This chapter examines urban governance in Colombia. It assesses the main challenges presented by the current system of multi-level governance in the framework of the decentralisation process. It argues that although municipalities have been given extensive competencies in urban development, they have not been given the means to perform their new tasks. The chapter begins with a discussion of the Colombian urban governance framework, focusing on vertical co-ordination across levels of government and metropolitan governance. This is followed by an examination of the financing of municipalities and proposals to improve their financial capacity to complement the fiscal decentralisation process. The chapter ends with a discussion of the need to improve the capacity for managing the public workforce, fostering evidence-informed policy making and engaging with stakeholders for urban development.

National Urban Policy Review of Colombia

5. Strengthening Colombia’s urban governance framework

Abstract

Introduction

Improving Colombia’s ability to design and implement its urban development agenda depends on having a solid, flexible, co-ordinated and dynamic governance framework that allows for an integrated and strategically driven approach to urban development. The governance framework needs to bring together national, departmental and municipal public and private actors as well as civil society and social organisations around a common vision and shared objectives. It should encourage and facilitate cross-sectoral policy making based on the broader strategic objectives of the National Development Plan (Plan Nacional de Desarrollo, PND). It is also essential to enhance the financial capacity of municipalities to finance local investment projects and join forces with neighbouring municipalities for investment and public service delivery if Colombia wants to improve its subnational governance arrangements that underpin its efforts for an increase in productivity and competitiveness in urban areas. Nurturing a talented public workforce with the right competencies and skills is critical to strengthening the capacity of municipalities to generate urban development plans and programmes tailored to their specific needs.

Colombia is in the process of revamping its national urban policy (NUP) to strengthen current policy actions aimed at building cities that are compact, connected, productive, inclusive, sustainable and innovative. Discussions on the new urban policy, called Cities 4.0, have covered these issues, which are very diverse and interconnected. They demand a multi-level, multi-sectoral and integrated policy approach. Building cities with those characteristics may be difficult in the absence of suitable governance arrangements, government capacities and sound planning.

This chapter discusses Colombia’s governance structure, with a particular emphasis on multi-level governance and the schemes available to municipalities to join forces for urban development. It also discusses ways to improve the institutional and financial capacity of municipalities to decide on how to invest their resources. A brief discussion on the need to improve municipal governments’ capacity for urban development will conclude the chapter.

Colombia’s urban governance framework

The national government faces implementation and co-ordination challenges

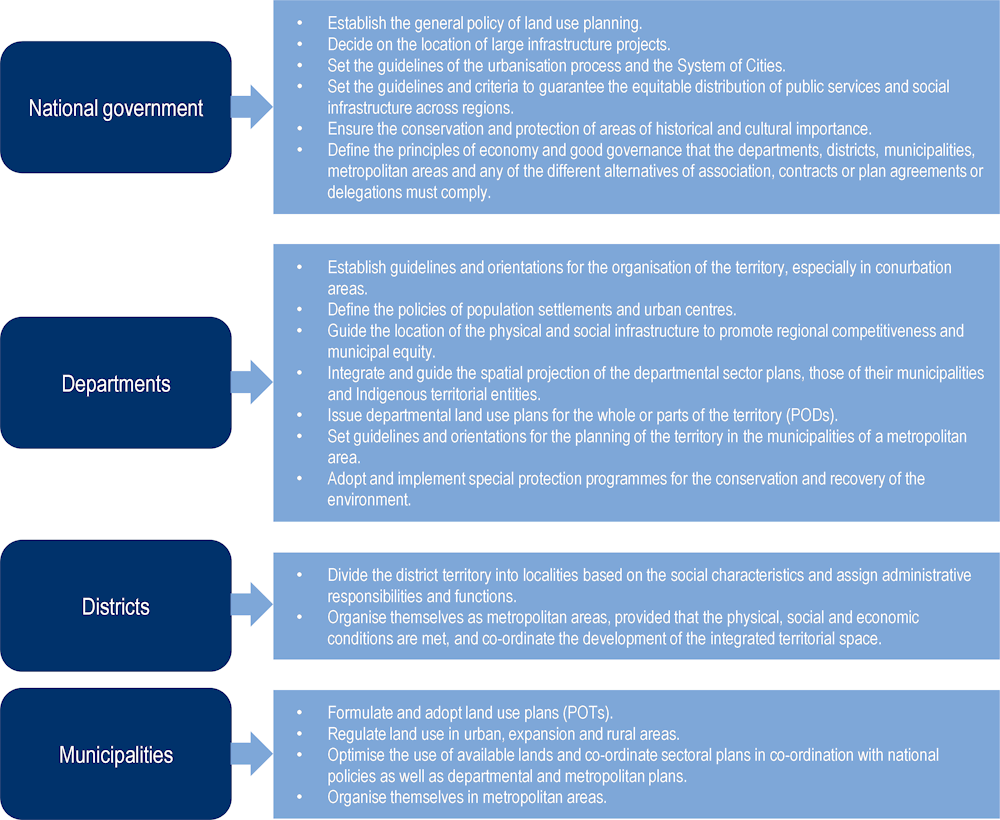

The Colombian national government establishes the general NUP framework that guides the urbanisation process. According to the Land Management Law (Gobierno de Colombia, 1997[1]), the central government is responsible for designing and implementing the general policy for land use planning in matters of national interest, setting the criteria to guarantee an equal distribution of public and social services across regions, locating large infrastructure projects, setting the guidelines of the urbanisation process and the National Policy for the Consolidation of the System of Cities in Colombia, know as the System of Cities, designing guidelines for the equitable distribution of public services and social infrastructure, and the measures for the conservation and protection of natural and cultural heritage.

There are three main urban policy actors at the national level

Three main national-level actors have responsibility in urban policy: i) the National Council for Economic and Social Policy (Consejo Nacional de Política Económica y Social, CONPES); ii) the Department of National Planning (Departamento Nacional de Planeación, DNP); and iii) the Ministry of Housing, City and Territory (Ministerio de Vivienda, Ciudad y Territorio, MVCT). Other institutions also have a specific sectoral responsibility in policies that have a direct impact on urban development, such as the Ministries of Environment and Sustainable Development, and Transport (Box 5.1). This is not unusual across OECD countries. In Finland, for example, the Ministry of Economic Affairs and Employment is co-leading the NUP with the Ministry of the Environment (OECD/UN-Habitat/UNOPS, 2021[2]).

CONPES, created in 1958, is the most important policy co-ordination institution in the government and the highest national planning authority. It serves as an advisory body to the national government on all aspects related to the economic and social development of Colombia. It co‑ordinates and guides the agencies responsible for economic and social policy. It conducts studies and approves documents on general economic and social policy known as CONPES documents (Gobierno de Colombia, 1958[3]). It endorses for possible consideration and approval by congress the four-year PND, which presents the policy agenda of the administration. CONPES is composed of the President of the Republic and four councillors: two appointed by the president, one by the senate and one by the Chamber of Representatives for a four‑year period open to re-election.

Box 5.1. Primary actors in urban development at the national level in Colombia

The National Planning Department (Departamento Nacional de Planeación, DNP), created through Law 19 of 1958, is a technical entity, with the rank of a ministry, which promotes the implementation of the country’s strategic vision in the social, economic and environmental sectors through the design, orientation and evaluation of public policies. Its main responsibility is to support line ministries, administrative departments and territorial entities in designing, monitoring and evaluating the implementation of policies, plans, programmes and projects that advance the PND. It co-ordinates the formulation of the PND across ministries, territorial authorities and administrative planning regions. Once the plan has been approved by congress, the DNP co-ordinates the implementation, monitoring, evaluation and management of results of the plan’s content. To this end, it approves procedures and guidelines for the design, monitoring and evaluation of all of the different programmes and projects contained in the plan. The DNP is also responsible for structuring the methodology for the design, monitoring and evaluation of the policies, programmes and projects contained in the PND and the methodologies for the identification, formulation and evaluation of projects financed using national resources. Its Urban Development Department (DDU) guides and promotes policies, plans, programmes, studies and investment projects in urban development, housing, public services, water, sanitation and social services. The DNP is also responsible for the follow-up and monitoring of the 2030 Agenda dealing with 16 major goals expected to fulfil the United Nations (UN) Sustainable Development Goals (SDGs).

The Ministry of Housing, City and Territory (MVCT) was created through Law 1444 of 2011. It formulates, guides and co-ordinates policies, plans and programmes on housing, urban development, land use, urban renewal, water and sanitation. The MVCT is responsible for the formulation of policies on urban renewal, comprehensive neighbourhood improvement, housing quality, urban planning and construction of sustainable housing, public space and equipment. It co-ordinates and monitors public and private entities in charge of housing production. It prepares, in co-ordination with the DNP, sectoral policy proposals for consideration, discussion and approval by CONPES. The ministry also articulates housing and housing finance policies with those of drinking water and basic sanitation and, in turn, harmonises them with policies on the environment, infrastructure, mobility, health and rural development. The MVCT has to co-ordinate its policies with the departmental (regional) and municipal governments to harmonise and strengthen the planning and execution of housing and urban development projects.

The Ministry of Environment and Sustainable Development (MADS) is in charge of the design and implementation of national policies related to the environment and renewable natural resources. It also establishes rules and criteria of environmental planning to ensure the conservation and sustainable use of land and oceans. Together with the DNP, it prepares plans, programmes and projects on environmental matters that must be incorporated into the projects of the PND and the National Investment Plan. In co-ordination with other ministries and state entities, MADS also establishes the environmental criteria that must be incorporated into sectoral policies.

