Several regulations that apply to both civil aviation and ports sectors pose challenges to competition. These norms are related to public procurement and procedures for foreign firms to operate in Brazil. This chapter makes recommendations for reform.

OECD Competition Assessment Reviews: Brazil

4. Horizontal findings on the civil aviation and ports sectors

Abstract

Further to the examination of legislation that deals specifically with the civil-aviation and ports sectors presented in Chapters 2 and 3, this chapter covers the barriers identified in horizontal legislation that applies across both sectors. In particular, this chapter covers issues related to:

regulatory simplification

authorisation for foreign companies to operate in Brazil

bids and public contracts.

4.1. Regulatory simplification

4.1.1. Description of the obstacle

The regulations reviewed in this project are often scattered across legal texts and sometimes repeated in different pieces of legislation. To determine the applicable rules, businesses need to identify the relevant provisions in each separate text, and understand how these provisions interact with each other. New legislation does not always explicitly repeal previous provisions. For example, the Brazilian Aeronautical Code, which gathers legislation applicable to the civil-aviation sector, contains several obsolete or superseded, but not explicitly repealed, provisions.1 The recently enacted Law No. 14.368/2022 has explicitly repealed most of these obsolete or superseded provisions. Other provisions identified by the OECD team as obsolete are available in a separate Excel spreadsheet available on our dedicated website.

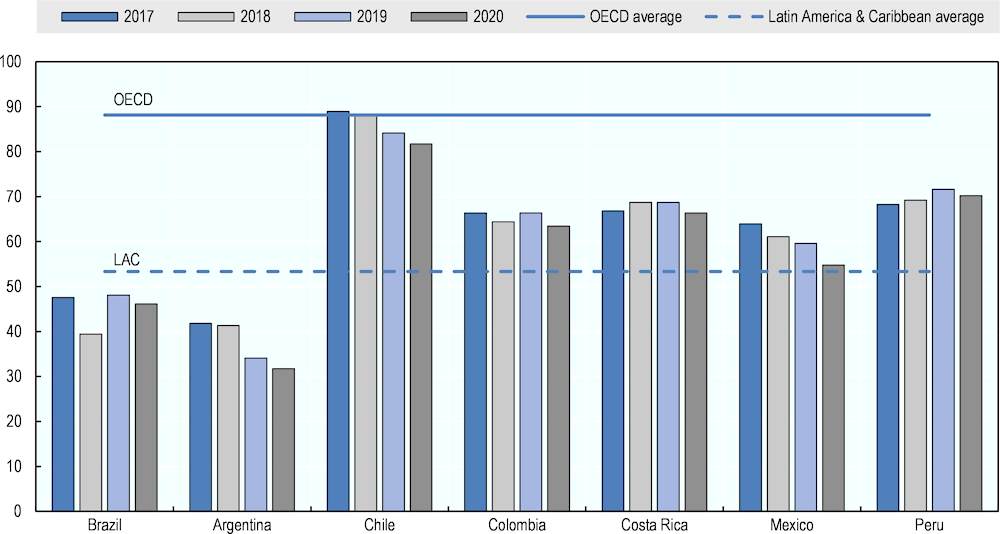

Shortcomings in regulatory quality are reflected in Brazil’s score in the World Bank’s Worldwide Governance Indicator (Figure 4.1). This estimate of regulatory quality captures the perception of a government’s ability to formulate and implement sound policies and regulations that permit and promote private‑sector development. Brazil scores below the average for Latin America and Caribbean.

Figure 4.1. World Bank Governance Indicator regulatory quality percentile ranking, 2017‑20

Note: The percentile rank ranges from 0 (lowest) to 100 (highest). The solid line is the average percentile rank of OECD countries (88) and the dashed line the average percentile rank of the Latin America & Caribbean (LAC) countries (53).

Source: World Bank Worldwide Governance Indicators, http://info.worldbank.org/governance/wgi

The Brazilian Government has recently made certain regulatory improvements. Since 2019, it has implemented a programme that aim to revise and consolidate regulations, including explicitly abolishing obsolete provisions, removing inconsistencies and ambiguities, simplifying legal drafting, and harmonising terms. These efforts have seen more than 74 000 regulations reviewed by 79 public bodies, and around 31 500 regulations being revoked (Secretaria Geral da Presidência da República, 2022[1]). In addition, a public Legislative Portal is available; this legal database includes consolidated versions of all texts of laws, including their respective subsequent amendments.2

Nevertheless, the OECD’s analysis has shown that the problem of obsolete legislation persists.

