Nicolas Gonne

OECD

OECD Economic Surveys: Belgium 2022

2. Improving economic opportunities for all

Abstract

Income inequality is low in Belgium, and intergenerational income mobility is on par with the average OECD economy. However, as in other OECD countries, there is scope to improve equal access to opportunities across the population. Poverty risks are high for the unemployed and the low-skilled. Vulnerable socio-demographics, in particular the low educated, single mothers and people with a migrant background and with disabilities have persistently low incomes. Moreover, low-income households are overburdened by housing costs. To foster upward income mobility, employment should be increased among vulnerable groups by enhancing skills through life-long learning, effective career guidance and continuing to strengthen work incentives. To prevent the transmission of disadvantages across generations, social segregation in compulsory education should be addressed, in particular through better-designed school choice policies, higher mobility between general and vocational tracks, and stronger incentives and training for teachers. Promoting quality and affordable housing is also necessary to reduce spatial segregation and mitigate barriers to opportunity.

Belgium has low income inequality overall, thanks to extensive tax and transfer policies and strong institutionalised social dialogue. The Gini coefficient is one of the lowest in the OECD, comparable to Nordic countries and below neighbouring countries, such as France, Germany and the Netherlands. Moreover, the overall share of the population at risk of poverty or social exclusion at 18.9% in 2020 is lower than the EU average of 22%, with regional disparities.

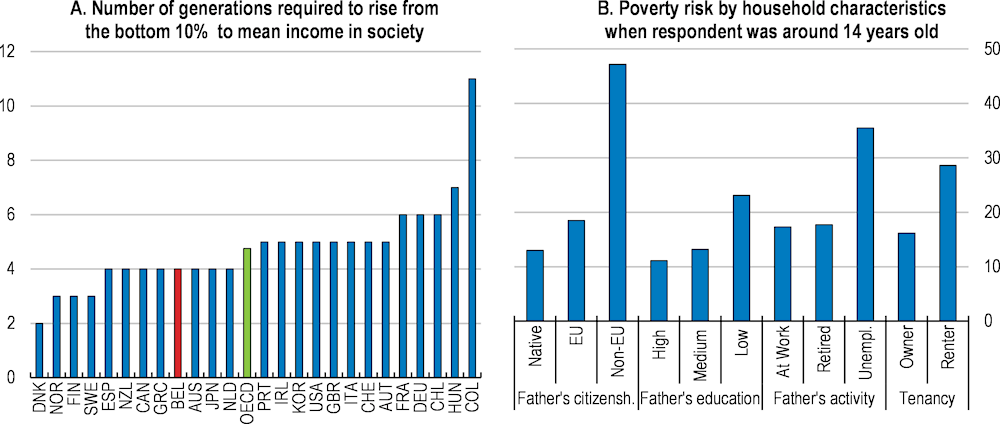

Intergenerational income mobility is also high in international comparison, i.e., the extent to which people’s income depends on that of their parents is less than the OECD average. Around 35% of the earnings differences between fathers carry over to the next generation in Belgium, below 50% in France or Germany (OECD, 2018[1]). On average, the offspring of a low-income family could reach Belgium’s mean income level in around 100 years (about four generations), a slow process, yet faster than in many OECD countries (Figure 2.1, Panel A). Belgium also does well in international comparison in other dimensions that help to lower income inequality, like access to healthcare and education (WEF, 2020[2]; Eurofound, 2017[3]).

However, the policies that deliver low inequality and good intergenerational mobility do not necessarily ensure equality of opportunities, i.e., access to the same life chances irrespective of initial life conditions. Indeed, Belgium’s good overall performance regarding income distribution and intergenerational mobility hides an uneven distribution of economic opportunities. Considerable disparities exist across groups according to, notably, parental background and the country of origin. For example, the offspring of non-EU citizens, low-educated or unemployed parents, and tenants are significantly more at risk of poverty or social exclusion (Figure 2.1, Panel B). Disparities also exist across occupations, as children of manual workers are 11.9 percentage points more likely to be manual workers than managers, a gap close to the OECD average but twice as large as in France or Germany (OECD, 2018[1]).

Figure 2.1. Relatively high intergenerational income mobility overall masks unequal opportunities

Note: Panel A: simulation based on estimates of earnings elasticities between fathers and sons, and on current household income levels at the bottom decile and the mean of the distribution, assuming constant elasticities; OECD is unweighted average based on 25 countries for which data were available. Panel B: respondents aged 25-59 at risk of poverty or social exclusion.

Source: OECD Income Distribution Database; and Statistics Belgium.

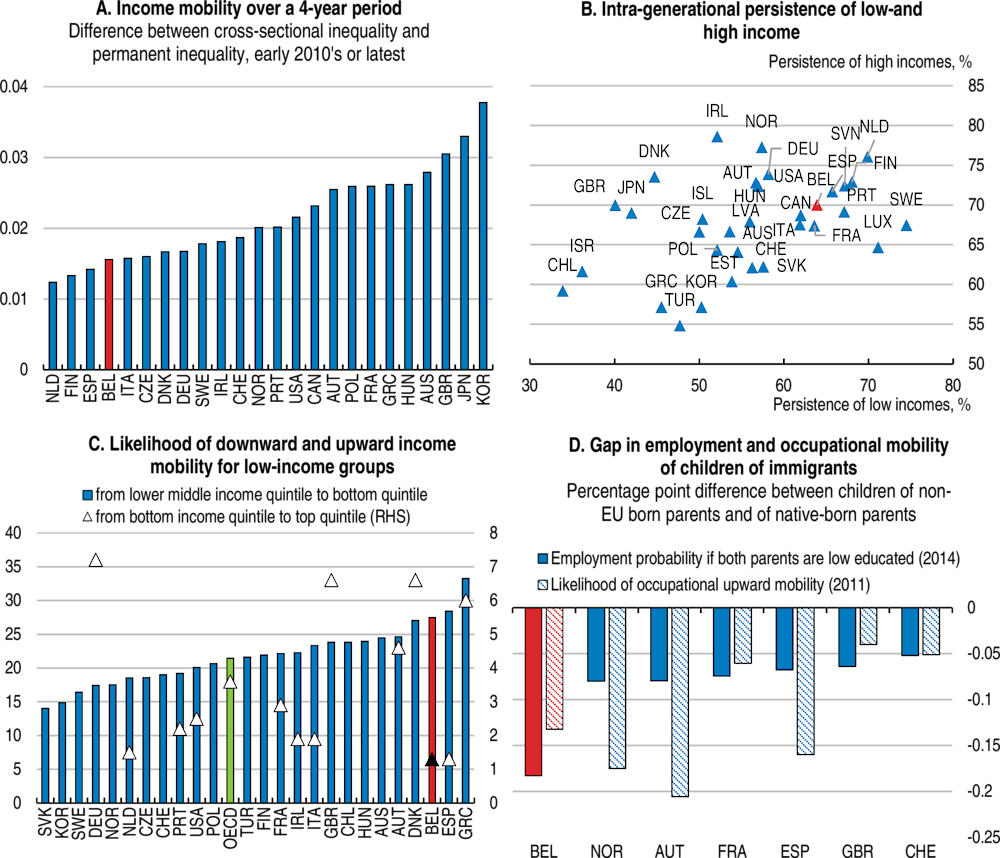

Unequal access to economic opportunities implies low intra-generational income mobility for members of vulnerable groups, i.e., their income changes little over their life course. Income stability over the life course partly reflects the existence of strong social security safety nets in Belgium, like in other countries, such as the Netherlands or the Nordic countries. However, such persistence can also point to structural impediments to improving one’s initial socio-economic condition. While data restrictions prevent a full analysis of income over the life cycle (Box 2.1), existing measures suggest that Belgium overall is characterised by strong intra-generational income persistence. For example, the so-called permanent income inequality, i.e., income inequality pooled over several years, is only slightly lower than income inequality at any point in time (Figure 2.2, Panel A).

Like several other OECD countries, Belgium is a country of “sticky floors and ceilings”, where income persistence is not distributed evenly across groups. While around half of the working age population remained in the same quintile of the income distribution over the period 2011-14, close to the OECD average, persistence is significantly and increasingly stronger for high- and low-income groups than for middle-income groups. Almost 64% of working age individuals in the bottom income quintile and 70% of those in the top income quintile remain in the same quintile over a four-year period (Figure 2.2, Panel B).

Upward income mobility is very low for low-income groups in Belgium and, at the same time, lower-middle income households are at a relatively high risk of sliding down to the bottom (Figure 2.2, Panel C). In Belgium, the unemployed, single-parent families and tenants are the most vulnerable to poverty (StatBel, 2019[4]). Economic opportunities are particularly weak for people with a migrant background. For example, the probability to be employed and the chances of upward occupational mobility are relatively low for the native-born with foreign parents (Figure 2.2, Panel D).

Differences between socio-demographic groups tend to persist across generations in OECD countries. Parents’ income is a key determinant of access to good-quality education, adequate healthcare and professional networks and, hence, of children’s career options and income (OECD, 2018[1]). Such uneven opportunities can entrench inequalities at significant economic cost, in particular as talents and human capital investments are missed out (OECD, 2015[5]). Ensuring that income is not stuck over time or transmitted across generations can be socially desirable, in particular in cases where initial conditions reflect discrimination against certain groups or are the results of cultural, ethnic or family backgrounds. Yet, attenuating frequent and uncertain swings in disposable income can also be desirable to reduce economic insecurity, e.g., through social insurance.

Box 2.1. Measuring income mobility: data availability

Measuring income mobility across a lifetime requires longitudinal data, i.e., repeated information for a consistent group of individuals over a relatively long period. Such data are rare as they are costly to collect, and they include caveats, in particular attrition bias. Moreover, some relevant survey variables are collected as part of thematic modules that are discontinued.

This chapter relies extensively on data from the 2018 OECD report, A Broken Social Elevator? How To Promote Social Mobility, a large-scale effort to pull together different data sources to provide a comprehensive, cross-country picture of social mobility. The data used at the time of publishing, which sometimes dates from the early 2010s, often remain the most relevant data to this day as the persistent and structural nature of income mobility patterns makes them still relevant for the analysis in this chapter.

Source: OECD (2018), A broken social elevator? How to promote social mobility.

Beyond lowering welfare and well-being of individuals, unequal opportunities weigh on key macroeconomic outcomes, namely potential growth, public finances and social cohesion. First, unequal access to economic opportunities contributes to misallocating or underusing talent and resources, in particular human capital, thereby dragging on productivity growth (OECD, 2018[6]). This is especially important in the context of high and rising labour market shortages in Belgium (Chapter 1). Second, persistently low incomes for some groups require extensive redistribution, thereby worsening medium-term fiscal sustainability challenges (Chapter 1). Third, low prospects of accessing opportunities (or the perception thereof) tends to decrease democratic participation and trust (OECD, 2018[1]; OECD, 2021[7]), a concern of particular relevance in Belgium, where trust in government experienced the strongest deterioration among OECD countries since 2007 (OECD, 2021[8]).

Figure 2.2. Intra-generational income mobility is relatively low and uneven across groups

Note: Data refer to working-age population (aged 18-65), early 2010s or latest. Panel A: difference between average cross-sectional Gini coefficient of annual incomes and Gini coefficient of 4-year averaged incomes. Panel B: share of individuals in the top or bottom income quintile staying in the same quintile after four years. Panel C: share of individuals moving to the bottom quintile after four years. Panel D: OLS estimates controlling for age, gender and highest educational attainment; probabilities are for population aged 25-54.

Source: OECD (2018,) A broken social elevator? How to promote social mobility; and OECD (2017), Catching up? Intergenerational mobility and children of immigrants.

This chapter reviews Belgium’s capacity to provide economic opportunities for all, irrespective of initial conditions, while continuing to promote low overall income inequality and economic security thanks to its outstanding social safety net. It identifies three key barriers, the labour market, education and housing, and discusses policies that can improve economic opportunities, especially concentrating on the situation of vulnerable groups, such as the low-skilled, people with a migrant background and single mothers. These include policies to: i) improve labour market transitions among vulnerable groups (e.g., lifelong learning); ii) attenuate the effect of socio-economic background on the educational attainment of disadvantaged students (e.g., teachers’ incentives); and iii) make quality housing affordable for low-income households (e.g., housing subsidies). As competencies concerning the labour market, education and housing are spread across different levels of government (Box 2.2), some recommendations related to non-federal competencies are more relevant to specific regions and communities according to their policy needs and priorities in various areas.

Box 2.2. Levels of government and competences regarding barriers to economic opportunities

Besides the federal government, the Belgian governance system comprises three regional authorities and three language communities (cutting across the regions), with significant autonomy and separate competencies. The regions refer to the Flemish, Brussels-Capital and the Walloon regions. The communities refer to the French, Flemish and German-speaking communities. Each authority has its own legislative and executive powers for its field of competences, and its own parliament and government to exercise these powers. The federal state, the regions and the communities are on an equal footing, so that no authority has precedence over another.

