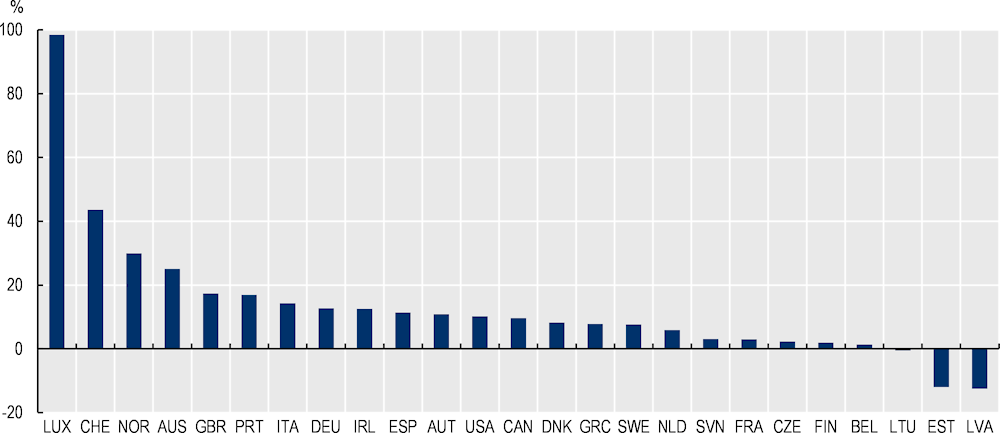

Figure 4.1 plots the share of the government’s expenditure on pure public goods that is financed by immigrants. This is calculated as the net fiscal contribution of immigrants in percentage of GDP from Column B in Table 4.1 divided by the host country’s expenditure on pure public goods in percentage of GDP. The median share of pure public goods financed by immigrants is 10%, and in 80% of countries, it is over 2%.

Figure 4.1. The share of the total government expenditure on pure public goods financed by immigrants, 2006‑18 average

Note: The share of total government expenditure on pure public goods financed by immigrants is the net fiscal contribution of immigrants in percentage of GDP from Specification B (Column B in Table 4.1) divided by the host country’s expenditure in pure public goods in percentage of GDP.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

When pure public goods are apportioned per capita to immigrants and natives alike (Columns C2), the total net fiscal contribution of immigrants is negative in 18 out of 25 countries, as is the total net fiscal contribution of the native‑born in 20 out of 25 countries. This is because most countries were running budget deficits over the years 2006‑18. In these estimations, the total net fiscal contribution of immigrants is between minus one and plus 1% of GDP for most countries, which is in line with the literature.

Box 4.1. Accounting for the fiscal impact of the native‑born children of immigrants: An incomplete picture

The native‑born children of immigrants represent an increasing share of the population in many OECD countries. Studying the fiscal impact of this group is of interest by itself. However, there is no information on the country of birth of the parents in the surveys used in the chapter. The native‑born children of immigrants are impossible to identify in the data, with the exception of those who live in the household of their parents.

Table 4.2 reproduces Table 4.1 but allocates the net fiscal contribution of the native‑born children of immigrants to the immigrant population, instead of the native‑born population. The net fiscal contribution of children consists exclusively in the government’s expenditure on their health and education. In both Table 4.1 and Table 4.2, the net fiscal contribution of the native‑born children of immigrants aged 15 and over is attributed to the native‑born population. In particular, the positive net contribution of the native‑born children of immigrants during their working years is attributed to the native‑born.

Shifting the expenditure on the native‑born children of immigrants from the native‑born to the foreign-born translates into a shift of ‑0.5% of GDP on average across countries in the individualised net fiscal contribution of the native‑born to the foreign-born. The largest expenditure of the native‑born children of immigrants are observed for Luxembourg, Sweden, Canada, the United States and Switzerland.

The relatively large magnitude of this shift in expenditure and the way it varies across countries is explained by two main factors. First, the native‑born children of immigrants represent a large share of the population aged under 15 in most countries. Annex Table 4.A.5 shows the distribution of the population aged 15 and less by their country of birth and the country of birth of the parents. On average across countries, 20% of native‑born children have at least one foreign-born parent. This share varies substantially across countries, e.g. 16% in Spain and 46% in Switzerland, which explains some of the differences in the expenditure shift across countries.

Second, education expenditure represents a large item in the government’s expenditure. Across countries and years, education accounts on average for 11% of total expenditure and 5% of GDP, and a large share of this expenditure is on children aged under 15. Differences in the share of education expenditure in the government budget also explain why the shift of expenditure towards the foreign-born leads to different changes in the fiscal contribution across countries. For example, in Austria, the share of native‑born children with at least one immigrant parent is larger than in Sweden (30% vs. 25% of the native‑born children). However, the expenditure on their education is larger in Sweden because education expenditure represents a larger share of GDP than in Austria (6.3% vs. 4.6%).

Table 4.2. The net fiscal contribution of the foreign-born and their native‑born children, 2006‑18 average

|

|

Foreign-born and native‑born children of the foreign-born |

Native‑born |

|||||

|---|---|---|---|---|---|---|---|

|

A |

B/C1 |

C2 |

A |

B |

C1 |

C2 |

|

|

Items at the individual level only |

With congestible public goods |

Items at the individual level only |

With congestible public goods |

||||

|

No pure public goods |

Pure public goods apportioned to the foreign and native‑born |

No pure public goods |

Pure public goods apportioned per capita to the native‑born only |

Pure public goods apportioned to the foreign and native‑born |

|||

|

AUT |

0.98 |

0.14 |

‑1.20 |

9.45 |

5.46 |

‑2.24 |

‑0.90 |

|

BEL |

0.73 |

‑0.52 |

‑1.93 |

14.20 |

7.32 |

‑1.93 |

‑0.52 |

|

CAN |

1.32 |

‑0.11 |

‑2.03 |

10.45 |

6.23 |

‑1.34 |

0.58 |

|

CHE |

2.45 |

1.73 |

0.11 |

6.36 |

4.58 |

‑1.06 |

0.56 |

|

CZE |

0.30 |

0.06 |

‑0.11 |

11.42 |

3.77 |

‑1.70 |

‑1.54 |

|

DEU |

1.03 |

0.42 |

‑0.79 |

9.75 |

6.63 |

‑0.67 |

0.54 |

|

DNK |

0.41 |

0.26 |

‑0.54 |

9.97 |

8.55 |

‑0.08 |

0.71 |

|

ESP |

1.37 |

0.46 |

‑0.48 |

6.88 |

1.02 |

‑5.89 |

‑4.96 |

|

EST |

‑0.14 |

‑0.84 |

‑1.71 |

10.04 |

6.34 |

0.85 |

1.72 |

|

FIN |

‑0.04 |

0.01 |

‑0.35 |

7.33 |

8.64 |

‑0.49 |

‑0.13 |

|

FRA |

0.46 |

‑0.31 |

‑1.41 |

9.87 |

4.73 |

‑3.79 |

‑2.69 |

|

GBR |

1.60 |

0.78 |

‑0.20 |

5.76 |

0.67 |

‑6.26 |

‑5.28 |

|

GRC |

0.96 |

0.77 |

‑0.25 |

7.53 |

5.16 |

‑8.27 |

‑7.26 |

|

IRL |

1.14 |

0.18 |

‑0.65 |

3.31 |

‑1.56 |

‑6.52 |

‑5.69 |

|

ITA |

1.50 |

1.11 |

0.20 |

10.27 |

6.21 |

‑4.18 |

‑3.26 |

|

LTU |

0.17 |

‑0.08 |

‑0.36 |

8.21 |

3.28 |

‑2.44 |

‑2.16 |

|

LUX |

6.20 |

3.78 |

1.46 |

5.90 |

2.81 |

‑2.48 |

‑0.16 |

|

LVA |

0.10 |

‑0.90 |

‑1.76 |

9.72 |

4.12 |

‑1.61 |

‑0.75 |

|

NLD |

0.35 |

‑0.12 |

‑0.85 |

8.37 |

4.74 |

‑1.65 |

‑0.92 |

|

NOR |

0.84 |

1.41 |

0.72 |

11.30 |

16.17 |

9.80 |

10.49 |

|

PRT |

1.43 |

1.20 |

0.52 |

5.72 |

2.75 |

‑6.49 |

‑5.81 |

|

SVN |

0.37 |

‑0.09 |

‑0.74 |

8.00 |

3.35 |

‑3.68 |

‑3.03 |

|

SWE |

0.13 |

‑0.19 |

‑1.69 |

10.86 |

9.37 |

0.57 |

2.07 |

|

USA |

0.23 |

0.23 |

‑1.45 |

2.64 |

2.59 |

‑7.20 |

‑5.52 |

|

Average |

1.00 |

0.39 |

‑0.64 |

8.47 |

5.12 |

‑2.45 |

‑1.41 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

The fiscal position of immigrants relative to the native‑born varies across countries

