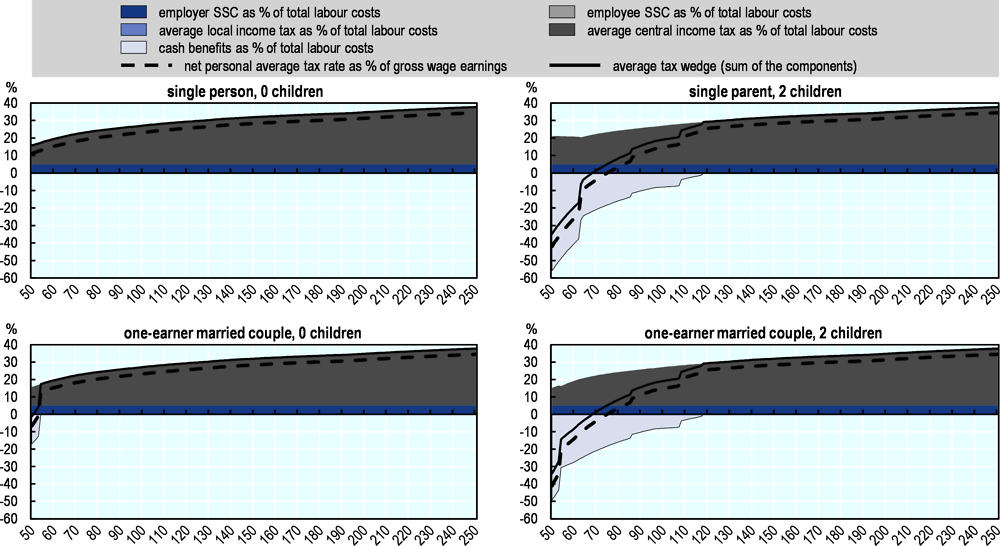

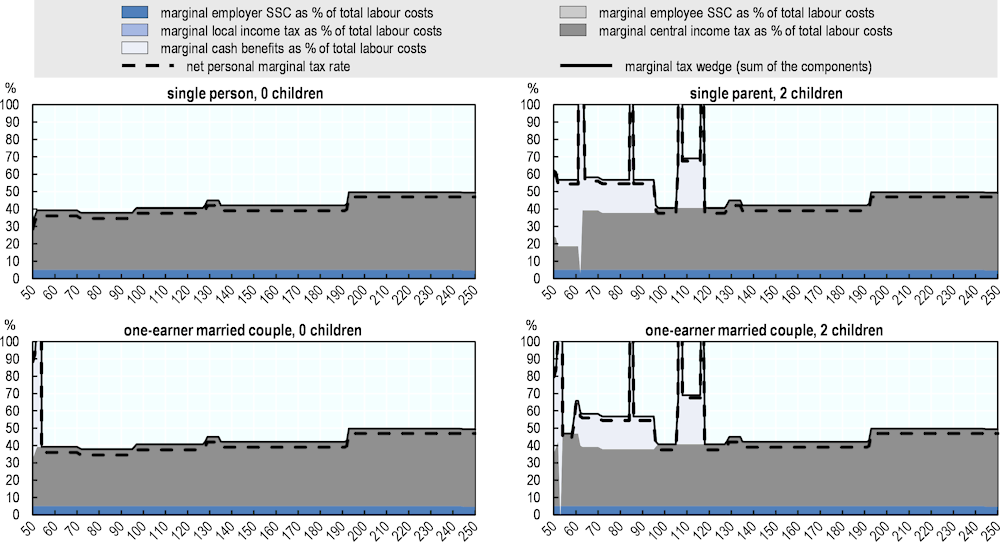

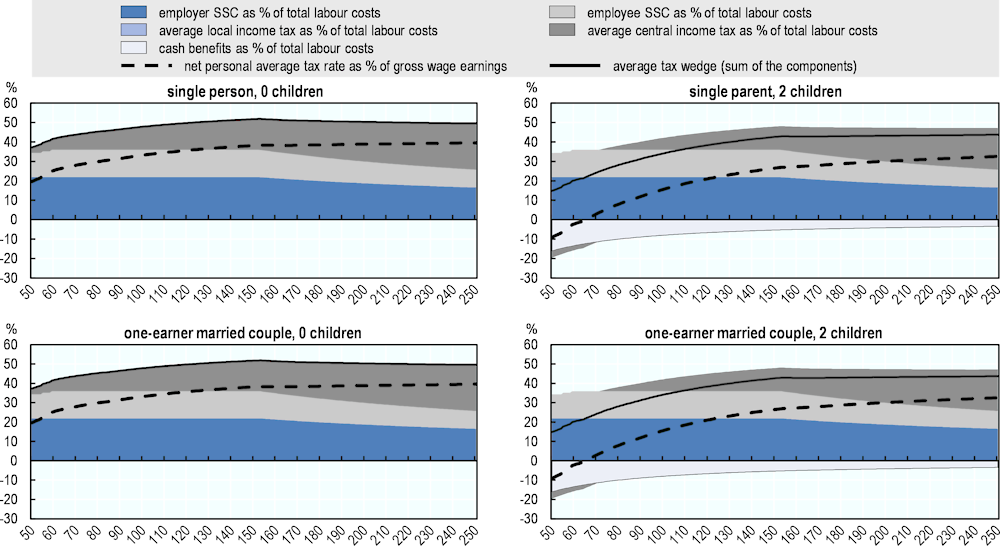

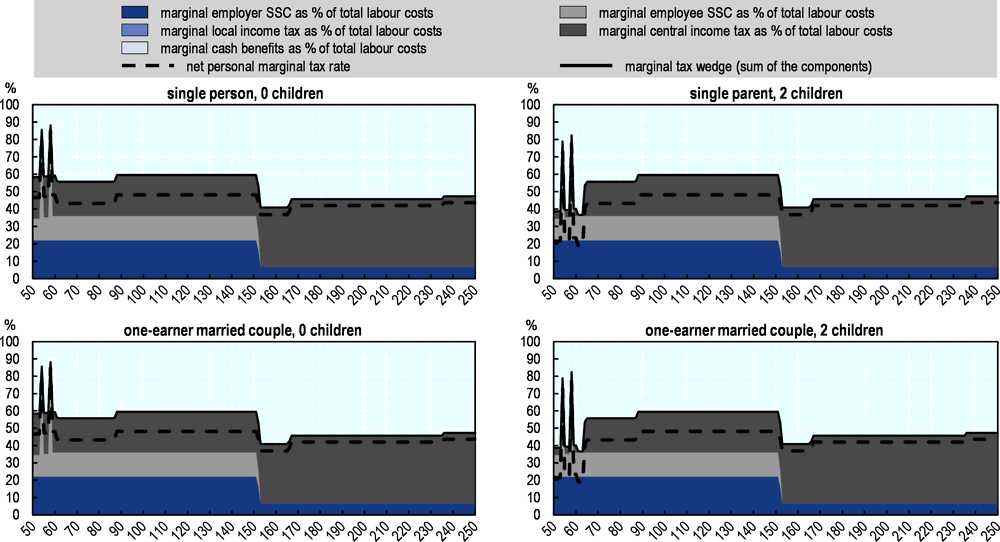

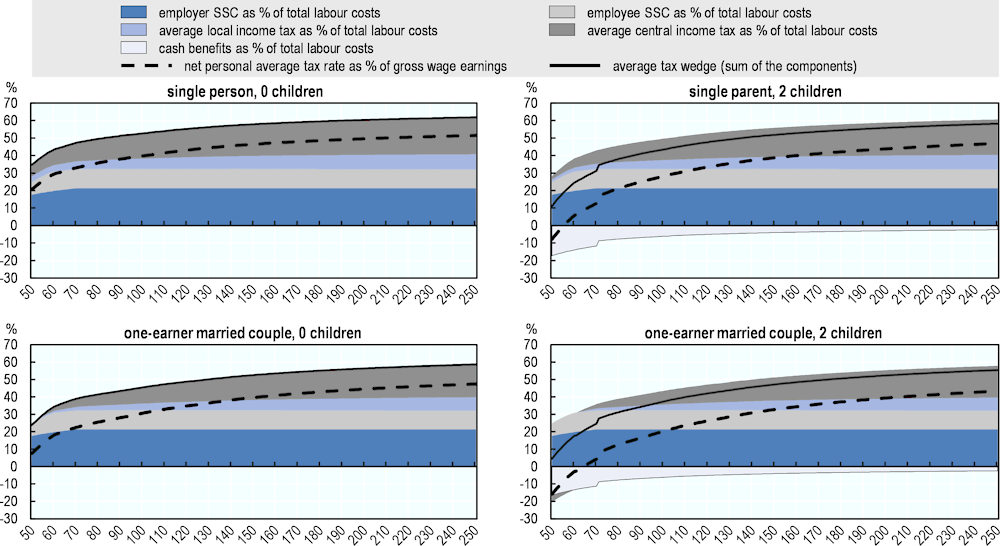

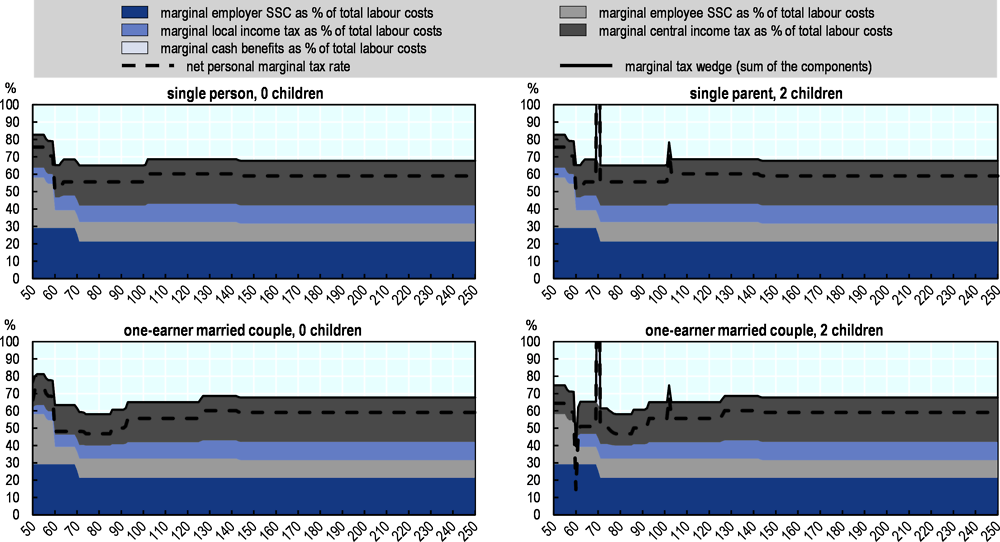

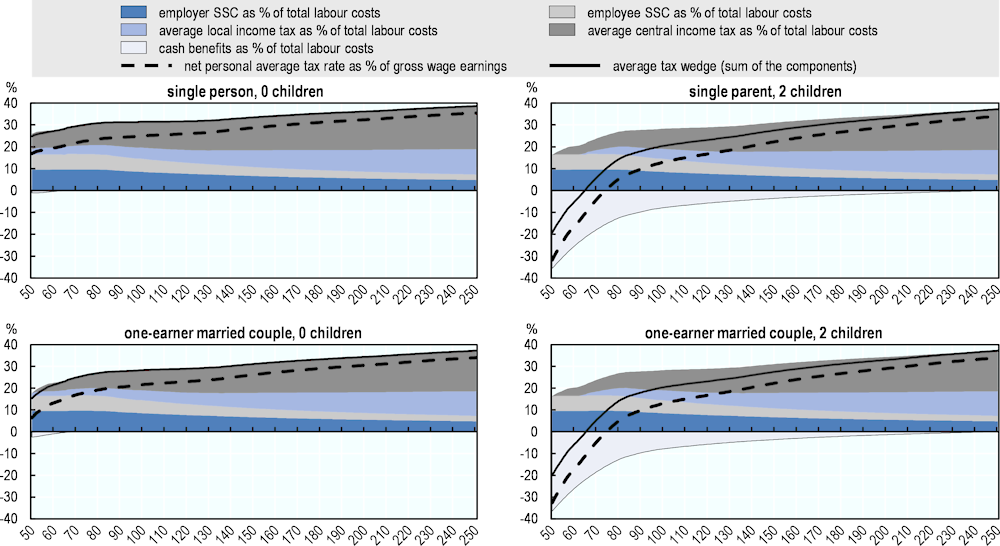

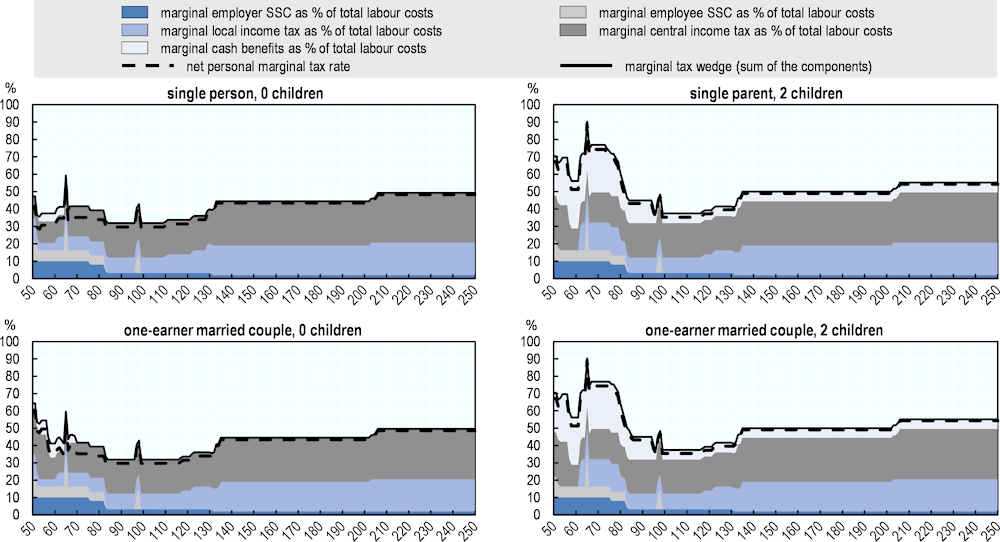

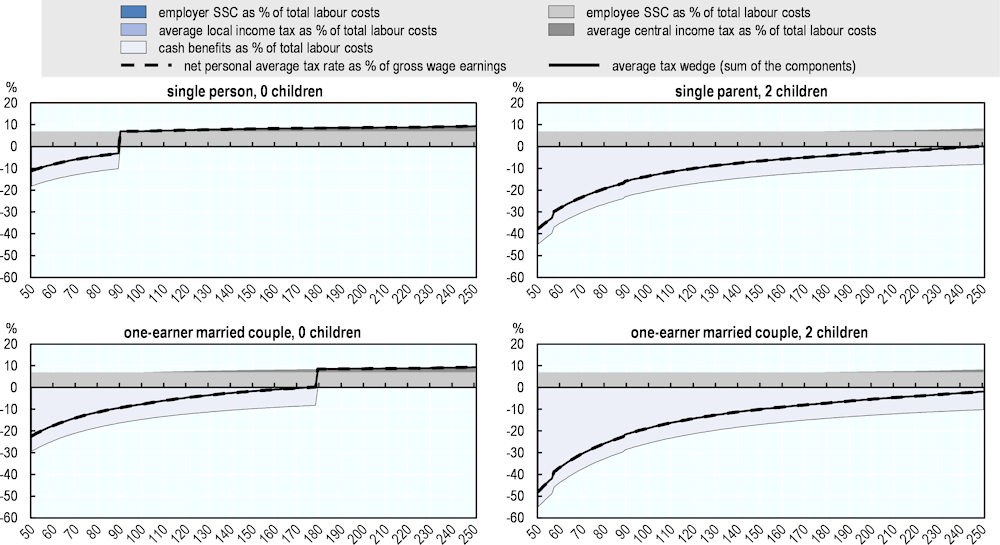

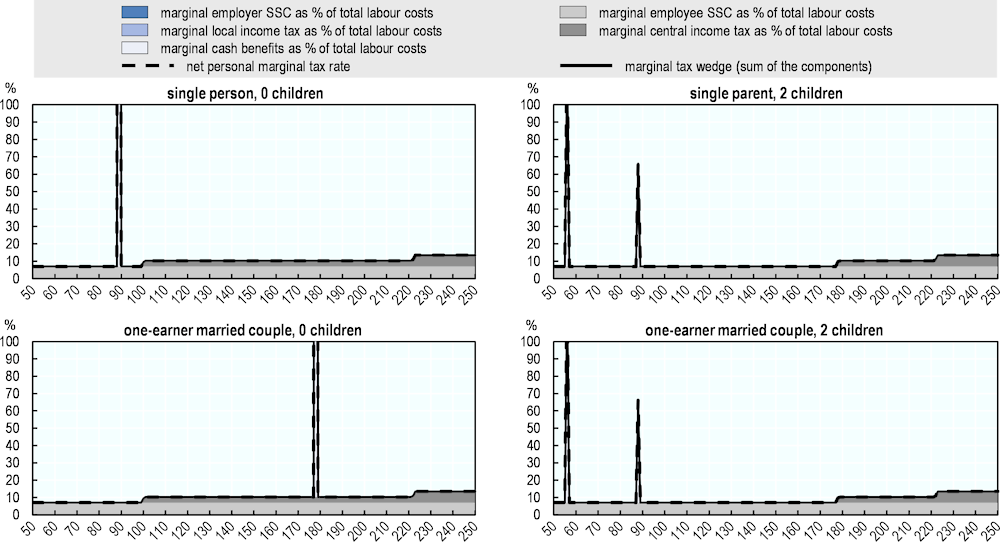

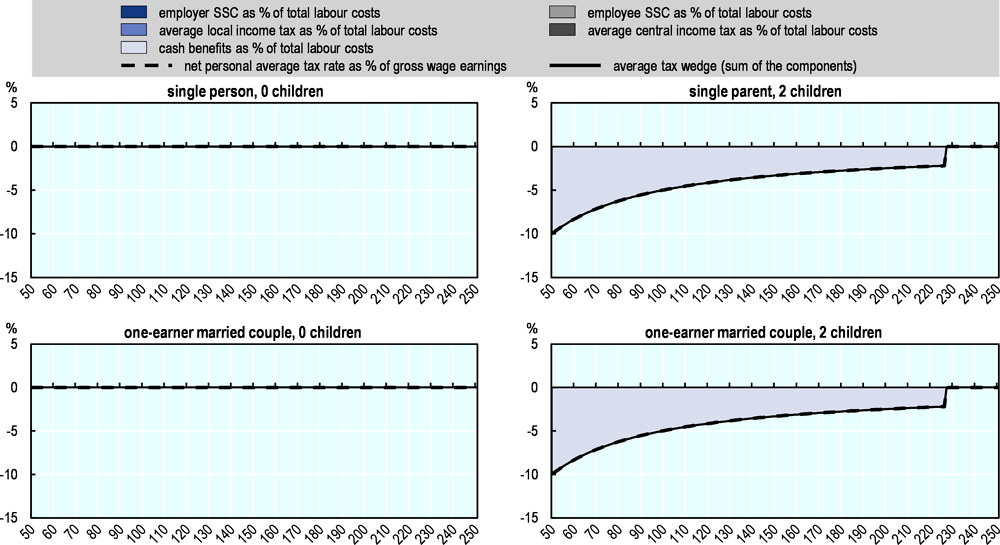

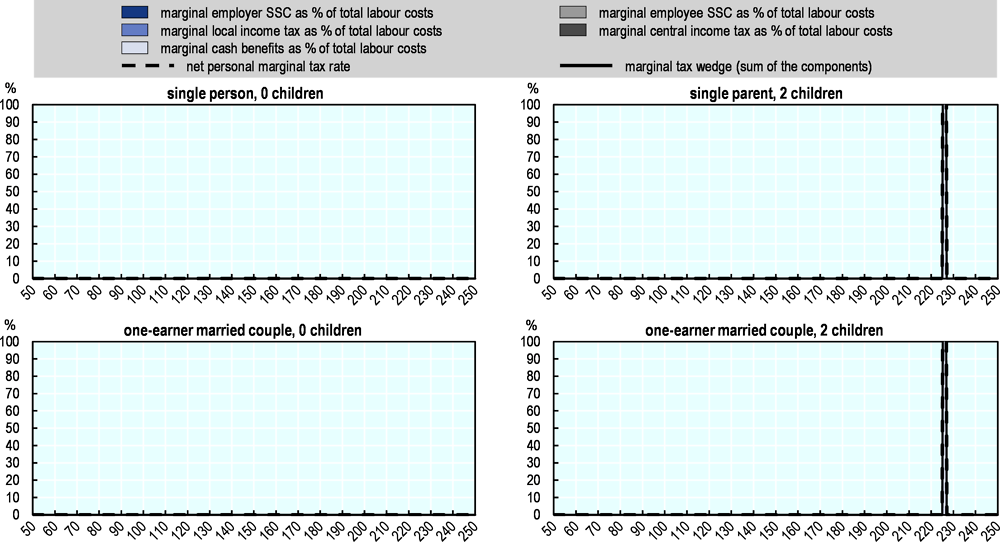

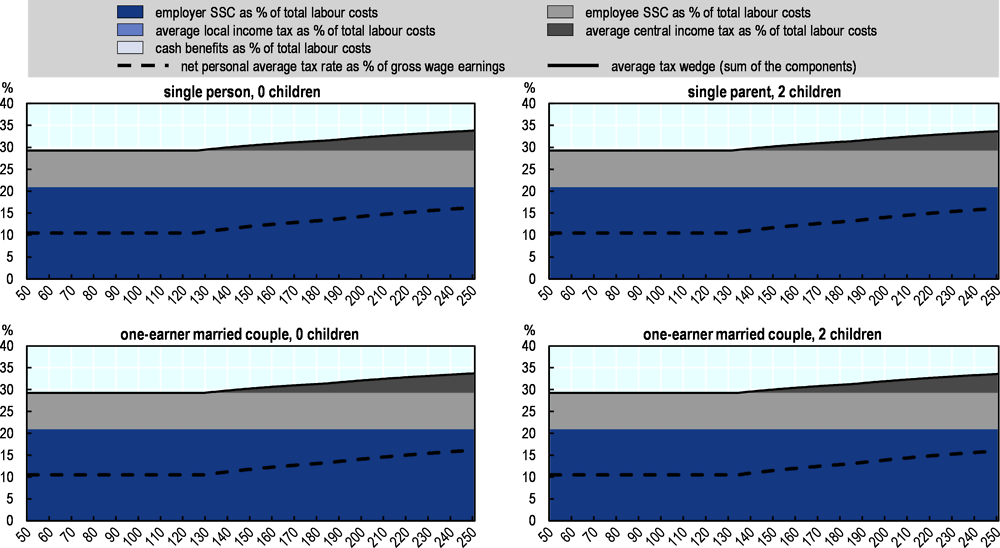

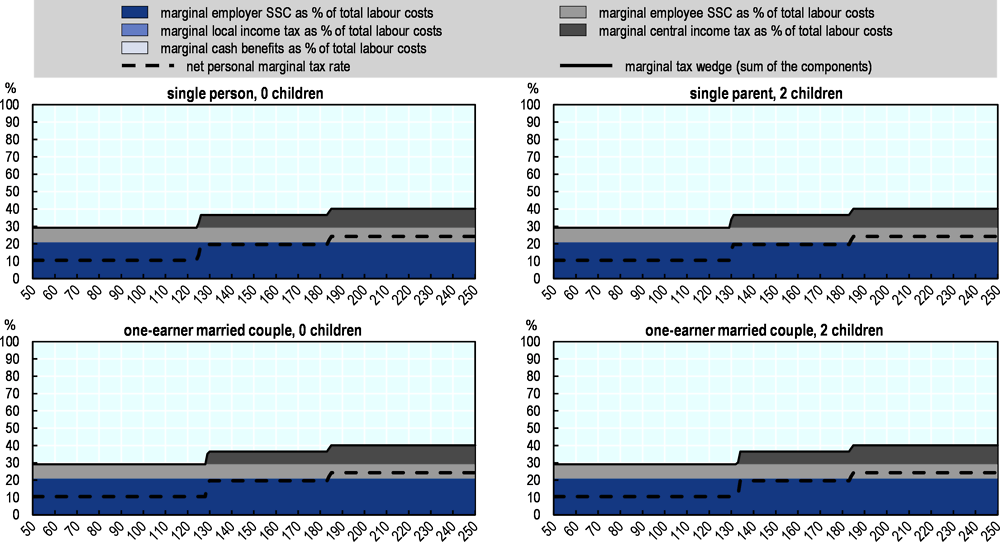

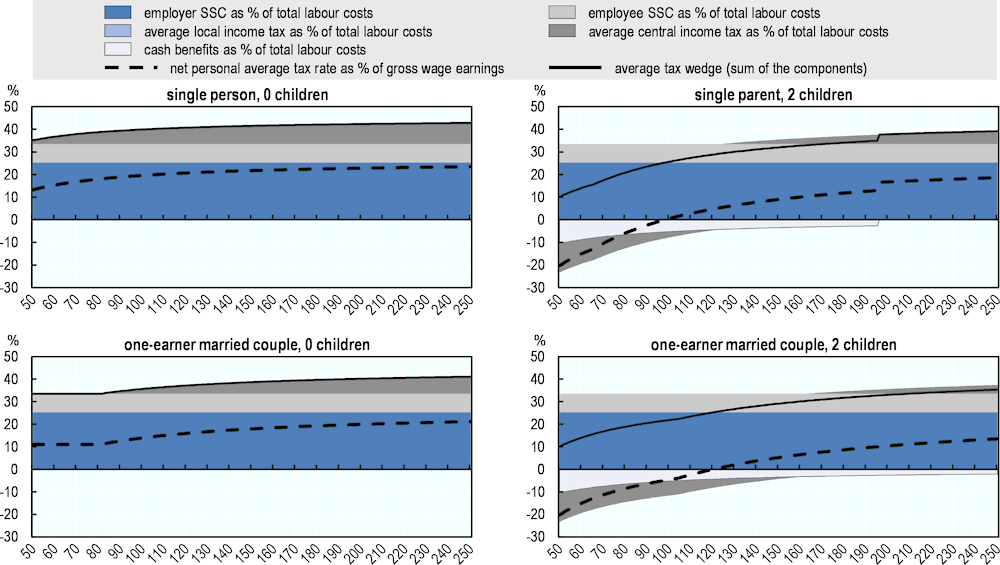

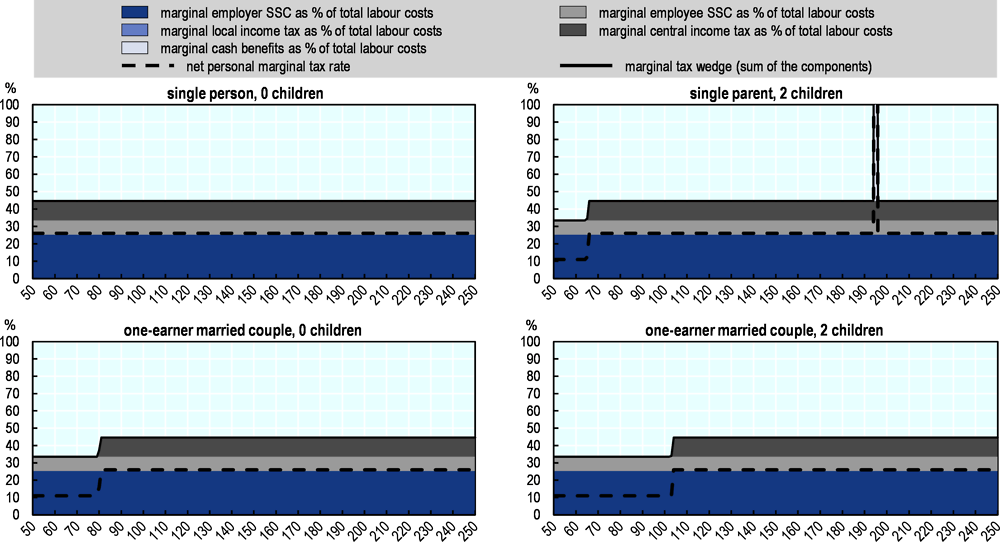

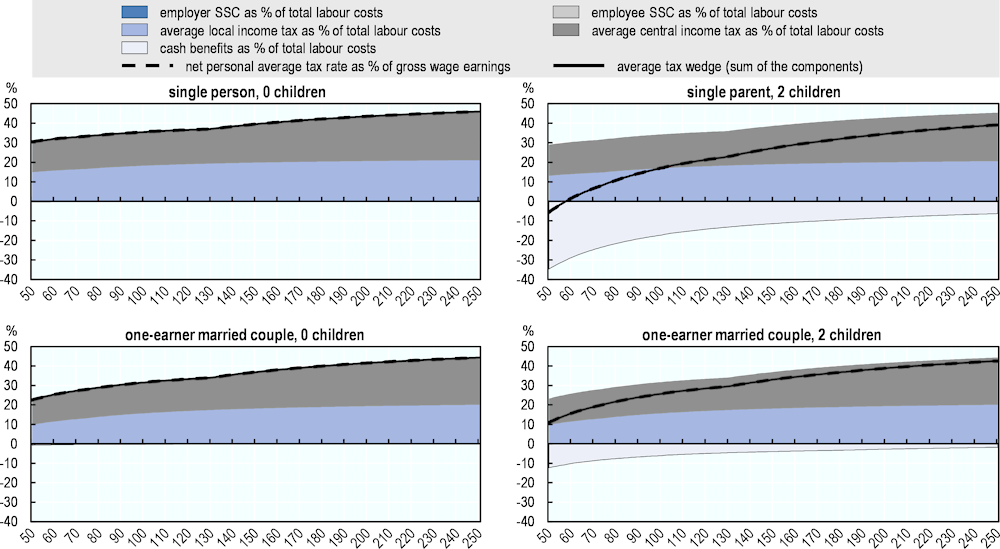

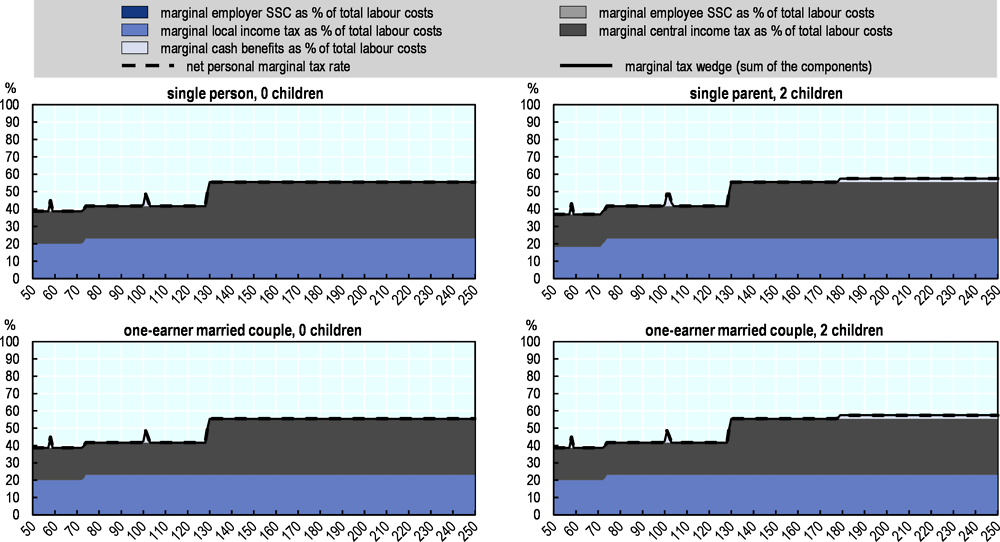

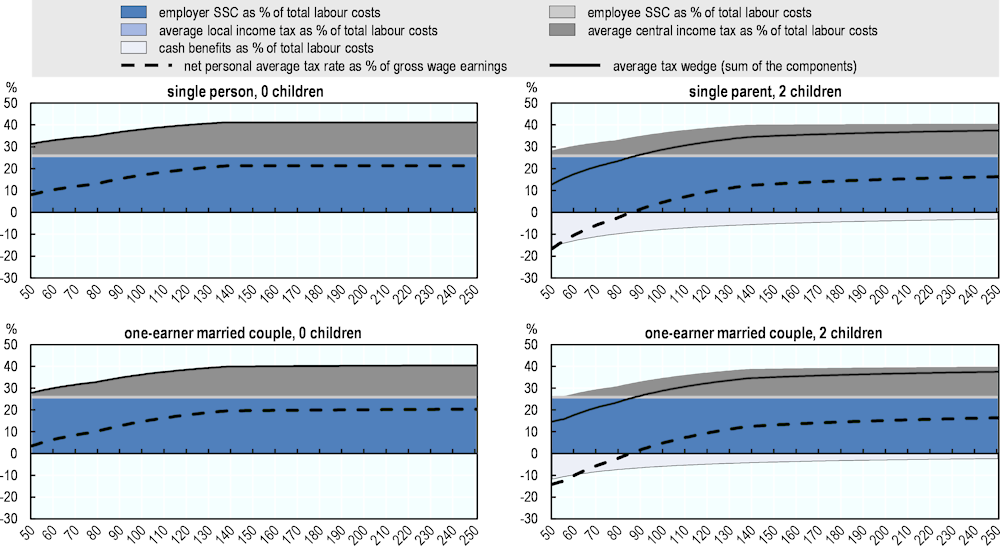

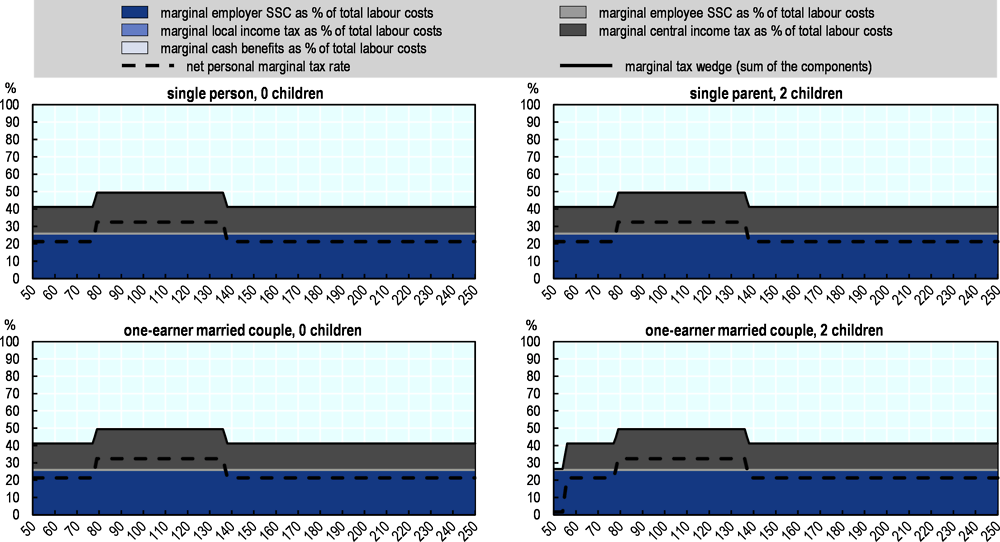

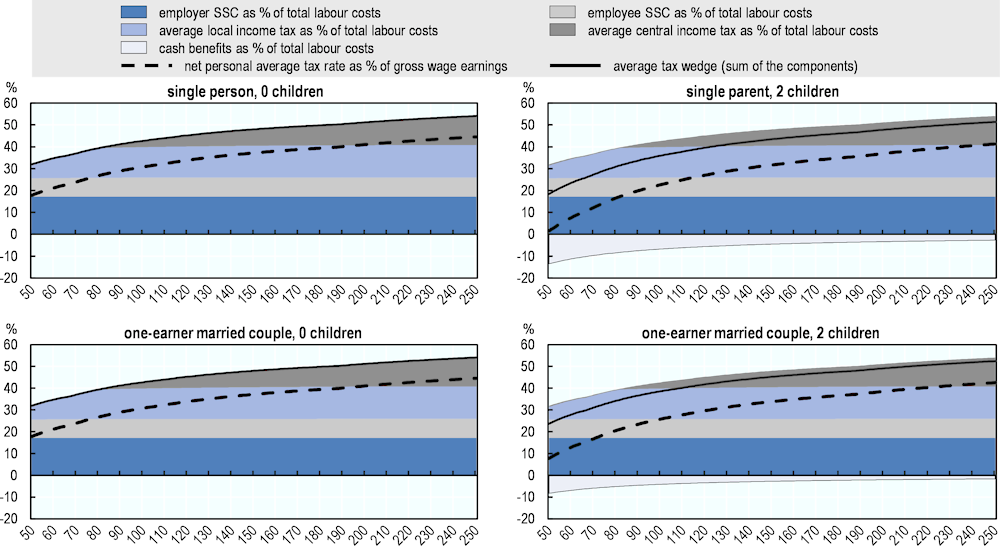

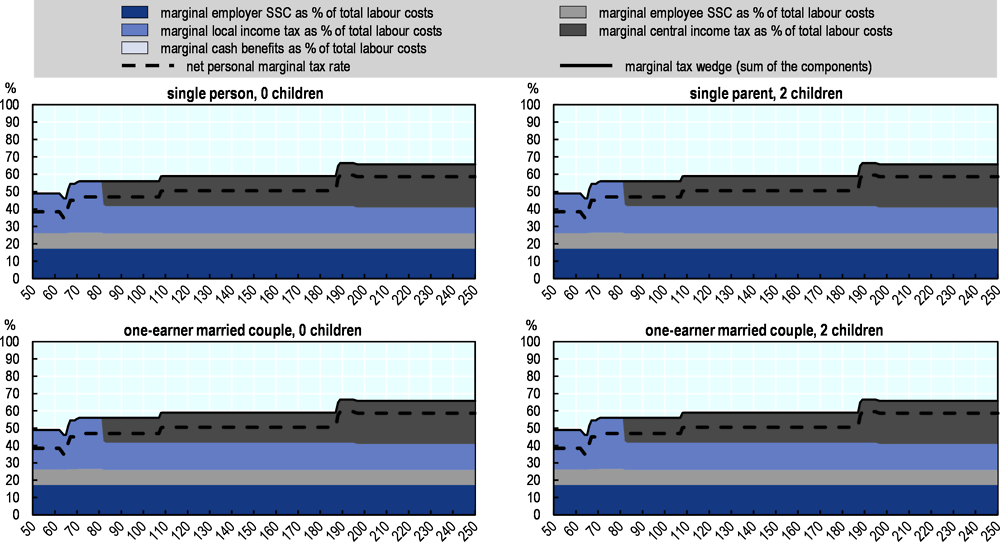

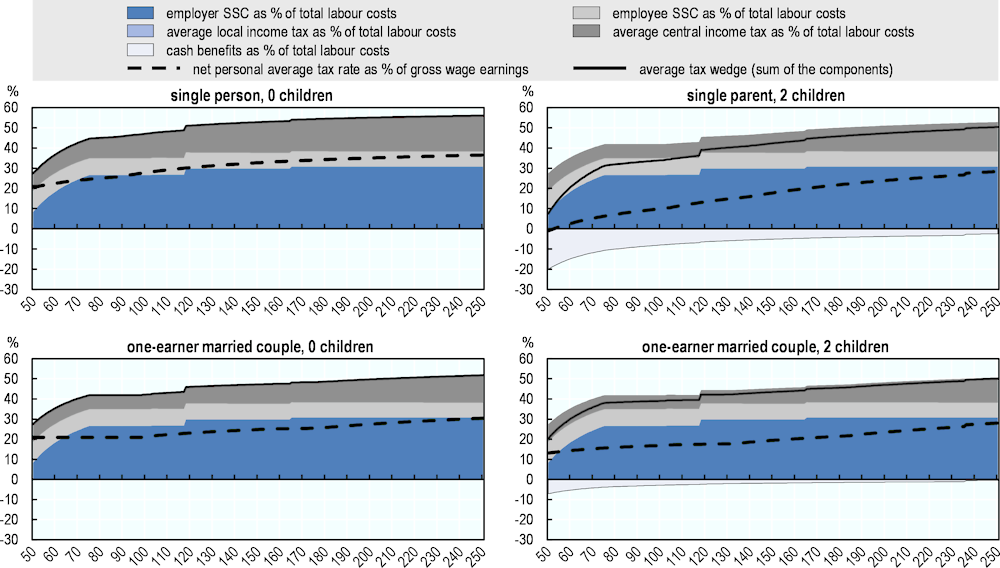

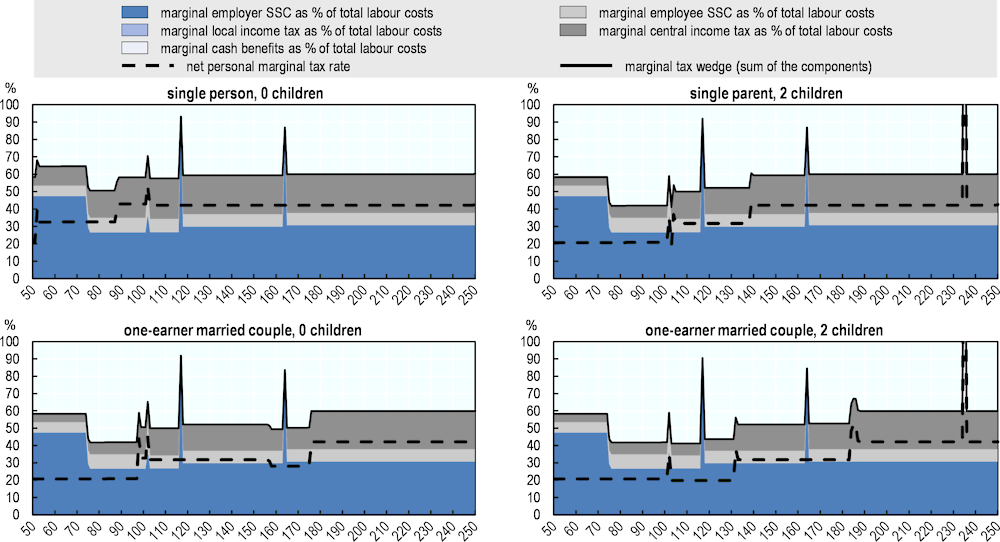

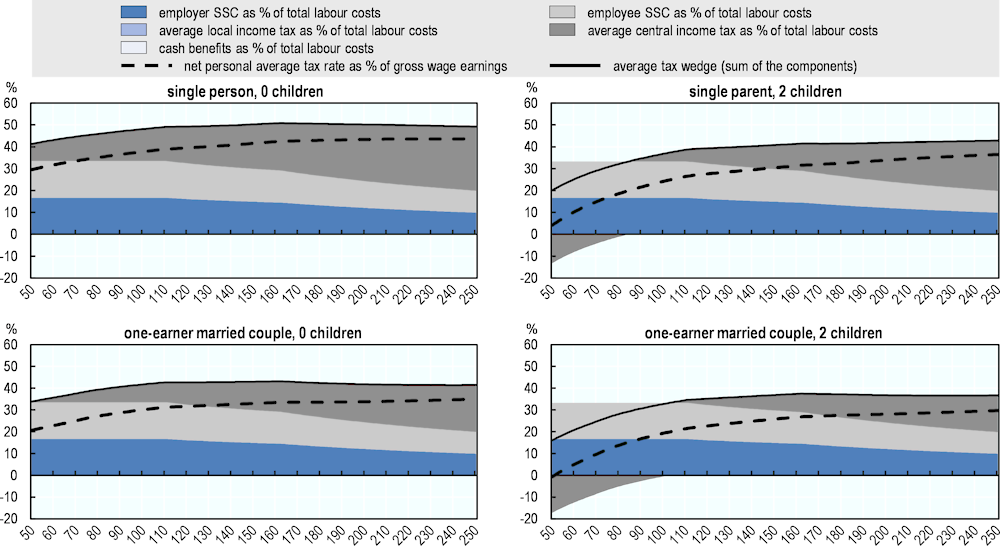

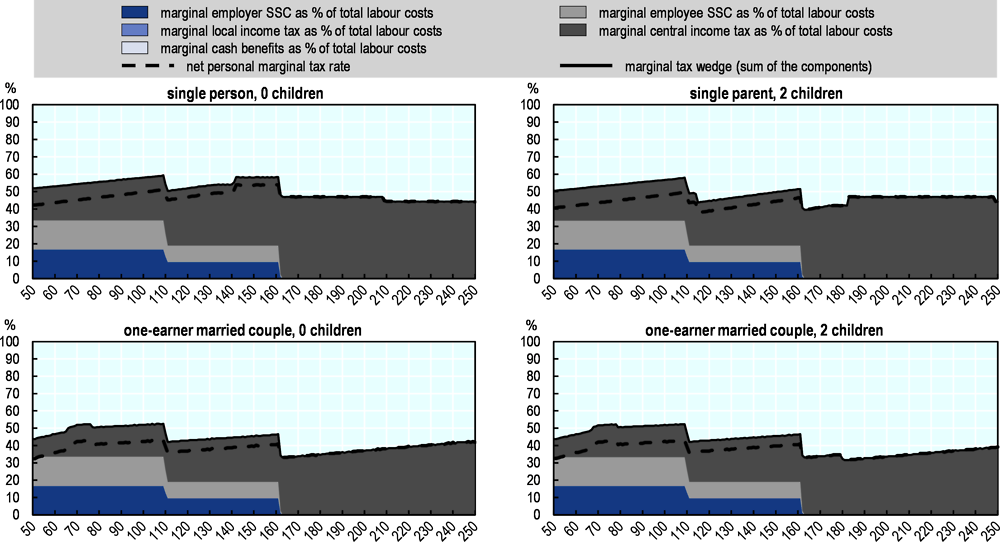

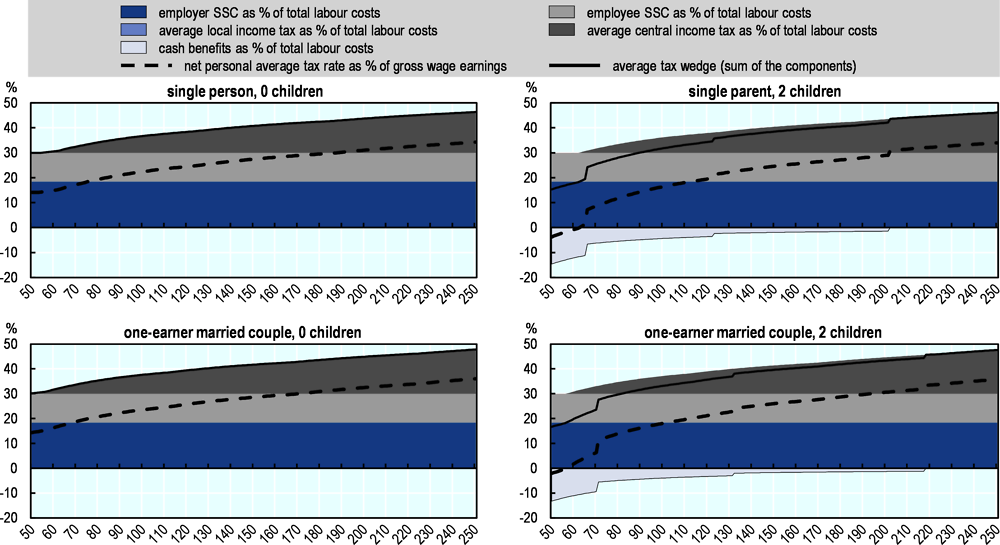

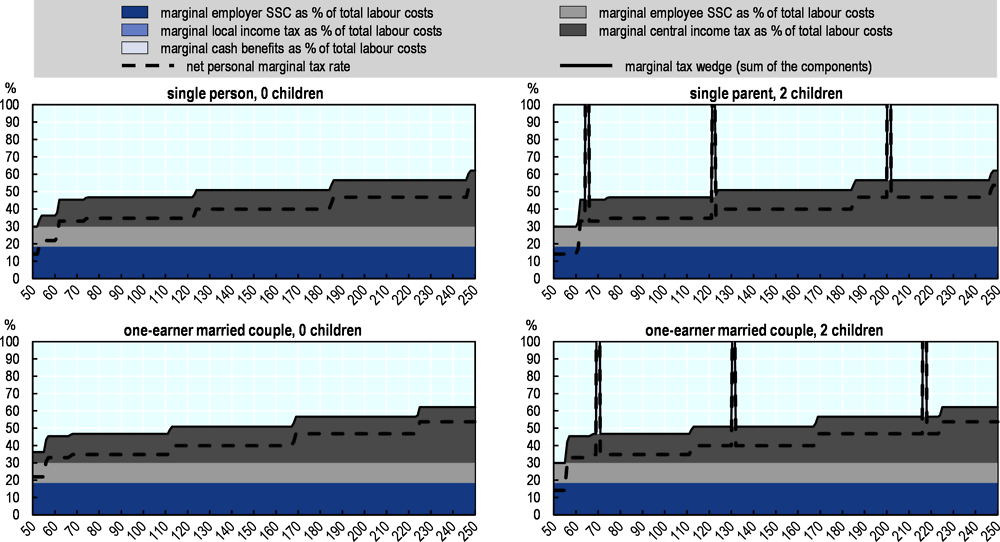

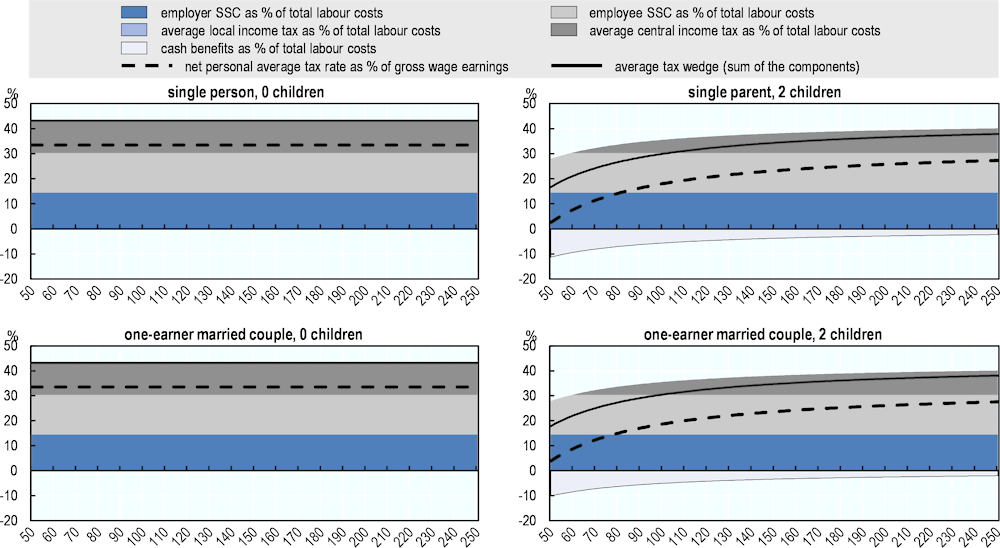

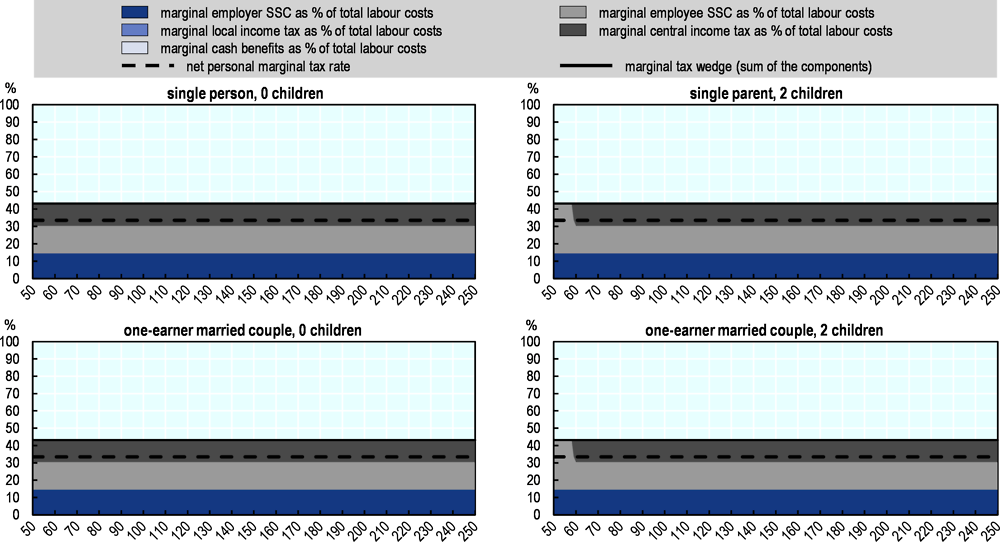

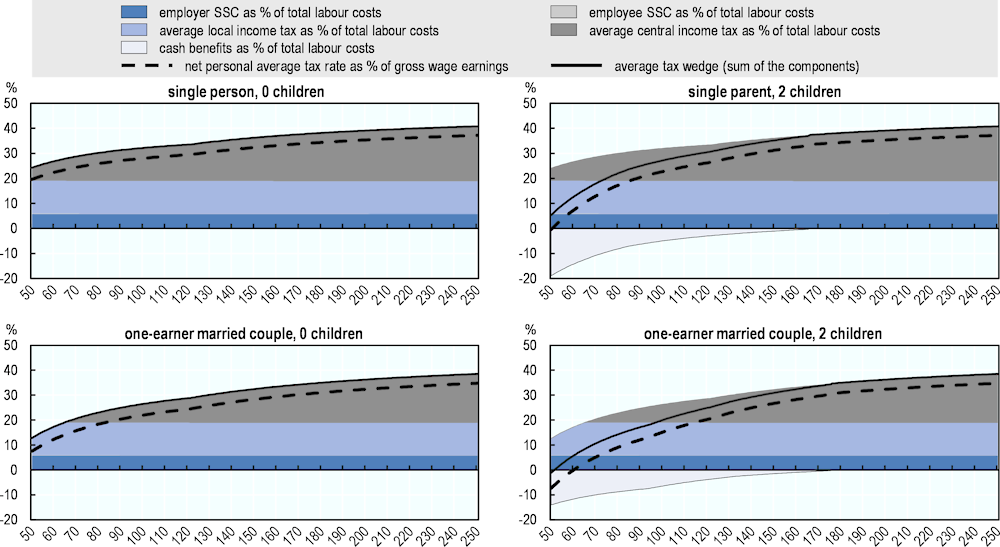

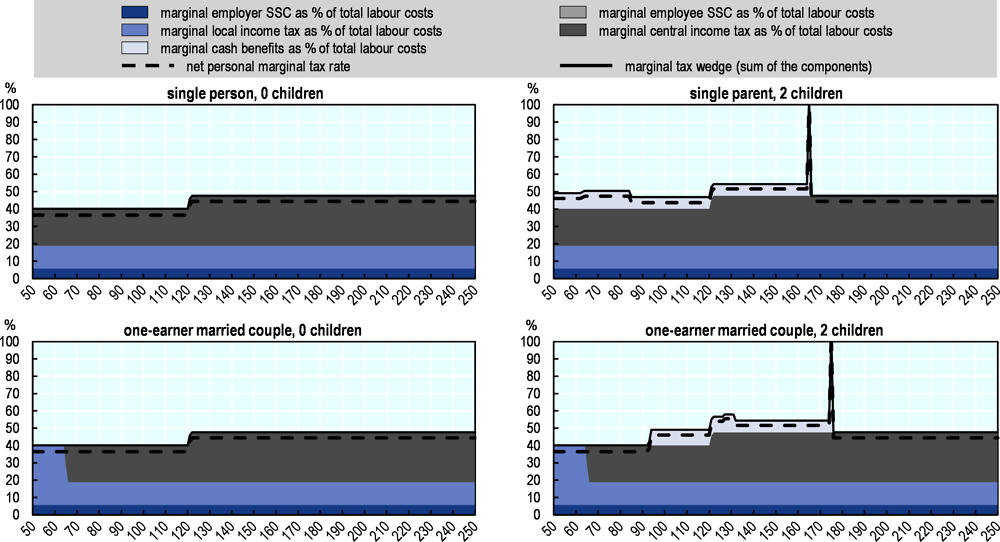

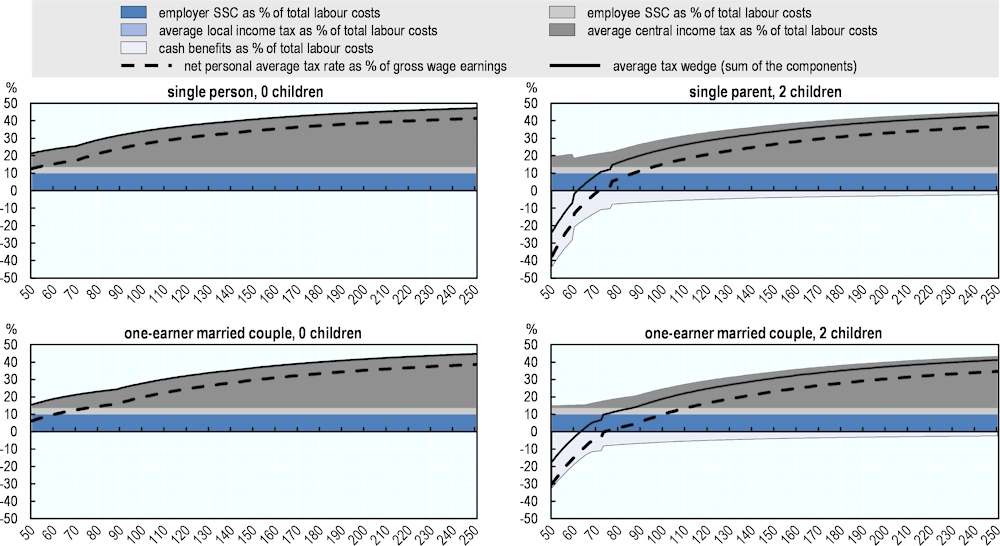

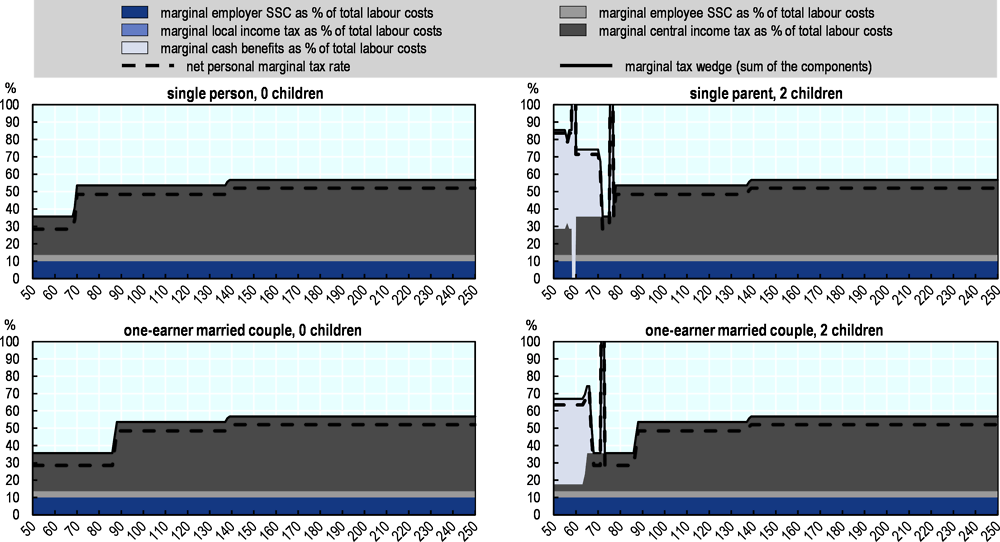

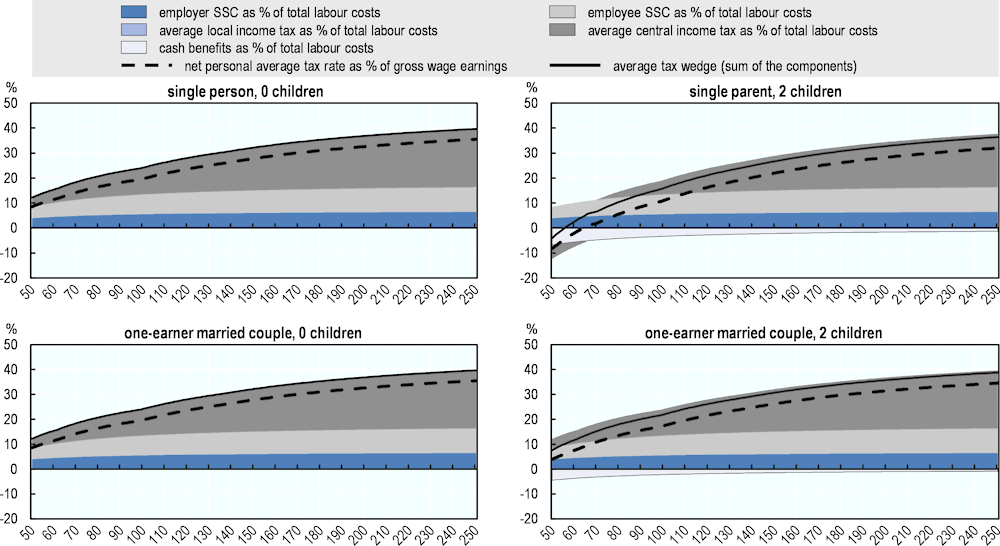

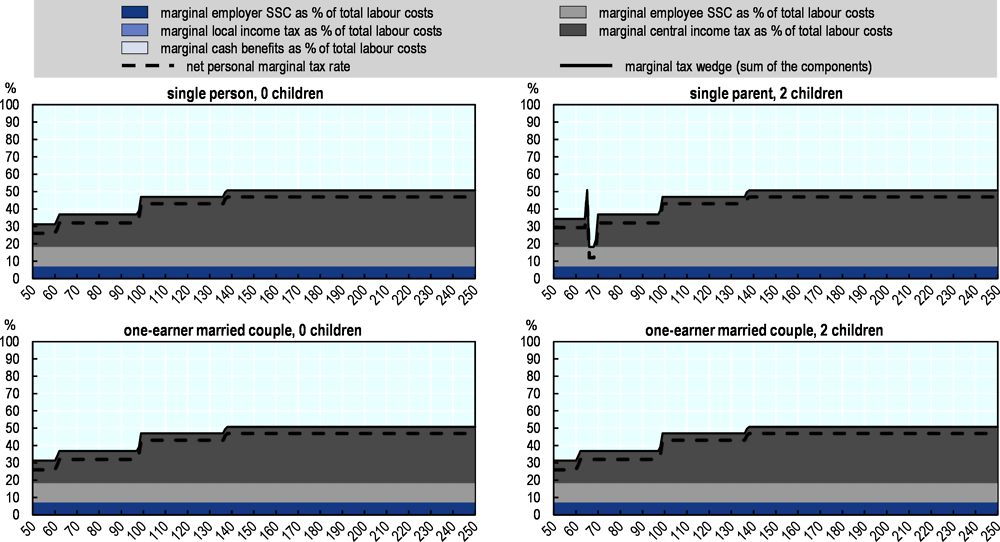

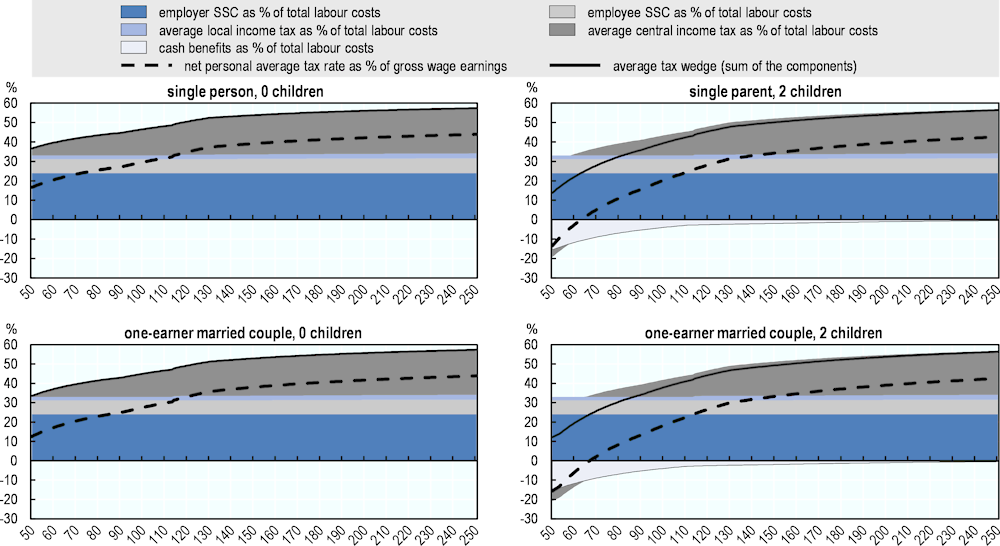

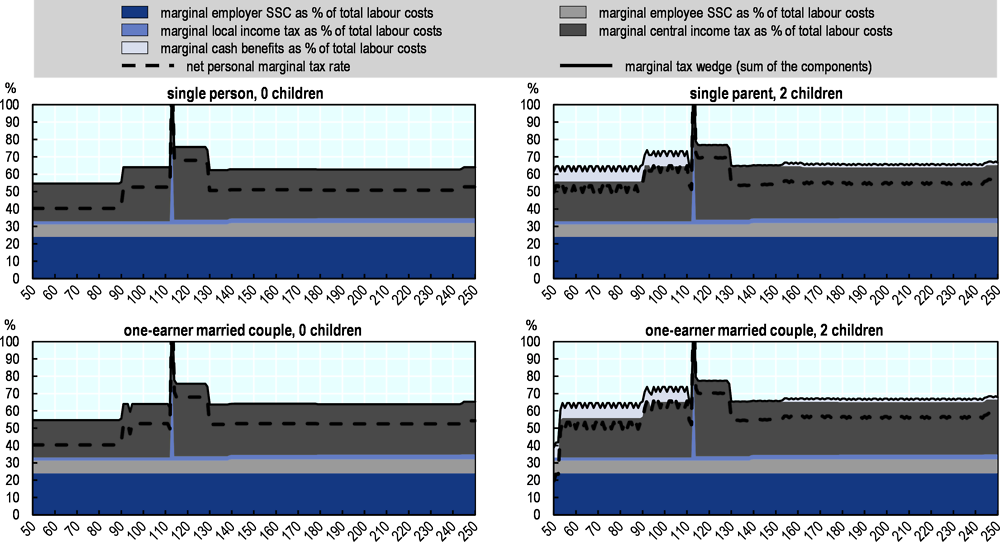