4.1.2. Harm to competition

The difficulty in identifying applicable legislation in force, in particular due to the existence of obsolete or superseded provisions, can act as a regulatory barrier to entry. It creates legal uncertainty, and so potentially raises regulatory and legal compliance costs for market players.

By contrast, a clear and easily accessible regulatory framework is essential for new entrants not necessarily familiar with the national legal framework, and for small businesses, for which compliance costs and administrative burdens are relatively more important than for larger companies.

4.1.3. International comparison

The transparent development and implementation of regulations is one of the key tenets of regulatory quality (see Box 4.1). Transparency and accountability to the public are among the requirements for the sound governance of regulators (OECD, 2014[2]), as transparency enhances accountability and confidence in the regulator. In addition, clarity helps regulated firms understand regulators’ policies and expectations, and anticipate how these will be monitored and enforced.

Box 4.1. What is regulatory quality?

Regulations are the rules that govern the everyday life of businesses and citizens. They are essential but they can also be costly in both economic and social terms. In that context, “regulatory quality” is about enhancing the performance, cost effectiveness and legal quality of regulatory and administrative formalities. The notion of regulatory quality covers process – the way regulations are developed and enforced – which should follow the key principles of consultation, transparency and accountability, and be evidence‑based. The concept of regulatory quality also looks at outcomes to understand if regulations are effective at achieving their objectives, efficient (do not impose unnecessary costs), coherent (when considered within the full regulatory regime), and simple (regulations themselves and the rules for their implementation are clear and easy to understand for users).

Building and expanding on the OECD Recommendation of the Council on Improving the Quality of Government Regulation, adopted in 1995, regulatory quality can be defined as regulations that:

1. serve clearly identified policy goals, and are effective in achieving those goals

2. are clear, simple, and practical for users

3. have a sound legal and empirical basis

4. are consistent with other regulations and policies

5. produce benefits that justify costs, considering the distribution of effects across society and taking economic, environmental and social effects into account

6. are implemented in a fair, transparent and proportionate way

7. minimise costs and market distortions

8. promote innovation through market incentives and goal-based approaches

9. are compatible as far as possible with competition, trade and investment-facilitating principles at domestic and international levels.

Source: (OECD, 2015, pp. 23-24[3]).

To improve regulatory quality, the OECD recognises the need for governments to undertake a comprehensive programme that includes systematically reviewing existing regulations to ensure their efficiency and effectiveness, and to lower the regulatory costs for citizens and businesses (OECD, 2012[4]).3

Recommendation

The OECD recommends that superseded legislation is explicitly abolished. In the longer term, consolidated versions of laws in force should always be made publicly available.

4.2. Authorisation for foreign companies to operate in Brazil

4.2.1. Description of the obstacle and policy makers’ objective

A foreign firm wishing to operate in Brazil through a branch must obtain prior authorisation from the federal government,4 through the National Department of Business Registration and Integration (Departamento Nacional de Registro Empresarial e Integração, DREI), which is part of the Ministry of Economy.5 Similarly, changes in a foreign company’s bylaws must be approved by DREI to be effective in Brazil.6 Obtaining such an authorisation requires a formal, registration-like procedure, even if DREI checks only whether the foreign company has submitted all the required documents listed in the legislation7 and makes no substantial analysis of the company’s future operations in Brazil.

After obtaining DREI-issued authorisation, a foreign firm must then submit certain of the same documents to the Board of Trade,8 which carries out its own formal analysis, to ensure that all documents necessary for registration have been submitted.9 A Board of Trade registration is a requirement for all companies in Brazil (including a branch or an agency), whether national or foreign.