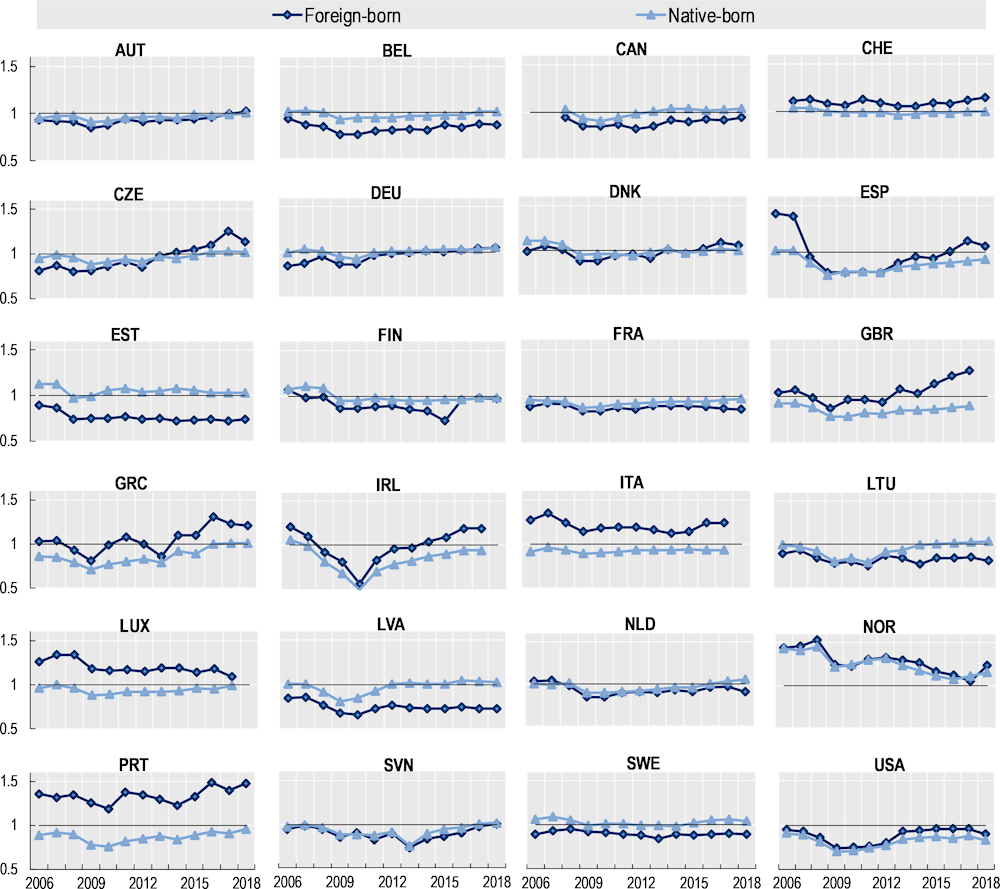

The cross-country differences in the magnitude of the net fiscal contribution of immigrants presented in Table 4.1 partly stem from differences in the size of the immigrant population across countries. Table 4.3 provides another measure of the fiscal impact of immigrants, which is the ratio of government revenue contributed by immigrants over government expenditure on immigrants. This ratio is referred to as the fiscal ratio in the literature.

The fiscal ratio allows for a simple and meaningful comparison of the fiscal position of population groups with different sizes. Furthermore, this measure has an intuitive interpretation as it is expressed in percentage terms. A ratio greater than one indicates that immigrants contribute more than they receive. A ratio of 1.2 (0.8) means that immigrants contribute 20% more (less) than they receive.14

While the fiscal ratio has the advantage that it is easy to interpret and independent of immigrant population size, both measures (fiscal ratio and fiscal contribution in terms of GDP) depend on macroeconomic conditions and the structure of the government’s budget. For example, during a downturn, the fiscal position of immigrants is likely to deteriorate, but so is that of the native-born. Immigrants in countries with high expenditure on defence, or on public debt charges, tend to have a more negative total net fiscal contribution. A way to net out these macroeconomic or structural factors is to divide the fiscal ratio of immigrants by that of the native‑born, that is to calculate the relative fiscal ratio.

Three groups of countries emerge from the comparison of the total fiscal ratio of immigrants across countries. In over a third of countries, the fiscal ratio of the foreign-born is considerably larger than that of the native‑born (Column C2). These are the Southern-European countries, Luxembourg and Switzerland, as well as the United Kingdom, Ireland, the United States and Australia. In a quarter of countries, the foreign-born contribute relatively less than the native‑born do. These are Estonia, Latvia, Sweden, Belgium, Lithuania and Canada. In the remaining countries, including traditional European immigration countries, such as Germany or France, the total net fiscal contribution of immigrants and that of the native‑born is more similar.

In most countries, governments spend less per capita on immigrants than on the native‑born, but also receive lower revenue per capita from them

Both the expenditure and revenue per capita of the foreign-born are in most countries slightly lower than that of the native‑born (Table 4.4). Immigrants contribute 11% per capita less than the native‑born, on average across countries. The government’s expenditure on immigrants is 12% lower on the foreign than on the native‑born.

On average across countries, the expenditure per capita on the foreign-born is lower than on the native‑born on old age and survival, sickness and disability, education and health. Conversely, the expenditure per capita on family and children, unemployment, social exclusion and housing is on average larger on the foreign-born.

Age differences between immigrants and natives drive part of the observed differences in government expenditure. In many OECD countries, immigrants are substantially younger than the native‑born, particularly so in recent immigration countries (Annex Table 4.A.1.). Hence, it is not surprising that government’s per capita expenditure on pensions is significantly larger for the native‑born.

The per capita expenditure on education of the foreign-born is less than half than that on the native‑born. Foreign-born children represent only a small share of the total number of children in all countries; they are younger on average and, in a number of countries, are less likely to be enrolled in tertiary education (Annex Table 4.A.5).15

On the contrary, expenditure per capita on social exclusion/housing is much larger for immigrants than for native‑born in most countries. The overrepresentation goes up to nine times in Sweden and more than six times in Belgium and Norway, and five times in Finland. Recently arrived refugees are notably often beneficiaries of this kind of support. Similarly, immigrants are also more likely to get family/children benefits. This is due to the younger age structure of immigrants who are more likely to have children in their household and to their relatively weaker economic status compared to the native born.

Table 4.3. The fiscal ratio (government revenue/government expenditure) of immigrants and the native‑born, 2006‑18 average