The Ministry of Transport (MT) is in charge of formulating and adopting the policies, plans, programmes, projects and economic regulation of transport, transit and infrastructure, in the country’s road, maritime, fluvial, railway and air modes of transport. It participates in the formulation of the country’s economic and social policy, plans and programmes. The MT is also responsible for the preparation of the sectoral plan for transport and infrastructure, in co-ordination with the DNP and sectoral entities. The MT establishes the provisions for the integration and strengthening of transport services.

The Ministry of Agriculture and Rural Development (MADR) is responsible for the design and implementation of policies of the agricultural, fisheries and rural development sectors. It guides and oversees the activities of the Unit for Agricultural Planning.

The Unit for Agricultural Planning (UPRA) defines the criteria and designs instruments for the management of rural land suitable for agricultural development, which serve as a basis for the definition of policies to be considered by the territorial entities in the land use plans (planes de ordenamiento territorial, POTs).

Source: Observatorio Regional de Planificación para el Desarrollo de América Latina y el Caribe (n.d.[4]), Departamento Nacional de Planeación (DNP) de Colombia, https://observatorioplanificacion.cepal.org/es/instituciones/departamento-nacional-de-planeacion-dnp-de-colombia; Minvivienda (n.d.[5]), Ministerio, https://minvivienda.gov.co/ministerio; Ministerio de Medio Ambiente y Desarrollo Sostenible (n.d.[6]), Noticias, https://www.minambiente.gov.co/#; Unidad de Planificación Rural Agropecuaria (n.d.[7]), Homepage, https://www.upra.gov.co/ (accessed in August 2021); Ministerio de Transporte (n.d.[8]), Homepage, www.mintransporte.gov.co/ (accessed 15 July 2021); Ministerio de Agricultura y Desarrollo Rural (n.d.[9]), Homepage, https://www.minagricultura.gov.co/paginas/default.aspx (accessed 15 October 2021).

The DNP is one of the most important entities of the executive power in Colombia as it co-ordinates national policies among ministries at the national level and conducts consultation of policy across levels of government. It acts as the technical secretariat for the Territorial Management Commission (Comisión de Ordenamiento Territorial, COT). The DNP is responsible for the allocation and management of the investment budget in the regions, which was COP 223 billion (approximately USD 60 million) in 2019. It also plans the execution of the country’s resources in co‑ordination with the different regions. It serves as the executive secretariat of the CONPES. The DNP led the elaboration of document CONPES 3819 for the consolidation of the System of Cities (Gobierno de Colombia, 2014[10]).

The MVCT has overall responsibility for urban policy and planning at the national level, in co-ordination with the DNP. One of its main challenges is to reduce the qualitative and quantitative housing deficit in the country through social programmes for medium- and low-income households. The MVCT and DNP are responsible for developing an integrated approach for sustainable urban development that links urban renovation with economic development, social inclusion and environmental protection practices.

To foster co-ordination across policy sectors on territorial organisation, the government established the COT, which is a technical advisory body created by the Organic Law for Territorial Organisation (Ley Orgánica de Ordenamiento Territorial, LOOT) (Gobierno de Colombia, 2011[11]). The COT’s function is to evaluate, review and suggest to the central government and national congress policies and regulations for a more effective organisation of the territory. The Ministry of the Interior (MI), MVCT, MADS as well as the Agustín Codazzi Geographical Institute (IGAC), the Regional Autonomous Corporation (CAR) and experts in the field representing public and private universities are all part of the COT. The DNP acts as the secretariat of the commission. The COT reviews and evaluates sectoral policies related to territorial planning. It also advises territorial departments and municipalities on their integration. The COT is in charge of the formulation of the General Policy of Territorial Management (Polítical General de Ordenamiento Territorial, PGOT) and promotes the articulation of different sectoral policies with the NUP.

Several other institutions play a role in urban policy. For example, the National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística, DANE) designs, plans, guides and implements statistics for evidence-based policy making. The Ministry of Mines and Energy deals with the quality of fuels and zero-carbon emissions. The Ministry of Culture leads projects to boost the cultural and creative potential of territories (orange economy). The National Unit for Risks and Disasters Management (UNGRD) supports national, departmental and municipal governments in the inclusion of a risk management component in their land use and development plans. The IGAC produces official maps and basic cartography to elaborate the national cadastre, builds the inventory of land characteristics and leads and co-ordinates the national spatial data infrastructure ICDE. The Institute of Hydrology, Meteorology and Environmental Studies (IDEAM) establishes the technical bases to classify and define land use for territorial planning at the national and regional levels.

The challenge of implementing policies and plans in Colombia

Colombia has solid experience in plan and policy making but implementation remains weak and is Colombia’s main difficulty in improving urban outcomes. This begs the question of whether possible implementation problems were considered and anticipated during the stage of policy design or plan-making. Land use plans (planes de ordenamiento territorial, POTs) are an example of limited implementation as municipalities generally lack the financial resources to carry out the activities contemplated in those plans (see Chapter 3).

Urban policy is relevant to and impacts on a number of different stakeholders from different levels of government and sectors, but their views on their roles and goals and the strategies to achieve them may likely diverge. Thus, the task for Colombian policy makers is to find a balance between all different views, build consensus and ensure that no single actor or group jeopardises implementation. A challenge is the “one-size-fits-all” approach taken in the NUP, which fails to recognise the heterogeneous nature of Colombian cities. For example, the coastal cities of Barranquilla and Cartagena face climate-change-related challenges such as floods and erosion of constructions (Milanés Batista, Meza Estrada and Cochero Cermeño, 2018[12]), while cities closer to the Venezuelan border (e.g. Arauza, Cúcuta, Puerto Carreño) are dealing with immigration flows that push to the limit their capacity for service delivery.

Moreover, the implementation of urban policy does not depend on a single ministry or agency alone but on the co-ordinated and collaborative involvement of different ministries, agencies and administrative departments at different levels of government. As will be discussed below, Colombia has a highly fragmented and siloed approach to policy making, which could be affecting implementation.

Two other factors that limit the implementation of urban-related policies are the weak institutional landscape and the crowded legal framework with a complex hierarchy of dispositions. Regarding the institutional landscape, the lack of multi-sectoral co-ordination at the national level stands out. The COT, which could be a co-ordinating agent of urban policy and territorial management, lacks the power to enforce its decisions and enact an agreed co-ordinated agenda for land management and urban development. Colombia may need to consider alternatives to strengthen the COT and make its decisions binding. There is a lack of co-ordination across levels of government, largely due to the overlapping responsibilities across the different levels of government and the large number of policies that are not always articulated with each other. Colombia lacks an effective forum where national and subnational urban authorities meet regularly to discuss and agree on a vision on urban issues.

The challenge of co-ordinating a large number of NUP actors

Given the large number of actors that take part in the urban development process, Colombia needs to develop an institutional framework that provides the incentives and mechanisms that enable policy co‑ordination. At present, collaboration and co-ordination for policy programming are dependent on the DNP’s ability to engage with sectoral agencies. Although the elaboration of the CONPES 3819 document for the consolidation of the System of Cities involved participation from a wide range of actors from different sectors and levels of government, policy implementation, approaches to urban development and management remain siloed, with limited cross-sectoral dialogue. Once the PND has been approved by congress, individual policy decisions affecting the plan’s implementation, such as urban policy, are made by the president and implemented by line ministries under the co-ordination of the DNP (OECD, 2013[13]) This creates a context where urban issues such as transport, housing, spatial planning and other policies are usually planned by different authorities, at different levels of government and in different institutional settings. It is currently difficult to assess to what extent line ministries can contribute their knowledge, expertise and know-how to urban policy making and implementation. For example, it is not clear whether ministries such as those in charge of the economy, finance or health are engaged in urban policy discussions. A lack of inter-ministerial dialogue may reinforce a narrow and sectoral perspective on urban policy matters. An example is the Biodiverciudades programme, which is managed by MADS but with little involvement from other national ministries and agencies, in particular the MVCT. It is also difficult to determine to what extent line ministries and other agencies feel they have ownership on the System of Cities despite several institutions taking part in its implementation according to the action plan. Their actions are therefore not guided by this policy and do not aim to contribute to the programme. This type of issue should be the focus of the COT and the DNP, which should review and provide options to ensure all related actors contribute to common objectives.

For Colombia, breaking silos is essential to maximise synergies and complementarities across the different government institutions and existing human and financial resources. For example, the System of Cities, the country’s NUP, promotes a more compact urban development. If Colombian authorities want to continue with the compact city approach in their next NUP, they need to foster sectoral policy complementarities. Compact city policies can be more effective if they are combined with policies on the environment, renewable energies and energy efficiency in buildings. While most of these policies are already in place in Colombia, they need to be managed with a holistic view to build synergies among them. The experience of OECD countries shows that, for example, when congestion charges and high parking fees are combined with mass-transit expansion, these actions can be mutually reinforcing (OECD, 2012[14]). To build complementarities, Colombia may draw inspiration from the US Partnership for Sustainable Communities to co-ordinate housing, transport and other infrastructure investments and, in doing so, to promote reinvestment in existing communities (Box 5.2). This is an option that Colombia could explore, in which the DNP and MVCT co-lead the partnership. For example, Biodiverciudades could be managed through a cross-sectoral partnership to be more effective.