Competences concerning the barriers to economic opportunities identified in this chapter, namely the labour market, education and housing, are spread across different levels of government (Table 2.1).

Table 2.1. Allocation of competences related to barriers to economic opportunities

|

Federal |

Regions |

Communities |

|

|---|---|---|---|

|

Labour market |

Unemployment, pensions and health insurance |

Active labour market policies, family benefits, health, social security contribution reduction for targeted groups |

|

|

Education |

Start and end age of compulsory education, minimal requirements for granting degrees, pension regimes for education staff |

Parts of adult learning and apprenticeships |

Pre-primary to tertiary and adult education, including granting of degree equivalence |

|

Housing |

Mortgage tax credit for non-owner occupied dwellings |

Social housing and property taxes, mortgage tax credit of owner occupied dwellings, housing allowances |

Note: The table is not exhaustive as only the main policies and responsibilities are listed. Flanders merged community and regional institutions. The Walloon region transferred some of its competences concerning German speakers to the German-speaking Community, including public employment services (ADG).

Barriers to economic opportunities in Belgium

Low labour market transitions hinder upward income mobility

Participation and transitions in the labour market are key drivers of income mobility over the life course (Box 2.3). In particular, long-term inactivity or unemployment and low-wage work contribute to the persistence of low income (OECD, 2020[9]). Difficult school-to-work transitions also hinder upward income mobility as they lead to unemployment spells and precarious early careers, especially for the disadvantaged youth (OECD, 2018[1]). Moreover, non-standard forms of work raise new challenges, as they have the potential to increase labour market participation, but often offer limited access to certain forms of social protection, which could exacerbate existing disparities (OECD, 2019[10]).

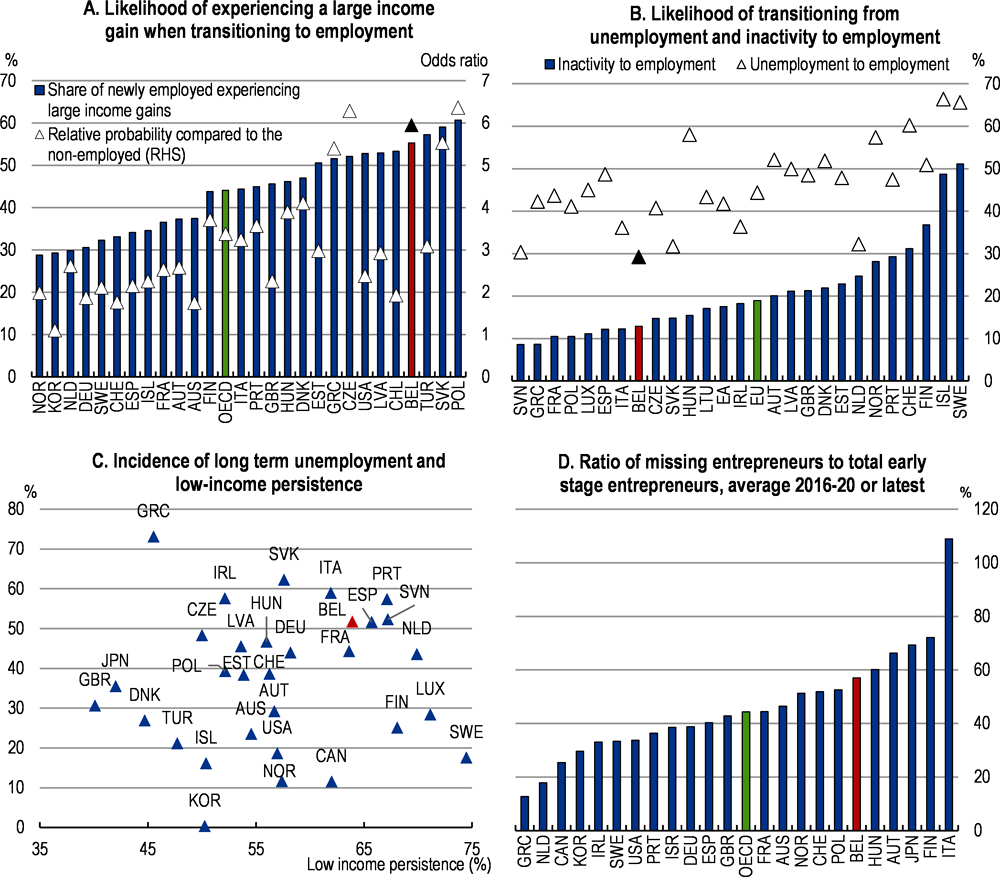

Stronger labour market outcomes are key for upward income mobility in Belgium. Indeed, individuals transitioning into employment are six times more likely to experience a large income gain than individuals who remain non-employed in Belgium (Figure 2.3, Panel A). More than half of the people becoming employed obtain an income increase of at least 20% in Belgium, compared to about a third in neighbouring countries. However, transitions from unemployment or inactivity to employment are particularly low in Belgium (Figure 2.3, Panel B). The probability of becoming employed conditional on being unemployed is less than 30%, the lowest value in the European Union. The incidence of long-term unemployment is also associated with low-income persistence (Figure 2.3, Panel C).

Figure 2.3. There is room for upward income mobility through better labour market outcomes

Note: Panel A: large income gains are defined as 20% or more income gains from one year to the next; data cover the working-age population (18-65). Panel B: probability of changing labour market status conditional on status at the end of the previous year; averages from weighted sample for the period 2005-2015; EU is the simple average across the 22 EU countries that are also members of the OECD, except Germany for which data are not available. Panel C: share of individuals in the top income quintile staying in the same quintile after four years; data refer to working-age population (18-65), early 2010s or latest; long-term unemployment as a share of total unemployment; data are from 2015. Panel D: OECD is the unweighted average of OECD countries for which data are available; data for Belgium are from 2015.

Source: OECD (2018), A broken social elevator? How to promote social mobility; Adalet-McGowan et al. (2020), Addressing labour market challenges in Belgium; OECD (2021), Missing entrepreneurs 2021: Policies for inclusive entrepreneurship and self-employment; and OECD (2020), Inclusive entrepreneurship policies country assessment notes: Belgium 2020.

Entrepreneurship offers upward mobility paths for people with the capability to identify new market opportunities and create value added. However, vulnerable groups are disproportionately affected by barriers to entrepreneurship, partly because necessary entrepreneurial skills and knowledge are often transmitted informally from parents to children or acquired in professional networks and alumni associations (OECD, 2018[1]). Belgium has a large share of “missing entrepreneurs”, i.e., individuals who would engage in entrepreneurial activity if the group to which they belong had the same early-stage entrepreneurship rate than that of men aged 30-49 (Figure 2.3, Panel D). Closing gaps in entrepreneurship activity across all socio-demographic groups would add 270 000 entrepreneurs to the existing 475 000, with women accounting for two-thirds of these missing entrepreneurs and migrants for 20% (OECD, 2020[11]).

Box 2.3. Barriers to upward income mobility in Belgium: new evidence from survey microdata

New OECD research uses the Household Finance and Consumption Survey (HFCS) for Belgium to estimate the correlation between labour market, education and housing characteristics of households and their mobility in the distribution of income, following the methodology in Martinez-Toledano et al. (2019[12]).

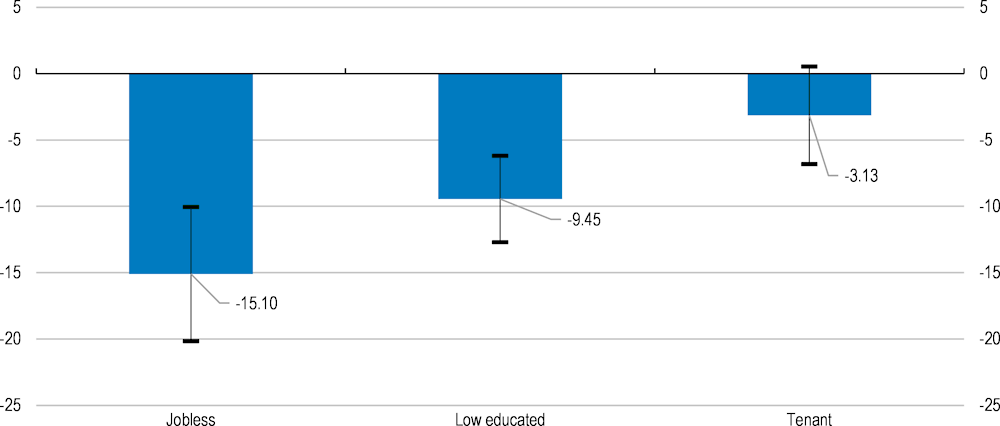

Preliminary results show that low education and joblessness are significantly associated with lower income mobility over the period 2011-17. Figure 2.4 shows the coefficients of a regression of the change of households’ position in the income distribution on dummy variables related to their labour market status, education level and housing tenure, controlling for age, income and wealth. Everything else equal, households of which the head is jobless will be about 15 percentiles lower in the income distribution after a three-year period, compared to a household of which the head either has a job or is retired. Similarly, households of which the head does not have tertiary education will be more than nine percentiles lower in the income distribution after three years than households of which the head attended tertiary education. Hence, policies that improve the labour market outcomes of vulnerable groups and enhance equal opportunities in education are key to boost upward income mobility.

Figure 2.4. Employment and education are significantly correlated with income mobility

Change in household income percentile position associated with selected determinants

Note: estimated coefficients from a household-level regression of the percentile position change in the distribution of equivalised gross income over a three-year period on three dummy variables capturing joblessness, low education level and housing tenancy (significant at the 10% level). Controls comprise age, income and wealth. All monetary variables are deflated and expressed in initial year prices. Data cover the years 2011-2017. The reference category is a household with equivalised gross income between the median and the 60th percentile of the distribution, which owns its residence and of which the head is of prime working age, active and with tertiary education. Whiskers indicate the 95% confidence interval.

Source: OECD calculations based on Household Finance and Consumption Survey.

Better school-to-work transitions are also necessary to improve upward income mobility prospects for the youth in Belgium. The proportion of people aged 15-24 not in education, employment or training (NEET) at 9.2% was lower than the EU average in 2020 according to Eurostat data, but significantly higher than in the Netherlands (4.5%) and Germany (7.3%), with regional differences. The proportion of NEET aged 15-24 is particularly large among those born outside of the EU at 18.1% in 2020. Moreover, more than one in five unemployed people aged 15-24 had been so for more than 12 months in 2020, compromising chances of upward mobility.

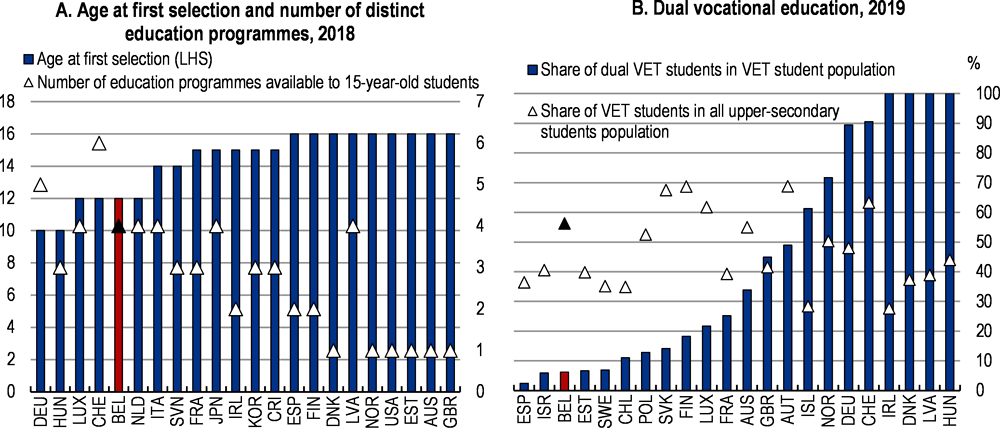

Inequalities of opportunity in compulsory education drag on intergenerational mobility

Education is a key factor affecting intergenerational income mobility (OECD, 2018[1]; OECD, 2018[13]). Children with better-educated parents obtain better educational outcomes, in part due to the investments that better-educated parents are able to make in their children. Therefore, the mere transmission of skills and educational preferences from parents to children contributes to intergenerational income persistence to the extent that earnings are correlated with educational attainment (Hanushek et al., 2021[14]; Blanden, Gregg and Macmillan, 2007[15]). While non-compulsory, early childhood education and care also have a large impact on social mobility (see below).