|

|

Foreign-born |

Native‑born |

Foreign-born/Native‑born |

|||

|---|---|---|---|---|---|---|

|

|

A |

C2 |

A |

C2 |

A |

C2 |

|

Items at the individual level only |

With all public goods apportioned per capita to all |

Items at the individual level only |

With all public goods apportioned per capita to all |

Items at the individual level only |

With all public goods apportioned per capita to all |

|

|

AUS |

1.69 |

0.96 |

1.47 |

0.91 |

1.16 |

1.06 |

|

AUT |

1.40 |

0.93 |

1.32 |

0.96 |

1.06 |

0.97 |

|

BEL |

1.31 |

0.83 |

1.50 |

0.97 |

0.88 |

0.86 |

|

CAN |

1.44 |

0.88 |

1.61 |

0.99 |

0.89 |

0.89 |

|

CHE |

1.67 |

1.09 |

1.41 |

0.99 |

1.19 |

1.10 |

|

CZE |

1.58 |

0.97 |

1.52 |

0.96 |

1.03 |

1.01 |

|

DEU |

1.36 |

0.96 |

1.38 |

1.00 |

0.99 |

0.96 |

|

DNK |

1.28 |

0.98 |

1.28 |

1.01 |

1.00 |

0.98 |

|

ESP |

1.98 |

0.96 |

1.27 |

0.87 |

1.56 |

1.11 |

|

EST |

1.01 |

0.75 |

1.53 |

1.05 |

0.66 |

0.72 |

|

FIN |

1.11 |

0.91 |

1.21 |

0.99 |

0.91 |

0.91 |

|

FRA |

1.24 |

0.88 |

1.29 |

0.93 |

0.96 |

0.94 |

|

GBR |

1.70 |

1.04 |

1.22 |

0.85 |

1.39 |

1.23 |

|

GRC |

2.36 |

1.01 |

1.27 |

0.85 |

1.86 |

1.20 |

|

IRL |

1.52 |

0.96 |

1.14 |

0.81 |

1.33 |

1.18 |

|

ITA |

2.52 |

1.20 |

1.34 |

0.92 |

1.88 |

1.30 |

|

LTU |

1.22 |

0.83 |

1.42 |

0.94 |

0.86 |

0.89 |

|

LUX |

1.86 |

1.18 |

1.25 |

0.94 |

1.48 |

1.26 |

|

LVA |

1.09 |

0.74 |

1.58 |

0.97 |

0.69 |

0.76 |

|

NLD |

1.29 |

0.93 |

1.31 |

0.96 |

0.98 |

0.96 |

|

NOR |

1.47 |

1.26 |

1.42 |

1.24 |

1.03 |

1.01 |

|

PRT |

2.42 |

1.33 |

1.20 |

0.86 |

2.02 |

1.54 |

|

SVN |

1.30 |

0.89 |

1.28 |

0.92 |

1.01 |

0.97 |

|

SWE |

1.19 |

0.90 |

1.36 |

1.03 |

0.88 |

0.87 |

|

USA |

1.36 |

0.88 |

1.10 |

0.81 |

1.24 |

1.08 |

|

Average |

1.53 |

0.97 |

1.35 |

0.95 |

1.16 |

1.03 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

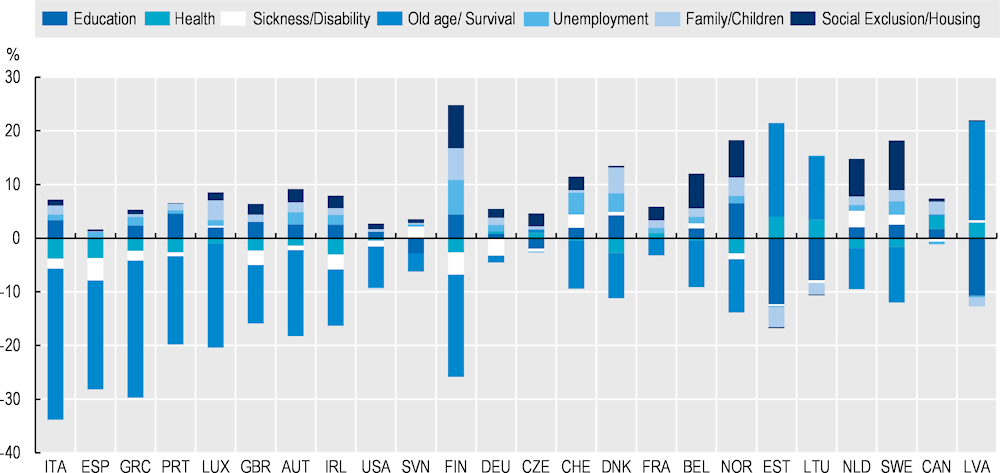

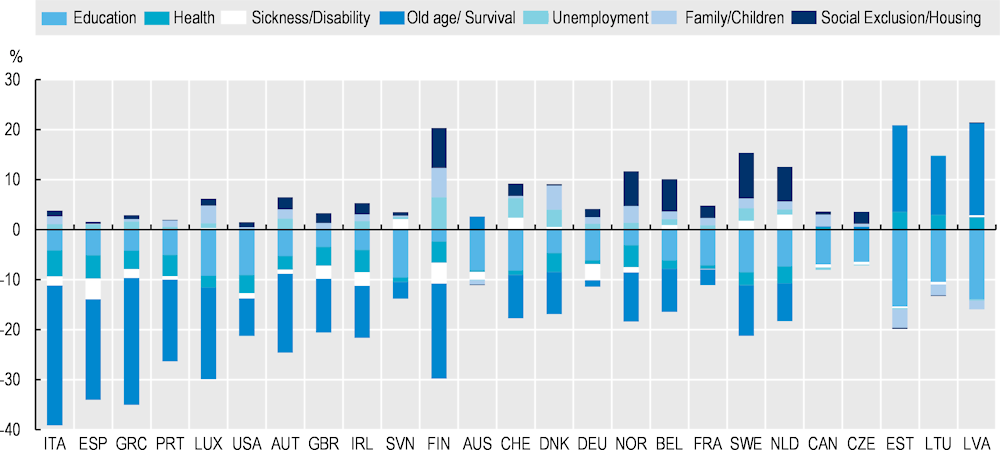

Figure 4.2 shows how the differences in per capita expenditure on the different items add up to the total difference16. For example, in Italy, the total per capita government expenditure on the foreign-born represents 64% of the expenditure on the native‑born. Expenditure on old age and survival accounts for over three‑quarters of this gap (28 out of 36 percentage points), expenditure on health and education account for 10 percentage points, expenditure on sickness and disability for 2 percentage points. Expenditure on family and children, unemployment, and social exclusion has an effect in the opposite direction. The higher expenditure per capita on the foreign-born accounts for +4 percentage points in the total expenditure per capita on the foreign-born relative to the native‑born.

Lower expenditure on old age and survival on the foreign-born explains for most countries the lower total expenditure per capita on the foreign-born. There are large differences in expenditure per capita on pensions between immigrants and natives, and pensions weigh heavily in the public budget of many countries. For example, in Italy or Greece, expenditure on old age and survival represent approximately one‑third of total government expenditure on natives. Excluding expenditure on old age survival, the expenditure per capita on the foreign-born is similar to that on the native‑born. The expenditure per capita on the foreign-born would be 95% the expenditure on the native‑born.

Table 4.4. Relative expenditure per capita (foreign-born/native‑born) in the different expenditure items of the government’s budget, 2006‑18 average