Following a 2019 reform aimed at simplifying the authorisation procedure,10 foreign businesses can now request the authorisation online through the Federal Government Service Portal.11 Furthermore, pursuant to Normative Instruction No. 82/2021, it is possible to obtain digital authentication of corporate documents by national commerce registries, further simplifying the procedure for foreign enterprises. These changes have substantially reduced the time required to issue such an authorisation (from 45 to 3 days). Finally, Law No. 14.368/2022 has recently amended Article 225 of Law No. 7.565/1986 (Brazilian Aeronautical Code), establishing that foreign air carriers no longer need to obtain the aforementioned authorisation from DREI to operate in Brazil.

When assessing how Brazil scores in the OECD Foreign Direct Investment (FDI) Regulatory Restrictiveness Index, the air and maritime sectors do not have any restrictions for screening and prior-approval requirements (Table 4.1).

Table 4.1. Screening and prior approval requirements, OECD FDI Regulatory Restrictiveness Index, 2020

|

Country |

Maritime |

Air |

All sectors |

|---|---|---|---|

|

Brazil |

0.000 |

0.000 |

0.009 |

|

Argentina |

0.000 |

0.000 |

0.000 |

|

Chile |

0.000 |

0.000 |

0.000 |

|

Colombia |

0.000 |

0.000 |

0.000 |

|

Costa Rica |

0.000 |

0.000 |

0.000 |

|

Mexico |

0.100 |

0.100 |

0.100 |

|

Peru |

0.000 |

0.000 |

0.000 |

|

OECD countries |

0.021 |

0.021 |

0.015 |

Note: Index scale 0 to 1, with 1 being the most restrictive. Screening mechanisms applicable only to foreign investors. At their most restrictive, they may apply economic needs, net economic benefit or national interest tests to both start-ups and acquisitions. In other cases, they are automatic and amount to little more than a pre‑notification requirement for investors (OECD, 2010[5]).

Source: OECD, https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX#.

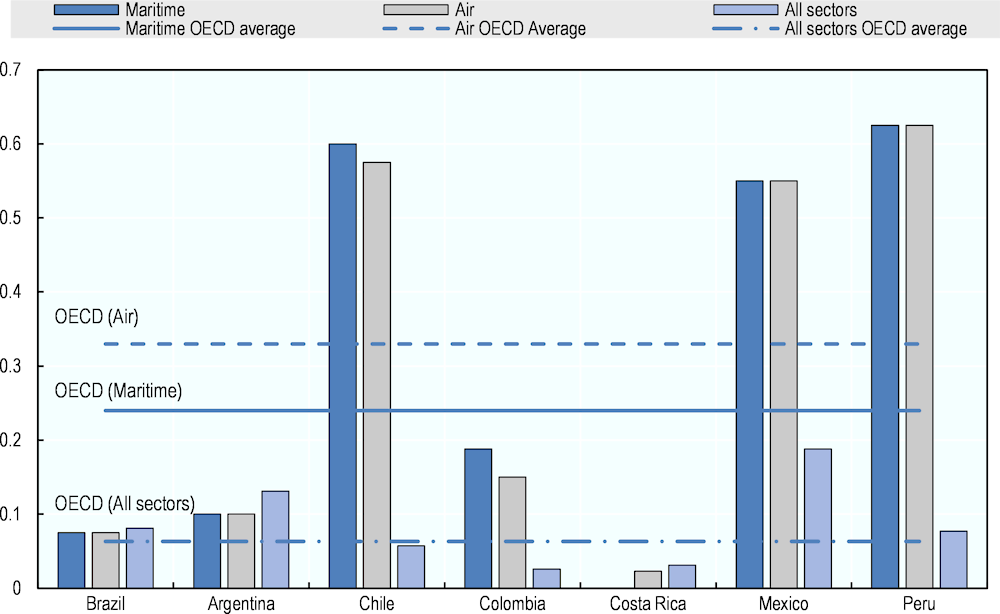

The OECD FDI Regulatory Restrictiveness Index measures four types of statutory restrictions on foreign direct investment; these are 1) foreign equity restrictions; 2) screening and prior-approval requirements; 3) rules for key personnel; and 4) other restrictions on the operation of foreign enterprises. For these, Brazil also scores below the OECD average and that of other neighbouring countries, especially in the air and maritime sectors, which means that Brazil is more open to foreign investors than these reference countries, except Costa Rica (Figure 4.2).