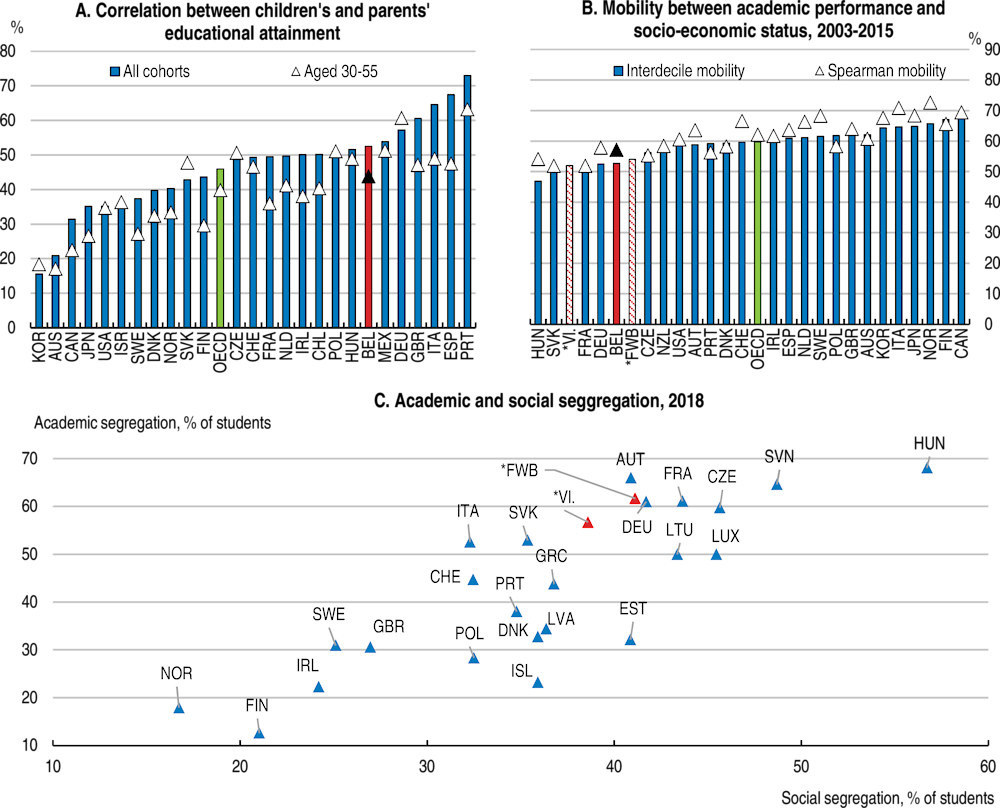

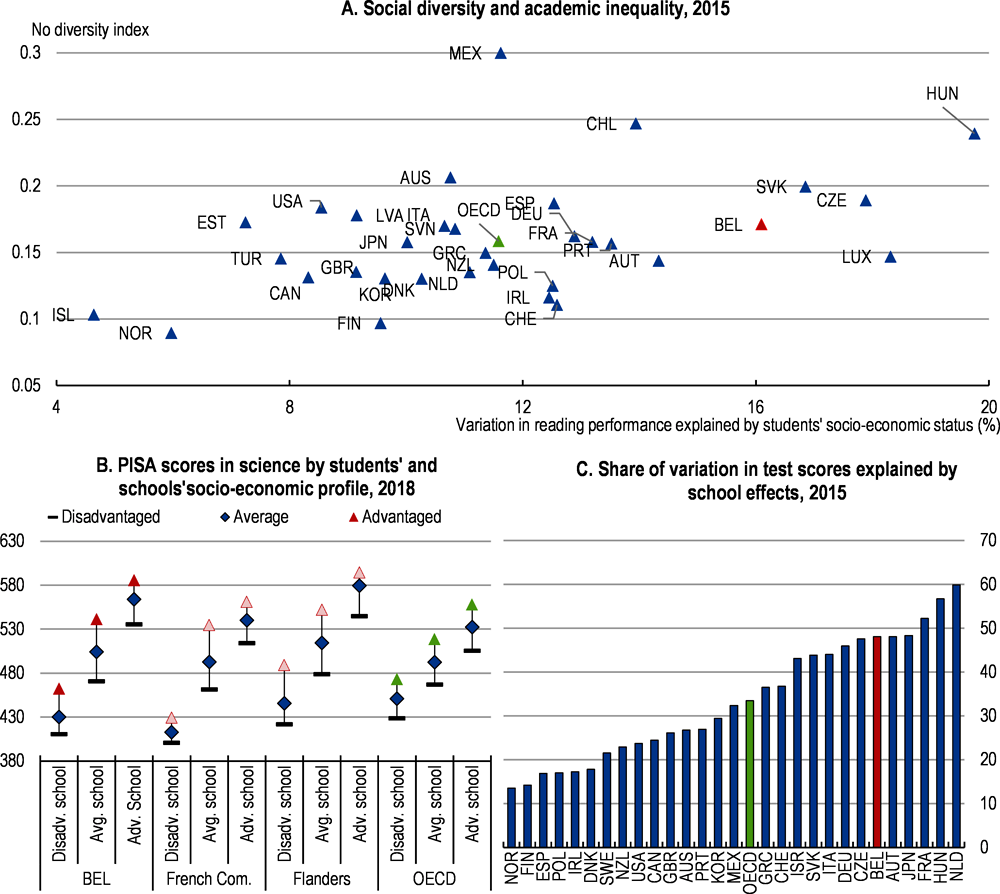

The education systems in Belgium feature high intergenerational persistence in attainment and strong links between students’ academic performance and socio-economic status. For example, the correlation between children’s and parents’ years of schooling is one of the strongest in the OECD, as an additional year of parental schooling is associated with more than half a year of additional schooling for their offspring (Figure 2.5, Panel A). The correlation is less strong for younger cohorts due to the overall expansion of participation in education, but remains higher than the OECD average. Social mobility at school, as measured by the average ratio of students’ position in the distribution of socio-economic status to their position in the distribution of academic performance, is also low (Godin and Hindriks, 2018[16]). By this measure, Belgian schools offer the fifth lowest level of social mobility at school among the 27 OECD countries that have participated in the Programme for International Student Assessment (PISA) since 2003 (Figure 2.5, Panel B). High persistence and low mobility at school point to the existence of strong intergenerational education transmission mechanisms in Belgium.

Strong segregation is prevalent in compulsory education (Figure 2.5, Panel C). The most recent PISA results indicate that Belgium is characterised by high shares of students attending “socially segregated schools” (schools with either a relatively high or a relatively low socio-economic background) and “academically segregated schools” (schools with either relatively high or relatively low average academic performance) (Hirtt, 2020[17]). Social and academic segregation go hand-in-hand due to a cumulative process of academic and social selection in Belgian students’ compulsory education path, which explains the particularly strong effect of schools on academic outcomes.

Figure 2.5. Educational disparities by socio-economic conditions are high

Note: Panel A: correlation measured as the coefficient of the regression of individuals’ years of schooling on their parents’ years of schooling and a constant; all cohorts cover individuals aged 25-90. Panel B: interdecile mobility measured as students’ average ratio of PISA mathematic score decile to PISA index of economic, social and cultural status (ESCS) decile, normalised so that 100% is perfect mobility; Spearman mobility measured as one minus the rank correlation between PISA mathematics score and ESCS score, so that 100% indicates the absence of correlation; "Vl." and "FWB" stand for the Flemish and French communities, respectively. Panel C: the share of students attending a school with average ESCS score more than half a standard deviation away from the country average.

Source: OECD (2018), A broken social elevator? How to promote social mobility; Godin and Hindrikx (2018), An international comparison of school systems based on social mobility; and Hirtt (2020), L’inégalité scolaire, ultime vestige de la Belgique unitaire?

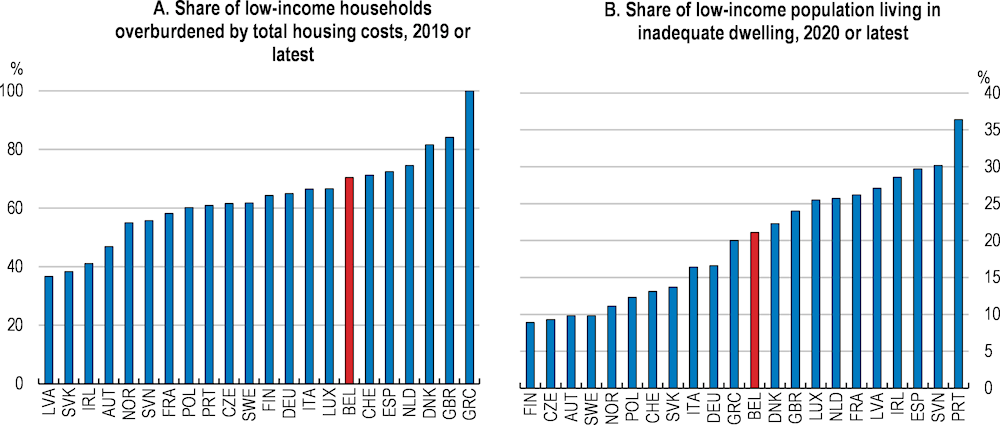

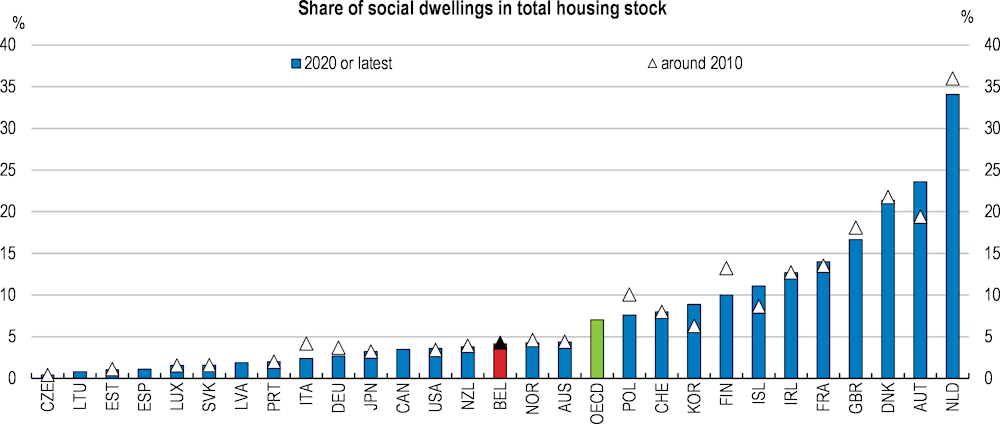

Lack of adequate affordable housing contributes to the persistence of low incomes

Affordable and quality housing availability is key in achieving equality of opportunity, as neighbourhood characteristics and peer effects can influence both educational attainment levels and access to public services and higher quality job networks (OECD, 2018[1]). Housing affordability promotes residential mobility, which increases labour market efficiency by improving job matching and boosts income mobility by facilitating access to better paying jobs and better quality education, especially for disadvantaged children and young people (Caldera Sánchez and Andrews, 2011[18]; OECD, 2021[19]). By contrast, large price differentials across neighbourhoods prevent households from moving and can lead socio-economic groups to sort into separate neighbourhoods.

