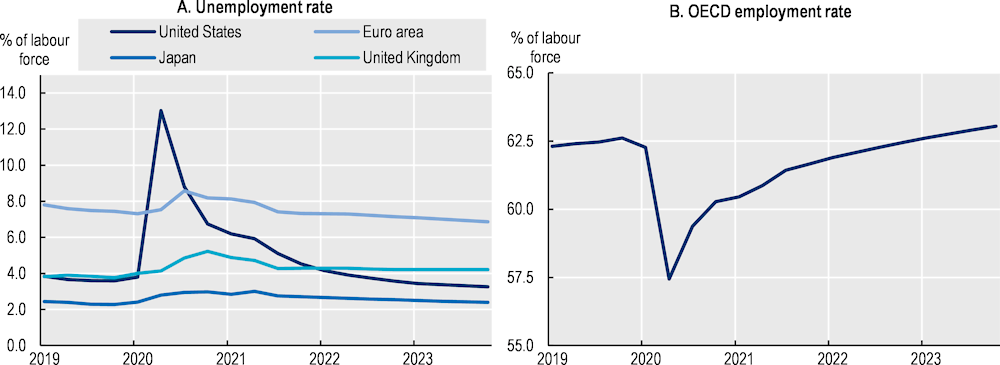

The COVID-19 pandemic has caused major disruption and accelerated long-term changes to labour markets in OECD countries. It has affected both the level of employment and the composition of the workforce. This chapter examines how labour taxation, including benefits administered through the tax system, responded to the impact of the pandemic across the OECD in 2020 and 2021. It does so with reference to three household types included in the Taxing Wages models: a single worker on the average wage, a single-earner married couple earning the average wage with two children, and a single parent earning 67% of the average wage with two children.

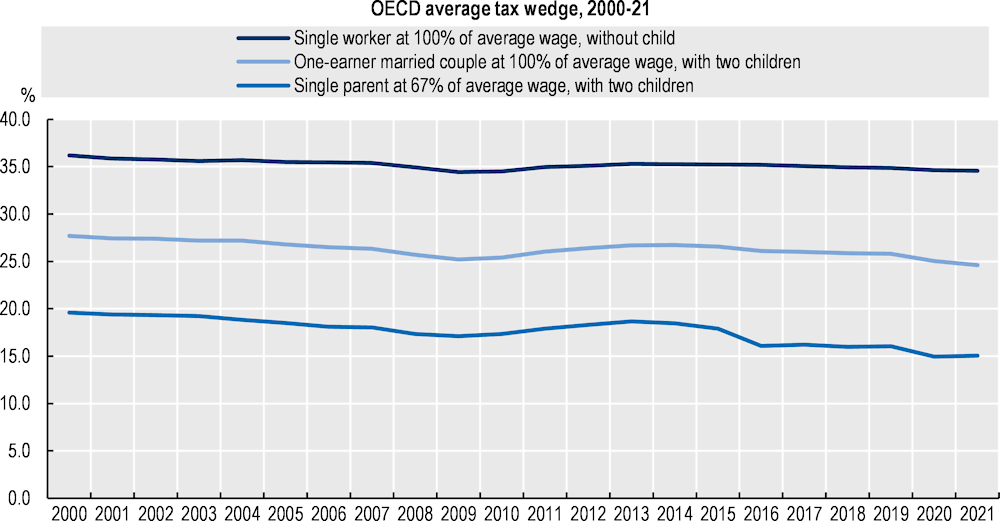

While chapter 1 of this Report examines changes in the tax wedge for different household types between 2020 and 2021, this chapter analyses the changes that occurred between 2019 and 2021, so as to show the overall impact of the COVID-19 pandemic on labour taxation across the OECD. The chapter also examines these changes against the evolution of labour taxation during the two decades prior to the pandemic, including those that coincided with the Global Financial Crisis in 2008-09, to compare the scale of the changes associated with COVID-19 and the extent to which these align with longer-term trends.