Figure 4.2. Restrictions, all types, OECD FDI Regulatory Restrictiveness Index, 2020

Note: Index scale 0 to 1, with 1 being the most restrictive. The horizontal lines correspond to the average of all OECD countries for maritime (0.24), air (0.33) and all sectors (0.06).

Source: OECD, https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX#.

Although there is no official recital of the objective of these provisions, the OECD team assumes that they are aimed at ensuring that foreign companies can only operate in Brazil if they comply with national legislation, such as corporate, tax and labour law. However, as previously mentioned, with no substantial assessment of requests, it appears that the provision cannot ensure that the policy objective is achieved. According to DREI, in the past, these provisions also enabled the government to keep track of all foreign companies entering the Brazilian market.

4.2.2. Harm to competition

There are currently two similar procedures intended to achieve the same objective of keeping a register of foreign firms operating in Brazil. Although these procedures are simple and usually fast, they nevertheless constitute an additional burden and may discourage foreign companies from entering the Brazilian market.

More generally, requiring foreign firms to obtain prior authorisation and the complexity of the procedure to open a branch in Brazil increase entry costs.12 This is confirmed by many companies choosing to incorporate a separate company in Brazil to establish their presence.13 However, this alternative solution also involves costs, as it requires establishing a distinct entity from the parent company and adopting one of the corporate types available in Brazil.

Recommendation

The OECD recommends that Brazilian authorities consider abolishing the need for prior authorisation for a foreign company to operate in Brazil and requiring only the registration of corporate documents with the Board of Trade.

4.3. Bids and public contracts

Most of the horizontal restrictions found by the OECD throughout the assessment relate to bids and public contracts. This section covers only those barriers that are particularly relevant to the civil aviation and ports sectors. The OECD Report Fighting Bid Rigging in Brazil: A Review of Federal Public Procurement (OECD, 2021[6]) includes a broader assessment of public procurement in Brazil (See Box 4.2).

Box 4.2. OECD Report: Fighting Bid Rigging in Brazil: A Review of Federal Public Procurement

In 2020, the Brazilian Competition Authority (CADE) invited the OECD to assess the Brazilian public-procurement framework in light of the OECD Recommendation and Guidelines for Fighting Bid Rigging in Public Procurement. During the process, the OECD assessed the main rules governing public procurement in Brazil at the federal level, as well as procurement practices of major federal procurers. The OECD’s assessment was presented in a report released in 2021.

The key recommendations to improve competition in public procurement included:

1. recognise and enhance the essential role of public-procurement officials in the fight against bid rigging

2. design procurement procedures based upon appropriate information

3. maximise participation of genuine competing bidders

4. improve tender terms and contract-award criteria

5. pay attention to transparency, disclosure and integrity in submitting bids

6. raise awareness of the risks of bid rigging

7. detect and punish collusive agreements.

Source: (OECD, 2021[6]).

4.3.1. Economic and financial burdens

Description of the obstacle and policy makers’ objective

In Brazil, the 1993 and 2021 procurement acts14 and other legal frameworks15 enable procurement authorities to request a multiplicity of economic and financial guarantees from bidders, including minimum capital, performance guarantees, and bid bonds.

Minimum-capital requirements are tools to ensure the solvency of the firms participating in a tender. Law No. 8.666/1993 allows for participation in a tender to be restricted to businesses with a certain minimum capital. More specifically, these frameworks provide that procurement authorities may require a minimum capital or minimum equity equivalent of up to 10% of the contract’s estimated value.16

Performance guarantees ensure that the contractor will perform its obligations under the terms and conditions laid down in the contract. In Brazil, procurement authorities can demand performance guarantees from bidders. These include cash bonds and public-debt securities, as well as warranties issued by banks or insurance companies to ensure compensation to the procurement authority if the contracting party fails to fulfil the object of the contract. According to both procurement acts,17 performance guarantees may be required at the discretion of the procurement authorities, although certain limitations are established in the legislation.18

Bid bonds are tools used at the tender stage to ensure that the bidder accepts the contract under the terms proposed in the bid and follows through on its bid. In Brazil, bid bonds should not be more than 1% of the estimated value of the contract, although in some specific cases the procurement authority may require bid bonds up to 5% of the estimated value of the contract.19

While bid bonds and performance guarantees aim to give some leverage to the procurement authorities in order to ensure the fulfilment of the bid and the contract respectively, minimum-capital requirements are intended to ensure that firms have sufficient economic and financial capacity.