The elaboration of the new NUP should pay particular attention to breaking silos by combining compact city policies with other urban economic initiatives that the government wants to promote, such as labour policy and innovation. This is not new in Colombia as the National Development Plan 2014-2018 called for an interagency commission to co‑ordinate housing, urban development and transport efforts, bringing together the then Ministry of Housing and Urban Development, the Ministry of Transport, the Ministry of Culture and the Ministry of Finance. Colombia should continue fostering that co‑ordination but make it more systematic.

Box 5.2. The US Partnership for Sustainable Development – An example of cross-sectoral co‑ordination

In 2006, the US government created the US Partnership for Sustainable Communities, which is a collaboration among the Department of Housing and Urban Development (HUD), the Department of Transportation (DOT) and the Environmental Protection Agency (EPA). The collaboration marked a change in how the US government structures its transport, environmental and housing policies, programmes and spending. The three agencies support the efforts of urban, suburban and rural communities to expand housing and transport choices, protect air and water, boost economic growth and promote well-being. The Partnership for Sustainable Communities is guided by liveability principles:

Provide more transportation choices.

Promote equitable, affordable housing.

Enhance economic competitiveness.

Support existing communities.

Co‑ordinate and leverage federal policies and investment.

Value communities and neighbourhoods.

The joint work of the three agencies led to the distribution of nearly USD 2 billion in grants to support vital transport infrastructure, equitable comprehensive planning and brownfield redevelopment. Some of the resources were targeted to areas where disinvestment and industrial pollution have led to a legacy of contaminated sites. The partnership also assists organisations in building capacity for environmental justice and equitable development.

Source: EPA (2010[15]), Partnership for Sustainable Communities: Supporting Environmental Justice and Equitable Development, https://archive.epa.gov/epa/sites/production/files/2014-08/documents/2010_1230_psc_ejflyer.pdf.

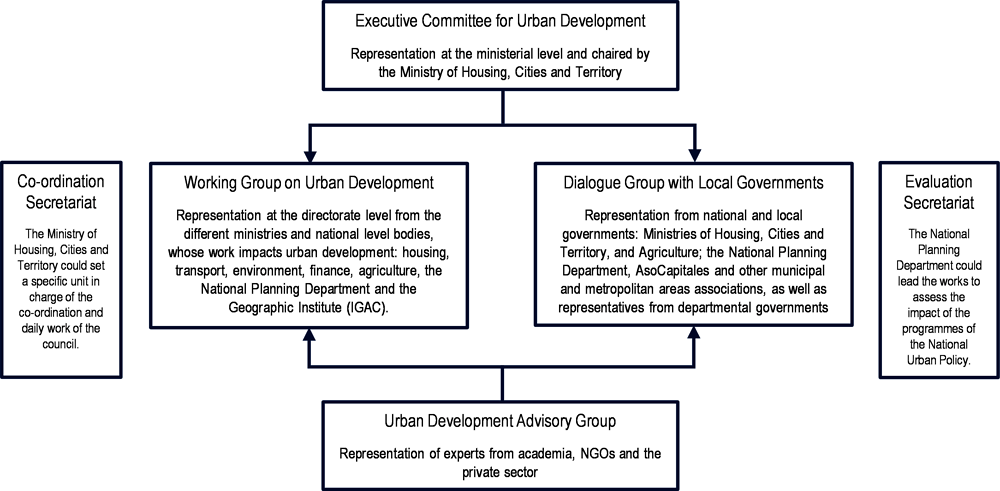

Another option for Colombia to ensure cross-sectoral co-ordination could be to set up a National Council for the Co-ordination and Evaluation of the National Urban Policy (Figure 5.1). Its main responsibility would be to ensure that all national-level actors are aligned towards the achievement of NUP objectives. It would not replace CONPES as it would not be in charge of defining policy but its mandate would be to ensure its implementation through the co-ordination of all line ministries and national-level agencies that have responsibility for plans and programmes related to urban development. The council could have an Executive Committee for Urban Development, whose role would be to agree on, co-ordinate and communicate top-level strategies on urban development among ministries and other bodies. It could meet two to three times a year with representation at the ministerial level and be chaired by the MVCT. The council could have a Working Group on Urban Development that would be the hub for cross-sectoral co‑ordination. It could oversee the implementation of the NUP and the different sectoral plans and programmes (e.g. housing, transport, land use, environment, urban regeneration, water, etc), conduct reviews and identify priorities and policy gaps. It would meet every two months with representation at the directorate level and be chaired by the MVCT. Moreover, the council could have a Dialogue Group with Local Governments where national-level representatives responsible for the NUP could meet on a regular basis with representatives of local governments (e.g. Association of Capital Cities [AsoCapitales], municipal and metropolitan associations, and representatives from the departmental governments) to co‑ordinate and assess progress on urban development. An Urban Development Advisory Group with representatives from academia, non-governmental organisations (NGOs) and the private sector could support the working group and the dialogue group. The MVCT could also set up a unit to function as the co-ordination secretariat in charge of the day-to-day business of the council. The DNP would be in charge of overseeing the evaluation of the different programmes that form the NUP and assessing their impact.

Figure 5.1. Proposal for a National Council for the Co-ordination and Evaluation of the National Urban Policy

The subnational level is composed of legally autonomous territorial units and territorial associative schemes

Colombia is a unitary state. Its territorial governance structure, as established in the constitution, is based on 32 departments, 1 102 municipalities and 11 districts. The roles and responsibilities of the national and subnational governments are defined by the 1991 Constitution, the Organic Law on Territorial Organisation (LOOT) (Gobierno de Colombia, 1997[1]), the Law of Regions (Gobierno de Colombia, 2019[16]) and other regulations Figure 5.2 presents the different responsibilities of each level of government regarding the territorial organisation.

The competencies and responsibilities of each level of government are set in the 1991 Constitution and other regulations (Laws 388 of 1997, 715 of 2001, 1176 of 2007, 1454 of 2011, 1551 of 2012 and 1617 of 2013), in particular the Land Management Law that guides urban development at the local level (Gobierno de Colombia, 1997[1]). Departments and municipalities share a majority of competencies in education, health, water, sanitation and housing (Table 5.1) (OECD, 2016[17]). The departments have a responsibility for planning and promoting economic and social development. They exercise administrative functions of co-ordination and intermediation with municipalities. Municipalities are in charge of public service provision such as electricity, urban transport, cadastre (when the municipality has been certified as cadastral manager or gestor catastral, otherwise the cadastre is managed by the IGAC), land use planning and police. The central government classifies municipalities as being “certified” or “non-certified” for the provision of services such as education, health, water and sanitation. It determines universal coverage and sets quality standards. Once a municipality reaches the targets and standards, it is entitled to use resources in other areas of its own competency (OECD/UCLG, 2019[18]). The DNP certifies that this universal coverage has been achieved at the request of the territorial authority. Only a few municipalities have reached the highest rating.

Table 5.1. Subnational governments’ main responsibilities by sector in Colombia

|

Sector |

Departments |

Municipalities |

|---|---|---|

|

General public services |

Passport issuance |

Civil registers, building permits, management of municipal property and enterprises |

|

Public order and safety |

Risk and disaster management |

|

|

Economic affairs/transports |

Rural development, regional policies, regional territorial planning, traffic management |

Promotion of social, economic and environmental development |

|

Environmental protection |

Environmental protection |

Solid waste management, sanitation |

|

Housing and community amenities |

Co‑ordination and co-financing of water schemes |

Territorial planning, local infrastructure, water supply, housing |

|

Health |

Public health, services for the uninsured population, operation of the hospital network |

Public health, administration of the subsidised scheme, services for the uninsured population |

|

Recreation, culture and religion |

Sport, culture leisure |

|

|

Education |

Management of teacher and administrative personnel in basic and primary education |

Early, primary and secondary education, construction and upkeep of buildings, canteen and extracurricular activities, payment of salaries |

|

Planning |

Guide territorial land use, define policies for human settlements and urban centres, guide the location of physical and social infrastructure, guide and integrate the spatial projection into sectoral plans of the department and municipalities, adopt total or partial land use plans |

Adopt land use plans (POTs), guide the use of urban, conservation and rural land, co‑ordinate sectoral plans based on national, departmental and metropolitan plans |

Source: OECD/UCLG (2019[18]), 2019 Report World Observatory on Subnational Government Finance and Investment - Key Findings, http://www.sng-wofi.org/publications/2019_SNG-WOFI_REPORT_Key_Findings.pdf (accessed on 28 August 2019); Gobierno de Colombia (1997[1]), Ley 388 de 1997 - Ley de Ordenamiento Territorial, https://www.minenergia.gov.co/documents/10180//23517//22687-Ley_388_de_1997.pdf (accessed on 21 April 2021).

Departments are led by governors who are directly elected every four years. They have autonomy in the management of their resources. The departments are responsible for establishing guidelines for planning the totality or specific parts of their territory, determining land use scenarios, defining policies for urban areas in line with the national framework, orientating the localisation of infrastructure and implementing programmes for the conservation of the environment (Gobierno de Colombia, 2011[11]). They act as intermediaries between the central government and municipalities, which according to the LOOT should be done through the Departmental Territorial Management Plan.