|

|

Total |

Health |

Education |

Sickness/Disability |

Old age/ Survival |

Family/Children |

Unemployment |

Social Exclusion/Housing |

|---|---|---|---|---|---|---|---|---|

|

AUS |

0.92 |

0.97 |

0.48 |

0.72 |

1.28 |

0.87 |

0.93 |

0.91 |

|

AUT |

0.82 |

0.80 |

0.45 |

0.78 |

0.46 |

1.43 |

2.06 |

2.64 |

|

BEL |

0.94 |

0.88 |

0.45 |

1.18 |

0.58 |

1.39 |

1.30 |

6.27 |

|

CAN |

0.95 |

1.03 |

0.51 |

0.83 |

1.04 |

1.53 |

0.74 |

1.21 |

|

CHE |

0.92 |

0.84 |

0.44 |

1.30 |

0.61 |

1.38 |

2.83 |

1.78 |

|

CZE |

0.97 |

1.00 |

0.35 |

0.91 |

1.03 |

1.18 |

0.68 |

2.80 |

|

DEU |

0.93 |

0.94 |

0.38 |

0.54 |

0.95 |

1.41 |

1.29 |

1.98 |

|

DNK |

0.92 |

0.73 |

0.62 |

1.06 |

0.44 |

1.56 |

1.68 |

1.07 |

|

ESP |

0.68 |

0.65 |

0.45 |

0.27 |

0.20 |

1.05 |

1.21 |

1.57 |

|

EST |

1.01 |

1.30 |

0.08 |

0.94 |

2.18 |

0.39 |

0.92 |

0.60 |

|

FIN |

0.90 |

0.67 |

0.79 |

0.45 |

0.18 |

2.05 |

2.68 |

5.22 |

|

FRA |

0.94 |

0.94 |

0.29 |

1.00 |

0.88 |

1.35 |

1.29 |

1.81 |

|

GBR |

0.82 |

0.76 |

0.69 |

0.53 |

0.46 |

1.33 |

0.99 |

1.34 |

|

GRC |

0.69 |

0.67 |

0.43 |

0.43 |

0.17 |

1.37 |

2.23 |

2.40 |

|

IRL |

0.83 |

0.71 |

0.63 |

0.62 |

0.34 |

1.28 |

1.38 |

1.63 |

|

ITA |

0.64 |

0.61 |

0.50 |

0.48 |

0.16 |

1.93 |

1.66 |

2.74 |

|

LTU |

1.01 |

1.25 |

0.15 |

0.94 |

1.70 |

0.43 |

1.07 |

0.89 |

|

LUX |

0.77 |

0.77 |

0.31 |

1.08 |

0.37 |

1.59 |

1.35 |

2.44 |

|

LVA |

1.06 |

1.27 |

0.07 |

1.08 |

2.17 |

0.39 |

0.78 |

1.14 |

|

NLD |

0.94 |

0.78 |

0.41 |

1.31 |

0.50 |

1.53 |

1.30 |

2.94 |

|

NOR |

0.93 |

0.71 |

0.71 |

0.92 |

0.33 |

1.49 |

2.78 |

6.41 |

|

PRT |

0.76 |

0.69 |

0.53 |

0.75 |

0.40 |

1.55 |

1.28 |

1.11 |

|

SVN |

0.90 |

0.93 |

0.26 |

1.44 |

0.86 |

1.06 |

1.35 |

1.47 |

|

SWE |

0.94 |

0.79 |

0.38 |

1.22 |

0.56 |

1.44 |

2.10 |

9.05 |

|

USA |

0.80 |

0.84 |

0.47 |

0.56 |

0.48 |

1.42 |

0.88 |

1.54 |

|

Average |

0.88 |

0.86 |

0.43 |

0.85 |

0.73 |

1.3 |

1.47 |

2.52 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

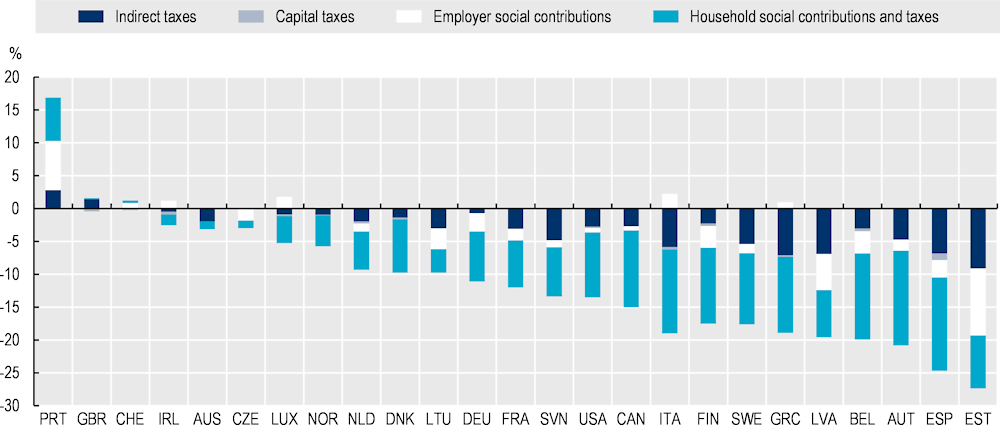

Table 4.5 and Figure 4.3 reproduce the same exercise on the revenue side. The contributions per capita are lower for the foreign-born than the native‑born across all items. The contributions of the foreign-born are 11% lower than the natives’ on average across countries. The differences are smaller in terms of employer social contributions, as the contributions of immigrants are 6% lower than that of the native‑born on average across countries. This is driven by the fact that immigrants are over-represented among the working-age population. The differences are larger in terms of household taxes and social contributions. Capital taxes are exceptional taxes, such as inheritance taxes, and represent a very small share of governments’ total revenue. They are apportioned per capita to individuals aged 70 and over. This explains why revenue per capita on capital taxes is much lower from the foreign than the native‑born, given that the foreign-born are under-represented among the older population in most countries.

Figure 4.2. Decomposition of the gap in expenditure per capita (foreign-born/native‑born) into the different expenditure items, 2006‑18

Note: Countries are sorted by relative expenditure per capita (foreign-born/native‑born), from the lowest to the highest. For each country, the sum of the seven items is equal to the difference between the total expenditure per capita on the foreign-born and the native‑born.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Figure 4.3. Decomposition of the gap in revenue per capita (foreign-born/native‑born) into different revenue items, 2006‑18

Note: Countries are sorted by relative revenue per capita (foreign-born/native‑born), from the highest to the lowest. For each country, the sum of the four items is equal to the difference between the total revenue per capita on the foreign-born and the native‑born.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Table 4.5. Relative revenue per capita (foreign-born/native‑born) in the different revenue items of the government’s budget, 2006‑18

|

|

Total |

Indirect taxes |

Capital taxes |

Employer social contributions |

Household social contributions and taxes |

|---|---|---|---|---|---|

|

AUS |

0.97 |

0.94 |

.. |

.. |

0.97 |

|

AUT |

0.79 |

0.84 |

0.58 |

0.88 |

0.67 |

|

BEL |

0.80 |

0.88 |

0.73 |

0.84 |

0.70 |

|

CAN |

0.85 |

0.91 |

|

0.86 |

0.76 |

|

CHE |

1.01 |

1.00 |

0.67 |

1.09 |

1.01 |

|

CZE |

0.97 |

1.00 |

1.18 |

0.92 |

0.97 |

|

DEU |

0.89 |

0.97 |

1.05 |

0.84 |

0.84 |

|

DNK |

0.90 |

0.95 |

0.43 |

1.01 |

0.86 |

|

ESP |

0.75 |

0.76 |

0.24 |

0.89 |

0.61 |

|

EST |

0.73 |

0.74 |

|

0.64 |

0.61 |

|

FIN |

0.82 |

0.91 |

0.29 |

0.79 |

0.70 |

|

FRA |

0.88 |

0.90 |

0.99 |

0.93 |

0.79 |

|

GBR |

1.01 |

1.04 |

0.55 |

0.99 |

1.00 |

|

GRC |

0.82 |

0.78 |

0.20 |

1.06 |

0.67 |

|

IRL |

0.99 |

0.99 |

0.31 |

1.11 |

0.96 |

|

ITA |

0.83 |

0.81 |

0.18 |

1.12 |

0.69 |

|

LTU |

0.90 |

0.91 |

1.75 |

0.87 |

0.87 |

|

LUX |

0.97 |

0.97 |

0.44 |

1.14 |

0.91 |

|

LVA |

0.80 |

0.80 |

2.41 |

0.69 |

0.75 |

|

NLD |

0.91 |

0.93 |

0.46 |

0.90 |

0.87 |

|

NOR |

0.94 |

0.95 |

0.28 |

1.02 |

0.88 |

|

PRT |

1.17 |

1.08 |

0.29 |

1.41 |

1.21 |

|

SVN |

0.87 |

0.85 |

0.78 |

0.92 |

0.81 |

|

SWE |

0.82 |

0.87 |

0.57 |

0.78 |

0.71 |

|

USA |

0.87 |

0.87 |

0.77 |

0.93 |

0.79 |

|

Average |

0.89 |

0.91 |

0.69 |

0.94 |

0.82 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Demographics are key in explaining the cross-country differences in the fiscal position of immigrants relative to the native‑born

The total net fiscal contribution of immigrants and the native‑born is largely driven by demographic differences between groups, which in turn are driven by countries’ immigration history. For example, in the Baltic countries, the foreign-born are concentrated among the older population. This explains the high government expenditure per capita on old-age and low contributions relative to the native‑born. In Southern Europe, migration is a relatively recent phenomenon, and most of the foreign-born are working-age. Immigrants tend to have larger contributions relative to expenditure than their native‑born counterparts do.

