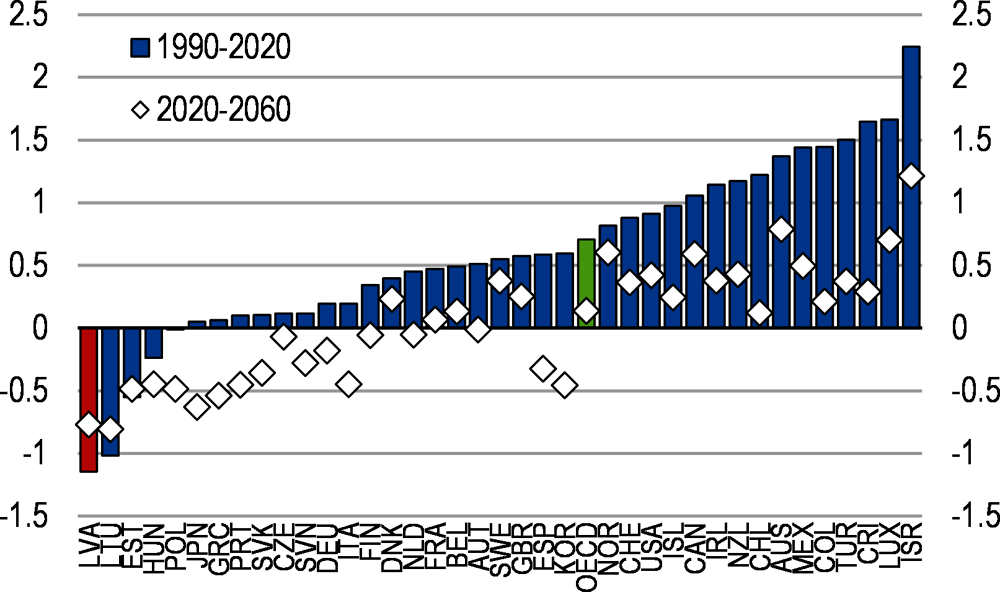

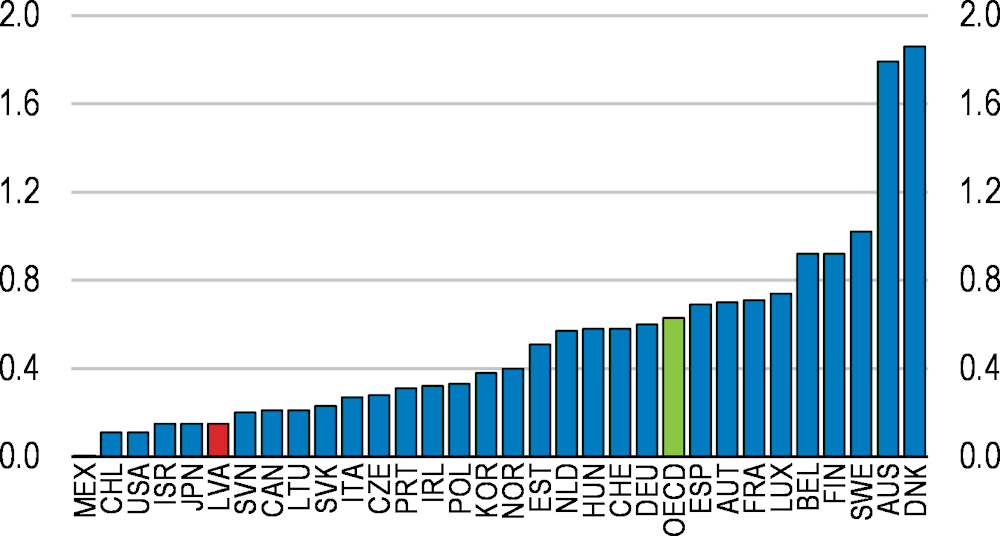

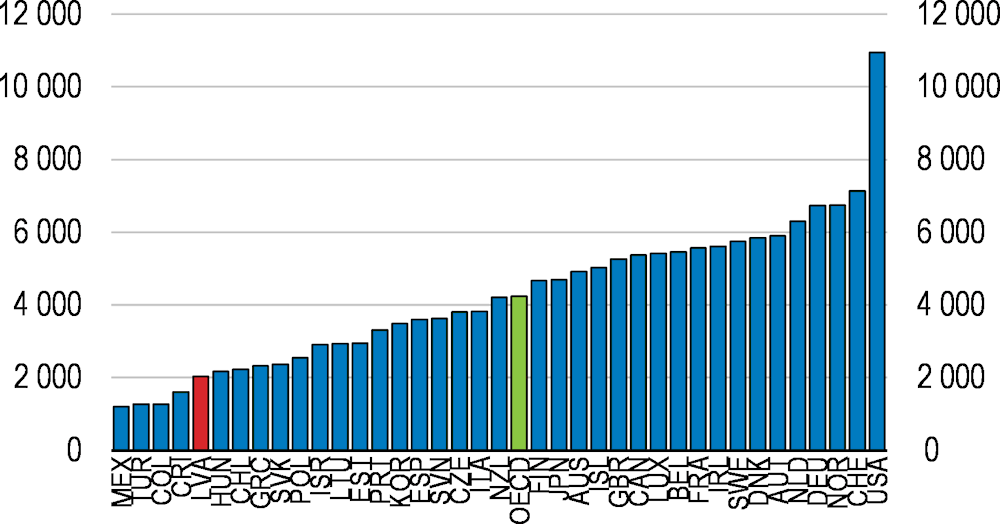

Demographic pressures and slowing income convergence underscore the need to rely more on investment, innovation and skills in the search for faster productivity growth.

Progress has been made in the fight against corruption, bribery and money laundering, which should encourage more investment. Yet, trust in government is low, and bribes are still seen as common. Meanwhile, the responsible agency has been given considerable additional resources, and Latvia has been deemed as largely or fully compliant in all dimensions of the MONEYVAL anti-money laundering process. The imminent government action plan to shrink the shadow economy must also be implemented effectively.

Investment is being held back by a lack of credit. While the large banks are in good shape, lending conditions are tight. Many households are credit constrained, and access to finance – along