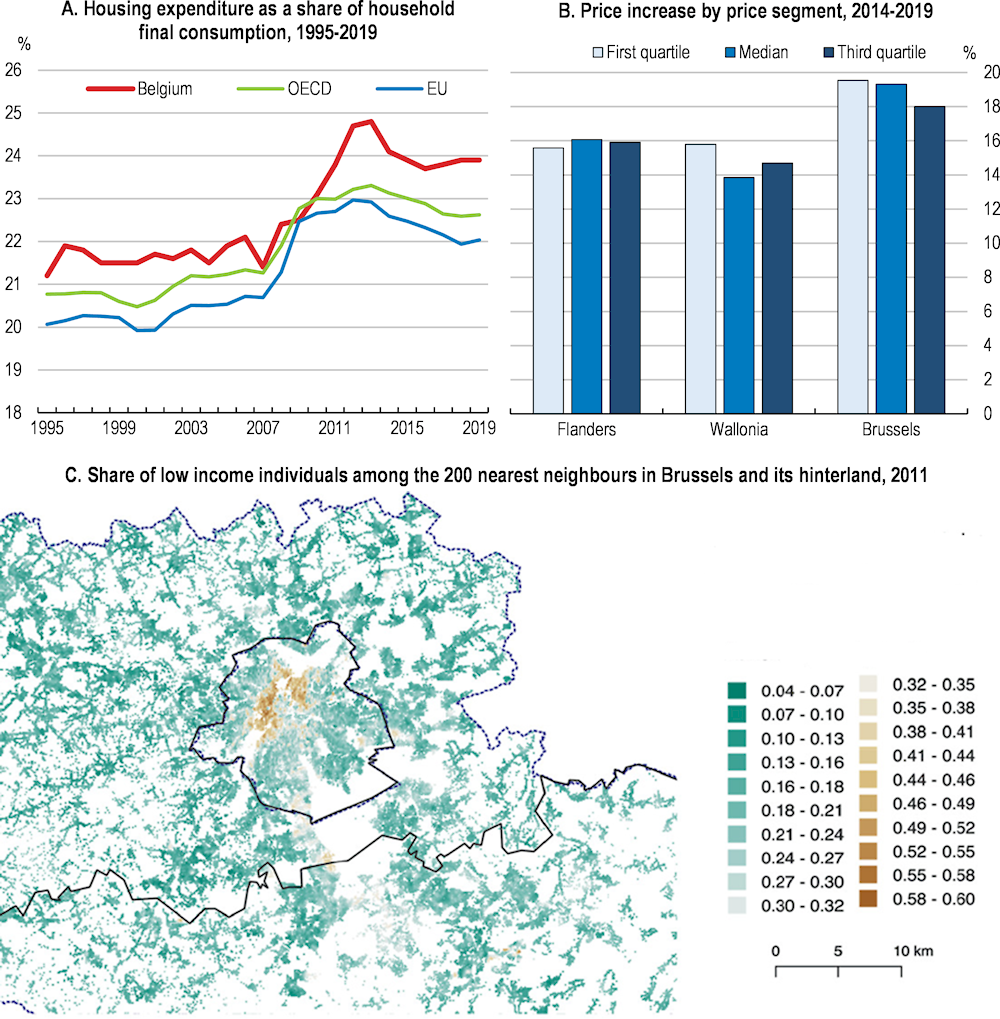

Rising housing costs can increase residential segregation on top of increasing vulnerabilities in the real estate sector (Chapter 1), as it puts a disproportionate burden on low-income households in Belgium, as in other OECD countries (OECD, 2021[19]). Housing expenditure accounts for around 24% of household consumption in Belgium, a two-percentage point increase since the global financial crisis, and above the OECD and the EU averages (Figure 2.6, Panel A). The rise in housing costs was particularly strong in the Brussels-Capital Region over the period 2014-19, where apartment prices on the lowest price segment have increased the most (Figure 2.6, Panel B). Moreover, spatial analysis based on the 2011 census shows strong residential segregation within Brussels and its hinterland (Figure 2.6, Panel C). Poverty is clustered in old industrial neighbourhoods offering low-quality housing from the private rental market, which have long been occupied by low-income households (Costa and De Valk, 2021[20]).

Figure 2.6. Low-income households bear a high burden from housing costs

Note: Panel B: percent change in the sale price of apartments at each quartile of the price distribution. Panel C: low-income individuals defined as those with income below 60% of the national median.

Source: OECD Affordable Housing Database; Statistics Belgium; and Costa and De Valk (2021), Socio-spatial disparities in Brussels and its hinterland.

Residential segregation can exacerbate the barriers to social mobility arising from the labour market and the education system and, therefore, negatively affect the life chances of residents of disadvantaged neighbourhoods. For example, local schools are likely less diverse than in mixed neighbourhoods, which is associated with more unequal school performance. The spatial concentration of people of foreign origin further compounds social mobility challenges, as deprived migrants are spatially isolated within large cities, such as Brussels, Antwerp and Liège (Costa and de Valk, 2018[21]).

Improving the labour market outcomes of vulnerable groups

Long-standing labour market challenges hinder social mobility over the life course in Belgium. Until the COVID-19 pandemic, strong job creation and historically low rates of unemployment co-existed with important challenges, including high levels of inactivity, low labour market transitions and growing skill shortages, especially digital, as discussed in the 2020 Economic Survey of Belgium, as well as sizeable regional disparities (Table 2.2). At the height of the pandemic, swiftly implemented income support measures complemented automatic increases in transfers and decreases in taxes to protect workers’ livelihoods. As the labour market recovers, addressing labour market challenges is key to improve opportunities of upward income mobility. Better labour market outcomes are particularly important for vulnerable groups, as they were disproportionately affected by the COVID-19 fallout and are benefitting less from the recovery (Chapter 1).

Table 2.2. Regional disparities in labour market and related outcomes are sizeable

2020 (%)

1. Aged 15-64.

2. Share of labour force unemployed for 12 months or more.

3. Aged 15-24.

4. Share of 15-24 year olds not in education, employment or training (Eurostat definition).

5. Share of population at risk of poverty or social exclusion.

Source: Eurostat.

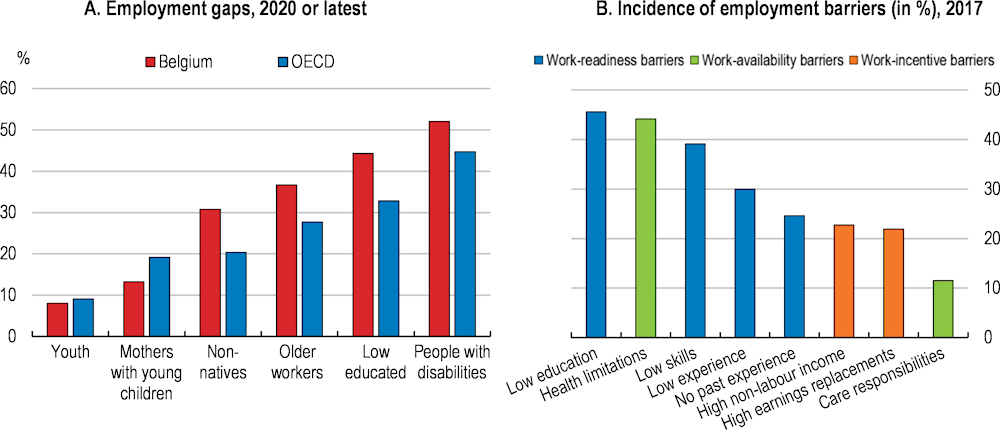

Beyond the challenge of decreasing youth unemployment and increasing activity rates of people above 55 (Chapter 1), employment gaps are particularly large for disadvantaged groups, such as the low educated, non-EU migrants and people with disabilities (Figure 2.7, Panel A). Transitions from inactivity or unemployment to employment are particularly low for vulnerable groups. For example, women transition 20 percent less from non-employment to employment than men in Belgium in 2019 (Causa, Luu and Abendschein, 2021[22]), and there is a five percentage points gap in the transition rate of non-EU migrants compared to natives on average over the period 2008-14 (HCE, 2018[23]). Significant increases in employment rates are necessary among these groups to achieve the government’s ambitious 80% employment target by 2030 for the 20-64 year-olds. Based on demographic projections and a comparison with top performers among neighbouring countries, the High Council of Employment estimates that the required increases in employment rates are particularly high for the low skilled, the youth and non-EU migrants.

Figure 2.7. Vulnerable groups face multiple barriers to employment

Note: Panel A: employment gap defined as the difference between the employment rate of prime-age men (aged 25-54) and that of the group, expressed as a percentage of the employment rate of prime-age men; OECD figures are unweighted averages of countries for which data are available; youth refers to those aged 15-29 excluding those in full-time education or training; mothers refer to working-age women with at least one child aged 0-14; non-natives refer to all foreign-born people with no regards to nationality. Older workers refer to those aged 55-64. Low educated refers to those aged 25-64 with education below upper secondary; data from 2017 for people with disabilities. Panel B: share of the population experiencing major employment difficulties, defined as those aged 18-64 that report to be long-term unemployed, inactive or to have a weak labour market attachment (unstable job, restricted working hours or near-zero earnings), excluding full-time students; bars do not sum to 100 as individuals can face multiple employment barriers.

Source: OECD calculations based on OECD Employment database, OECD International Migration database, OECD Education Database and OECD Family database; and Fernandez et al. (2020), Identifying and addressing employment barriers in Belgium, Korea and Norway.

Employment gaps often reflect multiple worker-related barriers to employment regarding work readiness, work availability and work incentives (Figure 2.7, Panel B). More than half of those who report to be long-term unemployed, inactive or to have a weak labour market attachment in Belgium face a combination of barriers, the most common of which are low education and health limitations (Adalet McGowan et al., 2020[24]). While many other OECD countries have similar worker-related barriers, Belgium tends to cumulate multiple barriers concurrently (OECD, 2020[25]). Language constitutes an important work-readiness barrier in Belgium and partly explains persistent disparities and imbalances between regions. For people of foreign origin (first and second generation immigrants who account for 32.7% of the population as of January 2021), discrimination likely adds to worker-related barriers (Baert, Heiland and Korenman, 2016[26]; FPS Employment/UNIA, 2019[27]). Unequal opportunities in education contribute to the persistence of work readiness barriers, in particular for children of non-EU migrants, who hardly fare better than their parents in terms of employment outcomes (Piton and Rycx, 2021[28]).

Household characteristics often intersect with gaps associated with the country of origin, so that labour market outcomes are particularly weak for migrant women. Only 46.2% of prime-age women born outside of the EU were in employment in 2020 according to Eurostat. Recent estimates based on social security data suggest that first- and second-generation immigrant women of non-EU origin face a double penalty in terms of employment probabilities that is larger than the sum of the penalties associated with gender and with foreign origin (Piton and Rycx, 2021[28]). Mothers in general are 3.2 percentage points less likely to be employed than women without children in Belgium, according to an analysis based on propensity score matching (Nautet and Piton, 2021[29]).

Important reforms have already contributed to increase the participation of low wage earners and older workers in Belgium, and planned reforms are expected to continue to do so (Box 2.4; Chapter 1). Further to these reforms, focusing policies and resources on vulnerable groups is essential to improve their economic opportunities, especially mothers with children, non-EU migrants and people with disabilities. Beyond promoting upward income mobility and strengthening well-being, such stronger focus can help alleviate fiscal sustainability challenges by reducing the need for redistribution (Chapter 1).

Box 2.4. Planned labour law reforms in Belgium

Labour law reforms discussed in this chapter focus on aspects most relevant for social mobility in Belgium, especially targeting of policies and resources on vulnerable groups. Broader analysis of labour market challenges and necessary reforms to increase participation are discussed in Chapter 1, as well as in the 2020 Economic Survey’s special chapter. This box offers a brief overview of labour law reforms included in the federal government’s October 2021 budget agreement and February 2022 reform package.

Planned reforms are expected to continue increasing labour market participation. A EUR 300 million tax shift away from social security contributions and partly funded through higher consumption (tobacco) and environmental (flights) taxes is intended to reduce the tax wedge on low wages further and to attenuate low-wage traps.

New measures will also improve labour market transitions, conditional on agreement with regional authorities and social partners. The individual training account is being implemented. One third of the employer social security contribution paid in case of layoff will be used for training the dismissed employee. Part of the severance pay will also be used to subsidise the wage at a new employer and starting a new job during the notice period will be possible in order to incentivise work-to-work transitions. Conditions for returning to work from disability leave will be made more flexible. Labour mobility will be incentivised by letting the long-term unemployed who take up a job across the linguistic border or fill a hard-to-fill vacancy to keep parts of their employment benefit for three months.

Finally, the overhaul of labour laws will increase flexibility. Full-time employees will be offered more flexible working weeks, including the option to allocate working hours across four days instead of five. Evening work between 8PM and 12AM will be easier to introduce to promote the development of e-commerce, and the status of platform worker is clarified.

Source: Chancellery of the Prime Minister.

Another set of recent reforms and measures at both federal and regional government levels were intended to increase the relatively low levels of business dynamism and entrepreneurial activity by reducing costs for failed entrepreneurs, lowering administrative barriers and promoting entrepreneurship education (OECD, 2020[9]; OECD, 2019[30]). However, perceived entrepreneurship capabilities remain low (OECD, 2021[31]), and underdeveloped entrepreneurial culture is a major obstacle to entrepreneurship (Mulder and Godefroid, 2016[32]), even though surveys show improvements in Flanders (Roelandt and Andries, 2021[33]). Barriers related to low skills and fear of failure appear particularly detrimental to vulnerable groups, especially women (OECD, 2020[11]). At the same time, the relatively high incidence of necessity self-employment in Belgium suggests that the potential of entrepreneurial activity to provide broad-based upward mobility could be limited. Subsistence entrepreneurship is particularly prevalent among women, as 38% of them report having started a business because they could not secure employment, larger than the 25% overall rate in Belgium and the EU average of 18.8% (OECD, 2020[11]).

Enhancing and recognising skills outside of formal education

Enhancing the digital skills of vulnerable groups is essential to boost upward social mobility by ensuring employability and smoothing labour market transitions (OECD, 2018[1]). Digital skills not only complement digital technologies to enhance productivity and income growth, but also enable individuals to thrive in a fast-changing world of work where automation accelerates the substitution of workers for machines for a range of tasks (OECD, 2019[10]). High-skilled workers generally benefit from digitalisation through higher employment and wages (OECD, 2015[34]). Moreover, current vacancy rates are particularly high in information and communication technology (ICT) related industries.