Districts are territorial entities that have specific regimes as they have special powers different from those of municipalities with the aim of promoting their socio-economic development. Some of the districts are: the Capital District of Bogotá (hereafter Bogotá, D.C.); the Special, Industrial and Port District of Barranquilla; the Special, Industrial, Port, Biodiverse and Ecotourism District of Buenaventura; the Special, Tourist, Cultural and Historical District of Santa Cruz de Mompox; the Medellín Science, Technology and Innovation District, the Touristic and Cultural Districts of Cartagena, Riohacha and Santa Marta; the Special, Sports, Cultural, Tourist and Entrepreneurial District of Santiago de Cali; and the Special, Industrial, Port, Biodiverse and Ecotourism District of Tumaco. Special districts are granted administration and financing schemes that allow greater efficiency in the fulfilment of goals and programmes. The 1991 Constitution authorises some metropolitan areas to become districts. To become a district, the territory must have at least 500 000 inhabitants or be located in coastal areas, be the capital city of a department and have the potential for the development of ports or tourism and culture (Gobierno de Colombia, 2019[19]). One of the characteristics of the districts is administrative decentralisation, which may contribute to optimising decision-making and service delivery for urban development.

Figure 5.2. Distribution of responsibilities across levels of government on the territorial organisation in Colombia

Source: Own elaboration based on Gobierno de Colombia (2011[11]), Ley 1454 de 2011 - Ley Orgánica de Ordenaminto Territorial, https://www.alcaldiabogota.gov.co/sisjur/normas/Norma1.jsp?i=43210 (accessed on 22 April 2021).

Like districts, municipalities have political, fiscal and administrative autonomy within the framework established by the 1991 Constitution. Their purpose is to ensure the general well-being and the improvement of the quality of life of their residents. Each municipality is led by a mayor (alcalde) and a municipal council, both directly elected every four years. Municipalities are responsible for providing public services and managing issues related to: public space, vehicular traffic, the provision of drinking water and basic sanitation services, the construction, maintenance and provision of official educational and sports facilities, primary healthcare centres, agricultural technical assistance, the implementation of integrated rural development programmes, the adaptation of road infrastructure, land, and public and communal services, the co-financing of social housing, the construction and conservation of road and municipal networks, the regulation of urban transport, the provision of home public services, urban safety, the promotion of peaceful co-existence and the care of vulnerable groups (OECD/UCLG, 2019[18]). Most of these competencies are shared with departments, which, within the national framework, co-ordinate, supervise and provide financial, administrative and technical assistance to municipalities and, in some cases, substituting them. Municipalities formulate and implement land use plans (POTs), regulate land use in urban and rural areas, and co-ordinate sectoral actions to ensure they are in line with national policies and regional and metropolitan development plans. Although the authorities in departments and municipalities are elected by local residents and are independent from the president, governors and mayors, they have the mandate to link the goals of their local development plans with those of the PND to have access to national resources.

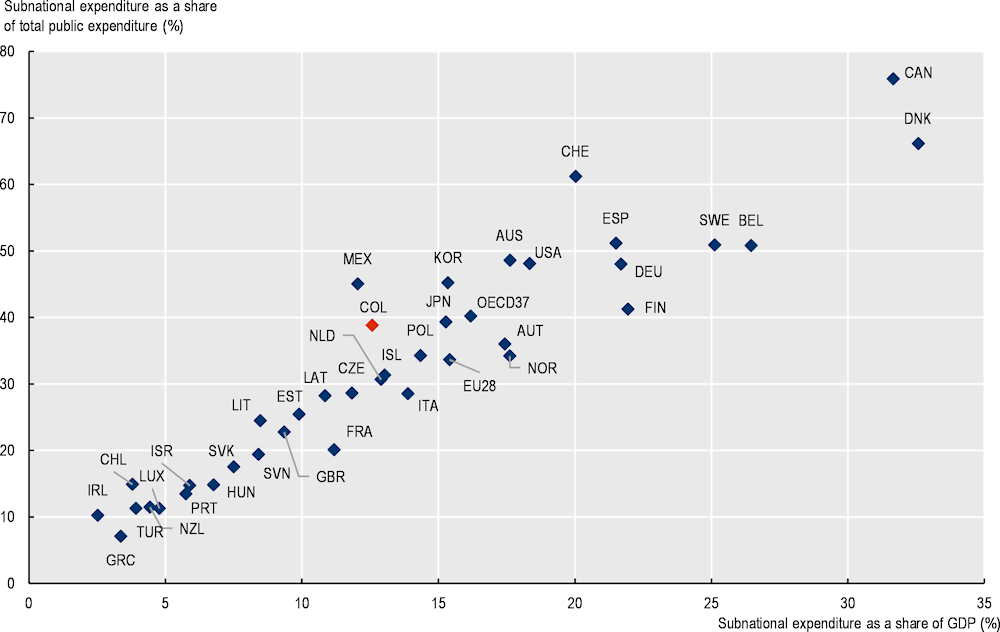

Decentralisation sets the ground for territorial co-operation

When compared to other Latin American countries, Colombia is one of the most administratively, politically and fiscally decentralised countries in the region (OECD, 2013[13]; 2016[17]). However, when compared with OECD countries, Colombia ranks among countries with an intermediate level of decentralisation (OECD, 2014[20]). The country has a strong centralist presidential system, which means that urban development policies tend to be centrally established by the national government with little subnational government consultation. Over the past four decades, Colombia has gone through different waves of decentralisation and re-centralisation, aiming to strike a balance between fiscal sustainability and more shared governance. The centralist tradition has been the national government’s tool to offset the country’s natural geographic fragmentation, contain interest groups, deal with extra-democratic insurgencies and manage regionally-based ethnocultural minorities (OECD, 2013[13]). The 1991 Constitution paved the way for the enactment and implementation of several laws that enforced political, fiscal and administrative decentralisation. The PND, the LOOT, the districts and municipal governments’ legal regime, and the Public-Private Agreements Law provide subnational governments with the tools to enhance their institutional ability to face emerging challenges. For example, local authorities have the possibility to perform their tasks through associative mechanisms such as regions, metropolitan areas and public associations. These mechanisms also provide them with the option to reduce fiscal costs through the involvement of the private sector in investing in local public infrastructure and services, and thereby enhancing the quality of public service delivery.

The enactment of the LOOT in 2011, 20 years after the adoption of the 1991 Constitution, regulates the devolution of powers to territorial entities (Gobierno de Colombia, 2011[11]).1 The LOOT specifies a devolution framework by which subnational governments implement decisions and strategies designed at the central level of government while working to promote their own development. Initially, this arrangement was devoid of any transfer of policy-making or strategy-setting authority and capacity to subnational authorities. However, the national government is not always in a position to make informed decisions about the specific needs of every community. Municipalities’ administrative capacity was not always sufficient to meet their economic and social demands either. Local public actors have therefore had to fend for themselves to find alternative policy responses to the needs of their municipalities and inhabitants (OECD, 2013[13]). This has led to the creation of informal networks of political and economic actors that have shaped multi-level governance in Colombia for the last three decades. Although the LOOT clearly defines the hierarchical inter-governmental order, a complex power grid occurs in practice, in which information brokers, contracts, relations and social capital have created their own procedures without a clear multi-level framework for effective decision-making processes (OECD, 2013[13]). This has had important effects on the urbanisation process, as municipalities’ technical and financial capacity and political leadership remain rather limited to conduct, for example, comprehensive planning of their territory.

The LOOT provides for legal arrangements and forms of territorial co-operation through which different levels of government and territorial entities can choose to form strategic alliances to boost the sustainable development of the communities. These associative territorial arrangements include associations of departments, special constituency associations, associations between municipalities, associations of metropolitan areas, management and planning regions, and administrative and planning provinces (Gobierno de Colombia, 2011[11]). The Territorial Associative Schemes (esquemas asociativos territoriales, EATs) constitute another form of co-operation among departments, districts and municipalities. EATs can provide public services (e.g. transport), conduct administrative activities (e.g. cadastre management) delegated by the territorial entities or even the national government, and conduct planning activities and development projects (Gobierno de Colombia, 2019[19]).

The LOOT defines the rules for decentralisation derived from the 1991 Constitution. It provides a stable legal and policy framework that strengthens the central government’s ability to co-ordinate the implementation of decentralisation across the country. The central government may contract or agree with the territorial entities, with the associations of territorial entities and with the metropolitan areas the joint execution of strategic projects of territorial development through the formulation of a Contratos Plan (contracts plan) which specifies the contributions of each party to the project and the respective sources of funding.

Inter-municipal co-operation needs to be reinforced

One of the main challenges for the territorial organisation in Colombia is to strengthen inter-municipal co‑operation mechanisms. Like in most OECD countries, inter-municipal co-operation is based on local authorities’ wishes to join an associative scheme on terms which they themselves set in statutes governing inter-municipal co-operation. Such voluntary action reflects municipal autonomy accepted by all and stated in the constitutions and other high-level laws. Colombia has several mechanisms that aim to make territorial organisation more effective and efficient: associations of departments, associations of metropolitan areas, municipal associations, administrative and planning regions (RAPs), planning and management regions (RPGs), special planning and administrative regions (RAPEs), provinces, associations of departments and metropolitan areas, and, more, recently the metropolitan region. Currently, 86 associative schemes are in place, including 56 municipal associations. About 70% of these associative schemes have been formed around environmental policy goals.

Municipal associations are the easiest way for municipalities to join forces for common objectives and some have been operating for more than 25 years. They obey a genuine motivation to co-operate as 90% of municipalities in the country are too small (less than 10 000 inhabitants) and, alone, they cannot afford meaningful investments (OECD, 2016[17]). Municipal associations can be formed without public consultation and municipalities from different departments can join the same association. This is a more flexible association scheme than metropolitan areas for example, which are more complex and rigid. There are also territorial integration committees aimed at promoting dialogue among municipalities. However, they are not having the expected result as municipalities do not communicate systematically due to political differences or they focus on their own priorities.