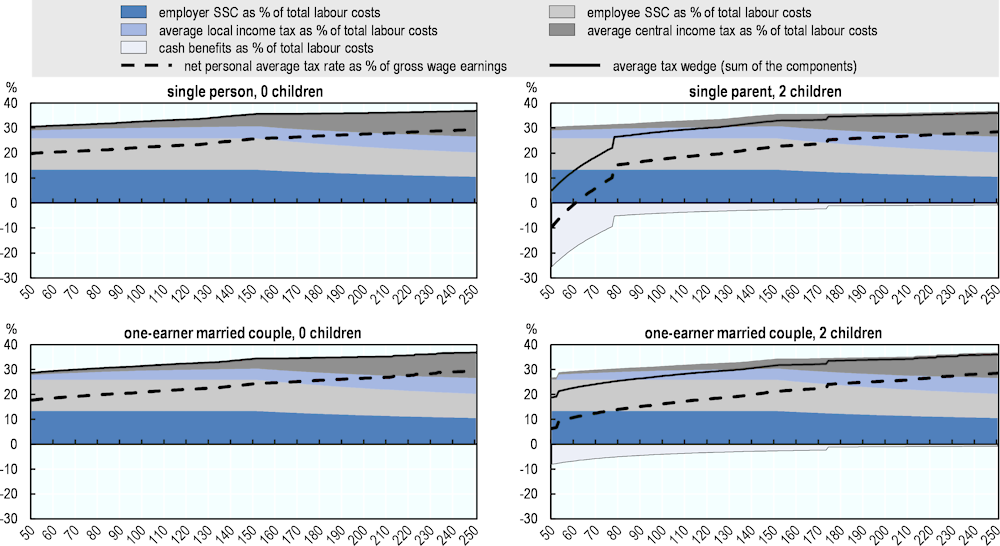

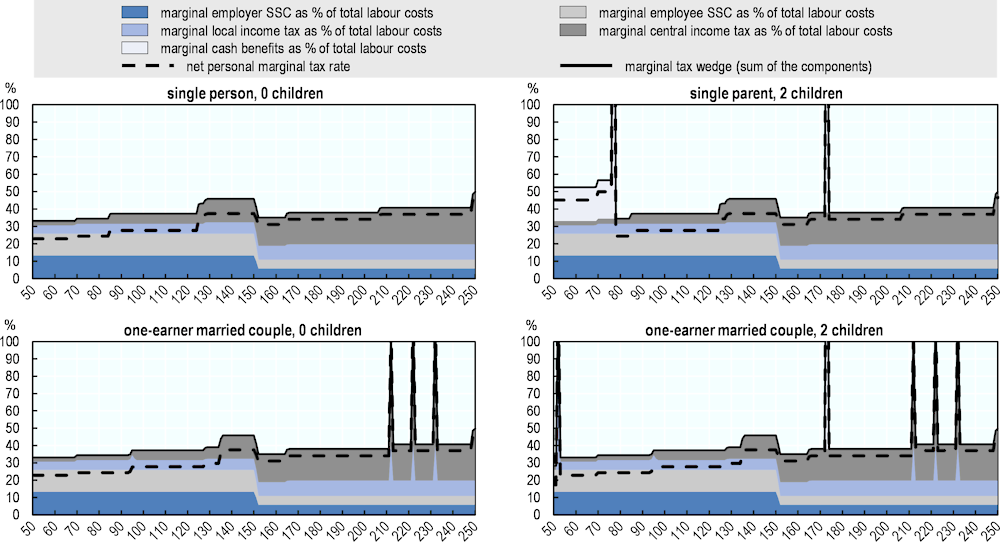

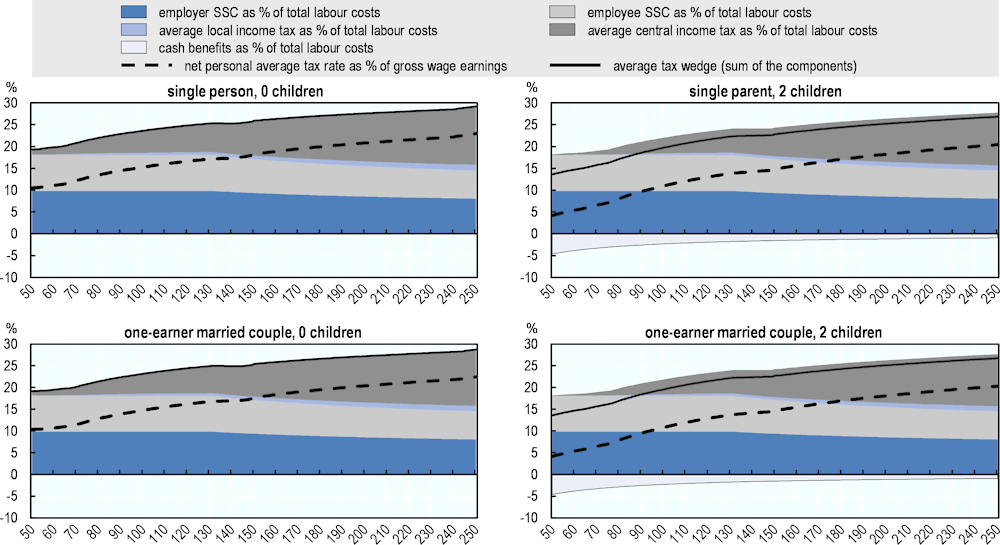

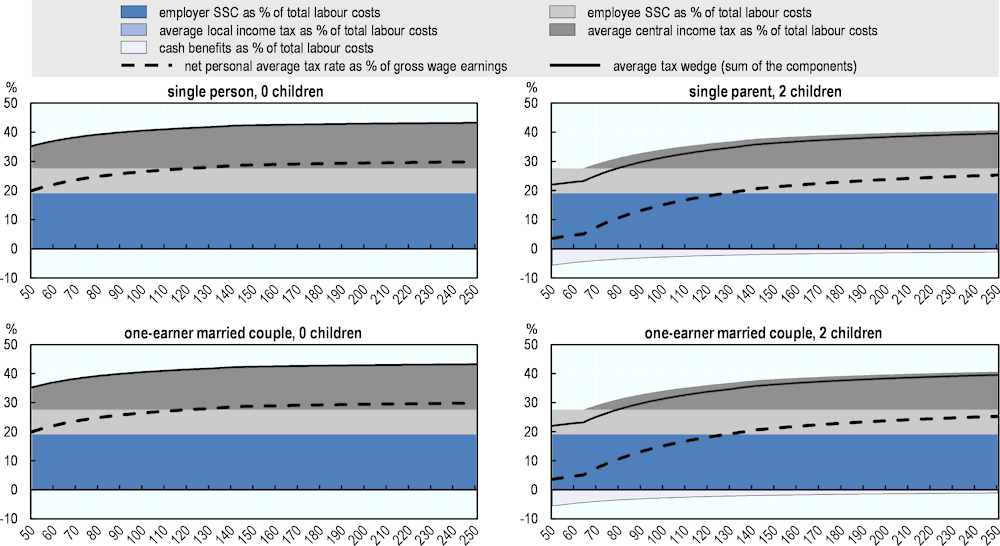

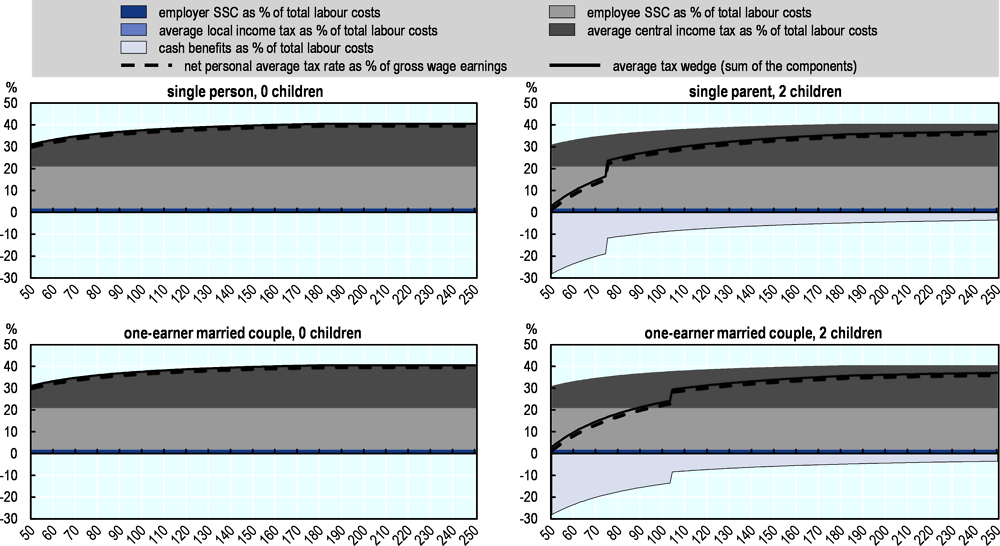

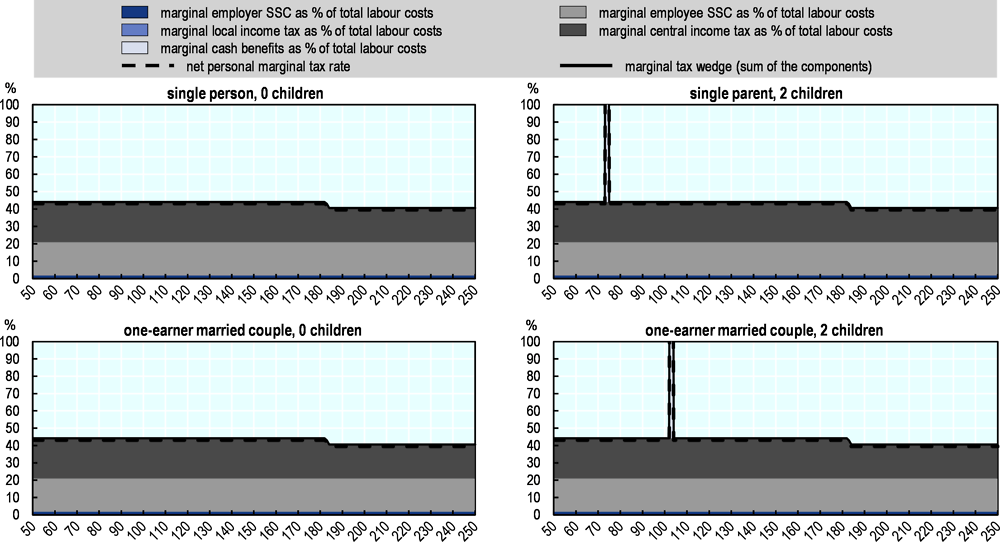

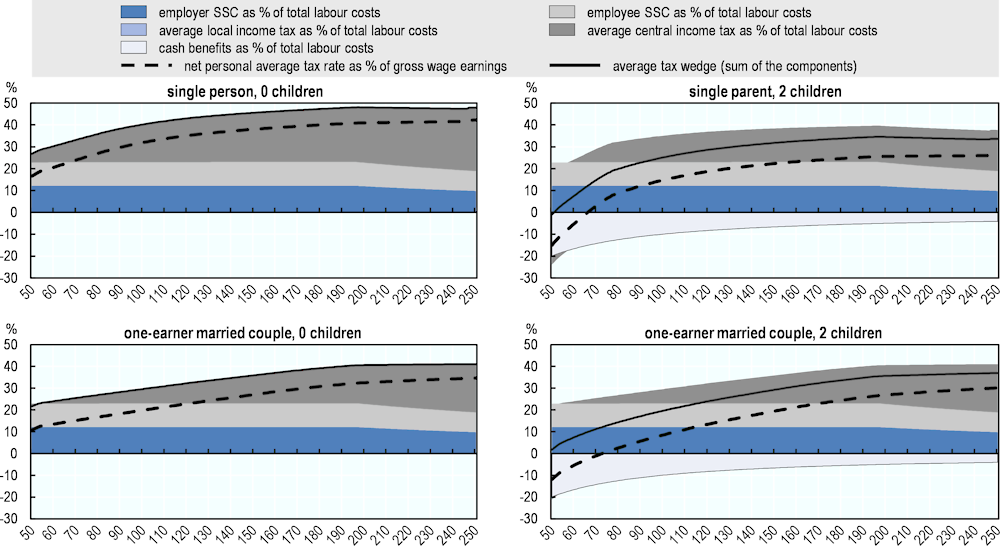

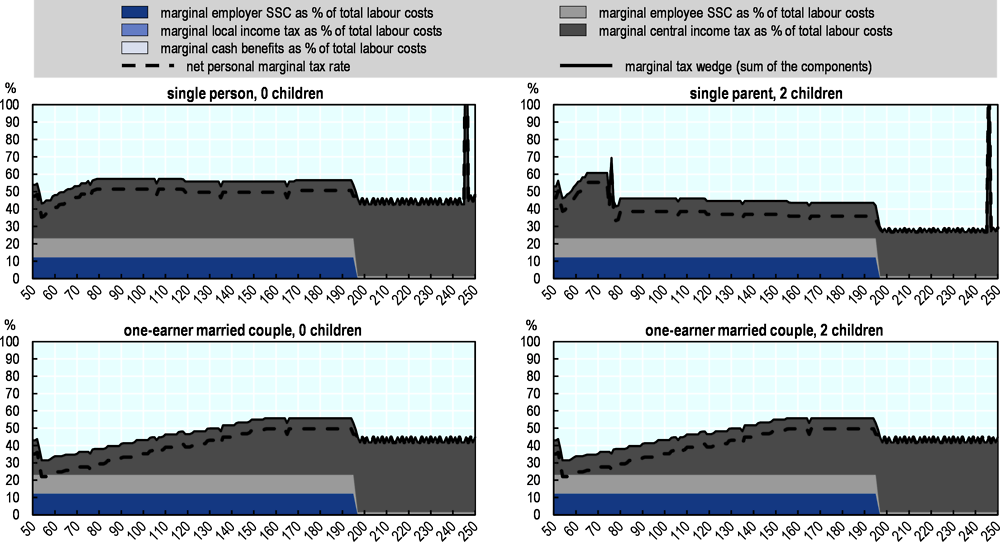

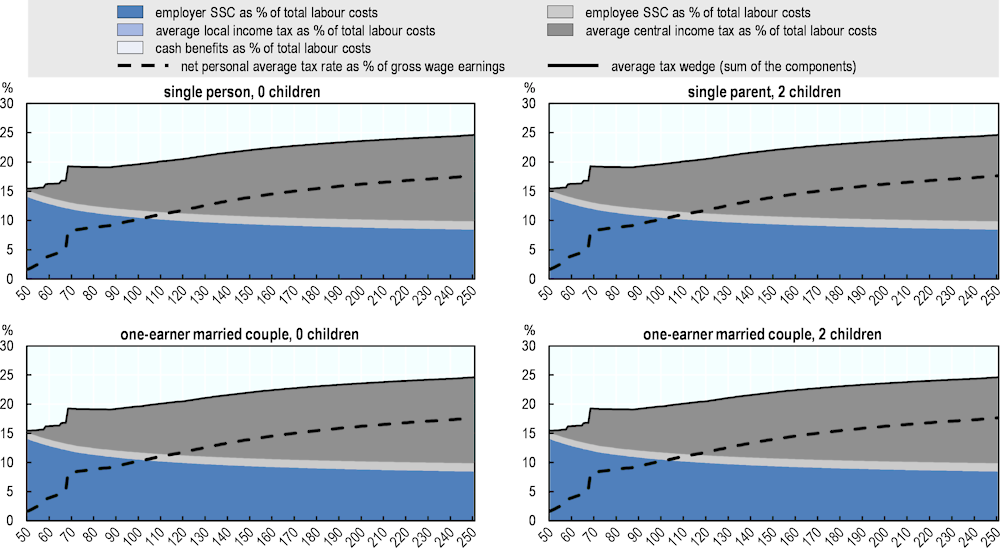

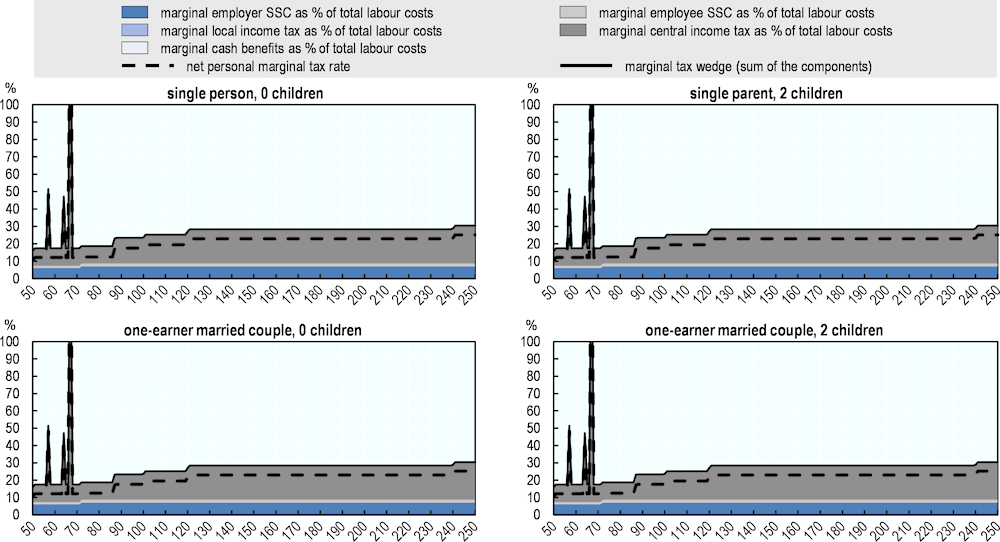

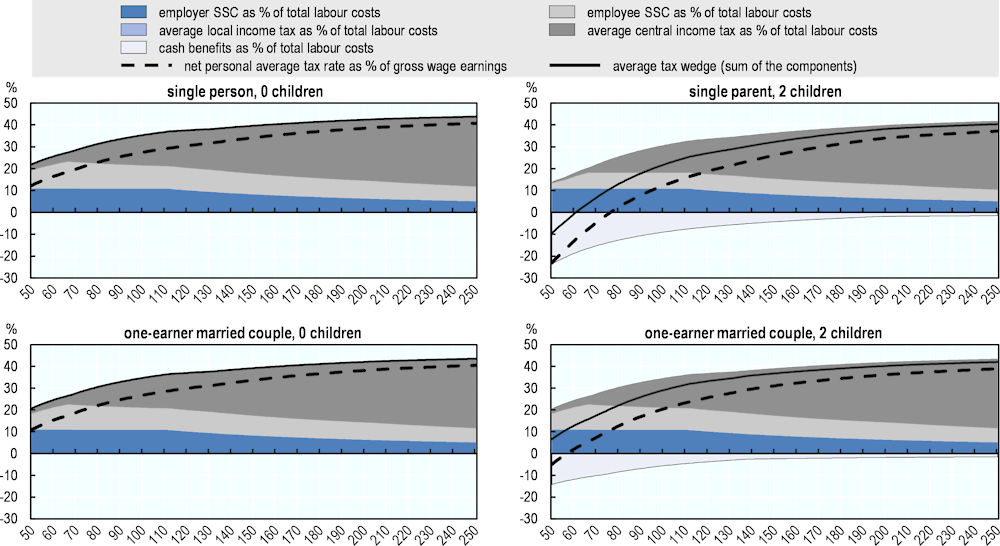

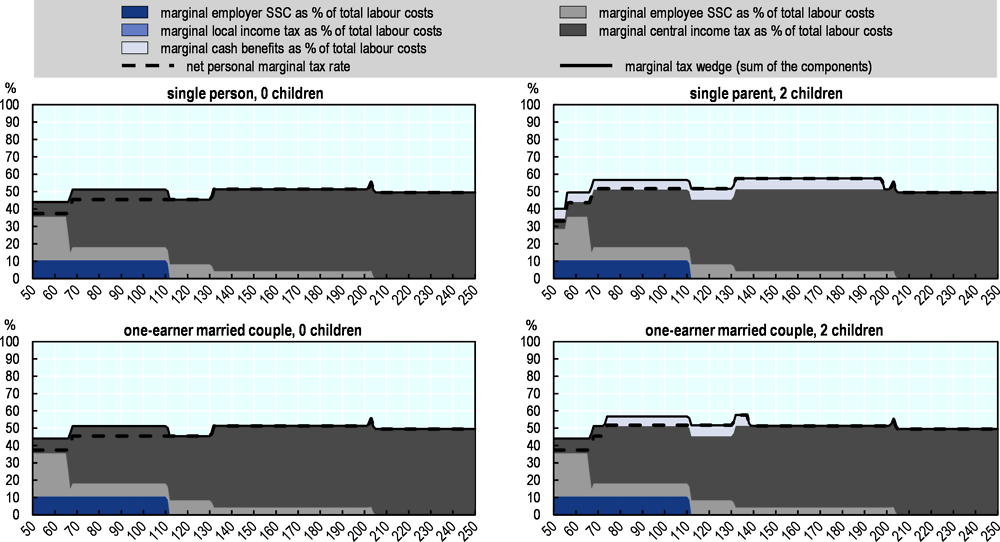

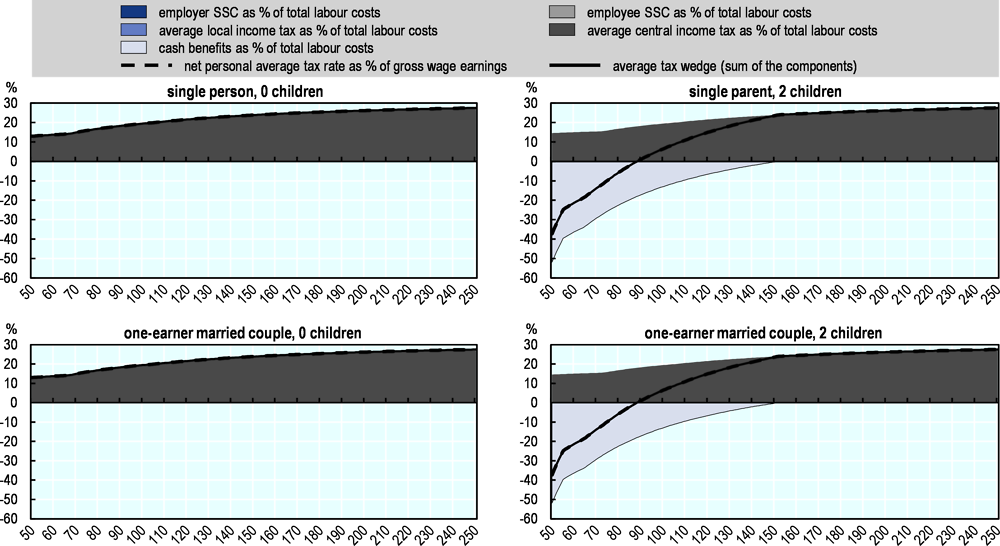

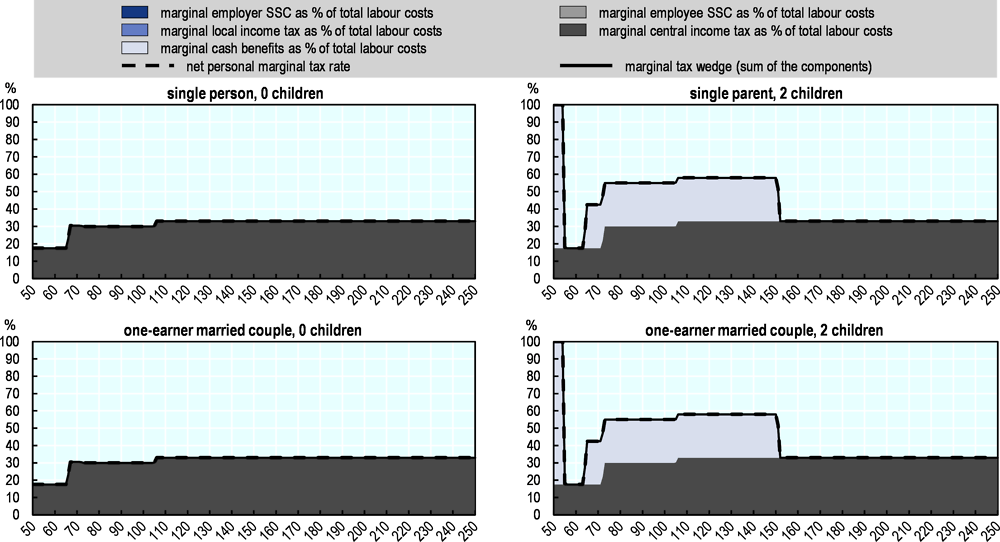

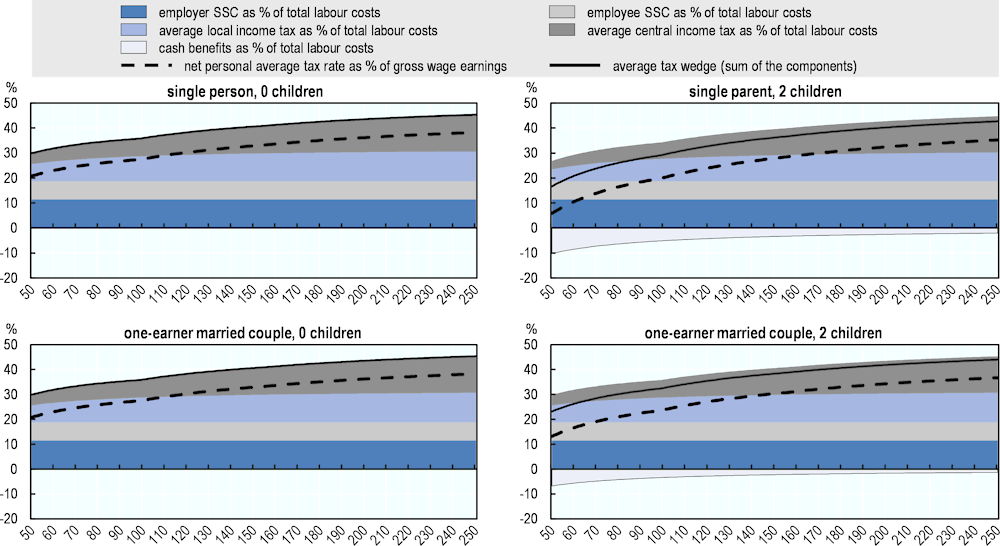

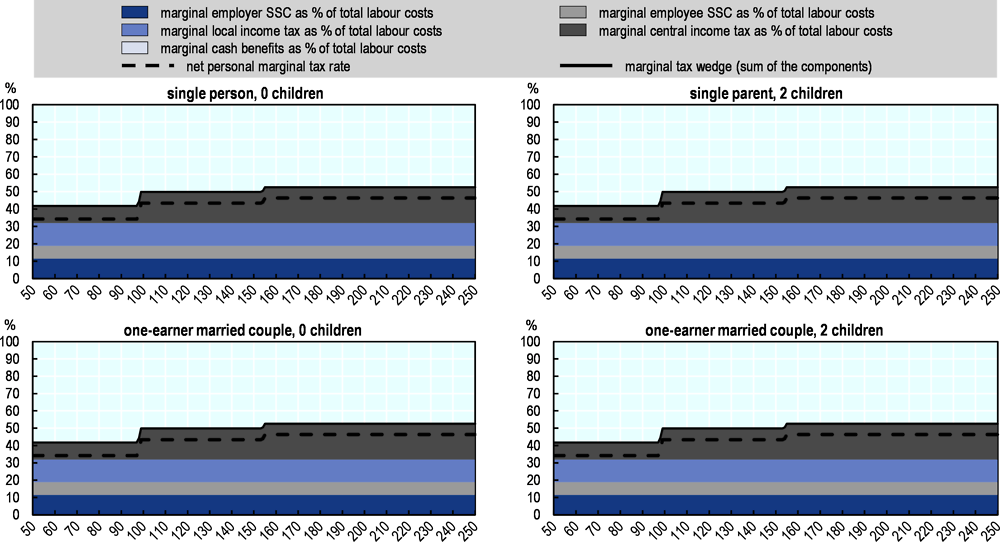

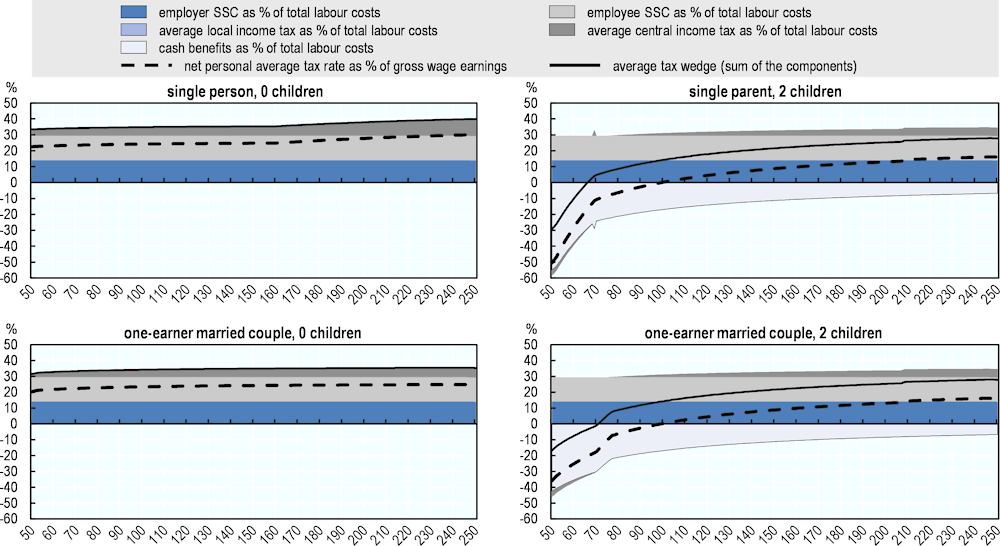

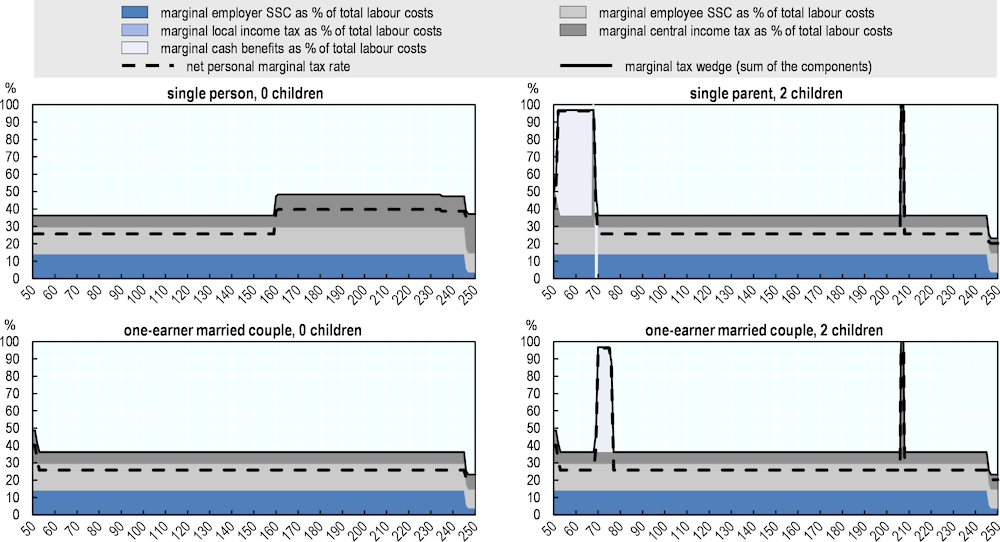

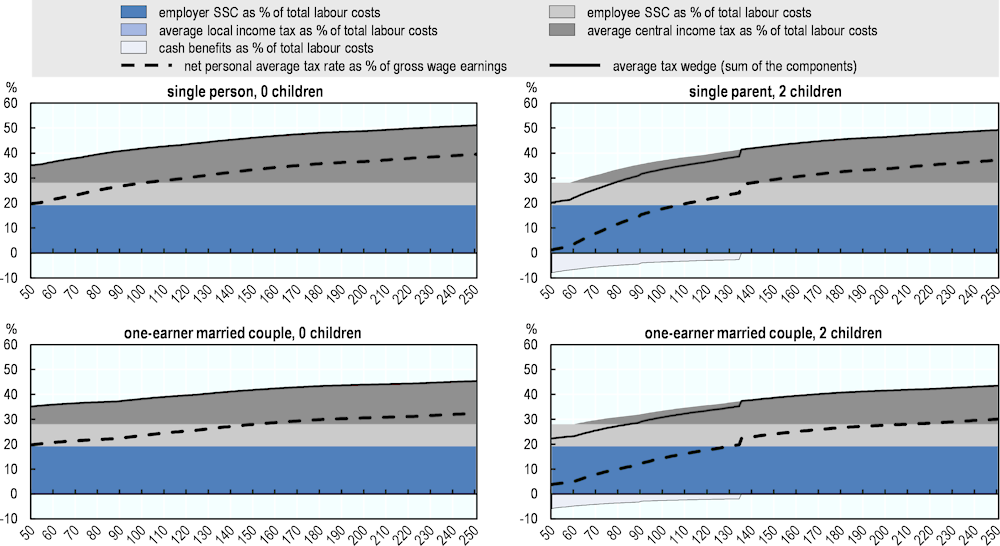

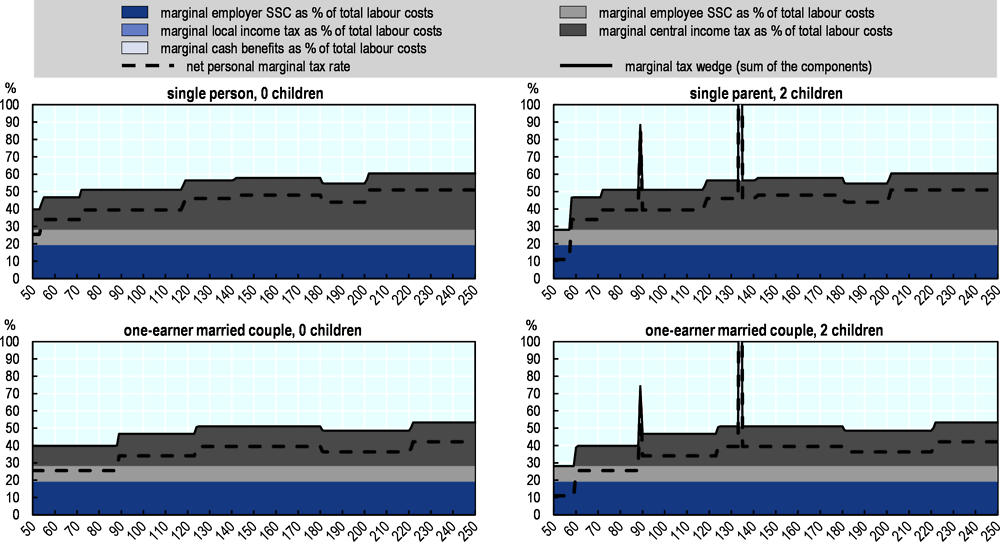

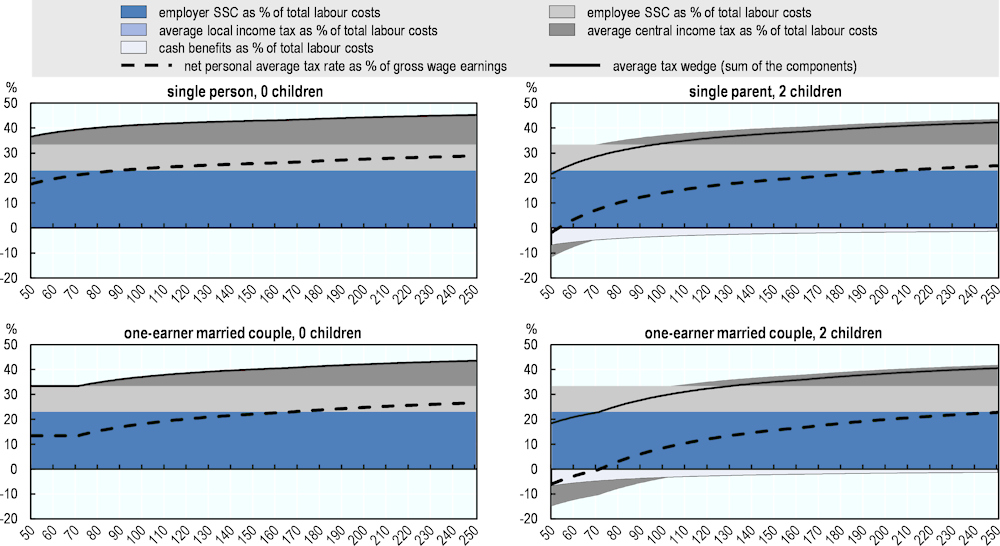

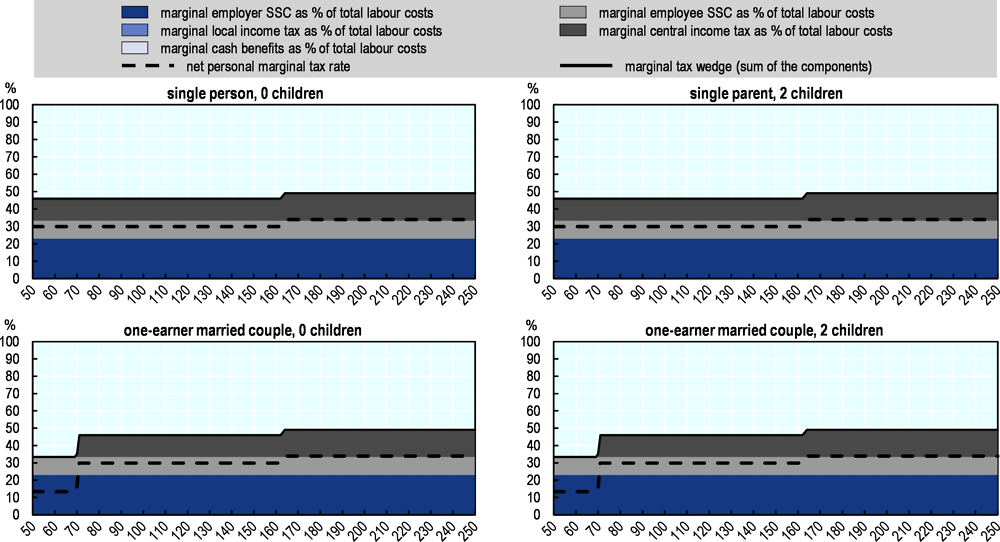

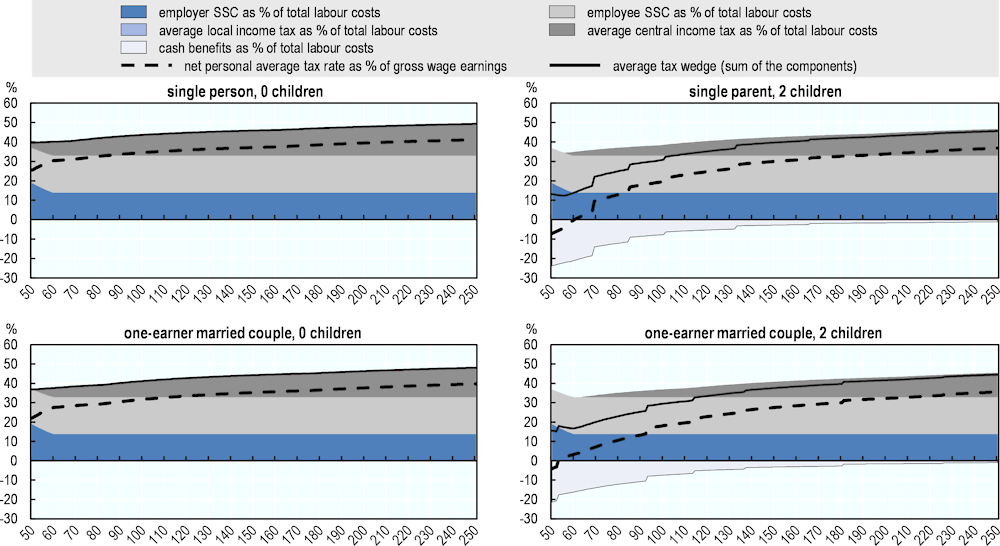

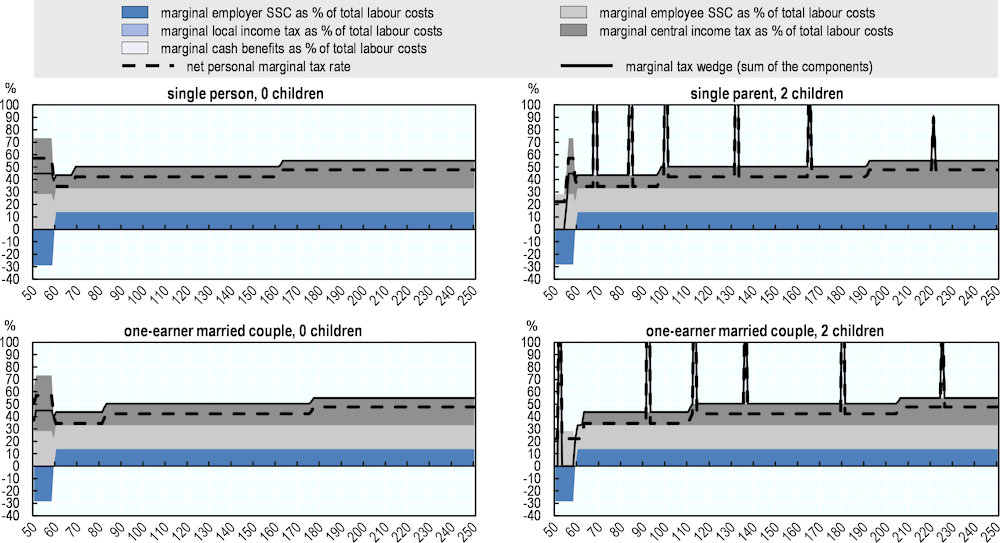

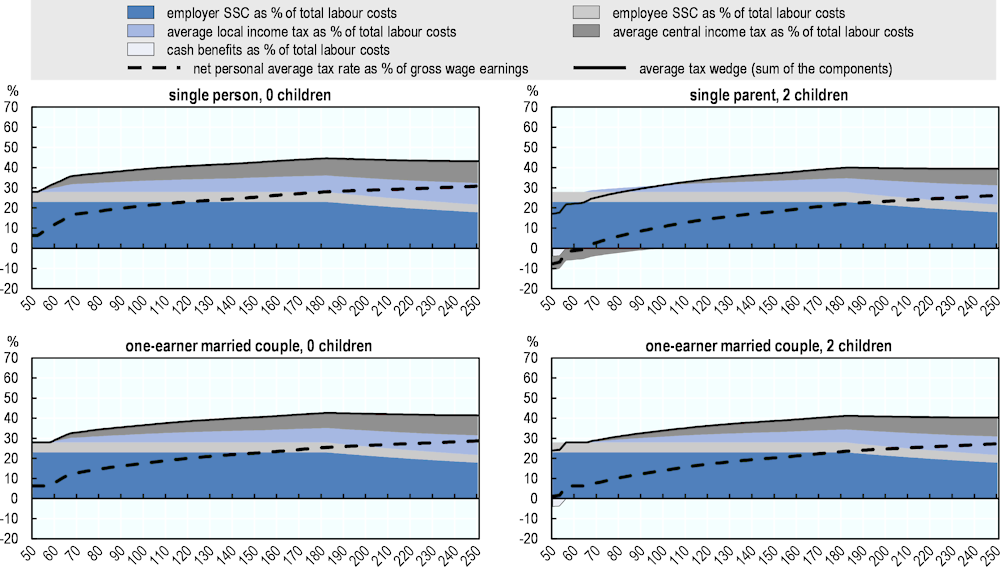

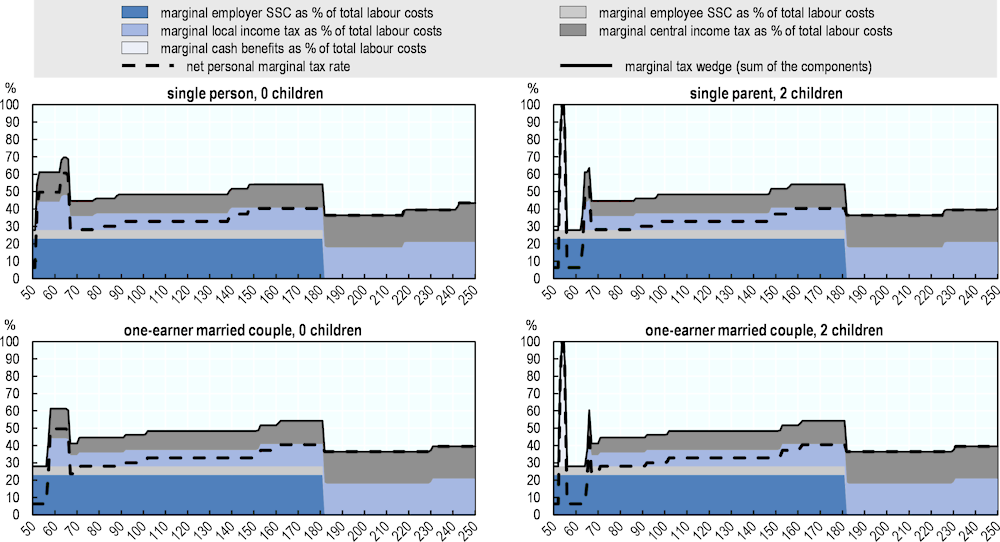

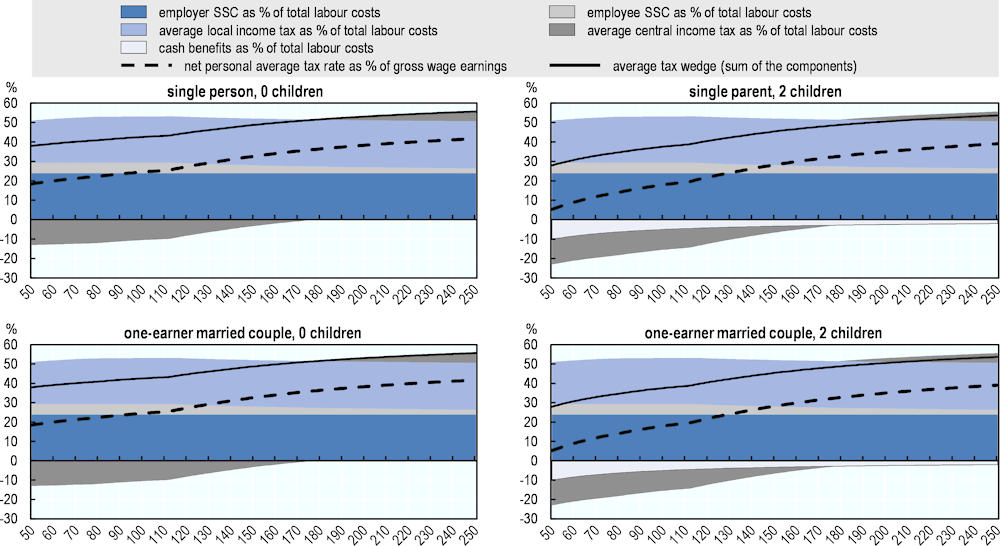

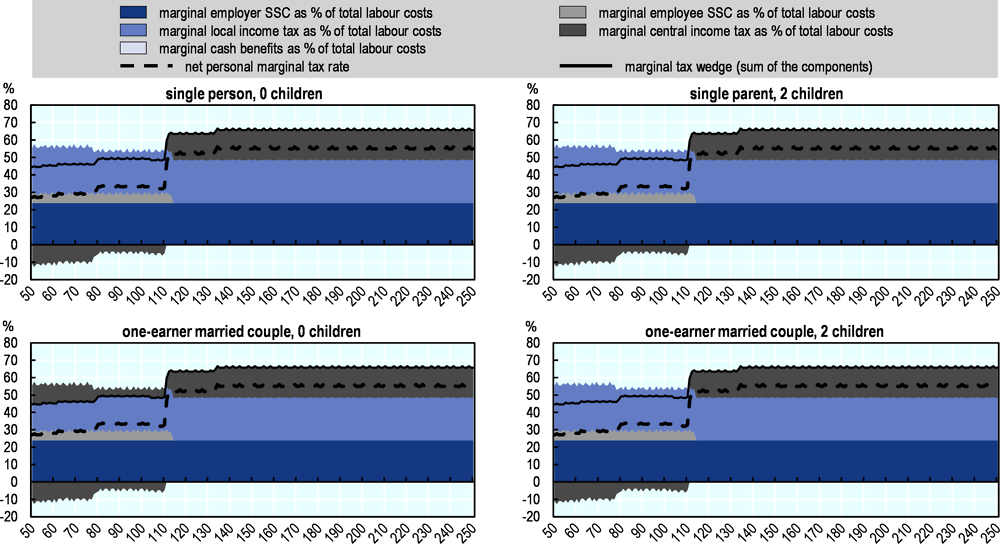

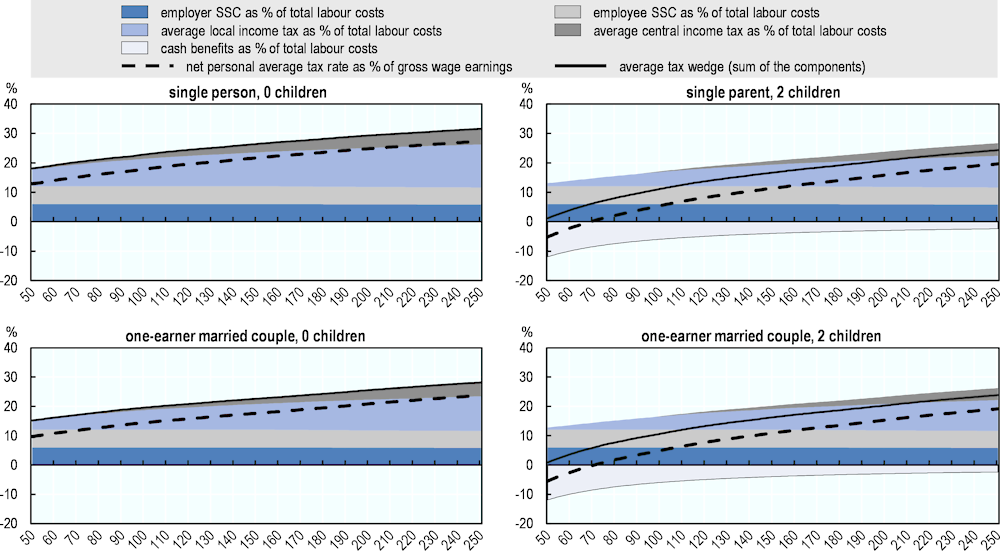

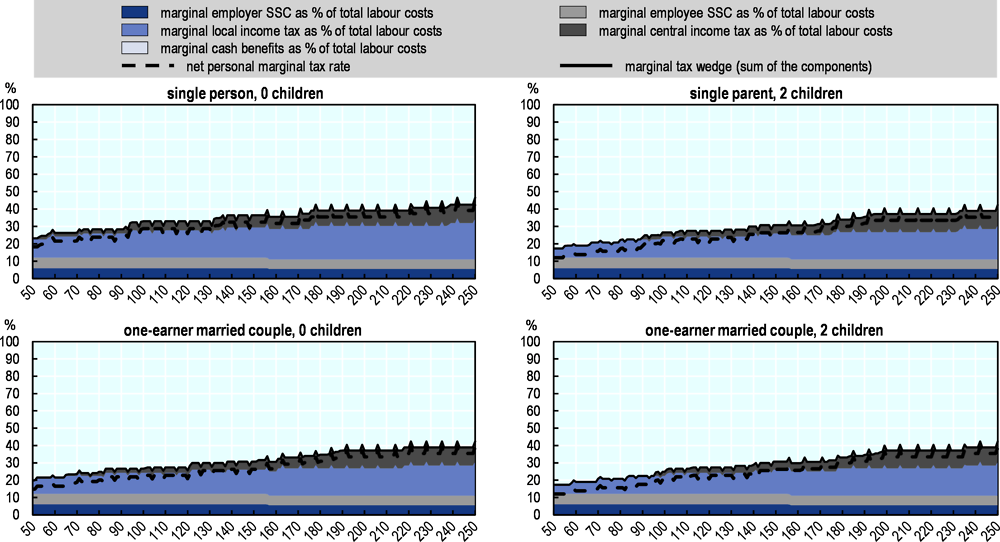

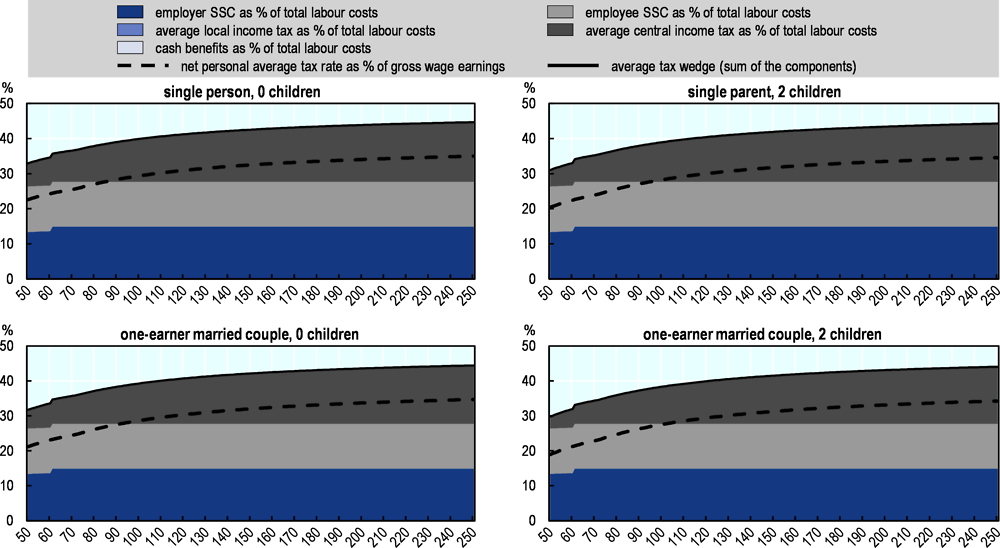

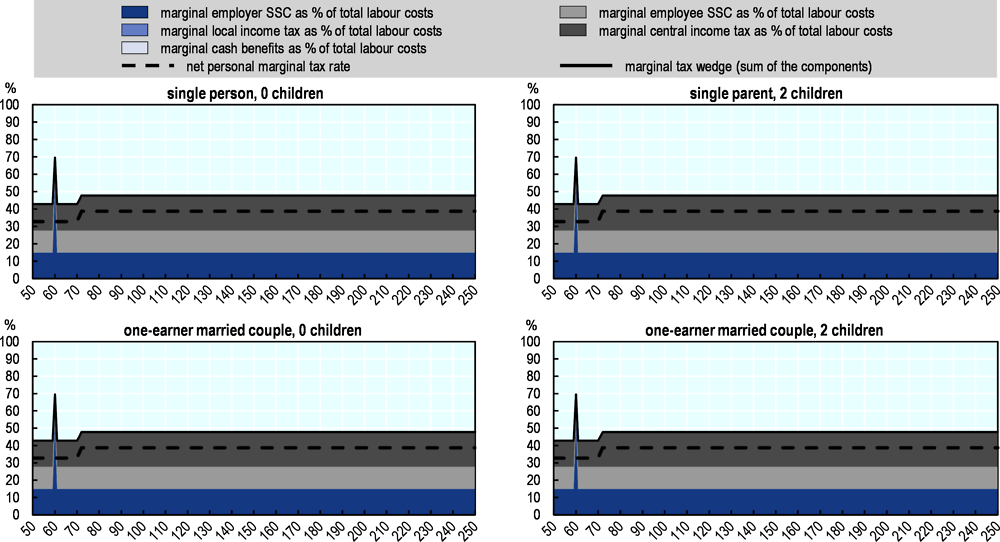

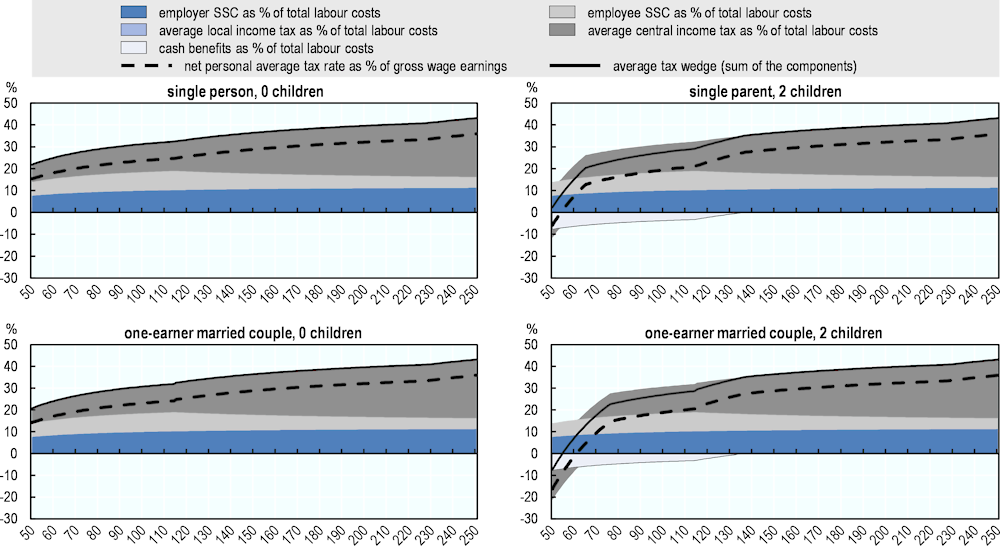

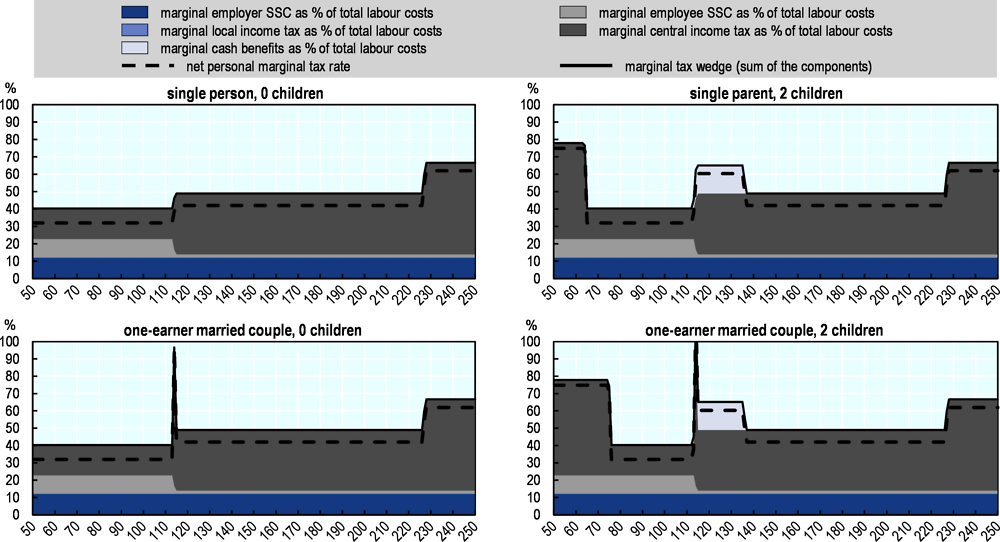

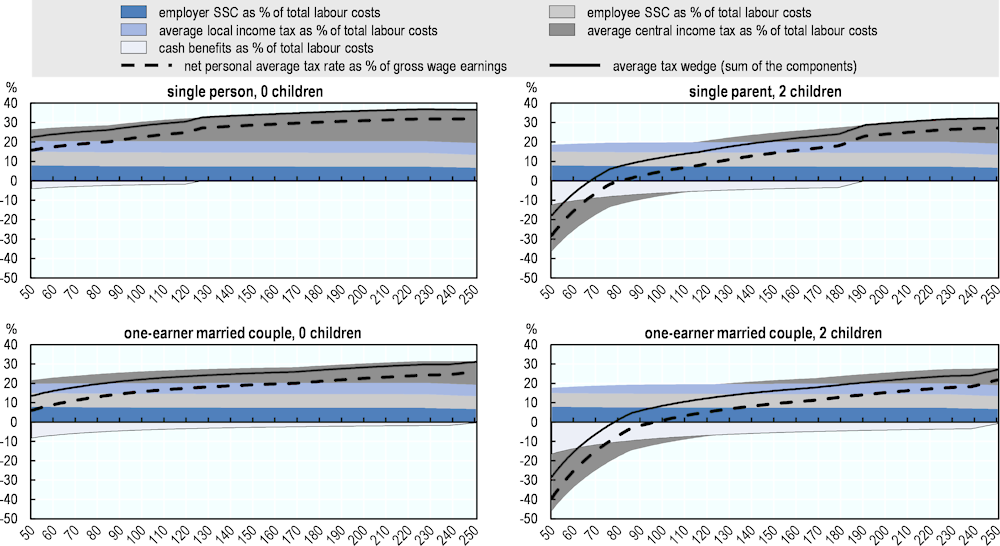

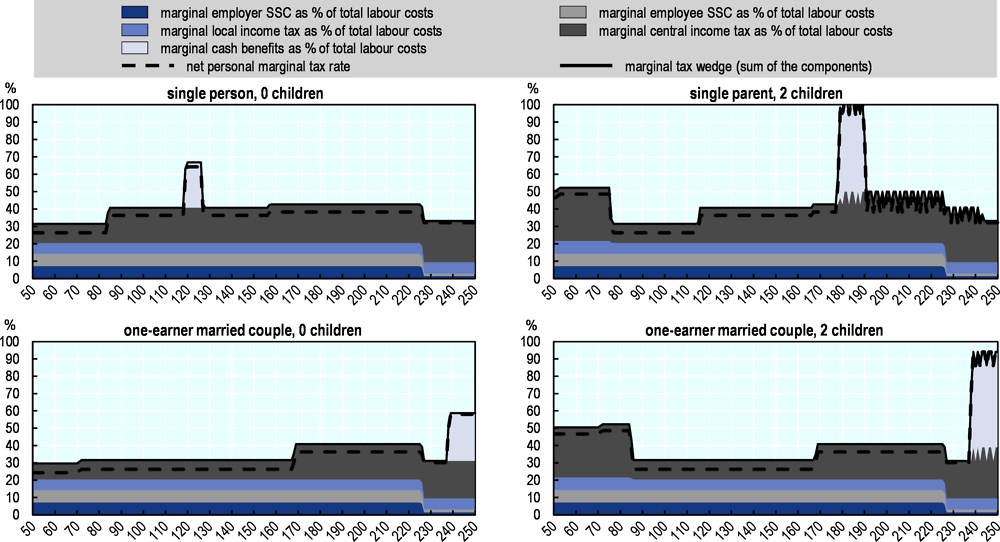