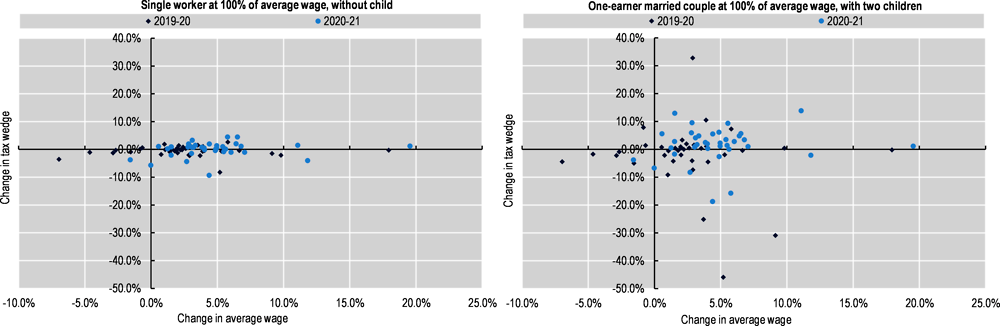

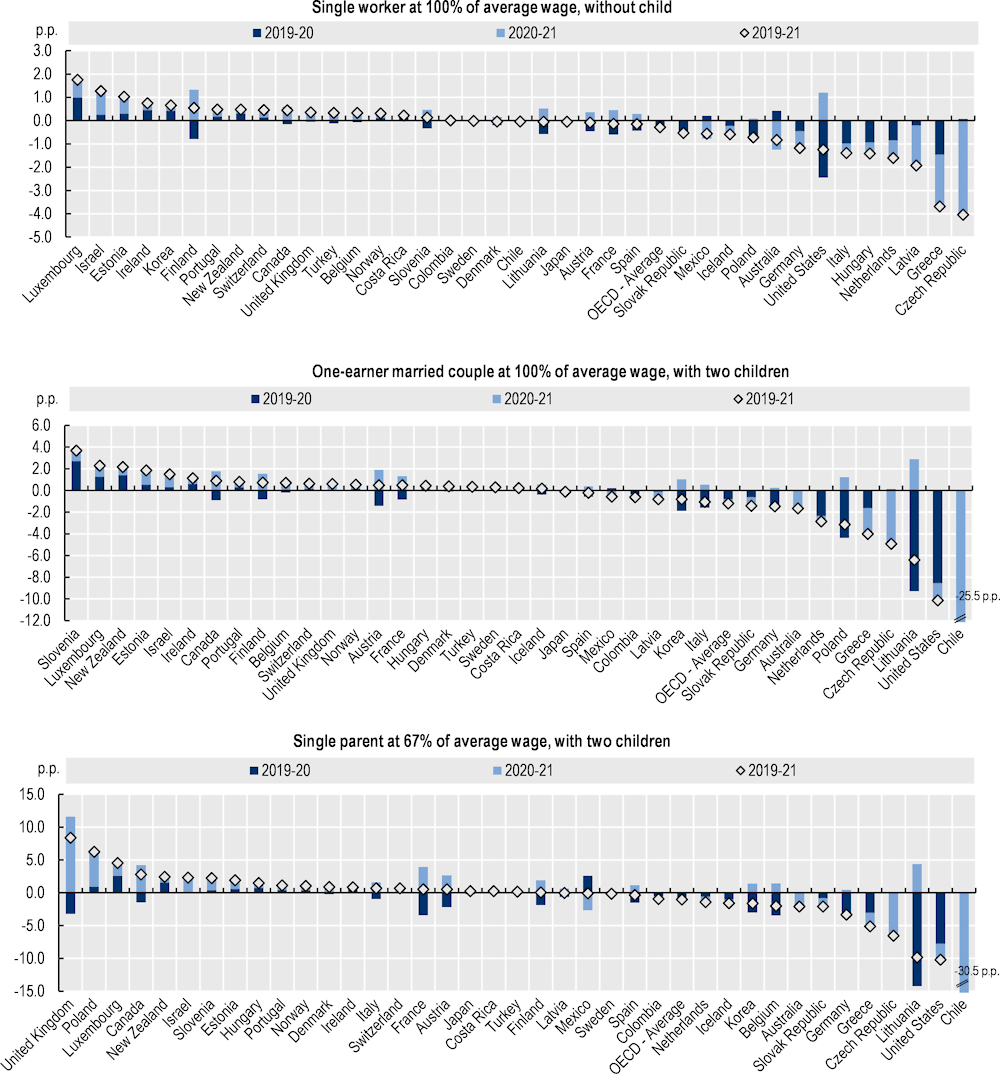

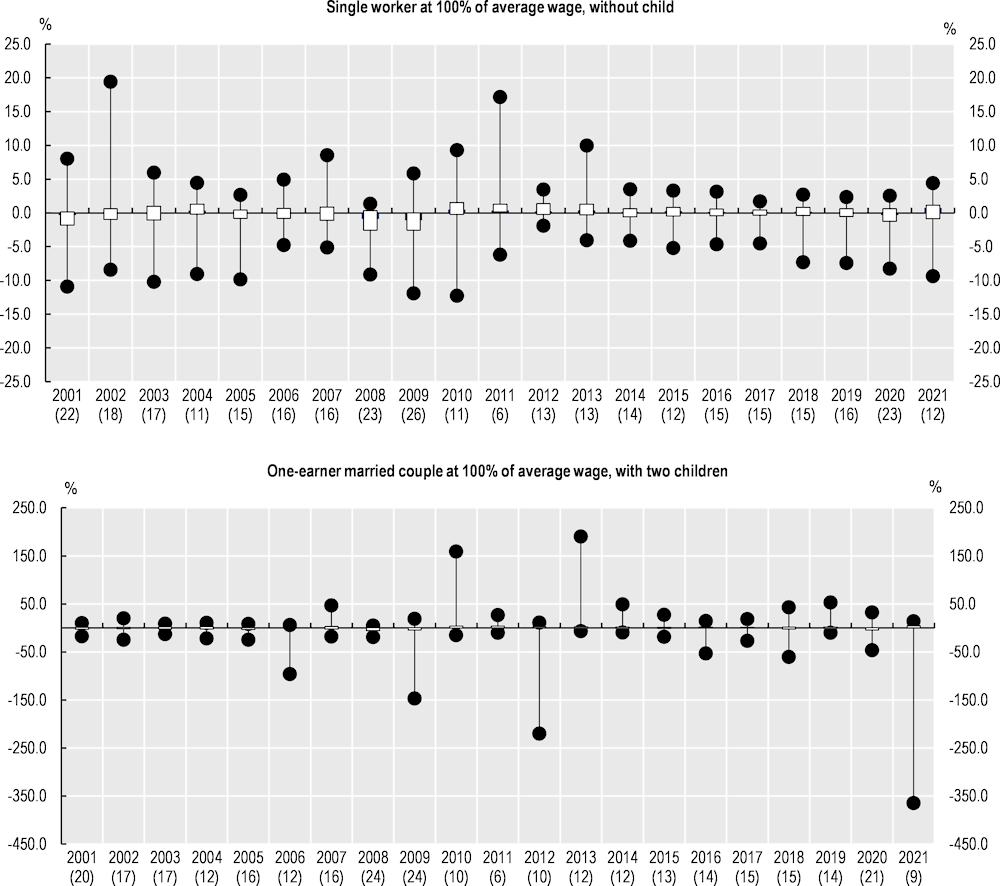

Between 2019 and 2020, the average tax wedge decreased for the three household types on average and in a majority of countries. This was largely due to the policies enacted by governments in response to the pandemic: the tax wedge declined even in a number of countries where average wages increased. Between 2020 and 2021, the tax wedge continued to decline on average for two of the three household types (the exception being the single parent on 67% of the average wage). However, it increased in the majority of countries as wages increased in all but two OECD countries and most governments discontinued COVID-19 support measures implemented in 2020 as the economic recovery took hold and countries were able to better mitigate the impact of the virus.

For both household types with children, 21 OECD countries recorded a higher tax wedge in 2021 than in 2019, prior to the pandemic. For the single earner, 16 countries recorded a higher tax wedge in 2019 than in 2021. The increases in the tax wedge observed across these countries contrasts with the overall decline in the average OECD tax wedge between 2019 and 2021 for all three household types. It is also notable that increases in the tax wedge were more widespread across the OECD for households with children even though many of the policy measures identified in this chapter were directed at this household type.

This chapter identifies two key factors behind changes to the tax wedge between 2019 and 2021. First, declines in the average tax wedge were driven by a small number of countries that recorded relatively large declines, notably Chile. Second, many of the COVID-19 measures were temporary and (in most cases) limited to 2020. Over the course of the two years, the impact of higher wages experienced in a majority of countries (31 in 2020, 36 in 2021) on the tax wedge was larger than the reductions caused by the policy response. It is also important to recall that a number of countries introduced policies in 2021 that were not related to the pandemic and which affected the tax wedge in that year.