One way of reinforcing the mechanisms for territorial co-operation in Colombia is to carry out checks on co-operation entities. These checks could be of an administrative, legal and financial nature as is the case in countries such as Austria, the Czech Republic, Finland, France, Germany, the Netherlands and Sweden. This should not be regarded as a violation of municipal autonomy but only as a method to ensure that the use of resources transferred from national government are being used properly. However, Colombia may wish to conduct checks that look into the effectiveness of action. In Germany, for example, the national government conducts legal and technical supervision to verify that bodies are carrying out their assigned duties lawfully and appropriately. In Austria and Norway, checks are conducted to verify the effectiveness in each type of inter-municipal co-operation covered by legislation. Alternatively, Colombia may explore adapting the Welsh corporate joint committees as a formal inter-municipal co-operative mechanism to support municipalities in urban planning and policy implementation (OECD, 2020[21]).

Metropolitan governance is key to invest at the right scale

Metropolitan governance is gaining significance

Metropolitan governance is of fundamental importance for Colombia due to the relevant role cities play in the economy and existence, according to the System of Cities, of 18 functional areas that account for 81% of the population of the System of Cities (Gobierno de Colombia, 2014[10]). Moreover, there is a growing number of urban residents in cities (i.e. Bogotá, D.C., Cali and Medellín) and their suburban areas, emigrated from rural areas largely due to armed conflict (see Chapter 1). This demographic phenomenon creates additional pressure on cities and their neighbouring municipalities to provide sufficient and high-quality public services to a growing population. Metropolitan governance arrangements allow municipalities to join forces and resources for a more efficient response to urban challenges and demands.

In Colombia, metropolitan governance arrangements are not unknown as, in 1968, authorities created the first metropolitan area in the Valle de Aburrá with Medellín as its core city (Box 5.3). The LOOT created the Territorial Organisation Commission (COT) responsible for the definition of territorial organisation policy, but its basic work instrument, the General Policy for Territorial Management (Polítical General de Ordenamiento Territorial, PGOT), is yet to be approved.

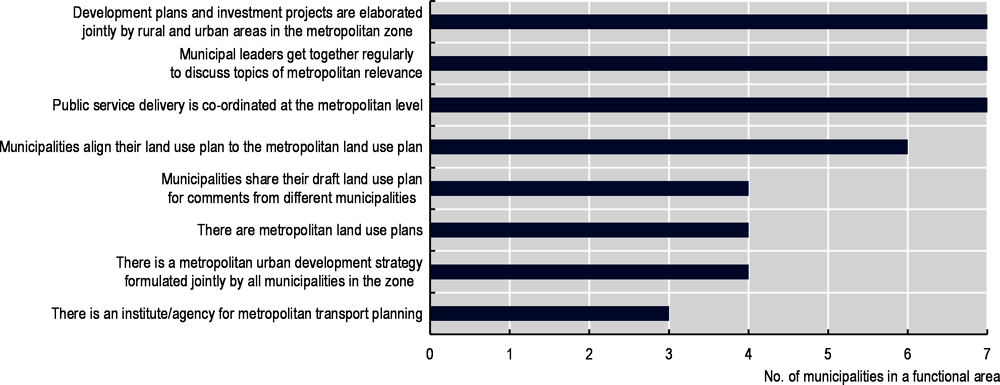

Promoting metropolitan governance is gaining importance in Colombia. Municipalities classified as functional according to CONPES 3819 on the System of Cities, used different mechanisms to strengthen metropolitan governance to achieve better urbanisation and increase competitiveness. According to the OECD Survey on Urban Policy in Colombia 2021, 23 of the 72 municipalities that answer the governance section of the survey are located in a metropolitan area. Figure 5.3 shows that joint elaboration of development and investment projects between urban and rural areas, co-ordinating public service delivery and having regular meetings among municipal leaders are the mechanisms that they used the most to promote urban development at the metropolitan level. The use of these mechanisms could be part of the activities undertaken within the framework of a municipal associative scheme. Metropolitan land use planning (Plan Estratégico Metropolitano de Ordenamiento Territorial, PEMOT) also appears to be an important mechanism for metropolitan governance driven by the need for spatial and land use planning to keep pace with changing functional territorial boundaries. This is particularly important for Colombia as it has a polycentric urban structure where the borders of local jurisdictions do not correspond to urban form and the patterns of residents’ daily activities.

Box 5.3. The Metropolitan Area of the Valle de Aburrá and the Metropolitan Region of Bogotá-Bucaramanga

The Metropolitan Area of the Valle de Aburrá (AMVA) was created in 1980. It is the most consolidated metropolitan entity in the country and second-largest agglomeration in Colombia with a population of 3.9 million inhabitants. It is formed by ten municipalities (Barbosa, Bello, Caldas, Copacabana, Envigado, Girardota, Itaguí, La Estrella, Sabaneta and Medellín as its core city). According to the statutes of AMVA, the metropolitan area has three main planning instruments: the Integral Metropolitan Development Plan, the Metropolitan Strategic Plan for Land Use Planning and the Metropolitan Management Plan. AMVA has developed the first Metropolitan Strategic Plan of Territorial Organisation in Colombia. It is the environmental and transport authority in the area and co‑ordinates land use planning in the metropolitan territory through an integrated development plan. AMVA has a public transport network that links all municipalities in the area. The Integrated Transport System of the Valle de Aburrá (SITVA) includes a metro, trams, metrocable as well as an extensive bus and bicycle network.

The metropolitan board, composed of the ten mayors of the Valle de Aburrá, approved the Management Plan 2020-2023 “Sustainable Future”. Its objective is to move towards a smart metropolis, with actions for a sustainable development focus on innovation and the use of information and communication technology (ICT) to increase people’s quality of life. The plan is structured around three axes – environmental sustainability, territorial synergies and physical and virtual connectivity – and six main components – information, innovation, knowledge, communications, technology and mobility. During the four-year period, authorities plan to invest COP 1.75 billion in 27 investment programmes such as mitigation and adaptation to climate variability, intelligent disaster risk management, intelligent management of surface and underground water resources, sustainable economic development, strengthening of open and digital institutions, inclusive social management, etc.

The Metropolitan Region of Bogotá-Cundinamarca (RMBC) is an associative model created through a constitutional reform in 2020. It encompasses the Capital District (Bogotá, D.C.), the Governorate of Cundinamarca and its municipalities. It is a co-ordination and complementarity mechanism to facilitate efficient use of public resources between public and private actors in the environmental, territorial and economic sectors, as well as public transport and mobility and public service delivery. The creation of the RMBC allows Bogota, D.C. and the Governorate of Cundinamarca to conduct joint planning of public policies on mobility, safety, public service delivery, budget management and sustainable development.

The RMBC concentrates 20% of the national population (11 million inhabitants) and contributes 32% to the country’s gross domestic product (GDP). It has a high level of GDP per capita (USD 9 274, compared to the national average of USD 2 600). There are 2.6 million daily trips between Bogotá, D.C. and Cundinamarca, and commuting may take up to 3.5 hours both ways per day. The Cundinamarca region has 190 protected areas. Bogotá, D.C. and 46 municipalities of Cundinamarca share the Bogotá River basin but there is a lack of an efficient waste water treatment system. About 87% of the food production in Cundinamarca is sold in Bogotá, D.C. It is expected that the creation of the RMBC will facilitate the planning and implementation of public transport infrastructure while reducing the public transport costs for passengers. The RMBC will create the co-ordination tools to facilitate the adaptation and mitigation of climate change while promoting a circular economy, with an emphasis on reducing food waste. The RMBC seeks to improve the planning of water supply and make more efficient use of the Bogota River basin. The region seeks to increase its capacity through a model of communication, co-ordination and co-operation that facilitates decision-making among the different levels of government.

Source: For AMVA: AMVA (n.d.[22]), Homepage, www.metropol.gov.co/ (accessed in August 2021); Junta Metropolitana del Valle de Aburrá (2013[23]), “Acuerdo Metropolitanao No. 10 Por medio del cual se modifican y adoptan los estatutos del Area Metropolitana del Valle de Aburrá”, https://www.metropol.gov.co/acuerdosmetropolitanos/2013/ACUERDO%2010.pdf; for the RMBC: RMBC (n.d.[24]), Cartilla de la Región Metropolitana Bogotá-Cundinamarca, www.regionmetropolitana.com/cartilla-region-metropolitana; Portafolio (2019[25]), “Producto interno bruto de Bogotá supera al de tres países de la region”, www.portafolio.co/economia/producto-interno-bruto-de-bogota-supera-al-de-tres-paises-de-la-region-532324.

Figure 5.3. Mechanisms to promote metropolitan governance in Colombia, n=23

Note: Answers to question “Q.6.2. If your municipality is in a metropolitan area, how do you promote metropolitan governance to improve the quality of urbanisation and competitiveness?”. Municipalities were invited to select all possible options.

Source: OECD Survey on Urban Policy in Colombia 2021, conducted with the support of the MVCT and AsoCapitales.

The most recent effort to enhance the intermediate level and contribute to the decentralisation process has been the enactment of the Metropolitan Areas Law (Ley de Áreas Metropolitanas) in 2013. The law provides metropolitan areas with a political, fiscal and administrative regime (Gobierno de Colombia, 2013[26]). It lays the ground for addressing challenges of large cities such as solid waste management, inter-municipal transport and harmonisation of the POTs across municipalities in the metropolitan area. The law empowers metropolitan areas to set and implement:

An action plan for their metropolitan development, called Comprehensive Metropolitan Development Plan (Plan Integral de Desarrollo Metropolitano), which provides a long-term vision for metropolitan development and common objectives for sustainable development among the different municipalities.