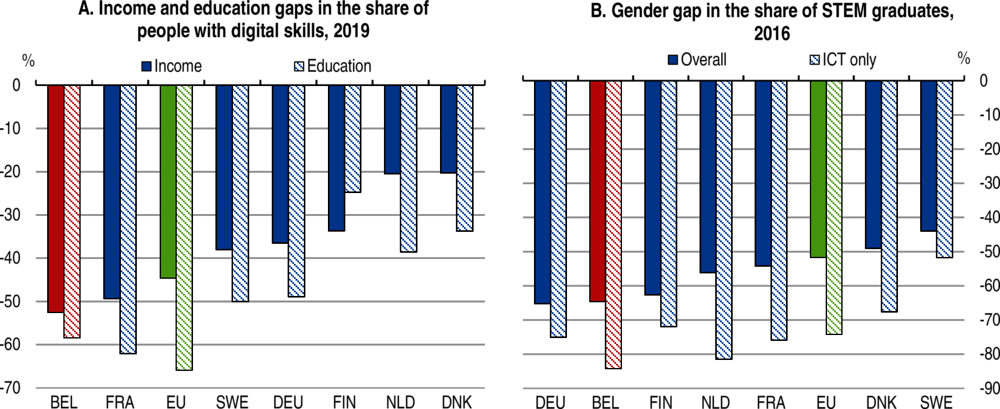

The distribution of digital skills across groups is particularly uneven in Belgium, with large education, income and gender gaps, which mirror disparities in labour market opportunities. For example, the gap in the share of people with basic or above basic digital skills between those with high and low income is larger than in neighbouring and Nordic countries (Figure 2.8, Panel A), and so is the gender gap in the number of science, technology, engineering and mathematics (STEM) university graduates (Figure 2.8, Panel B). According to the European Commission’s Women in Digital Scoreboard 2021, only 58% of women have at least basic digital skills in Belgium versus 63% of men, despite women being more educated than men on average. Tapping into the unused potential of these groups will be key to address acute and rising digital skills needs given the rapid spread of information and communication technologies (ICT) in the workplace in Belgium. Furthermore, the strong digital focus of investments under the national and regional recovery plans is expected to increase demand for digital skills (Chapter 1).

Figure 2.8. Digital skills are distributed particularly unevenly across groups

Note: Panel A: income gap: percent difference in the share of individuals with basic or above basic digital skills living in a household in the top quartile of the national income distribution and in the bottom quartile; education gap: percent difference in the share of individuals with basic or above basic digital skills with high and low formal education. Panel B: gender gap expressed as percent difference between the share of male and female graduates in science, technology, engineering and mathematics (STEM) overall and in information and communication technology (ICT) only.

Source: Eurostat Self-Reported Skills Statistics Database; and High Council of Employment (2021), La formation continue des salariés: Investir dans l'avenir.

Measures promoting participation in STEM training should be boosted in formal education and among both working and unemployed adults, especially women. Regional governments’ measures to promote STEM fields and address shortages of STEM graduates, including the 2020-30 phase of Flanders’ STEM Action Plan, Brussels’ Digital.Brussels, and Wallonia’s Digital Strategy 2019-24, go in the right direction, but more could be done. Making information about wage premia in digital-intensive jobs readily available could help attract candidates for STEM training. As this wage premium is low relative to other countries in the EU, employers may need to improve the compensation package offered to STEM professionals (OECD, 2020[9]). Stronger financial incentives could be achieved through more flexibility in the wage setting mechanism to allow for a stronger link between wages and productivity (Chapter 1).

Lifelong learning is essential for upward income mobility, as maintaining and upgrading skills help labour market transitions both from declining occupations to emerging ones and from inactivity to employment (OECD, 2018[1]). Adult training focused on ICT is particularly crucial given the large digital skill gaps of vulnerable groups in Belgium, in particular as the COVID-19 crisis is accelerating digitalisation (OECD, 2021[35]). All governments have initiatives to increase digital access by vulnerable groups (E-inclusionforBelgium at the federal level, Digibanks in Flanders, Brussels Digital Literacy Action Plan, Espaces Publics Numériques in Wallonia). Furthermore, only 45% of the 55-64 years olds have basic or above basic digital skills according to Eurostat, a major concern as recent pension reforms to delay the effective retirement age exacerbate the need for preventing older workers’ skills from becoming obsolete (Chapter 1).

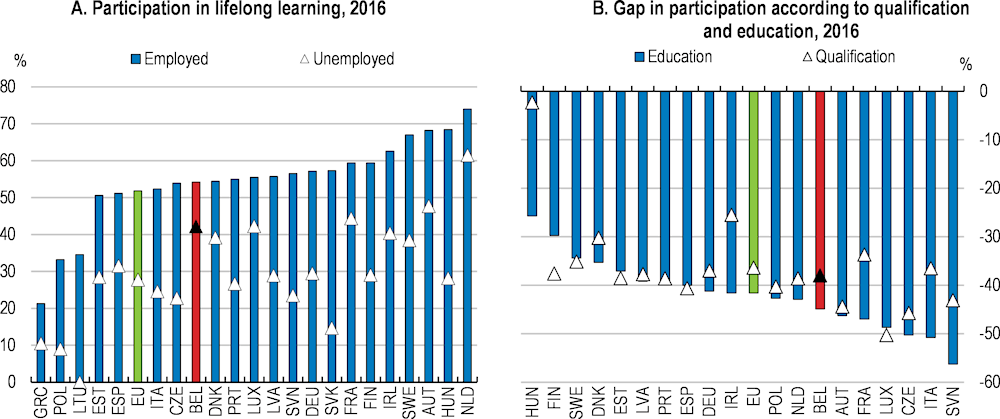

The overall participation in lifelong learning in Belgium is around the EU average, but hides important disparities by skill level (HCE, 2021[36]). Participation among employees is 54%, above the EU’s 52%, but significantly below best performers (e.g. the Netherlands) (Figure 2.9, Panel A). Participation among the unemployed is particularly high at 42%, compared to 28% in the EU, and reflects the many training opportunities offered by public employment services in the three regions. The evidence on the quality of training is scarce, but points to an overall strong and persistent effect on job finding trainees in Wallonia (Fonder, Lejeune and Tarantchenko, 2019[37]). However, participation among the low educated is 45 percentage points below the highly educated, and participation among workers in elementary jobs is 38 percentage points below workers in highly qualified jobs (Figure 2.9, Panel B). The age participation gap between young and old is also one of the highest in the EU. Persistent participation gaps risk entrenching current low-income persistence further by increasing pre-existing skill disparities (HCE, 2021[36]).

Figure 2.9. The low skilled participate far less in in lifelong learning

Note: Panel A: formal and informal training, population aged 25-64. Panel B: percentage point difference in participation rate between highly and low educated and between highly qualified workers and workers in elementary jobs.

Source: High Council of Employment (2021), La formation continue des salariés: Investir dans l'avenir.

Lifelong learning measures should be streamlined and better coordinated, as the high number of schemes, providers and governments involved creates complexity that is particularly detrimental to the participation of vulnerable groups (HCE, 2021[36]). The federal government rightly made lifelong learning a major policy goal, in line with the European Commission’s agenda. Planned reforms include the activation of Article 39 Ter of the Law on labour contracts, which holds that one third of severance pay will be used for providing training to the dismissed employee. The regions and social partners have their own measures, such as Flanders’ Action Plan on Lifelong Learning or CP200’s Cefora, a training initiative organised by the largest sectoral social partner committee. The national recovery and resilience plan also includes lifelong learning measures. This complex institutional framework should be streamlined and coordination between the different levels of government should be ensured.

The federal government’s budget agreement to implement an individual training account, as recommended in the 2020 Economic Survey, is a major step in the direction of increasing lifelong learning efficiency and inclusiveness. By transforming the pre-existing obligation for firms to grant five training days per employee per year on average into an individual right for workers, the individual training account ensures portability, increases workers’ responsibility regarding the choice of learning trajectories and ensures that all workers have access to training, including vulnerable groups, such as the low-skilled. Coordination with regional governments will need to be ensured so that the individual training account can accommodate regional lifelong learning initiatives, including the current development of a Flemish learning and career account and the planned reform of the Congé Education Payé in the Brussels-Capital Region.

A key necessary condition to make the individual training account successful is the provision of high quality training in areas of skill needs and of individual guidance on the choice of training programmes (OECD, 2019[38]). As career guidance is increasingly delivered digitally, options for face-to-face delivery should remain in place to avoid excluding populations with poor digital skills or access (OECD, 2021[39]). Targeted delivery could follow the Dutch model, where jobseekers who are statistically the most likely to be long-term unemployed are systematically invited to a face-to-face interview with a caseload worker, while the others are initially referred to digital services. Furthermore, adequate targeting is needed to both reduce fiscal cost and boost vulnerable groups’ participation. For example, establishing the individual allowance in monetary terms instead of days, as was done in France in 2018, would enable the low-skilled to get more training as the cost of training them is lower (OECD, 2019[40]). Ensuring continued employer involvement in the design of training programmes is also important to reduce skill mismatch for vulnerable groups (see below).

Better targeting of lifelong learning to vulnerable groups is necessary to promote income mobility, in particular through increasing the participation of the low-skilled. Existing information desks, such as Flanders’ Leerwinkel, should continue targeting the low skilled and immigrants in collaboration with public employment services and immigration services. Moreover, initiatives to reach out to those with a low participation rate, such as Brussels’ Formtruck, and Brussels’ and Wallonia’s Cité des Métiers, should be evaluated and expanded as appropriate. Flanders’ Opleidingskrediet scheme, which tops up the regionally-granted paid training leave, also targets low-participation groups by offering a higher allowance for single households. As they implement the individual training account, governments and social partners can also draw from the French experience with the “Compte Personnel de Formation”, in which access is universal but financial support varies across groups (Box 2.5).

Numerous regional policy measures and private initiatives aim at promoting entrepreneurship skills and knowledge for specific vulnerable groups, including the youth, the unemployed, women and people with disabilities. However, awareness is limited among some target groups, while complexity tends to reduce participation (OECD, 2020[11]). Moreover, little is known on the effectiveness of these programmes. Streamlining the offer of entrepreneurial skill programmes and creating a one-stop shop would provide clarity and facilitate outreach to target groups. Evaluating existing programmes is crucial and could benefit from the experience of the assessment of measures to promote entrepreneurship culture in secondary education under the Walloon Region’s Plan Marshall 4.0 (Van Haeperen, Meunier and Mosty, 2019[41]). Entrepreneurial skill programmes could also directly target people with a migrant background, given their large employment and skill gaps.

Box 2.5. Individualising training access schemes: the case of France

The French personal training account (compte personnel de formation, CPF) is an individualised financing scheme for professional training in which training rights are accumulated over time. Implemented in 2015, the account is open to all economically active persons, and is fully transferable throughout the individual’s working life, from the time they enter the labour market until they retire. The account was reformed in 2018 to develop access to training for low-skilled workers and jobseekers. The personal training account was previously measured in training hours, but has now been monetised in euros, a move to correct the disparities in hourly training costs. The amount of the annual payments is based on workers’ skills: each worker has EUR 500 per year in his CPF to pay for training, and the least skilled have EUR 800 (up to a ceiling of EUR 5 000 and EUR 8 000 over 10 years, respectively). The reform also introduced guidance for potential beneficiaries, as well as controls of the quality of and information about the training provided. Part of the funds dedicated to professional training and apprenticeship are earmarked for career advice (conseils en évolution professionnelle, CEP).

Source: OECD (2020) Individualising training access schemes: France; and OECD (2019) OECD Economic Surveys: France 2019.

Labour market mismatches also hinder the chances of upward mobility, as having the right skills or field of study for a job has long-lasting effects on wages and employment throughout workers’ careers (OECD, 2018[1]). Moreover, labour market mismatches are associated with lower productivity through less efficient allocation of resources and can contribute to income inequality in a context of skill shortages (Mcgowan and Andrews, 2015[42]). Mismatches can be particularly pervasive among immigrant workers, especially among those with non-labour migration motives, as poorer knowledge of the language and labour market of the host country hamper effective networking and job search.