The graphs in this section show the tax burden on labour income in 2021 for gross wage earnings between 50% and 250% of the average wage (AW). For each OECD member country, there are separate graphs for four household types: single taxpayers without children, single parents with two children, one-earner married couples without children and one-earner married couples with two children. The net personal average and marginal tax rates ([the change in] personal income taxes and employee social security contributions [SSCs] net of cash benefits as a percentage of [the change in] gross wage earnings) are included in the graphs that show respectively the average and the marginal tax wedge.1

The graphs illustrate the relative importance of the different components of the tax wedge: central government income taxes, local government income taxes, employee SSCs, employer SSCs (including payroll taxes where applicable) and cash benefits as a percentage of total labour costs. It should be noted that a decreasing share in total labour costs implies that the value of tax payments less benefits is not increasing as rapidly as the corresponding total labour costs. It does not necessarily imply that the value of payments less benefits is decreasing in cash terms.

Low-income households are treated favourably by the tax and benefit systems of many OECD countries. Negative central government income taxes are observed in Belgium because of the non-wastable tax credits for low-income workers and for dependent children; in Canada2 because of the non-wastable working income tax benefit; in Austria, the Czech Republic, Germany and the Slovak Republic because of non-wastable child tax credits; in the United Kingdom because of the non-wastable Universal Credit (UC) paid to low-income households; in Israel because of the non-wastable earned income tax credit (EITC) for families with children (since 2016, single parents have been eligible for the EITC for a wider income range); in Italy because of a payable tax credit targeting low-income workers; in Luxembourg because of a tax credit for social minimum wage earners introduced in 2019; in Poland because of a conditional refundable child tax credit since 2015; in Spain because of non-wastable tax credits for single parents; and in the United States because of the non-wastable EITC and the child tax credit. In Germany, the tax credits that are paid to families with dependent children were increased in response to the COVID-19 crisis in 2021. In the United Kingdom, the UC was increased from April to September 2021 in response to the pandemic. In Sweden, the charts show negative central government income taxes for the four household types due to an EITC; however, the tax credit is wastable in the sense that it cannot reduce the individual’s total income tax payments to less than zero. The EITC is also deducted from the local government income tax.

In some OECD countries, the net personal average tax rate is negative for single parents or one-earner married couples at lower income levels, meaning that these household types do not pay income taxes or SSCs, or these payments are fully offset by cash benefits. For example, the net personal average tax rate becomes positive