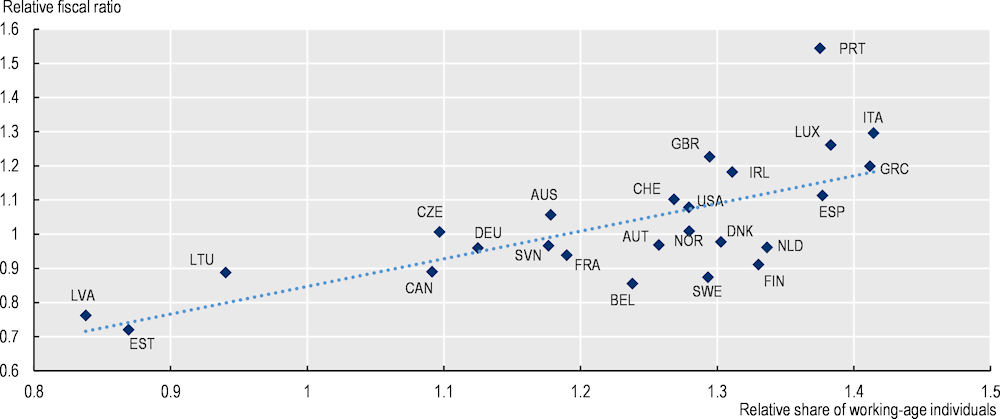

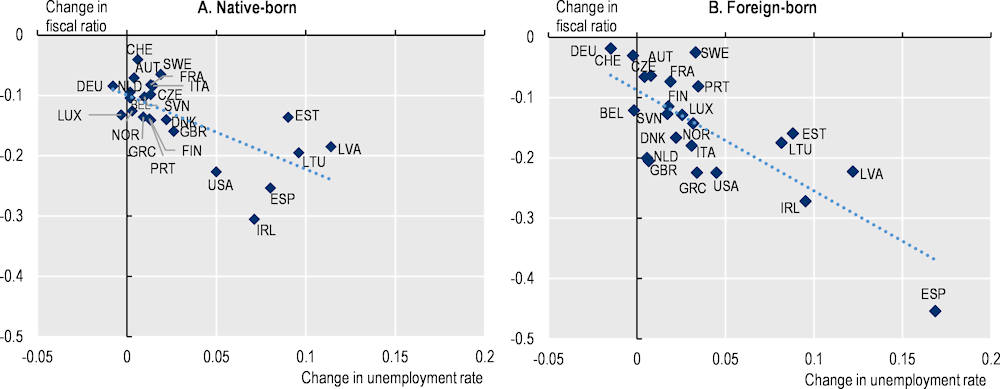

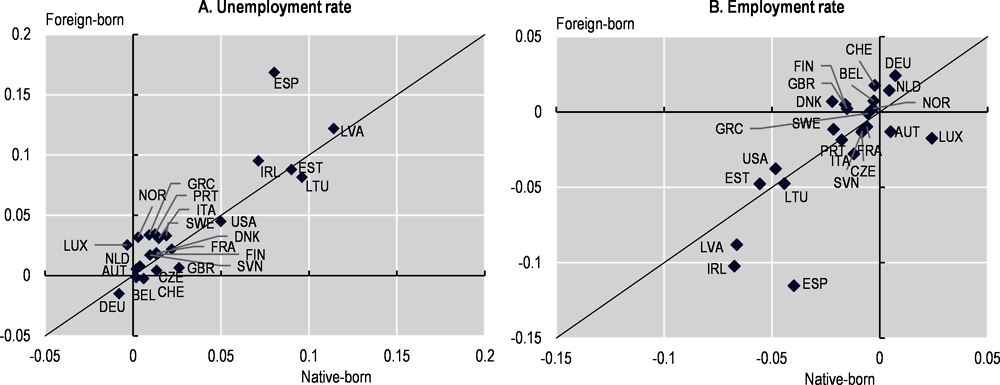

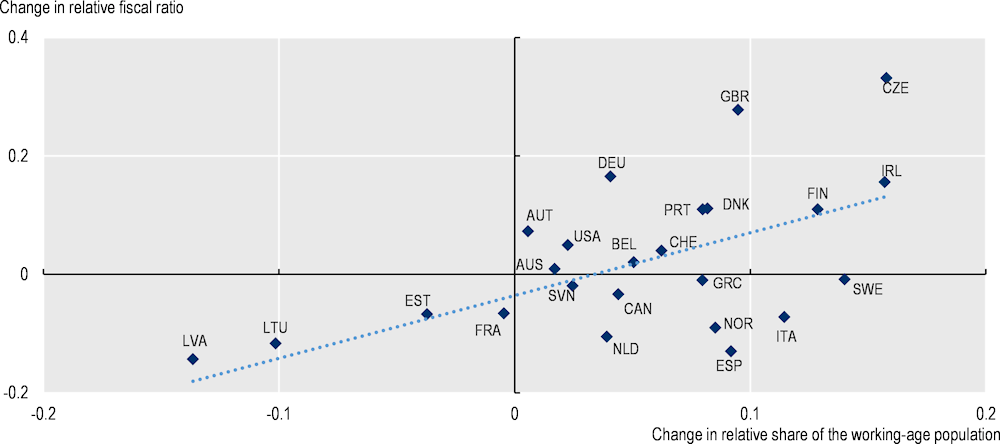

There is a strong correlation between the relative fiscal ratio (last column in Table 4.3) and the relative share of the population that is working age (that is the share of the foreign-born population aged 15‑64 divided by the share of the native‑born population aged 15‑64) (Figure 4.4).

Figure 4.4. Correlation between the relative fiscal ratio (foreign-born/native‑born) and the relative share of the population aged 15‑64, 2006‑18 average

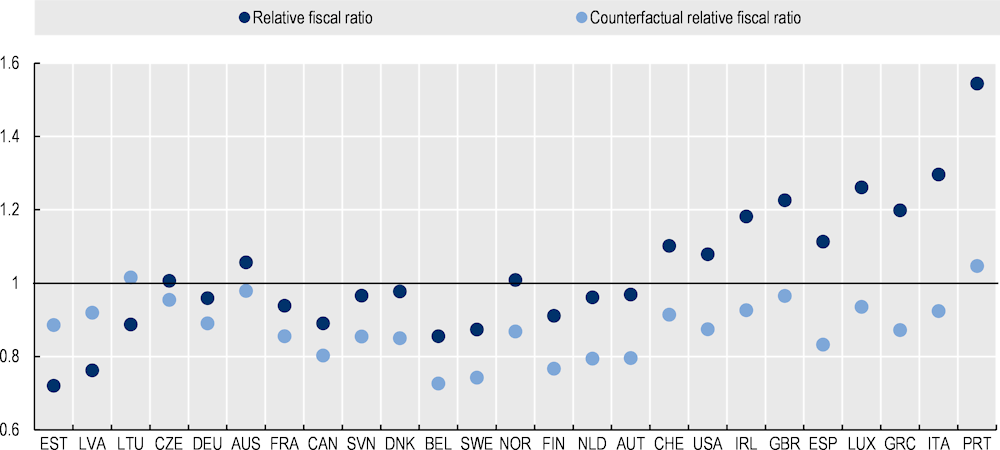

How much of the cross-country differences in the fiscal position of the foreign relative to the native‑born are explained by differences in their age distribution? To answer this question, this section presents the result of a counterfactual exercise.17 The idea is to keep unchanged the government expenditure and revenue per capita for the foreign and native‑born of each age group,18 but change the age distribution of the foreign-born so that it is the same than that of the native‑born. In this set up, the fiscal ratio of the native‑born does not change. The counterfactual fiscal ratio of the foreign-born is their fiscal ratio had they had the same age distribution than the native‑born in the same host country.

The results for each country are presented in Annex Figure 4.A.1. Overall, differences in the age distribution of immigrants, relative to the native‑born, account for 60% of the variation in the fiscal position of immigrants, relative to the native‑born across countries.19

The net fiscal contribution of immigrants by age, education and employment status, 2006‑18

Immigrants are over-represented among prime‑aged individuals, the age group with the largest net fiscal contributions

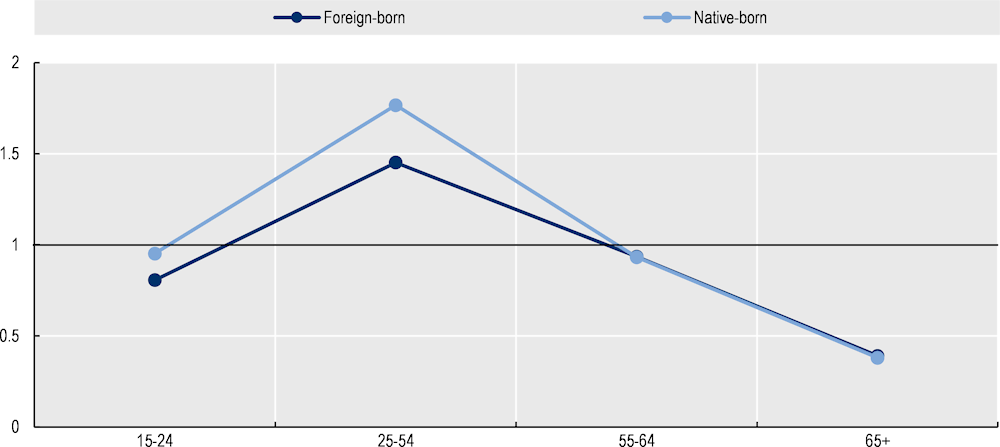

Age is a prime determinant of the net fiscal contribution of individuals. The net fiscal contribution is generally positive during the working years, whereas the net fiscal contribution of children and older individuals is negative due to government expenditure on their education, health and old age benefits.