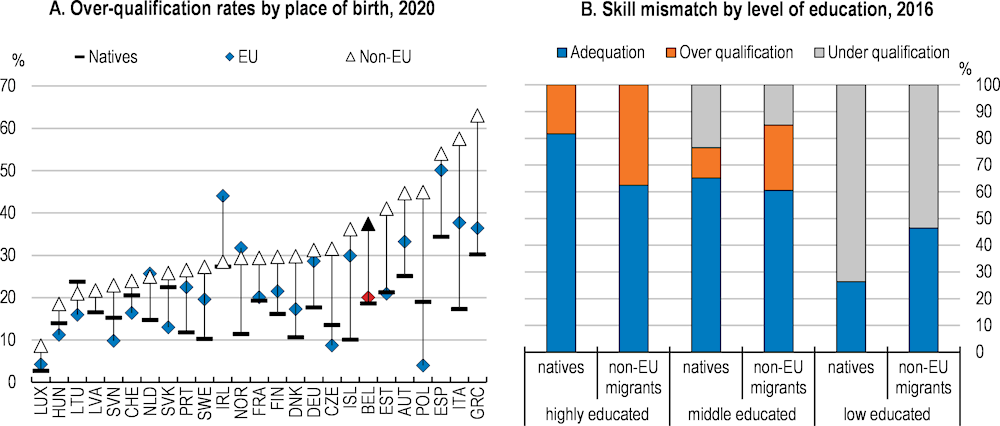

Over-qualification among working non-EU immigrants is relatively high in Belgium (HCE, 2018[23]). Almost 40% of those born outside of the EU working in Belgium are overqualified, twice the rate of those born in Belgium, and significantly more than in Germany, France and the Netherlands (Figure 2.10, Panel A). Mismatches between the level of qualifications possessed by non-EU immigrants and those required in their job is particularly pervasive for the highly educated and can lead to skill depreciation (Figure 2.10, Panel B). The composition of migration inflows, with a large share of migrants admitted on family or humanitarian grounds, also contributes to mismatches with labour market needs (OECD, 2015[43]).

The recognition of skills acquired outside standard education paths should be promoted, especially those acquired abroad by migrants. According to a special module of the 2014 Labour Force Survey, one quarter of over-qualified immigrant workers in Belgium attribute the mismatch to difficulties regarding the recognition of skills acquired abroad (HCE, 2018[23]). Therefore, migrants should be referred rapidly and systematically to services of skill validation. Referrals could go through multiple channels, including digital ones, such as the smartphone app “Recognition in Germany”, which was developed on behalf of the German Ministry of Education and Research to provide easily understandable information on recognition procedures and criteria (OECD, 2017[44]). Procedures to recognise degrees obtained abroad could be accelerated, following the example of the Swedish fast-track scheme for shortage occupations, which combines recognition of foreign credentials and prior learning with language classes to provide an occupational certificate (OECD, 2017[44]). Coordination should be ensured between the three communities, which are in charge of degree recognition, and fees could be means-tested or waived, as in the German-speaking Community.

Figure 2.10. Over qualification is high among non-EU immigrant workers

Note: Panel A: share of the highly educated (ISCED levels 5-8) working in low- or medium-skilled jobs (ISCO levels 4-9); data cover population in employment aged 15-64. Panel B: occupations (education) classified into high, medium and low skilled (educated) based on ISCO 2008 (ISCED 2011); over-qualification (under-qualification) is when education level is higher (lower) than occupation skill level.

Source: OECD (forthcoming), Settling in 2022 : Indicators of immigrant integration; and High Council of Employment (2018), Les immigrés nés en dehors de l’Union européenne sur le marché du travail en Belgique.

Making activation work for all

Active labour market policies are essential to limit the long-term impact of unemployment on income trajectories and prevent unemployment spells from hampering future upward mobility. Effective activation programmes can also help reduce downward mobility risks, as higher spending on active labour market programmes is associated with a lower share of middle-income households moving down to the bottom of the income distribution (OECD, 2018[1]). The COVID-19 crisis reinforced the importance of activation to foster labour market resilience, while the continuing digital transformation and changing nature of work tend to increase the risk of transitions out of standard forms of employment and, therefore, the need for job-search support (OECD, 2021[45]). Adequate targeting is key to ensure that activation increases job seekers employability in a cost-efficient manner (OECD, 2015[46]).

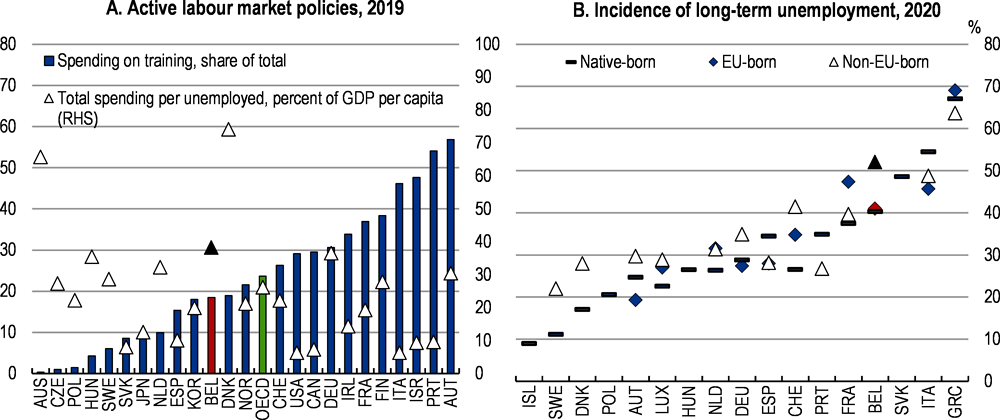

Belgium performs well regarding activation spending and planned reforms are expected to facilitate work-to-work transitions, including the use of parts of the severance pay to subsidise the wage at a new employer. The spending mix improved, as the share of activation spending allocated to training increased from 15.9% in 2017 to 18.5% in 2019, but remains below the OECD average of 23.7% (Figure 2.11, Panel A). However, spending could better target vulnerable groups, in particular migrants and people with disabilities. Non-Belgian citizens (both EU and non-EU) benefit less from activation measures than nationals do (HCE, 2018[23]). Yet, non-EU migrants tend to require more effective activation spending, as the incidence of long-term unemployment is significantly higher among that group, at 52% compared to 40.3% for natives (Figure 2.11, Panel B). Moreover, while labour market transitions out of employment and into inactivity increased for the whole population during the COVID-19 crisis, vulnerable groups were particularly affected: 29% of non-EU migrant workers and 21% of those with disabilities lost temporarily or permanently their job, compared to 14% and 15% of natives and people without disabilities, respectively (Lens, Marx and Mussche, 2020[47]).

The use of statistical profiling tools for delivering employment services should be expanded further in all three regions to target vulnerable groups. Public employment services increasingly complement rule- and caseworker-based profiling with statistical models to predict labour market disadvantage and classify job seekers into client groups for activation (Desiere, Langenbucher and Struyven, 2019[48]). Designing statistical tools to account for migrant or health status while respecting privacy regulations could facilitate the identification of those more at risk of long-term unemployment and, therefore, enable earlier stage interventions tailored more closely to individual needs. Evidence based on activation measures for the newly unemployed in Flanders shows that job seekers’ country of birth, together with their age and knowledge of the Dutch language, are strong predictors of the type of activation measures likely to accelerate return to employment (Boolens, Cockx and Lechner, 2020[49]). Existing machine learning-based models, such as Flanders’ NextBestSteps programme and the Walloon region’s assessment model of proximity to employment, should continue to be extended to develop tailor-made active labour market programmes for jobseekers.

On-the-job language training should be promoted, as knowledge of (at least one of the) national languages is essential not only for labour market integration, but also for participating in lifelong learning. Moreover, knowledge of one of the national languages likely reduces mismatches through faster labour market integration, as indirectly suggested by the fact that non-EU born immigrants are more likely to master a national language when in employment (HCE, 2018[23]). Belgian regional governments are increasingly investing in language training for migrants, like in many other countries (OECD, 2020[50]). Mandatory integration trajectories for migrants include language classes in Flanders, Wallonia and the German-speaking community, and the Brussels-Capital Region should proceed with plans to make the recently passed legislation regarding mandatory integration programmes effective without further delay.

Figure 2.11. Activation spending on training is low despite high long-term unemployment rates

Note: Panel B: share of long-term unemployment in total unemployment of population aged 20-64.

Source: OECD Statistics on Labour Market Programmes; and Eurostat Migrant Integration Statistics.

The effect of language training on labour market integration is stronger if linked with occupational language skills (OECD, 2021[51]). A larger share of active labour market spending could be allocated to on-the-job occupational language training. In Flanders, the public employment service’s Integratie door Werk (Integration through work) programme offers activation trajectories targeted to migrants that include Dutch classes at the workplace (HCE, 2018[23]). To implement and extend such measures, regional governments can draw from the experience of the Latvian State Employment Agency’s language mentorship programme for working refugees, which proved highly effective at helping migrants adapt to their working environment by providing vocation-specific language training on the job (OECD, 2020[50]).

Continuing to promote diversity and fight against discrimination is necessary to complement activation targeted at migrant populations. Labour market discrimination not only worsens employment gaps and contributes to wage gaps, but also decreases the effectiveness of activation measures (HCE, 2018[23]; FPS Employment/UNIA, 2019[27]; view.brussels, 2019[52]). Measures to protect witnesses in discrimination cases were recently added to an already robust anti-discrimination legislation at different levels of government. The 2018 federal law creating the possibility for social inspectors to prove discriminatory infringements through mystery calls or anonymous field tests is being made more flexible, as stringent conditions have strongly limited its use so far (UNIA, 2020[53]). Similar initiatives are being taken by regional governments. Moreover, legislation should be complemented with measures to support inclusive hiring practices, possibly building on available information on the origin composition of staff at the Crossroad Bank of Social Security to identify discrimination patterns and improve the design of anti-discrimination policies (UNIA, 2020[54]; view.brussels, 2019[52]). The federal government’s new measures regarding the monitoring of diversity in sectors are first steps in this direction.

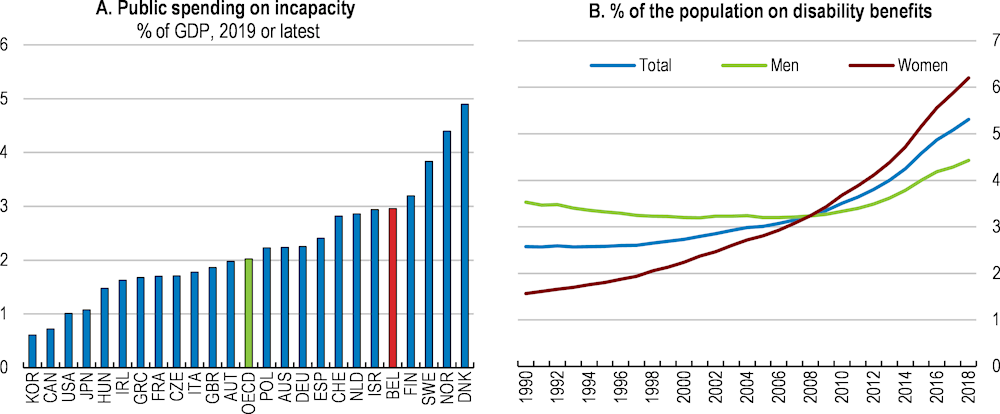

Disability benefit systems should balance protection with work incentives to reintegrate sick workers, while restricting unwarranted inflows into these schemes. Spending on incapacity (disability, sickness, occupational injury) at 3% of GDP in Belgium is higher than the OECD average of 2% (Figure 2.12, Panel A). The share of inactive people not seeking employment due to sickness and disability increased from 10.7% in 2007 to 18.4% in 2020, higher than the EU average of 12.3%. The share of disability recipients, especially for women, has increased (Figure 2.12, Panel B), partly due to the increase in the activity rate of women and the alignment of their statutory retirement age (Saks, 2017[55]), and partly due to the regularisation of previously undeclared workers under the service voucher scheme (Leduc and Tojerow, 2020[56]). The Budget 2022 plans to link funding to regions based on performance of reintegrating workers, introduce tools and incentives to combine partial work and benefits, tighten sanctions for employers and employees, and introduce a reintegration path 2.0, with a view to simplify and speed up the process of integration, including through the use of digital tools, which are welcome.

Early initiation of formal pathways to reintegrate sickness and disability beneficiaries into work should be prioritised. A formal integration procedure was introduced in 2016 to supplement the existing informal pathways, which included a voluntary medical visit with the occupational doctor or the mandatory return to work examination for workers under mandatory medical surveillance. The formal procedure requires mutuality doctors to assess the reintegration possibilities within the first two months of sickness absence. Employers and employees find the formal reintegration procedures to be administratively cumbersome, slow and not individualised and flexible enough. The employee can request formal reintegration anytime during the sick leave and the employer four months after the start of the incapacity, but participation in such formal pathways remains limited. Moreover, 40% of those on formal pathways wait at least one year for their first contact with the occupational physician, compared to 25% for the informal pathways and only 42% return to work (often with another employer), lower than that for informal ones (73%) (Boets et al., 2020[57]).