at more than 90% of the AW in the Czech Republic (at 99% of the AW for the single parent), in Poland (at 100% of the AW for the single parent and the one-earner married couple) and in the United States (at 97% of the AW for the one-earner married couple). In Austria, the Czech Republic, Israel, the Slovak Republic, the United Kingdom and the United States, the negative net personal average tax rates resulted from the combined effect of refundable tax credits and cash benefit payments. In contrast, the net personal average tax rate for single parents was negative mainly due to refundable tax credits in Spain (up to 64% of the AW). There are large variations in cash benefit levels across OECD countries. They represent about a quarter or more of total labour costs for low-income single parents and/or one-earner married couples with two children in Australia, Canada, Chile, Denmark, Ireland, Lithuania, New Zealand and Poland.

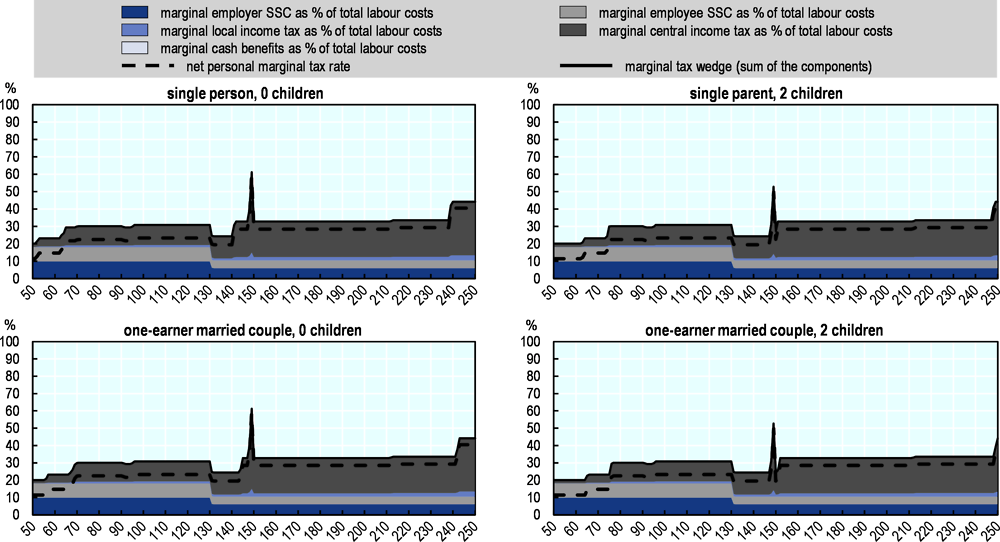

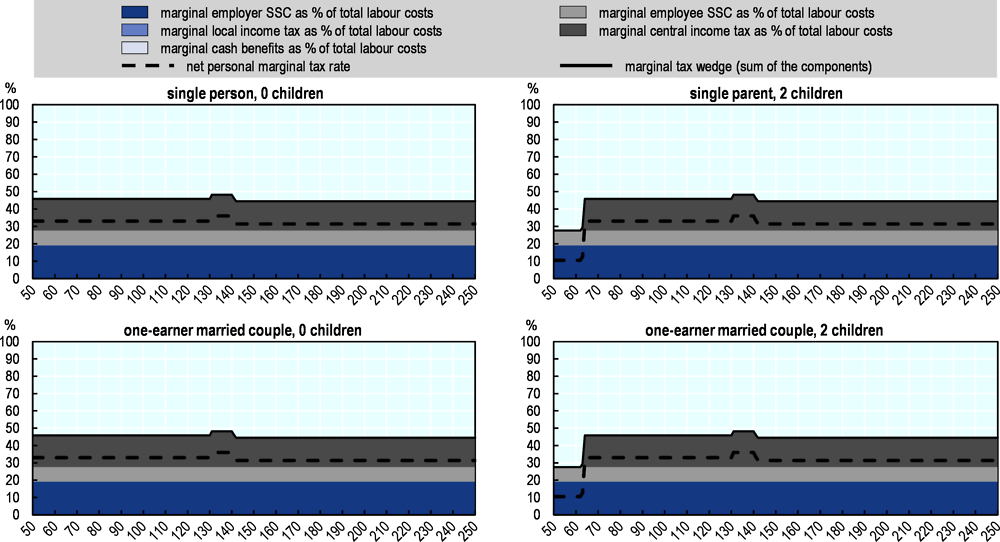

The marginal tax wedge is relatively flat across the earnings distribution in some countries because of flat SSC and personal income tax rates. Single taxpayers without children face a flat marginal tax wedge on incomes between 50% to 250% of AW in the Czech Republic (44.7%) and Hungary (43.2%). For Colombia, the marginal tax wedge for the single worker without children and for the other three household types was equal to zero across the whole income range, as no personal income taxes were paid at these levels of earnings. Moreover, their contributions to