A Strategic Plan for Metropolitan Territorial Organisation (Plan Estratégico Metropolitano de Ordenamiento Territorial), which sets the strategy for managing the metropolitan territory on issues such as water management, public transport, metropolitan infrastructure, land use management, social housing and rural and suburban organisation.

An enhanced decentralisation process, the legislation that defines co-ordination and collaboration mechanisms among municipalities, and a definition of responsibilities for urban development across levels of government provide Colombia with a solid ground for a metropolitan governance framework. Municipalities have access to mechanisms and tools for dialogue among peers, co-ordinating policy and planning and building economies of scale while respecting the autonomy of each other. Moreover, since metropolitan areas focus on transport and the environment, they can also strengthen their co-operation around concrete and tangible projects.

Although the mission for the elaboration of the System of Cities identified 18 agglomerations of supramunicipal nature, there are only six metropolitan areas (Barranquilla, Bucaramanga, Centro Occidente, Cúcuta, Valle de Aburrá and Valledupar) and three agglomerations2 (Cali, Cartagena and Manizales). The reason there are not more metropolitan areas as an associative scheme, even if not formalised, is that it is compulsory to hold a public consultation with strong citizen engagement in order to create a metropolitan area. Even though some mayors are interested in setting up a metropolitan area, they have not been able to organise the public consultation due to low levels of participation.

Metropolitan areas have authority over issues related to transport and the environment, which gives them a higher hierarchical level in comparison to other forms of association, such as municipal associations. They have the obligation to issue a metropolitan development plan and a metropolitan land use plan (PEMOT), both for a period of 12 years, which are approved by the metropolitan board (junta metropolitana), which is the governing body of a metropolitan area composed of the mayors of the member municipalities and chaired by the mayor of the core municipality. Those plans provide guidance to the municipalities that are part of a metropolitan area regarding service delivery and infrastructure. In some cases, the core municipality (municipio núcleo) conducts investments in smaller municipalities as they tend to have more resources. These investments are generally in public works (i.e. parks, gardens) and infrastructure (i.e. schools) as this in return contributes to well-being in the municipality where investment was generated and also helps to limit immigration to the core municipality.

Although metropolitan areas in Colombia may seem to have a solid governance arrangement, in reality, four main weaknesses hamper their consolidation:

A first critical problem is the predominance of one municipality over another, in particular that of the core municipality (municipio núcleo). In the Metropolitan Area of the Valle de Aburrá, for example, 80% of the resources come from the municipality of Medellín (IEU, 2020[27]). According to the Statute of the Metropolitan Area of the Valle de Aburrá, each member municipality has to decide the sources and number of resources that will be transferred to the metropolitan area (Junta Metropolitana del Valle de Aburrá, 2013[23]). This arrangement, although fair regarding the possibilities of each municipality, could potentially give the most affluent municipalities more influence than others over the Strategic Plan of Metropolitan Development, the budget and other decisions. To avoid this, regulation on the distribution of contributions and decision-making should be enacted by the national government in consultation with metropolitan and departmental authorities.

A second problem is the financing of metropolitan areas. The Metropolitan Areas Law establishes the sources of funding that would allow metropolitan areas to fulfil their duties. Two main sources of funding are the surcharge on the appraisal cadastral property and a percentage of central government transfers for the activities that have a metropolitan character. However, the municipal cadastre is outdated in most municipalities and the share of transfers is decided by the municipalities that largely rely on transfers for their financing, then the resources transferred to the metropolitan area are variable and insufficient to cover their functions. Other sources of funding include: contributions and fees for the use of renewable natural resources, land value capture mechanisms, transport fees, charges, fines or permits; and the resources allocated in national, departmental, district or municipal budgets for metropolitan areas (Gobierno de Colombia, 2013[28]). However, none of these sources can provide budget certainty or secure substantial financing to carry out metropolitan infrastructure projects. Metropolitan areas seem to have more responsibilities than resources to meet them. For metropolitan areas to meet their responsibilities, their resources should cover daily administration, operational costs of the execution of plans and projects, and capital investment (construction of infrastructure). Moreover, no taxes are used to finance metropolitan areas to meet their responsibilities such as the elaboration of metropolitan development plan and the metropolitan land use plan, the development of metropolitan housing programmes, the creation of real estate banks for land management, the exercise of the function of public transport authority, participation in public service delivery, etc. (Gobierno de Colombia, 2013[28]). Although metropolitan areas have a large economic base, they have a strong dependence on central transfers. This is because of the highly constrained fiscal autonomy of municipalities (see below). This reliance on central transfers undermines local autonomy and local accountability. The central government’s grants and transfers are earmarked and do not consider the specific needs of metropolitan areas in terms of infrastructure for transport, water, sanitation and welfare.

A third problem is a lack of co-ordination of different land use plans at different scales for the same territory: the departmental land use plan ((planes de ordenamiento departamental, POD), the metropolitan land use plan and the municipal land use plan (POT), which have different functions, scales and scope. The metropolitan and municipal plans tend to overlap and most of the municipalities within metropolitan areas struggle with technical and financial limitations to update their POTs. Moreover, even if municipal associations or metropolitan areas try to promote land use objectives that could benefit all, if they are not included in the municipal POTs, then they cannot be realised. The reason is that, despite the existence of territorial management guidelines, municipalities are the ultimate authority that decides on land use.

A fourth problem has to do with the real power of metropolitan areas. Even though the metropolitan areas are entities for strategic planning, they have no binding power and many municipalities are not even aware of their existence. This leads to situations in which the strategic planning of a metropolitan area and the management of individual municipalities go in different directions. It may be argued that the origin of this problem is that there is an exacerbated municipalism in Colombia, in which municipal mayors take little interest in the situation of the surrounding area of their municipality and do not fully understand the importance of associative schemes such as metropolitan areas (IEU, 2020[27]). Municipalities are expected to solve problems such as mobility environment, infrastructure, education, housing, among others; but those are issues that exceed municipal capacities and require a larger view.

The metropolitan region scheme as a horizontal co-ordination mechanism for the capital city

In 2020, the constitution was amended to create the Metropolitan Region of Bogotá-Cundinamarca (RMBC), the Colombian authorities’ latest attempt to empower the socio-economic development of the country’s economic engine where the largest share of the national population lives (Box 5.3). For more than 40 years, the capital city Bogotá, D.C., had looked for a multi-level governance scheme but political differences among regional leaders prevented the design of such a scheme. Since the Metropolitan Areas Law does not envisage the creation of a metropolitan area in the Bogotá-Region, the Colombian congress created the new entity of “metropolitan region”. There are four main differences between the metropolitan region and the metropolitan area:

First, while a metropolitan area promotes the integration of municipalities into a core municipality (municipio núcleo), the metropolitan region does not favour one municipality over another and does not authorise the annexation of municipalities.

Second, while a metropolitan area has a metropolitan board (junta metropolitana) as the highest governing body, in which the core municipality has veto power, the highest authority in the metropolitan region is the regional council (consejo regional), where all municipalities participate on an equal footing, regardless of their economic power or population size.

Third, while the metropolitan area focuses on predominantly urban and conurbation issues, the metropolitan region embraces a wider scope of territorial, environmental, social and economic issues related to Bogotá, D.C., and the municipalities of the department of Cundinamarca.

Fourth, while the metropolitan area includes only the core municipality and neighbouring municipalities, the metropolitan region includes the Capital District (Bogotá), the Governorate of Cundinamarca and the municipalities of the department of Cundinamarca.3

The RMBC scheme brings the mayor of Bogotá, D.C., and the governor of the department of Cundinamarca at the same level while eliminating the entity of “core municipality” (municipio núcleo) that prevails in metropolitan areas. Unlike in municipal associations or metropolitan areas, there is no risk of the annexation of municipalities by the core municipality, which is why there was no need for public consultation to create the RMBC. The metropolitan region does not have a fixed geographic area, which leaves the door open to other municipalities to join the RMBC. There are currently 66 municipalities from the department of Cundinamarca that could potentially join the metropolitan region. The RMBC aspires at least to be a transport authority to generate infrastructure projects but it will not be an environmental authority. The proponents of the metropolitan region expect the national government to include the RMBC in the national budget to ensure it has a secure source of funding as it contributes to 35% of the national GDP and accommodates 20% of the national population.

The success of the RMBC could inspire similar governance arrangements in other urban agglomerations in Colombia. However, the consolidation of the RMBC faces a number of challenges. Since the discussion of the constitutional reform that gave birth to the RMBC largely took place in congress without citizen engagement, it will need to provide evidence that the metropolitan region is responding effectively to citizens’ concerns regarding land use, public services, mobility and environment (Galvis Gómez, 2020[29]). Moreover, the RMBC needs to ensure that its creation is not just for the benefit of the Capital District (Bogotá) to the detriment of the municipalities of Cundinamarca. To this end, national and subnational authorities need to find mechanisms to integrate the poorest and marginalised municipalities into the administrative structure and bridge the gap between rich and poor municipalities in the region. The RMBC will need to facilitate citizens’ participation in planning and decision-making processes to ensure that there is no primacy of one municipality over another and that decisions respond to real local needs. Moreover, the RMBC needs to protect the land used for food production and leverage land use to achieve the SDGs. Finally, another challenge is to endow the RMBC with the financial resources to implement programmes and projects that have an impact on the territory. This is of critical importance as metropolitan areas in Colombia lack reliable sources of funding and financing to cover their needs.