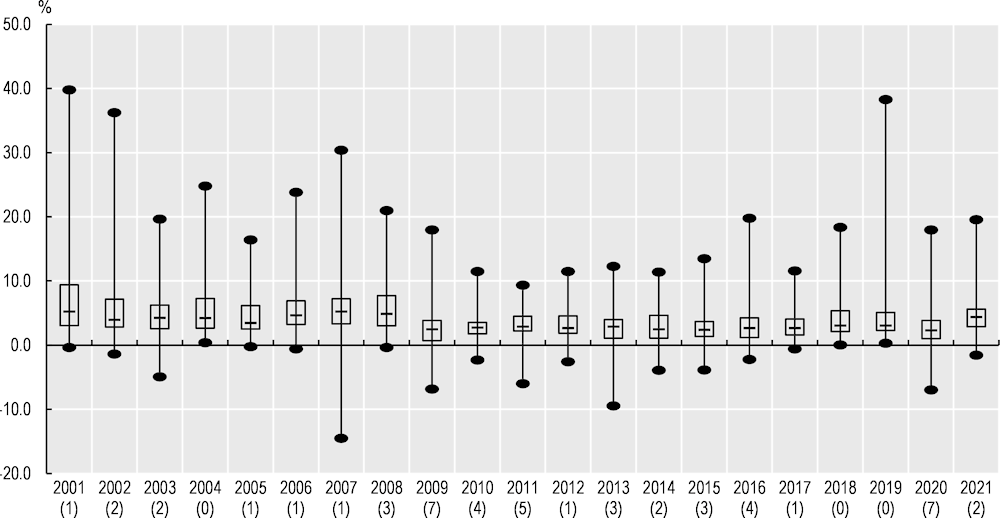

The chapter underlines that the tax wedge is influenced by the combination of changes in average wages and policy measures. Regarding wage changes, it is notable that wage growth in 2021 was not inconsistent with trends observed prior to the pandemic, although the number of countries that experienced a decline in average wages in 2020 was relatively large compared with the years before and after 2009, during the Global Financial Crisis.

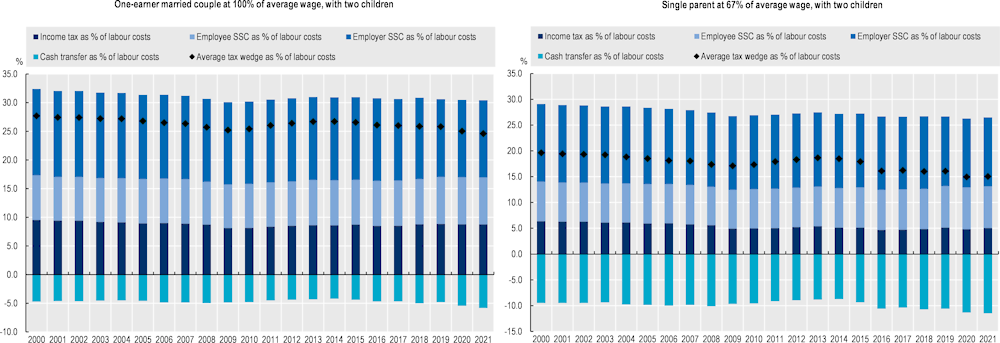

The changes to the tax wedge between 2019 and 2021 aligned with long-term trends: the tax wedge for both household types with children had declined appreciably in the years immediately prior to the pandemic (having increased in the wake of the Global Financial Crisis) while the tax wedge for the single worker declined very gradually between 2000 and 2021. Looking at the different components within the tax wedge, the decrease in the tax wedge was primarily due to the increase in cash benefits as a percentage of labour costs, with the contribution of personal income tax and SSCs largely unchanged between 2019 and 2021 on average. Cash benefits increased.as a percentage of labour costs throughout the period from 2000 to 2021, except between 2012 and 2014.

The changes to labour taxation associated with the COVID-19 pandemic have (so far) been no larger than those observed around the time of the Global Financial Crisis. The tax wedge declined in more countries in 2008 and 2009, while the distribution of changes in average wages across the OECD in 2020 was very similar to that in 2009, with the same number of countries – seven – experiencing declines in both years. The Global Financial Crisis had a more widespread impact on the different components of the tax wedge as a proportion of total labour costs, on average, across the OECD than the pandemic.

Overall, these findings suggest that, in many cases, changes to labour taxation may have been a relatively minor component of governments’ response to the economic impact of the pandemic. Cash benefits for children accounted for the majority of COVID-19 responses included in the Taxing Wages models in 2020 and 2021. Other policies not included here, such as job retention schemes or unemployment benefits, are likely to have been equally or more important. It is also worth recalling that certain parts of the economy have been affected more than others by the pandemic: specific support measures for these sectors are not included in the Taxing Wages models.

Looking ahead, the labour market faces further instability in 2022. The rise of inflationary pressures across the OECD in 2021 and into 2022 might have a significant impact on average wages in nominal and real terms. Employment prospects might weaken as the conflict in Ukraine undermines the economic recovery. At the same time, the ongoing COVID-19 pandemic retains the potential to cause major disruption. Future editions of Taxing Wages will monitor the impact of these large-scale phenomena on the taxation of the labour incomes of different family types, together with further changes in the labour market.