pension, health and employment risk insurances are considered to be non-tax compulsory payments (NTCPs)3 and therefore are not counted as taxes in the Taxing Wages calculations. The marginal tax wedge is also relatively constant in Iceland and Lithuania. In Iceland, the marginal tax wedge is 40.1% on earnings below 121% of the AW, 45.9% on earnings at 122% and then 47.6% on earnings from 128% of the AW to 250% of the AW. In Lithuania, it is 44.1% on earnings below 182% of the AW, 43.0% on earnings at 183% of the AW and 40.6% between 184% and 250% of the AW.

SSCs are levied at flat rates in many OECD countries. Some countries have an earnings ceiling above which no additional SSCs have to be paid. The variations in the marginal SSCs are in general the same for the four family types, since the contribution rates or income ceilings do not vary depending on the marital status or the number of dependent children. Nevertheless, in Hungary, the marginal employee SSCs are higher for families with children at low-income levels due to the impact of the withdrawal of the child tax allowance with increasing earnings. Families whose combined personal income tax base is not sufficient to claim the maximum amount of the family tax allowance can deduct the remaining sum from the health insurance and pension contributions. In contrast, in the Netherlands, the marginal employee SSCs were lower for single parents at low-income levels, as these households were eligible for a single parent tax credit that reached its maximum at 51.9% of the AW in 2021.