Improving metropolitan governance to underpin urban policy

The experience of OECD countries suggests that building compact, connected, clean and inclusive cities, as is the spirit of Colombia’s System of Cities, requires strong horizontal co-ordination at the subnational level. Colombia has a sound basis to improve and strengthen its horizontal co-ordination mechanisms. It has accumulated enough experience on how mechanisms for municipal co-operation work. Its practices and structures are largely aligned with the OECD Principles on Urban Policy. In particular, Principle 2 suggests:

“[a]dapt[ing] policy action to the place where people live and work by: promoting flexible and collaborative territorial governance and policy beyond administrative perimeters where appropriate, by supporting a functional urban area approach (cities and their commuting zones); adapting development strategies and public service delivery to the diversity of urban scales, ranging from neighbourhoods and intermediary cities all the way to metropolitan areas, large cities and megaregions…” (OECD, 2019, p. 14[30]).

Despite this progress, Colombia still needs to adjust some aspects of its governance arrangements to make them fit to support the implementation of local plans and strategies derived from the NUP. The supramunicipal level is crowded but weak. While some municipalities invest and deliver services jointly, several municipalities still prioritise their local objectives rather than those of the functional area. Financing remains uncertain and insufficient for joint investment ventures. Therefore, the following recommendations aim at supporting Colombia to revamp its existing structures for municipal co-operation:

Acknowledge the interdependence of policy sectors (e.g. housing, transport, land use, infrastructure, leisure, etc.) in inter-municipal or metropolitan planning and adopt an integrated policy approach. In line with the OECD Principles on Urban Policy, Colombia could strive to set the incentives to align and integrate sectoral policies to promote development. Clear messages must be sent from the central government on the importance of adopting integrated approaches to pursue the System of Cities aim of building compact, connected, clean and inclusive cities. Metropolitan areas in Colombia assume leadership on environment and transport but these two policy sectors have a considerable impact on and depend on others such as housing, land use, labour markets. For example, the experience of Greater Vancouver, Canada, suggests that to plan public transport, it is essential to plan for land use and housing and that providing affordable housing requires considering transport and land use policies (Huerta Melchor and Lembcke, 2020[31]). Even if Colombian metropolitan areas have authority for transport planning and environment, they should ensure that the design and implementation of land use, transport and housing policies are highly co-ordinated and mutually reinforcing. Moreover, in metropolitan areas (and regions) as well in the large agglomerations, the management of land requires a co-ordinated approach to contentious issues: regional transport investments, the location of industrial areas and the amount of housing that needs to be developed to satisfy demand. Metropolitan areas will have to ensure that spatial and land use planning keep pace with changing territorial boundaries.

Define an organising vision around multi-sectoral, cross-cutting strategies to guide municipal co-operation. There is little evidence that municipal associations in Colombia have a long-term strategic vision, as they generally seem to work around short-term investments and electoral cycles. A long-term vision should be devised and implemented by all municipalities in the association or metropolitan area (or region) to achieve more effective and coherent policy outcomes. Municipalities in Colombia will need to establish linkages between urban development policy and other cross-cutting objectives such as adaptation to climate change and economic growth. Departments and municipal associations should have a role in ensuring an open, clear and transparent process of policy making and that cities create a strategic vision of future urban development rather than focusing on separate sectoral programmes. The NUP should foster an understanding of cross-cutting policy issues and their importance in municipal urban development to try to obtain political support from municipal authorities.

Build on existing institutions of governance. As already mentioned, Colombia has a diversity of institutional arrangements among which municipalities can choose the model that best fits their needs, as well as those set in the LOOT (Gobierno de Colombia, 2011[11]). This variety of possible schemes is important as one single model may not be fit for all purposes. However, it is important to give time to the existing mechanisms of co-operation to mature and evolve rather than continue creating more. Experience suggests that building on existing governance mechanisms of co‑operation and co-ordination facilitates the development of a more holistic, multi-sectoral approach as key actors have already worked together (OECD, 2012[14]).

Revamp the role of departments as promoters of regional integration. The OECD had already recommended that departments should be given a clearer role in the promotion of regional integration through investment projects, strengthening their mandate to incentivise regional co‑operation for investment projects as technical support or political facilitator (OECD, 2016[17]). The role of departments could be enhanced by having a more active role in projects with cross-jurisdictional co‑operation.

Address the specific needs of the RMBC in the NUP. As the economic engine of the country, the RMBC has a primary role in driving the competitiveness of the country but it has a fragile legal situation and weak capacity. The city of Bogotá, D.C., has recently published a proposal for a new POT (Plan de Ordenamiento Territorial: Bogotá Reverdece 2022-2035),4 which highlights the need to promote associative mechanisms for the joint development of investment projects in the framework of the RMBC; it does not, however, provide further details on such associations. As people flee to the suburbs, congestion increases and related costs rise for the city, commuters and companies. Plans to expand and improve the quality and integration of public transport in the RMBC offer an important solution but public transport is not addressed in the new Bogotá POT under the regional metropolitan framework. The new NUP could provide the basis for strengthening the RMBC by promoting strategic and land use planning and investment at the metropolitan level in the region. Transport could be given priority to expand and improve the integration of the RMBC. The RMBC could benefit from a two-track strategy based on bringing not only jobs to people but also people to jobs.

Adopt strong and reliable instruments for monitoring and evaluation of continuous improvement of metropolitan issues. OECD country experience suggests that it is important to implement a long-term process of monitoring and evaluation to create and sustain credibility for reform based on tangible evidence (OECD, 2015[32]). The reason is that metropolitan areas continue to evolve and even governance structures that used to function well may eventually need to be adapted. Metropolitan areas (and regions) in Colombia could adopt a set of tools to ensure obtaining continuous feedback from citizens, academic experts and the private sector. For example, the metropolitan area of Toronto, Canada, has accumulated experience in collecting feedback from different actors. The Toronto City Summit Alliance is a multi-sector coalition working to meet regional challenges such as affordable housing, transport, infrastructure and immigrant integration. The city summit acts as a source of information, ideas, initiatives and as a neutral convener. While the main feedback tool is the summit that takes place every four years to drive collective action on key metropolitan issues, citizens can also contact the city summit with proposals at any time.5

Vertical co-ordination across levels of government to align policies to the NUP

Vertical co-ordination across levels of government in Colombia remains fragile despite efforts to strengthen it. A key limitation is the overlapping competencies across levels of government and the multiple plans territorial authorities must produce. For example, municipalities, districts, metropolitan areas and departments elaborate POTs that need to be co-ordinated but, since municipalities make the final decision on how land is used within its territory, it may not always be compatible with higher-level plans. There are no mechanisms for follow-up and evaluation of the different urban development plans and it is therefore difficult to analyse their impact on higher national urban development objectives.

The National Planning Department (DNP) is in charge of articulating national and territorial planning, co‑ordinating policy among sectors and across government levels as well as supporting the capacity enhancement of subnational governments. Since it acts as the technical secretariat of the COT, it has a prominent role in discussions on territorial organisation with governments of different levels. A key issue to consider is whether its decisions are binding and compulsory for all actors in urban and territorial development.

The role of departments in vertical co-ordination could be enhanced

According to the 1991 Constitution and LOOT, departments – the intermediate governmental level in Colombia’s territorial structure – are supposed to assume the role of intermediaries between the national government and the municipalities. They are also supposed to be key players for regional development as they have more technical and administrative capacity than the vast majority of municipalities. They share competencies with municipalities in several policy issues and provide financial, administrative and technical assistance to municipalities. However, departments have limited resources to meet their responsibilities and properly support municipalities. For example, while municipal tax revenues as a share of GDP grew from 0.9% in 1990 to 2.4% in 2017, those of departments fell from 1% to 0.8% in the same period (Pérez, Espinosa and Londoño, 2019[33]). Although they receive a considerable share of the royalties (see below), they do not decide on the execution of all projects funded through those resources.

The OECD had already recommended strengthening the role of departments as integrators and links between municipalities and the national government (OECD, 2016[17]). The reason is that departments are key partners for municipalities in terms of technical, administrative and financial support and they often substitute weak municipalities and co-ordinate regional projects. Departments have a key role in setting orientations for regional development, they are key players in the royalties system and co‑ordinate Contratos Plan (contract plans). Thus, they could take on a more proactive role to support critical projects with cross-jurisdictional co-operation and in the management of royalties. Their mandate to incentivise regional co‑operation for investment projects should be strengthened. The departmental land use plans (PODs) should help to orient municipal land use plans on regional issues. Co-ordination between PODs and municipal POTs remains a challenge as it is not mandatory. The MVCT could issue regulations to strengthen the role of PODs as a reference point for POTs.