Harm to competition

Many tenders related to airport concessions and port leases demand bidders provide performance guarantees, minimum capital, and bid bonds. In certain circumstances, these requirements appear reasonable to avoid public authorities bearing financial losses during the bidding phase and the contract; however, requiring all three obligations with similar public objectives could be burdensome in tenders that do not involve particularly complex, specialised or costly products or services. They might significantly raise entry costs, and so potentially restrict the number of participants in the public tender. In such cases, bid bonds could be especially burdensome and could be sufficiently replaced by minimum-capital requirements coupled with the possibility of awarding the tender to the second-best bidder in cases where the winning bidder fails to sign the contract under the terms proposed in the bid.

Recommendation

The OECD recommends that Brazilian authorities limit the economic and financial guarantees required to participate in public tenders in order to decrease the financial and economic burdens on bidders and increase the number of participants in the public tender. This could be done by ensuring requirements are the lowest possible, limited to cases where the signing and performance of the contracts present serious risk, and based on objective and proportionate criteria.

4.3.2. Prequalification

Description of the obstacle and policy makers’ objective

The public-procurement regime in Brazil enables procurement authorities to include a bidders’ prequalification stage in the tender.20 Prequalification is a pre‑bid selection procedure aimed at assessing all or some of the qualifications of interested parties and whether the offered good or service meets the tender authority’s technical or quality requirements (Justen Filho, 2011[8]). This administrative phase is laid out in the public notice.

A prequalification stage is often included when there is a need to assess thoroughly firms’ technical qualifications for large‑scale works or services with a high degree of complexity (Torres Pereira Júnior, 2003[8]). For complex contracts that demand costly preparation, the restriction of participation only to players with high levels of specialisation can make the tender more attractive as it increases the chances for the pre‑qualified firm to win the bid (OECD, 2021[6]).

Harm to competition

Publishing the list of pre‑qualified bidders21 makes it easier for participants to communicate with each other, increasing the risk of bid rigging. The Annex to the OECD Recommendation on Fighting Bid Rigging in Public Procurement highlights the risk of collusive practices among pre‑qualified groups, and recommends, to the greatest possible extent, that bidders qualify during the procurement process in order to increase the level of uncertainty among firms as to the number and identify of bidders. CADE’s investigations have also confirmed the seriousness of this risk. For example, in 2015, CADE opened an investigation concerning an alleged bid-rigging scheme in a tender by Eletrobras Eletronuclear for work at its Angra 3 nuclear-power plant. The bid had a prequalification phase, in which the two pre‑qualified consortia allegedly conspired to fix prices and share the bid’s lots (Conselho Administrativo de Defesa Econômica, 2015[9]).

Recommendations

The OECD has three recommendations.

1. Brazilian authorities should ensure that the use of prequalification does not unduly limit participation, in particular when more bidders could meet the tender requirements and so limiting the number of offers does not make sense.

2. Introducing market studies would be a valuable tool in assessing the status of the supply market.

3. Procurement entities should ensure the confidentiality of pre‑qualified bidders’ identities, at least until a certain time after the conclusion of the tender, or anonymise bidder information.

4.3.3. Necessity of certified translations and consulate‑authenticated documents for companies not operating in Brazil

Description of the obstacle and policy makers’ objective

Law No. 8.666/1993 requires foreign companies not active in Brazil wishing to bid in a public tender to present documents authenticated by their respective consulate and translated by a certified translator.22

The requirement of certified translation and authentication by a consulate aims to ensure that foreign documents can be properly assessed by the procurement authority.

The new Law No. 14.133/2021 does not lay down any similar requirements and provides for a more flexible solution, as it states that foreign companies not operating in Brazil will have to submit the equivalent documents required from firms operating in the country. A secondary legislation should be issued by the Federal Government defining the necessary documents foreign companies not operating in Brazil will have to submit.23 Nevertheless, certified translations and authentications appear still to be demanded.

Harm to competition

Complying with all these formalities makes foreign companies’ bid preparation more costly and complex, which can be particularly challenging when tender deadlines are tight. These requirements may restrict (or at least reduce incentives for) foreign companies to participate in bidding processes, reducing competition and possibly leading to higher prices or lower quality.