New reforms aimed to improve policy coordination and data collection to tailor policies to individual needs and track people through the different steps are welcome. Until recently, while some support measures existed for workers deemed unfit to return to their job, this was not systematic and data were not collected for their situation after the dismissal (Lopez-Uroz, Westhoff and Akgüç, 2021[58]). In January 2022, the return-to-work coordination plan created a return-to-work coordinator as employees of mutualities. The coordinator will enable a systematic approach to interact with the employees applying for sickness benefit early and guide them to create a tailor-made path back to work that meets the needs and competences of the person, and the collection of data and data exchange with regional public employment services will help. It will be important to evaluate the effects of this recent reform. Other OECD countries, such as Finland use “one-stop-shops”, which bring together public employment services, social and health care services, services of the national insurance agency and subcontracted professional experts, with a non-hierarchical partnership of actors from different levels of government (OECD, 2021[59]).

Incentives to participate in activation programmes should be strengthened. Workers unfit to return to their previous employment need to reskill, but participation in lifelong learning for those with disabilities at 10.8% in Belgium is lower than the EU average of 18.7%. One pathway for return to work is the vocational rehabilitation, which includes financial incentives for participation. Participants continue to receive their benefits and are paid for each hour of training plus a lump-sum payment of EUR 500 at the end of the training. However, participants can lose their entitlement to disability benefits within six months of the training, which can act as a disincentive. This rule should be removed and beneficiaries encouraged to participate in rigorously evaluated activation programmes.

Figure 2.12. There is a need to reform disability and sickness benefits

Note: Panel A: public spending on incapacity refers to spending due to sickness, disability and occupational injury; both benefits in cash and in kind are included. Panel B: population aged 15-64.

Source: OECD (2022), Social Expenditure database; National Institute for Sickness and Disability Insurance; and World Bank.

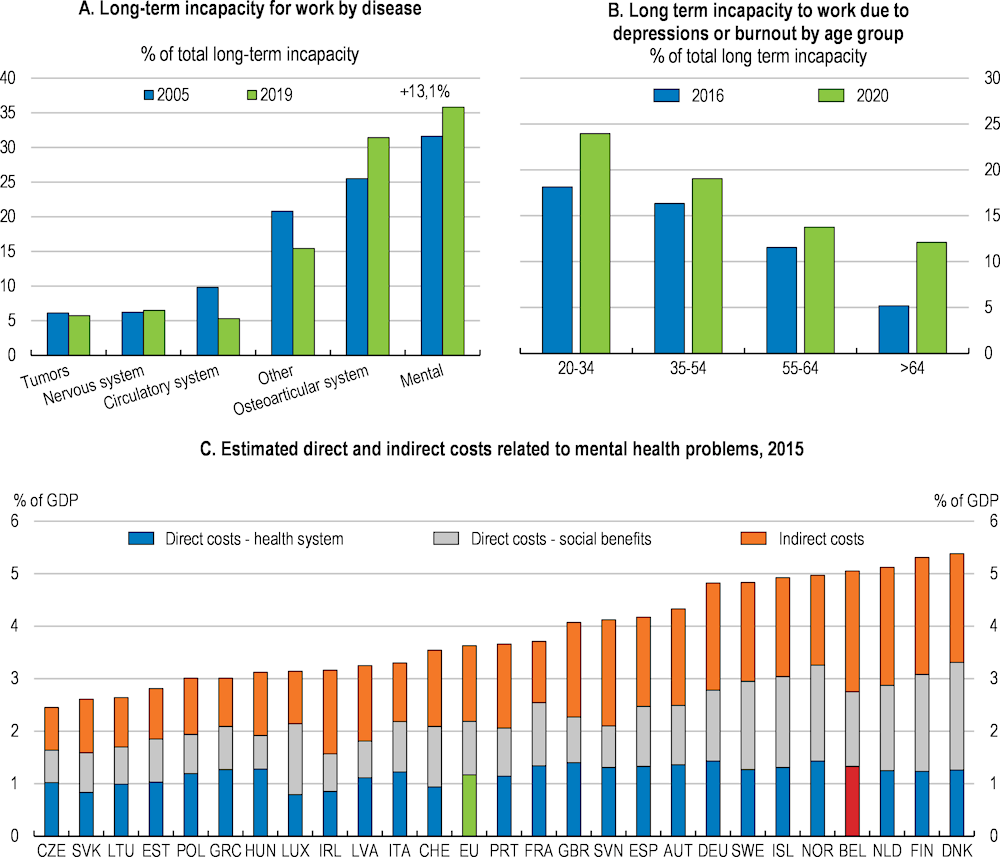

In Belgium, as in other countries, employee absence due to mental illness is rising. In 2019, 36% of those on invalidity benefits had mental-related issues (FPB, 2021[60]), especially among the youth (Figure 2.13, Panels A and B) and single mothers. The direct (health and benefits) and indirect costs (reduced participation and productivity) of mental health problems are 5.3% of GDP in Belgium, compared to the EU average of 3.6% (Figure 2.13, Panel C; OECD, (2021[61]). The pandemic can exacerbate these trends as the share of adults experiencing anxiety doubled in April 2020 from a year ago (OECD, 2020[62]) and stabilised at a higher level since (FPB, 2022[63]) (Sciensano, 2021[64]). Mental health has appropriately became a focus of the policy agenda of all levels of government (CSS, 2021[65]).

Beyond preventive measures, better integration of employment and mental health services and broader steps to identify people with mental health issues early are key. Reforming the disability benefit systems, as discussed above, will help. However, 50% of those persons with mental health conditions who receive benefits were on unemployment benefits in the mid-2010s (OECD, 2021[66]). Several evaluations highlighted the need to improve the continuity of care between services (health, mental health, social) as a priority in the organisation of mental health care for adults in Belgium (Devos et al., 2019[67]; Mistiaen et al., 2019[68]). According to a new benchmarking of mental health care systems, systematic inclusion of employment outcomes in mental health service delivery, or mental health outcomes in employment support services is lacking in Belgium (OECD, 2021[61]).

Individual placement and support (IPS) programmes, which are evidence-based practices where multidisciplinary mental health teams, including an employment specialist, provide co-ordinated health and employment support for jobseekers could be further used. Belgium has pilot IPS programmes for people suffering from mental health issues since 2017, which follows the “place-then-train” model, focusing on helping people to get a job rapidly. IPS programmes have resulted in positive employment outcomes in Australia and Denmark (OECD, 2021[66]). Dependent on the evaluations, which will be fully completed by 2023, such programmes should be scaled up. The design should ensure to address funding and implementation challenges of scaling up, based on international best practices (OECD, 2021[59]). For example, it will be important to complement the program’s focus on transitions into employment with measures to sustain jobs and enable career progression.

Figure 2.13. The prevalence of mental health issues is on the rise

Source: Federal Planning Bureau; National Institute for Sickness and Disability Insurance; and OECD/European Union (2018), Health at a glance: State of health in the EU cycle.

Strengthening work incentives for low-income single parents and second earners

Labour tax and benefit systems have important effects on income mobility, as they alter labour market participation and cushion the impact of adverse labour market transitions, e.g., into unemployment (OECD, 2018[1]). To foster social mobility without creating economic insecurity, taxes and benefits need to strike the right balance between maintaining strong labour market participation incentives and providing effective protection against labour income losses. Moreover, to ensure equality of opportunity on the labour market, tax and benefit systems need to be free of implicit biases against specific groups due to the different socio-economic realities they face, e.g., women due to gender gaps in labour market participation and income (Harding, Perez-Navarro and Simon, 2020[69]).

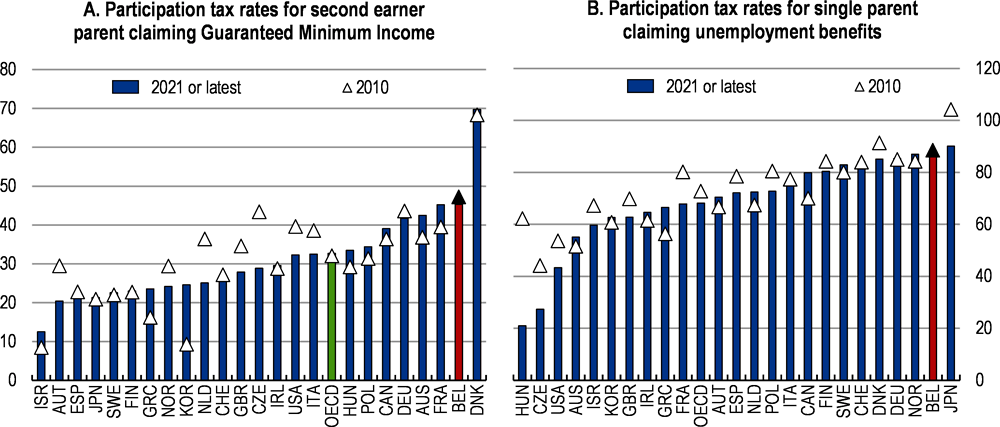

Belgium combines high replacement rates for the unemployed with strong work disincentives, in particular for formerly low-paid workers (Hijzen and Salvatori, 2020[70]), as explored in depth in the 2020 Economic Survey of Belgium. Belgium ranks among the countries where tax and transfers have a greater impact in cushioning large market income losses, together with France and most Nordic countries (OECD, 2018[1]). Despite the federal government’s intention to continue reforms to increase work incentives for low-earners (Box 2.4 above), participation tax rates (the share of additional earnings from work that is lost due to reduced benefits and increased taxes for workers with low wage) remain high for some groups (Adalet McGowan et al., 2020[24]; OECD, 2020[71]).

Participation tax rates for low-income single parents and second earners with children are among the highest in the OECD and should be reduced. In 2021, the participation tax rate was 45.3% for second earners claiming guaranteed minimum income, higher than the OECD average of 32.7% (Figure 2.14, Panel A). The federal government increased the tax advantage for childcare in 2020. Further measures to increase work incentives should address the case of second earners to achieve the federal government’s employment targets for specific groups at lower fiscal cost, in particular women. The partial splitting system for couples, which decreases the household overall labour income tax under progressive taxation by allowing a notional amount of income to be transferred between spouses if one earns 30% or less of the total family income, should be reduced or abolished, as it typically disincentives second earners’ participation in the labour market. In-work benefits would offset the accompanying increase in average labour taxation for low-income households (see below).

Figure 2.14. Low-income parents face weak work incentives

Note: participation tax rate expressed as a share of gross earnings in a new job that pays 67% of average wage, for households with two children, without temporary in-work or social assistance benefits. Panel A: first earner income is 67% of average wage. Panel B: participation tax rate after 6 months in unemployment and including housing benefits.

Source: OECD Social Protection and Well-Being Database.

Targeted improvements in work incentives should make work pay for single parents, who face a participation tax rate of 84.8% when claiming unemployment benefits, higher than the OECD average of 68.1% (Figure 2.14, Panel B). Introducing in-work benefits would support return to employment and avoid long-term benefit dependency. Such emphasis towards supporting those in work is common across OECD countries, including France (Prime d’activité) and the United States (Earned Income Tax Credit). Another option is to let low earners cumulate unemployment benefits and income from work, building on the existing scheme for part-time workers, as with the federal government’s planned reform for the long-term unemployed who take up a job across the linguistic border or fill a hard-to-fill vacancy. Effective targeting will be key to limit fiscal costs.

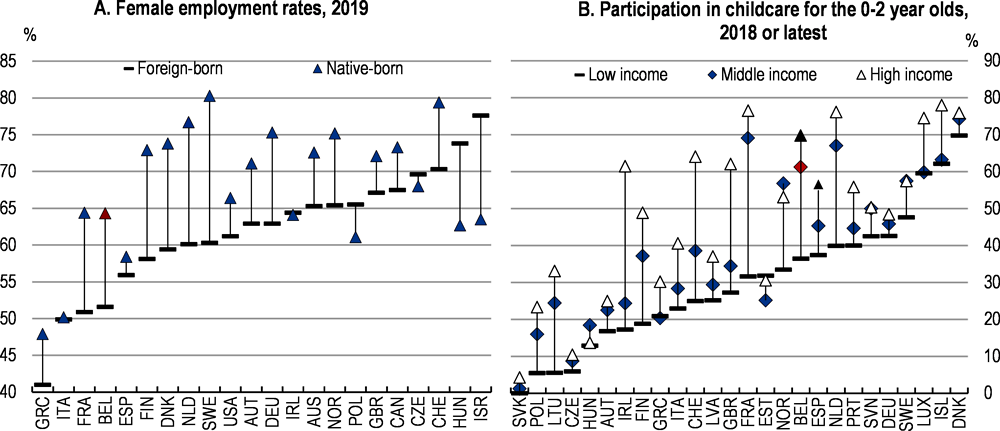

Boosting childcare access for 0-2 year-old children from low-income households would also help decrease participation tax rates for single parents and strengthen women’s work incentives, especially migrants. Enrolment in early childhood education and care for children aged three and older is almost universal in Belgium, and enrolment at 60% for children under three years old is still high (OECD, 2020[9]). However, uptake among migrant populations is relatively low despite high availability and moderate cost of formal childcare, which is reflected in large employment gaps for migrant women (Biegel, Wood and Neels, 2021[72]). There is a quasi-13 percent point gap between the employment rate of native women and that of migrants (Figure 2.15, Panel A). At the same time, almost 70% of 0-2 year-old children from high-income households participate in childcare in Belgium, but only 36.4% of those from low-income households, which are disproportionately households with a migrant background (Figure 2.15, Panel B).The provision of early childhood education and care for children below three should be increased, as recommended in the 2020 Economic Survey of Belgium. Outreach measures should target migrant households and address both cultural norms and the lack of knowledge of the childcare system.