Within the income range of 50% to 250% of the AW, the marginal employer SSC rates fall to zero as a result of income ceilings in Germany (at 163% of the AW), Luxembourg (at 197% of the AW), the Netherlands (at 112%) and Spain (at 183%). The marginal employee SSC rates fall to zero in Austria (at 156% of the AW), Germany (at 163%), the Netherlands (at 205%), Spain (at 183%) and Sweden (at 114%). In Canada, the marginal employee SSC rate falls to zero at 103% of the AW. However, a spike is observed at 99% of the AW. The Ontario Health premium, which is calculated on an income schedule, is a fixed payment that is adjusted when a taxpayer moves to a higher income bracket.

In addition, taxpayers may experience declining marginal employee and/or employer SSC rates as a percentage of total labour costs over some parts of the earnings range as income increases. This can be observed in Austria, Belgium, Canada, France, Germany, Japan, Korea, Luxembourg, the Netherlands, Switzerland, the United Kingdom and the United States. Large decreases in marginal rates as a percentage of total labour costs were observed in Japan, where the marginal employee and employer SSC rates drop from 12.53% to 4.99% and from 13.31% to 5.85% respectively on earnings above 151% of the AW; in Luxembourg, where the marginal employee SSC rate drops from 10.94% to 1.40% on earnings above 196% of the AW; in the United Kingdom, where the marginal employee SSC rate drops from 10.54% to 1.76% of earnings above 114% of the AW; and in the United States, where the marginal employer and employee SSC rates drop from 7.11% to 1.43% on earnings above 226% of the AW.