The burdensome nature of this requirement is also confirmed by a recent normative intervention. The Federal Government enacted Normative Instruction No. 10 of 10 February 2020, permitting foreign companies to present non-certified translations to participate in the bids. Only winning bidders are then required to submit documents authenticated by their respective consulate and translated by a certified translator. Normative Instruction No. 10/2020 does not, however, apply to the most relevant cases in the civil aviation and ports sectors (such as concession and lease auctions) as it refers only to bids placed through the Unified Suppliers Registration System (Sistema de Cadastramento Unificado de Fornecedores, SICAF), an electronic registry of suppliers for public purchases (Federal Executive Branch, 2022[10]). SICAF is only used for suppliers bidding in administrative contracts for the acquisition of goods and services, such as works and advertising, sales and leases.24

Recommendation

The OECD recommends that foreign companies present uncertified translations of foreign documents and certifications. Certified translations of documents authenticated by the relevant consulate should only be required if a foreign company wins a tender.

References

[11] Cardoso de Meneses, F. (2015), “Regime diferenciado de contratação – Lei nº 12.462/2011 – e suas implicações nos procedimentos licitatórios e de contratações nacionais”, http://www.jus.com.br/1035823-fabricio-cardoso-de-meneses/publicacoes.

[9] Conselho Administrativo de Defesa Econômica (2015), “Administrative Proceeding No. 08700.007351/2015-51”.

[10] Federal Executive Branch (2022), “Sistema de Cadastro de Fornecedores - SICAF”, http://www.gov.br/compras/pt-br/sistemas/conheca-o-compras/sicaf-digital.

[7] Justen Filho, M. (2011), “A Pré-qualificação como procedimento auxiliar das Licitações do RDC (Lei 12.462/2011)”, http://www.justen.com.br/pdfs/IE56/IE56-marcal_rdc.pdf.

[12] OECD (2022), OECD Reviews of Regulatory Reform: Regulatory Reform in Brazil, OECD Publishing, https://doi.org/10.1787/d81c15d7-en.

[6] OECD (2021), Fighting Bid Rigging in Brazil: A Review of Federal Public Procurement, OECD Paris, https://www.oecd.org/competition/fighting-bid-rigging-in-brazil-a-review-of-federal-public-procurement.htm.

[3] OECD (2015), Recommendation of the Council on Public Procurement, https://www.oecd.org/gov/public-procurement/recommendation/.

[2] OECD (2014), Factsheet on how competition policy affects macro-economic outcomes, OECD Paris, http://www.oecd.org/daf/competition/factsheet-macroeconomics-competition.htm.

[4] OECD (2012), Recommendation of the Council on Regulatory Policy and Governance, OECD Publishing, https://doi.org/10.1787/9789264209022-en.

[5] OECD (2010), “OECD’s FDI Restrictiveness Index: 2010 Update”, OECD Working Papers on International Investment, 2010/03, OECD Publishing, http://www.oecd.org/investment/investment-policy/WP-2010_3.pdf.

[1] Secretaria Geral da Presidência da República (2022), Governo Federal conclui quinta e última etapa do processo de revisão de atos normativos inferiores a decreto, https://inovecapacitacao.com.br/governo-federal-conclui-quinta-e-ultima-etapa-do-processo-de-revisao-de-atos-normativos-inferiores-a-decreto/.

[8] Torres Pereira Júnior, J. (2003), Comentários à Lei das Licitações e Contratações da Administração Pública, Editora Renovar.

Notes

← 1. It should be noted that at the time this report was being finalised Brazil has enacted Law No. 14.368/2022, which explicitly repealed most of these obsolete or superseded provisions.

← 3. In June 2022, the OECD Report of Regulatory Reform: Regulatory Reform in Brazil was released. It considers regulatory barriers to competition in Brazil, using Brazil’s results in the OECD Product Market Regulation indicators to propose a range of policy options to make the country’s regulatory framework more competition-friendly. It also considers Brazil’s institutional and policy arrangements for better regulation. The report documents the progress that the country has achieved so far, and provides recommendations to tackle the challenges ahead (OECD, 2022[12]).