Figure 2.15. Migrant women’s childcare responsibilities contribute to weak employment outcomes

Note: Panel A: employment rates of foreign born and native women, percent of population. Panel B: participation in centre-based care (e.g. nurseries or day care centres and preschools, both public and private), organised family day care or care services provided by (paid) professional childminders; income levels based on children's position in the national distribution of disposable income; low, middle and high income refers to the first three, middle four and upper three deciles, respectively.

Source: OECD International Migration Statistics; and OECD (2020), Is childcare affordable?

Measures to promote childcare among low-income households should be coupled with targeted activation measures, in particular language training in the case of migrant mothers, building on existing initiatives, such as Actiris’ Maison d’Enfants and the coordination of childcare structure network. While current practices prioritise working parents in case of scarcity in subsidised childcare facilities, actual utilisation can be below full capacity, e.g., due to sick children. Unused capacity leaves room for children from vulnerable households to attend while their parent participates in activation-based training. Such measures combining childcare and activation would help address the issue of parents, in particular migrants, being unable to attend training because of childcare responsibilities. Coordination between public employment services and public childcare organisers is required to forecast actual utilisation of childcare facilities and allocate the children of trainees accordingly.

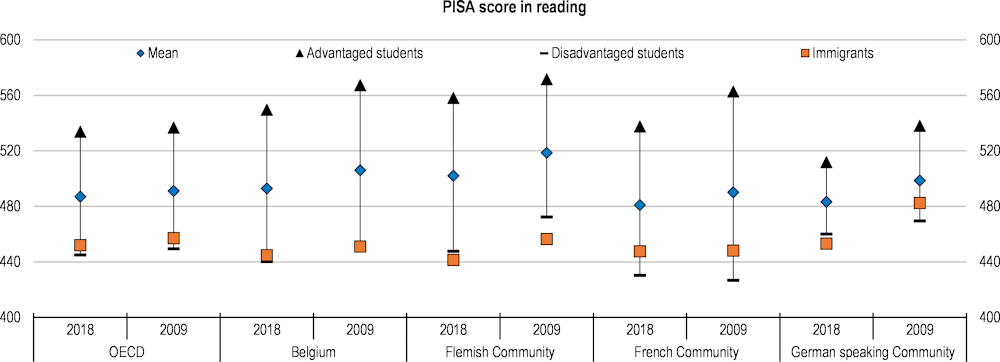

Enhancing equal opportunities in compulsory education

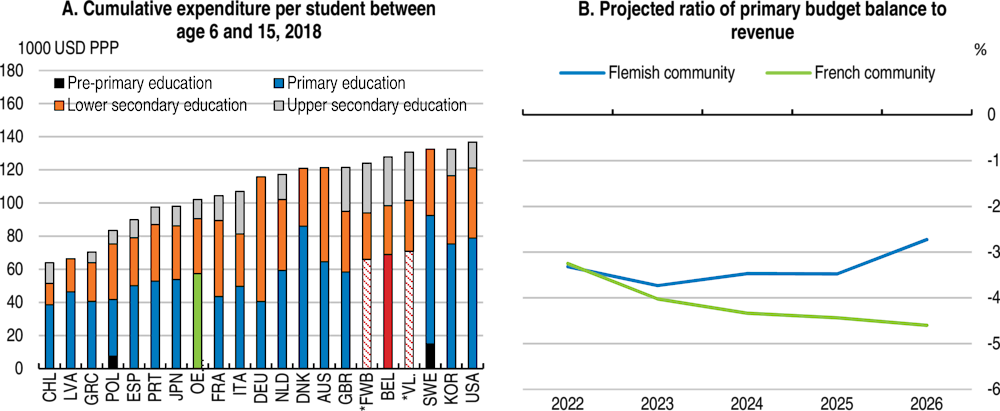

Belgian students’ overall academic performance is around the OECD average and at par with neighbouring countries, but displays large disparities between students. Performance varies between the three communities (the level of government at which education is organised in Belgium (see Box 2.6 and OECD (2017[73]) for details), with performance high but declining in the Flemish Community, relatively low in the French Community, and in-between in the German speaking Community. However, disparities in performance associated with parental background are substantially larger than differences between the communities. Both the Flemish Community and the French Community are characterised by relatively high socio-economic determination of educational outcomes, as reflected in large test score gaps associated with socio-economic status (Figure 2.16). According to the 2018 PISA results, the gap in reading performance between students in the top quarter of Economic, Social and Cultural Status (ESCS) index and those in the bottom is equivalent to more than three years of schooling, the fifth largest gap in the OECD (OECD, 2019[74]).

A number of other indicators highlight the importance of the correlation between student socio-economic background and performance. 17.2% of the variance in reading performance is explained by parental background, the fifth highest value in the OECD and well above the average value of 12% (OECD, 2019[74]). Only 9% of Belgian students are “academically resilient”, that is, score in the top quarter of performance in reading while belonging to the bottom quarter of ESCS, the fourth lowest share in the OECD (OECD, 2019[74]). Disruptions to in-person education due to the COVID-19 pandemic have likely worsened the socio-economic gap in performance due to differences in access to remote learning tools: 84% of Belgian disadvantaged students have access to a computer for schoolwork compared to 98% of advantaged students (OECD, 2021[75]). Against this backdrop, the communities rightly implemented measures targeting students at risk of exclusion from distance education platforms, including special efforts to make online learning more accessible to migrant children in the French Community (OECD, 2021[76]).

Figure 2.16. Belgian students’ good overall performance hides large disparities

Note: Immigrants are students whose mother and father were born in a country other than that where the PISA test was taken.

Source: OECD PISA database.

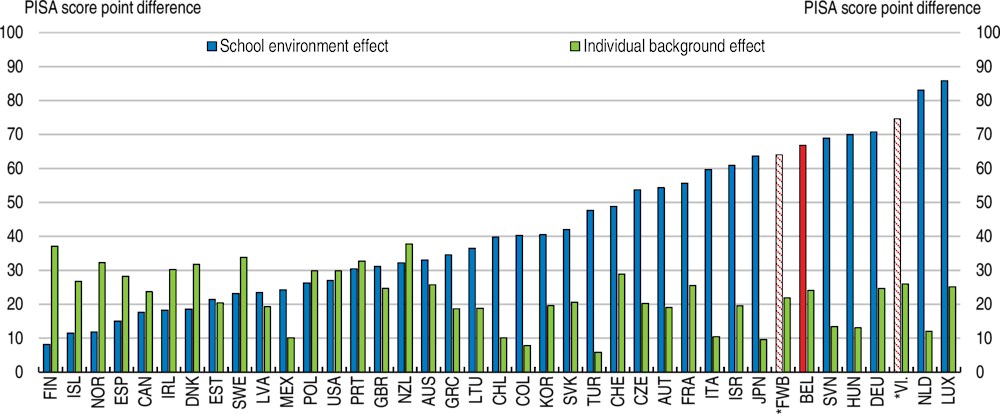

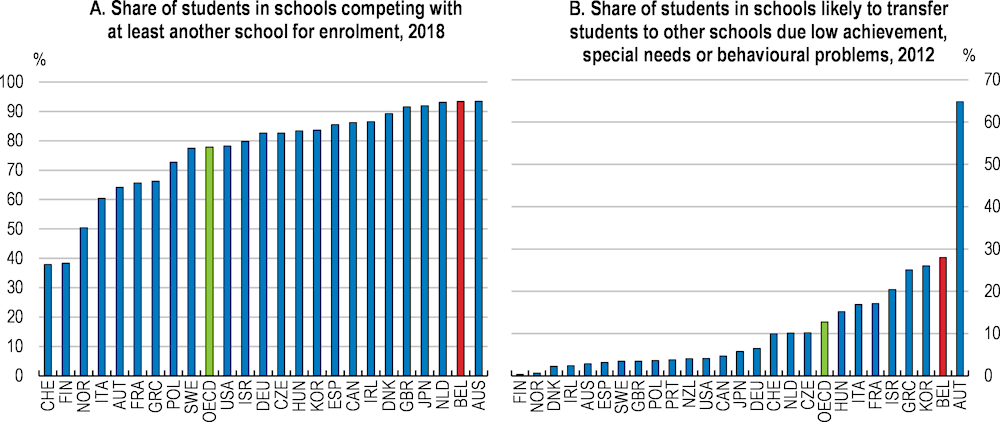

Disparities in the academic performance between advantaged and disadvantaged students are reflected in large differences between schools and programmes to the extent that students’ (effectively their parents’) free choice of school depends too heavily on their socio-economic background. Spatial segregation exacerbates differences between schools, as students are more likely to choose a nearby school. Sorting by socio-economic status across schools is generally negatively related to equity in education (Figure 2.17, Panel A; and (OECD, 2019[74]). Differences between schools reflect a cumulative process of both social and academic selection (Nicaise, 2019[77]). Initial self-sorting along socio-economic lines leads to unequal performance at school due to a variety of mechanisms, e.g., peer group effects or teachers having lower expectations for disadvantaged students (Nicaise, 2019[77]). Disparities in performance then widen due to the process of academic segregation, i.e., students are placed on different learning tracks based on previous achievement, so that social and academic segregation are mutually reinforcing.

Tracking along academic performance, itself strongly determined by socio-economic background, is a key driver of social inequality in Belgian education systems (Hindriks and Godin, 2018[78]; De Witte and Hindriks, 2018[79]). For example, in Belgium more than in the OECD, disadvantaged students in advantaged schools perform better than advantaged students in disadvantaged schools (Figure 2.17, Panel B). Moreover, disparities in terms of social mobility at school appear between tracks and types of education provider. For example, it is higher in vocational tracks than in general education in both the French Community and the German speaking Community (Hindriks and Godin, 2018[78]).

The process of academic and social selection explains the strong influence of school background on performance. For example, almost half of the variation in Belgian students’ performance in mathematics is explained by the school they attend, largely above the OECD’s average of one third (Figure 2.17, Panel C). In all three communities, schools’ average socio-economic environment is even more important than parental background, in the sense that students’ academic performance is more influenced by the average socio-economic status of parents of other students in the same school than by their own parents’ socio-economic status (Box 2.7). Attending a school where students are from more advantaged socio-economic backgrounds is associated with better test scores in all OECD countries, but the effect is particularly strong in Belgium.

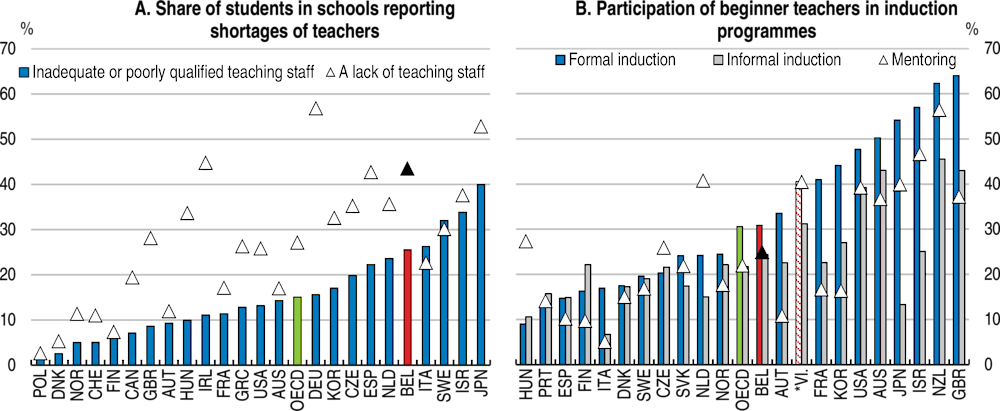

Figure 2.17. School environment strongly influences academic performance