In Slovenia, the marginal employer SSCs are negative up to 59% of the AW. This is because the employer pays additional contributions on earnings that are below the social security minimum income threshold. This penalty decreases as earnings increase and is completely exhausted once the employee’s earnings reach the social security minimum income threshold. The negative marginal employer SSC rates derive from the decreasing additional contributions.

Taxpayers face net personal marginal tax rates and wedges of about 70% or more in several of OECD countries at particular earnings levels. This is the case for taxpayers without children in Austria, Belgium, Chile, Italy, Luxembourg, Mexico and Portugal. They also apply to families with children in Australia, Austria, Belgium, Canada, Chile, Greece, Iceland, Ireland, Italy, Japan, Lithuania, Mexico, New Zealand, Poland, Portugal, Slovenia, Spain, Turkey and the United Kingdom. In many countries, these high marginal tax rates are partly the result of reductions in benefits, allowances or tax credits that are targeted at low-income taxpayers as income rises.

The zigzag movement in the marginal tax burdens observed in some of the graphs arises when the changes in taxes, SSCs, and/or cash benefits for small rises in income vary over the income range in a non-continuous way. This is the case because of rounding rules in Germany, Luxembourg, Sweden and Switzerland; and the discrete characteristics of the PAYE (Pay As You Earn) tax credit, the spouse tax credit and the child transfers in Italy.