← 4. Article 1.134 of the Brazilian Civil Code.

← 5. Article DREI

← 6. Article 1.139 of the Brazilian Civil Code.

← 7. According to Article 1.134, sole paragraph of the Brazilian Civil Code, these are: 1) proof that the company is incorporated under its national law; 2) articles of incorporation; 3) list of members of the corporate structure; 4) copy of the company’s internal document to operate in Brazil and fixing the capital assigned to operations in the country; 5) proof of appointment of a legal representative in Brazil; and 6) most recent balance sheet of the company.

← 8. According to Article 3 of DREI Normative Instruction No. 77/2020, these are: 1) authorisation to operate in Brazil issued by DREI; 2) copy of the internal document of the company deciding to operate in Brazil and fixing the capital assigned to operations in the country; 3) articles of incorporation; 4) list of members of the corporate structure; 5) proof of company’s incorporation under its national law; 6) proof of cash deposit of capital destined for operations in Brazil; and 7) statement indicating the firm’s Brazilian address. Documents 2, 3, 4 and 5 are also required for the prior authorisation.

← 9. Article 1.136 of the Brazilian Civil Code.

← 10. DREI Normative Instruction No. 59/2019, amending DREI Normative Instruction No. 07/2013. DREI Normative Instruction No. 77/2020 revoked both DREI Normative Instructions No. 59/2019 and No. 07/2013. Until 2019, authorisation was issued by the minister overseeing DREI, after assessment of documents by DREI. Since then, DREI has obtained the power to issue the authorisation itself, which has also simplified the process.

← 11. See https://www.gov.br/pt-br/servicos/requerer-autorizacao-para-atos-de-filial-de-sociedade-empresaria-estrangeira.

← 12. Law No. 8.666/1993 (General Procurement Act) requires foreign companies operating in Brazil to present such authorisations to participate in a bidding procedure. Firms not operating in the country can participate in the bid without the authorisation, which should only be presented if they win the tender. Law No. 14.133/2021 (New General Procurement Act) does not mention this requirement, but the regime does not seem to have changed.

← 13. See, Thomson Reuters Practical Law, “Establishing a Business in Brazil: Establishing a Presence from Abroad”, https://uk.practicallaw.thomsonreuters.com/7-570-8027?transitionType=Default&contextData=(sc.Default)&firstPage=true#co_anchor_a527608.

← 14. In April 2021, Law No. 14.133 of 1 April 2021 was promulgated, adopting a new procurement act in Brazil. Article 194 of Law No. 14 133/2021 determined that this legal framework would have immediate effect. Nonetheless, the same law (Article 193, item II) also permits that the previous procurement act in Brazil (Law No. 8.666 of 21 June 1993) remains in effect until April 2023.

← 15. Other legal frameworks related to bids and public contracts concern Law No. 11.079/2004 (Public-Private Partnership Law), Law No. 13.303/2016 (Law of SOEs), and Law No. 12.462/2011 (Differentiated Procurement Act). The last was enacted as a provisional and differentiated bidding model, aiming to give greater agility to the contracting of goods and services and to reduce fraudulent procedures (Cardoso de Meneses, 2015[11]).

← 16. Article 69, paragraph 4 of Law No. 14.133/2021, and Article 31, paragraph 3 of Law No. 8.666/1993.

← 17. Law No. 13.303/2016 regarding SOEs also permits the use of performance guarantees.

← 18. For instance, the performance guarantee usually must not exceed 5% of the value of the contract, although in specific cases it may be up to 30% of the value.

← 19. The two procurement acts allow bidding authorities to require bid bonds, as does Law No. 13.303/2016 (SOEs) and Law No. 11.079/2004 (Public-Private Partnership).

← 20. Article 114 of Law No. 8.666/1993; Article 30, paragraph 2 of Law No. 12.462/2011 (Differentiated Procurement Act); Article 80 of Law No. 14.133/2021.

← 21. Article 80, §9º of Law No. 14.133/2021.

← 22. Article 32, paragraph 4 of Law No. 8.666/1993.

← 23. Article 70, sole paragraph of Law No. 14.133/2021.

← 24. Article 1 of Decree No. 3.722, of 9 January 2001.