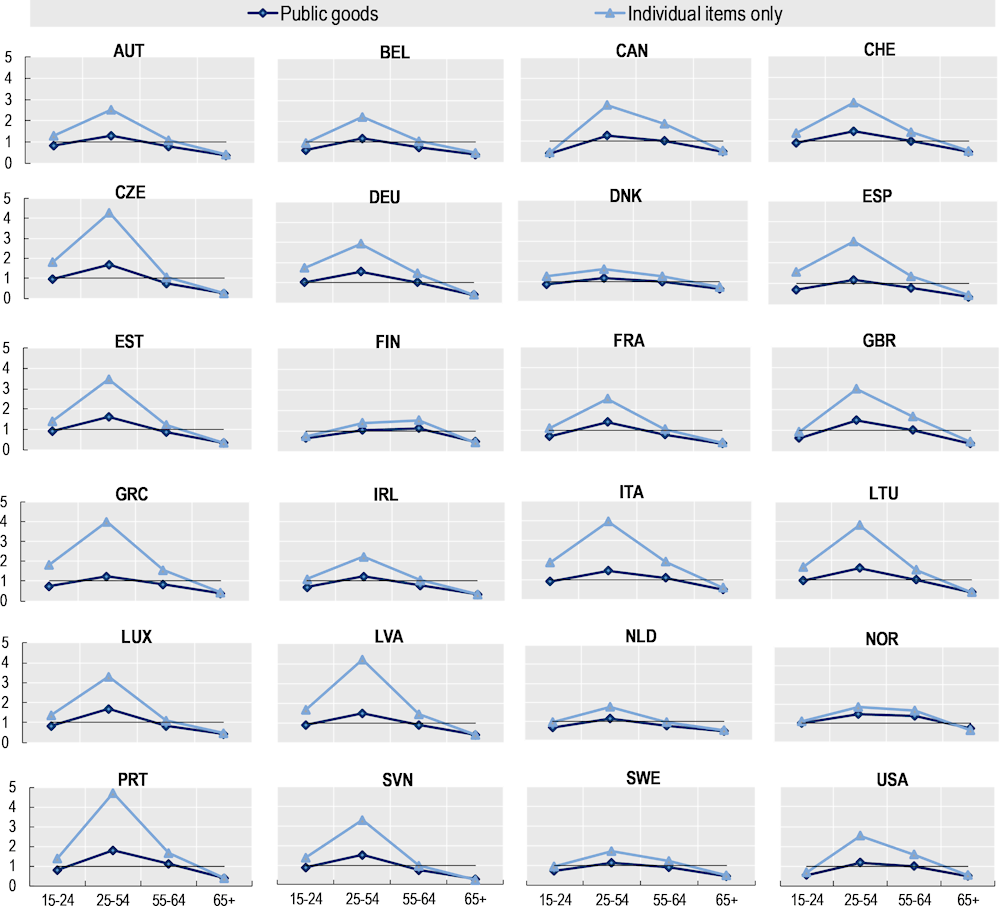

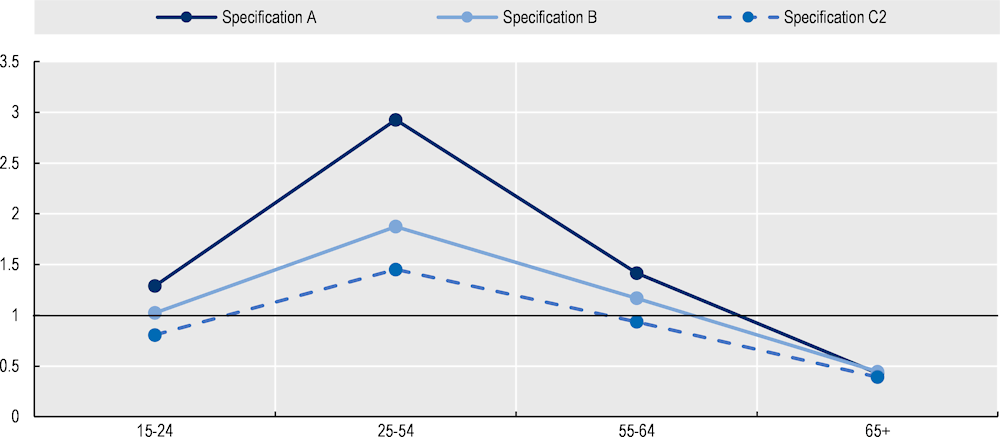

Figure 4.5 presents the median fiscal ratio (government revenue/government expenditure) across countries over the lifecycle for immigrants.20 Annex Figure 4.A.3 presents a similar figure for each country. The first line is the fiscal ratio taking into account all the individualised items of the public budget (expenditure on health, education, social protection and revenue from taxes and social contributions) (specification A). The second line adds expenditure and revenue items that are attributed per capita to all adults except pure public goods (specification B), and the third line adds pure public goods (specification C2).

Figure 4.5. Median fiscal ratio of immigrants by age group, 2006‑18 average

Note: Specification A corresponds to individualised items only; Specification B adds congestible public goods; Specification C2 adds also pure public goods apportioned to the foreign and native‑born.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Prime‑aged immigrants contribute three times more than the government spends on them; this is excluding revenue and expenditure items that are apportioned per capita. Furthermore, their fiscal ratio is always greater than one, which means that they finance their share of expenditure on congestible and pure public goods and have a positive net contribution to the public budget. This is the case in each country (Annex Figure 4.A.3).

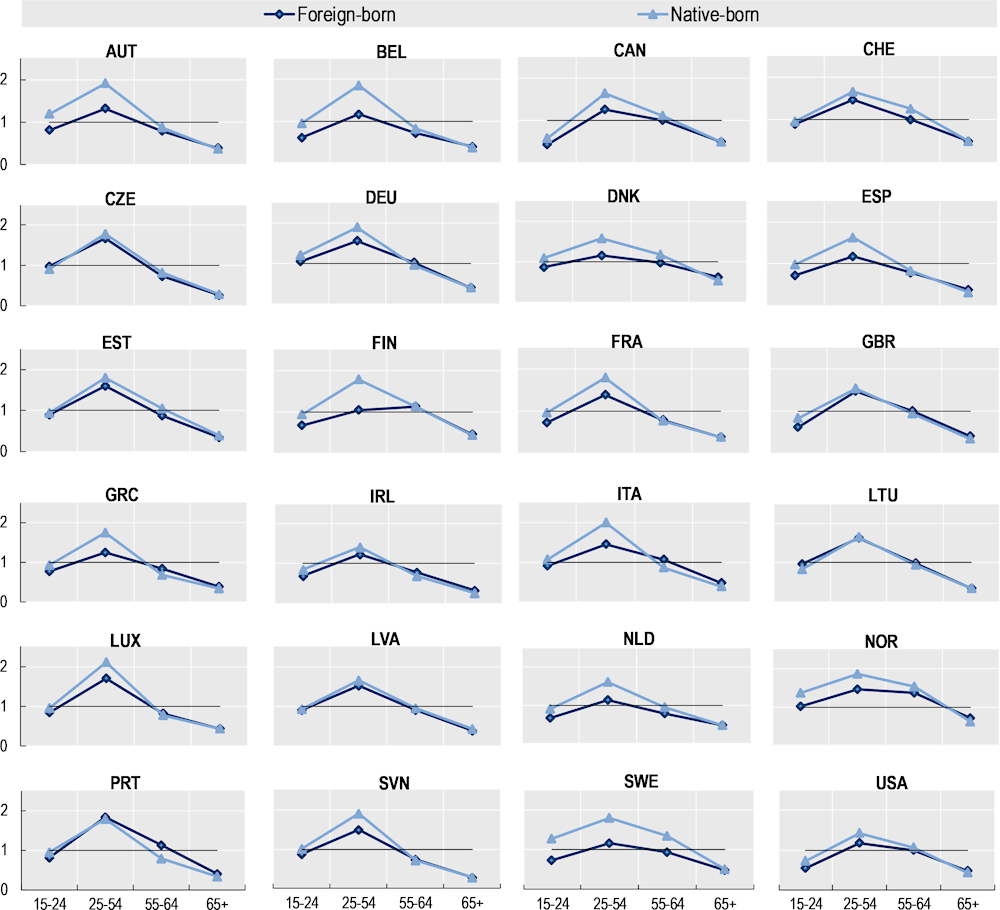

Over their lifecycle, the fiscal ratio of immigrants is lower than that of the native‑born among working-age individuals, but equal or larger among older individuals in most countries (Annex Figure 4.A.8 and Annex Figure 4.A.4).21

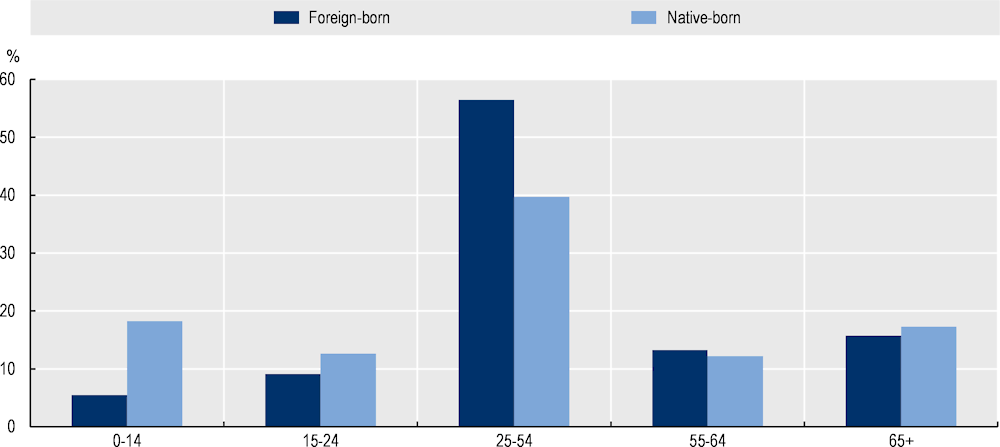

When comparing immigrants and natives over their lifecycle, it is important to keep in mind that their distribution across age groups differs significantly. Immigrants are over-represented among prime‑age individuals, the age group with the largest net fiscal contribution and under-represented among children (Annex Figure 4.A.9). In fact, most immigrants arrive in the host country having completed their education, at an age where the net fiscal contribution is already positive (Annex Figure 4.A.10).