Municipal associations as platforms for dialogue across levels of government

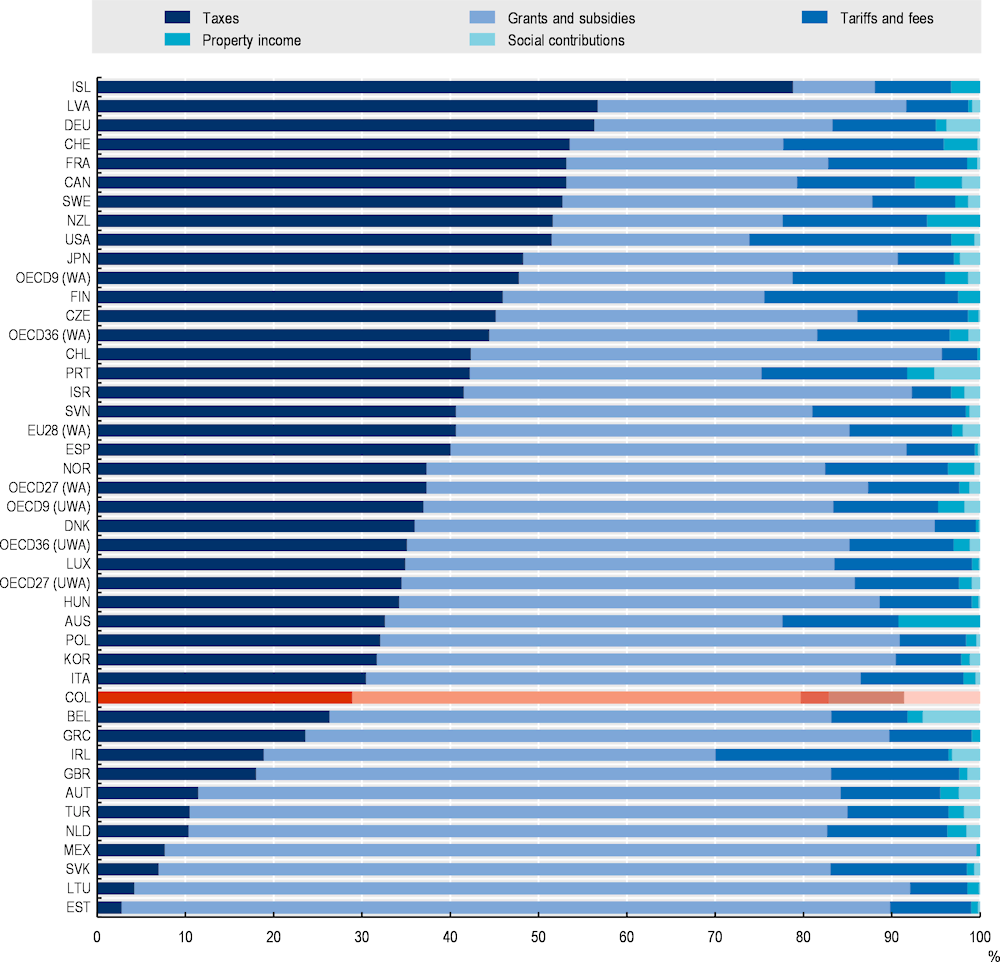

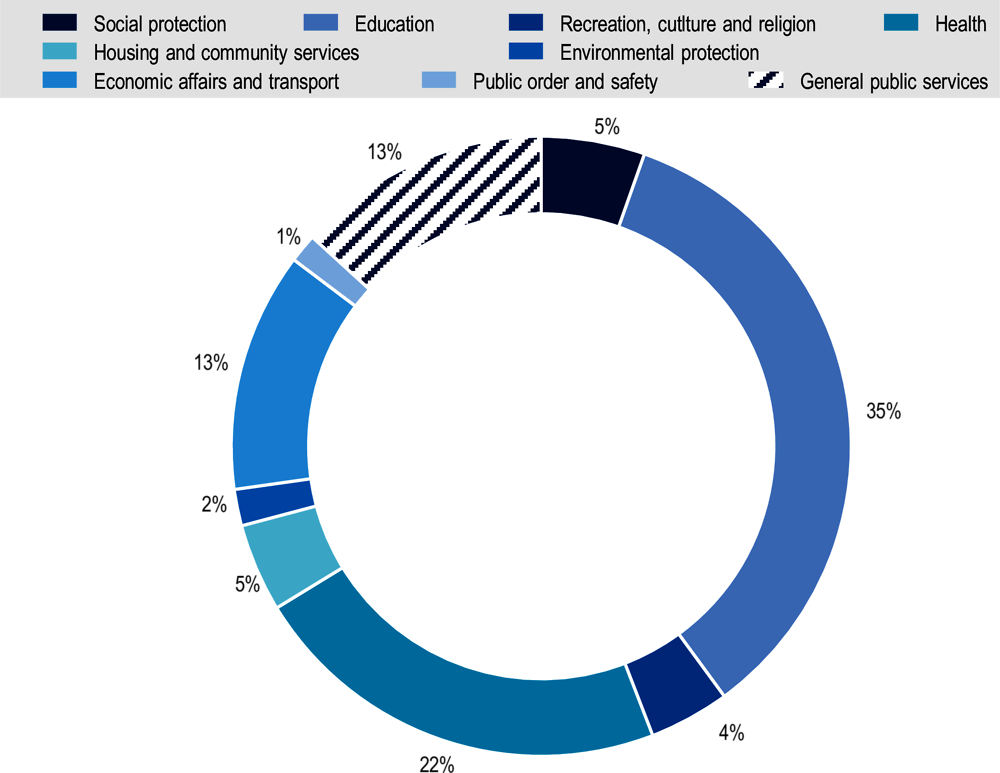

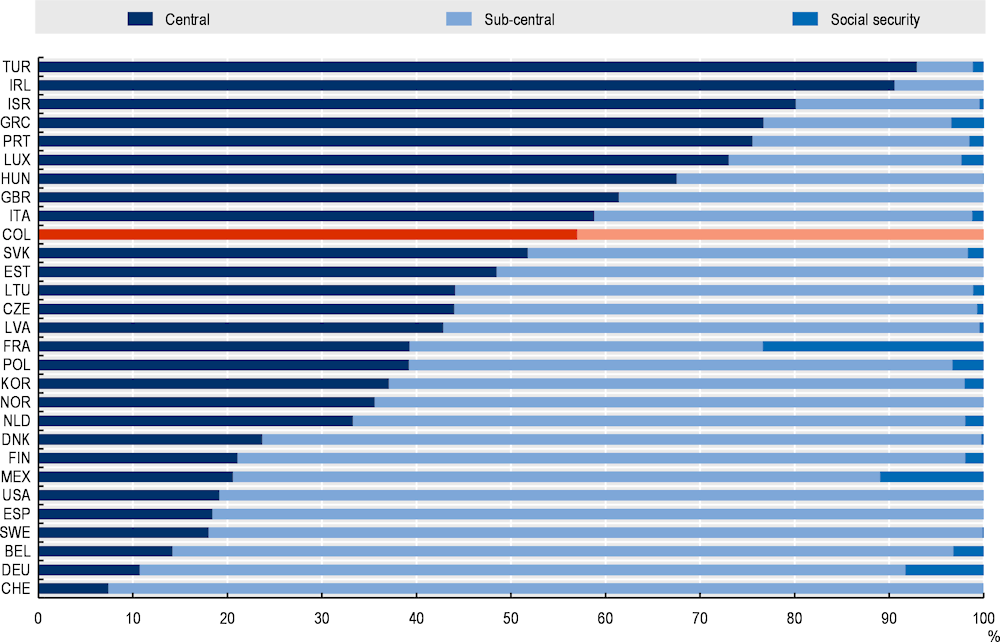

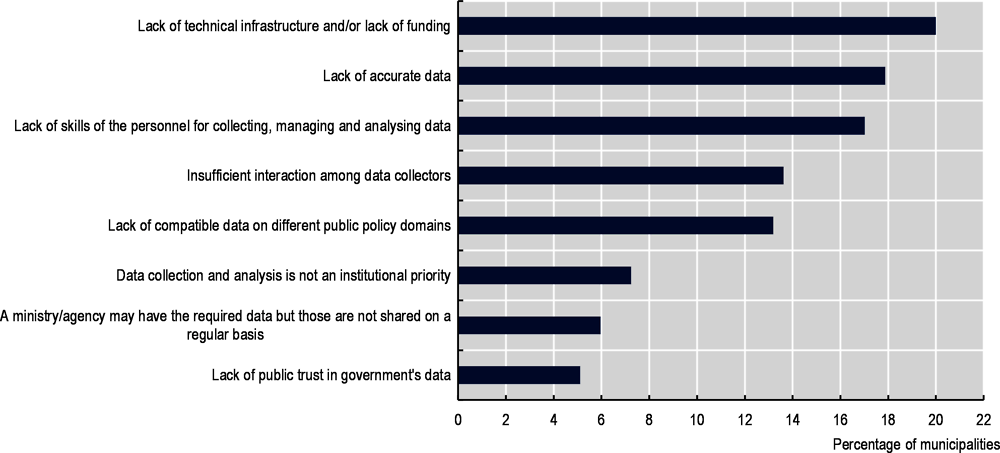

Municipalities are the beneficiaries of decentralisation but they cannot catalyse its benefits partly because of the lack of order in the intermediate level of government (IEU, 2020[27]). Colombia has been creating different territorial figures at the intermediate level with the purpose of facilitating co-ordination among governments at the same level and across levels of government. The intermediate level is composed of departments, metropolitan areas, municipal associations, administrative planning regions, associations of departments and associations of metropolitan areas. The problem is that they lack clear competencies and, in many cases, funding. These figures should be the link between national and municipal governments but the crowded landscape at the intermediate level is hindering that co-ordination. The co-existence of these various associative schemes highlights a landscape where the intermediate level is crowded with relatively weak administrative and territorial organisational figures without clear competencies and the (financial) resources to exercise them. Colombia has been experimenting with the adoption of these associative schemes since the enactment of the LOOT in 2011 but they have not matured and need strengthening, preventing the accumulation of experience to refine the schemes, and do not allow for consolidating the decentralisation process. The lack of (financial) incentives and competency for designing and implementing regionally co-ordinated investment and the possibility on incurring potentially costly co-ordination processes have contributed to the limited use of the associative schemes (OECD, 2016[17]).