with its cost and collateral demanded – is a serious barrier to business investment. The authorities need to deepen capital markets, create a culture of investment, starting with improving financial literacy, and fully transpose the EU restructuring directive, including simplifying corporate debt restructuring through out-of-court and hybrid procedures. A larger role for nonbanks, notably fintechs, would be helpful.

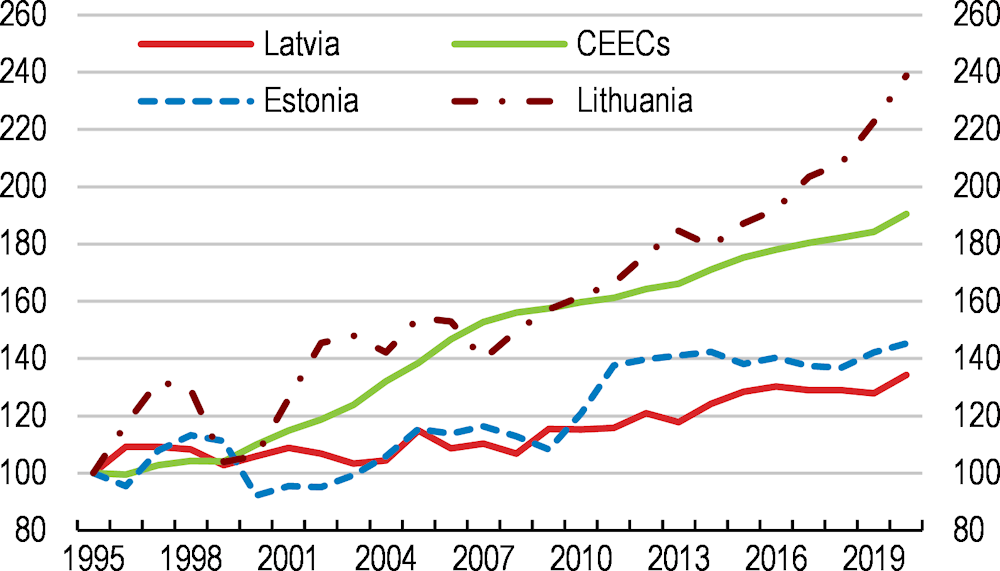

Focusing on exports is the best growth strategy for Latvia, given its demographic outlook. However, Latvia’s exports have underperformed in recent decades (Figure 4). This may be attributable to the country’s industrial structure, which is still dominated by low- and medium-low tech firms, along with the persistent rise in real labour costs. The government should aim to support the development of Latvia’s exports of more complex products by fostering innovation, increasing worker skills and improving the business environment.