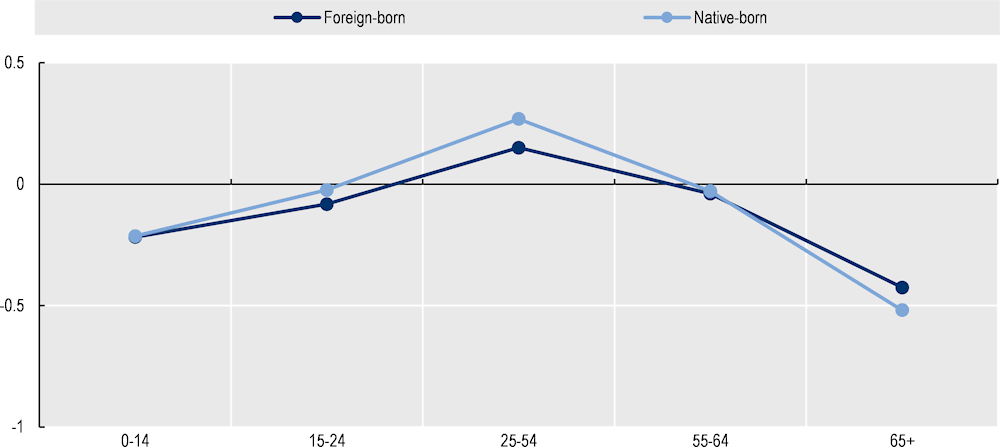

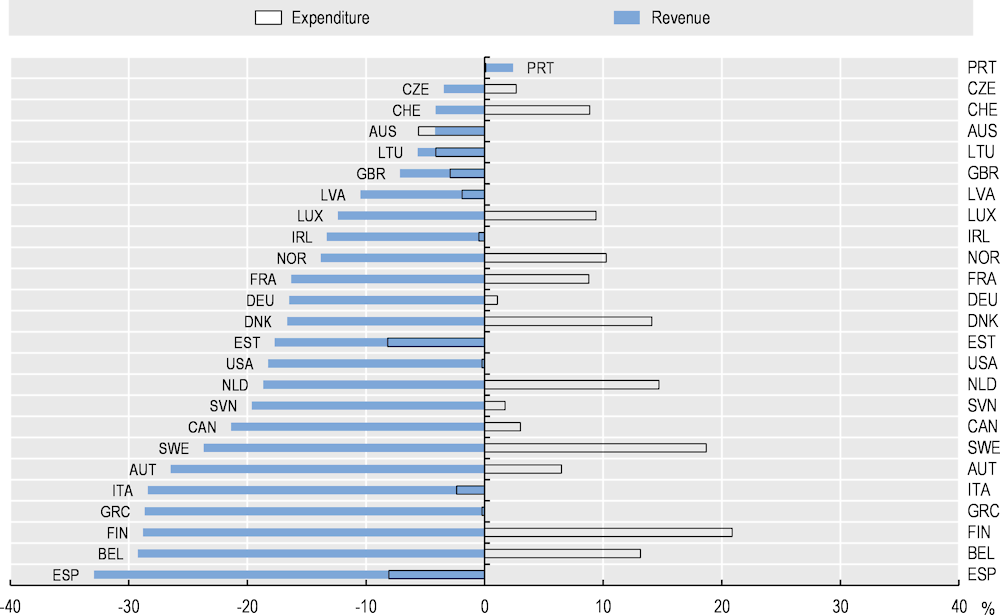

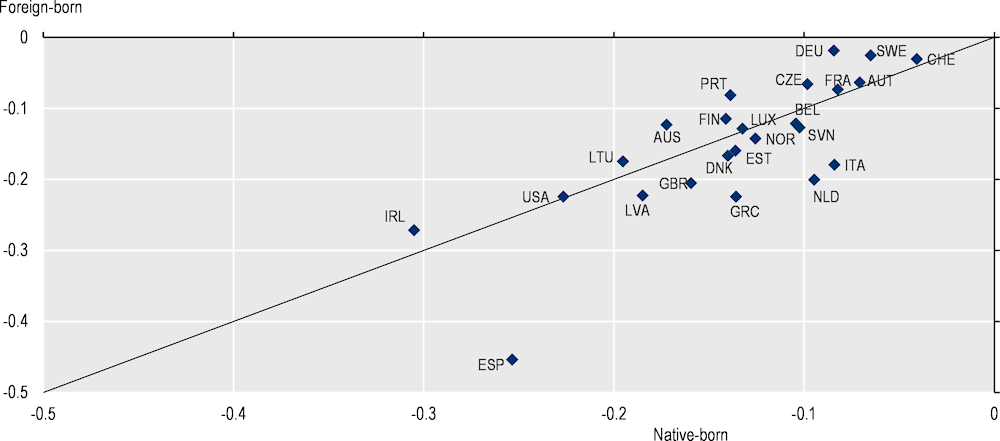

Prime‑aged immigrants lag behind their native‑born counterpart due to lower revenue per capita

Despite the large fiscal ratio of prime‑aged immigrants, their contributions, relative to expenditure, are lower than that of the natives by about 20% on average22. The lower revenue to expenditure ratio of the foreign-born, relative to the native‑born, is driven by differences in government revenue rather than in government expenditure per capita. On average across countries, the expenditure on the prime‑aged foreign-born is similar to that on the native‑born (4% larger). However, the contributions of the foreign-born are 17% lower than the contributions of the native‑born (Figure 4.6).

Figure 4.6. Relative per capita government revenue and expenditure (foreign-born/native‑born), prime‑aged individuals, 2006‑18 average

Note: The differences are in percentage terms. For example, in Portugal, expenditure per capita on immigrants and the native‑born is the same; revenue per capita from immigrants is 2% larger than from the native‑born.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

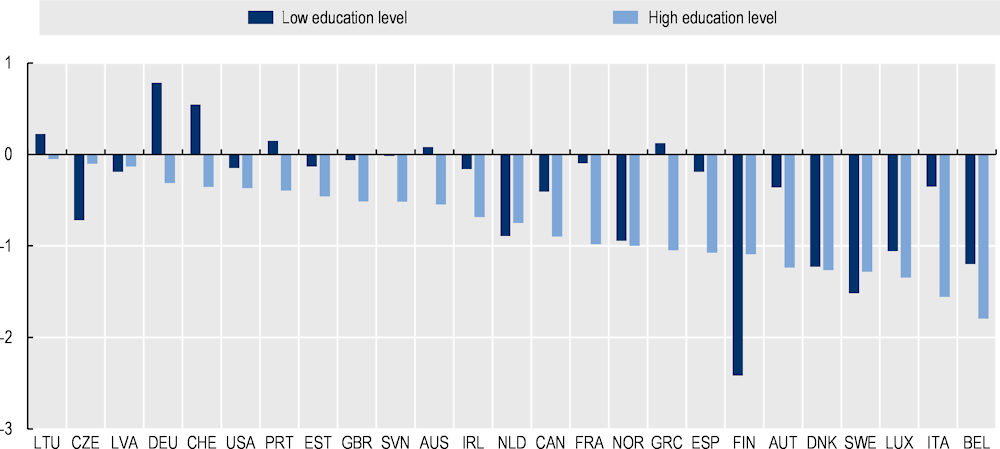

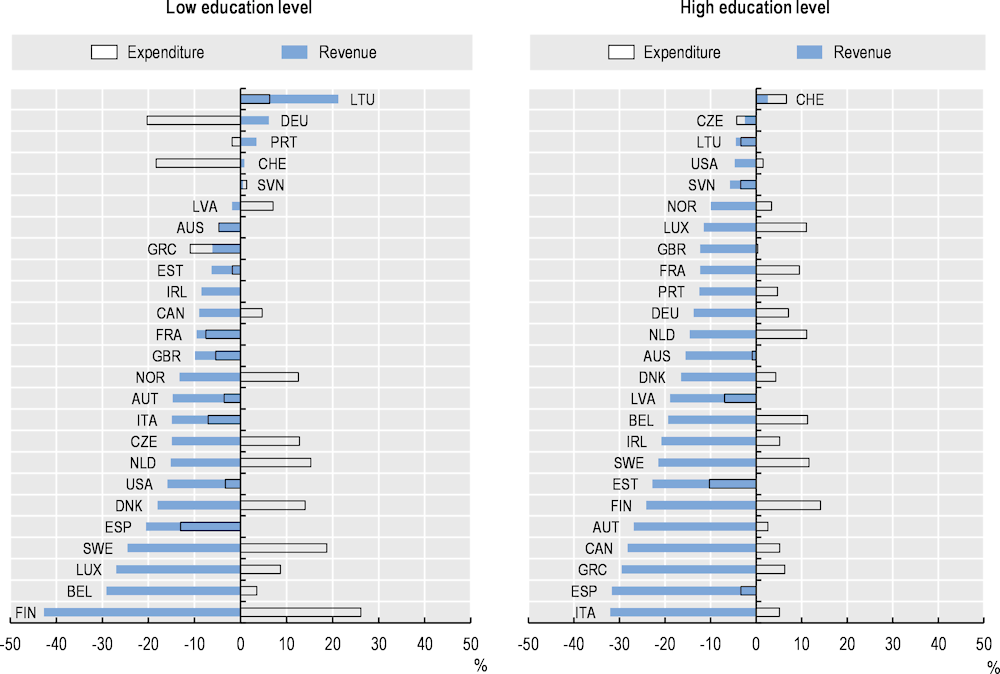

The revenue gap is larger for the highly educated

Differences in revenue per capita between the foreign and native‑born are larger than differences in expenditure per capita, at both low and high education levels (Figure 4.7).

Immigrants contribute less in social contributions and taxes than the native‑born at both high and low educational attainment. The difference increases with the educational level. Low-educated immigrants contribute 11% less per capita than the native‑born, on average across countries. High-educated immigrants contribute 16% less.

The larger difference between the revenue of the highly educated foreign and native‑born implies that the difference is also larger in absolute terms for the highly educated. This is because the revenue per capita of highly educated individuals in on average larger than the revenue per capita of the low educated (Annex Figure 4.A.5).

The differences in expenditure per capita between the foreign and the native‑born are small for both education groups, on average across countries. The expenditure on immigrants with low education is 1% larger than on the native‑born; the expenditure on immigrants with high education is 4% larger. However, there is significant variation across countries. The expenditure per capita is actually lower on immigrants than on the native‑born with low educational attainment in approximately half of the countries. Among the highly educated, expenditure per capita on the foreign-born is more similar to that on the native‑born.

Figure 4.7. Relative per capita government revenue and expenditure (foreign-born/native‑born), by educational attainment, prime‑aged individuals, 2006‑18 average

Note: The differences are in percentage terms. For example, in Germany, among individuals with low education, the revenue per capita from immigrants is 6% larger than that from the native‑born; expenditure per capita is 20% lower on immigrants than on the native‑born.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Immigrants lower employment rates represent significant losses in fiscal contributions in many OECD countries

Immigrants’ lower revenue per capita is driven, at least partially, by lower employment rates and lower wages. To get a sense of the magnitude of the losses in immigrants’ total net fiscal contribution due to immigrants’ lower employment rates, Table 4.6 presents the results of a counterfactual exercise. The employment rates of prime aged immigrants are set equal to those of the native‑born of the same gender and educational attainment, keeping all other factors equal. The underlying assumption is that non-employed immigrants would have the same net fiscal contribution as immigrants of the same gender and education who are in employment.

This simple exercise shows that the gains from increasing immigrants’ employment rates may be quite large. The gain is estimated at over 0.5% of GDP in Belgium and Sweden, and over a third of a percentage point in Austria, Denmark, Luxembourg and the Netherlands. The gains generally increase with the level of education. The gains are also larger for women than for men.

Table 4.6. Change in the total net fiscal contribution in percentage of GDP if prime‑aged immigrants had the same employment rate than the native‑born of the same gender and educational attainment, 2006‑18 average

|

Education level |

Gender |

|

||||

|---|---|---|---|---|---|---|

|

Low |

Medium |

High |

Men |

Women |

Total |

|

|

AUT |

0.05 |

0.15 |

0.14 |

0.10 |

0.24 |

0.34 |

|

BEL |

0.19 |

0.21 |

0.28 |

0.33 |

0.36 |

0.69 |

|

CAN |

0.00 |

0.04 |

0.22 |

0.07 |

0.19 |

0.26 |

|

CHE |

‑0.05 |

0.11 |

0.13 |

0.04 |

0.14 |

0.18 |

|

DEU |

‑0.01 |

0.08 |

0.09 |

0.03 |

0.12 |

0.15 |

|

DNK |

0.09 |

0.13 |

0.15 |

0.14 |

0.23 |

0.37 |

|

ESP |

0.01 |

0.03 |

0.05 |

0.06 |

0.03 |

0.09 |

|

FRA |

0.04 |

0.09 |

0.09 |

0.09 |

0.13 |

0.22 |

|

GBR |

0.03 |

0.06 |

0.11 |

0.05 |

0.16 |

0.21 |

|

GRC |

‑0.01 |

0.02 |

0.02 |

0.01 |

0.02 |

0.03 |

|

IRL |

‑0.02 |

0.06 |

0.22 |

0.13 |

0.14 |

0.27 |

|

ITA |

‑0.01 |

0.01 |

0.01 |

‑0.01 |

0.01 |

0.01 |

|

LUX |

‑0.03 |

0.12 |

0.24 |

0.13 |

0.20 |

0.33 |

|

NLD |

0.14 |

0.15 |

0.12 |

0.21 |

0.21 |

0.41 |

|

NOR |

0.04 |

0.09 |

0.09 |

0.10 |

0.13 |

0.22 |

|

PRT |

0.01 |

0.01 |

0.02 |

0.01 |

0.03 |

0.04 |

|

SVN |

0.00 |

0.03 |

0.02 |

0.00 |

0.05 |

0.05 |

|

SWE |

0.20 |

0.15 |

0.25 |

0.27 |

0.32 |

0.60 |

|

USA |

‑0.01 |

0.00 |

0.04 |

‑0.01 |

0.04 |

0.03 |

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

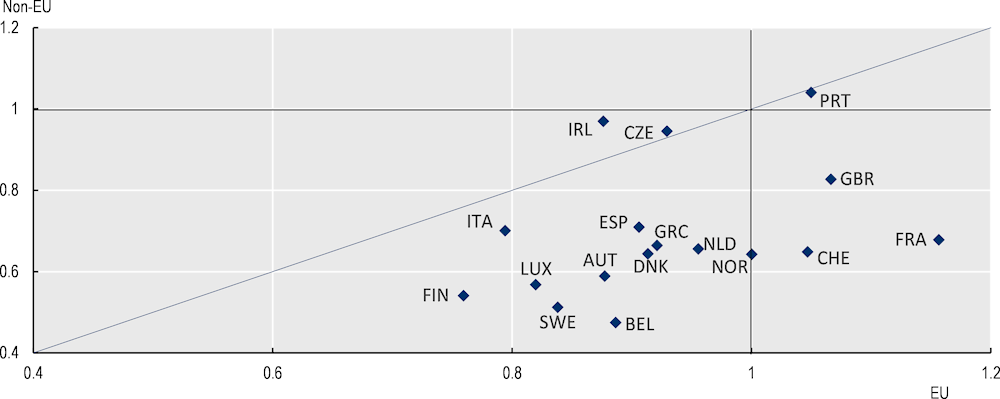

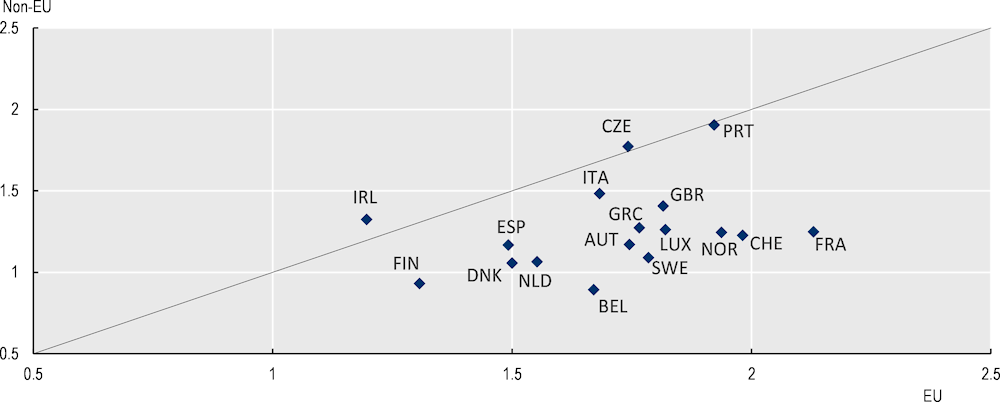

In OECD European countries, prime‑aged EU immigrants fare better than non-EU immigrants23

In European OECD countries, prime‑aged immigrants born in other EU countries have larger fiscal ratios than immigrants born outside the EU (Figure 4.8). In many countries, the differences are quite large. For example, in Sweden, contributions from non-EU migrants cover 109% of government expenditure on them. Contributions from EU migrants cover 179%. In a few countries, the fiscal ratio is similar for EU and non-EU migrants, such as in the Czech Republic, Ireland and Portugal.

Prime‑aged EU migrants contribute less, relative to public expenditure, than the native‑born in most EU countries (Annex Figure 4.A.6). In Switzerland, the United Kingdom, Portugal and France, the fiscal ratio is actually larger for EU-migrants than the native‑born.

Prime‑aged non-EU migrants contribute positively to the public budget in almost all EU countries, despite their lower fiscal ratios. Their fiscal ratio is above one even when all public goods are apportioned per capita to the foreign and native born. An exception are non-EU migrants in Belgium and Finland. Once pure public goods are apportioned per capita to both the foreign and native‑born, their contributions fall short of public expenditure by 11% and 7%.

Figure 4.8. Total fiscal ratio of immigrants born in EU countries and non-EU countries, European OECD countries, 2006‑18 average

Note: The line is a 45‑degree line. For countries to the right of the 45‑degree line, the total fiscal ratio of EU migrants is larger than that of non-EU migrants.

Source: Secretariat calculations based on Annual National Accounts data set OECD, income and labour force surveys. See Annex 4.B for details.

Changes in the fiscal contribution of immigrants since the mid‑2000s